How to Use the Wise Invoice Template for Efficient Billing

Managing payments and financial transactions efficiently is crucial for the success of any business. A well-designed document for requesting payments can save time, reduce errors, and ensure clarity between service providers and clients. With the right tools, creating such documents becomes an effortless task that enhances the professionalism of your business interactions.

In this guide, we explore a powerful and customizable solution that allows entrepreneurs and freelancers to generate clear, accurate, and aesthetically pleasing payment requests. Whether you’re a small business owner or an independent contractor, this tool simplifies the entire billing process, ensuring that both parties are on the same page when it comes to the details of each transaction.

From easy customization options to time-saving features, this approach empowers users to create tailored documents that reflect their unique brand and business style. Let’s delve into how this practical resource can transform your approach to managing financial documentation.

Wise Invoice Template Overview

Managing financial transactions efficiently is essential for maintaining a smooth workflow in any business. A streamlined document that helps in requesting payments can greatly reduce the chances of errors and confusion. This tool simplifies the process, making it easy for entrepreneurs and freelancers to produce professional-looking documents with minimal effort.

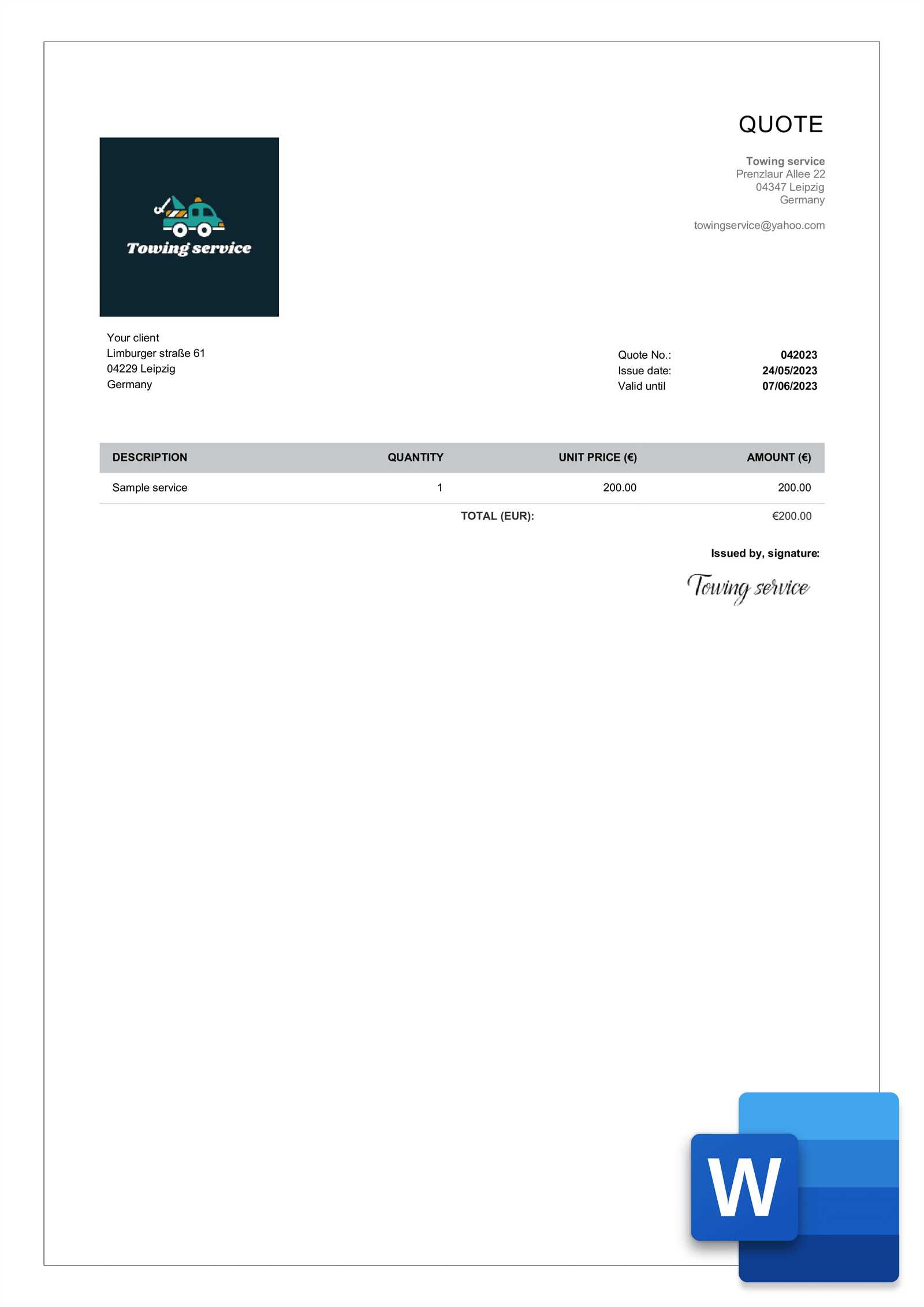

The platform provides a customizable solution, allowing users to create clean and organized payment requests that can be tailored to their specific needs. It includes all the necessary fields, such as item descriptions, amounts, and due dates, ensuring that all the relevant details are clearly presented. With this tool, users can focus on their work while having confidence in their financial communications.

Designed with user-friendliness in mind, the system ensures that even those with little to no design experience can create polished, business-ready documents. This ease of use, coupled with flexible options for customization, makes it a valuable asset for anyone looking to simplify their billing process and maintain a professional image in their financial dealings.

Why Choose a Wise Invoice Template

Having the right tool to create professional payment requests can make a significant difference in how efficiently a business manages its finances. A reliable solution can save time, reduce human errors, and ensure clarity between the service provider and the client. Opting for a well-designed, easy-to-use system streamlines the entire process, making it more efficient and less stressful.

One of the main advantages of this solution is its simplicity. It allows users to quickly generate structured documents with all the necessary details, eliminating the need to start from scratch each time. This reduces the time spent on administrative tasks, allowing business owners and freelancers to focus on their core activities. Additionally, the format ensures that every document looks polished and professional, reinforcing the credibility of the business.

Another key benefit is the customizability. The system is flexible enough to accommodate the specific needs of various industries, whether you’re a freelancer, small business owner, or large corporation. It also integrates easily with accounting software, simplifying the process of tracking payments and maintaining financial records. With these features combined, the solution offers a comprehensive approach to managing financial documents.

