Invoice Template Docs for Quick and Professional Billing

Managing business transactions requires clear, accurate, and professional paperwork. Whether you’re a freelancer, small business owner, or large enterprise, having a streamlined process for generating payment requests is essential. The right tools can simplify this task and ensure that you maintain a consistent, professional appearance in all your communications.

Customizable forms for billing offer flexibility in terms of design, content, and functionality. By using a well-organized structure, these tools help users quickly create precise and polished documents. They can be adapted to suit various industries and business needs, making it easy to track financial transactions and stay organized.

Efficiency is key when it comes to business documentation. With the right approach, generating detailed and clear payment reminders becomes an effortless task. These resources can help save valuable time while ensuring all necessary details are included, ultimately enhancing both professionalism and productivity.

Invoice Template Docs

Efficient billing is crucial for businesses of all sizes. Creating clear, professional documents for requesting payments can help establish trust and ensure timely transactions. Using structured formats for this purpose can simplify the process, reduce errors, and save valuable time. These resources can be tailored to specific needs and industries, making it easy for anyone to generate accurate financial records.

Key Features of Effective Billing Documents

When selecting or creating a document for payment requests, consider the following features:

- Clear Formatting: Ensures that all information is easily readable and accessible.

- Essential Fields: Includes sections like payment terms, contact details, and itemized charges.

- Customization Options: Allows modification to suit specific business requirements or branding.

- Automation: Some systems can automate the population of fields like dates and client names.

Advantages of Using Pre-Formatted Payment Documents

Opting for a ready-made structure for financial documentation offers several advantages:

- Consistency: Ensures that all documents follow the same professional format every time.

- Time Savings: Reduces the time spent on manually creating payment requests from scratch.

- Legal Compliance: Helps ensure that all necessary details, such as taxes and terms, are included.

- Accuracy: Minimizes the chance of missing or incorrect information.

Understanding the Importance of Invoice Templates

Creating structured and clear financial documents is essential for maintaining professionalism in business transactions. Having a consistent format for requesting payments helps streamline the billing process, ensuring accuracy and reducing the likelihood of errors. This approach not only improves efficiency but also builds trust between businesses and clients by ensuring that all necessary details are communicated effectively.

Using pre-designed formats offers significant advantages, especially for businesses that need to manage multiple transactions. These resources help eliminate guesswork and save time, allowing individuals to focus on core tasks without worrying about formatting each document from scratch. Additionally, having a reliable system in place can improve cash flow by ensuring timely payment requests.

| Benefit | Description |

|---|---|

| Time Efficiency | Reduces the time spent creating new documents for each payment request. |

| Accuracy | Ensures that all necessary information is included, reducing errors in billing. |

| Professionalism | Enhances the company’s image with well-organized and clear communication. |

| Consistency | Ensures all financial documents follow the same format, promoting clarity and uniformity. |

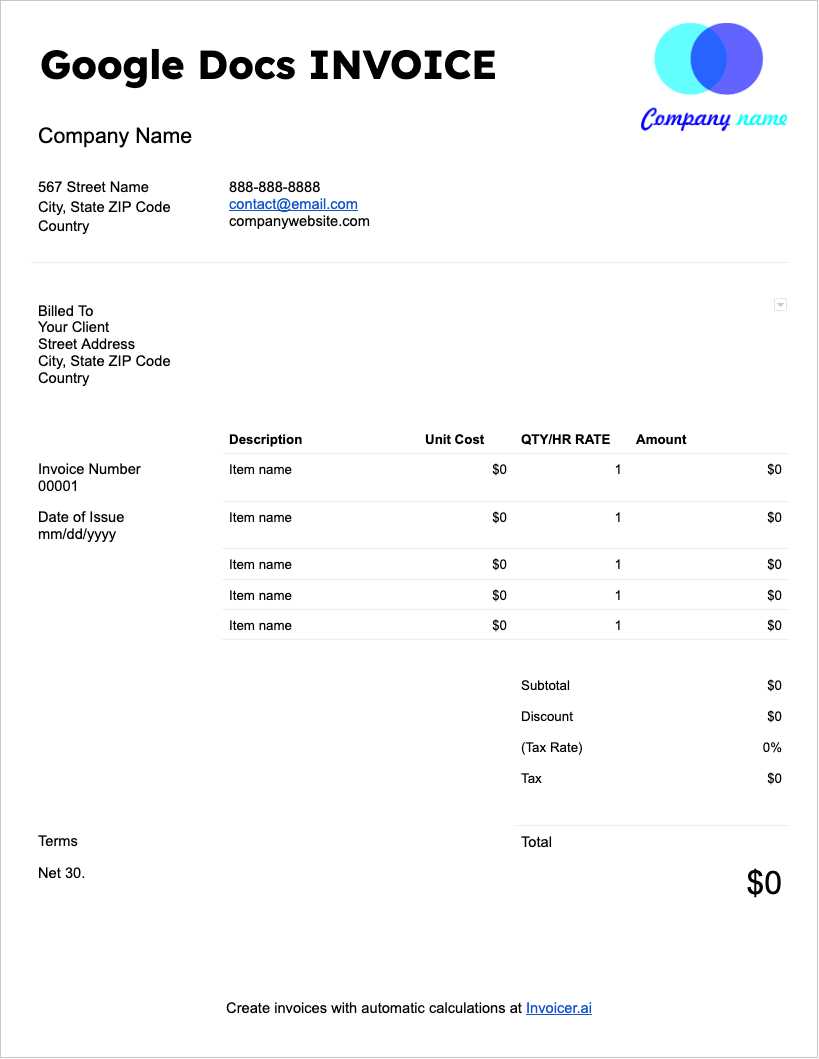

How to Choose the Right Template

Selecting the appropriate format for your billing and payment requests can greatly affect the efficiency and professionalism of your business operations. With various options available, it’s crucial to choose a structure that aligns with your specific needs, ensuring all relevant information is clearly presented and easily accessible. This process involves considering factors like simplicity, customization, and compatibility with your workflow.

Key Considerations for Choosing the Best Format

When evaluating different formats, keep the following points in mind:

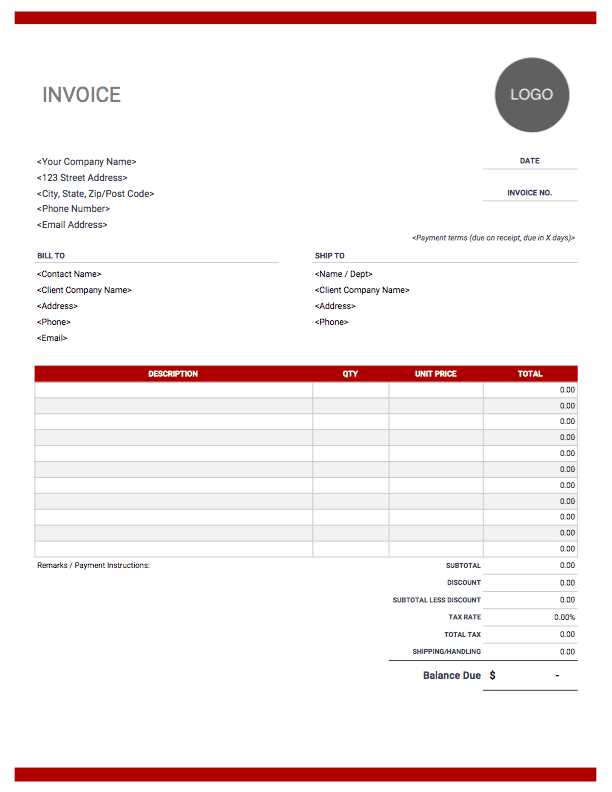

- Business Type: Different industries may require different layouts or sections. For instance, service-based businesses might need a more detailed breakdown, while product-based companies may focus more on quantities and prices.

