Free General Invoice Template for Effortless Billing

Managing financial transactions and ensuring timely payments is crucial for any business. One of the most effective ways to streamline this process is by using a structured document that helps keep track of amounts owed and due dates. With the right document in place, you can maintain professionalism while minimizing errors and delays in your billing process.

Customizable documents can be a game-changer for businesses of all sizes, enabling you to adjust details according to your specific needs. These documents not only improve your workflow but also offer a professional presentation to clients. A well-designed form can save valuable time, reduce misunderstandings, and help maintain a clear financial record.

Whether you’re a small business owner, freelancer, or large corporation, adopting an organized approach to billing is essential. By utilizing a reliable format, you ensure consistency across all your transactions, which in turn helps build trust with clients. This guide will explore how you can access and make the most of such a document for your business operations.

Free Billing Document for Business

For any business, having a clear and professional way to document transactions is essential. Using a well-structured form to track payments and amounts owed can save time, reduce errors, and ensure a smooth financial process. Having access to a reliable format without any additional costs can significantly benefit small businesses and freelancers, allowing them to focus more on growing their operations.

There are several key advantages to using a well-crafted document for your billing needs:

- Time Efficiency: Save time with pre-designed layouts that are ready to use right away.

- Accuracy: A structured document helps reduce common errors, ensuring the right amounts are always invoiced.

- Professionalism: Presenting a neat, formal document builds trust with clients and partners.

- Flexibility: Customizable fields allow businesses to adjust the document to fit their specific needs.

- Cost-Effective: Many businesses, especially startups, benefit from free access to well-designed options.

With a downloadable option, these forms are accessible to businesses of all sizes. The simplicity of using these documents ensures that even those with little experience in accounting can manage transactions effortlessly.

To make the most of these billing tools, it’s important to customize the document according to your business type, ensuring all necessary details are included for clarity and accuracy. This can include client information, services provided, payment terms, and due dates.

Why You Need an Efficient Billing Document

Having a standardized document to track transactions and payments is essential for any business, regardless of size. It simplifies the billing process, ensures accuracy, and helps maintain a professional image. Without such a document, businesses risk errors, delays in payments, and even confusion between clients and service providers. A well-organized system enhances transparency, fosters trust, and reduces the likelihood of financial disputes.

Here are some reasons why you should use a structured document for your financial records:

| Benefit | Explanation |

|---|---|

| Accuracy | A standardized layout ensures all necessary information is included, reducing errors in the amounts owed or services provided. |

| Time-Saving | Pre-designed structures save time, allowing you to focus on business tasks rather than creating documents from scratch. |

| Consistency | Consistent use of the same format helps maintain a professional appearance across all business dealings. |

| Legal Protection | Accurate and well-documented transactions provide legal proof in case of payment disputes. |

| Improved Cash Flow | Clear payment terms and deadlines help ensure timely payments from clients, improving overall cash flow. |

Using an organized structure for financial documents not only benefits the business but also improves relationships with clients. It adds credibility and demonstrates professionalism, making clients more likely to return for future business.

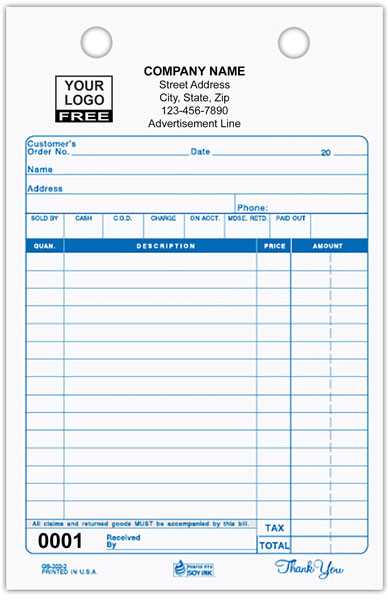

How to Create a Billing Document

Creating a well-structured financial document is essential for accurately recording transactions and ensuring clear communication with clients. By following a few simple steps, you can produce a professional and effective document that includes all the necessary details for both parties. Whether you’re a freelancer or a business owner, understanding how to properly create and format this document will help streamline your operations and improve payment timelines.

Here’s a step-by-step guide to creating a comprehensive billing document:

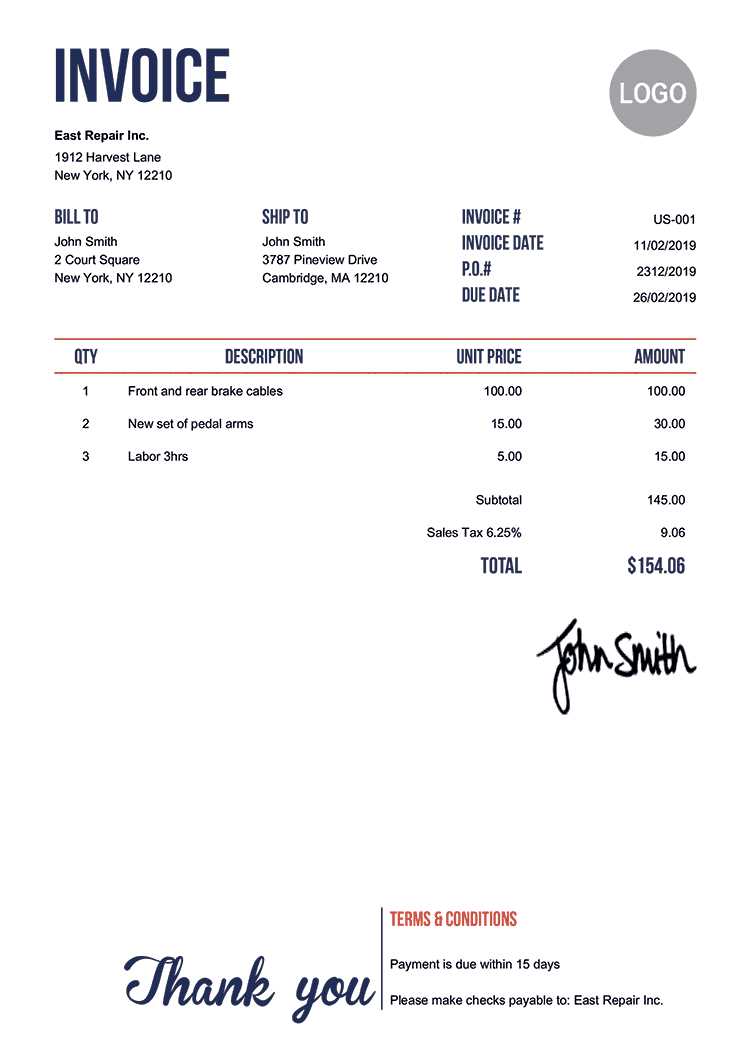

- Include Business Information: At the top, list your company name, address, phone number, and email. If applicable, also include your tax ID number.

- Client Information: Make sure to add the client’s name, company name (if relevant), address, and contact details for easy reference.

- Assign a Unique Number: Each document should have a unique identifier or number to track and reference payments. This helps with organization and reduces confusion.

- Detail the Products or Services: Clearly describe what was provided, including quantities, rates, and any applicable discounts.

