Late Payment Interest Invoice Template for Effective Billing Management

Handling overdue accounts is a crucial part of maintaining healthy business finances. When clients miss the agreed-upon deadlines for settling their bills, it can have a significant impact on cash flow. To ensure that these delays are addressed fairly and consistently, creating a structured approach for applying fees can be incredibly beneficial.

Clear communication is key when outlining the terms associated with overdue fees. By having a well-organized document that specifies the conditions under which additional charges are applied, businesses can help prevent misunderstandings and ensure timely resolution. This type of document not only helps in enforcing agreements but also promotes a sense of professionalism in financial dealings.

In this guide, we’ll explore how to create an efficient system for incorporating overdue charges into your billing process. Whether you’re a freelancer, small business owner, or large corporation, having a clear method for managing late charges can make all the difference in maintaining a smooth workflow and protecting your financial interests.

Late Payment Interest Invoice Template

Having a well-organized document to handle overdue balances is an essential tool for businesses of all sizes. This type of structured document allows you to set clear terms for additional charges applied when clients fail to settle their accounts on time. By including specific guidelines and calculations, you ensure consistency in managing these situations and maintaining cash flow.

Creating an effective form for managing overdue charges should involve several key components. These include a clear description of the original due amount, the date the payment was expected, and the percentage or flat fee applied for the delay. Additionally, the document should outline any grace periods and the date by which the overdue sum must be settled to avoid further penalties.

Using such a structured document not only promotes professionalism but also helps avoid confusion with clients. It sets clear expectations and acts as a reminder for those who may overlook or forget about their obligations. In turn, this contributes to smoother financial management and ensures timely recovery of outstanding balances.

Why Late Payment Interest Matters

Ensuring timely compensation for services or goods provided is crucial for any business to maintain financial health. When clients fail to meet agreed deadlines, it not only disrupts cash flow but can also affect long-term operations. By applying a fee for overdue balances, companies create an incentive for clients to fulfill their obligations on time, ensuring fair treatment for both parties.

Establishing clear terms for handling delays helps businesses remain consistent and transparent. It prevents the situation where clients may take advantage of relaxed payment timelines, which can ultimately strain business resources. A well-defined policy for handling overdue accounts ensures that all clients are aware of the potential consequences and encourages them to adhere to the agreed-upon schedule.

By implementing these charges, companies also demonstrate professionalism and seriousness in their financial dealings. It sends a message that timely payments are a priority and that delays are not simply overlooked. In doing so, businesses protect their financial stability and create an environment where clients are more likely to honor their commitments.

How to Create a Custom Invoice

Designing a tailored document for overdue charges requires attention to detail and a clear understanding of the terms involved. A custom approach ensures that each client receives an accurate and professional reminder for any outstanding balances. By following a structured process, you can create a document that reflects your business’s specific needs and maintains clarity in your financial dealings.

Define Key Elements

The first step in crafting a personalized form is to clearly outline the essential components. This includes identifying the original amount owed, the date it was due, and the applicable charges for delays. Be sure to include the total amount that is now due, along with a breakdown of how the charges were calculated. Transparency at this stage helps avoid confusion and promotes trust with your clients.

Customize for Your Business

Once the basic details are defined, consider personalizing the document to reflect your business’s branding and tone. Include your company name, logo, and contact information to ensure that the document looks professional. Additionally, you can customize the wording to match your company’s preferred style, whether formal or casual, to keep consistent with your overall brand identity.

By following these steps, you ensure that your clients receive clear, professional, and accurate documents for any overdue balances. This helps maintain a good relationship while also ensuring that your business is compensated fairly for the goods or services provided.

Essential Elements of an Invoice

When creating a document for overdue balances, certain elements must be included to ensure clarity and accuracy. These components not only help in tracking outstanding sums but also provide transparency for both parties. A well-constructed form will effectively communicate the details of the outstanding amount and the applicable fees, promoting smooth financial transactions.

- Client Information: Include the name, address, and contact details of the client. This ensures that the document is correctly addressed and easily identifiable.