- Customization Options: Ensure that the format allows you to easily add or remove fields according to your preferences. Flexibility is key to meeting your specific needs.

- Ease of Use: Choose a design that simplifies the process of entering and editing data, ensuring minimal effort on your part.

Benefits of the Right Choice

Choosing the ideal structure can enhance both your internal efficiency and customer satisfaction. A well-suited document will:

- Save Time: Streamline the creation process, making it quicker to generate new requests.

- Ensure Consistency: Maintain a consistent, professional appearance for all financial documents.

- Improve Communication: Present all necessary details in an easy-to-understand format, reducing confusion for both you and your clients.

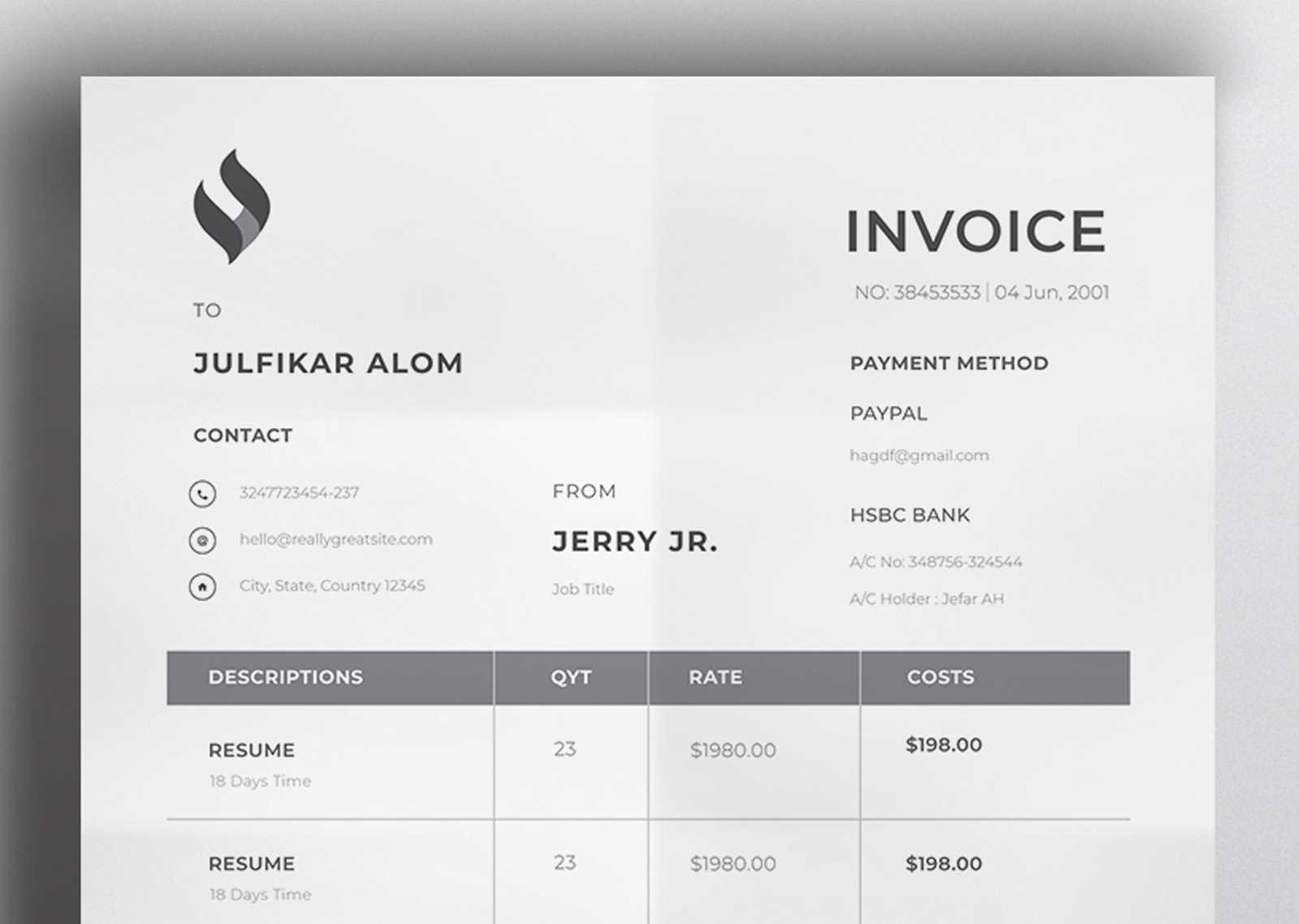

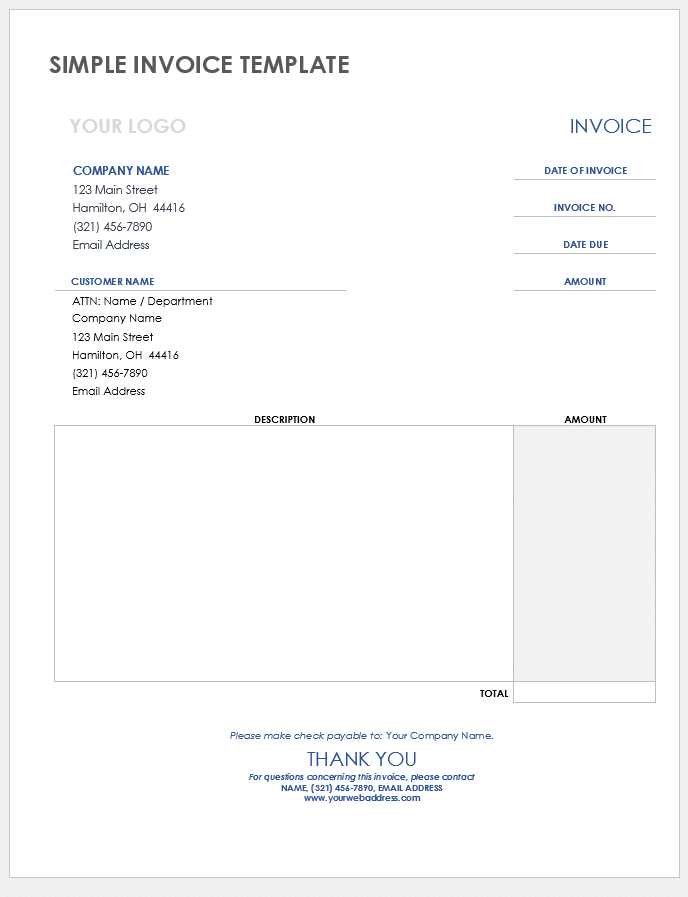

Customizing Your Invoice Template

Personalizing your payment request structure is an essential step in making your business transactions more efficient and professional. By tailoring the design and content to suit your specific needs, you can ensure that all necessary information is included, while also maintaining a clean and organized appearance. Customization not only helps reflect your brand identity but also streamlines the billing process.

