Download and Customize Invoice Template for OpenOffice

Managing finances and ensuring timely payments is crucial for any business. One essential aspect of this process is having a structured method for documenting transactions. By using a well-organized format, you can streamline the billing process and maintain a clear record of all financial exchanges.

For small business owners and freelancers, customizing these documents to reflect brand identity and professionalism is a valuable asset. With the right tools, you can create effective and reliable records, making your financial workflows more efficient and accurate.

With a wide range of customizable options available, you can design documents that meet your specific needs. Whether it’s for regular clients or one-time services, having the ability to adjust formats and details can significantly improve the presentation and clarity of your billing process.

Invoice Template for OpenOffice Overview

Having a structured document to handle payments and transaction details is essential for any business. These well-designed records help ensure that all necessary information is presented clearly, making the process more professional and organized. With the right design, you can keep track of services rendered, payment dates, and client information efficiently.

Customization and Flexibility

One of the main advantages of using these types of documents is their customizability. You can adjust the layout, font, and design elements to reflect your business identity. Whether you are a freelancer or a small business owner, having the flexibility to personalize these files ensures that they align with your branding while meeting your functional needs.

Ease of Use and Accessibility

Another benefit is the ease of access and usability. These files can be opened and edited without the need for complex software. They offer a straightforward solution for creating professional-looking records without requiring advanced skills, making them suitable for anyone who needs an effective way to manage their transactions.

Benefits of Using OpenOffice Invoices

Utilizing well-structured documents for tracking payments and services offers numerous advantages for businesses of all sizes. These documents provide an organized way to record transactions, ensuring that all the necessary details are captured and easily accessible. With the right setup, you can streamline your financial workflows, improve accuracy, and create a more professional image for your business.

Cost-Effectiveness

One of the primary benefits is the cost savings. Many solutions require expensive software, but with these files, you have a free alternative that doesn’t compromise on functionality. You can create and manage professional records without the need for costly subscriptions or complicated tools, making it an ideal choice for startups and small enterprises.

Easy Customization and Compatibility

Another key advantage is the ease of customization. You can modify the layout and details to suit your unique needs, whether it’s adjusting the design or adding specific client information. Additionally, these files are compatible with a range of platforms and can be shared easily, ensuring smooth communication with clients and colleagues.

