Freelance Illustrator Invoice Template for Quick and Professional Billing

For any creative professional, organizing payments and ensuring timely compensation is crucial. Having a reliable system to manage financial transactions not only enhances professionalism but also reduces the chances of misunderstandings with clients. Whether you’re working on a short-term project or a long-term collaboration, keeping track of earnings and managing the invoicing process efficiently is essential for maintaining a sustainable business.

Creating a structured document that outlines the agreed-upon payment details, work completed, and payment terms can help you maintain clarity in your business dealings. A well-organized billing document is a sign of professionalism and helps foster trust with clients, ensuring that you get paid accurately and on time.

In this guide, we’ll explore the key elements that make up a successful payment request document, how to customize it to fit your needs, and some tips for simplifying the process. Whether you’re just starting or are an experienced professional, the right approach to billing can save you time and reduce administrative headaches.

Freelance Billing Document Guide

Creating a professional billing document is a key step in ensuring smooth financial transactions with clients. A well-structured document not only helps in communicating payment expectations clearly but also establishes a professional image. This guide will walk you through the essential components needed in such a document and provide a practical overview of how to create one for your creative work.

Regardless of the service you offer, the core elements of a payment request remain the same. These include details about the work performed, the amount due, and the terms for payment. A solid billing document helps you keep track of payments, avoid misunderstandings, and ensure you’re compensated fairly for your time and expertise.

