Editable Invoice Template in Word Format for Easy Customization

For businesses and freelancers, managing financial transactions efficiently is essential. One of the best ways to streamline this process is by using customizable documents that can be easily modified to suit different needs. These documents help ensure that all relevant details are included, maintaining professionalism and accuracy in every financial interaction.

With the right tools, you can create professional-looking statements that meet your specific requirements. Whether it’s adjusting the layout, adding personalized information, or ensuring compatibility with various software, having the flexibility to tailor these forms saves time and reduces the risk of errors. The ability to modify key elements makes it easier to manage your records and stay organized.

In this guide, we’ll explore the advantages of using such documents and show you how to make the most of these versatile resources. From simple design adjustments to incorporating complex details, you’ll learn how to create a document that not only looks great but also serves your business needs effectively.

Why Use an Editable Billing Document

Customizable billing documents are an essential tool for businesses and freelancers who need to manage their financial transactions with ease. The ability to personalize these records offers several benefits that contribute to greater efficiency, accuracy, and professionalism. Rather than starting from scratch with each new request, having a flexible structure ready to be adjusted makes the entire process faster and more streamlined.

Key Advantages

- Time-Saving: Ready-to-use structures reduce the need to manually create every new document, saving time on formatting and design.

- Consistency: Using a pre-designed format ensures that all documents follow the same layout, making your records consistent and professional across the board.

- Customization: You can easily adapt the document to include specific information such as unique items, client details, or personal branding elements.

- Accuracy: Pre-built structures help ensure all required fields are filled in properly, reducing the risk of mistakes and missing information.

- Cost-Effective: Many free or low-cost options are available, making them an affordable choice for small businesses and freelancers.

How Customizable Billing Documents Improve Your Workflow

When you use a flexible structure, you can focus more on the content rather than on formatting. Modifying text, adjusting fields, or adding specific sections can all be done quickly, allowing you to produce accurate and clear financial records in less time. Additionally, the ease of use means that even those with limited design experience can create polished and professional-looking documents effortlessly.

Benefits of Word Format for Billing Documents

Using a widely recognized document format for creating billing records offers numerous advantages. It ensures that your files can be easily shared, opened, and edited across various platforms without compatibility issues. The simplicity and versatility of this format make it an ideal choice for professionals who need a reliable way to manage their financial paperwork while maintaining high standards of professionalism.

Universal Accessibility

One of the major benefits of using this format is its universal accessibility. Most computers, whether Windows or macOS, come pre-installed with software capable of opening and editing these files. This means you don’t have to worry about file compatibility when sending documents to clients or colleagues. It ensures smooth communication, regardless of the software or devices your recipients use.

Ease of Customization

Another key advantage is the flexibility in design. This format allows you to quickly adjust the content, layout, and formatting to suit specific needs. Adding or removing sections, updating client details, or modifying text is a straightforward process. This level of control makes it easier to create personalized, professional-looking records with minimal effort.

Additionally, this format supports a wide variety of formatting tools, including tables, bullet points, and custom fonts, which helps in presenting information clearly and effectively. This flexibility is especially useful for those who require a consistent yet customizable approach to their billing documentation.

