Ultimate Guide to Using a Computer Invoice Template for Your Business

Managing financial transactions smoothly and professionally is essential for any business. One of the most important aspects of this process is generating clear and accurate records for services rendered or products sold. A well-organized document can make a significant difference in how your clients perceive your business and in ensuring timely payments.

Automated tools have become indispensable in creating these essential business documents. With the right software, you can streamline the process, avoid errors, and maintain consistency across all your billing records. Whether you’re a freelancer, small business owner, or part of a larger organization, using a structured format can save valuable time and reduce administrative tasks.

In this guide, we will explore various options for creating and customizing these essential records, helping you choose the right approach for your specific needs. From free options to advanced paid solutions, there are many ways to ensure your documents are professional, accurate, and easy to generate.

Why You Need a Digital Billing Document Format

For businesses of all sizes, keeping track of financial transactions efficiently is crucial. Proper documentation not only helps maintain order but also ensures transparency and accuracy in business dealings. Having a consistent method for creating billing statements eliminates confusion and makes payment processing smoother.

Benefits of Using a Pre-Designed Format

Using a pre-designed structure for generating financial documents offers several key advantages. With the right approach, businesses can save time, reduce errors, and present a more professional image to their clients. Here are some reasons why adopting this method is beneficial:

- Time-saving: Generating standardized documents quickly without starting from scratch every time is highly efficient.

- Consistency: Maintaining uniformity across all records reinforces professionalism and enhances brand image.

- Accuracy: Pre-built structures reduce human errors, ensuring critical details like amounts and dates are correctly listed.

- Customizability: You can easily adjust the design to suit your business style while maintaining a structured approach.

How It Simplifies Your Workflow

By using a digital format to manage financial records, you simplify your entire workflow. Whether you’re handling a few transactions or a large volume, these formats allow for seamless integration with accounting tools and other business systems. This means faster processing, fewer mistakes, and a clear, organized record of all payments and charges.

Overall, adopting a digital approach to generating billing records makes it easier to stay on top of finances and maintain control over essential business operations.

Benefits of Using a Pre-Designed Billing Document

Adopting a structured format for generating billing statements can significantly enhance efficiency in managing finances. With a ready-made design, businesses can automate the process, ensuring all important details are captured accurately and professionally. This approach simplifies the task of creating documents, while also providing numerous other advantages that contribute to better financial management.

Here are some of the key benefits of using a pre-designed billing structure:

- Time Efficiency: A standardized document format allows for quick and easy generation, eliminating the need to start from scratch every time a new statement is needed.

- Professional Appearance: Consistency in design enhances the credibility of your business, leaving a positive impression on clients and partners.

- Reduced Errors: By using a structured format, you reduce the risk of mistakes, ensuring that all essential details are correctly included, such as amounts, due dates, and client information.

- Customization Options: These formats are flexible, allowing you to adjust the design to reflect your branding and meet specific business needs while maintaining clarity and organization.

- Better Organization: With pre-built fields for key information, tracking transactions becomes more straightforward, making it easier to manage payments a

How to Choose the Right Document Format

Selecting the right structure for generating billing statements is essential to ensure efficiency, clarity, and professionalism. With various options available, it’s important to consider your business needs, the type of transactions you handle, and the level of customization required. The right solution will not only simplify your process but also align with your company’s branding and workflow.

When evaluating different formats, here are key factors to consider:

Factor Considerations Business Type Choose a design that fits the nature of your business. Freelancers may need simpler formats, while larger companies may require more detailed layouts. Customization Ensure the document can be tailored to your specific needs, such as adding your logo, adjusting layout, or modifying fields. Ease of Use The format should be easy to fill out and understand, minimizing errors and streamlining your workflow. Integration If you use accounting software, ensure that the document format can be integrated with these tools for seamless financial tracking. Design & Professionalism Pick a format that looks professional and aligns with your brand image. A clean, organized documen Key Features of an Ideal Billing Document

