Free Rent Invoice Template for Easy Billing

Managing payments efficiently is essential for landlords and property managers. A well-structured document that outlines the terms of a tenancy can streamline financial processes, ensuring clarity and reducing the chances of misunderstandings. With the right tools, you can easily create professional-looking statements that reflect the transaction details accurately.

There are various ways to approach this task, but using digital tools can save valuable time. Whether you are handling multiple properties or a single rental unit, having a reliable method for tracking payments is crucial. This approach not only simplifies record-keeping but also enhances communication with tenants.

Adopting an easy-to-use document format will help you maintain consistency and professionalism. By utilizing customizable solutions, you can quickly generate accurate statements that meet your specific needs. No matter the scale of your property management, having the right tools in place can help you stay organized and ensure prompt payment collection.

Free Rent Invoice Template Overview

Managing financial transactions in a rental business can be simplified by using a structured document. These tools help ensure that payment details are presented clearly, offering an efficient way for landlords and property managers to document amounts due, dates, and terms. By utilizing customizable forms, landlords can quickly create consistent statements for their tenants.

Key Features of an Efficient Billing Document

Using a professional, standardized format allows you to focus on the essentials: the amount owed, due dates, and any specific conditions related to payment. A well-designed structure ensures that all necessary details are included without overwhelming the reader. This makes it easier to keep track of payments and maintain accurate records.

Advantages of Using Digital Tools

Adopting digital solutions for generating these documents brings numerous benefits. It eliminates the need for manual creation each month, saves time, and reduces the likelihood of human error. Additionally, digital records are easier to store, manage, and retrieve, providing both landlords and tenants with a clear transaction history at all times.

Why You Need a Rent Invoice

Maintaining accurate financial records is essential for any property owner or manager. Having a clear and formal document that outlines the terms of payment helps both parties stay on the same page, reducing misunderstandings and potential disputes. Here are the key reasons why such a document is crucial for property management:

- Ensures Clarity – A properly structured document provides all the necessary details, including amounts due, payment terms, and deadlines, ensuring both landlord and tenant understand the expectations.

- Legal Protection – This document acts as a legal record, protecting both parties in case of disagreements or if legal action becomes necessary.

- Organizes Finances – It allows landlords to track payments more easily and maintain accurate financial records for tax purposes.

- Professional Appearance – Using formal documents enhances professionalis

How to Create an Invoice for Rent

Creating a structured document to outline payment details is a straightforward process that ensures both parties are clear on the terms. Whether you are a property manager or a landlord, following a few simple steps will help you produce accurate and professional statements for your tenants. The process is easy to implement and can save time in the long run.

Here are the key steps to creating an effective payment document:

- Start with Basic Information: Include the names of both parties, contact details, and the address of the property. This makes the document easily identifiable and helps avoid confusion.

- Specify Payment Details: Clearly list the total amount due, the payment period, and any relevant payment methods. It’s essential to outline the exact terms, such as whether the payment covers monthly rent, utilities, or other fees.

- Include Payment Deadlines: Indicate the due date for the payment. This ensures that both parties are aware of when the payment is expected and helps avoid delays.

- Provide Additional Notes: If there are any special terms or late fees, make sure to include them. This can help reduce misunderstandings down the line.

- Review and Save: Once all the details are in place, review the document for accuracy. Save it in a digital format, such as a PDF, to ensure it remains accessible and professional.

By following these steps, you can easily create a document that is clear, professional, and effective in managing financial transactions with tenants.

Benefits of Using a Free Template

Utilizing a pre-designed document format offers several advantages, especially for landlords and property managers looking to streamline their financial processes. These ready-to-use formats save time, enhance consistency, and help create professional-looking records without the need for advanced design skills. By relying on established structures, you ensure that all important details are included every time.

Time-saving – Pre-built formats allow you to quickly generate documents without starting from scratch. This can be especially helpful when managing multiple properties or handling numerous tenants, as it speeds up the process and reduces the chance of errors.

Professionalism – Using a well-designed document gives you a polished and consistent appearance. A professional format reassures tenants that you are organized and serious about managing your property, which can help build trust and foster positive relationships.

Customization – Despite being pre-designed, these formats offer a high degree of flexibility. You can easily adjust them to suit your specific needs, such as adding special terms or adjusting for different payment structures, while still maintaining a consistent layout.

Cost-effectiveness – Many

Essential Information for a Rent Invoice

To ensure that both the property owner and tenant are on the same page, it’s important to include all the necessary details in the financial document. A well-constructed statement not only outlines the amount due but also provides clarity on payment terms and conditions, helping to avoid misunderstandings. Here are the key elements that should always be included:

1. Contact Information – The document should clearly list the names and contact details of both the landlord and tenant. This ensures that both parties can easily reach each other in case of any questions or concerns regarding the payment.

2. Property Address – Including the full address of the property in question is crucial. This provides context and makes it clear which property the payment relates to, particularly if the landlord owns multiple units.

3. Payment Amount – Clearly stating the amount due helps prevent confusion. Be specific about the total sum, including any additional charges such as utilities, maintenance fees, or late payment penalties.

4. Payment Due Date – The exact due date for the payment should be prominently displayed. This sets clear expectations and helps both parties stay on track with payment schedules.

5. Terms and Conditions – Any special payment terms, including discounts for early payments, late fees, or specific payment methods, should be outlined. This ensures both parties understand the rules governing the transaction.

6. Invoice Number or Reference – Assigning a unique number or reference code to the document allows for easy tracking and organization. This is especially helpful for landlords managing multiple tenants or properties.

By ensuring these essential details are included, the document becomes a clear, professional, and legally-binding record of the transaction, making financial management much more efficient for both parties involved.

