How to Use Joist Invoice Template for Easy Billing and Invoicing

In the world of freelance and contract work, managing payments and client transactions can often become overwhelming. Having an efficient system for generating professional documents that detail services rendered is crucial for maintaining clear communication and ensuring timely compensation. A well-structured billing document not only reflects your professionalism but also helps avoid payment delays and misunderstandings.

With the right tools, creating these financial records becomes simpler and more efficient. A user-friendly solution allows you to quickly generate accurate statements, tailor them to your business needs, and easily track outstanding balances. Whether you’re a solo entrepreneur or a growing business, having access to customizable templates can save time and reduce errors in your workflow.

By using specialized formats designed for easy use, you can present your services in a polished manner that enhances client trust and satisfaction. This approach ensures that both the financial aspects and your business reputation are handled seamlessly, allowing you to focus on the work that matters most to you.

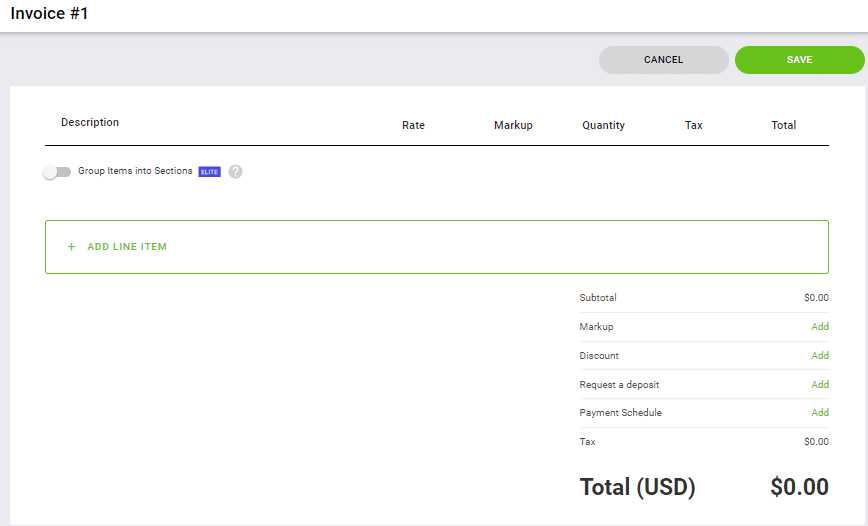

Joist Invoice Template Overview

Managing financial documents efficiently is a key part of running a successful business, especially for contractors and freelancers. With the right tools, creating accurate and professional billing records can become a quick and hassle-free process. The ability to easily generate customized forms that detail services provided, amounts due, and payment terms helps streamline the financial side of your work.

This solution offers a user-friendly approach that allows you to produce consistent and clear documents. Whether you’re tracking multiple projects or handling regular clients, the flexibility and design options ensure that you always present a polished and professional image. Below is an overview of the key components that make this solution so effective:

| Feature | Description |

|---|---|

| Customizable Design | Modify fonts, colors, and layout to match your business brand. |

| Automatic Calculations | Instantly calculate totals, taxes, and discounts without manual input. |

| Client Management | Store and organize client details for easy access and reuse. |

| Recurring Billing | Set up repeating billing schedules for ongoing projects or services. |

| Multiple Payment Methods | Offer different payment options, including online payments. |

With these features, this tool is designed to simplify and enhance the way businesses handle their financial transactions, saving time while improving accuracy and professionalism.

Why Use Joist for Invoices

For any business, especially in the freelance and contracting world, maintaining a smooth and professional billing process is essential. A reliable tool that simplifies the creation and management of financial documents can save valuable time, reduce errors, and help maintain a positive relationship with clients. With the right solution, generating clear and accurate records becomes seamless and efficient.

One of the primary reasons to choose this tool is its user-friendliness. It’s designed with simplicity in mind, allowing users to create professional documents with minimal effort. Whether you’re handling a few clients or managing numerous projects, this solution provides an intuitive interface that helps streamline the entire process.

Additionally, this tool offers great customization options, allowing users to tailor documents according to their specific needs. You can easily adjust the layout, add company logos, and apply personalized branding, making each record reflect your business’s identity. This ensures that clients receive a professional and cohesive experience, reinforcing trust and credibility.

Another significant advantage is the automation it provides. By calculating totals, taxes, and other variables automatically, the tool minimizes the risk of errors and makes it easy to stay on top of payment schedules. This level of automation frees up time for other business tasks and ensures that financial transactions are handled with accuracy and efficiency.

How to Download Joist Template

Getting started with this tool is quick and straightforward. Whether you’re new to digital billing solutions or simply looking to switch tools, downloading the right file format is the first step. Once you have access to the platform, the process of obtaining a customizable form is simple and fast.

Steps to Download

- Visit the official website or platform offering the service.

- Create an account or log in if you already have one.

- Navigate to the billing or financial documents section.

- Select the design or style that best suits your business needs.

- Click on the download button to save the file to your device.

File Format Options

- Download options may include PDF, Excel, or other editable formats.

- Ensure you choose the right format based on your preferred method of editing or sharing.

- Once downloaded, the document is ready for customization and use.

With these simple steps, you can easily download a professional, ready-to-use document and start managing your client transactions efficiently.

Customizing Your Joist Invoice

One of the key advantages of using a digital solution for billing is the ability to tailor financial documents to match your business’s branding and specific needs. Personalizing your billing records ensures they reflect your unique style while maintaining a professional appearance. Customization options allow you to make your documents both functional and aligned with your company’s identity.

Personalizing Design and Layout

- Modify the overall layout to suit your preference–choose between various styles and formats.

- Upload your company logo to make your documents instantly recognizable to clients.

- Select the font style and size that aligns with your brand’s visual identity.

Adding Essential Details

- Include your business contact information, such as address, email, and phone number.

- Customize the sections for project details, such as service descriptions, quantities, and rates.

- Ensure tax rates and other payment terms are clearly stated to avoid confusion.

Incorporating Client-Specific Information

- Enter your client’s details, including name, address, and contact information for easy reference.

- Personalize the payment due date and apply any specific discounts or adjustments for each client.

By adjusting these elements, you can create professional and personalized documents that not only enhance your workflow but also strengthen your brand image with every client interaction.

Key Features of Joist Templates

When it comes to generating professional financial documents, certain features can make a huge difference in both efficiency and accuracy. The best solutions for creating these records offer a range of powerful tools that simplify the process while ensuring every detail is correct. These key features not only streamline the creation of documents but also enhance their functionality and usability.

Customization Options

- Flexible Design: Easily adjust the layout to suit your brand’s style, adding logos, changing colors, and selecting fonts.

- Personalized Details: Input specific client and project information to tailor each document to the individual transaction.

- Branding: Customize your document with your business logo and colors to make it instantly recognizable.

Automation and Calculations

- Automatic Totals: Automatically calculate totals, taxes, and discounts, eliminating manual entry and reducing the chance of errors.

- Tax Rate Management: Easily apply the correct tax rates based on location or service type.

- Recurring Billing: Set up automatic billing for ongoing projects, saving time and ensuring consistency in payment schedules.

Easy Client Management

- Client Database: Store and manage client information in one place, making it easy to reuse and update for future projects.

- Client History: Keep track of past transactions and payment history for each client for better organization and follow-ups.

Payment Integration

- Multiple Payment Methods: Allow clients to pay via a variety of methods, including online payments and direct transfers.

- Payment Tracking: Monitor whether payments have been made or are still pending, helping you stay on top of finances.

These features work together to make managing your financial records easier, more professional, and more efficient, allowing you to focus on what matters most–growing your business.

Benefits for Contractors and Freelancers

For independent professionals and contractors, managing financial records efficiently is a vital part of running a business. The ability to create accurate, clear, and professional documents quickly can save time, reduce stress, and improve client relationships. With the right tools, contractors and freelancers can easily handle their billing and payment processes, allowing them to focus more on their work rather than administrative tasks.

Time-Saving Features

- Quick Document Creation: Generate professional financial records in minutes, reducing the time spent on paperwork.

- Automation: Automatic calculations for totals, taxes, and discounts eliminate the need for manual entries, speeding up the process and minimizing errors.

- Recurring Billing: Set up recurring transactions for regular clients, ensuring consistent billing cycles without extra effort.

Improved Client Communication

- Professional Appearance: Customizable designs allow you to present a polished, branded document that enhances your business’s credibility.

- Clear Payment Terms: Transparent and easy-to-understand records help avoid confusion with clients, ensuring everyone is on the same page regarding amounts due and deadlines.

- Client Tracking: Keep detailed records of each client’s billing history, ensuring you can follow up efficiently and maintain positive relationships.

By streamlining these essential tasks, contractors and freelancers can boost their productivity and maintain a professional image, all while saving valuable time and reducing the risk of errors in their financial processes.

Joist Template vs Other Options

When choosing a tool for creating professional billing documents, there are many options available, each offering unique features and benefits. However, not all solutions are created equal. Some may be more customizable, others might offer better automation, and some might simply be easier to use. Comparing different solutions can help you find the one that best meets your needs, whether you’re a freelancer, a small business owner, or a large enterprise.

Ease of Use

- Intuitive Interface: Some platforms are known for their user-friendly interfaces that allow even beginners to start creating documents with minimal training.

- Complexity: Other tools might offer more customization options, but this can sometimes come at the cost of a steeper learning curve and more time spent on setup.

Customization and Flexibility

- Design Freedom: Some tools allow for a high degree of customization, letting users adjust everything from layout and fonts to logos and color schemes.

- Pre-Formatted Options: Other options provide pre-designed formats, which are convenient but may lack the ability to fully align with a company’s branding or unique needs.

Automation and Features

- Automated Calculations: Some platforms automatically calculate totals, taxes, and discounts, which helps reduce errors and save time.

- Manual Entry: In contrast, other options may require more manual input, which can be prone to mistakes and take longer.

Cost and Accessibility

- Pricing: While some platforms offer free access with limited features, others may require a subscription or one-time payment for advanced functionalities.

- Accessibility: Consider whether the solution is available as a web app, desktop software, or mobile application to ensure it fits your work style.

Each option has its own advantages and drawbacks, and the right choice depends largely on your specific requirements. Whether you prioritize ease of use, customization, or automation, understanding the differences will help you make an informed decision.

Creating a Professional Invoice Easily

Generating professional and accurate financial documents doesn’t have to be a complicated task. With the right tools, you can quickly create polished records that reflect your business’s professionalism while ensuring all necessary details are included. Streamlining the process allows you to focus on your work while leaving the administrative tasks to an efficient and user-friendly system.

Steps to Create a Professional Document

- Select a clear and organized layout that best suits your needs.

- Input key information such as client details, services rendered, payment terms, and dates.

- Ensure the document is free of errors and clearly outlines payment amounts, taxes, and due dates.

- Add your company logo and branding elements to create a cohesive, professional appearance.

Essential Components of a Professional Document

| Component | Description |

|---|---|

| Client Information | Name, address, and contact details of the client to ensure clarity in communication. |

| Services and Products | Detailed descriptions of the work completed or products provided, including quantities and unit prices. |

| Payment Terms | Clearly stated terms for payment, including the due date and accepted payment methods. |

| Taxes and Discounts | Breakdown of applicable taxes and any discounts applied to the total amount. |

With these steps and components in place, creating a professional, detailed financial record becomes a quick and straightforward task that ensures timely payments and fosters trust with your clients.

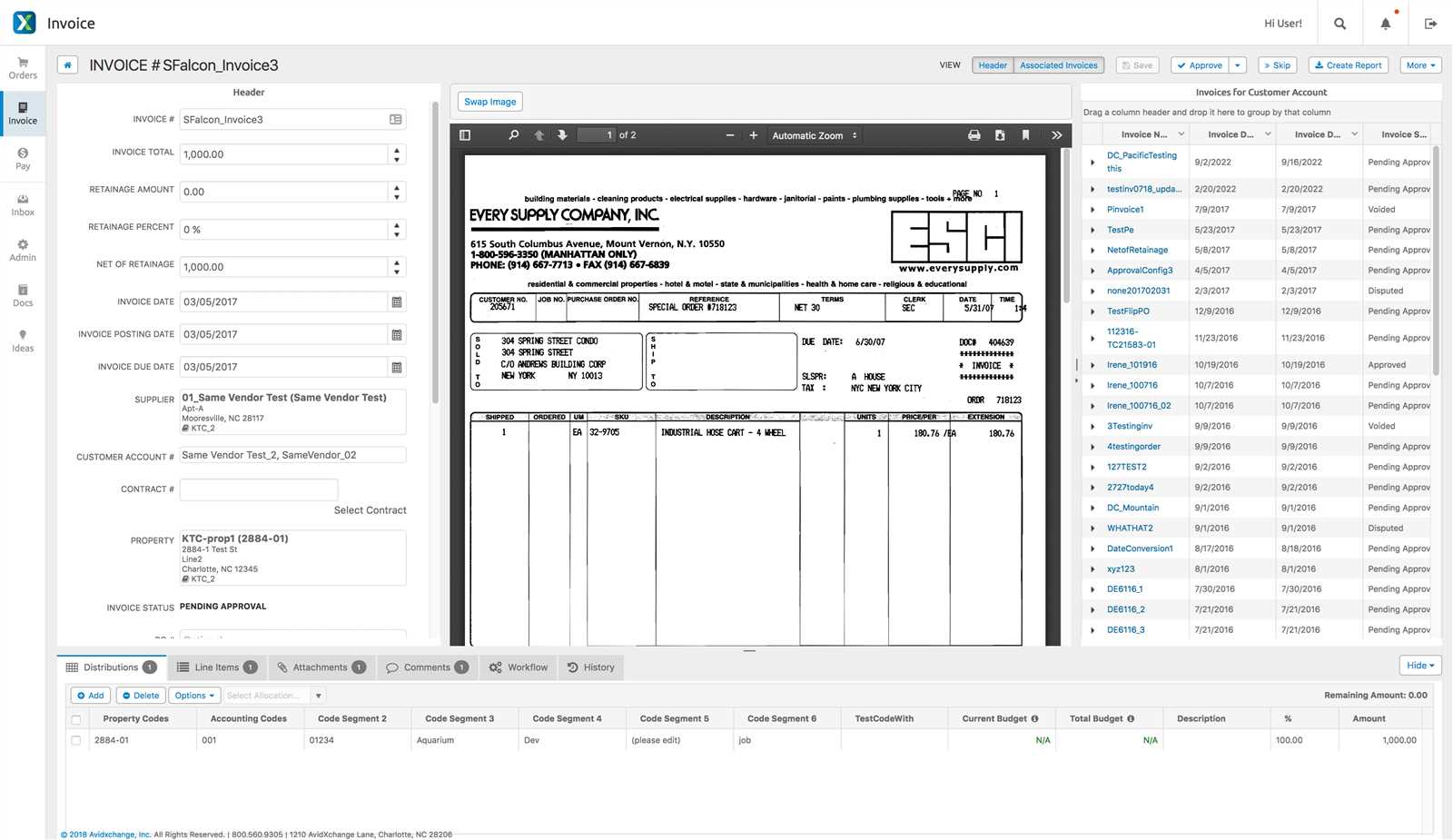

Managing Client Details in Joist

Effectively organizing and managing client information is essential for maintaining a smooth and efficient business operation. Having all relevant client details stored in one central location allows you to easily access and update their information when needed. This helps reduce errors, improve communication, and streamline the billing process, ensuring that each client receives accurate and timely records.

With the right tool, managing client details becomes effortless. You can store key information such as names, addresses, phone numbers, and email addresses, which can be automatically pulled into your documents, saving time and minimizing the chance of mistakes. This also ensures that client records are always up to date and easily accessible whenever you need them.

Key Features for Client Management

- Client Database: Store all client details in a searchable database, making it easy to retrieve and update information.

- Quick Access: With a few clicks, you can automatically populate new documents with previously entered client details, speeding up the process.

- Client History: Track past projects, payments, and communication with each client for better follow-up and relationship management.

Benefits of Centralized Client Information

- Improved Accuracy: Reduces the chances of incorrect or outdated details being used on documents.

- Time Efficiency: Quick access to client data means less time spent searching for information and more time for other tasks.

- Better Communication: Having up-to-date client contact information ensures you can easily reach out when needed for updates or clarifications.

By centralizing client data, you can improve both your efficiency and professionalism, ultimately leading to better client satisfaction and stronger business relationships.

Tracking Payments with Joist Templates

Keeping track of client payments is essential for maintaining a healthy cash flow and ensuring that all transactions are properly documented. An effective solution allows you to monitor outstanding balances, payment statuses, and due dates, helping you stay organized and minimize the risk of missed or delayed payments. The ability to quickly access and update payment information is key to running a smooth and efficient business.

With the right tool, you can easily record when payments are received and automatically update the status of each transaction. This feature enables you to track which clients have paid, which are overdue, and which require follow-up, all without manually entering the data every time. You can even set reminders for upcoming due dates, ensuring that no payment slips through the cracks.

Key Features for Payment Tracking

- Automatic Payment Status Updates: As soon as a payment is received, the system updates the transaction status, saving you time.

- Overdue Notifications: Receive automatic reminders for payments that have passed their due date, ensuring prompt follow-up.

- Detailed Payment History: Maintain a clear and organized record of all past payments for easy reference and reconciliation.

Benefits of Payment Tracking

- Improved Cash Flow: By staying on top of payments and outstanding balances, you can ensure a steady flow of income.

- Reduced Errors: Automated tracking minimizes the chance of human error in tracking payments and due dates.

- Better Client Communication: Easily communicate with clients about any overdue payments, leading to clearer and more transparent relationships.

By utilizing an automated payment tracking system, you can stay organized, reduce stress, and keep your business running smoothly with minimal effort.

Joist Template for Multiple Projects

When working on multiple projects simultaneously, managing each one individually can quickly become overwhelming. Having a streamlined system that allows you to track the progress, costs, and payments for each project helps you stay organized and ensures nothing is overlooked. A versatile solution can help you manage several projects at once, creating detailed documents for each without the need for separate tools or extensive manual input.

With a dedicated system, you can easily create customized records for each project, keep track of their statuses, and even generate reports to monitor the financial health of all ongoing work. This efficiency is especially beneficial for freelancers and contractors handling multiple clients or jobs at the same time.

Managing Multiple Projects

- Track individual project details, including services rendered, timelines, and costs.

- Keep client-specific information organized, even when juggling several different clients or projects.

- Easily update project status and payment progress without the risk of mixing up information.

Project Overview Table

| Project Name | Client | Status | Amount Due | Due Date |

|---|---|---|---|---|

| Website Redesign | ABC Corp | In Progress | $2,000 | 2024-11-15 |

| Marketing Campaign | XYZ Ltd | Completed | $1,500 | 2024-10-30 |

| Product Photography | 123 Studios | Pending | $800 | 2024-12-01 |

Using this approach, you can monitor multiple projects from a single platform, saving time and improving the accuracy of each document. This centralized system provides greater visibility into each project’s financials, ensuring that all milestones are met and payments are processed on time.

How to Send Invoices via Joist

Sending financial documents to clients efficiently is essential for maintaining a smooth workflow and ensuring timely payments. The process should be simple and secure, allowing you to deliver detailed records with minimal effort. Using the right system, you can quickly send professional billing statements directly to clients, track their delivery status, and receive payments faster.

Whether you’re sending an individual document or a series of records, the platform offers a streamlined process that eliminates manual work and ensures all essential details are included. Here’s how you can send your documents with ease.

Steps to Send Financial Documents

- Prepare Your Document: Ensure that all the required information–such as client details, services provided, and payment terms–is included.

- Enter Client Email: Add the recipient’s email address to ensure the document is sent directly to the intended person.

- Review the Content: Double-check the details for accuracy before sending, ensuring that all amounts, dates, and descriptions are correct.

- Send the Document: Once satisfied, click on the “Send” button to email the document to the client.

Tracking the Delivery and Payment

- Monitor Delivery: Some platforms allow you to track when your client has received and viewed the document, giving you a clear understanding of its status.

- Set Up Payment Reminders: If the payment is not received by the due date, automated reminders can be sent to clients, helping ensure timely payments.

- Confirm Payment: Once the client has paid, the system can update the document status and notify both you and the client that the transaction is complete.

By following these steps, you can send detailed financial records quickly and accurately, reducing the chances of mistakes and ensuring that your clients receive all necessary information for processing payments.

Using Joist for Recurring Invoices

Managing recurring billing can be time-consuming and repetitive, but with the right system, this process can be automated to save you time and reduce the chance of human error. Recurring charges for services or products that are billed regularly can be easily managed using automated solutions. This allows businesses to maintain consistent cash flow without having to manually generate and send new documents each time a payment is due.

By setting up automatic billing cycles, you can ensure that clients are invoiced on time, every time, without needing to remember each due date. This is especially useful for subscription-based services, retainer agreements, or any business that has regular, repeat payments from clients.

Setting Up Recurring Billing

- Choose Billing Frequency: Decide how often your clients will be billed, whether it’s weekly, monthly, quarterly, or annually.

- Enter Client Details: Add your client’s information, including payment terms, to automatically apply them to each billing cycle.

- Set Payment Reminders: Schedule reminders or automatic follow-ups to ensure clients are notified in advance of upcoming payments.

Benefits of Automated Recurring Billing

- Consistency: Ensure timely payments every cycle, which improves cash flow and financial planning.

- Less Administrative Work: Automating the process reduces the time spent on generating, sending, and tracking individual billing records.

- Reduced Errors: Automation minimizes human errors that can occur when manually handling repeat billing, ensuring accurate amounts and payment dates.

Automating recurring charges provides a hassle-free way to manage long-term client relationships, offering both convenience and efficiency. With the right system, you can focus more on your business and less on administrative tasks.

Joist Template Integration with Accounting Tools

Integrating financial document management with accounting software is a powerful way to streamline your business processes. When these systems work together, you can save time, reduce errors, and maintain consistent records across both platforms. By linking your billing documents to accounting tools, you can easily transfer payment data, track expenses, and manage financial reports without duplicating work or inputting data manually.

The integration of billing and accounting systems is particularly useful for small business owners, freelancers, and contractors who need a simple yet effective way to manage finances. Connecting these tools allows for seamless data flow between billing records and your financial accounts, ensuring that all transactions are automatically accounted for and up to date.

Steps for Integration

- Choose Compatible Tools: Ensure that the platform you use for creating billing records is compatible with popular accounting software or apps.

- Sync Client and Payment Data: Once integrated, automatically sync client details, payment amounts, and due dates between the two systems.

- Track Financials: Use your accounting software to track total revenue, expenses, and taxes, with all the relevant data from your billing records included automatically.

Benefits of Integration

- Improved Accuracy: Automation minimizes human error by transferring data directly between platforms, reducing the chances of discrepancies.

- Time Savings: By eliminating manual data entry, you can focus more on your business and less on administrative tasks.

- Streamlined Reporting: Integration allows for more efficient generation of financial reports, making it easier to understand the financial health of your business.

Integrating your billing system with accounting tools provides you with a more efficient, accurate, and automated way to manage your finances, ultimately helping you stay organized and improve business operations.

Setting Up Tax Rates in Joist

Configuring tax rates for your business is essential for ensuring compliance with local tax laws and providing accurate billing to your clients. Tax rates can vary depending on location, service type, or product category, so having a system that allows you to customize and automate these rates is crucial for maintaining efficiency and accuracy. By setting up tax rates properly, you can ensure that your financial records are correct and that you are charging your clients the appropriate amount.

Once you have tax rates set up, the system can automatically apply them to your documents, ensuring that taxes are calculated and displayed correctly every time. This eliminates the need for manual adjustments and helps avoid costly mistakes, particularly when managing multiple clients or projects.

Steps to Set Up Tax Rates

- Choose Your Tax Region: Specify the region or country where your business operates to set the correct tax laws and rates.

- Define Tax Categories: Set up different tax rates based on the type of services or products you offer, such as sales tax or VAT.

- Apply Rates to Documents: Once set, tax rates will automatically be applied to all financial documents, ensuring the right amounts are charged.

Benefits of Setting Up Tax Rates

- Accurate Calculations: Automated tax calculations reduce the chances of errors when determining taxes owed.

- Compliance: Ensure your business adheres to local and regional tax laws, avoiding penalties or audits.

- Efficiency: Save time by automatically applying the correct tax rate to each client’s bill, rather than calculating manually.

By setting up tax rates in your system, you can maintain accurate, up-to-date financial records and reduce the risk of making tax-related mistakes in your billing process. This feature helps streamline operations, leaving you more time to focus on growing your business.

Mobile Access to Joist Templates

Having access to your financial records and documents on the go is increasingly important for busy professionals and entrepreneurs. With mobile access, you can manage client records, track payments, and create new documents no matter where you are. This flexibility is crucial for staying on top of business activities, whether you’re in a meeting, on-site with a client, or traveling. A mobile-friendly platform ensures that you can keep your operations running smoothly without being tied to a desktop computer.

By using a mobile app or mobile-optimized platform, you can instantly create, edit, and send billing statements directly from your smartphone or tablet. This reduces the time spent on administrative tasks and ensures that you can respond to client needs promptly, even when you’re not at your desk.

Mobile Features for Managing Financial Records

- Real-Time Access: View, edit, and send documents anytime, directly from your mobile device.

- Instant Updates: Any changes made on your mobile device are reflected immediately, keeping all records up to date.

- Client Management: Access client information and track project statuses without needing to be at your computer.

Example of Mobile Access Table

| Feature | Description |

|---|---|

| Mobile-Friendly Interface | Optimized design for easy navigation and document management on smartphones and tablets. |

| Cloud Synchronization | All documents are synchronized in real time, ensuring seamless access across all devices. |

| Push Notifications | Receive updates and reminders for pending actions or due payments directly on your phone. |

By integrating mobile access into your workflow, you can stay connected to your business no matter where you are. This functionality not only makes your processes more efficient but also allows you to respond to clients and update documents on the go, ultimately improving your business’s productivity and client satisfaction.

Why Choose Joist Over Other Invoice Tools

When it comes to managing client billing and financial documents, there are numerous tools available, each offering a unique set of features. However, some solutions stand out due to their ease of use, customization options, and integration capabilities. Choosing the right platform can save time, reduce errors, and improve your overall business workflow. This system offers a variety of advantages that make it an appealing choice for freelancers, contractors, and small business owners looking for a simple yet powerful solution for managing billing tasks.

What sets this platform apart is its focus on simplicity without compromising on functionality. With a user-friendly interface, intuitive design, and the ability to manage all aspects of billing from one place, it provides a hassle-free experience for professionals who need to generate, send, and track payments. Compared to other tools that might require complex setups or involve unnecessary features, this platform focuses on the essentials, making it easy for users to get started quickly and efficiently.

Key Advantages of Using This System

- User-Friendly Interface: The platform is designed for simplicity, making it easy for anyone to create and send professional documents without technical expertise.

- Customizable Features: Tailor documents to suit your specific needs, including adjusting rates, adding personalized branding, and choosing tax settings.

- Mobile Access: Manage your documents and client records from anywhere with a mobile-optimized platform, keeping your business running smoothly on the go.

How This Platform Outperforms Other Tools

- Streamlined Workflow: Automate recurring billing, track payments, and manage projects all in one place, reducing the time spent on manual tasks.

- Seamless Integration: Easily integrate with accounting software, ensuring smooth data transfer between systems and accurate financial records.

- Affordable Pricing: Offers competitive pricing, making it accessible to freelancers and small businesses without compromising on essential features.

For those looking for an efficient, reliable, and easy-to-use solution for managing financial records, this platform stands out as a top choice. With its straightforward design and powerful capabilities, it enables users to focus more on their business and less on adm