Customizable Advertising Agency Invoice Template for Professional Billing

Why You Need a Professional Invoice Template

Key Features of an Effective Invoice

How to Customize Your Invoice Template

Best Invoice Software for Agencies

Steps to Create an Invoice for Advertising Services

Essential Elements to Include in an Invoice

Understanding Payment Terms and Deadlines

Tips for Avoiding Common Billing Errors

How to Set Up a Payment Schedule

Design Considerations for Your Invoice Template

How to Organize Client Information Efficiently

How to Add Discounts and Adjustments

Understanding Taxes on Advertising Services

How to Handle Late Payments and Penalties

How to Export and Send Your Invoice

Maintaining Accurate Billing Records

Advertising Agency Invoice Template Guide

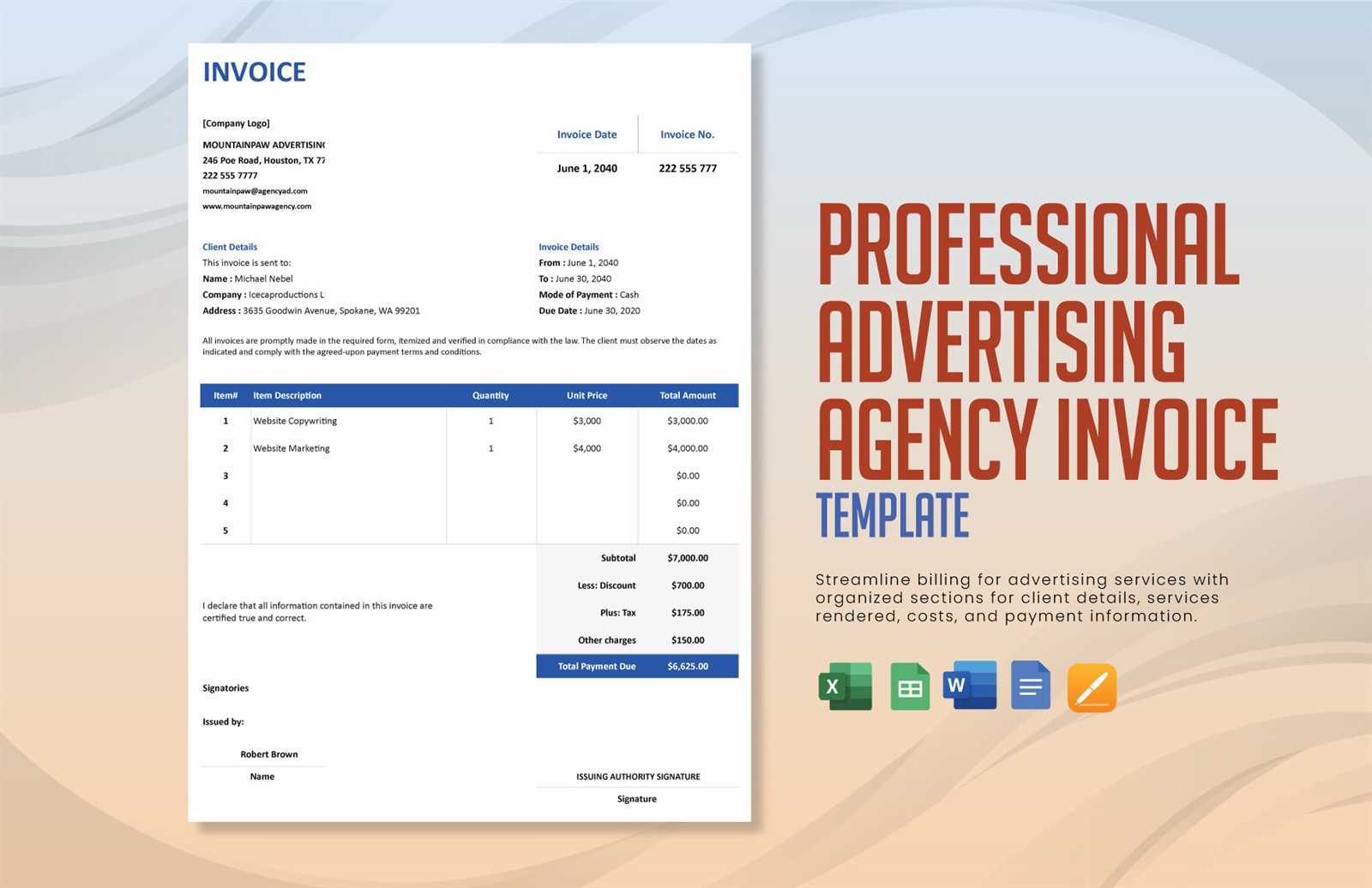

Creating a streamlined and professional billing document is essential for any business offering services. A well-structured billing statement not only ensures timely payments but also strengthens client trust. This guide will walk you through the essential elements and design features that make up an effective financial statement for your projects.

To begin, it’s important to understand the core components of a good billing statement. Every document should clearly present the details of the work completed, the agreed-upon rates, and the total cost for services rendered. Additionally, including clear payment instructions and timelines is crucial for smooth transactions.

