Free PayPal Invoice Template for Easy Billing

Managing payments and ensuring smooth transactions is a vital part of running any business, especially in the digital age. Whether you’re a freelancer, entrepreneur, or small business owner, having a clear and professional method to request payments is essential. A well-designed document for billing can save time, reduce errors, and enhance your credibility with clients.

In this guide, we explore simple and practical tools that allow you to create professional payment requests easily. These tools provide customizable formats that can be tailored to your needs, whether you’re providing services, selling products, or handling recurring payments. With a few easy steps, you can generate accurate and clear documents that facilitate smooth financial exchanges.

Streamlining your billing process not only makes transactions quicker but also improves communication with clients, ensuring that all important details are easily understood. An efficient system is a key step toward maintaining good financial practices and building trust with your customer base.

Free PayPal Invoice Template Guide

Creating a clear and professional document to request payments is an essential task for anyone managing financial transactions. With the right tools, this process can be streamlined and efficient, allowing you to focus more on your business rather than the details of each transaction. By utilizing customizable formats, you can easily generate payment requests that are both accurate and visually appealing.

Steps to Create Your Billing Document

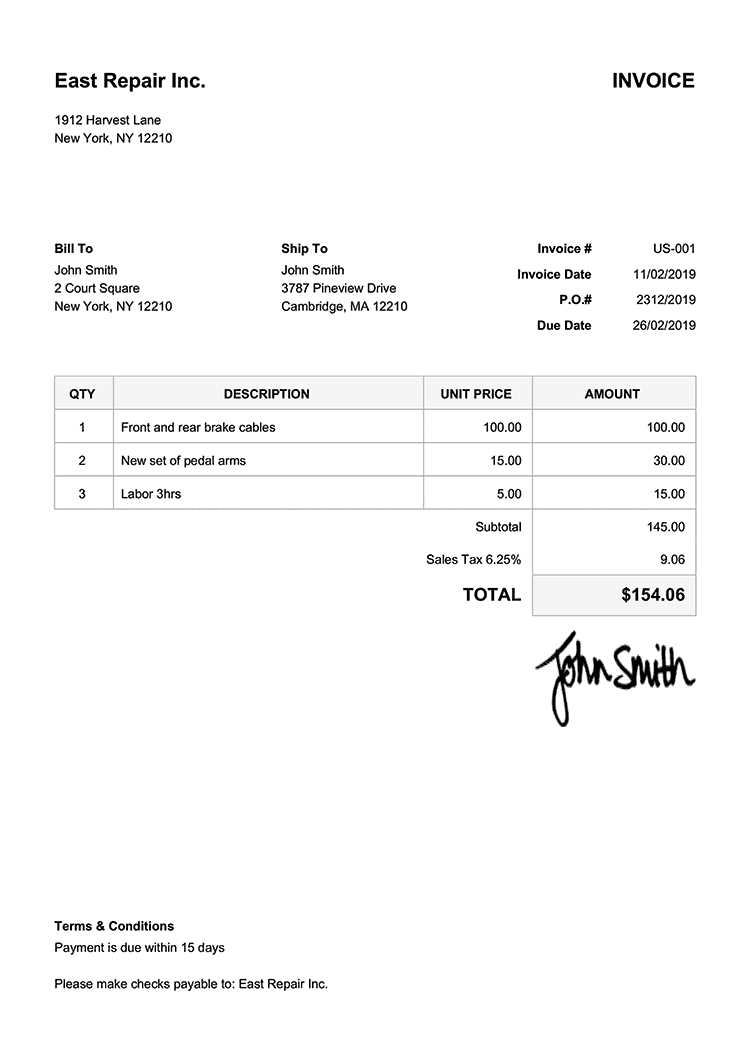

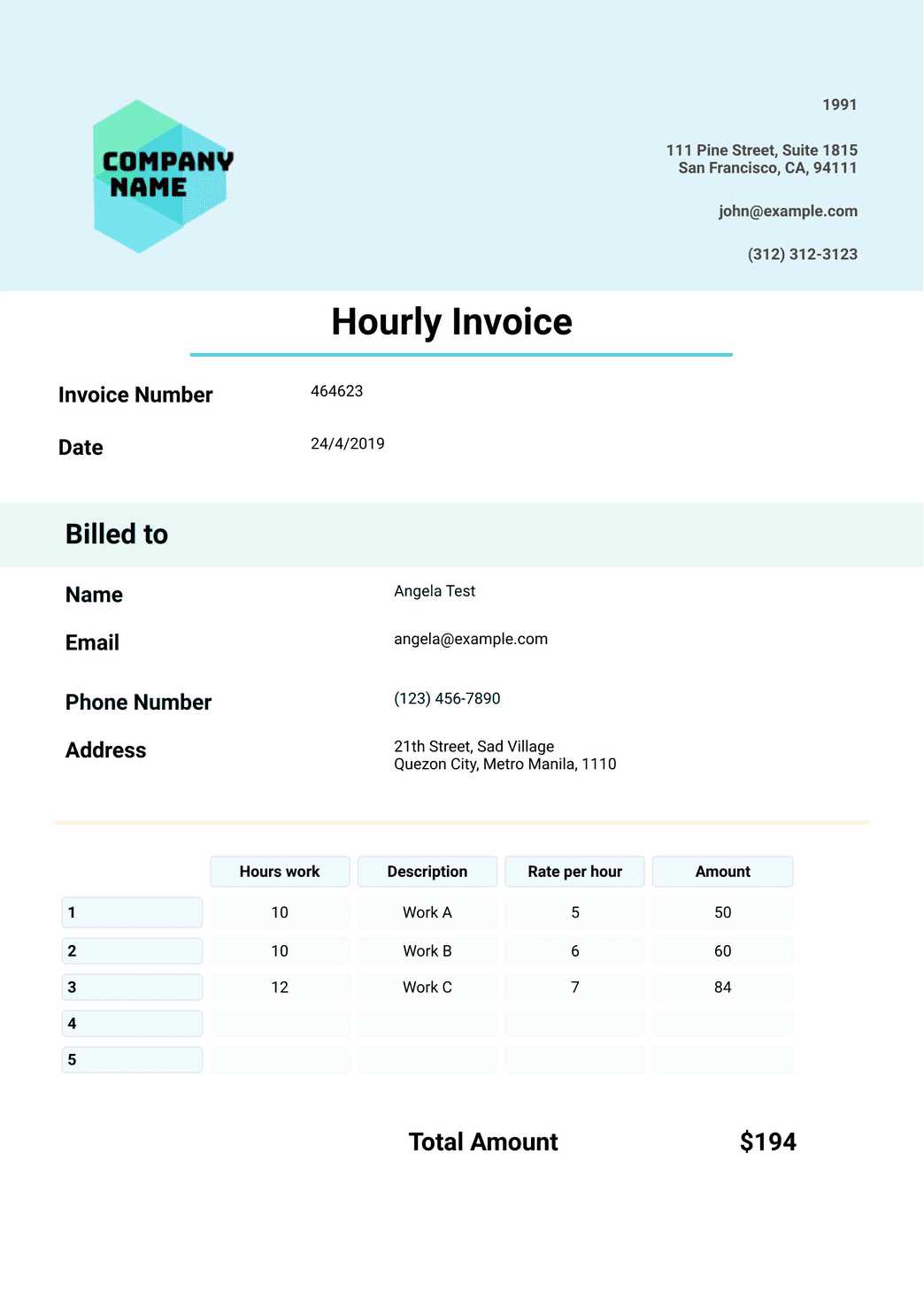

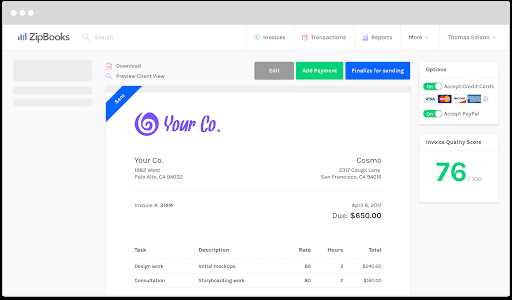

To get started, select a reliable platform or tool that offers pre-designed formats. These systems often allow you to add your company name, client details, services rendered, and payment terms with ease. A well-organized document not only makes the payment process smoother but also reflects professionalism, ensuring clients understand all necessary information at a glance.

