How to Use Office Word Invoice Template for Efficient Billing

Managing financial transactions effectively is crucial for any business. One of the most essential tasks is crafting clear and professional documents to request payments. With the right tools, generating these records can be quick, efficient, and visually appealing, ensuring that clients understand all the necessary details at a glance.

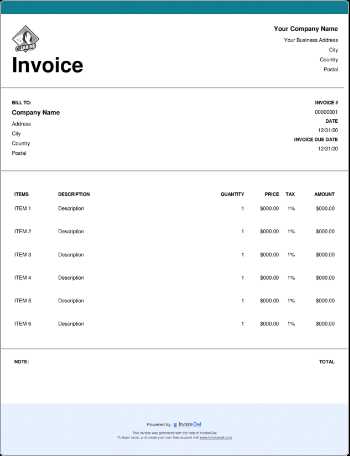

Creating these records doesn’t require advanced software or complicated processes. Simple programs offer a wide range of customizable solutions that allow you to design professional-looking forms in minutes. By adjusting key sections such as payment terms, contact details, and itemized lists, you can ensure your documents meet the specific needs of your business while maintaining a polished appearance.

In this guide, we will explore how to use these user-friendly solutions to create and manage your financial requests, from formatting tips to essential information. Whether you’re a freelancer, small business owner, or part of a larger organization, these methods will save you time and reduce errors when requesting payments from clients.

Office Word Invoice Template Benefits

Using simple, yet powerful tools to generate payment requests offers several advantages for businesses of all sizes. Whether you’re a freelancer or managing a large team, having easy-to-edit documents that look professional can streamline the process of managing financial transactions. The flexibility and accessibility of these solutions make them a popular choice for creating billing documents quickly and effectively.

Cost-Effective and User-Friendly

One of the most significant benefits of these tools is their cost-effectiveness. Many programs are already included in common software packages, meaning there’s no need to invest in additional expensive applications. Furthermore, the user-friendly nature of these programs means you don’t need to be a design expert to create a polished, functional document. With just a few clicks, you can generate a professional-looking request without the hassle of complicated software.

Customization and Flexibility

Another key advantage is the high level of customization these solutions provide. You can easily tailor the layout, fonts, and colors to match your brand or personal style. Adding company logos, adjusting payment terms, or including specific product details can all be done without any technical knowledge. This flexibility ensures that every document aligns with your business needs and presents a cohesive professional image.

Why Choose Word for Invoices

When it comes to generating professional payment requests, many people prefer using commonly available word processing software. These programs offer an intuitive interface and a variety of features that make creating billing documents quick and simple. The wide accessibility and ease of use make them a go-to choice for businesses and freelancers alike.

Key Benefits of Using Word Processing Software

- Ease of Use: Most users are already familiar with the basic functions of word processing programs, reducing the learning curve and allowing quick creation of documents.

- Cost-Effective: Many popular options are free or included in existing software packages, eliminating the need for additional purchases.

- Customizable Layout: You can modify fonts, colors, and layouts to fit your brand identity, ensuring that each document reflects a professional image.

- Compatibility: These documents are compatible with most devices and can easily be shared across platforms without any issues.

How It Simplifies the Billing Process

- Pre-Formatted Sections: Many word processors come with pre-designed sections, such as billing address fields, payment terms, and item lists, making it easy to fill in specific details.

- Quick Edits and Updates: Making revisions is straightforward, whether it’s adjusting numbers, adding discounts, or modifying due dates.

- Streamlined Workflow: With a template, you can reduce manual work and generate consistent documents faster, allowing you to focus on other important tasks.

Customizing Your Invoice Template in Word

Tailoring your billing documents to match your brand identity and specific business needs is an essential part of maintaining professionalism. By customizing pre-built forms, you can create a unique look that conveys consistency and attention to detail. Adjusting layout elements, fonts, and content ensures that each request for payment aligns with your company’s standards.

Steps to Personalize Your Billing Document

- Adjust the Layout: Modify the header, footer, and section placements to suit your business style. Make sure your contact information, logo, and company name are prominently displayed.

- Choose a Color Scheme: Pick colors that match your brand or the tone you want to set. Avoid using too many colors, as it can make the document look unprofessional.

- Modify Fonts: Select fonts that are both legible and professional. Avoid overly decorative fonts; stick to simple, clean typography for easy readability.

Adding Essential Business Information

- Company Logo: Place your logo in a visible spot, usually in the header, to reinforce your brand identity.

- Payment Details: Make sure the payment instructions and terms are clearly outlined, including due dates, accepted payment methods, and any late fees.

- Item Descriptions: Include a detailed breakdown of services or products provided, along with prices and quantities to avoid confusion.

By adjusting these elements, you can create a more professional, consistent, and business-aligned document that strengthens your brand and makes the payment process clear and straightforward for your clients.

How to Create an Invoice in Word

Creating a professional billing document doesn’t require advanced software or design skills. With the right tools, you can easily generate a payment request that looks polished and clear. By following a few simple steps, you can produce an effective document that communicates essential information while maintaining a professional appearance.

Step-by-Step Guide to Crafting a Payment Request

- Start with a Blank Document: Open your word processing software and choose a blank document. This gives you a clean slate to begin customizing your layout.

- Add Your Business Information: At the top of the document, include your company name, address, contact details, and logo. This helps clients easily identify the source of the request.

- Insert Client Information: Below your business details, add the recipient’s name, address, and contact information. This ensures the document is directed to the correct individual or company.

- Include an Invoice Number and Date: Assign a unique identifier for the document and include the issue date. This helps both you and your client keep track of transactions.

Essential Sections to Include

- Itemized List: Provide a detailed list of products or services provided, including quantities and individual prices. This section should be clear and easy to read.

- Subtotal and Total: After listing the items, include a subtotal, taxes (if applicable), and the final total amount due.

- Payment Terms: Outline payment methods, due dates, and any late fees that may apply to overdue payments.

By following these steps, you can create a clear and professional document that ensures both you and your client have all the necessary details to process the payment smoothly.

Design Tips for Professional Invoices

Creating a well-designed billing document can make a significant impact on how your business is perceived. A clean, organized, and visually appealing layout not only helps to convey professionalism but also ensures that your clients can easily understand the payment details. By following a few simple design principles, you can elevate the appearance and clarity of your financial documents.

Key Elements to Focus On

- Clear Structure: Use headings, subheadings, and bold text to organize sections logically. Ensure that each part of the document is easy to locate–such as client information, items listed for payment, and totals.

- White Space: Avoid clutter by leaving enough blank space between sections. This makes the document more readable and less overwhelming for the recipient.

- Consistent Fonts: Choose one or two fonts for the entire document. Use larger, bolder fonts for headings and smaller, simpler fonts for details to create a clear hierarchy of information.

Visual Appeal and Branding

- Brand Colors: Incorporate your company’s colors into the design. This can be done subtly in headings, borders, or accents. It helps reinforce your brand identity without overwhelming the content.

- Logo Placement: Ensure your business logo is prominently displayed, typically at the top or in the header. This reinforces your brand and adds credibility to the document.

- Professional Borders or Dividers: Use thin lines or borders to separate sections or highlight key information, such as the total amount due. This can give the document a polished, structured look.

By focusing on these design elements, you can create invoices that are not only functional but also enhance your brand image and make a lasting impression on your clients.

Saving and Reusing Your Invoice Templates

Efficient billing processes can be greatly improved by saving and reusing your custom-made forms. Once you have designed a suitable document for your needs, it’s a good practice to save it for future use. This allows you to avoid repetitive work and ensures that each request for payment is consistent and professional. By creating a reusable format, you save time and reduce errors with each new transaction.

How to Save Your Billing Documents for Future Use

To ensure that your documents are always available for reuse, save them in a location where you can easily access and update them when needed. Below are some recommended steps for saving and managing your customized files:

| Step | Action |

|---|---|

| 1 | Save as a Master Copy: Store your original document as a master version. This should be your editable copy that you can adjust for future use. |

| 2 | Save a Copy for Clients: Once the document is finalized with the client’s information, save a separate copy with their details, so the master version remains unchanged. |

| 3 | Use Cloud Storage: Save your files in cloud storage so you can easily access them from any device and keep them backed up for security. |

| 4 | Label Clearly: Name your files logically and consistently (e.g., “ClientName_Billing_Document”) to make them easy to locate later. |

Benefits of Reusing Your Billing Forms

- Consistency: Using the same layout and design for all documents ensures your brand image stays consistent.

- Efficiency: Reusing a saved format reduces the time spent creating a new document from scratch every time you need to request payment.

- Fewer Errors: By filling out pre-made forms, the chances of forgetting critical details, such as payment terms or item descriptions, are minimized.

- Time-Saving: Ready-to-use forms help you generate professional documents in a fraction of the time it would take to create one from scratch.

- Customization: Even though these forms come pre-designed, you can easily personalize them with your business details, logo, and other specific information.

- Cost-Effective: Many websites offer these forms for free, meaning you can access high-quality, professional documents without any extra cost.

Free Office Word Invoice Templates Online

There are many online resources offering free, ready-to-use forms for billing and payment requests. These pre-designed solutions allow you to quickly generate professional documents without the need to start from scratch. Whether you’re a small business owner or a freelancer, finding a customizable option online can save you time and effort while ensuring consistency in your financial communications.

Where to Find Free Billing Documents

Here are some popular websites where you can access free pre-designed billing forms that you can download and edit:

| Website | Features |

|---|---|

| Template.net | Offers a variety of customizable billing documents, ranging from simple to detailed formats. |

| Microsoft Office Templates | Provides numerous free billing options directly available for download and editing in a well-known program. |

| Invoice Generator | Allows you to create and download a simple billing document instantly with customizable fields. |

| Canva | Offers visually appealing, customizable designs that can be edited and exported for free. |

Advantages of Using Online Free Forms

By utilizing free online resources, you can quickly get your billing process up and running with minimal effort and expense, while still maintaining a

How to Add Your Business Logo

Incorporating your business logo into billing documents is a great way to reinforce brand identity and add a professional touch. By placing your logo prominently, you ensure that your clients instantly recognize the document as coming from your company. Whether you’re using a pre-made form or creating your own, adding your logo is a simple process that can make a big impact.

Steps to Insert Your Logo

- Prepare Your Logo: Make sure your logo is saved in a high-resolution format (such as PNG, JPEG, or SVG) and is ready for insertion into the document.

- Open the Document: Open your billing document in your preferred editing program. Navigate to the section where you would like to place the logo, typically in the header.

- Insert the Image: Use the program’s “Insert” function to add your logo. Select the image file and position it where it fits best within the header or top of the page.

- Resize and Adjust: If necessary, resize the logo to ensure it fits within the space without overwhelming the document. Keep it proportional to maintain clarity and visual appeal.

- Align for Balance: Align the logo with the text or other elements to create a balanced and professional look. Center or position it to the left or right as needed.

Best Practices for Logo Placement

- Keep it Subtle: The logo should be visible but not too large or distracting. It should complement the document’s design rather than overpower it.

- Use Consistent Branding: Ensure that the logo’s colors, size, and placement align with your overall brand guidelines to maintain a consistent look across all your business materials.

- Don’t Overcrowd: Make sure there is enough white space around the logo so it doesn’t compete with the other information on the page.

By following these simple steps and best practices, you can seamlessly integrate your business logo into your billing documents, making them not only professional but also

Formatting Invoices for Clarity and Impact

Properly formatting your billing documents is crucial for ensuring that your clients can easily read and understand the information provided. A well-organized and visually appealing layout not only enhances clarity but also leaves a lasting impression. By paying attention to structure, fonts, and spacing, you can create documents that convey professionalism and help ensure prompt payments.

Essential Formatting Tips for Clear Documents

- Organized Layout: Break the document into clearly defined sections, such as business details, client information, payment terms, and itemized lists. This makes it easier for the reader to locate specific information quickly.

- Use Headings and Subheadings: Bold or enlarge key sections, like “Subtotal,” “Total,” or “Due Date,” so that these important details stand out from the rest of the content.

- Consistent Alignment: Align text consistently, particularly numbers and totals. This improves readability and prevents confusion, especially when dealing with payment amounts.

Design Tips for Maximum Impact

- Appropriate Font Choices: Choose clear, legible fonts for both headings and body text. Avoid overly stylized fonts, as they can hinder readability. Stick to professional, easy-to-read options like Arial or Times New Roman.

- White Space: Ensure there is adequate white space around the text and between sections. This helps prevent the document from feeling cramped and makes the content more digestible.

- Highlight Key Information: Use bold text, borders, or color accents to highlight important figures, such as the total amount due or payment due date, ensuring they catch the reader’s eye.

By applying these formatting techniques, you can create billing documents that are not only easy to navigate but also reflect the professionalism of your business, improving the chances of timely payment and positive client relationships.

Ensuring Accuracy in Your Invoice Details

Accuracy in your billing documents is critical to prevent misunderstandings and delays in payment. Small errors, such as incorrect amounts or missing information, can lead to confusion and may result in delayed payments or disputes. By taking the time to carefully check all details before sending your document, you ensure smooth transactions and maintain professional relationships with your clients.

Key Areas to Double-Check

- Client Information: Verify that the recipient’s name, company name, and contact details are correct. Incorrect information could cause delays or miscommunication.

- Service or Product Descriptions: Ensure that all items or services listed are accurate, with correct quantities, descriptions, and prices. Misunderstandings about what was provided can lead to payment issues.

- Payment Terms: Confirm that the payment terms, such as the due date, late fees, and accepted payment methods, are clearly stated and accurate.

- Subtotal and Total Calculations: Double-check all calculations to ensure that the subtotal, taxes, discounts, and final amount due are accurate. A simple math mistake can undermine trust.

- Dates and Numbering: Make sure that the issue date and any relevant deadlines are correct. Also, ensure the document has a unique reference number to help both you and your client track the transaction.

Tips for Reducing Errors

- Use Predefined Forms: Using pre-designed formats can help reduce mistakes by providing consistent sections and standardized fields.

- Proofread: Before sending the document, take a few minutes to review all the details. It’s often helpful to take a break and come back to the document with fresh eyes.

- Automate Where Possible: Consider using software with built-in calculation tools to automatically generate totals and taxes. This minimizes the risk of human error.

By paying attention to these key areas and implementing a routine of double-checking, you can ensure that your billing documents are error-free, professional, and easy to understand, leading to quicker payments and stronger client relationships.

How to Include Payment Terms in Word

Clearly outlining payment terms in your billing documents is essential for setting expectations and ensuring timely payments. These terms not only define when and how you expect to be paid but also provide clarity on any late fees or penalties. Properly communicating these terms ensures both you and your client are on the same page, helping to avoid misunderstandings and potential disputes.

Steps to Add Payment Terms

- Identify the Section: Begin by identifying a clear section within your document where payment terms can be outlined. This is often placed near the bottom or right before the total amount due.

- State the Due Date: Specify the exact date when payment is expected. Common options are “Due upon receipt” or a specific number of days after the billing date (e.g., “Due in 30 days”).

- Late Fees or Penalties: If applicable, include any penalties for late payments. For example, “A late fee of 2% per month will be added to overdue balances.” Be clear about the conditions and amounts.

- Accepted Payment Methods: Clearly state which payment methods you accept (e.g., bank transfer, credit card, PayPal, check) to avoid any confusion about how the payment can be made.

- Discounts for Early Payment: If you offer any early payment discounts, mention them. For example, “A 5% discount is offered for payments made within 10 days of the issue date.”

Best Practices for Clarity

- Be Specific: Avoid vague terms such as “as soon as possible” or “within a reasonable time.” Use exact dates and percentages to make the terms clear.

- Use Bold or Italics: Highlight key points, such as the due date and late fees, using bold or italicized text to make them stand out.

- Keep it Simple: Ensure the language is straightforward and easy to understand. Avoid overly complex legal terminology unless absolutely necessary.

By following these guidelines and including comprehensive payment terms in your document, you ensure a transparent and professional transaction, making it easier for your client to understand their obligations and for you to receive timely payments.

Tracking Payments with Word Invoices

Keeping track of payments is a crucial part of managing finances and ensuring timely compensation for your services or products. A well-organized billing document not only provides the client with clear payment details but also serves as an important record for your own financial tracking. By properly documenting payment status and maintaining a system for updates, you can easily monitor outstanding balances and prevent any overdue payments from slipping through the cracks.

How to Track Payment Status

- Include a Payment Status Section: Add a clear section on the document where you can mark whether the payment has been made, is pending, or is overdue. This section can also include any partial payment details if applicable.

- Use Reference Numbers: Assign a unique reference or invoice number to each document. This makes it easier to identify and track payments in your accounting system.

- Update Payment Status Regularly: After each payment, update the status in your records. If payment has been received, mark the invoice as paid, and if not, ensure the due date is noted so that you can follow up accordingly.

Best Practices for Payment Tracking

- Record Payment Dates: Always log the date when payment was received. This helps you track cash flow and stay organized for financial reporting.

- List Payment Methods: Include information on how the payment was made (e.g., via bank transfer, credit card, cash, or check). This provides transparency and helps reconcile payments against your bank statements.

- Highlight Outstanding Amounts: Ensure any unpaid balances are easy to identify on the document. Using a different color or bold text can help emphasize these details.

By including a system for tracking payments directly within your billing documents, you streamline the process of managing outstanding balances and ensure that no payment is overlooked, ultimately leading to better financial organization and quicker follow-ups on overdue accounts.

Common Invoice Mistakes to Avoid

Even the most experienced business owners can make errors when preparing payment requests. These mistakes, while seemingly minor, can lead to confusion, delayed payments, or even strained client relationships. Ensuring that your documents are accurate and professional is key to maintaining smooth business operations. Below are some common errors to watch out for and tips on how to avoid them.

Frequent Errors to Watch Out For

- Incorrect or Missing Client Information: Always double-check the client’s name, business name, address, and contact details. An error in this area can cause the document to be misplaced or lead to payment delays.

- Failure to Include a Due Date: Never leave the payment due date unclear. Always specify when the payment is expected, whether it’s due on receipt or within a certain number of days (e.g., 30 days after issue).

- Not Including a Unique Reference Number: Each document should have a unique number for identification. This makes it easier to track payments and resolve any disputes that may arise.

- Math Errors: Simple arithmetic mistakes in totals, taxes, or discounts can cause major problems. Always double-check calculations and use automated tools if available to reduce the chance of human error.

- Omitting Payment Terms: Clearly outline your payment terms, including methods of payment, late fees, and any discounts for early payments. This transparency helps avoid confusion and ensures clients know exactly what is expected of them.

Tips for Avoiding Common Mistakes

- Proofread Carefully: Always review the document before sending it out. Take your time to spot any missing or incorrect details.

- Use Preformatted Documents: Consider using pre-designed layouts with preset fields. These templates help guide you through the process and reduce the likelihood of missing important sections.

- Automate Calculations: Many editing programs offer built-in calculation functions. Use these features to ensure accuracy in totals and taxes.

- Keep a Checklist: Create a checklist of all essential invoice elements (client info, item descriptions, amounts, due date, etc.) to ensure you never overlook any crucial details.

Avoiding these common mistakes can greatly improve the efficiency and professionalism of your

Invoice Template Compatibility with Other Software

When creating billing documents, it’s essential to ensure that your layout is compatible with various software programs. Compatibility ensures that your documents can be easily opened, edited, and saved across different platforms, making it more convenient for both you and your clients. Additionally, seamless integration with other tools, such as accounting software, can save time and reduce the risk of errors in your financial records.

Considerations for Cross-Platform Compatibility

- File Formats: Make sure to save your documents in widely accepted formats like PDF, DOCX, or XLSX, which are supported by most editing and viewing applications. These formats allow clients using different software to access your files without any issues.

- Standard Fonts and Layouts: Use basic fonts and avoid complex formatting that may not render correctly on other programs. Stick to commonly used fonts like Arial, Times New Roman, or Calibri, and keep your layout simple to ensure consistency across platforms.

- Accounting Software Integration: Many businesses use accounting or invoicing tools to manage finances. Check if your document format can be imported directly into popular accounting software, such as QuickBooks, Xero, or FreshBooks, to automate data entry and improve accuracy.

Maximizing Compatibility for Clients

- Consider Client Preferences: Some clients may prefer receiving files in a particular format. Always ask for their preferred file type (PDF, DOCX, etc.) and ensure your document is compatible with their software.

- Cloud Integration: Use cloud-based services like Google Drive or Dropbox to share and store documents. This ensures that your clients can access the files easily, regardless of the software they are using.

- Test on Multiple Devices: Before sending a document, test it on different devices and software to make sure it displays correctly and that there are no issues with the formatting or layout.

By ensuring that your billing documents are compatible with a wide range of software, you can avoid potential problems and create a smooth, professional experience for both you and your clients.

Automating Invoices with Word Templates

Automating billing documents can save businesses valuable time, streamline workflow, and minimize errors in repetitive tasks. By using pre-designed layouts, you can quickly generate accurate payment requests with minimal manual input. This not only enhances productivity but also ensures consistency in the details of every document sent out, reducing the risk of mistakes and improving professionalism.

Steps for Automating Your Billing Documents

- Set Up a Template: Start by creating a standard layout with all the necessary fields like client information, services provided, payment terms, and amounts due. This layout will act as a base for every future document, so you won’t need to manually re-enter the same details each time.

- Use Form Fields: Add form fields for recurring data such as client names, service descriptions, or dates. These can be quickly filled in or updated without altering the layout, allowing for faster document creation.

- Leverage Mail Merge: Utilize mail merge features to pull client details from a database or spreadsheet. This allows you to automatically populate fields like name, address, and payment information without needing to manually enter the same details for every document.

Tracking and Managing Automated Documents

Once you have set up your automated system, it’s essential to manage and track the generated documents effectively to ensure smooth operations.

| Task | Benefit |

|---|---|

| Save Generated Files in Standard Formats | Ensures easy sharing and accessibility, with consistent formats like PDF for distribution. |

| Store Documents in Cloud Storage | Provides easy access to all previous documents, and protects them from data loss. |

| Use Automated Reminders | Set up reminders for payment due dates, helping you follow up promptly with clients without manual tracking. |

By automating your billing documents, you can reduce administrative overhead and focus more on the core activities of your business. These time-saving practices not only improve accuracy but also enhance the client experience by providing fast, professional, and consistent communication.

Security Tips for Sending Word Invoices

Sending billing documents electronically has become the standard in today’s digital business world, but it also introduces certain risks related to data security. Protecting sensitive information, such as payment details and personal data, is crucial to prevent fraud, unauthorized access, and potential identity theft. By taking proactive steps to secure your documents before sharing them, you ensure the safety of your business and your clients.

Best Practices for Secure Document Sharing

- Use Password Protection: Before sending a document, apply a password to limit access to only those who are authorized. Many document editing programs allow you to encrypt files, ensuring that only recipients with the correct password can open them.

- Send via Secure Channels: Avoid using regular email for sensitive documents. Instead, use encrypted messaging services or secure file-sharing platforms such as Google Drive or Dropbox, which offer additional layers of security.

- Keep Software Up to Date: Ensure that both your document editing software and email programs are up to date with the latest security patches. Vulnerabilities in outdated software can be exploited by cybercriminals to gain access to your files.

Additional Security Measures

- Limit Document Sharing: Only share billing documents with the necessary parties. If possible, restrict access to a few trusted individuals within your company or to the client who needs to process the payment.

- Watermark Documents: Consider adding a watermark to your documents. This helps deter unauthorized copying and distribution of your files, adding an extra layer of security.

- Verify Recipient Details: Double-check that you are sending the document to the correct email address or recipient. Phishing attacks are common, and ensuring that the email address matches the intended recipient’s will help reduce the chances of fraud.

By implementing these security measures, you can safeguard your billing documents and protect both your business and clients from potential threats. A few extra steps now can save you from significant problems down the line, ensuring your transactions remain secure and confidential.