Download Sample Invoice Template in Word Format

When it comes to managing payments and maintaining professional communication with clients, having a ready-made document to track transactions is essential. These documents help ensure clarity and transparency, streamlining the entire process from creation to submission. Having an easily editable format can save time, reduce errors, and maintain consistency across different billing scenarios.

Finding a versatile and user-friendly option to generate such documents can greatly improve efficiency. With the right tools, you can quickly create professional-looking documents tailored to your business needs, ensuring that each bill reflects the unique aspects of your transactions. Whether you’re working with individual clients or larger corporations, the right solution can make all the difference.

Customizable billing documents are especially useful for businesses of all sizes. They offer flexibility in design, allowing you to adjust details such as payment terms, client information, and service descriptions. Using a well-structured template allows for quick customization without starting from scratch each time, making it an invaluable resource for both small business owners and large organizations alike.

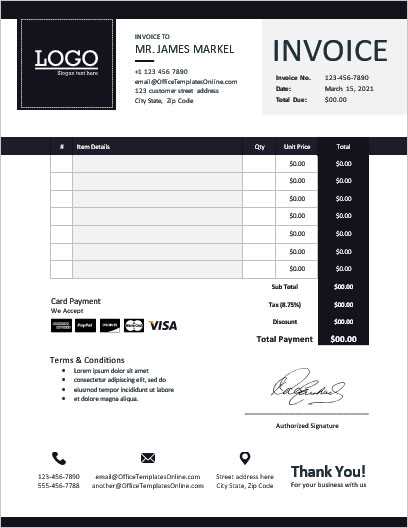

Sample Invoice Template Word Download

Having a structured document for managing payment requests is essential for any business. With the right layout, you can quickly organize transaction details, client information, and payment terms. Such documents offer a professional approach and help ensure both clarity and efficiency in your financial dealings.

Utilizing pre-made, editable formats allows you to customize and personalize each bill according to your specific needs. You can easily modify fields such as item descriptions, amounts, and contact details, making it suitable for a wide range of industries. These tools are especially useful for freelancers, small business owners, and large organizations alike, providing a quick and easy way to generate professional paperwork.

Pre-designed billing documents are available in various formats, and they offer great flexibility in terms of content. By choosing a well-structured solution, you can avoid the hassle of manually formatting each document. Using an adaptable format allows you to streamline the process and maintain consistency across multiple transactions.

Why Choose Word for Invoice Templates

When it comes to creating professional billing documents, having a flexible and widely accessible tool can make all the difference. Many businesses prefer using certain software due to its ease of use, compatibility, and customization options. The ability to quickly adjust the layout, text, and details of your document makes it an ideal choice for financial paperwork.

Ease of Use and Accessibility

One of the key reasons to choose this software for generating payment requests is its simplicity. Most users are familiar with its interface, allowing for easy navigation and quick document creation. Additionally, it’s compatible with nearly every operating system, making it accessible to a wide audience without any special requirements.

Customization and Flexibility

With this software, you have full control over your document’s design. Whether you need to add a company logo, change font styles, or adjust the overall layout, everything can be done with just a few clicks. Creating a custom bill ensures that your documents align with your business branding while maintaining a professional appearance.

How to Download Free Invoice Templates

Acquiring a free and customizable document for billing purposes has never been easier. With a simple search, you can access a variety of editable options that can suit any business need. These resources are often available online and can be saved directly to your device for immediate use.

Accessing Free Resources Online

Many websites offer free options that can be downloaded without any cost. Simply visit a trusted platform, search for the desired format, and choose the one that best fits your requirements. These sites typically offer a range of designs, from basic layouts to more advanced and detailed documents.

Saving and Editing Your Document

Once you have found the right option, you can easily save the document to your computer. Afterward, the file can be edited as needed, allowing you to fill in client details, payment terms, and other important information. Customizing your document ensures it aligns with your brand and specific business needs.

Step-by-Step Guide to Editing Templates

Editing a pre-designed document for billing purposes is a straightforward process. With the right tools, you can easily customize every aspect of the document to suit your business needs. Follow these simple steps to ensure that your document is personalized and ready for use.

1. Open the File

- Locate the saved file on your device.