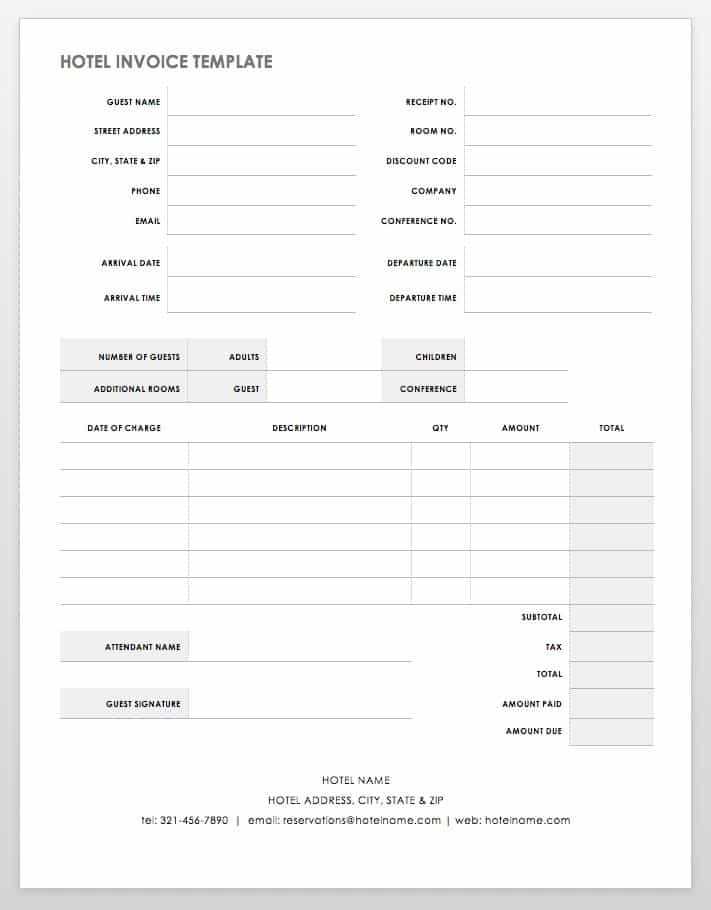

How to Customize Your Billing Document

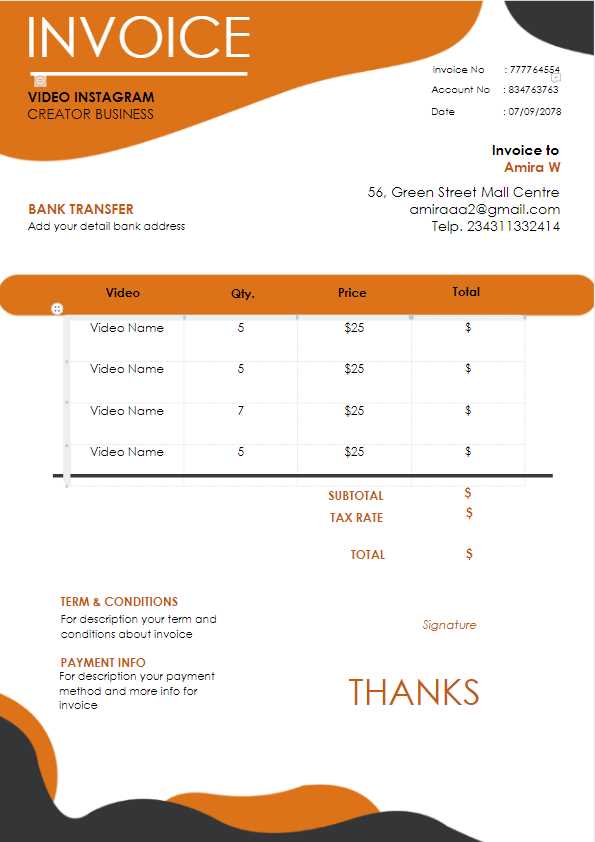

Personalizing your financial documents to reflect your brand and meet your specific needs is a simple yet effective way to enhance professionalism. Customization allows you to tailor the content, layout, and overall look to suit your style, while ensuring all necessary details are included. By following a few easy steps, you can create documents that align with your business requirements and make a lasting impression on clients.

Step-by-Step Customization Guide

- Modify Basic Information: Start by editing the essential fields such as your company name, address, and contact information. This helps ensure that the document is specific to your business and is easily identifiable.

- Adjust Layout and Design: You can easily change the structure by adding or removing sections, such as payment terms, service descriptions, or client details. Modify fonts, colors, and spacing to match your branding.

- Include Your Logo: Adding your logo to the document gives it a personalized touch and reinforces your business identity. Place it at the top or in a corner for easy visibility.

- Update Payment Details: Make sure to include accurate payment instructions, including bank account details, payment methods, and due dates. Clear payment instructions help avoid confusion.

- Save and Reuse: Once customized, save the document for future use. By keeping a master version, you can easily duplicate and adjust it for each new client or project.

Tips for Effective Customization

- Ensure that all fields are filled in correctly to avoid any misunderstandings or delays in payment.

- Keep the design clean and professional, focusing on readability and clarity.

- Review your document before sending to ensure that all necessary information is included and accurate.

With these simple steps, you can create fully customized documents that reflect your business’s professionalism while also providing all the necessary details your clients need.