- Company Details: Your business name, logo, and contact information should also be included to create a professional look and establish authenticity.

- Original Amount: Clearly specify the amount due for the services or goods provided before any charges are applied. This sets a baseline for the overdue sum.

- Due Date: Indicate the exact date by which payment was expected. This helps establish the timeline for any additional charges to be applied.

- Fee Structure: Outline the percentage or fixed amount that will be added to the original balance due to the delay. Specify how this fee is calculated and what factors may affect the total.

- Total Due: After calculating the overdue charges, clearly state the total sum now owed. This should include the original amount and any additional fees.

- Payment Instructions: Provide clear instructions on how the client can settle the balance, including preferred payment methods and deadlines.

Including these essential details ensures that the document is not only accurate but also transparent, helping clients understand the charges and preventing confusion. By structuring the form effectively, businesses can maintain professionalism while securing timely compensation for their services.

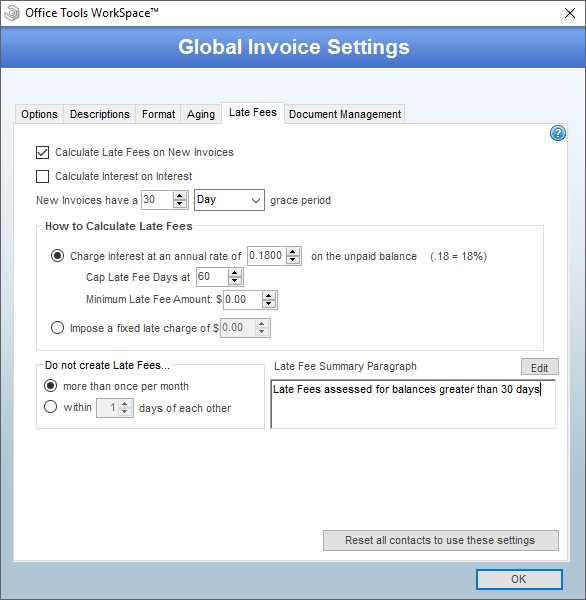

Automating Interest Calculation in Invoices

Efficiently managing overdue charges can be streamlined by automating the process of calculating additional fees. By integrating automated systems, businesses can ensure consistent and accurate calculations without manual intervention. This not only saves time but also reduces errors that could lead to confusion or disputes with clients.

Why Automation is Beneficial

Automating the calculation of fees associated with delayed accounts allows businesses to handle a higher volume of transactions without compromising accuracy. It removes the need for manual input, ensuring that every document reflects the correct amount due based on pre-set parameters. Here are some benefits of automating the process:

- Consistency: Automated calculations ensure that the same rules are applied to all accounts, minimizing the risk of mistakes.

- Efficiency: Automation speeds up the process, allowing you to generate documents quickly and without human error.

- Time-saving: By eliminating manual calculations, you free up time to focus on other aspects of your business operations.

- Transparency: Clients can clearly see how their charges were calculated, leading to better understanding and fewer disputes.

How to Set Up Automated Calculations

To automate the calculation of overdue charges, you can use spreadsheet software, accounting tools, or custom software solutions. Here are the basic steps to set up the system:

- Define the Rate: Establish a fixed rate or percentage that will be applied for overdue balances. This rate should be consistent and agreed upon with clients.

- Set the Parameters: Determine when the fee should be applied–whether after a certain number of days or based on specific thresholds.

- Implement the Formula: In software like Excel or through automated accounting tools, create a formula that calculates the fee based on the overdue amount and the defined rate.

- Test the System: Before fully relying on automation, test the system with sample data to ensure that the calculations are correct and as expected.

By integrating this automated approach, businesses can simplify the billing process, improve accuracy, and maintain a professional and consistent method for managing overdue accounts.

Choosing the Right Interest Rate

Selecting an appropriate fee for overdue balances is essential for maintaining a fair and professional approach in your financial dealings. The rate applied should be balanced to ensure it motivates timely settlement, while also remaining reasonable and compliant with applicable regulations. An excessively high fee could deter clients, while a low fee might not effectively encourage prompt action.

