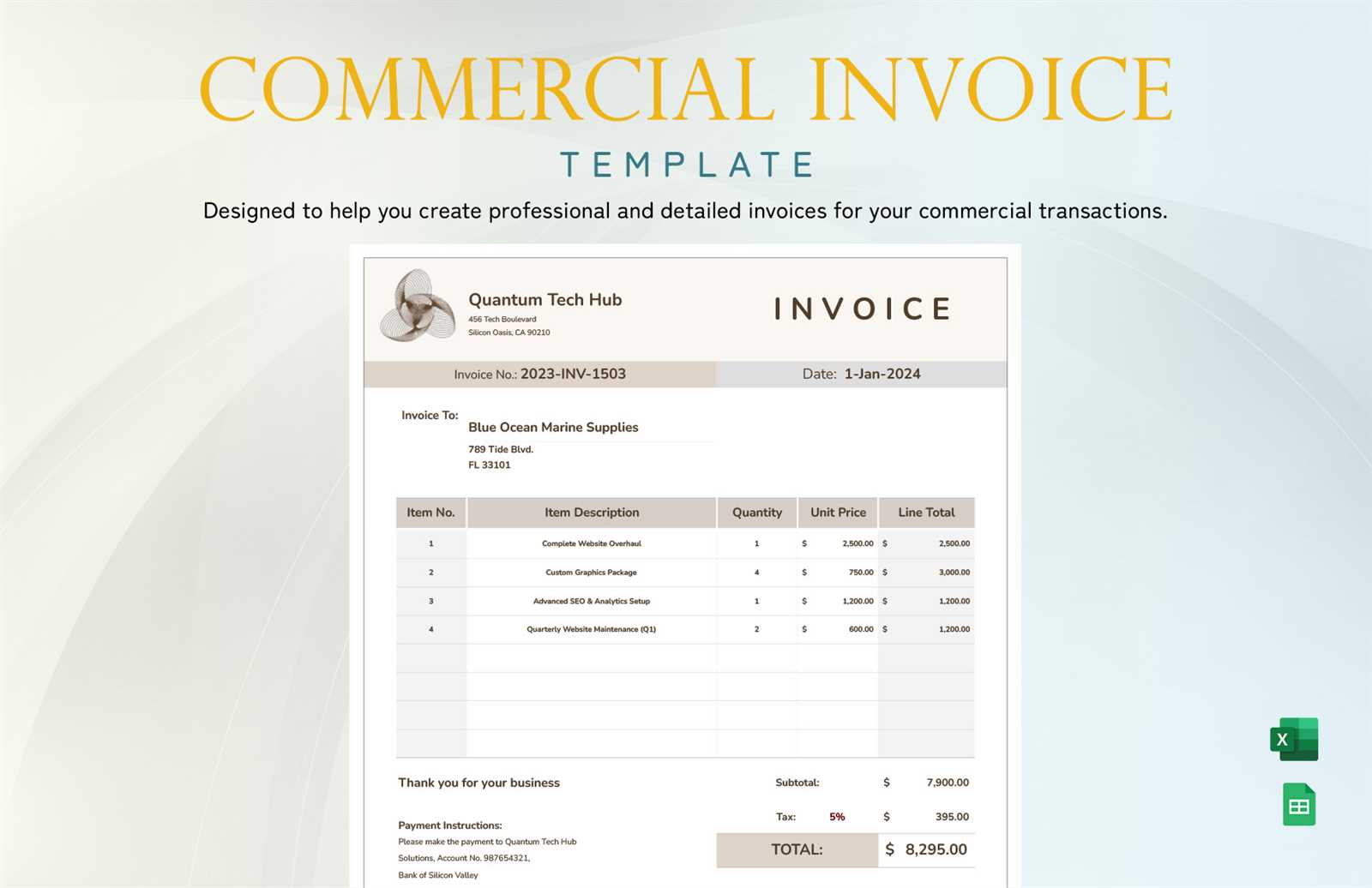

Commercial Invoices Template for Streamlined Business Transactions

In the world of business, maintaining clear and professional documentation for transactions is essential. Having a standardized structure for billing ensures that both parties understand the terms of exchange and can proceed smoothly with the financial process. These well-organized records not only streamline the workflow but also help avoid confusion and potential disputes.

By utilizing ready-made structures for financial statements, companies can save significant time and reduce errors. Whether you’re a small entrepreneur or part of a larger organization, adopting such methods will improve your invoicing system. Structured forms help present key details like product descriptions, amounts, and due dates in a consistent manner, making it easier to manage payments and track sales.

