Attorney Billing Invoice Template for Legal Services

Managing financial transactions efficiently is a critical part of any professional service, especially in the legal field. A well-structured document that details the costs of legal work can help ensure smooth communication and timely payments from clients. This document not only reflects the work completed but also helps maintain transparency and trust in client relationships.

Creating a clear and organized financial statement is essential for legal practitioners. It serves as an official record that outlines the services provided, the time spent, and the corresponding charges. With the right approach, this record can streamline the payment process, reducing misunderstandings and ensuring that both parties are on the same page regarding fees and expectations.

Effective financial documentation contributes to better business practices and strengthens the overall reputation of legal professionals. In this guide, we will explore the essential components and best practices for creating these important financial records, ensuring accuracy and professionalism in every transaction.

Attorney Billing Invoice Template Guide

Creating an organized and professional document to request payment for legal services is essential for every practitioner. This document serves as a clear reflection of the work done, detailing the services provided and the costs incurred. Having a consistent format for these records ensures both transparency and efficiency, making it easier for clients to understand the charges and for professionals to maintain accurate financial records.

By following a structured approach, legal professionals can craft documents that are not only easy to read but also legally sound. A well-organized payment request can prevent misunderstandings and help establish a sense of trust with clients. In this section, we’ll cover the key components and best practices to ensure that every payment request is comprehensive and professional.

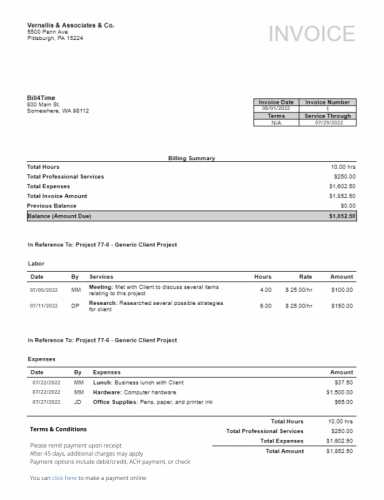

Key Elements of a Payment Request

A clear request should always include several critical pieces of information: the date of service, a description of the work completed, the time spent, the hourly rate or flat fee, and any additional expenses that may apply. Each of these elements plays a key role in ensuring that the client understands what they are paying for and why. A properly structured document includes all necessary details, making it easier for both parties to stay on track with payments.

Best Practices for Creating a Professional Request

To ensure your request meets the highest standards, it’s important to follow some best practices. First, consistency is key–using the same format for every document you send will create a sense of professionalism and make it easier for clients to understand. Additionally, be transparent about all costs, including taxes and additional fees, and provide a clear breakdown of charges. Finally, always include your payment terms, such as deadlines and methods of payment, to avoid confusion down the road.

Understanding the Importance of Billing Invoices

Creating a clear and accurate financial document is essential for any service provider, especially in the legal field. These documents serve not only as a record of the work performed but also as a tool to ensure that clients understand the costs associated with the services provided. Without well-structured records, misunderstandings regarding payments can arise, potentially leading to disputes or delays in payment.

In addition to serving as a reference for clients, these documents also play a vital role in maintaining accurate financial records for the service provider. A proper breakdown of services rendered, hours worked, and any additional costs helps in tracking revenue, preparing taxes, and staying compliant with industry regulations. It’s crucial for professionals to establish and maintain a consistent format for these financial documents.

| Component | Description |

|---|---|

| Work Description | Details of the services provided to the client, including specific tasks and their purpose. |

| Time Spent | The number of hours or days dedicated to completing the work, with an hourly rate if applicable. |

| Additional Costs | Any extra charges incurred, such as administrative fees, travel expenses, or third-party costs. |

| Total Amount | The sum of all charges, ensuring clients understand the total cost of services rendered. |