Factors to Consider When Setting the Rate

When deciding on a charge for overdue accounts, it is important to take several key factors into account:

- Industry Standards: Research what is common within your industry to ensure your rate is competitive yet fair. Setting a rate too high can make you seem unprofessional, while too low could weaken its impact.

- Local Laws: Check if there are legal limits or guidelines that govern how much you can charge for overdue sums. Some jurisdictions may have maximum allowable rates for such fees.

- Client Relationship: Consider the nature of your relationship with the client. For long-term customers, a more flexible approach might be appropriate, while for new or less-established clients, a stricter policy could be beneficial.

- Original Agreement: The terms initially agreed upon by both parties should always be respected. If the client has signed an agreement with set guidelines for overdue charges, it’s important to adhere to those conditions.

Setting the Rate: Percentage vs. Fixed Fee

There are two common methods for calculating overdue fees: applying a percentage or a fixed amount. Each has its pros and cons:

- Percentage-Based Fee: This method calculates the fee based on the total amount owed. It’s commonly used for larger sums, as it scales with the debt. For example, a 2% fee on a $1,000 balance results in a $20 charge.

- Fixed Amount Fee: A set fee is applied regardless of the total amount owed. This is often used for smaller amounts and provides predictable charges. For example, a $25 fee for any overdue balance.

Choosing the right structure depends on your business model and the nature of your client base. Whether opting for a percentage or fixed fee, the goal is to ensure that the fee is effective without being overly burdensome for the client.

Legal Considerations for Late Fees

When implementing fees for overdue amounts, it’s essential to ensure that your practices are in line with legal requirements. Charging excessive or unfair fees can lead to disputes or even legal action. Therefore, understanding the laws governing such charges and ensuring that your terms are transparent and fair is critical for protecting your business.

Key Legal Factors to Consider

Different regions have varying laws that dictate how fees can be applied. Businesses must remain compliant with these regulations to avoid potential legal complications. Below are some of the primary factors to consider:

| Factor | Considerations |

|---|---|

| Legal Limits on Fees | Many jurisdictions set a maximum allowable percentage or fixed fee for overdue balances. Ensure that the fee does not exceed these limits. |

| Transparency | Make sure the terms for overdue fees are clearly outlined in your agreement with clients, preferably before services are rendered or goods are provided. |

| Notification Requirements | Some areas require businesses to provide a formal notice before charging overdue fees, giving clients a final chance to pay without additional charges. |

| Consumer Protection Laws | Some laws protect consumers from unreasonable charges. Always ensure your fees are justifiable and not seen as exploitative or excessive. |

Enforcing Overdue Charges

When overdue fees are applied, they should be enforced according to the terms agreed upon by both parties. Any deviation from these terms, such as charging a fee not originally agreed upon, could lead to legal challenges. Make sure your business communicates clearly with clients about the consequences of overdue balances and keeps detailed records of all transactions and communications.

By adhering to legal requirements and being transparent with clients, businesses can confidently implement fees for overdue sums while protecting themselves from legal risks.

Designing a Clear Payment Terms Section

Clearly defining the terms for settling balances is crucial for ensuring smooth transactions between businesses and clients. A well-crafted section that outlines expectations helps prevent misunderstandings and sets a clear framework for when and how payments should be made. This transparency promotes trust and encourages timely resolutions of any outstanding balances.

Key Elements to Include

To create a section that effectively communicates expectations, consider including the following elements:

- Due Date: Clearly state when the amount is expected to be paid. This helps the client understand the exact timeline and avoids confusion.

- Accepted Payment Methods: Specify the types of payments you accept, such as bank transfers, credit card payments, checks, or online methods. This removes ambiguity for the client.

- Amount Due: Clearly list the amount that needs to be settled, breaking it down if necessary (e.g., for partial payments or additional fees).

