How to Create an Effective Invoice Disclaimer Template

In any business transaction, clarity is key to avoiding misunderstandings and disputes. Including specific terms on your financial documents can help define the responsibilities of both parties and protect your interests. By stating clear conditions, you set expectations for payment, delivery, and any potential issues that might arise during the course of the agreement.

Many businesses face challenges when it comes to late payments or disagreements over services rendered. A well-written set of terms can mitigate these risks by outlining what is expected from the client and what the consequences are for failing to meet these expectations. Whether you’re offering a product or service, clearly communicated conditions can prevent costly legal disputes down the line.

In this guide, we will explore how to craft a comprehensive set of legal protections that can be added to your billing documents. These conditions serve as a safeguard for your business while also ensuring a smooth transaction process. With the right wording, you can create a document that protects your business and fosters trust with clients.

Why You Need an Invoice Disclaimer

When running a business, it’s essential to clearly outline the terms and conditions of your transactions. Without clear communication on your billing statements, misunderstandings and disputes are more likely to arise. By including specific clauses that address various scenarios, you ensure that both you and your clients are on the same page, helping to prevent complications in the future.

Including legal protections on your financial documents helps define your business’s stance on key issues such as payment deadlines, late fees, and potential conflicts. These provisions create a clear framework for what happens if there is a breach of agreement, safeguarding your interests while maintaining a professional relationship with clients.

Moreover, setting clear expectations from the start builds trust and transparency. By proactively addressing potential concerns, you can reduce the risk of late payments and disputes, ensuring smoother transactions and a more stable cash flow for your business.

Understanding the Importance of Invoice Disclaimers

Clear terms and conditions on your billing documents are essential for protecting your business interests. By defining expectations up front, you create a framework that ensures both you and your clients are aware of your rights and responsibilities in the transaction. This not only reduces the chance of misunderstandings but also provides legal safeguards should any issues arise.

Why These Terms Matter

Including detailed clauses on your financial documents helps manage potential risks, including late payments, disputes over services rendered, and unforeseen issues with delivery or performance. When clients are fully aware of the terms, they are less likely to dispute charges or question agreements. Here are some key reasons why these terms are crucial:

- Prevents Confusion: Having well-defined conditions minimizes the chances of miscommunication between you and your clients.

- Legal Protection: Specific terms outline your legal rights, helping to protect your business in case of a conflict.

- Promotes Transparency: Being clear about your expectations helps build trust and ensures smoother business relationships.

How These Clauses Help Your Business

By taking the time to incorporate relevant legal language into your financial documents, you actively protect your business from potential risks. A well-written agreement can act as a shield, helping you avoid costly disputes and maintain a positive relationship with your clients. In addition, these terms also ensure that your expectations are met and that your business operations continue to run smoothly.

Key Elements of an Invoice Disclaimer

When creating financial documents that outline the terms of a transaction, it’s important to include certain clauses that clearly define the expectations and responsibilities of both parties. These key components help establish clear communication and protect your business from potential disputes. Below are the essential elements that should be included to ensure both clarity and legal protection.

| Element | Description |

|---|---|

| Payment Terms | Clearly outline the due date for payments and any late fees that will apply if the payment is not received on time. |

| Scope of Services | Define what products or services are being provided to ensure both parties understand the deliverables. |

| Limitation of Liability | Specify the extent to which your business will be held liable in case of issues arising from the transaction. |

| Dispute Resolution | Outline the procedures for resolving any disputes, including mediation or arbitration steps. |

| Refund Policy | Clarify the conditions under which refunds or adjustments can be requested by the client. |

These key elements provide the necessary framework for both parties to understand their roles and obligations. By incorporating these provisions, you can ensure that expectations are set clearly and that both parties are protected should any disagreements arise during the course of the transaction.

How Invoice Disclaimers Protect Your Business

Incorporating specific terms and conditions into your financial documents is essential for minimizing risk and protecting your business. These clauses serve as a safeguard, ensuring that both you and your clients are clear on expectations, responsibilities, and possible consequences. By setting these boundaries in writing, you create a solid foundation for future transactions, preventing disputes and clarifying any potential gray areas.

| Protection Aspect | How It Helps Your Business |

|---|---|

| Clear Payment Terms | Defines when payments are due and outlines penalties for delays, reducing the chances of late or missed payments. |

| Limitation of Liability | Limits your exposure to potential lawsuits by outlining the extent of your business’s responsibility in case of issues with the service or product. |

| Dispute Resolution Process | Establishes a process for resolving conflicts, ensuring that issues are handled in a structured manner, avoiding costly legal proceedings. |

| Refund & Return Policies | Clarifies the terms under which refunds or exchanges are allowed, helping to manage customer expectations and reduce refund disputes. |

| Protection from Fraud | By including specific terms regarding the handling of unauthorized payments or chargebacks, you protect your business from potential fraud or theft. |

By including these protective measures in your financial agreements, you not only safeguard your business from legal risks but also foster better relationships with your clients through clear communication and transparency. This proactive approach minimizes the chances of misunderstandings and provides a framework for resolving issues quickly and efficiently.

Common Legal Issues Addressed by Disclaimers

In any business transaction, having clear legal protections outlined in your documents is critical to prevent potential disputes and misunderstandings. By including certain provisions, you can address common legal issues that may arise during or after a transaction. These provisions help clarify the responsibilities of both parties and provide a legal framework for resolving any conflicts that could occur.

