Creating a Professional Template Email Invoice

In today’s fast-paced business environment, efficiency is key, especially when it comes to managing payments. A well-organized system for creating and sending transaction details can save time, reduce errors, and improve customer satisfaction. By implementing a structured approach to billing, businesses can ensure that clients receive clear and professional communication each time an order is processed.

Automating the process of preparing and sending payment requests helps businesses avoid the repetitive task of creating documents from scratch. By using pre-made structures, businesses can focus on more important tasks, while still maintaining a personal touch in their communications. This method not only simplifies the process but also helps establish consistency and reliability with clients.

Having a reliable way to present payment details ensures that clients understand exactly what they owe and how to settle their accounts. With the right tools in place, companies can streamline their operations and enhance their professional image, all while improving cash flow and reducing delays in payment collection.

Why Use an Invoice Format for Communication

Efficient billing is an essential part of any business, and having a consistent, professional method for sending payment details can significantly streamline the process. Adopting a standardized approach to billing correspondence helps businesses save time, reduce mistakes, and present themselves as more organized and reliable to clients.

Time-Saving and Efficiency

Using a consistent format for payment requests eliminates the need to recreate documents every time. Instead of manually drafting each message, businesses can quickly fill in necessary details such as amounts, due dates, and services provided. This approach offers several advantages:

- Faster Processing: Generate and send billing details in a matter of minutes.

- Consistency: Ensure every client receives the same clear and professional communication.

- Reduced Errors: Minimize the chances of missing or incorrect information.

Improved Professionalism and Trust

Clients expect clear, well-organized documents that reflect a company’s attention to detail. By using a standardized format, businesses can convey professionalism and foster trust with their customers. Key benefits include:

- Clear Communication: Easily understandable details that help clients know exactly what they owe.

- Branding Opportunities: Customizable formats can align with your company’s branding for added credibility.

- Reliability: Clients are more likely to pay promptly when they receive a consistent, professional request for payment.

Key Benefits of Invoice Formats

Adopting a predefined structure for billing communications offers significant advantages for businesses looking to streamline their processes. A standardized approach provides consistency, saves time, and enhances accuracy, making it easier to manage financial transactions efficiently. Below are some of the primary benefits of using a structured format for payment requests.

- Efficiency: With a ready-made framework, businesses can quickly generate and send payment requests without starting from scratch each time. This reduces the amount of time spent on administrative tasks.

- Consistency: A uniform format ensures that all communications are clear, professional, and contain the same essential information. This consistency builds trust with clients and helps avoid confusion.

- Accuracy: By relying on a preset structure, the chances of missing key details or making errors are significantly reduced. This helps businesses maintain reliable records and avoid costly mistakes.

- Professional Image: A polished, structured approach reflects well on a business, creating a more professional image that can foster better client relationships and prompt payment.

- Customization: Predefined formats can often be tailored to meet specific needs or branding requirements, allowing businesses to personalize their communications while maintaining consistency.

