General Contractor Invoice Template for Easy and Professional Billing

For any professional in the construction or renovation industry, having a well-organized system to manage payments and track work completed is essential. A structured approach to billing ensures clear communication with clients and helps avoid disputes, ensuring that both parties are on the same page regarding costs and due dates. Without an efficient method to issue and track bills, managing finances can quickly become overwhelming.

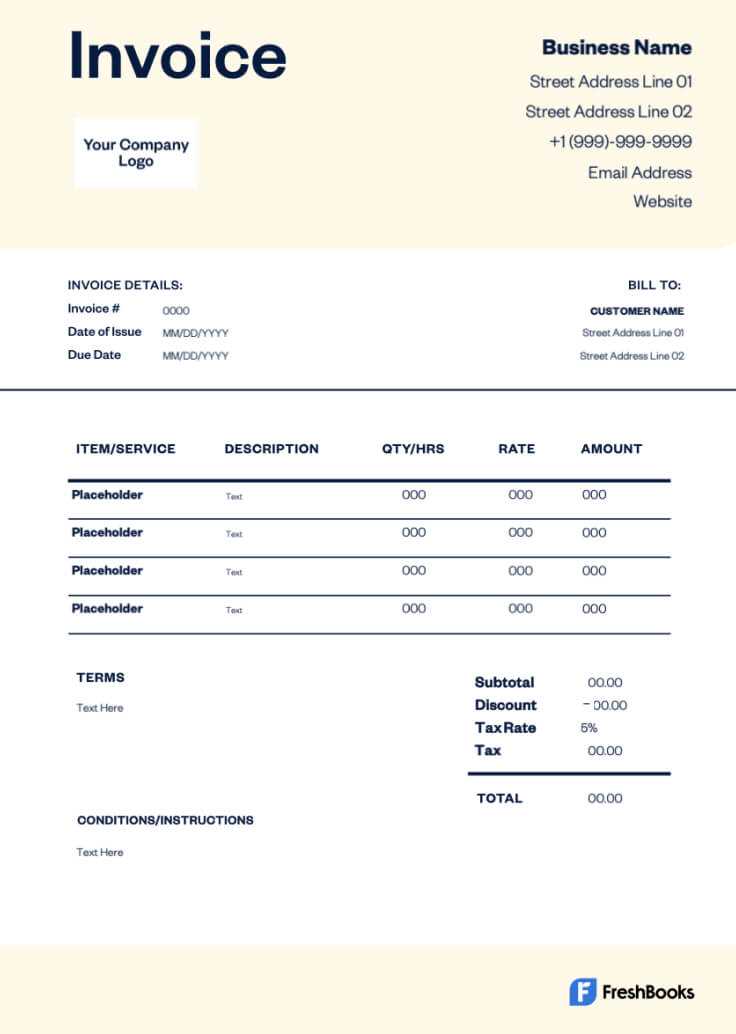

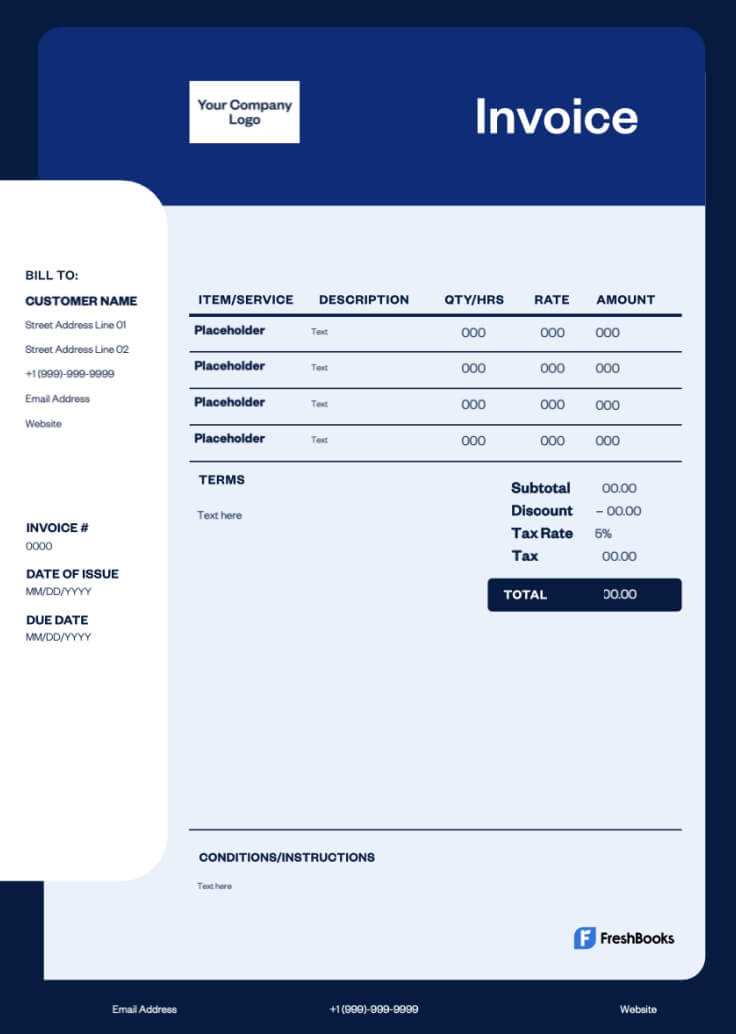

Customizable billing documents play a crucial role in streamlining this process. They allow workers to present a detailed breakdown of services rendered, materials used, and any additional charges, all in a professional format. By offering flexibility, these documents can be tailored to meet the specific needs of each project, helping contractors maintain a consistent and accurate approach to their financial dealings.