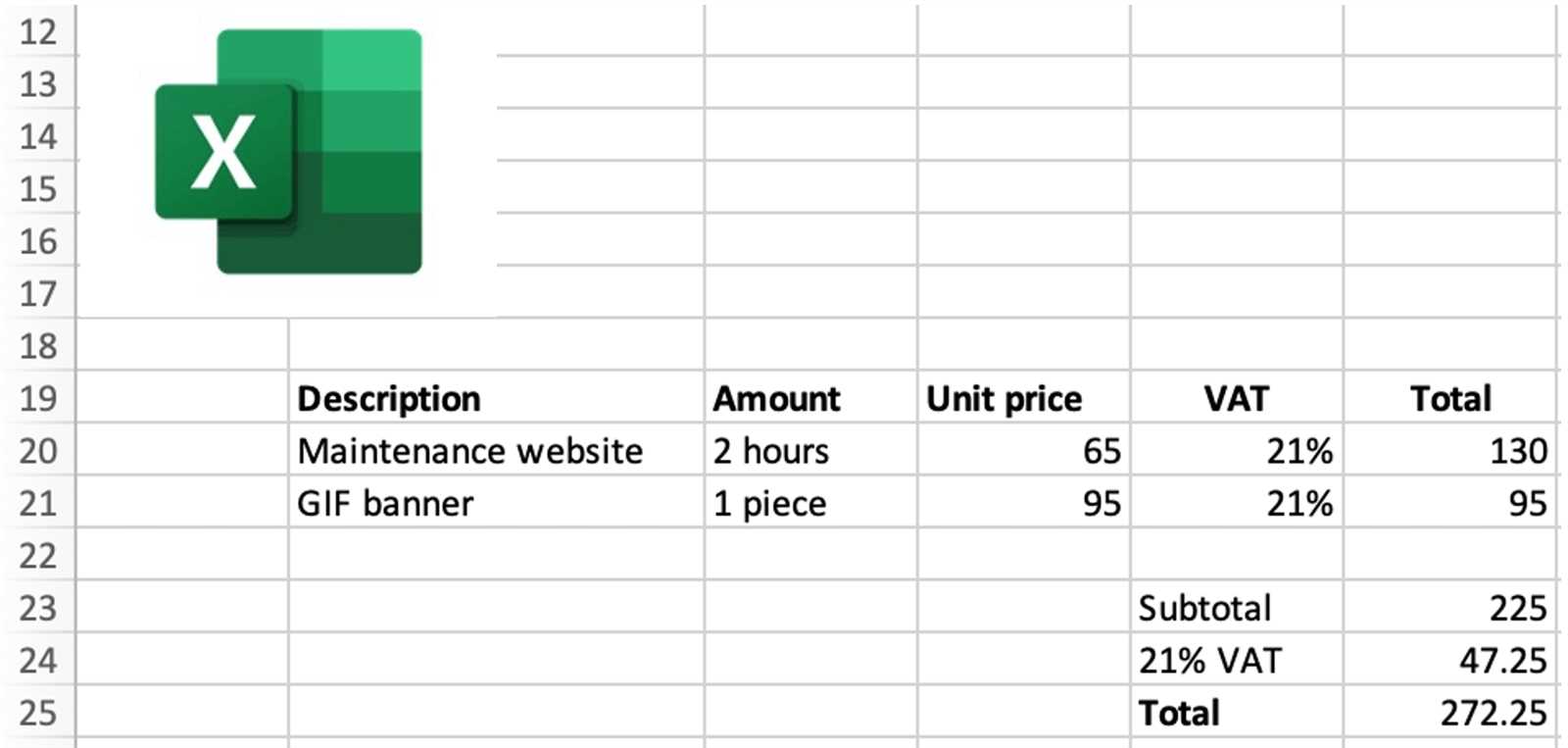

How to Create Custom Invoices

Designing personalized billing documents allows you to better reflect your business identity while meeting all necessary requirements for financial record-keeping. Customizing these documents is a straightforward process that ensures every detail is accurately presented, from client information to payment terms. With the right tools, you can easily create documents tailored to your specific needs.

Step-by-Step Process

To create your own personalized records, follow these simple steps:

- Select a Layout – Choose a structure that fits your business needs, whether you prefer a simple design or a more detailed one with logos and additional fields.

- Customize Fields – Modify sections like client details, payment terms, service descriptions, and amounts to suit your transactions.

- Add Branding – Incorporate your company’s logo, colors, and fonts to ensure the document reflects your brand identity.

- Adjust Calculations – If necessary, add formulas to automate calculations for taxes, discounts, or total amounts.

- Save and Export – Once your document is ready, save it in the preferred format and share it with your clients.

Tips for Effective Customization

- Keep the layout clean and easy to read to ensure clarity and professionalism.

- Use consistent font styles and sizes for a cohesive look.

- Ensure that all relevant information is included, such as payment instructions and contact details.