How to Customize Your Billing Format

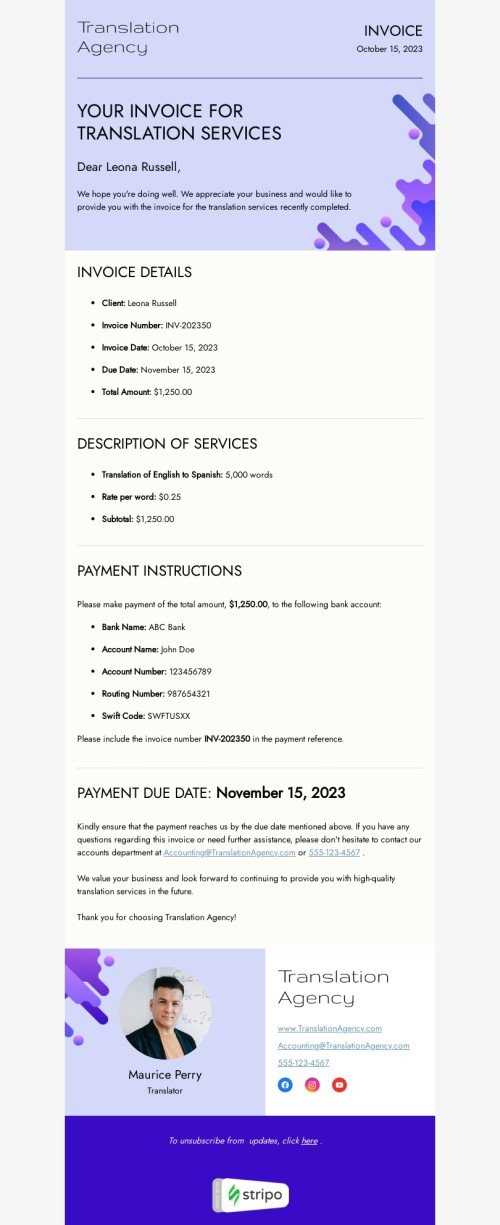

Customizing a standard billing structure allows businesses to tailor the document to their specific needs while maintaining a professional appearance. Whether you’re looking to adjust the layout, add personalized details, or include specific payment terms, having a flexible format makes it easy to adapt to various client requirements. Here are some essential steps to customize your payment request structure.

Adjusting the Layout and Design

The layout and overall design of your billing document can play a crucial role in how your client perceives the professionalism of your business. Consider adjusting the following elements:

- Logo and Branding: Add your company’s logo and color scheme to reinforce your brand identity.

- Contact Information: Ensure that your contact details are prominently displayed for easy communication.

- Section Organization: Organize the content into clear sections, such as services provided, payment terms, and total amount due.

Including Personalization and Payment Terms

Personalization can help build a stronger relationship with your clients. Adding specific details can make the document feel more tailored to each transaction:

- Client Information: Include the client’s name, address, and unique account number if applicable.

- Payment Terms: Clearly outline the due date, accepted payment methods, and any late fees if relevant.

- Custom Notes: Consider adding a personalized message thanking the client for their business or outlining next steps.

Choosing the Right Format for Billing Requests

Selecting the appropriate structure for sending payment details is crucial to ensure that the document is clear, professional, and easy to process. The format you choose should align with both your business needs and your client’s preferences. Different formats offer distinct advantages, and understanding which one works best for your situation can improve efficiency and client satisfaction.

Factors to Consider When Choosing a Format

Before deciding on a structure, consider these key aspects to ensure your billing documents meet all necessary requirements:

- Client Preferences: Some clients may prefer a simple, text-based format, while others might appreciate a more detailed, visually appealing design.

- Ease of Use: Select a format that is easy to fill out and adjust for each transaction, reducing the time spent preparing documents.

- Compatibility: Ensure that the format is compatible with the software or tools your business and clients use to avoid compatibility issues.

Common Formats for Payment Requests

There are several commonly used formats for structuring payment details. Here are a few to consider:

- Text-Based Format: A simple and straightforward layout that is easy to read and edit. Ideal for quick transactions and smaller businesses.

- PDF Format: Provides a more professional appearance and is easily shareable across different platforms. This format is suitable for clients who require formal documentation.

- Excel or Spreadsheet Format: Useful for businesses that handle multiple transactions and need to track payment status over time. Allows for easy calculations and record-keeping.

Essential Information to Include in a Billing Document

To ensure clarity and avoid confusion, it is important to include all the necessary details when preparing a payment request. A comprehensive document not only helps the client understand what is owed but also provides a record that can be used for future reference. The following are key elements that should always be included in a billing document.