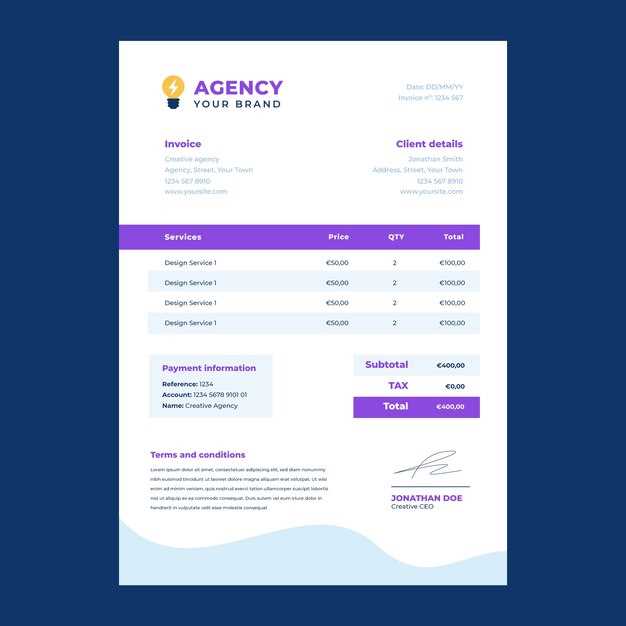

Customization is key to creating a document that reflects your brand identity while being clear and easy to understand. You may want to adjust fonts, colors, and layout to match your company’s professional style. The overall look of your financial statements should be aligned with the standards of the industry, ensuring they are easily recognizable and convey authority.

Timeliness and accuracy in issuing your financial statements are also essential for maintaining a smooth business operation. A clear, concise document reduces confusion and helps prevent delays in payments, which is why paying attention to every detail is crucial.

Ultimately, your goal is to craft a functional and professional billing document that leaves a positive impression on clients and streamlines your payment process.

Advertising Agency Invoice Template Guide

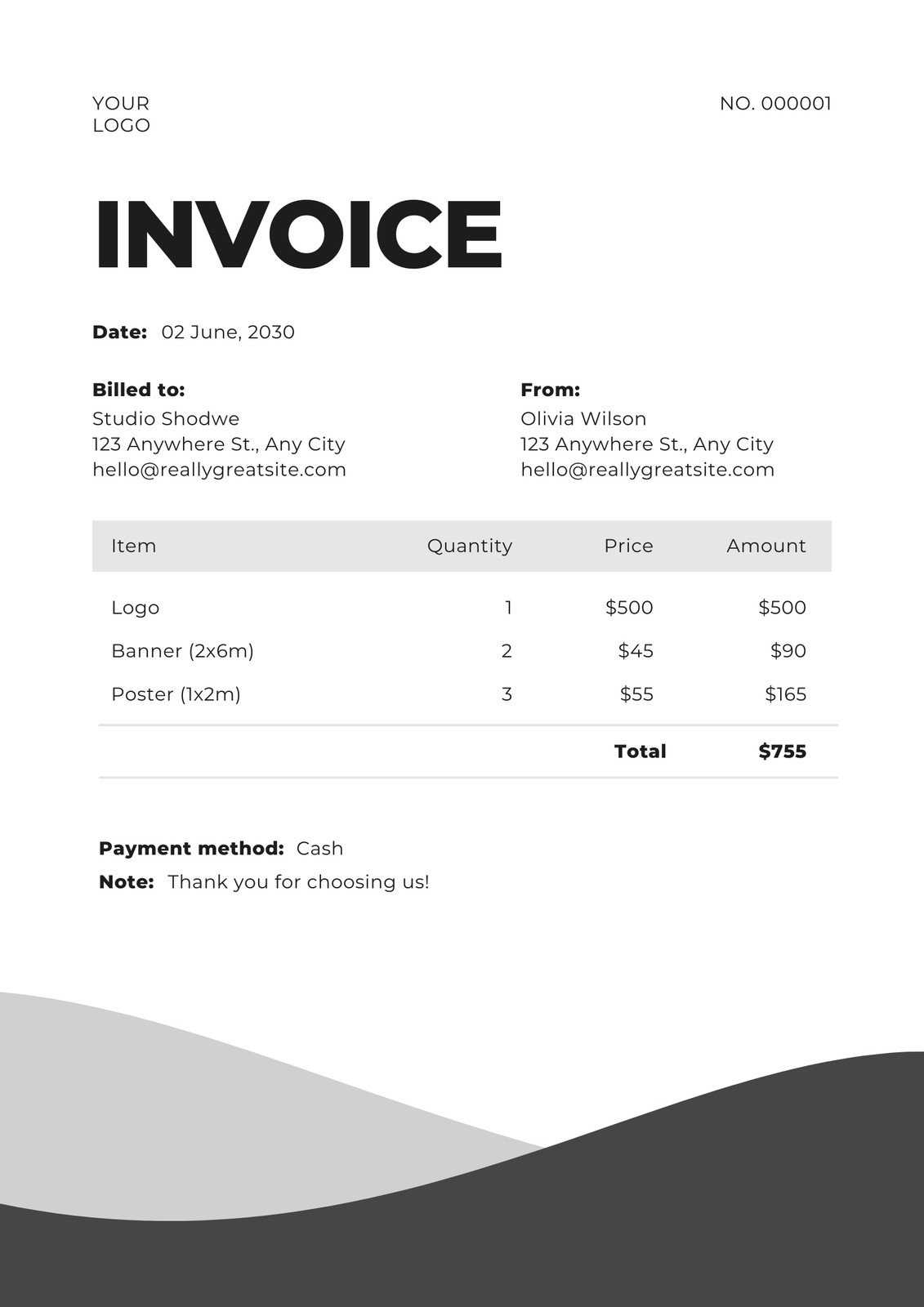

Creating a streamlined and professional billing document is essential for any business offering services. A well-structured billing statement not only ensures timely payments but also strengthens client trust. This guide will walk you through the essential elements and design features that make up an effective financial statement for your projects.

