How to Make an Invoice Template in Simple Steps

In any business, having a clear and organized way to request payment is essential for maintaining smooth financial transactions. A well-structured document that outlines the services or products provided, along with the corresponding charges, ensures transparency and professionalism. It serves as both a record for the client and a tool for tracking payments for your own accounting purposes.

Designing such a document involves more than just filling out a form. It requires attention to detail, including formatting, essential components, and customization based on the specific needs of your business and clients. Whether you’re a freelancer, a small business owner, or a large corporation, having a streamlined process for generating these documents can save time and reduce errors.

In the following sections, we’ll guide you through the essential steps for crafting a polished and functional billing record that can be easily adapted to your workflow. From the fundamental details to design tips and tools, you’ll learn how to create a document that looks professional and works efficiently for both you and your clients.

How to Create a Billing Document

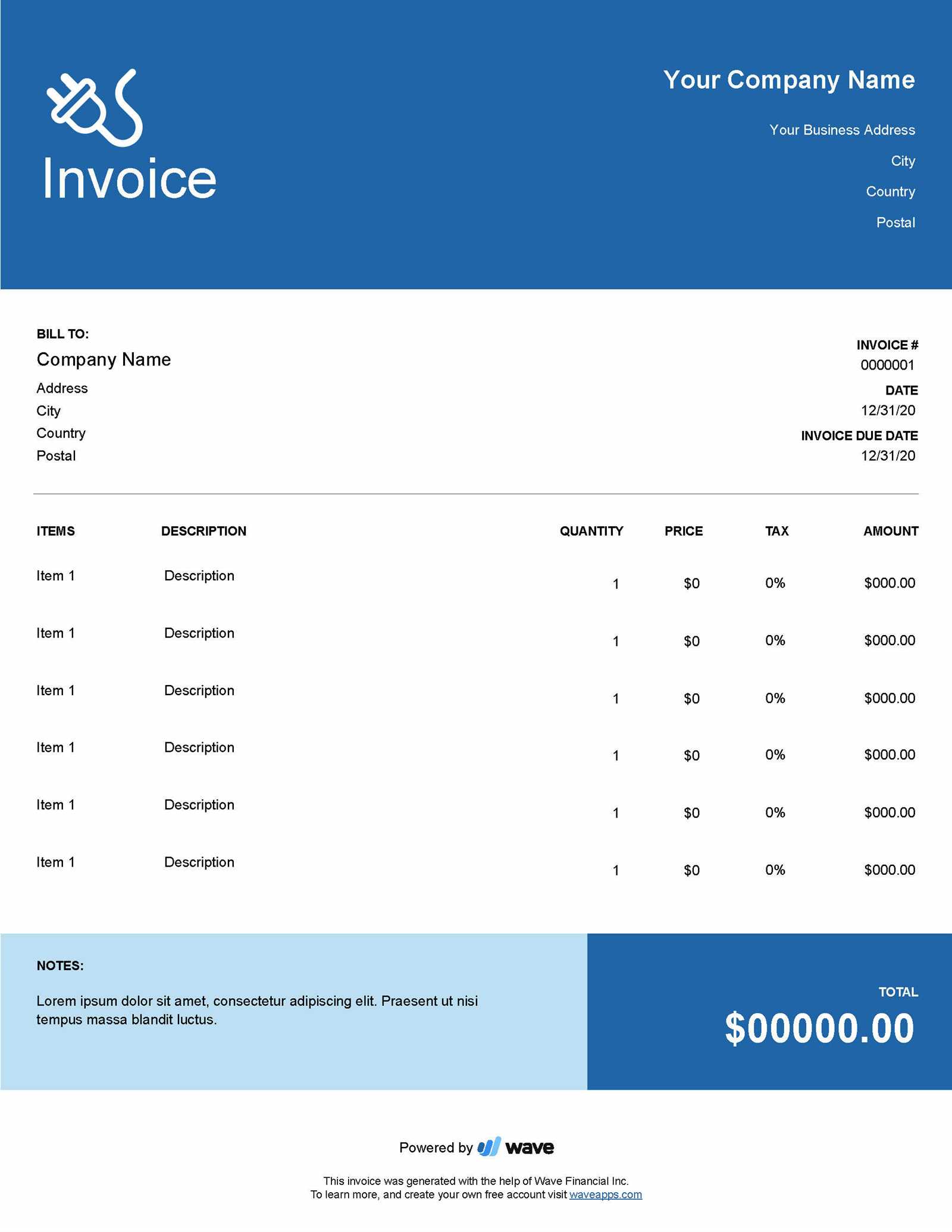

Designing a professional payment request form involves structuring all necessary elements clearly and logically. The goal is to present a well-organized summary of the transaction details, making it easy for both you and your client to understand the charges and terms. A carefully designed document reduces confusion, helps track payments, and ensures you maintain a professional image with your clients.

