Overdue Invoice Reminder Template for Effective Payment Follow-Up

Managing delayed payments can be one of the most challenging aspects of running a business. When clients fail to settle their balances on time, it affects cash flow and overall financial health. Clear communication is crucial to ensure prompt payment while maintaining strong business relationships. The right approach can encourage clients to pay quickly without damaging professional rapport.

Crafting a polite yet firm message is key to gently reminding clients of their outstanding balances. The tone, timing, and structure of such communications can make a significant difference in how quickly payments are received. This section will explore how to create effective messages that encourage payment while remaining professional and courteous.

Having a ready-made framework for these messages not only saves time but also ensures consistency across all communications. Whether you’re sending the initial follow-up or a second notice, a well-written message can help resolve payment issues efficiently. This guide will walk you through creating these important communications with practical tips and examples.

Overdue Invoice Reminder Template: A Comprehensive Guide

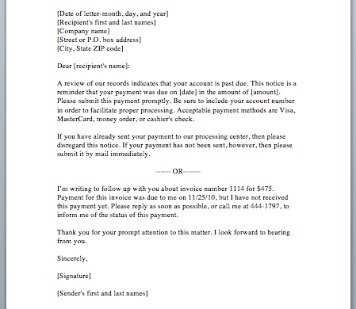

When payments are delayed, businesses face not only financial strain but also administrative challenges. Effective communication is essential to prompt clients to settle their outstanding amounts without causing friction. Having a structured approach to follow up on unpaid dues can significantly streamline the process and maintain professional relationships. This guide will help you create well-crafted messages that encourage timely payments while ensuring clarity and professionalism in your communications.

The key to successful follow-ups lies in delivering a message that is both polite and firm, with clear payment instructions and deadlines. Below, we’ve outlined essential components that should be included in your follow-up letters or emails, along with a sample structure for reference.

| Component | Description |

|---|---|

| Subject Line | A concise and clear statement that indicates the purpose of the communication. |

| Greeting | Start with a polite opening addressing the recipient by name. |

| Introduction | State the purpose of the communication, emphasizing the importance of resolving the pending balance. |

| Payment Details | Clearly mention the amount due, the due date, and any previous communications related to the payment. |

| Call to Action | Provide clear instructions on how to make the payment and offer assistance if necessary. |

| Closing | Close with a polite and professional sign-off, inviting further contact if needed. |

With this structure in mind, your follow-up communication can be clear, professional, and effective in encouraging payment. Whether sent via email or printed and mailed, maintaining consistency in your messaging will not only help recover funds but also reinforce your business’s professionalism in the eyes of your clients.

Why Send Overdue Invoice Reminders

Delayed payments can significantly disrupt a business’s cash flow, affecting operations and profitability. In order to maintain financial stability and ensure timely payments, it’s crucial to implement a system for notifying clients of outstanding balances. Sending polite but clear follow-up communications is an effective strategy to encourage prompt payment while preserving positive business relationships.

Benefits of Sending Payment Follow-Ups

By regularly reminding clients of unpaid dues, you can achieve several key benefits for your business:

- Improved Cash Flow: Timely reminders can lead to faster payments, helping you keep your cash flow healthy and avoid late fees or borrowing costs.

- Professionalism: A well-crafted follow-up communicates that you take your financial agreements seriously, which can strengthen your reputation.

- Reduced Risk of Non-Payment: The more transparent and proactive you are, the less likely clients are to ignore their financial obligations.

- Stronger Client Relationships: Handling payment issues professionally can maintain goodwill, preventing misunderstandings or resentment.

When to Send a Payment Follow-Up

Timing plays an essential role in the effectiveness of your follow-up messages. Here are some general guidelines to follow:

- Send an initial follow-up shortly after the due date has passed to gently remind the client of the outstanding balance.

- If no response is received, send a second follow-up, escalating the tone slightly while still maintaining professionalism.

- After repeated follow-ups with no payment, consider exploring other options, such as contacting a collections agency or taking legal action, depending on the situation.

Consistent communication and timely reminders help keep your business running smoothly by ensuring that clients meet their financial obligations without unnecessary delays.

