Easy to Use Printable Invoice Template for Your Business

Managing financial transactions and ensuring accurate record-keeping is essential for any business. One of the easiest ways to streamline this process is by using standardized documents that can be quickly generated and customized for each transaction. These ready-made forms save time, reduce errors, and provide a professional appearance for all your dealings.

Customizable billing documents offer flexibility while maintaining consistency across your transactions. Whether you’re a freelancer, small business owner, or part of a larger organization, using these documents ensures that all the necessary details are included and clearly presented. This helps to avoid confusion and potential delays in payments.

Designed for efficiency, these documents can be edited with ease, allowing you to adjust the content based on your specific needs. From adding client details to applying discounts or taxes, you can create a document that perfectly matches your business requirements. In this article, we will explore the advantages of using these forms and guide you on how to make the most of them for smooth financial management.

Printable Invoice Template for Your Business

For any business, having a reliable and consistent way to document transactions is crucial. Using a standardized document for billing ensures clarity and professionalism, helping to maintain smooth operations and accurate records. This simple tool helps you create a clear record of goods or services provided, making it easier to track payments and manage financials.

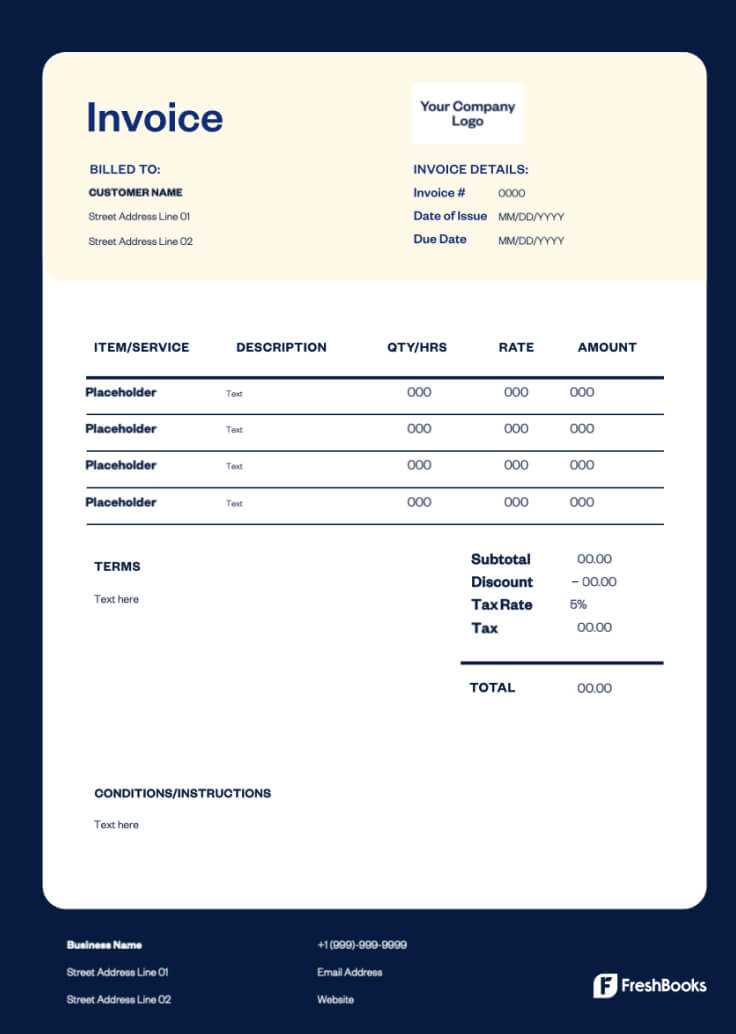

By adopting a well-structured form, you can ensure that every essential detail–such as itemized costs, client information, payment terms, and dates–is clearly presented. Customizing this document to fit your specific business needs provides both flexibility and consistency, which can be critical when dealing with various clients or changing services. Whether you are handling one-time projects or recurring services, this method makes invoicing more efficient.

Implementing this system allows you to focus more on your business growth rather than spending time on administrative tasks. By using a pre-designed form, you reduce the likelihood of errors, improve payment processing, and enhance the overall professionalism of your business dealings.

Why Use a Printable Invoice Template

Having a reliable and structured document for recording payments is essential for maintaining accurate financial records and ensuring smooth business operations. Using a consistent format for billing not only saves time but also helps establish professionalism in your interactions with clients. This method simplifies the process of managing transactions and makes it easier to track outstanding payments.

Save Time and Effort

When you rely on a pre-made form, much of the work involved in creating a billing document is already done for you. All the key fields–such as amounts, service descriptions, and payment terms–are neatly organized, allowing you to quickly fill in the relevant details. This eliminates the need to start from scratch each time you bill a client, which can be a tedious and error-prone task.

Ensure Accuracy and Professionalism

Using a standardized form minimizes the chances of overlooking important information and makes it easier to present a clear and accurate record. The professional appearance of a well-organized billing document can also enhance your business’s credibility. Clients are more likely to trust a company that uses structured and easy-to-understand documentation.

