Sample Invoice for Services Rendered Template Free Download

When running a business, maintaining a clear and organized financial record is essential. One of the most important tools for tracking payments and ensuring smooth transactions is a well-designed document that outlines what has been provided and the amount owed. A properly structured document helps both the client and the provider stay on the same page regarding payment expectations and terms.

Having a ready-made structure to follow can save valuable time. It ensures that all necessary details are included without the need to start from scratch each time. With the right layout, you can quickly generate accurate and professional documents for any work completed, whether you’re a freelancer or managing a larger business.

Customizing this document allows flexibility, allowing you to adapt the content to different industries or specific needs. From adjusting the payment terms to including taxes or discounts, a personalized format ensures consistency and reliability in all transactions.

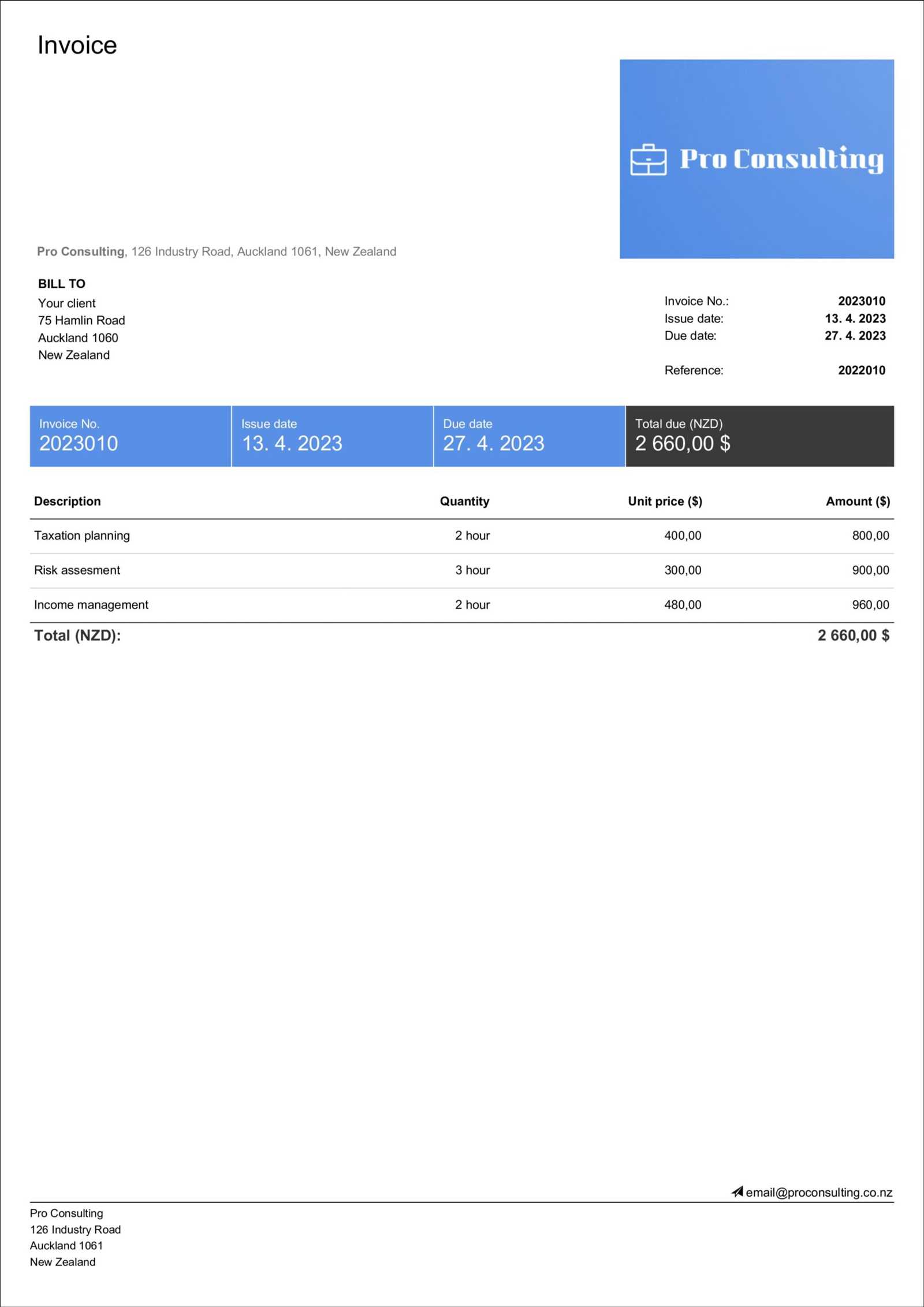

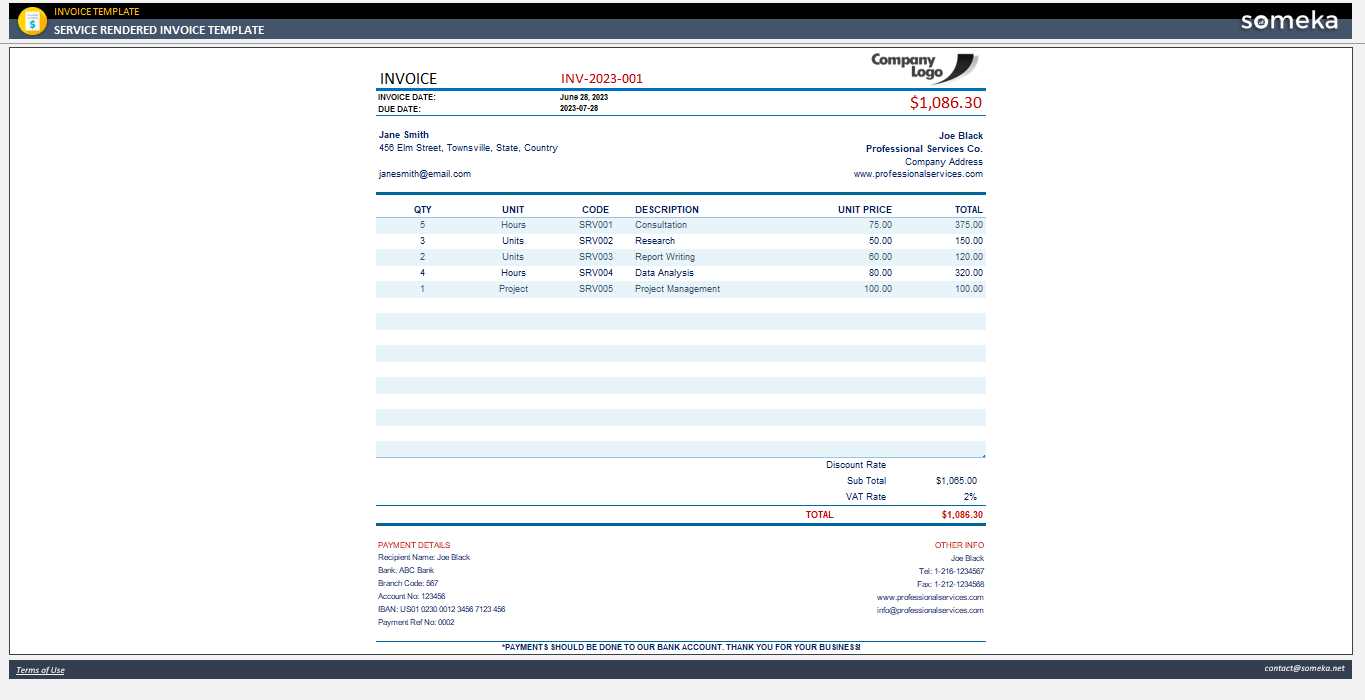

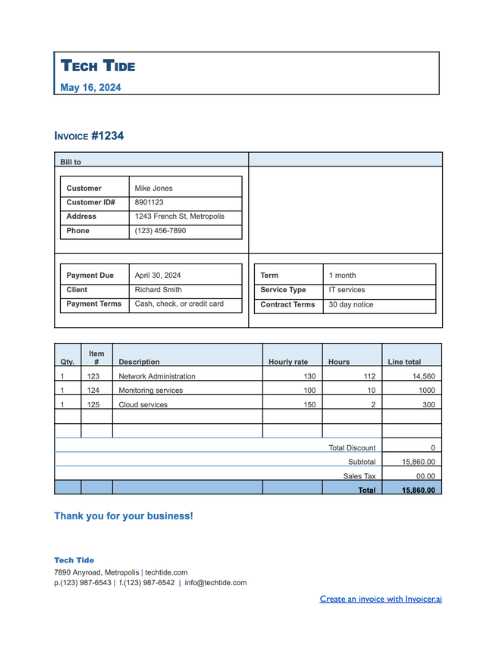

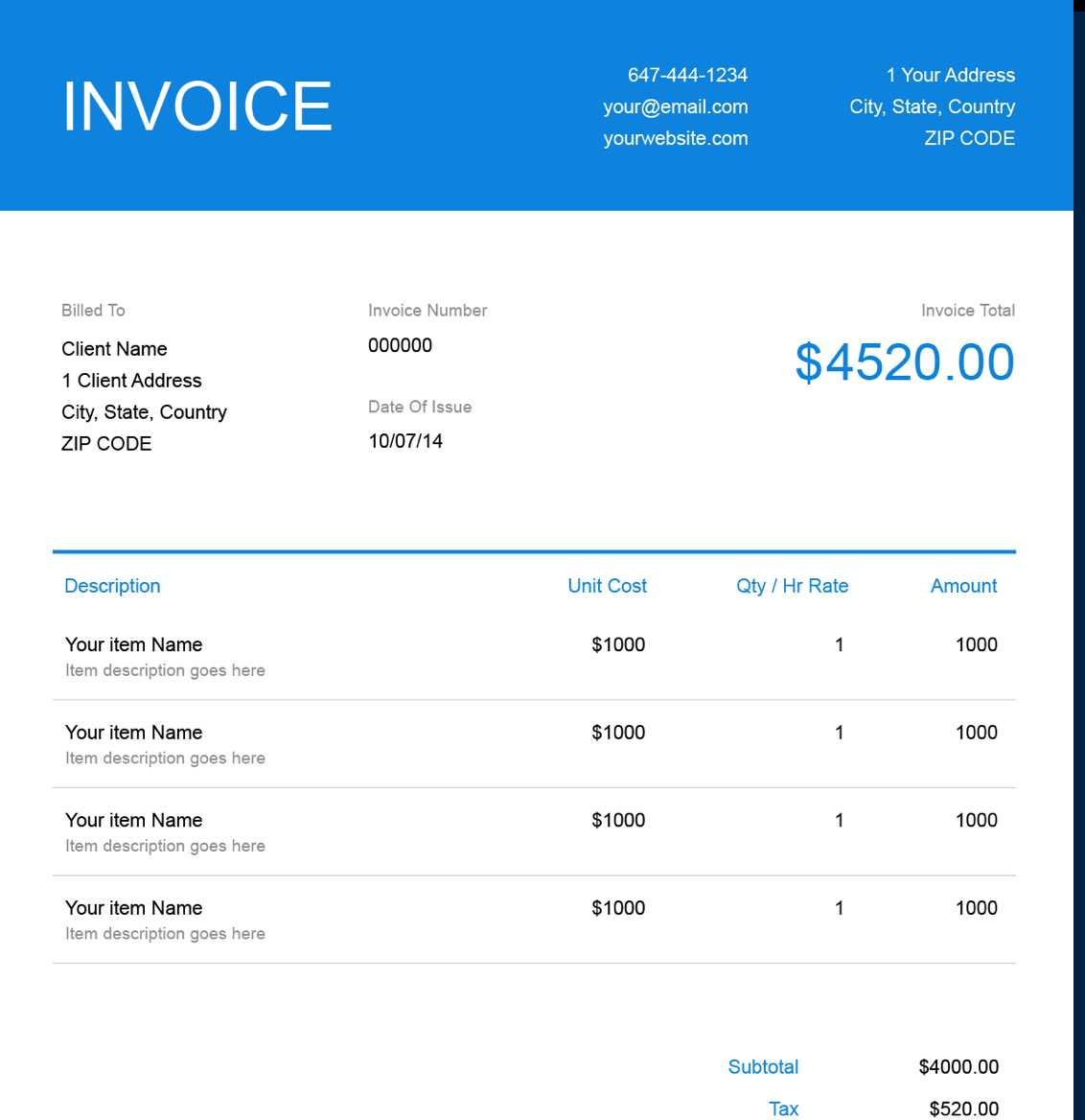

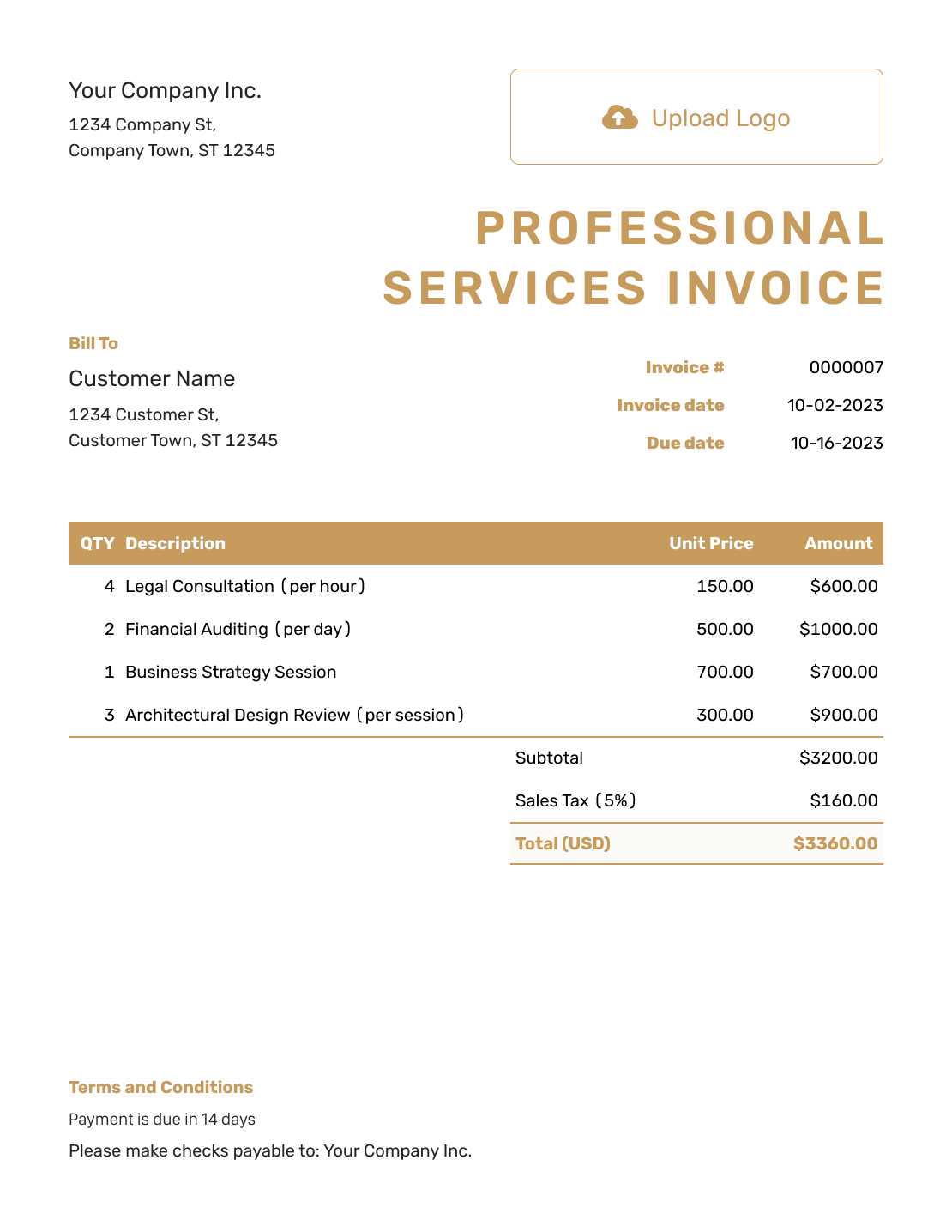

Sample Invoice for Services Rendered Template