- Payment Terms: Include the due date, late fees (if any), and payment methods accepted to avoid any misunderstandings.

- Sum Up the Total: Calculate the total amount due, including taxes and other applicable charges.

- Thank You Note: Add a brief thank you message to show appreciation for the client’s business.

Following these steps will help you create a clear, concise, and professional document that accurately reflects your transactions, improving the overall business experience for both you and your clients.

Key Elements of a Billing Document

To ensure clarity and avoid misunderstandings, every financial document should contain specific details that outline the terms of the transaction. These elements are crucial for both the issuer and the recipient, as they help establish a professional, transparent relationship. By including the right information, you ensure that all parties are clear on the terms of payment, services provided, and any deadlines involved.

The following are the key components that should always be included in a billing document:

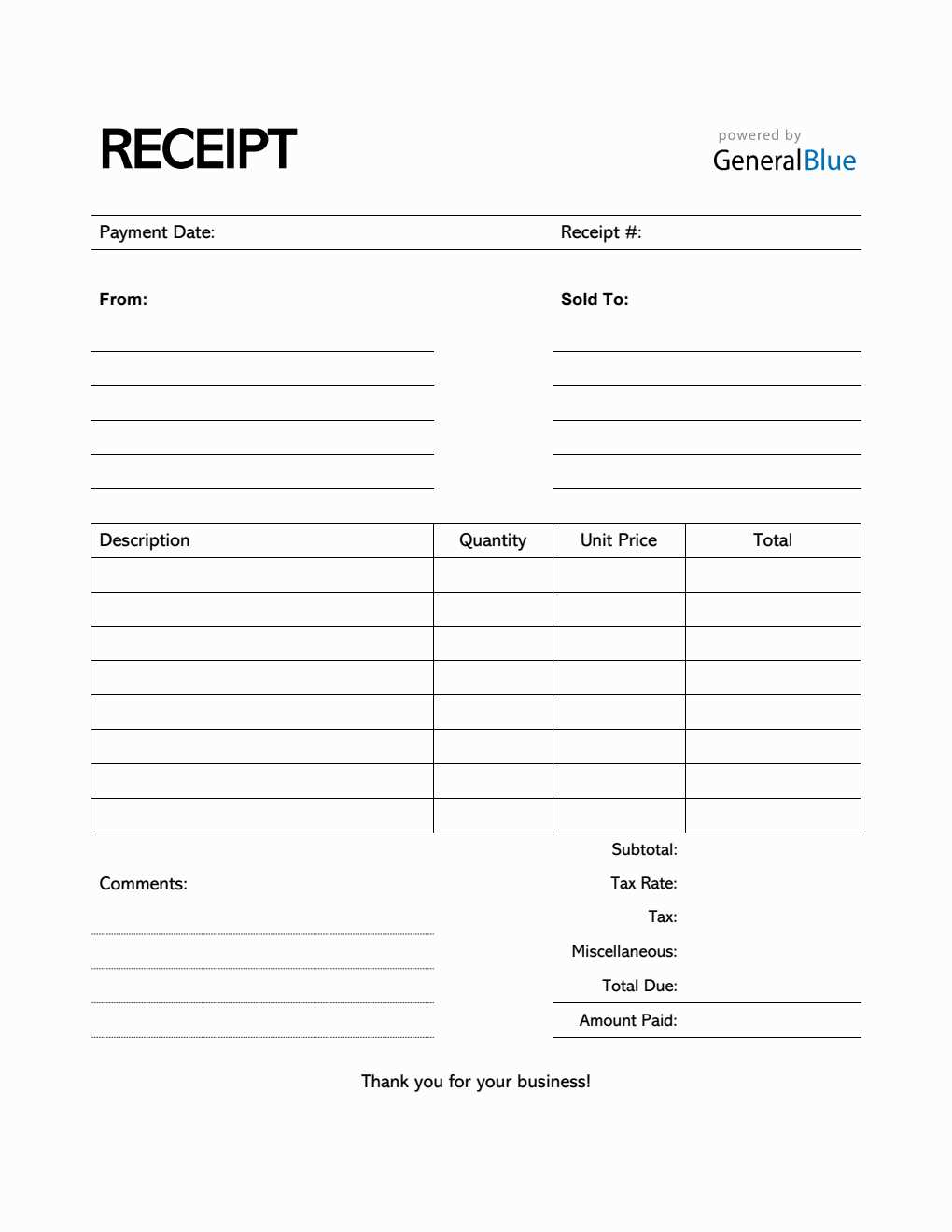

- Document Title: A clear title that specifies the nature of the document, such as “Receipt,” “Bill,” or “Statement.” This helps distinguish it from other documents.

- Unique Reference Number: A distinct number or code for tracking purposes. It’s essential for both organizational and legal reasons.

- Business Details: Your company’s name, address, phone number, and email. This allows the recipient to contact you if necessary.

- Client Details: Information about the customer, including their name, company name, address, and contact information, ensuring the document is correctly addressed.

- Detailed Description of Goods/Services: A list of products or services provided, with descriptions, quantities, and unit prices, ensuring clarity about what is being billed.

- Payment Terms: Clear terms regarding the due date, any discounts, late fees, and acceptable payment methods, ensuring both parties are aligned on payment expectations.

- Total Amount Due: A summary of the total cost, including taxes and any additional charges, presented clearly for easy reference.

- Due Date: The deadline by which payment should be made, helping to avoid confusion or delays in settling the account.

- Thank You Note: A polite note expressing gratitude for the client’s business, which can help foster positive customer relations.

Including these elements ensures that your billing documents are complete, professional, and transparent, which can contribute to smoother transactions and better relationships with clients.

Benefits of Using a Ready-Made Billing Document

Utilizing a pre-designed document for financial transactions offers numerous advantages, especially for small businesses and freelancers. These ready-to-use formats can save time, reduce errors, and ensure that your billing process is consistent and professional. By avoiding the need to design your own document from scratch, you can focus more on your core business activities and less on administrative tasks.

Time and Effort Savings

One of the key benefits of using a ready-made document is the time it saves. Rather than spending hours creating a layout or structuring data, you can download or customize a pre-built option in minutes. This allows you to quickly start issuing payment requests and stay focused on other important tasks.

Enhanced Professionalism

Using a polished, well-structured format helps to create a professional image for your business. Clients appreciate receiving clear and organized financial documents that reflect reliability and attention to detail. This can lead to better client relationships and more timely payments.

In addition, these ready-made solutions often come with useful features, such as automatic calculations and customizable fields, which reduce the likelihood of errors and ensure that all necessary information is included every time. For businesses that need to maintain consistency in their documents, this can be a huge advantage.

