Free Editable Invoice Template in Excel

Managing financial transactions is crucial for any business. Using the right tools can streamline the process, allowing for faster, more accurate record-keeping. One of the most effective ways to handle billing is by utilizing a structured document that can be personalized to suit individual needs.

These documents are designed to help businesses create professional records for every transaction. By providing a flexible framework, they enable users to input necessary details like amounts, dates, and client information. Whether you are a small business owner or a freelancer, having the ability to tailor your documents can save valuable time and ensure consistency.

Adapting these tools to your specific requirements allows you to maintain a clear and organized financial system. You can easily modify fields, adjust formats, and add relevant details that are unique to your services. This approach minimizes errors and enhances accuracy, ultimately improving the efficiency of your business operations.

Free Editable Invoice Template in Excel

Having a customizable document for financial records is essential for any business that deals with transactions. A well-structured sheet allows for easy updates, ensuring that each transaction is documented accurately and professionally. These tools help in managing billing data, providing a consistent format that is simple to adjust according to specific needs.

Key Benefits of Using Customizable Billing Documents

Customizable sheets bring several advantages, including the flexibility to modify them based on client requirements, business needs, and tax regulations. You can effortlessly add or remove fields, adjust design elements, and include details that are specific to your transactions. This adaptability makes the process faster and reduces the chances of mistakes.