Key Features to Look For

When choosing a system to create your payment requests, ensure it includes essential features such as automatic calculations, customizable fields, and easy-to-read layouts. Clear itemization of products or services, along with well-defined payment instructions, helps avoid misunderstandings and ensures timely payment. Additionally, the ability to save and track previous transactions makes record-keeping more efficient.

How to Create PayPal Invoices for Free

Generating a professional payment request is a straightforward task with the right tools. With the help of online platforms, you can create detailed billing documents without incurring extra costs. These systems allow for quick customization, enabling you to produce accurate and clean records for your clients in just a few steps.

Using Online Platforms to Design Billing Documents

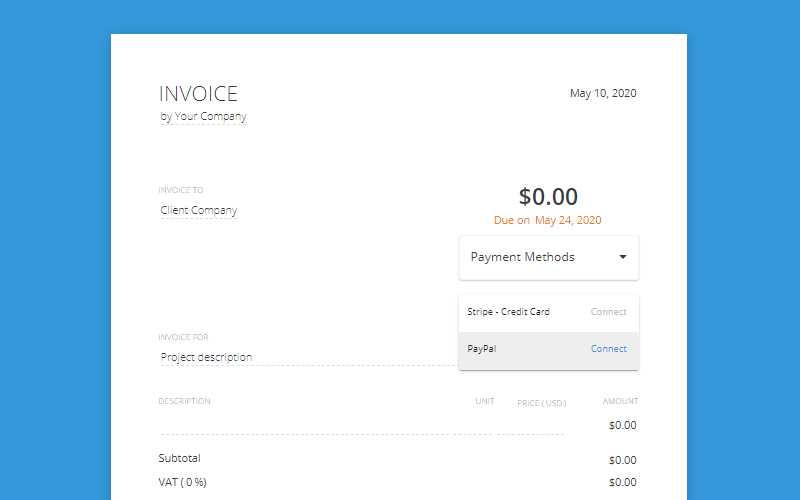

To start, choose a reliable online platform that provides pre-set formats for payment requests. These services typically offer simple drag-and-drop features, allowing you to add relevant details such as client information, service descriptions, and payment terms. Once you input the necessary data, the system automatically generates a neat and organized document ready for sending.

Personalizing Your Payment Request

Customizing the format to suit your business is easy and important. Make sure to adjust the layout to match your branding, including your logo and contact details. Clear breakdowns of the services provided or products sold ensure transparency, and automatic calculations help prevent errors in pricing. By doing so, you can create a professional document that facilitates smooth and accurate transactions every time.