Free Billing Documents for Word

If you’re looking for a simple and cost-effective way to manage your financial paperwork, there are plenty of free resources available online. These tools allow you to download and use pre-designed forms that can be easily customized to meet your needs. Whether you run a small business or work as a freelancer, having access to free templates can save both time and effort when creating professional financial records.

Where to Find Free Billing Documents

Many websites offer free options for creating professional financial records. These resources typically provide a variety of formats, each designed to suit different types of businesses or services. Here are some places where you can find downloadable forms:

- Online Template Libraries: Websites like Microsoft Office, Google Docs, and specialized financial platforms offer free pre-made designs that you can customize.

- Freelancer Forums: Many freelance communities share free resources, including document formats that suit specific industries or services.

- Small Business Websites: Many sites dedicated to small businesses provide free downloads for financial paperwork to help new entrepreneurs manage their operations more efficiently.

Benefits of Using Free Documents

Taking advantage of free forms can significantly reduce your operational costs, especially if you’re just starting out. Here are some benefits of using these resources:

- Cost-Effective: Accessing free tools means you don’t need to spend money on expensive software or design services.

- Ease of Use: These pre-designed formats are simple to fill out and customize, even for those with minimal experience in document design.

- Professional Appearance: Free resources are often created by design professionals, ensuring that your final product looks polished and business-ready.

- Time-Saving: With a ready-made structure, you can quickly input necessary information without wasting time on formatting.

By using these free resources, you can create professional financial documents that not only save time but also help you maintain a professional image with clients and business partners.

Creating Professional Billing Documents in Word

Creating well-organized and professional financial records is essential for businesses of all sizes. With the right tools, you can produce documents that not only communicate the necessary details clearly but also reflect your company’s professionalism. By utilizing the right design elements and ensuring that all critical information is included, you can craft documents that make a positive impression on clients and partners.

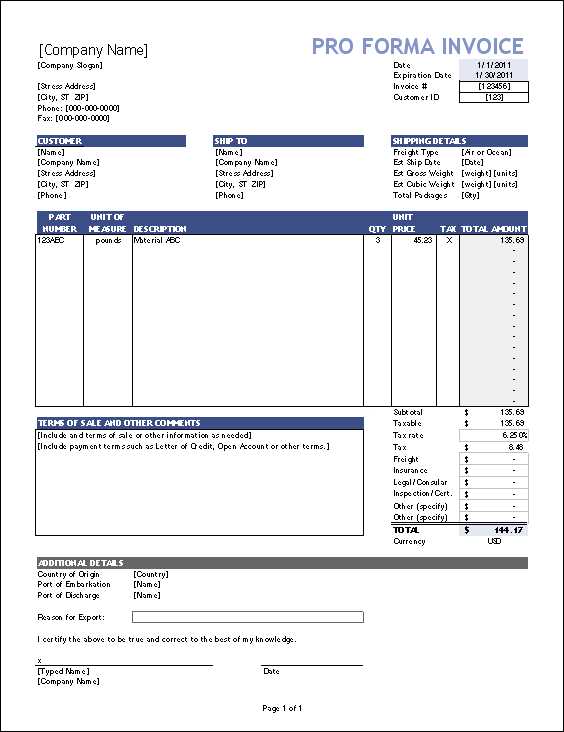

The process of building a polished financial document starts with a clear structure. By focusing on key sections such as the recipient’s details, service descriptions, payment terms, and due dates, you ensure that all important information is conveyed. A clean, consistent layout will help clients easily understand the payment details, reducing the risk of misunderstandings or delays.

Additionally, integrating your branding–such as your logo, business colors, and fonts–into the design adds a level of personalization and professionalism that makes the document stand out. This attention to detail helps reinforce your brand identity and shows that you take your business seriously, which can foster trust and confidence with clients.

Finally, double-checking for accuracy is crucial. Ensure that all financial figures are correct, dates are up-to-date, and that no fields are left incomplete. A small error can lead to confusion or even payment delays, so it’s essential to take the time to review each document carefully before sending it out.

Step-by-Step Guide to Document Editing

Editing a professional billing document doesn’t have to be complicated. By following a few straightforward steps, you can easily modify a pre-existing file to suit your specific needs. Whether you’re adding new items, adjusting amounts, or including personalized information, knowing the right sequence of actions ensures a smooth process. This guide will walk you through each stage, so you can quickly create customized records that are both accurate and professional.