Customizing Your Billing Document

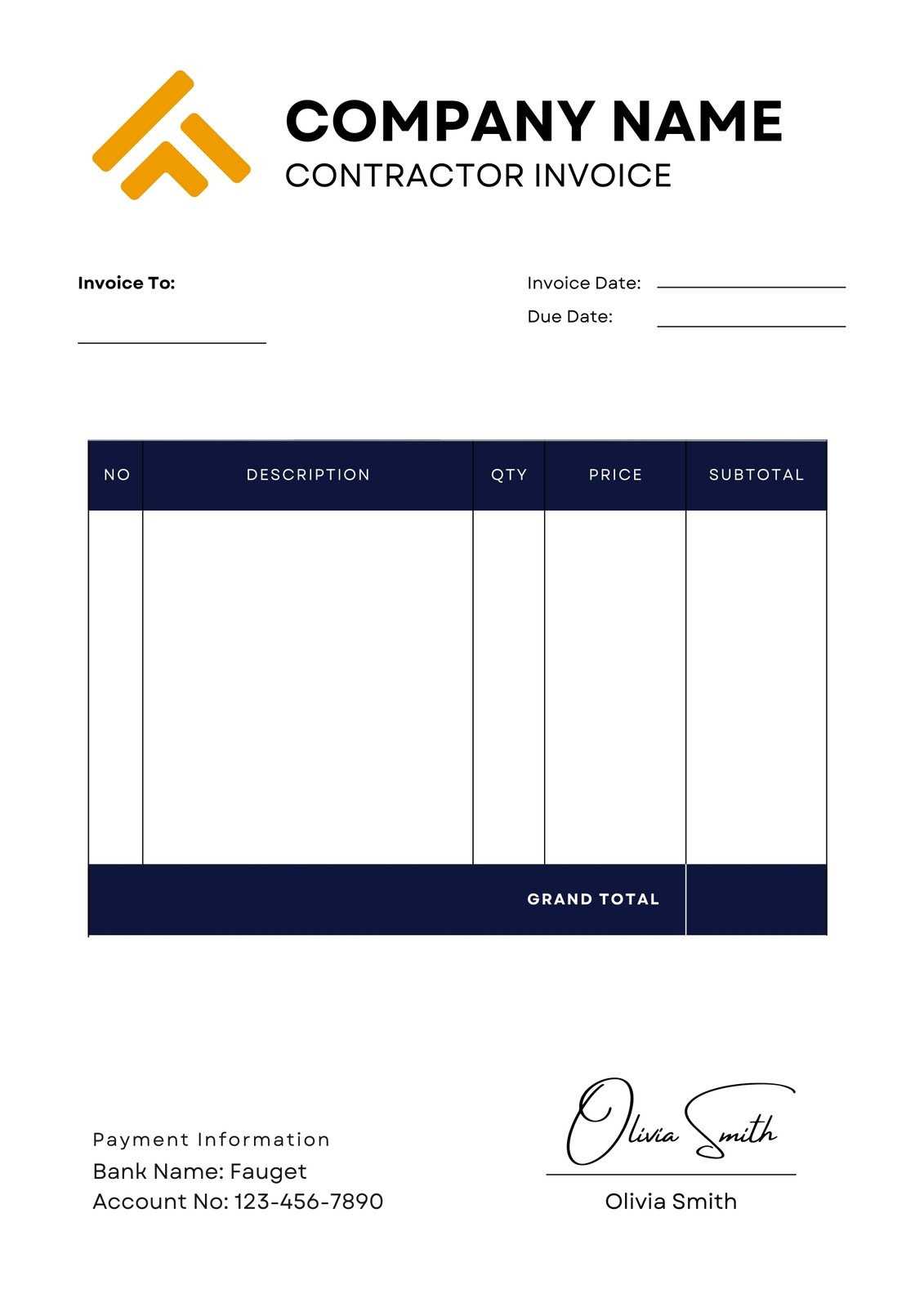

Tailoring a billing document to fit your specific needs is essential for ensuring it reflects your business and provides all the necessary details. Customization allows you to add branding elements, adjust layout, and incorporate unique terms that align with your business operations. Personalizing these documents ensures consistency across all transactions and reinforces your company’s identity.

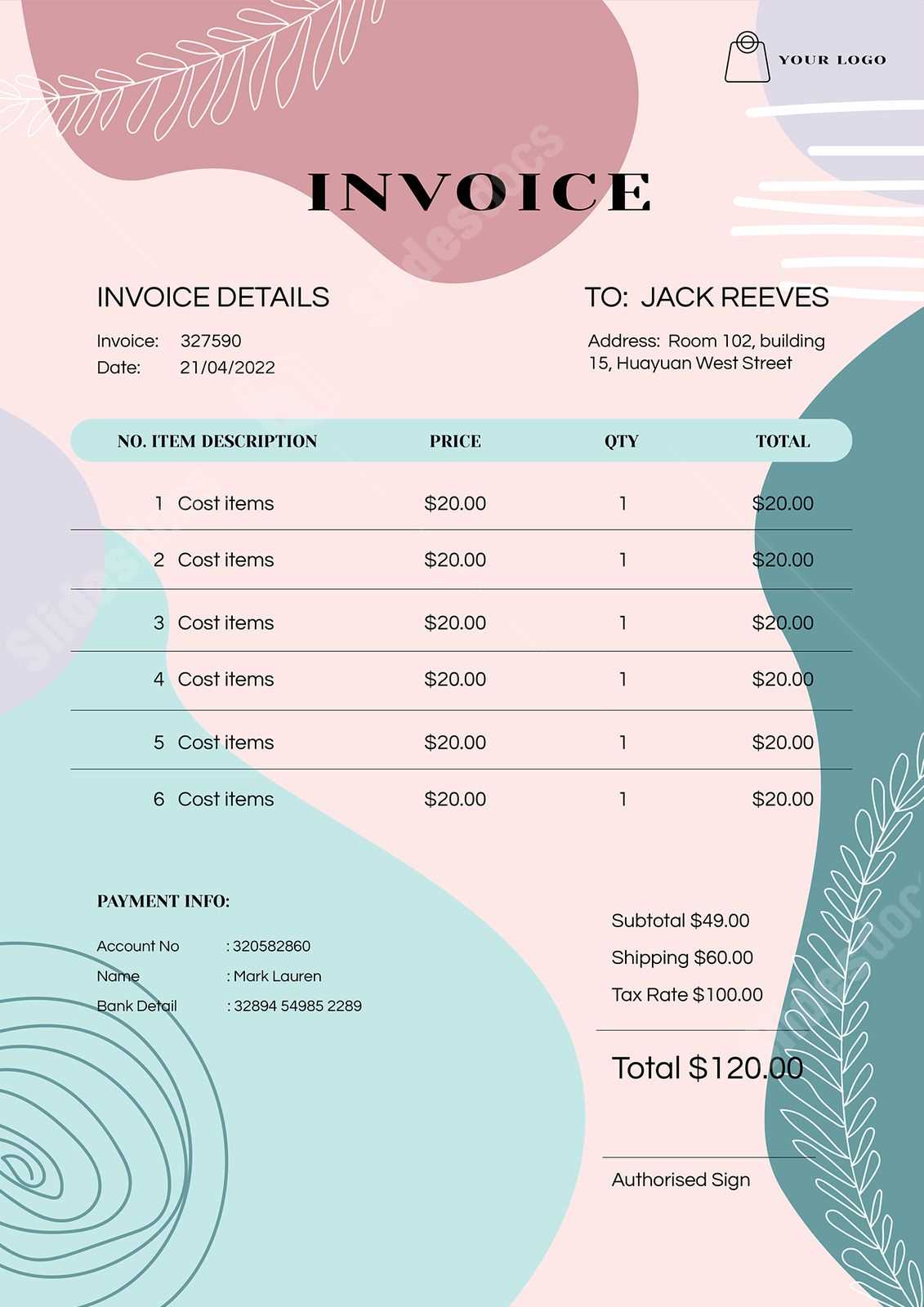

Adding Your Branding

One of the first steps in customizing a billing document is incorporating your business logo, color scheme, and contact details. Including these elements gives your document a professional look and enhances your brand’s presence. It also helps clients easily recognize your business. Make sure your company name, address, and customer service contact details are prominently displayed at the top for easy reference.