Key Elements of an Effective Reminder

When sending a message to follow up on an unpaid balance, it’s essential to structure it in a way that is clear, polite, and effective. A well-crafted follow-up communication increases the likelihood of prompt payment and maintains a professional tone. The key to success lies in balancing firmness with courtesy, ensuring that your message is understood without causing friction with the recipient.

To create an impactful communication, there are several critical elements that must be included. These components help convey the necessary information while fostering a positive client relationship.

- Clear Subject Line: The subject should immediately communicate the purpose of the message, such as “Payment Due” or “Action Required on Your Account.” This makes it easier for the recipient to prioritize the message.

- Polite Greeting: Address the recipient by name, and use a professional salutation to begin the message. A friendly tone sets the right mood for the rest of the communication.

- Specific Payment Details: Clearly mention the amount owed, the original due date, and any previous attempts to resolve the matter. Providing these details helps avoid confusion.

- Firm Yet Professional Language: While you want to remain polite, it’s important to be direct about the need for payment. Phrases like “Please settle the balance at your earliest convenience” or “We kindly request payment by [date]” strike the right balance.

- Call to Action: Clearly state how the recipient can make the payment, whether by bank transfer, credit card, or another method. Including easy-to-follow payment instructions will streamline the process.

- Graceful Closing: End the message on a positive note, inviting the recipient to reach out if they have questions or need assistance. This leaves the door open for future communication and ensures a smooth interaction.

By including these elements in your follow-up messages, you ensure that your communication is not only effective but also maintains a professional and respectful tone. This approach maximizes the chances of prompt payment while minimizing the risk of misunderstandings or conflicts.

How to Personalize Your Reminder Templates

Personalizing follow-up communications can significantly improve the chances of receiving prompt payment. A generic message may come across as impersonal or mechanical, while a personalized one makes the recipient feel that their account is being handled with care. Customizing the message shows professionalism and attention to detail, encouraging the client to resolve any outstanding balances promptly.

There are several strategies you can use to make your messages more personalized, ensuring that each client feels valued and that their specific situation is being addressed.

- Use the Recipient’s Name: Always address the person directly by their full name or, at the very least, their first name. This simple touch helps create a sense of familiarity and rapport.

- Reference Specific Details: Mention the product or service provided, the exact amount due, or the date of the original transaction. This reinforces that the communication is not a generic template but rather related to their individual account.

- Tailor the Tone: Depending on your relationship with the client, adjust the tone of the message. For long-term customers or partners, a friendlier, more conversational tone may be appropriate. For newer or less familiar clients, a more formal and neutral tone might be necessary.

- Offer Assistance: Sometimes delays happen due to unforeseen circumstances. Show understanding by offering help or solutions, such as payment plans or extended deadlines, if appropriate.

- Include Custom Sign-Offs: Personalize the closing of your communication with a warm, professional sign-off. For example, “Looking forward to hearing from you soon” or “Thank you for your continued business” adds a personal touch that encourages further engagement.

By taking these steps, you show your clients that you care about maintaining a positive relationship. Personalization not only increases the likelihood of timely payments but also helps build stronger, long-term professional connections.

Best Practices for Invoice Follow-Ups

Following up on unpaid amounts can be a delicate process. Striking the right balance between being firm and maintaining a professional tone is essential to ensuring timely payments while preserving customer relationships. By following a few best practices, you can improve the effectiveness of your follow-up communications and make the payment process smoother for both you and your clients.

Key Practices for Effective Follow-Ups

Here are some proven techniques to help you manage payment follow-ups efficiently:

- Be Timely: Send your first follow-up shortly after the payment due date has passed. The earlier you address the issue, the sooner it can be resolved.

- Maintain Professionalism: Even if the payment is delayed, always keep your tone polite and respectful. A professional approach helps maintain a positive relationship with your clients.

- Offer Clear Payment Instructions: Make it easy for the client to pay by clearly outlining the payment options and providing necessary details, such as account numbers or links to payment portals.

- Send Reminders in Stages: Start with a gentle reminder and escalate the tone only if necessary. For example, follow up once, then send a second, firmer notice if payment has still not been made.

