How to Create a Free Invoice Template for Your Business

Managing payments efficiently is essential for any business, whether you’re a freelancer, a small business owner, or part of a larger company. One of the key aspects of this process is having a structured document that ensures clear communication with clients and provides a record of transactions. Having a ready-to-use document can streamline your operations and save valuable time.

Instead of manually creating a new document every time you need to send a payment request, it’s a smart idea to design a reusable structure that meets your needs. This approach not only enhances professionalism but also improves consistency in your billing system. With the right layout, you can ensure that all necessary details are included and that the process remains smooth for both you and your clients.

Whether you’re looking to simplify your accounting or just need a reliable system to track payments, this guide will help you understand how to build a document that works for you. By following a few simple steps, you can have a functional and well-designed tool at your fingertips, allowing you to focus on growing your business.

How to Create a Free Invoice Template

Designing a useful billing document from scratch can be a simple and time-saving process, especially when you follow a clear structure. By customizing a ready-made framework or using available resources, you can quickly generate a professional-looking record that fits your specific needs. The key is knowing which elements to include and how to present the information effectively.

Follow these basic steps to build a customized document for managing payments:

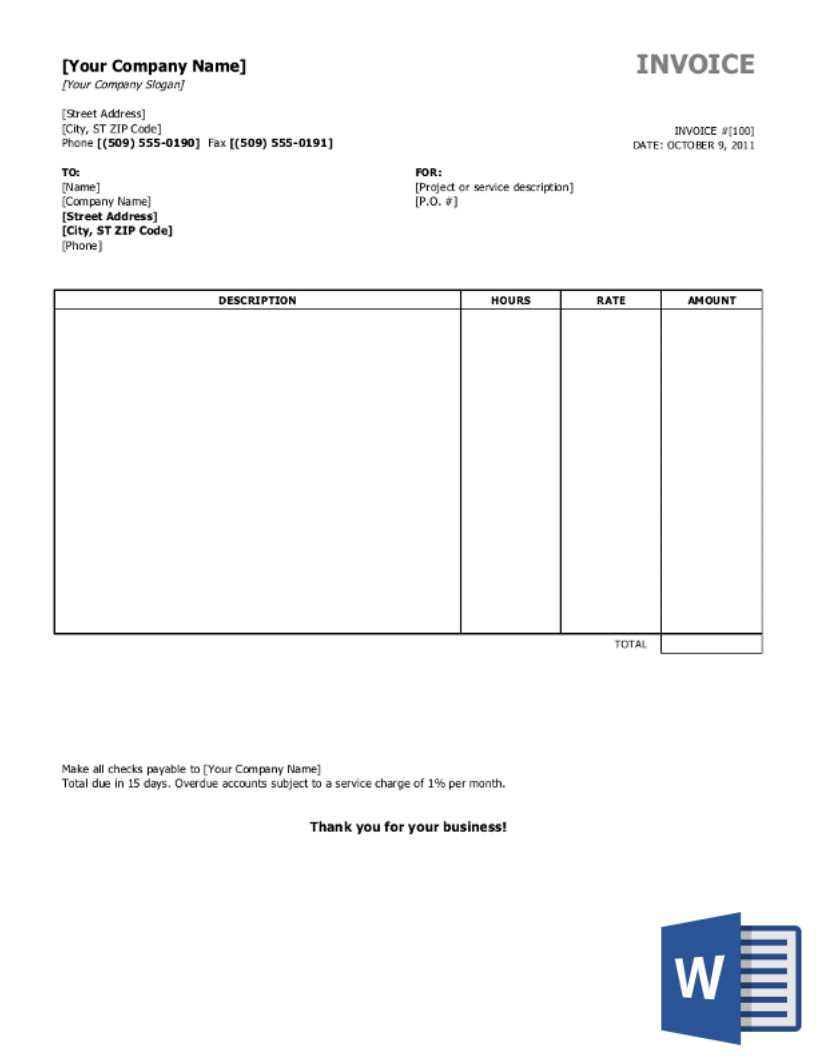

- Choose the Right Format: Start by deciding whether you want to use a word processor, a spreadsheet, or an online tool. Each option has its own advantages depending on your preferences and workflow.

- Include Essential Information: Every document should have certain key details, such as:

- Your business name and contact information

- Client details (name, address, email)

- Description of the goods or services provided

- Total amount due, including tax (if applicable)

- Payment terms and due date

- Invoice number for tracking

- Design a Clear Layout: Arrange the sections logically so that all information is easy to find. Make sure that the document is visually appealing but also functional. Use headings and lines to separate different sections.

- Customize the Design: Add your branding elements, such as your logo or company colors, to make the document more professional and aligned with your business image.

- Save for Future Use: Once you have a working version, save the file in a format that allows you to reuse and edit it easily. Consider saving multiple versions for different types of services or clients.

By following these steps, you’ll have a versatile billing document that can be tailored to meet your needs without the hassle of creating a new one every time. This process allows you to focus more on your business while maintaining a professional and organized approach to managing payments.

Why You Need an Invoice Template

Having a standardized document for billing clients is essential for maintaining professionalism and ensuring consistency in your business operations. A well-organized structure makes it easier to track payments, manage client relationships, and avoid potential errors. Without a reusable framework, you risk losing important details or sending unclear payment requests.

