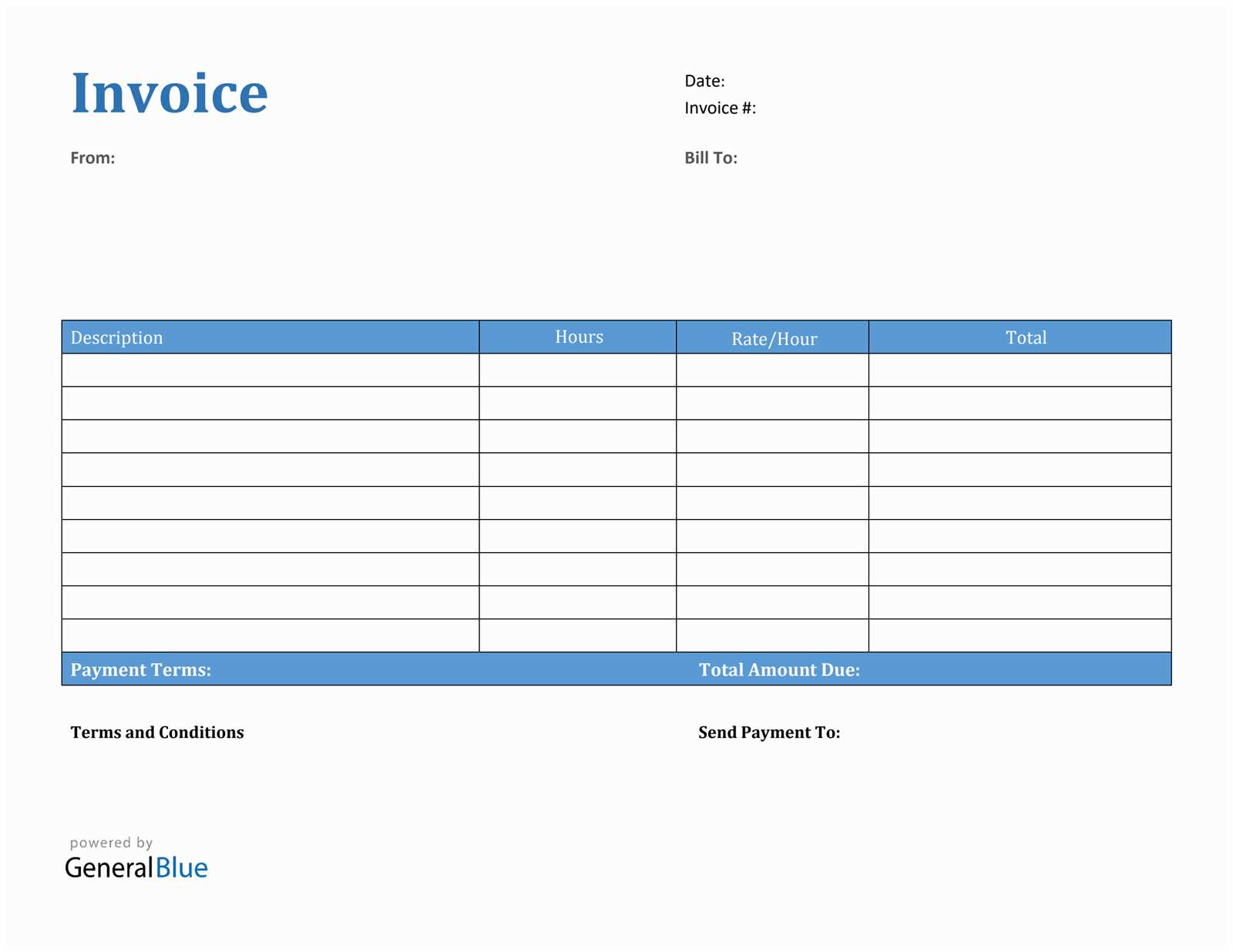

Get Your Free Invoice Template and Start Creating Professional Invoices

Managing business transactions can often be time-consuming, especially when it comes to creating accurate documents for payments. Having a ready-made structure to quickly fill out and issue these important records can save time and reduce the risk of errors. Whether you’re a freelancer or a small business owner, using a structured document format can ensure that all necessary details are included, making the process smoother and more professional.

With the right tools, you can eliminate the hassle of starting from scratch every time you need to send a request for payment. By leveraging accessible and customizable formats, you can create professional-looking documents in a matter of minutes. This approach not only streamlines your workflow but also helps maintain a consistent, reliable process for managing financial transactions.

Maximize efficiency and maintain a high level of professionalism by adopting a solution that fits your specific needs. Whether you need to issue a simple bill or a more detailed statement, a well-designed structure can help you do it effortlessly, keeping your business operations running smoothly.

Free Invoice Templates for Your Business

Every business, regardless of size, requires a reliable method to request payments and maintain clear financial records. Having a structured document that clearly outlines the details of a transaction is essential to ensure that both parties are on the same page. Whether you’re a freelancer or a small enterprise, using ready-to-use documents can streamline your billing process and avoid confusion.

There are various ways to obtain professional-quality billing documents without the need for expensive software or services. Many platforms offer easily customizable formats that allow you to enter the required information quickly. This means you can focus more on running your business rather than spending time on document creation.

Key Features to Look for in Billing Documents

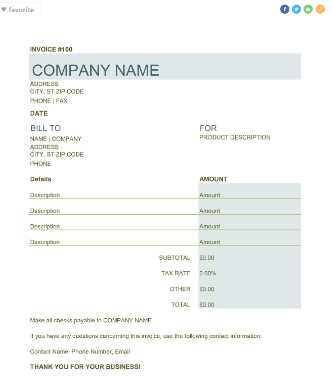

When choosing a format to use, ensure it includes essential details like transaction dates, payment terms, and the services or products provided. Having these sections clearly outlined helps to avoid mistakes and ensures that all necessary information is conveyed to the recipient. A good structure also improves your business image, as it shows professionalism and attention to detail.