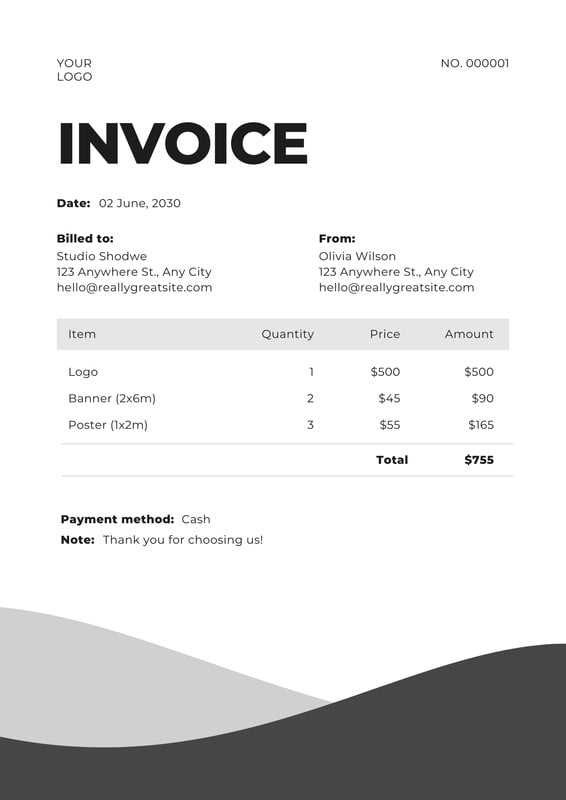

Start by including your business information, such as name, address, and contact details. This makes it easy for the client to identify who issued the request. Similarly, adding the recipient’s information, including their name and address, ensures that the document is personalized and accurate.

Next, focus on outlining the services or products provided. Include a brief description, quantity, price per unit, and the total amount for each item. This ensures complete transparency and avoids any misunderstandings. Be sure to also add any relevant taxes or discounts, as this gives a clear view of the final amount due.

Another essential component is setting the payment terms. Clearly state when the payment is due and any late fees that may apply if the payment is delayed. You may also want to include instructions on how the payment should be made, whether by bank transfer, check, or online payment system.

Finally, design your document with readability in mind. Keep the layout simple yet professional, ensuring there is enough space between sections for easy navigation. Consider using software tools that offer customizable templates to streamline the process while ensuring flexibility for future adjustments.

Understanding the Purpose of an Invoice

A payment request document serves as a formal record of a transaction between two parties. It outlines the terms of an agreement and specifies the amount due in exchange for goods or services rendered. This document is essential not only for securing payment but also for maintaining accurate financial records. By using this tool, businesses can keep track of earnings and ensure they receive compensation for the products or services they provide.

For the client, this document serves as a clear reminder of what has been agreed upon and when payment is expected. For the business, it ensures that all necessary details are provided for proper accounting, making it easier to monitor cash flow, taxes, and other financial obligations.

Here’s a simple breakdown of the core components found in a typical payment request document:

| Section | Description |

|---|---|

| Business Information | Details about the seller, including name, address, and contact information. |

| Client Information | Information about the buyer, such as name, address, and contact details. |

| List of Products/Services | A breakdown of what is being sold, including quantity, price, and total cost. |

| Payment Terms | Includes the due date, payment methods, and any applicable late fees. |

| Tax Details | Information on taxes applied to the sale, if relevant. |

This document is a crucial tool for creating a transparent and efficient financial process between businesses and clients, ensuring that both parties are clear on the transaction details.

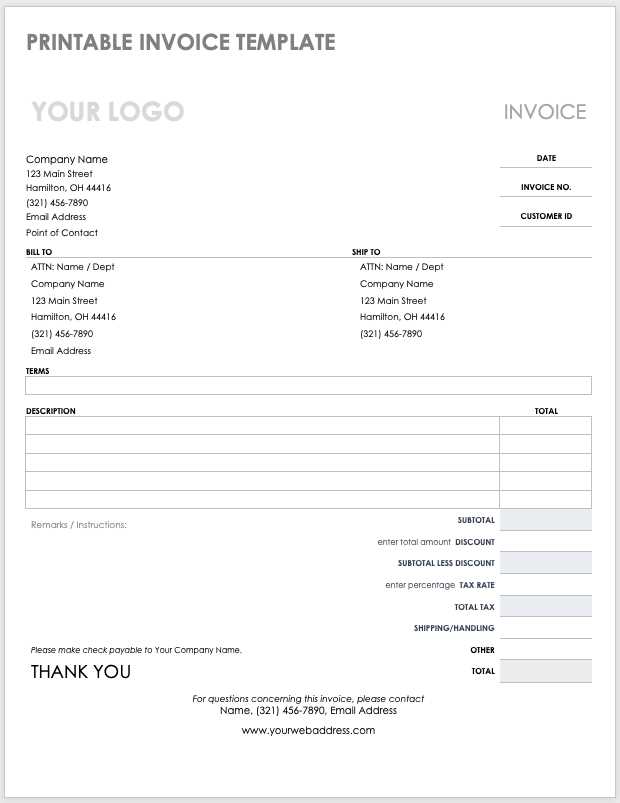

Key Elements Every Invoice Should Include

A payment request document needs to contain specific details to ensure it is both clear and legally binding. Without the necessary components, the document may lead to confusion or delays in payment. Including all the key elements ensures that the terms are transparent, and both the seller and buyer understand the financial transaction completely. These elements not only help with organizing payments but also facilitate proper record-keeping and accounting practices.

Business and Client Information

The first section should clearly state the names, addresses, and contact information for both the business issuing the document and the recipient. This makes it clear who is involved in the transaction and helps avoid any confusion, especially in case of disputes or follow-ups. Additionally, including a unique reference number helps track the transaction for future reference.

Transaction Details

One of the most important sections is the list of goods or services provided. Each item should be listed along with the quantity, price per unit, and total cost. This breakdown ensures that both parties are clear on what is being paid for. It’s also crucial to include any applicable taxes or discounts, so the final amount due is transparent.

Another critical element is specifying the payment terms. This includes the payment due date, late fees (if any), and the acceptable methods of payment. Being clear about these terms avoids misunderstandings and helps both parties stay on track with financial commitments.