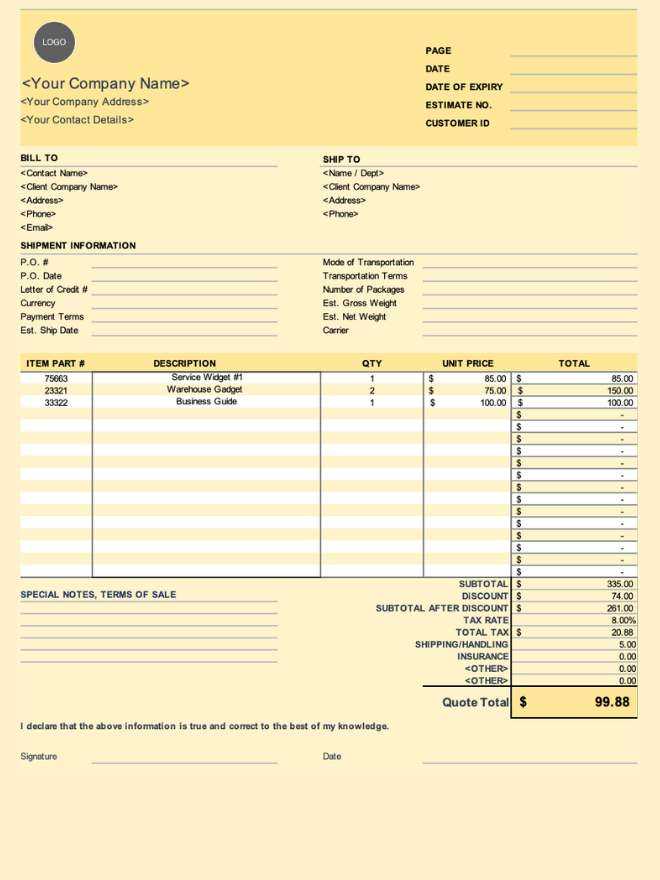

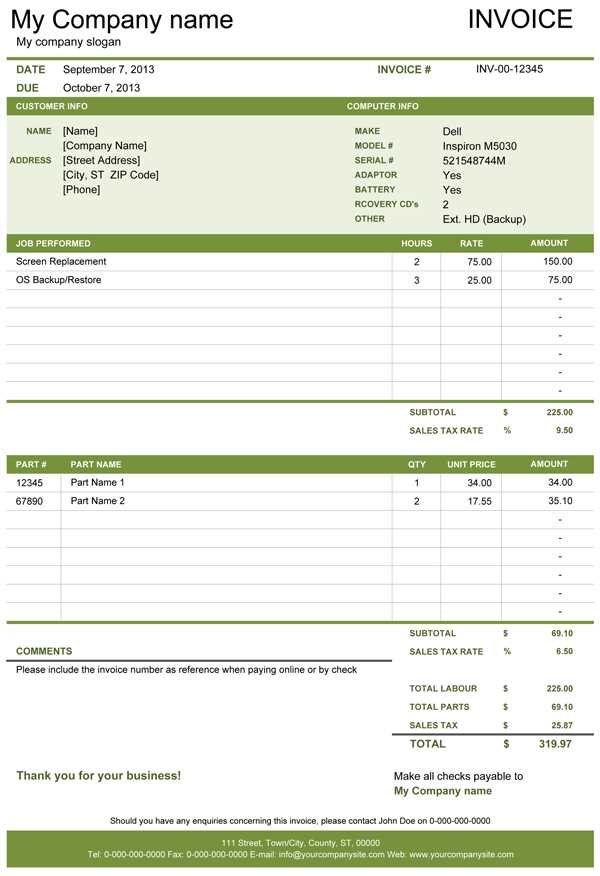

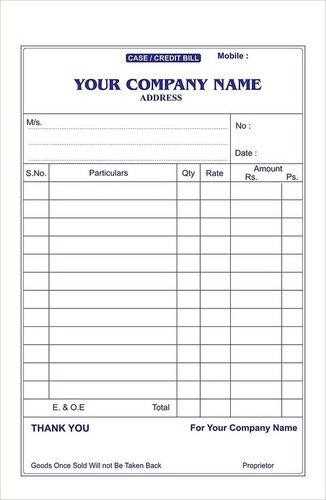

Creating a clear, professional, and accurate record for every transaction is essential for both businesses and clients. An ideal structure for financial records should be comprehensive, easy to understand, and tailored to the needs of your business. To ensure all relevant details are captured and easily readable, there are several key features that any effective document should have.