Where to Find These Resources

Many websites offer downloadable options that allow easy customization to fit your business’s needs. Here are a few key elements you should consider when selecting the right option:

| Feature | Importance |

|---|---|

| Customizable Fields | Ensure you can add specific transaction details |

| Professional Design | Helps to create a polished, consistent look for your brand |

| Compatibility with Different Formats | Allows easy editing and sharing across platforms |

By utilizing these easily accessible solutions, your business can manage its financial documentation efficiently while maintaining a high standard of professionalism.

Why Use a Free Invoice Template

Managing business transactions efficiently requires having the right tools in place. By utilizing a well-organized structure to request payments, businesses can save time, minimize errors, and enhance their professional image. Instead of creating documents from scratch every time, leveraging ready-made solutions can significantly streamline the process, making it simpler and faster to generate clear, precise payment requests.

Key Advantages of Using Pre-designed Formats

- Time-saving: Ready-made formats allow you to fill in key details quickly, speeding up the billing process.

- Consistency: By using the same structure for all your transactions, you ensure uniformity and professionalism in your business communications.

- Minimized Errors: A well-organized format reduces the chances of omitting important information or making mistakes when filling out payment details.

Cost-effective Solution for Small Businesses

For small business owners, using free resources can help cut unnecessary costs. Instead of investing in expensive software or hiring professionals, you can access high-quality, customizable options at no charge. This is particularly beneficial for startups and freelancers who need to keep overhead costs low while maintaining a professional appearance.

- No Extra Costs: Many online platforms offer these resources at no charge, making them an ideal solution for businesses with limited budgets.

- Easy Accessibility: Many of these formats can be downloaded or accessed directly online, providing instant access whenever you need them.

By using these efficient resources, businesses can streamline their billing process, maintain consistency, and enhance their professional presence without incurring additional expenses.

How to Choose the Best Template

Choosing the right structure to create payment requests is crucial for maintaining a professional image and ensuring that all necessary details are included. The ideal document should not only look polished but also be easy to customize and quick to fill out. When selecting the best format, it’s important to consider factors like design, functionality, and customization options to ensure it aligns with your business needs.

