Download a Professional Landscape Invoice Template for Easy Billing

Running a service-based business requires a reliable way to request payments for completed work. Whether you offer gardening, maintenance, or outdoor design services, having a well-structured document for billing is essential. These documents not only ensure proper payment but also reflect professionalism and trustworthiness in your business.

With the right tool, creating customized billing forms can be quick and simple. They help avoid errors, ensure clarity, and provide a clear breakdown of charges. Additionally, using a streamlined process for generating these forms can save time, especially when handling multiple clients or projects.

By leveraging customizable options, you can easily tailor each document to meet your specific business needs. This flexibility is particularly helpful when you need to adjust pricing, include special terms, or highlight different types of work done. Ultimately, having a professional billing system in place can enhance your reputation and improve cash flow.

Understanding the Importance of a Billing Document

Having a clear and professional payment request is essential for any service provider. It acts as a formal record of the work completed, the amount due, and the payment terms. Without a well-structured document, both clients and service providers can face confusion, leading to delayed payments, misunderstandings, and even disputes. Proper documentation fosters trust and ensures both parties are on the same page when it comes to financial agreements.

Key Reasons Why a Billing Document Is Crucial

- Clear Communication: A detailed document eliminates any ambiguity about the services rendered and the costs associated with them. It helps clients understand exactly what they are paying for and ensures there are no surprises.

- Legal Protection: In case of a dispute, having an official record provides legal protection for both the service provider and the client. It serves as proof of the agreed terms and conditions.

- Professionalism: Providing a well-organized document gives the impression of a reliable and established business. It shows clients that you take your work seriously and are committed to providing quality service.

- Financial Tracking: For business owners, these documents are crucial for maintaining accurate financial records. They help track income, manage taxes, and keep a history of transactions.

How It Benefits Both Parties

- For Service Providers: It ensures prompt payment, helps manage cash flow, and provides a straightforward way to handle multiple clients and projects simultaneously.

- For Clients: It gives them peace of mind, knowing exactly what services they are being charged for and when payments are due. It also provides transparency and a reliable reference for future services.

Why You Need a Billing Document Format

For any service-based business, having a standardized way to request payments is critical. A well-designed document not only ensures that payments are processed smoothly but also saves valuable time and reduces the risk of errors. By using a consistent format, businesses can streamline their financial processes, maintain professionalism, and avoid confusion with clients.

Having a set format for generating these documents allows you to quickly fill in relevant details, whether it’s the scope of work, the total amount due, or payment terms. This helps avoid mistakes such as missed charges, incorrect calculations, or missing client information, all of which can delay payment or damage client trust.

Advantages of Using a Standardized Billing Document

| Benefit | Description |

|---|---|

| Consistency | Ensures every document is organized in the same way, reducing the chances of forgetting important details. |

| Efficiency | Fills in key fields faster, allowing you to focus on providing services rather than creating documents from scratch. |

| Accuracy | Reduces the risk of errors such as incorrect totals, missing services, or unclear payment instructions. |

| Professionalism | Maintains a polished, business-like appearance that builds client confidence and trust. |

| Recordkeeping | Helps you keep accurate records of completed jobs and payments received, which is essential for financial tracking. |

Key Features of a Billing Document Format

A well-structured payment request is more than just a list of charges–it’s a tool that helps ensure accuracy, clarity, and timely payments. The features of a good document go beyond simple formatting; they must serve the purpose of clearly communicating services provided, amounts due, and payment terms. By incorporating the right elements, businesses can avoid confusion and foster smoother transactions with clients.