To begin, it’s important to understand the core components of a good billing statement. Every document should clearly present the details of the work completed, the agreed-upon rates, and the total cost for services rendered. Additionally, including clear payment instructions and timelines is crucial for smooth transactions.

Customization is key to creating a document that reflects your brand identity while being clear and easy to understand. You may want to adjust fonts, colors, and layout to match your company’s professional style. The overall look of your financial statements should be aligned with the standards of the industry, ensuring they are easily recognizable and convey authority.

Timeliness and accuracy in issuing your financial statements are also essential for maintaining a smooth business operation. A clear, concise document reduces confusion and helps prevent delays in payments, which is why paying attention to every detail is crucial.

Ultimately, your goal is to craft a functional and professional billing document that leaves a positive impression on clients and streamlines your payment process.

Advertising Agency Invoice Template Guide

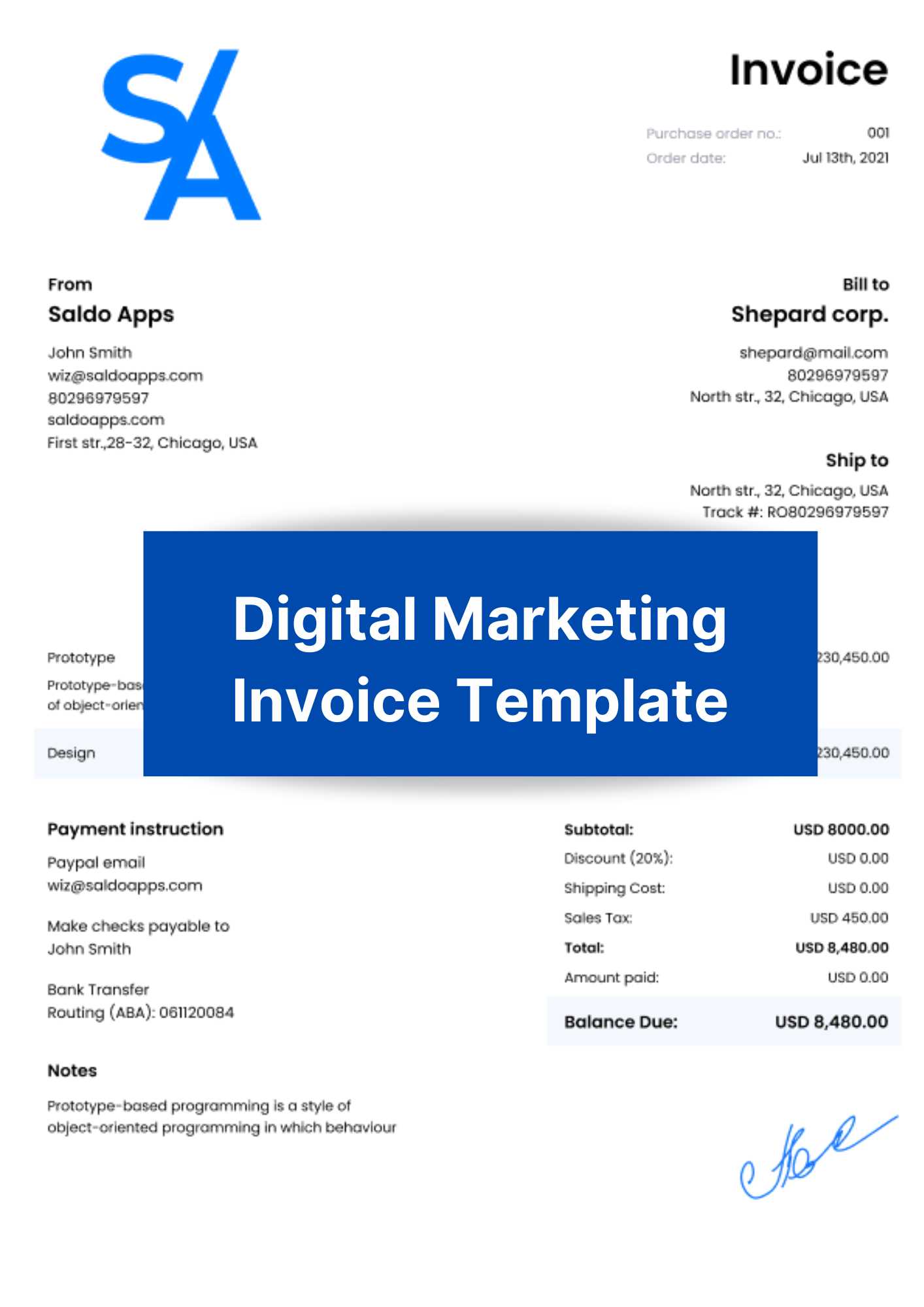

Creating a streamlined and professional billing document is essential for any business offering services. A well-structured billing statement not only ensures timely payments but also strengthens client trust. This guide will walk you through the essential elements and design features that make up an effective financial statement for your projects.

To begin, it’s important to understand the core components of a good billing statement. Every document should clearly present the details of the work completed, the agreed-upon rates, and the total cost for services rendered. Additionally, including clear payment instructions and timelines is crucial for smooth transactions.

Customization is key to creating a document that reflects your brand identity while being clear and easy to understand. You may want to adjust fonts, colors, and layout to match your company’s professional style. The overall look of your financial statements should be aligned with the standards of the industry, ensuring they are easily recognizable and convey authority.