How to Create a Wise Invoice

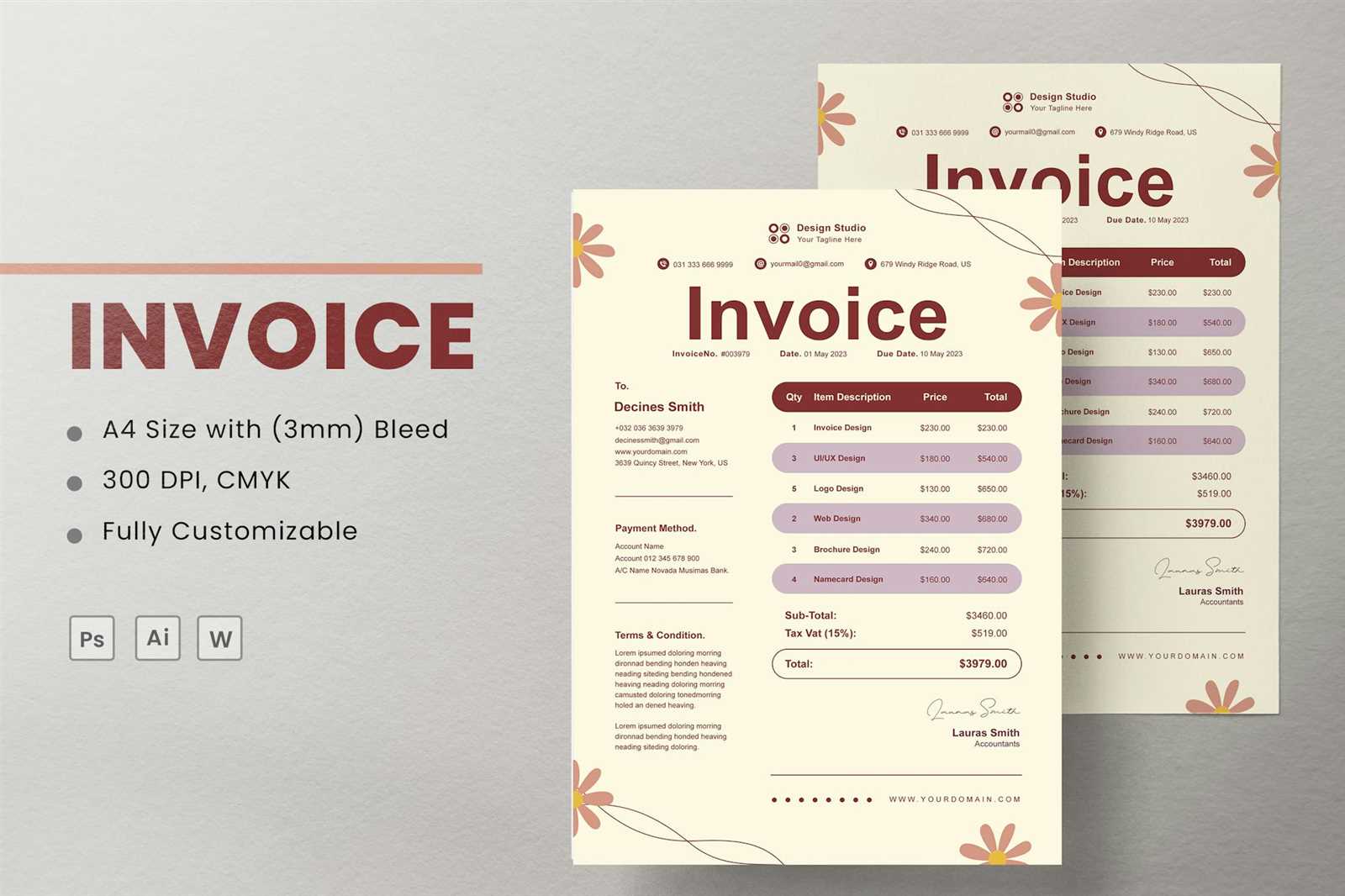

Creating a professional payment request document is a straightforward process that can be completed in just a few simple steps. The goal is to ensure that all essential information is included, making it easy for both parties to understand the transaction details. By following a clear structure and customizing the layout to match your business style, you can generate accurate and polished documents every time.

The first step is to choose a platform or tool that offers a user-friendly interface for document creation. Once you’ve selected the tool, you’ll typically begin by entering key details such as the recipient’s name, the products or services provided, and the corresponding amounts. Be sure to include payment terms, such as due dates and accepted payment methods, to avoid any confusion.

Next, customize the design to reflect your brand’s identity. This includes adjusting colors, fonts, and logos to match your business’s style. Most platforms allow for easy personalization, so you can make the document look professional without the need for graphic design skills. After filling in all relevant fields and reviewing the content for accuracy, the document is ready to be saved, shared, or printed for your client’s convenience.

Customizing Your Wise Invoice Design

Customizing the look of your payment request documents is an important step in ensuring that they reflect your brand and professionalism. A well-designed document not only looks appealing but also helps convey important information in a clear and organized way. Adjusting the layout and visual elements can make your requests stand out and create a positive impression with clients.

The first aspect to consider when personalizing your document is branding. You can easily incorporate your business’s logo, colors, and fonts to maintain consistency with your other marketing materials. This creates a cohesive experience for clients and reinforces your brand identity. Most platforms offer simple tools to add these elements, making the process both quick and effective.

In addition to branding, it’s essential to focus on readability. The design should prioritize clarity, with a layout that guides the reader’s eye through the document in a logical order. Using appropriate font sizes, spacing, and headings helps break up the content and makes it easier for your client to review the details. Ensuring that all key information is easy to find is key to a professional and functional design.