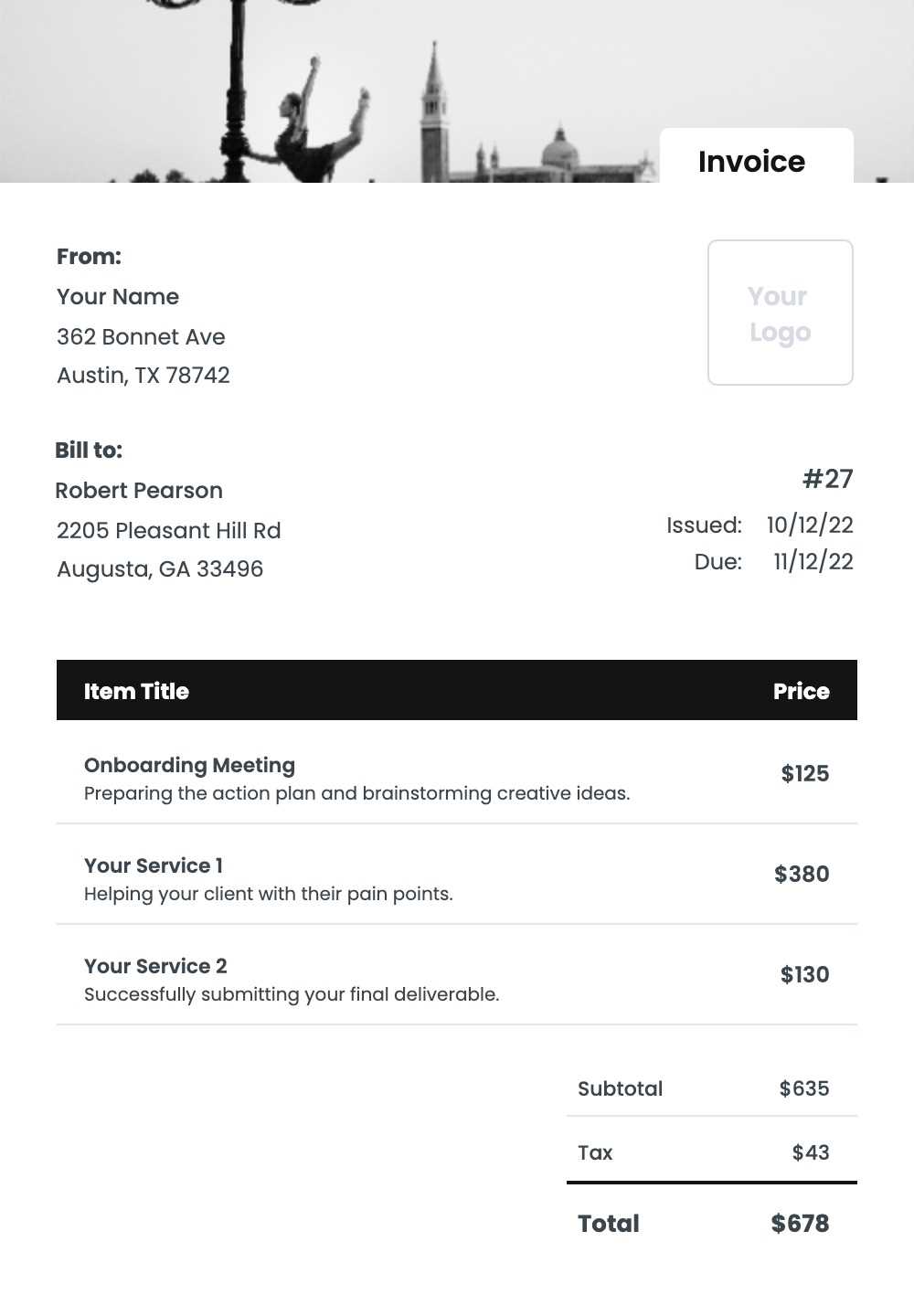

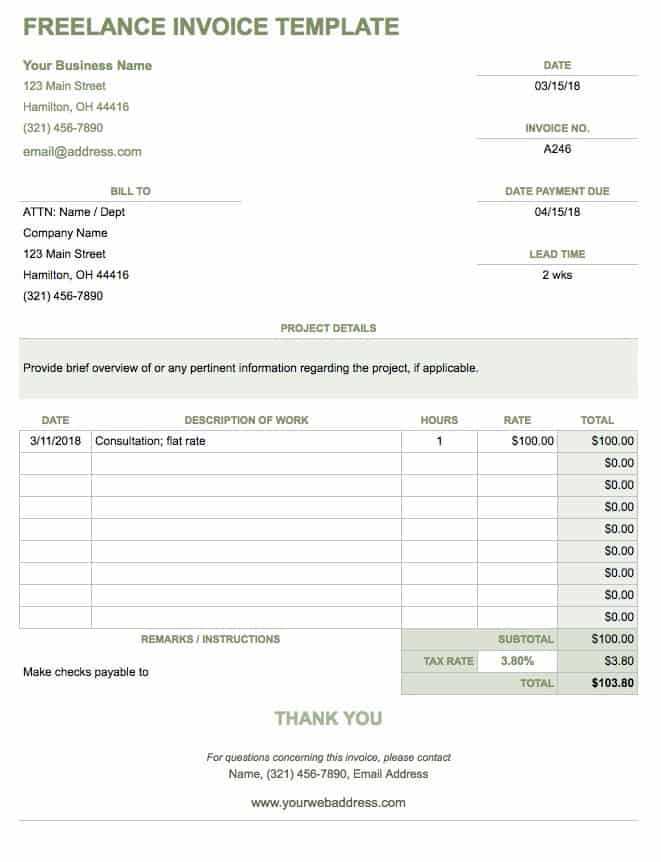

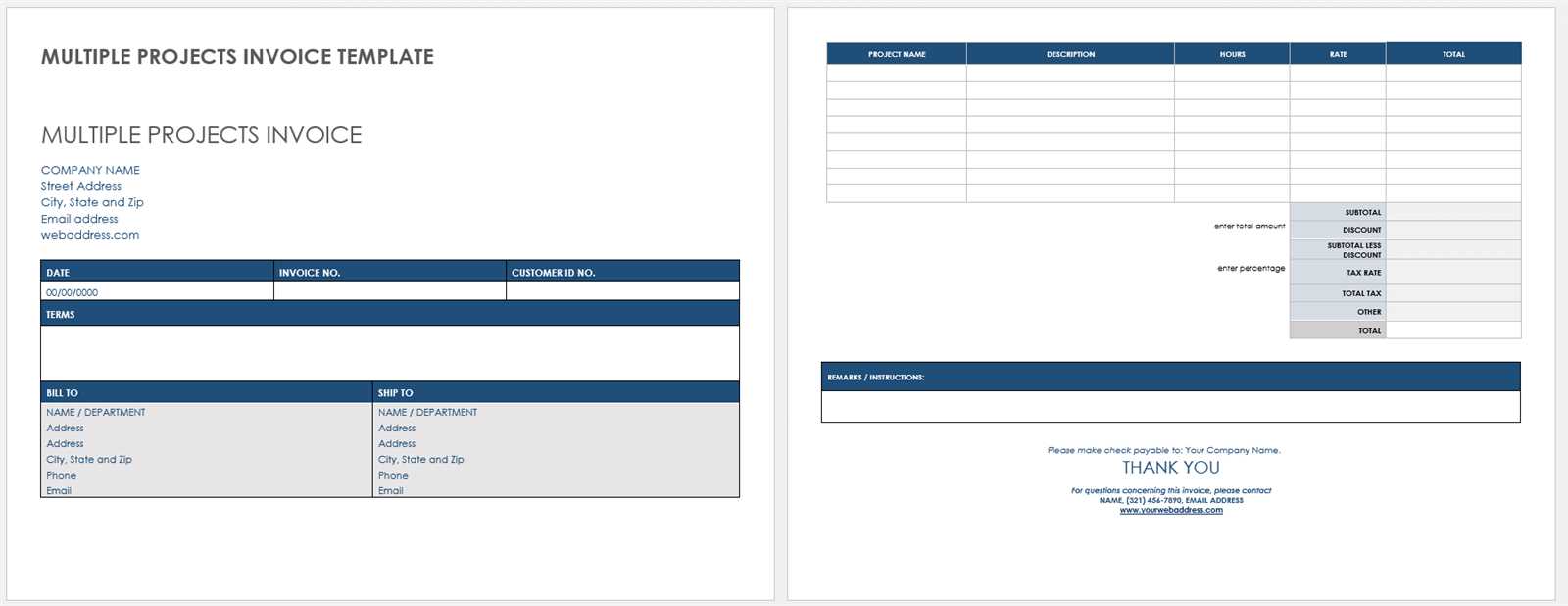

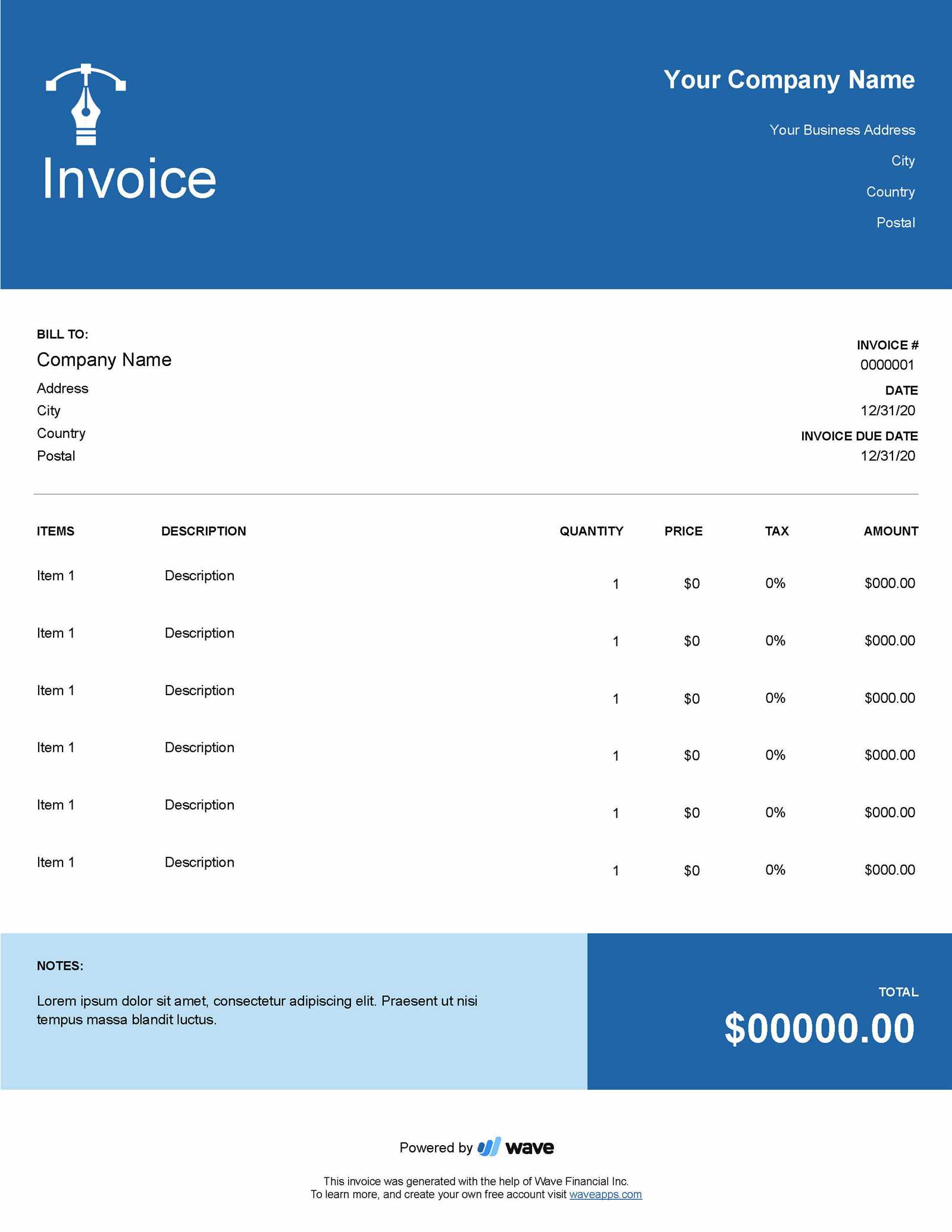

Here’s an overview of the basic sections to include in your document:

| Section | Description |

|---|---|

| Client Information | Include the client’s name, contact details, and billing address to ensure proper identification. |

| Your Details | Make sure to provide your name or business name, address, and contact information. |

| Work Description | Clearly describe the services or work completed, including any specifics like time spent or deliverables provided. |

| Amount Due | State the agreed-upon price for your services, including any taxes or additional fees. |

| Payment Terms | List the payment

Why Use a Billing Document Structure

Using a structured format for requesting payment brings significant benefits, whether you’re new to the industry or have been working for years. A well-organized financial document not only saves time but also ensures clarity between you and your client. Without a consistent structure, tracking payments and following up on outstanding amounts can become confusing and lead to unnecessary delays. Here are the key reasons why using a pre-designed structure is essential: Streamline the Process