Step-by-Step Editing Process

- Open the Document: Begin by opening the document you want to modify. Ensure that the file format is compatible with the software you’re using.

- Review the Layout: Take a moment to check the overall structure of the document. Make sure there are clear sections for contact details, service descriptions, and payment terms. If any sections are missing or need to be adjusted, now is the time to do so.

- Edit Basic Information: Update essential details such as your company’s name, address, phone number, and email. You should also update the client’s information, including their name and billing address.

- Modify Item Descriptions: Review the list of services or products being billed. Add or remove items as necessary, and update quantities and prices where applicable. Be sure to format everything clearly for easy reading.

- Adjust Payment Terms: Make sure that payment instructions and due dates are clearly stated. If necessary, update payment methods or add any specific instructions related to late fees or discounts.

- Proofread the Document: Before finalizing, double-check the document for any errors or omissions. Ensure that all calculations are correct, and there are no typos or missing information.

- Save and Export: Once you’re satisfied with the changes, save the file and export it in a preferred format. If you’re sending the document via email, consider saving it as a PDF to preserve the layout and prevent further edits.

Editing Tips

- Always keep a master version of the document so you can easily create new ones without starting from scratch.

- Use clear, concise language to avoid confusion with clients.

- Ensure that your contact information is up-to-date to avoid communication issues.

By following these simple steps, you can efficiently modify your financial records to fit the needs of each client while maintaining professionalism and accuracy in every document you send out.

Best Practices for Billing Document Design

Creating clear, professional, and easy-to-understand financial documents is crucial for maintaining good client relationships and ensuring prompt payments. A well-designed record not only conveys the necessary information but also reflects the professionalism of your business. Following best practices in layout, content structure, and visual appeal can significantly improve how your documents are perceived and how easily they are understood.

Key Design Principles

- Keep It Simple: Avoid clutter. A clean, minimalist design helps clients focus on the most important details, like the amount due and payment instructions.

- Use Consistent Branding: Incorporate your company’s logo, colors, and fonts to reinforce your brand identity. This adds a professional touch and makes your document easily recognizable.

- Organize Information Clearly: Arrange your document into logical sections, such as contact details, items or services, payment terms, and totals. Use headings or lines to separate each section for better readability.

- Ensure Legibility: Choose fonts that are easy to read, even at smaller sizes. Stick to standard font styles like Arial or Times New Roman, and avoid using too many different fonts or colors.

- Prioritize Important Information: Highlight the key details, such as the total amount due and payment due date, by using bold text or larger font sizes. This ensures that these critical pieces of information stand out.

Visual Enhancements

- Incorporate Tables: For a more organized look, use tables to list items or services with clear columns for quantities, rates, and totals. This makes it easier for your clients to follow the breakdown of charges.

- Use Whitespace: Don’t overcrowd the page. Leave enough space between sections and around the edges to make the document feel open and professional.

- Stay Consist

Common Mistakes in Document Creation

When creating professional financial records, small errors can lead to confusion, delays in payment, or even damage to your business’s reputation. These mistakes can often be avoided by paying attention to detail and following a consistent approach. Understanding the common pitfalls can help ensure that every document you send out is accurate, clear, and effective in communicating payment terms.

Frequent Errors to Avoid

- Missing Client Details: Failing to include complete and accurate client information, such as the correct billing address or contact details, can cause delays and confusion.

- Incorrect or Inconsistent Amounts: Double-checking the calculations and ensuring that all figures match is crucial. Incorrect pricing, tax rates, or totals can create problems and undermine trust.

- Omitting Payment Terms: Leaving out clear payment instructions, due dates, or accepted payment methods can lead to misunderstandings. Always include precise terms to avoid confusion.

- Not Including a Unique Identifier: Each document should have a unique reference number or ID to help both you and your client track the payment easily.

- Using Unclear Descriptions: Be specific and clear when describing the products or services provided. Vague or generic descriptions can lead to questions and delay payments.

Formatting Mistakes

- Cluttered Layout: Overcrowding the document with too much text or information can make it hard to read. A clean, well-organized layout enhances the overall clarity.

- Inconsistent Fonts and Styles: Using different fonts, sizes, or colors can make your document look unprofessional. Stick to a consistent style for a more polished appearance.