Key Features of Wise Invoice Templates

When creating financial documents, several essential elements make the design both efficient and functional. These features allow users to streamline the billing process, ensuring accuracy and professionalism. The structure and components of such forms are tailored to suit various business needs while maintaining a clean, understandable format.

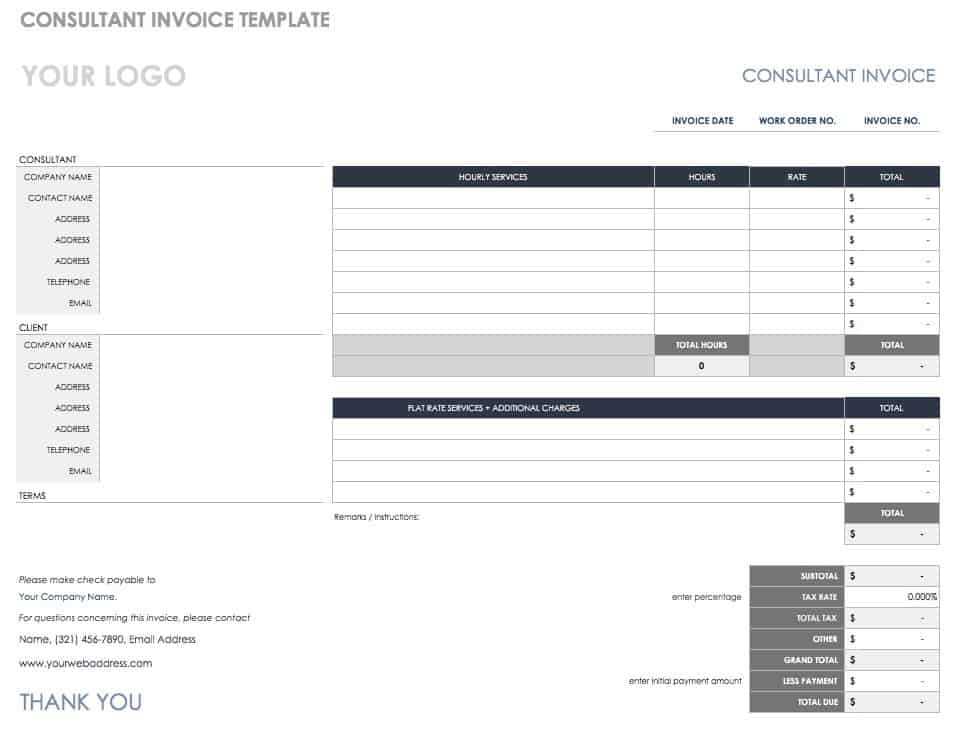

Customizability and Flexibility

One of the standout qualities of these forms is their high degree of customizability. Users can easily adjust fields, layout, and design to match their brand’s identity or to suit specific transaction details. Whether you’re invoicing for services, products, or subscriptions, there is flexibility in adapting the document’s style to your preferences.

Automated Calculations and Totals

Another practical feature is the built-in automated calculation functionality. This allows users to input figures and have totals, taxes, and discounts calculated instantly. This reduces the likelihood of errors and ensures accuracy in final amounts, making the entire process more efficient and reliable.

Wise Invoice Template for Small Businesses

For small enterprises, managing financial transactions efficiently is essential to maintain a smooth workflow and sustain growth. Having an easy-to-use document that can handle billing tasks accurately ensures businesses stay organized, professional, and up-to-date with their financial records. Customizable formats that adapt to various needs can simplify this process significantly.

Streamlined Process for Entrepreneurs

Small business owners often juggle multiple responsibilities, making it crucial to have tools that save time and reduce errors. With a well-designed document, creating and sending requests for payment becomes straightforward, eliminating the need for manual calculations and minimizing human error. This feature ensures that even entrepreneurs with limited financial expertise can handle billing tasks confidently.

Professional Appearance and Trust

These forms also contribute to a polished and credible business image. A professionally designed structure with clear itemization and transparent payment terms fosters trust between businesses and clients. This can lead to improved client relationships and timely payments, enhancing the overall efficiency of business operations.