Creating a well-organized document for billing purposes is crucial for any business. This document serves as a formal request for payment, outlining the work completed and the corresponding amount due. Using a consistent structure ensures clarity and helps prevent misunderstandings between you and your clients. Below is a guide to creating an efficient billing document that can be tailored to fit various industries.

Here are the key components to include when preparing such a document:

- Business Information: Include the name, address, and contact details of both parties–your business and the client.

- Document Date: Indicate the date when the document is created to help both parties track the timeline of transactions.

- Description of Work: Provide a detailed list of tasks completed, including dates, quantities, and rates for each task.

- Amount Due: Clearly state the total amount owed, breaking it down by individual items or services where applicable.

- Payment Terms: Include due dates and acceptable payment methods. You can also note any late fees or discounts for early payment.

- Tax Information: If applicable, add any relevant tax details, including rates and calculations.

- Additional Notes: Use this section to include any important reminders or terms that could affect the payment.

Using a structured document not only makes the billing process more efficient but also helps maintain a professional image with your clients. It’s a simple yet effective way to ensure that all parties are on the same page regarding financial transactions.

Why You Need an Invoice Template

When running a business, maintaining organized and consistent records is essential for smooth financial operations. One of the most effective ways to manage payments and keep track of transactions is by using a standardized document. Such a document ensures that both the provider and client are aligned on the details of the work completed and the amount due.

Having a pre-designed structure allows you to save time by eliminating the need to create new forms from scratch for every transaction. It helps ensure that all necessary information is included, reducing the risk of errors or missed details. A clear and professional document not only simplifies communication but also builds trust with clients, demonstrating that your business is organized and reliable.

Additionally, a ready-made structure allows for easy customization to meet specific needs. Whether you are working on a one-off project or ongoing contracts, you can adjust the content to fit the scope of work and payment terms, making the process more flexible and adaptable to different situations.

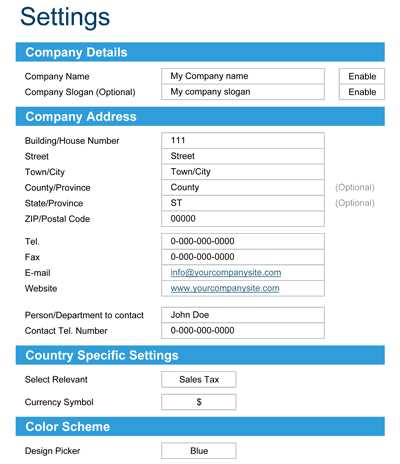

How to Customize Your Invoice Template

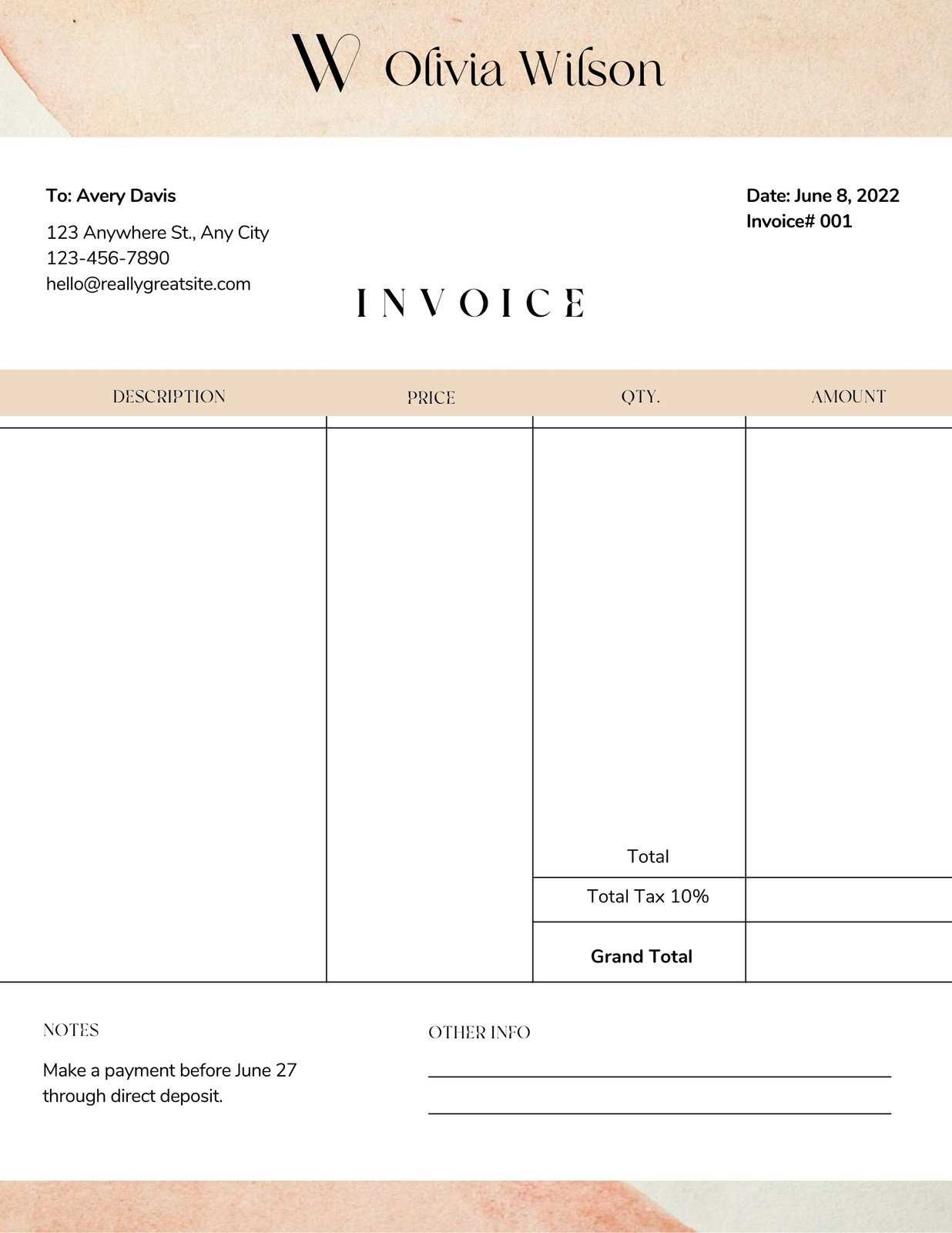

Adapting a billing document to meet the specific needs of your business is essential for maintaining professionalism and clarity. Customization allows you to tailor the layout and details to better fit the type of work you do, your branding, and the preferences of your clients. By adjusting the key elements, you can create a document that reflects your unique business style while ensuring all necessary information is conveyed clearly.