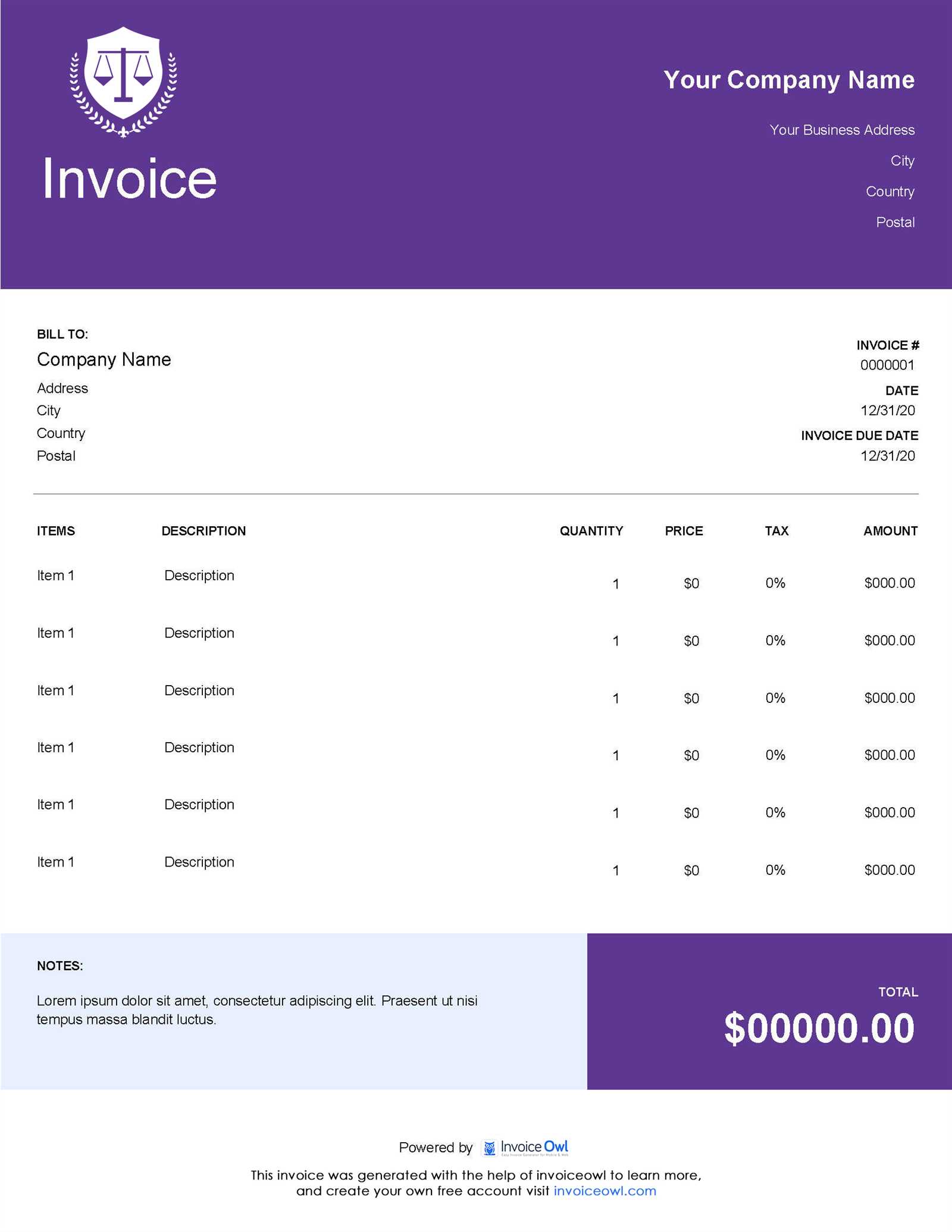

How to Customize Your Invoice Template

Adapting a standard payment request document to suit your specific needs is an important step in creating a professional and effective tool for managing financial transactions. Customization allows you to align the document with your business style and ensure it includes all relevant details, making it easier for clients to understand charges and for you to track payments.

Personalizing your document doesn’t just involve adding your business logo or contact details; it also means structuring the content in a way that is clear, concise, and tailored to the type of services you provide. This section will guide you through the process of modifying your payment request to reflect your unique requirements and maintain professionalism.