Benefits of Using PayPal Invoice Templates

Utilizing ready-made billing formats offers numerous advantages for businesses and individuals alike. These structured documents simplify the process of requesting payments, making it faster and more efficient. By using predefined layouts, you eliminate the guesswork involved in designing a payment request, ensuring all necessary details are included and correctly formatted every time.

Time-Saving and Efficient Process

One of the key benefits of using pre-designed payment request formats is the significant amount of time saved. Instead of creating a new document from scratch for each transaction, you can quickly select a layout, fill in the relevant information, and send it to your client. This streamlined approach speeds up your administrative work, allowing you to focus more on running your business.

Professional Appearance and Accuracy

These systems help present a polished, consistent look to your clients, which enhances your professional image. Well-organized documents with clear sections for services, prices, and payment terms promote transparency and reduce misunderstandings. Furthermore, the automatic calculations built into many platforms ensure that your figures are always correct, preventing costly errors.

Customizing Your PayPal Invoice Template

Personalizing your billing documents is a crucial step to ensure they align with your brand and business style. Customization options allow you to add unique elements that reflect your identity, making your payment requests both professional and easily recognizable to clients. Whether it’s adjusting the layout or incorporating specific details, tailoring these documents can help improve communication and enhance your credibility.

Key Customization Features

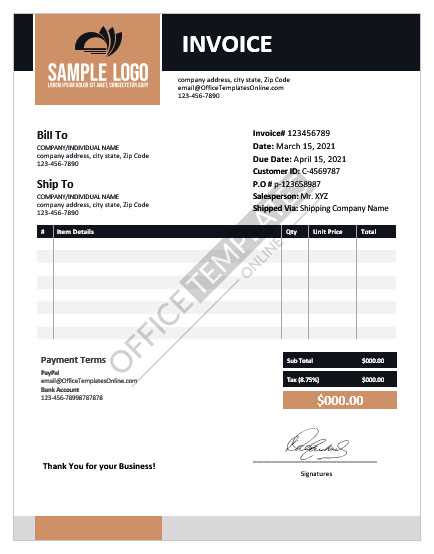

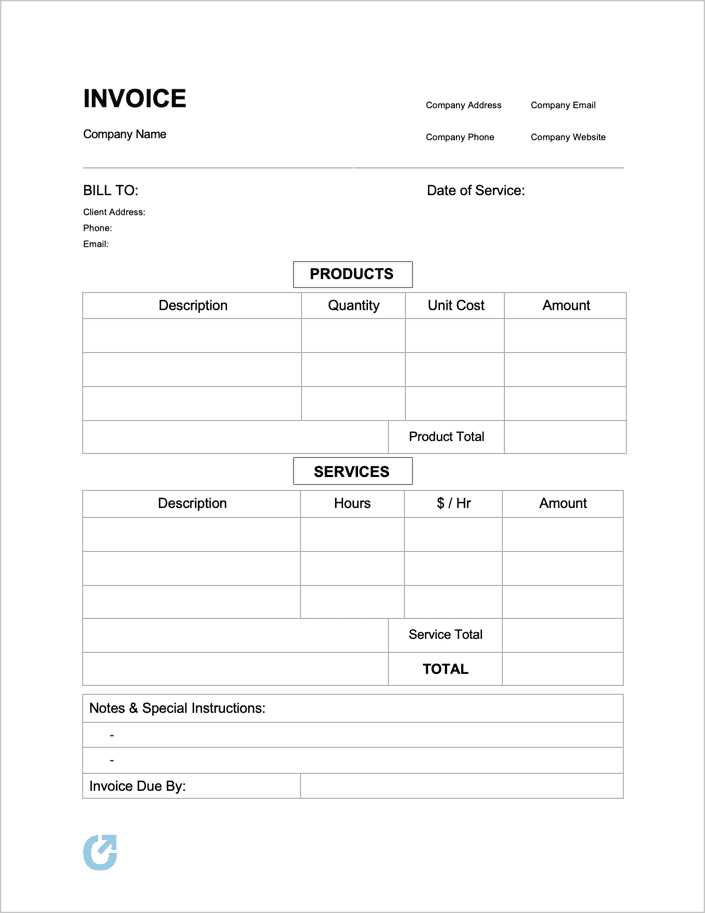

When working with a predefined format, there are several ways to personalize the document:

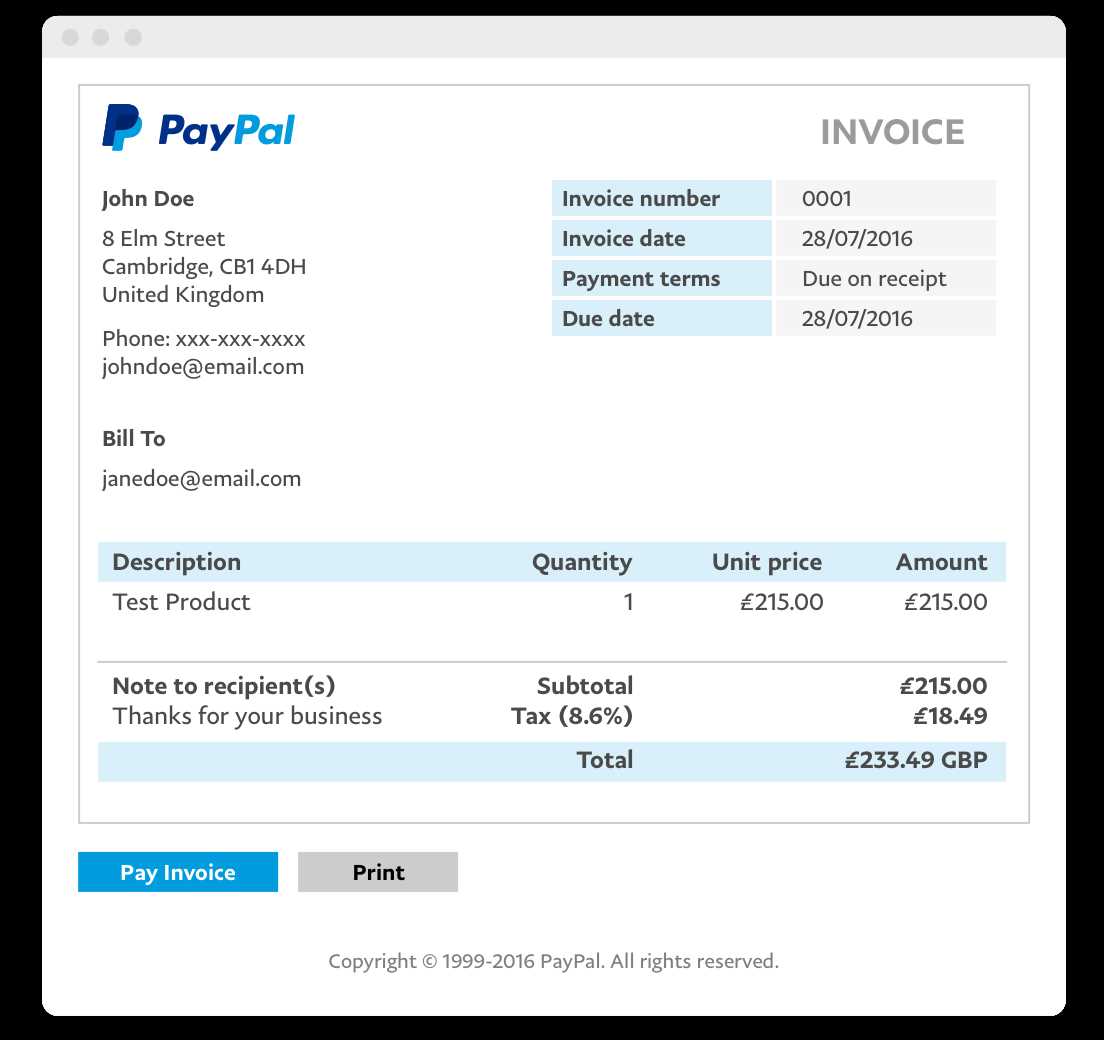

- Company Branding: Add your logo, business name, and contact information to the header for a consistent brand identity.

- Color Scheme: Modify the color scheme to match your company’s branding, creating a more cohesive and professional look.

- Payment Terms: Clearly define the payment deadlines, methods, and any late fees to avoid confusion and ensure timely transactions.

- Service/Item Details: List all products or services provided with descriptions, quantities, and individual prices to ensure transparency.

Why Customization Matters

Customizing these documents not only helps maintain a consistent professional appearance but also improves the clarity of your financial communications. Clients will appreciate a personalized document that is easy to understand and reflects the quality of your work. Additionally, a well-designed document reduces the likelihood of disputes or payment delays, as all necessary details are clearly presented.

Best Free Tools for PayPal Invoices

There are several online platforms that offer excellent tools to create and manage payment requests with ease. These systems simplify the process of billing by providing customizable options and automated features, allowing you to focus more on your business operations. Whether you’re a freelancer, small business owner, or a service provider, using the right tool can streamline your payment collection process and improve your professionalism.

Top Tools to Create Payment Requests

Here are some of the best tools that can help you craft professional payment requests:

- Zoho Invoice: This platform offers a user-friendly interface with customizable fields, automatic calculations, and options for recurring billing. Ideal for both small businesses and freelancers.

- Invoice Ninja: A popular tool for creating and sending invoices, it supports multiple currencies and allows for personalization. It also includes time tracking and payment reminders.

- Wave: A comprehensive tool for billing, accounting, and invoicing. Wave provides easy-to-use templates and integrates with your bank account for automatic transaction tracking.

- FreshBooks: Known for its intuitive interface, FreshBooks allows users to create detailed billing documents quickly, and includes automated reminders and payment tracking features.

Choosing the Right Tool for Your Business

Selecting the right tool depends on your business needs. If you require simple billing, a basic platform like Zoho Invoice might be sufficient. For businesses needing more advanced features like recurring payments or accounting integration, FreshBooks or Wave may be the better option. Consider your requirements carefully to find the best fit for your billing process.

PayPal Invoice Features You Should Know

Understanding the features of a payment request tool is essential to maximize its potential and ensure smooth transactions. The right tool offers several key functionalities that make the process of creating and managing payment documents more efficient. From automatic calculations to customizable fields, knowing these features can help you streamline your billing and improve the overall client experience.