1. Payment Disputes and Late Fees

One of the most common issues businesses face is payment delays or disputes over payment terms. Clearly stating the payment deadline, acceptable payment methods, and penalties for late payments can help prevent these issues. By outlining consequences for overdue payments, such as interest charges or additional fees, you establish a strong legal foundation that protects your business from delayed or incomplete payments.

2. Breach of Contract and Service Expectations

Another significant risk is a breach of contract, where either party fails to meet their agreed-upon obligations. Clear definitions of the scope of services or products being provided help set expectations from the start. In the event of non-compliance, including clauses that outline the steps for dispute resolution or penalties for non-performance can protect your business from legal challenges.

| Legal Issue | How It’s Addressed |

|---|---|

| Late Payments | Clearly defined payment terms and late fee policies prevent delays and outline consequences for non-payment. |

| Unclear Service Terms | Detailed descriptions of services or products ensure both parties understand the deliverables, reducing the risk of misunderstandings. |

| Breach of Agreement | Including penalties or consequences for non-compliance ensures there are legal actions available to remedy breaches. |

| Refund and Return Disputes | Explicit policies on refunds or returns help minimize disputes by setting clear guidelines on when and how clients can request adjustments. |

By proactively addressing these common legal issues through clear and comprehensive terms, businesses can mitigate risks and ensure that both parties are on the same page. A well-drafted agreement provides protection from disputes and offers a clear path for resolution, benefiting both the business and the client.

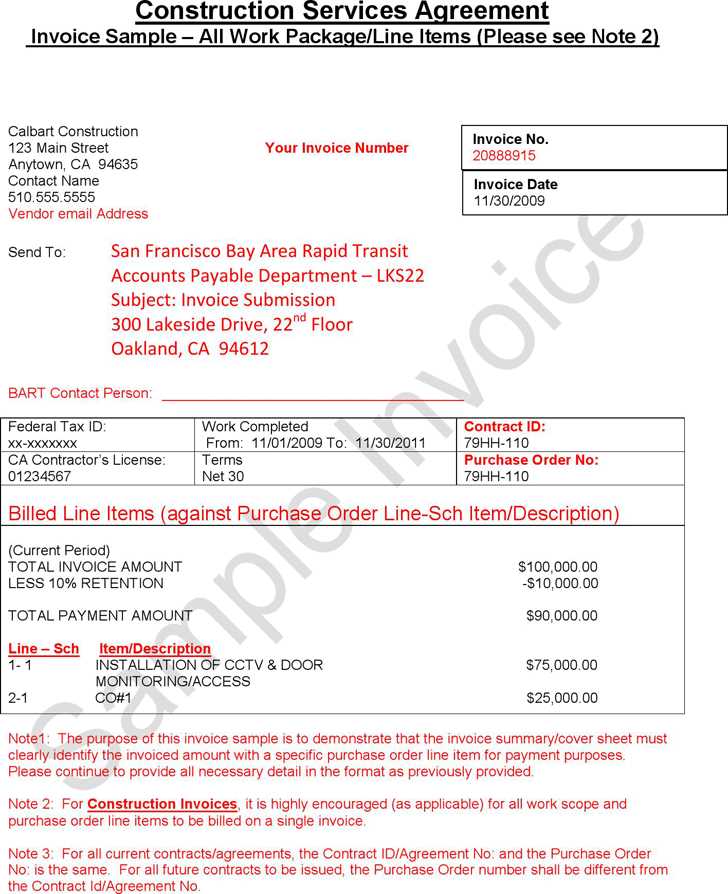

Steps to Create an Invoice Disclaimer

Creating effective legal provisions for your billing documents requires a methodical approach to ensure clarity, protection, and compliance. By carefully drafting the right language and including the necessary clauses, you can protect your business from potential disputes and minimize risks. The following steps will guide you through the process of developing a set of terms that safeguard both you and your clients.

| Step | Description |

|---|---|

| 1. Identify Key Terms | Start by identifying the most important elements of your transaction, such as payment deadlines, delivery timelines, and service terms. These form the foundation for your legal terms. |

| 2. Define Payment Terms | Be clear about the amount, due dates, and acceptable payment methods. Specify what happens in case of late payments, including any fees or penalties that may apply. |

| 3. Address Liability and Responsibility | Include clauses that limit your business’s liability in case of unforeseen issues, such as delays, product defects, or service interruptions. |

| 4. Set Refund and Return Policies | Clearly outline the conditions under which clients can request a refund or return. This helps manage expectations and prevents future disputes. |

| 5. Establish Dispute Resolution Process | Define a procedure for resolving conflicts, such as mediation or arbitration. This provides a clear path for handling disagreements without resorting to court. |

By following these steps, you can create a robust set of terms and conditions that protect your business, ensure clear communication with clients, and reduce the likelihood of legal conflicts. Having a structured approach to these legal aspects fosters trust and professionalism in every transaction.

Customizing Your Invoice Disclaimer Template

Every business has unique needs, and tailoring your legal terms to fit your specific operations is crucial for ensuring the best protection. A one-size-fits-all approach rarely works when it comes to financial agreements. Customizing your terms allows you to address the particular risks and requirements that apply to your industry, client base, and business model. This ensures that your agreements are both relevant and legally sound.

When personalizing your legal clauses, consider the following factors to ensure your documents align with your business practices and minimize future risks:

- Industry-Specific Conditions: Different industries have distinct regulations and expectations. For example, a service-based business may need to include detailed clauses about project timelines and deliverables, while a product-based business may focus more on warranty and return policies.

- Payment Structures: Adjust the terms to reflect the specific payment arrangements you offer, such as installment plans, deposits, or early payment discounts.