Adjusting Layout and Fields

Customizing the layout involves choosing a structure that best suits your business’s needs. You can adjust the columns, add custom fields, or remove unnecessary ones. For example, if you offer a discount or have specific payment terms, you can include sections for these details. Customization gives you the flexibility to capture all the important information in a way that makes sense for your business.

By tailoring your billing document to match your workflow, you ensure that each transaction is clearly documented and that your clients have all the information they need to make timely payments. Personalizing these documents also improves consistency and professionalism across all client communications.

Top Billing Documents to Download

If you’re looking for a quick and easy way to manage your business transactions, downloading a well-designed document layout can be a great solution. These pre-built options offer a streamlined approach to managing payments, saving time while ensuring that all essential details are included. Whether you’re a freelancer or a small business owner, the right document can make the billing process smoother and more efficient.

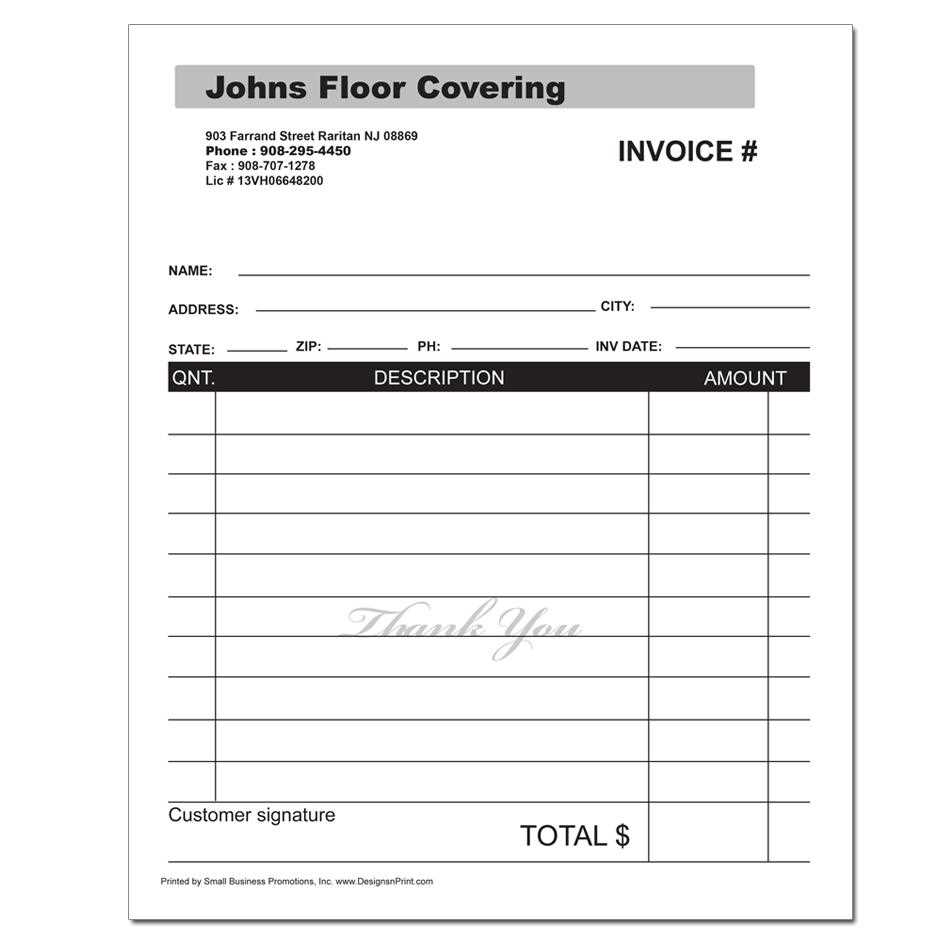

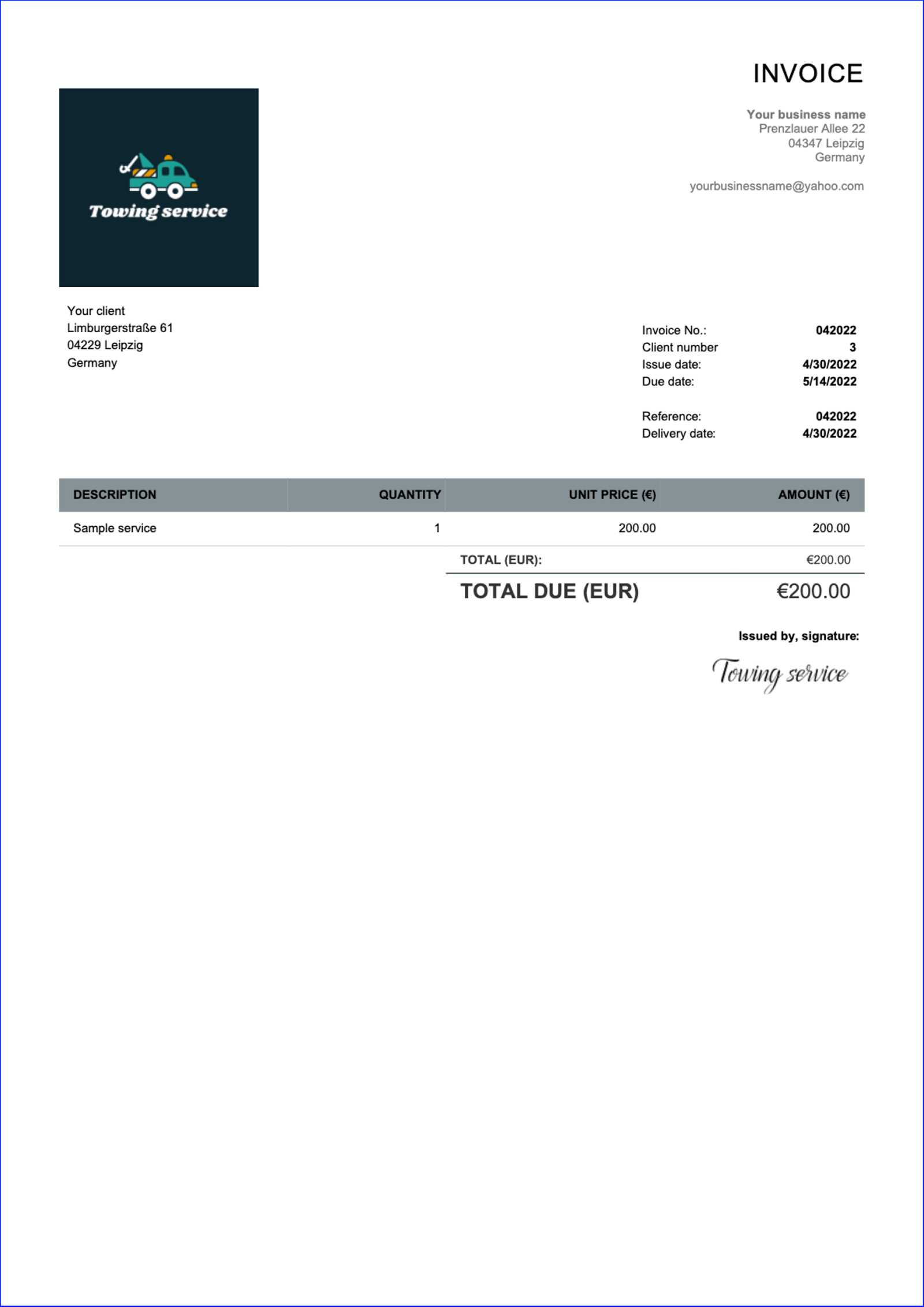

Simple and Professional Layout

This straightforward design is perfect for businesses that need a clean and professional document with minimal effort. It typically includes all the necessary fields, such as client information, service descriptions, and payment terms, laid out in a clear and easy-to-read format. Ideal for freelancers or small businesses that want to maintain a professional appearance without overcomplicating the process.