Essential Elements to Customize

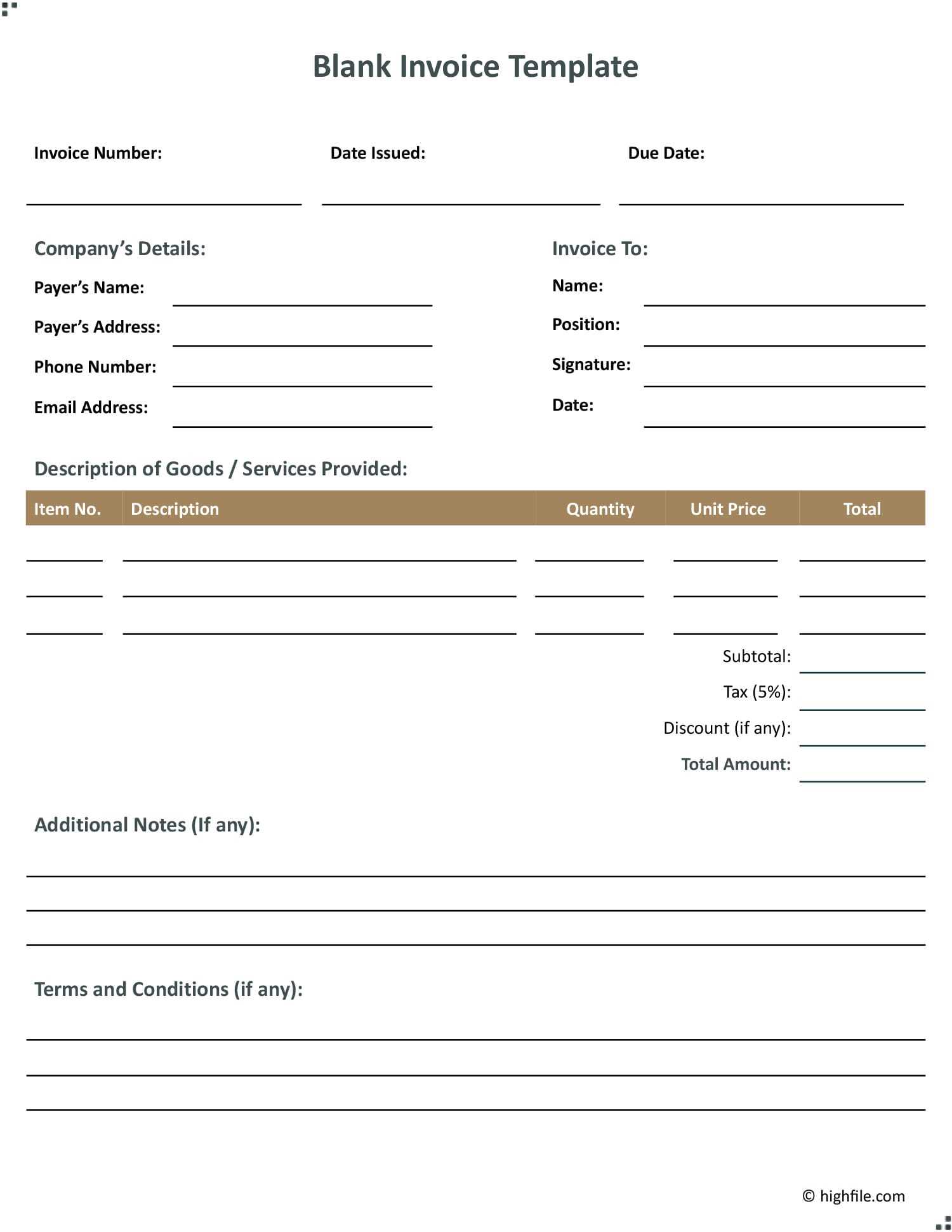

When adjusting your document layout, focus on these critical sections to ensure all relevant information is included:

- Company Details: Include your logo, business name, contact information, and website to personalize the document and maintain branding.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees to clarify expectations.

- Line Items: Clearly list each product or service, including quantities, unit prices, and totals for transparent communication.

- Taxes and Discounts: Make sure to add applicable tax rates or any discounts provided to ensure accurate calculations.

Tips for a Professional and Functional Layout

When customizing, keep the following tips in mind to ensure the document remains user-friendly and visually appealing:

- Keep it Simple: A cluttered design can confuse recipients. Use plenty of white space and clean lines to ensure the information is easy to read.

- Use Consistent Fonts and Colors: Stick to a professional color scheme and readable fonts to maintain clarity and enhance visual appeal.

- Ensure Mobile-Friendliness: Many clients may view the document on mobile devices, so make sure the layout is responsive and legible on smaller screens.