Timeliness and accuracy in issuing your financial statements are also essential for maintaining a smooth business operation. A clear, concise document reduces confusion and helps prevent delays in payments, which is why paying attention to every detail is crucial.

Ultimately, your goal is to craft a functional and professional billing document that leaves a positive impression on clients and streamlines your payment process.

Advertising Agency Invoice Template Guide

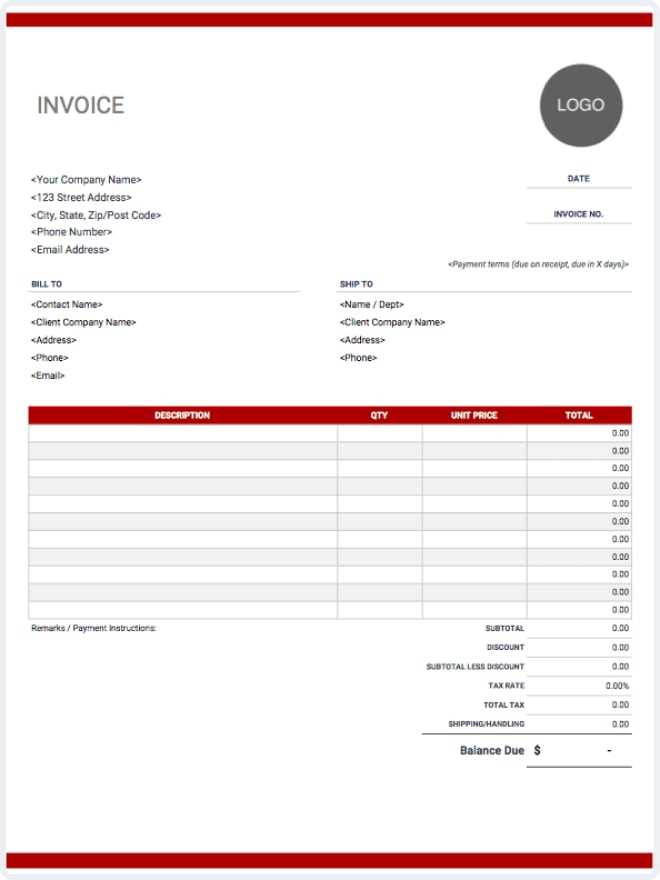

Creating a streamlined and professional billing document is essential for any business offering services. A well-structured billing statement not only ensures timely payments but also strengthens client trust. This guide will walk you through the essential elements and design features that make up an effective financial statement for your projects.

To begin, it’s important to understand the core components of a good billing statement. Every document should clearly present the details of the work completed, the agreed-upon rates, and the total cost for services rendered. Additionally, including clear payment instructions and timelines is crucial for smooth transactions.

Customization is key to creating a document that reflects your brand identity while being clear and easy to understand. You may want to adjust fonts, colors, and layout to match your company’s professional style. The overall look of your financial statements should be aligned with the standards of the industry, ensuring they are easily recognizable and convey authority.

Timeliness and accuracy in issuing your financial statements are also essential for maintaining a smooth business operation. A clear, concise document reduces confusion and helps prevent delays in payments, which is why paying attention to every detail is crucial.

Ultimately, your goal is to craft a functional and professional billing document that leaves a positive impression on clients and streamlines your payment process.

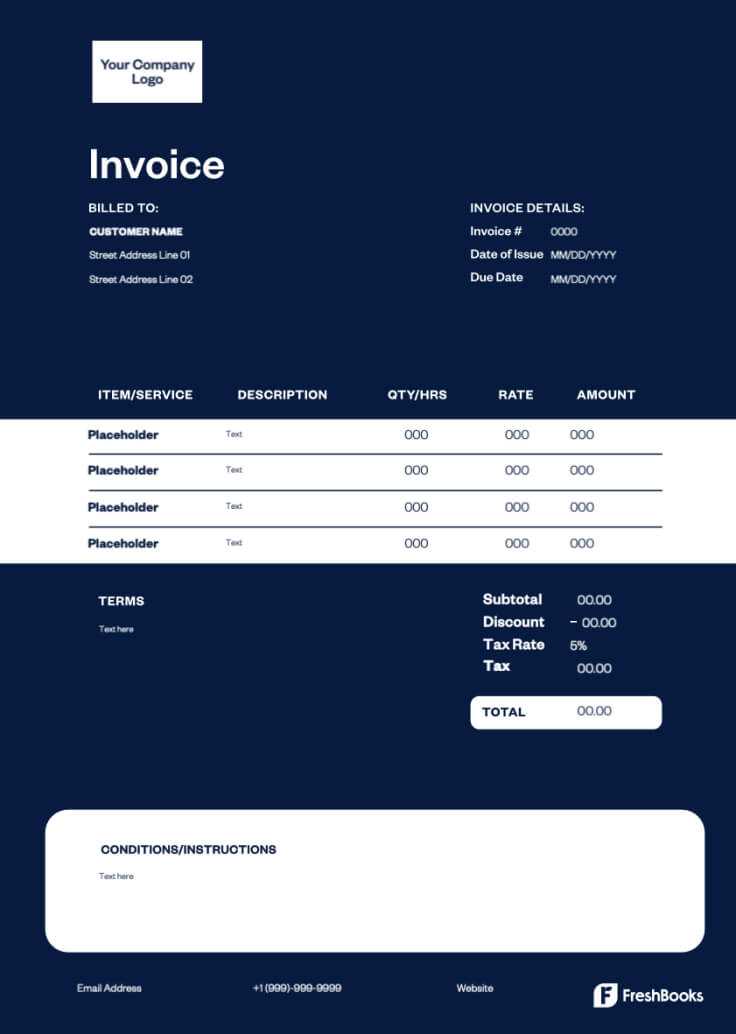

Best Invoice Software for Agencies

When it comes to managing client billing and payments, the right software can significantly improve efficiency and accuracy. Choosing the best tools for handling financial documents can save time and reduce errors, ensuring smooth transactions and timely payments. Here are some of the top options for businesses looking to streamline their billing process.