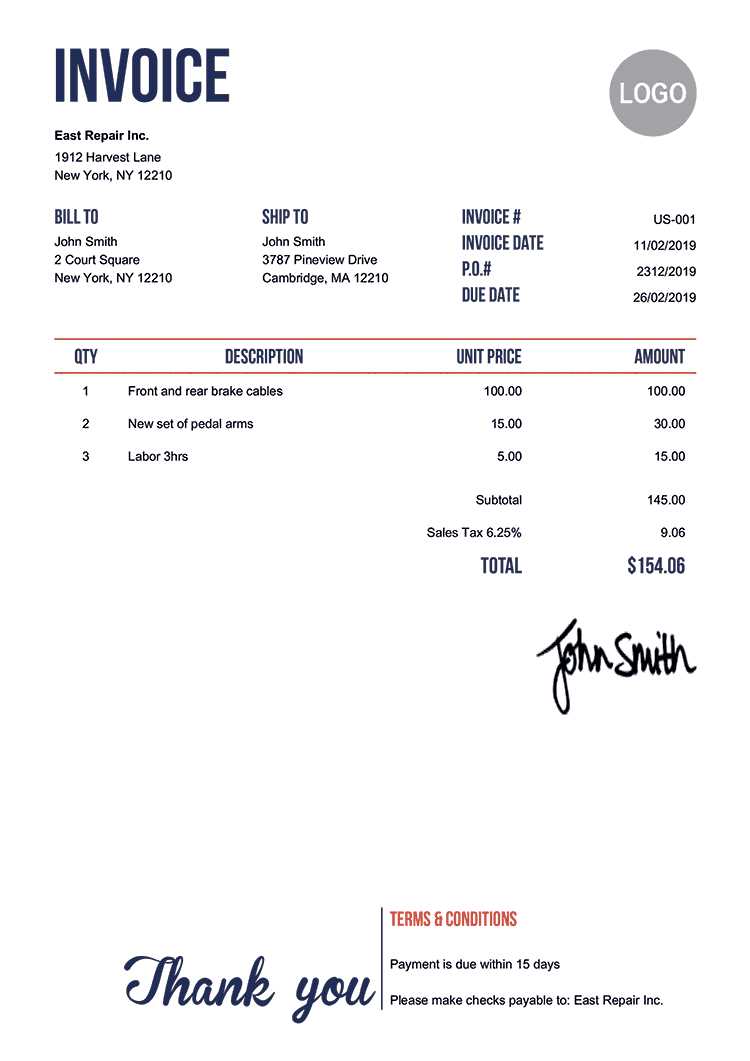

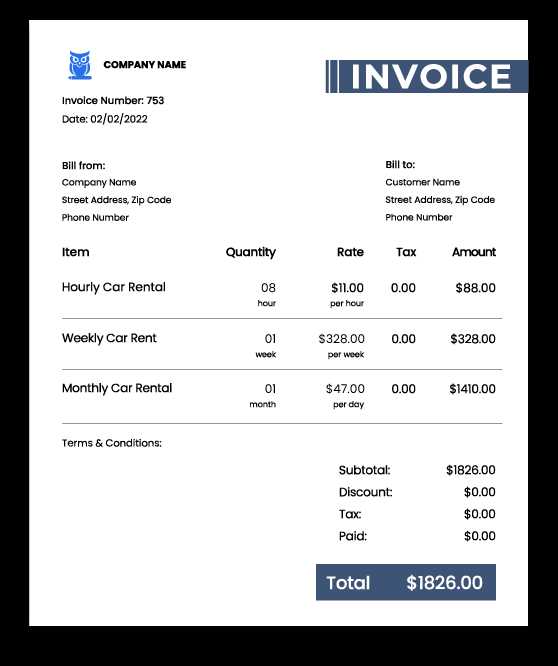

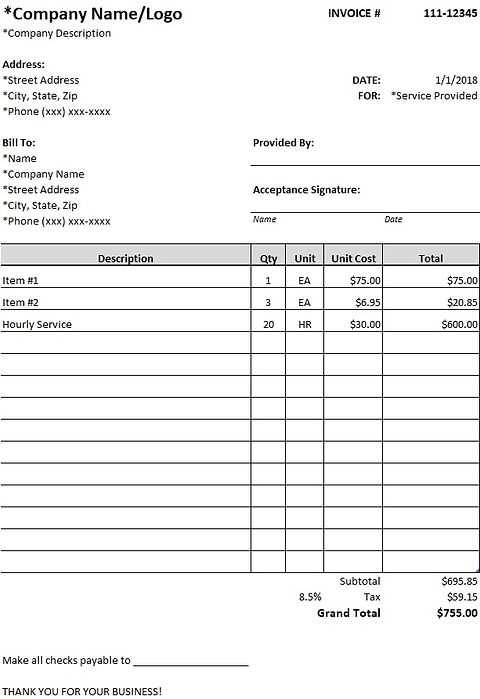

Start by evaluating your specific requirements. Depending on the nature of your business, you may need different features. For example, if you provide services, you might want a format that allows space for a detailed description of the work performed. On the other hand, product-based businesses may focus on including pricing and quantities. Ensure the structure you choose allows for these specific needs.

Consider Key Factors When Making Your Choice

- Ease of Customization: Select a design that lets you quickly add your business information, payment terms, and transaction details.

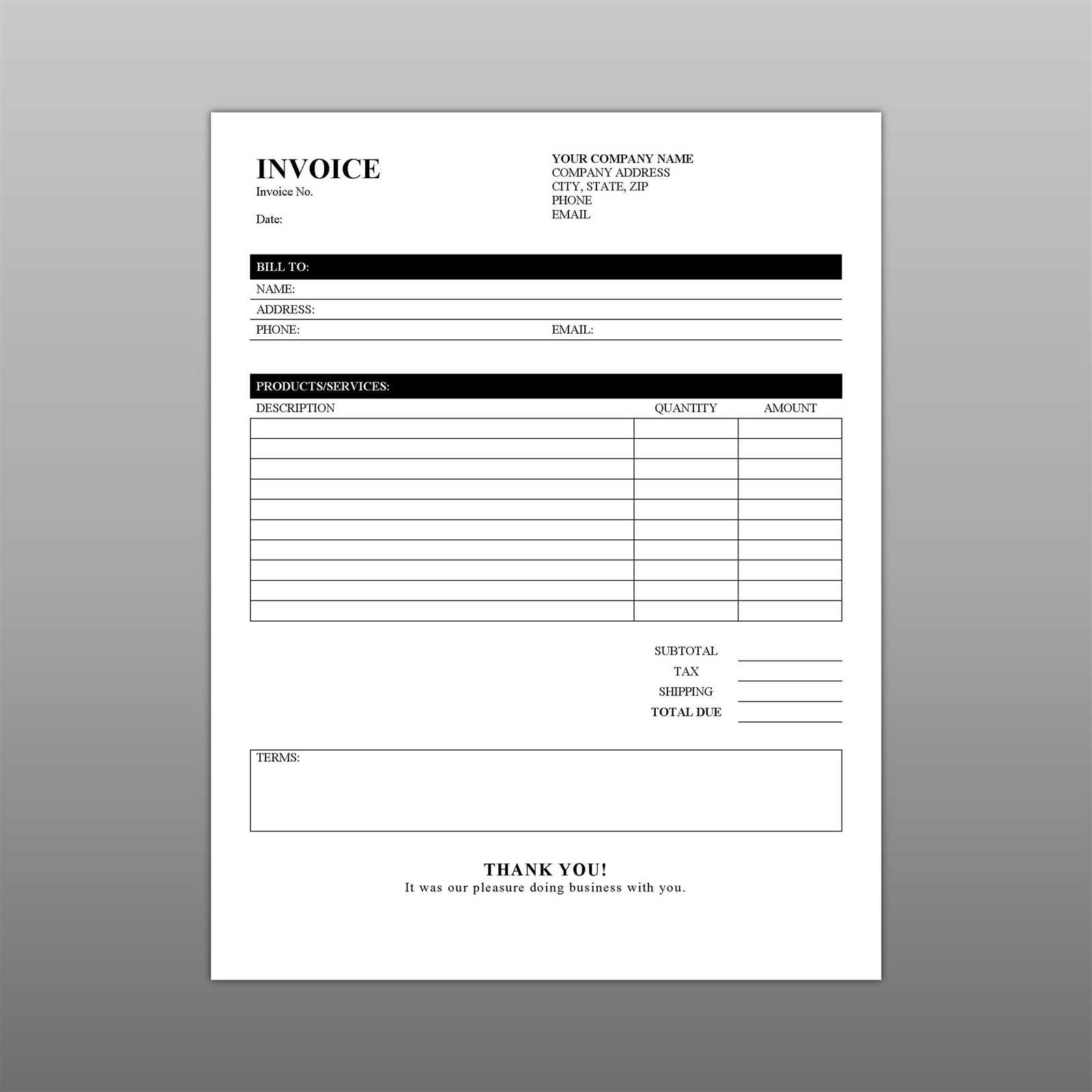

- Professional Appearance: The document should look polished and clean, with clear sections that make it easy to read and understand.

- Compatibility: Choose a format that is compatible with the software or tools you currently use, such as Word, Excel, or PDF editors.

Test Out Different Options

Before committing to a particular design, try out a few different options. This will allow you to see which layout works best for your business and if any adjustments are needed. Many online platforms offer sample formats that you can customize and download, so experiment with a few until you find one that suits your style and workflow.

In the end, the right choice will help you streamline your processes, maintain a professional brand image, and ensure smooth transactions with clients.

Benefits of Customizable Invoice Designs

Having the ability to adjust the design of your payment request documents allows you to create materials that truly reflect your brand identity and meet your specific needs. Customizable formats offer greater flexibility, ensuring that you can tailor each document to your preferences, whether you need to emphasize certain details or simplify the layout. This level of control can significantly improve your efficiency and professionalism when dealing with clients and customers.