- Keep Records: Maintain detailed records of all communications with clients regarding payments. This will help you track progress and ensure transparency.

- Use Automation Tools: Consider using automated tools or systems that send follow-up notifications. This can save time and ensure consistency across all communications.

When to Escalate

Sometimes, despite your best efforts, clients may not respond to follow-ups. In these cases, it may be necessary to escalate the situation. Consider the following actions:

- Personal Contact: If the client has not responded to email reminders, consider reaching out via phone for a more direct conversation.

- Final Notice: Before taking legal action or involving

Timing Your Overdue Invoice Reminder

One of the most critical aspects of successfully collecting payments is knowing when to reach out. Sending a follow-up message at the right time increases the likelihood of prompt payment and reduces the risk of damaging the relationship with the client. The timing of your communication can significantly influence the response rate and the tone of future interactions.

When to Send the First Follow-Up

The first contact should happen shortly after the payment due date has passed. Waiting too long can signal to your client that the payment isn’t urgent, potentially leading to further delays. A well-timed first reminder helps to keep the matter at the forefront of their mind without coming across as too aggressive.

- Within 1-3 Days After the Due Date: A polite, non-confrontational message reminding the client that the payment is now due or has passed can be highly effective. This is the ideal window to send your first follow-up.

- Check Your Client’s Payment Cycle: If you know your client has a specific payment schedule (e.g., net 30, net 45), consider factoring that into your follow-up timing.

Escalating the Follow-Up Process

If the first reminder does not result in payment, it’s time to follow up again. However, you should adjust the tone of your message to reflect the increased urgency of the situation.

- 1 Week After the First Reminder: If the payment has still not been made, send a second, firmer message. Politely but clearly express that the payment is now past due and request immediate action.

- 2 Weeks or More After the Due Date: At this point, your message should convey more urgency. Consider stating that further actions, such as late fees or additional charges, may apply if payment is not received within a specific timeframe.

By strategically timing your follow-ups, you can ensure that your communication is effective without being overly pushy. The goal is to encourage prompt payment while maintaining professionalism and a positive working relationship with your clients.

How to Maintain Professional Tone

When communicating about outstanding balances, maintaining a professional tone is essential to preserving business relationships. While it’s important to be clear about the need for payment, you should avoid using language that could come across as confrontational or demanding. A well-crafted message strikes the right balance between politeness and firmness, ensuring that your request is taken seriously without damaging the rapport you’ve built with your clients.

Key Strategies for Maintaining Professionalism

Here are several approaches to ensure your communication remains courteous and respectful:

- Be Clear but Courteous: Always express the issue clearly without sounding accusatory. Use neutral language such as “We kindly request” or “This is a friendly reminder,” which keeps the tone polite.

- Stay Neutral and Objective: Focus on the facts, avoiding any emotional language. For example, say “The payment is due” rather than “You haven’t paid yet,” which can sound negative and personal.

- Use Professional Language: Even if the payment is delayed, remain professional by avoiding overly casual or informal phrases. Stick to formal greetings and closings such as “Dear [Name],” and “Sincerely,” or “Best regards.”

- Offer Assistance: If you believe there may be an issue preventing the payment, offer help. For instance, “If you’re facing any issues with the payment process, please don’t hesitate to contact us.” This shows understanding and opens the door for communication.

- Avoid Threats: Never imply or directly threaten legal action unless absolutely necessary. While stating consequences, such as a late fee or interest, is acceptable, be sure to do so in a professional manner without making it sound like a threat.

When to Be Firm and When to Be Gentle

There are times when a more direct approach is needed, but even in those cases, it’s crucial to maintain respect and professionalism. Here’s how to adjust your tone depending on the situation:

- Early Follow-Ups: Keep your tone gentle and friendly, as most clients will appreciate a polite nudge. Use phrases like “We kindly ask you to review your payment status” or “Please let us know if you need any assistance with this matter.”

- Late Follow-Ups: As the payment deadline passes, you may need to become more assertive, but still polite. Phrases such as “We would appreciate prompt payment by [date]” or “We kindly request that the payment is made immediately” communicate urgency without being harsh.