Adjusting Key Information

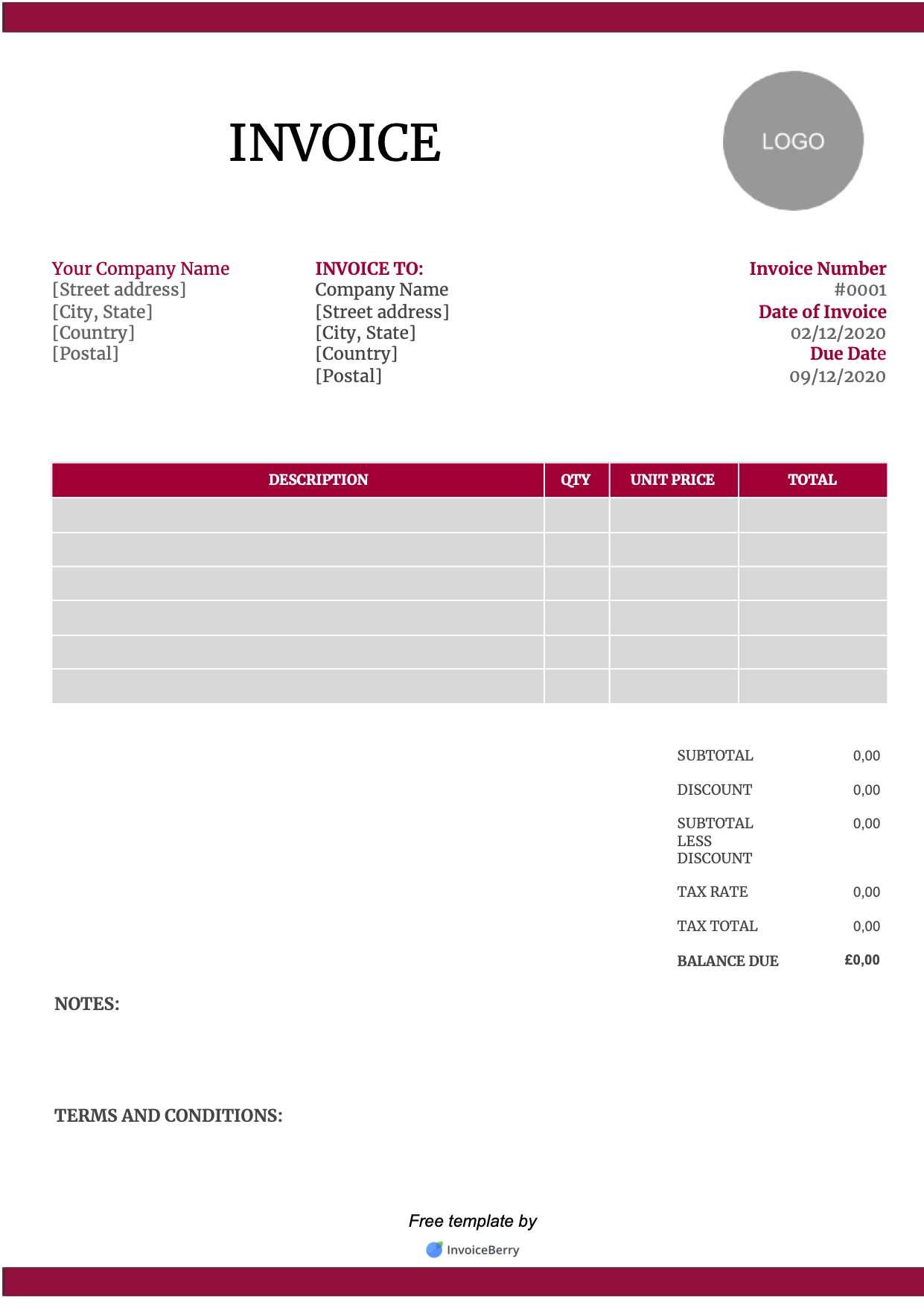

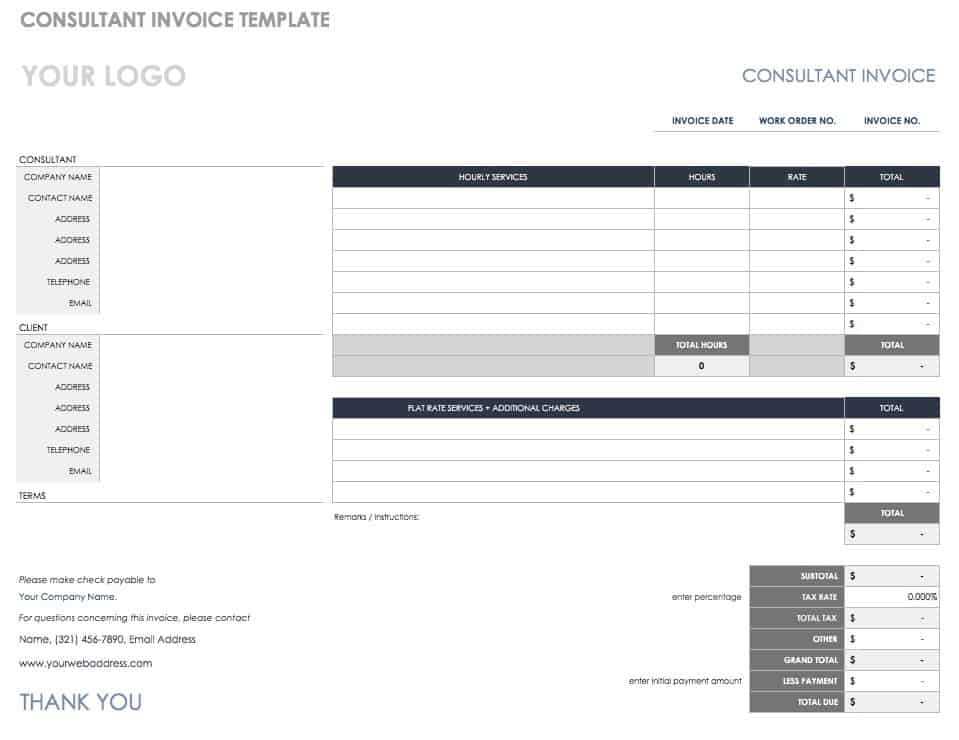

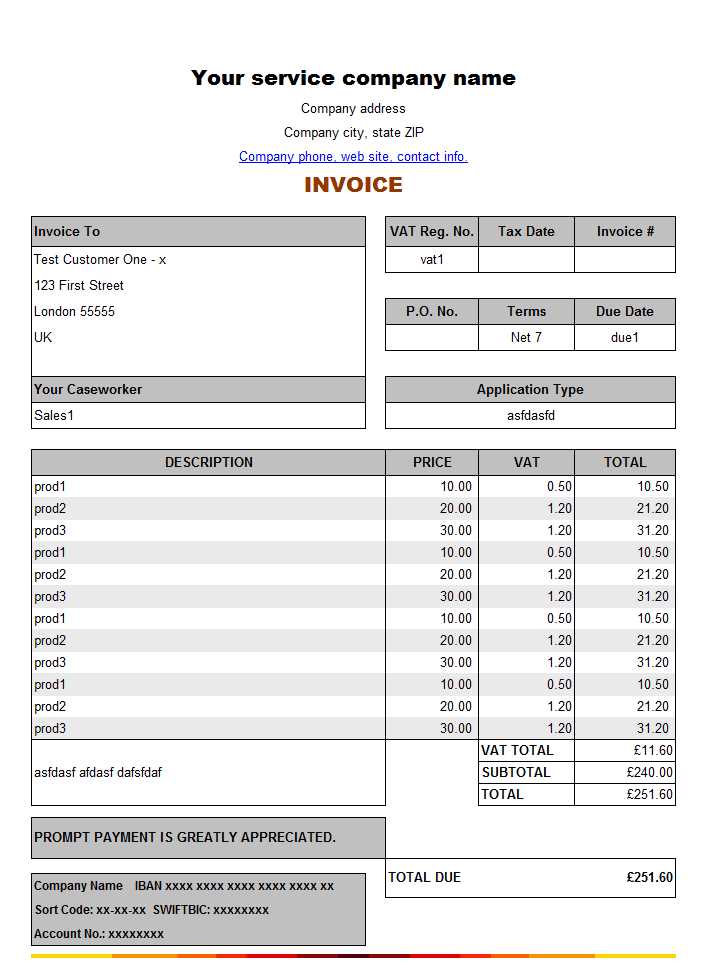

The first step in personalizing your document is to add essential details that reflect your business and its clients. This includes your business name, logo, address, and contact information, as well as the client’s details. Be sure to also include a unique identification number for easy reference, and ensure the date of creation is visible. These details not only make your document look professional but also help in organizing and tracking payments.