- Client Types: If you work with a mix of individuals and businesses, you may want to customize your clauses to cater to different legal requirements, such as tax obligations or invoicing protocols.

- Risk Management: Tailor your clauses to manage the risks most relevant to your business, such as limiting liability in case of product defects, service disruptions, or delayed deliveries.

By customizing your terms to suit your specific needs, you create a more effective legal safeguard that provides better clarity for your clients while ensuring that your business is protected from potential challenges. Customization helps make your agreements more efficient, minimizing ambiguity and fostering stronger relationships with clients.

Best Practices for Invoice Disclaimers

Including clear terms in your billing documents is essential for protecting your business and ensuring smooth transactions. By following best practices, you can reduce the risk of misunderstandings, disputes, and legal complications. These guidelines help ensure that your agreements are both legally enforceable and easy for your clients to understand.

1. Keep the Language Clear and Simple

One of the most important aspects of effective legal clauses is clarity. Using simple, straightforward language reduces the chances of confusion and helps ensure that both you and your clients are on the same page. Avoid jargon or overly complex legal terms that might lead to misinterpretation.

- Avoid Ambiguity: Ensure that your terms are specific and unambiguous. Vague clauses can lead to confusion and disputes later.

- Use Plain Language: Write in a way that anyone, regardless of their legal background, can understand. This makes the document more accessible and reduces misunderstandings.

2. Be Comprehensive but Concise

While it’s essential to cover all the necessary terms, try to avoid overloading the document with unnecessary details. A lengthy document may overwhelm clients, while a too-brief one may leave important details unaddressed. Strike a balance between thoroughness and brevity.

- Include Key Provisions: Address payment terms, delivery schedules, liabilities, and any refund or return policies that apply to your business.

- Prioritize Important Information: Focus on the most relevant terms and make sure they are clearly highlighted.

3. Ensure Legal Compliance

Make sure your terms comply with local laws and regulations to avoid future legal complications. This may involve consulting with a legal professional to ensure that your clauses are legally sound, especially if you’re operating in multiple jurisdictions.

- Stay Up to Date: Laws and regulations can change over time, so it’s important to review and update your terms regularly.

- Seek Legal Advice: When in doubt, consult with a lawyer to ensure that your terms are compliant with relevant laws and regulations in your industry.

By following these best practices, you can create

When to Include a Disclaimer on Invoices

There are specific situations in which including legal provisions on your financial documents becomes essential for protecting your business. These clauses help set clear expectations, define responsibilities, and minimize the risk of future disputes. Understanding when and why to include these protections can ensure that both you and your clients are well-informed and aligned throughout the transaction.

- When Offering Flexible Payment Terms: If you provide payment plans, installments, or extended deadlines, it’s important to clearly outline the terms and conditions. These provisions can address issues such as late fees or early payment discounts, ensuring that the client is fully aware of their obligations.

- When Dealing with High-Risk Transactions: For high-value or high-risk transactions, such as large orders or custom services, it’s crucial to include detailed terms that outline the scope of the agreement, the client’s responsibilities, and the potential consequences for non-compliance.

- When Handling Refunds or Returns: If your business has specific policies regarding refunds, exchanges, or returns, these terms should be clearly stated in order to avoid misunderstandings or disputes with clients later on.

- When Operating in Multiple Jurisdictions: If your business operates in different regions or countries, it’s necessary to include terms that comply with local laws and regulations. This ensures that you meet legal requirements and protect yourself from potential legal issues.

- When Offering Limited Warranties or Guarantees: If your products or services come with warranties or guarantees, these conditions must be clearly outlined to avoid confusion over the coverage and limitations of the offer.

By including these key terms when appropriate, you help reduce the likelihood of disputes, ensure smoother transactions, and provide clarity for both you and your clients. Knowing when to use legal clauses allows you to protect your business while maintaining positive relationships with your customers.

How to Avoid Common Mistakes with Disclaimers

Creating legal terms for your financial documents requires careful attention to detail. Even minor errors in the wording or structure of these clauses can lead to misunderstandings, legal complications, and disputes. By being aware of the common mistakes and knowing how to avoid them, you can ensure that your terms effectively protect your business and set clear expectations with your clients.

1. Be Clear and Specific

Vague language is one of the most common mistakes when drafting legal provisions. Ambiguous clauses can lead to confusion and misinterpretation, which can create challenges down the line. To avoid this, make sure that all terms are as specific as possible, leaving little room for uncertainty.

- Avoid General Terms: Instead of using terms like “reasonable” or “as soon as possible,” be precise about timeframes, amounts, and conditions.

- Clarify Consequences: Clearly state what will happen in case of late payments, non-compliance, or other issues to avoid potential disputes over enforcement.

2. Keep Terms Consistent

Another mistake is using inconsistent language throughout your terms. This can cause confusion and weaken the enforceability of the document. Ensure that the terms you use are consistent, both within the document itself and in relation to your general business practices.

- Standardize Terminology: Use consistent terminology to describe the same concepts (e.g., “late fee” vs. “penalty,” or “service delivery” vs. “completion”).

- Align with Practices: Make sure that the terms you include in your documents match how you actually operate. For example, if you do not offer refunds, make sure your terms reflect this.

By being clear and consistent in your terms, you reduce the chances of confusion and potential legal challenges. The more straightforward and well-organized your clauses are, the easier it will be for both you and your clients to navigate your agreements.