Benefits of Customizable Invoice Templates

Customizable billing forms offer several advantages for businesses looking to streamline their financial processes. With the ability to modify key elements, these forms provide the flexibility to meet various business needs while ensuring consistency. Tailoring documents to your specific requirements can significantly improve efficiency and accuracy when managing transactions.

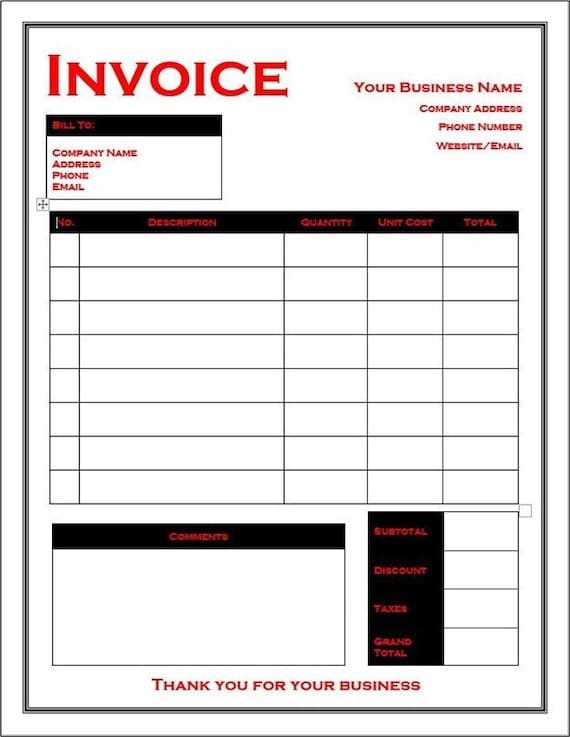

- Flexibility in Design: Customization allows you to adjust the layout, add or remove sections, and incorporate branding elements such as logos and color schemes. This ensures the document reflects your company’s identity.

- Personalization for Different Clients: Tailoring each document to individual client needs, such as specific services provided or unique payment terms, helps build stronger relationships and reduces misunderstandings.

- Easy Integration of Business Information: Custom forms can automatically include your business details (e.g., address, contact information), saving time and ensuring consistency across all documents.

- Adaptability to Different Business Models: Whether you run a freelance service, a retail store, or a consulting firm, you can modify the document to suit the specific requirements of your business operations.

- Accurate and Up-to-Date Information: Custom forms can be quickly updated to reflect changes in pricing, services, or terms, ensuring that every document issued is always current.

By offering these customizable options, businesses can enhance professionalism, reduce errors, and increase operational efficiency in their billing practices. These advantages make tailored billing documents an indispensable tool for companies of all sizes.

How to Create an Invoice from Scratch

Creating a billing document from scratch may seem like a daunting task, but it’s actually a straightforward process when you break it down into key components. By ensuring that you include all the necessary details, you can easily create a clear and professional record of the transaction. A well-constructed document not only serves as a receipt but also acts as a formal agreement between you and the client.