Key Details for Accurate Billing

Each document should contain specific information that is crucial for both the business and the client. Missing or incorrect details can lead to delays in payment or misunderstandings. The following table outlines the most important elements to include:

| Information | Description |

|---|---|

| Business Information | Company name, address, phone number, and email for easy contact. |

| Client Information | Client’s name, address, and contact details for accurate delivery. |

| Unique Reference Number | A specific number to identify the transaction, for both parties’ records. |

| Payment Breakdown | A detailed list of services or products provided, including quantities and rates. |

| Due Date | The date by which the payment should be made to avoid penalties. |

| Payment Terms | Accepted payment methods and any applicable late fees or discounts. |

Additional Information for Clarity

Depending on your business or the transaction type, you might need to include extra details, such as:

- Tax Information: Ensure that any applicable taxes are clearly stated, including tax rates and total tax amount.

- Custom Notes: A section for any specific instructions or messages to the client, such as “Thank you for your business!”

Design Tips for Professional Billing Documents

A well-designed billing document is not only functional but also reflects your business’s professionalism. The layout, fonts, and organization of information all contribute to how your client perceives your brand. A clear, visually appealing design can enhance communication and help ensure that your payment request is taken seriously.

Keep it Simple and Clean: Avoid clutter by using white space effectively. A clean design makes the document easier to read and ensures that important details stand out. Group related information together and use clear headings to guide the reader.

Use Consistent Branding: Incorporating your company’s logo, color scheme, and font choices can reinforce your brand identity. Ensure that your document is aligned with other business materials to maintain a cohesive look.

Highlight Key Information: Important details, such as the total amount due and payment due date, should be easy to find. Consider using bold text or larger font sizes to make these elements stand out, so the client can quickly spot them.

Organize Information Logically: Present the details in a structured manner. Use tables to break down services or products, include clear headings for each section, and ensure that your business and client information is placed in easily identifiable locations. This organization enhances clarity and makes the document more user-friendly.

Choose Readable Fonts: Select a clean, professional font that is easy to read, both on screen and in print. Avoid overly decorative fonts, as they can make the document difficult to follow. Stick to common fonts like Arial, Helvetica, or Times New Roman for readability.