Key Features of Payment Request Tools

Below are some important features to consider when using a platform for generating payment requests:

| Feature | Description |

|---|---|

| Customizable Layouts | The ability to personalize the appearance of your payment documents with your logo, business information, and preferred color schemes. |

| Automatic Calculations | Automatic addition of taxes, discounts, and totals based on the services or items you list, reducing the risk of manual errors. |

| Multiple Payment Methods | Support for various payment options such as credit/debit cards, bank transfers, or digital wallets, making it easier for clients to pay. |

| Recurring Billing | The ability to set up automatic recurring payments for clients with ongoing contracts or subscription-based services. |

| Client Management | Tools to store and manage client details, making it easier to send future requests and track payment histories. |

Why These Features Matter

These features significantly enhance the functionality of your payment system. Customization allows you to maintain brand consistency, while automatic calculations reduce administrative work and minimize errors. The ability to accept multiple payment methods ensures flexibility, and recurring billing is ideal for businesses with regular clients. Client management tools further simplify the process of maintaining long-term customer relationships, making it easier to manage and track payments over time.

How to Download a Free Template

Getting started with generating professional payment requests is easy when you have access to the right tools. Many online platforms offer pre-designed layouts that you can download and customize to suit your business needs. These tools are simple to use, and in just a few clicks, you can have a fully editable document ready for sending to your clients.

Steps to Download a Payment Request Layout

Follow these simple steps to quickly download a ready-made format:

- Choose a Reliable Platform: Look for trusted websites or platforms that offer customizable billing solutions. Many of these offer templates at no cost.

- Select a Suitable Design: Browse through available formats and select one that fits your business style and client needs. Consider options with customizable fields for services, quantities, and prices.

- Download the Document: Once you’ve chosen the desired format, click the download button to save the file to your computer. Most tools offer formats in PDF, Word, or Excel, depending on your preferences.

- Customize the Document: Open the downloaded file and replace the placeholder information with your business details, services, and payment terms. Add your logo or adjust the design to match your branding.

What to Look for When Downloading

When choosing a layout to download, consider the following features:

- Customization Options: Ensure the document allows you to edit key details, including client information, payment terms, and item descriptions.

- Format Flexibility: Check if the layout is compatible with your preferred file format, such as PDF, Excel, or Word.

- User-Friendliness: Choose a platform that offers an easy-to-navigate interface, making it simple to input and adjust the necessary details.

With these steps, you’ll have a professional payment request ready in no time, saving you time and effort while enhancing your business’s financial processes.

Step-by-Step PayPal Invoice Creation

Creating a professional billing document doesn’t have to be complicated. By following a clear, step-by-step process, you can generate accurate and clean payment requests quickly. Whether you’re sending a one-time bill or setting up recurring payments, the key is to ensure that all necessary details are included in a clear, organized manner.

Here’s a simple guide to creating a payment request from start to finish:

- Choose Your Platform: Select a tool or online platform that offers customizable payment documents. Many platforms provide simple drag-and-drop features, making the creation process fast and intuitive.

- Enter Client Information: Input your client’s name, email address, and any other contact details. This ensures the right person receives the payment request and can easily get in touch with any questions.

- Describe Products or Services: Clearly list all the services or products being billed. Include descriptions, quantities, unit prices, and any applicable taxes or discounts. This transparency helps avoid confusion and ensures that clients understand exactly what they are being charged for.

- Specify Payment Terms: Clearly state the payment deadline, accepted methods, and any late fees if applicable. This information ensures that the client knows when and how to make the payment.

- Double-Check for Accuracy: Before sending, review all the information carefully to make sure there are no errors. Accurate details prevent delays and ensure a smooth payment process.

- Send and Track: Once everything looks good, send the payment request to your client. Many platforms allow you to track when the document was viewed and when payment was made.

By following these simple steps, you can ensure that your payment requests are professional, clear, and efficient, leading to faster and smoother transactions.

Improving Payment Tracking with Templates

Effectively managing payments is crucial for any business, and having a structured document to track all transactions can significantly simplify the process. Using pre-designed formats for billing allows you to not only request payments efficiently but also to track their status in an organized manner. By incorporating key features like payment status updates, due dates, and automated reminders, you can stay on top of your financials and reduce the risk of missed or delayed payments.

Streamlining payment tracking helps you maintain accurate records, which are essential for financial planning and reporting. Many platforms allow you to store past transactions, providing a quick reference for future correspondence with clients. This can be especially useful for businesses with frequent repeat customers or recurring services.

Key Features for Enhanced Payment Tracking

When customizing your billing documents, consider including the following features to improve payment tracking:

- Status Indicators: Add fields to track the payment status (e.g., Pending, Paid, Overdue). This helps you quickly identify which payments need attention.

- Due Dates: Clearly state when payments are due to help prevent confusion. Setting up automatic reminders can also ensure that clients are aware of upcoming deadlines.

- Payment Methods: Include information about accepted payment methods to make it easy for clients to pay, reducing the chances of delayed transactions.

- Recurring Payments: If applicable, set up automatic billing for clients with ongoing services, ensuring regular payments without the need for manual intervention.

By leveraging these tracking features, you can maintain a clearer overview of your financial interactions, reduce administrative work, and improve cash flow. This organized approach also fosters better communication with clients, leading to fewer disputes and smoother payment processes.

How to Use PayPal Invoices for Small Business

For small businesses, managing payments efficiently is essential to ensure smooth operations and cash flow. Using a structured approach to request payments can streamline the billing process, saving time and reducing errors. Leveraging digital tools for generating professional billing documents not only enhances credibility but also makes it easier to track transactions and maintain accurate financial records.