Adding Essential Details

Start by ensuring that all critical information is included. These details should cover the scope of services provided, the time spent, and any additional costs incurred. You may also wish to add your business branding, contact information, and payment terms to ensure the document represents your company clearly and consistently.

Adjusting Format and Layout

Consider how the layout can impact the clarity of the document. A clean and well-organized structure ensures that clients can easily navigate through the details. Use sections to separate different types of information, such as labor costs, expenses, and payment instructions. Choosing the right fonts, spacing, and alignment will also contribute to a polished and professional appearance.

Key Elements in an Attorney Invoice

When preparing a financial document for services rendered, it’s crucial to include specific details that ensure clarity and transparency. A well-organized document not only helps clients understand the costs involved but also provides a clear record for the service provider to track their earnings. Several key elements must be present to ensure the document is comprehensive and professional.

These elements should cover the scope of work, the amount of time spent, and the agreed-upon rates. Additionally, any extra costs should be clearly stated, allowing clients to see exactly what they are paying for. Ensuring that all of these components are included can help prevent misunderstandings and foster a smooth financial transaction.

Essential Information to Include

Each document should start with the service provider’s contact information, followed by the client’s details. The description of services rendered should be clear and concise, while the total amount should be itemized for transparency. A breakdown of hours worked, if applicable, is also essential to demonstrate the time spent on each task.

Handling Additional Costs and Taxes

Any extra expenses, such as administrative fees or travel costs, should be listed separately. Taxes, if applicable, must also be clearly indicated, ensuring the client is aware of the total cost before making payment. This level of detail not only helps with communication but also protects both parties in case of disputes.

| Element | Description |

|---|---|

| Service Description | A detailed outline of the work provided, including tasks performed and outcomes achieved. |

| Time Tracking | The hours or days worked, with specific time blocks or tasks listed, if applicable. |

| Additional Costs | Any extra charges, such as travel fees, materials, or third-party services used. |

| Total Amount | The final amount due, clearly showing the sum of services, time, and additional charges. |

Best Practices for Legal Billing

Ensuring accuracy and transparency when requesting payment for professional services is vital for maintaining strong client relationships and smooth financial operations. Adhering to best practices in creating payment requests not only helps avoid confusion but also promotes trust and professionalism. These practices can streamline the process, making it more efficient and reducing the likelihood of disputes over charges.

Effective financial documentation should be clear, detailed, and consistent. By establishing a structured approach to documenting services, time, and associated costs, service providers can improve their communication with clients and minimize errors in their financial records.

Consistency in Documentation

Consistency is key when managing financial records. It is important to maintain the same format for each payment request to make it easier for clients to understand. Using standardized language and a clear breakdown of services and costs ensures that no details are overlooked. Additionally, providing clients with the same level of detail for every document fosters trust and reduces confusion.

Transparency and Clarity

Being transparent about charges is essential for ensuring that clients are aware of what they are paying for. Each cost, whether it’s for time spent on a task or additional fees, should be clearly stated. If applicable, providing an explanation for any extra charges, such as administrative or travel fees, can help clients feel more comfortable with the payment request and avoid potential misunderstandings.

Choosing the Right Format for Invoices

Selecting the appropriate structure for your payment request document is crucial for ensuring clarity and professionalism. The format you choose plays a significant role in how easily clients can process and understand the information. Whether you opt for a simple layout or a more detailed breakdown, the key is to ensure that the format matches the type of services provided and the preferences of your clients.

There are different formats available, ranging from basic outlines to comprehensive documents. The ideal choice depends on the complexity of the services offered and the level of detail required. Here are some important factors to consider when choosing the right layout for your financial documents.

Factors to Consider

- Client Preferences: Understand how your clients prefer to receive financial documents. Some may prefer a detailed breakdown, while others may only require a summary of key points.

- Service Type: For complex services, a more detailed format with itemized costs and hours worked is often necessary. Simpler tasks may only need a brief summary.

- Professional Appearance: The format should be neat and easy to follow. A well-organized structure gives a professional impression and reduces the risk of misunderstandings.