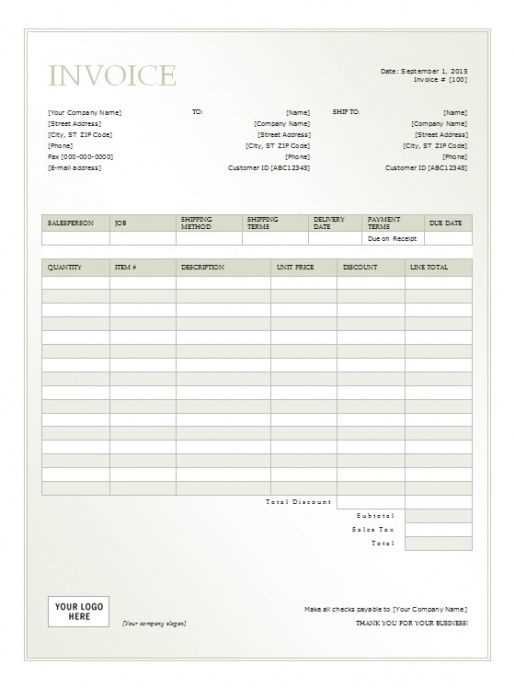

Steps to Customize Your Invoice

Customizing a financial document for your rental transactions ensures that it meets your specific needs and reflects the terms of your agreement. By tailoring the structure and content, you can create a professional and consistent record that aligns with your business practices. Here are the steps to follow to customize your statement effectively:

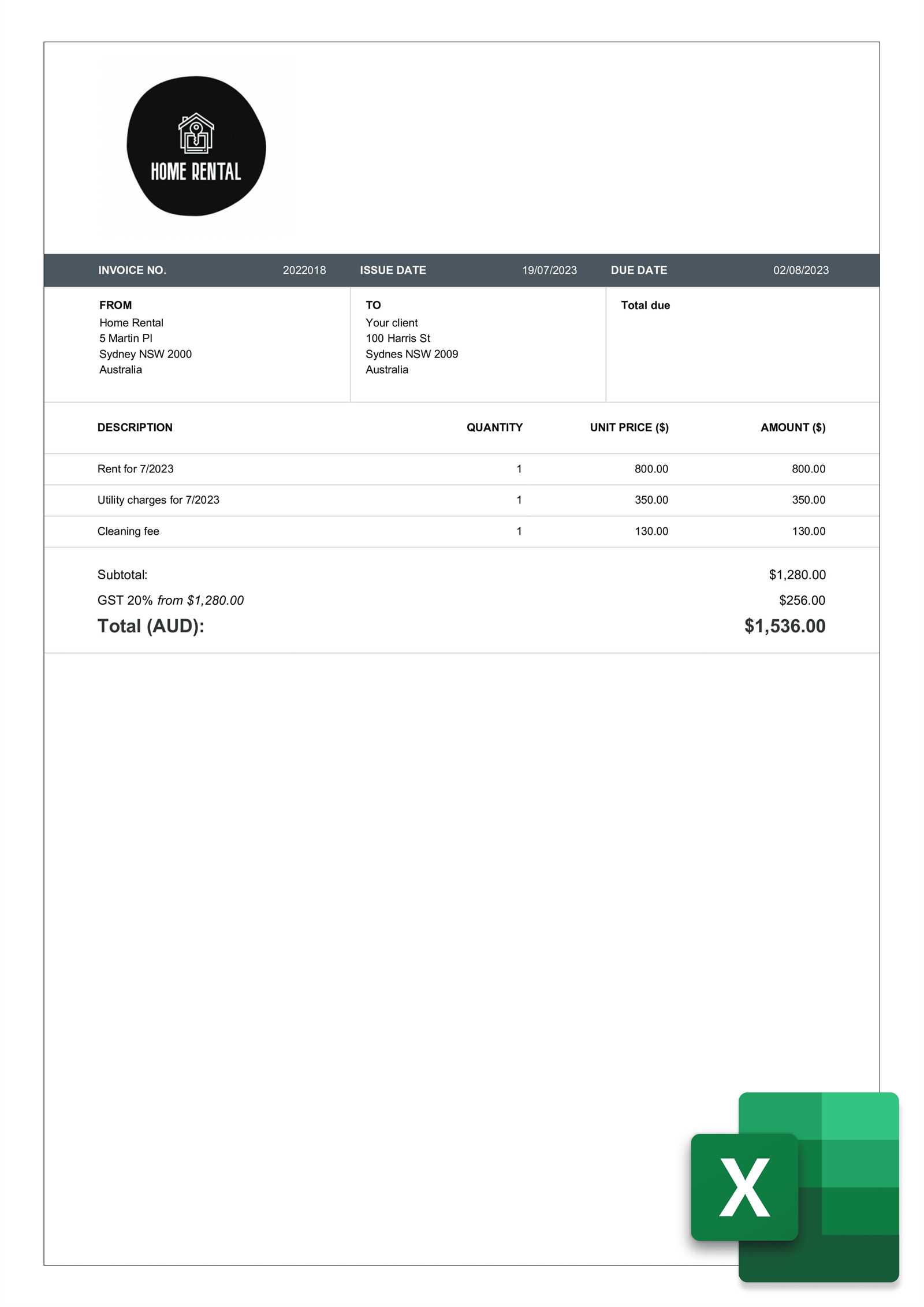

1. Choose the Right Layout – Start by selecting a layout that suits your style and requirements. Many platforms offer flexible options that allow you to adjust the design, making sure it aligns with your branding or personal preferences.

2. Add Your Logo or Branding – Including your business logo or other branding elements can make the document look more professional. This is especially important if you manage multiple properties and want to maintain a consistent identity across all communications.

3. Customize Payment Details – Modify the payment terms, including the amount due, payment period, and any additional charges. You can also add specific instructions regarding how the payment should be made, such as bank account details or online payment options.

4. Insert Special Terms or Discounts – If you offer any discounts for early payments or additional charges for late payments, make sure to include these terms in the document. This ensures that tenants are aware of the conditions from the outset.

5. Personalize for Each Tenant – Tailor each document with the tenant’s name, the specific property address, and any other unique details that apply. This level of personalization helps avoid confusion and ensures accuracy.

6. Save and Store for Future Use – Once customized, save the document in a convenient format for future use. Digital formats, such as PDFs, are easy to store and share, making it simple to access the document whenever necessary.

By following these steps, you can create a clear, personalized, and professional financial statement that reflects your individual requirements and ensures smooth transactions with tenants.