Lastly, don’t forget to include any legal or regulatory information, such as tax identification numbers or other mandatory details depending on local laws. These can be important for ensuring the document is valid and compliant with tax regulations.

Choosing the Right Format for Your Invoice

Selecting the appropriate structure for a payment request is essential for clarity and ease of use. The format you choose should reflect both professionalism and functionality, making it easy for clients to understand the charges and for you to keep track of payments. Whether you are working with a digital or physical document, the layout should be clean, organized, and consistent with your branding.

Digital vs. Paper Format

When deciding on the structure, consider whether you will be sending the document electronically or in print. Digital formats, such as PDFs, are often more efficient for fast delivery and easier for clients to store or share. On the other hand, paper documents might be necessary in certain industries or for clients who prefer physical copies. Whichever format you choose, ensure it is optimized for clarity and professional appearance.

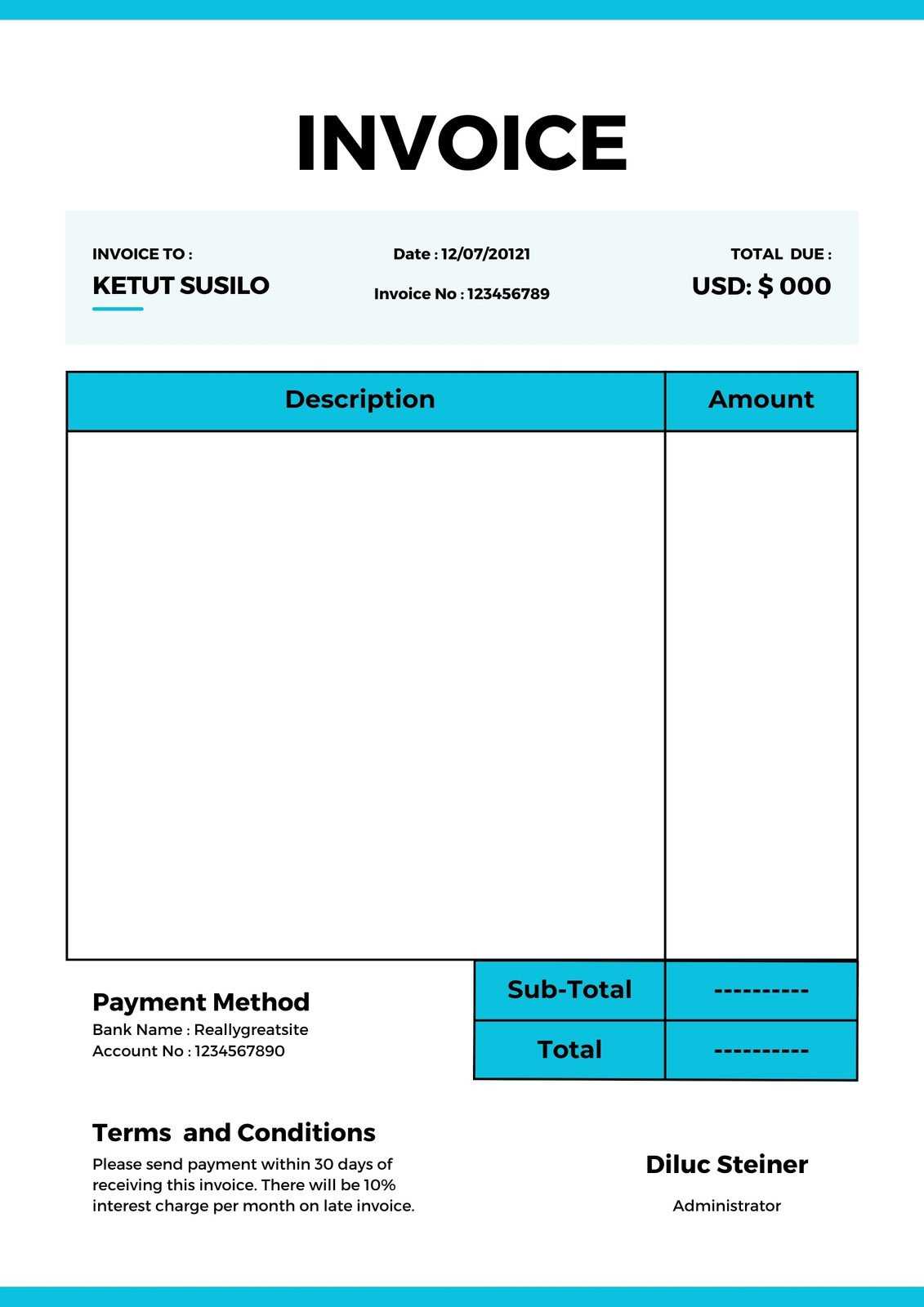

Choosing a Simple and Flexible Design

The design of your payment request should be simple yet flexible enough to adapt to different situations. A clean, minimalist design with clearly marked sections makes it easier for clients to find important information, such as the due amount and payment instructions. It should include space for adding specific transaction details without feeling cluttered. Customizable elements, like adjustable item lists or spaces for tax calculations, allow the document to meet various needs.