- FreshBooks: Known for its user-friendly interface, FreshBooks is a great choice for small to medium-sized businesses. It offers easy tracking of hours, automatic payment reminders, and customizable templates for all types of service work.

- QuickBooks: This popular option provides comprehensive features, including expense tracking, tax calculations, and invoice management. It’s suitable for businesses looking for an all-in-one accounting solution.

- Zoho Invoice: Ideal for businesses looking for a free, feature-rich tool, Zoho allows for easy creation and customization of billing documents, as well as integration with other Zoho apps for seamless workflow.

- Wave: A great free option for freelancers and small businesses, Wave provides invoicing features along with basic accounting tools, making it a budget-friendly solution for growing businesses.

- Bill.com: This cloud-based software simplifies the process of sending invoices and managing payments. It also integrates with popular accounting software like QuickBooks and Xero, making it ideal for businesses seeking streamlined accounting and invoicing solutions.

Each of these platforms offers distinct features that cater to different business needs. Depending on your company size and specific requirements, selecting the right software will help ensure that your financial documents are clear, professional, and easily managed.

Best Invoice Software for Agencies

When it comes to managing client billing and payments, the right software can significantly improve efficiency and accuracy. Choosing the best tools for handling financial documents can save time and reduce errors, ensuring smooth transactions and timely payments. Here are some of the top options for businesses looking to streamline their billing process.

- FreshBooks: Known for its user-friendly interface, FreshBooks is a great choice for small to medium-sized businesses. It offers easy tracking of hours, automatic payment reminders, and customizable templates for all types of service work.

- QuickBooks: This popular option provides comprehensive features, including expense tracking, tax calculations, and invoice management. It’s suitable for businesses looking for an all-in-one accounting solution.

- Zoho Invoice: Ideal for businesses looking for a free, feature-rich tool, Zoho allows for easy creation and customization of billing documents, as well as integration with other Zoho apps for seamless workflow.

- Wave: A great free option for freelancers and small businesses, Wave provides invoicing features along with basic accounting tools, making it a budget-friendly solution for growing businesses.

- Bill.com: This cloud-based software simplifies the process of sending invoices and managing payments. It also integrates with popular accounting software like QuickBooks and Xero, making it ideal for businesses seeking streamlined accounting and invoicing solutions.

Each of these platforms offers distinct features that cater to different business needs. Depending on your company size and specific requirements, selecting the right software will help ensure that your financial documents are clear, professional, and easily managed.

Best Invoice Software for Agencies

When it comes to managing client billing and payments, the right software can significantly improve efficiency and accuracy. Choosing the best tools for handling financial documents can save time and reduce errors, ensuring smooth transactions and timely payments. Here are some of the top options for businesses looking to streamline their billing process.

- FreshBooks: Known for its user-friendly interface, FreshBooks is a great choice for small to medium-sized businesses. It offers easy tracking of hours, automatic payment reminders, and customizable templates for all types of service work.

- QuickBooks: This popular option provides comprehensive features, including expense tracking, tax calculations, and invoice management. It’s suitable for businesses looking for an all-in-one accounting solution.

- Zoho Invoice: Ideal for businesses looking for a free, feature-rich tool, Zoho allows for easy creation and customization of billing documents, as well as integration with other Zoho apps for seamless workflow.

- Wave: A great free option for freelancers and small businesses, Wave provides invoicing features along with basic accounting tools, making it a budget-friendly solution for growing businesses.

- Bill.com: This cloud-based software simplifies the process of sending invoices and managing payments. It also integrates with popular accounting software like QuickBooks and Xero, making it ideal for businesses seeking streamlined accounting and invoicing solutions.

Each of these platforms offers distinct features that cater to different business needs. Depending on your company size and specific requirements, selecting the right software will help ensure that your financial documents are clear, professional, and easily managed.

Understanding Payment Terms and Deadlines

Clear payment terms and deadlines are crucial for maintaining a smooth business relationship. Setting expectations upfront regarding when and how payments should be made helps avoid misunderstandings and ensures that financial transactions are completed on time. In this section, we will explore common payment terms and the importance of defining deadlines in your contracts and billing documents.

Common Payment Terms

Payment terms are the conditions under which a client is required to pay for services rendered. These terms typically include the due date, any applicable discounts for early payment, and the penalties for late payment. Here are some commonly used payment terms:

| Term | Description |

|---|---|

| Net 30 | Payment is due within 30 days from the date of the bill. |

| Net 15 | Payment is due within 15 days from the bill date. |

| Due on Receipt | Payment is expected immediately after the bill is sent. |

| COD (Cash on Delivery) | Payment is due at the time goods or services are delivered. |

Importance of Clear Deadlines

Clearly defined deadlines prevent confusion and ensure timely payments. By specifying when payments are due, you create a clear expectation for the client, which improves cash flow and helps avoid delays. Additionally, late payment penalties can be established to encourage prompt payment, thus minimizing the risk of financial strain on your business.

