How to Create an Advanced Invoice Template in Xero

In today’s fast-paced business world, maintaining a professional and efficient billing process is crucial. Creating documents that not only look polished but also streamline financial tasks can significantly improve both client relationships and internal workflows. This section explores how to design personalized billing forms that suit your unique needs.

With the right tools, you can tailor these documents to reflect your brand, capture all necessary details, and automate repetitive tasks. By taking full control over layout and content, you can ensure every financial transaction is processed smoothly and consistently.

Custom designs allow for more than just aesthetic appeal. They enhance clarity and communication, making it easier for clients to understand charges and for businesses to track payments. Understanding the fundamentals of effective document creation will help you build a system that minimizes errors and maximizes efficiency.

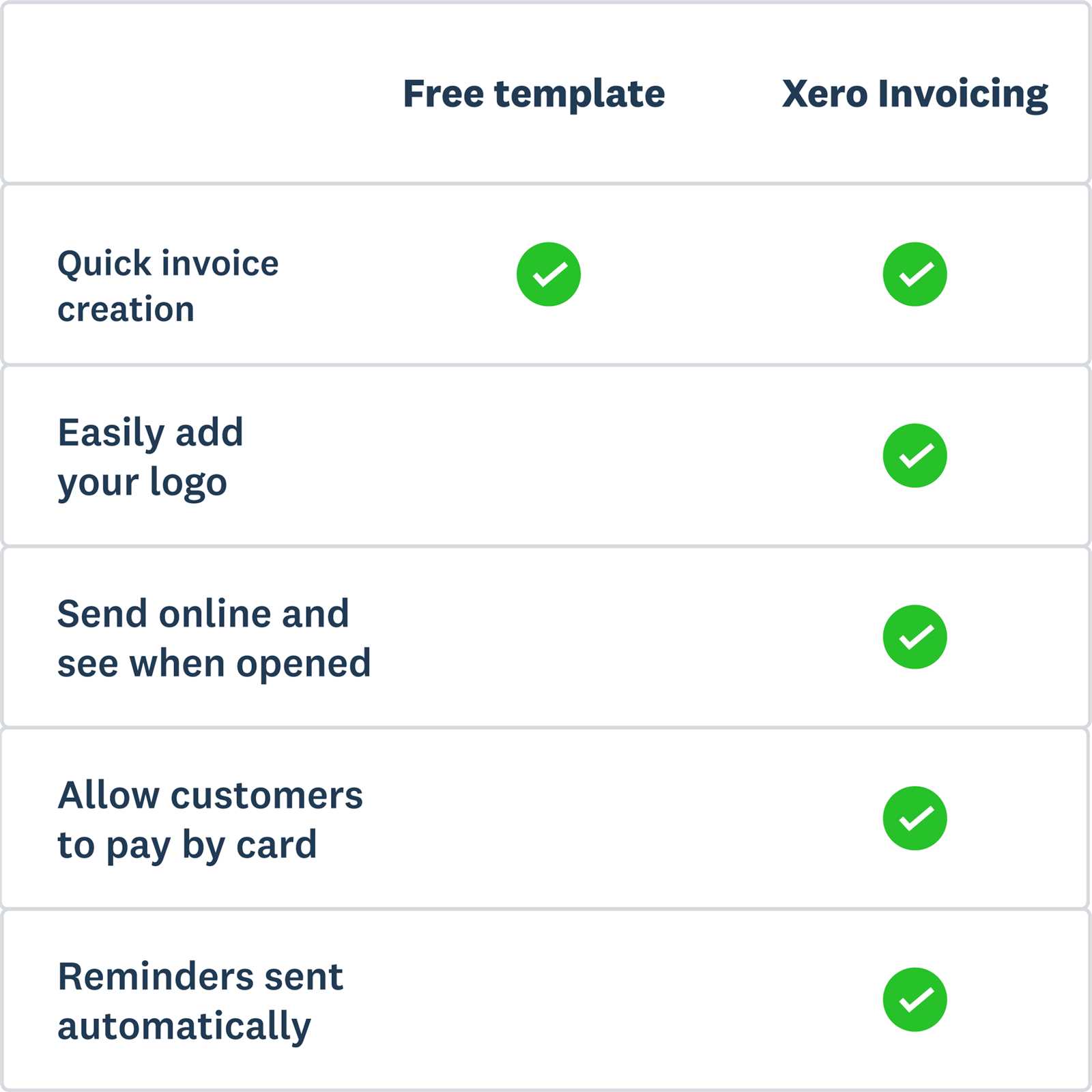

Custom Billing Forms in Xero

Creating tailored billing documents can help your business maintain a professional appearance while also improving workflow efficiency. These forms allow you to structure financial records in a way that fits your specific needs, from including custom fields to automating recurring charges. The ability to design personalized documents is essential for ensuring clear communication with clients and streamlining your accounting process.