Here’s a simple comparison of some popular format options:

| Format Type | Advantages | Disadvantages |

|---|---|---|

| Digital (PDF, Word) | Easy to send, store, and edit; eco-friendly | Can be harder to keep track of for clients without digital organization |

| Paper | Preferred by some clients; formal feel | Slower delivery, higher printing costs |

| Online Invoice Software | Automates many processes, tracks payments | Requires subscription or setup |

By carefully cons

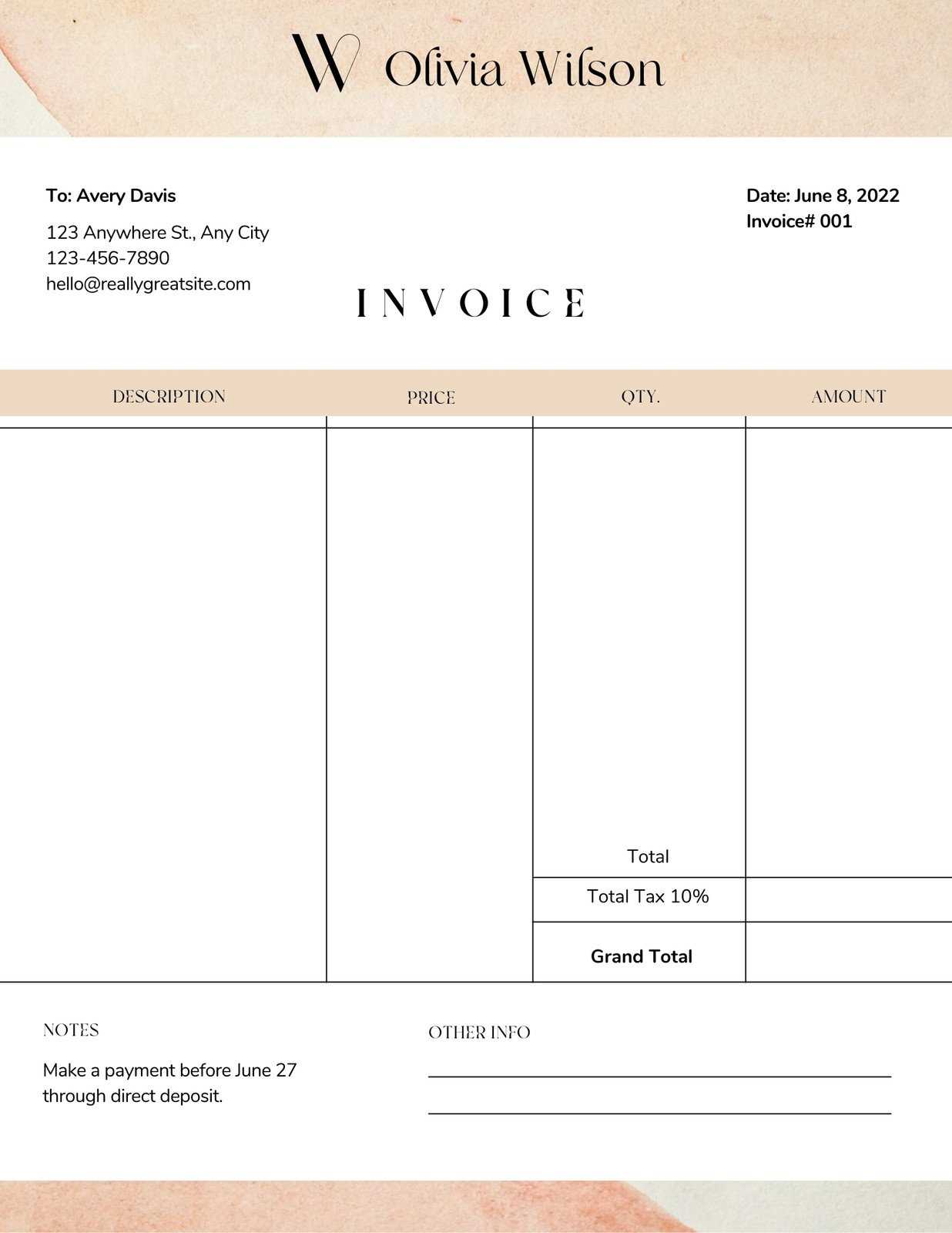

Designing a Clean and Professional Template

Creating a visually appealing and easy-to-read payment request document is key to maintaining a professional image. A well-designed layout not only enhances the document’s clarity but also builds trust with clients. The goal is to provide all the necessary information in an organized, straightforward manner, without unnecessary clutter. The design should support the content, ensuring that key details like amounts, dates, and payment instructions stand out clearly.

To achieve a clean and professional design, focus on the following aspects:

- Simplicity: Avoid overly complicated designs or excessive details. A minimalist approach with plenty of white space makes the document easy to read.

- Consistent Branding: Use your business’s colors, fonts, and logo to maintain brand identity. This helps reinforce your professionalism and ensures the document aligns with your company’s visual style.

- Clear Structure: Organize the information into distinct sections, such as business details, client details, list of services or products, and payment instructions. This helps the reader navigate the document quickly.

Consider the following tips for creating an effective layout:

- Use Readable Fonts: Choose simple, legible fonts like Arial, Helvetica, or Times New Roman. Avoid decorative fonts that may distract from the content.

- Incorporate Logical Hierarchy: Use headings and subheadings to guide the reader’s eye through the document. Larger font sizes for key headings help the most important sections stand out.

- Include Visual Elements Sparingly: A professional layout may include subtle design elements, such as borders or light shading, but avoid overusing images or graphics that can make the document look cluttered.

- Ensure Compatibility Across Devices: If sending documents electronically, ensure the layout is compatible across various devices and screen sizes, particularly for mobile users.

By following these guidelines, you can design a payment request that not only looks professional but is also functional and easy for clients to navigate, improving both your efficiency and the client’s experience.

