Download Free Invoice Template XLS for Quick and Easy Billing

Managing payments and issuing financial documents is a crucial part of running any business. Whether you’re a freelancer or a large corporation, having an organized method to handle transactions can save time and reduce errors. The key to success lies in using well-structured files that are easy to edit, update, and track.

Using spreadsheets for creating billing documents is an excellent solution due to their flexibility and ease of use. These files can be customized to suit your business needs, allowing you to include necessary details like pricing, tax, and payment terms. The simplicity of these formats ensures that even those with minimal technical expertise can create professional and accurate records.

In this article, we’ll explore the advantages of using such files, offer guidance on how to set them up, and provide tips on how to use them efficiently for your business operations. Whether you’re handling a few transactions or managing large volumes of sales, this approach will streamline your financial management tasks.

Invoice Template XLS Download Guide

Creating and managing professional billing documents can be a complex task, but using an organized and customizable file format can significantly simplify the process. This guide will show you how to access and use pre-designed spreadsheets that help streamline your financial record-keeping. These documents are tailored to suit various business needs, ensuring that you can quickly generate accurate and professional records.

Getting started is simple. You can easily find ready-to-use files online that are fully customizable to include your specific details, such as customer information, product descriptions, and payment terms. Once you have the right file, you can start editing it to match your requirements without the need for complicated software or technical expertise.

By following this guide, you’ll learn how to find these editable files, customize them for your business, and begin using them immediately to improve your billing process. Whether you’re a small business owner or a freelancer, this approach will save you time and help you maintain organized financial records.

Why Use an XLS Invoice Template

Using a structured and customizable document for managing payments and financial transactions can save significant time and reduce errors. When you choose the right format, you gain the ability to easily input, adjust, and track essential data, such as amounts due, customer details, and payment deadlines. This helps you maintain accuracy and professionalism in every financial record.

Efficiency and Customization

One of the main benefits of using an editable spreadsheet is the flexibility it provides. These files can be quickly adjusted to suit various needs, whether you’re managing a small-scale business or handling a large number of transactions. The format allows for quick modifications, such as updating prices, adding new customers, or altering payment terms. This reduces the need to start from scratch with each new entry, saving you valuable time.

Improved Organization and Accuracy

Having a consistent format for all your financial documents ensures better organization and reduces the risk of mistakes. By using pre-set structures, you ensure that all the important details are included every time. Additionally, built-in features like automatic calculations can help reduce human error when summing totals or calculating taxes, leading to more accurate records.

How to Download an Invoice Template

Accessing ready-made documents for managing payments and transactions is a simple and efficient way to ensure your financial records are both professional and accurate. These files are available through various online platforms and can be quickly retrieved with just a few clicks. Below, we’ll walk you through the steps to get your customized file without any hassle.

Finding a Reliable Source

The first step is to find a trustworthy website offering editable financial documents. There are many platforms that provide free and paid versions, so be sure to choose one that meets your specific business needs. Look for sites that offer templates with clear descriptions and allow you to preview the document before accessing it. Some popular sources also provide additional features, such as user reviews or ratings, which can help guide your decision.

Saving and Accessing the File

Once you’ve selected the right document, simply click on the link or button provided to save the file to your computer. Most files are offered in a format that can be easily opened using spreadsheet software. After saving the file, you can begin customizing it for your business right away, adding the necessary details such as customer names, amounts, and terms.

Customizing Your XLS Invoice Template

Once you’ve selected and opened your document, the next step is tailoring it to suit your business needs. Customizing your file allows you to include essential details specific to your transactions, ensuring that every record reflects the unique requirements of your company. This flexibility makes it easier to generate consistent, professional paperwork for each customer or client.