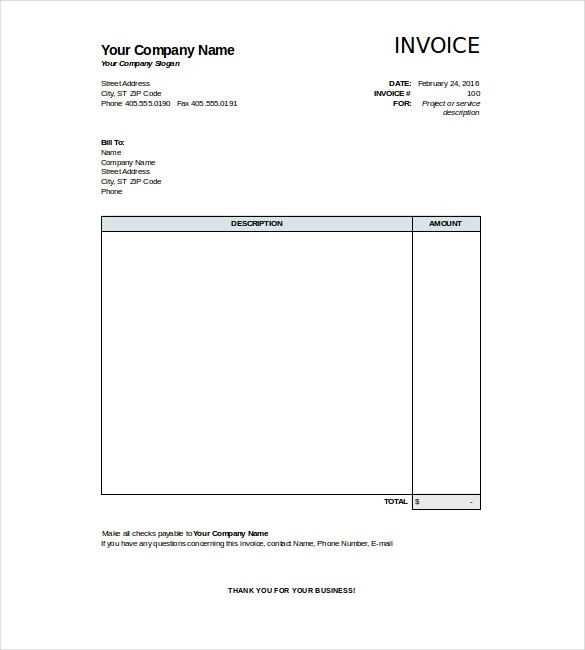

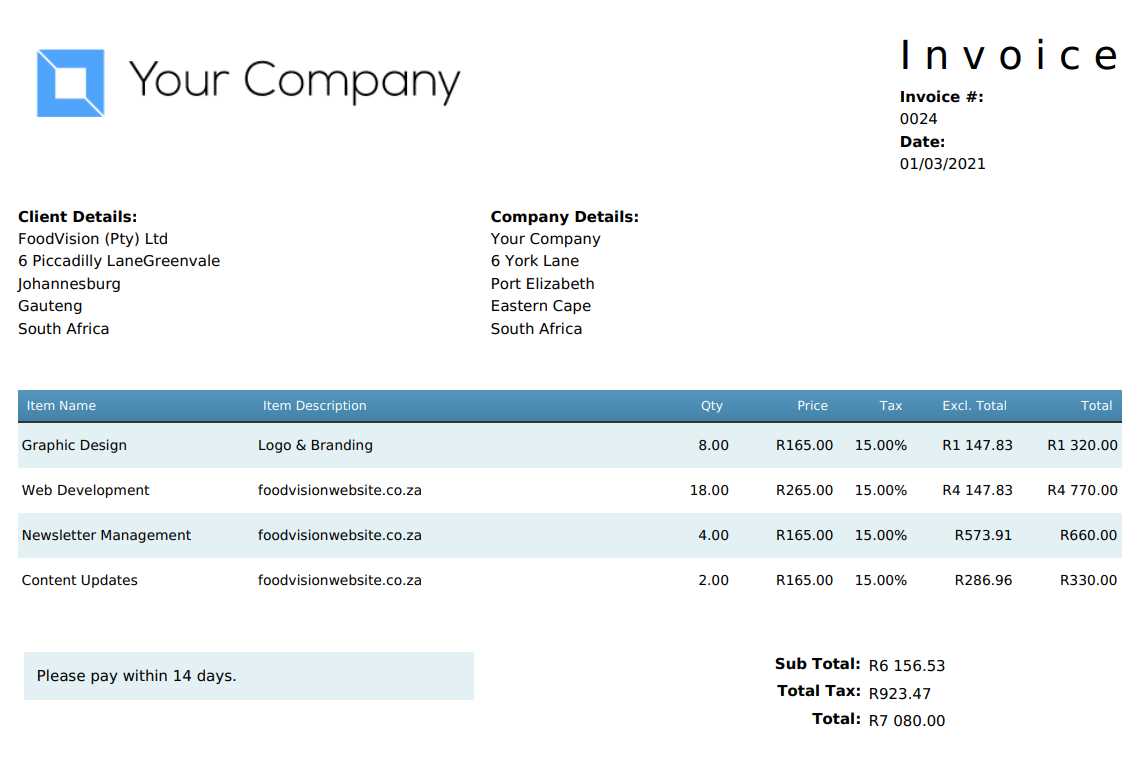

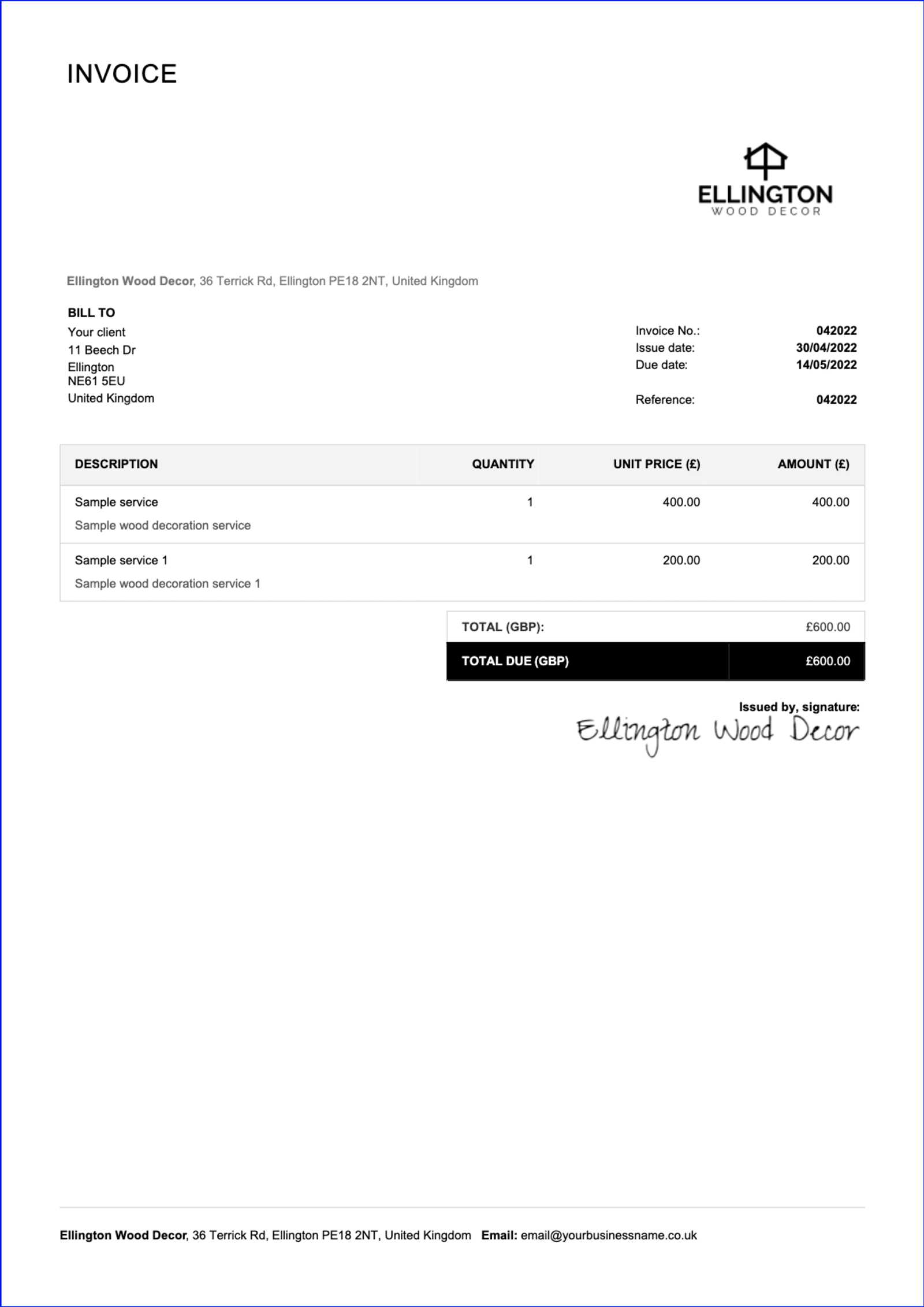

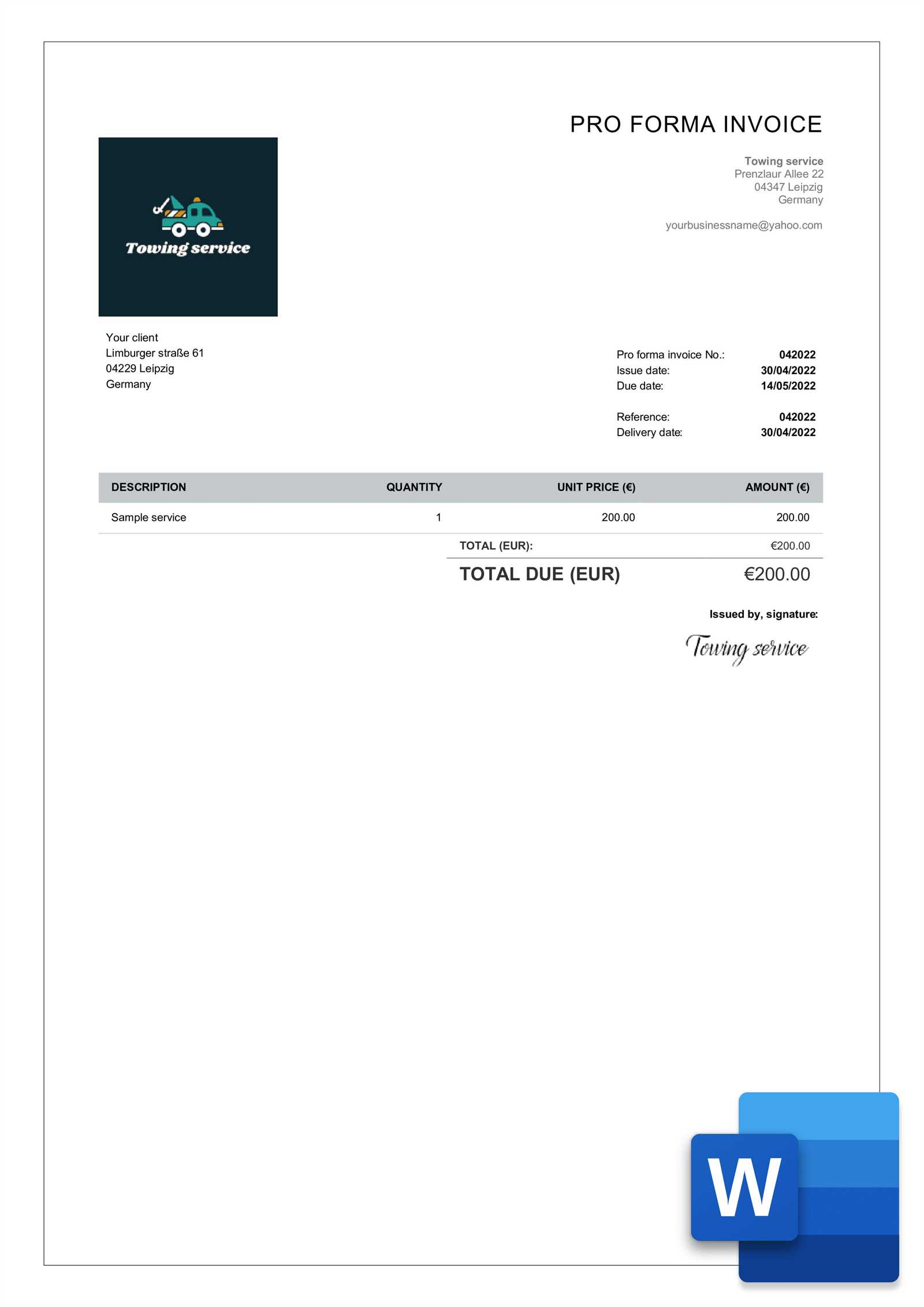

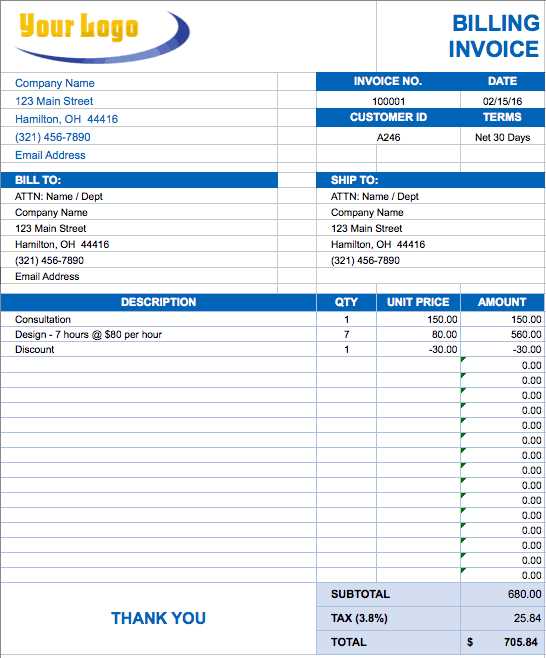

Structure of an Effective Billing Sheet

An ideal structure should cover all necessary components for accurate record-keeping. Below is a sample layout that includes essential sections:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service/Product 1 | 1 | $100 | $100 |

| Service/Product 2 | 2 | $50 | $100 |

| Total | $200 | ||

With this structure, users can easily track the items or services provided, the quantity, the unit price, and the overall total. Adjusting any of these details is a simple task, helping to ensure that each transaction is accurately recorded.

Why Use an Excel Invoice Template

Utilizing a digital document to manage financial records offers numerous advantages for businesses. By relying on a customizable sheet, you can maintain organized and accurate records with minimal effort. These documents simplify the billing process, allowing you to focus on more important aspects of your operations.

One of the main reasons for using such a tool is the flexibility it provides. With the ability to adjust fields and formats, you can tailor the layout to fit the specific requirements of each transaction. This adaptability makes it easy to include additional details like payment terms, discounts, or taxes, ensuring every necessary aspect is captured.

Furthermore, a structured and consistent format helps to reduce errors and streamline the overall process. By standardizing the document, you ensure that all records are uniform, making it easier to track payments, monitor outstanding balances, and generate reports.

Benefits of Customizable Invoice Templates

Using a flexible document for tracking payments and transactions brings numerous advantages to businesses of all sizes. Customizable records allow you to tailor the layout, fields, and calculations to your specific needs, ensuring accuracy and consistency in every transaction.

Some of the key benefits of using these customizable tools include:

- Time Efficiency: You can quickly adjust the document to include any required details, reducing the time spent on creating a new record for each transaction.

- Improved Accuracy: Customizable formats help to minimize mistakes, ensuring that all details are correctly represented and calculated without the need for manual adjustments.