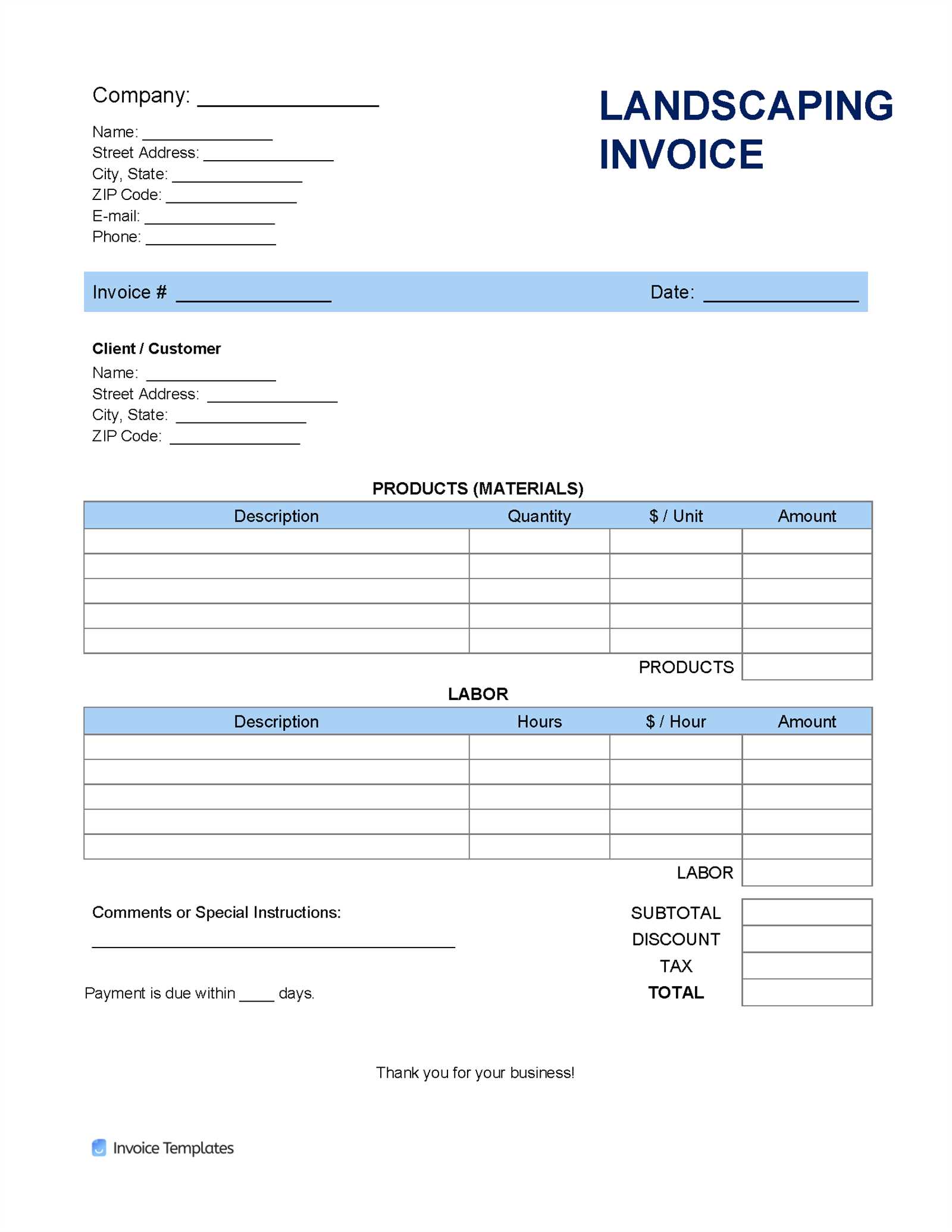

Essential Elements of a Professional Payment Request

- Header Information: This includes your business name, contact details, and a unique reference number for easy identification of the document.

- Client Details: Include the client’s name, address, and contact information to personalize the request and ensure it’s directed to the correct party.

- Service Breakdown: Clearly list each service performed, including descriptions, quantities, and individual costs. This helps clients understand exactly what they are being charged for.

- Payment Terms: Specify when the payment is due, any late fees, and acceptable payment methods (bank transfer, credit card, etc.).

- Tax Information: If applicable, include tax rates and amounts, ensuring transparency in the final total due.

- Total Amount Due: Clearly display the final amount that needs to be paid after all calculations are made, ensuring no ambiguity.

Additional Features for Added Efficiency

- Payment Instructions: Provide clear instructions for how and where the payment should be made, whether online or via other methods.

- Discount or Promotion Section: If relevant, include space for any discounts or promotions applied to the bill.

- Due Date Reminder: Emphasize the payment deadline to encourage prompt settlement and reduce the chance of overdue payments.

