Best Designer Invoice Template for Streamlined Billing

Efficient and organized billing is essential for any creative professional. Crafting clear, accurate, and visually appealing financial documents helps maintain a professional image while ensuring prompt payment. By using structured formats, you can streamline the process and avoid errors that could delay transactions.

In this section, we will explore various approaches to crafting billing documents that are both functional and aesthetically pleasing. These documents serve as a formal request for payment, but they also reflect your attention to detail and commitment to professionalism. Understanding the best practices for their creation can make a significant difference in the overall workflow.

Customizable formats offer flexibility and can be tailored to fit different projects or clients. Whether you are working on a one-time assignment or a long-term partnership, having the right structure can save you time and help establish trust with your clients.

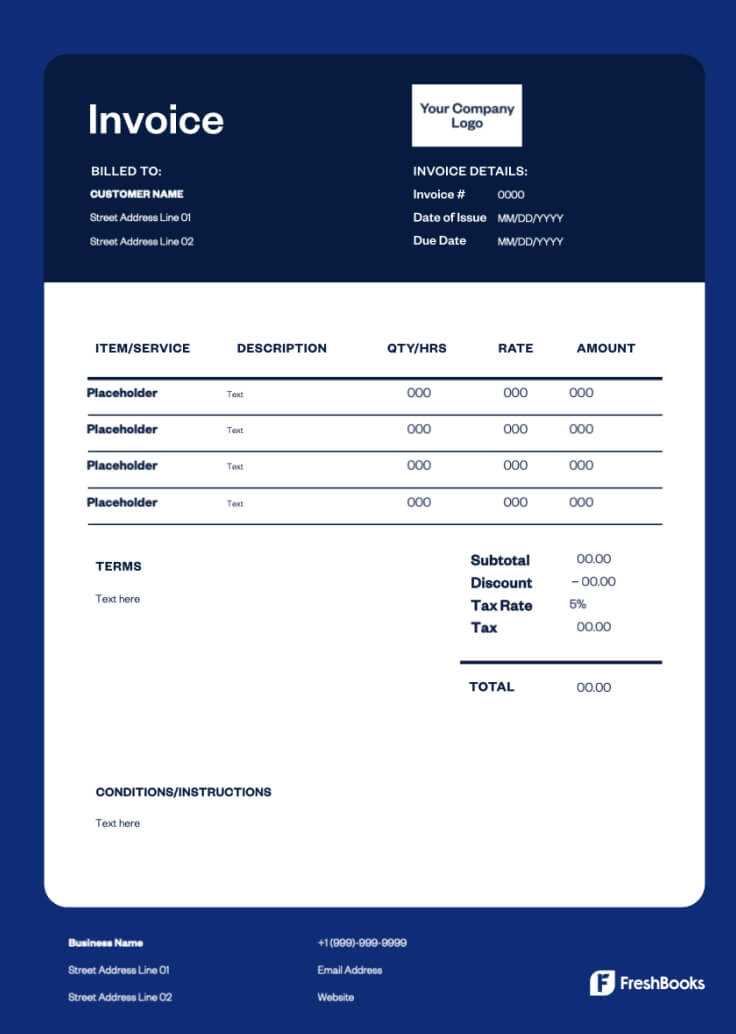

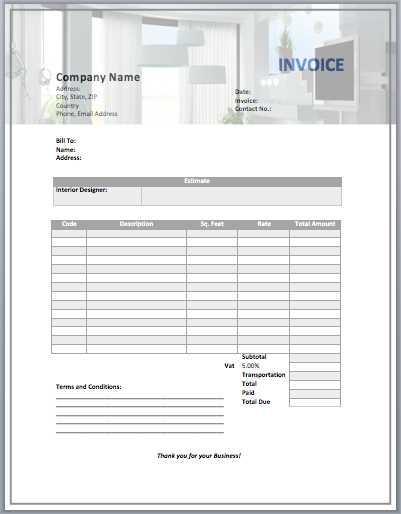

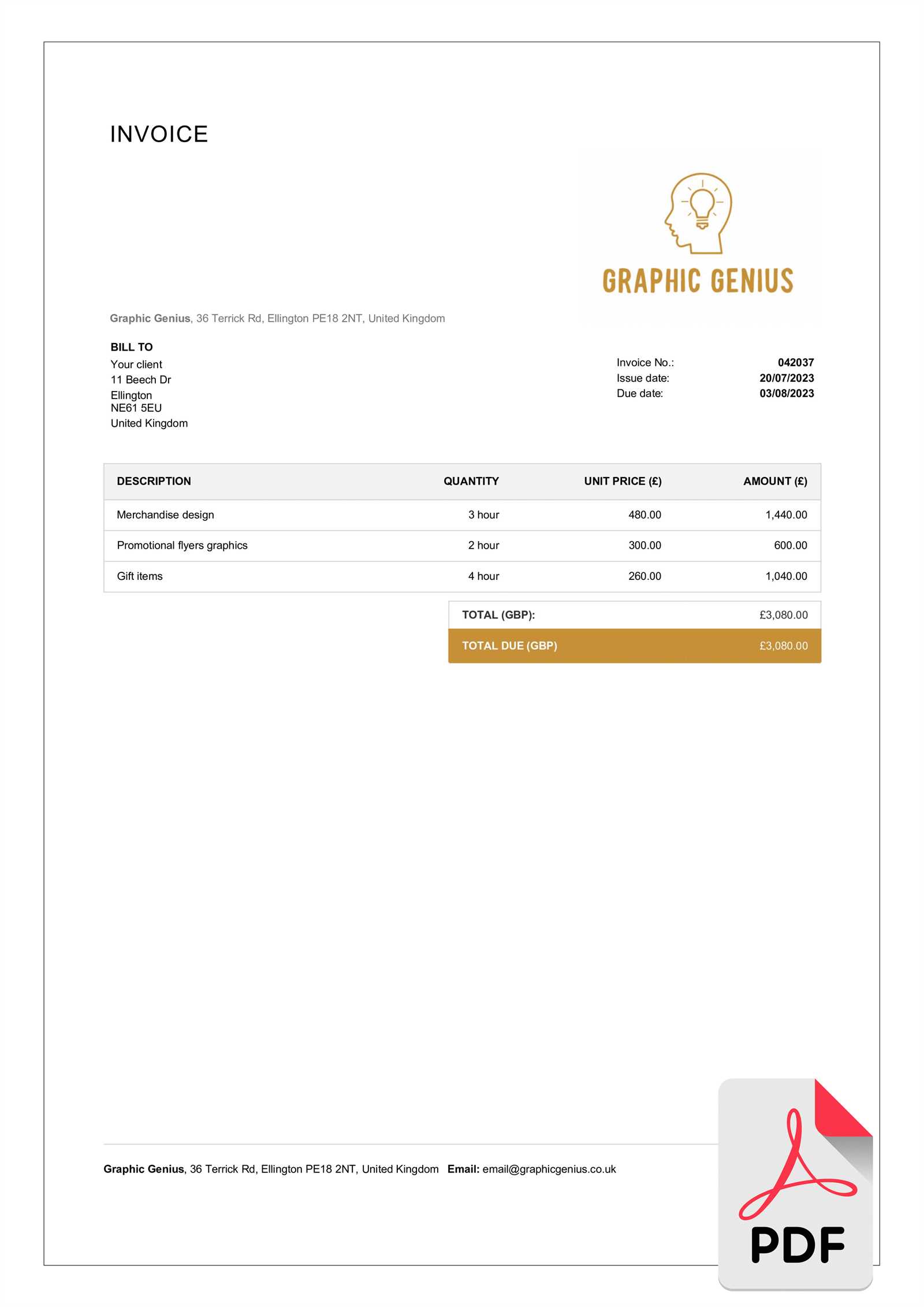

Designer Invoice Template Overview

When it comes to billing for creative work, having a clear and professional document is crucial. This document serves not only as a request for payment but also as a reflection of your professionalism and attention to detail. By using a structured approach, you ensure that all necessary information is included and easily understood by your clients.

These billing documents are designed to make the payment process smooth and efficient. They typically include key details such as services rendered, payment terms, and the total amount due. A well-crafted document helps eliminate confusion and provides clients with a clear understanding of the charges.

Customizable options allow you to adapt the structure to fit your specific needs, whether you are billing for a single project or multiple services. Having a consistent format ensures that your documents look polished, regardless of the work involved. By using a flexible format, you can maintain a high level of professionalism while saving time on repetitive tasks.

Why Use a Professional Invoice

Using a well-structured billing document is essential for ensuring clarity, accuracy, and professionalism in your financial transactions. When you provide clients with a polished, clear document, it not only streamlines the payment process but also fosters trust and credibility. A professional document serves as both a legal record and a means of effective communication between you and your clients.

Ensuring Clear Communication

A carefully crafted billing document outlines all the necessary details of the transaction in an organized manner. It clearly presents the services or products provided, the agreed-upon costs, and the payment terms. This reduces the likelihood of misunderstandings or disputes, as both parties have a clear reference for the work completed and the amount owed.

Building Trust and Credibility

Presenting a clean and well-formatted document gives your business an air of professionalism. Clients are more likely to take you seriously and feel confident in your services when they receive a document that looks polished and thorough. It shows that you value your work and respect their time, which can help build long-term, positive relationships.