- Consistency: A consistent format helps standardize records across your business, making it easier to maintain and review financial data over time.

- Flexibility: You can easily add, remove, or change sections based on your business needs, whether you need to adjust pricing, payment terms, or add extra fields for services or discounts.

- Branding: Customization allows you to incorporate your company’s logo, colors, and unique details, making your documents look professional and aligned with your brand identity.

These benefits not only streamline the billing process but also improve the overall management of financial records, allowing businesses to focus on growth and customer satisfaction.

How to Edit Invoice Templates in Excel

Customizing your billing sheet to fit your specific needs is a straightforward process. By making simple adjustments, you can tailor the document to capture all relevant details, from client information to payment terms. Whether you need to change a few values or update the layout, the process is quick and easy to follow.

Here’s a basic guide to help you modify the layout and fields:

- Open the Document: Start by opening the existing file. Most of the time, you’ll find the structure already set up with placeholders for essential information like item descriptions, quantities, and prices.

- Edit Fields: Click on any cell to change the data. You can update text, replace numbers, or change labels based on your needs. Use formulas to automatically calculate totals and taxes.

- Adjust Layout: If you want to add or remove sections, you can adjust the layout by inserting or deleting rows and columns. Make sure the new structure still aligns with the flow of information.

- Apply Formatting: Modify font styles, colors, and borders to match your brand’s visual identity. This helps make the document professional and easy to read.

- Save Changes: Once you’ve made the necessary edits, save the file with a new name to preserve the original version for future use.

The table below shows an example of how simple adjustments can change the layout:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 3 | $50 | $150 |

| Service B | 1 | $200 | $200 |

| Total Amount | $350 | ||

These simple steps ensure that your document is perfectly suited for each transaction, making the billing process faster and more efficient.