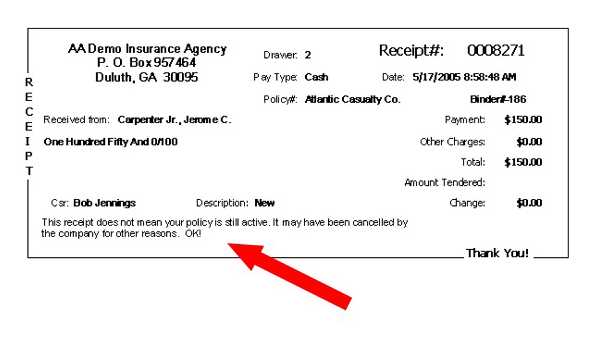

Examples of Effective Invoice Disclaimers

Including clear and well-crafted terms in your billing documents can make a significant difference in avoiding misunderstandings and protecting your business. Below are several examples of effective clauses that businesses can use to outline expectations, responsibilities, and limits, thereby minimizing the potential for disputes.

- Late Payment Terms:

“Payments not received within 30 days of the due date will incur a 5% late fee per month, compounded monthly. If payment is not received within 60 days, the account will be referred to collections.”

- Limitation of Liability:

“The company’s liability is limited to the total amount paid by the client for the service rendered and does not cover indirect, incidental, or consequential damages.”

- Refund Policy:

“Refunds are available only if the service or product is defective or does not meet the agreed specifications. Requests for refunds must be made within 14 days of receipt.”

- Warranty and Guarantee:

“The product is covered by a 12-month warranty against manufacturing defects. This warranty does not cover damages resulting from misuse or unauthorized repairs.”

- Payment Dispute Resolution:

“In case of payment disputes, both parties agree to attempt mediation before initiating legal proceedings. The mediation will take place in the jurisdiction where the business is located.”

These examples demonstrate how specific and transparent terms can clearly outline the expectations and legal protections for both parties. By incorporating such clauses, businesses can create stronger agreements that foster trust and minimize the risk of conflict.

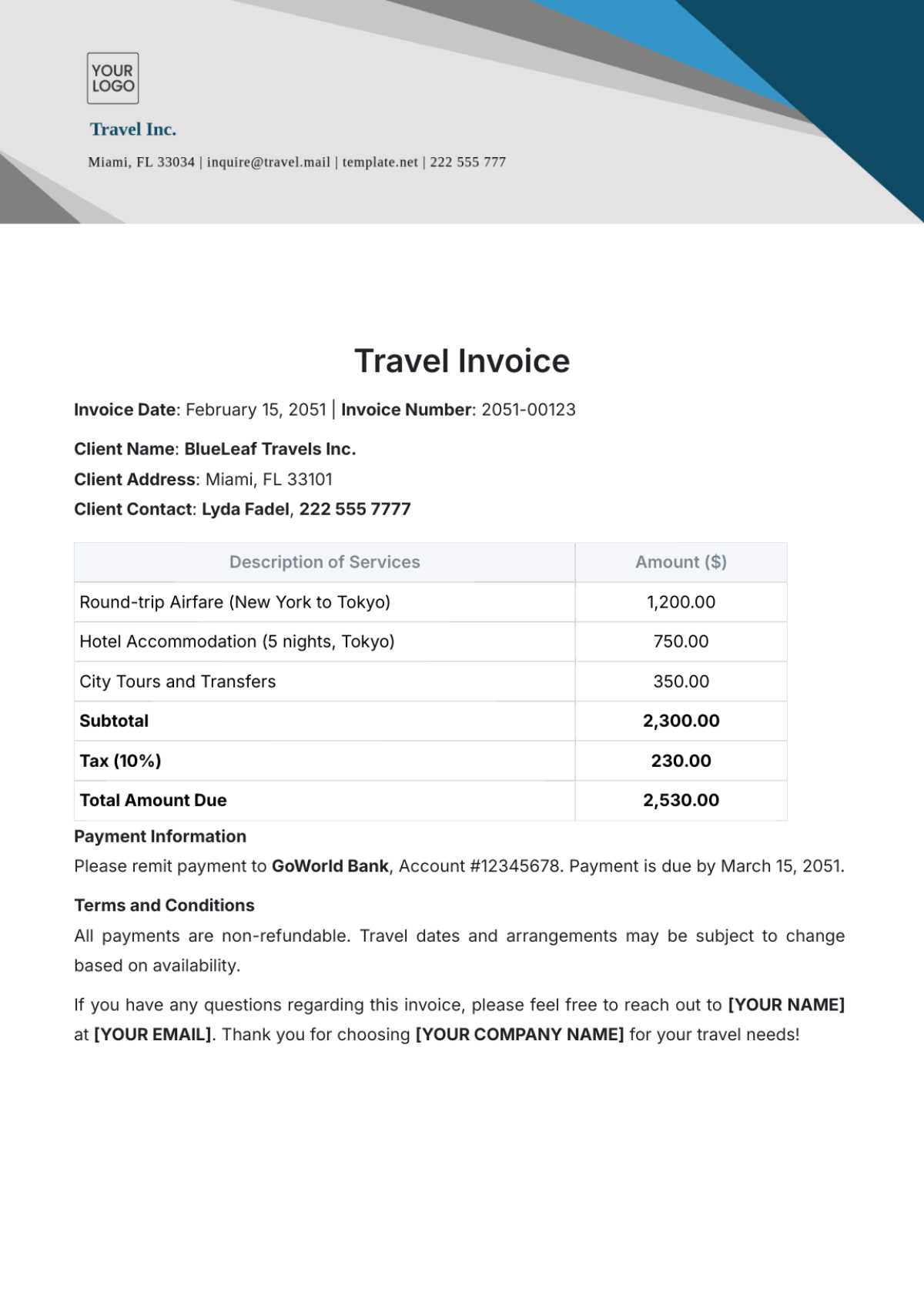

Invoice Disclaimers and Payment Terms

Clear payment terms are a crucial part of any business transaction, helping to set expectations for both parties. Including specific clauses that address payment responsibilities, deadlines, and penalties can help avoid disputes and ensure smooth financial operations. By establishing well-defined rules in your financial agreements, you protect your business from late payments and other potential issues.