Benefits of Using a Digital Invoice

Switching to digital billing documents offers numerous advantages for businesses looking to streamline their financial operations. These electronic forms simplify the billing process, reduce errors, and save valuable time. The convenience of managing and sending these documents instantly makes them an essential tool for modern businesses.

Improved Efficiency and Speed

Digital documents can be generated and sent within minutes, cutting down on the time spent preparing and mailing physical copies. This not only speeds up the entire billing process but also accelerates payment collection, benefiting cash flow management. Key advantages include:

- Instant generation and sending

- Reduced paperwork handling

- Faster receipt of payments

Cost Savings and Environmental Impact

By moving away from paper-based systems, businesses can significantly reduce costs associated with printing, postage, and storage. Additionally, this shift contributes to a more sustainable approach by minimizing waste. The benefits include:

- Lower operational costs

- Reduced environmental footprint

- No need for physical storage space

How Wise Invoice Template Saves Time

Time management is crucial for businesses, and having the right tools can significantly reduce the time spent on administrative tasks. By using a streamlined document system, companies can automate many of the repetitive tasks involved in creating and sending payment requests. This efficiency leads to faster operations and allows employees to focus on other critical areas of the business.

| Feature | Time Savings |

|---|---|

| Predefined Fields | Eliminates the need to input repetitive data manually, saving time on each document. |

| Automated Calculations | Instantly calculates totals, taxes, and discounts, preventing manual errors and delays. |

| Quick Customization | Adjust layouts and details easily, making it faster to adapt to different business needs. |

| Fast Delivery | Documents can be emailed directly, eliminating delays caused by postal services. |

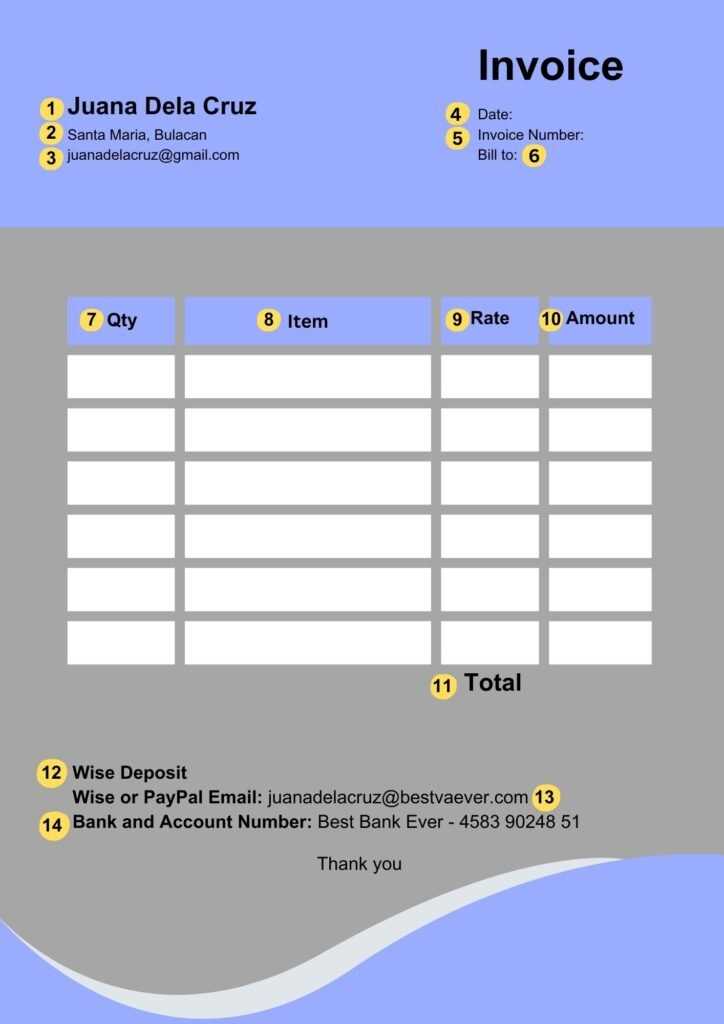

Step-by-Step Guide to Filling the Template

Filling out a billing document accurately is crucial for ensuring that all information is correct and payment is processed without issues. This step-by-step guide will walk you through the necessary fields and the process to follow when completing your document. Each section is designed to capture essential details while maintaining clarity and professionalism.