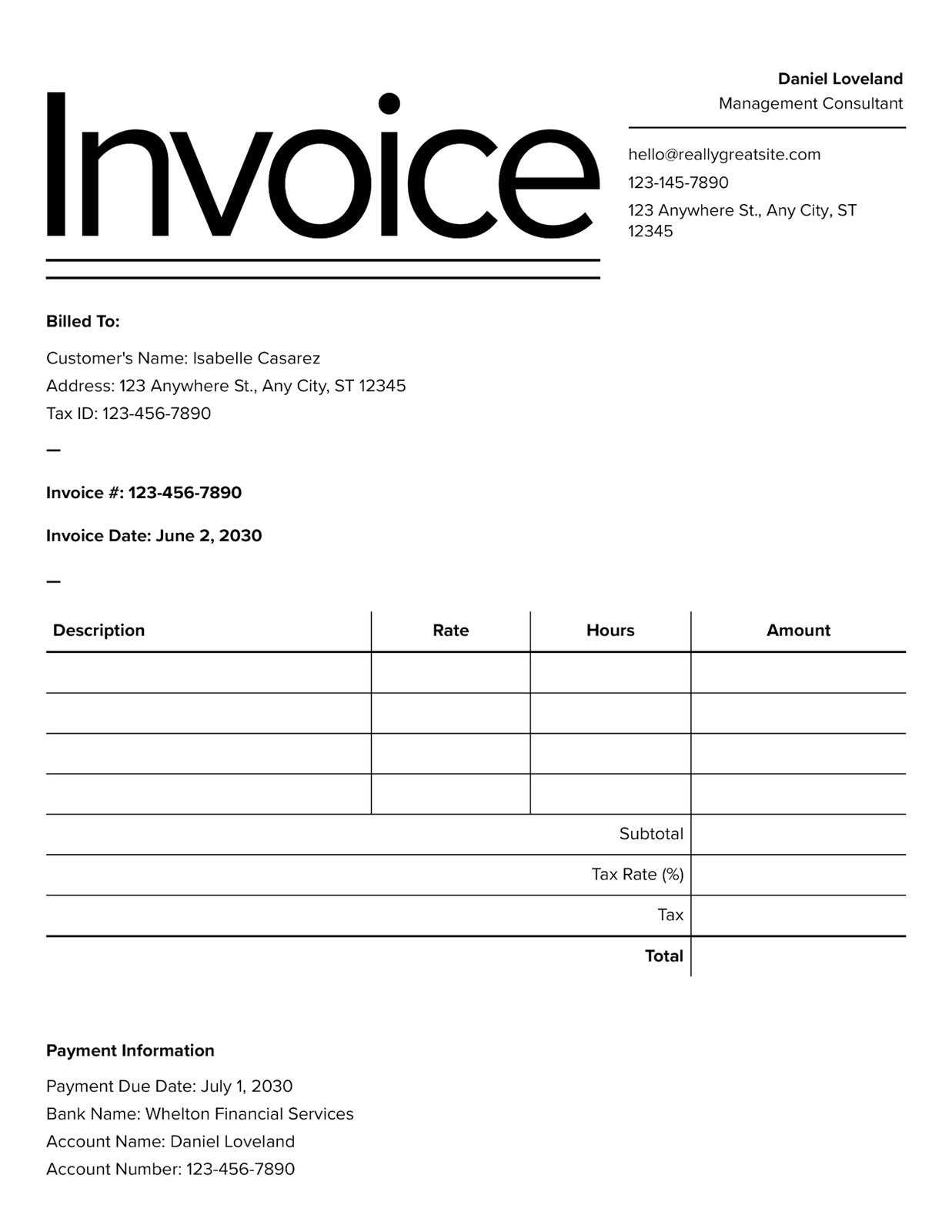

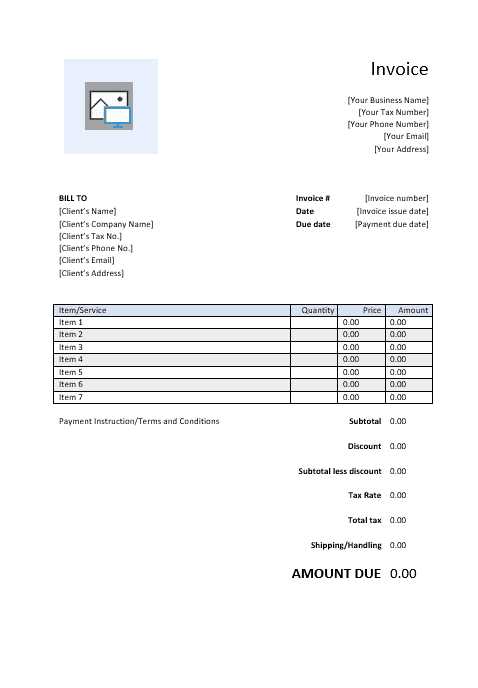

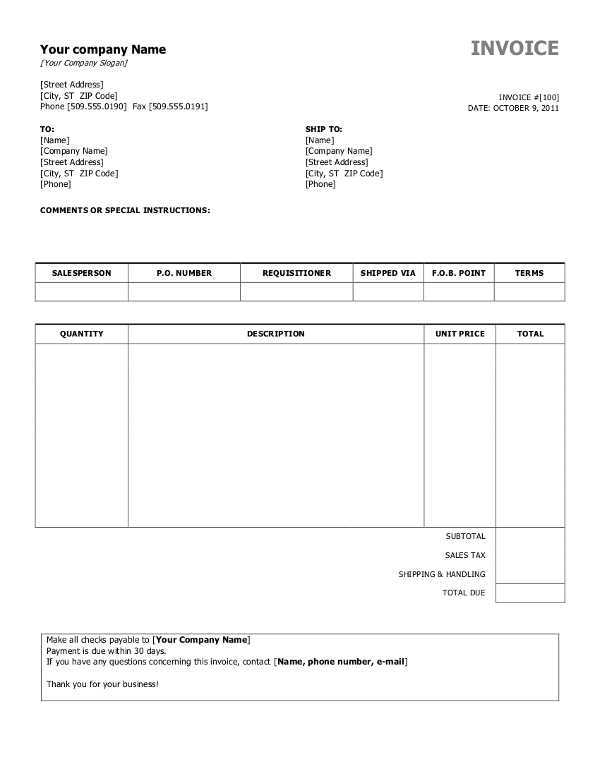

Top Features to Look for in Templates

When selecting a customizable billing document, it’s essential to look for specific features that enhance usability, accuracy, and professional presentation. The right tool should not only meet your immediate needs but also offer flexibility and scalability as your business grows. Below are some key characteristics to consider when choosing a financial document format.

Key features include:

- Clear Layout: A well-organized structure helps ensure that all relevant information is easy to input and review. Look for templates that have separate sections for client details, services/products, totals, and payment terms.

- Automatic Calculations: A good document should include built-in formulas that automatically calculate totals, taxes, and discounts. This reduces the need for manual calculations and minimizes errors.

- Customization Options: The ability to adjust fields, add or remove sections, and change design elements is crucial for tailoring the document to your specific needs. Flexibility ensures that the template can grow with your business.

- Professional Design: A clean, polished design not only makes your document look more credible but also enhances readability. Features such as bold headers, clear fonts, and well-structured tables contribute to a professional appearance.

- Client and Service Details: Templates should allow you to easily input client names, addresses, and contact details, as well as a clear breakdown of the products or services provided.

- Payment Terms and Due Dates: It’s important that the format includes space for payment deadlines, accepted payment methods, and any terms regarding late fees or discounts for early payments.

- Customizable Branding: Templates that allow you to add logos, colors, and business names are important for maintaining your brand’s identity and creating a more personalized experience for clients.

By focusing on these features, you can ensure that the document not only meets your current needs but also adapts to changes in your business, helping you stay organized and professional in all your transactions.

Step-by-Step Guide to Customizing Invoices

Customizing your financial documents ensures that each transaction is accurately recorded and tailored to your specific business needs. With the right steps, you can easily modify your record-keeping sheet to include all the necessary details, while also aligning it with your brand’s identity. Below is a straightforward guide to help you adjust the structure and content of your billing sheets.

Follow these steps to personalize your document:

- Open the Document: Begin by opening the existing financial document on your computer. If it’s a pre-made format, it will likely have placeholder fields that you can quickly modify to fit your business needs.

- Edit Business Information: Replace the company name, logo, address, and contact details with your own. This ensures that every document reflects your brand identity and looks professional.