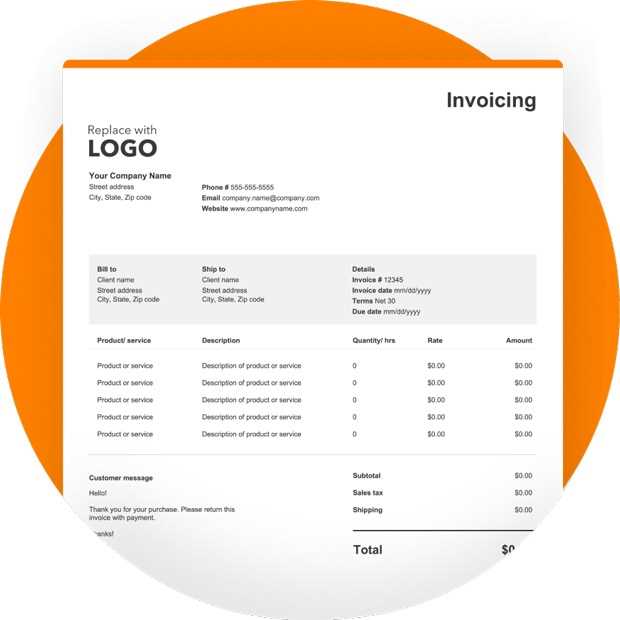

Using Software to Create an Invoice

Utilizing specialized software to design and generate payment request documents can save time and ensure accuracy. These tools provide customizable templates, pre-built layouts, and automated features that simplify the entire process. By using such software, you can create professional documents in just a few minutes, reducing the likelihood of errors and ensuring consistency across all your transactions.

Software options vary in complexity and functionality, ranging from simple, free tools to advanced, paid platforms that offer additional features like automated tracking, reminders, and integration with accounting systems. Choosing the right solution depends on the specific needs of your business and how frequently you generate payment requests.

Here’s a comparison of some common software options:

| Software Type | Key Features | Best For |

|---|---|---|

| Free Online Tools | Pre-designed templates, easy-to-use interface, basic customization | Freelancers, small businesses with occasional needs |

| Accounting Software (e.g., QuickBooks) | Integrated with financial tracking, automatic calculations, recurring billing | Growing businesses, teams that need advanced features |

| Invoice Generator Apps | Mobile-friendly, instant delivery, multiple payment options | Entrepreneurs on-the-go, businesses needing fast and flexible solutions |

By selecting the right tool, you can streamline your financial processes and focus more on running your business. Whether you choose a free platform or a more sophisticated accounting tool, software solutions help ensure that your payment requests are both professional and efficient.

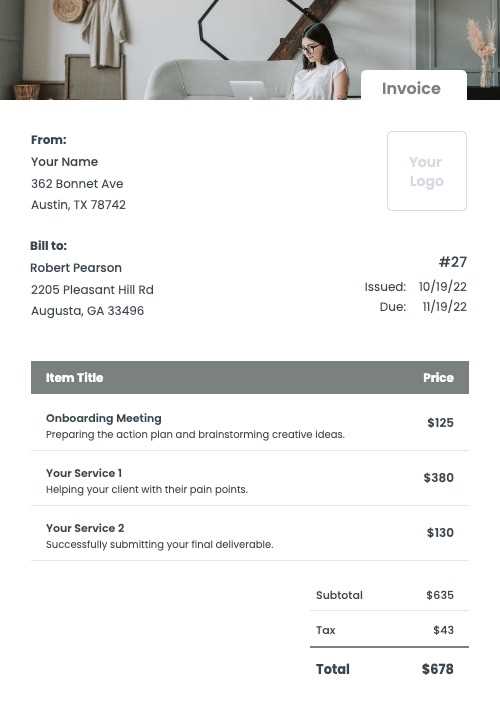

Customizing Your Template for Different Needs

Every business has unique requirements when it comes to creating payment requests. Tailoring your document to suit different situations can improve clarity and ensure that all necessary information is included. Customization allows you to adjust the layout, sections, and content to better fit specific industries, clients, or types of services provided. This flexibility ensures that your document remains effective in communicating key details, regardless of the situation.

Here are some ways to personalize your document based on different needs:

- Industry-Specific Information: Depending on your field, you may need to add specialized sections. For example, if you provide consulting services, you might include hours worked or project milestones. If you’re in retail, you may want to list product codes or item descriptions.

- Client Preferences: Some clients may prefer additional details, such as the project scope or payment milestones. Understanding client preferences and adjusting your format accordingly helps build strong, professional relationships.

- Frequent Adjustments: If you offer recurring services, adding a section for subscription details or billing cycles can simplify the process. This allows for easy tracking of ongoing payments without needing to rewrite or adjust the entire document each time.

To make this process more efficient, consider the following options:

- Flexible Fields: Choose a solution that allows you to add and remove sections easily. This could include editable fields for tax rates, discounts, or additional notes.

- Pre-Saved Customizations: For businesses with regular clients or repeating services, save commonly used configurations as templates. This reduces the time spent on creating new documents and ensures consistency.

- Automated Features: If your software allows for it, use automated fields for recurring charges or payment due dates. This ensures that important details are always included without the need for manual input.

By customizing your document to reflect the specifics of each transaction, you can make the process more efficient and professional. Tailoring it to your business needs not only improves your workflow but also enhances your client’s experience with clear and relevant information.

How to Add Your Business Information

Including your company’s details in every payment request is crucial for ensuring that clients know exactly who they are dealing with. This section serves as both an identification tool and a way to facilitate communication. Clear and accurate business information helps establish trust and ensures that the recipient can easily reach you if there are any questions or concerns about the transaction.