Step 1: Include Basic Business Information

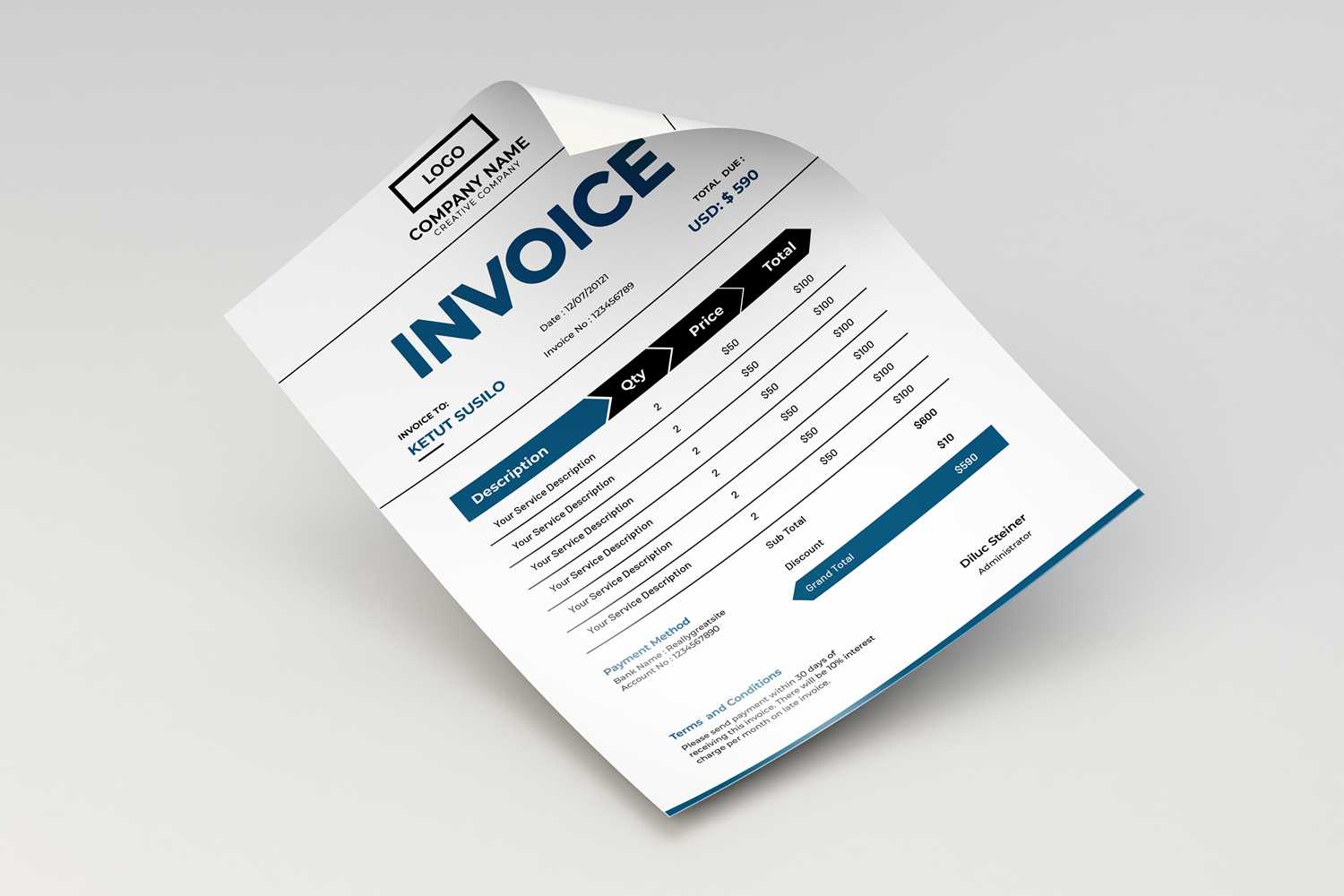

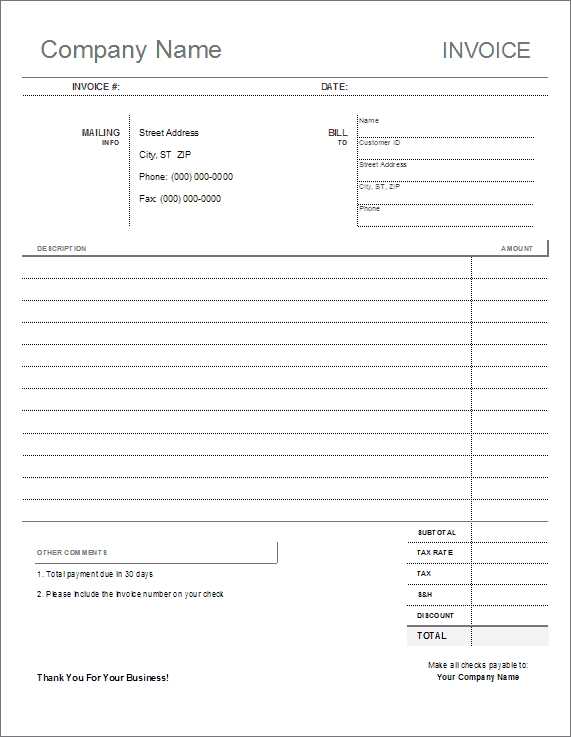

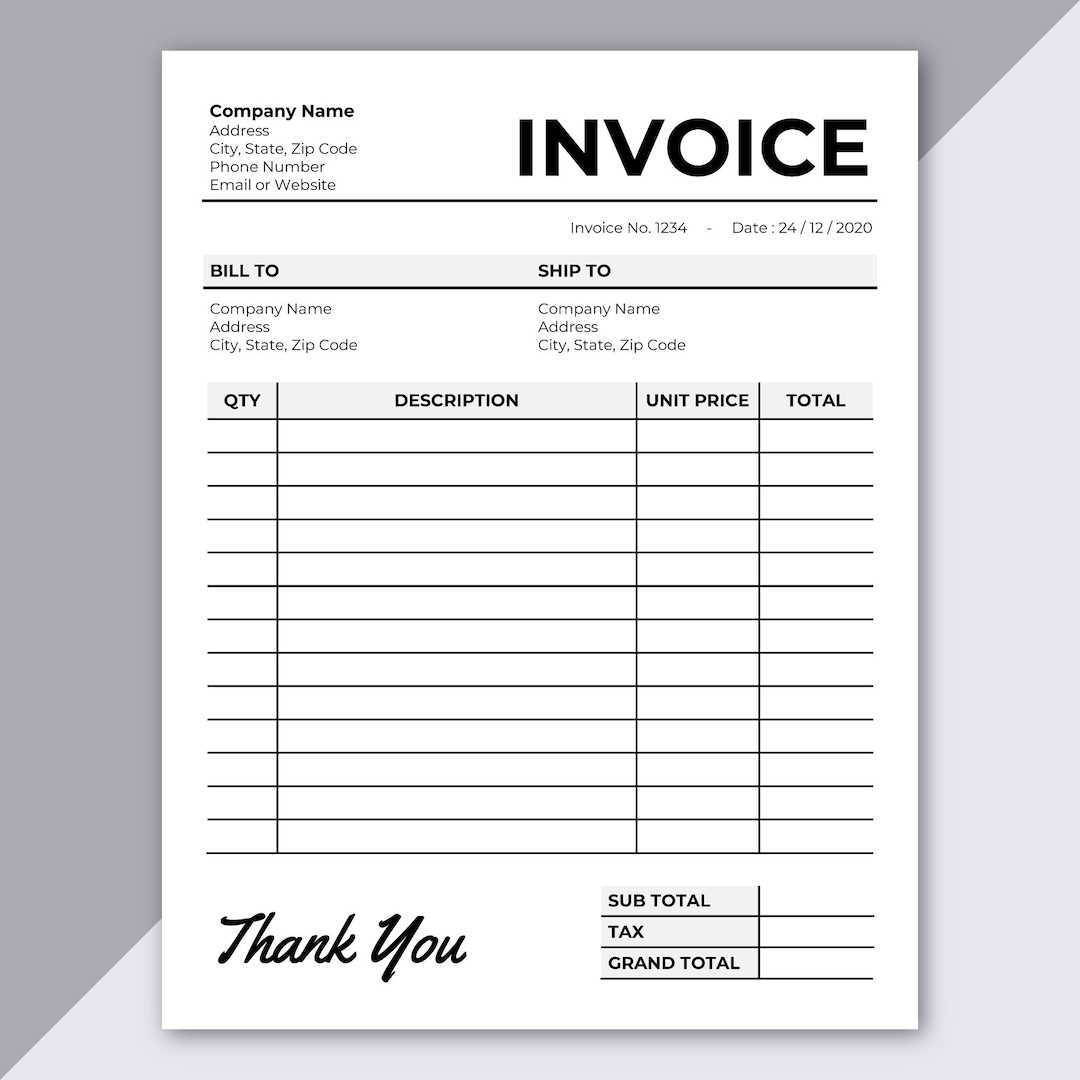

Start by adding your business name, address, and contact details at the top of the document. This ensures the client knows exactly who the bill is coming from. Having this information prominently displayed also helps maintain a professional image. You should also include the client’s details–such as their name, company name (if applicable), and contact information–beneath yours to clarify who is being billed.

Step 2: Add Transaction Details

Next, provide a clear breakdown of the goods or services provided. For each item or service, list the description, quantity, unit price, and total amount. Being specific about what has been delivered ensures that both parties are on the same page regarding the terms of the agreement. Don’t forget to include the date of the transaction and a unique reference number for easy tracking of payments.

Finally, make sure to include the payment terms–such as due date and accepted payment methods–so the client understands when and how to pay. Adding any applicable taxes or discounts will help clarify the final amount owed. Once you’ve gathered all the necessary details, review everything for accuracy, and your billing document is ready to be sent!

Top Features to Look for in Templates

When selecting a pre-designed billing form, it’s important to ensure it meets your specific needs and simplifies your financial processes. The right document can save time, reduce errors, and provide a professional appearance for your business. Here are the key features to look for when choosing a billing solution.

- Clear Structure and Layout: A well-organized format ensures that all the essential details, such as payment terms, item descriptions, and total amounts, are easy to find. This minimizes confusion for both you and your clients.

- Customizable Fields: The ability to edit and adjust fields allows you to tailor the document to different clients and services. This flexibility ensures that you can add or remove information based on your specific needs.