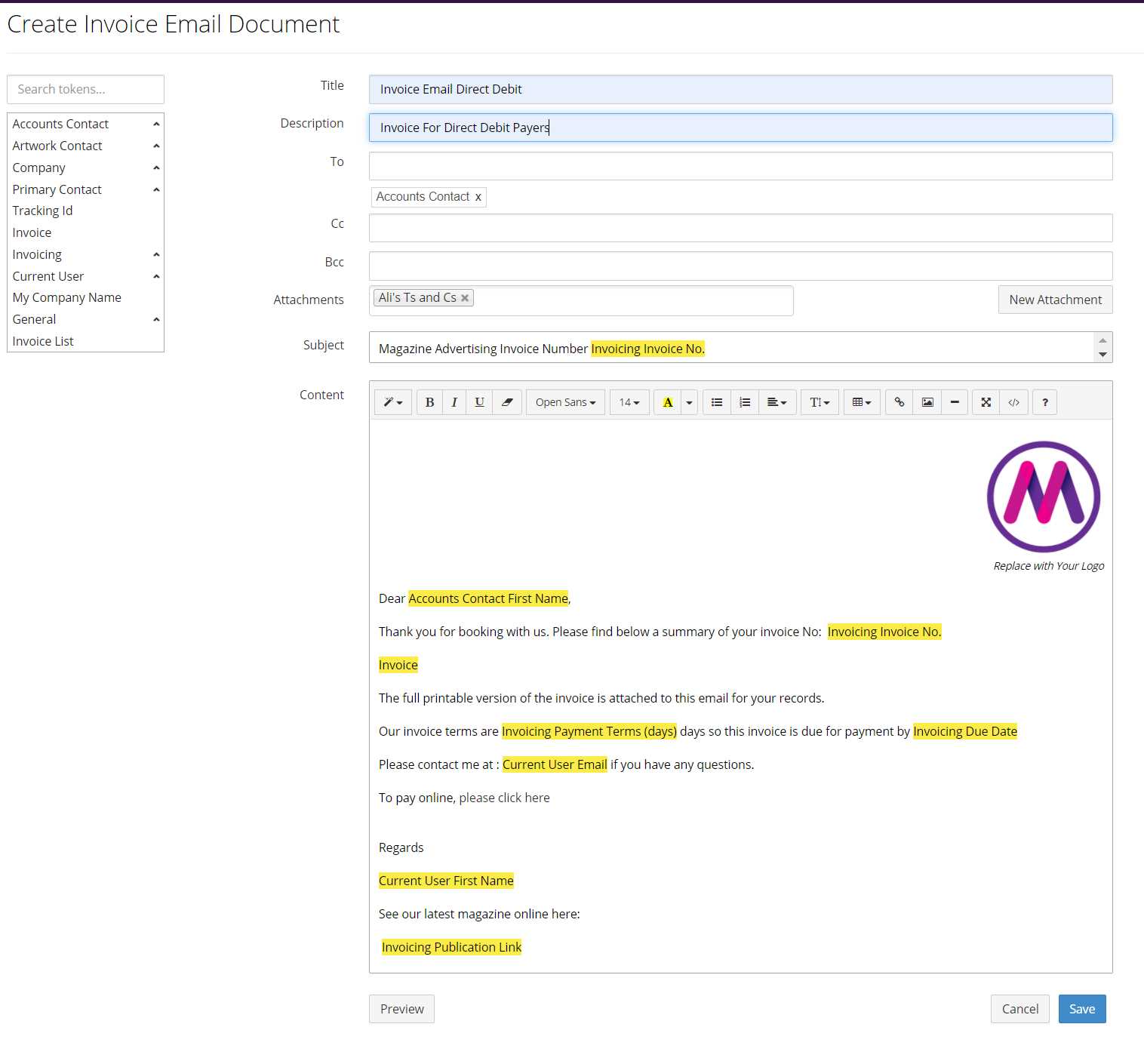

How to Automate Billing Document Creation

Automating the creation of payment requests can save significant time and effort for businesses, allowing them to focus on core activities. By leveraging technology, you can set up systems that automatically generate and send detailed billing statements without manual intervention. This not only speeds up the process but also reduces the chances of errors and ensures consistency.

Here are the essential steps to automate your payment document generation:

- Use Accounting Software: Many accounting platforms offer built-in automation features that allow you to set up recurring payment requests, track transactions, and generate documents automatically. Examples include QuickBooks, FreshBooks, and Xero.

- Integrate with Payment Systems: Link your payment processor with your accounting or billing software. This integration allows you to automatically capture transaction details and create a payment request as soon as a sale is made or a service is rendered.

- Create Templates: Set up a standardized format for your payment communications. This reduces the time spent on customization for each transaction and ensures consistency in presentation and content.

- Set Up Recurring Billing: For businesses with subscription models or regular customers, set up recurring billing schedules. Once established, the system will generate and send payment requests on predefined intervals, such as monthly or quarterly.

- Automate Notifications: In addition to generating the document, set up automatic email notifications to inform clients when a new payment request is available. You can also configure reminders for overdue payments.

By automating this process, businesses can not only streamline their operations but also enhance the customer experience by ensuring timely and accurate billing every time.

Best Practices for Sending Payment Requests

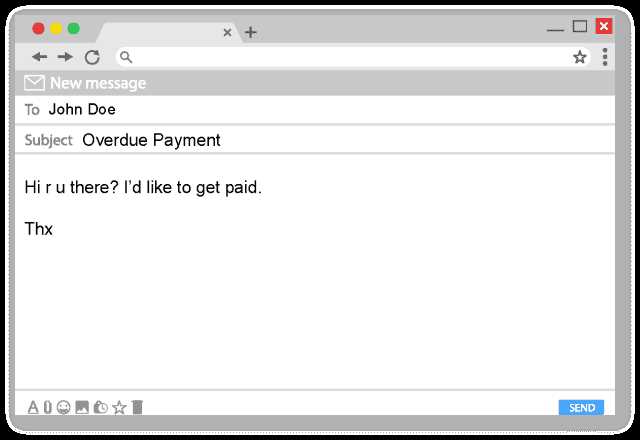

Sending clear, professional billing documents is essential for maintaining positive client relationships and ensuring timely payments. The way you communicate your payment details can affect how your clients perceive your business and how quickly they respond to your requests. Following best practices helps avoid confusion and ensures that both parties are on the same page.