Key Information to Include

Make sure to add the following details when listing your company’s information:

- Business Name: Clearly state your company’s official name as it appears in your registration documents.

- Address: Include the physical address of your office or headquarters. If you operate online, provide your business registration address.

- Contact Information: Include your phone number, email address, and website (if applicable). This gives clients multiple ways to reach you.

- Tax Identification Number (TIN): If applicable, include your business’s tax ID for legal and tax purposes, especially for international clients.

- Business Registration Number: Some countries require businesses to list their registration or license number on official documents.

Best Practices for Displaying Your Details

To ensure that your information is easily readable and professional, consider these tips:

- Consistency: Keep the same format across all of your documents. This includes using the same font, size, and layout for your business details.

- Visibility: Place your details at the top of the document where they are easy to find. It’s common to include this information in the header section for better visibility.

- Update Regularly: Ensure that your business information is up to date, particularly if you change locations, contact methods, or registration details.

By making sure that your business details are clear and easy to find, you ensure a smoother transaction process and reinforce your professionalism with every payment request.

Setting Payment Terms and Due Dates

Establishing clear payment terms and deadlines is vital for ensuring timely payments and minimizing confusion. By defining when payments are due and under what conditions, you set expectations upfront, creating a smoother financial transaction process. This section helps both parties understand their obligations, ensuring that payments are made promptly and without dispute.

When determining payment terms, consider the following key elements:

- Due Date: Specify the exact date by which the payment should be made. Common due dates are 30, 60, or 90 days after the transaction, but you can adjust this based on your business needs and client agreements.

- Late Fees: If applicable, outline any penalties or interest charges for late payments. This encourages timely payment and discourages delays. Clearly state the rate (e.g., a percentage per day or a flat fee) and when it will be applied.

- Payment Methods: Indicate which methods of payment you accept, such as bank transfer, credit card, check, or online payment systems like PayPal. This ensures that clients know how to submit their payment.

- Discounts for Early Payment: If you offer a discount for early settlement, such as a 2% discount for payment within 10 days, make sure to specify the conditions under which this applies. This can motivate clients to pay sooner.

By making these terms clear, you can avoid misunderstandings and protect your cash flow. If payment deadlines are flexible, include clear instructions on any agreed extensions. Transparency in these terms helps foster positive relationships with clients while keeping your business finances in order.

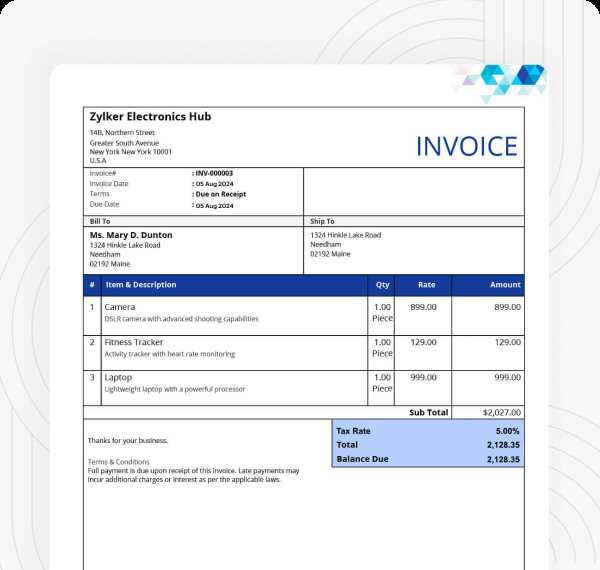

Including Taxes and Discounts in Invoices

Accurately calculating and displaying taxes and discounts is crucial for transparency and maintaining trust in business transactions. Both tax charges and discounts impact the final amount owed, and it’s important that these elements are clearly outlined in any financial document. By specifying tax rates and discount terms, businesses ensure that clients understand how the total amount due was calculated.

When adding taxes to a payment request, it is important to:

- Specify the Tax Rate: Indicate the percentage or amount of tax applied to the sale. Ensure that the rate complies with local regulations, as tax rates can vary by location or product type.

- Include Tax Breakdown: If multiple taxes are applied, break down each tax category separately. For example, show the sales tax, VAT, or any other applicable tax charges, along with their respective rates and amounts.

- Highlight Total Tax Amount: Clearly display the total amount of tax charged at the bottom of the payment request, making it easy for clients to see the exact tax cost.

Discounts are also an important consideration, and they can be used to incentivize prompt payments or reward bulk purchases. When including discounts, keep these points in mind:

- Specify the Discount Type: Clearly indicate whether the discount is a percentage (e.g., 10% off) or a fixed amount (e.g., $50 off) and under what conditions the discount applies.

- State the Discount Terms: If the discount is time-sensitive, such as offering a 5% discount for early payment, specify the deadline and any additional terms clearly.

- Show Discounted Amount: Deduct the discount from the subtotal before applying tax calculations. Ensure that the final amount after the discount is clearly shown so clients understand how the reduction was applied.

By accurately calculating and displaying taxes and discounts, you provide clarity for both you and your clients, reducing the risk of disputes and enhancing professionalism in your financial documentation.

Ensuring Your Template is Easy to Use

A well-designed document should not only look professional but also be user-friendly. The goal is to make sure that both you and your clients can quickly find and understand the information. A clear, straightforward layout saves time, reduces errors, and improves the overall user experience. Ensuring that your document is intuitive to navigate is key to creating an effective financial record.

Simplicity and Clarity

One of the most important aspects of usability is simplicity. The fewer distractions and complicated sections, the easier it is for the recipient to understand the details. Consider these tips for making your document straightforward:

- Use a Clean Layout: Avoid cluttering the page with unnecessary graphics or excessive text. Focus on the essential elements that the reader needs to see.