- Software Compatibility: Ensure the format you choose is compatible with the software you use for creating documents. Using standard formats can help prevent technical issues.

Common Formats to Use

- Simple List: A basic layout that lists the services provided with corresponding costs. Best for straightforward transactions with minimal detail.

- Detailed Breakdown: A comprehensive format with itemized descriptions, hours worked, and additional costs. Ideal for complex services where clients need transparency.

- Pre-made Templates: Many software programs offer pre-designed structures that allow easy customization while ensuring all essential details are included.

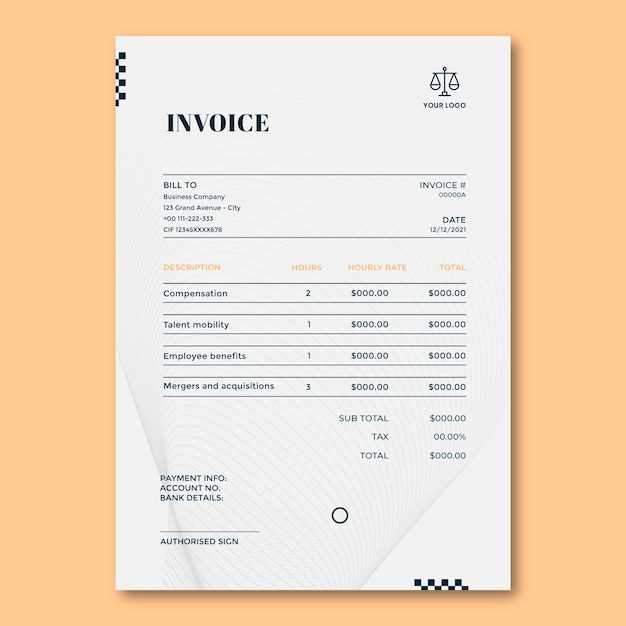

How to Handle Hourly vs Flat Fees

When requesting payment for professional services, one of the key decisions is how to structure the charges. The two most common approaches are charging by the hour or agreeing to a fixed fee for a particular service. Both methods have their advantages, depending on the nature of the work and the preferences of the client. Understanding how to manage these options can help streamline the payment process and ensure fairness for both parties.

Hourly rates are typically used when the scope of work is unpredictable or may change over time, allowing for flexibility. Flat fees, on the other hand, are often agreed upon when the services are well-defined and expected to remain consistent. Here are some important considerations for handling both fee structures effectively.

Managing Hourly Fees

- Track Time Accurately: It is essential to maintain detailed records of time spent on each task to ensure clients are billed correctly. Using time-tracking software can simplify this process.

- Clear Communication: Be transparent about the hourly rate and provide clients with regular updates on the amount of time spent on their matter to avoid surprises.

- Time Limits: If possible, set estimated time frames for tasks to give the client an idea of the expected cost and prevent any misunderstandings.

Managing Flat Fees

- Clear Scope of Work: When using a fixed fee, it’s crucial to define the scope of services covered by the flat rate. This helps avoid disputes about additional charges later on.

- Upfront Agreement: Discuss the details of the fee upfront with the client and ensure they understand exactly what is included in the agreed price.

- Flexibility for Changes: In the event the scope of work changes, consider discussing additional fees with the client to ensure both parties are in agreement.

Ensuring Compliance with Billing Standards

Maintaining consistency with industry regulations and client expectations is essential when preparing payment requests for professional services. Compliance ensures that the charges are fair, transparent, and legally sound. Whether you are following standard industry practices or adhering to specific client requirements, understanding and applying these guidelines can prevent disputes and build trust.

Adhering to proper standards not only protects the professional relationship but also ensures that your financial documents are clear and accurate. Here are some key points to consider to ensure your payment requests comply with recognized practices.

Key Guidelines for Compliance

- Clear Documentation: Ensure that every charge is documented with clear descriptions of the services provided. This helps to avoid confusion and shows transparency in your financial requests.

- Standardized Format: Consistency in the layout and structure of your documents can contribute to clarity. Use common formats that align with industry standards, including specific sections for services rendered, rates, and dates.