Understanding Payment Terms and Deadlines

Clear payment terms and deadlines are crucial for maintaining a smooth business relationship. Setting expectations upfront regarding when and how payments should be made helps avoid misunderstandings and ensures that financial transactions are completed on time. In this section, we will explore common payment terms and the importance of defining deadlines in your contracts and billing documents.

Common Payment Terms

Payment terms are the conditions under which a client is required to pay for services rendered. These terms typically include the due date, any applicable discounts for early payment, and the penalties for late payment. Here are some commonly used payment terms:

| Term | Description |

|---|---|

| Net 30 | Payment is due within 30 days from the date of the bill. |

| Net 15 | Payment is due within 15 days from the bill date. |

| Due on Receipt | Payment is expected immediately after the bill is sent. |

| COD (Cash on Delivery) | Payment is due at the time goods or services are delivered. |

Importance of Clear Deadlines

Clearly defined deadlines prevent confusion and ensure timely payments. By specifying when payments are due, you create a clear expectation for the client, which improves cash flow and helps avoid delays. Additionally, late payment penalties can be established to encourage prompt payment, thus minimizing the risk of financial strain on your business.

How to Set Up a Payment Schedule

Establishing a clear payment structure is essential for maintaining a smooth flow of finances between service providers and their clients. A well-defined payment schedule helps set expectations, ensures timely compensation, and minimizes the risk of late payments or misunderstandings. Setting up an appropriate plan involves determining milestones, payment amounts, and deadlines that align with the scope and duration of the work.

Define Payment Milestones

The first step in creating a payment plan is to establish key milestones or stages of the project. These milestones can be based on specific deliverables, phases of work, or time intervals. Each milestone should represent a significant point in the project where work is completed or progress is measurable. By breaking the work into manageable parts, both parties can ensure that the payments are aligned with the value delivered at each stage.

Set Clear Payment Terms

Once milestones are defined, it is crucial to set clear payment terms, including the amounts due at each stage and the timing of these payments. Decide whether to request full payment upfront, divide the total into several installments, or require partial payments after each milestone. Be sure to outline deadlines for each payment, and clarify any penalties or late fees in case payments are delayed. Transparency in these terms ensures that both sides understand when payments are due and can plan accordingly.

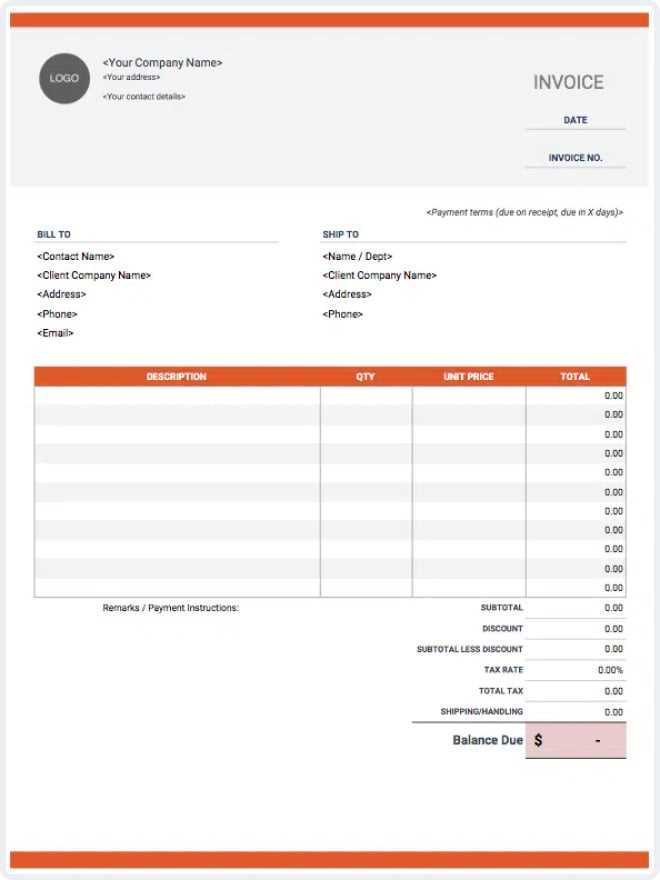

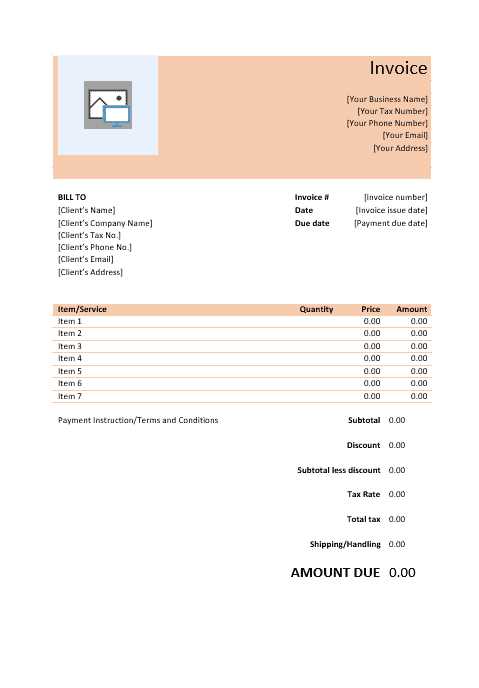

Design Considerations for Your Invoice Template

Creating a professional and functional billing document goes beyond just including numbers and dates. The layout, structure, and visual elements of the document play a crucial role in how clients perceive the professionalism of the service and how easily they can navigate the details. When designing such a document, it’s important to keep clarity, branding, and ease of use in mind to ensure smooth communication and prompt payments.