By striking

Common Mistakes in Reminder Letters

When sending follow-up communications regarding unpaid amounts, it’s easy to make mistakes that could either delay payment or damage client relationships. Crafting an effective message requires careful consideration of tone, timing, and content. Even small errors can lead to confusion or resentment. In this section, we’ll discuss some of the most common mistakes businesses make in their follow-up letters and offer solutions for each.

Common Pitfalls to Avoid

Below are some typical mistakes to watch out for when writing follow-up messages to clients:

Mistake Explanation Solution Unclear Payment Details Not providing the correct amount due or missing payment instructions can confuse the recipient and delay the payment. Always include the exact amount owed, the due date, and clear instructions on how to make the payment. Using Aggressive Language Using harsh or threatening language may put the client on the defensive and harm your business relationship. Keep your tone polite and professional, even if you need to express urgency. Too Much or Too Little Information Overloading the letter with unnecessary details or not providing enough context can confuse or frustrate the client. Stick to the essential facts–mention the payment due, the original due date, and any relevant previous communication. Delaying the Follow-Up Waiting too long to follow up gives the impression that the payment is not a priority. Send the first follow-up shortly after the due date, and schedule subsequent communications to maintain consistency. Ignoring Client’s Situation Assuming that the client has simply neglected their payment without considering potential reasons for the delay can create unnecessary friction. Be empathetic and polite. Offer to discuss any payment difficulties they may be experiencing. Additional Tips for Effective Communication

In addition to avoiding these common mistakes, here are a few more tips to improve your follow-up letters:

- Personalize the Message: Use the client’s name and specific details of the transactio

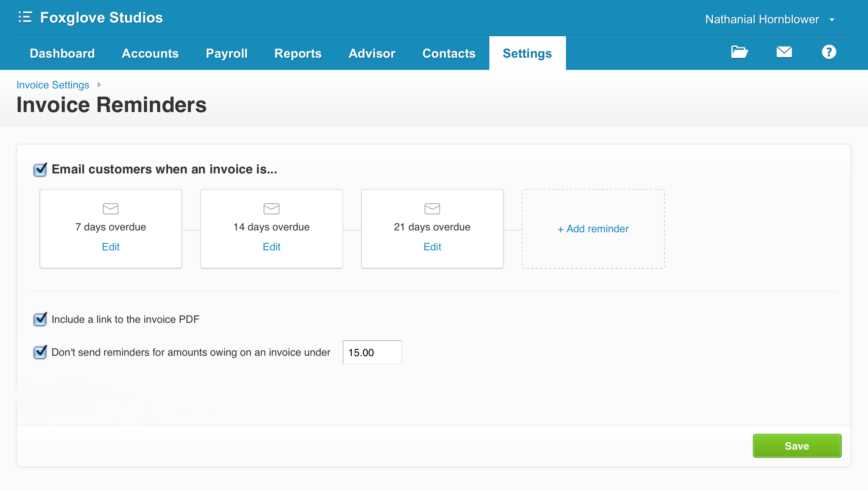

Automating Overdue Invoice Reminders

Automating follow-up communications for unpaid balances can save time and reduce the manual effort involved in chasing payments. By implementing automated systems, businesses can ensure that reminders are sent on time, consistently, and without requiring manual intervention for each client. This not only streamlines the process but also reduces the risk of human error, allowing you to focus on other important tasks.

Benefits of Automating Follow-Ups

There are several key advantages to automating your payment follow-ups:

- Consistency: Automated systems ensure that all clients are contacted at the appropriate times, reducing the risk of missed or delayed follow-ups.

- Time Savings: By automating repetitive tasks, you free up valuable time to focus on other aspects of your business, such as customer service or growth strategies.

- Improved Cash Flow: Timely reminders can lead to faster payments, improving your business’s cash flow and reducing the need for manual interventions.

- Reduced Errors: Automation eliminates the risk of forgetting to send follow-up messages or making errors in the communication.