- Automated Calculations: Look for forms that automatically calculate totals, taxes, and discounts. This reduces the risk of human error and speeds up the process of preparing your documents.

- Branding Options: A customizable form should allow you to incorporate your logo, business colors, and other branding elements. This helps reinforce your business identity and adds a personal touch to the document.

- Easy-to-Read Fonts and Formatting: Choose a design that uses professional, easy-to-read fonts and clear formatting. The easier the document is to read, the more likely your clients will pay attention to important details, such as payment due dates or amounts owed.

- Multiple File Formats: A good form should be available in different file formats (e.g., PDF, Word, Excel) for flexibility in how you present and send it. This ensures that you can choose the best format based on how your clients prefer to receive and process the documents.

By selecting a well-designed document that includes these essential features, you can ensure that your billing process is more efficient, professional, and accurate, ultimately leading to better financial management for your business.

How Printable Invoices Simplify Accounting

Using standardized billing documents can greatly streamline the accounting process for any business. By providing a clear and consistent record of transactions, these documents help keep financial records organized and ensure that all necessary details are tracked. This makes it easier to monitor payments, manage cash flow, and reconcile accounts.

Improved Accuracy and Consistency

When you use a structured document, the likelihood of missing or misplacing key information is significantly reduced. Every element, from itemized charges to client details, is clearly laid out, making it easier to identify discrepancies. This consistency helps prevent errors and ensures that all financial data is accurately recorded.