Formatting and Design Customization

Beyond the basic content, consider adjusting the layout and design of your document. You can experiment with different fonts, colors, and section layouts that match your company’s branding. For instance, adding a banner with your company logo at the top or using a consistent color scheme can make your document feel cohesive with your business identity. Keep in mind that while creativity is important, clarity should always come first to ensure that the document remains easy to read and understand.

Customizing your billing document in these ways helps to enhance your business’s image, streamline your workflow, and ensure clients receive clear and professional communications regarding their payments.

Key Elements of an Invoice

A well-constructed billing document includes several essential components that ensure clarity and accuracy in financial transactions. Each part of the document serves a specific purpose, providing both the client and the provider with all the information needed to process the payment smoothly. Understanding and incorporating these critical elements into your document is essential for maintaining professionalism and avoiding confusion.

Here are the key components that should be included:

- Business and Client Information: The full name, address, and contact details of both the business and the client are necessary for identification and communication purposes.

- Document Date: The creation date is crucial for tracking when the transaction occurred and determining payment deadlines.

- Unique Identifier: Including a reference or invoice number ensures easy tracking of payments and helps organize records.

- Detailed Description of Work: A breakdown of the tasks completed, including the quantity, description, and individual prices, provides transparency.

- Total Amount Due: The total sum owed should be clearly stated, with any applicable taxes or additional fees included.

- Payment Terms: These terms outline the due date, payment methods, and any other instructions, such as late fees or early payment discounts.

- Tax Information: If applicable, include tax rates and calculations to ensure compliance with local regulations.

- Additional Notes: Use this section to add any special terms, reminders, or conditions relevant to the transaction.

Including all these elements ensures that the document is complete, professional, and legally sound. A well-organized and transparent billing document minimizes disputes and sets clear expectations for both parties involved.

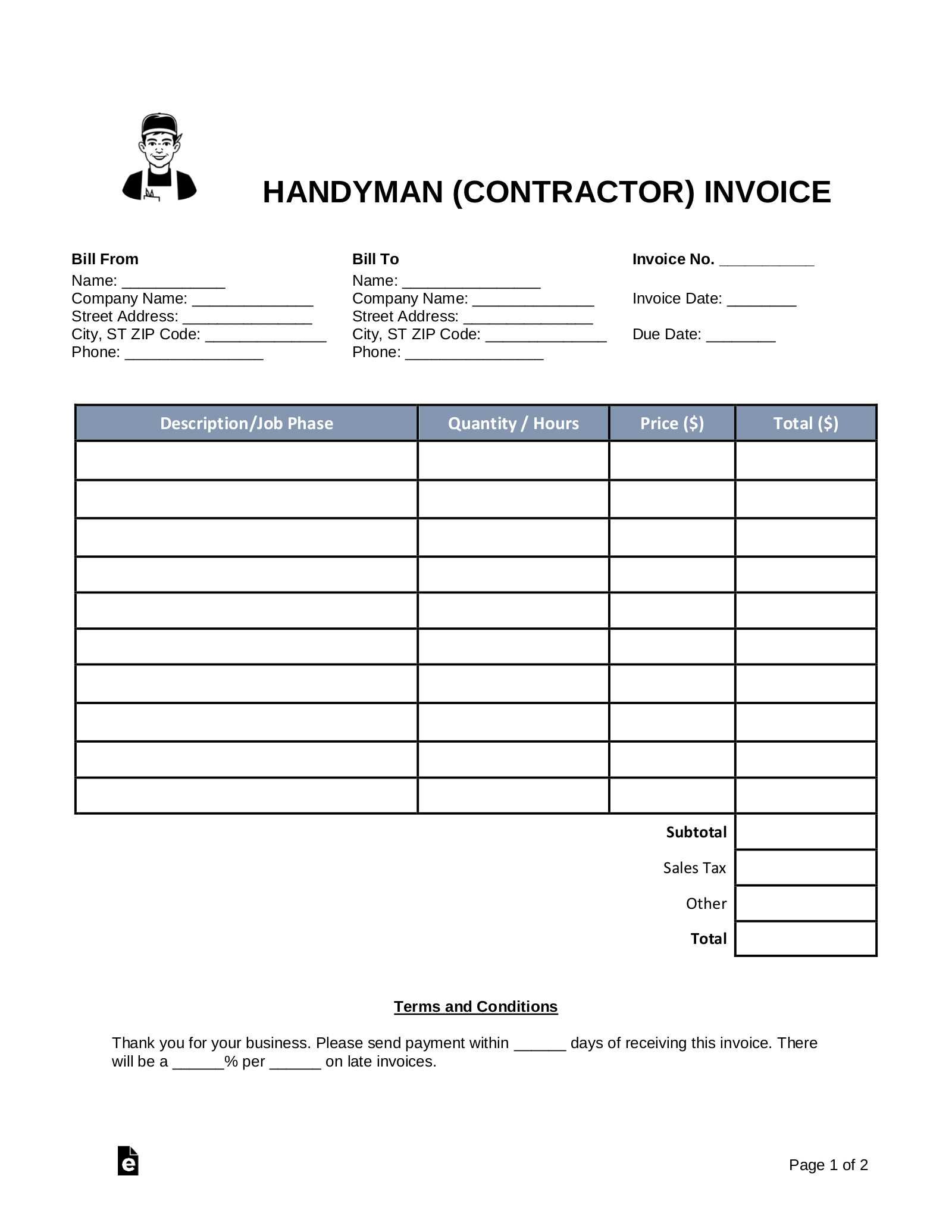

Free Invoice Templates for Service Providers

For any business offering specialized work, it’s essential to have access to efficient and professional documents for billing purposes. Many service providers seek easy-to-use, no-cost solutions to help streamline the process of creating payment requests. Free customizable options are available online, allowing businesses to focus on their work while ensuring their financial records remain accurate and organized. These documents are designed to be adaptable for different types of jobs, from consultations to long-term contracts.

Benefits of Using Free Templates

Using a no-cost solution provides several key advantages:

- Time-saving: Ready-made forms allow for quick generation of documents, reducing administrative workload.

- Professional Appearance: Pre-designed structures ensure your billing documents look polished and organized, enhancing your business’s image.

- Customizability: Templates can be easily modified to fit your specific needs, including adjusting pricing, adding work details, or including taxes.

- Cost-effective: As no payment is required, these templates are a great option for small businesses or freelancers.