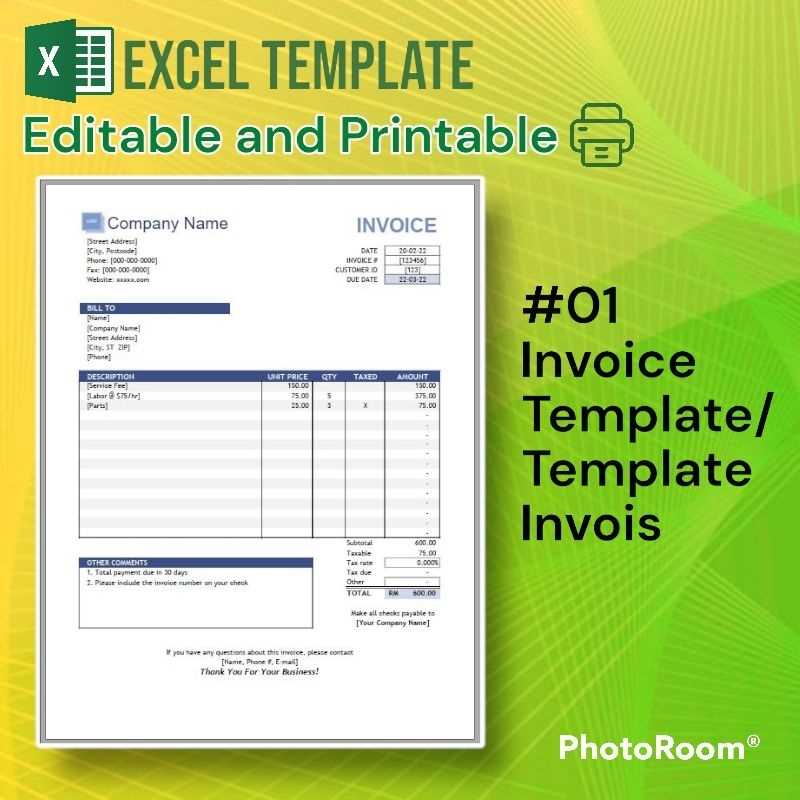

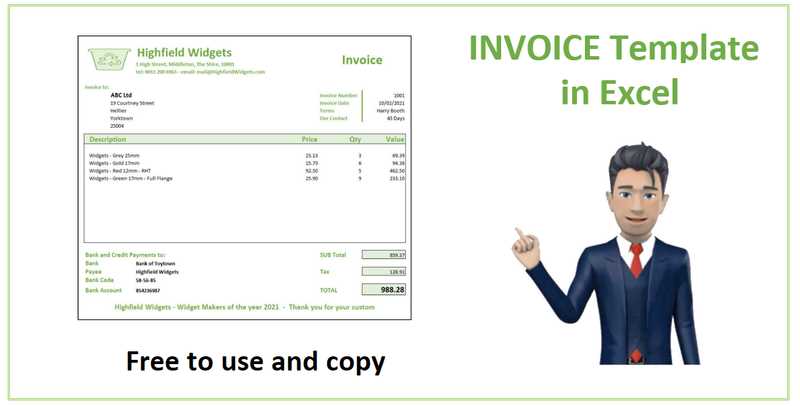

OpenOffice vs Microsoft Excel for Invoices

When it comes to creating professional billing documents, many users turn to either OpenOffice or Microsoft Excel. Both programs offer a range of features that can help streamline the process of generating financial records. However, each tool has its own strengths, making them suitable for different types of users and business needs. Understanding their differences is key to choosing the right one for your business.

Cost and Accessibility

One of the most significant differences between these two options is cost. OpenOffice is a free, open-source software, making it an attractive choice for small businesses or individuals with limited budgets. On the other hand, Microsoft Excel requires a paid license, which can be a barrier for those seeking a no-cost solution. If affordability is a priority, OpenOffice may be the better choice.

Features and Flexibility

Microsoft Excel offers a more robust set of tools, especially when it comes to advanced calculations and data management. It provides extensive templates and automated functions that can help users create highly customized financial documents. However, OpenOffice offers a simpler, more intuitive interface, which may be ideal for users who prefer ease of use without the need for advanced features. While Excel excels in complex data handling, OpenOffice provides sufficient functionality for everyday business needs.

Best Practices for Invoice Formatting

Creating well-structured financial documents is essential for clear communication and smooth transactions. Proper formatting ensures that all necessary information is easy to read and understand. A consistent layout not only enhances professionalism but also improves efficiency, reducing the likelihood of errors or misunderstandings.

When designing these records, keep the following best practices in mind to ensure clarity and effectiveness:

| Best Practice | Description |

|---|---|

| Clear Layout | Use a clean and organized layout that separates different sections (e.g., contact info, services, payment details) to improve readability. |

| Consistent Fonts | Choose easy-to-read fonts and maintain consistency in size and style throughout the document. |

| Accurate Dates and Numbers | Always double-check dates, amounts, and payment terms to avoid confusion and potential delays in payment. |

| Branding | Incorporate your business logo, colors, and fonts to maintain a professional and branded appearance. |

| Logical Order | Organize the sections in a logical flow, such as client details at the top, followed by services or products, and ending with payment instructions. |

How to Add Payment Terms to Invoices

Including clear payment terms in your billing documents is essential for setting expectations with your clients. These terms outline the conditions under which payments are due, the accepted methods of payment, and any late fees that may apply. Properly stating payment terms ensures that both parties understand the timeline and consequences, helping to avoid misunderstandings or delayed payments.