- Standardized Format: Each bill follows the same format, making it easier to compare multiple transactions.

- Easy Data Entry: Filling in information is quicker and more straightforward, reducing the time spent on manual data entry.

- Clear Payment Terms: Having payment deadlines and accepted methods clearly stated helps prevent misunderstandings and delays in receiving payments.

Simplified Record Keeping and Reporting

Having a consistent method of tracking payments and transactions simplifies the process of creating financial reports. By organizing transactions in a uniform way, you can easily calculate revenue, identify outstanding payments, and prepare tax documents. These forms also help you maintain a digital or paper trail that can be referenced at any time during audits or when reviewing your financial health.

Ultimately, using structured billing documents allows businesses to focus more on growth and less on administrative tasks. By reducing manual work and improving accuracy, these documents help maintain a smooth and efficient accounting process.

Free vs Paid Printable Invoice Templates

When it comes to creating billing documents, businesses have the option to choose between free and paid solutions. Both options have their advantages and drawbacks, depending on the needs of the business. While free options may offer basic functionality, paid solutions often come with additional features and customization options that can be beneficial for more complex or larger operations.

Advantages of Free Solutions

Free billing forms can be a great starting point, especially for small businesses or freelancers with simple needs. These options are typically easy to access and provide a basic structure for documenting transactions. Here are some benefits of free options:

- Cost-Effective: As the name suggests, free solutions require no financial investment, making them ideal for startups or those with limited budgets.

- Easy to Use: Most free options are straightforward and user-friendly, requiring little to no setup or technical knowledge.

- Basic Functionality: These forms typically include the essential fields, such as client details, service descriptions, and amounts, making them suitable for simple billing needs.

Advantages of Paid Solutions

While free options may meet the needs of some, paid solutions offer greater flexibility and additional features. These options are designed to cater to more complex billing requirements, providing tools that enhance efficiency and professionalism. Here’s why paid forms may be worth the investment:

- Customization: Paid solutions often allow for more detailed customization, such as adding logos, changing color schemes, and modifying field layouts to match your brand.

- Advanced Features: Paid options may include automated calculations, recurring billing options, and integration with accounting software, saving you time and reducing errors.

Choosing the Right Invoice Format for Your Needs Selecting the right format for your billing documents is crucial to ensure efficiency and clarity in your financial transactions. The format you choose should align with the complexity of your business and the way you handle payments. Different formats offer varying levels of customization, automation, and detail, so it’s important to choose one that fits your specific requirements.

Consider Your Business Type

One of the first things to consider when choosing a billing format is the nature of your business. For example, freelancers and small businesses with simple needs may benefit from a basic layout that focuses on essential information, like the amount due and payment terms. On the other hand, larger businesses or those offering multiple products and services may require a more detailed format that allows for itemized lists, taxes, and additional fees.

- Freelancers and Consultants: A simple, clean format with space for service descriptions, hours worked, and payment details.

- Small Retailers: A format that includes itemized listings, taxes, and total cost calculations.

- Larger Businesses: A more complex format with room for multiple services, recurring charges, or advanced payment terms.

Customizability and Automation

Another factor to consider is how much customization and automation you need. If you want to add branding elements such as logos and business colors, or if you need the ability to integrate with accounting software, look for a format that offers flexibility. Automated calculations, like tax rates and discounts, can also save you time and reduce errors, especially for businesses with regular billing cycles.

- Customization: The ability to add your logo, business name, and specific payment instructions can enhance your professionalism.

- Automation: Formats that auto-calculate totals, taxes, and discounts can save time and prevent errors in complex billing scenarios.

Ultimately, choosing the right format depends on your business needs, the frequency of transactions, and how much detail is required in each document. By selecting a format that suits your workflow, you can simplify your billing process, ensure accuracy, and improve your financial management.

How to Edit a Printable Invoice Template

Editing a billing document is a simple process that allows you to customize it according to your specific business needs. Whether you’re adding client details, updating item descriptions, or changing payment terms, being able to modify the document ensures that it remains relevant and accurate for each transaction. Here’s how you can efficiently edit your billing form to meet your requirements.

First, open the document in the program that supports the file format, such as Word, Excel, or PDF editor. Once you’ve opened the file, you can begin making the necessary adjustments. Follow these steps for quick and easy editing:

- Update Client Information: Replace the client’s name, address, and contact details with the correct information for each new transaction.

- Adjust Service Descriptions: Modify the list of services or products provided, ensuring that quantities, prices, and descriptions match what was delivered.

- Change Payment Terms: Edit payment due dates, methods, or any discounts that may apply. This ensures that your document reflects the current terms agreed upon with the client.

- Modify Taxes and Fees: If applicable, update any tax rates or additional charges, ensuring that the final amount accurately reflects the full cost of the transaction.

- Branding and Design: If you want to add or change your company logo, colors, or fonts, most formats allow you to easily modify these elements to align with your business branding.

Once all the information is updated, save the file in the desired format and review it for accuracy. Editing these forms as needed allows for faster processing and helps maintain professional communication with your clients.

