How to Use an Automated Invoice Excel Template for Efficient Billing

Managing financial transactions efficiently is crucial for businesses of all sizes. The process of creating and tracking payment requests can often be time-consuming and prone to errors, especially when done manually. However, there are solutions that help automate and simplify this workflow, saving valuable time and reducing the chance of mistakes.

By using a pre-designed system to generate and monitor payment documents, companies can easily customize and adjust their records as needed. These systems provide flexibility, consistency, and accuracy while helping business owners stay on top of their financial obligations. Whether you’re a freelancer, small business owner, or managing a larger team, this approach makes billing easier and more reliable.

Efficient management of financial processes not only improves cash flow but also builds trust with clients. The ability to automate repetitive tasks and focus on more critical aspects of your work can give you a significant advantage in a competitive market.

Understanding how to use these tools effectively can greatly enhance your business operations and lead to a more organized and professional approach to managing finances.

Automated Invoice Excel Template Overview

In today’s fast-paced business world, managing financial records with accuracy and efficiency is more important than ever. A well-organized system for creating and tracking payment requests can help reduce errors, save time, and streamline the billing process. With the right solution, you can simplify this task while maintaining professional standards and ensuring consistency across all transactions.

Using a pre-designed document generation system allows you to handle multiple clients and various payment structures without the need for manual calculations or repetitive work. This type of system ensures that all necessary fields are populated correctly, including amounts, dates, and terms, and automatically updates with each new entry. The result is a more reliable and efficient way to manage business finances.

Key Benefits of Using a Pre-designed Billing System

Efficiency and accuracy are two of the most significant advantages of using such a solution. Once set up, this system can create records in just a few clicks, eliminating the risk of human error and ensuring that every document meets the required format. Additionally, it allows for quick updates to payment schedules, which is essential when dealing with changing client needs or recurring charges.

How It Helps Businesses Stay Organized

Staying organized is essential to maintaining healthy financial practices. By reducing manual data entry, you can focus on more critical aspects of your business. These tools can track all necessary details, making it easier to monitor payments and follow up on overdue amounts. The ability to quickly generate and adjust documents also enhances your professionalism in front of clients, helping to build trust and improve your company’s reputation.

Why Choose Excel for Invoices

When it comes to managing financial documents, flexibility, ease of use, and customization are essential. Many businesses opt for spreadsheet software to generate and track payment requests due to its accessibility and powerful features. The ability to tailor documents according to specific needs makes this tool a popular choice for small and medium-sized enterprises looking for an efficient, cost-effective solution.

One of the key advantages of using a spreadsheet program is its simplicity and low learning curve. Most users are already familiar with its basic functions, making it easy to integrate into daily operations. Additionally, this platform offers a wide range of built-in formulas, which allow for quick calculations and automatic updates to the document as data changes.

Another reason for choosing a spreadsheet is its flexibility in customization. You can easily modify the design, add fields for specific details, and even incorporate automatic calculations that adjust as you update the data. This helps businesses maintain consistent formatting while ensuring all essential information is included in each document.

Key Features of Spreadsheet Solutions

Below is a table showcasing some of the key features of using a spreadsheet program for financial documents:

| Feature | Benefit |

|---|---|

| Customization | Easily tailor the design and content to fit your needs. |

| Automatic Calculations | Reduce errors by automating totals and tax calculations. |

| Integration with Other Tools | Seamlessly connect with accounting software for better tracking. |

| Accessibility | Available on most devices, making it easy to access anywhere. |

Overall, choosing a spreadsheet for financial records offers both practicality and flexibility, ensuring that your business can manage transactions more efficiently and

Key Features of Automated Invoice Templates

Pre-designed systems for managing payment documents offer numerous features that significantly improve the efficiency and accuracy of financial workflows. These systems are built with functionality in mind, ensuring that all necessary fields are filled correctly while reducing the time spent on creating and managing individual records. From automatic calculations to customizable fields, these solutions make the process both faster and more reliable.