How to Customize Your Billing Document

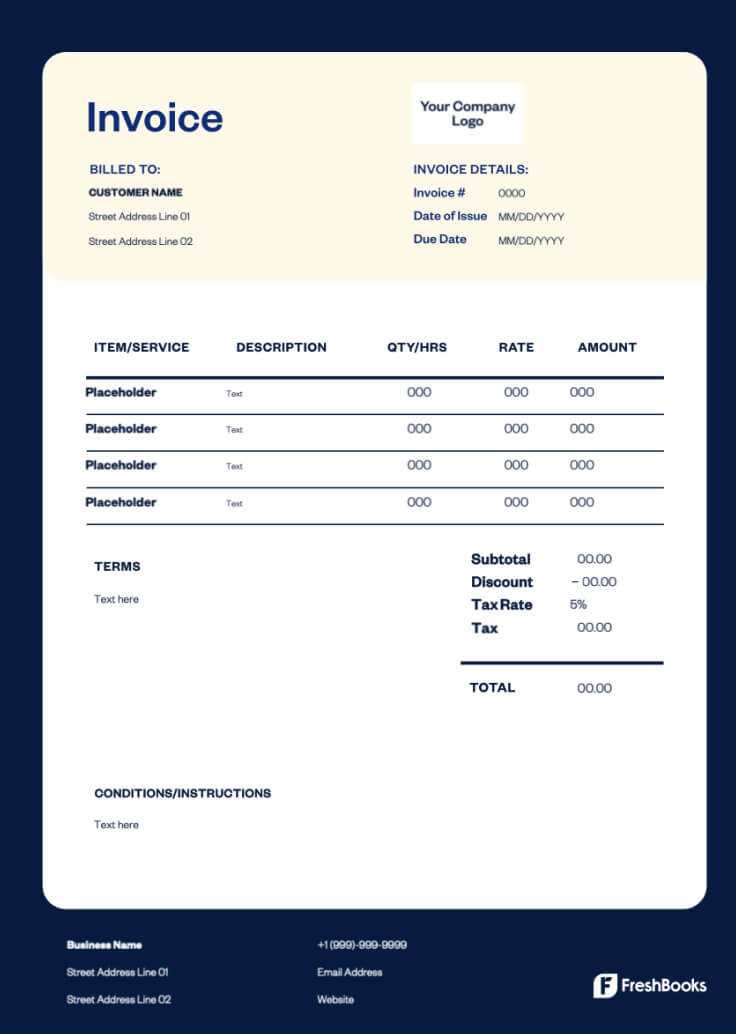

Customizing your payment request is essential for making it reflect your unique business needs. A personalized format allows you to showcase your brand, incorporate specific service details, and streamline the billing process. By adjusting key sections to match the type of work you offer, you ensure clarity, professionalism, and an organized approach to payments.

Key Steps to Personalize Your Payment Request

- Add Your Business Branding: Customize the header with your company logo, colors, and contact information to create a consistent look for your business communications.

- Modify Service Descriptions: Adjust the descriptions of the services you provide, ensuring that each entry accurately reflects the nature of the work performed and any relevant details.

- Update Payment Terms: Tailor the payment terms to match your business model, including the payment methods you accept, due dates, and late payment penalties.

- Include Optional Discounts: If applicable, add a section for discounts or promotional offers to encourage timely payments and incentivize repeat business.

Example Customization Breakdown

| Section | Customization Ideas |

|---|---|

| Header | Include your company logo, business name, and contact details to create a personalized look. |

| Service Breakdown | List specific tasks performed, such as lawn care, tree trimming, or garden design, with clear descriptions and quantities. |

| Payment Terms | Modify due dates, include payment options (check, online transfer, etc.), and note any applicable late fees. |

| Discounts | If you offer special pricing for returning customers, add a section for applying discount rates or seasonal promotions. |

Benefits of Using a Digital Billing Document

Switching to a digital payment request system offers numerous advantages that can significantly improve your business operations. Digital documents are not only easier to create and store but also provide greater flexibility and efficiency. With automated features and the ability to easily update information, digital formats streamline the entire billing process, making it faster and more reliable.