Benefits of Customizing Your Billing Documents

Customizing these documents offers several advantages, such as enhanced clarity, better organization, and the ability to reflect your business branding. By adjusting the format and content to match your requirements, you can improve the way transactions are presented and tracked. Personalized formats help reduce errors and prevent confusion, ensuring that all the essential information is included in an easy-to-read layout.

How to Design and Use Customized Billing Forms

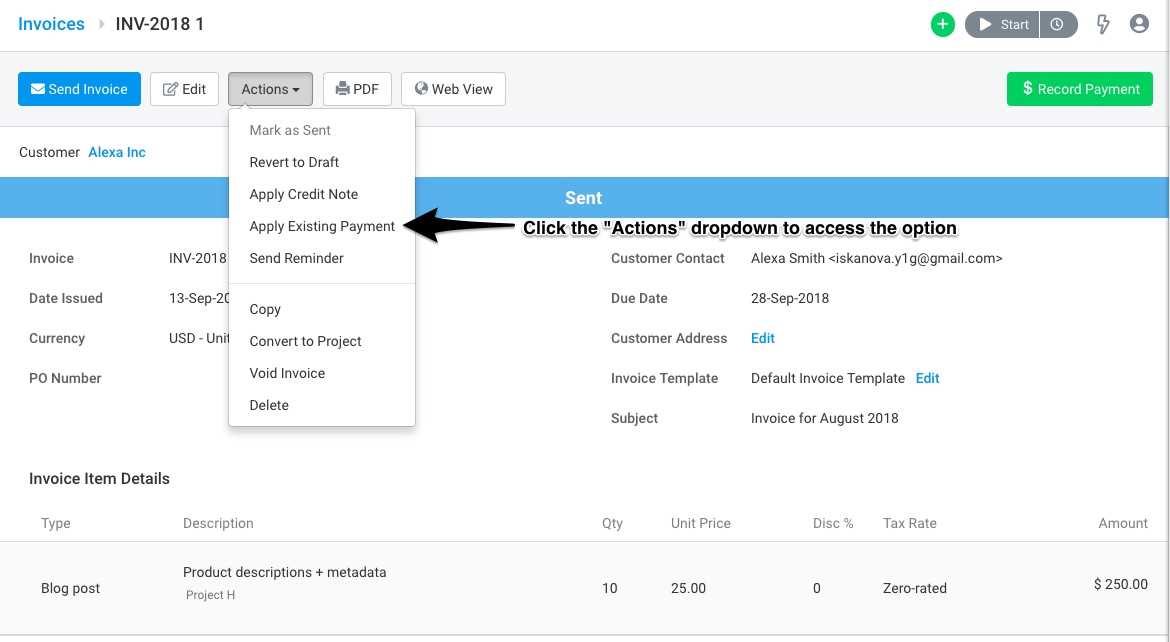

Designing these forms involves selecting the right fields to display, organizing them logically, and applying your company’s colors and logo for consistency. Additionally, you can set up automation for recurring transactions, reducing manual input. Once created, you can reuse these forms for future transactions, saving time and ensuring uniformity. Leveraging these features allows for a more efficient accounting process that keeps both your team and clients satisfied.

Why Use Custom Billing Documents

Customizing your billing forms offers numerous advantages that go beyond simple aesthetics. When you tailor your documents to your business’s unique needs, you can improve accuracy, enhance professionalism, and ensure smoother financial processes. The ability to adjust content and layout allows you to better reflect your brand and maintain consistency across all transactions.

Enhanced Clarity and Organization

One of the primary benefits of creating personalized billing documents is the improved clarity they provide. You can organize details in a way that makes sense for your business and your clients, making it easier for everyone involved to understand charges, discounts, and payment terms. Well-organized documents reduce confusion and prevent errors, saving both time and resources.

Reflecting Your Brand Identity

Custom forms offer the opportunity to showcase your brand’s identity through logos, colors, and fonts. A strong brand presence not only helps build trust with clients but also sets you apart from competitors. By integrating your company’s visual style into every financial document, you reinforce professionalism and consistency in all communications.

Step-by-Step Guide to Creating Custom Billing Forms

Creating personalized billing documents can seem like a complex task, but with the right tools, it’s a straightforward process that can be broken down into simple steps. Whether you’re starting from scratch or modifying an existing layout, understanding the essential components of a well-designed form is key to building something that suits your business needs. This guide will walk you through each phase of the creation process, ensuring you can produce a professional, functional, and branded document in no time.