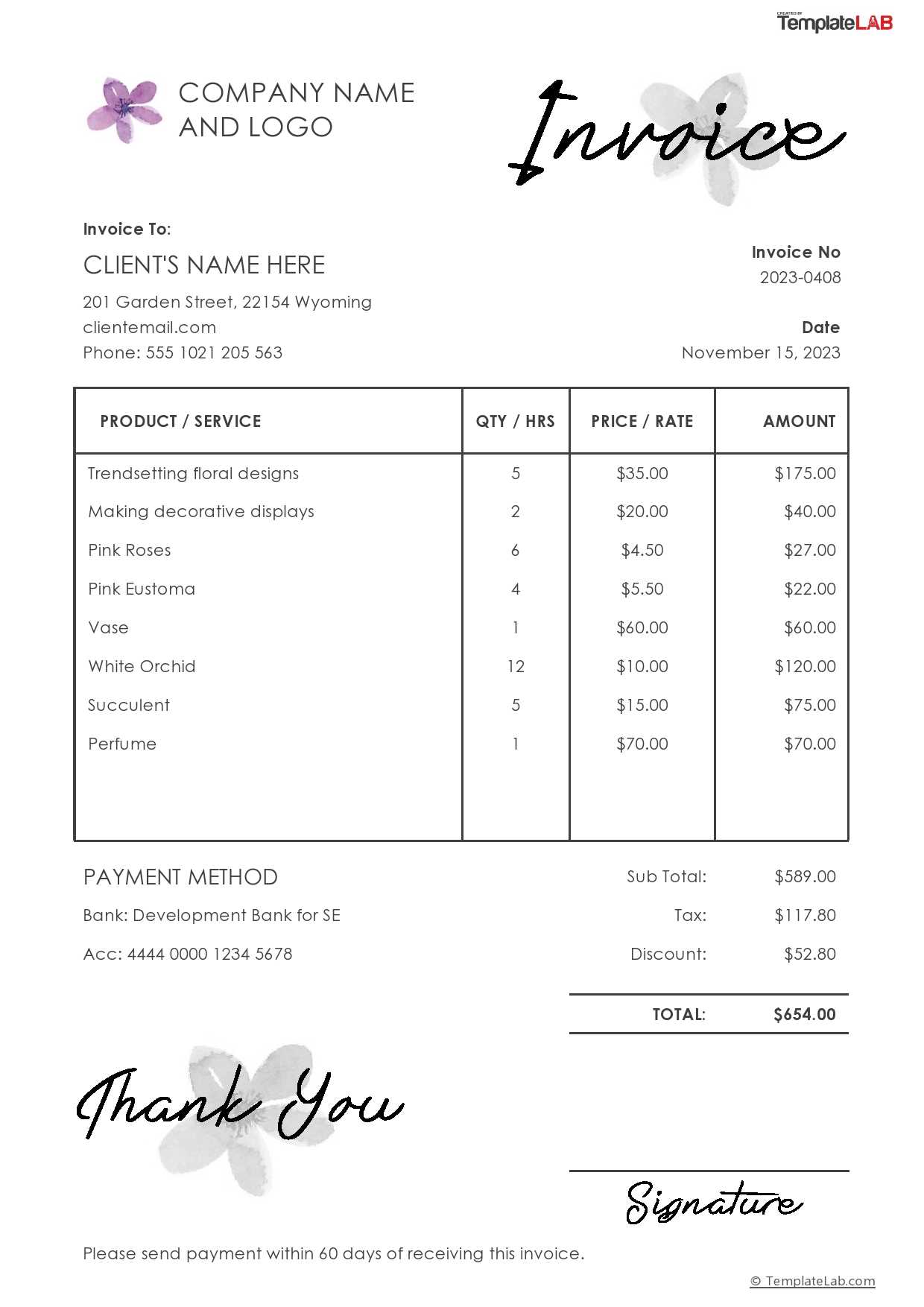

One of the main advantages of being able to modify your payment documents is the ability to create consistency across all of your business communications. By personalizing key sections, such as your logo, business name, and contact information, you can ensure a unified look that aligns with your company’s branding. This consistency builds trust and recognition with your clients.

Enhanced Professional Appearance

Customizable designs allow you to make your documents look more polished and professional. You can choose fonts, colors, and layouts that match your brand’s aesthetic. A well-designed document doesn’t just look good; it also makes your business seem more established and reliable, increasing client confidence in your services.

Increased Efficiency and Accuracy

- Quick Customization: Modify sections to suit each transaction type, such as adding specific product or service details with minimal effort.

- Focus on Relevant Details: Adjust the layout to emphasize important information, such as payment terms or due dates, ensuring no detail is overlooked.

- Easy Updates: As your business evolves, you can quickly update your design without having to start from scratch each time.

By customizing your documents, you gain full control over their appearance and content, allowing you to create more efficient, professional, and consistent communication with clients.

Simple Steps to Edit Your Invoice

Editing a pre-made payment request document is a quick and easy process. With the right structure, you can modify key details, ensuring that each document is tailored to the specific transaction. By following a few simple steps, you can efficiently update your records without hassle and maintain a professional standard for your business communications.

Step-by-Step Guide to Editing Your Payment Request

- Open the Document: Begin by opening the file in your preferred editing software, such as Word, Excel, or PDF editor. Most platforms offer easy-to-use formats compatible with these tools.

- Enter Client Information: Add or update your client’s details, such as their name, address, and contact information. Ensure accuracy to avoid potential issues with payments.

- Modify Service or Product Details: Clearly list the items or services provided. Include descriptions, quantities, and prices as needed, making sure everything is correct and easy to understand.

- Update Payment Terms: Include any important information related to the payment process, such as due dates, discounts, or late fees.

- Check for Consistency: Review the entire document for consistency. Ensure that fonts, alignment, and spacing are uniform for a clean, professional appearance.

- Save and Share: After editing, save the document with a new file name. Send it to your client via email or preferred method.

Tips for Efficient Editing

- Use Pre-filled Information: Many programs allow you to store client details, making future edits quicker.

- Utilize Templates: If you frequently send similar payment requests, using a standardized layout can save time on every new document.

- Double-chec

Common Features in Invoice Templates

When creating payment request documents, there are several key elements that should be included to ensure clarity and professionalism. These features help both the sender and the recipient easily understand the details of the transaction, facilitating smooth processing and payment. Most well-designed structures will contain standard sections, but the ability to customize them for specific needs is what makes these resources so useful.