Essential Elements to Include

Your document should contain specific key components that not only fulfill legal requirements but also enhance the client’s experience. Here are the most important details to include:

- Contact Information: Always display both your contact details and those of your client clearly. Include names, addresses, phone numbers, and email addresses to ensure communication is easy.

- Clear Itemization: List services or products provided, along with their corresponding costs, so the client can easily understand what they are paying for.

- Payment Terms: Clearly state when the payment is due, the acceptable methods of payment, and any penalties for late payments.

- Unique Identification Number: Include a reference number for easy tracking and future reference.

- Total Amount Due: Display the total clearly, including taxes, fees, and discounts, so that the final amount is transparent.

Visual Design Tips

The visual layout of your document can significantly affect how your message is received. Keep these design principles in mind:

- Clarity: Ensure all information is legible by using a clean, easy-to-read font. Avoid cluttering the page with excessive text or graphics.

- Consistency: Use your brand’s color scheme, logo, and font choices to create a unified and professional look.

- Whitespace: Incorporate adequate spacing to make the document easier to scan and read. A crowded page can overwhelm the reader.

- Hierarchy: Organize the information in a logical order, using headings, bullet points, and bold text

How to Organize Client Information Efficiently

Properly managing client data is essential for streamlining business operations and ensuring effective communication. Organizing information in a structured and accessible way not only improves workflow but also helps in maintaining long-term relationships. Whether it’s for billing, project tracking, or customer support, having a clear system in place ensures that details are always available when needed.

Key Steps for Efficient Organization

There are several strategies to ensure that client data is kept organized and accessible:

- Centralized Database: Store all client information in a single, secure location–whether it’s a cloud-based system or a physical database. This makes it easy to retrieve relevant details without searching through multiple platforms.

- Use Categories and Tags: Categorize client profiles by factors such as industry, service type, or project status. Tagging specific details, like payment terms or communication preferences, can further enhance organization.

- Consistent Naming Conventions: Use consistent naming conventions for files and client records. This ensures that all documents related to a particular client can be easily identified and located.

- Automate Where Possible: Leverage software tools to automate the collection and updating of client data. This minimizes the chances of human error and reduces time spent on manual tasks.

Maintaining Accurate and Up-to-Date Information

Efficient organization is only useful if the data is accurate and regularly updated. To ensure the integrity of your client records, consider the following practices:

- Regular Data Audits: Set a schedule to review and update client information at regular intervals. This ensures outdated or incorrect details are promptly corrected.

- Client Confirmation: Ask clients to review and confirm their contact information periodically, particularly after a major project or contract renewal.

- Tracking Changes: Implement a system that tracks any modifications made to client profiles. This allows you to maintain a history of updates and helps prevent errors.

How to Add Discounts and Adjustments

Offering discounts or making adjustments to a bill can be an effective way to build customer loyalty, reward long-term clients, or accommodate special situations. Whether it’s a limited-time promotion, a loyalty discount, or a necessary price correction, clearly presenting these changes on a document ensures transparency and keeps both parties on the same page. Knowing how to properly structure and display such modifications is key to maintaining professionalism and clarity.

Applying Discounts

When applying a discount, it’s important to be clear about the type of discount offered and how it affects the overall amount. Discounts can either be applied as a percentage or as a fixed amount. Here are some steps to consider:

- Percentage Discount: To apply a percentage discount, simply calculate the discount amount by multiplying the total cost by the discount rate. For example, a 10% discount on a $500 service would be $50. Subtract this amount from the total cost to show the discounted price.

- Fixed Amount Discount: A fixed amount discount is straightforward; just subtract the agreed-upon discount value from the total. For instance, if the discount is $30, simply deduct that from the full price.

- Clearly Labeling Discounts: Be sure to include a description for the discount (e.g., “10% off for early payment” or “Loyalty Discount”) and clearly show the original price, discount amount, and final adjusted total to avoid any confusion.

Making Adjustments

Adjustments may be necessary to correct errors, address overcharges, or accommodate changes in the scope of work. When making an adjustment, it’s crucial to provide a transparent explanation. Follow these steps:

- Adjusting for Errors: If there was an overcharge or incorrect billing, clearly state the reason for the adjustment and the amount being corrected. For example, “Adjustment for incorrect service charge” followed by the corrected amount.

- Changes in Scope: If additional services were added or removed after the original agreement, document the updated charges or credits. It’s helpful to reference the specific change in the project or service and show the new total after the adjustment.

- Breakdown of Adjustments: Always include a line-item breakdown for adjustments to show the client exactly what was changed and why. This promotes transparency and minimizes misunderstandings.

Understanding Taxes on Advertising Services

When providing services that involve promoting products or brands, it’s essential to understand the tax implications for both the service provider and the client. Taxes on such services can vary depending on the region, the nature of the work, and the specific terms of the agreement. Knowing how to apply the correct tax rates and ensuring proper documentation will help avoid legal issues and ensure that financial transactions are transparent and compliant with tax regulations.

Types of Taxes to Consider

There are various types of taxes that may apply to promotional services, depending on your location and the services offered. The most common taxes include:

- Sales Tax: In many regions, services related to promotion or marketing may be subject to sales tax. This is typically a percentage of the service fee and is added to the total amount due. Be sure to check whether the services you provide are taxable in your jurisdiction.

- Value-Added Tax (VAT): In countries with VAT systems, services such as creative work, digital marketing, and consultancy may fall under taxable activities. The rate and eligibility for VAT will depend on your location and the client’s country.