Essential Features for Efficient Document Management

Below are some of the key features that enhance the usability and effectiveness of a system for generating financial documents:

- Automatic Calculations – Calculations for totals, taxes, and discounts are done automatically, ensuring accuracy and saving time.

- Customizable Fields – You can adjust fields to fit specific client needs, including payment terms, services provided, and due dates.

- Recurring Payment Scheduling – Easily set up repeating charges for regular clients, ensuring consistency and reducing manual input.

- Pre-filled Client Information – Information such as name, address, and payment history can be saved and automatically inserted into each document.

- Professional Formatting – Pre-built, visually appealing layouts ensure that all documents look polished and consistent across different clients.

- Track Payment Status – Real-time tracking allows you to monitor the payment status of all documents, from pending to paid.

Why These Features Matter

These features not only enhance the speed and accuracy of the billing process but also help businesses maintain a high level of professionalism. By minimizing errors and improving consistency, companies can foster better relationships with clients and streamline their financial operations.

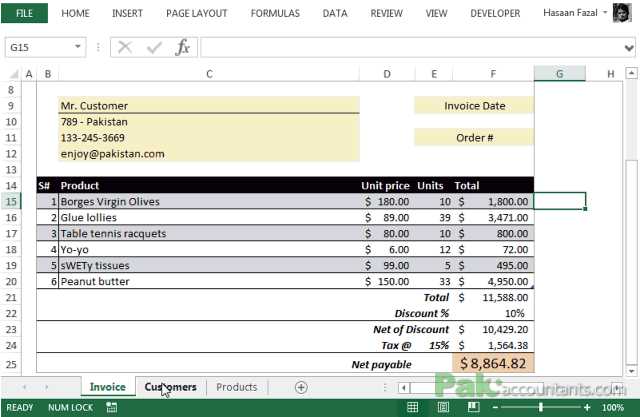

How to Create an Invoice Template in Excel

Designing a custom document for managing billing is an essential skill for business owners. With the right software, you can create a professional-looking and functional document that will automate much of the manual work. By following a few simple steps, you can set up a custom layout that suits your business needs while ensuring accuracy and consistency across all records.

Step-by-Step Guide to Creating Your Document

Here’s a simple guide to creating a custom payment request layout that includes essential fields, automatic calculations, and a clean design:

- Open a New Spreadsheet – Start by opening a blank file in your chosen spreadsheet software.

- Set Up the Header – Include your company name, contact details, and the title of the document, such as “Payment Request” or “Billing Statement.”

- Create a Table for Client Information – Leave space for the client’s name, address, phone number, and email. These fields will be used to personalize each document.

- List Services or Products – Use rows to describe the products or services provided, including quantities, unit prices, and total costs.

- Add Payment Terms – Specify payment due dates, methods, and any additional charges or discounts.

- Implement Automatic Calculations – Set up formulas to calculate the total cost, tax, and any other required calculations.

- Design the Footer – Include payment instructions, terms, or a thank-you note at the bottom of the document.

Example of a Basic Layout

Here’s an example of how your table could be structured:

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Product 1 | 2 | $50

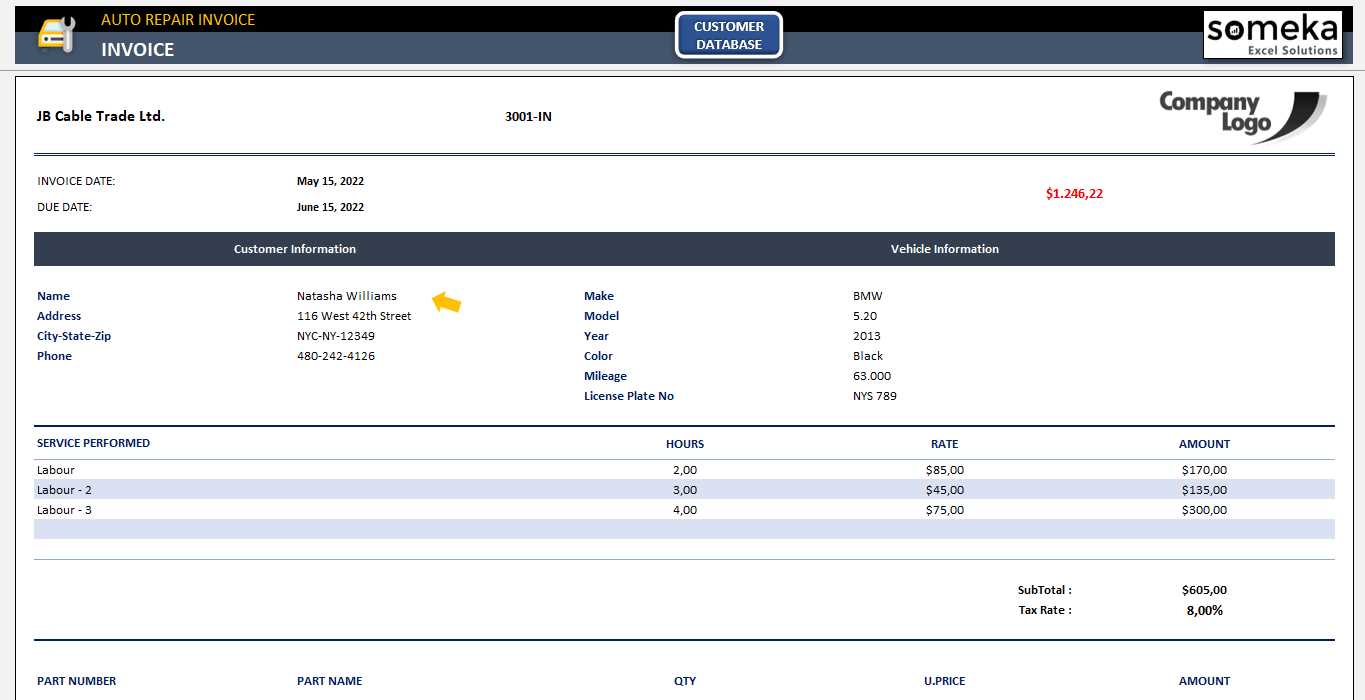

Benefits of Automating Your InvoicesStreamlining the process of creating and managing financial records can significantly improve efficiency and reduce errors. By utilizing digital tools to handle recurring tasks, businesses can save time, minimize mistakes, and ensure greater consistency across all financial documents. This transformation can positively impact cash flow management, client relations, and overall productivity. Time Savings and EfficiencyOne of the most significant advantages of implementing an automated system is the time it saves. Instead of manually entering data for each transaction, you can quickly generate documents with pre-filled information. This allows you to focus on more critical aspects of your business, such as customer service or strategy, while reducing the manual workload. Additionally, automatic calculations eliminate the need for constant checking and rechecking of numbers, ensuring faster processing times. Improved Accuracy and ConsistencyReducing human error is another key benefit. With a digital tool, there’s less chance of missing essential details like tax rates, payment terms, or due dates. The system can automatically adjust totals based on the data entered, further reducing the risk of mistakes. By using consistent formats for all transactions, you maintain a professional appearance, which builds trust with clients and helps avoid misunderstandings related to payments. Overall, automating the creation and management of financial documents ensures smoother business operations, better control over finances, and a more reliable workflow. These improvements can ultimately contribute to greater business growth and client satisfaction. Steps to Set Up Automated InvoicingSetting up a system for generating and managing billing documents is an essential step toward improving your business’s financial processes. By organizing the task into clear, manageable steps, you can ensure a smooth setup that saves time and minimizes errors. With the right system in place, creating and sending payment requests becomes a more efficient and reliable process. Step 1: Choose the Right SoftwareThe first step in setting up an efficient document management system is selecting the right software. Choose a platform that aligns with your business needs, offers customization options, and integrates with your existing financial tools. This could be spreadsheet software, accounting platforms, or specialized billing applications. Make sure the chosen tool has the ability to handle automatic calculations and easy record-keeping for better control over your transactions. Step 2: Design Your Document LayoutNext, create a structured layout for your billing documents. This should include sections for client details, descriptions of products or services provided, quantities, prices, payment terms, and totals. Customize your layout to reflect your business’s branding, ensuring that each document looks professional and contains all necessary information. For example, make use of fields that automatically populate the client’s name and address based on previously entered data. Setting up this structure will ensure consistency and help you avoid manual errors with each new record. Step 3: Add Calculations and FormulasIncorporate formulas that automatically calculate totals, taxes, discounts, or other necessary amounts. This eliminates the need to manually update each document, reducing the risk of mistakes. For example, set up formulas that sum the cost of services provided, apply a tax rate, and calculate any applicable discounts. Step 4: Set Up Client and Payment InformationSave essential client details in a database or a separate sheet for easy access. This allows you to quickly fill in the necessary information without entering it from scratch each time. Additionally, set up payment terms and due dates, so they are automatically included in each new record, further simplifying the process. Step 5: Test Your SystemBefore using your system for real transactions, run tests to make sure all calculations work correctly, fields are properly populated, and formatting looks good. Make adjustments Customizing Your Excel Invoice TemplatePersonalizing your document generation system is essential for