Benefits of Using a Structured Billing Document

Using a pre-designed format for generating payment requests offers several advantages:

| Benefit | Description |

|---|---|

| Consistency | A standard format ensures that each document contains all the necessary information in a uniform manner, helping clients understand the details quickly. |

| Time Savings | With a ready-to-use design, you can generate documents faster, saving time on manual formatting and data entry. |

| Professionalism | A clean, well-structured layout reflects positively on your business and shows clients that you take your work seriously. |

| Accuracy | Using a consistent format helps reduce the chances of forgetting important details like payment terms, dates, or item descriptions. |

How It Improves Cash Flow

A structured payment request is not only important for organization but also for ensuring timely payments. When clients receive clear, easy-to-understand documents, they are more likely to pay on time. The ability to include payment terms and due dates helps to avoid misunderstandings and delays. By streamlining the process, you can improve your business’s cash flow and reduce administrative overhead.

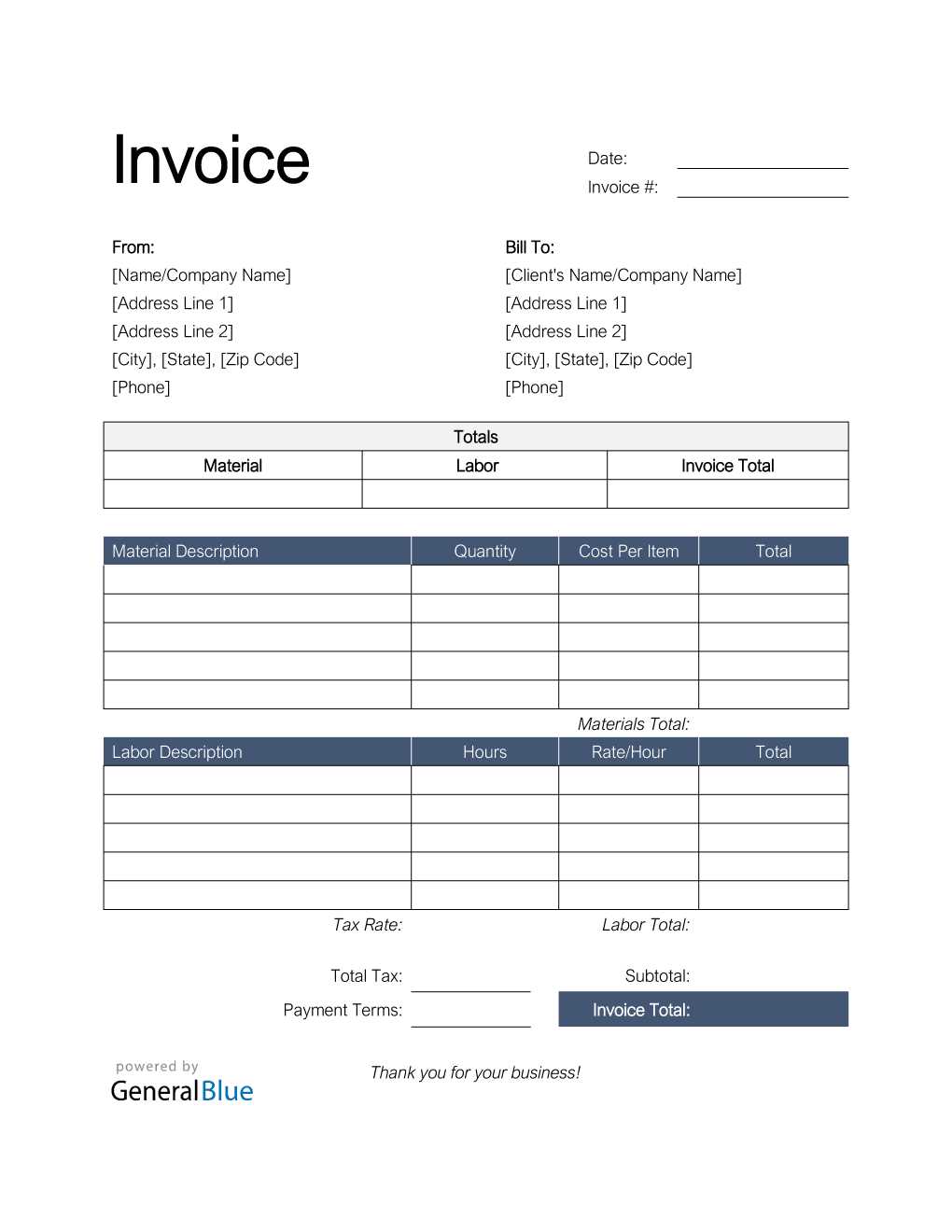

Steps to Build a Simple Invoice

Designing a straightforward document for billing clients doesn’t have to be complicated. By following a few simple steps, you can produce a professional-looking record that clearly communicates the necessary details. A well-organized payment request makes the process smoother for both you and your clients, ensuring that all essential information is included and easy to understand.

Follow these basic steps to build a simple and effective payment document:

- Start with Your Business Information: Include your business name, logo (if you have one), and contact details. This ensures that the client can easily reach you if necessary.

- Client Information: Clearly display the client’s name, address, and contact information to ensure they can easily identify the payment request.

- Assign an Identification Number: Give each document a unique reference number for tracking purposes. This helps keep your records organized and prevents confusion in future transactions.