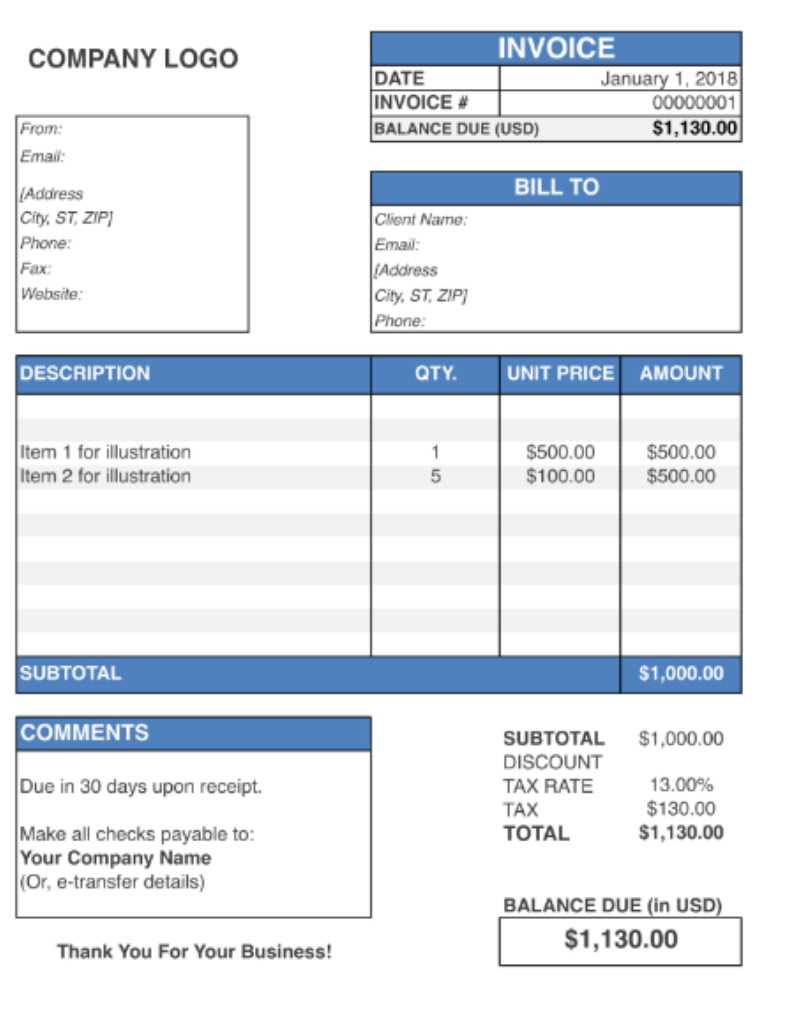

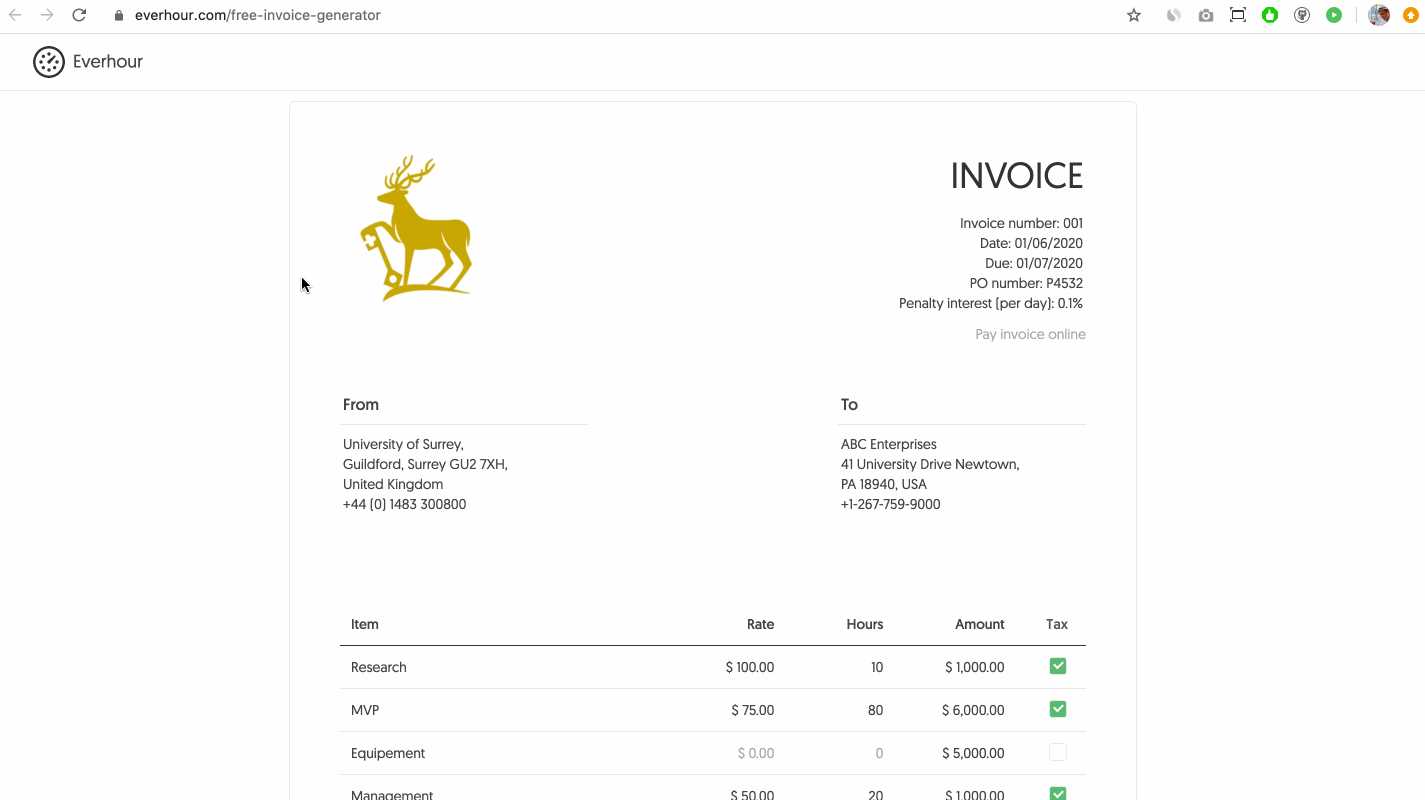

Top Features of a Good Invoice

Creating a well-structured and effective payment request is essential for smooth business transactions. A good document ensures that both parties have a clear understanding of the details involved, such as the amount owed and the terms of payment. The clarity and organization of the document play a significant role in avoiding misunderstandings and ensuring timely payments.

A high-quality payment request will contain several key elements that contribute to its clarity and professionalism. These features not only ensure that the details are communicated efficiently but also help maintain a positive business relationship with clients and customers.