Here are the key elements to consider when personalizing your document:

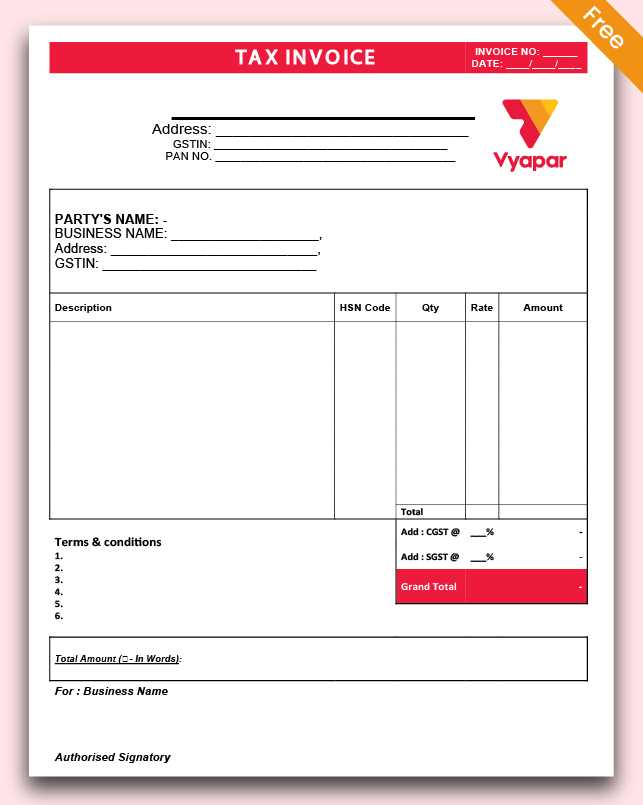

- Business Information: Add your company name, logo, contact details, and address to ensure your documents reflect your brand’s identity.

- Client Details: Include the recipient’s name, company (if applicable), and address. This ensures accuracy and helps avoid confusion during transactions.

- Transaction Information: Adjust the fields for products or services, unit prices, and quantities. Include any additional charges or discounts to reflect the full cost of the transaction.

- Payment Terms: Specify due dates, late fees, and payment methods to establish clear expectations with your clients.

- Currency and Tax Rates: Make sure to set the appropriate currency and include tax rates if applicable, based on the region or your business’s financial practices.

These customizations ensure that your records are tailored to your specific business needs, whether you’re dealing with a few clients or managing large-scale transactions. By personalizing these elements, you create documents that are not only functional but also professional and easy to understand for all parties involved.

Top Benefits of Excel Invoice Templates

Using structured spreadsheets for managing billing and payment records offers several advantages that can greatly improve efficiency and accuracy in your business processes. These files provide an easy-to-use, customizable solution that simplifies financial documentation, allowing businesses to maintain clear and consistent records. Below are some of the key benefits of using these versatile files.

Efficiency and Time-Saving

One of the primary benefits of using pre-made spreadsheets is the time saved in creating consistent documents. Once set up, the format allows for quick and easy updates, such as adding new entries or modifying details for each transaction. You can easily duplicate documents and make small adjustments for new clients or sales, eliminating the need to recreate the structure every time.

Improved Accuracy

With built-in features like automatic calculations and validation rules, these files reduce the chances of human error in calculations. When adding taxes, totals, or discounts, formulas can be applied to ensure precise results every time. This significantly enhances the overall accuracy of your records.

| Benefit | Description |

|---|---|

| Customization | These files are easily adjustable to match your specific business needs, from product lists to payment terms. |

| Organization | With a clear, structured format, these documents help you maintain consistent records and stay organized. |

| Professionalism | Using standardized, well-organized documents gives a professional image to your business interactions with clients. |

By incorporating these features into your workflow, you not only streamline your billing process but also ensure that each transaction is recorded accurately and professionally. These benefits can help businesses of all sizes improve their financial management and reduce administrative overhead.

Free vs Paid Invoice Templates

When choosing documents to manage payments and financial records, businesses often face the decision of whether to use free or premium versions. Both options offer distinct advantages depending on your specific needs and resources. While free versions can be a great starting point, paid versions tend to provide additional features and customization options that can save time and improve efficiency in the long run.

Free documents are usually a good option for small businesses or individuals just starting out. They are often simple and easy to use, providing the basic structure required to generate financial records without any upfront costs. However, the free versions may have limitations, such as fewer customization options or fewer built-in features like automatic calculations and advanced formatting.

Paid versions, on the other hand, offer a higher level of functionality. These files often come with advanced features like detailed templates, more customizable fields, and the ability to handle more complex financial transactions. Paid versions may also include customer support, additional design options, and integrations with accounting software, which can make your billing process more seamless and professional.

Ultimately, the choice between free and paid documents depends on the scale of your business and the level of complexity you require in your financial records. Free files are excellent for simple needs, while paid versions can offer the advanced functionality that larger businesses or those with specific requirements may need.

Common Features of XLS Invoice Templates

Spreadsheets designed for managing financial records are equipped with various features that make them efficient, customizable, and easy to use. These files are structured to handle important elements of business transactions, such as customer information, pricing, and payment details. Understanding the key features available in these files can help you make the most of them for your financial management needs.

Essential Features of Financial Record Files

These files typically come with several built-in elements to ensure they meet the needs of businesses of all sizes. Some common features include:

| Feature | Description |

|---|---|

| Predefined Fields | Fields for customer details, product descriptions, quantities, and prices are typically pre-arranged for quick entry. |

| Automatic Calculations | Formulas for adding up totals, applying discounts, and calculating taxes save time and reduce errors. |

| Customizable Layout | The layout can be adjusted to match your brand’s style, with options to add logos, colors, and change fonts. |

| Multiple Payment Methods | Fields for specifying payment terms, methods, and due dates allow you to manage different types of transactions. |

Advanced Features

In addition to the basic features, some more advanced options may include integration with accounting software, recurring billing setups, and the ability to generate reports from multiple entries. These advanced functions can help streamline business operations and ensure that your financial records are even more organized and accurate.

How to Save and Share Your Invoice

Once you’ve created a billing document, it’s important to save it correctly and share it with the relevant parties in a way that ensures security and professionalism. Saving the file in an appropriate format allows you to preserve your work and avoid any loss of data, while sharing it efficiently ensures that your clients or customers receive the necessary information in a timely manner. Below are the steps for saving and distributing your financial records.

Saving Your Document

To ensure your record is safely stored, follow these simple steps:

- Choose the Right Format: Save your file in a commonly used format such as PDF or Excel. PDFs are ideal for preserving the document’s layout and ensuring it can be viewed on any device without changes, while Excel formats are useful if you want to make future edits.

- File Naming: Use clear, descriptive filenames that include the client name or invoice number, such as “ClientName_Invoice_001.” This makes it easier to find and reference your documents later.

- Save Regularly: Remember to save your work often, especially before closing the file, to avoid losing any changes.

Sharing Your Document

After saving the file, it’s time to share it with your client or customer. Consider these methods for effective sharing:

- Email: Attach the saved document to an email, ensuring that the subject line is clear (e.g., “Payment Details for [Client Name]”). Include a brief message with the document to explain the purpose of the email.

- Cloud Storage: For larger files or for sharing with multiple people, upload the document to a cloud storage service like Google Drive or Dropbox. Share a link to the file directly with your client for easy access.

- Printed Copies: If necessary, you can also print a hard copy of the document and mail it to your client. This may be required in certain industries or for clients who prefer physical documents.

By saving your documents properly and using these efficient methods for sharing, you ensure that your transactions are both organized and professional. This approach helps you maintain a

Invoice Templates for Small Businesses

For small business owners, managing financial documents efficiently is essential to maintaining smooth operations. Using well-structured files to handle transactions helps save time, ensures accuracy, and presents a professional image to clients. These documents can be easily customized to meet the specific needs of your business, from tracking sales to managing payments and expenses.

Small businesses, whether a sole proprietorship or a growing startup, can benefit greatly from using financial record files that streamline billing and payment tracking. These customizable tools allow you to handle the basics of business transactions without the need for complex accounting software, making them an ideal choice for entrepreneurs with limited resources.

| Feature | Benefit for Small Businesses |

|---|---|

| Simple Structure | Easy to set up and use, perfect for business owners with little to no accounting experience. |

| Customizable Fields | Allows you to add your business details, customer information, and product or service descriptions easily. |

| Automatic Calculations | Helps to avoid manual errors by automating the calculation of totals, taxes, and discounts. |

| Professional Look | Enhances your business’s image by providing a polished, standardized format for every transaction. |

These advantages make financial record files an essential tool for small business owners who want to streamline their billing process and ensure that transactions are handled smoothly. Whether you’re just starting out or looking to improve your administrative tasks, using these files is an effective way to keep your business organized and your clients satisfied.

Creating Professional Invoices in Excel

Generating well-designed and organized billing documents is crucial for presenting a professional image to your clients. Using Excel to create these records offers flexibility and ease of use, enabling businesses to create detailed and accurate statements without the need for complex software. By following a few key steps, you can quickly produce professional-grade documents that help maintain clear financial transactions and promote trust with your customers.

Key Elements of a Professional Billing Document

When designing a document in Excel, certain elements must be included to ensure clarity and professionalism:

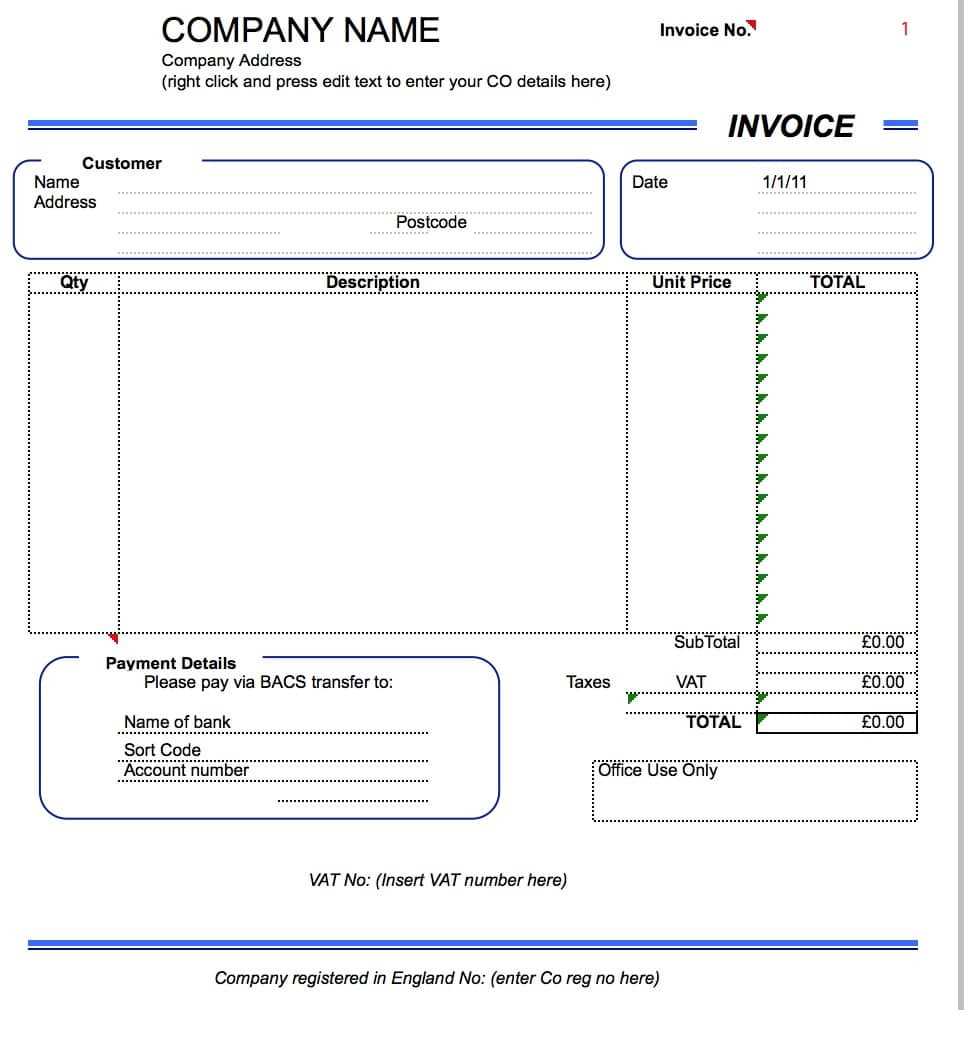

- Business Information: Always start with your company’s name, address, phone number, and email address. Including your logo can also enhance the appearance and brand identity of the document.

- Client Details: Clearly list the client’s name, company (if applicable), address, and contact information to ensure accurate and personalized communication.

- Transaction Details: Provide a breakdown of the services or products, including quantities, descriptions, and unit prices. This ensures transparency for both parties.

- Payment Terms: Outline due dates, accepted payment methods, and any late fee policies to set clear expectations with your clients.

Enhancing Your Document with Excel Features

Excel offers several features that can take your billing documents to the next level:

- Formulas: Use automatic calculations for totals, taxes, and discounts. Excel’s built-in functions allow you to easily add up totals and apply tax rates without needing to do the math manually.

- Formatting: Customize fonts, colors, and borders to make your document more visually appealing. This gives your billing records a polished and professional look.

- Saving and Sharing: After creating your document, save it in a secure format like PDF for easy sharing via email or cloud storage. This ensures that your client can easily access and view the document without formatting issues.

By incorporating these key elements and features, you can create billing documents in Excel that are not only functional but also look polished and professional. This approach will help ensure that your financial records are clear, organized, and presentable to your clients, ultimately boosting the credibility of your business.

How to Track Payments Using XLS Invoices

Tracking payments is a crucial part of managing any business’s finances, and using well-structured documents in a spreadsheet format can simplify this process. By incorporating payment tracking into your financial records, you can easily monitor outstanding balances, due dates, and payment statuses. This helps you stay organized, maintain accurate records, and ensure that clients or customers are paying on time.

Using a spreadsheet for this purpose provides the flexibility to include all relevant details such as payment amounts, dates, and method of payment. With the right setup, you can instantly see the status of all your transactions and quickly follow up with clients when necessary.

| Column | Description |

|---|---|

| Invoice Number | A unique identifier for each transaction, making it easy to reference specific records. |

| Amount Due | The total amount that is owed by the client for a specific transaction. |

| Payment Status | Indicates whether the payment has been made, is pending, or overdue. |

| Payment Date | The date on which payment was made, helping you track the timeliness of payments. |

| Payment Method | Documents how the payment was made, such as via bank transfer, credit card, or cash. |

By adding these columns to your spreadsheet, you can easily track and manage payments. Updating the payment status as soon as a payment is received helps you stay on top of your accounts, and using filters or conditional formatting can make it easier to highlight overdue payments or generate reports on payment history. This simple yet effective method ensures your financial records are always up to date and helps avoid confusion when managing multiple transactions.

Best Practices for Excel Invoice Design

Creating well-organized and visually appealing financial documents is essential for maintaining professionalism and ensuring clarity in business transactions. A good design not only improves the presentation of your records but also makes it easier for clients to understand the charges and payment terms. By following certain best practices, you can create documents that are both functional and attractive, enhancing the overall experience for both you and your customers.

Key Design Principles

When designing your documents in a spreadsheet program, consider the following best practices:

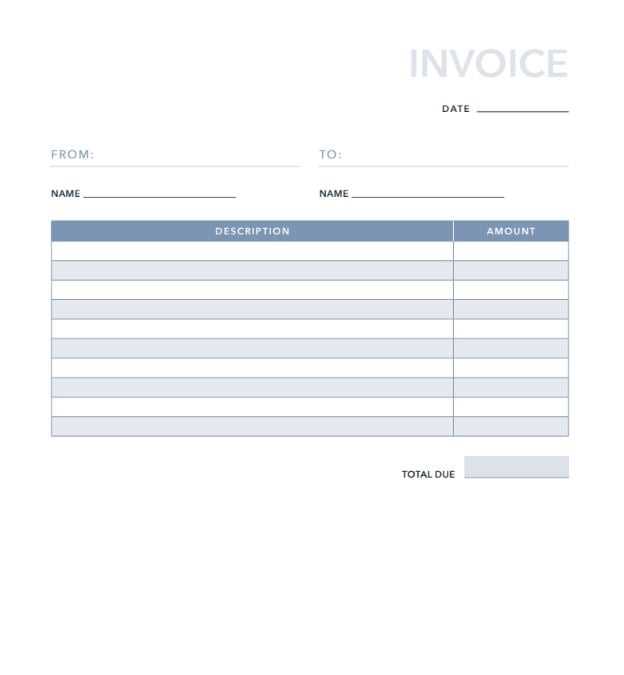

- Keep It Simple and Clean: Avoid cluttering the document with unnecessary information or complex formatting. A clean, simple design ensures the document is easy to read and understand.

- Use Consistent Fonts and Colors: Stick to one or two fonts and use colors that are easy on the eyes. This not only improves readability but also gives the document a professional and cohesive look.

- Organize Information Clearly: Structure your document with clear headings and sections, such as business details, client information, transaction list, and payment terms. This makes it easy for both you and your client to quickly find relevant information.

Useful Formatting Tips

Excel offers several formatting options that can enhance the visual appeal and functionality of your documents:

- Bold Headers: Use bold text for headings like “Total Amount Due” or “Payment Terms” to make these sections stand out and easy to locate.

- Cell Borders: Use borders to separate different sections of the document, such as payment details or product descriptions. This helps organize the layout and makes it look more structured.

- Alignment and Spacing: Properly align text and numbers for better clarity. For instance, align amounts to the right and descriptions to the left. Adequate spacing between rows and columns also makes the document less crowded.

By incorporating these design principles and formatting tips, you can create clear, professional documents that are not only easy to read but also reflect well on your business. A well-designed record ensures that both you and your clients have a smooth experience when reviewing transaction details, helping maintain positive business relationships.

Invoice Template Security and Privacy Tips

When managing financial records, safeguarding sensitive information is crucial for protecting your business and clients. Whether you’re storing or sharing billing documents, ensuring their security and privacy helps prevent unauthorized access and minimizes the risk of data breaches. By following a few key practices, you can enhance the confidentiality of your records while ensuring smooth and secure transactions.

One of the most important steps in securing financial records is to use strong encryption methods when saving or sharing documents. This prevents unauthorized individuals from accessing the sensitive details contained in your files, especially when they are transmitted electronically. Additionally, applying password protection to files adds an extra layer of security, making it harder for someone to view or edit the document without permission.

Best Practices for Protecting Your Documents:

- Use Strong Passwords: Always use complex, unique passwords for your files and accounts. Avoid simple or easily guessed passwords to ensure that unauthorized access is minimized.

- Limit Sharing: Share documents only with authorized individuals. When possible, use secure file-sharing platforms that offer end-to-end encryption to protect the information during transmission.

- Regular Backups: Always back up your documents on secure, encrypted cloud storage or external drives. This ensures that in case of a data loss or corruption, you can recover your records quickly.

- Update Software: Ensure that any software used to handle or store financial records is up to date with the latest security patches to prevent vulnerabilities.

By applying these practices, you can protect your business from the risks associated with data theft and unauthorized access. A secure approach to managing financial records ensures the integrity of your transactions and helps maintain trust with your clients.

How to Format Your Invoice Properly

Formatting your billing document correctly is essential for ensuring that your records are clear, professional, and easy for your clients to understand. A well-structured document helps prevent confusion and minimizes the likelihood of errors or disputes. Proper formatting also reflects positively on your business, demonstrating attention to detail and professionalism in your financial dealings.

When creating a billing document, it’s important to use a logical structure that includes all the necessary elements. Each section of the document should be clearly defined, and the information should be presented in an organized manner to facilitate easy reading and understanding.

| Section | Description |

|---|---|

| Business Information | Include your company name, address, phone number, email address, and logo (if applicable). This makes it easy for clients to recognize your business and contact you if necessary. |

| Client Details | List the client’s name, company (if applicable), and their contact information to ensure the document is personalized and directed to the correct recipient. |

| Transaction Details | Include a clear breakdown of the services or goods provided, including descriptions, quantities, unit prices, and totals. This ensures transparency and helps prevent misunderstandings about the charges. |

| Payment Terms | Clearly state payment due dates, accepted payment methods, and any late fees or interest that may apply to overdue payments. |

| Totals and Taxes | Ensure that tot

Integrating Your Invoice with Accounting SoftwareEfficiently managing financial records is crucial for businesses of all sizes. By integrating your billing documents with accounting software, you can streamline the entire process from tracking transactions to generating reports. This integration not only saves time but also reduces the chances of errors, allowing for seamless data transfer and up-to-date financial records. When you link your records to accounting systems, you automate much of the tedious work involved in tracking payments, expenses, and income. This integration can help you stay organized by automatically categorizing and recording transactions, eliminating the need for manual data entry. As a result, you gain greater insight into your business’s financial health and ensure that everything is properly documented and ready for tax season or audits. Many accounting platforms offer direct integrations with commonly used spreadsheet software, making it easy to import or export your data without disrupting your workflow. Additionally, these systems often provide built-in features for invoice tracking, financial reporting, and expense management, making it easier for you to keep your business’s finances in check. By integrating your records with accounting software, you enhance accuracy, efficiency, and overall productivity, allowing you to focus on growing your business rather than spending time on administrative tasks. This approach also ensures your financial data is secure, backed up, and easily accessible when needed. Tips for Quick Invoice Creation in ExcelCreating billing documents quickly and efficiently is important for any business. The faster you can generate and send out accurate records, the more time you can focus on other tasks. Excel offers powerful features that can help streamline the process and make invoice creation a breeze, even if you’re working with multiple clients or transactions. Here are some tips for speeding up the process of making billing records in Excel:

By incorporating these simple yet effective tips, you can create billing records in Excel faster, without compromising accuracy. This enables you to stay on top of your finances, improve client relations, and streamline your administrative tasks, ultimately boosting productivity and reducing stress. Managing Multiple Invoices in ExcelHandling multiple billing documents at once can become overwhelming, especially when you’re juggling several clients and transactions. However, with the right strategies in place, you can manage numerous records effectively within a single spreadsheet. Excel provides various tools to help you stay organized and track multiple transactions without losing track of key details. Here are some strategies for efficiently managing several billing records in Excel:

By using these techniques, you can efficiently manage multiple billing documents in Excel, saving time and reducing the risk of errors. Excel’s flexibility and functionality make it an ideal tool for businesses looking to stay organized and maintain accurate financial records, regardless of how many clients or transactions are involved. How to Automate Invoicing with Excel TemplatesAutomating the process of creating billing documents can save a significant amount of time and reduce errors. By setting up Excel to automatically generate these records, you can streamline your workflow, improve accuracy, and ensure consistency across all your financial paperwork. Excel’s features like formulas, macros, and data linking allow you to automate repetitive tasks, so you can focus more on your business operations. Here are some steps to help you automate the creation of billing records in Excel:

By implementing these automation techniques, you can reduce the time spent on generating billing records, decrease the risk of human error, and improve the efficiency of your business operations. Excel’s powerful automation features allow you to create streamlined, professional records with minimal effort, freeing up more time for g |