Increased Efficiency and Time Savings

One of the primary benefits of using a digital billing document is the time saved compared to manual processes. You can quickly generate and send requests, reducing the administrative effort involved. Some systems even allow for automatic population of fields, so you only need to enter new or unique information. This results in quicker turnaround times for both you and your clients.

Enhanced Accuracy and Organization

Digital formats reduce the risk of human error, such as incorrect calculations or missing details. They also make organizing and retrieving past records easier, allowing for better tracking of payments, transactions, and financial history. You can also customize documents for each client or project, ensuring every request is tailored and professional.

- Quick Creation: Generate documents in minutes using pre-made fields, speeding up the entire process.

- Better Recordkeeping: Store digital files in an organized manner, allowing for easy retrieval whenever needed.

- Environmentally Friendly: Reducing paper usage lowers your environmental impact and contributes to sustainability.

- Easy Sharing and Payment: Send documents electronically and provide clients with convenient online payment options.

Common Mistakes in Payment Requests

Even small errors in a billing document can lead to confusion, delayed payments, and damaged client relationships. Many service providers overlook key details, either by underestimating the importance of clear communication or by rushing the process. These mistakes, while often avoidable, can affect the professionalism of your business and result in financial setbacks.

Common Errors to Avoid

- Incorrect Client Information: Failing to include accurate client contact details, such as names, addresses, or phone numbers, can lead to payment delays or miscommunication.

- Missing or Vague Descriptions: A lack of detailed descriptions for the services rendered can cause confusion. Ensure that each service is clearly explained, including the scope of work, quantity, and rate.

- Inaccurate Calculations: Simple math errors, such as incorrect totals or missing taxes, can undermine trust. Double-check all numbers before sending the document to your client.

- Unclear Payment Terms: Not specifying payment deadlines, methods, or penalties for late payments can lead to misunderstandings and delayed payments.

- Failure to Include a Unique Reference: Each payment request should have a unique reference number for easy tracking. Omitting this detail can make it harder to identify and manage payments efficiently.

How to Avoid These Mistakes

- Double-Check Information: Always verify that the client’s contact details, services, and totals are accurate before sending the request.

- Use Automated Tools: Consider using digital systems to generate payment requests automatically, minimizing the risk of errors.

- Be Specific: Include clear descriptions for every item or service, breaking down costs as needed to ensure transparency.

How to Create an Accurate Payment Request

Creating an accurate billing document is essential for ensuring that you get paid promptly and that your clients understand the charges. A well-prepared request reduces the likelihood of disputes and fosters

Essential Information to Include in a Payment Request

To ensure a smooth transaction process, it’s crucial that your billing documents contain all necessary details. Missing or incomplete information can cause confusion, delay payments, or even result in disputes. Each document should clearly outline the work completed, the amount due, and the terms of payment to avoid any misunderstandings.

Key Elements of a Complete Billing Document

| Section | Details to Include |

|---|---|

| Business Information | Include your company name, address, phone number, and email for easy communication. |

| Client Information | Provide the client’s full name or business name, along with their address and contact details. |

| Service Description | Clearly describe the services provided, including quantities, specific tasks, and hourly or flat rates. |

| Dates | Include the date the services were performed and the date the payment is due. |

| Payment Terms | Outline the payment methods accepted (bank transfer, credit card, check, etc.), due date, and any applicable late fees. |

| Total Amount Due | Ensure the total amount is clearly stated, including a breakdown of charges, taxes, and discounts, if any. |

| Unique Reference Number | Assign a unique reference or invoice number for tracking and future reference. |

Using Payment Requests for Better Recordkeeping

Maintaining accurate records is essential for any business. Using organized payment documents helps keep track of services rendered, payments received, and outstanding balances. By properly managing these records, you can ensure compliance with tax regulations, simplify financial planning, and improve cash flow management.

Each document serves as both a request for payment and a detailed record of a transaction. By retaining these records, businesses can easily reference past work, monitor trends, and assess profitability. In addition, having a consistent approach to recordkeeping makes it easier to handle audits or disputes should they arise.

