Top Party Invoice Templates for Hassle-Free Event Billing

Organizing events involves managing numerous details, and one of the most important aspects is ensuring clear and accurate financial transactions. Whether you’re hosting a wedding, corporate gathering, or private celebration, having the right tools to handle payments is essential. This process becomes significantly easier with the use of well-designed billing documents that allow for easy customization and professionalism.

With the right approach, creating clear financial records for your clients can be simple. These documents not only help ensure that you’re compensated on time, but they also maintain a level of professionalism that enhances your reputation. By utilizing pre-made formats, you can save time and avoid errors while still delivering a polished experience to your clients.

In this guide, we’ll explore how customizable financial documents can simplify the billing process. From layout suggestions to essential information, learn how to craft the perfect payment request every time. Efficiency and accuracy are the keys to successful event management, and with the right tools, you can achieve both.

Party Invoice Templates for Event Planners

Event planners are often responsible for managing the entire process of an event, from the initial planning to the final payment. A key part of this responsibility is ensuring that all financial transactions are smooth and clearly documented. Using a well-structured document for billing not only ensures accuracy but also enhances the professionalism of the planner, making it easier for clients to understand the services provided and the associated costs.

For event planners, using customizable billing formats allows for easy adjustment depending on the event’s size and complexity. These documents help break down costs in a clear, organized manner and provide all the necessary information for clients to make payments promptly. By using a standardized format, event organizers can save time and avoid errors when preparing financial paperwork for multiple events.

Key Features to Include

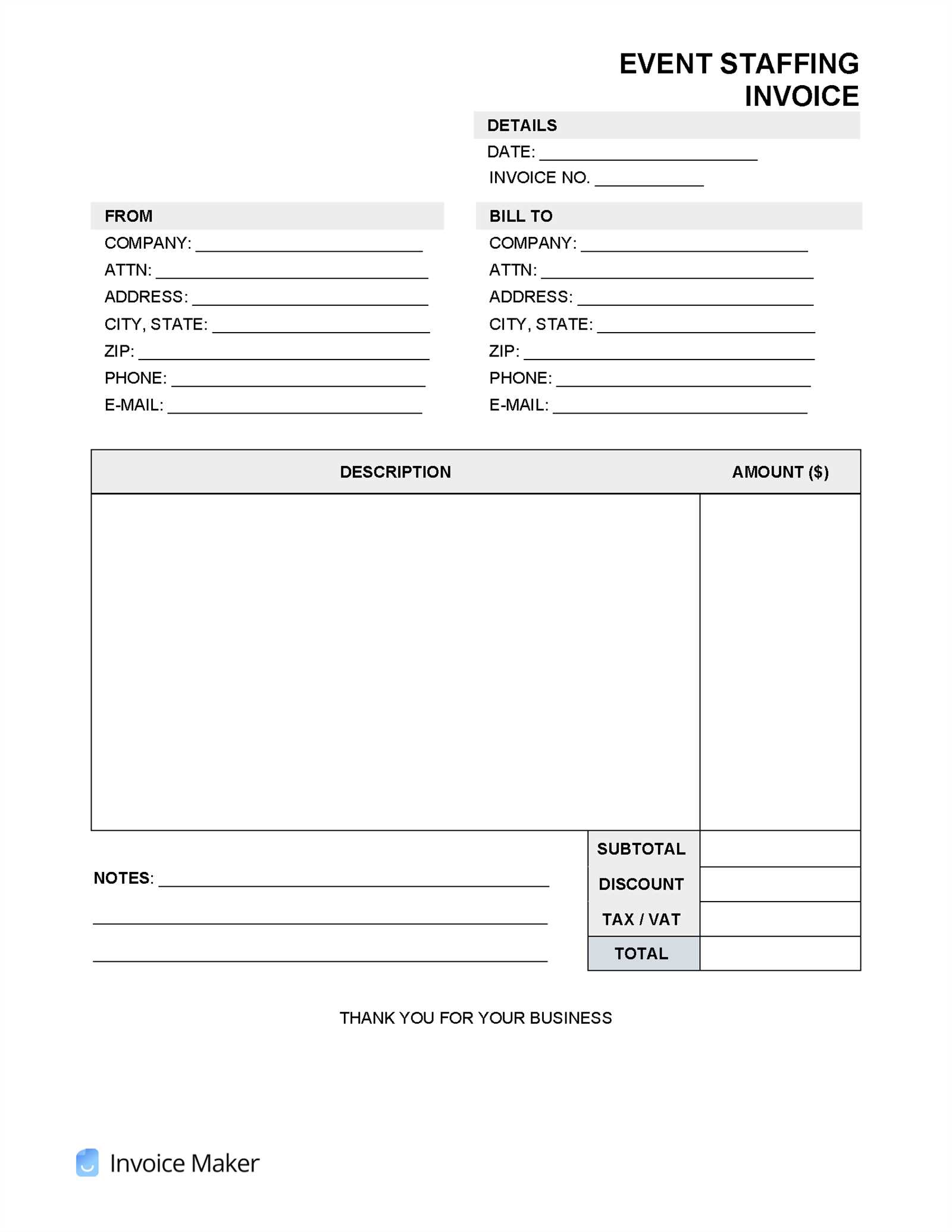

When creating financial documents for events, certain details must be included to make sure everything is transparent and clear. Below are some of the key components:

| Section | Description |

|---|---|

| Client Information | Full name, contact details, and billing address of the client |

| Event Details | Date, location, and type of event |

| Breakdown of Services | Clear list of all services provided, such as venue rental, catering, entertainment, etc. |

| Cost Breakdown | Individual costs for each service and total amount due |

| Payment Terms | Due date, acceptable payment methods, and any late fees |

Benefits of Using Standardized Billing Documents

Utilizing pre-designed billing documents ensures consistency and professionalism in all transactions. These formats are customizable, meaning they can adapt to a variety of event types and sizes. They also save valuable time, allowing planners to focus on the creative and logistical aspects of their work rather than spending hours drafting financial statements. Moreover, clear and concise billing helps prevent disputes and delays in payments, contributing to smoother operations for the event plan

Why Use Party Invoice Templates

For any event organizer, ensuring that financial transactions are handled smoothly is essential. Having a consistent, professional approach to documenting services and payments can save time, reduce errors, and help maintain positive client relationships. Using ready-made, customizable billing formats makes the entire process much more efficient, allowing for faster creation and accurate records for every event.

These structured documents not only help keep finances organized but also contribute to clear communication with clients. By providing a detailed breakdown of charges and payment terms, event planners can ensure that both parties are on the same page, preventing confusion or disputes over costs. This approach makes managing multiple events more streamlined and keeps operations running smoothly.

Time Efficiency and Accuracy

When organizing events, time is a valuable resource. Using pre-designed billing documents can significantly reduce the amount of time spent creating invoices from scratch. These ready-made formats allow for quick customization, ensuring that all necessary details are included without the need for repetitive data entry. Furthermore, the use of structured documents minimizes the risk of errors, ensuring that every charge is listed correctly.

Professionalism and Client Trust

Delivering well-structured and polished financial statements boosts your credibility as an event planner. A professional-looking document can reinforce the perception that your services are organized and trustworthy. Clear terms, payment schedules, and detailed breakdowns help establish transparency, fostering stronger relationships with clients and ensuring smoother financial transactions.

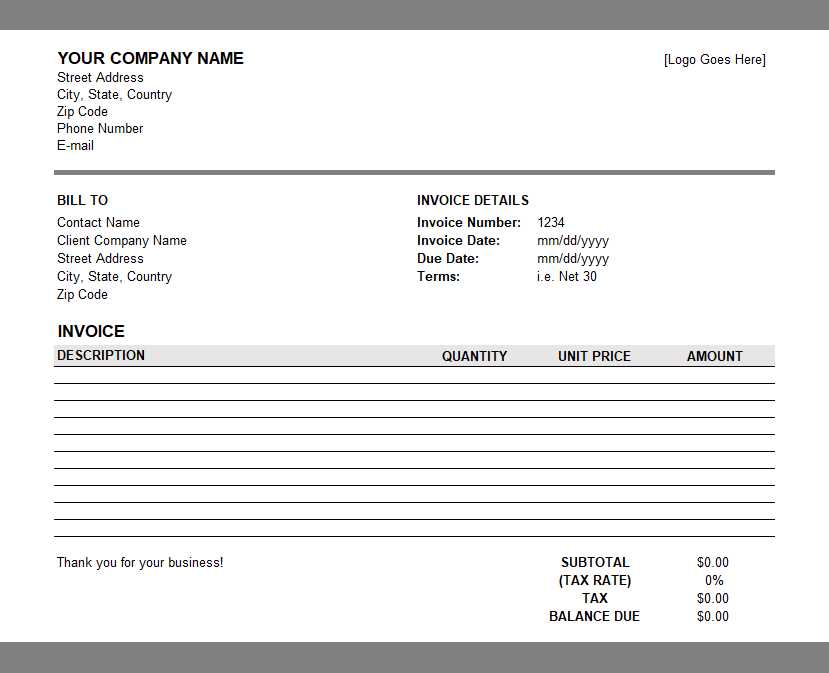

How to Customize Your Party Invoice

Customizing your billing document allows you to tailor the format to meet the unique needs of each event. This flexibility ensures that all relevant details are included and that the final document aligns with your brand’s style. Whether you’re working with different types of services or varying pricing structures, personalizing your financial records helps maintain consistency and professionalism across all your projects.

The process of customization typically involves adjusting several key elements, such as the layout, colors, and included information. With a well-designed structure, you can easily modify specific sections like client details, service descriptions, and payment terms to reflect the specifics of each event. By doing this, you ensure that every document is clear, accurate, and easy to understand.