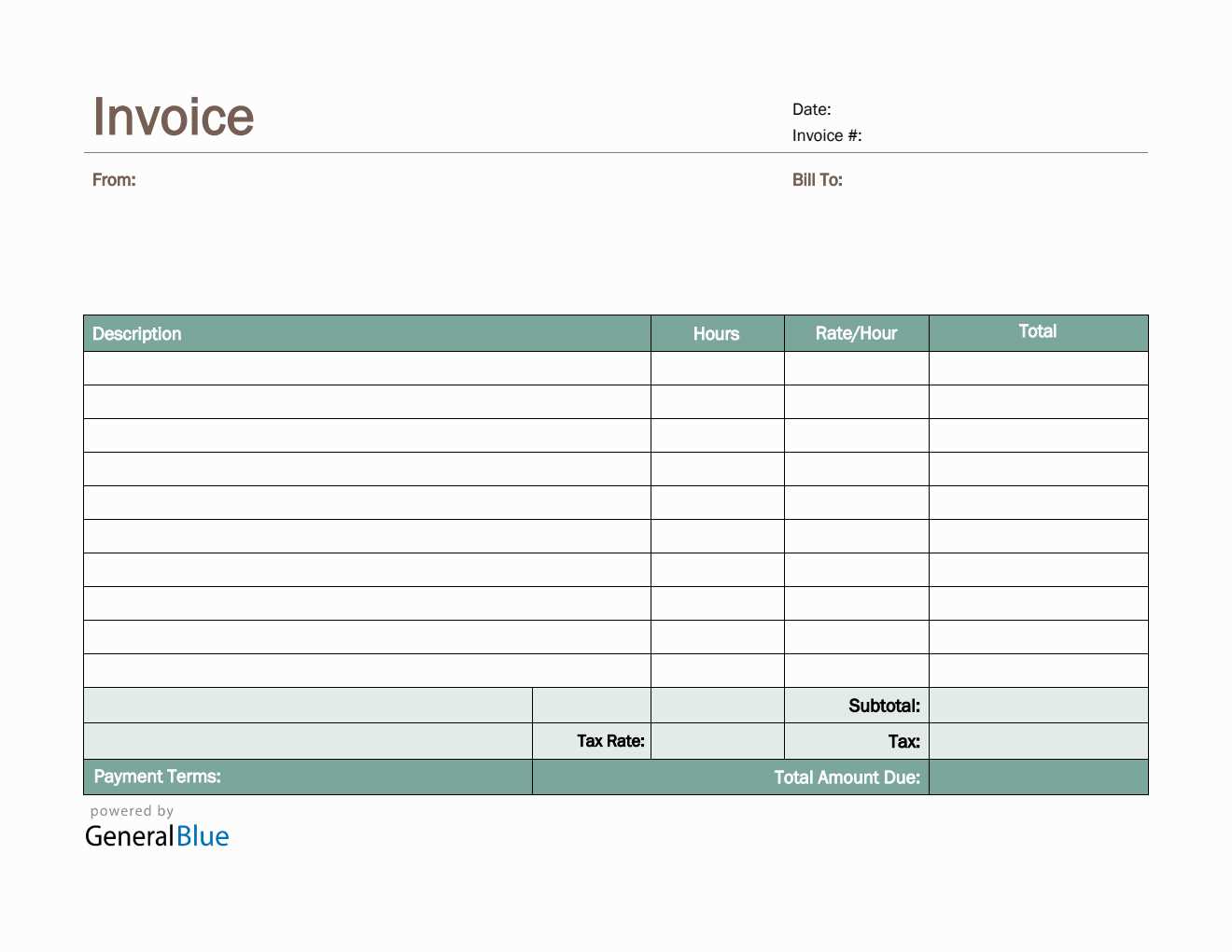

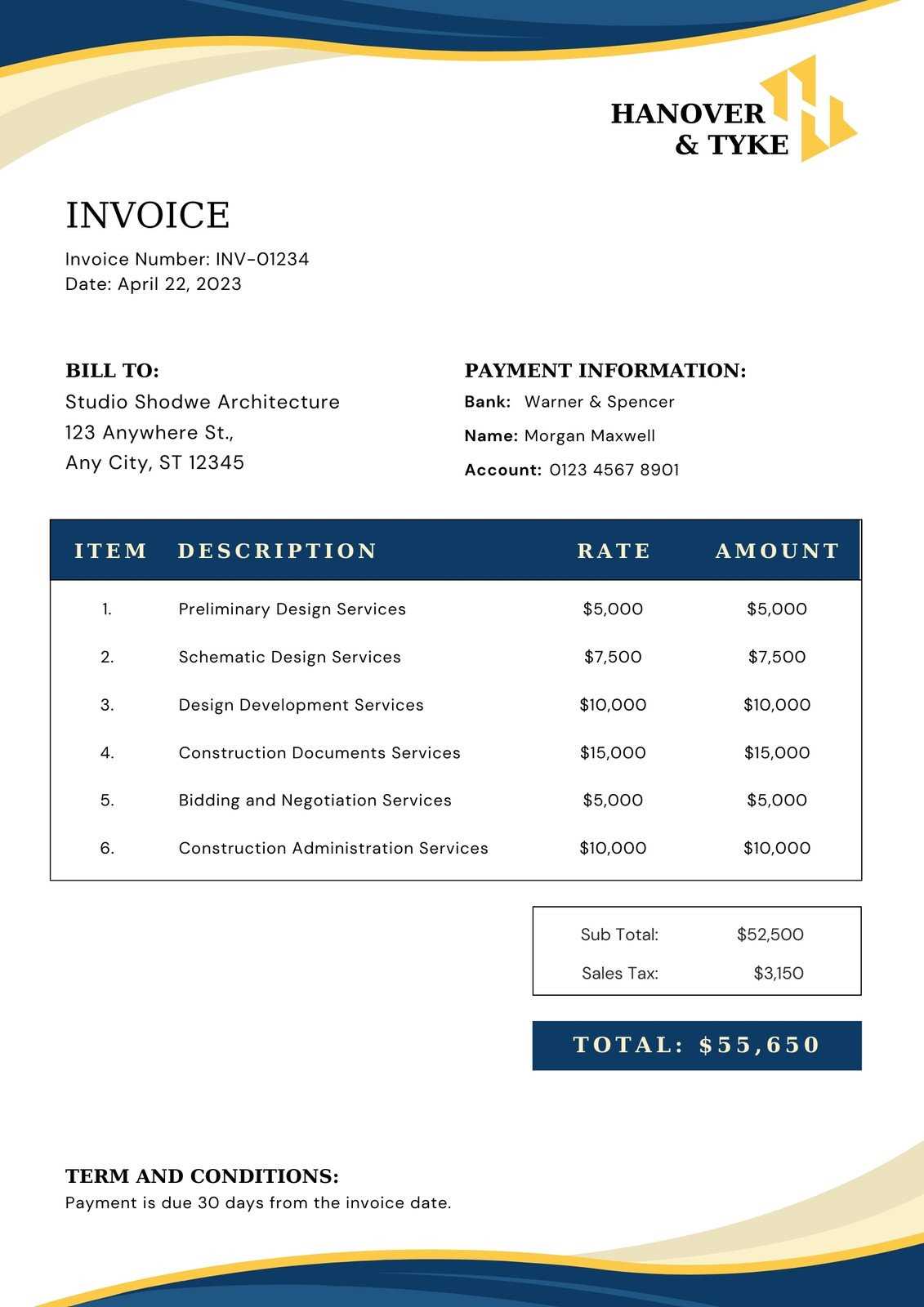

Detailed Billing Layout with Multiple Sections

If your business offers various services or products, this template provides extra sections to include detailed descriptions. It’s perfect for businesses that need to outline each item separately, including unit prices, quantities, and taxes. This design ensures your clients can easily understand each cost, leading to fewer payment disputes and a smoother financial process.

With these downloadable options, you can instantly access a professional and customized document for your business, helping you save time while maintaining a high level of professionalism.

How to Use Billing Documents Effectively

Using a pre-designed document format can significantly improve your billing process, ensuring consistency and accuracy in every transaction. However, it’s not just about filling in the blanks. To get the most out of these layouts, you need to understand how to tailor them to your specific needs, track payments, and maintain clear records. By doing so, you can ensure smooth and professional interactions with clients.

Here are some essential tips for using billing documents effectively:

- Customize Each Document: Make sure to adjust the layout to reflect your business and branding. Include your company logo, contact details, and any specific payment terms relevant to your industry.

- Be Accurate with Client Information: Always double-check that the client’s name, address, and contact information are correct. Inaccurate details can cause confusion and delays in payments.

- Include All Necessary Details: Ensure that you include a clear description of the services or products provided, along with quantities, unit prices, and any applicable taxes or discounts. This transparency helps avoid payment disputes.

By following these practices, you can ensure that your financial documents are effective and professional, improving both efficiency and client satisfaction.

For example, a well-organized table of services or products can help break down charges clearly:

| Service/Product | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $50/hr | $250 |

| Website Development | 1 | $1500 | $1500 |

| Total | $1750 |

By following these simple guidelines, you can optimize your billing documents, making them both functional and professional, which helps ensure faster payments and clear communication with clients.