- Adherence to Local Regulations: Understand the local laws and regulations that may impact your financial documentation. Certain industries or jurisdictions may have specific rules regarding what should be included in payment requests.

- Approval Processes: If applicable, follow any internal approval processes before sending payment documents. This ensures accuracy and consistency before the client sees the final request.

- Timely Submission: Submit your payment requests in a timely manner to avoid delays. Ensure that all deadlines are met and that payment terms are clearly communicated.

Best Practices for Maintaining Compliance

- Regular Review: Regularly review your billing practices and templates to ensure they meet current standards and client expectations.

- Stay Updated: Keep yourself informed about changes in regulations or best practices in your field. Regularly updating your processes can prevent potential issues.

- Seek Expert Advice: If needed, consult with legal or financial professionals to ensure that your payment requests are fully compliant with relevant laws and guidelines.

Using Templates to Streamline Billing

Automating the process of creating financial documents can greatly improve efficiency and reduce the chances of errors. By using pre-designed structures for requesting payments, professionals can ensure consistency, save time, and maintain accuracy in their documentation. These standardized formats provide a reliable foundation for detailing services provided, hours worked, and costs incurred.

Implementing structured formats can help speed up the process while ensuring that each document adheres to established standards. Customizable elements allow flexibility to address unique requirements, ensuring the document is appropriate for every situation.

Advantages of Using Pre-Designed Formats

- Consistency: Pre-designed documents ensure that each request follows the same format, making it easier for clients to understand and process them.

- Efficiency: By using a consistent layout, professionals can quickly fill in the necessary details, saving time and reducing administrative work.

- Accuracy: Templates help avoid mistakes, ensuring that all required information is included and formatted correctly.

- Professional Appearance: Structured documents present a professional image, reinforcing credibility and reliability.

- Customization Options: Templates can be tailored to meet the specific needs of each client or project while maintaining the same essential structure.

How to Implement Structured Formats Effectively

- Select the Right Template: Choose a layout that fits the services offered and ensures all relevant details can be included without clutter.

- Personalize the Format: Adjust the template to reflect your business’s branding and to incorporate any unique client requests or legal requirements.

- Update Regularly: Periodically review and update your template to ensure it remains compliant with any changes in regulations or business practices.

- Use Digital Tools: Leverage software tools that integrate customizable templates with features like automatic calculations, digital signatures, and easy document sharing.

Common Mistakes in Legal Billing

Even experienced professionals can make errors when requesting payment for their services, which can lead to misunderstandings or delays in receiving compensation. Mistakes in financial documentation can affect both the client’s experience and the efficiency of the payment process. Identifying common issues early can help prevent these pitfalls and ensure that every transaction is handled smoothly.

By understanding the typical errors that occur, professionals can better prepare themselves and ensure that their payment requests are both accurate and professional. Below are some of the most common mistakes in creating these documents and ways to avoid them.

Common Errors to Avoid

- Incomplete Information: Failing to include all necessary details, such as service descriptions, dates, or payment terms, can delay processing and lead to confusion.

- Incorrect Rates or Fees: Using outdated or incorrect rates for services rendered can lead to disputes and loss of trust between the service provider and the client.

- Not Including Payment Terms: Neglecting to clearly define payment deadlines and terms can result in missed payments or delayed processing.

- Lack of Clarity: Vague or unclear descriptions of services can confuse clients and create questions about the accuracy of the charges.

- Omitting Discounts or Adjustments: Forgetting to include discounts, adjustments, or previous payments can lead to billing discrepancies.

- Overcomplicating the Format: A document that is too complex or difficult to understand may discourage clients from paying promptly.

Tips to Avoid Mistakes

- Double-Check Details: Always review the document for accuracy before sending it to ensure that all information is correct and complete.

- Use Consistent Rates: Keep track of your rates and ensure they are up-to-date in every request to avoid confusion.

- Be Transparent with Terms: Clearly outline payment deadlines and terms to avoid delays or disputes later on.