Essential Elements of Payment Terms

When adding payment terms, it is important to include the following key elements to make the document comprehensive and clear:

| Element | Description |

|---|---|

| Payment Due Date | Clearly state when the payment is expected, such as “Due within 30 days of receipt” or a specific date. |

| Accepted Payment Methods | Specify the methods of payment you accept, such as bank transfer, credit card, or PayPal. |

| Late Fees | If applicable, mention any penalties for late payments, including the percentage or fixed fee charged after the due date. |

| Discounts for Early Payment | Offer incentives, such as a discount, for early settlement of the amount due. |

Formatting Payment Terms Clearly

To avoid confusion, ensure that the payment terms are placed in a visible location on the document, ideally near the total amount or at the bottom. Use bold text or a separate section to draw attention to the payment conditions, ensuring they are easily understood by the recipient.

Automating Invoice Creation in OpenOffice

Automating the process of generating billing documents can save you time and reduce the risk of errors. By leveraging the right tools and techniques, you can streamline the creation of these financial records, making it faster and more efficient. With automation, you can set up pre-filled fields, calculations, and customized formatting that adjust based on the input, allowing you to create consistent and accurate records with minimal effort.

Setting Up Automation Features

To get started with automating your documents, consider using built-in features like formulas and data fields. Here’s how you can begin:

| Automation Feature | Description |

|---|---|

| Pre-filled Data Fields | Set up placeholders for common information such as client names, service descriptions, and dates. These can be updated automatically with each new entry. |

| Formulas for Calculations | Use formulas to automatically calculate totals, taxes, or discounts, reducing the need for manual input and ensuring accuracy. |

| Batch Processing | Create multiple records at once by importing client data or generating documents in bulk based on a pre-defined format. |

Benefits of Automation

By automating the document creation process, you not only save time but also reduce the chances of human error, ensuring that every document is consistent and accurate. Additionally, automation allows you to focus more on your core business operations, instead of spending time on repetitive administrative tasks.