1. Defining Payment Deadlines

One of the most essential aspects of any agreement is setting a clear payment deadline. Clients should understand exactly when payments are due to avoid confusion. Clearly stated deadlines not only help streamline your cash flow but also reduce the risk of late payments.

- Immediate Payment: Specify whether the payment is due upon receipt or if there is a grace period.

- Fixed Deadlines: Set a specific date or time frame (e.g., “net 30 days”) for payment to ensure clarity.

2. Penalties for Late Payments

It’s essential to establish the consequences of late payments upfront. Including a penalty clause can motivate clients to settle their balances on time and protect your business from cash flow disruptions. Whether it’s an interest charge or a flat late fee, ensure that the penalty is clear and reasonable.

| Payment Terms | Penalty |

|---|---|

| Due Upon Receipt | 10% late fee after 7 days |

| Net 30 Days | 5% interest on overdue balance after 30 days |

| Net 60 Days | 15% flat fee for overdue payments |

By including clear payment deadlines and penalties for late payments, businesses can reduce the likelihood of delays and keep financial operations running smoothly. These terms are essential for maintaining a professional relationship with clients while ensuring that your company is

How to Update Your Disclaimer Template

As your business evolves, it’s essential to regularly review and update the legal provisions included in your financial documents. Outdated or incomplete terms can lead to misunderstandings and may leave your business vulnerable to legal risks. Updating these clauses ensures that they remain relevant, comply with current laws, and align with any changes in your business operations.

1. Review for Changes in Law and Regulation

Laws and regulations change over time, and it’s critical that your financial agreements reflect any new legal requirements. Failing to comply with updated laws could expose your business to legal challenges.

- Stay Informed: Regularly check for changes in relevant local, national, or international laws that could affect your business.

- Consult with Legal Experts: Seek advice from legal professionals who can provide guidance on how to adjust your terms to stay compliant.

2. Adjust for Business Changes

As your business grows, you may introduce new services, payment structures, or policies that require adjustments to your legal terms. It’s important to make sure your agreements reflect any modifications in your business model.

- Update Service Offerings: If you add new products or services, ensure that your legal provisions cover them, including any warranties, return policies, or special terms.

- Revise Payment Terms: If you adjust your payment structures (e.g., introducing installment plans or discounts), be sure to modify the terms accordingly.

Updating your legal clauses ensures that your business stays protected and maintains transparency with clients. By regularly reviewing and revising these provisions, you can minimize the risk of legal issues and keep your business on solid ground.

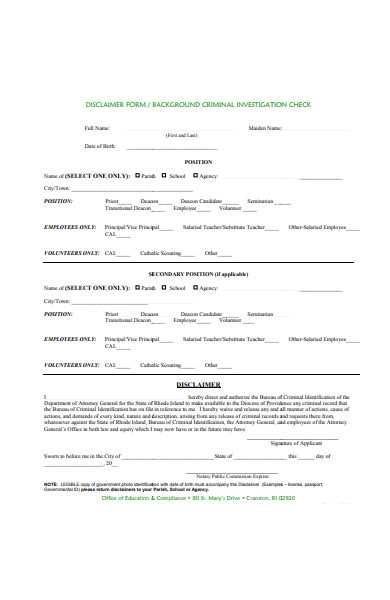

Legal Requirements for Invoice Disclaimers

When drafting legal terms for your financial documents, it is crucial to ensure compliance with the applicable laws and regulations. Different countries, industries, and business structures may have specific legal requirements that dictate what must be included in your agreements. Failing to meet these legal obligations can expose your business to potential liabilities or disputes. Therefore, understanding and implementing the necessary legal provisions is essential for protecting both your business and your clients.

1. Compliance with Consumer Protection Laws

Consumer protection laws are designed to ensure fairness in business transactions. These laws often require that certain terms be clearly communicated to customers, especially in the case of refunds, returns, or warranties.

- Clear Communication: Ensure that all terms are written in clear, understandable language, especially those related to refunds, cancellations, and warranties.

- Adherence to Consumer Rights: Make sure that your terms comply with local consumer rights laws, such as the right to a refund or cancellation within a certain period after purchase.

2. Taxation and Compliance Requirements

For businesses operating in multiple regions or countries, tax laws play a crucial role in shaping the terms included in your financial documents. In many cases, you must state the tax rates, whether they are included in the price or added as separate charges, and ensure you are following the correct procedures for reporting taxes.

- Accurate Tax Information: Include accurate details about any applicable taxes, including VAT, sales tax, or other local taxes.

- Jurisdiction-Specific Laws: Different jurisdictions may have different requirements for what must be disclosed, such as specific tax rates or invoice numbering conventions. Ensure compliance with these laws in every region where you operate.

3. Data Protection and Privacy Laws

With the increasing focus on data security and privacy, businesses must also consider data protection laws when drafting their terms. These laws govern how businesses collect, store, and use customer data, and your financial documents must reflect these requirements.

- Transparency on Data Usage: Clearly state how customer data will be used or processed, particularly if this information is necessary for payment processing or legal compliance.

- Place Clauses at the Bottom: In traditional printed forms, place important terms at the bottom of the page, ensuring they are visible but not overwhelming to the reader.