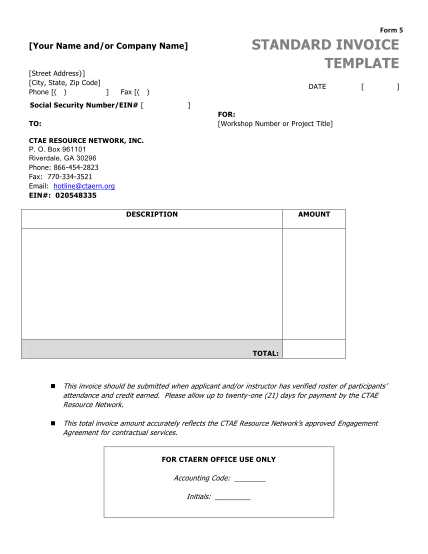

How to Download a Free Template

Obtaining a pre-designed document for managing payment records is a simple process. By using readily available resources, you can quickly access a structured format that helps you streamline your financial transactions. The steps for downloading and using these tools are easy to follow and can save you a great deal of time.

1. Choose a Trusted Platform – Begin by searching for reliable websites or platforms that offer downloadable documents. Look for those that provide a variety of formats, ensuring they meet your specific needs. Popular document-sharing platforms often offer a selection of templates designed for rental transactions.

2. Browse and Select a Suitable Design – Once on the platform, browse through the available options. Pay attention to the layout and features of each document, and select the one that best suits your style and requirements. Consider any additional features that may help you customize the document later.