How to Automate Payment Follow-Ups

To set up an effective automated system, follow these steps:

- Choose an Automation Tool: There are various software solutions available, from accounting platforms to specialized billing systems, that allow you to set up automated payment reminders. Choose one that integrates well with your existing processes.

- Set Reminder Triggers: Determine when reminders should be sent–immediately after the due date, after a certain number of days, or based on client-specific payment cycles.

- Customize Messages: Even in an automated system, it’s essential to personalize your messages. Customize the content to include the client’s name, amount due, and payment instructions.

- Adjust Frequency and Escalation: Set up different levels of reminders, such as a soft reminder initially, followed by more urgent notices if payments are delayed further. Ensure that the escalation process is automated as well.

- Monitor and Review: Regularly check the automated system’s perf

Legal Considerations for Payment Reminders

When following up on unpaid amounts, it’s essential to be aware of the legal boundaries surrounding the communication process. While sending polite, professional reminders is a standard business practice, it’s important to ensure that your actions comply with laws and regulations governing debt collection. Failure to do so can result in legal disputes or damage to your business’s reputation. This section outlines key legal considerations to keep in mind when reaching out to clients for payment.

Understanding Debt Collection Laws

Debt collection practices are regulated by various laws that aim to protect consumers from harassment or unethical practices. While these laws vary by jurisdiction, it’s important to stay informed about the general principles that apply to payment collections.

- Fair Debt Collection Practices Act (FDCPA): In the United States, this act governs the actions of debt collectors, setting clear boundaries on how they can communicate with individuals. It prohibits harassment, threats, or false representations when pursuing unpaid amounts.

- Consumer Protection Laws: Many countries have consumer protection laws that prevent businesses from engaging in misleading, aggressive, or unfair practices when communicating about outstanding payments.

- Privacy and Confidentiality: When discussing payment matters, it’s crucial to ensure that any confidential information is kept secure. Avoid sharing payment details or discussions about a client’s account with unauthorized parties.

Key Legal Guidelines for Payment Communications

To avoid legal complications, follow these best practices when communicating about payments:

- Avoid Harassment: Repeated or threatening communications can be considered harassment. Limit the number of follow-ups and ensure each message remains respectful and professional.

- Provide Clear Payment Terms: Your payment terms, including deadlines, penalties, and payment options, should be clearly stated in your initial agreements. This reduces the risk of confusion and disputes later on.

- Be Transparent About Consequences: If you need to apply late fees or take legal action, inform the client in advance, stating clearly the actions that will be taken if payment is not made within the agreed timeframe. Avoid using excessive threats.

- Do Not Use Deceptive Practices: Avoid language that could be construed as threatening or misleading. For example, stating that legal action has already been initiated when it has not can lead to legal repercussions.

When to Consider Legal Action

If payment remains unresolved after several attempts, you may need to consider escalating the situation. However, before taking legal action, it’s important to consult with a legal professional to ensure that you are following the appropriate procedures.

- Final Notices: Send a formal, final notice stating your intent to take legal action if payment is not received by a specific date. Ensure this notice is clear, precise, and does not contain threatening language.

- Involve a Collection Agency: If the amount is significant and your efforts have not resulted in payment, you may consider working with a professional debt collection agency. Make sure the agency is compliant with the relevant laws in your jurisdiction.

- Small Claims Court: For smaller amounts, you may consider filing a claim in small claims court. Be sure to keep accurate records of all communications and agreements leading up to this point.

By staying informed about legal requirements and following these guidelines, you can ensure that your payment follow-ups remain professional and compliant with the law, reducing the risk of legal challenges while improving your chances of receiving timely payment.

Template Options for Different Business Types

When managing unpaid balances, different industries may require different approaches for following up with clients. A customized approach that aligns with the nature of your business and client relationships can improve the effectiveness of your communication. Whether you’re dealing with corporate clients, freelancers, or service providers, adjusting the tone and structure of your follow-up letters can make a big difference in ensuring prompt payment.

Options for Service-Based Businesses

Service providers, such as consultants, designers, or contractors, often have more personal relationships with their clients. Therefore, the follow-up messages should strike a balance between professionalism and a more conversational tone. Here are some key considerations for service-based businesses:

- Friendly Yet Professional: In industries where client relationships are crucial, it’s important to keep the tone friendly, yet professional. Remind your clients of the service rendered and offer assistance with any potential payment issues.