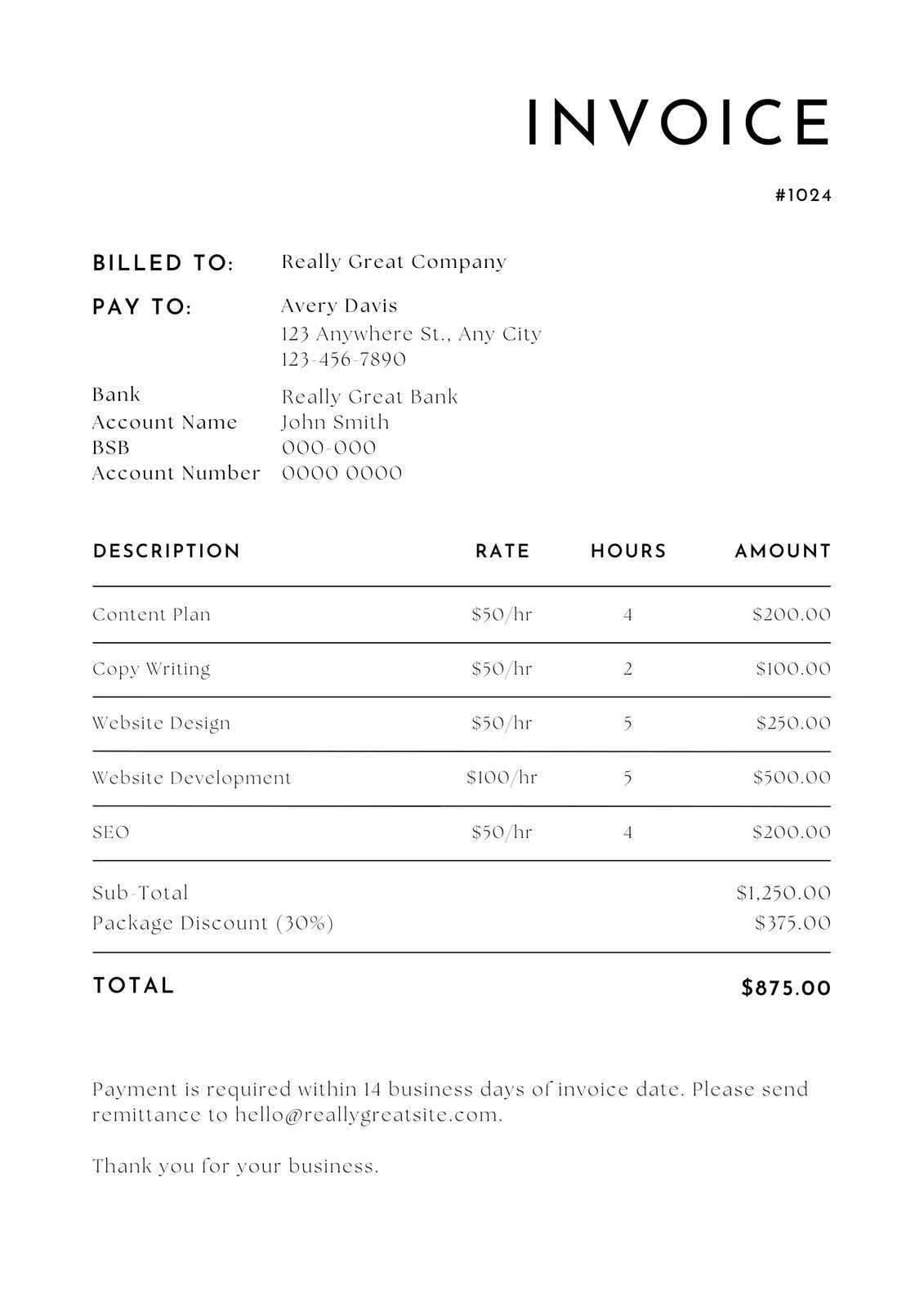

- Describe the Services or Goods: Provide a detailed description of what was provided, including quantities, rates, and any relevant product or service details. This helps the client understand exactly what they are being billed for.

- Specify Payment Terms: Indicate the due date, accepted payment methods, and any late fees that may apply. Setting clear terms ensures both parties are on the same page regarding payment expectations.

- Include Taxes and Discounts: If applicable, add any sales tax, VAT, or discounts to the total amount. Be transparent about how these figures are calculated to avoid confusion.

- Calculate the Total Amount: Sum up the cost of goods or services, taxes, and any other charges to get the final amount due. Ensure that the total is easy to locate for the client’s reference.

- Check for Errors: Before sending the document, double-check all the details to make sure everything is correct. Accuracy is essential to maintaining trust with your clients.

By following these steps, you can easily produce a simple, clear, and professional billing document that helps you manage your transactions with ease. Having a well-structured record not only simplifies the payment process but also reflects positively on your business’s professionalism.

Essential Elements of an Invoice

To ensure clear communication and efficient payment processing, certain key components must be included in every billing document. These elements not only help avoid confusion but also create a professional appearance for your business. Each part serves a specific purpose in providing both you and your client with the necessary details to complete the transaction smoothly.

Here are the essential parts that should be included in every billing request:

- Business Information: Your name, company name (if applicable), address, phone number, and email should be listed clearly at the top of the document. This ensures that clients can easily contact you if they have questions or concerns.

- Client Information: Include the client’s name, business name (if applicable), and contact details. This helps to avoid any confusion about who is responsible for the payment.

- Unique Identification Number: Each document should have a unique reference number to help track and organize transactions. This number is particularly useful for both your records and the client’s future reference.

- Description of Products or Services: Provide a detailed breakdown of what was provided, including quantities, prices, and any other relevant specifics. This helps the client understand what they are being charged for and ensures transparency.

- Dates: Include the date the request was issued and the payment due date. This sets clear expectations for when the client needs to complete the payment and helps you track overdue amounts.

- Payment Terms: Clearly state the payment due date, accepted methods of payment (such as bank transfer, credit card, or check), and any late fees or penalties that may apply if payment is not received on time.

- Tax Information: If applicable, specify any taxes (e.g., VAT or sales tax) that are included in the total amount. This should be clearly marked to show how much is tax and how much is the actual cost of the goods or services.