How Well-Organized Payment Documents Benefit Your Business

- Financial Tracking: Accurate records help you monitor income, manage budgets, and plan for future expenses. With detailed breakdowns of services and payments, it’s easier to stay on top of your finances.

- Tax Compliance: Keeping proper records ensures that you have the necessary documents to support your tax filings. It also helps track deductible expenses related to your business.

- Time Efficiency: By organizing your documents digitally, you can quickly retrieve past records, which saves you time and effort compared to manual filing systems.

- Improved Client Communication: With clear, organized records, you can address any client concerns or disputes quickly by referencing the original terms and details of the transaction.

Best Practices for Managing Records

- Digital Storage: Store all payment documents in a secure, easily accessible digital format. This reduces the risk of losing important records and improves organization.

- Consistent Filing: Use a consistent naming convention and filing structure, categorizing documents by date, client, or project type for easy retrieval.

- Regular Backups: Ensure your digital records are backed up regularly to prevent data loss in case of system failure.

How Billing Document Formats Save Time

One of the biggest advantages of using a standardized billing document is the time it saves in the billing process. By having a pre-structured format, you eliminate the need to start from scratch each time a new request is needed. With automated fields and pre-set sections, you can quickly generate a professional-looking document that includes all necessary information, reducing the time spent on administrative tasks.

Additionally, when you use a consistent structure, there’s less chance for mistakes, which can lead to wasted time correcting errors or dealing with confusion from clients. Streamlining the creation of these documents allows you to focus more on your core work rather than on paperwork, ultimately improving productivity and cash flow.

Key Time-Saving Benefits

- Pre-Populated Fields: With a pre-designed structure, you can quickly fill in client details, service descriptions, and costs without re-entering the same information repeatedly.

- Consistent Formatting: The format is already established, so you don’t have to worry about designing or formatting each document. This ensures uniformity and professionalism across all your requests.

- Faster Processing: Automated tools can generate these documents in minutes, which speeds up the overall process from creation to sending, getting you paid faster.

- Reduced Errors: Pre-defined fields and calculations reduce the risk of errors in totals, service descriptions, and client details, which means less time spent correcting mistakes.

Improving Efficiency with Digital Solutions

- Automated Calculations: Digital formats often come with built-in features like automatic tax calculations or total sums, saving you time on manual math.

- Quick Customization: Instead of creating a new document from scratch for each client, you can simply adjust existing fields to suit the specifics of each job, speeding up the entire process.

- Easy Storage and Retrieval: Digital records are easier to store, organize, and retrieve, allowing you to quickly find past documents without wasting time searching through paper files.

Choosing the Right Format for Billing Documents

Choosing the appropriate format for your payment requests is crucial for maintaining clarity and professionalism. A well-designed document not only ensures accurate communication of services provided and amounts owed but also contributes to better organization and faster payment processing. Selecting the right structure can streamline your workflow, reduce errors, and enhance client satisfaction.

When deciding on a format, consider factors such as the nature of your business, the types of services you offer, and how you intend to deliver the document. The format should align with your business needs and provide flexibility for easy customization while maintaining a consistent, professional appearance.

Factors to Consider When Choosing a Format

- Business Type: Different industries may have specific formatting requirements. For example, service-based businesses might need more detailed breakdowns of tasks, while product-based businesses may need to include product codes or descriptions.

- Client Preferences: Some clients may prefer receiving documents in a particular format, such as PDF or Word, which is easy to view or print. Understanding your clients’ preferences can help you choose the most efficient format.

- Customization Needs: Choose a format that allows for easy customization. The ability to update fields such as dates, rates, and descriptions ensures that each request is tailored to the specifics of the project or service.

- Digital or Paper-Based: Consider whether you’ll be sending digital documents, printing them, or both. Digital formats often offer more flexibility, but paper documents might still be necessary for clients who prefer physical copies.

Popular Formats to Choose From

- PDF: Portable Document Format is a popular choice for its consistent appearance across all devices, making it perfect for professional presentations and easy sharing.

- Excel or Spreadsheet: If you require more detailed breakdowns or need to track multiple line items, a spreadsheet format can help with calculations and organizing data.