Popular Features in Free Templates

Most free billing forms come with standard features that help ensure clarity and consistency:

| Feature | Description |

|---|---|

| Customizable Fields | Sections that allow you to input client information, work descriptions, and payment terms. |

| Payment Details | Options to include payment methods, bank information, or online payment links. |

| Tax Calculations | Built-in tools to automatically calculate taxes based on your location. |

| Professional Design | Pre-formatted layouts that ensure a consistent and visually appealing appearance. |

These features make free billing forms a great tool for service providers looking to manage their finances efficiently without additional cost. With the right document, you can focus more on your work and less on admi

Best Invoice Practices for Freelancers

As a freelancer, managing your billing process efficiently is key to maintaining a steady cash flow and building strong relationships with clients. Using the right approach to create clear, professional payment requests not only improves your chances of getting paid on time but also helps to present your business in a trustworthy light. Following best practices ensures that you avoid misunderstandings, streamline your operations, and maintain professionalism throughout the transaction.

Here are the best practices every freelancer should follow when creating payment requests:

- Include All Necessary Details: Always ensure that the document includes the date of creation, your contact information, and your client’s details. A clear and complete record helps both parties stay on track with payment expectations.

- Be Clear with Pricing: Break down the work done by listing each task or deliverable along with its rate. Transparency in pricing reduces the chances of disputes and ensures clarity for the client.

- Set Clear Payment Terms: Establish clear terms regarding the payment deadline, method of payment, and any late fees. Always outline when payments are due to avoid any confusion or delays.

- Make It Easy to Pay: Provide your client with simple payment options. Whether you’re accepting bank transfers, online payments, or checks, make sure your payment instructions are easy to follow.

- Follow Up on Late Payments: If payment is delayed, follow up promptly but professionally. A friendly reminder can often resolve any issues without causing tension.

- Stay Consistent: Use a uniform structure for every billing document. Consistency in format builds a professional reputation and helps you stay organized.

- Proof of Work: Include any supporting documentation or references to previous communications to confirm the scope of the work completed. This can be helpful in case of disputes or questions about the deliverables.

By adhering to these practices, freelancers can ensure smoother, more effective transactions, building a reputation for professionalism and reliability that will benefit their business in the long run.

Creating a Professional Invoice

Designing a clear and professional billing document is essential for any business, especially when it comes to getting paid on time and maintaining positive relationships with clients. A well-organized document not only reflects the quality of your work but also demonstrates your commitment to professionalism. Ensuring that your payment requests are detailed, accurate, and visually appealing is a key step in presenting your business as reliable and trustworthy.

Key Components of a Professional Billing Document

To create a document that looks professional and meets all necessary legal and business standards, be sure to include the following key elements:

| Component | Description |

|---|---|

| Business and Client Information | Ensure both parties’ contact details (name, address, phone, email) are included for proper identification. |

| Date and Invoice Number | Each document should have a unique reference number and a clearly visible creation date for easy tracking. |

| Detailed Description of Work | Clearly outline the tasks or products provided, including quantities, rates, and any additional details to avoid confusion. |

| Amount Due | List the total amount due, breaking it down by items and including any taxes or fees. |

| Payment Terms | State the due date for payment, preferred payment methods, and any late fees or discounts for early payments. |

Design Tips for a Professional Appearance

In addition to the content, the design of your document plays an important role in its professionalism. Keep these tips in mind to create a visually appealing layout:

- Use a Clean Layout: Ensure your document is easy to read by using clear headings, bullet points, and white space.

- Stay Consistent with Branding: Incorporate your business logo, brand colors, and font style to make the document feel cohesive with your business identity.

- Highlight

Common Mistakes to Avoid in Invoices

Creating a billing document may seem straightforward, but small errors can lead to misunderstandings, delays in payment, or even damage to your professional reputation. It’s crucial to ensure that all the necessary information is correctly included and formatted to avoid common mistakes that could create confusion for both you and your client. By understanding and addressing these potential issues in advance, you can ensure smoother transactions and maintain a professional image.

Here are some of the most frequent mistakes to watch out for when preparing your payment requests:

- Missing or Incorrect Client Information: Failing to include the client’s full name, address, or contact details can cause confusion or delay in payment. Always double-check these details before sending.

- Unclear Payment Terms: Not specifying when the payment is due or what payment methods are accepted can lead to delays. Always include clear, concise payment terms and any applicable fees for late payments.

- Incomplete Description of Work: Vague descriptions of the tasks or products provided can lead to confusion and disputes. Be specific about the work done, the time spent, or the quantities provided.

- Incorrect Pricing or Calculation Errors: Simple mistakes in pricing or math can lead to disputes and damaged trust. Double-check your calculations and ensure the pricing reflects what was agreed upon.

- Omitting a Unique Reference Number: Not including a unique identification number makes tracking payments difficult. Always assign a reference number to each document for easy follow-up.

- Forgetting Tax or Other Fees: Failing to include taxes, shipping costs, or additional fees can result in unexpected costs for your client or confusion about the total amount due. Make sure all charges are included and clearly outlined.

- Inconsistent Formatting: A poorly organized document can appear unprofessional. Keep a consistent format, with headings, clear sections, and easy-to-read fonts to ensure clarity.

By avoiding these common errors, you can ensure that your payment requests are clear, professional, and effective in facilitating timely payments. Taking the time to review and correct these details will make a significant difference in how your business is perceived by clients.

How to Add Tax Information to Your Invoice

Including accurate tax information in your billing document is essential for both legal compliance and transparency with clients. Taxes can vary based on your location, the nature of the work, or the client’s location, so it’s important to know how to correctly calculate and display tax details. Properly accounting for taxes ensures that your business stays in compliance with local regulations and avoids any confusion about the total amount owed.

Steps to Include Tax Information

To include tax details, follow these simple steps to ensure accuracy and clarity:

- Identify the Applicable Tax Rate: Research and determine the correct tax rate for your location or the location of your client. This could be a sales tax, VAT, or any other relevant tax.

- Clearly Label Tax Charges: Label the tax charge separately in the document, indicating the rate and the total amount of tax being applied. For example: “Sales Tax (10%)” followed by the amount.

- Show the Tax Calculation: If applicable, break down how the tax is calculated. For example, “Subtotal: $100, Tax (10%): $10, Total: $110.” This makes the calculation clear and avoids misunderstandings.

- Check Local Tax Laws: Be sure you understand and apply the correct tax rate for your region. Some areas may have special rules for certain types of businesses or goods/services, so ensure you’re in compliance with any legal requirements.

Best Practices for Displaying Tax Information

When adding tax details to your billing document, clarity is key. Follow these best practices to present the information professionally:

- Place tax information in a prominent location: Ensure that tax details are easy to find, typically near the subtotal or total amount due.

- Keep the formatting simple: Use clear and consistent fonts and spacing to make tax information easy to read and understand.

- Include any exemptions or discounts: If your client is eligible for tax exemptions or discounts, clearly indicate this on the document to avoid confusion.

By accurately including tax information, you ensure both compliance and professionalism in your payment requests. Proper tax documentation helps avoid misunderstandings and can foster trust with clients by demonstrating transparency in your financial dealings.

Setting Payment Terms in Your Invoice

Clearly defining payment terms is a critical component of any financial document. By establishing specific guidelines for when and how payment should be made, you help ensure that both parties are on the same page, which can reduce confusion and prevent delays. Well-defined terms not only make transactions smoother but also reinforce professionalism and transparency in your business dealings.

When setting payment terms, consider the following key factors:

- Payment Due Date: Clearly state when payment is expected. Common terms include “Net 30” (payment due within 30 days), “Due on Receipt,” or a specific date. This helps avoid misunderstandings about when the payment is due.

- Accepted Payment Methods: Specify which payment methods you accept, such as bank transfer, credit card, PayPal, or checks. This ensures the client knows how to settle the amount.

- Late Payment Fees: If you plan to charge fees for late payments, outline this clearly in the terms. For example, “A 2% late fee will be applied to overdue payments after 30 days.” This encourages timely payments and helps protect your business.

- Discounts for Early Payment: Offering discounts for early payment can be an incentive for clients to pay ahead of the deadline. For instance, “A 5% discount will be applied if paid within 10 days.”