- Total Amount Due: At the bottom of the document, clearly display the total amount due, including any taxes, fees, or discounts. Make sure the total is easy to find and clearly labeled for the client’s convenience.

By including these essential elements, you ensure that every billing document is clear, professional, and easy to understand. This not only helps to get payments on time but also builds trust with your clients by demonstrating that you are organized and transparent in your business dealings.

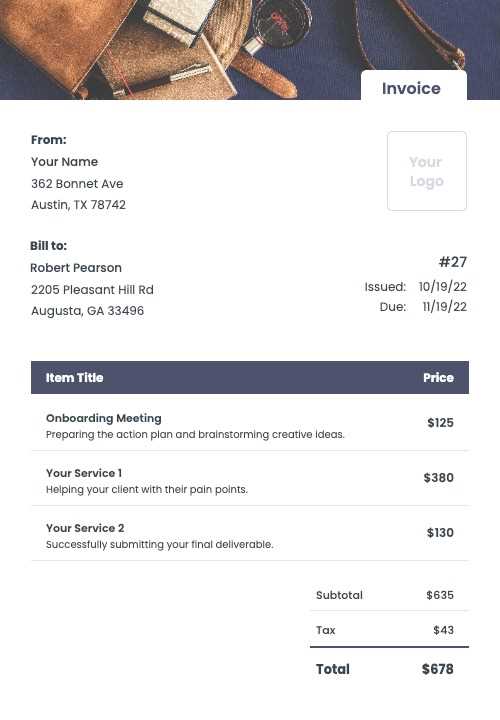

Choosing the Right Template Style

Selecting the appropriate style for your billing document is crucial to conveying professionalism and clarity. The right design not only enhances the overall appearance but also ensures that all relevant details are easy to find. Whether you’re aiming for a minimalist look or something more detailed, the style should reflect your business and meet the needs of your clients.

Factors to Consider When Selecting a Design

When choosing the style for your document, several factors should guide your decision:

- Business Type: The design should align with the nature of your business. For example, a creative agency might prefer a more modern, visually striking layout, while a consulting firm might opt for something more straightforward and formal.

- Client Expectations: Consider the preferences of your clients. Some industries may expect more detailed or formal documents, while others may appreciate a simpler approach.

- Ease of Use: Choose a design that is easy to navigate. Clients should quickly locate essential information like the amount due, payment terms, and due dates without unnecessary effort.

- Brand Consistency: Ensure the style reflects your brand identity. Incorporate your logo, color scheme, and font choices to maintain a cohesive image across all business communications.

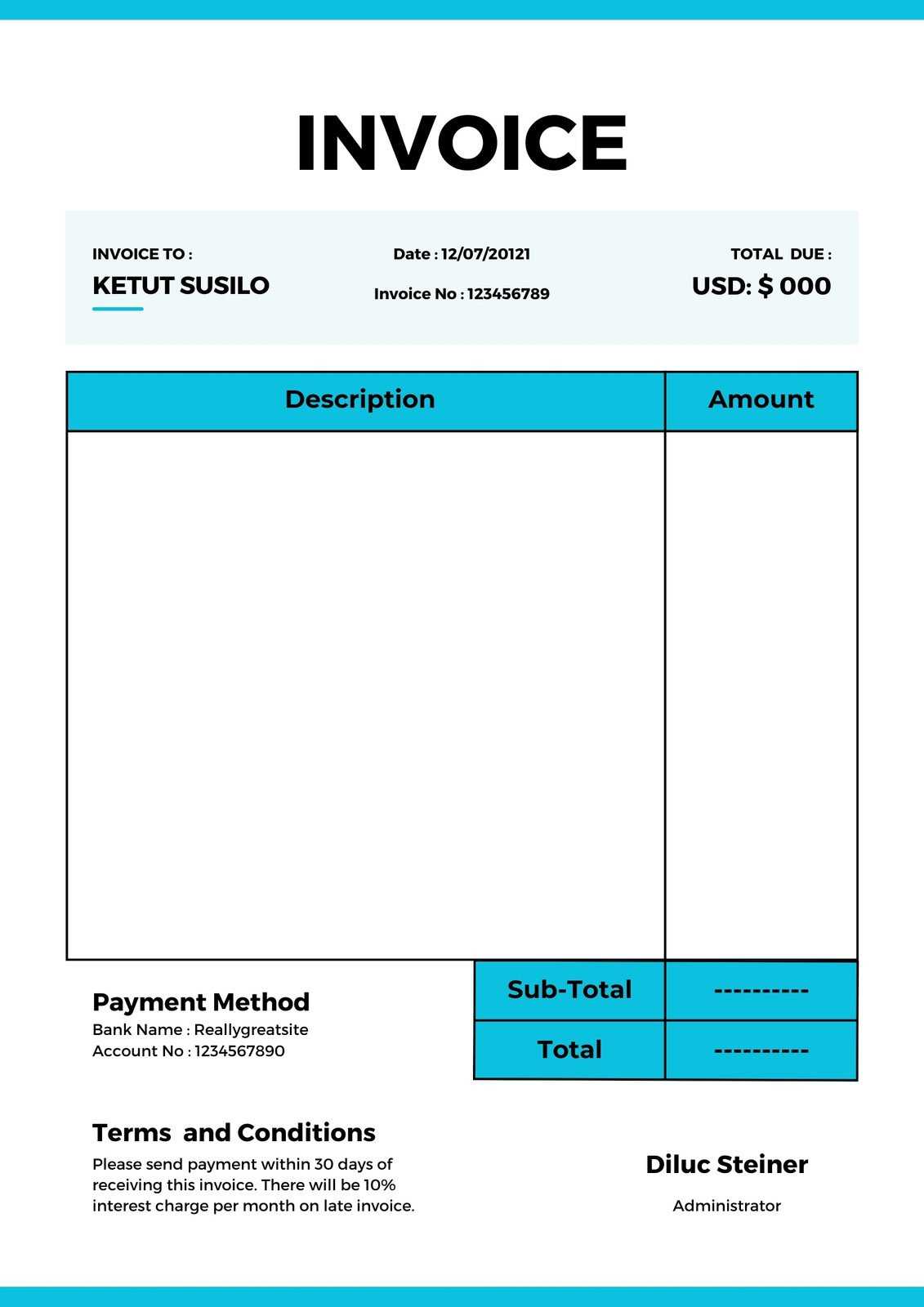

Types of Layouts to Consider

There are various layout options you can choose from based on your needs:

- Minimalist: A clean, simple design with plenty of white space. This style is great for businesses that value clarity and simplicity.

- Traditional: A more detailed, structured design with clear section divisions. This is ideal for industries that require formality and professionalism.

- Creative: A more visually engaging style with custom graphics and bold colors. This style works well for creative professionals like designers or artists.

Ultimately, the right style depends on your business needs, your brand image, and your client’s preferences. By choosing a design that complements these factors, you create a document that not only looks professional but also effectively communicates the necessary information to your clients.

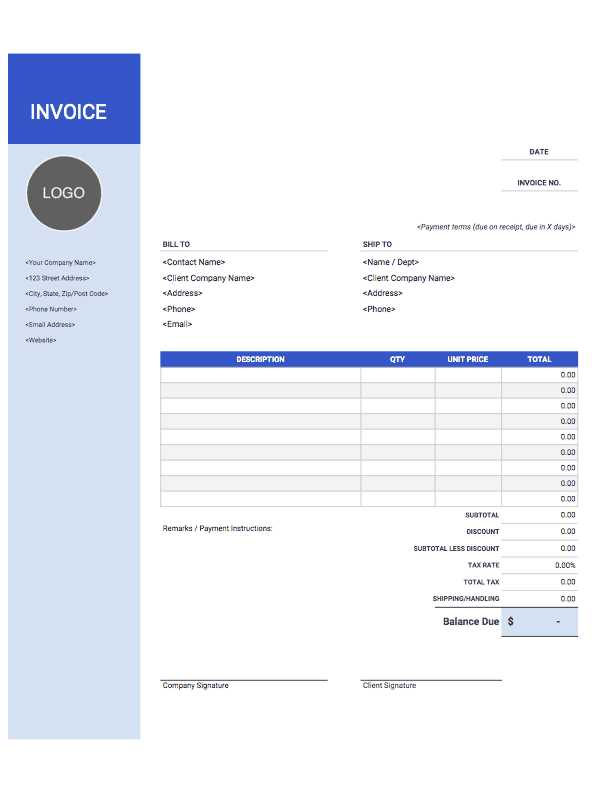

Customizing Your Invoice Template

Personalizing your billing document ensures it aligns with your business identity and makes the process more efficient. Customization allows you to add unique elements that reflect your brand while also ensuring all necessary information is presented clearly. By adjusting certain sections, you can cater the design to fit your specific needs and client preferences.

Here are some key areas to focus on when tailoring your document:

| Customization Area | Purpose |

|---|---|

| Business Branding | Incorporate your logo, color scheme, and fonts to make the document consistent with your overall brand identity. This helps clients recognize your business instantly. |

| Payment Terms | Modify the payment terms to reflect your preferred methods, due dates, and any discounts or late fees. This ensures your clients are well-informed and sets clear expectations. |

| Item Descriptions | Customize the description section to include any specific details that are relevant to the products or services you offer. Include quantities, rates, and any relevant notes or special instructions. |

| Additional Fields | If your business requires other information such as project codes, purchase order numbers, or specific tax breakdowns, customize the layout to include these fields. |

By adjusting these sections to reflect your unique business style, you make your document more personal and functional. A tailored approach helps foster better communication with your clients and ensures that your billing process is aligned with your business operations.

Free Tools for Creating Invoices

There are various online platforms and software tools that can help you design professional billing documents without any cost. These tools often provide customizable options and user-friendly interfaces, allowing you to generate documents quickly while ensuring all necessary details are included. Whether you’re a freelancer, small business owner, or part of a larger organization, these resources can save you time and effort.

Popular Tools for Designing Billing Documents

Here are some of the top free tools available to help you create professional billing documents:

| Tool | Features |

|---|---|

| Invoice Generator | Provides customizable fields for adding client details, items, and taxes. Generates professional documents in PDF format for easy sharing and printing. |

| Wave | Free accounting software that includes options for generating customized billing documents, managing payments, and tracking expenses. |

| Zoho Invoice | Offers pre-designed layouts and options to create and send professional documents. Includes integration with payment gateways for easy transaction management. |

| PayPal Invoicing | A simple tool for creating and sending payment requests directly through PayPal. Includes tracking features and easy integration with PayPal accounts. |

How These Tools Can Benefit Your Business

By using these free tools, you can save time, reduce administrative workload, and improve the consistency of your billing process. They provide templates that are already optimized for clear, professional communication, and many tools offer additional features such as automatic reminders and payment tracking. With minimal effort, you can ensure that your billing process is efficient, secure, and easy for clients to understand.

Design Tips for Professional Invoices

The design of your billing document plays a crucial role in how your business is perceived by clients. A well-designed layout not only improves clarity but also enhances professionalism, ensuring that your communication is taken seriously. The right design can make a lasting impression and facilitate a smoother payment process, which ultimately helps maintain good relationships with clients.