- Service Tax: Some areas impose a specific service tax on certain types of business activities. This tax is usually applied to the total service fee and may differ from regular sales or VAT rates.

How to Handle Taxation Correctly

To ensure proper taxation on your services, consider the following steps:

- Know the Tax Rates: Familiarize yourself with the tax rates applicable to the services you provide. Different services may be taxed differently, and these rates can change over time or vary by location.

- Document Tax Separately: On any financial document, make sure to list taxes separately from the base fee. This helps both you and the client understand the exact tax amounts being applied.

- Check for Exemptions: Some services or clients may be exempt from certain taxes. For example, non-profit organizations or government contracts might not be subject to tax. Be sure to verify any exemptions before applying taxes.

How to Handle Late Payments and Penalties

Late payments can disrupt cash flow and affect the financial health of any business. To ensure that payments are made on time and to protect your interests, it’s crucial to have a clear strategy for addressing overdue balances. Implementing late payment penalties and outlining them in the agreement can help encourage clients to pay promptly and provide a sense of accountability. Understanding how to apply these penalties fairly and effectively is key to maintaining strong professional relationships while safeguarding your business.

Setting Up Penalties for Late Payments

Late payment penalties should be clearly communicated in your terms and conditions, ideally before any work begins. These penalties serve as a deterrent for delays and ensure that clients understand the consequences of failing to meet payment deadlines. Common approaches include:

- Flat Fees: A set fee that applies after a certain period of delay, such as $25 or $50 after 30 days of non-payment.

- Percentage-based Penalties: A percentage of the total amount due, typically 1-2% per month, which increases as the payment becomes more overdue.

- Interest Charges: Some businesses choose to charge interest on overdue amounts, which can be calculated daily, weekly, or monthly, depending on the agreed-upon terms.

Example Late Payment Terms

Below is an example of how late payment penalties can be outlined in a payment agreement. This provides both you and your clients with clarity on what to expect if payments are delayed:

Payment Due Date Penalty Applied Penalty Description Within 30 days No Penalty Payment is due in full within 30 days of the due date. 31-60 days 5% Late Fee A 5% late fee is added to the total amount due. 61+ days 10% Late Fee + Interest A 10% late fee plus 1 How to Export and Send Your Invoice

Once you’ve finalized the billing details, the next step is to export and send the document to your client. The format in which you share your financial records and the method of delivery both play an important role in ensuring clarity, professionalism, and timely payments. Choosing the right approach for both exporting the document and sending it is essential for smooth transactions.

Choosing the Right Format for Export

Before sending your document, you must decide on the appropriate format. Here are the most commonly used file types for sharing such documents:

- PDF: The most professional and secure format for sending business-related documents. PDF files preserve the formatting and are universally accessible, ensuring the recipient sees the document as intended.

- Excel/Spreadsheet: If you need to provide a detailed breakdown or allow the client to make adjustments, an Excel file might be appropriate. However, this format may not be suitable for all situations as it lacks the professionalism of a PDF.

- Word Document: This format is useful for contracts or if you need to include detailed notes, but it’s less commonly used for standard billing purposes compared to PDF.

Sending Your Document

Once the document is properly exported, the next step is to send it to your client. The method of delivery can impact how promptly your client responds:

- Email: The most efficient and preferred method. Attach the exported file to a professional email, including a polite message with the relevant payment instructions and due date. Ensure the subject line clearly indicates that the document is related to payment.

- Cloud Storage Links: If the document is too large to send by email or if you need to provide access to multiple files, consider using cloud storage services such as Google Drive, Dropbox, or OneDrive. Ensure the link is properly shared with the correct permissions for the recipient to access the document.

- Physical Mail: In rare cases, or for high-value projects, you might prefer to send the document by postal mail. If choosing this method, ensure the document is printed professionally and sent via a reliable postal service with tracking.

Maintaining Accurate Billing Records

Keeping precise records of all transactions is essential for any business. Not only does this ensure that clients are billed correctly, but it also helps track payments, manage taxes, and maintain financial transparency. Properly organized records can prevent misunderstandings and provide a reliable reference in case of disputes or audits. Establishing a solid system for managing billing details is key to running an efficient and professional business.

Best Practices for Organizing Billing Information

To maintain accuracy and consistency in your financial records, follow these key practices:

- Keep Detailed Records: Always document the full scope of work, the agreed-upon price, payment terms, and any adjustments made. This ensures you have a complete picture of each transaction.

- Use Consistent Naming Conventions: Organize files with clear, consistent names that include the client’s name, the service or project provided, and the date. This will make it easier to locate and cross-reference documents later.

- Track Payments and Due Dates: Use a spreadsheet or financial software to track outstanding balances and payment deadlines. Set reminders to follow up with clients on overdue payments.

- Back Up Your Records: Ensure that all billing records are securely backed up, whether digitally or in hard copy. Consider using cloud-based storage or external drives to keep backups in case of data loss.

Tools for Managing Billing Records

There are various tools available to help streamline the process of managing and maintaining accurate billing data:

- Accounting Software: Tools like QuickBooks, Xero, or FreshBooks can help track payments, generate reports, and automatically update records in real time.

- Spreadsheets: For smaller businesses or freelancers, using spreadsheets (e.g., Excel or Google Sheets) to track billing details, payments, and due dates can be an effective and low-cost solution.

- Cloud Storage: Cloud services like Google Drive or Dropbox allow you to store and organize billing documents securely, making them accessible from anywhere.