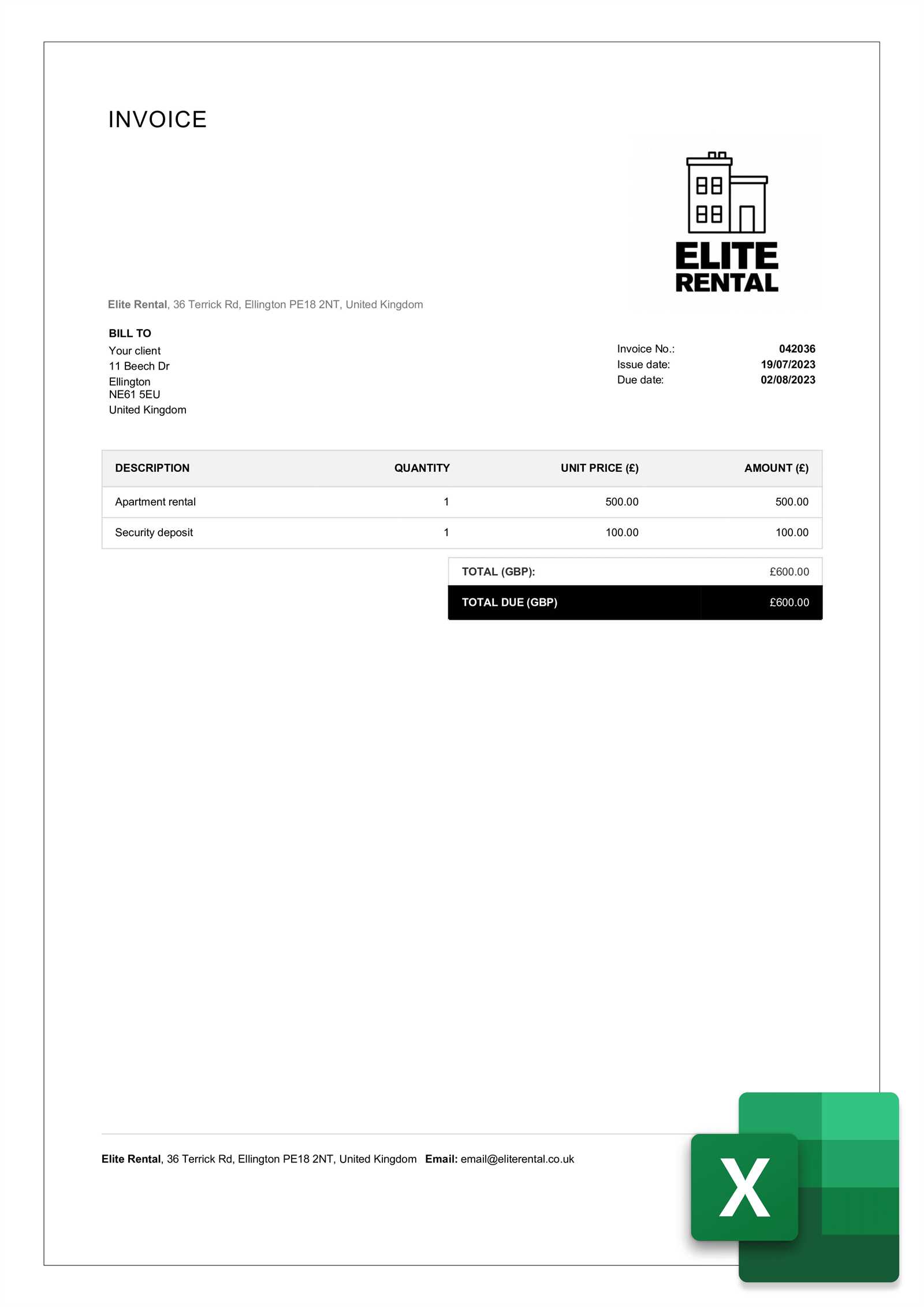

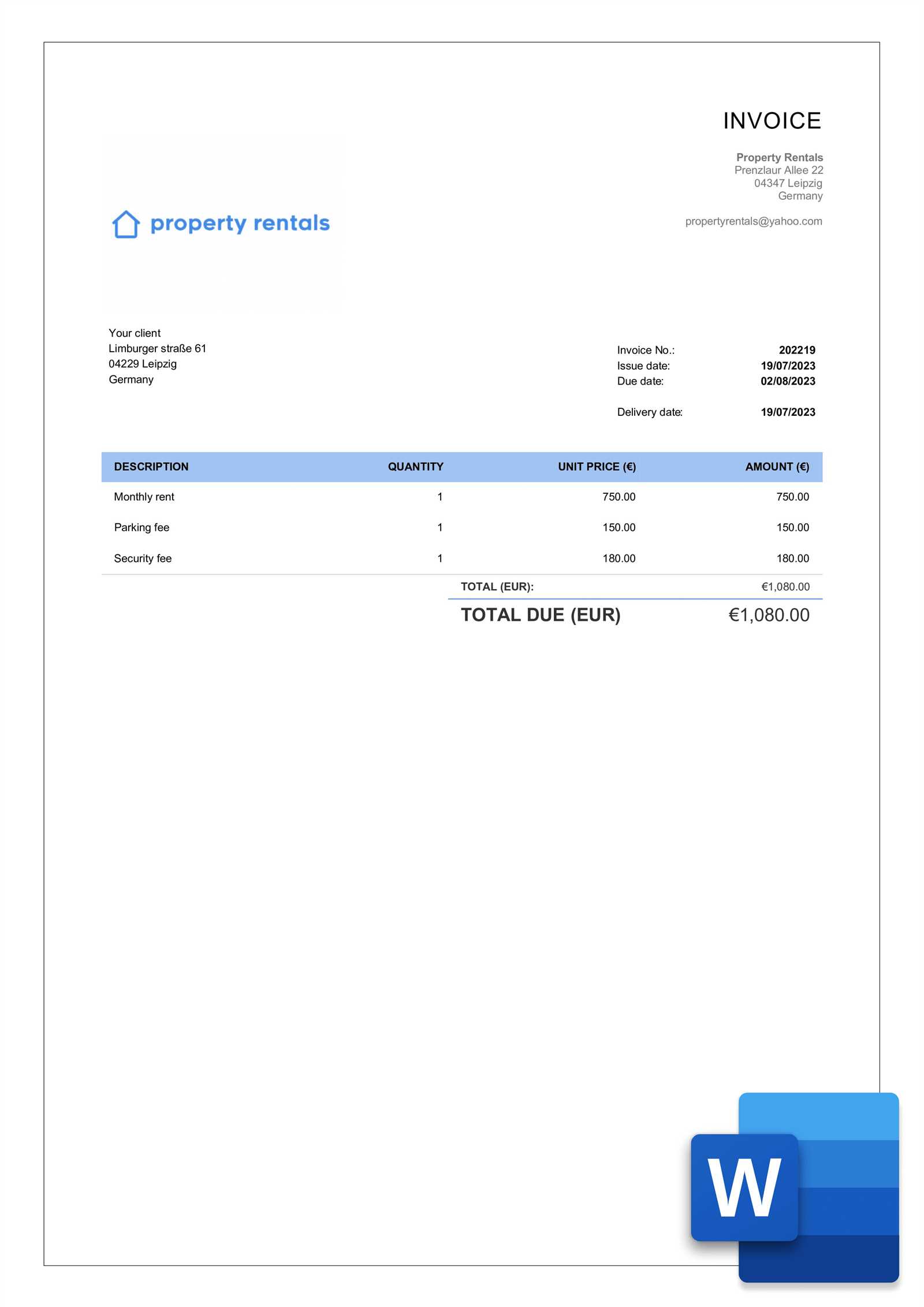

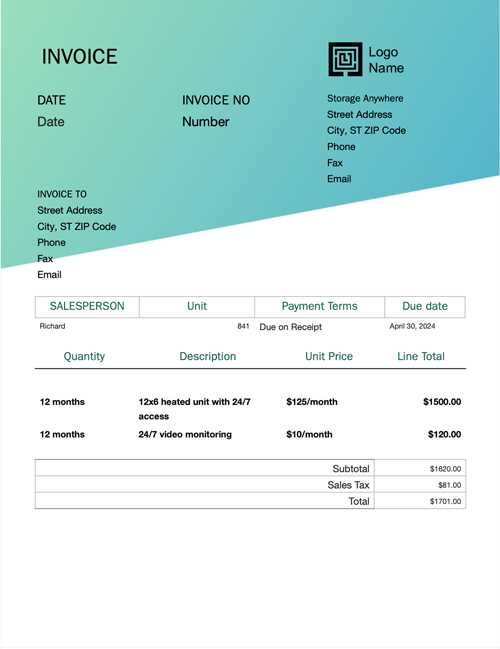

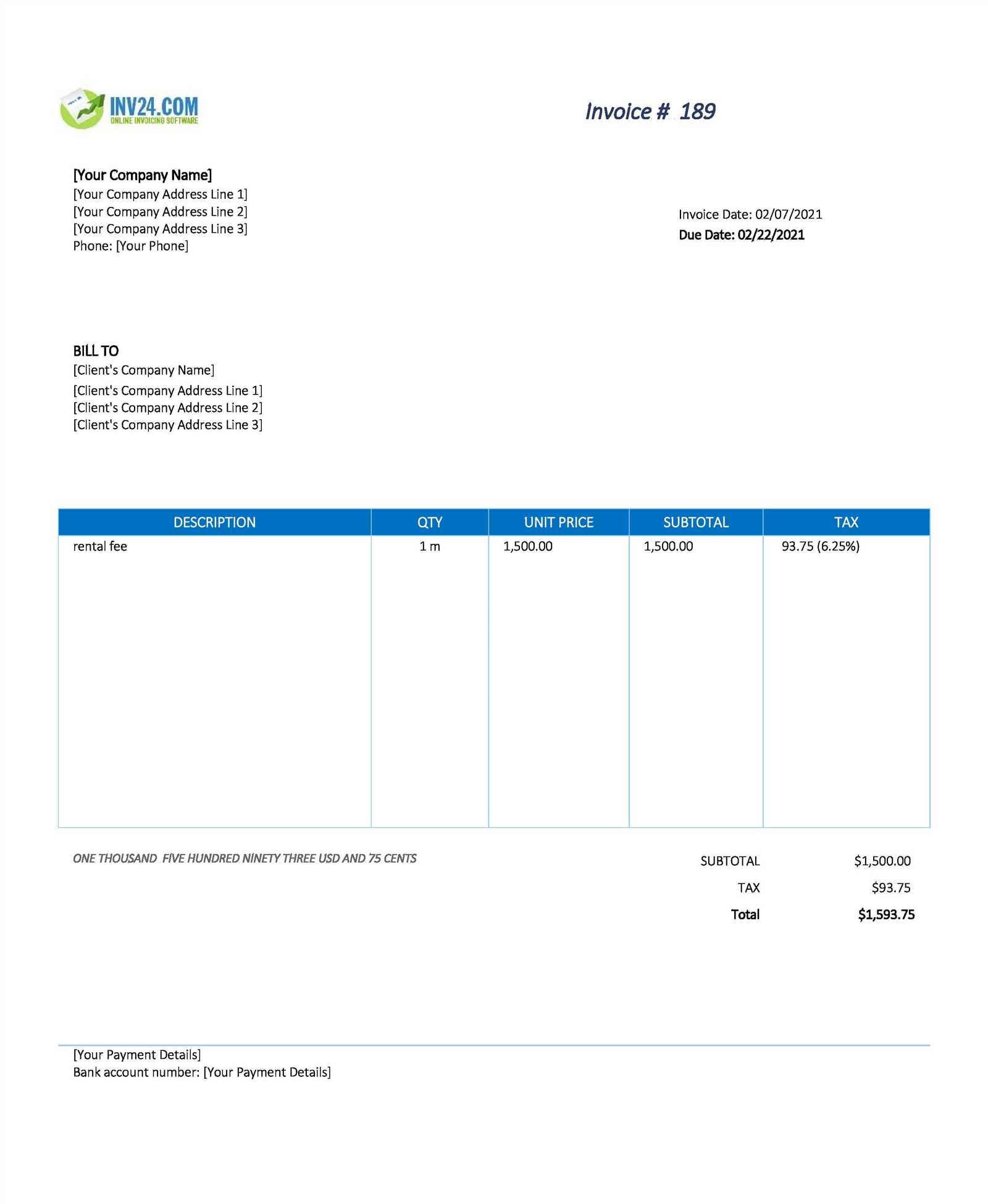

3. Download the Document – After choosing the appropriate document, locate the download button or link. Click to download the file, usually in a PDF, Word, or Excel format. Ensure that the document is compatible with your software or device.

4. Customize the Document – Once downloaded, open the file and begin customizing it according to your needs. You can adjust payment terms, add specific details, and personalize the document with your own branding or contact information.

5. Save and Use – After making the necessary changes, save the document for future use. You can store it digitally for easy access or print a copy for your records. This way, you’ll always have a reliable format available when you need it.

By following these simple steps, you can easily obtain a professional document that will help you manage your financial transactions with ease and efficiency.

Common Mistakes to Avoid in Invoices

Creating accurate financial records is essential for smooth business transactions. However, even with a structured document, small errors can lead to confusion, delayed payments, or legal issues. Avoiding common mistakes when preparing payment statements can save time and reduce the likelihood of disputes with tenants or clients. Below are some frequent errors and how to avoid them:

Common Mistake How to Avoid It Missing or Incorrect Dates Ensure the payment due date and issue date are clearly stated and accurate to avoid confusion regarding when payment is expected. Unclear Payment Terms Be specific about the amount due, any additional charges, and the payment deadline. Always include details of discounts, penalties, or late fees if applicable. Inconsistent Formatting Use a consistent layout and clear, readable fonts. This makes it easier for both parties to understand the details at a glance. Missing Contact Information Always include complete contact details, including names, addresses, and phone numbers. This helps ensure quick communication in case of issues. Incorrect or Missing Tenant Details Double-check tenant names, property addresses, and any other relevant information. An error here can cause significant confusion. Failure to Save or Back Up Documents Ensure digital copies are saved and backed up securely. This allows for easy retrieval in case of any future questions or disputes. By avoiding these common mistakes, you can maintain professionalism and ensure that all financial records are clear, accurate, and legally binding.