| Feature | Description |

|---|---|

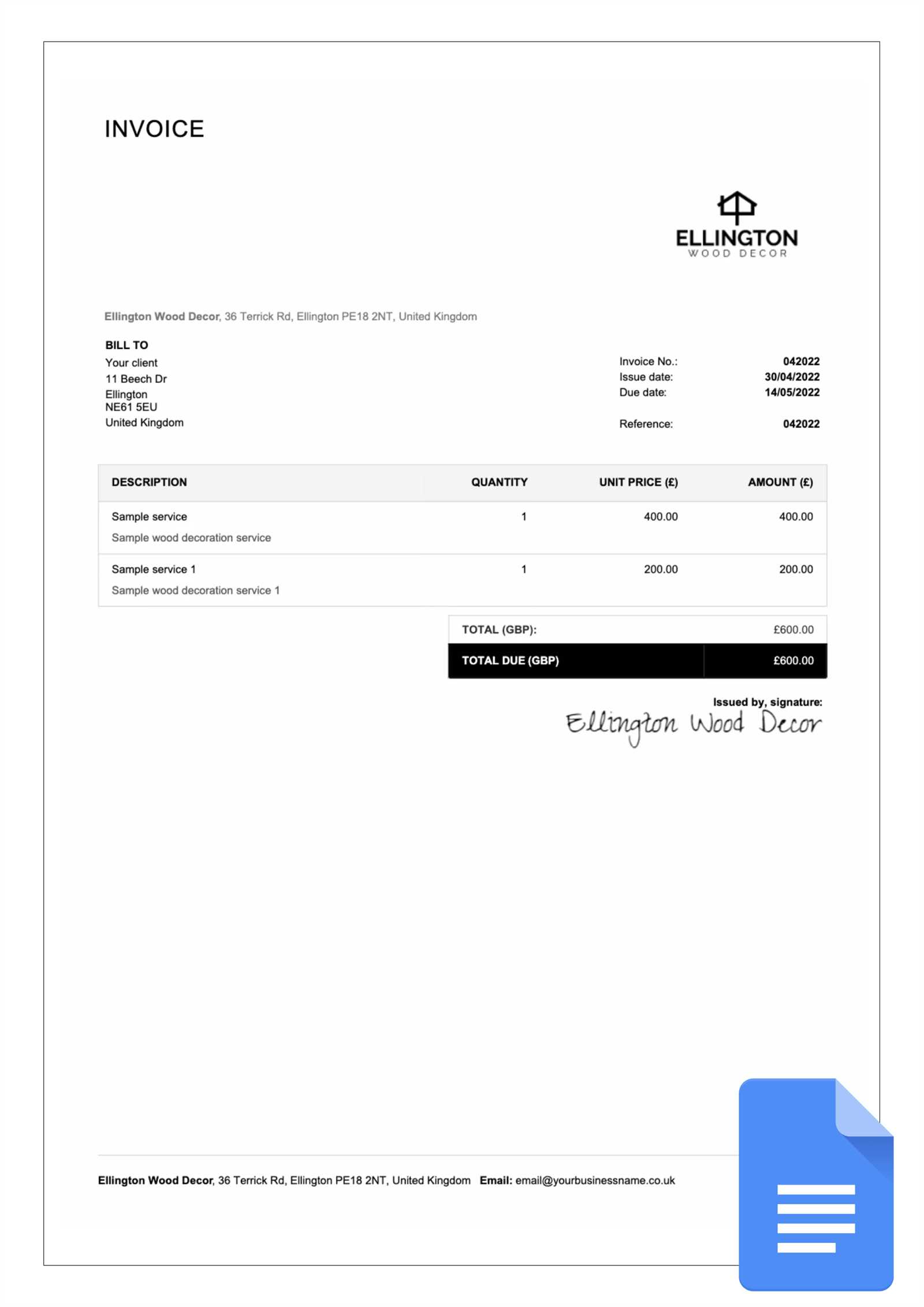

| Clear Header | The document should include a clear header with your business name, logo, and contact information, ensuring the recipient knows who the request is from. |

| Detailed Breakdown | All products or services should be listed individually with quantities, prices, and totals for transparency and accuracy. |

| Payment Terms | Include clear terms, such as due dates, accepted payment methods, and any late fees, to avoid confusion. |

| Unique Identifier | A unique reference number or code helps track the request and simplifies any future correspondence or payment tracking. |

| Tax and Discount Details | Ensure that any applicable taxes, discounts, or special offers are clearly listed and calculated to avoid errors. |

Benefits of Using Invoice Templates

Utilizing pre-designed formats for billing and payment requests offers several advantages that can streamline business operations and improve efficiency. These ready-made solutions save time, ensure consistency, and reduce the likelihood of errors, making them a valuable tool for businesses of all sizes. Whether you’re a freelancer or a large company, these formats simplify the creation and management of financial documents.

Here are some of the key benefits of incorporating standardized solutions into your billing process:

- Time Efficiency: By using a pre-structured format, you eliminate the need to manually design each document, speeding up the invoicing process.

- Consistency: A uniform layout ensures that all your documents look professional and follow the same design, which helps in maintaining brand identity.

- Accuracy: Reduces the risk of errors, as key sections such as amounts, tax rates, and terms are already included, and calculations can be automated.

- Customization: Many pre-made solutions offer flexibility, allowing you to adapt the format to your specific needs while retaining essential details.

- Legal Compliance: Standard formats are often designed to meet legal requirements, helping you ensure your documents comply with local laws.

- Ease of Use: Most of these solutions are user-friendly, making them accessible even to those with little design experience.

Free vs Premium Invoice Templates

When selecting a format for billing purposes, businesses often face the decision between using free or premium options. Both have their own set of advantages and drawbacks, and the choice largely depends on the specific needs and priorities of the business. While free solutions may be appealing due to their cost-effectiveness, premium offerings can provide additional features and customization that could better suit the demands of a growing business.

Free formats can be a good starting point for small businesses or freelancers looking for a straightforward way to request payment without investing in any software or services. They typically offer basic features, such as pre-defined sections for listing goods or services, payment terms, and contact information. However, they may lack some advanced customization options and professional design elements.

On the other hand, premium formats usually come with more advanced features and customization options. They often include a wider variety of design templates, allowing businesses to align their billing documents with their brand identity. Premium solutions may also offer integration with accounting software, automation of payment reminders, and customer support, which can be valuable for larger businesses or those with more complex billing needs.

While free solutions are perfectly suitable for small or one-off projects, premium options tend to offer greater value in the long run for businesses that require scalability, enhanced professionalism, and additional features. Depending on your business’s goals and resources, the right choice can help streamline operations and improve overall efficiency.

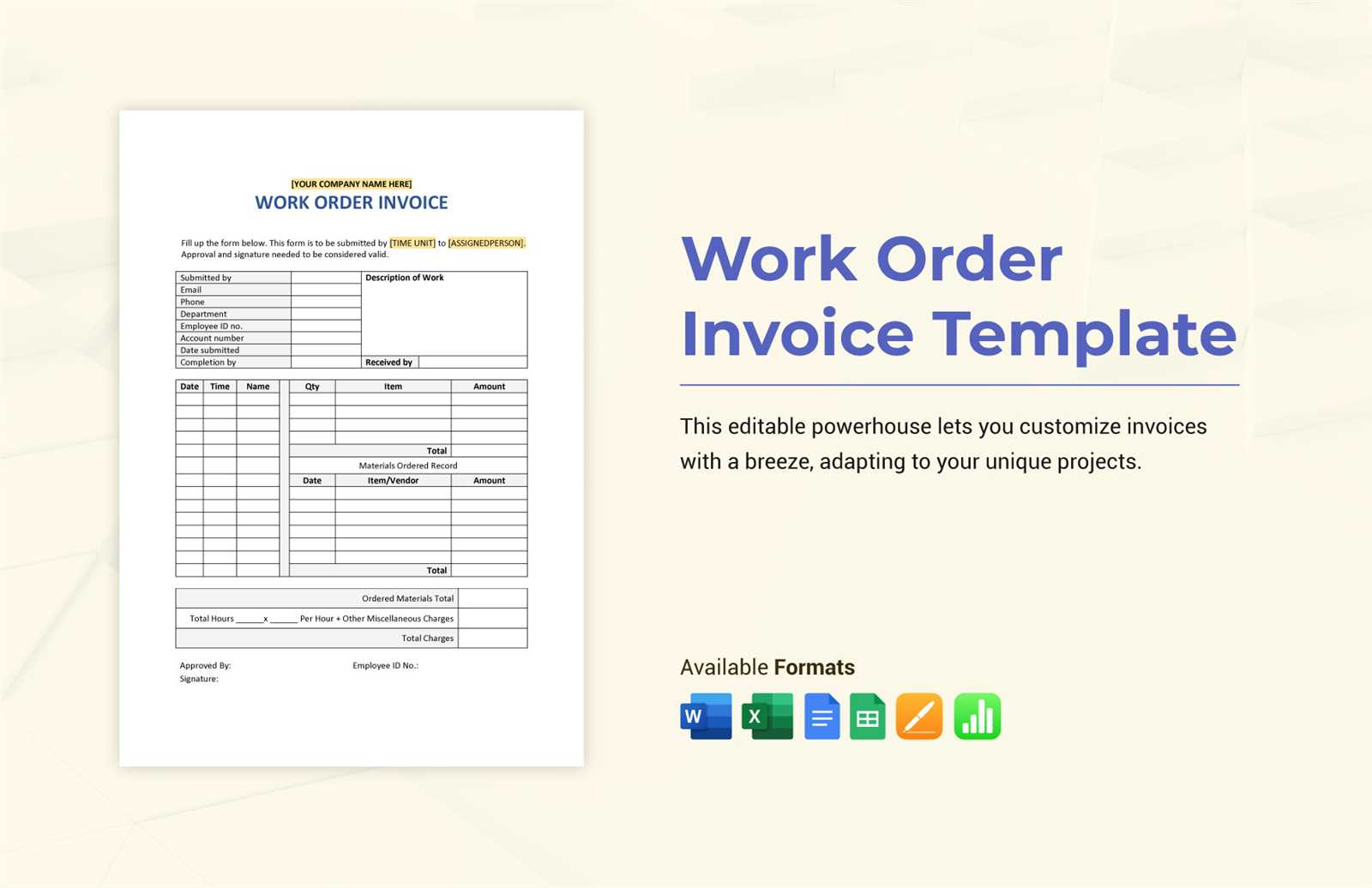

Using Invoice Templates for Different Industries

Every industry has unique billing requirements, which can vary depending on the services provided, the complexity of the pricing structure, and the overall workflow. Adapting billing documents to meet the specific needs of various sectors ensures both efficiency and professionalism. By using standardized formats tailored for different industries, businesses can streamline their invoicing process, maintain consistency, and ensure compliance with industry-specific regulations.

