How to Use an Invoice Template for Email to Improve Your Billing Process

Managing payments effectively is crucial for maintaining a smooth and professional relationship with clients. When it comes to requesting compensation, having a clear and structured approach can make a significant difference in how quickly and efficiently you receive what you’re owed. With modern tools, it’s now easier than ever to create well-organized documents that communicate all the necessary details in a way that is both straightforward and polished.

By adopting a digital method of sending these documents, businesses can save time, reduce errors, and ensure that all relevant information is delivered directly to the recipient’s inbox. This process not only increases the chances of prompt payment but also enhances the professionalism of your communication. When well-crafted, these documents can become a valuable asset in managing financial transactions.

In this guide, we will explore how to design and implement effective methods for preparing and sending these financial requests, ensuring clarity, accuracy, and efficiency in every interaction. Whether you’re a freelancer, a small business owner, or part of a larger enterprise, adopting a streamlined approach will improve your overall workflow and payment cycles.

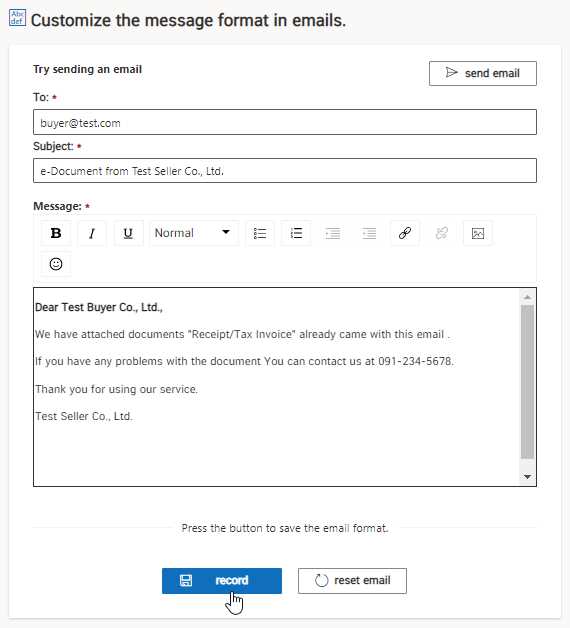

How to Create an Email Invoice Template

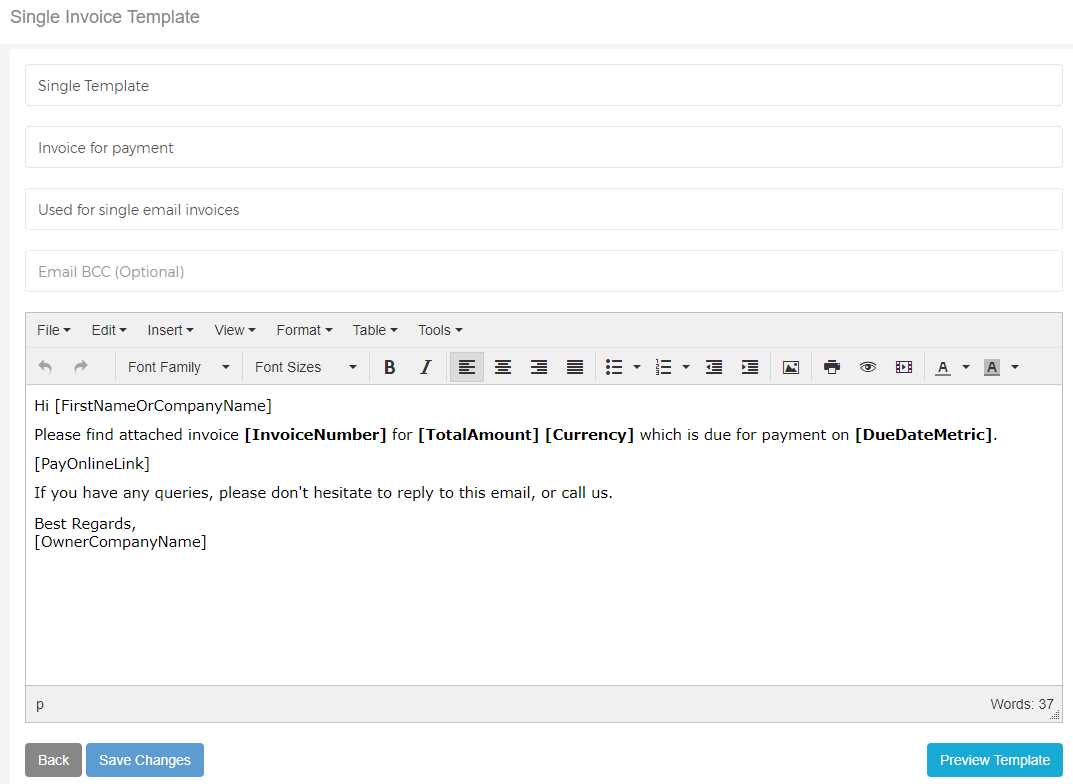

Designing a professional document to request payment involves careful attention to detail, ensuring that all necessary information is clearly displayed for the recipient. A well-structured approach not only enhances the recipient’s understanding but also streamlines the process of payment. Whether you’re preparing a one-time request or looking to standardize your communications, creating an efficient layout is key.

Start by including essential details such as the recipient’s name, contact information, and the specific service or product provided. Organizing these elements in a simple, easy-to-read format helps avoid confusion and promotes prompt action from the client. Below is an example of a basic structure that can be tailored to suit your business needs:

| Details | Information |

|---|---|

| Recipient Name | John Doe |

| Service Description | Web Development Services |

| Date of Service | October 10, 2024 |

| Total Amount | $500.00 |

| Due Date | October 30, 2024 |

| Payment Instructions | Bank Transfer to Account #123456 |

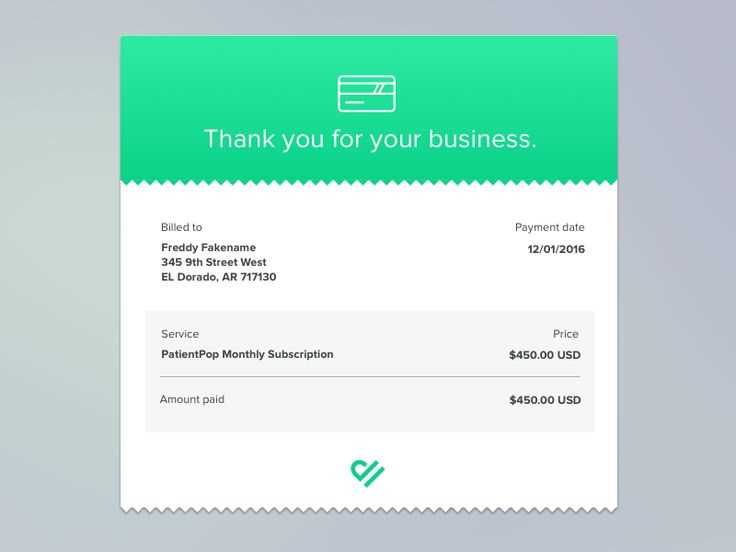

Once you’ve set up the key components, you can further customize the appearance and formatting to align with your brand’s style. Adding your logo, choosing an appropriate color scheme, and ensuring a professional tone will help reinforce your company’s image. It’s also helpful to include a brief note expressing gratitude or reminding the client of payment terms.

By creating a standardized and clear layout, you ensure that clients understand their obligations without unnecessary back-and-forth communication. This will save you time and reduce the chances of errors or delays in receiving payment.

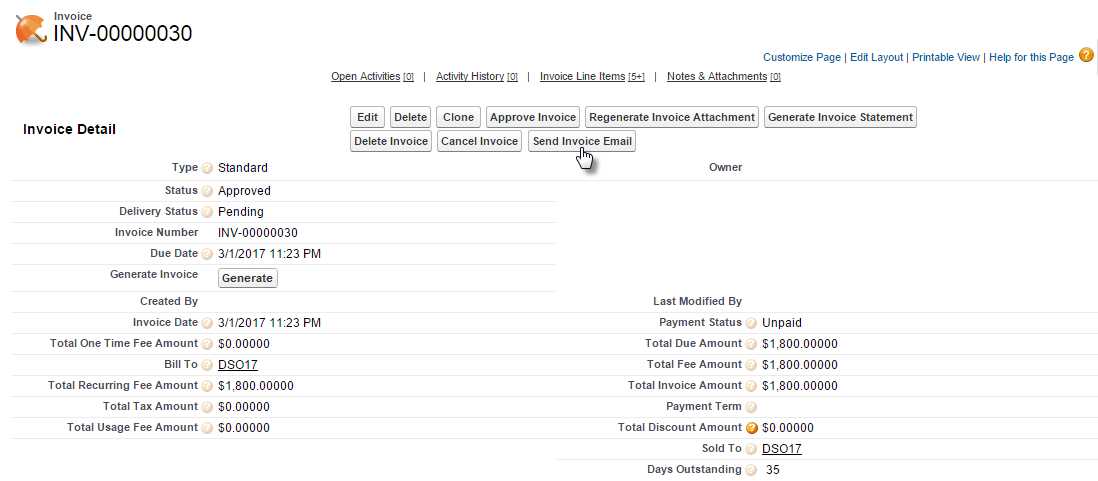

Why Email Invoices Are Important for Business

In today’s fast-paced business environment, quick and efficient communication is essential for maintaining positive client relationships and ensuring timely payments. Sending payment requests through digital channels offers a streamlined approach that benefits both businesses and customers. Not only does it improve efficiency, but it also helps maintain professionalism and organization.

One of the primary advantages of using digital methods is the ability to instantly reach clients, regardless of their location. Unlike traditional methods, which may involve delays due to postal services or human error, digital communication allows for the immediate delivery of important documents. This reduces the chance of lost paperwork and ensures the recipient has all the necessary information at their fingertips.

Moreover, adopting a digital approach helps businesses track communications with ease. Sending these requests electronically ensures you have a record of all transactions, making it easier to monitor payments and follow up with clients who may be late. It also adds a layer of security, as these records can be stored and backed up online for future reference.

Another significant benefit is the environmental impact. By shifting from paper-based processes to digital solutions, businesses can reduce their carbon footprint and cut costs related to printing and postage. This not only helps the environment but can also contribute to your company’s reputation as a forward-thinking and eco-conscious organization.

Ultimately, transitioning to digital payment requests is a simple yet effective way to modernize business operations, increase efficiency, and ensure that clients receive clear, timely communication. It’s a small change with the potential for significant positive impact on cash flow and client satisfaction.

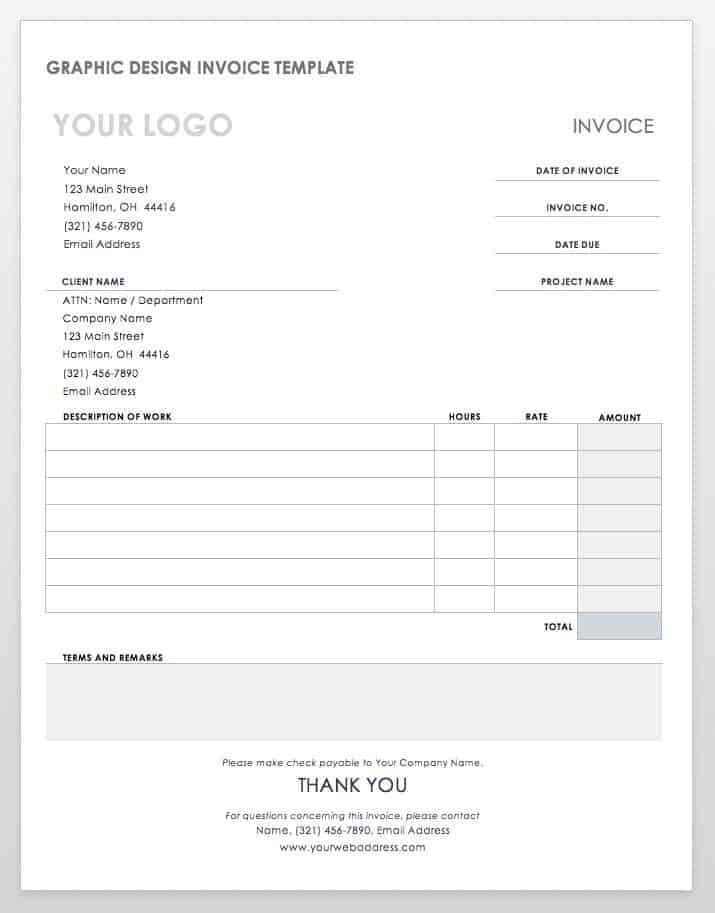

Key Elements of a Professional Invoice

Creating a clear and comprehensive document to request payment is essential for maintaining professionalism and ensuring timely transactions. The right structure and detail can make a significant difference in how your clients perceive the request and respond to it. A well-organized document not only communicates your expectations but also strengthens your business reputation.

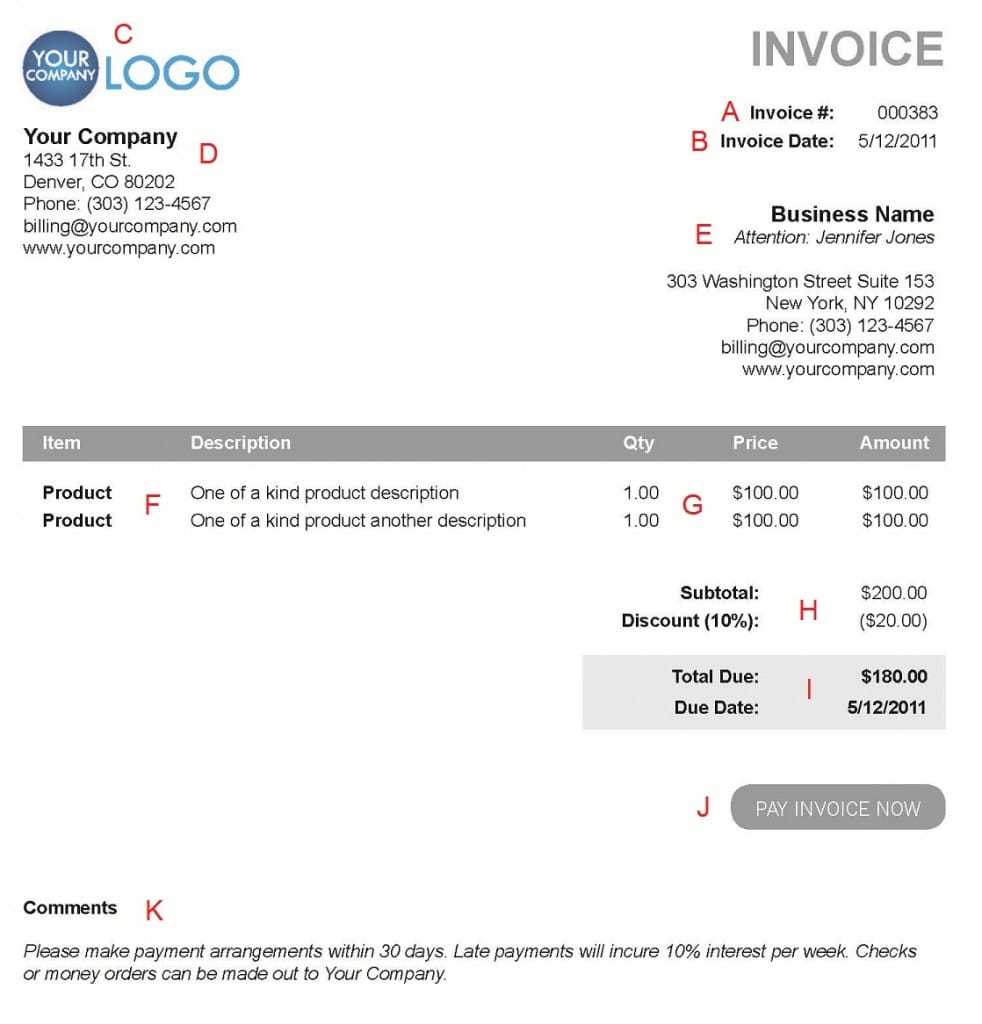

To start, make sure to include your business information, including your name, address, and contact details. This establishes transparency and makes it easy for the client to reach out if needed. Similarly, the recipient’s details should be clearly listed to avoid any confusion. This includes the client’s name, address, and other relevant information.

Next, be sure to include a clear description of the products or services provided. The details should be specific, listing the type of service, date provided, and any applicable rates. This helps clients understand what they are paying for and justifies the charges. The payment terms should also be defined, including the due date and accepted methods of payment.

Another crucial element is the total amount due, which should be clearly highlighted. This should include any taxes, discounts, or additional charges that apply to the final amount. A breakdown of each charge, along with the subtotal, can help clients see the transparency of the costs involved. Finally, including a polite note of thanks or a reminder of payment instructions adds a personal touch and promotes prompt payment.

When all these elements are present and well-organized, the document serves not only as a request for payment but also as a reflection of your professionalism. A thorough, easy-to-read format helps ensure clarity and reduces the chances of miscommunication or delays.

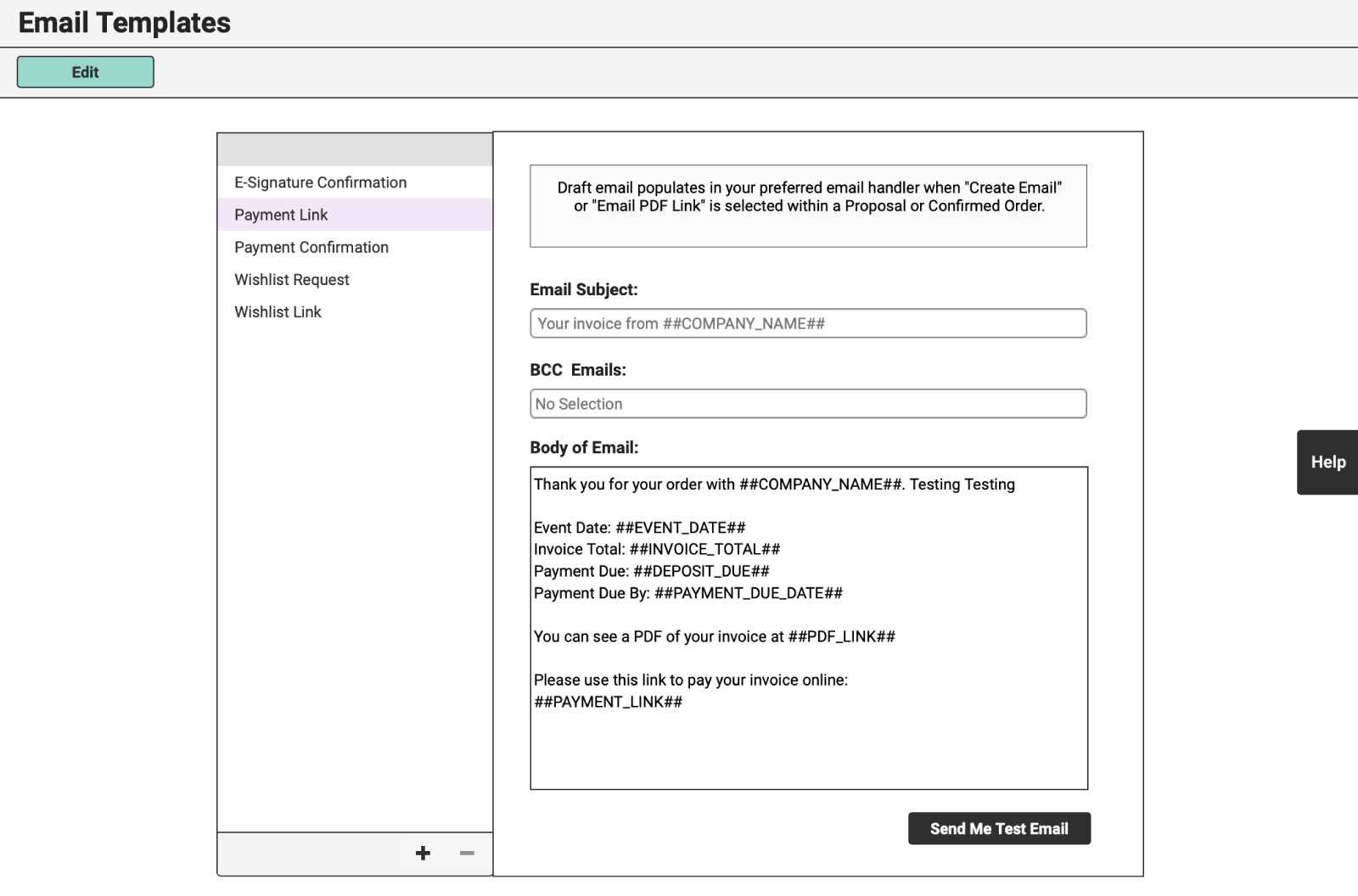

Customizing Your Invoice Template for Clients

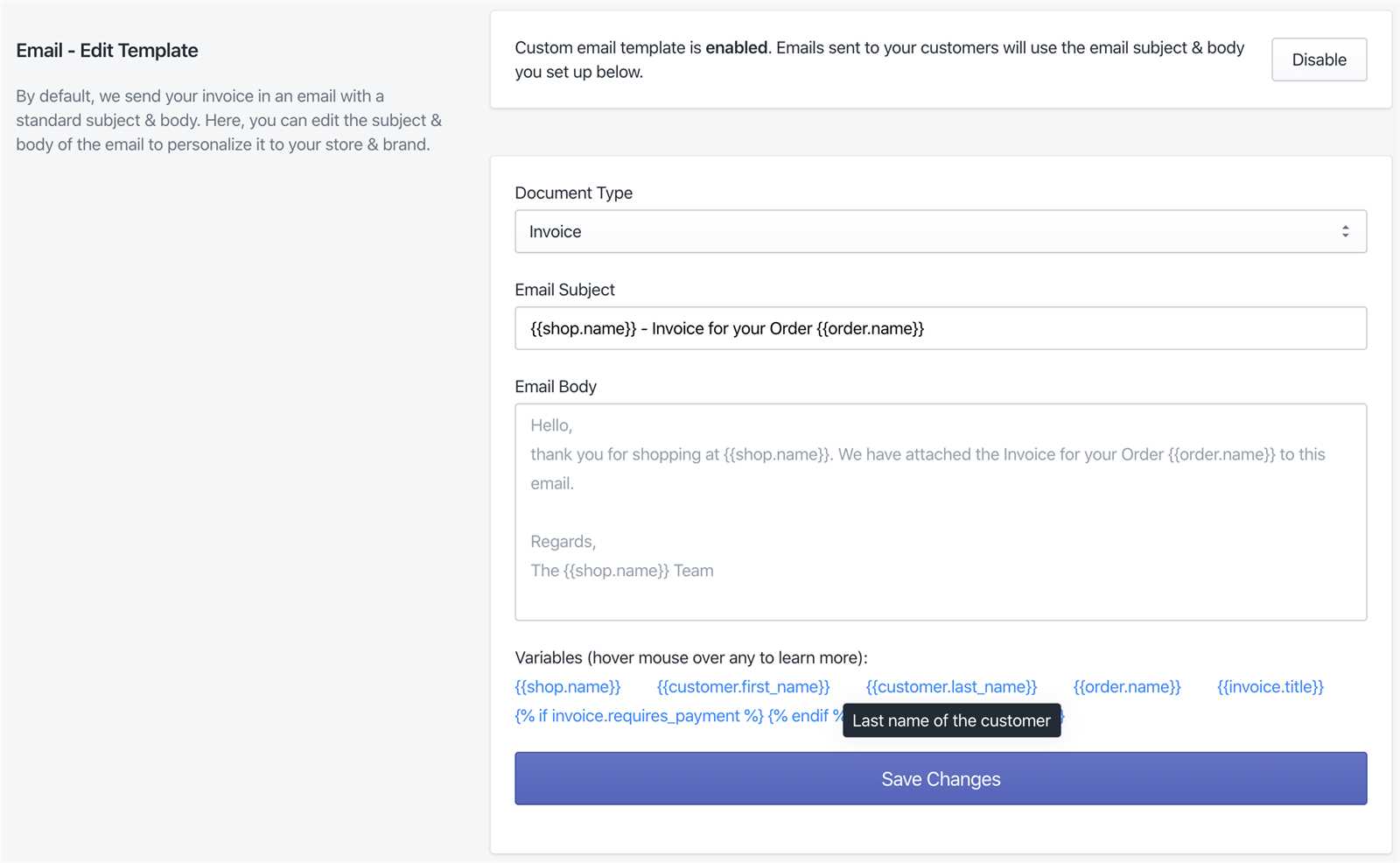

Adapting your payment request document to suit the needs of individual clients is an important step in building strong business relationships. Personalization helps convey a professional image while ensuring that the recipient receives exactly what they need to process the payment. Customizing your communication can also improve client satisfaction and encourage prompt responses.

Include Client-Specific Information

When tailoring your document, it’s essential to include details that make the request more relevant to the specific client. Some key elements to personalize include:

- Client’s Name and Contact Information – Always ensure that the correct recipient information is listed, including name, company, and contact details.

- Project or Service Details – Reference specific services rendered or products delivered. Adding a brief description helps avoid confusion and strengthens the connection between the work and the payment.

- Due Date – If the client has agreed to specific payment terms, make sure these are clearly outlined, adjusting the due date if necessary.

Maintain a Consistent Branding Style

While personalization is important, consistency in your branding also plays a vital role in maintaining a professional image. Customize the layout with your company’s logo, colors, and fonts to create a unified brand experience. This consistency also helps clients quickly recognize your documents and associate them with your business.

- Logo Placement – Ensure your logo appears prominently at the top of the document.

- Color Scheme – Use your brand’s color palette for headings, borders, and other elements to create a cohesive look.

- Font Selection – Stick to professional, easy-to-read fonts that align with your company’s visual identity.

By customizing your document with both client-specific details and consistent branding, you not only make the payment process easier for the client but also reinforce your company’s professionalism and attention to detail. A well-designed, personalized request enhances your chances of receiving timely payments and fosters positive long-term relationships with

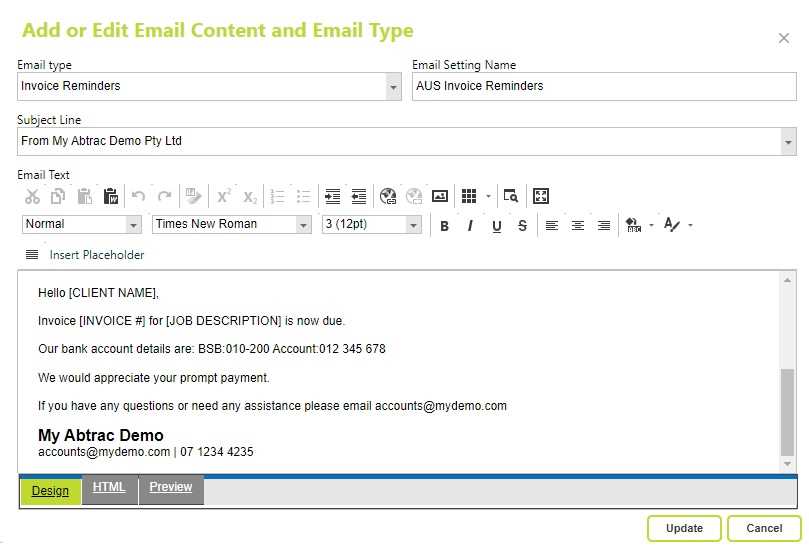

Best Practices for Sending Invoices via Email

Sending payment requests through digital channels offers a fast and efficient way to collect outstanding amounts, but to ensure smooth transactions, certain best practices should be followed. Clear communication, professionalism, and proper formatting are crucial in helping your clients understand and process their payments without confusion or delay. Following a structured approach will not only improve your chances of timely payments but also enhance your business’s reputation.

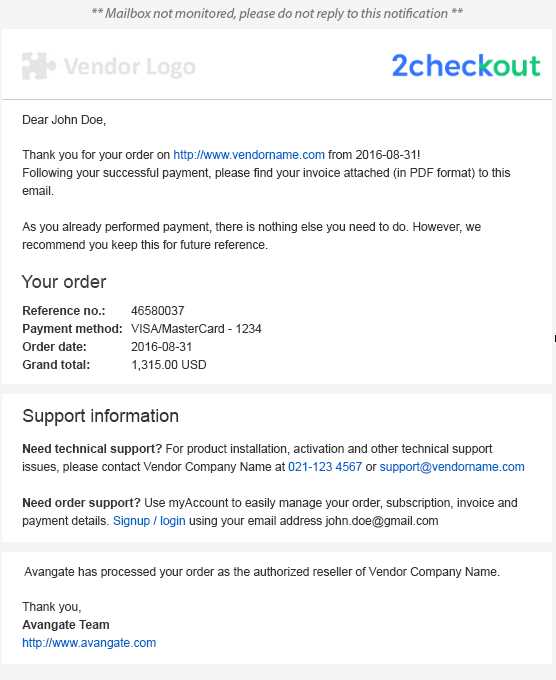

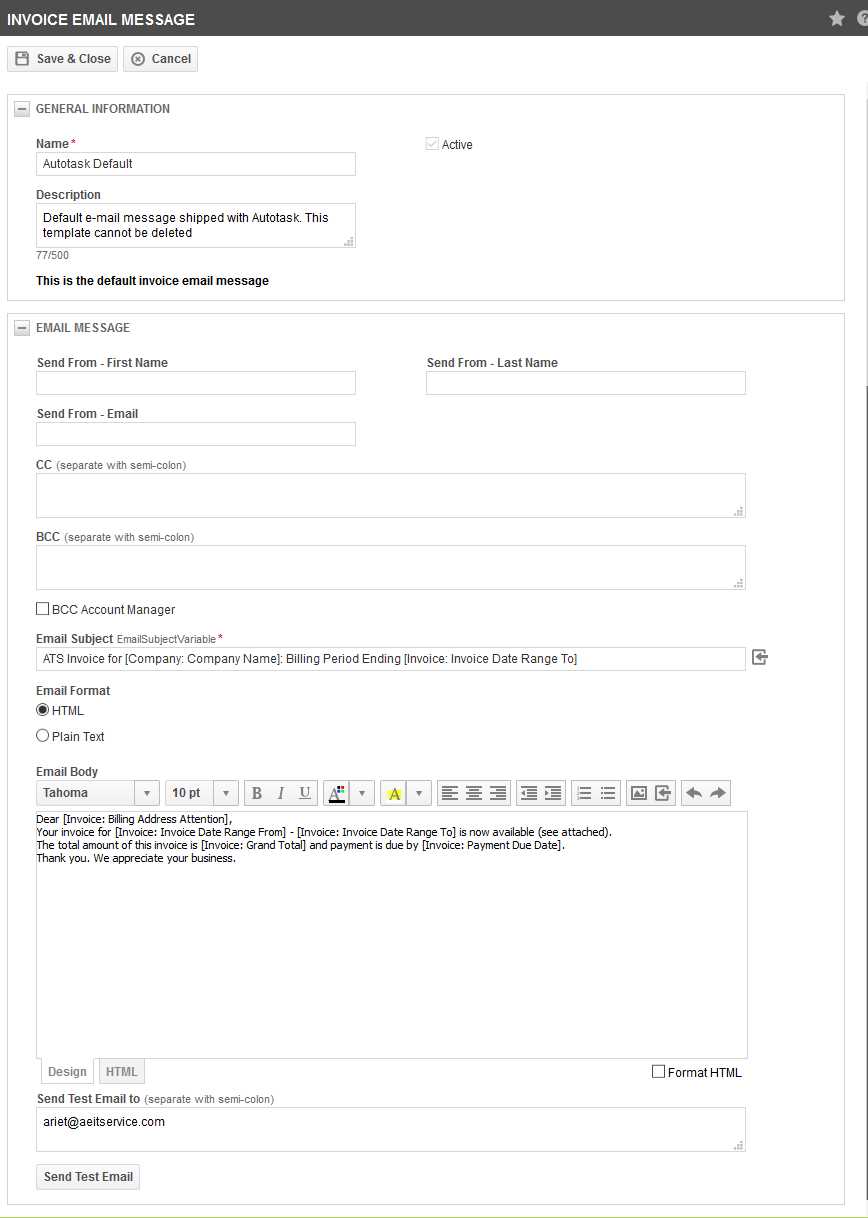

First and foremost, always ensure that the recipient’s contact details are accurate. Double-check the email address to avoid sending the request to the wrong person. Incorrect contact details can lead to unnecessary delays and frustration. Additionally, ensure that your subject line is clear and to the point, such as “Payment Request for [Service/Product]” or “Amount Due for [Company Name].” This will grab the recipient’s attention and make them aware of the document’s purpose immediately.

When attaching the request document, consider using a widely accepted file format, such as PDF. This format preserves the integrity of your layout and ensures that the client can easily open and view the document without encountering compatibility issues. Avoid sending documents in file formats that may be unfamiliar or difficult to access, like Word documents or compressed files. It’s always best to choose a format that’s universally readable and professional.

In your email body, briefly summarize the key points of the document, such as the total amount due and the due date. Providing this information upfront makes it easier for the recipient to quickly process the details without opening the attachment. You may also want to include a polite reminder of payment terms, any late fees, and accepted payment methods. Be concise and clear in your message to avoid confusion.

It’s also essential to maintain a professional tone in both the subject line and the email content. While it’s important to be friendly and approachable, always keep your language formal and polite. Closing your message with a thank-you note and offering assistance or clarification, if necessary, can foster positive relationships with clients.

Lastly, remember to follow up if the payment has not been received by the due date. A gentle reminder can encourage prompt payment, but it should be courteous and respectful to maintain a professional relationship with the client.

Choosing the Right Format for Email Invoices

When sending a payment request through digital means, selecting the right file format is crucial to ensure that your document is both accessible and professional. The format you choose can impact how easily the recipient can view, print, or save the document, as well as how it reflects on your business. It’s important to consider factors such as compatibility, clarity, and security when deciding which format to use.

PDF is often the best option for most businesses. This format preserves the layout, fonts, and images exactly as you intended, ensuring that your document appears the same across all devices and platforms. PDFs are universally accessible and can be opened on nearly any device without needing specific software. They also offer the benefit of being secure, as you can password-protect the document or add encryption to prevent unauthorized changes or access.

Word Documents can be used, but they are generally less secure than PDFs and can appear unprofessional to some clients. Additionally, not everyone may have the appropriate software to view a Word document, which can lead to accessibility issues. If you choose this format, ensure that the file is virus-free and properly formatted before sending it.

Excel or CSV Files are suitable when dealing with detailed calculations or itemized lists, particularly in businesses that handle large quantities of products or services. These formats allow for easy modification, but they can be more difficult for clients to read and may not give the same polished appearance as a PDF. Be sure to add clear headers and structure to the data to make it easy for clients to follow.

Text Files (like .txt) should generally be avoided, as they lack the formatting options and professionalism of other formats. They are simple to create but do not provide a visually appealing or organized presentation, which can hurt your business’s image. Use them only when absolutely necessary and when the client prefers or requests this format.

Another consideration is the file size. Large attachments may cause issues with email delivery, especially if the recipient’s email server has size restrictions. Aim to keep the file size as small as possible while ensuring the document is clear and readable. Compressing images or using simple formatting can help minimize file size.

Ultimately, the goal is to provide a document that is easy for the client to open, read, and save while maintaining a high level of professionalism. The right format will ensure that your payment request is received without issues and reflects positively on your business.

Common Mistakes to Avoid in Invoices

When preparing a document to request payment, it’s crucial to avoid errors that could lead to confusion, delays, or even missed payments. A small mistake can tarnish your professional image and disrupt your cash flow. Ensuring that your payment request is accurate, clear, and comprehensive is essential for smooth transactions and maintaining positive client relationships.

Here are some common mistakes to avoid when creating your payment request:

- Incorrect Client Information – Always double-check the client’s name, address, and other details before sending. Even a small error can create confusion and delay payment.

- Missing Payment Terms – Be sure to clearly state the payment due date, any applicable late fees, and the accepted methods of payment. Lack of clarity in these areas can lead to misunderstandings.

- Unclear Service Descriptions – Provide a detailed breakdown of services rendered or products provided. Vague descriptions may leave the client unsure about what they are being charged for, causing delays in payment.

- Failure to Include Tax Information – If applicable, make sure to list any taxes separately and clearly. Failing to include this information may cause confusion or even legal issues.

- Typos and Errors in Numbers – Ensure that all figures, including the amount due, are accurate. A simple mistake in numbers can lead to discrepancies and a lack of trust from your client.

- Not Providing Contact Information – If there’s a need for clarification or issues arise, make sure your contact information is clearly listed. This ensures easy communication if the client has questions or concerns.

- Overcomplicating the Design – While it’s important to include all necessary details, keep the layout clean and easy to read. Overcrowding the document with excessive text or unnecessary information can make it harder for the client to understand the key points.

Avoiding these mistakes will help you maintain a professional and efficient payment process. Taking the time to review and double-check your document before sending it ensures that all details are correct and that your request is clear, leading to timely and smooth transactions.

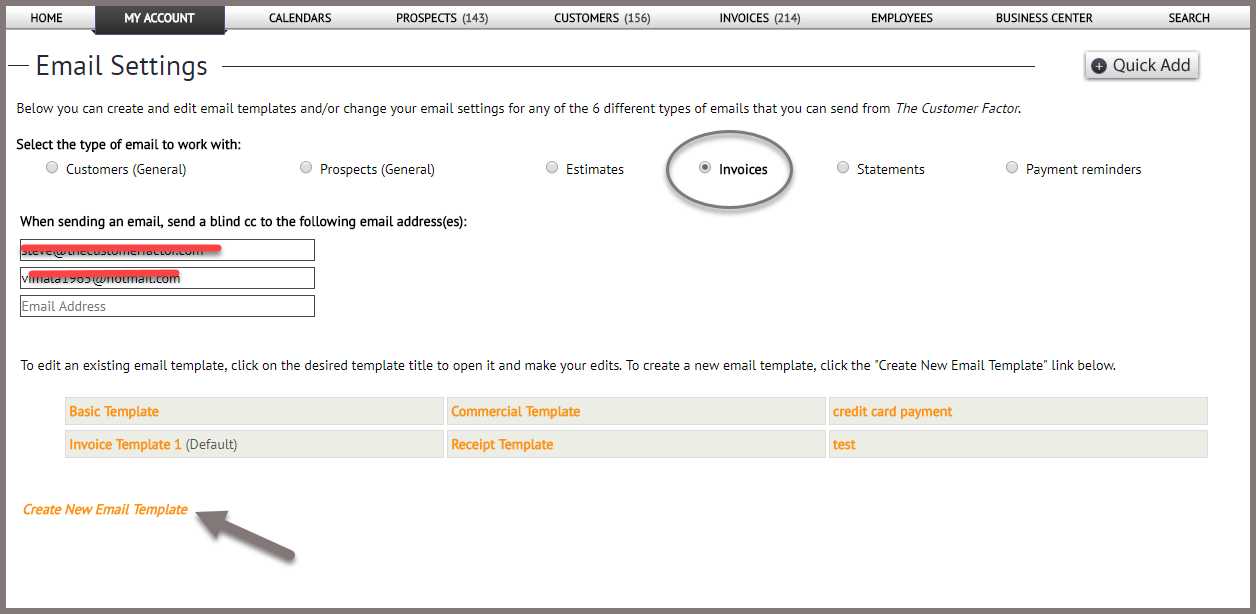

Free Invoice Templates for Email Users

Many businesses, especially small ones or freelancers, rely on cost-effective solutions to handle their payment requests. Using a ready-made document format can save time and reduce the complexity of creating customized forms from scratch. Fortunately, there are numerous free options available online that provide pre-designed layouts, making it easier to send professional payment reminders without a steep learning curve.

These ready-to-use forms typically offer a variety of designs and formats that can be customized with your business details. By using these free resources, you can ensure consistency in your communication and save time on formatting, allowing you to focus on delivering excellent products and services. The best free options allow you to easily input your business name, services provided, payment terms, and amounts due.

Advantages of Using Free Templates:

- Cost-Effective – There are no fees involved in using most online templates, making them ideal for businesses with tight budgets.

- Ease of Use – Many free options are simple to use, requiring only basic input of information such as service descriptions, dates, and amounts.

- Professional Design – Even free formats often come with polished, modern designs that help you maintain a professional image.

- Customizable – Most options allow you to add or remove sections depending on your needs, giving you the flexibility to adjust the format to suit your specific business model.

Where to Find Free Options: Numerous websites offer free downloads, including platforms like Canva, Microsoft Office, and Google Docs. Additionally, many business-oriented sites provide free downloadable forms that are already optimized for digital use. Some offer the ability to export your form directly to PDF or Word format, making it easy to send as an attachment to clients.

Using these resources can he

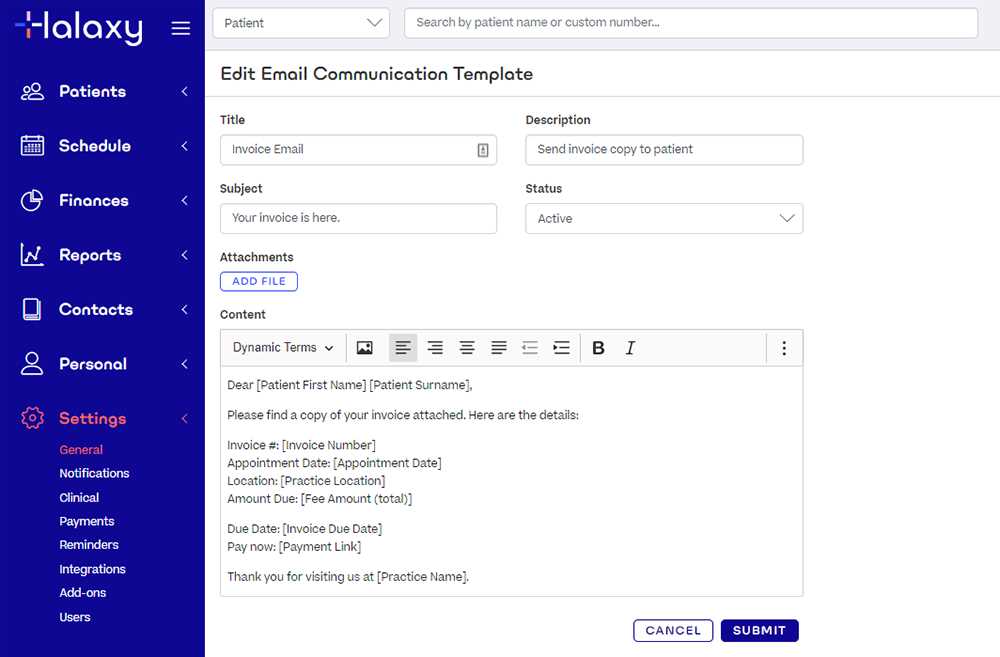

How to Personalize Your Invoice Template

Customizing your payment request document is essential for maintaining a strong connection with clients. Personalization not only helps create a professional impression but also enhances clarity and strengthens your business relationships. By adding tailored details, you can make the communication more relevant and ensure that your clients understand the specifics of the transaction.

Here are some key ways to personalize your document:

- Client’s Information – Always include the correct name, address, and contact details of your client. This helps avoid confusion and ensures the document is directed to the right person.

- Service or Product Descriptions – Be specific about what was delivered. Include relevant details such as project name, hours worked, or the exact items purchased to make it clear what the charges are for.

- Tailored Payment Terms – Customize payment deadlines based on previous agreements with each client. You might offer different terms based on the project or the client’s payment history.

- Friendly Message – Adding a short, personalized note of thanks or appreciation can help maintain a positive relationship with your client. For example, “Thank you for your continued business” or “We appreciate your timely payment.”

- Branding – Include your logo, business colors, and fonts to maintain consistency with your brand’s identity. This adds a professional touch and makes the document instantly recognizable as coming from your company.

In addition to these elements, you can also tailor the design of the document itself. Choose a layout that aligns with your brand, but also ensure it’s simple, clear, and easy to navigate. Avoid overcrowding the document with too much information. A clean, well-structured format makes it easier for your clients to understand the payment details and take action accordingly.

By making these customizations, you create a more professional and engaging experience for your clients, increasing the likelihood of timely payments while reinforcing your business’s identity and attention to detail.

Ensuring Accuracy in Your Email Invoice

Accuracy is critical when preparing a document to request payment. Even minor errors can lead to confusion, delayed payments, or strained client relationships. It is essential to double-check all the details to ensure the information is correct, clear, and consistent. By taking the time to verify each element, you can improve the chances of a smooth transaction and demonstrate professionalism.

Key Areas to Check for Accuracy

There are several areas to focus on when reviewing your payment request document:

- Client Information: Ensure the recipient’s name, address, and contact details are correct. Even a small mistake can cause the request to be sent to the wrong person or department.

- Service Details: Make sure the description of services or products is accurate, including quantities, rates, and dates. This will prevent any confusion about what the payment is for.

- Payment Terms: Verify that the due date, any discounts, and late fees are clearly stated and correct. This helps ensure that both you and the client are on the same page regarding payment expectations.

- Financial Details: Double-check all calculations, including the subtotal, taxes, and the total amount due. A mistake in these numbers can lead to delays or disputes.

Reviewing and Verifying the Document

To ensure accuracy, take a systematic approach:

- First, verify the client’s contact information is up to date and correct.

- Then, review the service descriptions to ensure they reflect what was actually provided and align with the terms of your agreement.

- Next, check all financial details, including prices, taxes, and discounts, against your records.

- Finally, proofread the document for spelling and grammatical errors that could undermine your professionalism.

Example of a Financial Breakdown:

| Description | Quantity | Unit Price | Total | ||||

|---|---|---|---|---|---|---|---|

| Consulting Services | 10 hours | $50 | $500 | ||||

| Legal Element | Required Information |

|---|---|

| Transaction Details | Description of services, products, or work provided, including quantities, prices, and dates. |

| Client Identification | Full name, business name (if applicable), and contact details of the recipient. |

| Tax Information | Tax rates, amounts, and total tax charged, according to local regulations. |