- Use Clear Headings: Highlight legal provisions with bold or underlined headings to ensure they stand out and are easily identified by the reader.

- Include a Signature Line: To further ensure acknowledgment, include a space where clients can sign to confirm their understanding of the terms.

- Embed Clickable Links: For online invoicing systems, include hyperlinks to full terms and conditions that clients can easily access without cluttering the document itself.

- Interactive Pop-Ups: Some platforms allow for terms to appear in pop-up windows or as part of the checkout process, ensuring clients are prompted to review them before completing a transaction.

- Automatic Acknowledgment: Incorporating checkboxes for clients to confirm they have read and accepted the terms can ensure a more seamless and legally binding process.

- Late Payment Fees: Clearly stating late payment fees encourages clients to settle their invoices on time. It also creates a formal structure for addressing overdue payments.

- Interest Charges: Including interest rates for overdue payments provides an additional incentive for clients to pay promptly, while also ensuring that freelancers are compensated for the time value of money.

- Service Expectations: By detailing the scope of services, deadlines, and deliverables, freelancers can protect themselves from clients who may later claim dissatisfaction with the work.

- Transparent Terms: Displaying payment schedules and conditions on all financial documents helps build trust with clients, ensuring that both parties are aligned on the agreed-upon terms.

- Research Local Taxation Rules: Different countries have varying rules on sales tax, VAT, and other levies. Ensure that the relevant taxes are clearly stated and calculated in accordance with local law.

- Payment Terms Variations: Some countries have stricter regulations regarding payment deadlines, penalties for late payments, and the maximum allowable interest rates. Be sure to adjust your terms to comply with these local standards.

- Specify Currency and Exchange Rates: Clearly state the currency in which payments are expected. If applicable, provide guidelines for converting the amount to another currency and include the exchange rate if necessary.

- Offer Translations for Key Terms: If you’re dealing with clients in non-English-speaking regions, consider providing translations of important terms or clauses to ensure they fully understand the terms of the agreement.