- Fee Details: If applicable, mention any additional charges that may apply for overdue balances. Make sure this is clearly stated and easy to understand.

- Consequences of Non-Payment: Outline any steps that will be taken if the payment is not received by the due date. This might include applying additional charges, pausing services, or other actions.

- Discount for Early Payment: If offering a discount for early settlement, specify the terms for qualifying for this benefit, such as percentage off and the deadline for payment.

Tips for Effective Communication

To ensure your terms are clear and easy to follow, follow these best practices:

- Keep it Simple: Use straightforward language. Avoid legal jargon or overly complex terms that may confuse your client.

- Be Specific: Instead of vague terms like “soon” or “as soon as possible,” provide exact dates and clear instructions.

- Use a Consistent Format: Present the terms in a uniform format, such as bullet points or numbered lists, to improve readability.

- Review and Update Regularly: Ensure that the terms reflect any changes in your business policies or relevant legal requi

Tracking Overdue Payments Efficiently

Effectively monitoring outstanding balances is essential for maintaining healthy cash flow and ensuring that your business receives timely compensation. By staying organized and implementing clear tracking methods, you can quickly identify overdue amounts and take appropriate action. A well-structured system helps streamline this process and reduce the chances of overlooking any unsettled debts.

Methods for Tracking Outstanding Amounts

There are several strategies you can use to keep track of overdue balances. Whether you prefer manual tracking or automated systems, the goal is to stay consistent and proactive in following up on overdue sums.

Method Advantages Manual Spreadsheets Simple to implement and cost-effective, but can become cumbersome as the number of accounts increases. Accounting Software Offers automated reminders and reports, reducing the chance of human error. Suitable for businesses with multiple clients. Dedicated Collection Systems Specialized tools that provide in-depth tracking and allow for easy communication with clients about overdue balances. Cloud-Based Platforms Accessible from anywhere and often integrate with other business systems, offering real-time updates on outstanding balances. Essential Features for Effective Tracking

Regardless of the method you choose, ensure that your system includes the following key features:

- Automated Reminders: Set up automatic reminders to notify clients when their balances are approaching the due date or have become overdue.

- Clear Due Dates: Ensure that all due dates are clearly marked and easily accessible, so clients know exactly when to expect the amount to be due.

- Easy Communication: Implement tools that allow for quick and easy follow-up with clients regarding overdue amounts, such as email templates or automated notifications.

- Tracking of Partial Payments: Record any partial payments made to ensure that clients are credited properly, and you can track remaining balances accurately.

By adopting efficient tracking methods and staying organized, you can manage overdue balances with ease and ensure smoother cash flow for your business.