- Personalization: Since many service-based businesses work with a smaller client base, it’s easier to personalize each message. Referencing specific projects or outcomes can create a sense of connection.

- Flexible Payment Options: Service-based businesses might consider offering clients flexible payment terms or installments, especially if they’ve provided a large service or project.

Options for Retail and E-commerce Businesses

For retail or e-commerce businesses, the approach is typically more formal and structured. These businesses often deal with a higher volume of clients, so automating the follow-up process is a good strategy. The key for these businesses is maintaining professionalism and clarity:

- Clear Payment Terms: Be sure to highlight the payment terms clearly in your communication. This includes listing product prices, shipping fees, and any applicable taxes to avoid confusion.

- Automated Follow-Ups: Due to the volume of transactions, automated systems work well for retail businesses. They can send reminders based on preset time intervals, ensuring no follow-up is missed.

- Offer Incentives: Retail businesses may offer discounts or coupons for early payment or as an incentive to settle the balance quickly, which could help increase payment turnaround time.

Options for Subscription-Based Businesses

Subscription models–whether for software, memberships, or other recurring services–require a more structured approach to payment collection. These businesses often have ongoing billing relationships with clients, so it’s important to establish clear communication about recu

How to Handle Non-Payment After Reminder

When a payment is not received even after sending multiple follow-up messages, it can be frustrating and challenging for businesses. At this point, it’s crucial to assess the situation carefully and take further steps to encourage settlement while maintaining a professional relationship with the client. This section will guide you through strategies to address non-payment effectively, from assessing the cause of delay to escalating the situation if necessary.

Step 1: Review the Situation

Before taking any further action, it’s important to assess the circumstances surrounding the non-payment. There are several factors to consider that could explain why payment has not been made:

- Client’s Financial Issues: Sometimes clients may be facing financial difficulties and are unable to pay on time. It’s important to determine whether this is the case to avoid escalating the situation unnecessarily.

- Communication Breakdown: Check if there was any miscommunication regarding the terms of payment or if the client was not aware of the due amount. Clear up any confusion before proceeding.

- Incorrect Payment Details: Double-check the payment methods and account details you provided to ensure there were no errors that might have caused payment failure.

Step 2: Direct Communication

If the initial follow-up did not yield results, consider reaching out to the client directly via phone or email. A more personal approach can sometimes lead to faster resolutions. When contacting the client, keep the following points in mind:

- Be Professional and Respectful: While it’s important to assertively request payment, maintain a polite tone. Accusatory language or aggressive behavior will damage the client relationship and may prevent payment altogether.

- Offer Solutions: If the client is experiencing financial issues, offer flexible payment options, such as a payment plan or deferred payment schedule. This can help them settle the debt without feeling pressured.

- Set Clear Expectations: Clearly communicate the next steps, including the consequences of non-payment, such as late fees or service suspension. Make sure they understand the urgency of resolving the matter promptly.

Step 3: Final Notice and Legal Actions

If all attempts to reach an agreement have failed, and the payment is still not made, it may be time to escalate the situation. A final notice should be sent, clearly stating the intent to take fur

Why Clear Payment Terms Are Essential

Establishing clear payment expectations from the outset is crucial for maintaining smooth business operations. When payment terms are defined clearly in agreements, both parties understand their responsibilities, reducing confusion and minimizing the risk of delayed payments. Whether you’re working with one-off clients or ongoing contracts, clear terms set a foundation for trust and professionalism. This section explores why well-communicated payment conditions are key to ensuring timely settlements and fostering long-term relationships.

1. Preventing Misunderstandings

Clear payment terms help prevent misunderstandings that can arise during the billing process. When both parties know when payments are due, how much is owed, and what the payment methods are, it becomes easier to avoid disputes. Ambiguity around these points often leads to unnecessary friction between the business and the client, which can delay or even jeopardize payment.