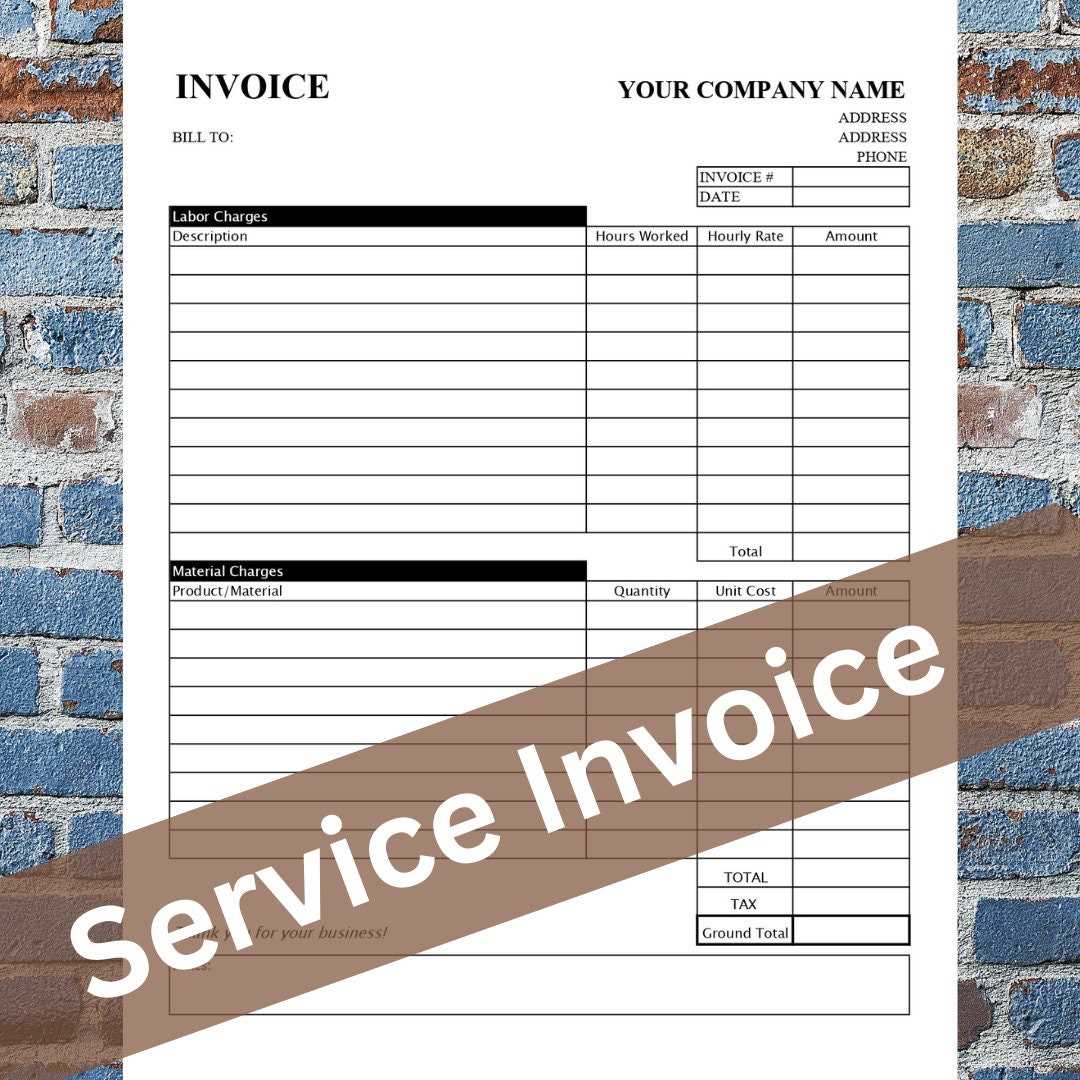

Free Invoice Templates for OpenOffice

There are numerous resources available online that offer free designs for billing documents. These ready-made files can significantly speed up the process of generating professional financial records. With a variety of customizable options, these free designs are an excellent starting point for businesses of all sizes looking to maintain consistency without the need for extensive design work or advanced software.

By using these free resources, you can easily create clear and functional documents that meet your needs, while still presenting a polished and professional image to your clients. Whether you’re just starting or looking for a simple solution, these designs offer flexibility and ease of use.

Advantages of Using Free Designs:

- Cost-effective: No need for expensive software or subscriptions.

- Easy to Customize: Tailor the design to your business’s needs with minimal effort.

- Quick Setup: Start using them immediately after downloading without requiring advanced skills.

How to Include Tax Information

Properly displaying tax details in your financial documents is crucial for clarity and compliance. Whether you are required to charge sales tax or value-added tax (VAT), it is essential to list this information accurately. Doing so ensures that your clients understand the total amount they need to pay and the specific tax rates applied to their purchase.

Essential Tax Information to Include

When including tax details, be sure to specify the following key elements:

| Tax Information | Description |

|---|---|

| Tax Rate | Clearly state the percentage rate of tax applied to the products or services, such as “5%” or “20% VAT”. |

| Tax Amount | List the exact amount of tax charged, based on the rate and total value of the products or services provided. |

| Tax Identification Number (TIN) | If applicable, include your business’s tax identification number to comply with local regulations. |

Formatting Tax Information Clearly

Ensure the tax details are placed in a separate section to avoid confusion. A clear breakdown of the amount before and after tax will help clients understand how the total is calculated. Use bold or highlighted text to make tax-related information stand out, making it easy for clients to verify the charges.

Tracking Payments with OpenOffice Templates

Keeping track of payments is an essential part of managing your finances. By using structured documents, you can efficiently record and monitor the status of each payment, ensuring that no transactions go unnoticed. Whether payments are made in full, partially, or with a delay, having a clear record helps you maintain financial transparency and avoid misunderstandings with clients.

To streamline this process, you can integrate payment tracking features into your documents. By adding columns for payment dates, amounts received, and outstanding balances, you can easily monitor the status of each transaction and ensure that all payments are accounted for.