For instance, in the construction industry, where projects can span several months, invoicing often involves progress billing and detailed breakdowns of labor, materials, and equipment used. In contrast, service-based businesses such as consulting or IT services typically require more straightforward formats that outline hourly rates, services provided, and any agreed-upon terms. By selecting the right format for their industry, businesses can ensure that all necessary information is included and organized in a way that is easily understood by their clients.

Choosing the appropriate format for your business type not only helps you stay organized but also demonstrates a level of professionalism that can strengthen client relationships and encourage timely payments.

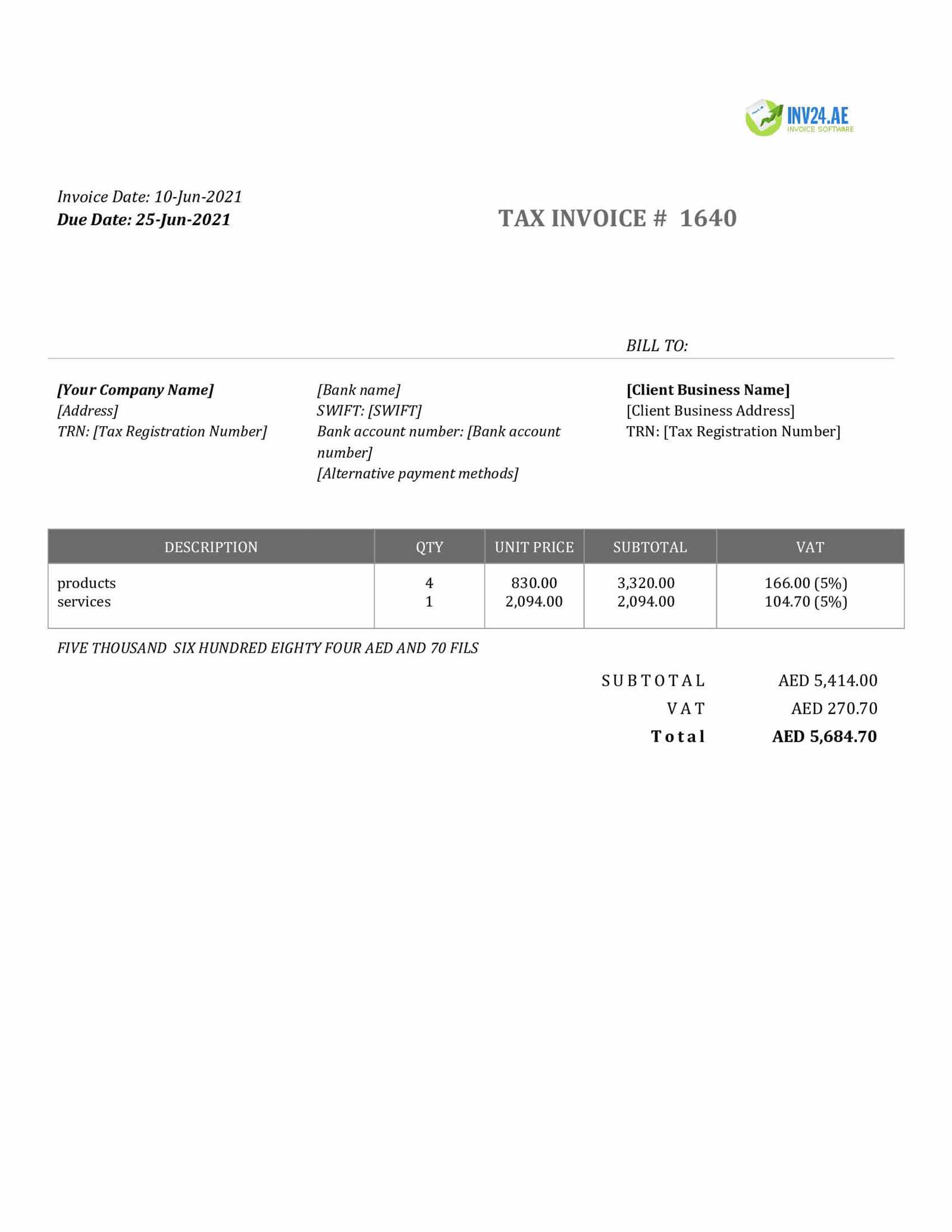

How to Add Tax Information

Including accurate tax details is an essential part of ensuring transparency and compliance with local tax regulations when preparing financial documents. Whether you’re providing goods or services, adding the appropriate tax information helps your clients understand the charges they are paying and provides a clear record for your accounting. Correctly documenting taxes can also protect your business from potential issues with tax authorities.

Understanding Tax Rates

Before adding tax information, it’s important to understand the applicable rates for your region and industry. Tax rates can vary depending on the type of product or service, as well as the location of your business and your client. Ensure that you research the correct tax rates based on these factors before applying them to your charges.

Where to Add Tax Information

Tax details should be clearly indicated on the document in a section dedicated to additional charges. Typically, this information includes the tax rate, the amount of tax applied, and the total amount with tax included. It is also a good practice to label the tax with a specific term, such as “Sales Tax” or “VAT,” to avoid confusion. Be sure to break down the total cost by including both the subtotal and tax amount, so that your client can see exactly what they are being charged for.

Incorporating Payment Terms in Your Invoice

Clearly stating payment terms is crucial in ensuring smooth financial transactions between you and your clients. By outlining these terms, you set expectations for when payment is due, any late fees, and the methods of payment you accept. Including such details in your documents helps prevent misunderstandings and encourages prompt payment, which is vital for maintaining positive cash flow in your business.

Key Payment Terms to Include

When specifying payment terms, it is essential to include the following details:

- Due Date: Indicate the specific date by which the payment should be made, such as “Due within 30 days” or a specific date like “Due by March 15, 2024.”

- Late Fees: If applicable, mention any fees that will be charged for overdue payments, for example, “A 5% late fee will apply after 30 days.”

- Accepted Payment Methods: Specify the methods of payment you accept, such as bank transfer, credit card, or online payment systems.

Additional Payment Considerations

Depending on the nature of the transaction, you may also want to consider adding information such as discounts for early payments or installment options for larger amounts. Providing flexibility in your payment terms can help you accommodate clients while ensuring that payments are received on time.

Tracking Payments with Invoice Templates

Efficiently monitoring payments is vital for maintaining a smooth financial process and ensuring that clients meet their obligations. By incorporating a system within your documents that tracks payment status, you can easily follow up on overdue amounts, prevent missed payments, and maintain good cash flow. Having a clear record of all transactions is an essential part of business operations, helping you stay organized and avoid confusion.