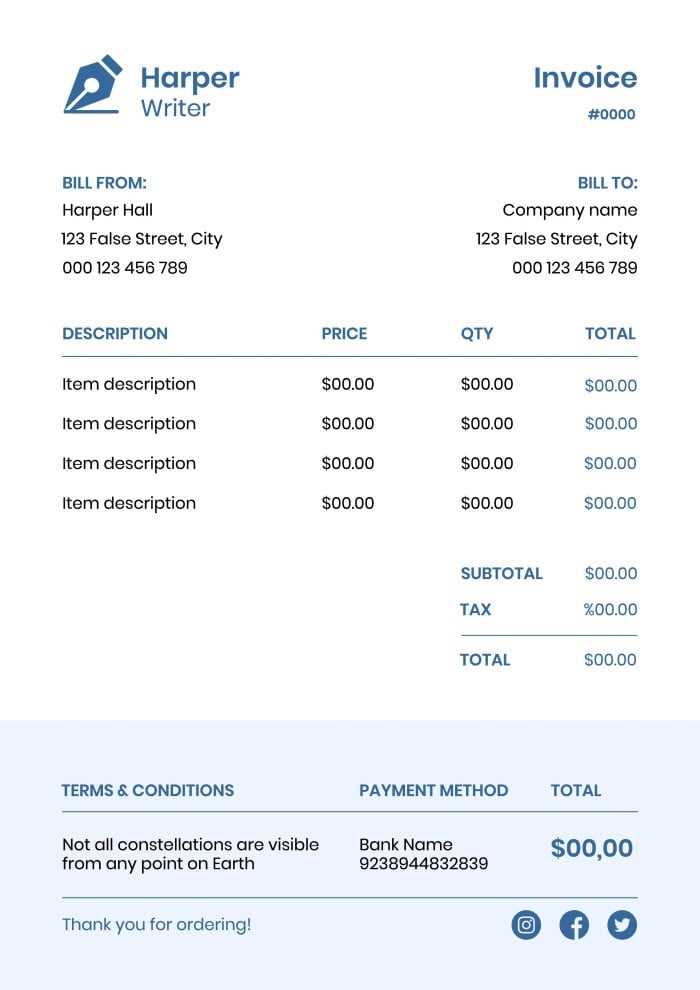

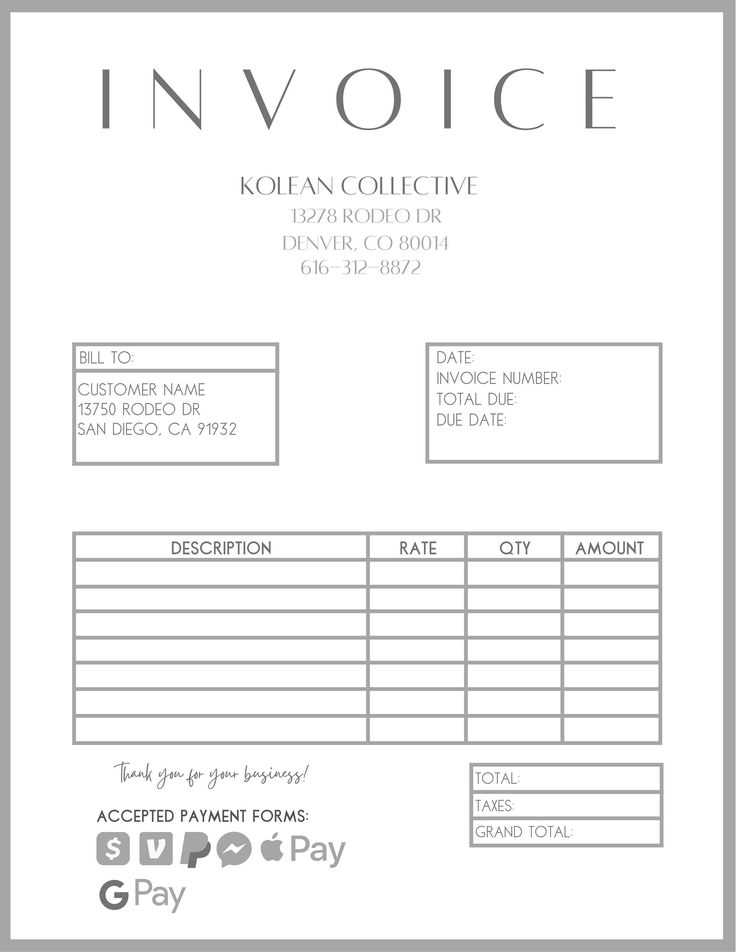

Enhance Professionalism

By adopting a standardized approach to your financial documents, you not only save valuable time but also ensure that your work and payment expectations are presented in the most professional manner possible. A solid structure reinforces your commitment to delivering quality work and helps maintain smooth relationships with clients. Key Elements of a Billing Document