- Double-click to open it with your preferred document editing software.

2. Modify the Header Information

- Update your company’s name and contact details, including address and phone number.

- Add your company logo if necessary, ensuring it fits the design layout.

3. Edit Client Details

- Fill in the client’s name, address, and contact information.

- Ensure all fields are correctly aligned and formatted for clarity.

4. Customize the Transaction Information

- Adjust the descriptions, quantities, and prices for the services or products provided.

- Ensure tax rates, discounts, and total amounts are accurate.

5. Finalize and Save the Document

- Review the document for any missing or incorrect information.

- Save the file under a new name to preserve the original template for future use.

By following these simple steps, you can ensure that your billing documents are clear, professional, and tailored to your specific business needs.

Customizing Your Invoice for Business Needs

Tailoring

Top Benefits of Using Invoice Templates

Using a pre-designed billing document offers numerous advantages for businesses of all sizes. These ready-to-use files streamline the billing process, reduce errors, and ensure that important details are never overlooked. Whether you’re managing a few transactions or a high volume of orders, having a structured format can save time and improve accuracy.

One of the key benefits is efficiency. By eliminating the need to create a document from scratch every time, you can quickly generate and send out payment requests without losing focus on other tasks. This saves valuable time, allowing you to focus on growing your business or serving clients.

Consistency is another major advantage. A standardized format ensures that all of your financial documents look professional and contain the same essential elements. This consistency not only builds trust with your clients but also helps to maintain a clear and organized record of transactions.

Additionally, customization options allow you to tailor each document to meet the specific needs of your business and clients. From adjusting payment terms to incorporating branding elements, you can create personalized bills that reflect your unique business practices.

Common Mistakes When Creating Invoices

Even with a structured billing document, it’s easy to overlook key details that can lead to confusion or delays in payment. Many businesses make common errors when preparing their financial documents, which can affect both their cash flow and client relationships. Avoiding these mistakes ensures that your documents are accurate, clear, and professional.

1. Missing or Incorrect Contact Information

One of the most frequent mistakes is failing to include complete contact details. Omitting a client’s full name, address, or business information can lead to confusion or delays in payments. Similarly, if your own contact information is incorrect, clients may struggle to reach you for clarification. Always double-check that all relevant details are accurate and up to date.

2. Not Clearly Stating Payment Terms

Failing to clearly outline payment terms can lead to misunderstandings and late payments. Be sure to specify due dates, any applicable discounts for early payments, and any penalties for overdue balances. Clear payment terms ensure that both parties are on the same page and help to prevent unnecessary disputes.

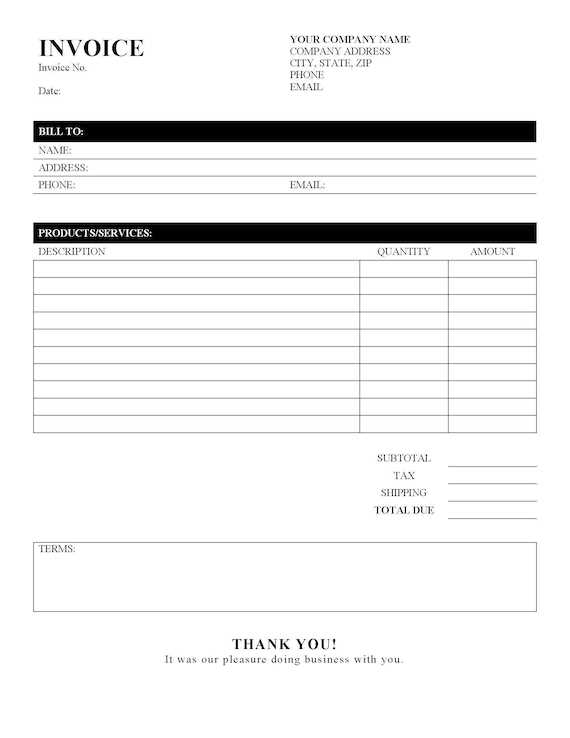

How to Ensure Professional Invoice Formatting

Creating a well-structured and visually appealing billing document is essential for presenting a professional image to clients. Proper formatting not only ensures clarity but also promotes a sense of trust and reliability. With a few key steps, you can ensure that your financial documents stand out for all the right reasons.