How to Track Payments Effectively

To effectively manage and track payments, it’s important to include certain details within your records:

- Payment Status: Clearly label whether a payment has been received, is pending, or overdue. This helps you quickly identify which accounts need attention.

- Transaction Dates: Include the date when a payment was received or when it was due. This will help you keep track of any delays and avoid confusion.

- Outstanding Balance: Always update the remaining balance after a partial payment has been made, so both you and the client can easily see the amount still owed.

Using Digital Tools for Tracking

Using accounting software or digital solutions can simplify the tracking process by automatically updating payment statuses and notifying you of overdue accounts. These tools provide real-time updates and offer advanced features such as sending reminders, generating reports, and syncing with your bank account for automatic payment tracking.

Common Mistakes to Avoid with Invoices

When managing financial documents, avoiding common errors is crucial for maintaining a professional image and ensuring timely payments. Small mistakes can lead to misunderstandings, delayed payments, and unnecessary confusion. By understanding and preventing these errors, you can streamline your billing process and avoid issues down the line.

1. Incorrect Client Information

One of the most frequent mistakes is failing to include the correct details for the recipient. Ensure that the client’s name, address, and contact information are accurate and up to date. An incorrect address or contact details could cause delays in processing and could even result in lost payments.

2. Missing Payment Terms

Another common error is not clearly stating the payment terms. Make sure to specify the due date, late fees, or any discounts for early payment. This not only helps in setting expectations but also reduces the chances of delayed payments.

3. Lack of Detailed Descriptions

Omitting itemized descriptions can lead to confusion and disputes. Always provide a detailed breakdown of the products or services rendered, including quantities, unit prices, and totals. This transparency helps clients understand the charges and prevents misunderstandings.

4. Failing to Follow Up on Overdue Payments

Sometimes, businesses forget to follow up on overdue payments, leading to unnecessary delays. Implement a system to track overdue amounts and promptly send reminders to clients. This ensures that payments are made on time and helps maintain a steady cash flow.

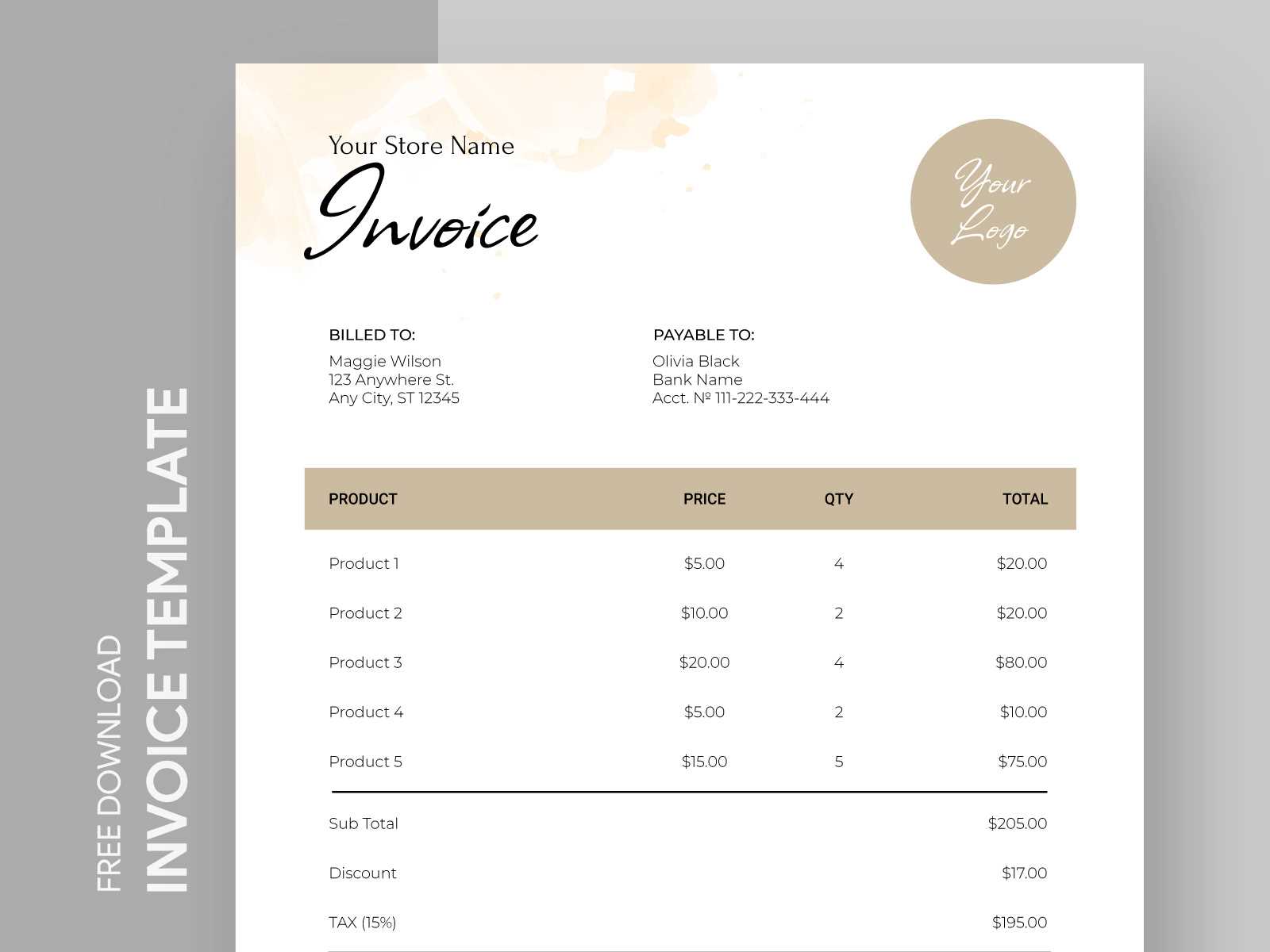

Design Tips for Professional Invoices

Creating clear, organized, and visually appealing financial documents not only reflects professionalism but also makes it easier for your clients to understand the charges and process payments efficiently. A well-designed document sets the right tone for your business and fosters trust and credibility with clients.

1. Use Clear, Easy-to-Read Fonts

The font you choose plays a significant role in the readability of your document. Ensure that the text is legible and clean by using simple fonts. Avoid overly decorative or difficult-to-read typefaces. Some recommended fonts include Arial, Helvetica, and Times New Roman.

2. Consistent Branding

Incorporating your business’s logo, colors, and fonts will create a consistent brand identity across all your documents. This reinforces your brand’s image and builds recognition, making your documents instantly identifiable to clients.

3. Organize Information Clearly

Proper layout and structure are key to a professional look. Use headers, bullet points, and sections to organize information logically. For example, list services or products provided, their respective quantities, and their prices in separate sections to enhance clarity.

4. Incorporate White Space

Too much information crammed into a small space can overwhelm the reader. Make sure there is enough white space between sections and around the edges of the document. This allows the information to breathe, improving the overall visual appeal.

5. Highlight Key Information

- Due date – Make it stand out by using bold text or a larger font size.