To get started, follow these steps:

Step 1: Choose a Starting Point

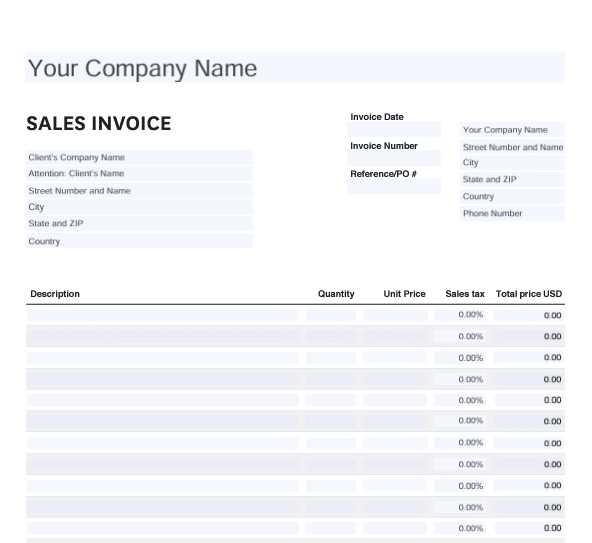

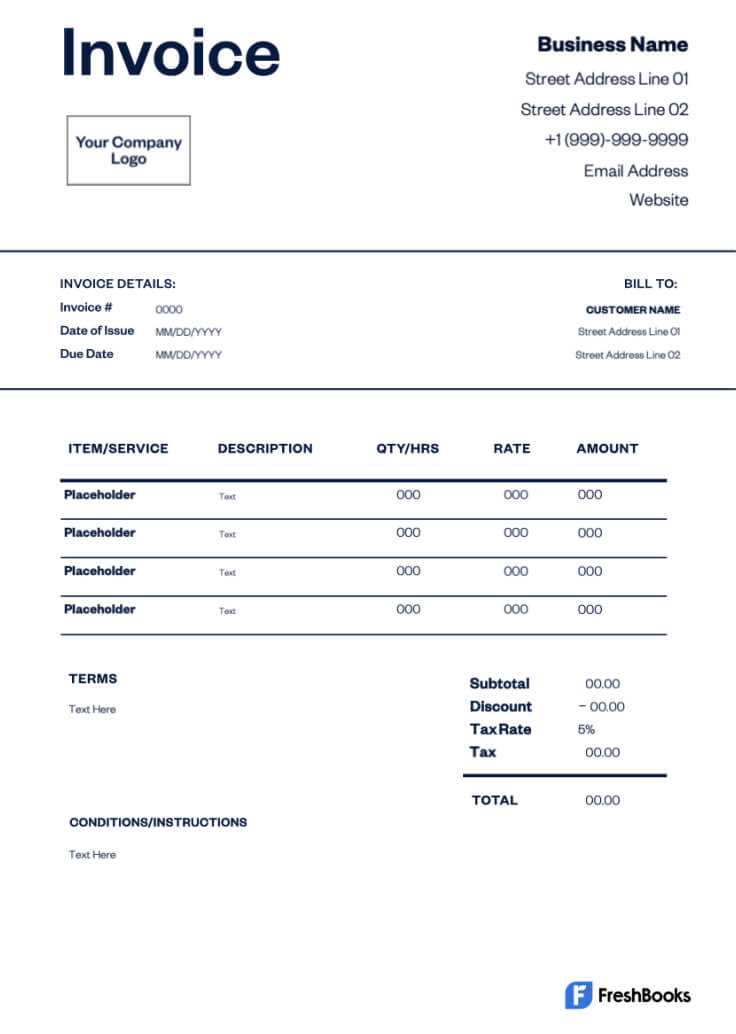

Start by selecting an existing form layout or create a completely new one. Many platforms provide basic structures that you can customize, saving you time on the initial setup. Consider the most important elements you need to include, such as client information, product or service descriptions, and pricing details.

Step 2: Add Necessary Fields

Once you’ve chosen a starting point, begin adding all the fields relevant to your business. This may include customizable sections for taxes, discounts, payment terms, and due dates. Keep in mind that clarity is essential, so only include the information that is necessary for the transaction.

Step 3: Customize the Design

Now that you’ve added the necessary details, it’s time to design the layout. This includes choosing fonts, colors, and the placement of logos. Customizing the design ensures that the final document reflects your brand and enhances the professional appearance of your transactions.

Step 4: Save and Reuse

Once your document is designed to your satisfaction, save the layout as a reusable format. This will allow you to generate future documents quickly, saving you time on manual creation. Many systems also allow you to automate this process for recurring transactions.