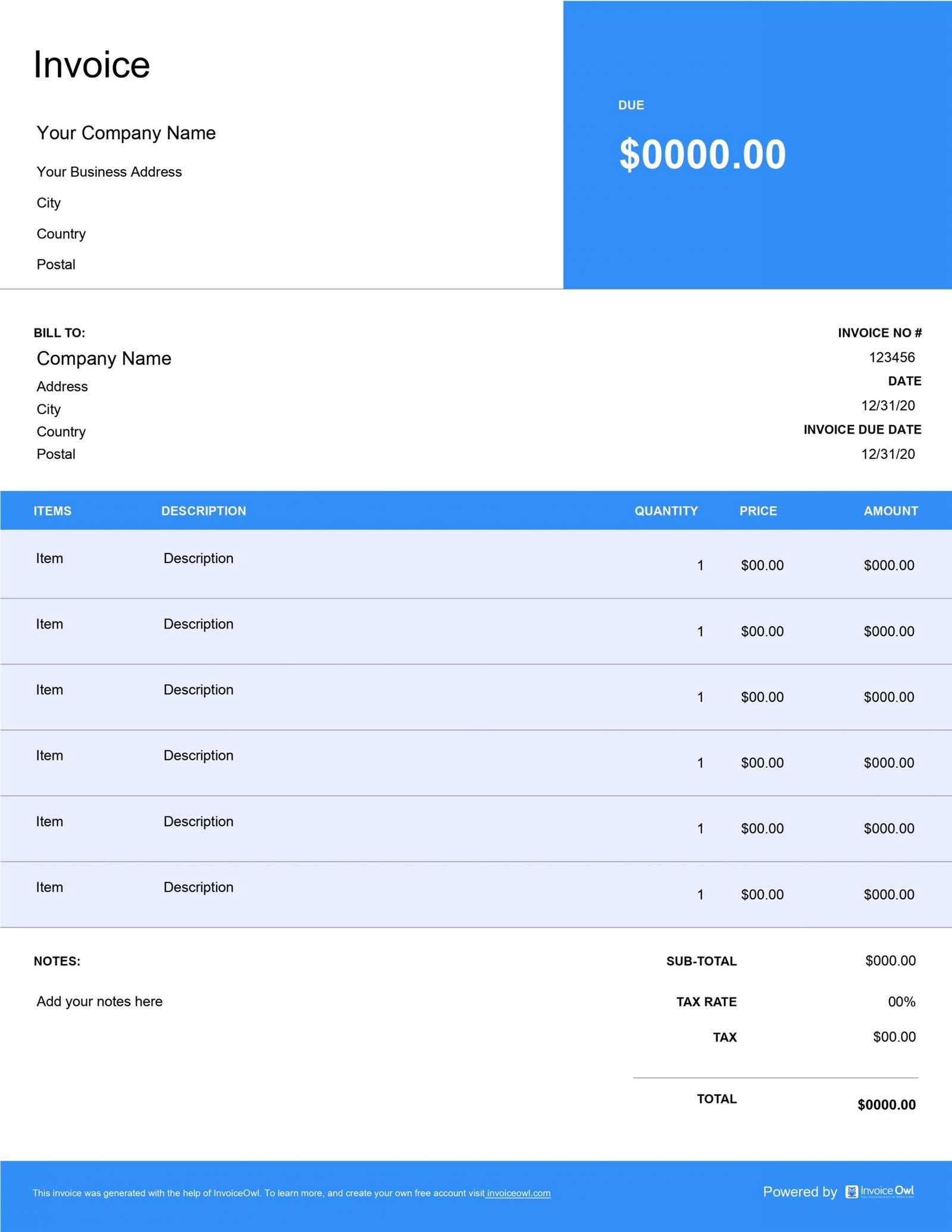

Personalizing the Layout and Design

When customizing your financial statements, the first step is to choose a layout that suits your business needs. Many professionals prefer clean, minimalist designs that focus on readability. You can select different fonts, adjust headings, and incorporate your company logo to ensure that the document feels cohesive with your brand’s identity. The more visually appealing and organized the document is, the more likely it is to leave a positive impression on your clients.

Adding Event-Specific Information

Each event is unique, so it’s crucial to adapt the details in your document accordingly. Be sure to include specific information like the event type, location, and any special services or packages offered. Additionally, if there are any custom charges–such as last-minute changes or additional equipment–make sure these are clearly stated. This level of detail will help your clients understand exactly what they are paying for and why.

Essential Elements of a Party Invoice

When preparing a financial document for an event, it’s crucial to include all the necessary information to ensure clarity and transparency. A well-structured record should outline all relevant details in an organized manner, making it easy for the client to review charges and understand payment expectations. Whether you’re handling a small gathering or a large-scale celebration, the following elements are essential to include in every document you create.

- Client Information: Ensure the document includes the full name, address, and contact details of the client. This ensures that the financial record is properly attributed to the right individual.

- Event Details: Clearly list the event’s date, time, and location. You can also include the event’s theme or type to provide context for the charges listed.

- Services Provided: Break down all the services you offered, such as venue rental, catering, entertainment, or decorations. Each service should be listed separately with corresponding charges.

- Payment Breakdown: Itemize the cost of each service, including any applicable taxes, fees, or discounts. This helps avoid confusion and ensures both parties understand how the total amount is calculated.

- Payment Terms: Specify the due date for the payment, the accepted methods (credit card, bank transfer, etc.), and any late fees for overdue payments.

- Terms and Conditions: Include any policies regarding cancellations, refunds, or other important contractual terms that may impact the payment process.

These elements are the foundation of a well-organized financial document. By including each of them, you ensure that your records are professional and clear, which will help prevent misunderstandings and disputes with clients.

Benefits of Professional Event Invoicing

Using a professional approach to billing for events offers numerous advantages that not only improve the efficiency of financial transactions but also enhance the overall client experience. Clear, accurate, and well-organized billing documents ensure transparency, reduce misunderstandings, and contribute to building trust between you and your clients. Adopting a standardized and polished method for financial records can streamline operations and help maintain a high level of professionalism.

By utilizing structured and easy-to-understand documents, event organizers can avoid common mistakes such as miscalculation of charges, missing details, or unclear payment terms. Additionally, these professional records serve as a clear reference point for clients, making it easier for them to review their expenses and make timely payments.

| Benefit | Description |

|---|---|

| Increased Professionalism | A well-organized financial document conveys professionalism and reliability, boosting your business reputation. |

| Time Efficiency | Pre-designed formats save time by reducing the need to create each financial record from scratch. |

| Improved Accuracy | Structured layouts reduce the likelihood of errors in pricing or service descriptions, ensuring accurate billing. |

| Clear Communication | Detailed and transparent information helps avoid confusion and ensures both parties understand the charges. |

| Faster Payments | Clear payment terms and due dates encourage clients to pay on time, reducing the risk of late payments. |

By incorporating professional billing practices, event planners not only improve internal processes but also build stronger, more trusting relationships with their clients. A well-prepared document makes the financial aspect of any event smooth and straightforward, ensuring that everyone is on the same page from start to finish.

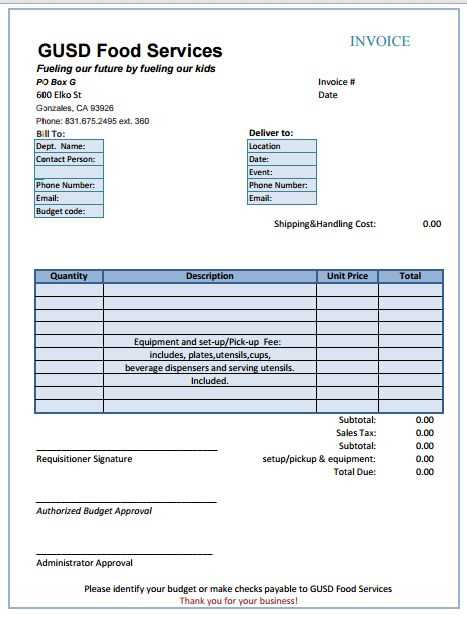

Choosing the Right Invoice Format

Selecting the right format for your billing documents is crucial to ensuring clarity and efficiency in financial transactions. The right structure not only makes it easier for you to manage payments but also helps your clients quickly understand the details of the charges. Different events and services may require different formats, and choosing the one that fits best can streamline the process and minimize confusion.

There are several factors to consider when choosing a billing structure. These include the size and complexity of the event, the variety of services offered, and the preferences of your clients. A well-chosen format can also enhance your brand’s image and help you stand out as a professional in the event planning industry.

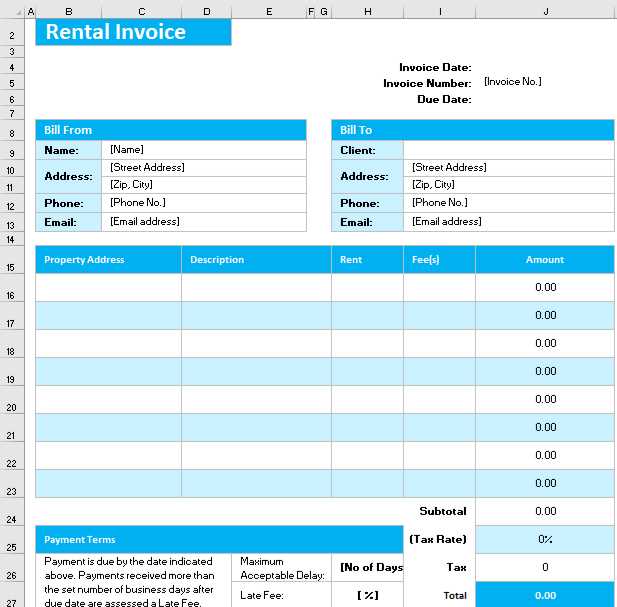

Simplified vs. Detailed Formats

For smaller or less complex events, a simplified format may be sufficient. This type of layout focuses on the basic details such as client information, event date, and total cost. However, for larger events with multiple services or customized offerings, a more detailed format may be necessary. A detailed document provides a breakdown of each service, pricing, and additional terms, offering full transparency to your clients.

Customizable vs. Standardized Formats

Another factor to consider is whether you need a completely customizable format or a standardized one. Customizable formats give you the flexibility to adjust the layout and sections according to the specifics of each event. On the other hand, standardized formats offer consistency and are quicker to fill out, making them ideal for recurring events or clients with similar service packages.

Ultimately, the right format depends on your business needs and the nature of the events you organize. Whether you choose a simple or detailed layout, ensuring that it’s easy to understand and professionally presented will help build trust and streamline the payment process.

Common Mistakes in Event Invoicing

When preparing financial records for events, it’s easy to overlook certain details that can lead to misunderstandings, delays in payment, or dissatisfaction from clients. Common mistakes in creating these documents can result in confusion, and even financial loss. Identifying and addressing these errors early on will help ensure that your billing process remains efficient, accurate, and professional.

Several factors can contribute to errors in event-related financial documents. These mistakes may range from basic administrative oversights to more complex issues related to service details or payment terms. Below are some of the most common pitfalls to avoid when preparing your billing statements.

Missing or Incorrect Details

- Omitting Client Information: Always ensure that the client’s full name, address, and contact details are included. Missing this information can cause delays in payment or confusion regarding the recipient.

- Incorrect Event Details: Verify that the event date, location, and type are listed correctly. Errors here can cause miscommunication and lead to clients disputing charges.

- Overlooking Service Breakdown: A clear and thorough list of services provided is essential. Missing or vague descriptions can cause clients to question what they are paying for.

Unclear Payment Terms

- Lack of Payment Deadlines: Without a clear due date, clients may delay payments. Always specify when payment is expected and any late fees for overdue amounts.

- Unspecified Payment Methods: Make sure to state the acceptable payment methods, whether it’s bank transfer, credit card, or cash. Not outlining this can confuse the client and lead to payment delays.

- Ambiguous Discounts or Fees: If you offer discounts, special offers, or additional charges, ensure they are clearly explained. Hidden fees or unclear discounts can lead to disputes or dissatisfaction from clients.

By being mindful of these common mistakes and taking the necessary steps to correct them, you can streamline your financial record-keeping process and avoid unnecessary complications. Clear, accurate, and professional documents not only enhance your credibility but also improve client trust and ensure timely payments.

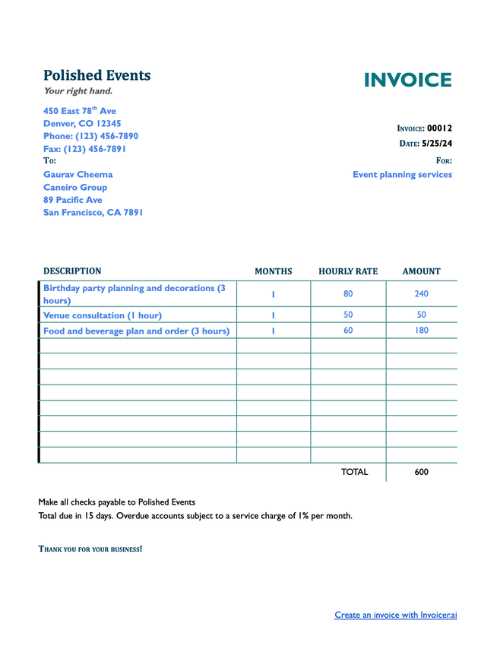

Free Party Invoice Templates for Quick Use

For event planners and organizers, the ability to quickly generate billing documents is a valuable asset. Free, ready-to-use billing formats provide a fast solution, enabling you to prepare professional financial records without spending hours on design or formatting. These pre-made documents allow you to focus on delivering exceptional events while ensuring timely and accurate payments.

Using these free formats eliminates the need for starting from scratch each time you prepare a payment request. Whether you’re handling small private gatherings or large-scale corporate functions, these tools offer convenience and flexibility. With a variety of options available, you can find the right format to suit your needs, ensuring that all relevant information is included and presented clearly.

Advantages of Using Free Formats

- Time-Saving: Pre-designed documents allow you to fill in the specific details of your event quickly, reducing the time spent on paperwork.

- Professional Look: Ready-made layouts provide a clean, polished appearance that enhances your reputation and makes your records look more credible.

- Customization Options: Many free formats are editable, allowing you to adjust them to fit the specific needs of your event or client.

- Easy Access: Free formats are available online and can be downloaded instantly, making them accessible whenever you need them.

Where to Find Free Formats

There are numerous online platforms that offer free, downloadable financial documents. Some websites provide a wide range of designs that can be customized according to your event type and services offered. Additionally, many tools allow you to create or edit these formats directly in your browser, streamlining the entire process even further.

Using free formats not only saves time but also ensures consistency in your billing process. By taking advantage of these resources, you can maintain a professional image while simplifying your administrative tasks.

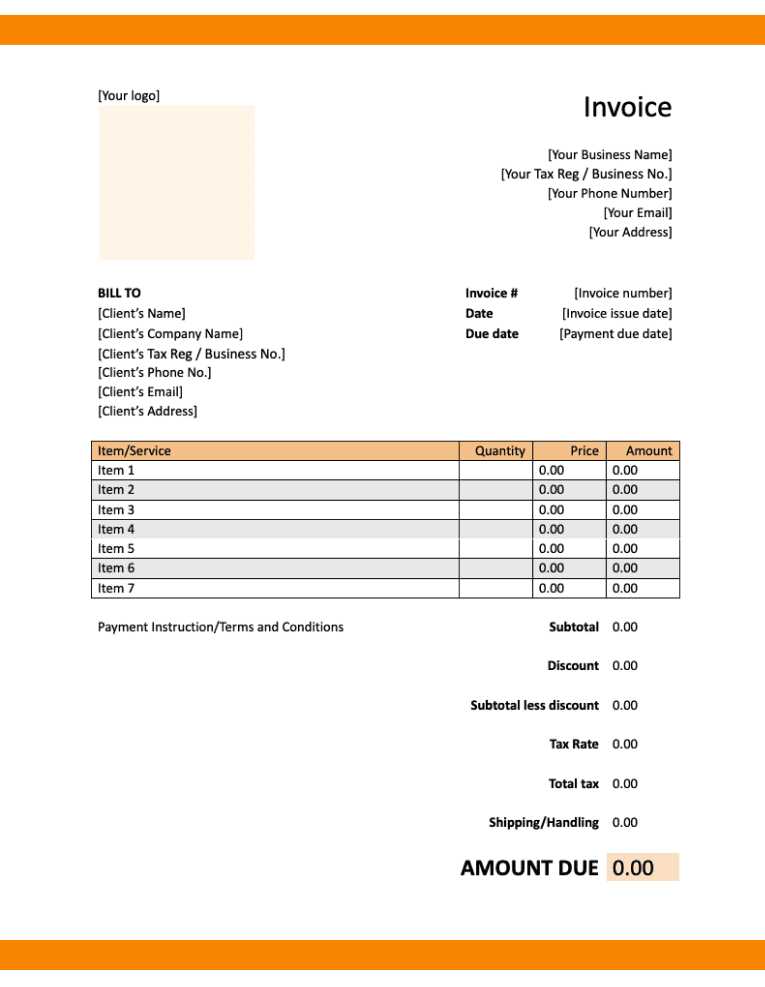

How to Add Taxes and Discounts

When preparing financial documents for an event, it’s essential to accurately include applicable taxes and discounts. These adjustments ensure that both parties understand the final payment amount and that all charges are transparent. Adding taxes and offering discounts correctly can also enhance your professionalism and prevent potential confusion or disputes with clients.

Calculating taxes and discounts requires a clear understanding of the rates or amounts involved, as well as how they apply to the total cost of services. Whether you’re applying a flat rate or percentage, it’s important to break down these adjustments so that clients can easily see how the final amount is determined. Properly presenting these elements contributes to building trust and ensuring accurate payments.

Adding Taxes

Taxes are often a necessary component of event billing, depending on your location and the services provided. To add taxes to your document, follow these steps:

- Determine Tax Rate: Know the applicable tax rate for your services. This rate can vary based on the region or service type.

- Calculate the Tax: Multiply the total cost of your services by the tax rate. For example, if the tax rate is 10% and the total cost is $500, the tax will be $50.

- Itemize the Tax: List the tax separately on the document so that the client can clearly see how much they are being charged for taxes.

Applying Discounts

Discounts can be used to incentivize early payments, reward loyal clients, or provide promotional offers. To apply discounts, follow these steps:

- Specify Discount Type: Decide if the discount will be a percentage off the total amount or a fixed amount (e.g., $50 off).

- Apply the Discount: For a percentage discount, multiply the total by the discount rate (e.g., 10% off $500 = $50 discount). For a fixed amount, simply subtract the discount from the total.

- List the Discount: Clearly state the discount applied and the reason, such as a “Seasonal Offer” or “Early Payment Discount.”

By adding taxes and discounts clearly, you ensure transparency in your financial documentation. This not only helps avoid confusion but also demonstrates your attention to detail and professionalism.

Streamlining Payments with Invoice Templates

Efficiently managing payments is a crucial aspect of any event planning business. Using structured, pre-designed billing formats can significantly speed up the payment process, reducing delays and improving cash flow. By providing clients with clear, professional financial records, you make it easier for them to review charges and complete payments quickly, which ultimately benefits both parties.

Using a streamlined billing system helps you eliminate unnecessary administrative tasks and ensures that clients receive all the information they need to process payments without confusion. From clear payment terms to easy-to-follow service breakdowns, well-organized documents can simplify the entire process, making it easier to track outstanding balances and monitor cash flow.

Advantages of Streamlined Payment Management

- Faster Payment Processing: Pre-designed documents with clear payment instructions and due dates make it easier for clients to submit payments without unnecessary back-and-forth.

- Reduced Errors: By using standardized formats, you can avoid mistakes in billing amounts or service descriptions, which might otherwise delay payment processing.

- Better Cash Flow: Streamlined payment systems lead to quicker collections, helping you maintain better cash flow for your business operations.

- Improved Client Relationships: Clients appreciate easy-to-understand billing that gives them clear insights into what they’re paying for and why. This can improve trust and long-term business relationships.

Making the Most of Automated Tools

- Automation of Recurring Payments: For clients with regular events or services, automated billing systems can ensure that payments are received on time without additional manual effort.

- Online Payment Integration: Many billing formats allow you to integrate online payment options, making it easier for clients to pay via credit card, bank transfer, or other online methods.

- Tracking and Reporting: Some tools offer built-in tracking and reporting features, allowing you to quickly see which payments have been made, which are overdue, and how your financial records are progressing.

By leveraging structured billing formats and integrating automated payment options, you can significantly reduce the time spent managing finances. This approach not only simplifies payment tracking but also helps you stay organized and professional in your event planning business.

Creating Branded Invoices for Your Parties

For event planners, creating custom financial documents that reflect your brand is an essential step in building credibility and professionalism. A well-designed billing statement not only helps convey the details of the transaction but also serves as an opportunity to showcase your company’s unique identity. By incorporating branding elements into your documents, you reinforce your business image and create a more cohesive client experience.

Branded documents provide a polished and consistent look across all aspects of your communication. Whether it’s the logo, color scheme, or font choice, the details you include help your clients instantly recognize your company. This attention to detail can set you apart in a competitive market and make your financial statements feel more official and personalized.

Key Elements of a Branded Financial Document

- Company Logo: Including your logo at the top of the document immediately signals professionalism and helps clients associate the document with your brand.

- Color Scheme: Use your company’s brand colors in headings, borders, and accents to create a visually cohesive document. This adds a polished, branded feel to your communication.

- Consistent Typography: Use fonts that match your brand’s style guide. This consistency extends across your website, marketing materials, and financial documents, making your business instantly recognizable.

- Custom Header and Footer: Adding a custom header and footer with your contact information, website link, and social media handles can help your clients stay connected with your business.

Enhancing Client Experience Through Customization

- Personalized Content: Including the client’s name, event details, and tailored service descriptions adds a personal touch to the document, which can improve client satisfaction.

- Professional Formatting: Clear and organized formatting, with well-defined sections for services, costs, and payment terms, makes the document easy to read and understand, enhancing the client’s experience.

- Customizable Sections: Depending on the complexity of the event, you can modify the content to reflect the specific services provided, discounts, taxes, and other elements that may apply.

By integrating your brand identity into your financial documents, you not only create a professional appearance but also reinforce your business values and style. Branded documents help elevate the overall client experience, contributing to a lasting impression and improving the likelihood of repeat business.

Digital vs Paper Invoices for Events

When managing financial transactions for events, choosing between digital and paper documents is an important decision. Both options have their benefits and drawbacks, and the right choice depends on factors such as efficiency, client preferences, and environmental impact. Understanding the pros and cons of each method will help you determine which option best suits your business needs and client expectations.

Digital and paper billing each offer unique advantages. Digital records can be more efficient and environmentally friendly, while paper documents may offer a more traditional, tangible experience for clients. By weighing the benefits of each, you can streamline your payment process and ensure that your billing practices align with your business’s operational goals.

Benefits of Digital Billing

- Convenience: Digital documents can be created, sent, and received instantly, speeding up the entire billing process and reducing delays in payment.

- Cost-Effective: Eliminating the need for paper, ink, and postage saves money, particularly for businesses that handle a high volume of transactions.

- Environmentally Friendly: Digital records reduce paper waste and are a more sustainable option, contributing to a greener business model.

- Easy Tracking and Management: Digital systems allow for easy storage, organization, and retrieval of documents, making it simple to track payments and manage financial records over time.

- Secure Payment Integration: Many digital formats offer built-in payment gateways, allowing clients to pay directly from the document, reducing friction in the payment process.

Benefits of Paper Billing

- Personal Touch: Some clients may prefer the tangible feel of a physical document, which can feel more personal or official compared to digital alternatives.

- Familiarity: For clients who are not as tech-savvy or prefer traditional methods, paper documents may be easier to understand and manage.

- Legal or Regulatory Requirements: In certain regions or industries, paper records may be required for legal or tax purposes. Always ensure that you’re meeting any local or industry-specific regulations.

- Physical Reminders: A paper document serves as a ph

Incorporating Payment Terms in Invoices

Clearly stating payment terms in financial documents is essential for ensuring timely payments and avoiding misunderstandings with clients. By outlining specific terms, you define expectations for both parties, helping to prevent confusion about due dates, late fees, and payment methods. These terms act as a contract that ensures smooth transactions, fostering trust and clarity in your business dealings.

Including payment terms on your documents provides both you and your client with a clear understanding of the agreed-upon conditions for payment. This includes specifying due dates, payment methods, and any penalties for late payments. Properly communicated terms can help avoid delays, disputes, and complications, leading to a more professional relationship with your clients.

Key Payment Terms to Include

- Due Date: Always specify the exact date by which payment is due. Clear due dates help prevent late payments and set expectations for when funds should be transferred.

- Late Payment Fees: Outline the consequences for overdue payments, such as late fees or interest charges. This encourages clients to pay promptly and serves as a deterrent against delays.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, checks, or online payment services. This ensures that clients know how to complete their payments efficiently.

- Early Payment Discounts: If you offer discounts for early payments, be sure to specify the percentage and the deadline by which the payment should be made to qualify for the discount.

Example of Payment Terms in a Billing Document

Payment Term Details Due Date Payment is due within 30 days from the date of issue. Late Payment Fee A late fee of 5% will be added for payments received after the due date. Accepted Payment Methods We accept payments vi Party Invoice Templates for Different Events

Each event has its own unique requirements, and it’s important to create billing documents that reflect the specifics of the occasion. Whether you are organizing a wedding, corporate gathering, or casual celebration, tailoring your financial documents to suit the type of event ensures clarity and professionalism. By using customized formats, you can ensure that clients understand the charges, services provided, and payment expectations specific to their event.

Adapting your billing documentation to fit different types of events allows you to address the varying needs and expectations of your clients. For example, a formal corporate gathering may require more detailed line items, while a casual birthday party might only need a simple summary of services. Understanding these nuances helps improve client satisfaction and promotes timely payments.

Customizing for Weddings

- Detailed Service Breakdown: Weddings often involve multiple services, such as catering, entertainment, and décor. A detailed list ensures transparency and helps clients understand the cost of each individual service.

- Payment Installments: Weddings may require multiple payments over time, especially for larger events. Clearly outlining payment schedules helps avoid confusion and ensures that all parties are aligned.

- Custom Items and Requests: Include any custom requests, like floral arrangements or special decorations, that are unique to the wedding to make sure they are properly accounted for.

Adapting for Corporate Events

- Itemized Costs: Corporate events typically require a more formal and itemized structure. Including detailed costs for each service or product ensures that clients know exactly what they are paying for.

- Taxation and Discounts: Corporate clients may expect tax calculations and discounts for bulk services or early payment options. Be sure to clearly outline these elements in the document.

- Terms and Conditions: Corporate clients often require more detailed terms and conditions related to payment, cancellation policies, and service guarantees. Including this information ensures professionalism and reduces the risk of disputes.

For Informal Celebrations

- Simplified Layout: For more casual events, such as birthdays or family gatherings, a simple, easy-to-read format will suffice. Focus on clarity and conciseness, without overwhelming clients with unnecessary details.

- Flat Rates or Packages: Many informal events use flat rates or package deals, which should be clearly outlined to avoid confusion about the overall cost.

- Flexible Payment Options: Casual eve

How to Avoid Late Payments with Invoices

Late payments can cause significant disruptions in your cash flow, affecting your ability to manage business operations smoothly. To prevent delays and ensure timely payments, it is essential to create clear, professional financial documents that outline payment expectations and penalties for overdue amounts. A well-structured billing statement not only informs clients of what they owe but also motivates them to settle their dues promptly.

By implementing a few proactive strategies, you can reduce the likelihood of late payments and maintain a steady flow of revenue. Key practices such as setting clear terms, offering convenient payment options, and sending reminders can help prevent overdue balances from becoming a recurring issue.

Clear Payment Terms

- Set Specific Due Dates: Always provide an exact due date on your documents. Avoid vague terms like “due in 30 days” and instead use clear deadlines (e.g., “Payment due by April 15”).

- Late Payment Penalties: Clearly communicate the consequences of late payments, such as a fixed fee or percentage charge added to the amount owed after the due date. This can incentivize clients to pay on time.

- Early Payment Discounts: Offering a small discount for early payments can encourage clients to settle their accounts faster, benefiting both parties.

Make Payment Easy

- Multiple Payment Options: Make it easy for clients to pay by offering various payment methods such as bank transfers, credit cards, online payments, or checks. The more options they have, the less likely they are to delay payment.

- Invoice Clarity: Ensure that the billing statement is easy to understand, with clear breakdowns of services, amounts due, and payment instructions. Confusion over the charges can lead to unnecessary delays.

- Payment Reminders: Send friendly reminders before the due date, as well as follow-up notifications after the deadline if payment has not been received. Many clients will appreciate the gentle nudge and settle promptly.

By adopting these strategies, you can reduce the risk of late payments and maintain better control over your cash flow. Setting clear expectations and offering multiple payment methods will encourage clients to pay on time, ensuring a smoother and more efficient billing process for your business.

Tracking Multiple Event Invoices Efficiently

Managing several financial records across different events can quickly become overwhelming, especially when deadlines are tight and payments are due. To ensure a smooth process, it’s crucial to have an organized system in place that allows you to track each transaction effectively. Implementing a streamlined tracking method will not only reduce the risk of errors but also help you stay on top of payments, making sure you don’t miss any important deadlines.

Whether you’re handling multiple clients or different types of events, having a consistent approach to managing your billing records can improve efficiency. The key to success lies in using digital tools, clear documentation, and regular follow-ups to keep everything organized and on track.

Methods for Effective Tracking

- Use Accounting Software: Software like QuickBooks, Xero, or Zoho can help you automatically generate and track financial documents for each event. These tools provide a clear overview of all outstanding payments and due dates in one place.

- Spreadsheet Tracking: If you prefer a more manual approach, spreadsheets can also be an effective solution. Use columns for event names, due dates, payment amounts, and statuses (paid/unpaid). Regularly update your sheet to keep track of outstanding balances.

- Centralized System: Maintain all your billing records in a single, easy-to-access location–whether on a cloud platform or in a dedicated folder. This will ensure that nothing slips through the cracks and you can quickly find the details of any specific event.

- Automated Reminders: Set up automated reminders for payments due in the coming weeks. This proactive approach will help you stay ahead of late payments and keep clients informed of their financial obligations.

Tracking Key Information

- Due Dates: Keeping track of each event’s due date is crucial. This will help you determine when to send reminders and follow-ups.

- Payment Amounts: Always keep a record of the agreed payment amount for each event, including any deposits or partial payments already made.

- Payment Status: Maintain a clear status indicator (paid, unpaid, partially paid) to track the current status of each event’s transaction.

- Client Contact Information: Make sure to store up-to-date contact details for each client, so you can reach out easily if there are any issues or delays in payments.

By establishing a solid tracking system, you can efficiently monitor multiple financial transactions across different events.