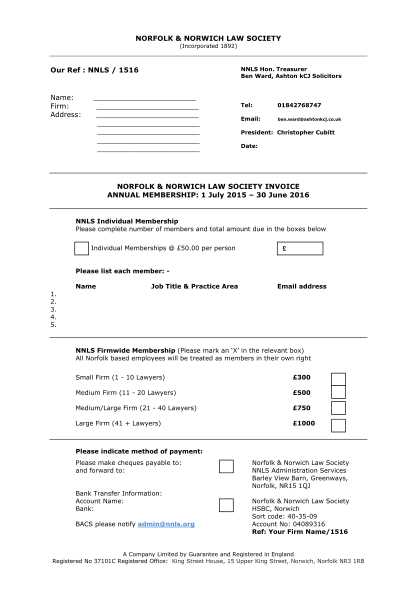

Pre-Designed Documents for Different Industries

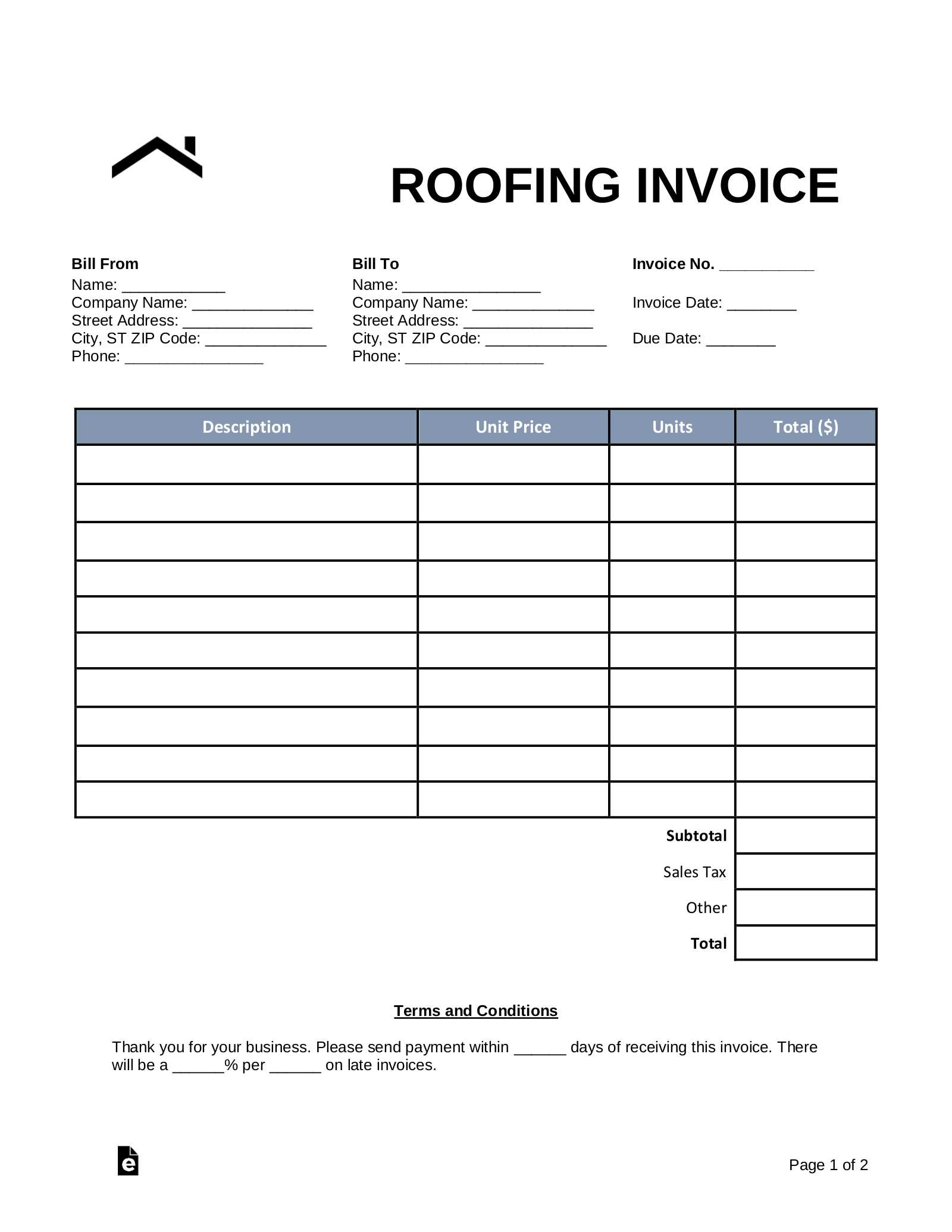

Each industry has its own set of requirements when it comes to documenting transactions. A generic layout may not always be sufficient, which is why tailored solutions can be beneficial. Industry-specific layouts are designed to include all the essential details relevant to particular businesses, ensuring accuracy and clarity in every document. Whether you’re in the creative field or managing a service-based business, there are options available that cater to your unique needs.

Here are some examples of industry-specific documents that you can use for various purposes:

- Freelancers and Consultants: A layout that includes detailed sections for hourly rates, project milestones, and payment schedules. This allows for clear communication between you and your client about the work completed and the expected payment timeline.

- Retail and Wholesale: A structure that includes product descriptions, unit costs, and bulk pricing, suitable for businesses that regularly sell physical products. This layout also allows for easy addition of taxes and shipping fees.

- Creative Professionals (Designers, Writers, Photographers): An option that emphasizes the creative services provided, offering space to outline project scope, deliverables, and specific terms, such as licensing or usage rights for intellectual property.

- Construction and Contractors: A layout tailored to the construction industry, which often requires itemized lists of labor, materials, and additional fees. This format can also include project milestones or work phases to help track progress and payment schedules.

- Health and Wellness: A simple yet effective format for wellness coaches, personal trainers, or therapists, which clearly lists services rendered, session duration, and rates, along with space for client details and payment terms.

By selecting the right document for your industry, you ensure that you provide your clients with a clear, professional, and accurate representation of the work completed and the payments due.

Billing Document for Freelancers

As a freelancer, managing payments and keeping track of your work can be challenging, especially when you’re juggling multiple clients. A well-structured billing document can help streamline the process, ensuring that you communicate clearly with your clients and maintain a professional image. The right format not only lists the services rendered but also outlines the terms and conditions, making it easier for clients to understand the charges and make payments on time.

Here are the key elements that should be included in your billing document as a freelancer:

- Your Contact Information: Always include your name, business name (if applicable), phone number, email, and address. This ensures clients can reach out if they have any questions or issues.

- Client’s Information: Make sure to include the client’s full name, company (if applicable), and their contact details. This ensures there is no confusion about which client the bill refers to.

- Description of Services: Be clear and concise about the services you’ve provided. Include hourly rates, flat fees, or project-based pricing. If applicable, break down the hours worked or items delivered.

- Payment Terms: Clearly state your payment terms, including the total amount due, payment method, and due date. If you offer early payment discounts or late fees, include these details as well.

- Project Milestones: For longer or ongoing projects, consider including a section for milestones. This helps track progress and gives the client a clear understanding of what has been completed and what’s left to do.

- Tax and Additional Fees: If applicable, make sure to include any relevant taxes or additional fees, such as materials or travel costs, to ensure full transparency.

Having a clear and well-organized billing document allows freelancers to maintain professional relationships with clients and helps ensure timely payments, contributing to a more efficient and successful freelance business.

Common Mistakes in Billing