Key Features of Designer Invoices

A professional billing document is more than just a request for payment; it serves as a clear and organized record of the services provided. The key to an effective document lies in its structure and the details it includes. The right features ensure that the document communicates everything necessary for the client to process the payment promptly and accurately.

Comprehensive Information is crucial. A well-structured document should include the service provider’s name, contact information, and payment details, along with a clear breakdown of the services rendered and their respective costs. This transparency helps clients understand exactly what they are being charged for.

Clarity in Payment Terms is another vital feature. By outlining the payment due date, methods of payment accepted, and any late fees, you can set clear expectations for both parties. This minimizes the chance of confusion or delays and fosters a smoother transaction process.

How to Customize Your Invoice

Personalizing your billing document allows you to make it both functional and aligned with your brand. By adjusting the layout, design, and details, you can create a document that reflects your unique style while still ensuring clarity and professionalism. Customization helps you stand out while providing the essential information your client needs for a smooth transaction.

Adjusting the Layout and Design

One of the first steps in personalizing your document is choosing a layout that suits your needs. You can opt for a minimalistic style with clear headings and sections, or you can incorporate your brand colors, logo, and fonts for a more distinctive look. Branding elements not only enhance your document’s visual appeal but also reinforce your business identity.

Adding Essential Information

While customizing, it’s important to ensure that all necessary details are included. Contact information, service descriptions, payment methods, and due dates should be prominently displayed. These elements help clients quickly understand the terms and facilitate prompt payments.

Benefits of Using a Template

Utilizing a pre-designed format for your billing documents offers numerous advantages. Not only does it save time, but it also ensures that every essential detail is included in a clear and professional manner. By relying on a structured layout, you can focus more on the content and less on the formatting, making the process more efficient.

- Time-saving: A predefined structure eliminates the need to create a new document from scratch each time. You can easily fill in the necessary details, allowing you to quickly generate billing requests without wasting time on design elements.

- Consistency: Using a standardized format ensures that every document maintains the same professional appearance. Clients will recognize your work and appreciate the consistency in your communication.

- Accuracy: Templates are designed to include all the essential sections needed for a complete document. This reduces the risk of leaving out important information such as payment terms, due dates, and service descriptions.

- Customizability: While templates offer a base structure, they can still be tailored to your specific needs. You can adjust sections, add logos, and modify other elements to match your business style.