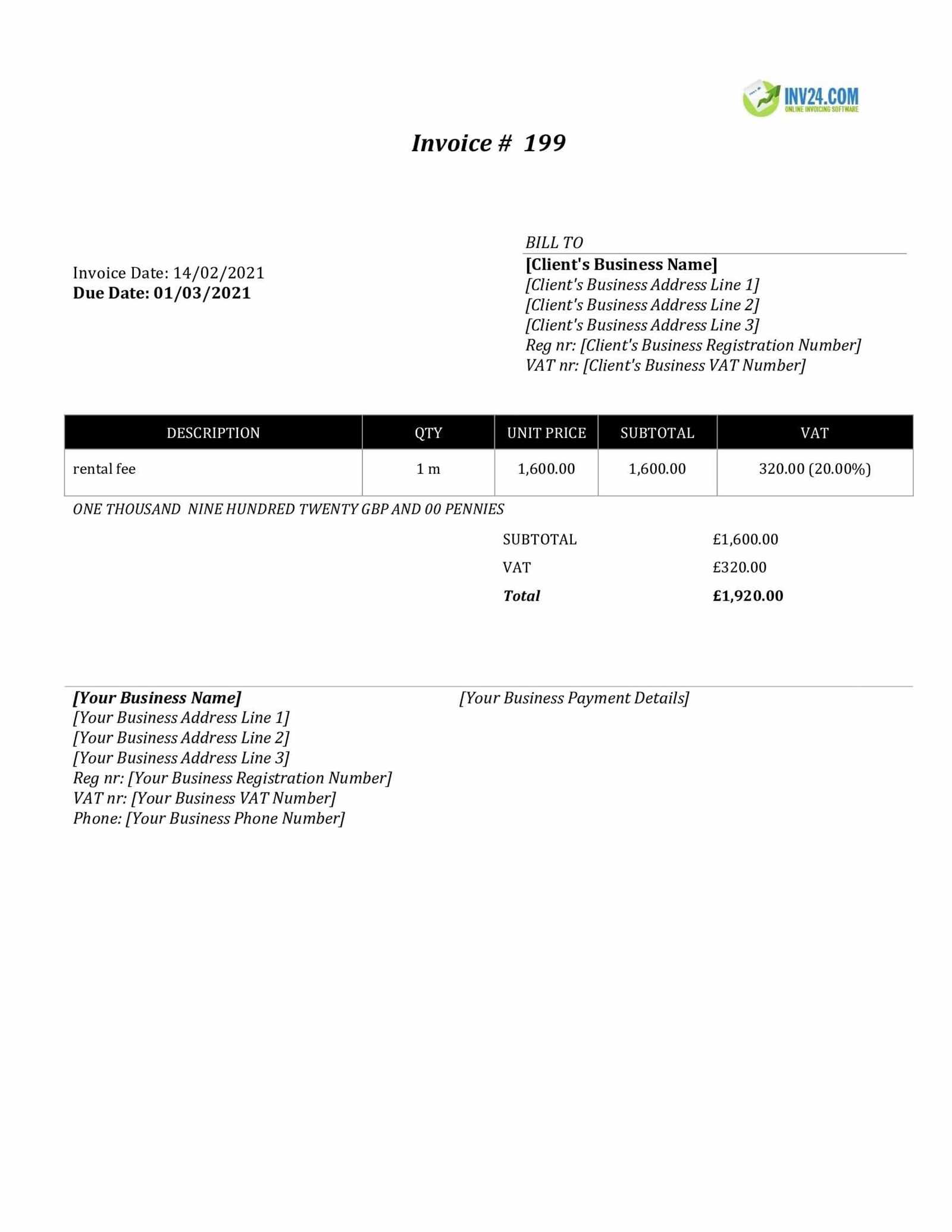

How to Add Taxes to Your Rent Invoice

When managing rental payments, it’s important to account for applicable taxes to ensure that all transactions are compliant with local laws. Including taxes in your financial documents not only ensures legal accuracy but also helps avoid any misunderstandings with tenants. This section will guide you on how to add taxes effectively to your billing statements.

Step 1: Understand the Tax Rate

Before applying taxes to any transaction, you must first determine the correct tax rate for your location. Tax rates can vary by city, state, or country, and may depend on the type of property or service being provided. You can usually find this information through local government resources or consult a tax professional if you’re unsure.

Step 2: Calculate the Tax Amount

Once you know the applicable tax rate, you can calculate the tax amount by multiplying the total charge by the tax rate percentage. For example, if the total amount due is $1,000 and the tax rate is 8%, the tax would be $80, making the total amount due $1,080.

Formula: Total Charge x Tax Rate = Tax Amount

For accurate records, clearly display the calculated tax amount on your statement. This ensures both parties can verify that the correct tax has been applied.

Step 3: Include the Tax on the Document

Once the tax is calculated, include it as a separate line item on the document. It’s important to label the tax clearly (e.g., “Sales Tax” or “Service Tax”) to avoid confusion. This makes it clear to your tenant how much of the total amount is tax and how much is the base payment.

Example:

- Base Rent: $1,000

- Sales Tax (8%): $80

- Total Due: $1,080

Adding taxes correctly to your documents not only ensures compliance but also helps maintain transparency and professionalism in your financial dealings.

Using Invoice Templates in Different Software

Various software applications allow users to create and manage financial documents with ease. Whether you’re using a basic word processor or a specialized accounting program, these tools offer a variety of formats to help you structure and send professional payment records. Understanding how to use pre-designed layouts within different software can save time and improve accuracy when managing transactions.

Common Software Options for Generating Documents

There are many platforms available that offer customizable templates to streamline the process. Below are a few common types of software that can help you create and manage your financial records:

- Microsoft Word – Word offers a variety of pre-built layouts that can be easily edited and personalized for your specific needs. You can download templates directly from Microsoft’s online library or create your own document from scratch.

- Google Docs – Google Docs is a free, cloud-based word processor with access to numerous document templates, including options for generating payment documents. It’s ideal for quick editing and sharing.

- QuickBooks – For more advanced financial management, QuickBooks offers automated document generation. It allows you to create payment records, track transactions, and integrate your documents directly into your accounting system.

- Excel or Google Sheets – Spreadsheets are great for creating and customizing financial records, offering more control over formulas and calculations. You can use built-in functions to automatically calculate totals and taxes.

- Zoho Invoice – This accounting software is designed specifically for managing payments and includes several customizable layouts. It’s a great tool for freelancers and small businesses.

How to Use These Tools Effectively

While each software platform offers different functionalities, they all make it easy to insert, edit, and send your documents. Here’s a general guide on how to make the most of these tools:

- Choose a Layout: Select a design that suits your style and needs. Ensure it includes all the necessary fields such as the payment amount, due date, and any terms and conditions.

- Customize Your Document: Add your business or personal contact details, tenant information, and payment terms. Tailor the document to reflect the specific transaction.

- Review the Information: Double-check all fields for accuracy before sending. This helps avoid mistakes and ensures that both parties are clear on the terms.

- Save and Share: Once finalized, save the document in your preferred format (such as PDF) and send it directly to your tenant or client. Most software platforms allow for easy sharing via email or cloud storage.

By utilizing the right software and following these simple steps, you can efficiently manage your financial documents and ensure that all transactions are handled professionally and accurately.

How Rent Invoices Help Landlords

Managing rental properties involves a variety of administrative tasks, and maintaining clear financial records is one of the most important. Using a structured document for each transaction can simplify this process and provide both the landlord and tenant with clear, accurate records. These documents help ensure transparency, avoid disputes, and keep everything organized for tax and legal purposes.

Key Benefits for Landlords

By using a well-organized financial document, landlords can streamline their operations and maintain professionalism. Here are some of the key advantages:

- Clear Payment Records – Documents help track all payments received and ensure that both the landlord and tenant have a clear record of the transaction. This can be especially helpful in the event of a dispute over payment amounts or dates.

- Legal Protection – A proper record serves as proof of payment and can be useful in case of legal disputes or disagreements. It also demonstrates that the landlord is adhering to the terms of the rental agreement.

- Tax Purposes – Having a well-maintained record simplifies the process of preparing taxes. Landlords can easily track income and claim any allowable deductions related to property management and maintenance.

- Professionalism – Using structured and consistent documents gives a professional appearance and can help build trust with tenants. It shows that the landlord takes their responsibilities seriously and values clear communication.

- Payment Reminders – A document can be used as a reminder of upcoming payments, helping to reduce late fees and encourage on-time payments from tenants.