- Clarity on Deadlines: Specifying exact dates or periods when payments are due leaves little room for misinterpretation.

- Transparent Fees: Clearly outlining any additional charges, such as late fees or interest, ensures clients understand the total cost from the start.

2. Establishing Professionalism and Trust

When your business clearly outlines payment terms, it communicates professionalism and builds trust with clients. Clients appreciate knowing exactly what to expect, which helps to avoid any feelings of uncertainty. Transparency in payment expectations also shows that your business is organized and serious about its agreements.

- Setting a Positive Tone: Clear terms present your business as reliable and prepared, which can improve client confidence and encourage timely payments.

- Strengthening Client Relationships: Transparent payment practices foster a sense of mutual respect, which can le

Benefits of Using a Reminder Template

Utilizing a standardized approach for following up on unpaid balances can offer significant advantages for businesses. By using pre-written structures for communication, companies can streamline their processes, maintain consistency, and ensure that no important details are overlooked. This section explores how a structured format can improve efficiency, enhance professionalism, and help businesses manage late payments more effectively.

1. Time Efficiency

Creating and customizing a new message each time a client misses a payment can be time-consuming. Using a pre-designed structure significantly reduces the time spent drafting follow-up communications. With a template, you can quickly modify the necessary details–such as the client’s name, outstanding amount, and due dates–while the core message remains consistent.

2. Consistency and Professionalism

Having a consistent approach ensures that all clients receive the same level of professionalism in every communication. A well-crafted structure helps maintain the tone, formatting, and essential points that should always be addressed. This consistency reflects positively on your business, showing that you are organized and reliable in your dealings.

3. Reduced Risk of Human Error

Relying on a pre-written format minimizes the risk of forgetting important information or making mistakes. With a template, you’re less likely to miss key details, such as payment terms, deadlines, or contact information. This accuracy helps avoid misunderstandings or disputes with clients, ensuring smooth communication.

4. Customization for Different Scenarios

While templates offer a standard structure, they are also easily customizable for specific situations. For instance, you can adjust the tone of the message depending on how many reminders have already been sent or whether you are offering flexible payment terms. This flexibility ensures that each client receives an appropriate communication that fits their specific payment status.

5. Better Record Keeping

Using a standardized format allows for easier record-keeping. Each communication is consistent in structure, making it simpler to track the follow-up history with individual clients. In the event of future disputes, you can quickly refer to past messages to ensure that all necessary steps were taken to resolve the situation.

6. Stress Reduction for Employees

Automating and streamlining the process of following up on unpaid balances reduces the stress and pressure on employees. They no longer have to come up with the right wording or worry about leaving out important details. Templates provide a safety net, making the process easier to handle and less overwhelming for staff members.

In conclusion, using a standardized follow-up structure brings multiple benefits, inc

How to Track Payments Effectively

Proper tracking of outstanding payments is essential for maintaining healthy cash flow and ensuring financial stability for your business. Without an organized system, it’s easy to lose track of what’s due and when, which can lead to missed payments, confusion, and unnecessary administrative work. This section will explore strategies for effectively monitoring payments, so you can take timely action and prevent financial setbacks.

1. Utilize Payment Tracking Software

One of the most efficient ways to track payments is through specialized accounting or payment management software. These tools provide an automated way to record and monitor every payment, making it easy to see what has been paid and what remains outstanding. Payment software often includes features like reminders, payment history logs, and customizable reports, which can significantly reduce the time spent manually tracking payments.

2. Create a Payment Tracking System

If you prefer a more manual approach or need a complementary method alongside software, setting up an organized tracking system is key. Start by creating a central record where all due payments are logged. This could be a spreadsheet, a physical ledger, or a simple database. Ensure that you include the following details:

Client Name Amount Due Due Date Status Follow-up Date Client A $500 10/10/2024 Unpaid 10/20/2024 Client B $1,000 10/15/2024 Paid 10/18/2024 Regularly update this record to ensure that all payments are accounted for, and you’ll have a clear overview of what actions need to be taken.