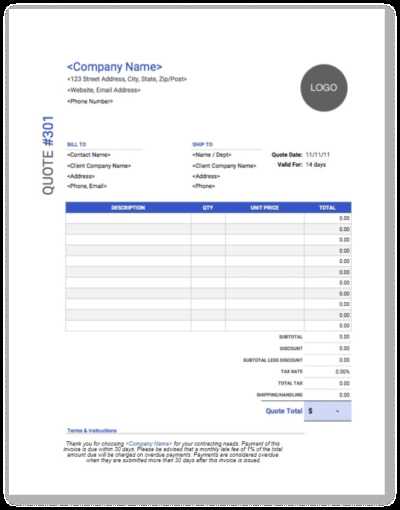

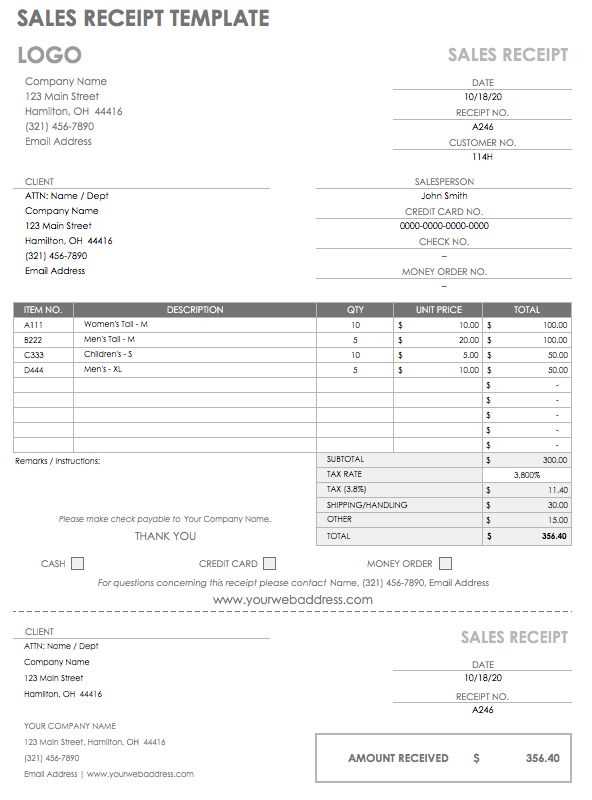

Invoice Templates for Small Businesses

For small business owners, creating professional and clear billing documents is crucial for managing finances effectively and ensuring timely compensation. Customizable billing forms provide a simple way to track charges, streamline the accounting process, and maintain a polished image for clients. These documents should be straightforward, easy to use, and adaptable to suit the unique needs of each business.

Benefits of Using Pre-Made Billing Forms

Using ready-made billing forms can save small business owners time and effort, allowing them to focus on their core activities. These forms typically come with essential elements, such as business details, itemized lists, due dates, and amounts. Below are some of the main advantages of using pre-designed documents:

- Professional Appearance: Ready-made forms ensure your documents appear polished and organized, enhancing your business’s image.

- Consistency: Using the same structure for each bill helps maintain consistency in communication with clients.

- Time-Saving: Pre-designed forms eliminate the need to start from scratch each time a new bill is issued, speeding up the billing process.

- Customization: These documents can be easily tailored to include specific business information, additional charges, or discount options.

Features to Look for in Billing Forms

When selecting or designing a form, it’s important to include key features that make the document clear and effective. Here are the essential components that should be present in any business form:

- Business Information: Include your business name, address, contact details, and logo to personalize the form and ensure clients can easily reach you.

- Client Information: Include the client’s name, address, and contact information to ensure the bill is directed to the right person.

- Itemized List: Provide a breakdown of services or products provided, along with their individual costs, so the client understands exactly what they are being charged for.

- Due Date and Terms: Clearly state the due date and any relevant payment terms, such as discounts for early settlement or fees for overdue amounts.

By incorporating these features, small businesses can ensure their billing documents are comprehensive, professional, and easy for clients to understand.

Customizing the Template for Different Clients

Tailoring your billing documents for each client ensures that the information provided is clear, relevant, and aligned with the specific needs of the customer. By adjusting the structure and content to reflect each client’s requirements, you not only improve professionalism but also enhance client relationships. Customization can include varying the level of detail, payment terms, or additional instructions based on the nature of the transaction or agreement.

Adjusting for Client Needs

Each client may have unique preferences or contractual terms that should be reflected in your documents. Personalizing the information allows clients to easily understand their obligations, making the process smoother for both parties. Here are a few key adjustments you may want to consider:

- Custom Payment Terms: Some clients may need extended timeframes or different conditions regarding the timing of their dues. Adjust your documents accordingly.

- Detailed Itemization: Certain clients may require more detailed breakdowns of the services or products they are being billed for, especially for complex projects or high-value transactions.

- Specific Contact Information: If you are working with a particular department or individual, ensure that the contact details provided reflect the right person or team.

Incorporating Client Branding

Including elements that reflect the client’s branding can help to make the document feel more personalized and aligned with their corporate identity. This can include using their logo, business colors, or specific language that aligns with their brand tone. Customizing the visual aspect of the document in this way also helps maintain a professional appearance and builds trust.

- Client’s Logo: Incorporate the client’s logo to make the document feel more cohesive with their branding.