Here are some design tips to keep in mind when structuring your billing documents:

- Use a Clean Layout: A simple and organized structure makes the document easier to read and navigate. Avoid clutter and unnecessary graphics. Use clear headings, sections, and plenty of white space to give each part of the document its own space.

- Choose Readable Fonts: Use professional, easy-to-read fonts such as Arial, Helvetica, or Times New Roman. Ensure that the font size is large enough to be legible, especially for important information like payment terms and totals.

- Include Your Branding: Incorporate your logo, business colors, and any other elements that reflect your brand identity. This will make your document look polished and help clients recognize your business immediately.

- Highlight Important Information: Use bold or colored text to emphasize crucial details such as the total amount due, payment due date, and client information. This ensures that clients can quickly locate the most important parts of the document.

- Keep it Consistent: Maintain a consistent style across all documents, from the layout to the fonts and colors. This reinforces your brand image and makes your billing process appear more organized and professional.

- Use Clear Section Dividers: Make sure there are clear distinctions between sections such as client details, item descriptions, and payment terms. This can be achieved with lines, borders, or shaded backgrounds to separate each area of the document.

- Make the Total Easy to Find: The total amount due should be prominently displayed, ideally at the bottom of the document. Ensure it’s clear, bold, and stands out from the rest of the information.

- Ensure Mobile Compatibility: Many clients may view your document on mobile devices. Make sure the layout is responsive and looks good on smaller screens, especially if you’re using online tools or sending digital documents.

By focusing on these key design elements, you can create billing documents that not only look professional but also improve communication and streamline the payment process for your clients.

Invoice Template for Small Businesses

For small businesses, having an efficient and organized method for documenting payments is crucial to maintaining smooth operations and a professional image. A well-structured payment request not only helps with clear communication but also ensures that you are paid on time. Small businesses, in particular, can benefit from an easy-to-use layout that saves time and keeps things simple, without compromising on professionalism.

Key Features for Small Business Billing Documents

When designing a payment document for your small business, consider including the following essential elements to ensure it meets your needs and serves both you and your clients effectively:

- Clear Business Information: Include your company name, contact details, and logo (if applicable). This makes your document easily recognizable and accessible for future reference.

- Client Information: Clearly list the client’s name, address, and email. Having all relevant contact details in one place helps avoid confusion and facilitates communication.

- Simple Breakdown of Services or Products: Clearly describe what was provided, with quantities, unit prices, and any additional details. This ensures transparency and prevents misunderstandings.

- Payment Terms: Include payment due dates, accepted payment methods, and any late fees or discounts. Clear terms help set expectations and encourage timely payments.

- Unique Document Identification: Assign a reference number to each document for easy tracking and future reference. This helps you stay organized, especially when managing multiple clients.

- Tax and Total Amount: Display the total due, including taxes and any additional charges, in a clear and easy-to-find location.

Benefits for Small Business Owners

Having a well-organized and consistent payment document is essential for small businesses. It improves your professional image, reduces the chance of errors, and speeds up the payment process. Additionally, having a ready-to-use layout that you can customize as needed saves time and ensures that you never miss an important detail in your transactions. The right structure allows you to focus more on growing your business while maintaining a professional and efficient billing system.

How to Save and Reuse Templates

Once you’ve designed a professional and effective billing document, saving and reusing it can greatly improve your efficiency and consistency. By creating a master version that you can modify as needed, you eliminate the need to start from scratch each time. This approach not only saves time but also helps maintain a consistent format across all your transactions.

Here are some tips on how to save and reuse your billing documents effectively:

- Save a Master Copy: Keep a blank or general version of your document with all placeholders and common fields. This allows you to quickly adjust details such as client names, item descriptions, and amounts, without needing to rebuild the document each time.

- Use Cloud Storage: Storing your file in cloud-based services like Google Drive, Dropbox, or OneDrive ensures easy access from any device. This is particularly helpful if you need to access or update your document while working remotely or on the go.

- Utilize Editable Formats: Save your document in editable formats like Word, Excel, or Google Docs. These allow you to make quick changes without the need to reformat or retype everything each time. Many of these platforms also offer version control, so you can track changes made to the document.

- Create a Folder for Billing Documents: Organize your saved documents into a dedicated folder with clear naming conventions, such as “Billing Documents” or “Payment Requests.” This helps you quickly find and reuse previous records, reducing the time spent searching for old files.

- Use Software for Automation: Some invoicing tools or accounting software allow you to save and reuse billing documents with even more automation, such as pre-filled client details or recurring billing cycles. This can save significant time for businesses that need to issue documents regularly.

By following these simple steps, you can easily save and reuse your billing documents, streamlining your workflow and ensuring that each document maintains the same professional standard. Reusing a well-structured layout not only saves time but also ensures that you consistently provide clear and accurate billing information to your clients.

Invoice Template for Freelancers

For freelancers, having a reliable and professional way to document payment requests is essential to maintaining a smooth business operation. Clear and well-structured billing documents help ensure timely payments and minimize misunderstandings. As a freelancer, it’s important to use a consistent format that not only reflects your professionalism but also includes all the necessary details to avoid confusion.

When preparing a billing document for your freelance work, there are a few key elements that should be included to make the process as straightforward as possible:

- Your Contact Information: Always include your full name, business name (if applicable), and contact details such as phone number and email. This ensures clients can easily reach out if needed.

- Client’s Details: Include the name, address, and contact information of the client you are billing. This helps ensure the document is correctly addressed and prevents any mix-up between clients.

- Clear Breakdown of Services: List the specific services you provided, along with the corresponding rates, time spent, and any other important information. This adds transparency and clarifies what the client is paying for.