Essential Elements to Include

- Business Information: Always include your business name, address, phone number, and email address. This ensures that the recipient knows who the document is from and how to contact you if necessary.

- Client Details: Include the name and address of the client, as well as any relevant contact information. This ensures that the correct party is being billed and avoids confusion.

- Description of Goods or Services: List the products or services provided, along with quantities, unit prices, and a brief description. This section clarifies what was delivered and helps the recipient understand what they are being charged for.

- Total Amount Due: The total cost, including taxes, shipping, and any discounts, should be clearly stated at the bottom of the document. This gives the recipient a clear idea of how much is owed.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or discounts for early payment. Clear payment terms help ensure that the recipient knows exactly how and when to pay.

- Invoice Number: Assigning a unique reference number helps track payments and manage records efficiently. This also makes it easier to refer to the document in future correspondence.

Additional Features for Customization

- Logo and Branding: Including your company logo and choosing colors and fonts that match your brand helps create a professional, consistent appearance.

- Notes or Special Instructions: This section can be used for any additional messages, such as thank-you notes, reminders, or instructions related to payment.

- Discounts or Special Offers: If applicable, clearly display any discounts, offers, or promotional rates to ensure transparency and avoid confusion.

By ensuring that these essential features are included and easily customizable, your payment request documents will look professional, organized, and clear, making the process smoother for both parties involved.

How to Save Time with Templates

Running a business requires handling many tasks efficiently, and managing financial documents is no exception. One of the best ways to save valuable time when creating payment requests is by using pre-designed formats. These ready-made structures allow you to quickly input details and generate professional documents without starting from scratch every time. This approach helps streamline your workflow and ensures consistency in your business communications.

Key Ways to Save Time

- Pre-filled Information: By using a structure that allows you to store client details, payment terms, and service descriptions, you can instantly fill in the relevant fields without re-entering the same information repeatedly.

- Quick Customization: With editable formats, you can easily update sections such as quantities, pricing, or due dates, ensuring that your documents are always accurate and up to date.

- Standardized Layouts: Using a consistent layout saves time spent on formatting. Since the layout is already organized, you don’t need to worry about alignment, font sizes, or spacing.

Additional Time-Saving Tips

- Batch Processing: If you handle multiple transactions, you can use the same layout and modify only the relevant details, reducing the need to create individual documents from scratch each time.

- Automated Calculations: Some structures offer built-in formulas that can automatically calculate totals, taxes, and discounts, minimizing the time spent on manual calculations.

- Instant Sharing: Once completed, documents can often be saved in various formats (e.g., PDF) and easily shared with clients via email, reducing the time needed for printing or manual delivery.

By incorporating these time-saving strategies, you can focus more on other aspects of your business, knowing that your payment requests are generated quickly and accurately.

How to Avoid Errors in Invoices

When generating payment requests, accuracy is crucial. Mistakes can lead to delays in payments, confusion, and a lack of trust between you and your clients. By using a structured approach, you can minimize the chances of errors. Proper attention to detail and following a systematic process will ensure that each document is correct, clear, and professional.

Steps to Minimize Mistakes

- Double-check Client Details: Ensure that the recipient’s name, address, and contact information are accurate. Even a small typo can lead to confusion and delays in processing.

- Verify the Product or Service Descriptions: Make sure each item or service listed is correct. Check quantities, unit prices, and any additional fees to ensure they match the terms of the agreement.

- Confirm Totals and Calculations: Double-check all mathematical calculations, including subtotals, taxes, discounts, and final amounts due. Mistakes in numbers can cause problems with payments.

Tools and Practices to Help Avoid Errors

- Automated Calculations: Use formats with built-in formulas that automatically calculate totals and taxes. This reduces the risk of manual errors in math.

- Consistent Formatting: Standardize your layout to avoid accidentally omitting important information. A well-organized structure ensures that no fields are overlooked.

- Proofread Before Sending: Always review the completed document to ensure all fields are filled out correctly. A quick check can prevent simple but costly mistakes.

- Use Clear Terms: Be explicit about payment terms, due dates, and any additional instructions. This eliminates any ambiguity and helps avoid misunderstandings.

By following these best practices, you can significantly reduce the likelihood of errors and ensure that your payment requests are clear, accurate, and professional every time.

Where to Find Reliable Invoice Templates

Finding a trustworthy and professional document format to manage payments is essential for businesses of all sizes. Reliable resources allow you to quickly generate consistent, well-structured records without worrying about errors or missing information. Several platforms offer easy access to high-quality designs that you can use and customize according to your needs, making the entire billing process more efficient.

Top Sources for Professional Payment Request Formats

- Online Template Providers: Numerous websites offer a wide range of customizable formats. These platforms allow you to download or use templates directly in your browser, making it easy to get started without having to design documents from scratch.

- Business Software Suites: Popular accounting and business management software often includes pre-designed options for payment requests. These are typically integrated with other financial tools, allowing for seamless usage within your workflow.

- Document Sharing Platforms: Websites like Google Docs, Microsoft Office, or other cloud-based services offer shared templates that you can modify. These tools often allow easy collaboration if you work with a team.

What to Look for in a Reliable Source

- Customization Options: Choose a platform that allows you to personalize the document with your business name, logo, and relevant payment details.

- Variety of Designs: Ensure the source offers different layouts to fit your needs, whether you’re creating a simple payment request or a more detailed document.

- Ease of Use: Look for easy-to-edit formats that don’t require extensive technical skills. User-friendly tools help streamline the process without wasting time.

- Security: Always select platforms that offer secure downloads, ensuring your data is safe and protected.

By exploring these trusted resources, you can find the perfect solution to manage your business transactions efficiently, keeping them accurate, professional, and well-organized.

Free vs Paid Invoice Templates: Which to Choose

When choosing a format for creating payment requests, one of the first decisions you’ll face is whether to go with a no-cost option or invest in a premium version. Both options come with their pros and cons, and the right choice depends on your business’s specific needs. Understanding the differences between the two can help you make an informed decision that best suits your workflow and budget.