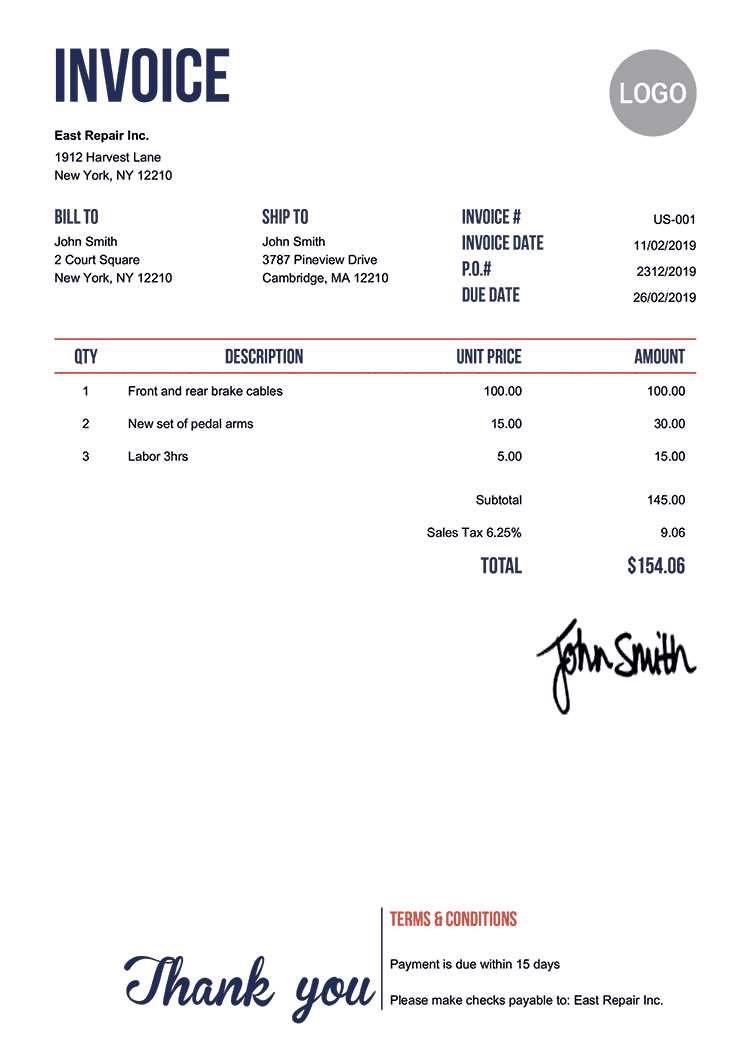

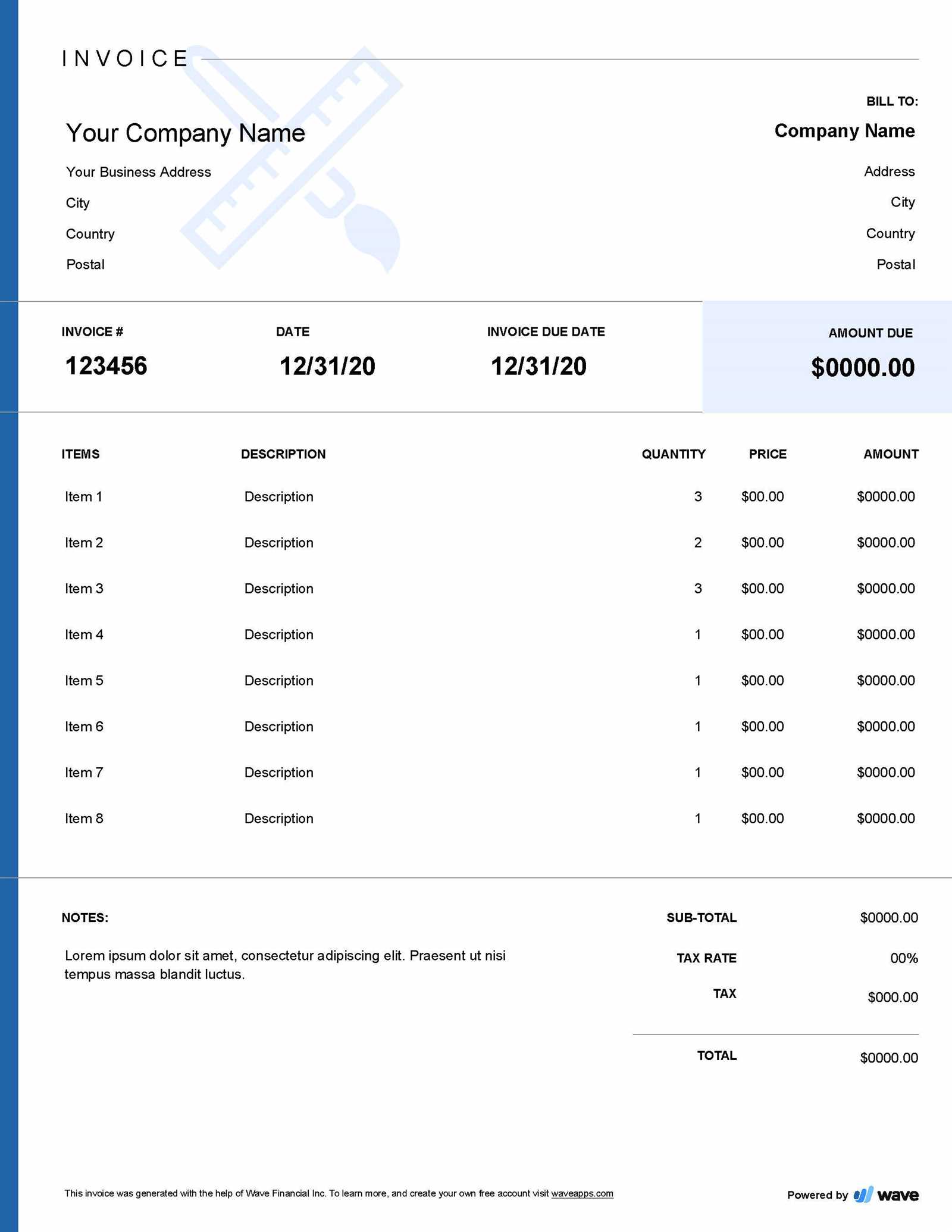

Essential Details to Include in Invoices

When creating a billing document, it’s important to ensure that all necessary information is included to avoid confusion and ensure prompt payment. A well-organized document not only serves as a record of the services provided but also sets clear expectations for the client regarding payment terms and due dates. Including the right details ensures a smooth transaction and reduces the chances of misunderstandings.

Contact Information: Always include the names, addresses, and contact details of both the service provider and the client. This information ensures that both parties can easily communicate if any issues arise regarding the billing process.

Service Descriptions: Clearly list the services or products provided, along with any relevant details such as quantities, rates, and specific terms of service. This transparency helps clients understand exactly what they are being charged for.

Payment Terms: Specify when payment is due, the accepted payment methods, and any late fees that may apply. Having this information clearly outlined helps clients stay on track with their payments and ensures that both parties are aware of the expectations.

Unique Reference Number: Assign a unique reference or invoice number to each document. This number helps in tracking and referencing the document for both the provider and client, especially for record-keeping or future queries.

Understanding Invoice Numbering Systems

A well-structured numbering system is essential for organizing and tracking billing documents. A clear and consistent approach to numbering not only simplifies the process of managing documents but also aids in efficient record-keeping. Each document should have a unique number that helps identify it, making it easier to reference or locate in the future.