Step 5: Review and Finalize

Before you begin using the form in real-world transactions, review everything carefully. Ensure that all fields are accurate and that the design works well across devices. A final check can prevent potential issues and help maintain consistency in all your billing practices.

Essential Features of Xero Billing Documents

When creating billing documents, there are several key features that can enhance both functionality and professionalism. These elements ensure that the form is clear, comprehensive, and easy for both you and your clients to understand. By integrating essential fields and tools, businesses can streamline their processes and maintain accuracy in their financial transactions.

Key Components to Include

Every well-designed billing document should contain a few critical components that help track transactions, provide clear details, and facilitate payment. Below are some of the most important features to consider when creating or customizing your forms:

| Feature | Description |

|---|---|

| Client Information | Include fields for client names, addresses, and contact details to ensure proper communication. |

| Itemized List | Break down products or services with descriptions and individual costs to avoid confusion. |

| Payment Terms | Clearly state payment due dates, late fees, and available payment methods to prevent delays. |

| Tax Information | Include relevant tax rates and breakdowns to ensure transparency and avoid errors. |

| Company Branding | Incorporate your logo, colors, and branding elements for a professional and consistent appearance. |

Additional Tools and Features

In addition to basic fields, there are several tools that can further enhance the functionality of your billing documents:

- Automated Reminders: Set up automatic payment reminders to ensure timely payments without manual follow-up.

- Recurring Billing: Automate recurring charges for subscription-based services or regular payments.

- Custom Fields: Add custom fields to capture specific information unique to your business or industry.

- Multi-Currency Support: For international clients, include the ability to handle different cur

How to Personalize Your Billing Document Design

Personalizing your billing documents is a key step in making them reflect your brand and ensuring they stand out in a professional way. A well-designed form not only improves the overall appearance but also enhances clarity, making it easier for your clients to understand the charges. Customization options allow you to include your company’s identity, adjust the layout, and add personalized fields to suit your specific business needs.

Here are some steps to help you create a unique and branded design for your financial documents:

1. Incorporate Your Brand Identity

Start by adding your company’s logo, colors, and fonts. This ensures that the document aligns with your brand guidelines and maintains consistency across all client-facing materials. Including a logo or custom header can also make the document feel more professional and increase brand recognition.

2. Adjust the Layout and Structure

Customize the layout by arranging the sections in a way that suits your preferences. For example, you may want to place the client’s details at the top, followed by itemized descriptions, and then the payment terms at the bottom. A clean, organized structure ensures that the information is easy to digest, improving the client’s experience.

3. Add Custom Fields

Depending on your business, you may need additional fields such as project numbers, service descriptions, or custom notes. This level of personalization makes the document more relevant to your specific industry, ensuring that all necessary details are included and properly displayed.

4. Choose the Right Color Scheme and Fonts

Selecting a color scheme that matches your brand and is easy on the eyes is essential. Keep in mind that too many colors can clutter the document, so it’s best to stick with a simple, professional palette. Additionally, choose readable fonts and sizes, especially for important details like payment terms and amounts due.

5. Include Payment Instructions and Policies

Personalization is not only about the design but also the information you provide. Be sure to include clear payment instructions, deadlines, and any late fees or policies. Customizing this information according to your business practices helps manage client expectations and ensures transparency.

By following these steps, you can create a billing document that not only reflects your business identity but also enhances the overall client experience, making financial transactions more seamless and professional.

Best Practices for Billing Document Layout

A well-structured billing document is essential for both professionalism and clarity. The layout of these documents plays a critical role in ensuring that clients can easily understand the charges, payment terms, and any other relevant details. A clean, organized design not only improves the user experience but also reduces the likelihood of errors or confusion. By following best practices, you can create a document that is both functional and visually appealing.

1. Keep it Simple and Organized

The layout should be straightforward, with clear headings and sections that guide the reader through the information. Avoid cluttering the page with unnecessary graphics or text. A simple design helps keep the focus on the important details, such as the client’s information, services rendered, and payment amount. Group related information together and ensure that each section is easy to identify.

2. Prioritize Important Information

The most critical information, like the total amount due and payment terms, should be prominently displayed. Clients should be able to find the key details quickly, without having to search through the document. Use larger fonts or bold text for these sections to make them stand out, but ensure they still blend seamlessly with the rest of the document.

3. Use Consistent Formatting

Maintain consistency in the formatting of headings, subheadings, and body text. This includes font type, size, and color. Consistent formatting helps create a professional appearance and makes the document easier to read. For example, use one font for headings and a different, more readable font for the body text. Similarly, ensure that spacing between sections is uniform, so the document doesn’t feel crowded.