- Dates: Include the date when the work was completed and the date when payment is due. This sets clear expectations for both parties.

- Payment Terms: Specify your preferred payment methods, such as bank transfer, PayPal, or check, along with any due dates and penalties for late payments. Be clear about the payment expectations to avoid confusion later.

- Total Amount Due: At the bottom of the document, clearly state the total amount the client owes. Make sure this is easy to find, ideally in bold or a larger font, to draw attention to the final amount.

By including these key elements, freelancers can maintain a professional appearance while ensuring their clients understand exactly what is being billed. This clear communication helps prevent misunderstandings, keeps cash flow steady, and enhances your reputation as a reliable professional.

Making Invoices Look More Attractive

A well-designed billing document can have a significant impact on how your business is perceived. Not only does an attractive layout reflect professionalism, but it also shows that you value your work and your clients. By enhancing the visual appeal of your payment requests, you make them more engaging and easier to read, improving the likelihood of timely payments and positive client relations.

Here are a few simple yet effective ways to enhance the visual appeal of your documents:

- Use Your Branding: Incorporating your logo, color scheme, and fonts into your document design helps reinforce your business identity. This creates a cohesive and professional appearance, making your communications more memorable.

- Make the Layout Clean and Organized: A cluttered document can be difficult to read and may confuse your clients. Ensure your billing details are clearly structured with enough white space between sections. A clean layout enhances readability and presents your business as organized and trustworthy.

- Add Visual Elements: Using subtle design elements such as borders, shading, and icons can break up the content and make the document more visually appealing without making it too busy. For example, using a soft background color for headings or section titles can create contrast and draw attention to important information.

- Highlight Key Information: Make important details, such as the total amount due, due date, and payment terms, stand out by using bold fonts or larger text. This helps ensure that your clients can quickly identify the key points without having to search through the document.

- Consider Typography: Choose clean and easy-to-read fonts. Using a mix of fonts (e.g., one for headings and another for body text) can add visual interest. However, avoid using too many different fonts, as this can make the document look chaotic.

By incorporating these design tips, you can make your payment documents not only more attractive but also more effective. An eye-catching document is more likely to be noticed, appreciated, and remembered by your clients, which can positively impact your overall business relationships.

Common Mistakes to Avoid in Invoices

When preparing a billing document, small errors can lead to confusion, delays in payment, or misunderstandings with clients. It’s important to ensure that every detail is accurate and clear to avoid these issues. Even simple mistakes can undermine the professionalism of your business, which is why attention to detail is essential.

Frequent Errors to Watch Out For

Here are some common mistakes that can negatively impact the effectiveness of your billing documents:

- Missing or Incorrect Contact Information: Ensure that both your contact details and your client’s information are correct. Any incorrect or missing details can delay communication and cause confusion during the payment process.

- Unclear Payment Terms: Not clearly stating the payment due date, accepted payment methods, or any late fees can lead to confusion. Make sure these terms are easy to find and understand to avoid future disputes.

- Failing to Include Tax Information: If you are required to include taxes, ensure that the tax rates and amounts are clearly listed. Forgetting to include this information can lead to legal or financial complications.

- Ambiguous Descriptions of Services or Products: Vague or unclear descriptions can cause misunderstandings about what is being billed. Provide specific details for each item or service provided, including quantities and prices, to avoid disputes.

- Forgetting to Include a Unique Reference Number: Every billing document should have a unique reference number for easy tracking and organization. Forgetting this can make it difficult for both you and your client to reference the document in the future.

- Not Double-Checking the Total Amount: Always double-check the final amount due, including any discounts, taxes, or additional charges. Simple math errors can create frustration and delay payments.

- Overcomplicating the Design: A cluttered or overly complicated document can confuse the recipient and make the billing details harder to locate. Keep the design clean and straightforward, with clear headings and well-organized sections.

How to Avoid These Mistakes

To avoid these common pitfalls, always review your document before sending it to your client. Double-check the details and ensure that all necessary information is included and correct. By maintaining accuracy and clarity in your billing documents, you will foster better relationships with clients and ensure a smoother payment process.

Best Practices for Sending Invoices

Sending a billing document is just as important as creating it. How and when you send your payment requests can impact your cash flow and client relationships. Following best practices ensures that your documents are delivered promptly and clearly, increasing the likelihood of on-time payments and maintaining a professional image.

Effective Methods for Sending Payment Requests

Here are some best practices to consider when sending your billing documents:

- Send via Preferred Communication Channel: Always send your payment documents through the method preferred by your client, whether that’s email, a project management tool, or a dedicated platform. This ensures that the document reaches the right person in the most efficient way.

- Send Promptly After Completion: It’s best to send your payment request as soon as the work is completed or as agreed upon in your contract. Prompt billing helps avoid delays and sets clear expectations for payment timing.

- Use Professional Email Subject Lines: Make sure the subject line of your email is clear and concise. A good example is “Payment Request for [Project Name] – Due [Date]” or “Billing for [Service Provided]”. This makes it easy for your client to identify and prioritize your email.

- Attach Documents in Accessible Formats: Always attach your document in a format that is easy for your client to open and read. PDF is the most commonly used format, as it preserves the layout and is universally accessible.

- Provide Clear Instructions: Include any necessary instructions or additional information in your email, such as payment methods, deadlines, and any late fees or early payment discounts. This eliminates confusion and provides all the details upfront.

Follow Up and Maintain Professionalism

Sending a billing document is not the end of the process. It’s essential to follow up if payment is not received by the due date. However, be sure to maintain professionalism in your communication. A polite reminder email or message can help prompt your client to settle their account without damaging the relationship.