- Branding Colors: Use color schemes that match the client’s brand for headings, borders, or highlights to ensure visual consistency.

By tailoring each document for individual clients, you not only meet their expectations but also make the process more streamlined and effective for your business operations.

Using Excel for Late Payment Invoices

Excel is a versatile tool that can streamline the process of creating and managing billing documents for overdue balances. With its built-in functions and customizable features, Excel allows business owners to easily track and manage amounts owed by clients. By using spreadsheets, you can quickly calculate outstanding charges, adjust terms, and generate clear, professional documents that can be sent directly to clients.

Advantages of Using Excel for Billing

There are several benefits to using Excel for managing overdue balances and generating billing statements. Here are some of the key advantages:

- Automation: Excel can automatically calculate totals, penalties, and due amounts, saving you time and minimizing errors in manual calculations.

- Customization: You can design your billing document to fit the specific needs of your business, adding or removing fields, and adjusting the layout as needed.

- Data Management: Excel provides a great way to organize client information, track overdue balances, and maintain records in one place.

- Quick Updates: It is easy to update Excel documents with new payment details, client information, and adjusted charges.

Steps for Setting Up Billing in Excel

Creating a customizable and effective spreadsheet for billing overdue amounts is simple. Follow these steps to get started:

- Create a New Workbook: Open Excel and create a new workbook to store all your client details and billing information.

- Set Up Columns: Include columns for client name, due date, original amount, overdue charges, total balance, and other relevant information.

- Use Formulas: Utilize Excel formulas such as SUM, IF, and multiplication to automate calculations for overdue charges and total balances.

- Apply Conditional Formatting: Use conditional formatting to highlight overdue accounts, making it easy to spot which clients owe money and by how much.

- Save as Template: Save your file as a template so you can easily reuse it for future billing cycles with minimal changes.

By following these steps, you can create a simple yet effective system for managing overdue balances and generating accurate, customized billing documents using Excel.

Common Mistakes in Late Payment Invoices

When it comes to creating documents for overdue balances, even small mistakes can cause confusion or delays in receiving what is owed. Many businesses overlook the importance of clarity and consistency, which can lead to misunderstandings and disputes. Recognizing and avoiding common errors in these documents can make the collection process smoother and more professional.

Missing or Incorrect Information

One of the most frequent errors is failing to include essential details. Incomplete or inaccurate information can cause delays in processing or make it difficult for clients to understand their obligations. Common oversights include:

- Incorrect due date: If the date is unclear or incorrect, it can cause confusion about when payment is expected.

- Missing client details: Failing to include the correct client name or contact information can result in the document being sent to the wrong person or department.

- Unclear charges: Not specifying the services or products involved may make it hard for the recipient to identify the reason for the balance owed.

Not Specifying Terms Clearly

Another common mistake is not outlining the terms clearly. If the terms for overdue charges or conditions for repayment are not explicitly stated, clients may misunderstand or ignore them. Clear, detailed terms are critical for avoiding disputes and ensuring prompt settlement of dues. Points to watch for include:

- Vague late fees: Be specific about how and when fees are applied. Avoid general terms like “late fees may apply” without explaining the rate or conditions.

- Ambiguous payment methods: Clearly outline acceptable payment methods, so there’s no doubt about how clients should make their payment.

Lack of Professional Language

Using overly aggressive or informal language in your documents can lead to a breakdown in client relations. It’s important to remain professional and courteous, even when collecting overdue amounts. Avoid:

- Threatening language: Phrases such as “pay now or else” can damage relationships with clients.

- Casual tone: Using too informal a tone can undermine the seriousness of the matter and make the request feel less professional.

By addressing these common mistakes, you can ensure that your documents for overdue balances are clear, professional, and more likely to result in timely resolutions.

Sending Invoices and Payment Reminders

Effective communication is key when managing overdue accounts. Sending documents that outline the amounts due, along with timely reminders, is crucial to ensure that balances are settled without unnecessary delays. Understanding the best practices for sending these communications can help maintain positive business relationships while also ensuring that payments are processed promptly.