Essential Elements of a Perfect Document

Below are the most important components that should be included in every billing statement to ensure its completeness and professionalism:

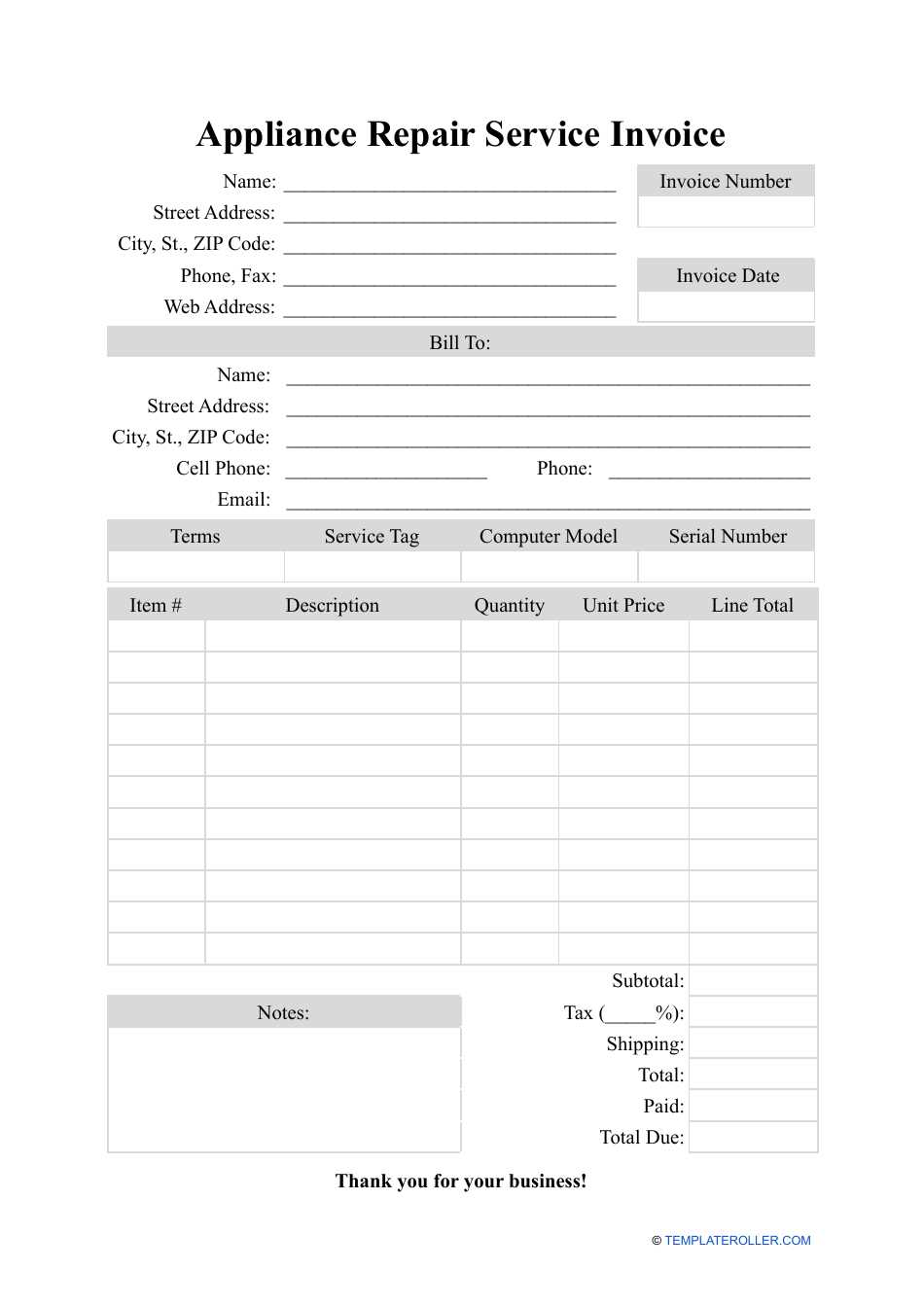

Feature Description Header with Business Information Always include your business name, logo, contact details, and any necessary registration information to reinforce your brand and credibility. Client Details Include the recipient’s full name, address, and contact information to ensure accuracy and proper delivery of the document. Clear Breakdown of Charges List each item or service provided, along with the cost, quantity, and description to maintain transparency and prevent misunderstandings. Payment Terms Clearly state payment due dates, acceptable methods of payment, and any late fees or discounts for early settlement. Unique Reference Number Customizing Your Invoice Template