Advantages of Free Options

Cost-effectiveness is the primary benefit of using free resources. These formats allow small business owners, freelancers, and startups to get started quickly without worrying about additional expenses. You can easily find simple, functional designs that meet basic billing needs, making them an excellent choice for those just starting out or with limited financial resources.

- No Upfront Costs: The most obvious advantage is that there’s no financial investment required to access free designs.

- Quick Setup: Free formats are often ready to use immediately, which means you can start creating documents without delay.

- Basic Functionality: For smaller businesses with straightforward billing needs, these options often provide just enough customization and functionality to get the job done.

Benefits of Paid Solutions

On the other hand, premium resources generally offer more sophisticated features and customization options. Paid designs are typically better suited to businesses that require advanced functionality, higher volumes of transactions, or a more polished appearance. These formats often come with additional benefits, such as automatic calculations, more complex layouts, and better support options.

- Professional Appearance: Paid resources often offer more polished, visually appealing designs that can help enhance your brand image.

- Advanced Features: Premium options frequently include features such as automatic tax calculations, customizable fields, and integration with accounting software.

- Better Customer Support: With a paid plan, you’re more likely to receive customer support for any issues or questions that arise during use.

Ultimately, the choice between free and paid options depends on your business needs. If you’re just starting out or have a small volume of transactions, free resources might be all you need. However, if you’

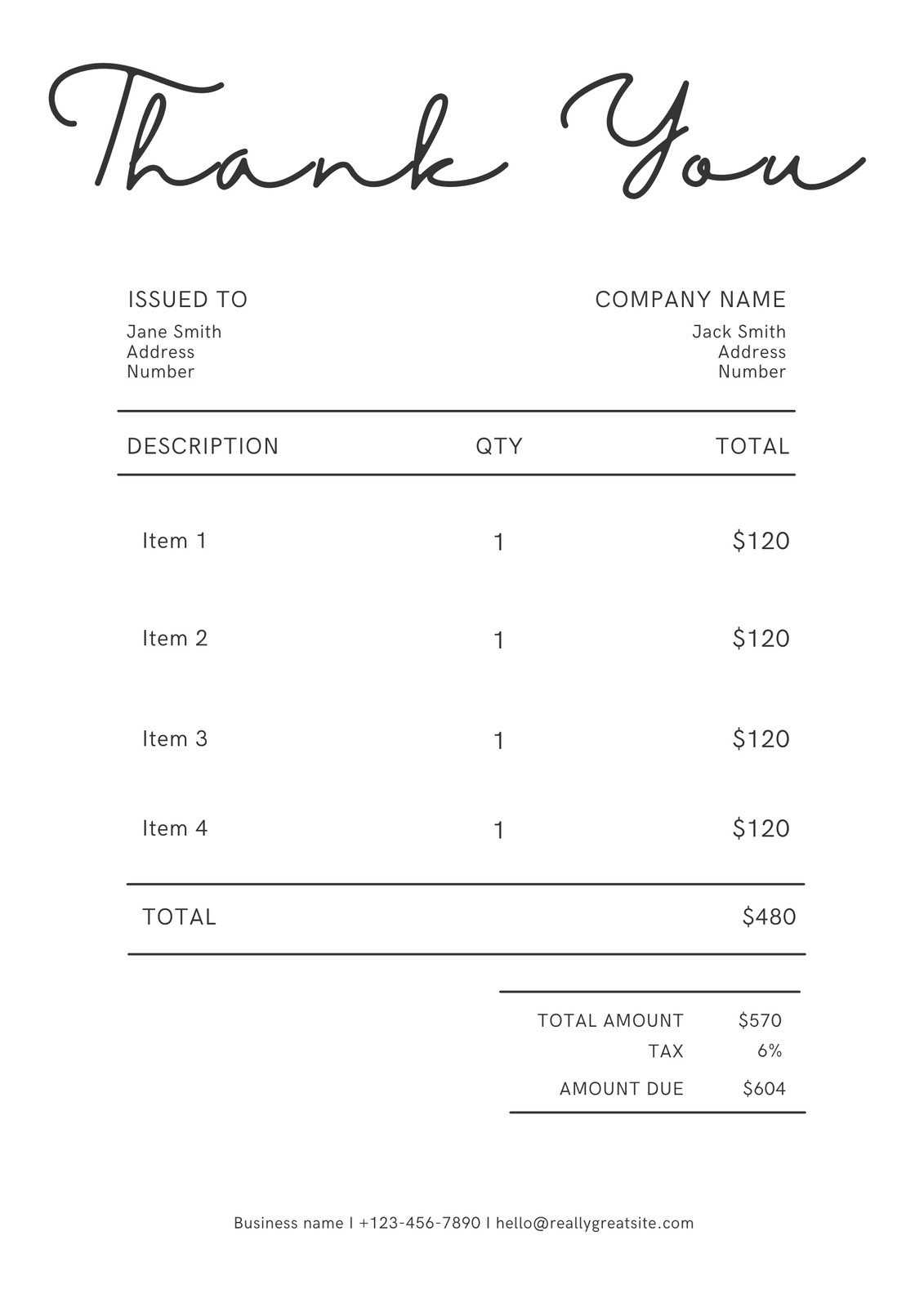

Tips for Personalizing Your Invoice

Customizing your payment request documents is a great way to make them more professional and aligned with your business brand. Personalization helps ensure that your documents are not only functional but also visually appealing and consistent with the image you want to project to clients. Simple modifications can make a big difference in how your business is perceived, building trust and recognition with your customers.

Key Personalization Strategies

- Include Your Branding: Add your logo, company name, and business color scheme to create a branded look. Consistency in design helps strengthen your brand’s identity and gives the document a more polished appearance.

- Customize the Layout: Adjust the layout to match the specific needs of your business. For example, if you offer a variety of services or products, consider organizing them in a way that makes the document easy to read and understand for the recipient.

- Use Clear, Professional Fonts: Choose fonts that are easy to read and complement your business style. Avoid overly decorative fonts and keep the text clear and legible for quick understanding.

Advanced Personalization Tips

- Tailor the Language: Consider adding a personal touch with a friendly greeting or a thank you note. It helps build rapport and shows appreciation for the client’s business.