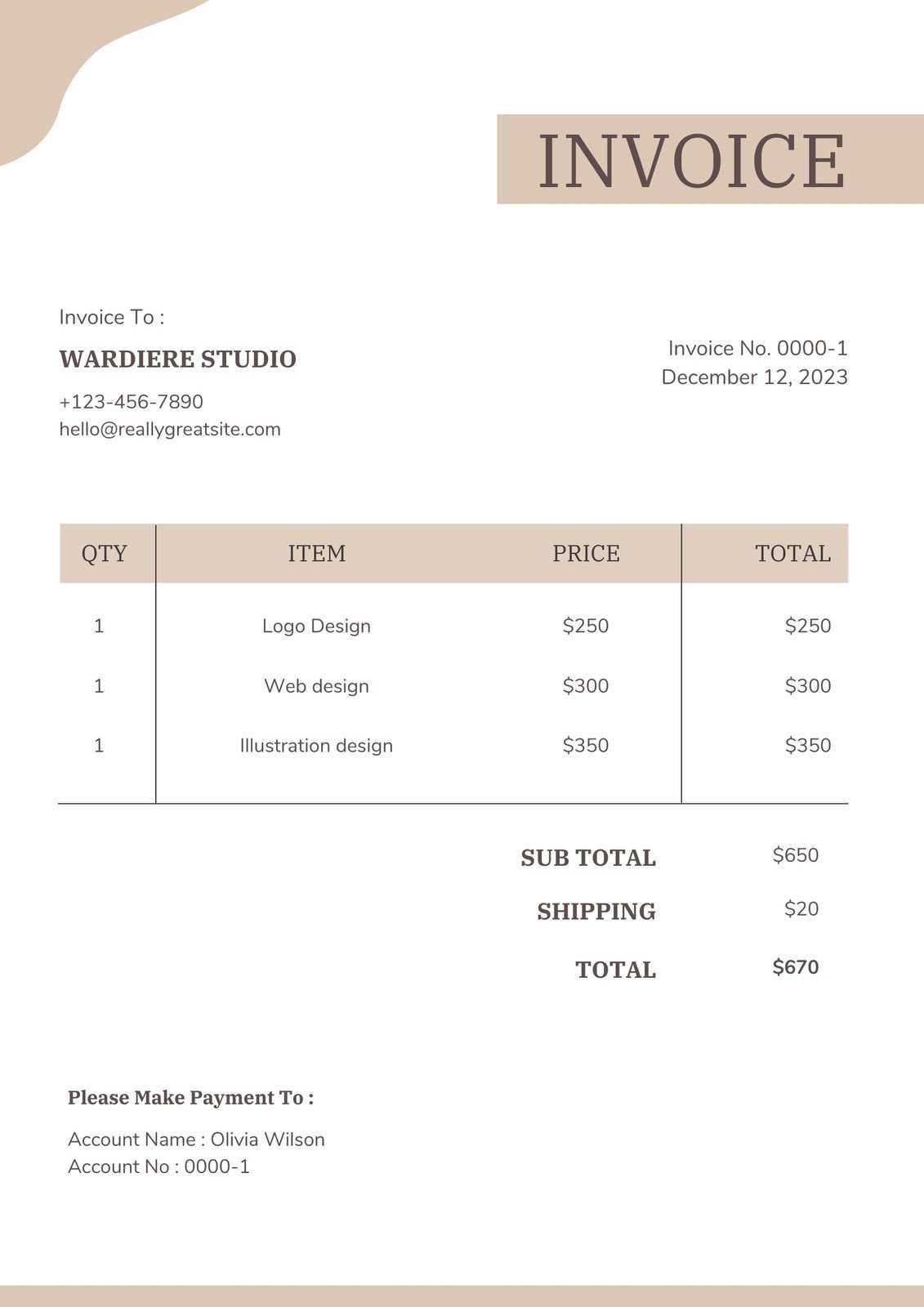

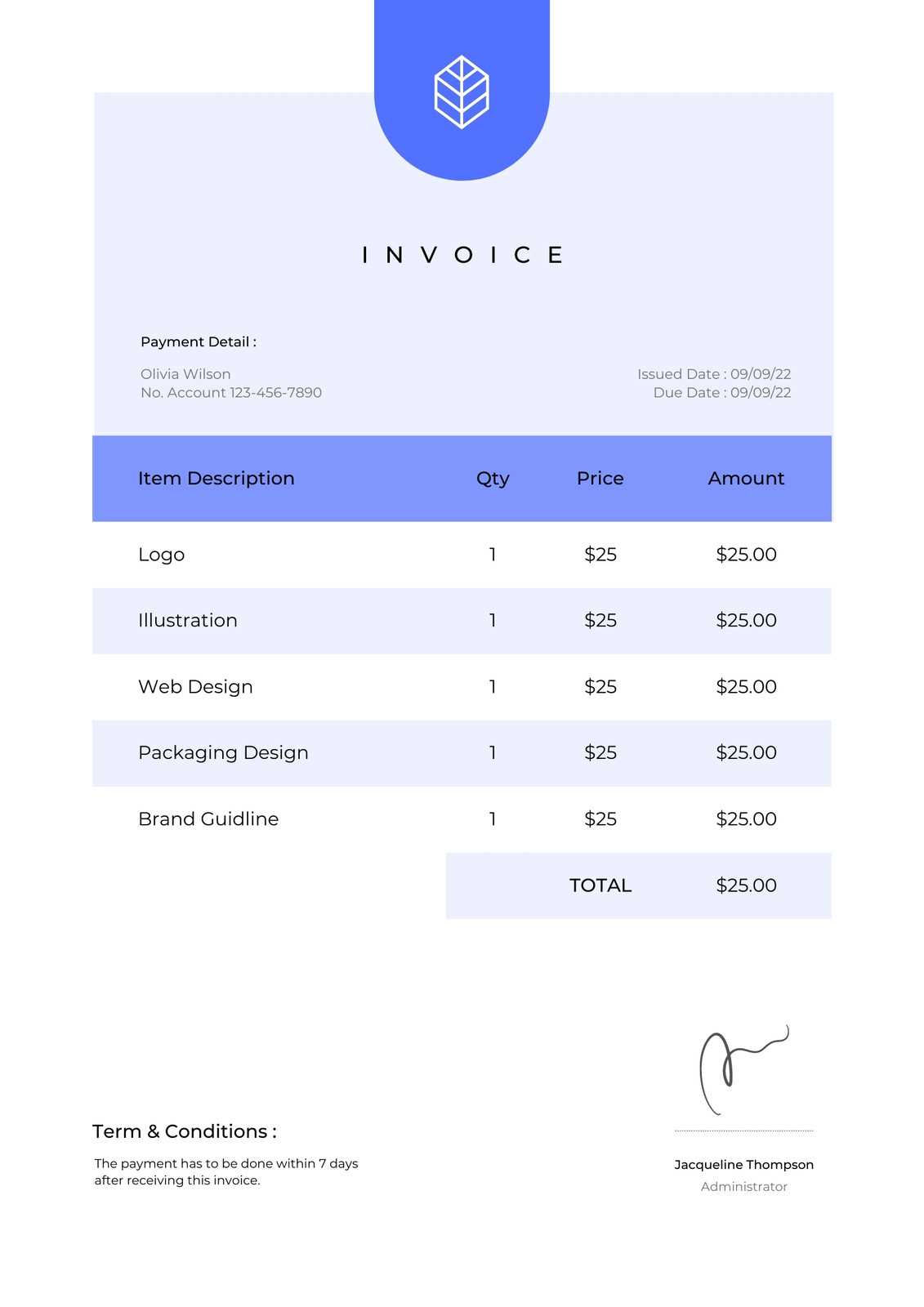

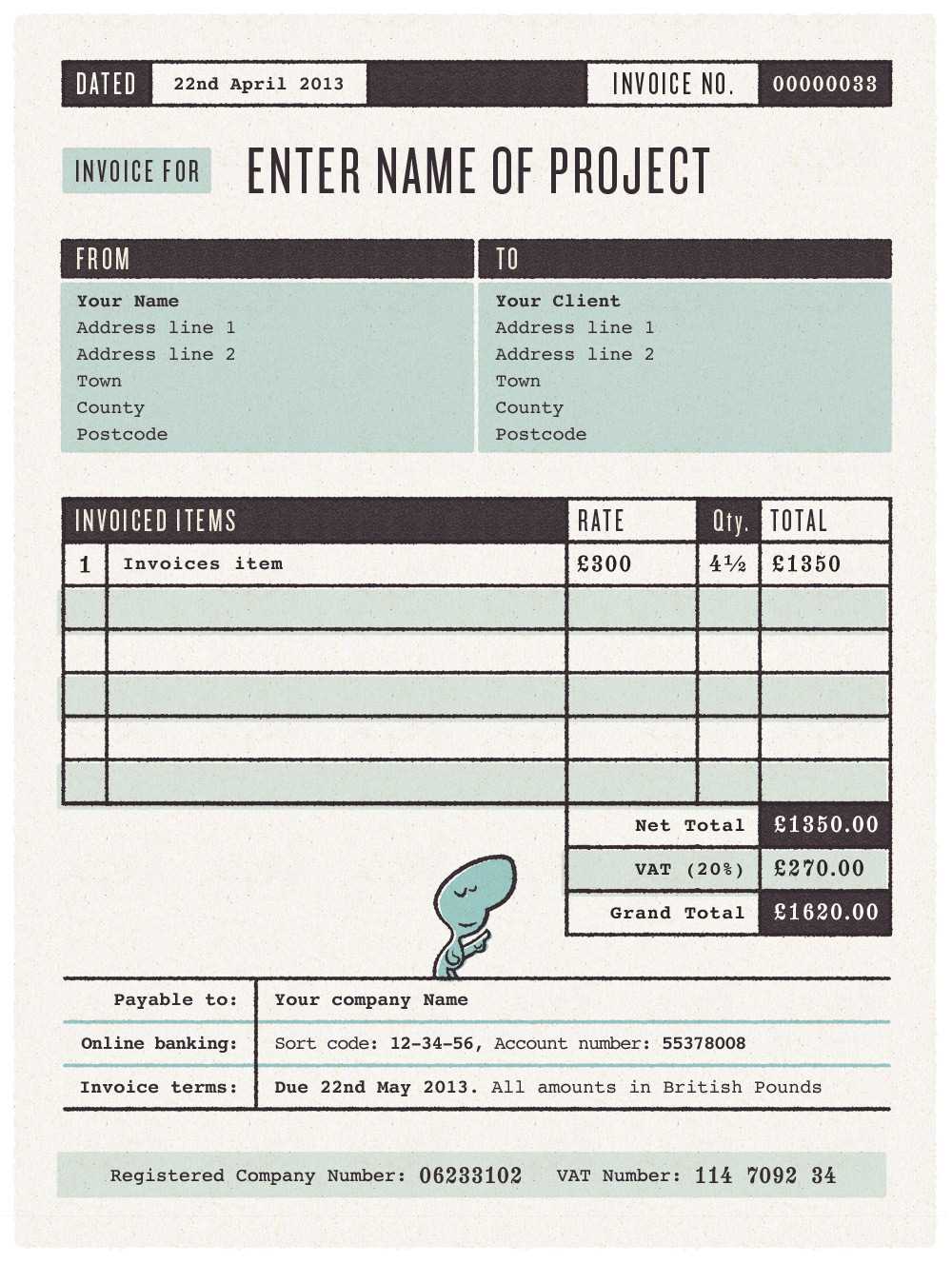

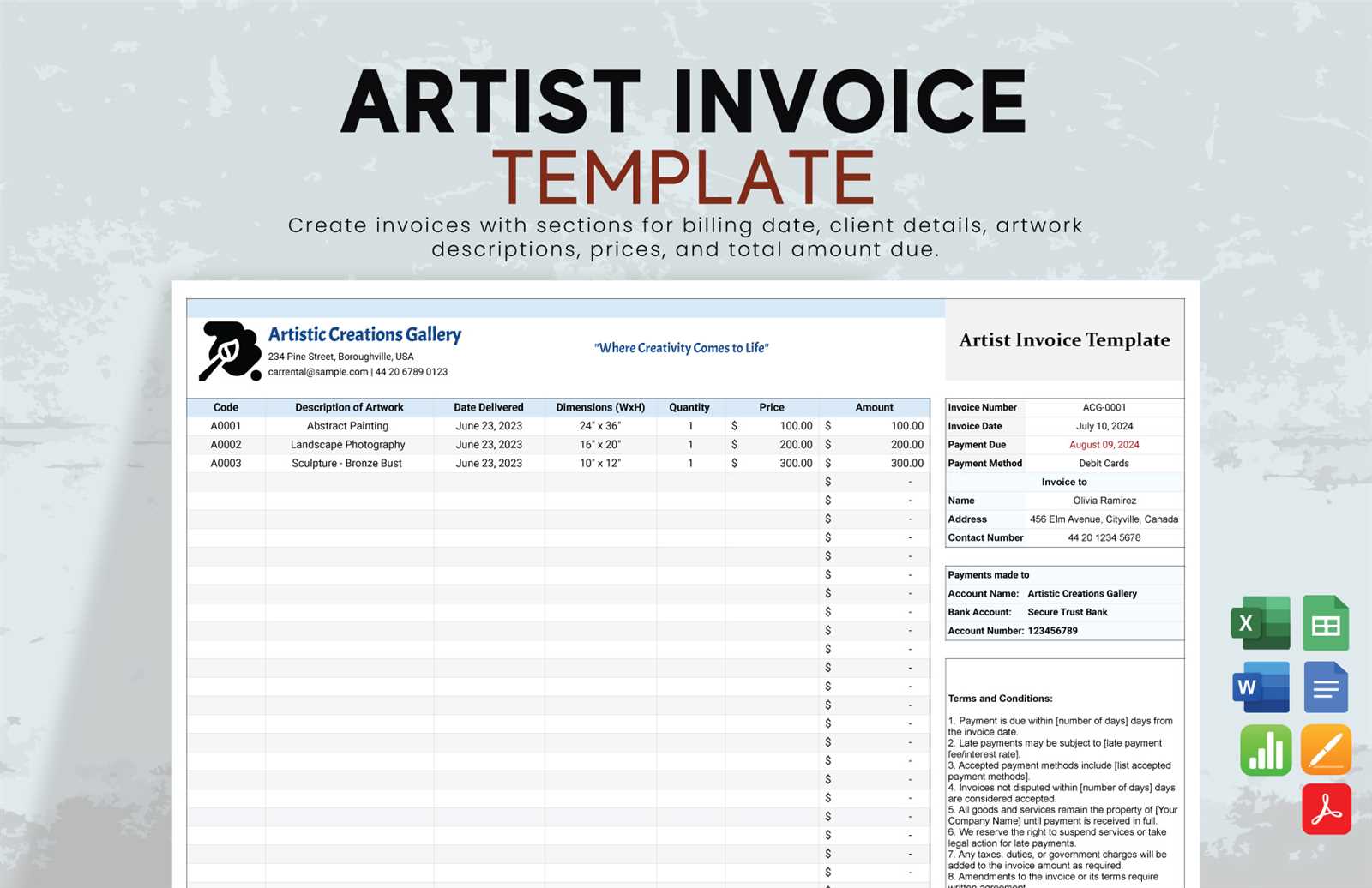

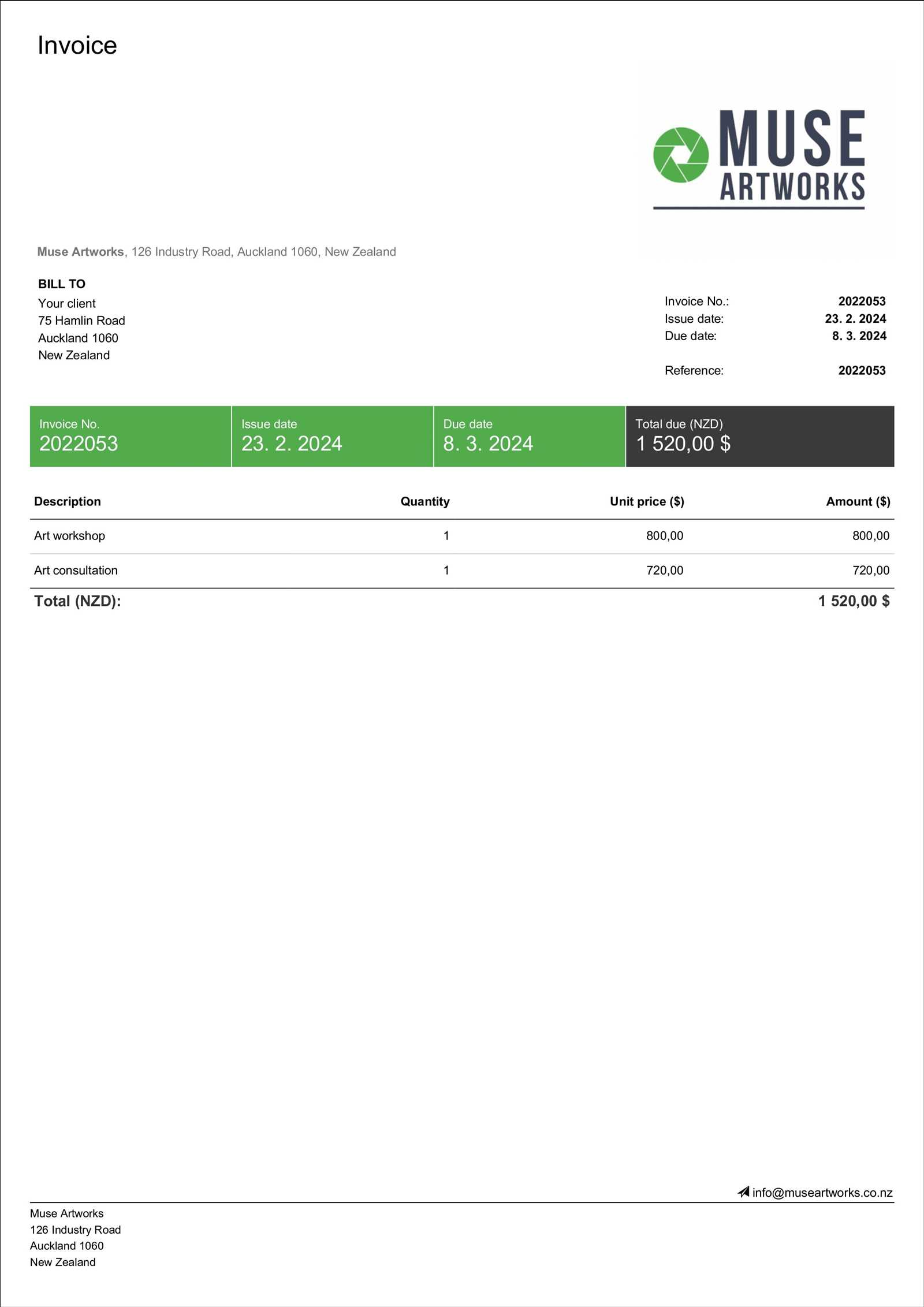

When requesting payment for your services, it’s crucial to include all necessary details to ensure that both you and your client are clear about the terms. A well-structured document not only provides transparency but also protects both parties in case of disputes. The following sections are essential to include in any financial document to make sure everything is covered and accurate. Client and Provider InformationClear identification of both the service provider and the client is a