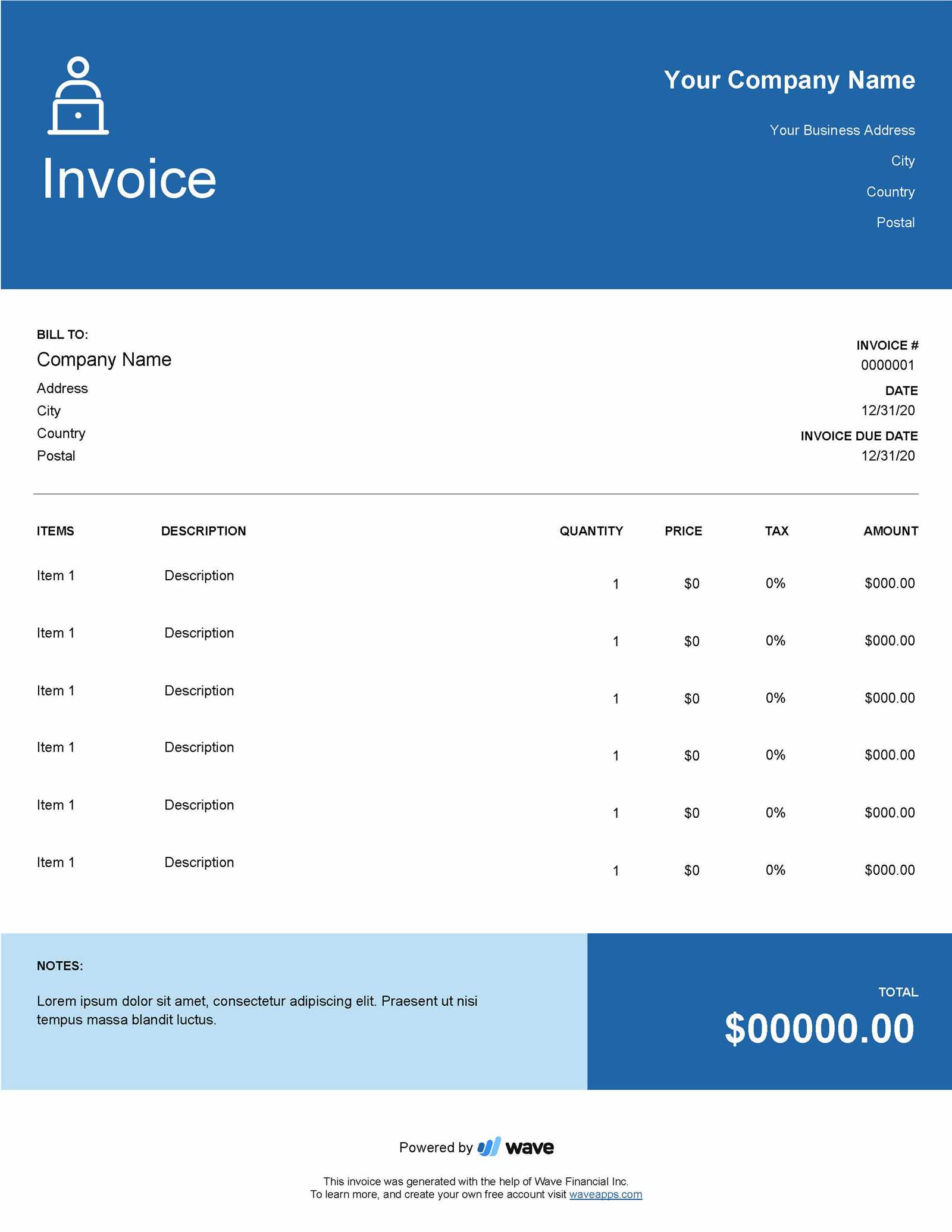

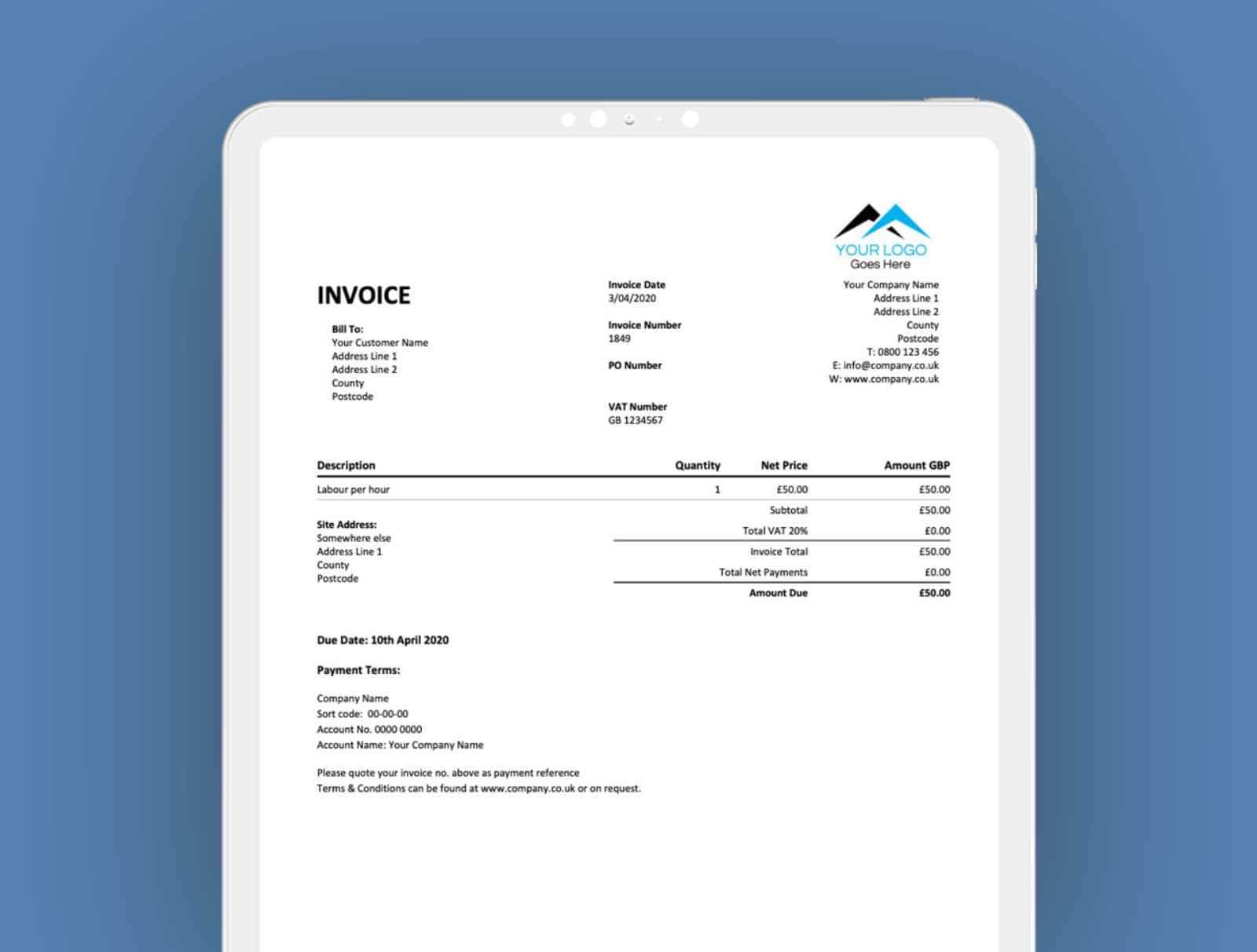

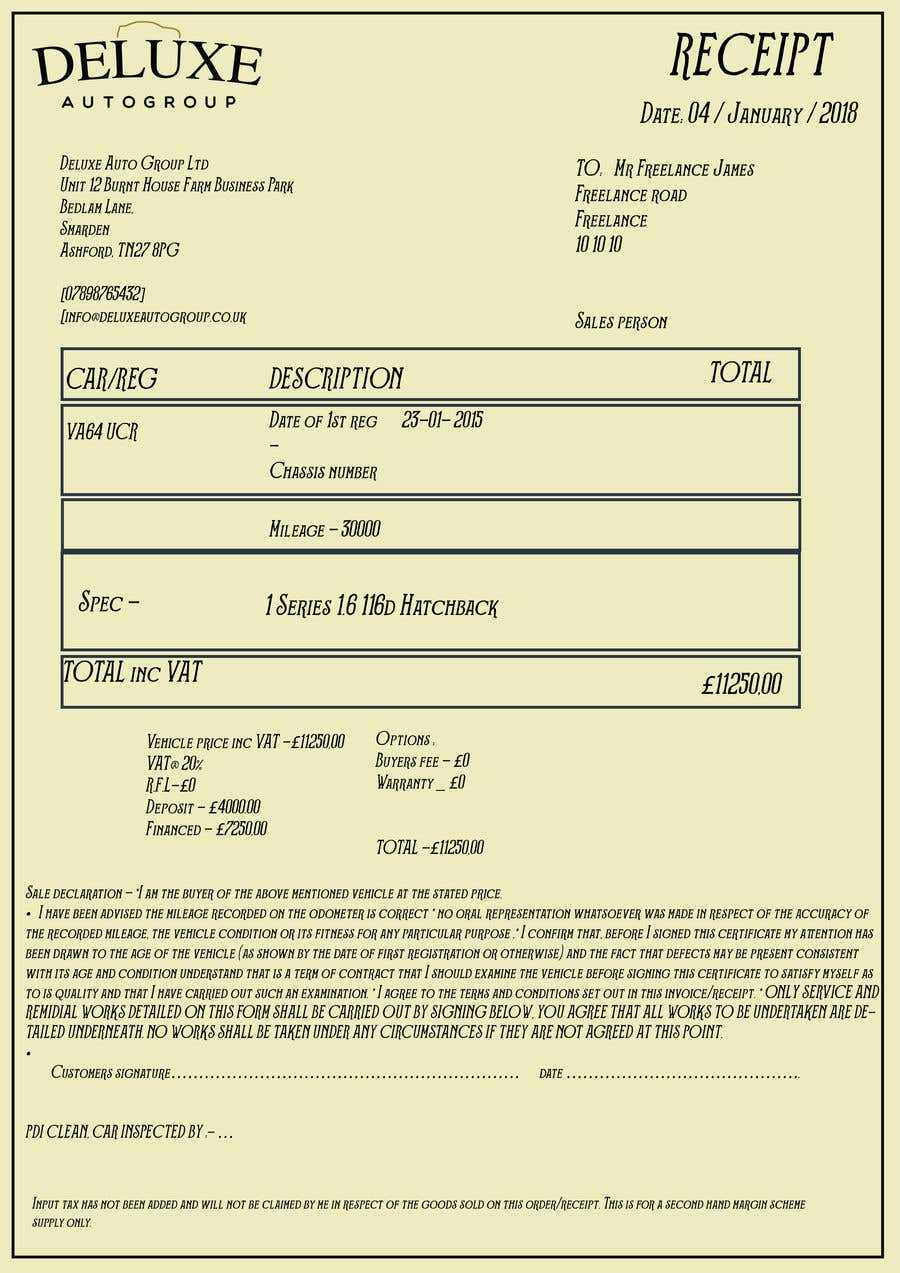

Incorporating Disclaimers in Different Invoice Formats

When creating financial documents, the format you use can impact how your terms and conditions are presented and perceived by clients. Whether you are using a paper-based document, a digital invoice, or an online platform, each format offers unique advantages and challenges in terms of presenting legal provisions. Understanding how to properly incorporate these terms in various formats ensures that your business is both transparent and legally protected, no matter the medium of communication.

1. Traditional Paper-Based Documents

For businesses that still rely on physical paperwork for their transactions, ensuring that legal clauses are prominently displayed is key. Paper documents may limit space, but they still offer a direct and formal way to communicate terms.

2. Digital and Online Platforms

In the digital world, there are more opportunities to display legal clauses in a way that is easy for clients to review without overwhelming them. Online invoices or digital billing systems allow for a more interactive and flexible approach.

Each format offers distinct ways to incorporate terms and conditi

How Invoice Disclaimers Benefit Freelancers

Freelancers often face unique challenges when it comes to managing payment terms and protecting their interests in business transactions. Including specific terms and legal provisions in billing documents can significantly benefit freelancers by ensuring clear communication with clients, preventing misunderstandings, and safeguarding against potential payment disputes. By outlining expectations and responsibilities from the outset, freelancers can establish a more professional relationship with their clients and reduce the risk of financial setbacks.

1. Protection Against Late Payments

One of the most significant benefits of including legal clauses in payment documents is the protection it offers against delayed or missed payments. Freelancers depend on timely payments to maintain their cash flow, and clear payment terms can help ensure clients adhere to deadlines.

2. Clarity and Professionalism