- Word Document: Word allows for more flexible text formatting, which can be useful for businesses that want to create highly customizable document

Integrating Payment Options in Your Billing Document

Offering a variety of payment options in your payment requests is essential for making the transaction process as smooth and convenient as possible for your clients. By providing multiple methods for clients to pay, you increase the likelihood of faster payments and improved client satisfaction. This flexibility not only makes it easier for clients to settle their balances but also streamlines your accounting process.

Integrating clear payment options in your billing document ensures there is no confusion about how payments can be made. Whether you prefer bank transfers, credit card payments, or online payment platforms, detailing these methods upfront can save time and prevent delays in receiving payments.

Types of Payment Methods to Include

- Bank Transfers: Provide your bank account details, such as account number and routing number, along with any relevant instructions for domestic or international transfers.

- Credit/Debit Cards: If you accept card payments, include the card types you accept (Visa, MasterCard, etc.) and the necessary instructions or links to online payment portals.

- Online Payment Services: Incorporating popular platforms like PayPal, Stripe, or Venmo can simplify the process for clients who prefer digital transactions.

- Checks: For clients who prefer traditional payment methods, provide clear instructions on where to mail the check, and note whether you accept personal or business checks.

- Cash: If applicable, specify whether you accept cash payments and any necessary details for in-person payments.

How to Effectively Present Payment Options

- Clear Payment Terms: Ensure that payment terms, including due dates, late fees, and accepted methods, are easy to find and understand.

- Multiple Methods: Offering a range of payment options accommodates clients with different preferences, increasing the likelihood of timely payments.

- Payment Links: If you accept online payments, include clickable links or QR codes to make the payment process as seamless as possible for your clients.

How to Handle Late Payments with Billing Documents

Late payments can be a common issue in business, but it’s important to address them professionally and efficiently. When clients fail to pay on time, it can disrupt your cash flow and hinder your ability to run your business smoothly. However, by taking proactive steps and clearly outlining payment terms in your billing documents, you can minimize the impact of late payments and encourage prompt settlement.

Setting clear expectations upfront and including late fee policies in your billing documents can help prevent payment delays. If payments do fall behind, it’s essential to communicate effectively and follow up in a professional manner. Below are some strategies to handle overdue payments while maintaining positive client relationships.

Steps to Take for Handling Late Payments

- Establish Clear Payment Terms: From the start, include clear terms regarding payment deadlines, accepted payment methods, and penalties for late payments. This transparency will help clients understand their obligations and the consequences of missing a payment.

- Send Friendly Reminders: If the payment deadline has passed, send a polite reminder to your client. A gentle nudge can often resolve the issue without causing tension. You can do this via email or phone.

- Issue a Formal Notice: If the payment remains unpaid after the initial reminder, send a more formal notice outlining the amount overdue, any interest or fees that have been added, and the consequences if the payment is not received promptly.

- Offer Payment Plans: In some cases, clients may face financial difficulties. Offering a payment plan or installment options can help them pay off the balance over time, making it easier for both parties.

- Enforce Late Fees: If your payment terms include late fees, be sure to enforce them consistently. This reinforces the importance of paying on time and can act as a deterrent for future late payments.

When to Take Further Action

- Legal Action: As a last resort, if the payment remains overdue for an extended period and no resolution has been reached, you may need to consider taking legal action or using a collections agency.

- Contract Review: For future agreements, consider including clauses that protect your business in case of non-payment, such as requiri

Free vs Paid Billing Document Formats

When choosing a format for your payment requests, one of the first decisions you’ll face is whether to use a free or paid version. Both options offer their own benefits and drawbacks, and the choice largely depends on the complexity of your needs and the level of customization you require. Free options are often a great starting point for small businesses or those just getting started, while paid formats provide additional features and enhanced flexibility for those looking to streamline their invoicing process.

While free formats may be sufficient for basic transactions, a paid solution can offer advanced tools, customization, and a more professional appearance. In this section, we will compare the benefits of both free and paid options to help you decide which is best suited for your business.

Advantages of Free Billing Formats

- Cost-Effective: Free formats are ideal for startups or small businesses with a limited budget. They provide the basic functionality needed to create and send payment requests without incurring any costs.