- Customize Client Details: Input the client’s name, address, and contact information in the designated fields. This helps personalize each record and ensures accuracy for future communication.

- Modify Itemized Sections: Update the list of goods or services provided. Change item descriptions, quantities, unit prices, and add or remove rows as needed. Ensure that each entry is clear and precise.

- Adjust Payment Terms: Update payment terms, such as the due date, late fees, and accepted payment methods. This helps clarify expectations for your clients and avoids potential misunderstandings.

- Apply Formatting: Make design adjustments, such as changing fonts, colors, and cell sizes. You can also add borders or shading to differentiate sections, making the document easier to read and more visually appealing.

- Review and Save: Double-check all the information for accuracy, and save the document under a new name to ensure that the original remains intact for future use.

By following these simple steps, you can quickly create a customized billing sheet that meets your business requirements and maintains a professional look for your clients.

Common Mistakes When Using Templates

Even with the most customizable tools, there are common pitfalls that many businesses face when creating and managing their billing records. Whether it’s a minor oversight or a recurring issue, these mistakes can lead to confusion, delays, and errors that affect your financial operations. Understanding what to avoid can help you streamline the process and ensure that every document is accurate and professional.

Here are some of the most frequent mistakes to watch out for:

- Leaving Incomplete Information: Failing to fill out all necessary fields, such as client details, item descriptions, or payment terms, can lead to confusion and delays. Always double-check that each section is fully completed before sending the document.

- Using Incorrect Calculations: Manual errors in summing totals or applying tax rates can lead to significant discrepancies. Ensure that formulas are correctly implemented and double-check calculations to avoid mistakes.

- Not Updating Terms and Conditions: Sometimes, businesses forget to adjust payment terms or delivery details when they change. Always ensure that the payment due date, fees, and other terms reflect the current agreement.

- Overlooking Branding Consistency: Using outdated logos, fonts, or design elements can make your documents look unprofessional. Regularly update your branding to maintain consistency across all business communications.

- Not Saving or Backing Up Documents: Failing to save or back up your customized records can lead to data loss. Always save copies of your documents, and store them in a secure location to avoid potential issues.

- Using a One-Size-Fits-All Approach: Not adjusting the layout or content for different client needs can make your document appear generic. Tailor each record to suit the specific transaction to provide clarity and a personalized touch.

By avoiding these common errors, you can improve the accuracy and professionalism of your records, making the billing process smoother for both you and your clients.

Best Practices for Invoice Formatting

Formatting your billing document correctly is essential for clarity, professionalism, and ensuring that all necessary information is communicated effectively. A well-structured document not only makes it easier for your clients to process the details, but it also ensures that your payment requests are clear and easy to understand. Following best practices in layout and design will help avoid confusion and ensure that your financial documents reflect your business’s attention to detail.

Key Elements to Include

Critical sections such as client details, itemized services/products, total amount, and payment instructions should always be clearly visible and easily accessible. Make sure that these sections are well-organized and easy to navigate.

- Client Information: Place the client’s name, address, and contact details at the top, so they are the first thing that the recipient sees.

- Clear Itemization: List services or goods provided with concise descriptions, quantities, and unit prices. This helps avoid any misunderstandings and allows for transparent communication of costs.

- Total Calculation: Ensure that the total amount, including taxes and discounts, is clearly displayed at the end. Highlight this total to make it stand out from the rest of the content.

Design Tips for Clarity

When it comes to design, simplicity and legibility are key. Avoid overcrowding the document with unnecessary information or overly complicated elements.

- Whitespace: Proper spacing between sections allows for easy reading and helps the document feel less cluttered.

- Fonts: Use a simple, professional font such as Arial or Helvetica. Avoid using more than two different fonts to maintain visual harmony.

- Alignments: Ensure that text and numbers are aligned properly, especially in tables. Align amounts to the right, and descriptions to the left, to improve readability.

By following these best practices, you can ensure that your document is not only functional but also visually appealing and professional, helping to create a positive impression with your clients.