Whether you’re a small business owner or a larger construction firm, adopting an efficient system for creating and sending payment requests can save time and improve client relations. It reduces the risk of errors, delays, and misunderstandings while helping to maintain a smooth cash flow for ongoing work.

Billing Document Overview

Creating a professional billing document for construction work is essential to ensure smooth financial transactions between service providers and their clients. These documents serve as a formal request for payment, outlining the services rendered, materials used, and any additional costs. They play a key role in maintaining transparency and clarity throughout the duration of the project.

What Makes a Strong Billing Document?

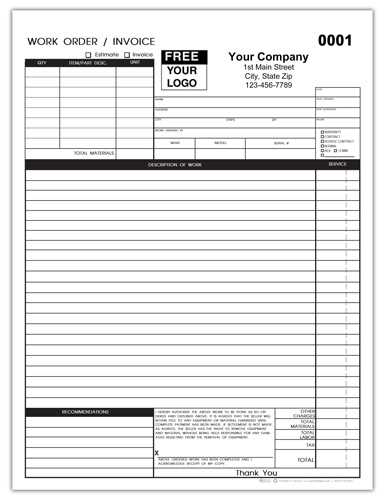

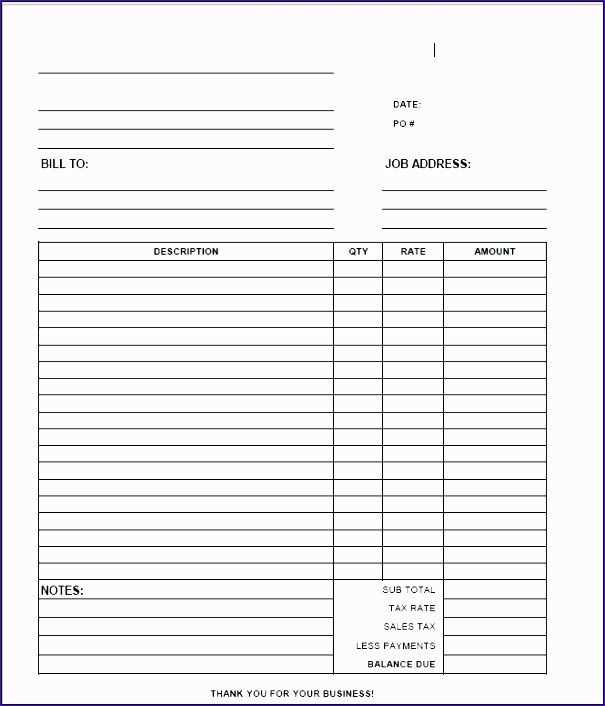

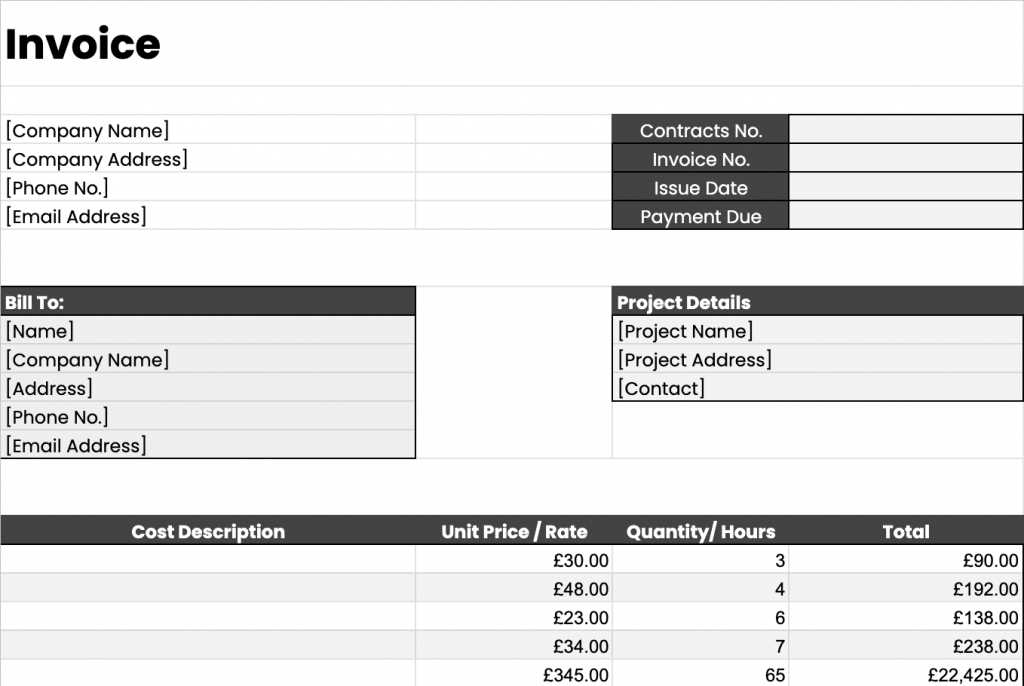

A well-designed document should be clear, concise, and contain all the necessary details to avoid confusion. It should be easy for both parties to understand the charges and terms involved. Essential elements typically include:

- Work completed with descriptions

- Itemized list of materials and labor costs

- Payment terms, including deadlines and penalties for late payments

- Client contact information and project details

- Unique reference number for tracking purposes

Why Use a Pre-Designed Document?

Using a pre-designed structure for your billing requests helps save time and ensures consistency across all client transactions. It minimizes the risk of missing important details and allows you to focus on project completion. Additionally, it enhances your professional image and ensures you remain organized throughout the process.

Having a customizable format allows for flexibility, ensuring that each project’s unique details are accurately reflected in the final document. Whether you’re working on a small residential job or a larger commercial project, an adaptable system can make managing finances simpler and more efficient.

Why Use a Billing Document Format

Adopting a structured format for creating payment requests is crucial for efficiency and professionalism. It allows for consistency in the way charges and services are presented to clients. By using a ready-made layout, businesses can ensure that they do not overlook important details and that all necessary information is included in a clear and organized manner. This simplifies the billing process and reduces the chance of errors that could lead to confusion or delayed payments.

Key Advantages of Using a Pre-Designed Format

Here are some of the main reasons why using a predefined structure is beneficial:

| Advantage | Description |

|---|---|

| Time Savings | Pre-built formats allow you to quickly generate a document without starting from scratch each time. |

| Consistency | Maintains a uniform presentation for all clients, helping establish a professional brand image. |

| Accuracy | Ensures that all required fields are included and reduces the likelihood of missing key information. |

| Customization | Most formats are easily customizable to reflect the specifics of each project, such as rates, terms, or materials used. |

| Clarity | Clients receive a detailed, easy-to-understand summary of charges and services rendered. |

Streamlining Payment Tracking

Using a structured document format also helps businesses keep track of payments. With consistent documentation, it’s easier to monitor which bills have been paid, which are outstanding, and which may require follow-up. This can significantly improve cash flow management and avoid misunderstandings with clients.

Benefits of Customizing Your Billing Document

Tailoring your billing documents to suit each project or client can significantly improve the overall payment process. Customization allows you to present a clear, personalized record of services provided, while also ensuring that specific details and terms are accurately reflected. By adapting your payment request forms, you ensure that all relevant information is included, leading to a smoother and more efficient transaction for both parties.

Enhanced Professionalism is one of the primary advantages of customizing your billing documents. A personalized format demonstrates attention to detail and a commitment to delivering quality service, which can strengthen your reputation in the eyes of clients. When each document is customized to reflect the nature of the project, clients will appreciate the extra effort, contributing to better relationships and repeat business.

Flexibility is another key benefit. Customizing your forms allows you to easily adjust for unique project requirements, whether it’s adding additional fees, accounting for different payment schedules, or listing various materials used. This flexibility ensures that every document is specific to the work completed, preventing any ambiguity or misunderstanding.

Brand Identity is also strengthened through customization. By incorporating your company’s logo, colors, and contact information, you reinforce your business identity in every communication. A well-branded billing document helps clients recognize your company’s professionalism, even in something as routine as a payment request.

Lastly, a personalized format can improve accuracy and efficiency. By including pre-defined fields or sections tailored to your services, you reduce the risk of errors or omissions, ensuring that all necessary information is included in each document. This reduces the back-and-forth with clients and speeds up the payment process, helping to maintain a steady cash flow.

Key Elements of a Billing Document

For any professional in the construction or service industry, creating an accurate and detailed payment request is essential. A well-structured document ensures that clients understand exactly what they are being charged for, minimizing the chances of disputes. Including the right information in your billing documents is crucial for smooth transactions and maintaining a professional image.

Essential Information to Include

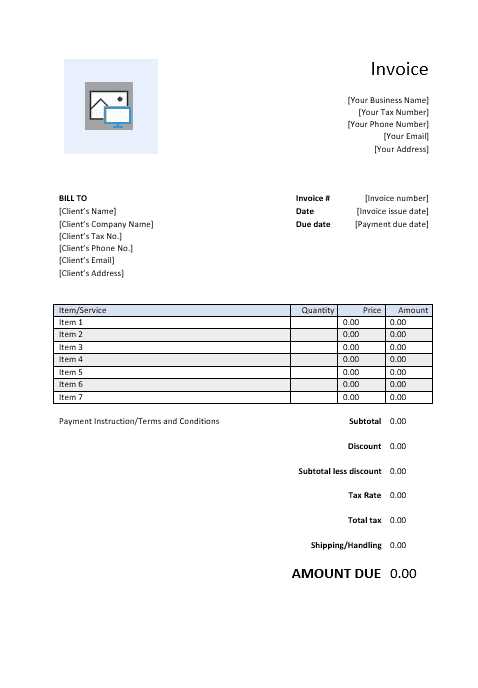

A comprehensive billing document should include several critical components to ensure clarity and accuracy. These include:

- Contact Details: Clearly display your business name, address, phone number, and email, along with the client’s details for easy reference.

- Project Description: Provide a brief summary of the work completed, highlighting key services and materials used.

- Itemized Breakdown: List all charges separately, including labor, materials, and any additional fees, to ensure transparency.

- Payment Terms: Include the agreed-upon payment schedule, due dates, and any penalties for late payments.

- Unique Invoice Number: Assign a distinct reference number to each billing document for tracking purposes.

- Total Amount Due: Ensure the total amount to be paid is clearly stated, including any applicable taxes or discounts.

Additional Considerations

While the basic elements above are vital, there are other details that can help protect both parties and improve the billing process:

- Terms of Service: Clarify any specific terms or conditions related to the payment or project.

- Completion Date: Indicate when the work was finished or when the final deliverables were provided.

- Payment Methods: Offer options for how payments can be made, such as credit card, bank transfer, or check.

Including these elements ensures that your billing documents are thorough and professional, reducing misunderstandings and fostering trust between you and your clients.

How to Create a Billing Document for Construction Projects

Creating a billing document for construction work involves more than just listing services and costs. It’s about clearly presenting detailed information that both you and your client can rely on to ensure accurate payment. By following a structured approach, you can make the process smoother and more efficient, ultimately leading to better communication and quicker payments.

Steps to Create a Detailed Payment Request

Follow these essential steps to create a comprehensive payment request for construction services:

- Include Your Business Information: Start by adding your company name, contact details (phone number, email, and address), and business logo. This establishes the document as a formal and professional communication.

- Add Client Information: Include the name, address, and contact details of the client you’re billing. This ensures the document is properly addressed and helps avoid confusion.

- Provide a Clear Project Description: Briefly describe the services rendered and the work completed. Include dates and any specifics that reflect the scope of the project.

- List Detailed Charges: Break down the costs into categories such as labor, materials, equipment rentals, and any other expenses. Include the rate and quantity for each item to clarify the charges.

- State Payment Terms: Indicate the due date for payment, as well as the accepted payment methods. It’s also helpful to mention any penalties for late payments or discounts for early payments.

- Assign a Unique Reference Number: This helps you track the billing document and simplifies record-keeping for both parties.

- Summarize Total Amount Due: Clearly display the total amount owed, including any applicable taxes or discounts, to avoid confusion.

Tips for Effective Billing

In addition to following these steps, consider the following tips for creating a smooth and professional payment request:

- Stay Consistent: Use the same format for every billing document to maintain a professional and organized approach.

- Be Detailed: The more information you include, the less room there is for misunderstandings. Detailed descriptions prevent clients from questioning the charges.

- Provide Clear Payment Instructions: Offer straightforward payment instructions to make the process as easy as possible for your clients.

- Follow Up: If payments are not received on time, follow up promptly to avoid delays in cash flow.

Essential Information to Include in Your Billing Document

When creating a payment request for work completed, it’s important to include specific details that ensure clarity and prevent any confusion. A well-organized billing document helps both you and your client keep track of charges and expectations, streamlining the payment process. Including the necessary information not only improves communication but also helps avoid misunderstandings.

Key Details to Ensure Accuracy

To ensure your payment request is complete and professional, be sure to include the following essential elements:

- Business and Client Information: Include your company’s name, address, contact details, and logo, as well as the client’s name and contact information. This ensures the document is properly addressed and clearly identifies both parties.

- Invoice Number: Assign a unique reference number for easy tracking and to help both parties identify the document in case of any future questions or disputes.

- Project Description: Include a brief summary of the services provided, highlighting key tasks, milestones, or deliverables, along with the dates the work was completed.

- Itemized Charges: List all the services, materials, and other costs involved in the project. For each item, specify the quantity, unit price, and total cost to avoid confusion and provide transparency.

- Total Amount Due: Clearly display the sum of all charges, including any taxes or discounts, so your client knows the exact amount owed.

- Payment Terms: Specify the payment due date, any late payment penalties, and accepted payment methods to ensure both parties are clear on the financial terms.

Additional Information to Include

Beyond the basic elements, there are a few other pieces of information that can help further clarify your payment request:

- Project Completion Date: Indicate the date when the work was completed or when services were last provided to ensure there is no confusion about the timing.

- Terms of Service: If applicable, include any special terms, such as warranty information or agreed-upon follow-up services, to reinforce the scope of your work.

- Contact Information for Queries: Provide a phone number or email address where clients can reach you with any questions regarding the payment or the project itself.

By including these key elements, you create a professional, clear, and thorough document that helps ensure timely payments and fosters a positive relationship with your clients.

Common Mistakes to Avoid on Billing Documents

Even a small mistake on a payment request can lead to confusion, delays, and even disputes. Creating a clear, accurate document is essential for maintaining positive relationships with clients and ensuring timely payments. However, certain mistakes are common and can make a professional document appear unorganized or incomplete. By being aware of these errors, you can avoid potential issues and streamline your billing process.

Frequent Errors in Billing Documents

Here are some common mistakes that should be avoided when preparing a payment request:

- Incorrect or Missing Contact Information: Failing to include accurate details for both your business and the client can cause confusion. Always ensure that names, addresses, and phone numbers are correct to avoid any misunderstandings.

- Failure to Itemize Charges: A vague description of charges can lead to questions and disputes. Always break down the costs clearly–whether for labor, materials, or any other expenses–so clients can see exactly what they are paying for.

- Omitting Dates: Not including the date of the service or the due date for payment can cause uncertainty about when the work was completed or when payment is expected. Always specify these dates to avoid confusion.

- Unclear Payment Terms: Be explicit about payment terms, including the amount due, due dates, and any late fees. Vague or missing terms can delay payment and cause unnecessary back-and-forth.

- Errors in Calculations: Simple math mistakes–whether in totals, tax calculations, or rates–can erode trust with clients. Double-check your calculations to ensure accuracy before sending out the document.

Additional Pitfalls to Avoid

In addition to the errors listed above, here are other common mistakes that can impact the professionalism of your payment request:

- Inconsistent Formatting: Using a messy or inconsistent format can make the document hard to read and appear unprofessional. Stick to a clean, uniform layout for easy readability.

- Missing Unique Invoice Number: Not assigning a unique reference number to each billing document can make tracking payments difficult, leading to confusion if there are multiple jobs with the same client.

- Not Including Payment Instructions: F

How to Personalize Your Billing Document Format

Customizing your billing document to reflect your business’s unique style and the specifics of each project can significantly enhance its professionalism and clarity. Personalization goes beyond adding your logo–it involves adjusting the layout, content, and terms to ensure the document is tailored to your client’s needs. A well-personalized format helps establish trust and ensures a seamless payment experience.

Steps to Personalize Your Payment Request

To create a personalized and professional document, consider the following adjustments:

- Add Your Business Branding: Include your company logo, colors, and a consistent font style to reinforce your brand identity. This makes your document look polished and professional.

- Customize Contact Information: Ensure that your business contact details, including phone number, email address, and business location, are prominently displayed. Add your client’s contact details as well for easy communication.

- Adjust Payment Terms to Fit Each Project: Modify payment schedules, deadlines, and any applicable late fees to suit the specifics of the project. For example, if you agreed on milestone payments, reflect that clearly in the document.

- Include a Detailed Project Description: Provide an accurate summary of the work completed, along with specific materials used, hours worked, and any additional charges. This makes the request more transparent and justifiable.

- Update Your Legal Terms: If there are any specific conditions tied to the job, such as warranty information, guarantees, or service limitations, make sure these are clearly outlined in the document.

Additional Customization Tips

For even more personalization, consider these additional tips:

- Payment Options: Adjust the available payment methods according to the client’s preferences. Some may prefer credit card payments, while others might opt for bank transfers or checks.

- Unique Project Reference Number: Each project should have a unique reference number for tracking purposes. Ensure that this number is clearly stated and consistent across all your documents.

- Client-Specific Notes: Include a personalized note or message for the client, expressing gratitude for the project or providing any relevant follow-up information.

- Flexible Discounts or Offers: If applicable, offer client-specific discounts or early payment incentives. Personalizing these terms makes clients feel valued and may encourage prompt payment.

B

Using Billing Software vs. Pre-Designed Formats

When it comes to creating payment documents, businesses have two primary options: using specialized software or relying on pre-designed formats. Both methods offer distinct advantages depending on your needs and workflow. While software often provides automation and customization options, pre-made layouts can offer simplicity and ease of use. Understanding the differences can help you decide which approach best suits your business’s requirements.

Billing Software often provides advanced features, such as automatic calculations, customizable fields, and the ability to store and track past payments. Many software tools allow you to generate documents quickly, manage multiple clients, and even send invoices directly to customers. These tools can be ideal for businesses that handle high volumes of work or want more streamlined and professional-looking documents. Software solutions may also integrate with accounting tools, making financial management easier.

On the other hand, using a pre-designed format offers a simple, no-cost solution that still delivers professional results. Templates can be customized to a certain degree but do not provide the same level of automation or flexibility as software. They are easy to use, especially for small businesses or individual contractors who prefer a straightforward approach without the need for technical setup or ongoing subscriptions. This option is ideal for those who generate invoices infrequently or prefer handling billing manually.

Ultimately, the choice between software and pre-designed formats comes down to your business needs. If you require efficiency, automation, and scalability, software may be the better option. However, for those looking for simplicity and lower overhead, a pre-designed format could be the best solution.

Free vs. Paid Billing Document Formats

When deciding on a format for your payment requests, you may come across both free and paid options. While free formats are a popular choice for many businesses, paid versions often offer more features and greater customization. The decision between using a free or paid format depends on the specific needs of your business, such as the volume of transactions, the complexity of your services, and your desire for additional functionality.

Free Options are widely available and provide a simple solution for those who need basic documents without investing money. These formats are generally easy to find and can be customized to an extent. Free options are ideal for small businesses or freelancers who generate invoices occasionally and have minimal requirements. However, they may lack advanced features such as automation, tracking, and premium design options.

- Advantages of Free Formats:

- Cost-effective–no fees involved.

- Quick and easy to set up, especially for small businesses.

- Basic customization options available.

- Disadvantages of Free Formats:

- Limited functionality (e.g., no integration with accounting software).

- Fewer design options and templates.

- Basic features, may lack advanced automation or tracking capabilities.

Paid Options generally offer more sophisticated features, such as customizable fields, invoicing automation, and the ability to integrate with accounting or financial software. These formats are perfect for businesses that require a higher level of functionality, especially those dealing with high volumes of work or managing multiple clients. Paid formats often come with customer support, more extensive design options, and added security features that may be essential for growing businesses.

- Advantages of Paid Formats:

- More customization options, allowing you to adjust the document for specific needs.

- Automated calculations and invoice tracking.

- Better security and integration with accounting systems.

- Professional design choices to enhance your branding.

- Disadvantages of Paid Formats:

- Ongoing costs (e.g., subscription fees or one-time payments).

- More complex to set up initially.

- May require a learning curve to fully utilize advanced features.

Ultimately, the choice between free and paid formats depends on your business’s requirements. If you’re just starting out or have minimal invoicing needs, a free format may be sufficient. However, if you need advanced features, more design control, and better overall efficiency, investing in a paid version could be worthwhile.

How to Calculate Payment Terms and Fees

Calculating payment terms and associated fees is a critical aspect of managing financial transactions for any business. Ensuring that both you and your client are on the same page regarding when payments are due, and how much they will be, can help prevent misunderstandings and disputes. Clear payment terms provide structure to the process, while well-calculated fees ensure you are compensated appropriately for your time and services.

Payment terms typically outline when the client is expected to pay and any conditions related to the payment, such as early payment discounts or late payment penalties. Fees can include the total amount due, taxes, and any additional charges related to the project. Calculating these elements accurately is key to maintaining a healthy cash flow and good client relationships.

Steps to Calculate Payment Terms

Here are the key components to consider when setting payment terms:

- Due Date: Clearly define when the payment is expected. Common options include “Net 30” (payment due 30 days after the service is completed) or “Due on Receipt” (payment due immediately).

- Advance Payment: Some businesses require a deposit before work begins. This amount is typically a percentage of the total cost and serves as a commitment from the client.

- Installment Payments: For larger projects, consider setting up a payment plan where the total is broken down into stages. Each installment is due after completing certain project milestones.

- Late Fees: Establish clear terms for late payments, such as a percentage fee for every day the payment is overdue. This motivates clients to pay on time and helps compensate for any inconvenience caused by delayed payments.

- Early Payment Discounts: Offering a discount for early payment can encourage quicker settlements. For example, “2% discount if paid within 10 days” is a common practice.

How to Calculate Fees

When calculating fees for your services

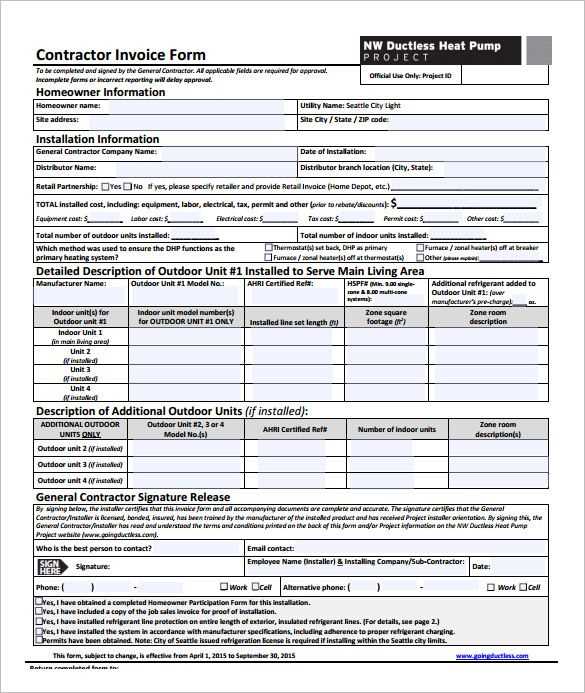

Billing Formats for Different Types of Contracting Services

Each type of project requires a specific approach when it comes to billing documents. Whether you are working on a small home renovation or a large commercial development, tailoring your payment requests to the type of service provided can ensure clarity and professionalism. Different industries and job types may require varying levels of detail, from labor costs and materials to specific project milestones or timelines. Understanding how to customize these documents based on the service offered helps both you and your clients stay organized and clear on expectations.

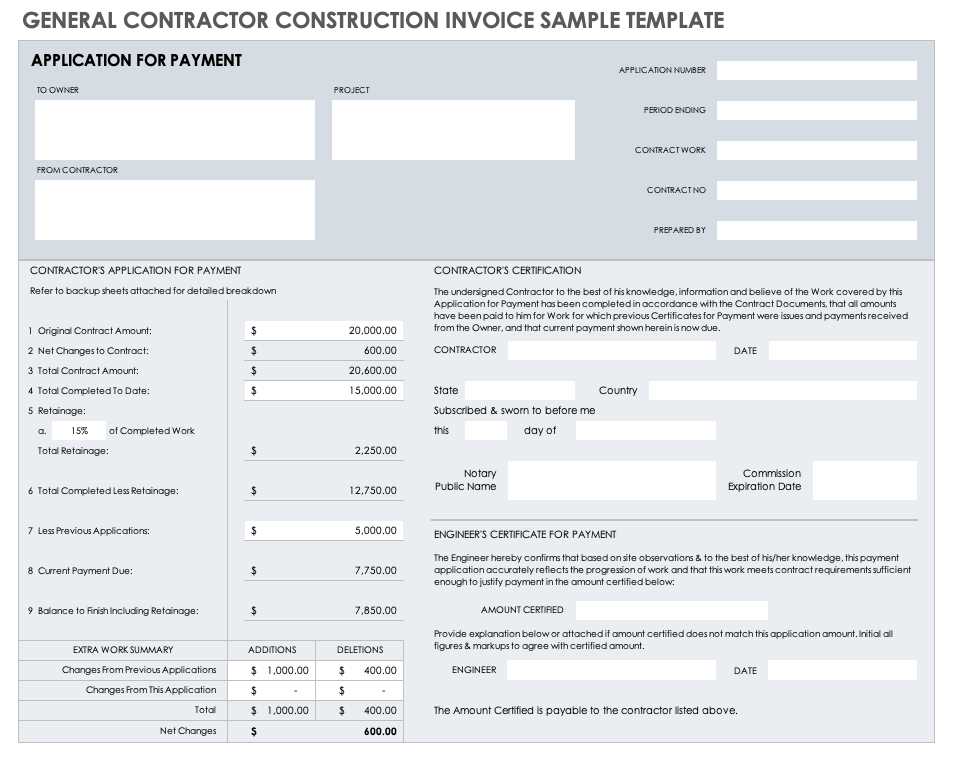

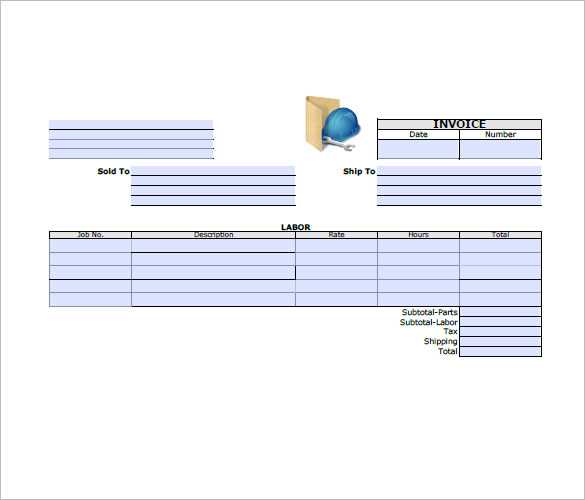

Billing for Construction and Renovation Projects

For construction or renovation work, where projects can span weeks or months, the billing document needs to be detailed and broken down into specific milestones or phases. It’s essential to clearly define each phase, from planning and permits to material procurement and final touches. Here’s how to structure such a payment request:

- Itemized Costs: List all major expenses, such as materials, labor, and equipment rentals.

- Payment Milestones: Include payment due at each project stage, such as 30% upfront, 40% upon halfway completion, and the final 30% upon project completion.

- Change Orders: If additional work was requested, ensure these changes are clearly outlined along with the associated fees.

- Completion Dates: Specify estimated or actual completion dates for each phase.

Billing for Maintenance or Repair Services

When dealing with maintenance or repair services, the billing document typically needs to be simpler, as the scope of work is often more straightforward. For such services, include clear descriptions of the work done, the time spent, and any parts or materials used. Here’s what should be included in the billing document:

- Service Details: Include a brief description of the work completed (e.g., electrical repairs, plumbing fixes, etc.).

- Labor Charges: Clearly outline the number of hours worked and the hourly rate.

- Material Costs: List any parts or materials used, with individual prices if necessary.

- Flat Fees or Hourly Rates: Choose a clear pricing structure, whether based on flat fees for specific tasks or hourly billing.

By customizing your payment documents to

How to Handle Late Payments on Billing Documents

Dealing with delayed payments can be a frustrating part of running a business, especially when clients don’t adhere to the agreed-upon payment terms. However, managing late payments effectively is crucial to maintaining healthy cash flow and professional relationships. It’s important to have a clear, consistent process in place for following up on overdue payments and taking appropriate actions when necessary.

First, set clear terms and expectations from the start. Specify payment due dates, late fees, and consequences for missed payments in your agreements and billing documents. This helps clients understand their obligations and provides you with a reference point when addressing delays. Clearly communicating your policies upfront can often prevent late payments from occurring in the first place.

If payments become overdue, it’s important to take prompt action:

- Send a Friendly Reminder: Sometimes, clients simply forget or overlook the payment. A polite, professional reminder can go a long way in getting your payment processed.

- Follow Up with a Formal Notice: If the payment is still not received after the reminder, send a more formal notice. This document should reiterate the amount owed, the original due date, and any late fees that may apply.

- Apply Late Fees: If outlined in your initial agreement, apply any late payment fees. Be sure to remind the client of this policy to reinforce the seriousness of the situation.

- Offer Payment Plans: If the client is struggling to pay, offering a payment plan may help. This shows flexibility on your part, while still ensuring you receive the funds owed.

- Consider Legal Action: As a last resort, if the payment continues to be ignored and is substantial, you may need to consider legal action or the services of a collection agency. However, this should be avoided if possible, as it can damage your client relationship.

By having a clear strategy in place, you can maintain professionalism while addressing overdue payments in a way that ensures you get paid promptly and fairly.

Best Practices for Sending Billing Documents Promptly

Timely billing is essential for maintaining healthy cash flow and ensuring that your business operations run smoothly. Sending billing documents promptly not only helps you get paid on time but also reinforces your professionalism and reliability. Adopting best practices for issuing payment requests can save you time, reduce confusion, and avoid potential delays in payment.

Key Strategies for Prompt Billing

Here are some best practices to consider when preparing and sending payment documents:

- Establish Clear Terms Upfront: Clearly outline payment terms and due dates in your agreements. This ensures that clients are aware of expectations from the start, minimizing the chances of confusion later.

- Use a Consistent Billing Schedule: Whether you bill weekly, bi-weekly, or after project completion, consistency is key. Establish a regular schedule for sending documents to ensure you are paid on time.

- Automate the Process: Consider using invoicing software or billing systems that automate the process of creating and sending payment requests. This reduces the chances of delays and helps you stay organized.

- Send Immediately After Completion: Once the work is completed or a milestone is reached, send your payment request as soon as possible. Don’t wait too long, as it can lead to delays and forgotten details.

- Confirm Client Contact Information: Ensure that you have up-to-date contact details for the client, such as their email address, so that payment requests are sent to the right place without delay.

Following Up and Tracking

After sending the payment request, make sure to track its status and follow up as needed. Here are some tips:

- Track Sent Documents: Keep a record of all sent billing documents and note when they were sent. Use tracking systems to stay organized.

- Send Reminders: If a payment is overdue, send a polite reminder shortly after the due date. This shows professionalism and helps keep the payment process on track.

- Maintain a Payment Log: Keep a log of all payments and track their status (paid, pending, overdue). This will help you monitor outstanding payments and follow up effectively.

By implementing these best practices, you can improve your billing process and reduce delays in receiving payments, allowing your busin

How to Track Billing Documents and Payments

Keeping track of payment requests and their corresponding payments is essential for maintaining a smooth cash flow in your business. By staying organized and monitoring both outstanding and completed payments, you can ensure that no funds are overlooked and that clients are paying as expected. Efficient tracking not only helps you manage your finances but also makes it easier to follow up on overdue payments and maintain transparency with your clients.

Organizing and Tracking Your Documents

Effective tracking starts with properly organizing the payment requests you send out. Here are some strategies to ensure that all your documents are accounted for:

- Use a Centralized System: Whether you prefer digital software or spreadsheets, keeping all your billing documents in one central location allows you to easily access and track them.

- Assign Unique Identifiers: Each payment request should have a unique number or reference code. This makes it easier to track and follow up on specific documents.

- Track Dates: Keep track of when each request was sent, the due date, and when the payment was actually received. This helps you stay on top of deadlines and follow up promptly on overdue payments.

- Organize by Client or Project: Group payment records by client or project. This will make it easier to track outstanding balances and know which clients or projects require attention.

Tracking Payments and Monitoring Due Dates

Once you’ve sent out payment requests, it’s crucial to track payments as they come in. Here are some tips for efficient payment tracking:

- Set Up Payment Reminders: Many invoicing systems or financial tools allow you to set up reminders for upcoming due dates. This ensures you are proactive and avoid missing payment deadlines.

- Monitor Partial Payments: If clients are making partial payments, keep a record of how much has been paid and how much remains. This helps prevent confusion and ensures that you’re always aware of outstanding balances.

- Use Financial Software: There are several software tools that can automate the tracking of both payments and outstanding requests. These tools can send automatic reminders and generate reports, making it easier to stay organized.

- Review Payment History Regularly: Regularly review your payment records to identify patterns in late payments or clients who may need extra attention. This allows you to take proactive steps before the situation becomes an issue.

By effectively tracking your payment requests and received payments, you can maintain accurate financial records, reduce the risk of missed payments, and keep your business operations running smoothly.

Legal Considerations for Billing Documents

When issuing payment requests for services rendered, it’s essential to ensure that the document complies with legal requirements. Properly structured billing not only guarantees that both parties understand the terms of payment but also provides protection in case of disputes. There are various legal aspects to consider, from tax requirements to contractual obligations, that can impact the enforceability of your payment documents.

Clear Terms and Conditions should be included in every payment request. Establishing detailed terms up front, such as payment deadlines, interest rates on overdue amounts, and penalties for non-payment, can help prevent legal complications later. It’s important that these terms are agreed upon in advance and outlined in the document itself.

Compliance with Local Laws is also crucial. Different regions may have specific laws governing payment deadlines, tax rates, and late fees. Make sure your billing documents align with these local regulations to avoid legal issues. For example, some jurisdictions require that late fees be stated in the agreement to be enforceable. Research local laws or consult with legal counsel to ensure you’re compliant.

Retention of Rights and Liens may be necessary for certain types of work. In industries like construction or renovation, there are often laws that allow you to place a lien on a property if payment is not received for services rendered. Including a statement about your right to file a lien in your billing document can serve as a legal safeguard in case payment is not made.

Tax Obligations should also be considered. Depending on your location and the nature of the work, certain services may be subject to sales tax or other taxes. It’s important to include the correct tax rate on your payment document and remit the appropriate amounts to tax authorities. Ensure that your business is registered for tax purposes and that you include any necessary tax information on the document.

By being aware of these legal factors and including the proper language in your billing documents, you can protect your rights, minimize the risk of disputes, and ensure that your payment requests are legally enforceable.

How to Organize Your Billing Documents for Tax Season

When tax season approaches, having organized financial records is crucial for smooth filing and ensuring compliance with tax regulations. Properly managing your payment requests and receipts can save you time and reduce the stress of gathering everything at the last minute. By keeping detailed, well-organized records throughout the year, you can make tax preparation more efficient and avoid missing any deductions or required reports.

Tracking and Categorizing Your Documents

The first step in organizing your billing documents for tax season is to categorize them in a way that reflects your income and expenses. Here are a few tips to get started:

- Create Separate Folders for Income and Expenses: Organize your documents into distinct categories for payments received and money spent. This will make it easier to identify your gross income and deductible expenses when filing your taxes.

- Use Digital Tools: If you haven’t already, consider using digital invoicing software that can automatically track your documents and store them in an organized way. Many software programs also allow you to categorize payments, add taxes, and generate reports for tax purposes.

- Label Documents Properly: Label each payment document with the date, client name, and amount. This will help you quickly identify any discrepancies or incomplete information when it’s time to prepare your tax filings.

- Include Taxable Sales: Ensure that any sales tax you’ve collected is recorded separately. This will make it easier to calculate tax payments owed to local or federal authorities.

Maintaining a Payment Log

Maintaining a detailed log of all transactions is essential for accurate reporting. Here are some best practices:

- Record Each Payment: Log every payment as soon as it’s received. Include the client’s name, the date, the amount, and any relevant project details. This record will act as a reference when you’re preparing your taxes.

- Track Overdue Payments: Keep track of payments that have not been received on time. These payments may affect your overall income for the year, so it’s important to include them in your reports once they are collected.

- Reconcile Monthly: At the end of each month, review your billing and payment records. This ensures everything is up to date a

Updating and Adjusting Your Billing Documents

As your business evolves, so should the documents you use to request payments. Periodically reviewing and making adjustments to your payment requests is essential to ensure they remain accurate, relevant, and professional. Whether it’s reflecting changes in your pricing, updating your business details, or including new terms, keeping your documents up-to-date is a key part of maintaining smooth financial operations.

Reasons to Update Your Billing Documents

There are several factors that may require you to update your payment requests. Here are some of the most common reasons:

- Changing Business Information: If your business name, address, or contact details have changed, ensure that your payment documents reflect this updated information to avoid confusion.

- Adjusting Payment Terms: As your business grows, you may decide to adjust payment terms, such as the due date, late fees, or discounts for early payment. It’s important to clearly communicate any changes to clients in your payment requests.

- Incorporating New Services or Pricing: If you’ve introduced new services or altered your pricing structure, make sure these changes are accurately reflected in your payment documents to prevent any discrepancies or misunderstandings.

- Compliance with Legal Changes: Laws and regulations related to taxes, late fees, or business practices may change over time. Adjust your documents to ensure they comply with new legal requirements.

How to Adjust Your Billing Documents

Updating your payment request documents can be a straightforward process. Here are some tips to help you make necessary adjustments:

- Use Software for Easy Updates: If you’re using invoicing software, you can typically make changes quickly, and the system will automatically update all future documents. This is an efficient way to maintain consistency across your payments.

- Review Terms Regularly: Set a reminder to review your payment terms every few months to ensure they align with your current business needs. If necessary, adjust your payment methods or deadlines to reflect the most current practices.

- Communicate Changes with Clients: If any major adjustments are made to your payment requests, such as changes in pricing or terms, inform your clients beforehand to maintain transparency and trust.

By consistently updating and adjusting your payment documents, you can keep your billing process aligned with your business goals, avoid misu