There are several types of numbering systems used, depending on the needs of the business. A good system helps maintain order, especially when dealing with large volumes of documents, and ensures that there are no duplications. Below is a table outlining some of the most common methods for numbering billing documents:

| System | Description |

|---|---|

| Sequential | This method uses a simple numbering sequence (e.g., 001, 002, 003) that increments with each new document. |

| Date-Based | Combines the date with a sequence number (e.g., 2024-001, 2024-002), which helps identify when the document was created. |

| Client-Based | This system includes a unique code or reference number for each client (e.g., CLIENT001-001, CLIENT001-002), helping to track multiple documents for the same client. |

| Custom Prefix | Some businesses use a custom prefix to categorize different types of documents (e.g., PROD-001 for product sales, SER-001 for services). |

Choosing the right numbering system helps businesses stay organized and simplifies financial reporting or auditing tasks in the future.

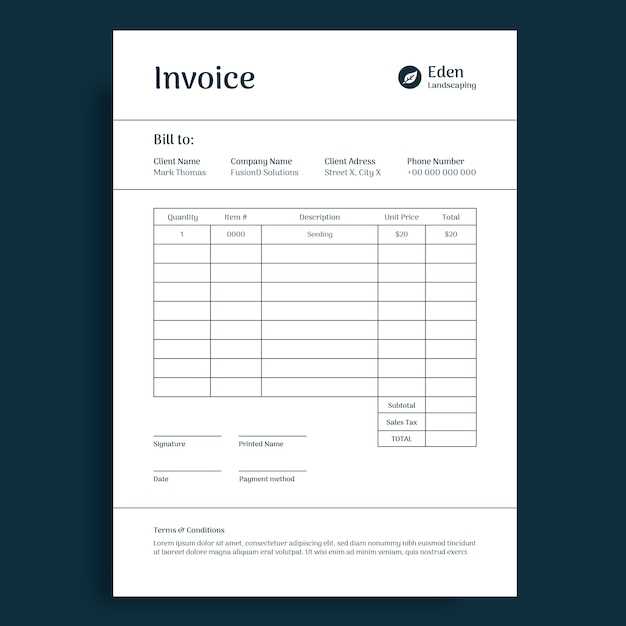

Choosing the Right Design for Invoices

When creating billing documents, the visual appearance is just as important as the content. A well-designed document not only enhances the professionalism of your business but also makes it easier for clients to understand the details at a glance. The right layout ensures that key information stands out, reducing the chances of confusion or delays in payments.

Here are a few considerations when selecting the right layout for your billing documents:

- Clarity: Ensure that the layout is simple and easy to read. Information should be organized logically, with clear headings and enough white space to avoid clutter.

- Branding: Customize the design to reflect your business’s brand. Include your logo, company colors, and fonts to create a cohesive look that aligns with your overall branding.

- Professionalism: Opt for a design that conveys professionalism and trustworthiness. Clients should feel confident in your services based on the quality and presentation of your documents.

- Consistency: Use a consistent design across all of your billing documents to create a unified experience for your clients. This also helps in maintaining recognition and reinforcing your brand.

- Functionality: Prioritize a design that allows for all the necessary details to be easily included. Important sections such as service descriptions, payment terms, and due dates should be prominently displayed.

Ultimately, the best design for your billing documents is one that balances both aesthetics and practicality, ensuring your clients receive clear, professional, and organized records of their transactions.

Common Mistakes to Avoid in Invoices

While creating billing documents, it’s easy to overlook important details or make errors that could affect payment processing or client satisfaction. Avoiding common mistakes can streamline your operations and help maintain professionalism in your business transactions. Below are some of the most frequent pitfalls to watch out for:

- Incorrect or Missing Contact Information: Always double-check the contact details for both your business and the client. An incorrect address or email can lead to delays in communication or payments.

- Unclear Payment Terms: Failing to clearly specify payment terms, including the due date and accepted payment methods, can result in misunderstandings or delayed payments.

- Missing or Inaccurate Service Descriptions: A vague or incomplete description of services or products provided can lead to disputes. Be specific and detailed to ensure clarity and avoid confusion.

- Not Including a Unique Reference Number: Each billing document should have a unique identifier. This helps both you and your clients keep track of transactions and is vital for accounting purposes.

- Errors in Calculations: Mistakes in adding or applying discounts can cause frustration for both parties. Double-check all figures to ensure that everything is accurate and clearly presented.

- Failure to Customize the Document: Using a generic design without branding or necessary details can make your document seem less professional. Personalizing it with your company’s logo, colors, and business information helps create a strong brand image.

- Not Including a Payment Reminder: Failing to add a polite payment reminder or late fee policy can result in delayed or ignored payments. Including this can encourage timely transactions.

By avoiding these common mistakes, you ensure a smooth, professional, and efficient process for both you and your clients, helping to build trust and maintain positive business relationships.

How to Track Payments with Invoices

Tracking payments effectively is essential for maintaining healthy cash flow and managing financial records. Properly monitoring when payments are received ensures that you can follow up on any outstanding balances, keeping both you and your clients on track. Below are some key strategies for tracking payments when creating and managing your billing documents:

Include Clear Payment Terms

Clearly outlining payment due dates, methods, and any late fees on your documents will help set expectations from the start. A well-defined payment schedule allows you to track payments based on the date you specify, and will help reduce any confusion or delays in processing payments.

Use a Payment Tracking System

To efficiently manage payments, consider using a payment tracking system or software. Many tools are designed to sync with your billing documents, allowing you to see which payments have been made, which are pending, and any that are overdue. This system can help you organize your records and send reminders for outstanding payments.

In addition to these methods, always make sure to update your financial records regularly, marking payments as received once they are confirmed. This helps you keep accurate accounts and ensures that no payment is overlooked.

Using Templates for Consistency

Consistency plays a crucial role in maintaining professionalism and clarity in your financial communications. By using predefined formats, you can ensure that all your documents follow the same structure, making it easier to manage, read, and understand. This approach not only saves time but also helps in presenting a uniform image to your clients.

Here are a few reasons why utilizing standardized formats is beneficial:

- Efficiency: Pre-built formats save time as you don’t need to redesign the layout each time.

- Brand Identity: Consistent use of specific colors, fonts, and logos reinforces your brand’s image.

- Accuracy: A structured approach reduces the likelihood of missing important details or making errors.

- Professionalism: Clients appreciate a clean, organized, and consistent presentation of billing information.

By using formats tailored to your business needs, you can keep your communications uniform and professional, ensuring that clients receive clear and reliable documents every time. This also helps in building trust and streamlining the overall administrative process.