- Forgetting to Proofread: Even minor spelling or grammatical mistakes can undermine your credibility. Always take time to proofread before sending.

Avoiding these common mistakes can help ensure that your financial documents are professional, accurate, and well-received by clients. By reviewing each document carefully and maintaining a consistent, clear format, you can foster trust and improve the efficiency of your payment processes.

Where to Find Customizable Billing Documents

Finding the right resources for creating professional financial records is key to streamlining your business processes. Whether you’re looking for a simple layout or something more intricate, many online platforms provide easily accessible tools to help you generate personalized documents. Below are some of the best places where you can find pre-made files that can be adjusted to fit your specific needs.

Popular Resources for Customizable Forms

- Microsoft Office: The Microsoft website offers a wide range of free and premium templates for different types of financial documents. These options are fully customizable and can be easily downloaded and modified using Microsoft Office applications.

- Google Docs: Google provides free online forms that can be accessed and edited directly in the cloud. This allows for easy customization and sharing, making it a great option for remote businesses or freelancers.

- Template Websites: Dedicated platforms such as TemplateLab or HubSpot offer a variety of free and premium document designs that can be adjusted to meet your needs.

- Freelancer and Small Business Communities: Many online forums and communities dedicated to small business owners and freelancers share free customizable document formats. Websites like Reddit or specialized business blogs often have downloadable resources shared by other entrepreneurs.

- Design Marketplaces: Websites such as Creative Market and Etsy offer professionally designed documents for purchase. These often come with advanced customization options and unique layouts suited to specific industries.

Advantages of Using Online Resources

- Variety of Designs: Whether you need a minimalist layout or a more detailed design, you can find multiple options that fit your business style.

- Ease of Access: Most resources are available online for free or at a low cost, and can be downloaded instantly for immediate use.

- Customization: Even pre-designed documents can be easily modified to include your branding, client details, and unique payment terms.

- Compatibility: Many of these files are designed to work with multiple software applications, ensuring you have no trouble accessing or editing them on your preferred platform.

By utilizing these resources, you can save time and effort while still ensuring that your financial records look professional and are tailored to your business’s needs.

How to Add Your Logo to Billing Documents

Including your company logo in financial documents is a great way to enhance your brand’s professionalism and recognition. It adds a personalized touch and ensures that your documents are immediately identifiable. Whether you’re creating a new record or customizing an existing one, placing your logo correctly can make a big impact. This guide will walk you through the steps of adding your logo to documents quickly and easily, so they look polished and cohesive with your brand identity.

Step-by-Step Guide to Adding Your Logo

- Prepare Your Logo: Ensure that your logo image is in an appropriate format (JPEG, PNG, or SVG). It’s best to use a high-resolution image to avoid pixelation when displayed on documents.

- Open Your Document: Start by opening the document where you want to add your logo. If you’re working with an existing file, make sure it’s ready for editing.

- Insert the Logo: In most software, go to the “Insert” menu and choose the “Image” or “Picture” option. Locate the logo file on your computer and click “Insert” to add it to the document.

- Resize and Position: Once your logo is inserted, resize it by dragging the corners of the image. Place it in a prominent location, typically at the top of the document, either in the header or aligned to the left or right corner.

- Adjust Text Flow: Ensure the text around your logo flows properly. You can adjust text wrapping settings to prevent the content from overlapping with the logo, creating a clean and organized layout.

- Save and Review: After positioning your logo, save your work and review the document. Check that the logo looks clear and that everything is properly aligned.

Tips for Effective Logo Placement

- Choose the Right Size: Ensure your logo isn’t too large or too small. It should be visible but not overwhelm the content.

- Consider Transparency: If using a PNG file with a transparent background, your logo will blend seamlessly into the document, especially when placed over colored backgrounds.

- Maintain Consistency: Use the same logo placement and size across all your documents to keep your branding consistent.

By following these simple steps, you can ensure that every document you send reflects your brand’s identity and adds a professional touch to your communications.

Choosing the Right Billing Document Format

Selecting the right format for your financial documents is essential for ensuring clarity, professionalism, and ease of use. The design and structure of the document you choose can significantly impact how your clients perceive your business and how efficiently you can track and manage payments. A well-organized and appropriate layout will make it easier for clients to understand the details, while also providing you with a clear record of the transaction.