| Step | Description |

|---|---|

| 1. Enter Business Information | Start by filling in the business name, address, and contact details. This helps the recipient identify the source of the document. |

| 2. Add Client Details | Input the client’s name, address, and contact information. Be sure to double-check these details to avoid confusion. |

| 3. Specify Products or Services | List all the items or services being billed, including descriptions, quantities, and rates. This section provides transparency to the client. |

| 4. Calculate Totals | Ensure that all amounts, taxes, and discounts are calculated correctly. Many systems will automate this step for you. |

| 5. Set Payment Terms | Clearly define the payment due date, methods of payment accepted, and any late fees if applicable. |

Best Practices for Wise Invoice Creation

Creating clear and professional billing documents is essential for maintaining good relationships with clients and ensuring timely payments. Following best practices helps ensure accuracy, professionalism, and consistency in all financial transactions. Adhering to these guidelines makes the process smoother and helps avoid potential issues.

- Ensure Clarity and Transparency: Provide a detailed description of goods or services provided. Make sure the terms are clear to avoid confusion.

- Use Professional Formatting: Choose a clean, easy-to-read layout with consistent font styles and sizes. A polished appearance can enhance your business reputation.

- Double-Check for Accuracy: Always verify all numbers, dates, and client information before sending the document. This minimizes errors and the need for revisions.

- Specify Payment Terms: Clearly define payment due dates, accepted methods, and any penalties for late payments to avoid misunderstandings.

- Include Unique Identifiers: Assign a unique number to each document to help with tracking and record-keeping.

- Keep It Simple: Avoid cluttering the document with unnecessary information. Focus on the essential details to ensure clarity.

How to Avoid Common Billing Errors

Accurate financial documentation is critical to maintaining professional relationships and ensuring timely payments. Mistakes in payment requests can lead to confusion, delays, or even lost business. By being mindful of common errors and adopting careful practices, you can ensure that all transactions are smooth and precise.

- Double-Check Client Details: Verify the recipient’s name, address, and contact information before finalizing the document. An incorrect address or misspelled name can delay processing or cause confusion.

- Review Item Descriptions and Pricing: Ensure that the description of goods or services is clear and that prices are correct. Incorrect pricing or missing details can lead to misunderstandings and disputes.

- Ensure Accurate Dates: Pay attention to both the issue date and the payment due date. Late or incorrect dates can affect cash flow and give clients an excuse to delay payment.

- Check Tax Calculations: Mistakes in tax rates or amounts can result in incorrect totals. Make sure all applicable taxes are included and calculated properly.

- Avoid Duplicate Entries: Double-check that no items are listed more than once, as this could cause overbilling and damage trust with clients.

- Use Clear Payment Terms: Specify how and when payments are expected, along with any late fees. Vague terms can lead to confusion about the due date or payment method.

Integrating Wise Invoices with Accounting Tools

Streamlining financial processes is key for maintaining accuracy and efficiency in any business. By integrating billing documents with accounting software, businesses can automate data entry, track payments, and reduce human error. This integration allows for seamless communication between the different systems involved in financial management, ensuring that all records are up to date and accessible.

| Benefit | Impact |

|---|---|

| Automated Data Syncing | Direct integration ensures that payment details and client information are automatically updated in your accounting software, reducing manual input. |

| Real-Time Financial Overview | Integrating with accounting tools gives businesses a live overview of their financial status, including unpaid balances and cash flow projections. |

| Improved Accuracy | Syncing billing documents with accounting software reduces the risk of errors that can occur during manual data entry, ensuring accuracy in financial reporting. |

| Time Savings | Eliminates the need for double entry of information, allowing staff to focus on other essential tasks, improving overall productivity. |

Managing Multiple Invoices with Wise

Handling numerous payment requests can become overwhelming, especially when dealing with multiple clients and varying payment terms. Using a well-structured system to organize and track these documents ensures that no transaction is missed, and each request is processed on time. By adopting an efficient approach, businesses can streamline their billing processes and improve overall financial management.