ensuring that it aligns with your business needs and enhances the professional appearance of your financial records. Customization allows you to include specific details, adjust formatting to match your branding, and automate repetitive tasks, improving both efficiency and consistency. Tailoring the layout and structure of your documents can make them more functional and visually appealing for clients. By customizing your document, you can add elements such as your company logo, unique fonts, and specific terms that reflect your business practices. Adjusting fields for the types of services or products you offer, as well as incorporating features like automatic calculation of taxes and discounts, further streamlines the process. Key Areas to CustomizeHere are some important elements to consider when personalizing your billing document:

Making It User-FriendlyCustomization also involves creating a user-friendly interface within the system. This means organizing the layout in a way that makes it easy for you to fill out the necessary information without confusion. Use clear headings, section dividers, and appropriate spacing to ensure readability. Additionally, consider including drop-down menus or checkboxes for recurring items or payment methods, further simplifying the entry process. Once you have customized your document system, you will find that managing financial records becomes quicker, easier, and more professional. Customization ensures that your documents are not only functional but also consistently reflect your business How to Add Payment Terms in ExcelSetting clear and consistent payment terms is essential for maintaining healthy business relationships and ensuring timely payments. When creating financial documents, it’s important to clearly specify the conditions under which payments should be made. This can include specifying due dates, early payment discounts, or penalties for late payments. By incorporating these terms directly into your document, you can avoid misunderstandings and make your billing process more transparent. Step 1: Choose the Right Section for Payment TermsThe first step is to decide where to place the payment terms within your document. Typically, payment conditions are included towards the bottom of the document, after the list of services or products provided. You can create a dedicated section labeled “Payment Terms” or “Payment Instructions” to make it stand out. Step 2: Adding Specific Payment ConditionsOnce you’ve selected the location for payment terms, you can begin adding the relevant information. Common payment conditions include:

To make these conditions even clearer, you can use bold or underlined text for emphasis or create a separate table to list different payment methods and their associated deadlines. Step 3: Implementing Automatic Date CalculationsFor added convenience, you can set up automatic calculations for due dates based on the issue date. For example, if the document is issued on a specific date, you can use a formula to automatically calculate the due date based on your payment terms (e.g., 30 days from the issue date). This ensures accuracy and reduces the Integrating Excel Templates with Accounting SoftwareCombining the use of financial documents with accounting software can greatly streamline your business’s financial operations. Integration allows you to automate the flow of information between systems, reducing manual data entry, minimizing errors, and ensuring that all financial records are consistent across different platforms. By linking your document creation system with accounting tools, you can save time, enhance accuracy, and improve the overall efficiency of your accounting processes. Why Integration is ImportantIntegrating your billing system with accounting software ensures that all financial data is synced in real-time, providing you with up-to-date insights into your business’s financial health. When your documents are automatically linked to accounting records, you eliminate the need for double data entry and reduce the chances of discrepancies between your billing and accounting systems. This creates a more efficient workflow, allowing for better decision-making and easier financial tracking. Steps for Integrating Your Financial DocumentsHere are some key steps to help you integrate your document system with accounting software:

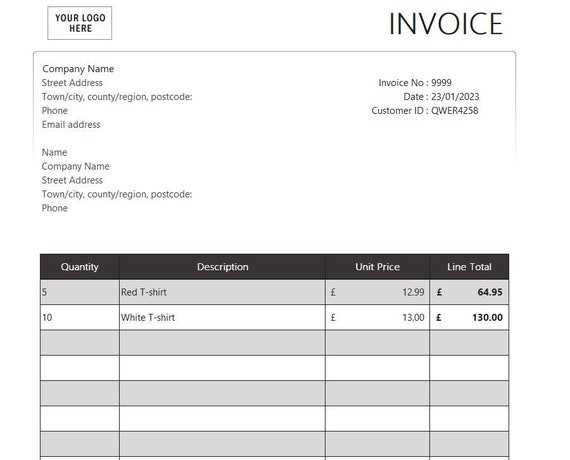

Benefits of IntegrationBy integrating your document creation system with accounting software, you can ensure seamless data flow, reduce errors, and gain real-time financial insights. This integration also simplifies tax reporting, ensures accurate record-keeping, and helps you maintain compliance with accounting standards. Ultimately, this saves time, reduces administrative work, and improves the overall efficiency of your financial operations. When you integrate financial document management with accounting systems, your busi Common Errors to Avoid in InvoicesEven small mistakes in financial documents can lead to confusion, delays in payments, or disputes with clients. Ensuring accuracy in every aspect of your records is crucial to maintaining professional relationships and avoiding unnecessary complications. Being aware of common errors and how to avoid them will help streamline your process and ensure smooth transactions. 1. Incorrect or Missing Client DetailsOne of the most common errors is failing to accurately include the client’s contact information. Missing or incorrect names, addresses, or email addresses can lead to delays or lost communications. Always double-check that all client details are correct before finalizing your documents. This ensures your clients receive their records promptly and reduces the chances of miscommunication regarding payments. 2. Calculation MistakesManual errors in calculations can result in discrepancies between the amount due and what was actually calculated. Whether it’s forgetting to apply tax rates or miscalculating totals, these mistakes can cause confusion for both you and your clients. Double-check all calculations, or better yet, use formulas to automatically perform calculations for subtotals, taxes, discounts, and totals. 3. Missing Payment TermsFailure to clearly specify payment terms can lead to delayed payments and misunderstandings. Always include important details such as the payment due date, acceptable methods of payment, and any penalties for late payments. Without these details, clients may not know exactly when or how to pay, resulting in avoidable delays. 4. Not Including a Unique Reference NumberEvery financial document should have a unique reference number or identifier for tracking purposes. Without it, keeping track of payments, especially in the case of multiple clients, becomes difficult. Ensure that each document has a distinct number or code that can easily be referred to for record-keeping. 5. Overlooking Professional FormattingPresentation matters. A poorly formatted document with unclear text or disorganized information may appear unprofessional and confuse your clients. Always maintain a clean and consistent layout. Make sure key information, such as totals and payment terms, is clearly highlighted, and use a logical structure to guide the reader through the document. By avoiding these common errors, you ensure that your financial records are clear, accurate, and professional. This reduces the chances of disputes and improves the efficiency of your billing process, ultimately leading to faster payments and stronger client relationships. Best Practices for Invoice FormattingProperly formatting your financial documents is essential to maintaining a professional appearance and ensuring clarity for both you and your clients. A well-structured document not only conveys the necessary information but also helps to avoid confusion and disputes. Adhering to best practices in document design will streamline the payment process and improve the overall customer experience. One of the key aspects of formatting is consistency. Ensure that the layout is clean, with well-defined sections for essential information like client details, transaction items, and payment terms. This organization makes it easier for your clients to understand the document and find the information they need quickly. 1. Clear and Readable FontsChoose a professional and easy-to-read font. Sans-serif fonts like Arial or Helvetica are ideal for clarity, especially in digital documents. Avoid overly decorative fonts, as they can make the text harder to read. Maintain a consistent font size throughout the document, reserving larger fonts for headings and important information such as totals or due dates. 2. Use of Tables for Clarity