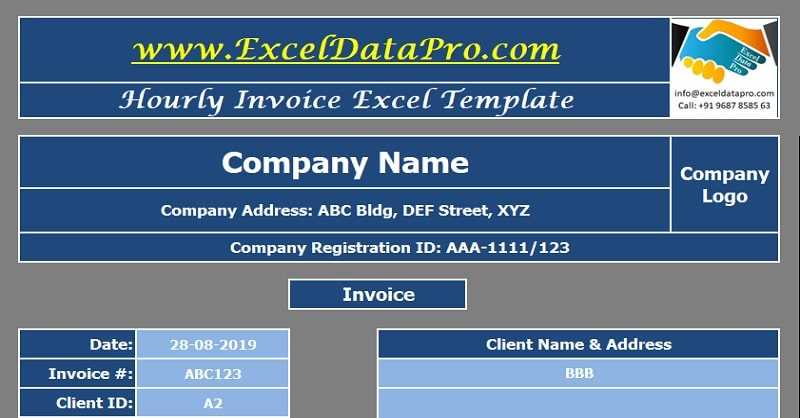

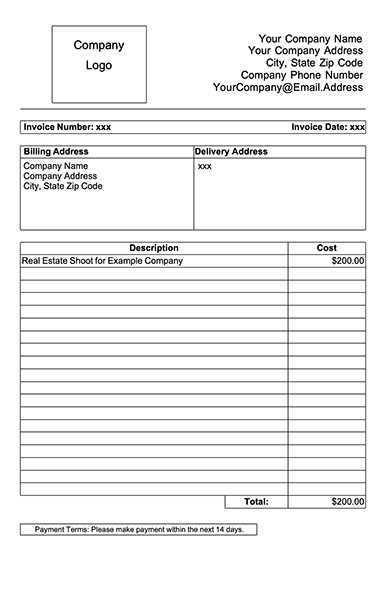

Customizing Invoice Layout for Your Business

Tailoring the appearance of your billing documents to suit your business needs not only enhances professionalism but also helps reinforce your brand identity. A customized layout ensures that essential information is presented clearly and in an organized manner, making it easier for clients to understand the details and for you to maintain consistency across all transactions.

Key Elements to Personalize

When adjusting the layout, consider incorporating the following elements to make the document truly reflect your business:

- Company Logo and Branding: Include your logo, business name, and contact information at the top to create a professional and recognizable appearance.

- Color Scheme: Use your brand’s colors to highlight key areas such as totals, payment terms, and headings.

- Font and Typography: Choose clear, readable fonts and adjust sizes to emphasize important information like due dates or amounts owed.

Improving Functionality with Customization

In addition to design elements, customizing the layout can also improve the functionality of your documents. For example, adding rows for itemized charges, adjusting columns to better fit the types of services or products you provide, or incorporating specific sections for discounts or tax information can make your billing documents more efficient and tailored to your needs.

Integrating Logos and Branding

Incorporating your company’s visual identity into your financial documents is essential for building a strong and professional image. Adding logos, brand colors, and consistent typography helps clients recognize your business, ensuring your materials reflect your values and professionalism. A well-branded document not only conveys trust but also reinforces your company’s presence with every interaction.

Placing Your Logo for Maximum Impact

Your company logo should be prominently placed at the top of the document, ideally near the header, where it’s most visible. This is often the first thing clients notice, so it’s important to make it stand out. Make sure the logo is clear and not distorted by resizing, and ensure that it complements the overall layout rather than overcrowding it.

Choosing Colors and Fonts that Reflect Your Brand

Consistency in color and font usage is key to reinforcing your brand identity. Choose colors that align with your company’s color scheme and use them strategically to highlight important sections such as totals, payment terms, and headings. Similarly, select fonts that are easy to read while reflecting your business’s personality, whether it’s professional, creative, or casual.

Saving and Sharing OpenOffice Invoice Files

Efficiently managing your financial documents involves not only creating them but also ensuring they are properly saved and easily shareable with clients. The ability to save files in different formats and share them through various channels can streamline your workflow and reduce potential issues related to file compatibility or security.