How These Documents Enhance Communication

When landlords use detailed and transparent documents, it sets clear expectations for the tenant and reduces misunderstandings. The document provides both parties with a clear breakdown of the amount due, the payment due date, and any other relevant terms, ensuring that both are aligned on the specifics of the transaction.

Overall, these records offer convenience, clarity, and peace of mind for both landlords and tenants, making financial transactions smoother and more transparent for all parties involved.

Best Free Rent Invoice Tools Available

There are numerous online tools that allow landlords and property managers to create and manage their financial documents without the need for expensive software. These tools simplify the process by offering user-friendly features, customizable formats, and instant access, ensuring that users can generate accurate and professional records in no time. Here are some of the best tools that can help you with your financial documentation needs:

Top Tools for Managing Payment Records

Each of the following tools provides easy-to-use interfaces and essential features for creating accurate records of rental payments. They are suitable for both small-scale property owners and larger property management businesses.

Tool Key Features Best For Wave Customizable templates, automatic calculations, easy-to-use, integrates with accounting software Small businesses and independent property owners Zoho Invoice Automated payment reminders, customizable designs, multi-currency support Freelancers and small to medium property managers QuickBooks Online Automated document creation, integration with accounting and tax systems, recurring billing Property managers with multiple tenants PayPal Invoicing Fast document generation, secure payment options, mobile compatibility Landlords who need simple and immediate payment processing Invoice Ninja Customizable invoices, time tracking, client management, multi-currency options Property owners and small businesses with global clients Why Use These Tools?

These platforms offer a range of benefits that help landlords save time, stay organized, and ensure that financial records are accurate and up to date. Whether you’re managing a few properties or handling multiple tenants, these tools can simplify billing and payment tracking. The best part is that most of these platforms offer free versions with essential features, making them ideal for property managers who need efficient solutions without a significant financial investment.

With easy customization, automatic reminders, and clear reporting features, these tools can help streamline your management tasks and reduce the risk of errors in your payment documentation.

When to Send Rent Invoices

Determining the right time to issue payment records is essential for maintaining a smooth financial process. Sending these documents at the right intervals ensures that tenants are aware of their obligations and helps avoid any confusion or late payments. Proper timing also contributes to your overall organizational system, making it easier to track payments and manage your financial records effectively.

1. Send Early in the Month – It’s common practice to send payment requests early in the month, preferably around the 1st to the 5th. This gives tenants enough time to review the document, process their payments, and make any inquiries if necessary. It’s always better to give them a few days’ grace rather than rushing them.

2. Prior to the Due Date – In addition to sending early in the month, some landlords send a reminder closer to the due date. This second notification can help tenants remember their obligations and prevent missed payments. The reminder should be sent at least 5–7 days before the due date to ensure tenants have time to act.

3. After a Payment is Received – It’s important to send a confirmation or receipt once the payment has been made. This provides transparency and assures both the landlord and tenant that the transaction has been completed. It also serves as a record for both parties in case of future disputes.

4. For Recurring Payments – For tenants on a regular payment schedule, such as monthly or quarterly, it’s advisable to send the necessary documents at the beginning of each cycle. This helps establish a predictable pattern and makes it easier to track outstanding balances.

By sending payment records at the right time, you create a reliable communication flow, improve payment punctuality, and ensure that all transactions are documented properly.

How to Track Payments with Invoices

Efficiently tracking payments is crucial for property owners to ensure that all transactions are processed on time and recorded accurately. By using well-organized payment documents, landlords can easily monitor what has been paid and what is still owed, helping to maintain a steady cash flow and avoid disputes. This section will cover practical ways to track payments and ensure your records remain up to date.

Key Methods for Payment Tracking

There are several effective strategies to keep track of payments when using structured payment documents:

- Log Payments Immediately: As soon as a payment is made, record it in your system. This helps you maintain real-time tracking and ensures that no payment is overlooked.

- Use Unique Reference Numbers: Assign each transaction a unique reference number. This makes it easier to cross-reference payments and reduces confusion in case of discrepancies.

- Track Partial Payments: If a payment is made in installments or is partial, make sure to update the balance remaining. This prevents miscommunication and provides a clear view of how much is still due.

- Record Payment Dates: Include the date of payment on each document. Knowing when each payment was received helps you stay on top of due dates and manage overdue accounts effectively.

Using Software to Automate Tracking

Many accounting and management platforms offer built-in payment tracking features that can automate much of the process. Using these tools can save time and reduce the likelihood of errors. Some key benefits include:

- Automatic Updates: Once a payment is received, the system can automatically update the balance, making tracking simpler and faster.

- Reminders: Automated reminders for overdue payments can be sent to tenants, reducing the need for manual follow-ups.

- Reports: You can generate regular reports to track payment history and identify any outstanding balances.

By consistently tracking payments and staying organized, you ensure that your financial records are accurate and your rental business runs smoothly.

Legal Requirements for Rent Invoices

When managing rental transactions, it’s crucial to ensure that all financial records meet the necessary legal standards. Proper documentation not only helps maintain transparency but also protects both the landlord and tenant in case of any disputes. There are several key legal requirements that need to be considered when issuing payment records to ensure compliance with local laws and regulations.

Key Legal Elements to Include

The following components are essential for creating legally compliant financial records:

- Tenant and Landlord Details: Include full names, addresses, and contact information for both parties involved. This ensures that the document can be easily traced back to both the landlord and tenant.

- Payment Amount: Clearly state the amount due for the payment period, including any additional fees or charges. Transparency about the amount helps avoid confusion.

- Payment Due Date: Include the exact date by which the payment is due. This is crucial for tracking whether payments are made on time or if any late fees should be applied.

- Transaction Date: The date when the payment is processed or when the document is issued should be clearly mentioned. This helps both parties track the payment timeline.

- Legal Terms: Any terms related to late fees, penalties, or other payment conditions should be clearly outlined in the document to avoid misunderstandings later.

- Unique Reference Number: Using a unique identifier for each transaction helps to maintain organized and easily traceable records.

Regulations to Follow

In addition to the key elements listed above, landlords must also consider the legal framework governing payment records in their region. Some common regulations include:

- Local Tax Laws: Some jurisdictions require specific tax information to be included, such as VAT or sales tax rates, depending on the amount and nature of the transaction.