- Group Related Information: Arrange related data together in a logical order. For example, all contact details should be grouped at the top, while payment details and amounts should be clearly listed in the middle.

- Simple, Consistent Formatting: Use consistent fonts, sizes, and spacing. This ensures that important details stand out and makes the document more visually appealing.

Enhancing Accessibility

It’s essential that the document is accessible and easy to use across different platforms, whether it’s being viewed on a computer, tablet, or mobile phone. Consider the following factors:

- Responsive Design: Ensure that your document looks good on different screen sizes. For digital files, a responsive layout can adjust automatically to fit smaller screens, such as on smartphones or tablets.

- Editable Fields: If you are using a digital platform, make sure key areas are easily editable. This allows for quick adjustments, such as updating amounts or client details.

- Clear Call-to-Action: Highlight important actions, such as the payment due date or payment methods. A clear call to action will make it easier for your clients to act on the information provided.

By focusing on simplicity, clarity, and accessibility, you ensure that your financial documents are not only professional but also practical and easy for both you and your clients to use. This improves efficiency, reduces misunderstandings, and enhances the overall experience for everyone involved.

Common Mistakes to Avoid in Invoice Creation

While creating payment request documents, small errors can lead to confusion, delays, and even disputes. It’s crucial to pay attention to the details and ensure that all required information is accurate and clearly presented. Avoiding common mistakes can help streamline the process, maintain professionalism, and improve cash flow management. Below are several key errors to watch out for when preparing your financial documents.

Here are some of the most common mistakes businesses make:

| Mistake | Consequences | How to Avoid |

|---|---|---|

| Missing or Incorrect Contact Details | Client may not know how to reach you or misinterpret the information. | Double-check that your business name, address, and contact details are correct and up to date. |

| Not Including a Due Date | Payment may be delayed or overlooked. | Always specify a clear payment due date to avoid confusion. |

| Failure to Itemize Services or Products | Clients may question the charges, leading to delays in payment. | Clearly list all items, services, quantities, and rates for transparency. |

| Omitting Taxes or Discounts | Incorrect amounts might be charged, resulting in dissatisfaction or disputes. | Ensure all applicable taxes and discounts are clearly stated and calculated correctly. |

| Using Inconsistent Formatting | Confusing layout that makes it hard for the client to understand. | Maintain consistent fonts, spacing, and structure throughout the document for easy readability. |

By taking care to avoid these mistakes, you can create clear, accurate, and professional payment documents that reduce misunderstandings and expedite the payment proce

How to Save and Reuse Your Template

Once you’ve created a well-designed payment request document, saving it for future use can save you significant time and effort. By reusing a consistent structure, you ensure uniformity in all of your transactions while minimizing the need to recreate the document from scratch every time. The key is to store your document in a way that allows for easy access and quick edits, ensuring that it remains efficient and adaptable to different clients or services.

Saving Your Document for Future Use

To effectively store and reuse your financial document, consider these options:

- File Formats: Save your document in an editable format such as Word (.docx) or Excel (.xlsx) to allow easy updates. Alternatively, save it as a PDF for sharing, but keep an editable version for modifications.

- Cloud Storage: Use cloud storage platforms like Google Drive or Dropbox for easy access from any device. This ensures that your document is always available, even when working remotely or on the go.

- Organized Folders: Create a dedicated folder for all your payment request documents, categorized by client or service type. This makes it easy to find the right version whenever you need it.

Reusing Your Document Efficiently

When you need to send out a new payment request, reusing your document efficiently involves a few key steps:

- Updating Client Information: Quickly replace outdated details such as client name, address, and contact information. Many platforms also allow for the automatic filling of client fields if you’re using CRM software.

- Modifying Payment Amounts: Adjust the amounts, item descriptions, and other financial details to reflect the new transaction. Keeping a master version with placeholders for pricing can make this process much faster.

- Adding Specific Terms: If the payment conditions or terms vary for each client or project, customize the relevant sections, such as due dates, payment methods, and any special discounts or fees.

By following these steps, you can create a reliable system for saving and reusing your documents, allowing for streaml

Exporting Your Invoice for Client Use

Once your payment request document is complete and ready, it’s time to share it with your client. Exporting your document correctly ensures that the client receives it in the proper format, which maintains both clarity and professionalism. The format you choose can influence how easily the client can access, read, and store the document, as well as how you maintain the integrity of the information.

Choosing the Right File Format

Different file formats offer varying levels of convenience and compatibility. The most common formats for sharing financial documents include:

- PDF: This is one of the most widely used formats for sharing documents. It preserves the layout, fonts, and design of your document, ensuring that it looks the same regardless of the device used to view it. PDFs are ideal for sharing finalized documents.

- Excel: If the client needs to make changes or view calculations, exporting your document as an Excel file can be helpful. Excel allows clients to adjust the numbers or update details without altering the original structure.

- Word: For a more flexible format, Word allows clients to edit the document as needed. However, it is less secure than PDF and may not preserve the formatting exactly across different devices.

Exporting and Sharing Options

Once you’ve chosen the format, there are several methods to send the document to your client:

- Email: The most common and direct method. Attach the file to an email with a polite message that includes details such as the due date and payment instructions.

- Cloud Storage: If the document is too large or if you want to ensure it is always accessible, uploading it to a cloud storage service like Google Drive or Dropbox provides a secure link that you can share with your client.