Importance of Clear Payment Terms

Establishing clear and concise payment guidelines is essential for both businesses and clients. It ensures that both parties have a mutual understanding of when and how payments are expected, which helps to avoid misunderstandings and delays. Transparent terms create a foundation of trust, allowing for smoother transactions and professional relationships.

Benefits of Clear Payment Terms

- Prevents Disputes: Clear terms eliminate confusion over deadlines and amounts, reducing the chances of conflicts.

- Improves Cash Flow: Well-defined deadlines help businesses manage their cash flow more effectively by ensuring timely payments.

- Strengthens Professionalism: Setting clear payment expectations reflects a business’s commitment to transparency and organization.

- Boosts Client Confidence: Clients appreciate knowing exactly what to expect, which can lead to long-term partnerships.

Essential Elements to Include

Key components such as payment deadlines, accepted payment methods, late fees, and discount options for early payments should always be included. This clarity helps clients know exactly what is expected and provides both parties with a sense of security.

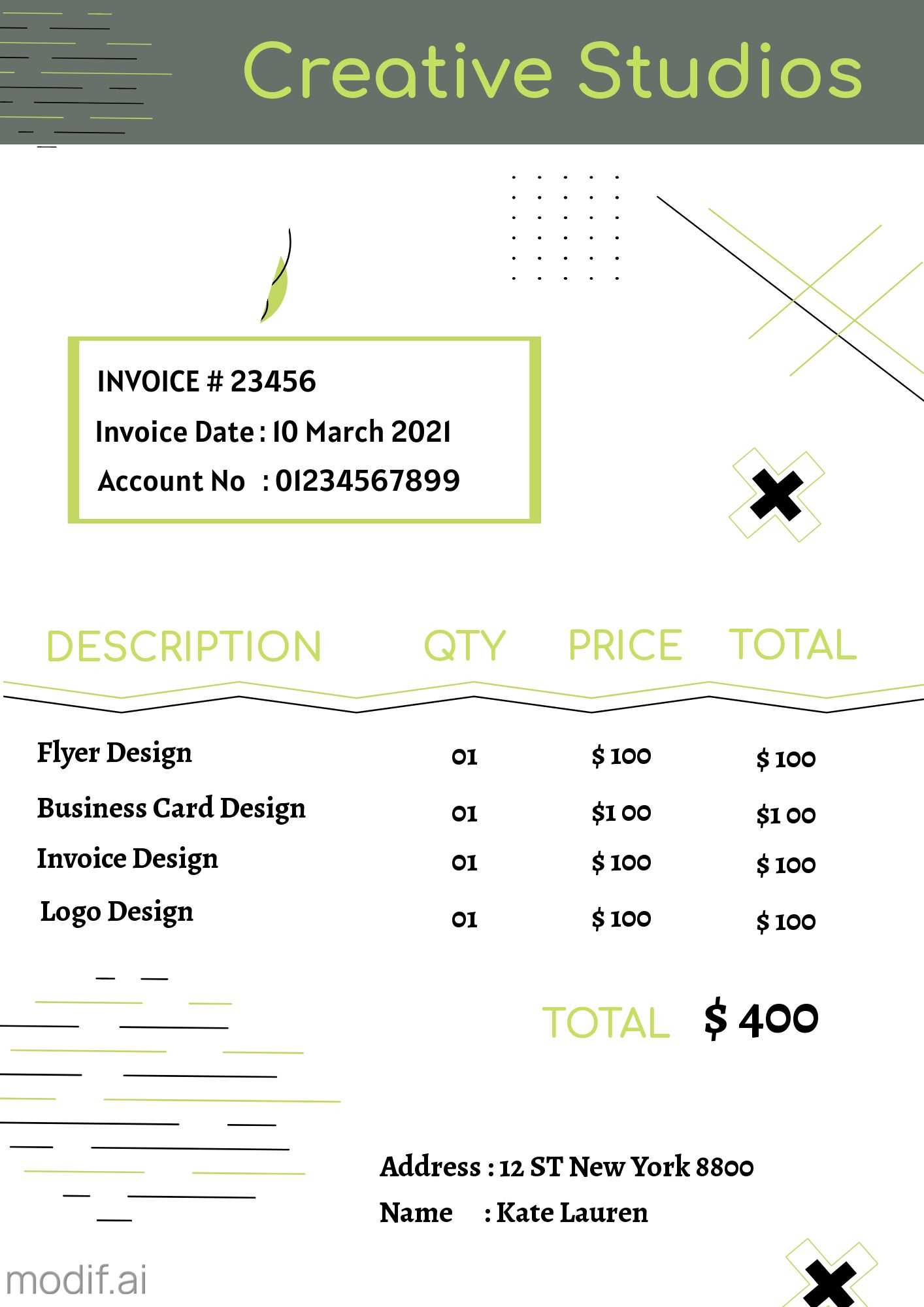

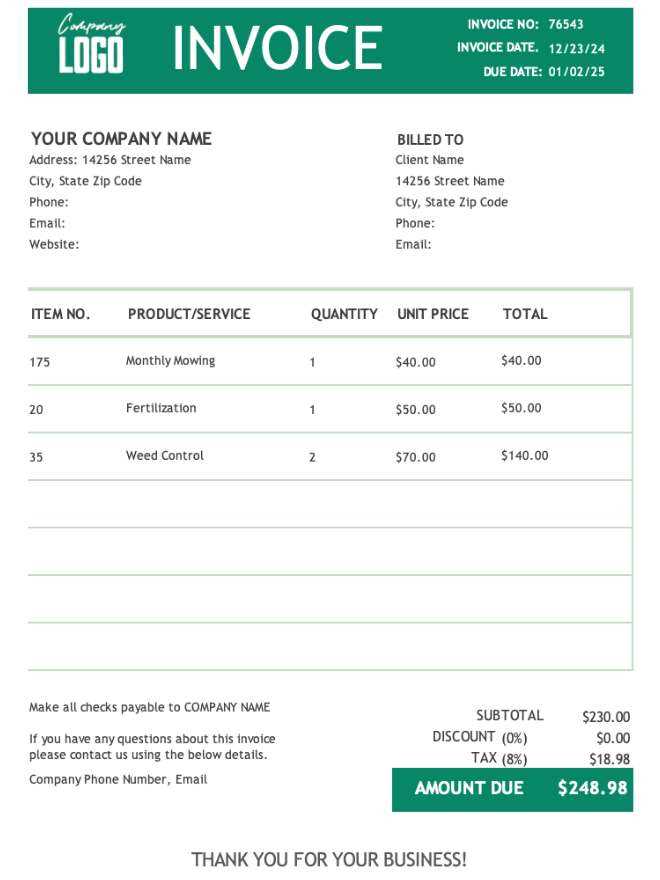

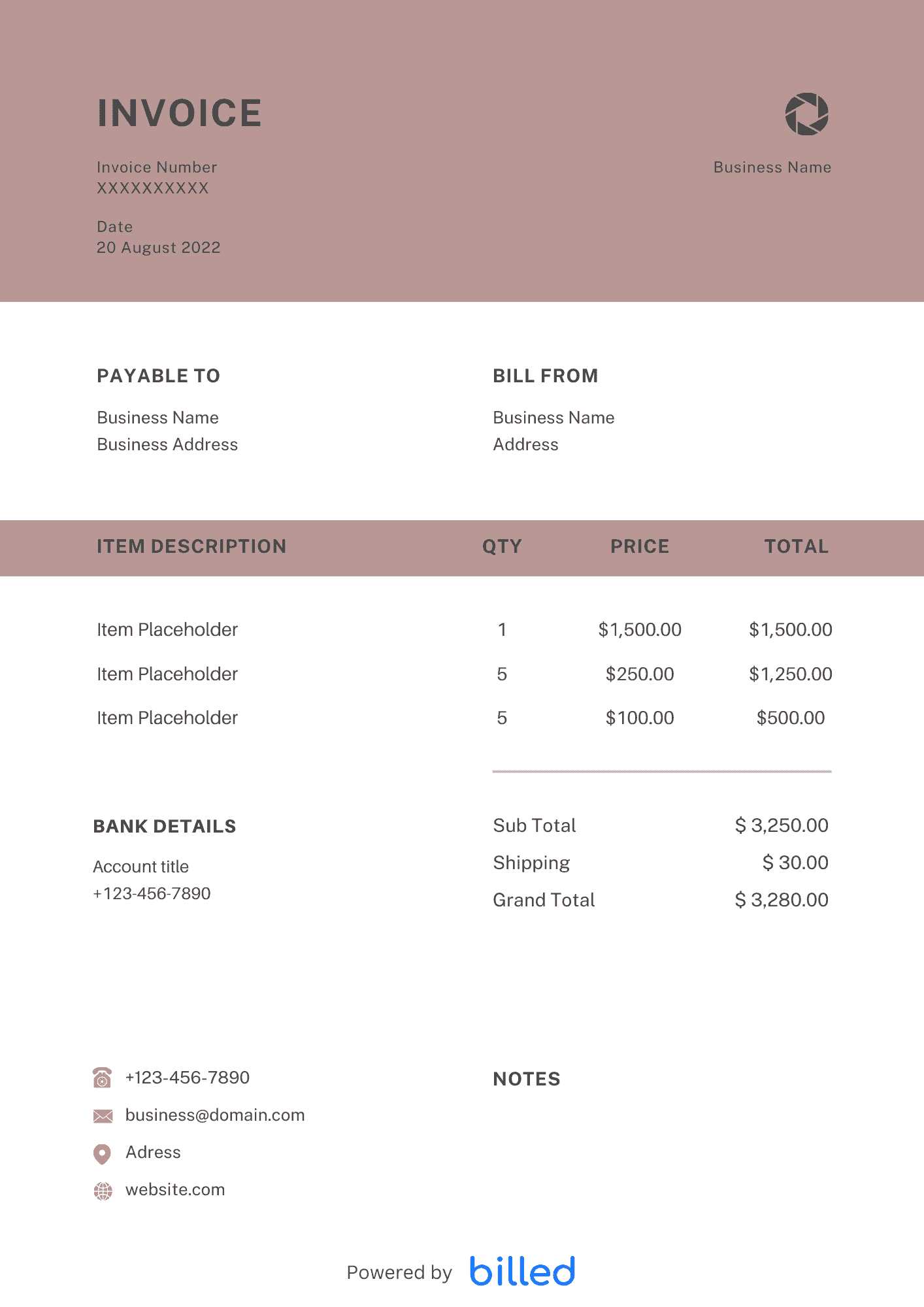

Invoice Template Formats and Styles

There are several formats and designs available when it comes to preparing billing documents. Each style serves different purposes depending on the type of business, the complexity of the services provided, and the preferences of the client. Choosing the right layout and structure is crucial for ensuring that all necessary details are presented clearly and professionally.

Common Formats

- Basic Format: A simple and straightforward layout that includes essential details such as the service provider’s information, client details, itemized services, and payment terms.

- Detailed Format: A more complex layout that breaks down each service or product with greater detail, often used for large projects or services that require multiple steps.

- Professional Style: A polished and well-organized design, often featuring company branding, such as logos, fonts, and colors, to present a high-end appearance.

- Minimalist Style: A clean, modern layout that focuses on the essentials with fewer distractions, perfect for businesses that prefer simplicity.

Choosing the Right Style