4. Include Clear Payment Terms

Clearly state payment terms and conditions in a dedicated section of the document. This may include the due date, late fees, and accepted payment methods. Clients should never have to wonder about the payment deadlines or conditions. Use bullet points or short paragraphs to break down this information and keep it easily digestible.

5. Incorporate Visual Hierarchy

A good layout takes advantage of visual hierarchy to lead the reader’s eyes through the document in a logical order. For instance, the most important information, like the total due, should be placed at the top or bottom of the document, where it’s most likely to be noticed. Use bold or larger fonts for headings and totals, and smaller fonts for descriptions and other secondary details.

6. Leave Space for Notes and Custom Messages

It’s helpful to leave a section for additional

Saving and Reusing Custom Billing Forms

Once you have created a personalized billing document that suits your needs, it’s important to save it in a way that allows for easy reuse. By storing and reusing custom forms, you can save time, reduce repetitive work, and maintain consistency across all your financial transactions. This process not only streamlines your workflow but also ensures that each document remains uniform and professional.

How to Save Your Customized Form

After designing your billing form, most systems provide an option to save it as a template. This allows you to keep your customized layout and fields intact for future use. To ensure your custom form is accessible for future transactions, make sure to name it clearly and store it in a designated folder or category within your platform. Many platforms also offer cloud storage, ensuring you can access your forms from any device.

Benefits of Reusing Custom Forms

Reusing customized forms offers several advantages. First, it saves time, as you don’t have to manually design each new document. Instead, you can simply select the saved layout, fill in the relevant details, and send it to the client. Additionally, reusing the same form ensures consistency, which helps maintain a professional image for your business. You can also easily update your saved forms whenever necessary, ensuring that any changes in your business practices or branding are reflected in future transactions.

Automating Billing Processes

Automating your billing process can significantly reduce manual effort, improve efficiency, and ensure timely payment collections. By setting up automatic billing, you eliminate the need to manually create and send documents for each transaction, which helps to save time and minimize errors. This system also ensures that recurring payments are handled consistently without the need for ongoing intervention.

How to Set Up Automation

To start automating your billing system, you’ll first need to identify which transactions should be automated. Common examples include subscription-based services, memberships, or regular product deliveries. Once identified, most platforms provide an option to set up recurring billing. You can choose the frequency (e.g., monthly, quarterly), specify the due date, and enter any terms or discounts that should apply to the recurring charges.

Benefits of Automation

Automating your billing saves valuable time and ensures that no payments are missed. By scheduling the generation and sending of documents, your clients receive timely reminders without requiring manual input. Additionally, it minimizes the chances of human error and reduces the administrative burden on your team. As a result, you can focus more on other aspects of your business while maintaining a steady cash flow.

Incorporating Branding into Billing Documents

Including your brand elements in billing documents is a powerful way to strengthen your company’s identity and leave a lasting impression on your clients. A well-branded document not only enhances professionalism but also builds trust with your customers. By carefully integrating your logo, colors, and fonts, you can create a cohesive and consistent experience for your clients at every touchpoint, including financial transactions.

Here are several ways you can effectively incorporate branding into your billing forms:

- Logo Placement: Make sure your company’s logo appears prominently, typically at the top of the document. This is the first thing clients will see and immediately associates the document with your business.

- Brand Colors: Use your company’s color palette for headings, borders, and key information. A consistent color scheme reinforces your brand and makes your documents visually appealing.

- Fonts and Typography: Choose fonts that align with your brand guidelines. Keep the fonts legible and professional, using bold or larger fonts for important information like totals and due dates.

- Custom Design Elements: Incorporate design elements such as background patterns, borders, or icons that are consistent with your brand style. These small touches can help create a more polished and recognizable document.

By implementing these design strategies, you can ensure that your billing forms are not only functional but also align with your brand’s visual identity, creating a more professional and cohesive experience for your clients.

Using Advanced Fields in Billing Documents

Incorporating customized fields into your billing forms allows you to capture specific information relevant to your business and clients. These fields go beyond the standard sections, offering flexibility and allowing you to include additional details, such as special discounts, custom payment terms, or detailed product descriptions. By using these fields, you can tailor each document to reflect the unique requirements of a particular transaction.

Types of Custom Fields to Add

Custom fields can be added to a billing document for a variety of purposes. Here are some examples of fields that can enhance your documents:

- Discount Fields: Include space for special offers or negotiated discounts, making it easy to apply promotions to specific clients or transactions.

- Project or Order Numbers: Add fields for project identifiers or order numbers, which can be useful for tracking work or linking transactions to specific projects.

- Custom Notes: Insert custom fields to add special notes or messages for clients, such as payment instructions or thank-you messages.

- Tax and Compliance Information: Include custom fields for specific tax rates, compliance information, or other legal requirements relevant to your region or industry.