Common Mistakes to Avoid in Invoices

When creating a billing document, it’s easy to overlook certain details that could lead to confusion or delayed payments. Making mistakes on these forms can result in frustration for both you and your clients, and even lead to payment disputes. To ensure smooth transactions and maintain professionalism, it’s important to avoid some common errors when preparing these essential documents.

- Incorrect Client Information: One of the most common mistakes is listing the wrong client name, address, or contact details. Always double-check that the information is accurate before sending the document.

- Missing or Incorrect Payment Terms: Failing to clearly state payment due dates, accepted methods, or any discounts can lead to confusion and delayed payments. Be specific about when payment is expected and any terms regarding late fees or penalties.

- Unclear Item Descriptions: Vague descriptions of the services or products provided can lead to misunderstandings. Be precise and clear about what you are charging for to avoid disputes or questions from your clients.

- Mathematical Errors: Simple calculation mistakes can create problems and delay payments. Always double-check your totals, taxes, and discounts to ensure everything adds up correctly.

- Missing or Incorrect Tax Rates: Failing to apply the correct tax rate or leaving taxes off altogether can lead to inaccurate amounts being charged. Make sure to check current tax rates and apply them properly to each item or total.

- Failure to Include a Unique Reference Number: Every billing document should have a unique reference number for tracking purposes. This helps both you and your clients keep track of the transaction and avoids confusion with multiple invoices.

- Lack of Professional Appearance: A poorly designed or unprofessional-looking document can make your business appear disorganized. Ensure the format is clean, easy to read, and reflects your brand’s image.

By avoiding these common mistakes, you can ensure that your billing process runs smoothly and professionally. Taking the time to carefully review your documents before sending them out will help you build trust with your clients and maintain accurate financial records.

How to Save Time with Invoice Templates

Creating billing documents from scratch for each transaction can be time-consuming and inefficient, especially when you’re managing multiple clients or projects. By using pre-designed forms, you can automate much of the process and focus on what really matters–delivering your services. These ready-to-use solutions save you valuable time, helping you streamline your workflow and stay organized.

Key Time-Saving Benefits

Here are some of the main ways using ready-made billing solutions can speed up the process and reduce the time spent on paperwork:

- Consistent Format: Pre-designed documents follow a consistent structure, eliminating the need to reformat or adjust layout details every time you generate a new document.

- Pre-Filled Fields: Many forms come with fields like your company name, address, and contact details already filled in, so you only need to update the client’s information and transaction details.

- Automated Calculations: Built-in calculations for totals, taxes, and discounts can save time on manual math, reducing errors and ensuring accuracy in your documents.

- Quick Customization: Ready-to-use solutions allow for fast editing. You can quickly add or remove items, update prices, or adjust payment terms without starting from scratch.

- Batch Processing: Some solutions allow you to generate multiple documents at once, making it easy to handle a series of transactions in one go.

How This Saves You Time

By using these ready-made solutions, you can reduce the hours spent creating documents manually and focus more on running your business. Instead of spending time formatting, calculating, and customizing each document, you simply update the relevant fields and send it off. This leads to faster turnaround times, fewer mistakes, and a more organized billing process.

Ultimately, using pre-built billing forms helps improve efficiency and consistency, making it easier to manage your financial records and keeping your workflow smooth and uninterrupted.

How to Add Tax and Discounts to Invoices

Accurately applying taxes and discounts is essential for ensuring that your billing documents reflect the true cost of the products or services provided. Including these adjustments not only helps you comply with local regulations but also ensures transparency with your clients. Here’s how you can effectively add tax and discounts to your billing forms to maintain accuracy and professionalism.

Adding Taxes

Taxes are an important part of many billing documents, and applying them correctly ensures that both you and your clients remain compliant with tax laws. Here’s how to properly add tax to your document:

- Identify Applicable Tax Rates: Before adding tax, make sure you know the correct rate for your location or industry. Different products and services may also be subject to different tax rates, so it’s important to be specific.

- Calculate Tax Amount: Multiply the taxable amount by the applicable tax rate to find the total tax due. For example, if a service costs $100 and the tax rate is 10%, the tax amount would be $10.

- Clearly Display Tax Information: Include a separate line for taxes on your document, specifying the tax rate and the amount charged. This helps your clients understand exactly what they are paying for.

Applying Discounts

Offering discounts is a common practice to incentivize clients or reward loyalty. Here’s how to apply discounts correctly:

- Define the Discount Type: Discounts can be either percentage-based or a fixed amount. Be clear on how much the client will save, whether it’s a 10% discount or $20 off the total.

- Calculate the Discount: For a percentage discount, multiply the total amount by the discount percentage. For example, a 15% discount on a $200 charge would be $30.

- Subtract the Discount from the Total: Deduct the calculated discount from the original total, and clearly show the discounted price on the form. This ensures your client knows the original price and the reduced amount they are paying.