must. This includes full names, addresses, and contact details. Providing this information helps avoid confusion, especially when dealing with multiple clients or projects at once. Having this information on hand also ensures that both parties are easily reachable if any issues arise.

Work Details and Payment TermsClearly describe the work completed or the service provided. This section should be as detailed as necessary to avoid any confusion about the work that was agreed upon. Along with a description, include payment terms such as rates, the amount due, and payment deadlines. Specifying these terms can help ensure you are paid on time and in full.

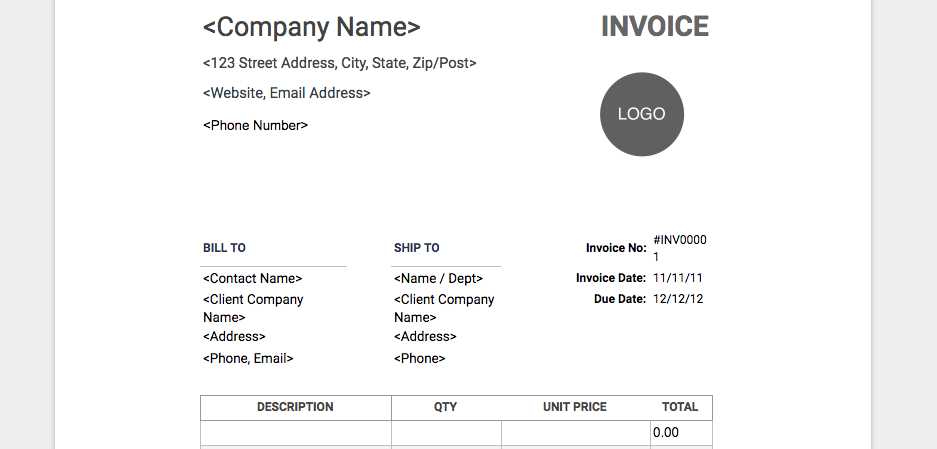

By including these key elements in your payment request, you ensure that both you and your client have a mutual understanding of the expectations and terms. This transparency reduces the potential for disputes and fosters a more professional relationship. How to Customize Your Billing DocumentCustomizing your financial document is a crucial step in making sure it reflects your personal or business brand while also meeting the specific needs of each client. A standardized structure is useful, but personalizing it can enhance professionalism and help establish a consistent appearance across all your transactions. Here’s how you can adapt the document to better suit your preferences and requirements. Adjusting the Layout and DesignThe design of your payment request should be simple, clear, and easy to read. Customizing the layout allows you to match your personal style or brand identity, which can help you stand out in a competitive market. Consider these elements when designing your document:

Modifying Sections to Fit Your BusinessWhile many billing structures follow a similar outline, certain details may vary depending on the nature of the work or your client’s needs. Customizing specific sections can make the process more efficient:

Including Additional FeaturesDepending on your needs, you can also incorporate additional features into your document to make the billing process smoother:

|