- Keep It Simple: A straightforward, easy-to-read format can help your clients process payments without confusion.

How to Include Disbursements on Invoices

When preparing a payment request for services rendered, it is important to account for additional costs that may arise during the process. These costs, often referred to as disbursements, are out-of-pocket expenses that the service provider incurs on behalf of the client. Properly documenting these costs is essential for transparency and ensuring that the client is aware of the full amount due.

Including these expenses in the payment request is necessary to maintain clear communication and avoid misunderstandings. Below are the steps for including disbursements accurately in the documentation.

Steps to Include Disbursements

- Identify Eligible Costs: Ensure that the costs being passed on to the client are directly related to the services provided and are reasonable.

- Provide Detailed Descriptions: For each disbursement, include a detailed description of the expense, such as travel fees, filing costs, or any third-party services used.

- Separate from Service Fees: Clearly distinguish between the service fees and the disbursements in the document. This ensures clients can easily differentiate between costs for work performed and additional expenses.

- Use Clear Formatting: Present the disbursements in a clear, organized format. This can be done by listing them separately or in a distinct section to avoid confusion.

- Attach Receipts or Proof: Whenever possible, provide receipts or evidence of the expenses to give the client confidence in the accuracy of the charges.

- Include Payment Terms: Clearly indicate how these additional costs should be paid, whether along with the regular fees or separately.

Best Practices for Including Disbursements

- Be Transparent: Ensure the client is informed beforehand about any potential disbursements that may occur throughout the process.

- Itemize Disbursements: List each expense separately with the exact amount, and avoid lumping multiple costs together.

- Consistency: Always include disbursements in the same format and section of the document to maintain clarity across all requests.

Why Accurate Time Tracking Matters

Keeping precise records of the time spent on tasks is crucial for both clients and service providers. Accurate documentation ensures that both parties are on the same page regarding the duration and scope of services provided. It also plays a key role in creating transparency, managing expectations, and maintaining fair compensation for the services rendered.

Proper time tracking helps to avoid disputes, guarantees that clients are only charged for the actual time spent, and ensures that service providers are fairly compensated for their work. Below are the key reasons why accurate time management is essential.

Benefits of Accurate Time Tracking

- Transparency: Clients have a clear understanding of how their funds are being used, reducing the likelihood of confusion or dissatisfaction.

- Fair Compensation: Service providers are ensured they are compensated appropriately for the actual time spent on tasks, preventing underpayment.

- Enhanced Accountability: By documenting time spent, both parties can track progress and ensure that work is completed efficiently and effectively.

- Reduced Disputes: Accurate records provide a clear basis for resolving any disagreements regarding the amount of time worked or services rendered.

- Improved Efficiency: Tracking time accurately can highlight areas where time management can be improved, leading to greater productivity.

Best Practices for Time Tracking

- Use Reliable Tools: Invest in time-tracking software or systems that automatically log time spent on tasks.

- Be Consistent: Record time as tasks are completed, rather than relying on memory later.

- Break Down Tasks: Split larger projects into smaller, measurable tasks for more accurate tracking.

- Regularly Review Time Entries: Periodically review the recorded time to ensure there are no errors or omissions.

Creating Clear Payment Terms for Clients

Establishing clear and precise payment expectations is essential for building trust and maintaining positive relationships with clients. By outlining terms early in the process, both parties can avoid confusion or disagreements regarding fees, deadlines, and payment schedules. Transparent payment terms also ensure that clients are aware of their financial obligations and the procedures for fulfilling them.

Clear payment terms contribute to a smooth workflow, as both the service provider and the client have a mutual understanding of the financial arrangement. Below are the essential elements to include when setting clear payment guidelines.

Essential Elements of Payment Terms

| Element | Description |

|---|---|

| Payment Amount | Clearly state the total amount due for services provided, including any additional costs or disbursements. |

| Due Date | Specify the exact date by which payment should be made to avoid any late charges or misunderstandings. |

| Payment Methods | Outline the accepted methods of payment, such as bank transfer, credit card, or online platforms. |

| Late Payment Penalties | Describe any consequences for late payments, including interest charges or a specific grace period. |

| Discounts for Early Payment | Incentivize prompt payment by offering a discount if payment is made before the due date. |

Best Practices for Setting Payment Terms

- Be Specific: Avoid vague language and clearly define the terms to prevent any ambiguity or confusion.