By following these best practices, you ensure that your billing process is smooth, timely, and professional, helping to improve your cash flow and maintain positive client interactions.

How to Automate Invoice Generation

Automating the creation of billing documents can save you a significant amount of time and effort, particularly if you regularly issue payments requests to clients. By streamlining the process, you reduce the chances of human error, ensure consistency in your documents, and improve your overall efficiency. Automation tools allow you to quickly generate accurate payment requests with minimal input, freeing up time for other tasks in your business.

Tools and Software for Automation

There are various tools available that can help automate the creation of billing documents. These tools can connect to your accounting software or project management platforms to generate customized documents based on the data you input. Here are some features to look for in automation tools:

- Integration with Payment Systems: Many automation tools integrate directly with accounting software or payment platforms like PayPal, Stripe, or QuickBooks, allowing for seamless data transfer between platforms and reducing the need for manual entry.

- Customizable Fields: Automated systems typically offer customizable fields for your business information, client details, service descriptions, and payment terms. This allows you to quickly generate personalized documents without starting from scratch each time.

- Recurring Billing: For businesses with ongoing clients or subscription-based services, look for tools that support recurring billing. This allows you to set up billing cycles that automatically generate payment requests on a schedule, reducing the need for manual reminders.

- Cloud-Based Solutions: Using cloud-based tools ensures that your billing documents are always accessible from any device with an internet connection. This also helps keep your data secure and backed up in case of unexpected events.

- Automated Reminders: Some tools can send reminders for upcoming or overdue payments automatically. This reduces the need for you to manually chase clients for payment, improving cash flow.

Example of Automated Document Creation Workflow

Here is an example of how the automation process might work:

| Step | Description |

|---|---|

| 1. Enter Client Information | Input the client’s name, contact information, and payment terms into your automation tool. |

| 2. Add Service Details | Include the specific services or products delivered, along with prices and quantities. |

| 3. Set Payment Terms | Choose the payment method and set the due date, applying any discounts or taxes as needed. |

| 4. Review and Send | Review the generated document, make any final adjustments, and send it to the client automatically. |

By integrating automation into your billing process, you save valuable time, reduce the risk of errors, and improve the consistency of your payment requests. As a result, your workflow becomes smoother, and you can focus more on growing your business.

How to Track Invoice Payments

Keeping track of payments for your services or products is essential for managing your cash flow and ensuring that you are paid on time. Without a reliable system in place, it’s easy to lose track of outstanding balances or forget to follow up on overdue payments. Fortunately, there are several effective methods and tools that can help you track payments efficiently, saving you time and preventing potential financial issues.

Here are some practical ways to track payments for your billing documents:

Manual Tracking

For small businesses or freelancers with a manageable number of clients, manual tracking might be a simple solution. Using a spreadsheet, you can record essential details for each payment, such as the date issued, amount due, payment method, and the payment status. You can also add columns to track when payments were received and any outstanding balances.

- Spreadsheet Tracking: A basic spreadsheet allows you to keep track of payments in real-time. It’s an easy solution if you prefer to handle things manually and don’t want to rely on complex software.

- Mark Payment Status: Clearly label payments as “Pending,” “Paid,” or “Overdue” to ensure you know the status of each transaction.

Automated Tools and Software

For businesses that deal with more frequent transactions or want a more efficient solution, accounting software and invoicing platforms can automate the process of tracking payments. Many tools integrate directly with payment gateways, allowing you to track when payments are made and send automatic reminders for overdue amounts.

- Accounting Software: Platforms like QuickBooks, Xero, or FreshBooks offer built-in payment tracking features. These tools not only generate billing documents but also track payments, sending notifications when a payment is due or overdue.

- Integration with Payment Systems: Some tools sync with payment processors like PayPal, Stripe, or bank accounts to automatically mark payments as received, making tracking even more effortless.

Best Practices for Payment Tracking

In order to maintain accurate records and keep cash flow smooth, consider these best practices:

- Set Clear Payment Terms: Define your payment deadlines and methods clearly on your billing documents. This helps reduce confusion and sets expectations for both you and your clients.

- Regularly Check Payment Status: Review your payment status regularly to catch overdue balances early and follow up promptly. The sooner you

Benefits of Using Free Invoice Templates

Utilizing pre-designed billing documents offers numerous advantages, especially for small businesses, freelancers, or anyone looking to streamline their payment processes. These documents are readily available and designed to cover essential details, saving you time and effort in the creation process. They allow you to focus more on your core tasks while ensuring that your payment requests are professional and accurate.

Key Advantages

Here are some of the primary benefits of using pre-designed billing documents:

- Time-Saving: By using a ready-made design, you eliminate the need to start from scratch. This enables you to generate billing documents quickly and efficiently, reducing the time spent on paperwork.

- Professional Appearance: Pre-made documents are usually designed with a clean and professional layout. This helps present your business as organized and trustworthy, which can enhance your reputation with clients.

- Customization Options: Many free designs offer customization options that allow you to add your business logo, adjust colors, and input specific details, making the document feel personalized while still saving time.

- Consistency: Using a standardized format for all your payment requests ensures consistency in your documentation. This can help both you and your clients stay organized and avoid confusion when reviewing records.

- Legal Compliance: Many of these pre-designed forms include required legal information, such as tax identification numbers or business registration details, ensuring that you meet necessary legal standards.

Cost-Effective Solution

For businesses or freelancers just starting out, pre-made billing documents provide a cost-effective alternative to expensive software. Many options are available at no cost and can be downloaded or used directly online. This is especially beneficial for those with limited budgets who still need a professional solution.

Overall, using these documents simplifies the billing process, saves time, and ensures professionalism–all while