When deciding on a format, consider factors such as your business type, the complexity of your services or products, and how often you need to send financial documents. Different layouts work better for different industries or client relationships, so it’s important to choose one that aligns with your needs and brand image.

Key Factors to Consider

- Business Type: A freelancer offering simple services might not need as complex a layout as a company offering multiple products with detailed descriptions. Choose a format that reflects the scale and nature of your business.

- Document Structure: Decide if you need a simple one-page format or a more detailed, multi-section layout. If your work involves multiple items or services, a table layout may be ideal to keep everything organized.

- Customization Options: Select a format that allows you to add your own branding, such as logos, colors, and fonts, to ensure the document aligns with your company’s image.

- Ease of Use: Choose a format that’s easy to edit and update as needed, without requiring extensive design skills. Pre-made formats can save time, but they should be simple enough to adjust quickly when necessary.

- Client Preferences: Consider how your clients prefer to receive and review your financial documents. Some may appreciate a clean, minimalist design, while others might prefer more detailed breakdowns of charges.

By taking these factors into account, you can select a format that not only serves its purpose but also reflects your professionalism and enhances your client relationships.

Formatting Tips for Billing Documents

Proper formatting is key to creating professional and clear financial records. A well-organized document not only helps clients understand the details but also enhances your business’s credibility. Effective use of text, spacing, and layout can improve the readability of your document and ensure that all important information is easily accessible. Below are some essential formatting tips to help you create polished and professional documents every time.

Key Formatting Considerations

- Use Consistent Fonts: Stick to standard fonts like Arial or Times New Roman. Keep font sizes consistent for similar sections, with headings slightly larger to differentiate them from the rest of the text.

- Set Clear Section Headers: Use bold or larger font sizes for section titles (such as “Client Details” or “Payment Terms”) to make them stand out. This helps the reader quickly find the information they need.

- Keep Spacing Balanced: Use appropriate spacing between sections to make the document easy to follow. Avoid cramming text together or using excessive space that could make the document feel disorganized.

- Align Text Properly: Left-align text for clarity and consistency. Center-align titles or logos at the top of the document to create a polished and symmetrical look.

- Incorporate Tables for Itemized Lists: If your document includes a breakdown of services or products, use tables to organize the information clearly. This makes it easier for your client to review each item, price, and total.

- Highlight Key Information: Make important details like the total amount due or payment due date stand out by using bold text or a larger font size. This ensures that your client notices the most critical information.

Additional Tips for Polished Documents

- Use Colors Sparingly: While colors can add personality to your document, it’s important to keep them professional. Stick to one or two complementary colors for headings, borders, or logos to maintain a clean look.

- Incorporate Your Branding: Add your company logo and brand colors to make the document look cohesive with your other marketing materials.

- Proofread Before Sending: Even with perfect formatting, a document full of spelling or grammatical errors will lose its impact. Always double-check for mistakes before finalizing.

By following these formatting tips, you’ll ensure that your documents are both visually appealing and functional, helping you build a professional image and make the payment process as smooth as possible for your clients.

How to Save and Share Billing Documents

Once your financial document is complete, saving and sharing it efficiently is key to ensuring prompt payments and maintaining organized records. Whether you need to send it via email, share it in a cloud system, or keep a hard copy for your files, it’s important to choose the right method based on convenience and security. Below are some helpful tips for saving and sharing your financial records with ease and professionalism.

Saving Your Document

- Choose the Right File Format: Save your document in a format that’s easy to open and read across different platforms. PDF is the most common format for sharing professional documents, as it preserves the layout and can be opened on any device.

- Organize Your Files: Use a clear naming system for your documents. Include the client’s name or company, the service provided, and the date (e.g., “JohnDoe_Consulting_Invoice_June2024”) to make it easy to find later.

- Back Up Your Documents: Keep a copy of each document in a safe, organized location on your computer or in cloud storage. This ensures that you have access to your records even in case of hardware failure.

Sharing Your Document

- Emailing the Document: Email is the quickest way to send documents to clients. Make sure to attach the file and include a clear subject line, such as “Your Payment Statement for [Month/Service].” Always check the file size to ensure it’s not too large to be sent.