Best Practices for Sending Documents

When sending billing documents, clarity and professionalism should always be prioritized. Following these steps can help streamline the process:

- Choose the right timing: Send the document as soon as the due date has passed, but give your clients a reasonable window before sending reminders.

- Personalize the communication: Ensure each document is addressed specifically to the client. Personalized messages can help maintain a positive tone and show attention to detail.

- Ensure proper formatting: Clear and organized formatting makes the document easier to read and helps clients understand the amounts and terms without confusion.

Effective Payment Reminders

Reminders should be sent at strategic intervals to encourage timely action without being too aggressive. Here are some tips on how to send effective reminders:

- Start with a friendly reminder: A gentle reminder can often resolve the issue without further action, so make sure your first follow-up is polite and respectful.

- Send multiple reminders: If the first reminder goes unanswered, send a second notice. Include the same details but emphasize the importance of resolving the issue. For recurring issues, a third or final notice might be needed.

- Offer payment options: If possible, provide flexible options for settling the balance. Offering multiple payment methods can make the process easier for clients.

By following these best practices for sending documents and reminders, you can maintain a professional tone while ensuring that payments are processed on time, improving both cash flow and customer relations.

How to Handle Disputes Over Late Fees

Disputes regarding overdue charges can arise for several reasons, often due to misunderstandings or miscommunications. Addressing these concerns in a professional and effective manner is essential for maintaining a positive client relationship while ensuring that your business interests are protected. By approaching such issues with a clear process and transparency, you can resolve conflicts amicably and avoid escalation.

Steps for Addressing Disputes

When a client challenges overdue charges, it’s important to respond promptly and with professionalism. The following steps can help guide you through the dispute resolution process:

- Review the situation: Before responding, ensure that all the facts are accurate. Double-check the original terms and the due date to verify whether the charges were applied correctly.

- Open a dialogue: Reach out to the client calmly and respectfully. Express your willingness to discuss the situation and find a mutually agreeable solution.

- Clarify the terms: If the terms of the agreement are being questioned, take the time to clearly explain them to the client. Having a written agreement or clear contract can help resolve most misunderstandings.

Offering a Solution

Once you’ve established the facts and communicated with the client, the next step is offering a solution. Being flexible and reasonable can often lead to a satisfactory resolution for both parties:

- Negotiate a compromise: If a mistake was made or the client is facing financial difficulties, consider offering a payment plan or partial discount on the charges. This can show goodwill and encourage the client to settle the matter quickly.

- Stick to your policies: If the client has been informed of the charges upfront and refuses to pay, you may need to enforce your terms. However, maintaining a diplomatic tone is still important to avoid further damage to the business relationship.

Handling disputes professionally and calmly is crucial for maintaining trust with clients. By addressing any concerns quickly and fairly, you not only resolve the issue at hand but also reinforce your commitment to transparency and strong customer relations.

Benefits of Using Late Payment Templates

Having a structured document to manage overdue fees and charges brings several advantages to both businesses and clients. It ensures clarity, professionalism, and consistency when dealing with delayed financial obligations. With a clear framework in place, companies can streamline their processes and reduce the risk of misunderstandings or missed opportunities for collection.

Here are some of the key benefits of utilizing pre-designed documents to manage overdue charges:

- Consistency: A standardized approach ensures that all overdue obligations are handled in the same manner, making it easier to track and follow up on outstanding debts.

- Efficiency: By using a ready-made format, businesses can quickly generate the necessary paperwork without having to start from scratch each time. This saves valuable time and effort.

- Clear Communication: A professionally drafted document communicates the terms and consequences of overdue fees in an understandable way, reducing the potential for disputes or confusion.

- Legal Protection: Using a formal document that outlines the terms can provide legal safeguards, ensuring that businesses have a record of their efforts to resolve the matter.

By adopting a formalized approach, businesses can create a clear and professional image, while reducing administrative burden and improving cash flow management. This proactive approach helps ensure timely resolutions for all involved parties.