Using tables for itemizing goods or services provides a structured, organized way to present detailed information. Ensure that the table is simple, with clear column headings for descriptions, quantities, unit prices, and totals. This layout allows for easy comparison and ensures that no details are overlooked. 3. Highlight Key InformationImportant elements, such as the total amount due, payment due date, and client information, should be clearly highlighted. Use bold or larger font sizes for these sections to make them stand out. Proper emphasis on key details ensures that clients immediately notice the most crucial aspects of the document. 4. Maintain Consistent AlignmentAlign your content correctly to ensure that the document looks tidy and well-organized. Aligning numbers to the right and text to the left ensures consistency throughout. This small detail enhances the overall readability and appearance of your document, making it look professional and polished. 5. Include Clear Section DividersDividers or lines between sections help visually separate different parts of the document, such as client information, service descriptions, and payment terms. This simple yet effective practice keeps the document clean and easy to navigate. By following these formatting best practices, you can create documents that are not only easy to read but also convey professionalism and reliability. A well-formatted document builds trust with clients and reduces the risk of misunderstandings, ensuring smooth and efficient transactions. How to Track Invoice Payments AutomaticallyKeeping track of payments can be a time-consuming task, especially as the number of clients and transactions grows. However, by implementing automatic tracking methods, you can ensure that your records are always up-to-date and accurate, without the need for manual entry. Automating payment tracking helps reduce errors, improves efficiency, and provides you with real-time insights into your cash flow. Steps to Set Up Automatic Payment TrackingHere are some effective methods to automatically track payments in your financial documents:

Tools and Features to UseTo facilitate automatic payment tracking, consider these helpful features:

Managing Multiple Clients with Excel TemplatesHandling a diverse client base requires effective organization and streamlined processes to ensure that all client data, transactions, and communications are properly tracked. Using structured documents can greatly assist in managing multiple clients at once, helping you stay on top of tasks and maintain accuracy. By using a well-organized system, you can handle the complexity of different clients and their specific requirements without confusion or errors. 1. Organizing Client Information