Benefits of Using Custom Fields

Using these advanced fields helps to improve the accuracy and comprehensiveness of your documents. It allows you to capture all the necessary details in a single, organized place, making it easier for both you and your clients to track and review the transaction. Additionally, it provides a more personalized experience, helping your business to stand out with tailored forms that reflect your specific services or terms.

Tracking Payments with Custom Billing Documents

Efficiently tracking payments is essential for maintaining a healthy cash flow and ensuring that all financial transactions are recorded properly. Custom billing documents offer the flexibility to include specialized fields that help you monitor payments more effectively. By incorporating features that track payment status, due dates, and client details, you can streamline your payment collection process and reduce the risk of missed or delayed payments.

Here are several ways to enhance your ability to track payments using customized billing documents:

- Payment Status Fields: Include a dedicated section for tracking the payment status, such as “Paid,” “Unpaid,” or “Partially Paid.” This makes it easier to quickly identify which transactions are still pending or have been completed.

- Due Dates and Payment Terms: Clearly indicate the payment due date and any applicable terms. Custom fields allow you to specify early payment discounts, late fees, or flexible terms that may apply depending on the client’s history or agreement.

- Transaction Reference Numbers: Adding a unique reference or transaction number to each billing document can help with organizing payments, particularly if you’re dealing with multiple clients or recurring payments. This helps maintain a clear record of each payment, linked directly to the corresponding billing document.

- Multiple Payment Methods: Allow clients to select or indicate their preferred payment method, whether it’s credit card, bank transfer, or check. Custom fields can also help you track when each payment was made and which method was used.

- Payment History Section: Including a section for tracking the history of payments against a particular transaction or client can be useful. This helps you keep a complete record of when payments were made and how much has been paid toward the total balance.

By customizing your billing documents with these tracking features, you can gain greater control over your payment process, making it easier to manage cash flow and resolve any payment discrepancies quickly. Additionally, clear tracking helps maintain transparency and keeps both you and your clients informed throughout the transaction process.

Integrating Taxes and Discounts

Including taxes and discounts in billing documents is an essential part of accurately reflecting the financial terms of a transaction. These elements not only ensure compliance with local laws but also offer opportunities to incentivize prompt payments or reward loyal customers. By integrating taxes and discounts into your documents, you can maintain transparency, streamline your financial processes, and make it easier for both you and your clients to track payments and obligations.

Setting Up Tax Details

Properly calculating and displaying taxes is critical to avoid discrepancies and ensure accurate payment collections. Custom billing documents allow you to add tax fields tailored to your business location and industry. Here are some ways to effectively manage taxes:

- Tax Rate Customization: Define the applicable tax rates based on the client’s location or the type of service/product provided. This ensures that each transaction reflects the correct amount of tax, whether it’s local, state, or international.

- Tax Breakdown: Provide a breakdown of how taxes are calculated, especially if multiple tax rates are applied. This helps clients see exactly how much of their total is going toward taxes.

- Multiple Tax Jurisdictions: If your business operates in multiple regions, consider adding custom fields to accommodate different tax rates for each jurisdiction. This allows you to handle complex taxation rules with ease.

Applying Discounts

Discounts are a great way to build relationships with your clients or incentivize timely payments. Custom fields allow you to offer a variety of discounts, whether they are promotional, seasonal, or based on payment conditions. Here are a few ways to integrate discounts into your billing forms:

- Early Payment Discounts: Offer discounts for clients who pay before a certain date. This can be automatically calculated and reflected in the final amount due.

- Volume or Bulk Discounts: If you sell products or services in bulk, include fields to automatically apply a discount based on the quantity or total order value.

- Loyalty Discounts: For returning customers, create custom fields to provide loyalty-based discounts, making the transaction more attractive and encouraging long-term business.

By effectively integrating taxes and discounts into your billing documents, you not only ensure accurate financial records but also offer added value to your clients. Whether you’re complying with tax r

Common Issues with Billing Document Layouts

While customized billing documents offer flexibility and efficiency, they can sometimes present challenges that hinder smooth use. Whether it’s misalignment of elements, errors in fields, or difficulties in applying certain settings, understanding the common issues can help you avoid frustration and streamline the document creation process. Recognizing and addressing these issues ensures that your financial documents are both professional and functional.

1. Misalignment of Elements

One of the most frequent issues with customized billing documents is the misalignment of text, logos, or other elements. This can result from incorrect formatting or the use of incompatible fonts or sizes. Misalignment makes documents look unprofessional and can make important information difficult to find. To resolve this:

- Check margins and padding: Ensure that all elements have proper spacing and alignment. Pay attention to the layout preview before finalizing.