By accurately calculating and clearly displaying taxes and discounts, you not only ensure compliance but also improve the transparency and professionalism of your billing documents. This helps build trust with your cl

Printable Invoice Templates for Freelancers

For freelancers, maintaining an organized and professional approach to billing is essential for building trust and ensuring timely payments. Using pre-designed forms tailored for freelance work allows for quick and easy creation of billing documents, saving time and reducing errors. These customizable forms can be adapted to suit various types of services, whether you’re a writer, designer, developer, or consultant.

Freelancers often deal with varying project types, rates, and payment terms, making it important to have a billing system that is flexible and easy to update. With the right form, you can quickly fill in the necessary details, ensuring that each transaction is accurately documented and presented in a professional manner.

Essential Features for Freelance Billing

When choosing a billing form, there are several key features that freelancers should look for to make sure they are meeting their business needs:

- Customizable Fields: You should be able to add and remove items as needed to reflect different services, rates, or project details.

- Payment Terms Section: Clear payment instructions, including deadlines and late fee policies, help set expectations and encourage timely payments.

- Space for Time Tracking: If your work is billed by the hour, a dedicated section to track the number of hours worked and the hourly rate ensures accurate charges.

- Branding Options: Freelancers can stand out by adding their logo and choosing a design that reflects their personal brand.

How These Forms Help Freelancers

Using ready-to-use billing documents simplifies administrative tasks and ensures consistency across all transactions. These forms help reduce the time spent on paperwork, making it easier to focus on client work and growing your freelance business. Additionally, having a professional billing system in place can give clients greater confidence in your services and encourage repeat business.

Whether you’re a freelance consultant, designer, or developer, using the right billing format is a key step in managing your finances efficiently and professionally. With easy-to-edit forms, freelancers can ensure they are paid on time and maintain an organized record of their work.

Best Invoice Template Tools for Small Business

For small businesses, managing billing efficiently is key to maintaining healthy cash flow and ensuring timely payments. Using the right tools to generate professional billing documents can streamline this process, saving time and reducing errors. Whether you’re just starting out or looking to upgrade your current system, there are several excellent options available that cater to the specific needs of small business owners.

These tools allow business owners to create, customize, and send billing forms with ease, and often include features like automatic calculations, reminders, and integrations with accounting software. Here are some of the best tools that can help small businesses handle their billing needs smoothly and professionally:

Top Tools for Creating Billing Documents

- FreshBooks: Known for its simplicity and ease of use, FreshBooks offers an intuitive platform that allows you to generate and customize billing documents quickly. It also includes features like time tracking and expense management, making it a great all-in-one solution for small businesses.

- QuickBooks: A popular accounting tool, QuickBooks allows small business owners to create professional billing documents while also managing finances, taxes, and payroll. It integrates seamlessly with other accounting features to provide a comprehensive financial management solution.

- Zoho Invoice: This tool is perfect for businesses that need a customizable solution. Zoho offers a variety of templates that can be easily modified to suit different business needs. It also includes options for automated billing, recurring invoices, and multi-currency support, making it ideal for international businesses.

- Wave: Wave offers a free, user-friendly platform for generating billing documents and handling basic accounting tasks. It’s an excellent choice for small businesses on a budget, offering easy integration with payment processors and customizable design options for billing forms.

- Invoice Ninja: Invoice Ninja is a robust tool that offers free and paid plans. It provides customizable forms, time tracking, and the ability to handle multiple clients and projects. The platform is great for freelancers and small business owners who need a flexible, scalable solution.

Choosing the right tool depends on the size of your business, your budget, and the features you need. By using one of these tools, s

How to Ensure Invoice Accuracy and Clarity

Creating accurate and clear billing documents is crucial for maintaining professionalism and ensuring timely payments. Mistakes or unclear information can lead to confusion, delays, and even disputes with clients. To ensure that your financial documents are both correct and easy to understand, it’s important to follow best practices for accuracy and clarity. Below are some key tips to help you achieve this.

Tips for Ensuring Accuracy

- Double-Check Client Information: Ensure that all client details–such as name, address, and contact information–are correct. Small errors in this section can delay processing or cause confusion.

- Verify Pricing and Quantity: Double-check the unit prices, quantities, and descriptions of each item or service. Small mistakes here can lead to significant discrepancies in the total amount due.

- Review Calculations: Always recheck your calculations, including totals, taxes, and discounts. Use built-in calculators or tools to avoid manual errors.

- Include Clear Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. This reduces the risk of misunderstandings with clients.

How to Ensure Clarity

- Use Simple and Direct Language: Avoid jargon or complex terminology. The simpler and more direct the language, the easier it is for your client to understand.

- Organize Information Logically: Present the information in a clean, organized manner. Use headings, bullet points, and tables to make each section easy to read and find.

- Provide a Breakdown of Charges: Clearly itemize each charge so that clients can easily see what they are paying for. Avoid combining different services or products into one line–separate them for clarity.

- Use a Professional Design: A clean and consistent design improves readability. Use your business branding, but keep the layout simple and uncluttered to ensure all details stand out.