1. Maintain a Clean and Simple Layout

- Use clear, easy-to-read fonts like Arial or Times New Roman.

- Keep the text size consistent, especially for headings and body text.

- Avoid overcrowding the document with unnecessary elements.

2. Align Elements for Readability

- Ensure that text, numbers, and columns are properly aligned to create a neat and organized appearance.

- Use bold for section titles or important information like totals and payment terms.

- Leave enough space between sections to avoid a cluttered look.

Following these simple guidelines will help create a clear, professional document that clients will appreciate. Consistent formatting contributes to smoother business operations and helps maintain a professional image throughout your dealings.

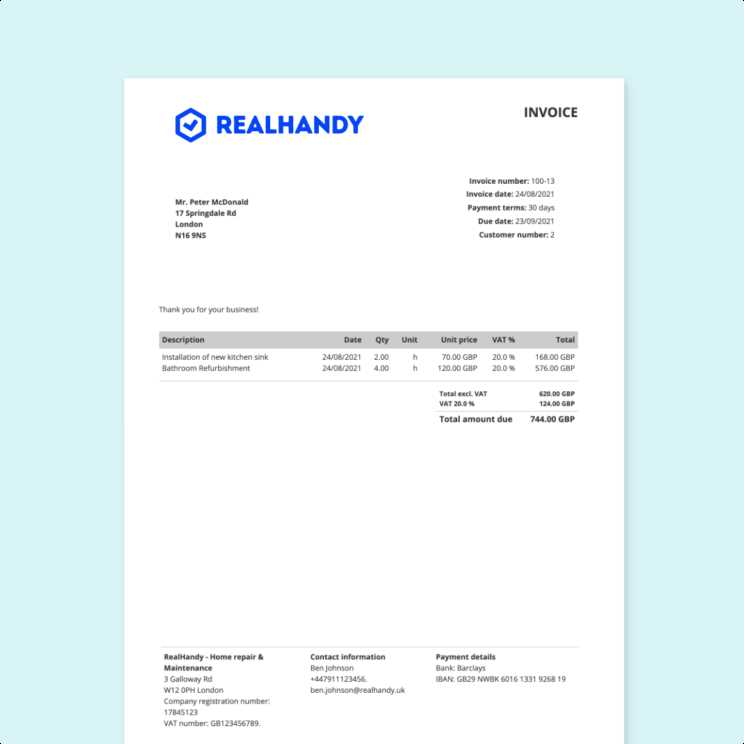

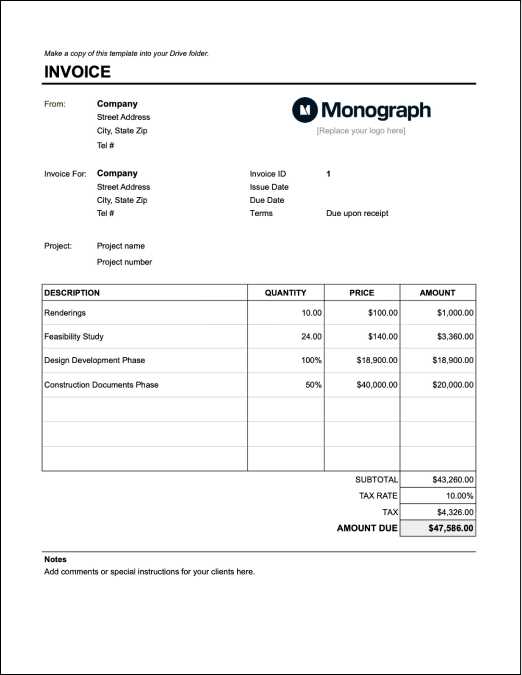

Types of Invoices and Their Uses

There are various kinds of billing documents used in different business scenarios, each serving a unique purpose based on the nature of the transaction. Understanding which type to use in each situation is essential for maintaining accurate financial records and ensuring timely payments. Below, we explore the most common types and their specific applications.

1. Standard Invoice

The standard billing document is used for most straightforward transactions. It includes details such as the products or services provided, quantities, prices, and total amounts. This type is typically sent once the service has been completed or the goods have been delivered, and payment is expected within the stated terms.