Start by creating a centralized document or spreadsheet where you can store key client details, including names, contact information, payment terms, and transaction history. Organizing this information in one place helps you quickly access the data you need, whether you’re following up on overdue payments or preparing a new set of records for a client. Ensure that each client has their own dedicated section or sheet to avoid mixing up information. 2. Setting Up Standardized ProcessesImplement a consistent system for managing different clients, including standardized templates for each document you generate. Using pre-set categories or tables for services, products, prices, and payment conditions ensures that the process remains uniform across all clients. This reduces the risk of errors and ensures that no steps are missed when handling multiple clients simultaneously. With a clear and consistent structure, you’ll be able to efficiently manage multiple clients, track their payments, and stay organized without feeling overwhelmed. A systematic approach not only saves time but also enhances professionalism, allowing you to focus on providing better services to your clients. Using Excel Templates for Recurring BillingFor businesses that offer subscription-based services or regular payments, managing billing cycles can quickly become complex. By using structured documents, you can simplify the process of recurring charges, ensuring that your clients are billed consistently and on time. Setting up an efficient system for recurring billing helps eliminate errors and ensures predictable cash flow, while minimizing the need for manual intervention each billing cycle. 1. Setting Up a Recurring Billing ScheduleStart by creating a system that automatically tracks the frequency of payments for each client, whether it’s weekly, monthly, or annually. Using a structured document with predefined fields for payment dates, amounts, and service details helps to maintain consistency. You can use formulas to calculate the next payment date and amounts due, reducing the risk of missed or incorrect billing cycles. 2. Tracking Payment StatusImplementing a column or section to monitor payment statuses for each billing cycle is essential. You can create a simple system with options like “Paid,” “Pending,” or “Overdue,” allowing you to easily track which clients have completed payments and which ones require follow-up. This not only improves organization but also gives you a clear view of your cash flow. By using a structured approach for recurring charges, you can manage multiple clients with ease, reduce administrative workload, and ensure that your billing processes are accurate and timely. With this system in place, you can focus on providing excellent service to your clients while maintaining a reliable and consistent revenue stream. Improving Workflow with Automated InvoicingStreamlining billing processes can have a profound impact on overall business efficiency. By reducing manual tasks and integrating intelligent systems, businesses can improve their workflow and reduce the time spent on administrative tasks. Automating routine aspects of billing ensures that tasks are completed accurately and on time, allowing you to focus on more strategic areas of your business. 1. Reducing Manual Data EntryOne of the most time-consuming tasks in billing is manually inputting client and transaction details. By utilizing a structured system, much of this data can be auto-filled or updated with minimal effort. This eliminates the risk of human error, speeds up the entire process, and frees up time for more important business activities. 2. Consistent and Timely BillingAutomated processes ensure that billing occurs consistently and on schedule. With predefined settings for payment cycles, you no longer need to manually track due dates or send reminders. The system can handle recurring charges and send out reminders for overdue payments, ensuring that your billing process is timely and reliable. 3. Integration with Other SystemsBy linking your billing system with other business tools, such as accounting software or customer relationship management (CRM) systems, you can create a seamless workflow. This integration helps synchronize data, eliminating the need for duplicate entries and providing a unified view of client payments, outstanding balances, and financial reporting. By optimizing and automating your billing workflow, you not only increase productivity but also improve client satisfaction by ensuring timely, error-free transactions. As your business grows, these automated systems will scale with you, making it easier to manage a larger client base without increasing administrative workload. Where to Find Free Invoice Templates

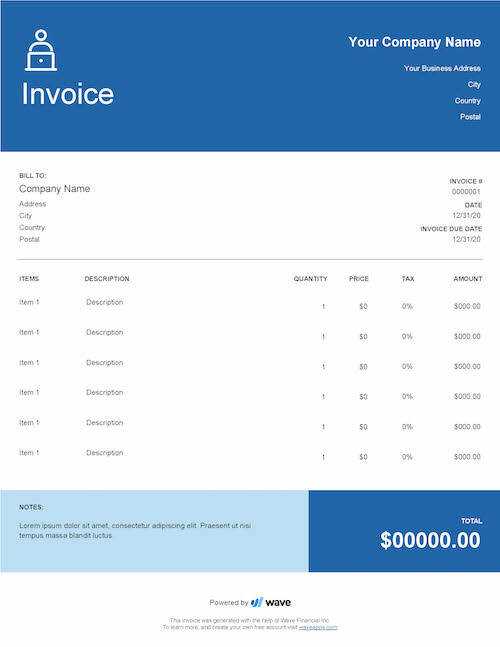

If you’re looking to simplify the billing process without spending money on software or custom solutions, free resources are available to help. Many websites offer downloadable or editable financial documents that can suit a variety of business needs. Whether you’re a freelancer, small business owner, or freelancer, these resources allow you to create professional, organized documents for tracking payments. 1. Online Platforms Offering Free Templates

Several online platforms provide easy access to free templates that can be customized to your business needs. These templates typically include pre-filled sections for common billing details, such as client name, services rendered, and payment terms.

2. Freelance and Small Business ResourcesMany websites designed for freelancers and small businesses offer free billing tools. These platforms often include templates that align with industry-specific needs, making it easy to find the right design for your service or product offerings.

By exploring these resources, you can find the right format that fits your business needs and start creating professional documents without any cost. These free options make it easier for small businesses or independent contractors to stay organized and ensure time |