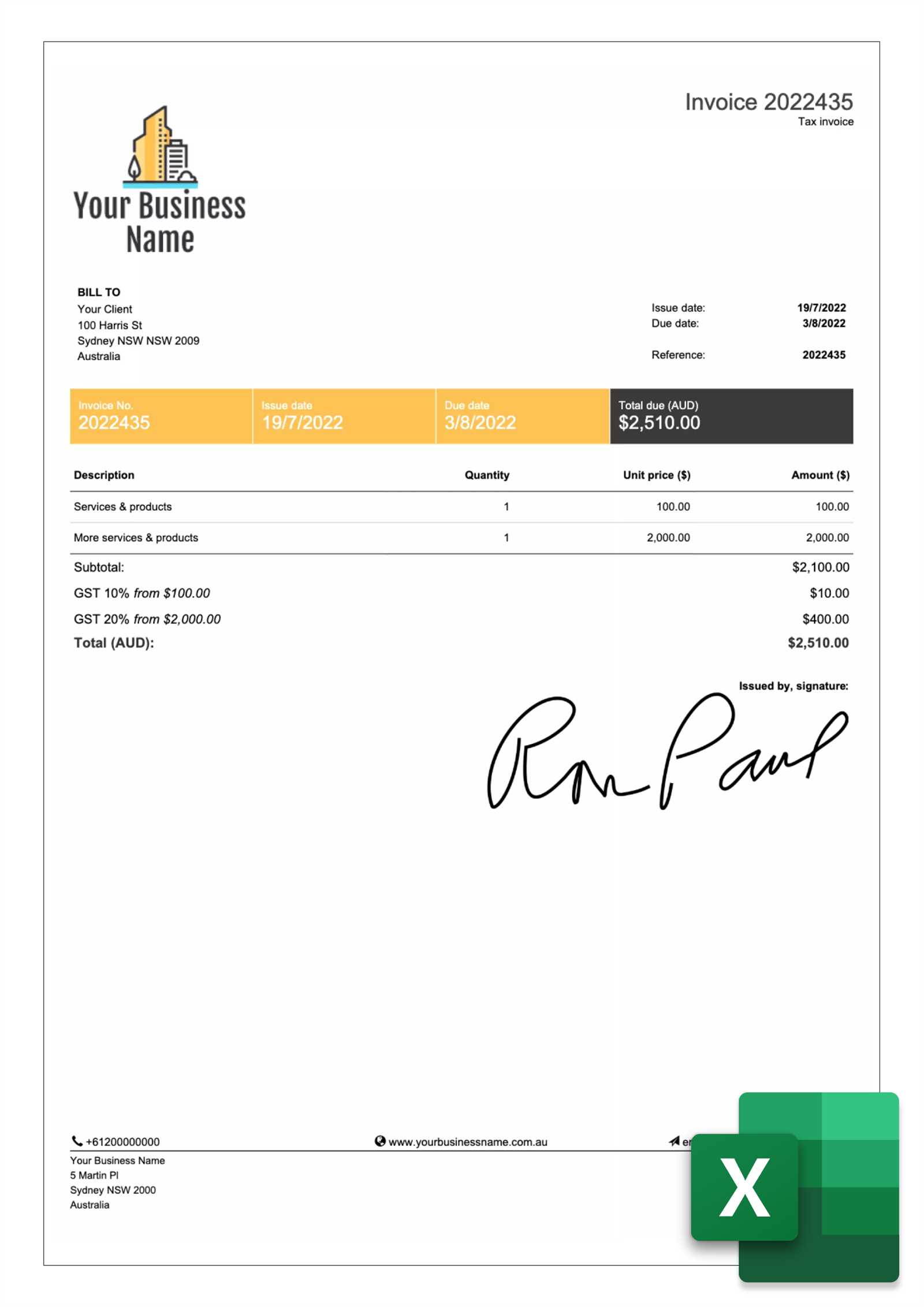

How to Include Taxes and Discounts

When creating a financial document for services or goods provided, it’s important to accurately reflect taxes and discounts to ensure transparency and clarity for both parties. Including these elements correctly ensures that your clients understand the final amount due and prevents confusion or disputes later on. Below is a guide on how to incorporate taxes and discounts into your record-keeping sheets.

Incorporating Taxes

Taxes are a critical component of most transactions. To ensure that they are calculated properly, you must account for the tax rate, apply it to the subtotal, and then display the total amount due. Below is an example of how to organize tax information in your document:

| Description | Amount |

|---|---|

| Subtotal | $100.00 |

| Sales Tax (10%) | $10.00 |

| Total Amount | $110.00 |

Steps to Include Taxes:

- Determine the applicable tax rate based on your location or the client’s location.

- Multiply the subtotal by the tax rate to calculate the amount of tax.

- List the tax amount separately in the document, clearly identifying it as a tax charge.

- Ensure that the total reflects both the subtotal and the tax charge.

Applying Discounts

Discounts can be offered to clients for various reasons, such as early payments or bulk purchases. It’s important to display these discounts clearly so that both you and the client understand the adjustment to the total price.

| Description | Amount |

|---|---|

| Subtotal | $200.00 |

| Discount (5%) | -$10.00 |

| Total Amount | $190.00 |

Steps to Apply Discounts:

- Determine the percentage or fixed amount of the discount.

- Subtract the discount from the subtotal to find the adjusted amount.

- Clearly list the discount in the document, identifying the percentage or amount discounted.

- Ensure the final total reflects the new, discounted amount.

By carefully incorporating both taxes and discounts, you ensure accuracy in your documents and promote clear communication with your clients, preventing any misunderstandings regarding the amounts due.

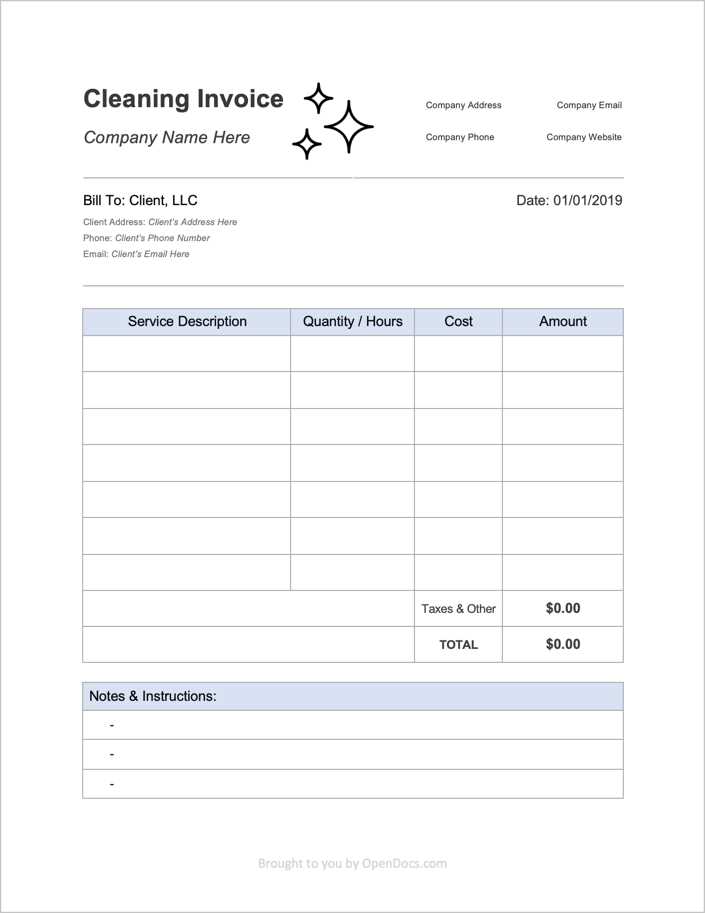

Understanding Invoice Template Layouts

The layout of your financial record plays a crucial role in presenting information clearly and professionally. An organized structure not only helps to ensure that all required details are included, but also allows for easy navigation. The right layout can make your document more readable and help your clients quickly find the information they need, such as amounts due, payment terms, and itemized services.

Key Elements of a Well-Structured Layout

A well-designed record should include several essential sections, each clearly distinguished to make the document easy to follow. Here are the key components to consider when setting up your layout:

- Header: This section should include your company’s name, logo, and contact details. It is important to place this information at the top so that it is immediately visible to the client.

- Client Information: Below the header, include your client’s name, address, and any relevant contact details. Make sure this is placed in a distinct section so it is easy to identify.

- Itemized List: This is the section where you list all services or products provided. Be sure to provide clear descriptions, quantities, unit prices, and total costs.

- Amount Due: Clearly display the total amount, including taxes and any additional charges. This should be prominently displayed at the bottom or at the end of the document.

- Payment Terms: Always include terms such as the due date, accepted payment methods, and any late fees or discounts. This information should be easy to find, preferably at the bottom of the page.

Different Layout Styles

There are various layout styles to choose from, depending on your needs and preferences. Some common styles include:

- Classic: A traditional, simple layout with a clear division between different sections. It typically includes a large, bold header with the company and client details at the top, followed by the itemized list and payment terms.

- Modern: A sleek, contemporary layout that focuses on design, using less clutter and more whitespace. Modern designs often include visually appealing fonts, clean lines, and minimalist styles.