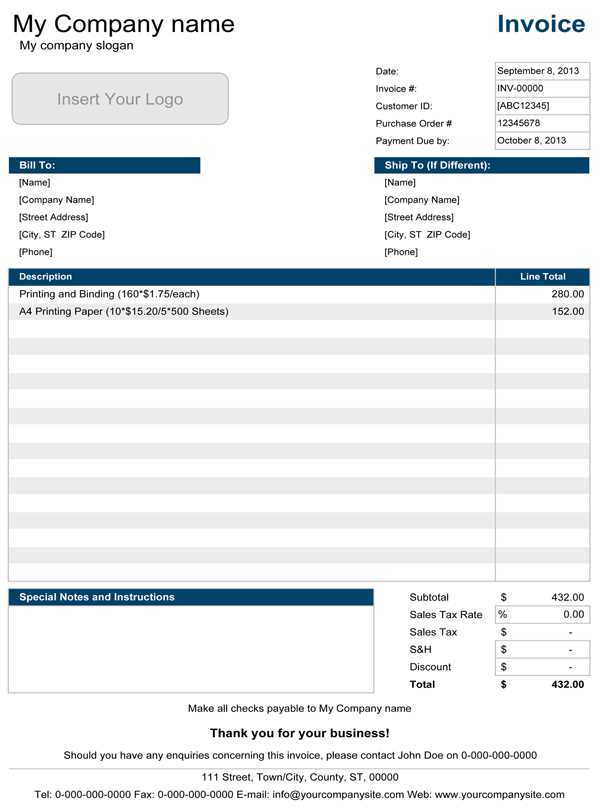

Personalizing your billing document allows you to create a unique and professional look that aligns with your business brand. Tailoring the structure, content, and design elements will help ensure clarity and enhance your client’s experience. This approach not only makes your paperwork stand out but also boosts your credibility as a business owner.

Here are key aspects to consider when customizing:

- Brand Identity: Incorporate your company logo, colors, and fonts to ensure that the document reflects your business identity.

- Layout & Design: Choose a clear and organized structure. Decide on the alignment, spacing, and grouping of information to enhance readability.

- Field Customization: Add or remove fields according to your needs. You may want to include specific details like item descriptions, terms, or additional notes.

- Legal Compliance: Ensure that all required fields, such as tax numbers or payment instructions, are included to stay compliant with regulations in your jurisdiction.

By considering these elements, you can create a streamlined, functional document that reflects your business’s professionalism while making transactions smooth and efficient for your clients.

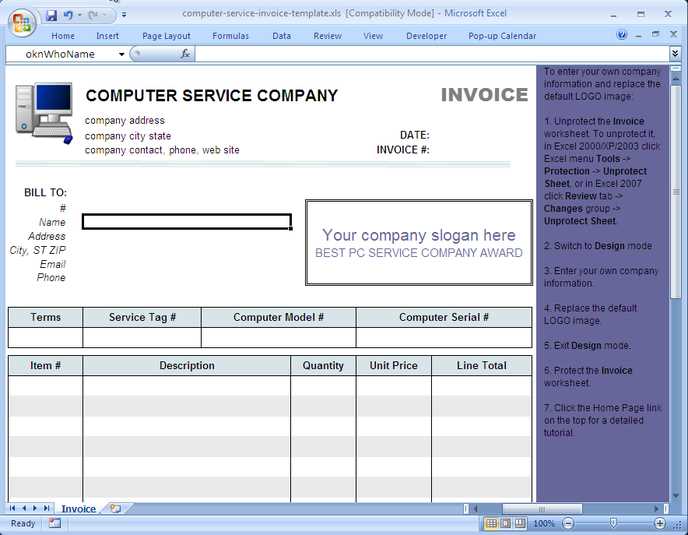

Top Software for Invoice Creation

Choosing the right software to generate billing documents is essential for simplifying administrative tasks, reducing errors, and saving time. With the variety of available tools, you can easily find a solution that suits your business size, industry, and specific requirements. These tools offer various features, from automation and customizable designs to integration with payment systems and accounting software.

Here are some of the top options:

- QuickBooks: A popular choice for businesses of all sizes, this platform offers easy-to-use features for generating detailed invoices, managing finances, and tracking payments.

- FreshBooks: Ideal for freelancers and small businesses, FreshBooks provides a simple interface and excellent customer support for creating professional documents with minimal effort.

- Zoho Invoice: A versatile solution with advanced customization options, Zoho allows users to create highly personalized documents, automate reminders, and track outstanding payments.

- Wave: A free tool perfect for small businesses, Wave enables you to generate and send billing documents quickly, with automatic syncing to your accounting records.

- Invoicely: Offering a straightforward approach, Invoicely is great for both small businesses and larger enterprises, allowing for multi-currency support and detailed reporting.

Selecting the best tool depends on your specific needs, but these platforms are trusted by many for their ease of use, flexibility, and range of features that streamline the billing process.

How to Include Payment Terms on Invoices

Clearly defining payment terms ensures that both you and your clients are on the same page regarding when and how payments should be made. Including these terms helps avoid misunderstandings and ensures timely payments, ultimately improving cash flow for your business.

Key Elements to Include

- Due Date: Clearly state the exact date by which the payment should be completed.

- Late Fees: Specify if there will be additional charges for overdue payments and outline the fee structure.

- Accepted Payment Methods: List the types of payment you accept, such as bank transfer, credit card, or online payment platforms.

- Discount for Early Payment: If applicable, offer a discount for early settlement, and specify the percentage or amount.

How to Present the Terms

It’s important to place the payment terms in a prominent section of the document, typically near the total amount due or at the bottom. Make the wording clear and concise to avoid any confusion. Additionally, consider providing a brief reminder or summary of the terms in your communications with the client.

Tips for Professional Invoice Design

A well-designed billing document not only enhances the professionalism of your business but also makes the process of payment more straightforward for your clients. Clear organization, effective use of space, and a cohesive visual layout contribute to a document that looks polished and is easy to understand. Proper design ensures that all key information is readily accessible and leaves a positive impression on your clients.

Here are some design tips to help create a professional and effective billing document:

- Keep It Clean and Simple: Avoid clutter. Use enough white space to create a balanced, easy-to-read layout. Group related information together and leave space between sections.

- Use Consistent Branding: Incorporate your logo, brand colors, and fonts to create a cohesive look that aligns with your company’s identity.

- Highlight Key Information: Make the total amount due, payment due date, and client details easy to find. Use bold fonts or larger text sizes for important sections.

- Choose Readable Fonts: Stick to clear, legible fonts like Arial, Helvetica, or Times New Roman. Avoid overly decorative fonts that may hinder readability.

- Use Grids for Alignment: Align text and figures neatly to make the document look more organized. A grid layout can help you maintain consistency throughout.

- Include Clear Payment Instructions: Provide straightforward instructions on how and where to make the payment, ensuring that there is no ambiguity.

By focusing on clarity, organization, and brand consistency, you can create a professional billing document that reflects the values of your business and makes the payment process smooth for your clients.

Invoice Template Formats and Options

Selecting the right format and options for your billing documents is crucial for ensuring clarity and convenience. Different formats offer distinct features and customization possibilities, depending on your business needs. By choosing the right one, you can streamline the payment process and maintain a professional appearance.

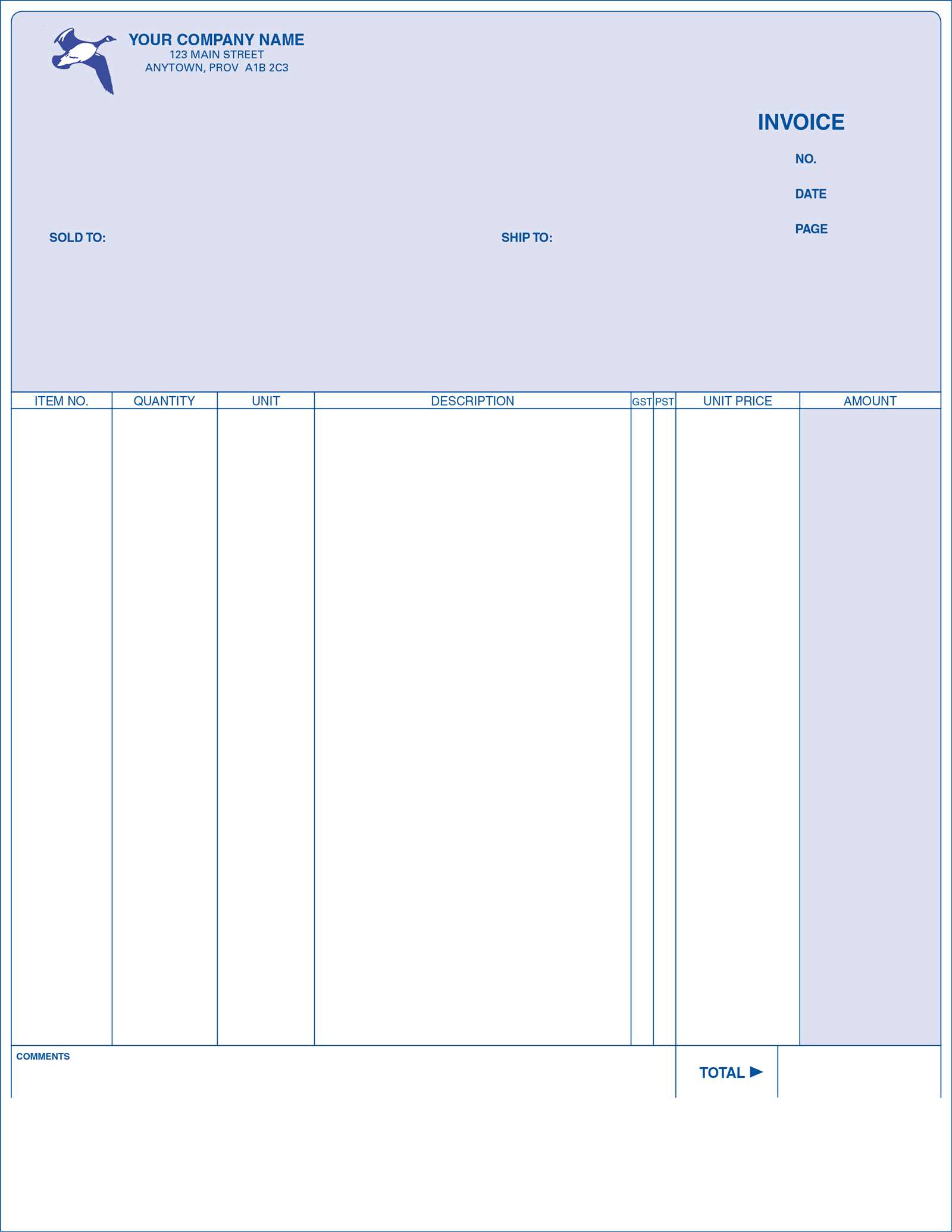

Common Formats

- PDF Format: One of the most widely used formats, PDF is portable, easy to share, and ensures that the layout remains consistent across devices. It’s a great option for clients who prefer to print or save the document.

- Excel or Spreadsheet: Ideal for those who need to perform calculations or track multiple transactions in a single document. These formats allow for easy edits and adjustments, but may not look as professional when shared externally.

- Word or Text Document: A more flexible format that can be easily edited, though it may require more manual effort to create a polished and consistent look compared to PDF or spreadsheet formats.

- Online Solutions: Web-based tools offer dynamic options for creating and managing billing documents. Many allow for real-time collaboration and automatic updates, ensuring that the most current version is always available.

Customization Options

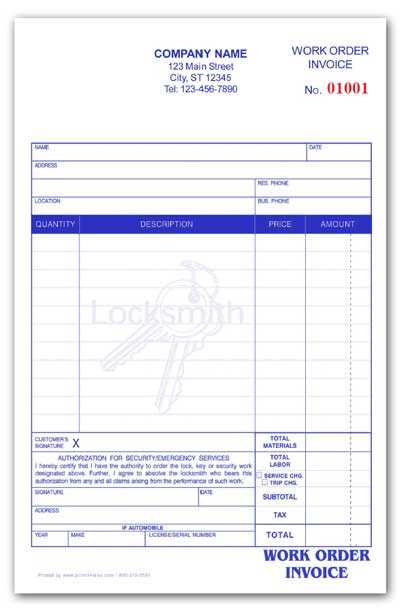

- Pre-Designed Layouts: Many platforms offer pre-designed layouts that you can quickly customize by adding your business logo, client details, and other required fields.

- Manual Editing: Some solutions offer full flexibility for customizing the entire layout, including fonts, colors, and fields, to match your brand and specific needs.

- Automation Features: Advanced options include automation for recurring clients or services, making

How to Automate Invoice Generation

Automating the creation of billing documents can save significant time and reduce errors, especially for businesses that deal with recurring clients or frequent transactions. By leveraging automation tools, you can streamline your workflow, ensure consistency, and focus more on your core operations. There are various ways to set up automated systems depending on your needs and business size.

Here are some key steps to automate the creation process:

- Use Accounting Software: Many modern accounting platforms offer built-in automation for generating and sending bills. These tools can pull client information and transaction details directly from your records, creating documents instantly.

- Set Up Recurring Billing: For clients with ongoing contracts or subscription-based services, automate recurring charges. This ensures that you never miss a billing cycle and clients receive consistent, timely documents.

- Integrate with Payment Systems: Connect your billing system with your payment gateway. This allows you to generate and send documents automatically once a payment is processed or due, and even trigger reminders for unpaid balances.

- Use Templates with Dynamic Fields: Create reusable layouts with fields that can be dynamically filled based on transaction data, such as client name, services rendered, and amounts due.

- Automate Reminders and Follow-ups: Many platforms allow you to schedule payment reminders and late fee notices to be sent automatically based on predefined timelines.

By setting up an automated system for document creation, you ensure accuracy, reduce manual input, and create a smoother experience for both you and your clients.

Common Mistakes to Avoid with Invoices

Creating a billing document may seem straightforward, but small errors can lead to delays in payment, confusion, or even disputes with clients. Ensuring that all the necessary information is included, presented clearly, and accurate is crucial for maintaining a professional image and fostering smooth financial transactions. Avoiding common mistakes can make the entire process more efficient and help you build stronger relationships with your clients.

Here are some frequent errors to watch out for:

- Missing Contact Information: Always include both your business details (name, address, and contact information) and the client’s information. Missing or incorrect details can delay the payment process or lead to confusion.

- Incorrect or Unclear Payment Terms: Failing to clearly outline when payment is due or any penalties for late payment can create misunderstandings. Always be specific about deadlines and accepted payment methods.

- Not Numbering Documents: Each document should have a unique reference number to avoid confusion, particularly when you’re tracking multiple transactions. It also helps you keep records organized and simplifies follow-ups.

- Omitting Detailed Descriptions: Avoid vague or incomplete descriptions of services or products provided. Be specific about what was delivered to justify the charges and prevent disputes.

- Errors in Calculations: Double-check all totals, taxes, and discounts before sending the document. Simple math mistakes can undermine your credibility and delay payment.

- Failure to Proofread: Always review the document for spelling, grammar, or formatting errors. A polished document reflects professionalism, while mistakes can appear sloppy and reduce your credibility.

- Not Including Payment Instructions: Make s

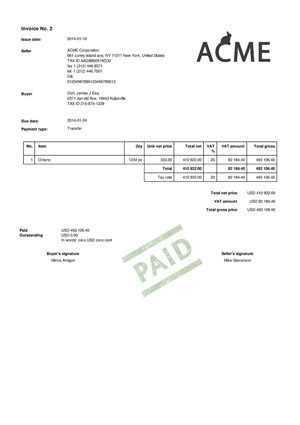

Understanding Invoice Numbering Systems

Having a clear and consistent numbering system for your billing documents is essential for organization and tracking. A well-structured system makes it easier to manage records, follow up on outstanding payments, and ensure that all transactions are properly accounted for. It also helps maintain professionalism and can be crucial for tax and financial reporting purposes.

Types of Numbering Systems

There are various ways to organize the numbering of your billing documents. The key is to choose a system that fits the size and structure of your business, while ensuring it remains easy to manage as your client base grows.

Numbering Style Description Best For Sequential Each document is assigned a unique number that follows a sequential order (e.g., #001, #002, #003). Small businesses with a low volume of transactions. Date-Based Numbers are based on the date, such as the year followed by a unique sequence (e.g., 2024-001, 2024-002). Companies that want to organize documents by fiscal year. Client-Based Numbers include the client’s ID or name as part of the reference (e.g., C123-001, C124-002). How to Track Invoices Efficiently

Effectively managing your billing documents is essential for maintaining cash flow and ensuring that payments are received on time. A systematic approach to tracking helps you monitor due dates, outstanding balances, and payment statuses without confusion. By implementing the right strategies and tools, you can streamline this process and minimize the risk of missed payments or lost records.

Methods for Tracking

There are several methods for keeping track of your financial transactions, each with varying levels of complexity and automation. The best option depends on the size of your business and the volume of transactions you manage.

- Manual Tracking: For small businesses or freelancers, maintaining a simple spreadsheet with client details, amounts due, and payment dates can be effective. This method requires regular updates but offers full control over the information.

- Accounting Software: Using dedicated accounting platforms like QuickBooks, FreshBooks, or Zoho can help automate tracking by automatically updating payment statuses, sending reminders, and generating reports.

- Cloud-Based Tools: Many cloud-based solutions offer real-time updates and easy access across multiple devices. These tools are ideal for teams or businesses that need remote access and collaboration features.

- Payment Gateways: Platforms like PayPal, Stripe, or Square can track payments automatically when clients pay through these systems. They provide instant updates and detailed records, making it easy to monitor payment history.

Best Practices for Efficient Tracking

- Assign Unique Reference Numbers: Use a unique reference number for each document. This ensures that you can quickly locate and identify any specific transaction, reducing errors and confusion.

- Set Up Payment Reminders: Automate reminders for upcoming and overdue payments. This ensures that you follow up

Integrating Invoices with Accounting Software

Incorporating billing systems with financial management applications streamlines administrative tasks and enhances accuracy. By connecting these two systems, businesses can efficiently track revenue, expenses, and maintain organized financial records.

Benefits of Seamless Integration

Linking financial documents with accounting tools offers numerous advantages, reducing the likelihood of manual errors and improving data consistency across platforms. This method allows real-time access to transaction history and simplifies tax preparation and reporting processes.

- Automated data entry minimizes human errors

- Real-time updates on cash flow and payment statuses

- Simplified financial audits and reconciliation tasks

Steps to Connect Billing and Accounting Systems

Setting up integration between billing and accounting solutions may vary depending on the software used. However, certain general steps can guide the

Legal Considerations for Invoices

When managing billing documents, it is essential to understand the legal requirements that govern these records. Compliance with relevant laws ensures the validity of transactions and provides necessary protections for both the issuer and the recipient.

Essential Elements for Compliance

To be legally compliant, billing records must contain certain key details. These typically include the identification of both parties, a clear description of goods or services provided, and specific financial terms. Ensuring that these elements are present can help avoid disputes and support legal enforceability.

Regional and Tax Regulations

Legal standards for billing vary by country and may include specific tax implications. Businesses must stay informed about local requirements, including VAT or sales tax information, to prevent legal issues and penalties. Regularly reviewing these guidelines is crucial to staying compliant with updated regulations.

Maintaining legally sound financial records is essential for a transparent and accountable business operation.

How to Send Invoices to Clients

Delivering billing documents to clients requires a clear process to ensure timely payments and maintain professional communication. Choosing the right delivery method can impact both the efficiency of transactions and client satisfaction.

Email Delivery

Sending billing records via email is one of the most efficient ways to reach clients. Attach the document in a commonly used format, such as PDF, to ensure readability across devices. Include a brief message outlining the details of the transaction, and verify the recipient’s email address to avoid delivery issues.

Steps for Emailing:

- Attach the document in a standard format (e.g., PDF) for easy access.

- Provide clear instructions on payment options and deadlines.

- Request a read receipt or follow up to confirm the message was received.

Sending via Mail

Free vs Paid Invoice Templates

When selecting a format for billing documents, choosing between free and premium options is an important consideration. Each type has unique benefits and limitations, which may affect the professional appearance and functionality of the document.

Advantages of Free Options

- Cost-Effective: Free versions are suitable for those with limited budgets or occasional needs.

- Basic Design: Most free designs offer a simple layout that meets basic requirements.

- Quick Access: Free resources are widely available online and are easy to download and use immediately.

Benefits of Paid Options

- Customization: Paid versions often include options to personalize branding, colors, and layout.

- Adv