When selecting a design, it’s important to consider factors such as the industry you are in, the nature of your transactions, and the preferences of your clients. A professional layout can make your documents appear more reliable and trustworthy, while a simple style may work better for smaller, less formal transactions. It’s important to strike the right balance between clarity, aesthetics, and functionality.

How to Convert Documents to PDF

Converting documents into a universally accessible and professional format is an essential step for sharing or storing files securely. PDFs are ideal for maintaining the integrity of the content and ensuring compatibility across different platforms and devices. This process is easy and can be achieved using a variety of tools and methods, whether through online services, desktop software, or integrated features within other applications.

Methods for Conversion

Here are a few common ways to convert your documents to PDF format:

| Method | Description | Pros |

|---|---|---|

| Online Converters | Web-based platforms allow for quick uploads of your document to be converted into PDF format. | Easy to use, no software installation needed, accessible from any device with an internet connection. |

| Desktop Software | Programs like Microsoft Word or Google Docs allow you to export your file directly as a PDF. | Reliable, can work offline, customizable options for formatting and layout. |

| Print to PDF | Most operating systems, like Windows or macOS, include the “Print to PDF” option from any application. | Works with almost any application, simple and quick, no need for additional software. |

Choosing the Right Method

The method you choose will depend on your needs. For a quick one-time conversion, an online tool might be the most convenient. If you work offline or need to convert documents regularly, desktop software may provide more control. The print-to-PDF option is a versatile tool available for most users and is ideal for both casual and professional use.

Integrating Documents with Accounting Software

Seamlessly connecting your financial records with accounting tools can greatly enhance efficiency and accuracy in managing your business’s finances. By integrating these documents into accounting systems, you can automate processes such as tracking payments, generating reports, and maintaining up-to-date financial statements. This integration reduces manual data entry and ensures that all transactions are recorded in a consistent manner.