2. Proforma Invoice

A proforma bill is usually issued before a product or service is delivered, providing an estimate or preliminary details about the transaction. It’s commonly used in international trade to give buyers an idea of what to expect in terms of costs. While it does not demand immediate payment, it serves as a commitment to the terms of sale.

3. Recurring Invoice

For ongoing services, a recurring billing document is used. This is ideal for subscription-based models or any service that requires regular payments. It outlines the periodic charges and payment schedule, ensuring that clients are aware of the upcoming charges and due dates.

Best Practices for Invoice Payment Terms

Establishing clear and consistent payment terms is crucial for smooth business operations and healthy cash flow. Well-defined terms help set expectations between businesses and clients, reducing confusion and ensuring that payments are made on time. Here are some best practices to consider when defining payment conditions for your financial documents.

Clearly state the due date on each document. Whether it’s a specific calendar date or a set number of days after the document is issued, make sure the due date is easy to identify. This clarity avoids any misunderstandings and helps clients prioritize their payments accordingly.

Offer multiple payment options to make it easier for clients to pay. Providing several methods–such as bank transfers, credit card payments, or online payment platforms–can streamline the process and reduce the likelihood of delays. Additionally, it shows flexibility and can enhance client satisfaction.

It’s also important to define late payment penalties if payments are not received within the agreed timeframe. Clearly mention any interest or late fees that will apply after the due date. This policy encourages timely payment and protects your business from cash flow issues caused by delayed transactions.

Lastly, communicate any early payment discounts that may be available. Offering a discount for early payment can incentivize clients to settle their balance sooner, benefiting both parties. Ensure that the terms of such offers are outlined clearly, specifying the exact discount and deadline.

How to Add Your Company Logo

Including your company logo in your financial documents is an excellent way to brand your business and present a professional appearance. A logo not only reinforces your identity but also adds a personal touch that can help strengthen your relationship with clients. Here’s how you can easily incorporate your logo into your billing documents.

First, ensure that your logo image file is high-quality and properly sized for inclusion. Ideally, the image should be clear and not pixelated, with a resolution that is appropriate for both digital and printed formats.

Next, most document editing software allows you to insert images directly into your document. Simply look for the “Insert” tab or option, choose the “Picture” option, and select the logo file from your computer. Position the logo in the top section of your document, typically aligned to the left or center, where it will be easily visible without interfering with the layout of other content.

Finally, ensure the logo doesn’t overpower the rest of the content. It should be appropriately sized so that it complements the document’s design without distracting from important details such as payment terms and transaction amounts. If needed, adjust the size to ensure it fits seamlessly with your chosen layout.

Creating a Tax-Compliant Invoice Template

Ensuring that your financial documents comply with tax regulations is crucial for avoiding potential legal issues and ensuring smooth business operations. A tax-compliant document includes all the necessary information required by tax authorities, ensuring that both you and your clients are on the same page when it comes to taxes. Here’s how to create a document that meets all necessary tax requirements.

Essential Elements for Tax Compliance

- Tax Identification Number (TIN): Include your business’s tax ID number, as well as any applicable tax numbers for your client, depending on the region.

- Tax Rate and Amount: Clearly state the applicable tax rate and the total amount of tax charged for the transaction.

- Detailed Itemization: Break down the items or services provided, showing how the tax is applied to each individual item or service.

- Taxable Status: Indicate whether or not the transaction is subject to tax, particularly if you are operating in an area with complex tax rules.

Tips for Creating a Compliant Document

- Ensure that the tax rate you use is current and in line with local laws. Stay updated with any changes in tax legislation.

- Double-check your tax calculations to avoid errors, as incorrect charges can lead to disputes or fines.

- Clearly communicate any exemptions, deductions, or special tax rates applied to the transaction.

By following these guidelines and including all necessary details, you can ensure that your billing documents remain compliant with tax laws, protecting your business from unnecessary complications.

Free Invoice Template Resources Online

There are numerous online platforms that offer free resources for creating professional billing documents. These resources can save time, enhance accuracy, and help you maintain consistency across all your transactions. Whether you’re looking for a simple design or a more detailed format, there are several websites that provide downloadable options suited to various business needs.

