Download Proforma Invoice Template DOC for Easy Business Documentation

In today’s fast-paced business world, having a structured approach to managing financial transactions is crucial. The use of well-organized documents can simplify communication, reduce errors, and enhance professionalism. A ready-made document format allows businesses to quickly create accurate records for sales, shipments, or service agreements, ensuring that all necessary details are included for both internal and external use.

By utilizing a flexible and customizable file, companies can maintain consistency across their financial paperwork. Such formats save time and help avoid the need for manual entry, which can lead to mistakes. With the right structure, businesses can handle invoicing, quotations, and other financial exchanges with ease and precision, streamlining workflows and improving overall efficiency.

In this article, we will explore how to access and customize a professional document model, its benefits for daily operations, and how it can enhance communication with clients and partners. Whether you’re a small business owner or part of a larger enterprise, these tools can be a game-changer in simplifying transaction management.

Why Use a Proforma Invoice Template?

Using a predefined document format for financial transactions offers a variety of advantages for businesses of all sizes. When managing orders, estimates, or agreements, having a structured layout ensures that all necessary information is captured accurately and efficiently. A customizable form simplifies the process, saving valuable time while reducing the chances of errors.

Here are some reasons why businesses benefit from using a predefined document structure:

- Consistency: A set format ensures that all important details are included in every transaction, keeping records uniform and professional.

- Time-saving: Instead of creating documents from scratch for every new transaction, a ready-to-use structure can be filled out in just a few minutes.

- Reduced Errors: With fields clearly defined, there’s less room for mistakes when adding or omitting key information.

- Clear Communication: Well-organized documents enhance communication between businesses and clients by presenting data in a straightforward and accessible manner.

- Improved Professionalism: Using a formalized approach reflects positively on the business, building trust with clients and partners.

Whether you’re generating sales quotations, agreements, or shipping details, adopting a standard format for these documents makes the process more efficient and reliable. This approach allows businesses to focus on growth while ensuring accurate and timely transactions.

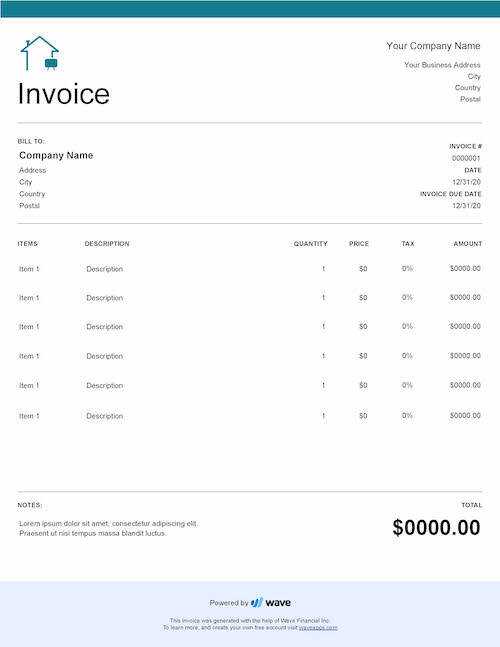

Benefits of Using DOC Format for Invoices

Choosing the right file format for business documents is essential to ensuring smooth operations. The use of word processing files offers numerous advantages when creating financial records, agreements, and transactional documents. A widely used format such as the Word document (.doc) is not only versatile but also compatible with a variety of systems, making it a preferred choice for many professionals.

Here are the key benefits of using this file format for business documentation:

- Easy Customization: Word documents allow for easy editing and customization, so you can modify the content as needed without hassle.

- Universal Compatibility: .doc files are widely compatible with most software, ensuring that recipients can view and edit the document regardless of the platform they are using.

- Professional Appearance: A well-structured .doc file gives documents a polished and formal look, which is essential for maintaining credibility and professionalism in business dealings.

- Convenient for Printing: Word files are printer-friendly, making them an ideal choice when physical copies are needed for official records or client meetings.

- Cloud Integration: Word documents can be easily stored and accessed via cloud-based platforms, allowing for efficient collaboration and secure document management.

Whether you’re preparing contracts, sales estimates, or service agreements, using a word processing file format streamlines the process, enhances productivity, and ensures your documents meet the highest standards of quality and professionalism.