Here’s how small businesses can effectively use digital billing documents to simplify their payment process:

Steps for Effective Payment Requests

By following these steps, you can make the most out of your billing system:

| Step | Description |

|---|---|

| Create a Custom Layout | Personalize your payment document by adding your business logo, contact details, and any specific payment terms that are relevant to your services. |

| Include Service Descriptions | Clearly list the products or services provided, including quantities, prices, and any applicable taxes. This ensures transparency with your clients. |

| Set Payment Terms | Specify when payments are due and what methods are accepted. Be clear about late fees or discounts for early payments to avoid confusion. |

| Track Payment Status | Use features to monitor whether payments have been made, are pending, or overdue. This can help you stay on top of your finances. |

| Send Automated Reminders | Set up automatic payment reminders to ensure clients are notified of upcoming due dates or overdue payments. |

Benefits for Small Businesses

Using these tools offers several key advantages for small businesses:

- Time Efficiency: Automating the payment request process saves time compared to manually creating each document.

- Consistency: Customizable formats ensure that all payment documents have a un

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is crucial for maintaining healthy business operations. However, mistakes in these documents can lead to confusion, delayed payments, and even damage to your business reputation. It’s important to pay attention to the details and avoid common errors that can negatively impact your cash flow and client relationships.

Here are some common mistakes to watch out for when preparing your payment requests:

Common Billing Mistakes

Mistake Explanation Incorrect Client Details Double-check that your client’s name, address, and contact information are accurate. Mistakes here can delay payment processing and communication. Missing or Incorrect Pricing Ensure all products or services are listed with correct prices, quantities, and applicable taxes. Errors in pricing can lead to disputes or underpayments. Omitting Payment Terms Be clear about the payment due date, accepted methods, and any penalties for late payments. Missing this information can lead to confusion and late payments. Lack of Unique Identification Each document should have a unique reference number or identifier. This makes it easier for both you and the client to track payments and avoid mistakes. Not Including Payment Instructions Provide clear instructions on how clients can make payments, especially if you’re using multiple payment methods. Missing instructions can delay the process. Why These Mistakes Matter

Avoiding these common errors can improve the professionalism of your billing process, making it easier for clients to understand and act on the payment request. Accuracy in billing helps ensure timely payments and reduces the need for follow-up communications. By being diligent in creating precise and comprehensive documents, you build trust with your clients, which can lead to stronger, long-term business relationships.

Integrating PayPal Invoices with Accounting Software

Efficiently managing finances is key to running a successful business, and integrating your payment requests with accounting software can streamline the process. This integration allows for seamless tracking, reporting, and record-keeping, reducing the time spent on manual data entry and ensuring that your financial records are up to date. With this setup, you can automatically sync payment data, track expenses, and generate financial reports directly from your accounting system.

Benefits of Integration

Connecting your payment documents to accounting software offers several advantages:

- Automated Data Syncing: Payment information from your billing documents is automatically updated in your accounting software, reducing the risk of errors and saving time on manual data entry.

- Real-Time Financial Tracking: Integration allows you to track payments and expenses in real time, giving you an accurate view of your business’s financial health at any moment.

- Improved Reporting: With automatic data synchronization, generating financial reports becomes simpler. You can easily track revenue, monitor cash flow, and prepare for taxes without the need to manually input transaction details.

- Increased Efficiency: Automated workflows eliminate the need to manually transfer payment details between systems, which speeds up administrative tasks and frees up time for other important business functions.

- Better Client Management: Integration allows you to maintain accurate client payment histories, making it easier to manage outstanding balances and handle recurring payments.

How to Set Up the Integration

Setting up the integration between your payment system and accounting software typically involves the following steps:

- Select Compatible Software: Choose accounting software that supports integration with your payment system. Popular options like QuickBooks, Xero, and FreshBooks often offer built-in integration features.

- Connect Accounts: Link your payment platform to the accounting software by entering your account details and authorizing the connection. Many platforms offer step-by-step guides to make the process easier.

- Customize Settings: Adjust settings to ensure that data is synced properly. This may include setting up categories for different types of income and expenses or selecting the frequency of updates.

- Test the Integration: Run a test to ensure that payments are being transferred accurately and that the integration is functioning as expected.

- Monitor and Adjust: Once integrated, monitor the sync process and make adjustments as needed to ensure everything continues to operate smoothly.

How PayPal Invoices Help with Taxes

When it comes to managing taxes for your business, accurate and organized financial records are essential. Billing documents can play a crucial role in this process by providing a clear and easily accessible record of income, taxes collected, and payments received. By using well-structured billing documents, you can streamline tax preparation, ensure compliance with tax regulations, and make the filing process more efficient.

Key Tax-Related Benefits of Using Billing Documents

Using billing documents effectively helps keep track of important tax information, such as sales tax, VAT, or other relevant tax charges. Here are some ways that these documents can help with tax management:

Tax Benefit Description Clear Record of Income Each billing document serves as an official record of income. This allows you to track your revenue and helps ensure that all business earnings are accounted for during tax season. Accurate Tax Calculations Many billing systems allow you to automatically calculate and include taxes such as sales tax or VAT. This reduces the chance of errors and ensures accurate reporting. Tips for Making Professional Invoices Creating clear and professional billing documents is essential for maintaining good relationships with clients and ensuring timely payments. A well-designed document not only makes a positive impression but also reduces the chances of misunderstandings regarding payment terms. By following a few key guidelines, you can create documents that are both professional and easy to understand.