- Use consistent fonts: Choose fonts that are compatible with your layout and make sure the sizes are uniform across headings and body text.

- Preview before sending: Always preview your document to spot any misalignment or inconsistencies before sending it to clients.

2. Missing or Incorrect Fields

Another common problem is the incorrect placement or omission of fields such as tax rates, payment terms, or client details. This may lead to incomplete or inaccurate billing documents that confuse clients or delay payments. To fix this:

- Ensure fields are correctly set up: Double-check the custom fields and ensure they are properly configured for each document type.

- Use default values when needed: For fields that should remain constant, use default values to ensure consistency across all documents.

- Test the layout: Before using the layout in a live scenario, test it with sample data to ensure all fields are pulling the correct information.

3. Calculation Errors

Errors in calculations, particularly when it comes to taxes, discounts, or totals, can create confusion and lead to client dissatisfaction. Common issues include incorrect tax rates or failure to apply discounts as intended. To avoid these mistakes:

- Review tax and discount settings: Make sure tax rates and discount calculations are applied correctly and check if any custom rules are being overridden.

- Verify formulas: If the system allows for custom formulas, ensure they are set up properly to calculate totals and taxes acc

Optimizing Your Billing Document for Mobile

With more people using smartphones and tablets to manage their finances, it’s essential to ensure that your billing documents are easily readable and functional on mobile devices. Optimizing your forms for mobile viewing not only enhances the user experience but also ensures that clients can quickly review and process payments without any issues. By making your documents mobile-friendly, you ensure that they maintain their professional appearance and usability across all platforms.

Key Tips for Mobile Optimization

Here are several strategies to optimize your billing documents for mobile devices:

- Responsive Layout: Use a layout that adapts to different screen sizes. This ensures that all the text, fields, and sections are properly adjusted to fit smaller mobile screens without overlapping or becoming difficult to read.

- Minimalistic Design: Avoid clutter by using simple, clean designs. Stick to essential information and prioritize readability. Mobile screens are limited in space, so keep the layout straightforward and user-friendly.

- Legible Fonts: Use fonts that are easy to read on small screens. Avoid overly decorative or small fonts, as these can be difficult to read on mobile devices. Stick to standard, sans-serif fonts for better clarity.

- Optimized Images and Logos: Ensure that your logo and other images are scaled correctly. Large files can slow down loading times or distort on mobile screens. Compress images to reduce file size without losing quality.

Testing and Refining for Mobile

To ensure your billing documents are mobile-friendly, always test them on multiple devices before sending them to clients. Here’s how you can improve the mobile experience:

- Preview on Various Devices: Use tools or apps that allow you to preview your document on different screen sizes to check how it looks on smartphones, tablets, and desktops.

- Optimize Links and Buttons: If your document includes links to payment portals or other resources, make sure they are clickable and large enough to be easily tapped on mobile screens.

- Keep File Sizes Small: Large files can take time to load, especially on mobile networks. Compress documents to ensure they download quickly without losing quality.

By following these practices, you can ensure that your billing forms are both professional and user-friendly, allowing your clients to access, review, and pay their bills quickly and easily from any device.

Setting Up Recurring Billing in Your System

For businesses that offer subscription-based services or regular payments, automating the billing process can save time and reduce the chance of errors. Setting up recurring billing allows you to automatically generate and send documents to clients on a scheduled basis. Whether it’s weekly, monthly, or annually, this feature ensures that you don’t have to manually create new documents each time a payment is due.

Here’s how you can set up recurring billing in your system to streamline the process and enhance your financial workflows:

1. Create a Recurring Schedule

Start by defining the frequency at which the payments will be made. The system allows you to set up a recurring schedule that works best for your business model. You can choose:

- Weekly: Ideal for services that are billed on a weekly basis, such as membership fees or subscriptions.

- Monthly: Common for businesses that bill customers for ongoing services or products, such as SaaS or utility services.

- Annually: Perfect for annual subscription fees or long-term service contracts.

2. Customize Billing Information

Once the schedule is set, customize the billing details for each cycle. Ensure that all necessary fields–such as client name, address, items or services provided, and payment terms–are included. You can also add discounts, taxes, or other specific terms relevant to the recurring charge. Customizing these elements ensures consistency and reduces the need for manual updates each time.

3. Automate Reminders and Notifications

Set up automatic reminders and notifications to keep clients informed about upcoming payments. This can include:

- Pre-Payment Reminders: Notify clients a few days before their payment is due to ensure they are prepared.

- Post-Payment Receipts: Automatically send receipts once a payment has been processed, maintaining transparency and trust.

- Failed Payment Alerts: If a payment fails, you can set up an alert to notify both you and the client, providing a chance to resolve the issue quickly.