- Cloud Storage Services: Platforms like Google Drive, Dropbox, or OneDrive allow you to upload your documents and share them with clients via a link. This is a convenient method, especially for clients who prefer online access.

- Using Accounting Software: If you use accounting tools, many allow you to generate and send documents directly to clients through the platform. This can streamline the process and help you track payments more easily.

- Physical Copies: If your client requires a hard copy, print the document and send it via postal mail or hand it over in person. Be sure to use high-quality paper and keep a copy for your records.

By following these best practices for saving and sharing your financial documents, you’ll ensure that your records are always accessible, secure, and easy for your clients to review. Maintaining good organization also helps streamline your workflow and keep your business running smoothly.

Keeping Track of Paid and Unpaid Documents

Managing payments efficiently is a crucial part of any business. Being able to clearly differentiate between completed and pending transactions helps maintain cash flow, prevents misunderstandings, and ensures that you stay on top of outstanding balances. By using a structured system to track payments, you can easily identify which clients have paid, which ones are overdue, and take appropriate action when necessary.

Methods for Tracking Payments

- Use a Simple Spreadsheet: Create a spreadsheet to track payments. Include columns for the client name, amount due, payment date, and status (paid or unpaid). This provides a quick visual reference to monitor all your transactions.

- Accounting Software: There are many software solutions designed specifically to help manage financial records. Tools like QuickBooks, FreshBooks, or Xero allow you to automatically track which payments have been received and which remain outstanding, streamlining the entire process.

- Online Payment Platforms: If you use online payment systems like PayPal or Stripe, these platforms automatically track payment status and provide reports, making it easier to see which invoices have been settled.

- Manual Tracking: If you prefer a more hands-on approach, you can manually update the status of each document in a physical logbook or folder. While this method requires more effort, it can still be effective for smaller businesses.

Best Practices for Managing Payments

- Set Clear Payment Terms: Clearly state payment deadlines and any late fees in your documents. This helps clients understand when they need to pay and the consequences of not doing so.

- Regularly Follow Up: If a payment is overdue, send a polite reminder. You can automate reminders or schedule them manually to keep clients aware of outstanding balances.

- Organize Your Records: Keep detailed records of all transactions, including partial payments or payment plans. This makes it easier to resolve disputes and maintain accurate financial reporting.

- Maintain a Professional Tone: When communicating with clients about overdue payments, always remain professional. This maintains a positive relationship while ensuring that your business gets paid.

By implementing an organized system for tracking paid and unpaid documents, you ensure smoother cash flow, reduce the risk of missed payments, and maintain professionalism in your business operations.

Legal Considerations for Billing Document Creation

When preparing financial documents for your business, it’s essential to ensure that they meet all legal requirements. Proper documentation not only ensures that you get paid on time but also protects you in case of disputes. By understanding the key legal elements that should be included, you can avoid common mistakes and ensure that your documents comply with tax regulations, business laws, and contractual agreements.

Essential Legal Elements to Include

- Contact Information: Always include your business name, address, and contact details, as well as the client’s information. This helps clearly identify both parties involved in the transaction.

- Clear Payment Terms: Specify when payment is due and outline any penalties for late payments. Including information about late fees or interest rates can help you protect your business from non-payment.

- Tax Identification Number: Include your tax identification or VAT number, especially if your business is registered. This helps ensure compliance with local tax laws and makes the document valid for business purposes.

- Legal Disclaimers: Include any necessary legal disclaimers, such as terms for refunds, warranties, or guarantees, if applicable to your business or services.

- Contractual References: If your work is based on a contract, refer to the terms and conditions of that contract in the financial document. This helps clarify any legal obligations tied to the transaction.

Compliance with Local Laws and Regulations

- Tax Compliance: Ensure that the financial document reflects any applicable taxes based on your location. Depending on your country or region, you may need to include sales tax, VAT, or other mandatory charges.

- Record Keeping Requirements: Many countries require businesses to keep records of all financial transactions for a set period. Be sure to follow local laws regarding the retention of financial records.

- Legal Formats and Language: Be mindful of any specific format or language requirements imposed by your local government. For example, certain regions may require specific wording or additional clauses for validity.

By integrating these legal considerations into your financial documents, you can protect your business, comply with relevant laws, and maintain a professional relationship with your clients. Ensuring legal clarity in your documents reduces risks and provides peace of mind for both you and your clients.