Essential Elements of a Professional Document

When crafting your billing documents, it’s important to include the necessary details that make them clear and easy to process. Here are some key elements to consider:

- Accurate Contact Information: Always include your full business name, address, phone number, and email. Additionally, ensure that the client’s details are correct to avoid any delays in communication.

- Unique Reference Number: Assign a unique identification number to each document. This helps both you and your client track payments and makes it easier to refer back to specific transactions.

- Clear Payment Terms: Specify the payment due date, the accepted methods, and any penalties for late payments. This helps avoid confusion and sets clear expectations.

- Detailed Description of Products/Services: Include a detailed list of the products or services provided, with their respective prices and quantities. This ensures transparency and minimizes the risk of disputes.

- Tax Information: If applicable, include any relevant tax details, such as sales tax or VAT. Ensure the tax rates are correct and easy to understand.

Additional Tips for Making a Strong Impression

Beyond the basics, you can enhance the professionalism of your billing documents by following these additional tips:

- Use a Clean Layout: Keep the design simple and organized. Avoid cluttering the document with unnecessary information or decorative elements. A clean and well-structured layout makes it easier for clients to read and understand.

- Branding: Incorporate your company logo and use consistent branding elements such as colors and fonts. This helps reinforce your brand identity and creates a more polished appearance.

- Person

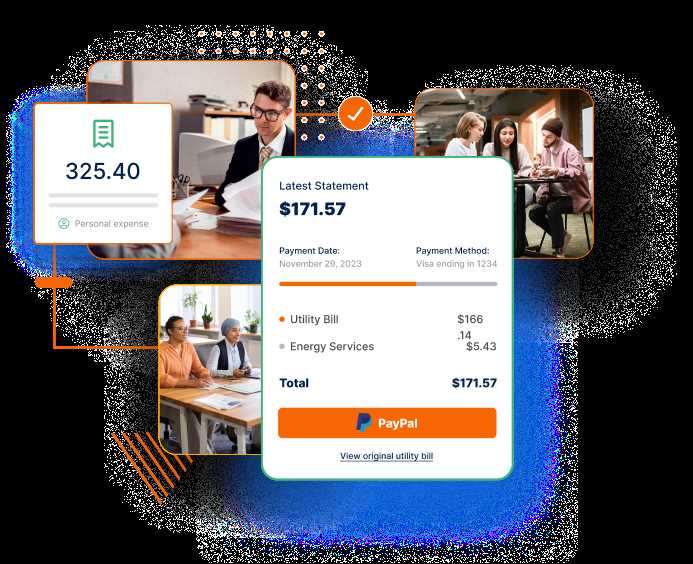

Secure Payments with PayPal Invoice Templates

Ensuring secure payment processing is crucial for any business, especially when handling online transactions. By using secure billing methods, you can protect your financial data, reduce the risk of fraud, and give your customers confidence in their transactions. One effective way to achieve this is by incorporating secure payment systems within your billing documents. This provides a safe and trustworthy method for both you and your clients to complete payments online.

How Secure Payment Features Work

Secure payment processing involves several layers of protection that ensure both parties are safeguarded against fraud and unauthorized access. Here’s how secure payment methods typically work:

- Encryption: Modern payment platforms use high-level encryption to protect sensitive data during transmission. This ensures that both customer and business information remains private and secure.

- Authentication: Secure systems often require authentication before a transaction is processed, whether through two-factor authentication or secure login methods. This adds an extra layer of protection against unauthorized access.

- Payment Confirmation: Upon completing a payment, the customer receives an instant confirmation. This not only assures them that their transaction is successful but also provides a record for both parties in case of disputes.

- Fraud Detection: Many payment platforms incorporate advanced fraud detection algorithms that monitor transactions for unusual activity, providing an added layer of security for both the business and the customer.

Benefits of Using Secure Payment Methods in Billing Documents

Integrating secure payment options into your billing documents offers several key advantages:

- Trust and Reliability: Customers are more likely to pay quickly and feel secure when they know their payment information is protected by trusted security features.

- Reduced Risk of Chargebacks: Secure payment processing reduces the chances of fraudulent chargebacks, as the transaction is verified and protected by encryption and authentication measures.

- Compliance with Payment Regulations: By using secure systems, you ensure that your business is in compliance with various financial regulations and industry standards, such as PCI-DSS (Payment Card Industry Data Security Standard).

- Faster Payment Processing: Secure methods streamline the payment process, ensuring that funds are transferred efficiently and without delays, allowing you to maintain healthy cash flow.

By prioritizing security in your billing system, you protect your business and customers, fostering trust and ensuring smooth transactions. Secure payment methods not only enhance the customer experience but also contribute to the overall success of your business.

How to Send PayPal Invoices Efficiently

Sending billing documents in an efficient and timely manner is crucial for maintaining positive cash flow and ensuring prompt payments from clients. By streamlining the process, you can save time, reduce errors, and improve communication with customers. Leveraging tools that automate key aspects of the process can make sending documents faster and more reliable, allowing you to focus on other areas of your business.

Steps to Send Billing Documents Efficiently

Here’s how you can simplify and speed up the process of sending payment requests to your clients:

- Automate Creation: Use software or systems that allow you to create billing documents quickly by automatically pulling in relevant customer information, such as their name, contact details, and purchased products or services.

- Save and Reuse Formats: Save your most commonly used payment request formats and reuse them for future transactions. This will eliminate the need to start from scratch each time.