Ensure Accuracy and Clarity

Before sending a payment request, double-check that all the information is correct. This includes verifying the recipient’s contact information, the billing details, and the payment terms. Make sure that the document clearly outlines the services or products provided, the amount due, and any other important terms. A well-structured and error-free request is more likely to be paid promptly.

Timing and Frequency

Sending payment requests at the right time is crucial. Ensure that you send them promptly after a service has been completed or a product has been delivered. Setting up automated reminders for overdue payments is also a helpful practice. This minimizes the chance of missed or delayed payments.

Here are a few additional best practices for sending billing documents:

- Use a Professional Subject Line: Keep the subject clear and concise, such as “Payment Request for [Service/Product]” to ensure it is easily identifiable.

- Attach the Document in a Common Format: Use widely accessible formats like PDF for the attachment, which ensures that your client can open and view the file without issues.

- Personalize Your Message: A brief, courteous note at the beginning of your email can help maintain a good relationship with your client, such as thanking them for their business or offering assistance with any questions.

Common Mistakes to Avoid with Billing Documents

Creating and sending a payment request might seem straightforward, but even small mistakes can lead to delays, confusion, or disputes. By being aware of common errors and avoiding them, you can ensure a smoother payment process and maintain a professional image with your clients.

Here are some frequent mistakes to avoid when preparing payment requests:

- Incorrect or Missing Contact Information: Always double-check that the client’s name, address, and contact details are accurate. Sending a document with wrong information can delay payments or cause misunderstandings.

- Failure to Include Payment Terms: Clearly outline your payment terms, including the due date, late fees, and accepted payment methods. Ambiguity here can lead to confusion and delayed payments.

- Not Providing a Clear Breakdown of Charges: Ensure that your request includes a detailed list of products or services, including quantities, rates, and total amounts. Clients may be hesitant to pay if they don’t understand what they are being charged for.

- Sending Documents Without Reviewing: Always proofread your documents for errors in calculations, spelling, or grammar. Mistakes can reduce your credibility and may lead to unnecessary disputes.

- Neglecting to Send Reminders: After sending a payment request, consider setting up automatic reminders for overdue payments. A polite reminder can significantly increase the likelihood of timely payment.

- Unprofessional Format: Avoid using inconsistent fonts, colors, or layouts. A disorganized or unprofessional document can negatively impact your business image.

- Not Keeping Records: Failing to maintain records of sent documents or payments can lead to confusion and missed opportunities to follow up on overdue payments.

Legal Considerations for Billing Documents

When it comes to sending payment requests, understanding the legal framework surrounding the process is crucial. Ensuring that your documents comply with relevant laws helps protect both your business and your clients. There are several key legal factors to consider to avoid potential disputes or complications.

Compliance with Local Regulations

Different regions and countries have specific regulations regarding the format and delivery of payment requests. It’s important to familiarize yourself with these rules, especially when dealing with international clients. Some jurisdictions may require certain information, such as tax identification numbers or specific language, to be included in your documents.

Electronic Signatures and Authentication

In many cases, electronic signatures are legally valid, but it’s essential to understand the requirements for them in your region. While some contracts or payment requests may require a physical signature, others may only need an authenticated digital signature. Ensure that the method you use to sign documents aligns with local laws regarding electronic transactions.

Data Protection and Privacy: Make sure that any personal or financial information included in your documents is protected in accordance with data protection laws such as GDPR or CCPA. Always take precautions to ensure that client information is stored securely and shared only with authorized parties.

Payment Terms and Enforcement: Be clear about your payment terms, including late fees, interest rates, and the steps you will take in case of non-payment. In many jurisdictions, these terms are legally enforceable as long as they are clearly stated and agreed upon by both parties.