3. Set Up Automated Alerts

Many modern payment systems and software allow you to set up automated notifications when payments are approaching their due dates or have passed. This can save you time and ensure that no payment slips through the cracks. You can also se

Tips for Avoiding Late Payments

Preventing delayed payments is an essential part of running a successful business. By taking proactive steps, you can minimize the chances of clients failing to pay on time and ensure smooth cash flow. This section covers effective strategies that will help you encourage timely payments and reduce the occurrence of late balances.

1. Set Clear Expectations from the Start

Establishing clear payment terms at the beginning of every business relationship is crucial. Make sure your clients understand when payments are due, the accepted payment methods, and any penalties for late payments. Having these terms outlined in writing, whether in a contract or an agreement, can avoid confusion and ensure that both parties are on the same page from the outset.

2. Send Early Payment Reminders

Sending a gentle reminder before the payment due date can encourage clients to pay on time. This reminder could simply be a courteous note or email to inform them that a payment is approaching. A small nudge can often be enough to prompt action and avoid any delays.

3. Offer Multiple Payment Options

Make it as easy as possible for clients to pay by offering multiple payment options. Some clients may prefer credit cards, while others may want to use bank transfers, checks, or digital payment platforms. Providing various methods allows clients to choose the option that best fits their needs and helps eliminate barriers to timely payment.

4. Invoice Promptly

Send out your payment requests as soon as the work is completed or goods are delivered. Prompt invoicing not only helps clients remember their obligation but also accelerates the payment process. The sooner they receive the request, the sooner they will be able to settle their balance.

5. Build Strong Client Relationships

Maintaining open lines of communication with clients and building strong relationships can increase the likelihood of timely payments. When clients feel valued and respected, they are more likely to prioritize your payments. Regularly check in with clients, be responsive to their concerns, and ensure a positive business experience to foster trust and reliability.

6. Automate Payment Reminders

Using automated systems to send payment reminders can help ensure clients don’t forget their obligations. Setting up automated notifications before, during, and after the due date removes the need for manual follow-ups and ensures that no payment is overlooked. Automation also reduces the burden on your team and improves efficiency in managing outstanding balances.

7. Apply Late Fees When Necessary

While it may not be ideal, having a late fee structure in place can incentivize clients to pay on

How to Create a Professional Reminder Template

When dealing with delayed payments, having a well-structured and professional communication format is crucial. Crafting a clear, polite, and effective message can help prompt your clients to settle their outstanding balances without damaging your relationship. This guide will walk you through the key steps in designing a professional follow-up message that encourages prompt payment while maintaining a respectful tone.

1. Start with a Polite Opening

Begin your communication with a courteous greeting. A friendly tone sets the stage for a professional conversation and reminds your client that the relationship is important to you. Avoid using confrontational language, and instead, focus on gratitude and mutual respect. A simple, “I hope this message finds you well” or “Thank you for your continued business” helps maintain a positive atmosphere.

2. State the Purpose Clearly

Once the opening pleasantries are out of the way, quickly state the reason for your message. Make sure to mention the specific amount due and the original due date, so your client is aware of the context. Be clear and concise about what action is needed, but avoid sounding overly demanding. For instance, you might say, “We wanted to kindly remind you that the payment of $500 for services rendered on [date] is still pending.” Keep the language factual and direct, but always polite.

3. Provide Payment Details

To make it easy for your client to settle the balance, include all relevant payment details in your message. This should include:

- The amount due

- The due date

- Your payment methods (bank details, online payment links, etc.)

- Any applicable late fees (if relevant)

Providing this information upfront saves your client time and minimizes the risk of confusion or further delays.

4. Maintain a Positive and Professional Tone

Throughout the message, it’s essential to maintain a tone of professionalism and understanding. Avoid using harsh language or making threats. Instead, express your desire to resolve the issue quickly and smoothly. You might say, “We understand that sometimes things get busy, and we appreciate your attention to this matter at your earliest convenience.” This shows empathy while still reminding the client of their responsibility.

5. Offer Flexibility and Support (If Applicable)

If your client is experiencing financial difficulties, consider offering flexible payment options or negotiating new terms. This shows goodwill and could improve the chances of receiving payment. For example, you could say, “If you need an ex