- Partial Payments: If you allow partial payments or installments, specify the conditions for these, including due dates for each installment and amounts required.

By clearly setting payment terms, you create a more predictable cash flow for your business while maintaining a professional relationship with clients. It’s essential to be specific and consistent with these terms to avoid any misunderstandings that could affect your income or client relations.

How to Include Discounts in Your Invoice

Offering discounts can be an effective way to encourage early payments or reward loyal clients. Including clear and accurate discount information in your billing document ensures transparency and helps avoid any confusion about the final amount due. It’s essential to outline the discount terms clearly so the client understands how much they’re saving and what conditions apply.

Steps to Include Discounts

Follow these simple steps to properly add discount details to your payment request:

- Specify the Discount Type: Be clear about the type of discount you’re offering. This could be a percentage discount, a flat-rate reduction, or a promotional discount for a specific period or quantity of work.

- State the Eligibility Criteria: Include any conditions that must be met for the discount to apply, such as early payment, bulk purchase, or a special promotional offer. For example, “5% discount for payment within 10 days” or “10% off for orders over $500.”

- Show the Discount Amount: Clearly indicate how much the discount is worth. If it’s a percentage, calculate the discount and display the amount subtracted from the total. For example, “Subtotal: $200, Discount (10%): -$20, Total: $180.”

- Highlight the Discount: Use bold text or a different color to make the discount stand out, ensuring that the client doesn’t overlook it. Transparency helps build trust and encourages prompt payments.

Best Practices for Offering Discounts

While offering discounts is a great way to incentivize clients, it’s important to establish clear guidelines and maintain consistency. Here are some tips:

- Set a clear expiration date: If the discount is time-sensitive, include the expiration date so clients know when the offer ends. For example, “Valid until [Date].”

- Be transparent with conditions: Always state the exact terms of the discount, whether it’s contingent on early payment, a large order, or a long-term contract.

- Track discount usage: Keep records of all discounts applied to ensure that you’re offering them correctly and consistently across all transactions.

By clearly outlining discounts in your billing documents, you provide your clients with transparent and easy-to-understand payment information. This can enhance your professional relationship and encourage timely payments, while also helping you maintain control over your pricing strategy.

Using Invoice Templates for Quick Billing

When running a business, efficiency is key to maintaining smooth operations, especially when it comes to requesting payments from clients. Using pre-designed forms can save significant time and effort. These ready-made structures allow you to quickly input the necessary details, generate a professional-looking document, and send it off without delays. By utilizing standardized forms, you can streamline your entire billing process, reducing the chances of errors and improving cash flow.

Benefits of Using Pre-designed Billing Forms

Here are the key advantages of using ready-made billing documents to simplify and expedite the payment process:

- Time-Saving: Pre-formatted documents eliminate the need to create a new one from scratch each time. You simply input the details of the transaction and the document is ready to go.

- Consistency: Using the same format for every request ensures consistency, which builds professionalism and makes your business appear more organized.

- Accuracy: With predefined fields and structures, the risk of missing critical information or making formatting mistakes is significantly reduced.

- Customization: Although they are pre-designed, these documents can often be customized to reflect your brand and specific needs, such as adding your logo, adjusting payment terms, or changing item descriptions.

How to Choose the Right Billing Form

When selecting a pre-designed document, it’s important to consider the following factors:

- Ease of Use: Choose a layout that is simple to navigate and doesn’t require complex instructions. Your goal is to save time, not waste it on a complicated system.

- Flexibility: The ability to customize key sections, such as the breakdown of charges, payment terms, or client information, is essential for ensuring the form meets your business’s needs.

- Legal Compliance: Make sure the form includes all required legal elements, such as your business registration number or tax information, especially if you operate in a regulated industry.

By using pre-designed documents, you can focus on growing your business while ensuring that your payment requests are always timely, accurate, and professional. The quicker you can send these out, the faster you’ll receive payments, keeping your cash flow healthy.

How to Send Your Invoice Effectively

Sending a well-prepared payment request is only part of the process. To ensure that your client receives and processes it promptly, it’s important to follow best practices for delivery. By using the right methods and strategies, you can improve the chances of timely payments and maintain a professional relationship with your clients. This section will guide you through the most effective ways to send your billing documents, minimizing delays and avoiding common pitfalls.

Best Practices for Sending Payment Requests

Here are some key tips to ensure your payment requests are received and processed smoothly:

- Use Email for Faster Delivery: Email is one of the fastest and most reliable ways to send a payment request. Attach the document as a PDF to prevent any formatting issues, and ensure it’s accessible on any device.

- Include a Clear Subject Line: In your email, use a clear and specific subject line, such as “Payment Request for [Project Name] – Due [Date].” This helps the recipient quickly identify the purpose of the email.

- Provide Relevant Details in the Message: In the body of the email, briefly summarize the document’s contents, including the amount due and the due date. This gives the client a quick overview without needing to open the attached document right away.

- Send a Reminder Before the Due Date: A gentle reminder a few days before the payment is due can help keep your request top-of-mind for the client. It also reduces the chance of late payments.

- Use Online Payment Platforms: If possible, provide a link to an online payment platform where clients can settle their dues quickly. This simplifies the payment process and can encourage faster action.

- Maintain a Professional Tone: Always use polite and professional language when communicating about payments. A friendly yet firm approach helps maintain a positive client relationship, even if you need to follow up on overdue payments.

Alternatives for Sending Payment Requests

While email is the most common method, there are other ways to send billing documents, depending on your business type and client preferences:

- Postal Mail: If email isn’t an option or if the client specifically requests a physical copy, sending the document by postal mail is a valid alternative. Be sure to use tracked shipping to confirm delivery.

- In-Person Delivery: For local clients, delivering a printed copy in person can help build stronger business relationships. This method also allows you to answer any immediate questions regarding the payment.

- Through Online Accounting Software: Many businesses use accounting software that allows for direct billing. This can help automate reminders, manage multiple clients, and streamline payment collection.

By choosing the most appropriate and efficient delivery method, you ensure that you

Invoice Formatting Tips for Clarity

A well-structured document is key to ensuring that your payment requests are easily understood by clients. Clear and organized formatting not only makes it easier for your client to process the payment but also helps to avoid disputes and misunderstandings. By focusing on readability and ensuring that all necessary details are presented logically, you can create a document that is professional and user-friendly.

Key Formatting Elements for Clear Billing Documents

Here are some essential tips for formatting your payment requests effectively:

- Use Clear Headings: Divide the document into sections with clear headings such as “Client Details,” “Payment Summary,” and “Total Due.” This helps the reader quickly find the information they need.

- Maintain a Logical Layout: Arrange the information in a logical order: start with contact details, followed by the breakdown of charges, and conclude with payment instructions. This sequence makes it easier for clients to follow.

- Keep It Simple: Avoid clutter by using simple fonts and enough spacing between sections. This makes the document visually appealing and easier to read.

- Use Tables for Breakdown: When listing items or charges, use tables to display the data clearly. This makes it easy for the client to see individual line items and understand the calculation.

- Highlight Key Information: Use bold or larger fonts to emphasize important details such as the total amount due, payment terms, and due date. This ensures that critical information stands out.

- Keep Your Language Concise: Avoid long paragraphs or excessive text. Use bullet points or numbered lists for clarity, especially when outlining terms, charges, or payment instructions.

- Provide Contact Information: Include your business name, address, phone number, and email at the top or bottom of the document, making it easy for clients to contact you if needed.

Best Practices for Readability

In addition to organizing your document logically, it’s important to consider its overall readability. Here are a few additional practices to improve how your document is viewed:

- Choose a Professional Font: Stick to clear, easy-to-read fonts like Arial, Calibri, or Times New Roman. Avoid using decorative or overly complex fonts that can be difficult to read.