By automating recurring billing, you can streamline your processes, reduce administrative tasks, and maintain consistent cash flow. This system ensures that both you and your clients are on the same page, with clear and timely payment documentation every

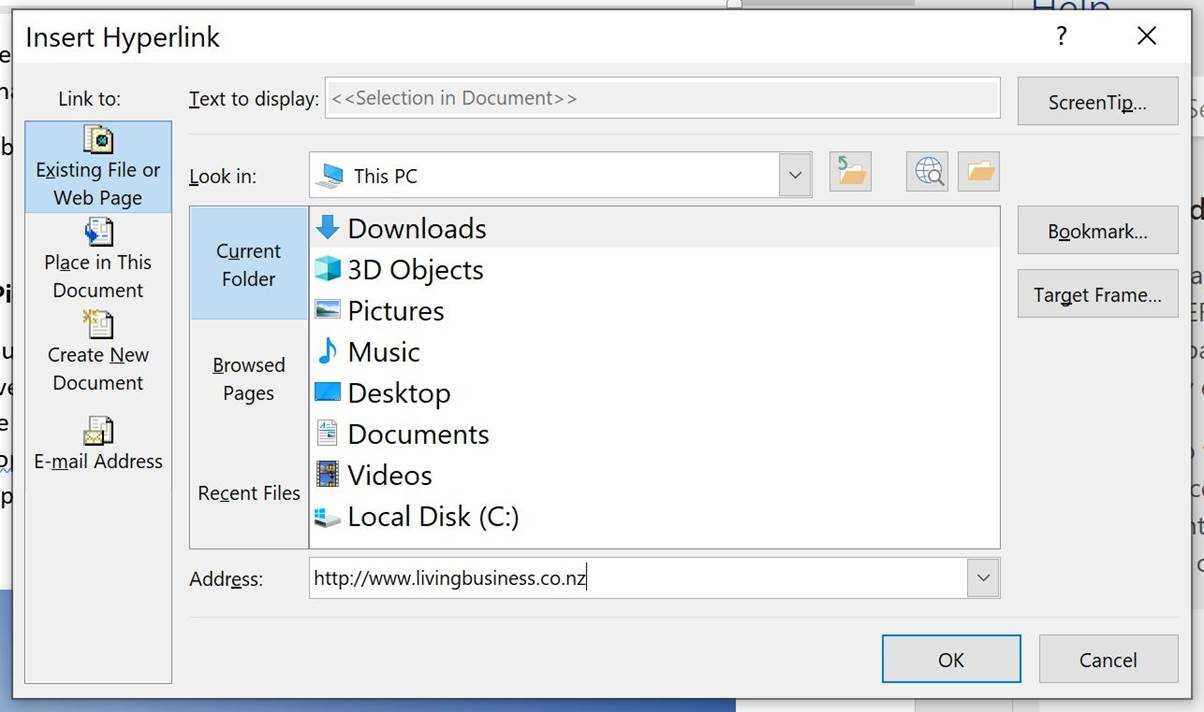

Exporting and Sharing Billing Layouts

Once you’ve created a customized billing layout, you may need to share it with colleagues, clients, or external partners. Whether it’s for collaboration, review, or simply sending a copy of the document, exporting and sharing the layout is a crucial step in ensuring smooth communication. This process enables you to share your work in a variety of formats, making it accessible and easy to use across different platforms.

Exporting Your Billing Layout

Exporting your layout allows you to save and transfer it in a format that can be opened by others or used in different systems. Here are the most common export options:

- PDF: A portable format that preserves your design and can be opened on almost any device. This is ideal for sharing completed documents that need to be printed or archived.

- CSV or Excel: If you need to share raw data or require a format that can be easily edited, CSV or Excel files are perfect for data analysis or modifications.

- HTML: For those who need to embed the layout into websites or web-based applications, exporting to HTML ensures that the design remains intact across digital platforms.

Sharing Your Layout with Others

Sharing your billing layout with others, whether for review, approval, or operational use, is straightforward. You can choose from various sharing methods, depending on your needs:

- Email: Sending your layout directly via email is one of the quickest ways to share it. You can attach the exported file as a PDF or any other format.

- Cloud Storage: Uploading the layout to cloud storage services like Google Drive, Dropbox, or OneDrive allows you to share a link with colleagues or clients, providing easy access to the document.

- Integrated Sharing: If your system supports it, you can share layouts directly within the platform to other team members or departments, making collaboration seamless.

By exporting and sharing your customized billing layout efficiently, you ensure that your work reaches the right people in the right format. Whether for internal purposes or client-facing communications, this process helps streamline your workflow and main