Tracking and Managing Payment Settlements

Effectively tracking and managing payment settlements is a crucial aspect of maintaining healthy cash flow and ensuring the financial stability of a business. By staying on top of payments, you can avoid delays, prevent missed payments, and identify potential issues early. Implementing a streamlined system for monitoring these transactions can save time and reduce errors.

Methods to Track Payments

There are various ways to track payments, and selecting the right approach depends on the size of your business and the volume of transactions. Below are some common methods:

- Accounting Software: Using software like QuickBooks or Xero can help automate the tracking of payments, generate reports, and provide real-time updates on outstanding balances.

- Spreadsheets: For smaller businesses, tracking payments using a well-organized spreadsheet can be effective. You can manually enter payment details, update statuses, and monitor overdue accounts.

- Payment Processors: Many online payment processors, such as PayPal or Stripe, offer tools for tracking and managing transactions directly through their platforms.

Managing Overdue Payments

When payments are overdue, it’s important to have a clear procedure for following up. Implementing a systematic approach can help resolve payment issues swiftly. Consider the following strategies:

- Automated Reminders: Set up automatic reminders that notify clients when their payment is due or overdue. This can be done through accounting software or email scheduling tools.

- Clear Terms and Penalties: Ensure that your payment terms are clearly stated and include information on late fees or penalties for overdue payments. This helps motivate clients to pay on time.

- Personalized Follow-Ups: If reminders don’t work, send personalized follow-up emails or call the client directly to address the issue and discuss possible solutions.

By implementing effective payment tracking and management strategies, businesses can minimize payment delays, improve cash flow, and enhance client relationships.

Integrating Payment Requests with Accounting Software

Integrating your billing process with accounting software can significantly streamline your financial management. By automating the transfer of payment details and reducing manual input, you can ensure accuracy and save valuable time. This integration not only helps with tracking payments but also simplifies reporting and tax preparation.

Benefits of Integration

Integrating payment requests with your accounting system offers several advantages, including:

- Improved Accuracy: Automatically syncing transaction data reduces the risk of errors caused by manual entry, ensuring that your records are accurate and up-to-date.

- Time Savings: Integration eliminates the need to enter payment information into multiple systems, saving you time and effort in managing financial records.

- Real-Time Updates: Integration provides instant access to up-to-date financial data, making it easier to track payments, outstanding balances, and cash flow.

- Better Reporting: With integrated systems, generating financial reports becomes easier. You can instantly pull up detailed records of transactions, taxes, and accounts receivable.

How to Integrate Your System

To integrate your billing system with accounting software, follow these steps:

- Choose Compatible Software: Select an accounting software that supports integration with your billing platform or payment system. Popular options include QuickBooks, Xero, and FreshBooks.

- Connect Your Accounts: Link your billing system and accounting software by following the provided instructions. This typically involves authorizing access to both platforms and syncing your accounts.

- Configure Integration Settings: Customize your integration settings to match your business needs. You may want to adjust preferences such as payment terms, tax rates, or currency formats.

- Test the Integration: Before using the system for real transactions, run a test to ensure the integration is working correctly and that data is syncing accurately across both systems.

Challenges to Consider

While integrating billing and accounting systems offers many benefits, it’s essential to consider some potential challenges:

- Software Compatibility: Ensure that both systems are compatible, as some platforms may not integrate seamlessly with certain accounting software.

- Initial Setup Time: Setting up the integration may take some time, especially if you need to adjust settings or

Customizing Payment Request Formats for Different Clients

Tailoring your payment request formats for individual clients helps create a personalized experience while ensuring all the necessary details are accurately conveyed. Customizing these documents allows you to adapt to your clients’ preferences, business needs, and specific contractual agreements. This approach can also enhance professionalism and foster stronger client relationships.

Key Customization Considerations

When customizing documents for different clients, consider the following key elements:

- Branding: Incorporate your client’s logo, colors, or any other brand elements into the document to make it feel more tailored and aligned with their business identity.