Organizing and Tracking Requests

When managing multiple requests, it’s essential to have a method that allows for easy sorting and quick access to specific documents. By assigning unique identifiers and organizing them by client or due date, you can efficiently track each one. This system reduces the chances of overlooking overdue payments or duplicating entries. A few strategies include:

- Labeling and Categorizing: Group documents based on client, status (paid or pending), or due date for quicker reference.

- Automated Reminders: Set up automated notifications to remind clients of upcoming or overdue payments, ensuring timely collection.

- Centralized Storage: Store all documents in a single, easily accessible location, either in the cloud or within your accounting software.

Reducing Errors and Enhancing Efficiency

With multiple transactions to handle, accuracy is key. Automation tools can help ensure that information remains consistent across all documents. Calculating totals, applying taxes, and generating consistent formats can save significant time and reduce the risk of errors. Benefits of automation include:

- Time Efficiency: Automatic calculations save time spent on manual entry, ensuring accuracy and faster turnaround.

- Reduced Human Error: Automation minimizes the possibility of mistakes that can occur when manually inputting data across multiple documents.

- Consistent Formatting: Automatically applying a standard structure to all requests helps maintain a professional appearance across your business transactions.

Improving Cash Flow with Wise Invoices

Maintaining a healthy cash flow is crucial for business stability and growth. Timely and accurate financial documents can significantly impact how quickly payments are collected, which in turn improves liquidity. By streamlining the billing process, businesses can reduce delays, avoid late payments, and ensure smoother cash flow management.

Faster Payment Processing

With a well-organized system for generating and sending payment requests, businesses can ensure quicker responses from clients. By automating key steps–such as calculation, customization, and delivery–companies reduce the time it takes to issue and track each request. Benefits include:

- Instant Delivery: Send documents immediately upon completion, speeding up the overall process.

- Clear Payment Terms: Clearly defined payment terms and due dates help avoid confusion, encouraging clients to pay on time.

- Automated Reminders: Set up automatic reminders for overdue payments, helping to follow up without manual intervention.

Enhanced Accuracy and Reduced Disputes

Ensuring that all information is accurate from the start minimizes the chance of disputes, which can delay payment. Automating calculations, ensuring the correct application of taxes, and offering detailed breakdowns of charges help foster trust and transparency. This results in faster approvals and fewer delays caused by incorrect or disputed amounts. Key advantages include:

- Precise Calculations: Automatic calculations eliminate the possibility of human error, ensuring accurate totals.

- Transparent Details: A clear breakdown of charges fosters trust and reduces misunderstandings.

- Consistent Formatting: A uniform appearance across all documents ensures professionalism and reduces confusion.