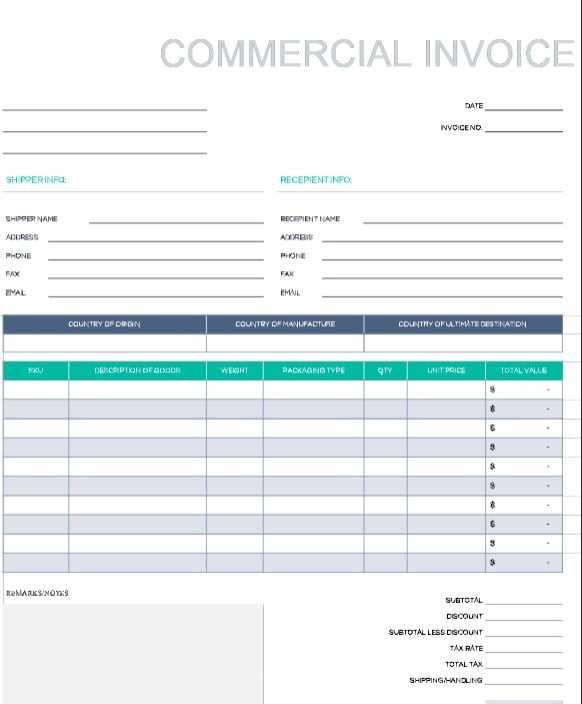

These solutions can be tailored to fit your specific business needs, from simple designs to more comprehensive formats. The choice of format is crucial, as it should align with the scale of your operations and the preferences of your clients. Choosing the right layout is one of the first steps toward creating an efficient and professional approach to handling financial documentation.

Billing Document Guide

Creating professional billing records is an essential task for any business. A well-organized format ensures clarity and reduces the likelihood of errors, making it easier to manage financial transactions. By following a structured approach, you can maintain consistency across your financial documents and improve communication with clients.

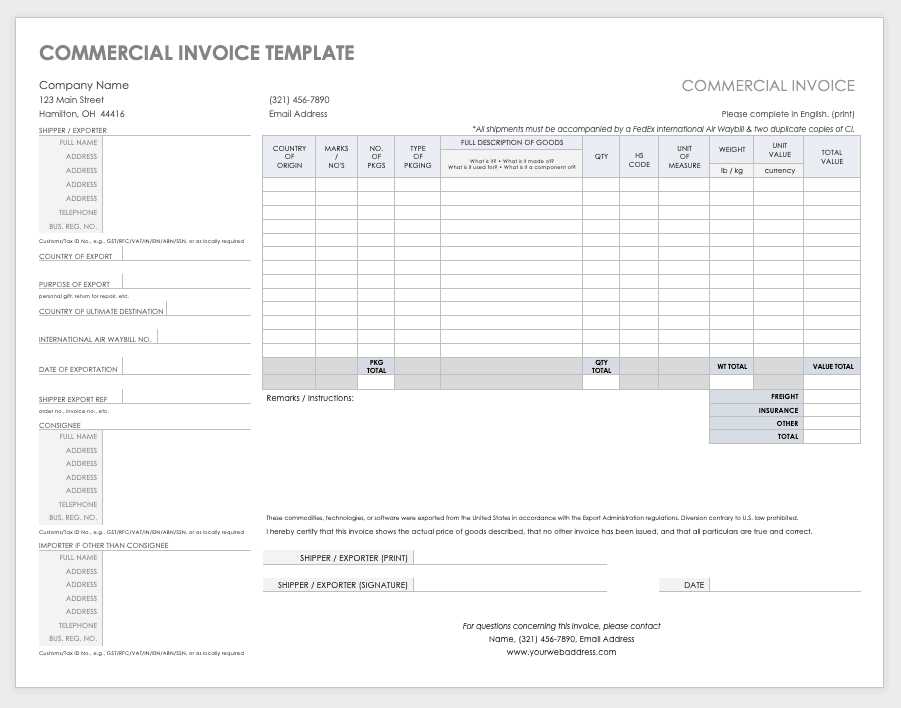

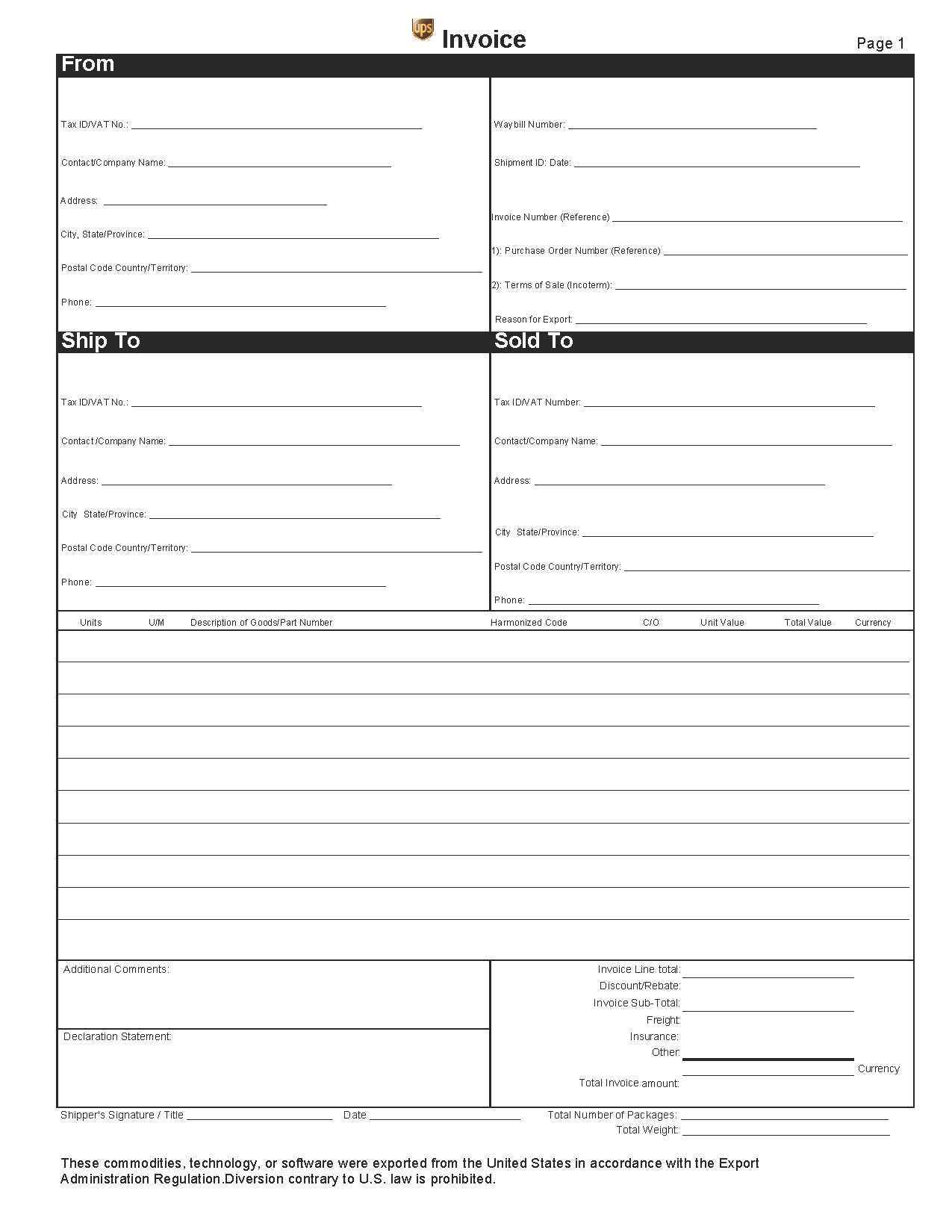

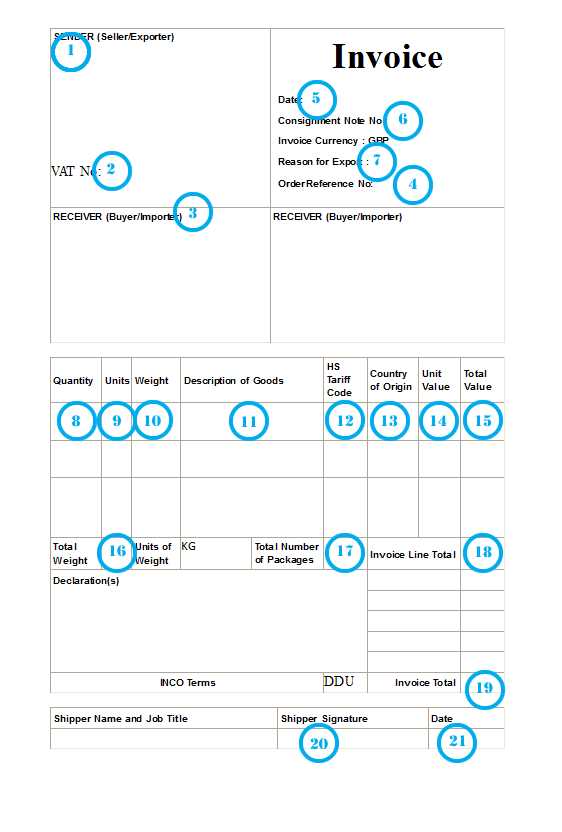

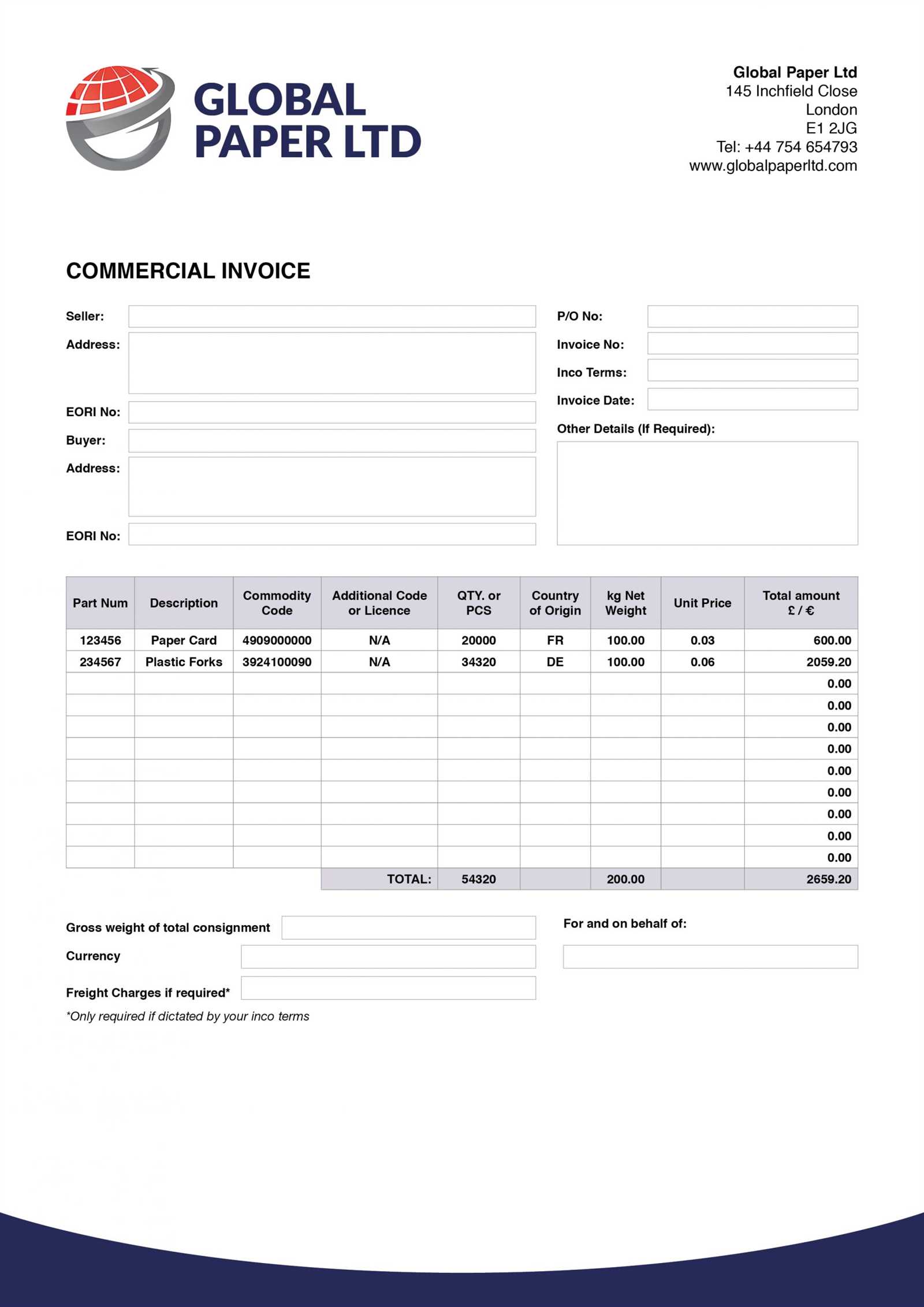

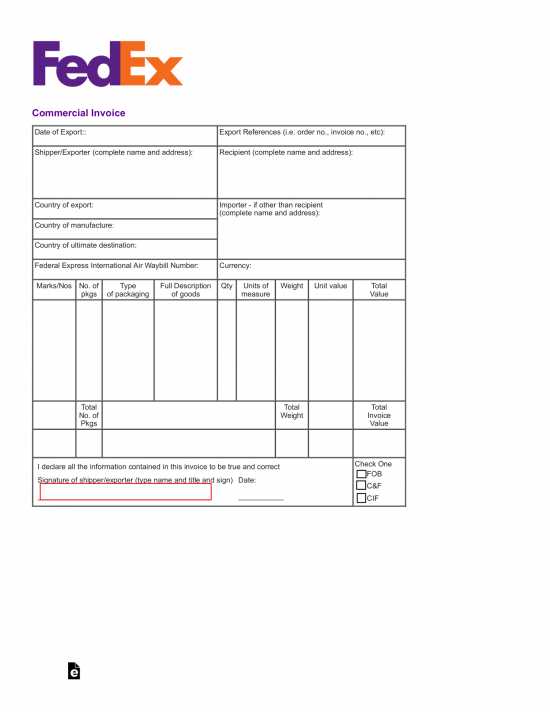

When designing these documents, it’s important to include key information such as the buyer’s and seller’s details, a description of the goods or services provided, payment terms, and any applicable taxes or fees. These elements help prevent misunderstandings and provide a clear breakdown of the transaction. Accurate formatting allows for quick reference and smooth processing of payments.

There are many ways to create these forms depending on the complexity of your business. Whether you prefer a simple structure or a more detailed design, customizing the format to fit your specific needs will help ensure the document meets both legal and professional standards. Choosing the right format based on the type of transaction and your industry will improve both efficiency and accuracy in your billing process.

What is a Billing Document Format

A billing document format is a standardized structure used by businesses to detail the terms and conditions of a transaction between the buyer and the seller. It serves as an official record of the goods or services provided, the agreed price, and the payment terms. This structure helps ensure both parties are clear about the financial aspects of the deal.

These documents are essential for maintaining accuracy and consistency in the financial workflow of a company. By following a predefined layout, businesses can quickly generate these records, reducing the risk of missing key details and improving efficiency in processing payments. Such formats often include fields for product descriptions, quantities, prices, and payment deadlines.

Benefits of Using Billing Document Formats

Utilizing a standardized structure for your financial records offers numerous advantages to businesses of all sizes. These ready-made designs help streamline the process of documenting transactions, ensuring all necessary details are included accurately and consistently. By following a structured approach, businesses can save time and reduce the risk of errors in their records.

One of the key benefits is increased efficiency. With a predefined layout, employees can quickly generate documents without having to design each one from scratch. This not only speeds up the billing process but also enhances professionalism. Moreover, using a consistent format

Essential Components of a Billing Record

A well-structured billing document should include several key elements to ensure clarity and accuracy. These components are crucial for both the seller and the buyer to understand the terms of the transaction and avoid any misunderstandings. The main purpose of these elements is to provide all the necessary details in a clear and organized manner, facilitating smooth business operations.

Key Details for Accurate Documentation

Every billing record should contain specific information that outlines the transaction’s essential terms. This typically includes the buyer and seller details, product or service descriptions, prices, and payment terms. These components ensure that both parties are on the same page regarding the specifics of the deal.

| Component | Description |

|---|---|

| Seller Information | Includes the name, address, and contact details of the seller. |

| Buyer Information | Details of the buyer, including their name and address. |

| Product/Service Description | Clear descriptions of the items sold or services rendered. |

| Pricing Details | Breakdown of the costs for each item or service. |

| Payment Terms | Information about due dates, payment methods, and any late fees. |

| Invoice Number | A unique identifier for the billing record for easy tracking. |

Additional Considerations

While the components listed above are the foundation of any billing record, there are other details that may be relevant depending on the nature of the business. These may include taxes, shipping information, and any discounts or promotional offers applied to the transaction. Including all relevant information ensures transparency and helps avoid potential disputes.

How to Customize a Billing Document Format

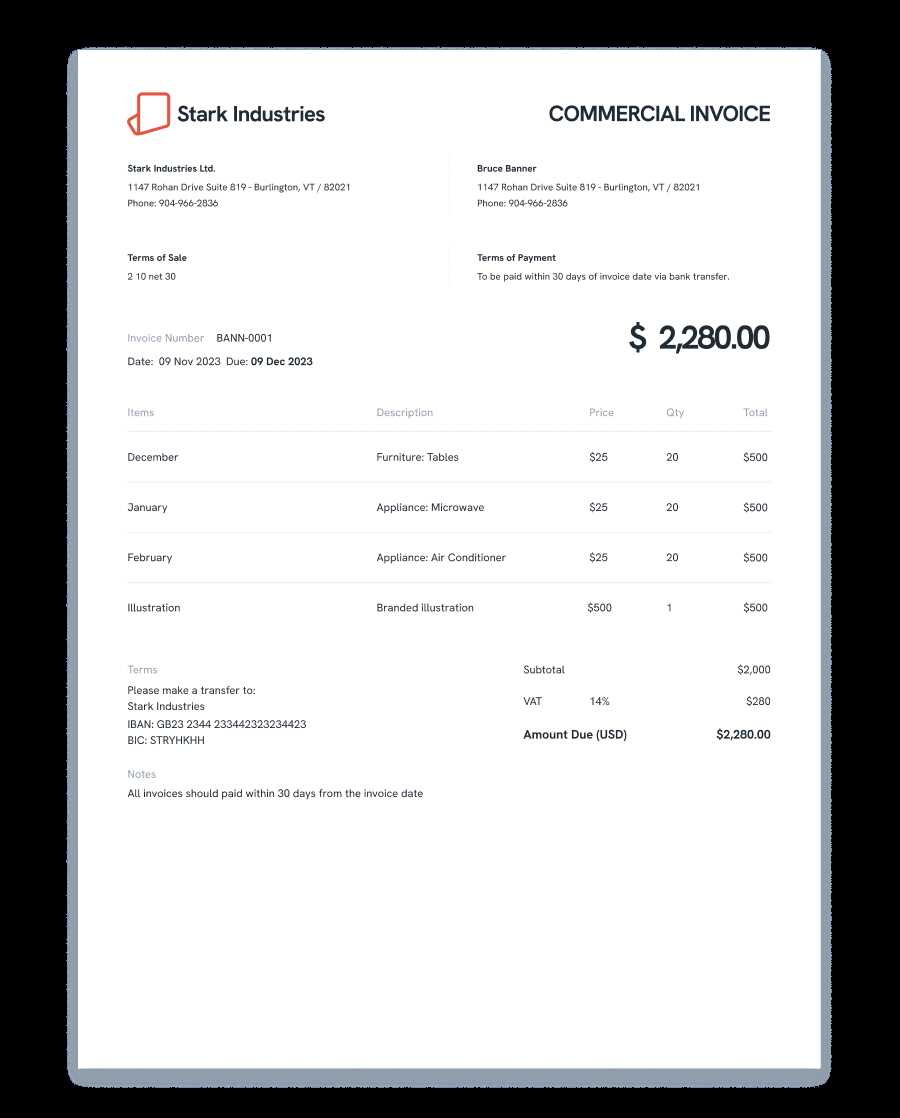

Customizing a billing document is an essential step for businesses that want to tailor their records to specific needs. By adjusting the layout, design, and included information, companies can create documents that better reflect their brand and make the transaction process more efficient. Customization not only makes the documents more professional but also ensures they include all relevant details for smooth transactions.

Modifying Basic Information

The first step in customizing a billing record is to modify the basic details. This includes updating your business’s name, logo, and contact information to ensure that the document is branded correctly. Additionally, make sure to include the appropriate fields for buyer information, product or service descriptions, and payment terms. These elements should be clearly labeled and easy to locate on the document.

Enhancing the Layout and Design

Beyond the basic details, adjusting the layout and design of the document can further enhance its readability and professionalism. This may involve changing the font style, size, and color to align with your business’s branding. You may also choose to add a header or footer that includes additional company information, such as a website URL or customer service contact details. Clear sections and adequate spacing make it easier for recipients to review the details of the transaction.

Common Mistakes in Billing Documents

Even with a standardized structure, errors can still occur when creating financial records. These mistakes can lead to confusion, delayed payments, and even disputes between businesses and clients. Understanding the most common errors can help prevent them, ensuring smoother transactions and more reliable record-keeping.

Key Errors to Avoid

There are several common mistakes that businesses often make when preparing their financial records. These errors can affect the clarity of the document and create misunderstandings. Here are some of the most frequent mistakes:

- Incorrect Contact Information: Failing to include accurate seller or buyer details, such as addresses or phone numbers, can delay communication and cause confusion.

- Missing or Incorrect Payment Terms: Not specifying the payment deadline or including incorrect terms can lead to delayed payments and frustration.

- Inaccurate Pricing or Quantity: Errors in product descriptions, prices, or quantities can cause disputes over charges.

- Omitting Tax Information: Not including the applicable tax rates or leaving out important tax details can result in compliance issues.

How to Avoid These Errors

To ensure accuracy and avoid these common mistakes, follow these simple guidelines:

- Double-check all buyer and seller details before finalizing the document.

- Always include a clear payment schedule and specify any late fees or early payment discounts.

- Review all pricing and quantities carefully to ensure they match the agreed terms.

- Include any relevant tax details, ensuring they comply with local laws and regulations.

By being mindful of these common mistakes, businesses can create accurate, professional billing records that foster positive relationships with clients and streamline their financial operations.

Best Practices for Billing Document Design

Designing clear and professional financial documents is essential for ensuring that both parties involved in a transaction can easily understand the terms. A well-designed record not only improves readability but also strengthens the reputation of your business. Following best practices in document design can make the process smoother and more efficient for everyone involved.

Key Design Principles

When creating financial records, it’s important to keep the design simple, clean, and consistent. The layout should be easy to follow, with important information easily accessible. Here are some key principles to consider:

- Clarity: Make sure that the document is easy to read by using a clear font and well-organized sections.

- Consistency: Use the same format for every document to ensure consistency across your business records.

- Branding: Include your business logo and colors to maintain a professional appearance that reflects your company identity.

- Legibility: Ensure that the font size is large enough for easy reading and that there is sufficient contrast between the text and background.

Essential Elements in the Design

While the design is important, the structure and layout should also highlight key details. A well-organized document will help prevent errors and make it easier for the recipient to find important information. Some essential elements to include are:

- Contact Information: Clearly display both the buyer’s and seller’s contact details, including phone numbers and addresses.

- Itemization: List each product or service provided along with their quantities and unit prices.

- Payment Information: Include payment terms, such as due dates and methods of payment.

- Subtotal and Taxes: Ensure all amounts are clearly shown, including taxes and any discounts.

By adhering to these design principles and including the necessary details, businesses can create professional, efficient billing documents that foster trust and minimize errors.

How Billing Document Formats Save Time

Using a predefined structure for creating financial documents can significantly reduce the amount of time spent on administrative tasks. With a ready-made layout, businesses can generate accurate records quickly, without the need to manually input details every time. This streamlined approach allows companies to focus more on their core activities rather than spending valuable time on paperwork.

Efficiency in Document Creation

By utilizing a consistent format, businesses eliminate the need to design each record from scratch. This not only speeds up the process but also reduces the likelihood of errors that could arise from inconsistent formatting. With fields already in place for buyer details, pricing, and payment terms, all that’s left to do is fill in the relevant information.

Consistency Across Transactions

Another time-saving benefit is the consistency that comes with using a predefined structure. When businesses use the same format for every transaction, they can quickly recognize and process the necessary details, which speeds up both the creation and the review of records. Familiarity with the format helps both employees and clients understand the document more easily, reducing the time spent answering questions or correcting mistakes.

Incorporating these ready-made formats into everyday operations makes the billing process faster and more efficient, saving valuable time that can be directed elsewhere in the business.

Choosing the Right Document Format for Your Business

Selecting the right format for financial records is a critical decision for any business. The format you choose should reflect the needs of your business while also being functional and easy to use. A well-suited document format helps streamline transactions, ensuring accuracy and professionalism while reducing administrative workload.

Consider Your Business Needs

Every business has unique requirements when it comes to documenting transactions. When choosing a format, consider factors such as the type of products or services you offer, your target market, and the complexity of your pricing structure. For example, if your business deals with bulk orders or complex services, you may need a format that allows for detailed itemization and clear payment terms.

Professionalism and Branding

Beyond functionality, the format should align with your business’s branding. A professional and consistent design reinforces your company’s identity and helps create a positive impression with clients. Choose a format that includes your logo, contact details, and follows your company’s visual style. A clean, well-organized layout with clear headings and sections makes the document easier to read and understand.

Ultimately, the right format will balance usability and branding, ensuring smooth transactions and enhancing your company’s professional image.

Automating Document Creation with Predefined Formats

Automating the creation of financial records can significantly improve efficiency by reducing manual work and minimizing human errors. By utilizing predefined formats, businesses can automate key steps in document creation, such as populating client information, pricing, and terms. This streamlining of the process saves time and ensures consistency across all records.

Benefits of Automation

Automating document creation offers several advantages. First and foremost, it reduces the time spent on administrative tasks. With automated systems, businesses can generate accurate records instantly, simply by inputting the necessary data. This allows employees to focus on more critical aspects of the business, such as customer service or strategic planning.

How to Implement Automation

Implementing automation for document creation is easier than ever with modern software solutions. Many tools allow you to create and store predefined formats, which can then be filled in automatically based on customer orders or transactions. By integrating these systems with your customer relationship management (CRM) or accounting software, you can streamline the entire process–from data entry to document generation–and ensure that every record is accurate and on-brand.

By embracing automation, businesses can ensure timely, professional, and error-free documents, enhancing overall operational efficiency.

Legal Requirements for Financial Records

When generating official financial documents, it’s essential to ensure compliance with local and international regulations. Certain elements must be included to make these documents legally valid. Failing to meet legal requirements can lead to disputes, delays in payments, and potential legal penalties.

Key Legal Elements to Include

Each document used for financial transactions should contain specific information to ensure its legal validity. These elements vary depending on the jurisdiction, but generally, they include:

- Seller’s and Buyer’s Information: Full names, addresses, and contact details of both parties involved.

- Unique Reference Number: A unique identifier to track and reference the document.

- Itemized Description of Goods or Services: Clear details about the products or services provided, including quantities and unit prices.

- Taxes and Additional Charges: Accurate breakdown of any applicable taxes, discounts, or additional charges.

- Payment Terms: Clear instructions on how and when the payment is due, including any penalties for late payments.

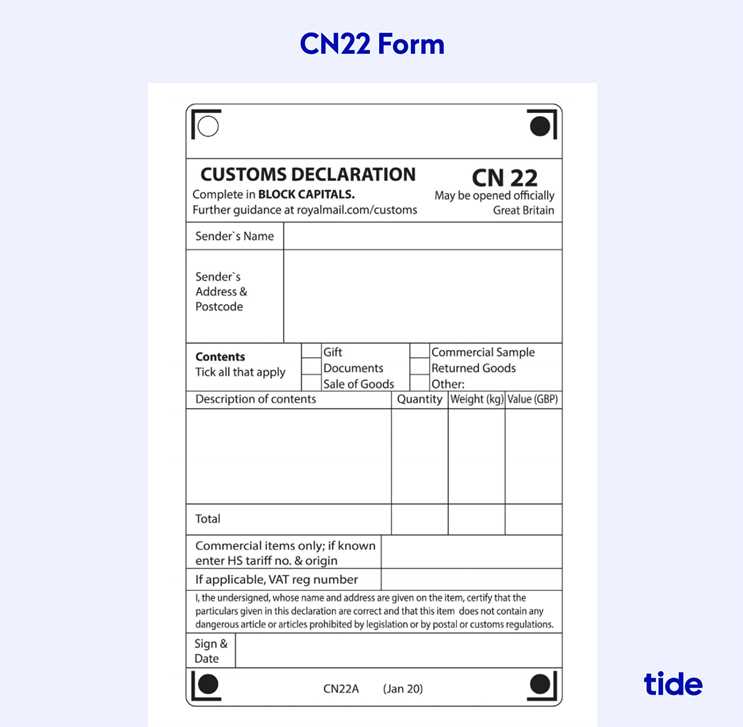

International Considerations

For businesses involved in international trade, additional requirements may apply. These could include:

- Currency and Exchange Rates: The currency used for the transaction and applicable exchange rates if international payments are involved.

- HS Code for Customs: A Harmonized System (HS) code for goods that must be used for customs declarations in many countries.

- Compliance with Import/Export Laws: Adhering to the laws governing imports and exports, including any necessary permits or certifications.

By ensuring that all necessary information is included, businesses can protect themselves legally and streamline the transaction process.

How to Send Billing Documents Professionally

Sending financial documents in a professional manner is essential for maintaining positive business relationships and ensuring timely payments. The way you send these documents not only reflects your company’s image but also helps avoid misunderstandings or delays. There are several key practices to follow when dispatching records to clients or business partners.

Choosing the Right Delivery Method

Selecting the appropriate delivery method is crucial to ensure the document reaches its destination securely and promptly. Some of the most common methods include:

- Email: This is the fastest and most convenient way to send documents. Ensure the file is in a widely accepted format, such as PDF, and that the email is professional and clear.

- Postal Mail: For official transactions or international dealings, sending physical copies via postal services may be necessary. Ensure the document is well-packaged and reaches the recipient on time.

- Document Management Platforms: For businesses using specialized systems, sending via a secure platform can streamline the process and allow for tracking of receipt.

Formatting Your Email or Letter

When sending documents through email or postal mail, it’s important to include the correct details to make the communication clear and professional. Follow these best practices:

- Clear Subject Line: Use a subject line that is specific and identifies the document, such as “Payment Details for Order #12345” or “Billing Statement for [Your Company Name]”.

- Formal Greeting: Address the recipient by name and maintain a polite and formal tone throughout the message.

- Attachment Labeling: Label the attached document clearly, such as “Invoice_12345.pdf”, so the recipient can easily identify it.

- Detailed Message: In the body of the email or letter, briefly mention the purpose of the document and any next steps the recipient needs to take.

By following these professional practices, you can ensure that your financial documents are delivered in a clear, respectful, and timely manner, contributing to smoother business transactions and improved client relations.

Understanding Billing Payment Terms

Payment terms are a critical part of any business transaction. They define the timeline and conditions under which payment for goods or services is expected. Clear and well-communicated payment terms help ensure that both parties–sellers and buyers–are aligned and understand their financial obligations, reducing the risk of delays or disputes.

Payment terms typically include the due date, acceptable payment methods, and any penalties or discounts related to early or late payments. Understanding these terms helps businesses manage their cash flow and set proper expectations with clients.

Common Payment Terms

There are several widely used payment terms that businesses should be familiar with, including:

- Net 30: Payment is due within 30 days from the date the document is issued. This is one of the most common payment terms.

- Due on Receipt: Payment is due as soon as the recipient receives the document. This is often used for smaller transactions or when working with trusted clients.

- Net 60/90: Payment is due within 60 or 90 days. This term is typically used for large transactions or by businesses with long-term client relationships.

- Cash on Delivery (COD): Payment must be made when the goods are delivered. This is commonly used in retail or when shipping physical products.

Why Payment Terms Matter

Payment terms protect both parties and help maintain smooth business operations. By clearly stating the expected payment timeframe, businesses can better manage cash flow and reduce the risk of overdue payments. Additionally, offering incentives like early payment discounts or imposing late fees can encourage prompt payment from clients.

Ultimately, understanding and setting clear payment terms fosters transparency, trust, and mutual respect in business relationships, ensuring that financial transactions are conducted efficiently and professionally.

How to Track Payments Using Billing Documents

Tracking payments is an essential part of managing finances in any business. By effectively monitoring when payments are made or remain outstanding, businesses can maintain a steady cash flow and avoid confusion or delays. Billing records serve as key tools for tracking these payments, providing a clear overview of transactions and payment statuses.

Steps to Effectively Track Payments

Here are several steps you can take to efficiently track payments through billing records:

- Assign a Unique Number: Each document should have a unique reference number. This makes it easier to track individual payments and match them to the correct record.

- Record Payment Dates: Always log the date when the payment was made. This will help you keep track of which payments have been completed and which are still due.

- Monitor Payment Methods: Be sure to note the payment method used (e.g., bank transfer, credit card, cash). This can be helpful in case there are any disputes or if you need to verify a transaction.

- Track Outstanding Amounts: If a payment is partial or overdue, it’s essential to note the remaining balance, allowing you to follow up with the client promptly.

Using Digital Tools for Tracking

To streamline the payment tracking process, many businesses now use digital tools and accounting software. These tools can automate much of the process, including:

- Automatic Updates: Many systems update payment statuses in real-time as payments are received, reducing the need for manual tracking.

- Payment Reminders: Set up automated reminders for overdue payments, ensuring that clients are notified promptly.

- Reporting Features: Advanced features allow you to generate payment reports, track trends, and monitor outstanding balances across multiple clients or transactions.

By staying organized and utilizing the right tools, you can ensure that all payments are accounted for, helping to maintain a smooth and efficient financial process.

Free vs Paid Billing Document Designs

When it comes to managing business transactions, selecting the right document format is crucial. Whether you opt for a free or paid option, the right choice will depend on your specific needs and the level of customization you require. Both free and paid designs offer unique advantages, but they come with differences in features, support, and overall flexibility.

Advantages of Free Designs

Free billing document formats are widely available and can be a good starting point for small businesses or startups with limited budgets. Here are some benefits:

- No Cost: The biggest advantage is the cost–free options require no investment, making them ideal for businesses just starting or those looking to minimize expenses.

- Quick Access: Free designs are easily accessible online, often with no sign-up or long setup process.

- Simplicity: These formats are typically straightforward, with essential fields that cover the basics of a transaction.

Advantages of Paid Designs

Paid billing document formats come with additional features and benefits that may be worth the investment for growing businesses. Some key advantages include:

- Customization: Paid formats usually offer more customization options, allowing you to adjust the design and layout to better align with your brand identity.

- Advanced Features: These options may include automated calculations, recurring billing setups, and integrated payment processing, making invoicing more efficient.

- Technical Support: With a paid option, you often receive customer support, helping you address any technical issues or questions.

- Professional Appearance: Paid designs are often more polished and professionally designed, which can help improve your business image.

Choosing between free and paid billing document formats depends on your specific business needs and how much customization and functionality you require. For small businesses, free formats may suffice, but as your operations expand, investing in a paid solution could provide valuable long-term benefits.

Integrating Billing Document Designs with Accounting Software

Integrating billing document designs with accounting software can significantly streamline your financial processes. By automating the flow of data between your transaction records and accounting system, you can reduce errors, save time, and improve the accuracy of your business operations. This integration allows for seamless data transfer, making it easier to track payments, generate financial reports, and manage your overall cash flow.

Many accounting platforms now offer built-in tools or third-party integrations that allow you to incorporate your custom billing document designs directly into the system. This means you can automatically generate and send records without having to manually input data, while keeping everything synchronized for better financial tracking.

Key Benefits of Integration

- Reduced Manual Entry: Automating the process eliminates the need for manual data entry, reducing the chance for human errors.

- Consistency: Ensures that all your financial documents are consistent in format and meet legal or company standards.

- Efficiency: Saves time by automatically populating billing documents with data already stored in your accounting system.

- Improved Cash Flow Management: With automatic updates, you can better track payments and outstanding amounts in real time.

How to Integrate

Integrating billing document designs with accounting software can vary depending on the software you’re using. Here’s a general overview of the process:

| Step | Description |

|---|---|

| 1. Select Your Accounting Software | Choose software that supports integration with external billing document designs. |

| 2. Set Up Integration | Follow the instructions provided by your software to connect to the document management system or design tool. |

| 3. Customize Your Documents | Design or import your billing document format into the software, ensuring it aligns with your branding and business needs. |

| 4. Automate Data Entry | Link the software’s transaction records to your billing documents to automatically populate fields like dates, amounts, and client details. |

| 5. Review and Send | Once the integra |