When working with documents, it’s essential to choose the right file formats for saving and sharing. Using universally accepted formats like PDF ensures that the recipient sees the document exactly as you intended, without worrying about software compatibility. Meanwhile, saving in editable formats allows for easy adjustments and updates when needed.

Saving Documents in Multiple Formats

Most software applications allow saving files in various formats. Here are a few common ones:

| File Format | Best For |

|---|---|

| Sharing with clients while preserving the layout and content. | |

| ODT (Open Document Text) | Editing within the same software or other compatible applications. |

| Excel/CSV | For easy data manipulation and calculations. |

Sharing Files with Clients

Once your document is ready, sharing it is the next step. Here are a few efficient ways to do so:

- Email: Attach the file to an email for quick and direct delivery to clients.

- Cloud Storage: Upload your file to a service like Google Drive or Dropbox, and share the link with clients.

- File Transfer Services: Use platforms such as WeTransfer for large files or documents that require secure transfer.

By choosing the right file formats and sharing methods, you can ensure smooth communication with clients and maintain organized, accessible records of your financial transactions.

How to Update Templates for New Year

As the new year approaches, it’s important to refresh your business documents to reflect the changes that come with the new year, whether they are related to new tax rates, updated business details, or any branding adjustments. Updating your documents ensures that they remain accurate and professional, ready for use in the upcoming months.

Adjusting Financial Information

One of the key areas to focus on when updating your documents is ensuring that all financial information, such as tax rates or payment terms, is current. Here’s how you can do it:

- Tax Rates: Update the tax percentage fields based on the new year’s regulations.

- Business Information: Ensure your business name, address, and contact details are up-to-date.

- Payment Terms: Adjust any deadlines, due dates, or early payment discounts based on your business’s new policy.

Refreshing Design and Branding

Along with updating information, it’s also a great time to refresh the design. You may want to change colors, fonts, or add new branding elements. This is an opportunity to give your documents a fresh look that aligns with any rebranding efforts for the new year.

- Update Logo: If your logo has changed or been redesigned, make sure it is replaced on all your documents.

- Color Scheme: Refresh your color scheme to align with new marketing materials or to create a more modern look.

- Font Adjustments: Consider switching to a new font for a more contemporary or easier-to-read style.

By reviewing and updating these aspects, your documents will stay relevant and reflect your company’s commitment to maintaining professional standards in the new year.

Common Mistakes to Avoid in Invoices

Creating accurate and professional business documents is crucial for maintaining good relationships with clients and ensuring smooth financial operations. However, mistakes can sometimes slip through the cracks, leading to confusion, delays, or even payment disputes. By understanding common errors and taking steps to avoid them, you can ensure that your records remain clear, precise, and efficient.

Common Errors in Information

One of the most frequent problems in business documentation is the inclusion of incorrect or incomplete information. Here are some common mistakes to be aware of:

- Incorrect Contact Details: Always double-check that your business and client contact information, such as addresses and phone numbers, are accurate.

- Missing Dates: Ensure that both the issue date and the due date are clearly stated. This helps avoid misunderstandings about payment terms.

- Wrong Pricing or Calculation Mistakes: Ensure that all products or services are priced correctly, and double-check any math to avoid calculation errors.

Formatting and Layout Issues

While content accuracy is essential, presentation also plays a significant role in professionalism. Here are some formatting mistakes to avoid:

- Unclear Layout: Ensure that the document is well-organized and easy to read, with clear headings, sections, and itemized lists for transparency.

- Lack of Consistent Branding: Make sure your business’s logo, color scheme, and font styles are consistent to maintain a professional appearance.

- Unorganized Terms: Payment terms, such as due dates and discounts, should be easy to locate, ideally placed in a dedicated section.

Additional Considerations

Aside from basic details, there are some other important factors to keep in mind:

| Error | Impact | Solution |

|---|---|---|

| Missing Tax Information | Could lead to misunderstandings about total charges and legal compliance issues. | Always include applicable taxes and ensure the tax rate is correct. |

| Failure to Include Payment Instructions | May result in delayed payments if clients are unsure how to submit payment. | Provide clear instructions on how and where payments should be made. |

By avoiding these common mistakes, you can ensure that your business documents are both professional and effective, making it easier to manage financial transactions and build trust with clients.