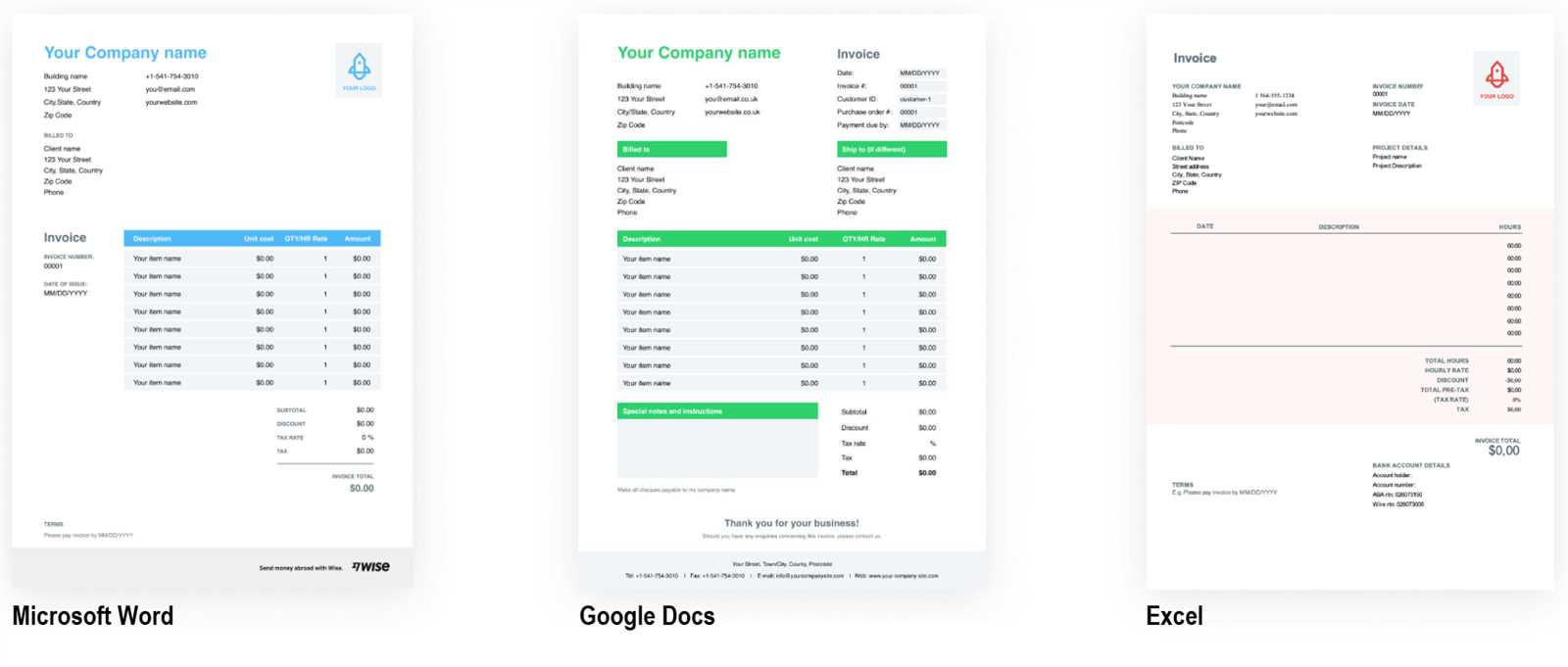

How to Download and Print Your Invoice

Once your financial document is ready, it is essential to know how to properly download and print it for record-keeping, sharing with clients, or submitting to accounting systems. The process is simple and ensures that you have both a digital and physical copy of the document for your convenience.

Downloading the Document

To download your financial record, follow these steps:

- Access the Document: Log into your account or system where the document is stored and open it for review.

- Choose Download Option: Look for the “Download” button or option in the interface, typically located near the top or bottom of the screen.

- Select File Format: Choose the format in which you wish to download the document (e.g., PDF, Word, Excel). PDF is often preferred for its universality and security.

- Save to Desired Location: Choose the folder or directory on your computer where the file will be saved, making it easy to find later.

Printing the Document

After downloading, you can print your document by following these steps:

- Open the Downloaded File: Locate the file you just downloaded and open it with the appropriate program (e.g., Adobe Reader for PDFs).

- Choose Print Option: Click on the “Print” icon or go to the “File” menu and select “Print” to open the printing dialogue box.

- Select Printer: Choose the printer you want to use from the list of available devices.

- Adjust Settings: Configure settings such as number of copies, page orientation, and paper size before hitting “Print.”

- Confirm Print: Review the print preview to ensure everything looks correct before clicking “Print.”

Wise Invoice Template for Freelancers

Freelancers often juggle multiple projects and clients, which makes managing financial records crucial for maintaining a steady income and ensuring timely payments. By using a streamlined system for billing, freelancers can easily track services rendered, set clear payment terms, and reduce the chance of payment delays. A well-structured document helps present professionalism and clarity in all financial dealings.

| Feature | Benefit |

|---|---|

| Customizable Layout | Allows freelancers to tailor the document according to the specific nature of each project or client. |

| Clear Itemization | Provides a detailed breakdown of services or hours worked, preventing misunderstandings with clients. |

| Automatic Calculations | Minimizes errors by automatically calculating totals, taxes, and discounts. |

| Payment Terms | Clearly defines when payments are due, reducing ambiguity and ensuring timely receipts. |

| Professional Appearance | Ensures all documents maintain a professional look, which enhances credibility and client trust. |