Clear and professionally presented terms signal to clients that the freelancer is serious about their business practices. By explicitly stating conditions related to payment, services, and deliverables, freelancers can avoid misunderstandings that may arise later in the working relationship.

3. Reducing Legal Risks

Freelancers are often working as independent contractors, which means they may not have the same legal protections as employees. Having clear terms in place can help minimize legal risks and offer some protection in case of a dispute.

| Legal Issue | Benefit of Including Terms |

|---|---|

| Non-payment or Delayed Payment | Legal clauses outlining late fees or interest help enforce timely payment. |

| Scope of Work Disputes | Clearly defined services and deadlines reduce the chances of clients claiming work was not completed as agreed. |

Re

How to Use Disclaimers in International InvoicesWhen dealing with clients across borders, it’s essential to ensure that your financial documents comply with international regulations and address specific cultural and legal requirements. Including clear terms in such documents helps to prevent confusion, establish mutual expectations, and protect your business from potential disputes. International transactions often involve different laws, currencies, and expectations, making it crucial to adjust your terms accordingly for each market. 1. Understand Local Laws and RegulationsEach country has its own set of rules regarding business transactions, including payment terms, tax laws, and consumer protection standards. Failure to comply with local legal requirements can result in disputes, fines, or damaged relationships with clients. 2. Currency and Language Considerations

When working internationally, it’s important to address currency conversion and language differences to avoid confusion. Inaccurate currency information or language barriers can cause delays in payment and misunderstandings between parties. By adjusting your terms to account for local laws, currency differences, and language barriers, you can ensure smoother transactions and build trust with international clients. Customizing your financial documents to the specific requirements of each market will also help minimize risks and streamline the payment process. |