- Payment methods – Clearly specify the accepted methods of payment.

- Total amount due – Ensure it’s easily visible to avoid confusion.

6. Add a Personal Touch

Consider including a brief thank-you message or personalized note. This small gesture can create a positive impression and help build stronger relationships with your clients.

Legal Requirements for Invoices

When creating financial documents, it’s essential to comply with the regulations and standards that govern business transactions. These legal requirements ensure that both businesses and clients have a clear record of transactions and that tax obligations are properly met. Failing to include necessary information could lead to legal issues or delays in payments.

Key Legal Information

To meet legal obligations, certain details must be included in the financial document. Below is a list of essential components:

| Required Information | Description |

|---|---|

| Business Name and Contact Details | Include the full name of the business, address, and contact information for both the seller and the buyer. |

| Date of the Transaction | Ensure the date the document is issued and the date the goods or services were provided are clearly stated. |

| Unique Reference Number | Every document must have a unique reference number to track and organize transactions. |

| Tax Information | Include any applicable tax rates or exemptions, along with the tax identification number of the business. |

| Description of Products or Services | Clearly describe the goods or services provided, including quantities and unit prices. |

| Total Amount Due | Ensure the total amount due, including taxes, is easily visible and calculated accurately. |

Compliance with Local Laws

Legal requirements vary by country, state, or region. It’s important for businesses to familiarize themselves with the specific laws governing their area. For instance, certain jurisdictions may require specific wording, or businesses may need to include additional legal disclosures on their documents. Always verify with local authorities or legal experts to ensure full compliance with applicable laws.

How to Save Time with Templates

Using pre-designed formats for your financial documents can significantly streamline your workflow. By eliminating the need to create each document from scratch, you can save valuable time that would otherwise be spent on repetitive tasks. With a structured approach, you can focus on the important aspects of the transaction while ensuring accuracy and consistency across all your records.

Here are some ways to make the most of ready-made formats:

- Consistency: Having a standardized layout ensures that every document looks professional and adheres to the same style, reducing errors in formatting and presentation.

- Quick Customization: Easily update fields such as client names, dates, and amounts. These can be automatically filled in for each new entry, making the process faster and more efficient.

- Pre-set Calculations: Many formats come with built-in calculations for taxes, totals, and discounts. This eliminates the need for manual math, which can save time and reduce mistakes.

- Record Keeping: Using these formats allows you to create organized records quickly, making it easier to track payments and outstanding balances.

By incorporating ready-made solutions, you can reduce the amount of time spent on each document, allowing you to focus more on core business tasks and improve overall productivity.

Invoice Template Formats and Compatibility

When creating financial documents, it’s essential to choose the right format to ensure seamless use across different devices and platforms. Depending on your needs, various file formats are available, each with its unique advantages and compatibility features. Understanding these options can help you select the one that works best for your business operations and client interactions.

Common Formats

There are several popular formats for generating financial documents, each offering distinct features and benefits:

| Format | Description | Advantages | Compatibility |

|---|---|---|---|

| A widely used format for fixed documents that retain the original layout and design. |

|

All major operating systems (Windows, macOS, Linux), mobile devices | |

| Excel | A spreadsheet-based format that allows for calculations and easy updates to numeric data. |

|

Microsoft Office, Google Sheets, OpenOffice |

| Word | A flexible text format that is easy to edit and customize. |

|

Microsoft Word, Google Docs |

Choosing the Right Format

Choosing the right format depends on how you intend to share and manage the documents. If you need to send something that looks exactly the same on any device, PDF is the most reliable option. For tasks that require ongoing editing and calculation, formats like Excel may be more suitable. Word documents are great for customizing the appearance and content in a detailed, professional manner.

Consider the software your clients or partners are using and ensure the format you choose is compatible with their systems to avoid any issues. By selecting the right format, you can ensure a smooth process for both creating and sharing your documents.

Best Tools for Creating Invoices

When it comes to managing financial transactions, choosing the right tools can significantly improve efficiency and accuracy. Various software options are available that can help streamline the process of generating and managing these documents, making it easier for businesses to maintain a professional image and ensure timely payments. Below are some of the top tools that can assist in crafting clear, reliable, and customized financial records.

Top Software for Creating Financial Documents

Here are some of the most popular options for designing and managing your financial paperwork:

- QuickBooks – A leading accounting software with powerful invoicing features. It allows users to create professional financial records, track payments, and generate reports. Great for small to medium-sized businesses.

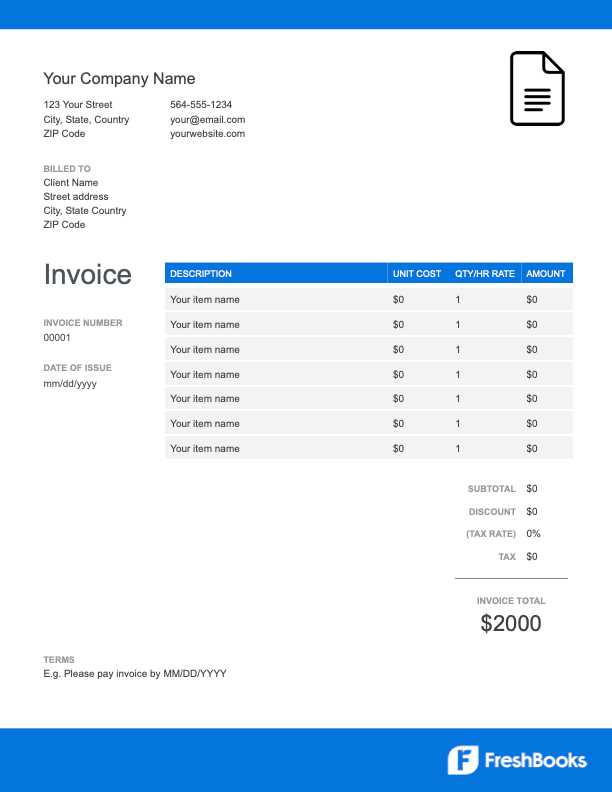

- FreshBooks – An intuitive cloud-based solution that simplifies the process of creating, sending, and managing documents. It also includes time tracking and expense management tools, making it ideal for freelancers and small businesses.

- Zoho Invoice – A free tool that provides customizable options for creating professional records. It includes features like automated billing, multi-currency support, and detailed reporting.

- Wave – A free, user-friendly tool perfect for small businesses and freelancers. It offers a range of features including customizable templates, recurring billing, and automatic payment tracking.

- Microsoft Excel/Google Sheets – For those who prefer more flexibility, these spreadsheet applications allow users to design their own layouts with built-in functions for calculations and easy updates.

Key Features to Look For

When selecting the right software for your business needs, consider the following features:

- Customization Options: The ability to personalize designs, layouts, and content is crucial for creating professional and consistent financial records.

- Integration with Accounting Systems: Look for tools that can sync with your existing financial management software for seamless workflow integration.

- Automation: Features such as automatic payment reminders, recurring billing, and data entry automation can save time and reduce errors.

- Reporting Tools: Tools that allow you to generate detailed financial reports can help track revenue, expenses, and business performance.

Choosing the right tool depends on the size of your business, the level of customization required, and your specific accounting needs. With these tools, you can create professional, efficient, and accurate financial documents that meet both your business and client expectations.