- Payment Terms: Each client might have different payment terms, such as due dates, discounts for early payment, or late fees. Ensure these are clearly specified for each client.

- Contact Information: Ensure that the appropriate contact details (such as phone numbers, emails, or address) are visible, especially if the client has specific preferences for communication.

- Itemization: Some clients may need detailed breakdowns of services or products, while others might prefer a more general summary. Customize the level of detail according to each client’s needs.

- Language and Tone: Adjust the language and tone of the document based on your relationship with the client. For example, formal language might be required for corporate clients, while a more casual tone could work with smaller businesses or long-term partners.

Steps to Customize Payment Requests

Follow these steps to customize payment request formats effectively for each client:

- Gather Client Information: Start by collecting all relevant details about the client, including their preferred payment methods, specific terms, and any branding requirements.

- Use a Customizable Format: Choose a flexible document format that allows easy customization. Many tools, such as accounting software or word processors, offer options for editing fields and layout.

- Adjust Layout and Content: Modify the layout to align with the client’s preferences, ensuring important information stands out and is easy to find.

- Revi

How to Add Payment Terms Effectively

Clearly defining the conditions of payment is essential for smooth transactions and maintaining healthy business relationships. Payment terms ensure that both parties understand when and how payments should be made, preventing misunderstandings or delays. Properly stating these terms can also streamline the entire billing process, making it easier for clients to comply with deadlines.

When adding payment conditions, it’s important to be both clear and specific. These terms typically include due dates, methods of payment, penalties for late payments, and any discounts for early settlement. Including this information ensures transparency and sets expectations for both you and your client.

Here are some steps to add payment conditions effectively:

- Specify the Payment Due Date: Clearly state the date by which payment is expected. This can be a fixed date or a period after the service is delivered, such as “30 days from the date of this document.” Make sure this is prominently displayed.

- Define Payment Methods: List all accepted payment methods, whether it’s bank transfer, credit card, or another online payment platform. Offering multiple options can make it easier for clients to pay on time.

- Include Late Payment Penalties: Clearly outline any fees or interest charges that apply if payment is not made by the due date. This serves as an incentive for clients to pay promptly and protects your cash flow.

- Offer Early Payment Discounts: Providing discounts for early payments can be an effective strategy to encourage prompt payment. For instance, you might offer a 2% discount if the payment is made within 10 days of the issue date.

- Clarify Currency and Taxes: Specify the currency in which the payment is due and any applicable taxes. This is especially important when dealing with international clients or different tax regulations.

By incorporating clear and fair payment terms, you not only help protect your business interests but also create a more transparent and professional relationship with your clients. Well-defined payment conditions reduce confusion, minimize delays, and improve cash flow management.

Ensuring Invoice Clarity for Clients

Clear and transparent documentation is vital for maintaining strong business relationships. When sending a billing document, it’s important that clients fully understand the charges, due dates, and payment instructions. Ambiguity can lead to confusion, delayed payments, and disputes, which can harm your professional reputation and cash flow. Therefore, ensuring clarity in your billing documents is essential to streamline transactions and foster trust with clients.

To make sure your charges are easy to understand, there are several key elements to focus on:

Key Elements to Include for Clarity

- Itemized Breakdown: Provide a detailed list of services or products, along with their respective costs. This transparency helps clients understand exactly what they are being charged for and prevents surprises.

- Clear Payment Instructions: Include simple, step-by-step instructions on how the client can settle the bill. Specify accepted payment methods, any bank details, or online portals to make the process as easy as possible.

- Accurate Dates: Make sure to highlight the date the bill was issued and the due date for payment. This allows clients to prioritize the payment and avoid missing the deadline.

- Tax and Discount Information: Clearly outline any applicable taxes and discounts, ensuring that these charges are visible and comprehensible. Clients should be able to see how their final amount was calculated.

- Clear Contact Information: Provide your contact details, in case the client has any questions or needs clarification. This builds confidence and encourages prompt communication if there are any issues with the document.