Benefits of Integration

Integrating your financial documents with accounting software offers several advantages:

- Automated Data Entry: Automatically populate accounting records with transaction details from your documents, saving time and reducing human error.

- Real-Time Updates: Ensure that your financial information is always up to date, with no delay between creating records and updating your accounts.

- Improved Accuracy: With fewer manual entries, you reduce the risk of mistakes in your financial data.

- Time-Saving: The integration speeds up administrative tasks and allows you to focus on more critical aspects of your business.

How to Set Up Integration

Setting up an integration between your financial documents and accounting software is typically straightforward. Most accounting platforms provide built-in tools or allow for easy linking with external services. Here’s how you can do it:

- Choose an accounting platform that supports document integration, such as QuickBooks or Xero.

- Ensure your document management system is compatible with your chosen software.

- Follow the instructions to connect the two systems, either through an API or an import/export feature.

- Test the integration to make sure that data transfers correctly and automatically.

By integrating your documents with accounting software, you simplify your workflow, ensure better accuracy, and ultimately save time on financial management tasks.

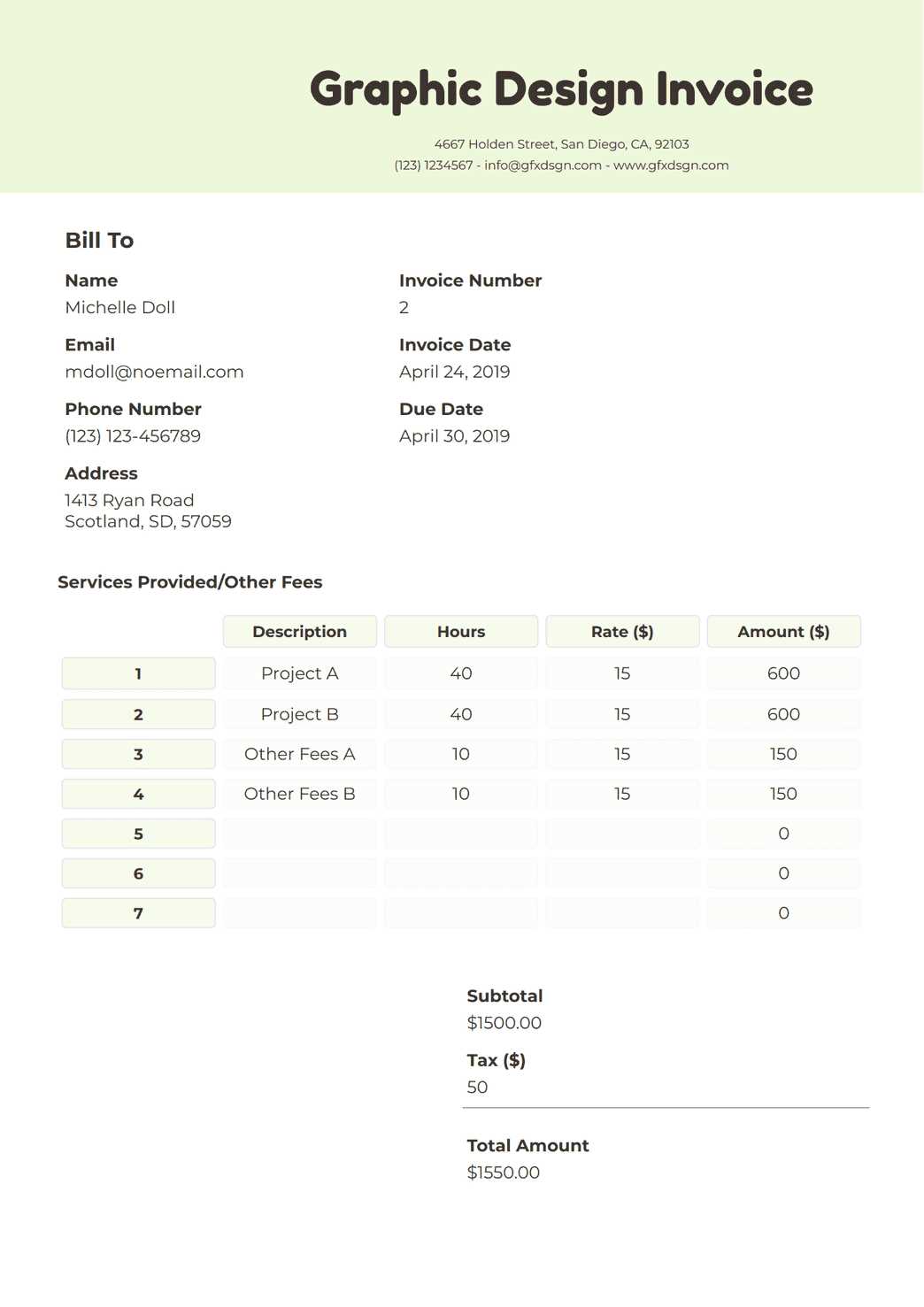

Creating Documents for Different Clients

When working with various clients, it’s essential to tailor your financial records to meet their unique needs and expectations. Customizing these documents helps maintain professionalism and clarity in your transactions. Understanding how to adapt your documents according to the type of client–whether a business, individual, or international client–can make the entire process smoother and more efficient.

Each client may have specific requirements regarding the structure, content, or formatting of these records. For example, some may prefer a more detailed breakdown of charges, while others might need simplified forms for quicker processing. Being flexible in your approach helps you maintain positive relationships and streamline the payment process.

Customizing for Business Clients

For business clients, especially those in corporate environments, your records should reflect a more formal, comprehensive structure. Consider including:

- Tax Identification Number: Ensure your business and the client’s tax IDs are clearly stated for compliance purposes.

- Detailed Itemization: Provide a clear breakdown of all services or products rendered, including individual prices and quantities.

- Payment Terms: Specify payment deadlines, applicable late fees, and other conditions clearly to avoid confusion.

Adapting for Individual Clients

When dealing with individuals, your records may be more straightforward and personal. Keep these key points in mind:

- Personalized Greetings: Adding a friendly note can create a more engaging and professional impression.

- Simplified Breakdown: While you still need to include all necessary information, keep the language and formatting simple and easy to understand.

- Flexible Payment Options: Consider offering flexible payment methods, such as online options or installment plans, to cater to the individual’s preferences.