By following these best practices, you can ensure that your billing documents are both accurate and clear, making the process easier for you and your clients. This not only helps in

Printable Invoices vs Digital Invoices

When it comes to billing, businesses have two main options: traditional paper-based documents or digital alternatives. Each method has its advantages and drawbacks depending on the specific needs of a business, its clients, and its workflow. Understanding the differences between physical and electronic billing documents can help you decide which method works best for your business operations.

Benefits of Paper-Based Documents

- Physical Documentation: Some clients may prefer receiving a physical copy, especially in industries where paper records are standard or legally required.

- Professional Appearance: A physical bill can feel more formal and personal, which may be important for certain businesses or industries.

- No Dependence on Technology: Paper-based documents don’t require an internet connection or software to be viewed, making them accessible to anyone without digital access.

Advantages of Digital Documents

- Faster Delivery: Sending digital documents is instantaneous, allowing clients to receive them without the delays that come with postal services.

- Cost-Effective: Digital documents eliminate the need for paper, ink, and postage, helping businesses save money over time.

- Easy to Track and Store: Electronic billing documents can be easily stored in digital archives, making it simpler to keep track of transactions, access records, and search through past documents.

- Automation Features: Many digital platforms allow businesses to automate certain processes, such as sending reminders for overdue payments or generating recurring charges.

- Environmentally Friendly: Digital documents help reduce paper waste, making them a more sustainable option for eco-conscious businesses.

Choosing the Right Option for Your Business

The choice between physical and electronic billing documents largely depends on your clients’ preferences and your business’s needs. While paper-based forms may still be necessary for certain industries or clients, digital alternatives offer a range of time-saving a

How to Organize Your Printed Invoices

Efficiently organizing your billing records is essential for managing your finances, ensuring timely payments, and maintaining a professional image. When dealing with physical copies of billing documents, it’s crucial to have a structured system that allows for easy tracking, retrieval, and storage. Below are some practical tips on how to organize your printed documents to ensure smooth business operations.

Setting Up a Filing System

A well-organized filing system is key to staying on top of your billing records. Here are some ways to structure your files:

- Use Categorized Folders: Create separate folders for different categories such as “Paid,” “Unpaid,” and “Pending.” This will help you quickly identify the status of any document at a glance.

- Label Clearly: Each folder and file should be clearly labeled with relevant details, such as the client name, date of the transaction, and invoice number. This makes it easy to find specific documents when needed.

- Sort Chronologically: Organize your documents by date, either by month or by year. This allows you to track progress over time and quickly access historical records for reference or tax purposes.

Using Digital Tools for Backup

While physical records are important, it’s also a good idea to have a digital backup for added security and convenience. Scanning and storing your documents digitally offers many advantages:

- Cloud Storage: Store scanned copies of your records in cloud storage platforms. This ensures they are accessible from anywhere and protected against damage or loss.

- Digital Sorting: Use digital folders with tags and search functions to organize your documents in a way that’s easy to navigate and retrieve when needed.

- Backup Regularly: Make sure your digital records are backed up regularly, whether on a hard drive or in a secure online location, to prevent data loss.

By implementing these organizational strategies, you can ensure that your physical billing records remain secure, accessible, and easy to manage. Whether you’re organizing hard copies or digitizing your documents for backup, staying organized will save you time and help maintain accurate financial records for your business.

Where to Find Quality Printable Invoice Templates

Finding the right tools to create professional billing documents is essential for any business. Whether you’re a freelancer, a small business owner, or part of a larger organization, having access to high-quality, customizable options is important for maintaining consistency and professionalism in your transactions. Fortunately, there are numerous online resources where you can find well-designed and reliable forms that suit your needs.

Top Resources for Finding Quality Forms

- Online Document Creation Tools: Websites like Canva, Venngage, and Lucidpress offer a wide range of customizable forms. These platforms provide user-friendly interfaces, allowing you to easily create, download, and print your forms with just a few clicks. Most offer both free and paid options, depending on your specific needs.

- Accounting Software Platforms: Platforms like QuickBooks, FreshBooks, and Zoho not only allow you to manage your finances but also come with pre-designed options to generate billing documents. These tools typically include features like automatic calculations, tax rates, and more, making them a great all-in-one solution.

- Free Download Websites: Websites such as Microsoft Office Templates, Template.net, and Invoice Generator provide free downloadable options. These sites offer basic forms that can be customized to fit your business style and needs.

Premium Resources for More Customization

- Template Marketplaces: Platforms like Etsy and Creative Market offer premium designs, with more intricate and professionally created options. These paid templates often include advanced features, such as automated calculations and better customization for branding purposes.

- Freelance Designers: If you’re looking for a truly unique design, hiring a freelance designer through platforms like Fiverr or Upwork may be an excellent choice. Custom-made forms ensure your business has a distinctive look that sets you apart from the competition.

Whether you choose a free downloadable form or a professionally designed, premium option, it’s important to select a resource that fits your business’s branding and functional needs. With so many tools available, finding the perfect solution to streamline your billing process has never been easier.