When it comes to managing payment documents, even small errors can lead to confusion, delayed payments, and strained relationships with clients. Many businesses, especially those new to handling transactions, make common mistakes that can be easily avoided. Understanding these pitfalls can help you avoid costly mistakes and ensure that your documents are clear, accurate, and professional.

1. Missing or Incorrect Client Information

One of the most common errors is failing to accurately include client details, such as their full name, company name, or contact information. An incorrect address or name can cause confusion and delay payments.

2. Lack of Clarity on Payment Terms

Without clear terms, clients may be uncertain about when payment is due or how to make the payment. Ensure that you clearly specify the due date, payment methods accepted, and any late fees that may apply.

| Issue | Solution |

|---|---|

| Missing client details | Always double-check contact information before sending a document. |

| Unclear payment terms | Clearly state due dates and acceptable payment methods, along with any late fee policies. |

| Omitting service details | Break down services provided, hours worked, and rates to avoid confusion. |

| Not including taxes or additional fees | Ensure taxes and extra charges are clearly listed to avoid misunderstandings. |

By avoiding these common mistakes, you can ensure that your documents are professional and easy to understand, making the payment process smoother for both you and your clients.

How to Avoid Payment Delays

Payment delays can be frustrating for businesses, especially when cash flow is affected. To ensure timely payments, it’s crucial to take steps that encourage clients to settle their balances promptly. From clear communication to setting proper expectations, several strategies can help reduce the chances of delays and ensure that payments are received on time.

1. Set Clear Payment Terms

One of the best ways to avoid payment delays is to establish clear and transparent payment terms from the start. Make sure your clients understand when payments are due, how they should be made, and any penalties for late payments. This helps set the tone for a professional transaction and reduces misunderstandings.

2. Send Detailed and Accurate Documents

Errors or omissions in payment documents can lead to confusion and delay the payment process. By providing a detailed breakdown of services or products provided, along with accurate amounts, clients will have no reason to delay payments due to confusion about charges.

| Action | Benefit |

|---|---|

| Clearly communicate payment deadlines | Reduces misunderstandings about when payments are expected. |

| Offer multiple payment options | Gives clients flexibility, increasing the likelihood of timely payments. |

| Use digital tools to track payments | Helps you monitor payment statuses and follow up on overdue accounts easily. |

| Send reminders before payment due date | Encourages clients to settle accounts before the deadline. |

By adopting these practices, you can significantly reduce the chances of payment delays, improve cash flow, and maintain positive relationships with your clients.

Automating Invoice Generation

Automating the process of creating payment documents can save time, reduce errors, and streamline your workflow. Instead of manually creating each document, automated systems can generate them based on predefined criteria, ensuring consistency and accuracy. This process is especially beneficial for businesses that deal with high volumes of transactions and need a more efficient way to handle billing.

Benefits of Automation

Implementing an automated solution offers numerous advantages for businesses looking to improve their billing process:

- Time-saving: Automatically generate documents instead of creating them from scratch every time.

- Accuracy: Automated systems reduce the risk of errors in calculations or missing details.

- Consistency: Ensures that each document follows the same format, reducing confusion for clients.

- Efficiency: You can generate multiple documents at once, speeding up the payment process.

Steps to Automate Your Billing

Here’s a simple guide to help you get started with automating your payment document generation:

- Choose an automation tool: Select a software solution or online service that fits your business needs.