By adjusting the structure and tone of your documents for different clients, you ensure clarity, professionalism, and smoother transactions for all parties involved.

Legal Aspects of Payment Records

When creating payment documents for services rendered, it’s crucial to understand the legal requirements and implications involved. These documents not only serve as a record of transactions but also protect both parties in case of disputes. Ensuring compliance with relevant laws and regulations is essential for maintaining professionalism and avoiding legal issues.

One of the key legal aspects is ensuring the accuracy of the information contained within these documents. This includes having clear terms regarding payment deadlines, interest rates for late payments, and any applicable taxes. Furthermore, it is essential to include specific details like the names and contact information of the involved parties, the scope of services, and agreed-upon fees, as these elements are often required for legal purposes.

Another important consideration is understanding your local laws concerning taxation. Depending on the jurisdiction, there may be specific requirements for how taxes are applied to services or products. In some regions, for example, you may be obligated to provide tax registration numbers or include detailed tax breakdowns for each service.

Lastly, clearly outlining payment terms and consequences for non-payment is vital for safeguarding your interests. This includes setting expectations for payment deadlines, outlining penalties for overdue payments, and specifying the actions to be taken in case of failure to pay. Adhering to these guidelines can help avoid future conflicts and ensure that your transactions are legally protected.

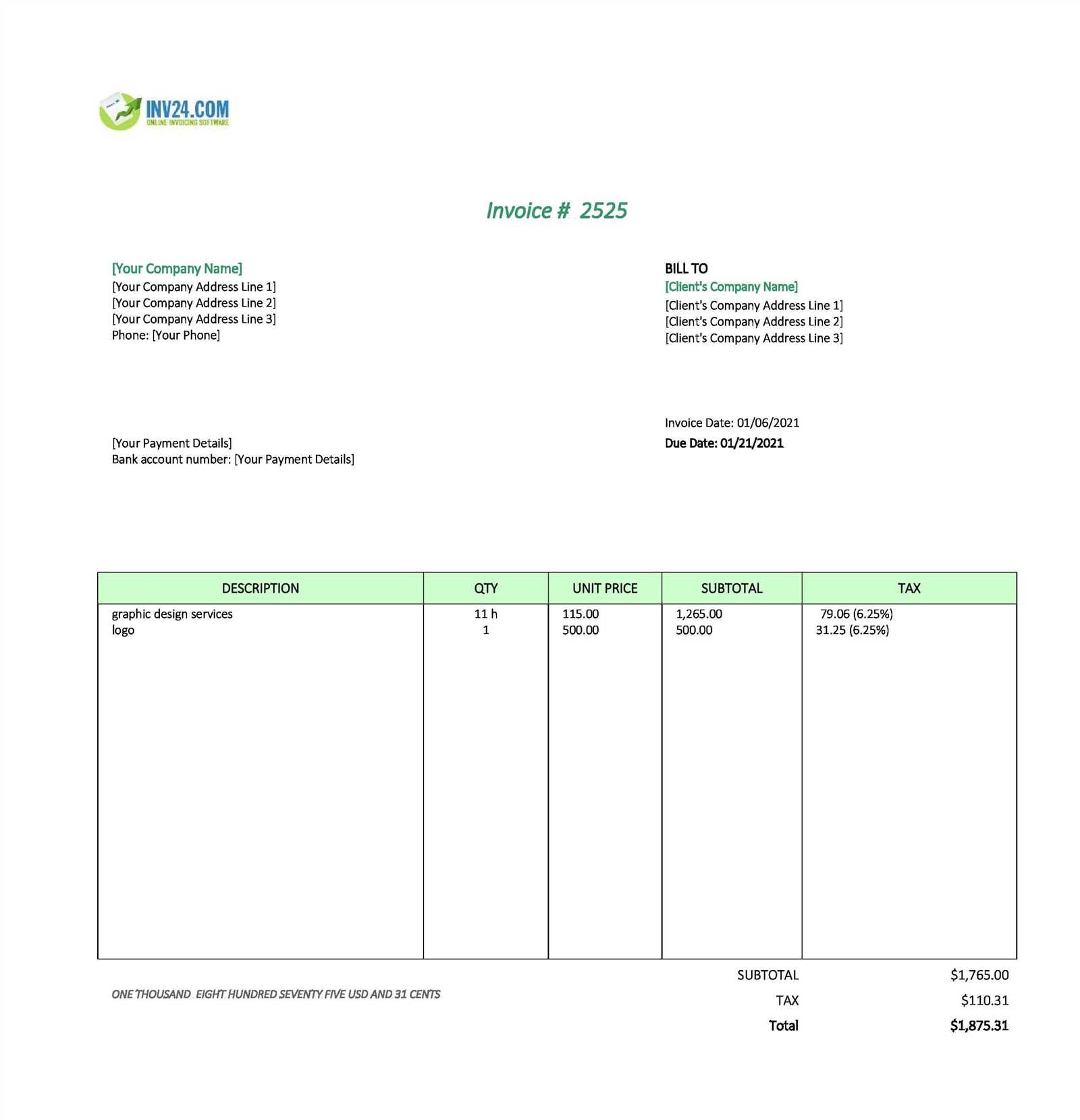

Free vs Premium Payment Documents

When it comes to creating professional payment documents, choosing between free and premium options is an important decision. Both options offer different levels of customization, design quality, and support. The choice largely depends on your needs and the scale of your business operations.

Free Payment Documents

Free options are widely available and can be a great starting point, especially for small businesses or those just beginning their operations. These documents typically offer basic functionality, including space for essential details like client information, payment terms, and amounts owed. However, their designs may be limited, and customization options could be minimal. Often, free templates are more generic and may lack advanced features such as automatic calculations or branding integration.

Premium Payment Documents

Premium documents, on the other hand, offer more flexibility and advanced features. They often come with a wider range of professional designs, and many allow for deeper customization. With premium versions, users typically gain access to templates that align better with their brand identity, include automatic calculations, and offer enhanced security options. Additionally, premium options often come with customer support, ensuring that any issues or queries are resolved efficiently.

| Feature | Free Documents | Premium Documents |

|---|---|---|

| Customization Options | Limited | Extensive |

| Design Quality | Basic | Professional |

| Automatic Calculations | Not Available | Available |

| Support | No Support | Customer Support Available |

| Price | Free | Paid |

Ultimately, the decision between free and premium documents depends on the specific needs of your business. If you’re just getting started and require simple functionality, free options may be sufficient. However, for those looking for more features, a professional look, and ongoing support, premium options provide greater value in the long run.