- Integrate with Your Accounting System: Sync your billing system with your accounting platform to automatically update financial records and track payments. This integration can save you from entering data manually and prevent mistakes.

- Use Email or Digital Platforms: Sending payment requests via email or through digital platforms can greatly reduce the time spent on postal services. Additionally, digital documents are easily accessible and can be tracked for confirmation.

- Set Clear Payment Terms: Ensure that the terms for each transaction are clear, such as due dates and payment methods. Including this information upfront can prevent confusion and expedite the payment process.

Best Practices for Efficient Follow-ups

Efficient follow-ups are essential to ensuring timely payments. Here are some tips to handle reminders effectively:

- Automated Reminders: Set up automated reminders to notify clients when a payment is approaching or overdue. This will help prompt them to take action without you needing to manually follow up.

- Be Professional and Polite: While it’s important to follow up on unpaid transactions, maintaining a professional tone and polite language ensures good relationships with clients, even if they miss a payment deadline.

- Keep Records of Communication: Maintain a log of all communication related to billing, including sent requests and follow-up messages. This helps avoid misunderstandings and

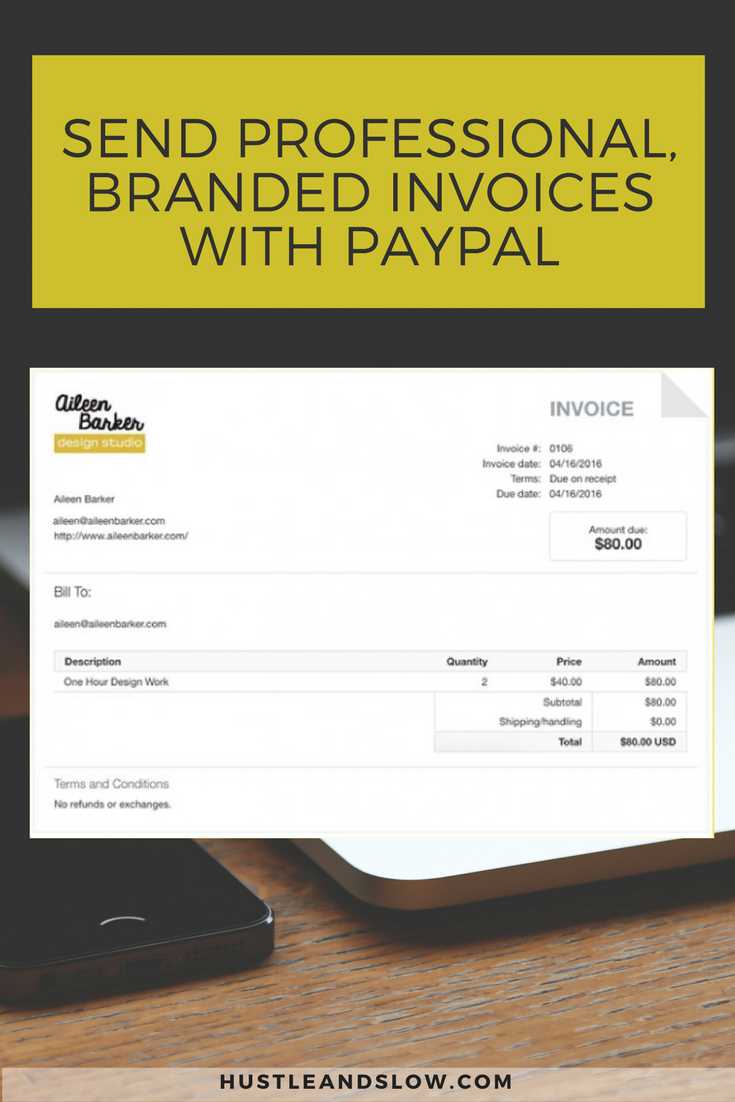

Why PayPal Is a Top Choice for Invoices

When it comes to handling payments and managing financial transactions, one platform stands out for its reliability and ease of use. It offers a simple, secure way to send requests for payment and accept funds, making it a top choice for businesses around the world. The platform provides essential features that streamline the billing process and ensure payments are processed quickly, safely, and efficiently.

Advantages of Using a Reliable Payment System

There are several reasons why this service is favored by businesses of all sizes when it comes to managing payment requests. Below are some of the key benefits:

- Global Reach: The platform allows businesses to send payment requests to clients all over the world, supporting multiple currencies and languages. This global reach ensures that no matter where your clients are located, payments are easy to process.

- Security Features: With built-in encryption and fraud protection, the platform helps safeguard both the business and customer data, reducing the risk of unauthorized access and chargebacks.

- Ease of Use: Sending payment requests is straightforward, with user-friendly interfaces that require minimal setup. The ability to create, send, and track payment requests is simplified, which saves businesses valuable time.

- Integrated Payment Options: Clients can make payments directly through a variety of methods, including credit cards, debit cards, and bank transfers, which makes it convenient for both parties involved.

- Fast Payment Processing: Payments are typically processed quickly, allowing businesses to receive funds faster than with traditional payment methods, which helps maintain cash flow.

Features That Set This Payment Platform Apart

In addition to the core benefits mentioned above, this payment system offers several other features that make it especially useful for businesses:

- Customizable Invoices: Businesses can easily customize payment requests with their logo, business details, and specific terms, which adds a professional touch and reinforces brand identity.

- Automatic Payment Reminders: The platform can send automatic reminders for outstanding pay