- Communicate Early: Make sure clients are aware of the payment terms before the work begins to avoid misunderstandings later.

- Offer Flexibility: If possible, offer flexible payment options to accommodate clients’ preferences or financial situations.

- Keep it Professional: Use formal and professional language in your payment terms to ensure that both parties take the agreement seriously.

Including Taxes and Additional Fees

When finalizing the amount due for services rendered, it is crucial to account for taxes and any extra charges that may apply. These additional costs should be clearly outlined to avoid any confusion for the client. Including taxes and extra fees in a transparent manner ensures that both parties are aware of the full financial obligations involved and helps prevent misunderstandings.

Including these charges can be tricky, but with careful attention to detail, it is possible to maintain clarity and professionalism. Below are important points to consider when including taxes and extra charges in your financial agreements.

Key Points to Include

- Sales Tax: Ensure that you specify the applicable sales tax rate and calculate it correctly based on the service or product provided. Indicate whether it’s included in the total or needs to be added separately.

- Additional Costs: Clearly outline any extra fees for services beyond the standard agreement. This may include things like administrative fees, research costs, or travel expenses.

- Disbursements: Mention any costs incurred on behalf of the client that should be reimbursed. This could include court filing fees, postage, or other third-party charges.

Best Practices for Handling Additional Charges

- Be Transparent: Always provide a breakdown of any additional fees or taxes to avoid confusion or surprises for the client.

- Provide Clear Explanations: If the client questions any additional costs, be prepared to explain them in detail and show how they are justified.

- Stay Consistent: Ensure that the same fees are applied across all clients where applicable to maintain fairness and consistency in your approach.

Managing Client Expectations with Billing

Effectively managing client expectations regarding financial matters is essential for maintaining a healthy working relationship. Clear communication about the cost of services, payment schedules, and potential additional charges can help avoid misunderstandings. Setting realistic expectations from the outset allows clients to feel informed and confident, while also ensuring that both parties are aligned on the terms of payment.

It is important to be transparent about what clients can expect when it comes to costs. This includes providing them with a clear understanding of the pricing structure, payment terms, and any potential fees that may arise throughout the engagement. By addressing these points upfront, clients are less likely to experience surprises when they receive a final bill.

- Be Transparent: Clearly outline the costs involved and any additional charges that might be incurred. This can include service fees, taxes, or other incidental costs. Transparency helps build trust.

- Set Payment Milestones: If your work is completed in stages, communicate when payments will be due. This prevents confusion and gives clients a clear timeline for when to expect payments.

- Provide Regular Updates: Keep your clients informed about the progress of the work and any changes that could affect the overall costs. Regular communication helps avoid surprises.

- Clarify Terms: Ensure that clients fully understand payment schedules, late fees, and other terms. Clear terms prevent confusion and create a more professional relationship.

Digital vs Paper Invoices for Attorneys

When it comes to handling financial documentation, professionals have the option of choosing between digital and paper methods. Each format offers its own set of advantages and challenges. The choice often depends on the needs of the practice, the clients, and the desired level of efficiency and convenience. Understanding the benefits and potential drawbacks of both options can help in making the best decision for both the provider and the client.

Digital formats provide greater efficiency and flexibility. They can be easily customized, stored, and shared with clients through email or secure online portals. Digital records also enable automatic tracking and reminder features, ensuring timely payments. On the other hand, paper records offer a more traditional approach, which some clients may prefer for familiarity or due to specific legal requirements that mandate physical documentation in certain cases.

In deciding between the two, it is important to consider factors such as speed, security, and client preference. Many practices are opting for a hybrid model, where both formats are offered depending on the situation or client request. The key is finding the right balance that supports business operations while maintaining professional standards.