Formatting Tips for Readability

- Use Simple Language: Avoid jargon or complex terms that may confuse your client. Keep the language clear and straightforward.

- Logical Layout: Organize information in a logical sequence, such as listing the most important details first (e.g., total amount due), followed by the itemized breakdown.

- Highlight Key Information: Use bold text or boxes to highlight important sections, such as the total amount due or the payment deadline.

By focusing on these elements, you ensure that your clients understand the terms of payment clearly and can act on them quickly. This reduces the risk of miscommunication and fosters a smooth transaction process for both parties.

Making Your Invoices Mobile-Friendly

In today’s digital world, many people access documents and make payments on their mobile devices. Ensuring that your billing documents are easy to read and interact with on smartphones and tablets is essential. A mobile-friendly format ensures that clients can quickly view, understand, and pay without any difficulty, regardless of the device they use. This not only improves the customer experience but can also speed up payment processing.

There are several key strategies for optimizing your billing documents for mobile users:

Key Strategies for Mobile-Friendly Documents

- Responsive Layout: Ensure that your document is designed to adapt to various screen sizes. A responsive layout will automatically adjust, making it readable on smaller screens without the need for zooming or scrolling horizontally.

- Simple, Clean Design: Keep the design minimalistic and uncluttered. Use clear fonts and simple colors, which will look good on both large and small screens.

- Easy-to-Click Links: Ensure that any links, such as payment buttons or bank details, are large enough to click easily on a touchscreen. Avoid small buttons or links that are hard to tap.

- File Size Optimization: Keep the document file size small to ensure it loads quickly on mobile networks. Large files can be cumbersome for mobile users and may cause delays in opening the document.

- Readable Font Sizes: Choose font sizes that are large enough for easy reading on small screens. Avoid using tiny text that requires zooming in.

Mobile-Friendly Design Considerations

Below is a sample of a simplified layout structure for mobile optimization:

Element Mobile-Friendly Approach Layout Responsive and adaptive to screen size Font Readable, with appropriate size for mobile Links Clickable and large enough for touchscreens File Size Optimized for fast loading on mobile networks By taking these steps, you can create a seamless experience for clients viewing and interacting with your billing documents on mobile devices. This will not only improve client satisfaction but also increase the likelihood of timely

Why Timely Invoices Matter for Cash Flow

Sending your billing statements on time is crucial for maintaining a healthy cash flow in any business. When you delay issuing statements or payment reminders, it directly impacts your ability to receive funds promptly, which can create a ripple effect on your financial stability. Timely payments allow businesses to cover operational expenses, invest in growth, and avoid the financial strain of overdue accounts.

Here are some reasons why timely payment requests are essential for keeping your cash flow in check:

Key Reasons for Timely Billing

- Prevents Delays in Payments: When you send out your payment requests on schedule, customers are more likely to pay on time, reducing the risk of delayed funds.

- Enhances Professionalism: Timely billing portrays your business as organized and reliable, fostering trust and respect with your clients.

- Reduces the Risk of Late Fees: Late payments often result in penalties for both the client and the business, making it harder to maintain a stable cash flow. By sticking to a set schedule, you avoid this risk.

- Improves Budgeting and Planning: Regular payments allow you to predict revenue more accurately, which helps in planning for future expenses, investments, and growth opportunities.

- Encourages Better Client Relationships: Clients appreciate clear and timely billing, which builds stronger relationships and leads to more repeat business.

Impact on Financial Operations

Failure to issue billing statements promptly can lead to an unpredictable cash flow. This unpredictability can cause difficulties in paying suppliers, employees, and other operational costs. By staying on top of billing cycles, you ensure that cash enters your business at the right time, enabling smoother financial operations.

In conclusion, consistently issuing payment requests on time not only strengthens your business’s cash flow but also helps build stronger professional relationships and ensures financial health. Staying organized and prompt in your financial operations is one of the key factors for long-term success.