- Adjust the Payment Terms: Ensure that the payment terms are tailored to each client, such as offering different due dates or payment methods based on prior agreements or specific business arrangements.

- Include Additional Information: If applicable, add a field for a tracking number, project details, or any other custom notes that are relevant to the transaction. This level of detail can improve transparency and customer satisfaction.

By taking the time to personalize your documents, you not only enhance their professional appeal but also make sure your clients have all the relevant details they need to process payments efficiently. This effort reflects your attention to detail and can make your business stand out in a competitive marketplace.

What Information Should Be Included in Invoices

When creating a payment request document, it’s essential to ensure that all the necessary information is included for both clarity and legal purposes. A well-structured document not only ensures that your clients can easily understand the details of the transaction but also helps prevent delays in payments. There are key elements that should always be present to make the process as smooth as possible.

Essential Details to Include

- Business Information: Include your company name, address, phone number, and email address. This establishes your identity and makes it easy for the recipient to contact you if needed.

- Client Information: Add your client’s name, address, and relevant contact details. This helps ensure that the right person receives the request and avoids confusion.

- Unique Reference Number: Assign a unique number to each document for tracking purposes. This makes it easier for both parties to reference the transaction in future communications.

- Payment Due Date: Clearly state the due date for payment. This helps set expectations for when the payment should be made and avoids misunderstandings.

Additional Key Information

- Detailed Description of Goods or Services: List the products or services provided, including quantities, unit prices, and any applicable descriptions. This section should be clear and detailed to avoid any confusion about the charges.

- Total Amount Due: Provide a breakdown of the total amount, including subtotals, taxes, discounts, and any additional fees. This ensures transparency and prevents discrepancies.

- Payment Terms: Specify the payment methods you accept (e.g., bank transfer, credit card) and any late fees or discounts for early payment. Clear terms help avoid any potential payment issues.

- Additional Notes or Instructions: This is an optional section where you can add extra details such as special instructions, project notes, or thank you messages to personalize the document.

By including all of these essential elements, you can create a comprehensive, professional document that provides all the necessary details for the transaction, ensuring smooth communication and timely payments.

How to Organize Your Invoice Templates

Efficient organization of your payment request documents is essential to maintaining a streamlined workflow and ensuring that you can quickly access and modify the necessary files. A well-organized system helps you avoid confusion, reduce errors, and stay on top of your billing tasks. Whether you’re managing a small business or handling numerous transactions, having a clear structure will save you time and effort.

Effective Ways to Organize Your Documents

- Create Separate Folders: Organize your files into different folders based on client names, project types, or billing periods. This makes it easy to locate specific documents when needed.

- Use Clear Naming Conventions: Name each file with specific details like the client’s name, the date, and the invoice number (e.g., “ClientName_Invoice_001_2024”). This will help you quickly search for and identify documents in your system.

- Maintain a Master File: Keep a master copy of your most commonly used format. This allows you to easily duplicate and modify it for new clients or transactions, saving time and effort on future requests.

Advanced Organization Tips

- Version Control: If you make updates or adjustments to your document formats over time, consider keeping a version history. This way, you can always access older versions if needed and track any changes made.

- Leverage Cloud Storage: Use cloud storage platforms such as Google Drive, Dropbox, or OneDrive to store your documents. This ensures easy access from any device and adds an extra layer of security with automatic backups.

- Automate Filing: Some accounting software or document management tools allow you to automatically categorize and store your files as they are created. This reduces manual effort and minimizes the chances of misplaced documents.

By implementing these organizational strategies, you can ensure that your payment requests are always readily available, accurate, and easy to manage. An organized system helps reduce stress, increases efficiency, and improves your ability to track tr

Design Considerations for Professional Invoices

When creating payment request documents, the design plays a crucial role in conveying professionalism and clarity. A well-designed document not only makes a great impression but also ensures that the recipient can easily understand the details of the transaction. Thoughtful design can help you stand out while maintaining a clean, organized appearance that encourages prompt payments.

Key Design Elements to Focus On

- Brand Consistency: Your document should reflect your brand identity. Include your business logo, use your brand colors, and choose fonts that are consistent with your overall branding. This helps build recognition and trust with your clients.

- Clear Structure: Organize the document in a logical and easy-to-read manner. Use distinct sections for contact information, item descriptions, pricing, payment terms, and totals. A clear layout ensures that each piece of information is easy to find and understand.

- Readable Fonts: Choose fonts that are easy to read both on screen and in print. Avoid overly decorative fonts, especially for key information like prices, terms, and totals. Stick to professional, legible fonts like Arial, Helvetica, or Times New Roman.

Additional Considerations for Professionalism

- Whitespace: Use adequate whitespace to avoid a cluttered look. A clean design makes the document feel more organized and gives the recipient space to focus on important details.

- Color and Contrast: Use color strategically to highlight key areas such as the total amount due, payment terms, or deadlines. Ensure that the colors you use contrast well with the background for better readability.

- Visual Hierarchy: Apply visual hierarchy by making headings bold or larger than the regular text. This guides the reader’s eyes to the most important parts of the document, like the payment amount or due date.

- Use of Icons or Graphics: While too much decoration can make the document look unprofessional, subtle icons (like a dollar sign for pricing or a calendar for the due date) can enhance readability and add a polished look without overwhelming the content.

By focusing on these design principles, you can create payment request documents that are not only functional but also visually appealing and easy to navigate. A professional de

How to Make Invoices Look Professional

Creating a polished and professional-looking payment request document is crucial for leaving a positive impression on your clients. A well-designed document reflects your business’s credibility and helps establish trust. By following a few key design and formatting principles, you can make your documents not only functional but visually appealing, ensuring they stand out in a competitive marketplace.

Key Tips for a Professional Appearance

- Maintain a Clean and Organized Layout: A cluttered document can be confusing and unprofessional. Use clear sections with headings, such as “Billing Information,” “Service Description,” and “Amount Due,” to create an easy-to-follow structure.

- Incorporate Your Brand Elements: Include your company logo, business colors, and consistent fonts that match your branding. This gives your document a cohesive, professional look that aligns with your brand identity.