- Record Retention: Many regions mandate that landlords retain financial documents for a certain number of years for tax or audit purposes.

- Currency and Language: Ensure that the document uses the correct currency and language for the region where the property is located.

- Electronic Records: In some areas, digital records must meet certain criteria to be considered legally valid, such as using secure and verifiable formats.

By adhering to these requirements, landlords can avoid legal pitfalls and ensure that both their business operations and relationships with tenants are handled professionally and transparently.

Invoice Template for Commercial Properties

When managing commercial real estate, having a well-structured document for each financial transaction is essential. Commercial agreements typically involve larger sums of money and more complex terms compared to residential contracts. As such, a detailed and clear document that outlines the terms of payment ensures transparency, avoids confusion, and helps maintain smooth operations. Below are the key elements that should be included in such a document for commercial properties.

Essential Components for Commercial Transactions

A document for commercial properties should be more comprehensive due to the higher stakes and complexity involved. The following details should be included:

- Property Details: Clearly list the address, unit number, or other identifying features of the property. This ensures that both parties are aware of which commercial space the transaction pertains to.

- Business Information: Include the name of the business renting the property, along with the legal business structure (e.g., LLC, corporation). This helps establish the formal relationship between the business and the property owner.

- Payment Amount: Specify the amount due for the leasing period. Be sure to include any additional charges such as maintenance fees, utilities, or parking costs.

- Terms and Conditions: Outline any special conditions or charges that apply to the lease agreement. This might include escalation clauses, security deposits, or other fees that are not part of the base rent.

- Payment Due Date: Indicate the exact date when the payment is due to ensure that both parties are clear on the expectations regarding timely payments.

- Late Fees: If applicable, include details about any late fees or penalties that apply if the payment is not made by the due date.

- Lease Period: Clearly define the start and end dates of the lease agreement, along with any renewal options or terms related to the length of the tenancy.

- Unique Reference Number: Use a unique identifier for each transaction. This makes it easier for both the landlord and tenant to track payments and any discrepancies that may arise.

Additional Considerations for Commercial Property Documents

While the basic elements are essential, commercial agreements often involve additional layers of complexity, including:

- Insurance Requirements: Some commercial leases require tenants to carry specific types of insurance. If this is part of the agreement, it should be noted in the document.

- Tax Implications: Depending on the location, commercial agreements may include taxes such as sales tax or property tax. Be sure to include any tax-related details and specify whether the tenant or landlord is responsible for paying these taxes.

- Amortization or Payment Plans: In certain situations, tenants may pay for improvements or repairs in installments. This should be clearly outlined to prevent misunderstandings.

For commercial property owners, having a well-organized document that includes all the necessary information can help avoid legal and financial issues and keep operations running smoothly.

How to Automate Rent Invoicing

Automating the process of generating payment requests can significantly reduce the time and effort involved in managing rental transactions. By implementing automation tools, property owners can streamline their administrative tasks, minimize human error, and ensure timely delivery of documents. In this section, we’ll explore how to leverage automation to make the entire process more efficient and consistent.

To start automating payment record generation, follow these steps:

- Choose the Right Software: Select an accounting or property management platform that offers automated billing features. Look for systems that allow you to customize payment schedules, send notifications, and track transactions automatically.

- Set Up Payment Schedules: Establish recurring billing cycles that match your lease agreements. Most systems will allow you to set up automatic reminders and generate payment requests at regular intervals, such as monthly or quarterly.

- Integrate Payment Gateways: Link your automation platform with payment processors to automatically update your records once a transaction is completed. This integration ensures that payments are logged in real time and removes the need for manual entry.

- Customize Document Templates: Even with automation, it’s important to ensure that the documents sent to tenants meet your specific requirements. Customize the layout, add relevant details such as terms, and adjust for any extra charges or taxes.

- Set Up Notifications: Enable automatic email notifications to be sent to tenants when a new document is issued. You can also schedule reminder emails for upcoming payments, which helps tenants stay on top of their obligations.

- Track Payment History: Use your software’s reporting features to monitor payments. Automated systems will often generate financial reports that allow you to see which payments are pending and which have been successfully completed.

By automating your payment record process, you not only save valuable time but also improve accuracy and consistency, making the entire property management experience smoother for both parties involved.

Tips for Professional Invoice Design

A well-designed payment document not only looks more professional but also helps ensure that all necessary details are clear and easily understood. A clean and organized layout can improve the overall experience for both the issuer and the recipient, reducing confusion and promoting timely payments. Here are some key design tips to create professional and effective financial documents.

Key Design Elements to Consider

- Clear Branding: Ensure that your logo, business name, and contact information are prominently displayed at the top. This establishes credibility and ensures the recipient knows who the document is coming from.

- Consistent Fonts and Colors: Choose professional fonts and stick to a limited color palette. Avoid overly bold or decorative fonts that may distract from the main content. Simple and legible fonts such as Arial or Helvetica work best for financial documents.

- Logical Layout: Structure the document so that information flows logically. Group related details together (such as amounts and due dates) and leave enough white space between sections to enhance readability.

- Detailed Breakdown: Provide a clear, itemized list of charges, including unit price, quantity, and total amount for each service or product. This transparency can prevent misunderstandings and build trust with the recipient.

- Payment Instructions: Make payment instructions easy to find, including preferred payment methods, account details, and payment terms. Include any late fee policies or early payment discounts as applicable.

Additional Tips for Improving Usability

- Include a Unique Reference Number: Always use a unique reference number for each document to help you and your clients track payments effectively.

- Highlight Important Dates: Make sure that due dates, late payment penalties, and other key deadlines stand out by using bold text or color highlights.

- Provide Contact Information: Include multiple ways for the recipient to contact you with questions or concerns–whether by email, phone, or other channels. Clear communication is essential for building good relationships with clients.

- Mobile-Friendly Design: With increasing reliance on smartphones, make sure that your document is easy to read and navigate on mobile devices. Avoid clutter and ensure that the key information is easily accessible.

By following these design principles, you’ll create documents that not only look professional but also enhance the efficiency of your financial transactions. A well-designed document helps ensure that payments are processed smoothly and reflects positively on your business.