- Set up templates: Customize the document format with the necessary fields (client name, services rendered, due date, etc.).

- Integrate with other systems: Link the tool with your accounting or CRM software to streamline data entry.

- Review before sending: Although automated, it’s still important to review the documents before they are sent out to ensure everything is accurate.

By adopting automation, businesses can save valuable time and resources, reduce administrative overhead, and improve the overall efficiency of their billing process.

Tracking Documents for Better Cash Flow

Monitoring financial documents is crucial for maintaining a healthy cash flow in any business. By keeping track of payments due and received, businesses can prevent cash shortages and ensure that financial obligations are met on time. Efficient tracking systems help to spot overdue payments early, enabling proactive action to be taken before they affect your operations.

Benefits of Tracking Financial Documents

Regularly monitoring your payment documents brings several key advantages:

- Improved cash flow: Ensures timely payments, keeping the business running smoothly without unexpected shortages.

- Faster decision-making: By having a clear view of outstanding payments, you can quickly assess your financial situation and make informed decisions.

- Better client relationships: Consistent tracking and follow-up can help maintain a professional image, showing that you are organized and dependable.

- Reduced late payments: Tracking overdue documents allows you to follow up promptly, reducing the chance of payment delays.

How to Track Payments Effectively

Here are some practical steps to effectively track your financial documents:

- Use accounting software: Invest in software that automates tracking and provides real-time updates on payment statuses.

- Create reminders: Set up automatic reminders for clients before the payment due date to ensure they are aware of their obligations.

- Maintain a spreadsheet: For smaller businesses, a simple spreadsheet can be an efficient tool for tracking payments and deadlines.

- Regularly review outstanding payments: Establish a routine of reviewing all outstanding amounts on a weekly or monthly basis to ensure no payment is overlooked.

By implementing a tracking system and taking proactive steps to monitor payment statuses, businesses can maintain a stable cash flow and prevent financial disruptions.

When to Update Your Invoice Template

As your business evolves, the documents you use to request payments should also reflect those changes. Updating your payment request formats ensures that you stay compliant with any new regulations, accommodate changes in your service offerings, or simply improve the clarity and professionalism of your communications. Regularly reviewing and refreshing your document layout can help you avoid mistakes and maintain a streamlined billing process.

Here are some situations when it’s essential to update your payment documents:

- Business Changes: If your business expands or introduces new services or products, you may need to revise the details presented in your documents, such as service descriptions or pricing.

- Legal or Tax Changes: Any changes in tax laws or industry regulations may require updates to your documentation to ensure compliance with the latest standards.

- Rebranding: If your business undergoes a rebranding, it’s important to update the look and feel of your payment documents to reflect your new brand identity.

- Customer Feedback: If clients suggest changes or improvements, such as clearer breakdowns of charges or additional payment options, consider incorporating their suggestions into your documents.

- Technology Integration: If you switch to an automated billing system or integrate new software, the format of your documents might need adjustments to align with the new system.

By keeping your payment documents up to date, you can ensure that they are functional, professional, and aligned with your business’s current needs and legal obligations.

Legal Considerations for Invoices

When creating and sending payment requests, it’s essential to be aware of the legal requirements that govern these documents. Failure to comply with applicable laws can lead to payment disputes, fines, or damage to your business’s reputation. Ensuring that your payment requests contain all necessary details and meet legal standards is critical to safeguarding both your business and your clients.

Here are some key legal aspects to keep in mind when drafting payment requests:

| Legal Consideration | Description |

|---|---|

| Business Information | Your business name, address, and tax identification number should be clearly listed on the document to identify your company for legal purposes. |

| Payment Terms | Specify the due date for payment and any penalties for late payments. This helps avoid disputes over overdue amounts and clarifies expectations for both parties. |

| Tax Requirements | Ensure that taxes are calculated correctly and that the appropriate tax codes or VAT numbers are included in the document to comply with local tax regulations. |

| Itemized List of Charges | To avoid confusion, make sure that your document clearly outlines all goods and services provided, including quantities, rates, and descriptions. |

| Legal Disclaimers | Depending on your jurisdiction, you may need to include specific disclaimers or statements related to payment disputes, interest on overdue amounts, or other legal terms. |

By adhering to these legal guidelines, you can protect your business from unnecessary legal risks and ensure smoother transactions with your clients.

Best Software for Customizing Invoices

Choosing the right software for creating and personalizing your billing documents can make the process more efficient and professional. With the right tools, you can customize payment requests to match your business’s branding, include specific terms, and automate repetitive tasks. The software options available today provide a wide range of features to suit different business needs, from simple solutions to more advanced accounting platforms.

Here are some of the best software solutions for tailoring your payment requests:

- FreshBooks: FreshBooks offers a simple interface that allows users to create fully customizable billing documents. You can add your company logo, set up recurring payments, and choose from various templates to match your brand.

- Zoho Invoice: This platform provides an array of customization options, including the ability to add specific payment terms, tax settings, and multiple currency support. It also integrates with other Zoho products to streamline your business processes.

- QuickBooks: As one of the leading accounting software options, QuickBooks allows you to design professional billing forms with personalized fields and flexible templates. It also offers features for tracking payments and generating reports.

- Invoice Ninja: Invoice Ninja is an open-source tool with highly customizable design options. It provides an extensive library of templates, automated invoicing, and integrations with payment gateways to accept payments directly.

- Wave: Wave is a free platform that offers customizable billing solutions suitable for freelancers and small businesses. You can add logos, adjust templates, and track payments with ease.

Each of these platforms allows for significant customization, ensuring your payment documents align with your business’s unique needs and look professional.

Free Invoice Templates vs Paid Services

When it comes to creating billing documents, businesses have the option of using no-cost solutions or investing in premium services. Both options come with their advantages and trade-offs. Choosing the right approach depends on your business size, budget, and specific needs for customization and functionality. Free solutions can be a great starting point for small businesses or freelancers, while paid services offer advanced features and enhanced support.

Advantages of No-Cost Solutions

Using no-cost tools for generating payment documents can be a practical solution for those just starting out or with limited resources. These options typically provide basic layouts that are quick to use and easy to customize. Some of the key benefits of free tools include:

- Low cost: Free tools allow businesses to create and send billing documents without any financial investment.

- Ease of use: These solutions often offer simple, user-friendly interfaces, making them ideal for users with little experience in accounting or design.

- Basic customization: You can typically add your business name, logo, and payment details to the pre-designed layouts.

Benefits of Premium Services

While free tools serve their purpose, paid services can provide added value, especially for businesses that need more robust features. Premium platforms offer a higher degree of customization, automation, and support. Benefits of paid services include:

- Advanced customization: You can fully tailor your billing documents to match your brand, with more layout options and the ability to modify detailed sections.

- Automation: Paid services often come with automated invoicing, payment reminders, and integration with accounting software, saving time and reducing manual work.

- Support and security: These platforms often include customer support, enhanced security features, and regular updates, ensuring reliability and peace of mind.

Ultimately, the choice between free and paid options comes down to your business’s needs and long-term goals. Small-scale operations with limited needs may find free tools sufficient, while growing businesses may benefit from the added functionality and professional features of paid services.