- Professional: A highly structured layout suitable for businesses that need to maintain a formal or corporate appearance. It includes detailed sections, with the totals and payment instructions clearly highlighted.

Choosing the right layout depends on your brand, the type of services or products you offer, and the client’s needs. A well-chosen layout can make your financial documents more professional and help ensure smooth transactions.

How to Protect Your Excel Templates

When creating digital documents for business or personal use, it is important to ensure that the structure and content are protected from unauthorized edits or loss. Whether you are sharing or storing these files, securing your work is essential to prevent accidental changes, data corruption, or misuse. Below are several effective ways to protect your documents while keeping them functional and accessible for necessary edits.

Methods to Lock Your Document

One of the simplest ways to protect your file is by setting permissions to restrict access to certain elements. This can include locking specific cells or the entire sheet. By applying these protections, you prevent others from altering critical parts of the document.

- Locking Cells: You can lock individual cells or ranges of cells that contain important information. This allows you to prevent changes while leaving other areas of the document open for edits.

- Password Protection: Set a password to restrict access to the document itself. This ensures that only authorized individuals can open or modify the file.

- Protecting the Entire Sheet: If you want to prevent any changes to the structure of the file, you can protect the entire sheet. This will stop anyone from adding or removing rows, columns, or changing formulas.

Encryption and Backup Options

Another critical method of protecting your documents is by encrypting them and maintaining a backup system. Encryption ensures that even if someone gains access to your file, they cannot view or alter its content without the correct decryption key.

- File Encryption: Use encryption software or built-in file protection tools to encrypt your documents. This adds a layer of security by making the file unreadable without a password.

- Backing Up Files: Regularly create backups of your important documents. Cloud storage and external hard drives are great options for keeping secure copies of your work in case of data loss or corruption.

- Automated Backups: Consider setting up automatic backups on cloud storage platforms to ensure your document is always safe and recoverable.

By employing these strategies, you can ensure that your files are safe from unauthorized access and accidental changes, maintaining the integrity of your documents and ensuring smooth, secure operations for your business or personal use.

Integrating Payment Terms into Invoices

Clear communication regarding payment expectations is a key part of any financial document. By incorporating well-defined terms, you ensure that both parties understand when and how payments should be made. This not only helps avoid misunderstandings but also promotes timely transactions, improving your cash flow and maintaining good business relationships.

Essential Elements of Payment Terms

Including the right payment terms ensures that your client knows exactly what is expected. Here are some essential elements that should always be included:

- Due Date: Clearly specify when the payment is due. This is often a set number of days after the document date (e.g., “Due in 30 days”).

- Accepted Payment Methods: List the methods through which payment can be made, such as bank transfers, checks, credit cards, or online payment platforms.

- Late Payment Fees: If applicable, include any penalties or interest that will apply if payment is made after the due date. This provides an incentive for timely payment.

- Discounts for Early Payment: Some businesses offer discounts to encourage early settlement. If you offer such discounts, make sure to mention the percentage and timeframe for the discount.

How to Present Payment Terms Clearly

Clarity is essential when communicating payment expectations. Here’s how to present these terms clearly:

- Positioning: Place the payment terms in a prominent location on the document, typically at the bottom or near the total amount due. This ensures that they are easy to find and reference.

- Simple Language: Use straightforward and concise language. Avoid jargon or overly complicated terms that could confuse the client.

- Formatting: Bold or highlight important information, such as the due date or late fee charges, to make them stand out.

By integrating clear and well-structured payment terms, you can help ensure smoother transactions and reduce the risk of delayed payments, benefiting both your business and your clients.

Tracking Payments Using Invoice Templates

Managing payments efficiently is essential for maintaining healthy cash flow and ensuring that no transaction is overlooked. By using a structured approach, you can easily track incoming payments and monitor the status of each outstanding balance. A well-organized system helps to identify which clients have paid, which are pending, and which require follow-up, reducing confusion and administrative workload.

One of the best ways to streamline payment tracking is by integrating specific tracking fields into your documents. These fields should include spaces for recording payment dates, amounts received, and the outstanding balance. Having these details clearly listed allows you to quickly assess the financial status of your transactions.

For example, include a “Payment Status” section where you can mark whether the payment has been completed, partially paid, or is still pending. Additionally, incorporate fields for a “Payment Date” and “Amount Received” to keep track of when and how much has been paid. This simple yet effective approach ensures that all transactions are properly accounted for and reduces the likelihood of errors.

Moreover, updating the balance after each payment received will help in maintaining accurate records and ensure that both parties are on the same page regarding the remaining amount due. With this system in place, you can reduce the time spent chasing overdue payments and focus more on growing your business.

How to Save and Share Excel Invoices

Once your financial document is created and completed, the next step is saving and sharing it with the relevant parties. Whether it’s for client review, record-keeping, or filing, proper storage and efficient sharing are essential to maintain organization and avoid loss of information. A well-managed system for saving and sharing these documents ensures smooth operations and timely processing of payments.

Saving Documents for Future Use

When saving your document, consider the format and location to ensure it is easily accessible and secure. Here are some tips for effective saving:

- Save Locally or in Cloud: If you need to access the file from multiple devices, using a cloud storage service like Google Drive, OneDrive, or Dropbox can be helpful. If security is your primary concern, you may opt for local storage on a dedicated device.

- File Naming Convention: Create a consistent naming convention to easily identify each document. For example, you can use the client name and date of issuance, such as “ClientName_2024_01_Invoice”.

- Version Control: If you make changes to a document, save different versions to track updates. Include a version number or date in the file name to differentiate each revision.

Sharing Documents Securely

Once the document is ready, it’s important to share it securely and professionally. Here are some tips for sharing:

- Email: The most common way to share documents is via email. Attach the file in a PDF or the native file format, depending on what the recipient needs. Include a brief message with instructions or additional details regarding the document.

- Online Links: If using cloud storage, you can generate a shareable link that provides access to the document. Be sure to set appropriate permissions to control who can view, edit, or download the file.

- Encrypted Files: If the document contains sensitive information, consider encrypting the file before sharing. This adds an extra layer of security to protect the contents.

By following these simple steps to save and share documents, you ensure that your financial records are kept secure, easily accessible, and can be efficiently transmitted to clients or team members as needed.

Creating Professional-Looking Invoices Quickly

Creating a polished and well-structured document for financial transactions is essential for presenting a professional image to clients and ensuring clarity in communication. The process can be streamlined to save time without compromising on quality. With the right approach and tools, it’s possible to generate high-quality records efficiently and consistently, whether you are a small business owner, freelancer, or part of a larger organization.

Key Elements of a Well-Formatted Document

To achieve a professional appearance, it’s important to focus on several key components that make the document both clear and visually appealing. These include:

- Branding: Ensure that your logo, company name, and contact details are clearly visible at the top of the document. This reinforces your brand identity and provides essential information in a glance.

- Clear Layout: Use sections to separate key information such as the billing address, payment details, and transaction description. This helps the recipient easily navigate the document.

- Legible Fonts: Choose simple, professional fonts that are easy to read. Avoid overly decorative fonts that may distract from the content.

Efficient Process for Quick Creation

To produce these documents quickly, consider the following strategies:

- Use Pre-Formatted Documents: Start with an existing framework that already includes the necessary fields. This can save you the time of formatting and organizing information from scratch.

- Automatic Calculations: Incorporate automatic calculations for subtotals, taxes, and totals to avoid errors and reduce manual work.

- Consistent Information: Maintain a standard format for every document you create, including consistent language, design, and structure. This will save time by reducing the need to make changes for each new file.

Streamlining the Process

By combining these techniques, you can create professional documents in no time. A consistent, organized approach will help you to quickly generate clear, professional records that can be sent out promptly. This efficiency not only saves time but also reflects well on your business’s professionalism.

How to Automate Invoice Generation in Excel

Automating the creation of financial documents can save a significant amount of time and reduce the chances of human error. By leveraging built-in features and functions, you can streamline the process of creating transaction records. This allows you to quickly generate accurate documents without the need for manual input every time a new one is required. Here’s how you can automate the creation process and simplify your workflow.

Using Formulas and Functions

One of the key tools for automating the document creation process is the use of formulas and functions. By setting up formulas for essential calculations, such as totals, taxes, and discounts, you can eliminate the need to manually calculate each entry. For example, using SUM for totals and multiplication for tax rates, you can ensure that every new record automatically reflects accurate amounts based on the input data.

Setting Up Data Fields

To automate the document generation, set up predefined fields that can be easily filled in with the relevant details, such as client information, item descriptions, and quantities. By linking these fields to a data source, such as a customer list or product database, you can quickly populate the document without having to re-enter repetitive information each time. This can be achieved by using lookup functions like VLOOKUP or INDEX-MATCH to pull data from other sheets.

Creating Dynamic Templates

Another key automation feature is creating dynamic documents that automatically adjust to changes in the data. By setting up conditional formatting or utilizing data validation techniques, you can ensure that the document displays the necessary information in the right format. This could include highlighting overdue amounts or automatically adjusting the layout based on the length of the list of items or services provided.

Generating Multiple Records

By combining these features, you can create a system where multiple financial documents can be generated from a single input source. This can be particularly helpful for businesses that need to create and send numerous documents regularly. Instead of manually entering data into each file, you can simply input new details into a centralized data source, and the automated system will generate the necessary records for you.

Automation not only saves time but also ensures consistency and accuracy across your financial documentation. By implementing the techniques above, you can streamline the process and focus more on other aspects of your business.

Using Excel for Recurring Invoices

Managing regular billing cycles can be time-consuming, but with the right tools, this process can be simplified. For businesses that require repeated billing for services or products, having a streamlined approach to generating and tracking payments is essential. By using a spreadsheet application, you can automate and organize recurring transactions, reducing the manual effort and ensuring accuracy in each cycle.

Automating Recurring Billing with Formulas

To efficiently handle recurring charges, setting up a spreadsheet with formulas can save significant time. For example, you can create a table with all the necessary fields, such as client name, service description, start and end dates, and payment amounts. By applying formulas, such as those for date calculation and multiplication, you can automatically calculate future due dates and payment totals without needing to manually enter the same information repeatedly.

Organizing Payment Schedules

For a smoother process, it’s essential to keep track of payment schedules and frequencies. Excel allows you to set up a clear structure that defines when payments are due and how often they should recur. By setting up a column for the next payment date and using Excel’s DATE and EDATE functions, you can automatically generate the next billing date, whether it’s weekly, monthly, or annually. This will keep your billing cycle consistent and help you avoid any missed payments.

Tracking Recurring Payments

Once the recurring billing is set up, you’ll want to track payments and balances. You can create a system that records when payments are received and whether any balances remain. Using basic conditional formatting or color-coding, you can visually distinguish between paid and unpaid bills. You can also use an automatic IF function to check whether a payment is overdue, helping you stay on top of outstanding transactions.

Benefits of Using a Spreadsheet for Recurring Charges

- Efficiency: Automating recurring billing reduces the time spent on each cycle, allowing you to focus on other areas of your business.

- Accuracy: With built-in formulas, you can eliminate human error and ensure that each charge is calculated correctly.

- Flexibility: Customizing payment schedules for each client is easy, making it adaptable for different business needs.

- Organization: Keeping all payment records in one file ensures easy access and tracking for future reference.

By setting up a system for recurring payments in your spreadsheet, you can streamline the billing process and save time on manual entries. This approach will allow you to focus on growing your business while ensuring that your clients are billed accurately and on time.

Where to Find Free Invoice Templates

Finding the right tools to handle financial documentation can be crucial for streamlining your business operations. Luckily, there are numerous online platforms and software solutions where you can access professional-grade documents that can be customized to suit your specific needs. These resources help businesses of all sizes create organized, clean, and accurate records for their billing process.

Online Websites Offering Ready-to-Use Documents

Many websites provide pre-made, customizable forms that can be easily downloaded and used for any business transaction. These online sources are a great starting point if you’re looking for a quick and efficient way to create professional documents. Here are a few places where you can find such resources:

- Template Libraries: Many free online libraries specialize in business forms, including financial records, payment slips, and other business documentation. Websites such as Microsoft Office and Google Docs offer free document creation tools with various pre-designed layouts.

- Business Platforms: Several business software providers, like Wave and FreshBooks, offer downloadable business forms as part of their basic plans or even free trials.

- Design Tools: For more creative customization, websites like Canva and Template.net offer free resources for designing business documentation, allowing you to add unique elements to your forms.

Utilizing Software Programs for Customization

If you’re already using software for managing your business operations, it’s often easy to create your own documents from scratch or customize available designs. Many spreadsheet and word processing programs include built-in document templates that are specifically tailored for business transactions. Programs such as Microsoft Word and Google Sheets can help you generate the exact structure you need with minimal effort. These programs also allow you to save and reuse customized designs, making them a great long-term solution.

By leveraging these resources, you can quickly create organized, customized financial documentation that fits your business’s needs. Whether you choose to download ready-made forms or build your own from scratch, there are numerous ways to simplify and automate your billing processes.