- Use Consistent Formatting: Be consistent in font size, style, and color throughout the document. This prevents the reader from getting distracted and ensures a uniform, polished look.

- Ensure Proper Alignment: Align text neatly, especially numerical data. Ensure columns in tables are aligned to the right for numbers and to the left for text. This makes it easier to read and compare figures.

- Leave White Space: Don’t crowd the document. Adequate margins and spacing between sections make the document easier on the eyes and less overwhelming.

By following these formatting tips, you can create a clear, professional, and easy-to-read document that helps to avoid confusion and ensures a smoother payment process. Clarity and attention to detail in your documents reflect positively on your business and make it easier for clients to settle their dues on time.

Legal Requirements for Service Invoices

When preparing a billing document, it’s essential to ensure that it meets the legal requirements set by your country or region. A properly formatted document not only helps maintain professionalism but also ensures that you comply with tax and business laws. Each jurisdiction has specific regulations on what information must be included, and failure to comply could lead to disputes, delays, or penalties. This section outlines the basic legal elements that should be present in any business transaction document.

Key Legal Elements to Include

In order to ensure your billing document is legally compliant, it should contain the following details:

- Business Identification Information: Include the full legal name of your business, business registration number, and tax identification number (TIN) if applicable. This is crucial for taxation purposes and to confirm the legitimacy of your business.

- Client Identification: Clearly state the full name or registered company name of the client being billed. Include the client’s address, phone number, or email if needed.

- Description of Work or Goods: Provide a clear and detailed description of the work completed or goods delivered. This ensures that there is no ambiguity about what the client is being charged for.

- Amount Due: The total amount payable must be clearly outlined, including individual charges for each item or task, applicable taxes, and any discounts if applicable.

- Tax Information: Indicate the tax rate applied (if relevant), as well as the total amount of tax. Depending on your location, you may be required to display your VAT, sales tax, or other applicable tax information.

- Issue and Payment Dates: Clearly mention the date the document was issued and the payment due date. This ensures that both parties know when the payment is expected and prevents any confusion about deadlines.

- Payment Terms: Define the accepted payment methods (e.g., bank transfer, online payment platforms) and any late fees or interest charges for overdue payments.

Additional Legal Considerations

Depending on your country’s legislation, you may also need to include other details to meet local business regulations. Here are some other points to consider:

- Electronic vs. Paper Documents: Some countries allow electronic documents as valid proof of transactions, while others may require a physical document with signatures. Be sure to understand the requirements for electronic invoicing in your area.

- QuickBooks: A widely used accounting software that offers easy-to-use features for generating billing documents, tracking payments, and managing financial reports. QuickBooks integrates well with many other financial tools and is especially useful for businesses looking for an all-in-one solution.

- FreshBooks: Known for its user-friendly interface, FreshBooks makes it easy to create custom billing documents, set payment reminders, and track time spent on projects. It’s a great option for freelancers and service-based businesses.

- Wave: A free tool with basic features that allow business owners to create and send professional payment requests, track payments, and manage their expenses. It’s particularly helpful for small businesses with simple invoicing needs.

- Zoho Invoice: A flexible invoicing tool that offers customizable billing templates, online payment options, and automatic payment reminders. Zoho Invoice also integrates with other Zoho business apps, making it ideal for businesses using a suite of tools.

- PayPal Invoicing: If you’re already using PayPal for transactions, you can also use it to create and send invoices directly from your account. It’s a quick solution for businesses that already rely on PayPal for payments and want a streamlined approach to billing.

- Customization Options: The ability to create professional, branded documents that reflect your busine

How to Track Your Invoices

Effectively managing and tracking your billing documents is essential for maintaining healthy cash flow and ensuring timely payments. Whether you’re a freelancer, a small business owner, or a large enterprise, keeping track of outstanding payments and knowing the status of each request helps avoid confusion and ensures financial stability. This section covers strategies and tools to track your billing documents efficiently, so you can stay on top of what’s owed and when payments are expected.

Methods for Tracking Your Billing Documents

There are several methods to help you track your payment requests, whether you prefer manual tracking or automated solutions:

- Spreadsheets: Many small business owners rely on spreadsheets (like Excel or Google Sheets) to record payment requests. You can create a simple system by listing each request with details like client name, date sent, amount due, payment due date, and payment status. This allows you to manually monitor and update the status of each document.

- Accounting Software: Using accounting software like QuickBooks or FreshBooks simplifies the tracking process. These tools automatically update the status of your documents and provide you with a centralized place to view all transactions, from pending to paid, reducing the risk of losing track of payments.

- Online Payment Platforms: If you use online payment services such as PayPal or Stripe, you can track payments directly through their dashboard. These platforms allow you to see the status of payments in real-time, giving you an instant update on when payments are received.

- Dedicated Tracking Tools: Some invoicing tools, such as Zoho Invoice or Wave, provide integrated tracking features. These platforms automatically update the payment status, send reminders, and can even notify you when a payment is overdue.

Best Practices for Tracking Billing Documents

Regardless of which method you use, there are best practices that can help you stay organized and reduce the risk of overdue payments:

- Set Up Reminders: Most tools, whether software-based or manual, allow you to set reminders for upcoming or overdue payments. This helps ensure that you never miss a follow-up and reduces the chances of forg

Benefits of Digital Invoices Over Paper

With the rise of technology, many businesses are moving away from traditional paper billing methods in favor of digital alternatives. Digital documents offer numerous advantages, not only in terms of efficiency but also in cost savings, accuracy, and environmental impact. In this section, we’ll explore the key benefits of using electronic billing over paper-based methods.

Key Advantages of Digital Billing

- Speed and Convenience: Digital payment requests can be created, sent, and received almost instantly. This allows businesses to reduce the time spent on mailing physical documents and enables quicker payment processing.

- Reduced Costs: Digital documents eliminate the need for printing, postage, and physical storage, reducing both overhead and administrative costs. There’s no need to purchase paper, envelopes, or stamps.

- Enhanced Accuracy: With digital systems, automated calculations minimize the risk of human errors that often occur when creating paper-based documents. This ensures that amounts are correct and avoids costly mistakes.

- Better Organization: Digital records are easier to store and organize. Files can be categorized by date, client, or type of transaction, making it easier to retrieve when needed, as opposed to sifting through paper stacks.

- Environmental Impact: Moving to digital methods helps reduce paper waste, contributing to a greener and more sustainable business model. This eco-friendly approach can also appeal to clients who are environmentally conscious.

- Accessibility and Mobility: Digital records can be accessed from anywhere, on any device, making it easy to manage payments while traveling or working remotely. Clients can also view and pay their dues at their convenience, reducing delays.

- Improved Tracking and Reporting: Digital platforms often come with built-in tracking and reporting tools. This allows you to monitor the status of your payment requests in real-time and generate detailed financial reports with ease.

Security and Compliance

- Stronger Security: Digital systems often come with encryption and password protection, making it more secure than paper documents that can be lost, stolen, or

Invoicing Tools for Small Business Owners

Managing billing efficiently is crucial for small business owners, as it directly impacts cash flow and financial health. In today’s digital age, there are numerous tools available that can streamline the process, making it easier to create, track, and manage payment requests. These tools not only save time but also ensure that the billing process is professional, accurate, and compliant with regulations. This section explores some of the most effective solutions for small business owners to manage their payment requests with ease and confidence.

Top Invoicing Solutions for Small Businesses

There are several software options designed specifically to meet the needs of small business owners. Here are some of the most popular tools:

Features to Look for in Invoicing Tools

When choosing an invoicing tool, it’s important to consider the features that will best serve your business needs. Here are some key features to look out for: