How to Use an Invoice with Remittance Slip Template for Efficient Payments

Managing financial transactions effectively is crucial for any business. One of the best ways to streamline this process is by using well-structured documents that facilitate smooth payments. These essential tools not only provide clarity to clients but also help maintain organized records for your company.

Designing a clear and professional document that includes essential payment details can significantly reduce misunderstandings and delays. Whether you’re handling recurring billing or one-time charges, ensuring your clients know exactly how to proceed with payment is key to maintaining a steady cash flow.

Incorporating all necessary information in a concise format not only boosts professionalism but also enhances the payment experience for your customers. By including clear instructions, payment options, and account details, you ensure that both parties can easily manage their transactions, resulting in fewer errors and faster processing times.

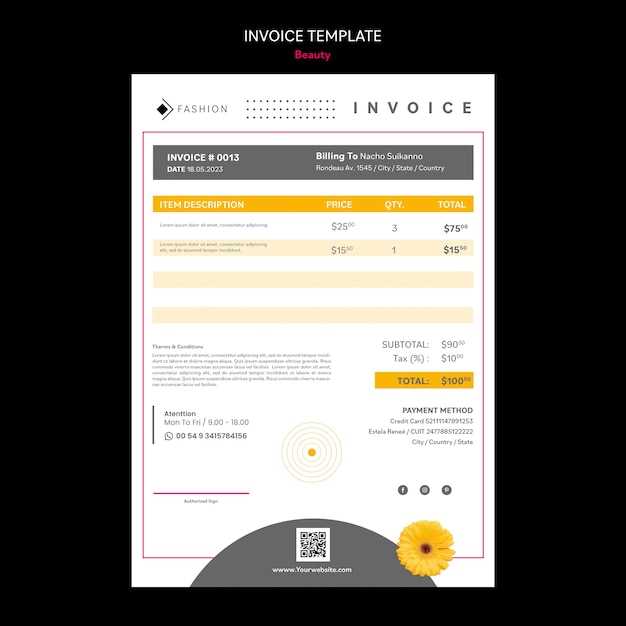

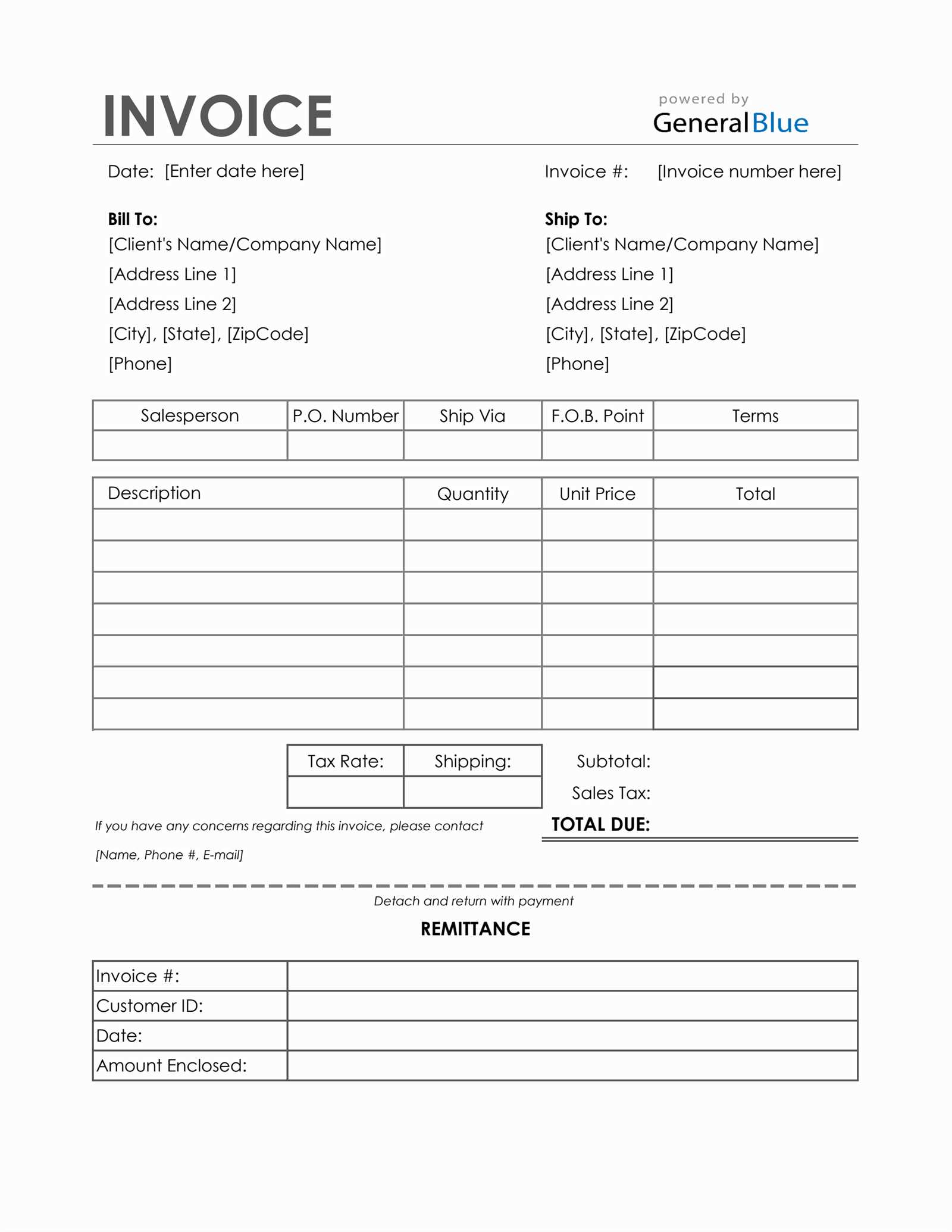

Invoice with Remittance Slip Template Guide

Creating a well-structured document to request payments and provide necessary instructions is an essential part of business operations. This guide will help you design an efficient tool that ensures both clarity and ease for your clients when making payments.

The key to an effective document lies in its layout and the inclusion of critical information that makes payment processes straightforward. By following a few simple steps, you can create a professional document that serves both as a request for payment and a guide for the recipient to complete the transaction smoothly.

- Start with essential business information: Include your company name, address, contact details, and tax identification number. This establishes the legitimacy of the request.

- Clearly state the amount due: Be specific about the total amount that is owed, including any relevant breakdowns for products or services provided.

- Provide payment options: Offer various methods for payment such as bank transfers, checks, or online payment platforms to accommodate different preferences.

- Include payment instructions: Outline how to submit the payment, including necessary reference numbers or account details to ensure correct processing.

- Offer a contact point for questions: Ensure that the recipient can reach out if there are any issues or clarifications needed regarding the payment.

By incorporating these key elements, you ensure that your document is both user-friendly and legally sound, reducing the likelihood of payment delays or confusion. With a simple, clear, and professional format, you make it easier for clients to comply with payment terms, helping to maintain healthy cash flow for your business.

Benefits of Using an Invoice Template

Using a structured document for payment requests can bring numerous advantages to your business. Not only does it streamline financial transactions, but it also helps ensure consistency, reduces errors, and improves overall professionalism. By incorporating a standardized format, businesses can maintain clarity in communication and keep everything organized, which in turn boosts efficiency and saves time.

Improved Accuracy and Efficiency

With a pre-designed format, you can ensure that all necessary information is included every time. This reduces the chances of mistakes such as missing key details or including incorrect figures, which are common in manually created payment requests. An automated layout makes it easy to input the right numbers and ensures consistent formatting.

Enhanced Professionalism

Using a well-crafted document demonstrates that your business is organized and detail-oriented. A clear, polished layout not only makes a positive impression on clients but also builds trust, showing that you take your financial processes seriously.

| Benefit | Explanation |

|---|---|

| Time-Saving | Pre-designed formats reduce the time spent creating documents from scratch, allowing for faster invoicing. |

| Consistency | Maintains uniformity across all outgoing payment requests, ensuring your communications are always clear and organized. |

| Reduced Errors | Minimizes the risk of mistakes by ensuring all necessary fields are included and calculated correctly. |

| Professional Appearance | Gives your business a polished and credible look, increasing customer confidence in your services. |

By adopting a standardized approach, you not only make it easier to request payments but also create a streamlined, professional experience for your clients. This leads to smoother transactions and a better overall relationship with your customers.

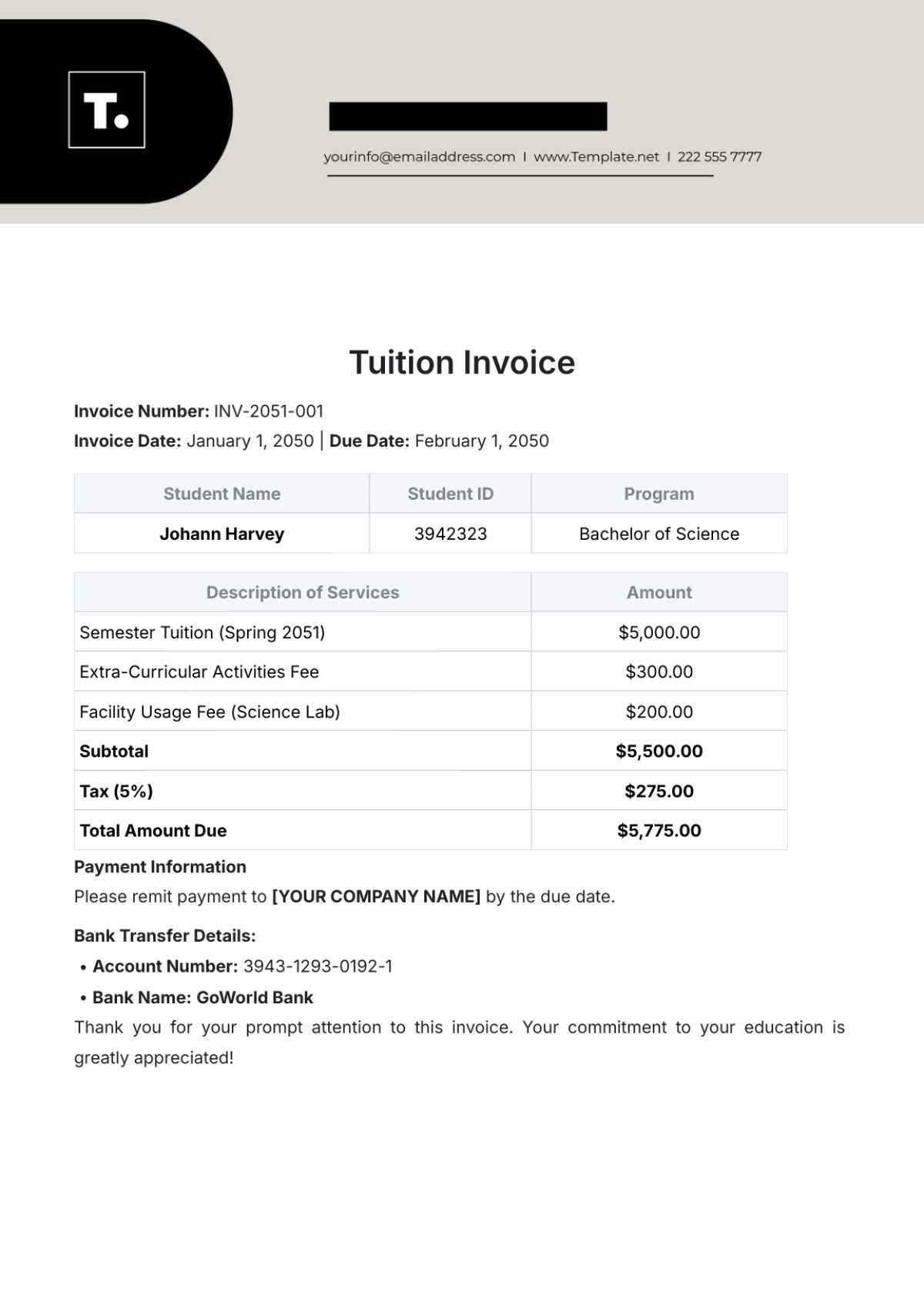

How to Customize an Invoice with Remittance Slip

Tailoring your payment request documents to match the unique needs of your business can enhance both functionality and client experience. Customizing a payment request form allows you to include all the necessary information while aligning the format with your brand’s identity. This process involves adjusting key sections to ensure that the document is both professional and user-friendly.

Step 1: Adjust Layout and Branding

Start by customizing the layout to reflect your company’s style. Include your logo, color scheme, and contact details to ensure the document feels cohesive with the rest of your communications. You can modify the header section to feature your company’s name and tagline prominently, making sure it looks polished and easy to recognize.

Step 2: Tailor Payment Details

Ensure that the details about the payment amount, due date, and payment methods are clearly stated. You can choose to list items individually or show a lump sum total, depending on your business model. For added clarity, provide a breakdown of any applicable taxes, discounts, or fees. This makes it easier for the client to understand the exact amount owed and how to process the payment.

To make it even more user-friendly, you can include a section for easy instructions on how to complete the transaction, along with any reference numbers or bank details required for accurate processing. By simplifying these instructions, you reduce the chances of errors and ensure smoother payment flow.

Tip: Offering multiple payment options, such as bank transfer, checks, or digital payment methods, gives clients flexibility and improves payment success rates.

Through these customizations, your payment request document will not only look professional but will also serve as a clear guide, helping both you and your clients keep track of payments efficiently.

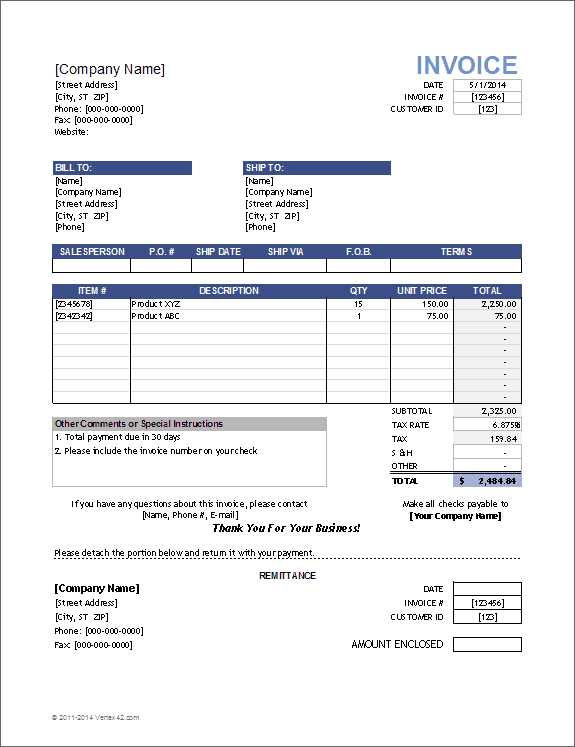

Choosing the Right Invoice Format for Your Business

Selecting the appropriate structure for your payment requests is essential to ensure smooth transactions and professional communication with clients. The format you choose should not only suit the nature of your business but also enhance clarity, minimize errors, and streamline payment processes. There are various options available, and finding the right fit depends on your business needs and the preferences of your customers.

One of the first factors to consider is the type of transactions your business typically handles. For example, if your services are recurring, you may need a format that allows for easy adjustments in amounts or billing cycles. On the other hand, if your business deals with one-time payments or large projects, a more detailed, itemized format might be appropriate.

Key Considerations When Choosing a Format

- Clarity: Ensure the format is easy to read, with clearly defined sections for services or products, amounts, payment terms, and contact information.

- Flexibility: Choose a structure that can be easily customized or adapted as your business evolves, such as adding or removing payment options or changing the layout to suit different clients.

- Professionalism: A well-organized layout gives clients a positive impression and demonstrates your attention to detail. Use consistent branding and professional fonts to maintain your company’s image.

Digital vs. Paper Formats

Another decision to make is whether to use digital or printed formats. Digital formats offer the advantage of quick delivery, easy archiving, and the ability to integrate with accounting software. On the other hand, paper formats might be necessary for businesses that require physical documentation or work with clients who prefer paper records. Ultimately, your choice will depend on your workflow and the preferences of your customer base.

By carefully considering your business model, client preferences, and the specifics of your transactions, you can choose the most effective structure for your payment request documents. A clear, organized format will not only improve your payment processes but also enhance customer satisfaction.

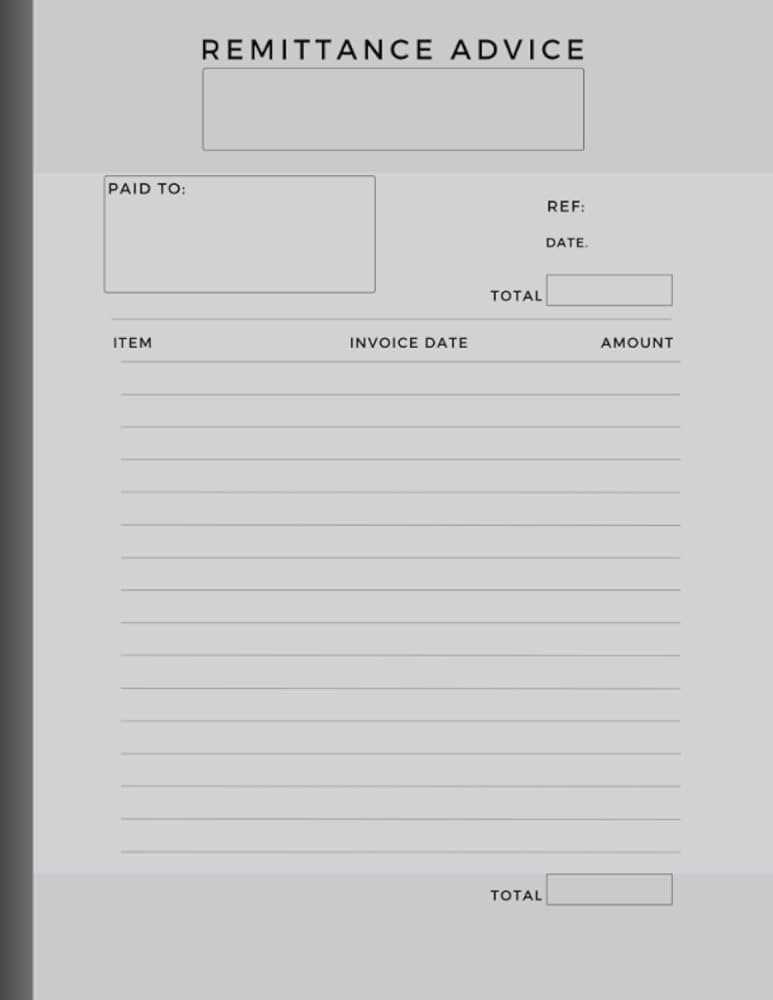

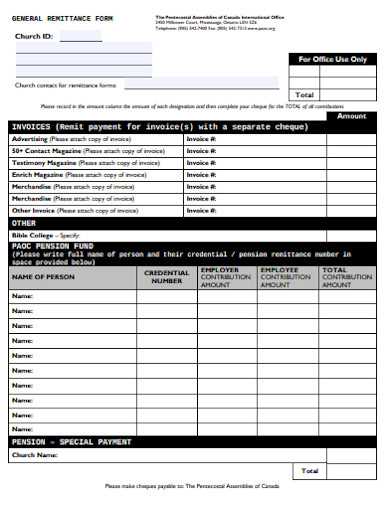

Why Remittance Slips Are Essential for Payments

When businesses handle payments, clarity and accuracy are paramount. Proper documentation ensures that transactions are processed smoothly and that both parties can track the movement of funds. A well-structured payment stub can streamline this process by clearly identifying the transaction and connecting it to the appropriate details. These simple documents help avoid confusion, errors, and delays in the payment process.

Clear Identification of Payments

One of the main benefits of using such payment documents is that they provide clear identification of the payment purpose. Without them, it might be challenging to match payments to the corresponding invoices or services. By attaching relevant details, the payer and payee can easily reference the transaction in the future. Key information typically included are:

- Invoice numbers

- Payment amounts

- Due dates

- Payer and payee details

Prevention of Payment Errors

These forms also help prevent mistakes during the payment process. By outlining the specific amount to be paid, the intended recipient, and the payment date, the chances of incorrect payments or missed deadlines decrease significantly. This is especially important when dealing with multiple transactions or when payments are made through different channels.

- Ensures the right person or business receives the correct amount.

- Helps in reconciling payments in the accounts.

- Reduces the need for follow-ups due to errors or ambiguities.

In conclusion, such documents offer essential benefits for both payers and recipients, ensuring that financial exchanges are well-documented and that the whole process is carried out smoothly and efficiently.

Why Remittance Slips Are Essential for Payments

When businesses handle payments, clarity and accuracy are paramount. Proper documentation ensures that transactions are processed smoothly and that both parties can track the movement of funds. A well-structured payment stub can streamline this process by clearly identifying the transaction and connecting it to the appropriate details. These simple documents help avoid confusion, errors, and delays in the payment process.

Clear Identification of Payments

One of the main benefits of using such payment documents is that they provide clear identification of the payment purpose. Without them, it might be challenging to match payments to the corresponding invoices or services. By attaching relevant details, the payer and payee can easily reference the transaction in the future. Key information typically included are:

- Invoice numbers

- Payment amounts

- Due dates

- Payer and payee details

Prevention of Payment Errors

These forms also help prevent mistakes during the payment process. By outlining the specific amount to be paid, the intended recipient, and the payment date, the chances of incorrect payments or missed deadlines decrease significantly. This is especially important when dealing with multiple transactions or when payments are made through different channels.

- Ensures the right person or business receives the correct amount.

- Helps in reconciling payments in the accounts.

- Reduces the need for follow-ups due to errors or ambiguities.

In conclusion, such documents offer essential benefits for both payers and recipients, ensuring that financial exchanges are well-documented and that the whole process is carried out smoothly and efficiently.

How Remittance Slips Simplify Payment Tracking

Tracking payments can often be a complex and time-consuming task, especially when multiple transactions are involved. Clear documentation that links a payment to a specific transaction helps both the payer and the recipient stay organized. Using a well-structured payment notification ensures that each payment is properly recorded, and all relevant details are easily accessible for future reference.

Streamlined Transaction Matching

One of the most significant advantages of using such payment forms is their ability to streamline the process of matching payments to the correct transactions. By providing essential details such as the amount, due date, and the payer’s identification, businesses can quickly link payments to outstanding balances. This minimizes the risk of misallocated funds and reduces the time spent searching for payment records.

- Payment reference numbers allow for quick matching between payments and outstanding amounts.

- Recipient information ensures payments are directed to the right party.

- Transaction notes help explain the purpose or nature of the payment.

Improved Financial Organization

Another benefit is that these forms help maintain an organized record of all financial transactions. By keeping track of payments in an orderly manner, businesses can quickly reconcile their accounts and assess the status of all open invoices or outstanding debts. This leads to better cash flow management and a reduction in errors when performing financial audits.

- Consistent record-keeping allows businesses to maintain an accurate financial history.

- Clear documentation helps reduce discrepancies and disputes.

- Quick referencing saves time during financial reviews or audits.

In conclusion, incorporating such payment documentation simplifies the entire tracking process, making it easier for businesses to maintain accurate records and ensure timely payments. The organized approach minimizes errors and helps businesses stay on top of their financial obligations.

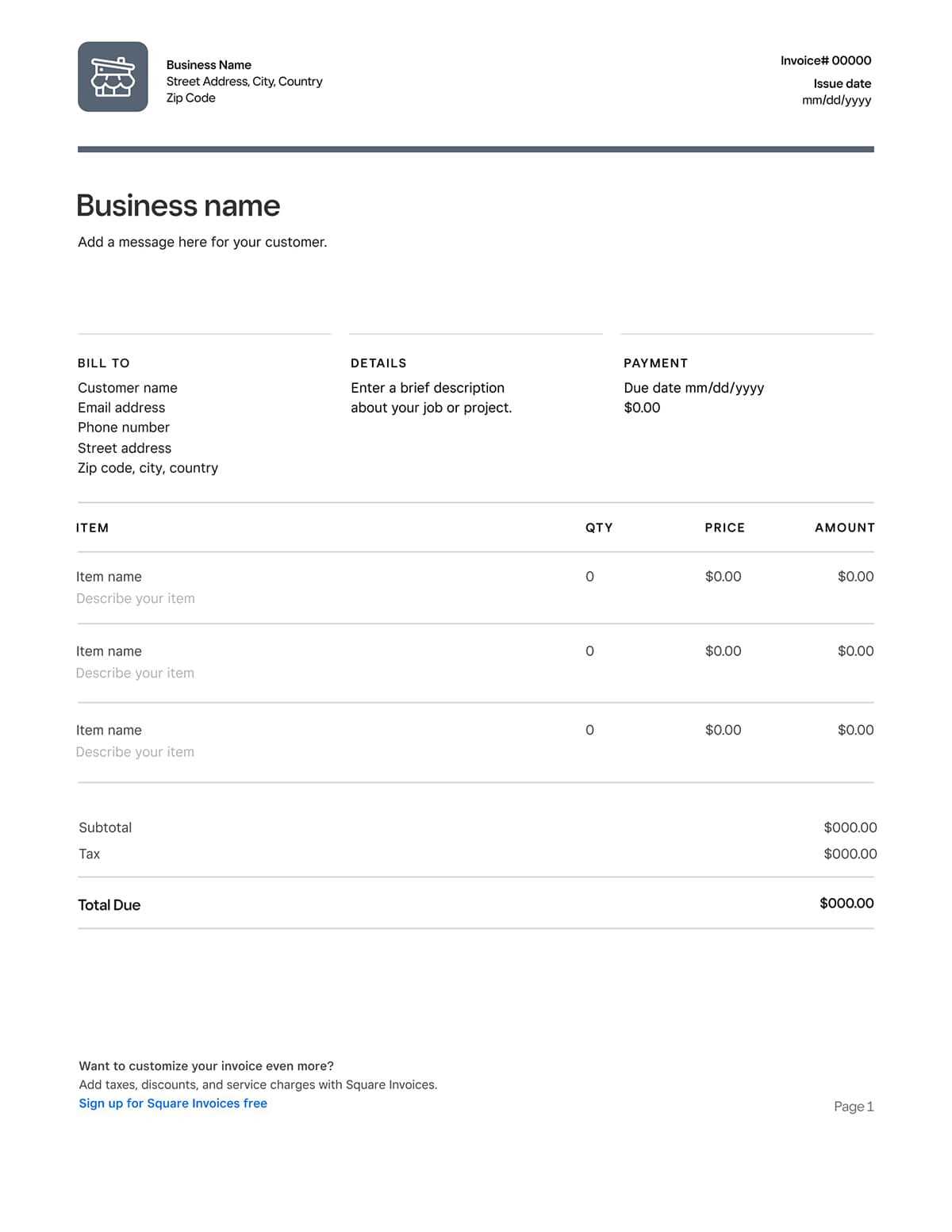

Top Features to Include in Your Invoice Template

When creating a document for payment processing, it’s crucial to include all the necessary details that ensure clarity and accuracy for both parties involved. A well-structured document not only helps in tracking payments but also plays a role in reducing confusion and errors. By including the right features, businesses can improve their billing process, ensure proper records, and make transactions more efficient.

Essential Information for Clear Communication

To avoid any misunderstandings, it’s important to clearly present all the critical details in the document. These pieces of information serve as the foundation for successful and accurate payment processing:

- Business details: Include your company name, address, contact information, and tax identification number.

- Client information: Ensure the recipient’s name, address, and contact details are clearly stated.

- Unique transaction number: Assign a distinct number to each document for easy reference and tracking.

- Clear breakdown of services or goods: Provide itemized details of the products or services provided, including quantities, descriptions, and rates.

Payment Terms and Deadlines

Including clear payment terms ensures both parties understand their obligations and deadlines. This helps in avoiding late payments and encourages timely settlements.

- Due date: Clearly state the deadline for payment to avoid any ambiguity.

- Accepted payment methods: List the available methods for making payments (bank transfer, credit card, etc.).

- Late payment penalties: Specify any late fees or interest charges that will apply if the payment is not made on time.

Easy Reference for Both Parties

Adding easy-to-read references like payment breakdowns or subtotal sections ensures that both the payer and the payee can quickly verify the details. A detailed, yet simple format improves the overall experience and reduces follow-up questions.

- Subtotal: Show the total amount before tax and any discounts.

- Tax calculations: Include a section for applicable taxes based on the total amount.

- Grand total: Provide the final amount that the client needs t

Top Features to Include in Your Invoice Template

When creating a document for payment processing, it’s crucial to include all the necessary details that ensure clarity and accuracy for both parties involved. A well-structured document not only helps in tracking payments but also plays a role in reducing confusion and errors. By including the right features, businesses can improve their billing process, ensure proper records, and make transactions more efficient.

Essential Information for Clear Communication

To avoid any misunderstandings, it’s important to clearly present all the critical details in the document. These pieces of information serve as the foundation for successful and accurate payment processing:

- Business details: Include your company name, address, contact information, and tax identification number.

- Client information: Ensure the recipient’s name, address, and contact details are clearly stated.

- Unique transaction number: Assign a distinct number to each document for easy reference and tracking.

- Clear breakdown of services or goods: Provide itemized details of the products or services provided, including quantities, descriptions, and rates.

Payment Terms and Deadlines

Including clear payment terms ensures both parties understand their obligations and deadlines. This helps in avoiding late payments and encourages timely settlements.

- Due date: Clearly state the deadline for payment to avoid any ambiguity.

- Accepted payment methods: List the available methods for making payments (bank transfer, credit card, etc.).

- Late payment penalties: Specify any late fees or interest charges that will apply if the payment is not made on time.

Easy Reference for Both Parties

Adding easy-to-read references like payment breakdowns or subtotal sections ensures that both the payer and the payee can quickly verify the details. A detailed, yet simple format improves the overall experience and reduces follow-up questions.

- Subtotal: Show the total amount before tax and any discounts.

- Tax calculations: Include a section for applicable taxes based on the total amount.

- Grand total: Provide the final amount that the client needs to pay, including all costs and adjustments.

By including these key features, businesses can create a more professional and transparent payment document, leading to smoother transactions and better financial management.

How to Design an Effective Remittance Slip

Creating a document that clearly communicates payment information is essential for ensuring smooth transactions and avoiding any confusion. A well-designed payment notification document serves as a useful reference for both the payer and the recipient, making it easier to track and process payments. A clear layout, logical flow of information, and a professional appearance all contribute to an effective design.

Key Elements to Include

To design an effective payment notification, it’s important to include essential details that allow both parties to identify and track the transaction with ease. The document should have a structured format that is easy to read and understand. Below are the key elements that should be included:

Element Description Business Information Include the name, address, contact information, and tax ID number of your company for reference. Client Information Provide the recipient’s name, address, and other relevant contact details. Transaction Details Include a unique transaction or reference number, the date, and the amount to be paid. Payment Method Specify the accepted payment methods (e.g., credit card, bank transfer, etc.). Due Date Clearly state the payment due date to avoid delays. Layout Tips for Clarity

The design should be simple, yet effective in delivering the necessary information. Consider the following tips to make the document more user-friendly:

- Use clear headers: Label each section clearly so that the payer can easily locate important information like the total amount, payment methods, and due date.

- Keep the format simple: Use a clean and organized layout, avoiding unnecessary graphics or complex design elements that could distract from the essential details.

- Highlight key information: Ensure important data, such as the total amount due and payment instructions, stand out using bold text or a larger font size.

By focusing on clarity, simplicity, and structure, businesses can create a document that helps streamline the payment process, reduces confusion, and ensures timely payments.

Common Mistakes to Avoid in Invoice Creation

Creating a payment request document may seem like a straightforward task, but small errors can lead to confusion, delayed payments, or even disputes. It’s crucial to ensure that all necessary details are included and presented clearly. Avoiding common pitfalls during the creation process can help maintain professionalism and keep the payment process smooth and efficient.

Top Errors in Document Creation

There are several common mistakes that businesses often make when preparing a payment request. Addressing these issues beforehand will help ensure that all transactions are processed without unnecessary delays or misunderstandings.

Error Consequences Missing or Incorrect Details Omitting key information such as business name, client address, or the transaction date can lead to confusion and delays in processing the payment. Unclear Payment Instructions If payment methods, account details, or due dates are not clearly stated, the recipient may face difficulty completing the transaction. Not Using Unique Reference Numbers Without distinct identifiers, it’s harder to track specific payments, which can lead to confusion when reconciling accounts or resolving disputes. Failure to Include Taxes or Discounts Not specifying taxes or discounts can result in discrepancies in the total amount owed, leading to possible mispayments or misunderstandings. How to Avoid These Mistakes

To prevent the issues mentioned above, ensure that all details are accurate and consistent. Here are a few tips to help avoid these common errors:

- Double-check all information: Before sending the document, verify that all fields are correctly filled out, including names, dates, and amounts.

- Clearly state payment methods and due dates: Provide simple and clear instructions on how and when payments should be made.

- Use unique reference numbers: Assign a specific transaction or reference number to each payment request to make tracking easier.

- Include all necessary calculations: List the breakdown of charges, including any taxes or discounts, to avoid confusion about the final total.

By carefully reviewing the document and avoiding these common mistakes, businesses can create a payment request that is clear, professional, and ensures timely payments.

Automating Invoice Creation with Templates

Streamlining the process of generating payment request documents can save businesses significant time and reduce human error. By utilizing automated systems, companies can create standardized documents quickly and accurately. Automating this process ensures consistency and allows staff to focus on more critical tasks while maintaining professional and precise records for each transaction.

Benefits of Automation

Automating the creation of these documents offers several advantages, particularly when handling a high volume of transactions. Here are a few reasons why automation can be a game-changer for businesses:

- Time-saving: Once set up, automated systems can generate payment requests in a fraction of the time it would take to do manually, allowing businesses to handle more transactions in less time.

- Reduced errors: Automation minimizes the chance of human mistakes, such as incorrect amounts, missing information, or inconsistent formats.

- Consistency: Automation ensures that every document is created in the same format, improving clarity and professionalism across all transactions.

- Efficiency: Once configured, automated systems require minimal ongoing input, freeing up valuable resources for other tasks.

How to Implement Automation

To implement an automated system for generating payment request documents, businesses should follow a few basic steps. The key is selecting the right tools and setting them up to match the company’s unique needs:

- Choose the right software: There are a variety of accounting tools and platforms that can automate document creation. Look for one that integrates seamlessly with your current accounting system and allows for easy customization.

- Set up default fields: Customize your system to include all necessary fields like business and client details, transaction numbers, and amounts that will be automatically populated for each document.

- Establish templates: Define the structure and design of your documents, ensuring that all essential elements are included (e.g., payment instructions, itemized charges, due dates). The system will use this as a foundation for every generated document.

- Regularly update and review: Ensure that the software stays up to date with any changes in pricing, tax laws, or business information. Review and refine templates as needed to adapt to changing needs.

By embracing automation, businesses can not only save time but also increase the accuracy and pr

Automating Invoice Creation with Templates

Streamlining the process of generating payment request documents can save businesses significant time and reduce human error. By utilizing automated systems, companies can create standardized documents quickly and accurately. Automating this process ensures consistency and allows staff to focus on more critical tasks while maintaining professional and precise records for each transaction.

Benefits of Automation

Automating the creation of these documents offers several advantages, particularly when handling a high volume of transactions. Here are a few reasons why automation can be a game-changer for businesses:

- Time-saving: Once set up, automated systems can generate payment requests in a fraction of the time it would take to do manually, allowing businesses to handle more transactions in less time.

- Reduced errors: Automation minimizes the chance of human mistakes, such as incorrect amounts, missing information, or inconsistent formats.

- Consistency: Automation ensures that every document is created in the same format, improving clarity and professionalism across all transactions.

- Efficiency: Once configured, automated systems require minimal ongoing input, freeing up valuable resources for other tasks.

How to Implement Automation

To implement an automated system for generating payment request documents, businesses should follow a few basic steps. The key is selecting the right tools and setting them up to match the company’s unique needs:

- Choose the right software: There are a variety of accounting tools and platforms that can automate document creation. Look for one that integrates seamlessly with your current accounting system and allows for easy customization.

- Set up default fields: Customize your system to include all necessary fields like business and client details, transaction numbers, and amounts that will be automatically populated for each document.

- Establish templates: Define the structure and design of your documents, ensuring that all essential elements are included (e.g., payment instructions, itemized charges, due dates). The system will use this as a foundation for every generated document.

- Regularly update and review: Ensure that the software stays up to date with any changes in pricing, tax laws, or business information. Review and refine templates as needed to adapt to changing needs.

By embracing automation, businesses can not only save time but also increase the accuracy and professionalism of their financial documentation, leading to better client relationships and smoother operations.

Legal Requirements for Invoices with Remittance Slips

When creating documents for payment requests, businesses must ensure that they comply with local regulations to avoid legal issues. These documents often serve as both a record of the transaction and a formal request for payment, making it essential to include all required information. Adhering to legal standards helps businesses maintain transparency, protect themselves in case of disputes, and ensure smooth financial transactions.

Key Legal Information to Include

In many jurisdictions, specific information must be included in every document sent to request payments. The purpose is to provide clear details that ensure the transaction is transparent and easily verifiable by both parties. Below are some of the mandatory elements that businesses should always include:

- Business Identification: The name, address, and tax identification number of the issuing business are typically required for legal and tax purposes.

- Client Information: The recipient’s full name or business name, address, and contact information should be clearly stated.

- Transaction Details: Clear breakdowns of the goods or services provided, the total amount due, applicable taxes, and any discounts offered are essential.

- Due Date and Payment Terms: Businesses must specify the exact date by which payment is expected and any penalties or late fees for delayed payments.

- Legal Disclaimers: Depending on local laws, some businesses must include specific disclaimers regarding their terms of service or other contractual obligations.

Compliance with Tax Regulations

Another crucial aspect of legal requirements is ensuring that the document complies with tax laws, which can vary significantly by region. Many countries require businesses to include detailed information regarding taxes, such as the tax rate applied and the total tax amount. Failure to provide accurate tax information could result in fines or issues during tax audits.

- Tax Identification Numbers: Both the business and, in some cases, the recipient may need to provide their tax IDs on payment request documents.

- Tax Rate and Amount: The document must clearly outline the tax rate applied to the transaction and the final amount of tax collected.

- Currency Information: Some jurisdictions require the currency to be explicitly stated to avoid confusion during cross-border transactions.

By carefully following these legal requirements, businesses can avoid costly mistakes, ensure smooth financial operations, and protect themselves in the event of legal or tax-related disputes.

How to Protect Your Business with Detailed Invoices

Accurate and thorough documentation is essential for protecting your business in the event of disputes, misunderstandings, or audits. A well-drafted payment request document not only facilitates smooth transactions but also acts as a legal safeguard for both parties involved. By including all the necessary details, businesses can ensure they have a clear, defensible record of their transactions.

Key Details to Include for Protection

When crafting a payment request, it’s important to include specific details that help protect your business and ensure that all terms are clear. The following elements can be particularly useful in preventing disputes and securing your legal standing:

- Clear Itemization: Break down the goods or services provided with precise descriptions, quantities, and rates. This will help prevent any confusion about what the payment is for.

- Payment Terms: Clearly state the amount due, due date, and any late fees or interest that may be applied. This ensures both parties understand their obligations from the start.

- Client and Business Details: Include both your and the client’s full legal names, addresses, and contact information. This makes it easier to identify each party in case of any legal issues.

- Unique Reference Number: Assign a unique transaction or reference number to each request. This will make it easy to track payments and resolve any discrepancies later.

- Signed Agreement (if applicable): If the terms of the sale are based on a prior agreement, include references to the signed contract or provide a copy to back up the terms.

Using Detailed Documents for Legal Protection

In addition to the practical benefits, detailed payment documents can also act as a form of protection during legal proceedings. Should a dispute arise, these documents can serve as valuable evidence, ensuring that both parties are clear about the terms of the agreement.

- Proof of Delivery: If the product or service was delivered, include a signed acknowledgment or reference to the shipping confirmation, which can help demonstrate fulfillment of the order.

- Clear Payment History: Maintaining a clear record of payments, along with dates, amounts, and payment methods, provides a solid history to back up your claims in case of non-payment.

- Legal Recourse Clauses: Include any relevant legal clauses or disclai

How to Protect Your Business with Detailed Invoices

Accurate and thorough documentation is essential for protecting your business in the event of disputes, misunderstandings, or audits. A well-drafted payment request document not only facilitates smooth transactions but also acts as a legal safeguard for both parties involved. By including all the necessary details, businesses can ensure they have a clear, defensible record of their transactions.

Key Details to Include for Protection

When crafting a payment request, it’s important to include specific details that help protect your business and ensure that all terms are clear. The following elements can be particularly useful in preventing disputes and securing your legal standing:

- Clear Itemization: Break down the goods or services provided with precise descriptions, quantities, and rates. This will help prevent any confusion about what the payment is for.

- Payment Terms: Clearly state the amount due, due date, and any late fees or interest that may be applied. This ensures both parties understand their obligations from the start.

- Client and Business Details: Include both your and the client’s full legal names, addresses, and contact information. This makes it easier to identify each party in case of any legal issues.

- Unique Reference Number: Assign a unique transaction or reference number to each request. This will make it easy to track payments and resolve any discrepancies later.

- Signed Agreement (if applicable): If the terms of the sale are based on a prior agreement, include references to the signed contract or provide a copy to back up the terms.

Using Detailed Documents for Legal Protection

In addition to the practical benefits, detailed payment documents can also act as a form of protection during legal proceedings. Should a dispute arise, these documents can serve as valuable evidence, ensuring that both parties are clear about the terms of the agreement.

- Proof of Delivery: If the product or service was delivered, include a signed acknowledgment or reference to the shipping confirmation, which can help demonstrate fulfillment of the order.

- Clear Payment History: Maintaining a clear record of payments, along with dates, amounts, and payment methods, provides a solid history to back up your claims in case of non-payment.

- Legal Recourse Clauses: Include any relevant legal clauses or disclaimers that explain what will happen in the case of non-payment or breach of contract. This provides a clear legal path for resolving issues.

By including these essential details and ensuring clarity, businesses can protect themselves from potential risks, avoid misunderstandings, and streamline their payment processes. Thorough documentation acts as both a preventative measure and a valuable resource in case of disputes.