One of the easiest ways to find free resources is by searching for customizable templates that are already formatted to meet basic legal and business requirements. These can be tailored to fit the specifics of your business, such as adding your logo, payment terms, and services offered. Some platforms also allow you to adjust the tax rates and itemization to suit your region.

Additionally, many websites provide options that are fully compatible with popular document editing software, making the process of modifying and saving your billing documents simple. Some resources even come with tips on best practices, ensuring that you stay compliant with local business regulations.

Using free online resources can be a great solution for small businesses and freelancers who may not have the budget for specialized software. With the right resources, you can create professional-looking financial documents that align with your business’s branding and operational needs.

How to Save and Share Your Invoice

Once you’ve created your billing document, it’s important to save it in a format that ensures easy access and sharing. Additionally, knowing the best methods to distribute your document to clients can improve communication and payment processing. Here’s how you can save and share your completed financial document efficiently.

Saving Your Document

When saving your document, choose a file format that is widely accepted and preserves the document’s formatting. The most common formats are PDF, which ensures the layout remains intact across devices, and Excel for more detailed data management. Below is a comparison of popular file formats:

| Format | Advantages | Best For |

|---|---|---|

| Preserves formatting; widely used; professional appearance | Sharing with clients, archiving | |

| Excel | Editable; excellent for complex calculations | Internal use, record-keeping |

| Word | Easy to edit and format; compatible with most systems | Internal edits, drafts |

Sharing Your Document

After saving your document in the desired format, it’s time to share it with the client. Here are a few options for sending your document:

- Email: The most common method for sending billing documents. Attach your saved file to an email and include a polite message with payment instructions.

- Cloud Storage: If you need to share multiple documents or large files, upload your document to a cloud service like Google Drive or Dropbox. Share the link with your client for easy access.

- Direct Messaging: For faster communication, you can use platforms like WhatsApp or Slack, though make sure the document format is compatible with the platform.

By saving your document in the right format and choosing the best method to share it, you ensure that your clients can easily access and process their payments in a timely manner.

Invoice Templates for Small Businesses

For small businesses, having a professional and efficient way to create billing documents is crucial to maintaining smooth operations and timely payments. Customizable document designs can help simplify the process, ensuring all necessary information is included while saving time. Below are a few options small business owners can use to create professional billing statements that align with their unique needs.

Choosing the right design is essential for both branding and clarity. A well-organized statement not only looks professional but also ensures clients understand payment terms, due dates, and itemized charges. Below is a comparison of different billing document styles often used by small businesses:

| Style | Features | Best For |

|---|---|---|

| Simple Layout | Basic design, easy to read, quick to fill out | Freelancers, service providers |

| Itemized Design | Breaks down charges by service or product | Retailers, contractors |

| Custom Branding | Incorporates company logo and colors | Businesses wanting a personalized touch |

Using these designs, small businesses can quickly generate professional documents that are tailored to their specific industry, making the billing process easier and more effective. The right format can also help create a positive impression on clients, contributing to long-term business relationships.

Why Invoice Templates Save Time and Money

Creating clear and accurate billing documents is essential for every business, but the process can be time-consuming and repetitive. Using ready-made designs can streamline the task significantly, helping companies save both time and money. By eliminating the need to start from scratch every time a billing document is needed, businesses can operate more efficiently, allowing them to focus on other important tasks.

Time Efficiency

Ready-to-use designs simplify the creation process by providing a predefined structure. This reduces the amount of time spent on organizing information, ensuring that every detail is accounted for and presented in a professional manner. By having a consistent layout, employees or business owners can quickly generate billing documents without needing to format or adjust the layout each time.

Cost Savings

By saving time, businesses can reduce labor costs associated with administrative tasks. Instead of allocating time and resources to create new documents, using a pre-designed layout allows for faster turnover and fewer errors. Moreover, businesses can avoid the costs associated with hiring external services or purchasing expensive software to create customized forms. The ability to reuse a simple, efficient document saves both time and money in the long run.

By integrating ready-made designs into their workflows, businesses not only improve productivity but also ensure that billing is done in a timely, consistent, and professional manner, which can further strengthen client relationships and improve overall cash flow management.