- Use Consistent and Legible Fonts: Stick to simple, professional fonts like Arial, Helvetica, or Times New Roman. Avoid using too many different font styles, as this can create visual chaos. Keep the text uniform and easy to read.

Design Enhancements for a Polished Look

- Add Subtle Design Elements: Use horizontal lines or borders to separate sections or highlight important information. Ensure these elements are subtle and don’t distract from the content.

- Include a Clear Payment Summary: Make sure the total amount due is prominent and easy to locate. Use a larger font size or bold text to draw attention to this key figure, making it the focal point of the document.

- Choose a Professional Color Scheme: Select a color scheme that complements your brand. Stick to neutral tones for the background, and use accent colors sparingly to highlight important sections like totals or due dates.

- Ensure Accurate Alignment: Proper alignment of text, figures, and headings is essential for a clean look. Use tables or grids to organize information neatly and ensure everything lines up properly.

By incorporating these elements into your payment request documents, you create a professional, polished appearance that reflects well on your business. The attention to detail and consistency in design will not only improve the document’s effectiveness but also enhance your reputation as a reliable and organized business partner.

How to Send and Track Invoices

Efficiently sending and tracking payment requests is crucial to maintaining a smooth cash flow and ensuring timely payments. Properly managing this process not only reduces administrative work but also helps in maintaining transparency and professionalism with your clients. By following a few simple steps, you can streamline the process and keep track of your outstanding transactions.

Sending Payment Requests Effectively

- Choose the Right Delivery Method: Depending on your client’s preferences, you can send documents via email, postal mail, or through an invoicing system. Electronic delivery is often the fastest and most efficient way to ensure your request reaches the client promptly.

- Personalize Your Message: When sending a payment request, consider adding a brief message or a polite reminder. A personal touch can enhance your relationship with the client and encourage a timely response.

- Double-Check the Details: Before sending, ensure that all the information is accurate, such as the client’s details, the amount due, payment terms, and any applicable taxes or discounts. Mistakes can delay the payment process and harm your professional reputation.

Tracking and Managing Outstanding Requests

- Use an Automated System: Leverage accounting software or online invoicing platforms that offer tracking features. These tools can automatically notify you when a document is viewed or paid, providing real-time updates on your transactions.

- Set Reminders: Set automatic reminders for follow-ups, especially for clients with overdue payments. This helps you stay on top of outstanding balances without having to manually track each one.

- Maintain Records: Keep a copy of all sent payment requests and related communications in a central, easily accessible location. This ensures you have documentation if any issues arise and provides clarity on any ongoing discussions with clients.

By efficiently sending and tracking your payment requests, you not only improve the administrative aspects of your business but also foster better relationships with clients by providing clear and timely communication. The more organized your process, the smoother the payment cycle will be, helping you maintain a steady cash flow.

Benefits of Using Digital Invoice Templates

Using digital tools to create payment request documents offers numerous advantages over traditional methods. With the ability to automate, customize, and streamline the billing process, digital solutions can save both time and money, while also enhancing professionalism and accuracy. Whether you’re a small business owner or a freelancer, going digital simplifies how you manage and send financial documents.

Key Advantages of Digital Solutions

- Time Efficiency: Digital tools allow you to generate payment request documents in just a few clicks. Rather than manually writing out each document, you can quickly fill in the necessary details and send it out with minimal effort.

- Consistency and Accuracy: With pre-designed layouts, you can ensure that each document is structured consistently, reducing the likelihood of errors. Automatic calculations for totals, taxes, and discounts help ensure accuracy every time.

- Customization Options: Digital tools often provide a wide range of customizable features, allowing you to tailor documents to match your branding, client needs, or project specifics. From logo placement to color schemes, you can personalize documents easily.

Additional Benefits

- Environmental Impact: Digital solutions reduce paper waste, which is not only better for the environment but also eliminates the need for printing and physical storage.

- Security: Sending payment requests digitally ensures that your documents are delivered quickly and securely. Additionally, digital formats can be easily encrypted or password-protected, providing an added layer of security.

- Tracking and Notifications: Many digital tools include features that let you track when a document has been viewed or paid, offering you real-time updates and helping you stay on top of pending payments.

Digital Tools Comparison Table

Feature Manual Process Digital Solution Time to Create Hours Minutes Customization Limited Fully Customizable Tracking Capabilities None Real-time Tracking Environmental Impact High Low By adopting digital tools for your payment requests, you can enhance efficiency, improve accuracy, and save valuable time. The ability to customize, track, and securely

How Free Templates Help Save Money

Utilizing pre-designed documents is an effective way to reduce overhead costs while maintaining a professional appearance. Instead of paying for custom designs or hiring a graphic designer, you can access high-quality, ready-made layouts that can be easily personalized to suit your business needs. This approach allows you to allocate resources more effectively, helping you save money without compromising on quality.

Cost Savings in Various Areas

- Avoid Design Fees: By using readily available layouts, you eliminate the need for external design services, which can be expensive. Whether you’re a freelancer or a small business owner, these savings can add up quickly, especially if you regularly need to create similar documents.

- Minimize Software Expenses: Many pre-designed solutions are compatible with free or low-cost software, reducing the need for expensive design programs. This enables businesses to create polished documents without investing in costly tools or subscriptions.

- Increase Time Efficiency: Ready-made layouts allow you to quickly generate documents without spending time on complex design work. This time saved can be reinvested into other areas of your business, improving overall productivity.

Long-Term Benefits of Using Pre-Made Documents

- Scalability: As your business grows, you can continue to use these pre-designed solutions without additional costs, making it easier to scale your operations. Custom-made designs often require ongoing fees for updates and modifications, while pre-made layouts offer a one-time solution.

- Consistency: Using the same pre-designed layouts for all your documents ensures that your business maintains a consistent and professional image, which helps build trust with clients and partners. This consistency is more cost-effective than investing in a variety of custom designs.

In conclusion, using pre-made documents is a practical and cost-effective solution for businesses of all sizes. It enables you to keep your expenses low while still delivering professional-quality communication to your clients, helping you maintain a strong financial position in the long run.