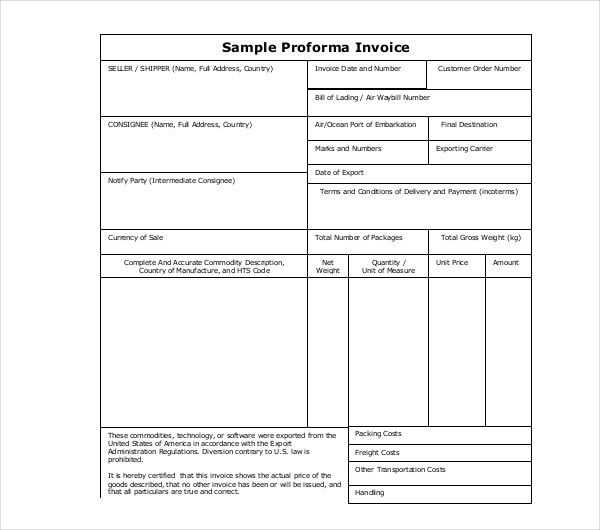

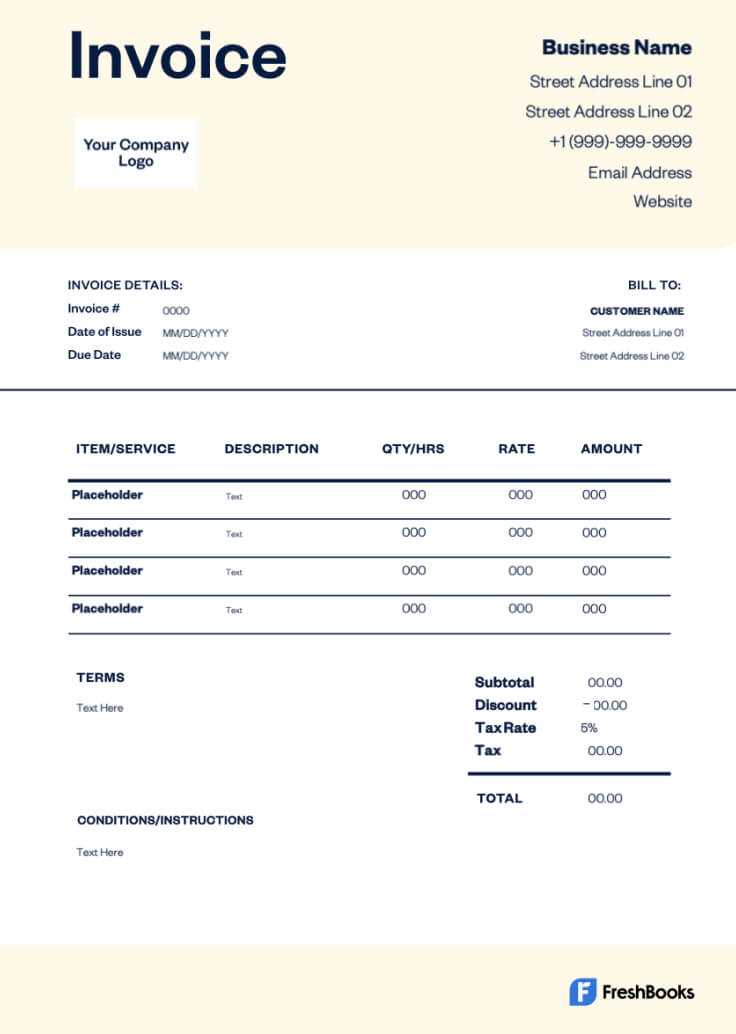

How to Create a Proforma Invoice

Creating a detailed and accurate document for a transaction is essential for businesses, whether you’re providing a quote, confirming a sale, or preparing for an upcoming shipment. A structured format ensures that all necessary information is clearly presented and easy to understand. Here’s a step-by-step guide to help you create a professional document for any business transaction.

Follow these basic steps to ensure your document meets all the required standards:

- Start with Your Business Information: Include your company’s name, address, contact details, and logo. This helps establish credibility and ensures the recipient knows how to reach you for follow-up questions.

- Include Customer Details: Add the client’s name, address, and contact information. This ensures that the document is directed to the right party and helps avoid confusion later on.

- Assign a Reference Number: Every document should have a unique identifier. This could be a reference number, which helps both parties track and organize documents efficiently.

- List the Products or Services: Clearly describe the items, services, or goods being offered. Include quantities, unit prices, and total amounts. This section should provide a comprehensive breakdown of all charges.

- Provide Terms and Conditions: Make sure to include payment terms, delivery conditions, and any other relevant details, such as expected timelines or penalties for late payments.

- Sign and Date: Ensure that the document is signed by an authorized representative and includes the date of issue. This makes the document legally binding and establishes when the terms are valid.

By following these steps, you’ll be able to create a clear and professional document that helps facilitate smooth transactions and protects both your business and your clients. Always ensure that all the information is correct before sending, as this will reduce the likelihood of disputes or misunderstandings.

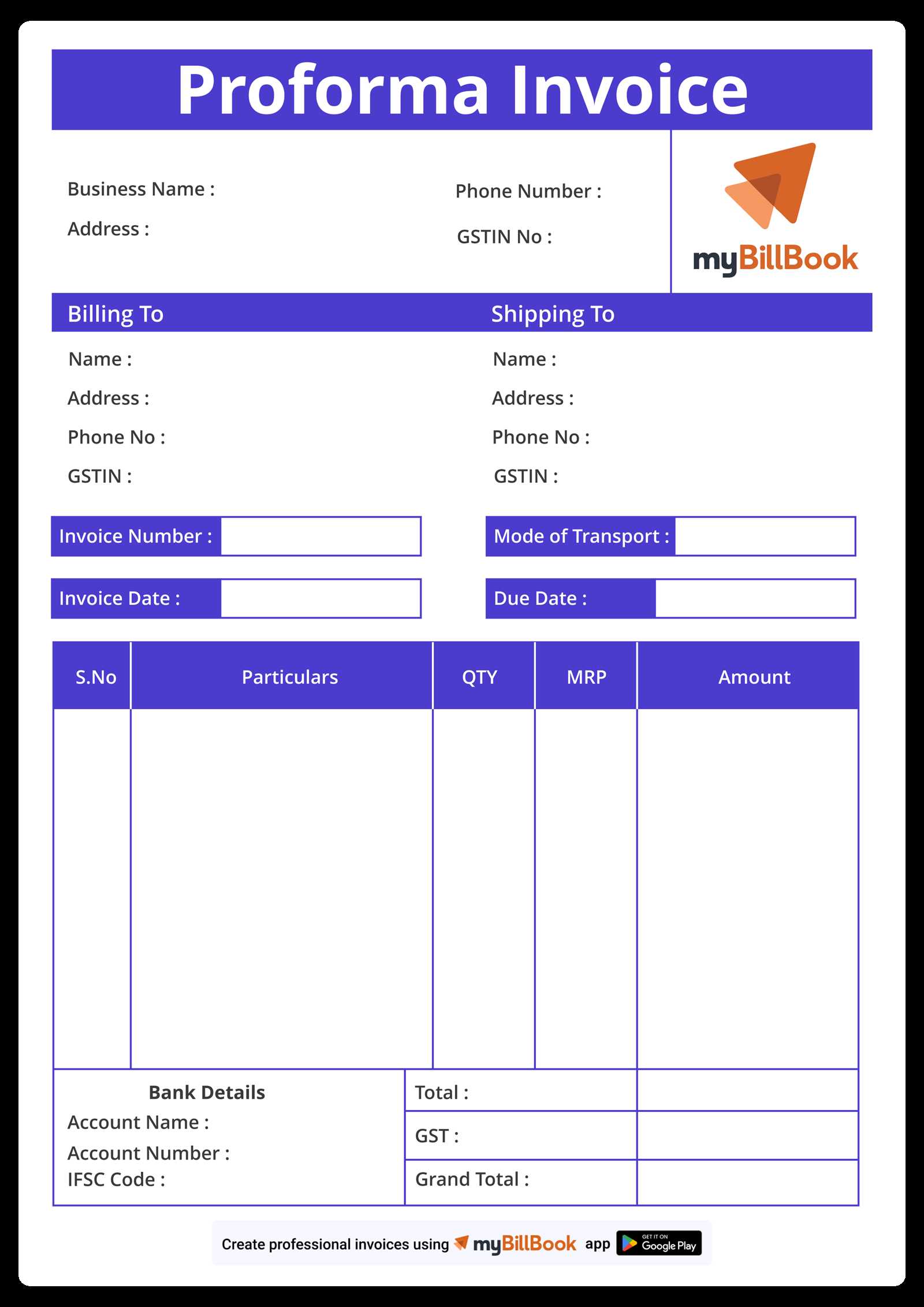

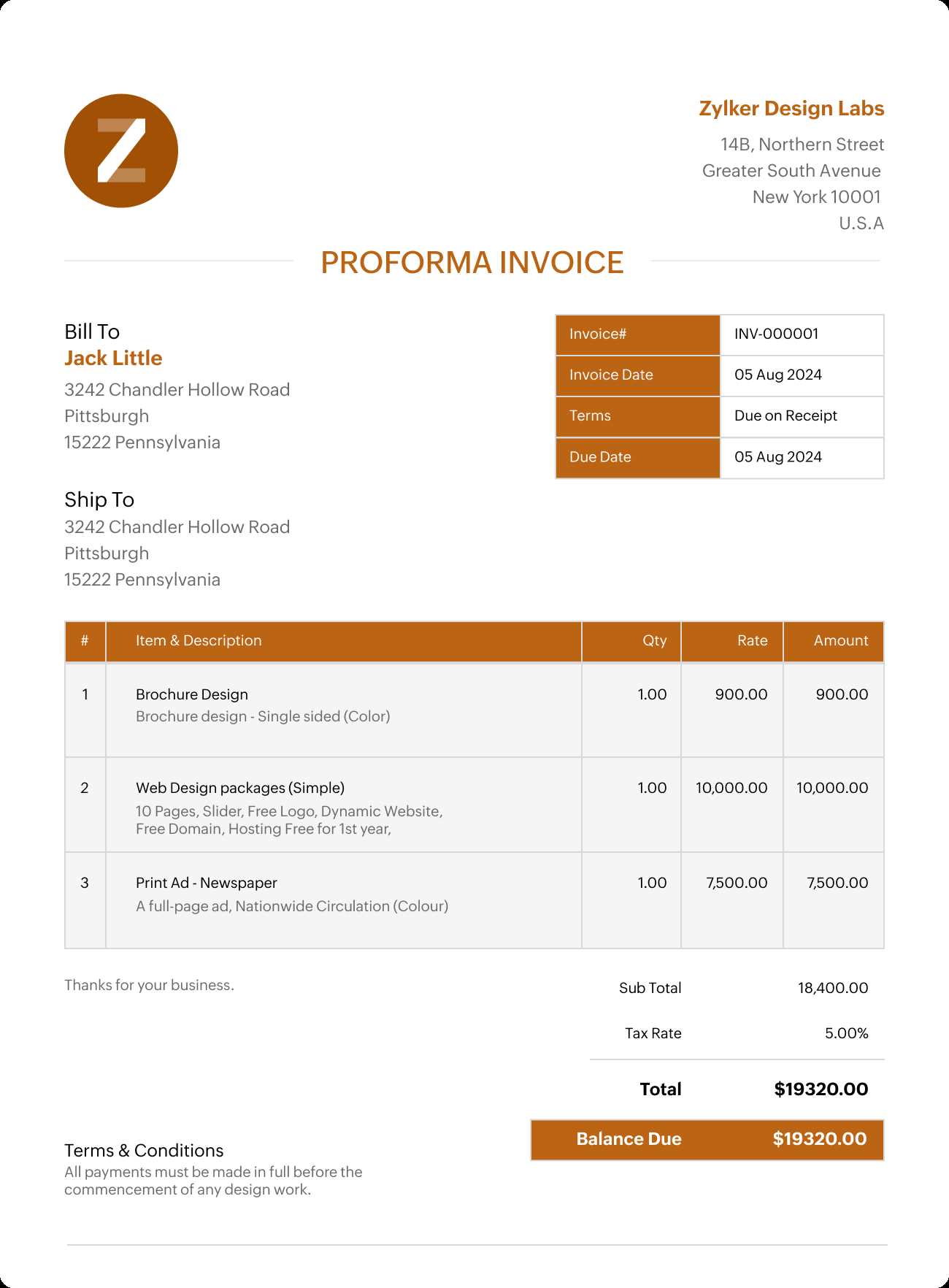

Key Information to Include in Proforma Invoice

When creating a document for a business transaction, it’s crucial to include all the necessary details to ensure clarity and avoid misunderstandings. A comprehensive record will help both the buyer and seller understand the terms and conditions, ensuring a smooth process. The following are essential pieces of information that should always be included in such documents.

| Information Category | Description | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Details | Include your company’s name, address, phone number, email, and website. This ensures your client knows how to reach you for any questions or issues. | |||||||||||||||||||||||||||||||||||||||||

| Customer Information | Provide the customer’s full name or business name, address, and contact details to ensure accurate delivery and communication. | |||||||||||||||||||||||||||||||||||||||||

| Document Reference Number | Assign a unique reference number to track the document easily. This also helps in organizing transactions for both parties. | |||||||||||||||||||||||||||||||||||||||||

| Item Description | List the products or services being offered, including quantities, individual prices, and any applicable discounts. Make sure the descriptions are clear and detailed. | |||||||||||||||||||||||||||||||||||||||||

| Total Cost | Provide a breakdown of the total cost, including any taxes, fees, or other additional charges that apply. | |||||||||||||||||||||||||||||||||||||||||

| Payment Terms | Outline the payment methods, due dates, and any penalties for late payments to avoid confusion later on. | |||||||||||||||||||||||||||||||||||||||||

| Delivery Terms | Specify the delivery method, expected shipping date, and any terms related to the delivery of goods or services. | |||||||||||||||||||||||||||||||||||||||||

| Validity Period | Indicate how long the offer or quotation is valid, to ensure that the terms are time-sensitive and avoid misunderstandings. | |||||||||||||||||||||||||||||||||||||||||

| Signature and Date | Ensure that the document is signed by an authorized representative of your company and includes the date of issue to make it legally bind

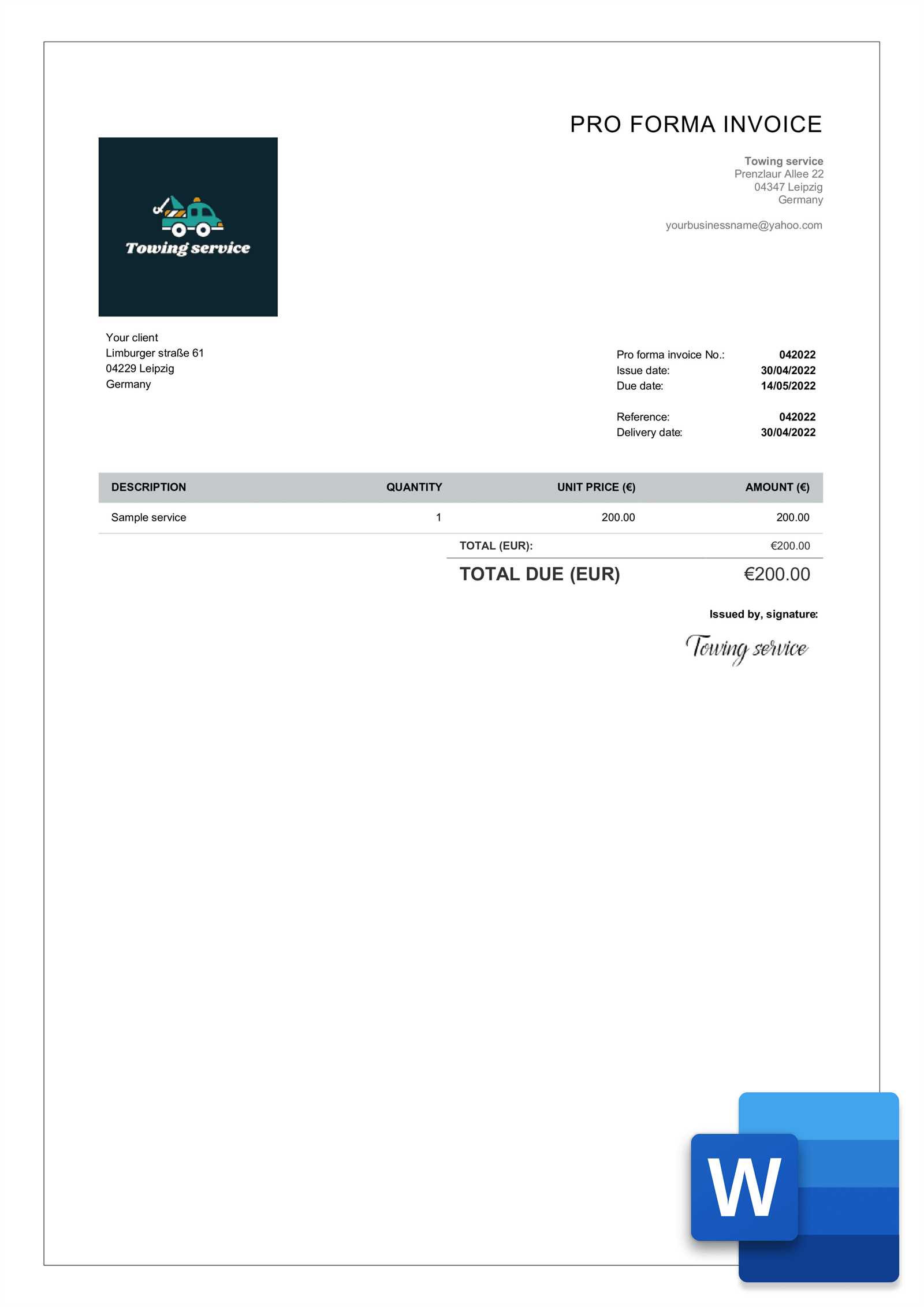

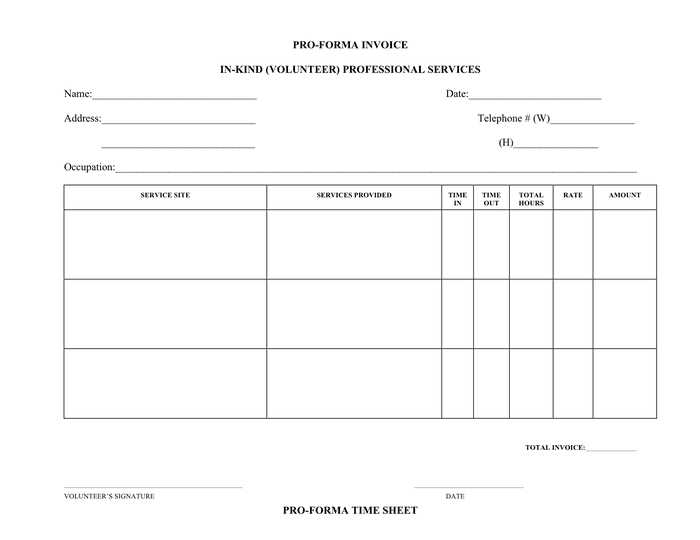

Free Proforma Invoice Templates for BusinessesFor businesses looking to simplify their transaction documentation, free document formats are an excellent solution. These ready-made structures save time and effort, allowing companies to quickly generate professional records for sales, services, or quotations. Many online platforms offer customizable options that cater to different industries and business needs, ensuring that companies can easily create accurate and consistent records. Here are some benefits of using free document formats for your business:

With so many resources available, businesses can access high-quality, free document formats that simplify transaction management. Whether you are issuing quotes, confirming orders, or preparing for delivery, these tools help ensure consistency and accuracy in all your financial dealings. How to Customize Proforma Invoice DOCCustomizing a business document is an essential step to ensure that it aligns with your company’s branding, meets specific transaction requirements, and addresses the unique needs of your clients. With the right approach, you can easily modify a standard layout to include all the necessary details while keeping it professional and clear. Here’s how you can personalize a document for your business transactions effectively. Follow these steps to customize your business document:

Here’s a table summarizing some key fields you may want to modify:

|