- Online Payment Systems: Some businesses integrate invoicing and payment features into platforms like PayPal, Stripe, or QuickBooks. These services can automatically generate and send the payment request, allowing clients to view and pay immediately.

By choosing the right format and distribution method, you ensure that your payment request is delivered clearly and securely, making it easier for your client to access and respond promptly.

Automating Invoice Generation

Automating the creation of payment requests can significantly streamline your workflow, save time, and reduce human error. By using specialized tools or software, you can generate consistent and accurate documents quickly, without needing to manually input information each time. Automation also helps ensure that invoices are sent out promptly, improving cash flow management and client satisfaction.

Benefits of Automation

Implementing an automated system can bring several advantages to your business:

- Time-Saving: Automating the process allows you to focus on other important tasks, as you won’t need to manually fill in each client’s details or perform repetitive calculations.

- Accuracy: Automated systems minimize the risk of errors in calculations, such as taxes, discounts, or totals, ensuring that your documents are always correct.

- Consistency: By using predefined settings, automated solutions create uniform payment requests every time, keeping your documents professional and standa

Best Practices for Invoice Accuracy

Ensuring that your payment requests are precise and error-free is critical for maintaining professional relationships and smooth business operations. Mistakes in billing can lead to confusion, delayed payments, and loss of trust from clients. By following best practices for accuracy, you can avoid common pitfalls and ensure that all details are correct from the start, streamlining your payment processes and improving client satisfaction.

Here are key strategies to maintain accuracy when preparing financial documents:

- Double-Check Client Information: Always verify the client’s name, address, and contact details before finalizing any document. This ensures that your payment request reaches the correct person and avoids delays caused by incorrect contact information.

- Itemize Every Charge: Clearly list all goods or services provided, including descriptions, quantities, rates, and totals. Providing a detailed breakdown reduces the risk of disputes and makes it easier for the client to review the charges.

- Review Payment Terms and Deadlines: Ensure that the payment due date, method, and any applicable late fees or discounts are clearly stated. Clear and accurate payment terms prevent confusion and encourage timely payments.

- Calculate Totals Accurately: Always double-check the addition of taxes, discounts, and final amounts. Simple errors in math can lead to incorrect billing, requiring time-consuming corrections. Using automated tools can help minimize such mistakes.

- Include Relevant Supporting Information: If there are additional references like purchase orders, contracts, or project numbers, make sure these are included and correct. This helps clients cross-check and validate the document quickly.

By following these best practices, you not only ensure accuracy but also present yourself as a detail-oriented and reliable business partner. Consistently accurate documents reflect professionalism and help maintain strong, positive client relationships.

Managing Multiple Invoice Templates

As businesses grow, it becomes necessary to generate various payment request documents tailored to different services, clients, or projects. Managing multiple document formats can be challenging, but with the right approach, it’s possible to stay organized, efficient, and consistent. The key is to develop a system that allows easy access to the right format at the right time, while maintaining clarity and accuracy in all documents.

Organizing Different Versions

To manage different types of financial documents efficiently, consider the following strategies:

- Use Folders for Categorization: Create separate folders for each type of document, such as client-specific, service-specific, or project-specific versions. This way, you can quickly find the correct document when needed.

- Label Files Clearly: Include clear labels with relevant details in the file name, such as the client name, date, or project name. This helps avoid confusion and makes it easier to locate files when required.

- Version Control: Keep track of different document versions to ensure that you are using the most up-to-date format. This can be done by including version numbers in the file name (e.g., “ClientXYZ_Invoice_v2”).

Using Tools for Efficient Management

There are several tools and software options that can help you manage multiple payment request documents more effectively:

Tool Features Advantages Cloud Storage (Google Drive, Dropbox) Organize, categorize, and access documents from any device. Easy sharing and collaboration, automatic syncing, and backup. Accounting Software (QuickBooks, Xero) Create and store customized payment documents for different clients and services. Automated generation, integration with payment systems, and tax calculations. Document Management Systems (Evernote, OneDrive) Store, categorize, and search for various document types quickly. Advanced search functions, easy access, and sync Tips for Managing Client Payments Efficiently

Managing client payments effectively is crucial for maintaining healthy cash flow and ensuring the smooth operation of your business. By streamlining the payment process, you can reduce delays, minimize administrative work, and avoid potential misunderstandings with clients. Establishing clear systems for tracking, following up, and recording payments helps ensure that no transactions slip through the cracks and that you maintain a professional relationship with your clients.

Establish Clear Payment Terms

Setting clear expectations upfront can prevent payment delays and confusion later on. Ensure that your clients are aware of:

- Due Dates: Clearly specify when payments are expected to be made. Including a specific due date on your documents can eliminate ambiguity.

- Accepted Payment Methods: List the payment methods you accept (e.g., bank transfer, credit card, PayPal) to make it easier for clients to pay.

- Late Fees: If applicable, include details on any late payment penalties to encourage timely payments and protect your business from cash flow problems.

Track and Monitor Payments

Effective tracking of incoming payments is key to staying organized and ensuring that clients pay on time:

- Use Accounting Software: Tools like QuickBooks, FreshBooks, or Xero can automate much of the payment tracking process. These platforms can help you record payments, send reminders, and generate reports, saving you time and effort.

- Create a Payment Log: For smaller businesses or those not using accounting software, maintaining a simple spreadsheet can help you monitor which payments have been received and which are still outstanding.

- Automate Payment Reminders: Set up automated email reminders for clients before and after the payment due date to help minimize late payments.

By combining clear communication with systematic tracking, you can significantly improve the efficiency of managing client payments and reduce the chances of missed or delayed transactions.