- Simplicity: Free formats tend to be straightforward and easy to use, with fewer complex features that could be overwhelming for new users.

- Quick Setup: Many free tools are available immediately and don’t require long setup processes, allowing you to start invoicing clients quickly.

- Basic Customization: While options may be limited, free formats usually allow for basic customization such as adding your company logo, changing fonts, or modifying payment terms.

Benefits of Paid Billing Formats

- Advanced Features: Paid versions often include useful features such as automatic calculations, multi-currency support, and integration with accounting software, which can help save time and reduce errors.

- Increased Customization: With paid formats, you can often fully customize the layout, add more detailed fields, and design the document to match your brand identity.

- Professional Appearance: Paid formats usually provide a more polished and professional look, helping to enhance your company’s image and credibility with clients.

- Dedicated Support: Paid solutions typically offer customer support, which can be valuable if you encounter technical issues or need assistance with customization.

- Security Features: Paid formats often come with enhanced security options, such as password protection and secure payment processing, ensuring t

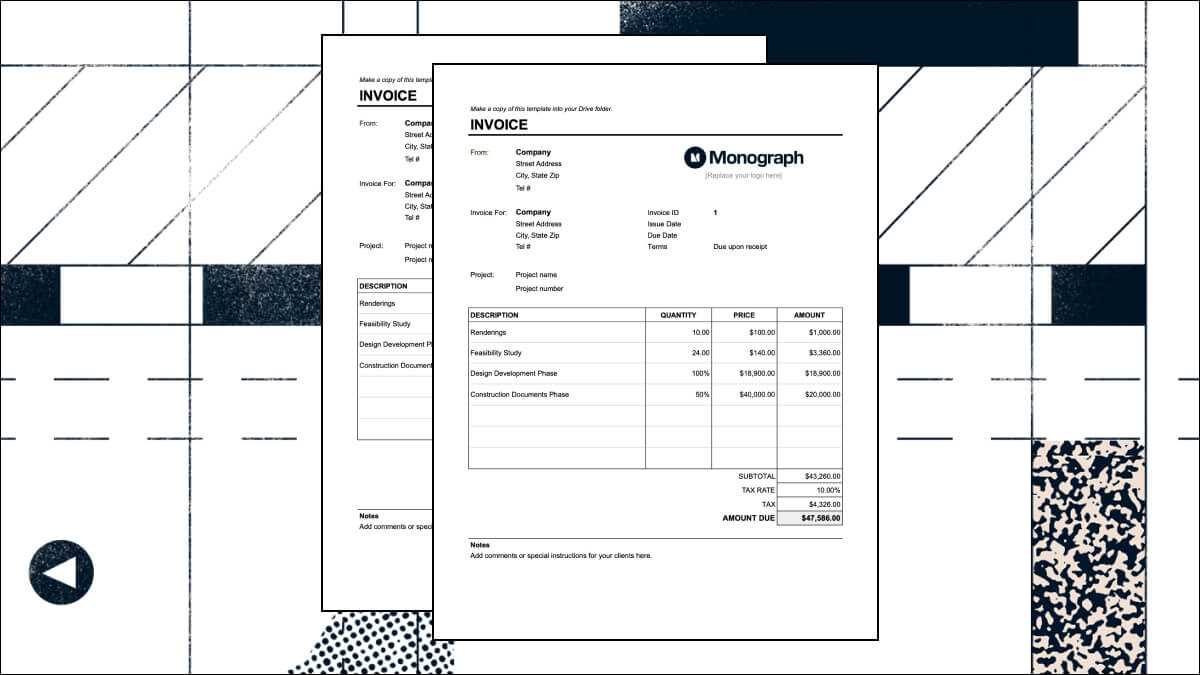

Best Software for Creating Billing Documents

When it comes to generating professional billing documents, the right software can save you time, improve accuracy, and streamline your entire payment process. There are various options available, each catering to different business needs, whether you’re a freelancer, a small business owner, or managing a larger enterprise. The best tools offer customization features, easy integration with accounting systems, and enhanced functionalities like automated calculations and payment tracking.

In this section, we’ll explore some of the top software choices for creating professional payment requests, helping you decide which solution best suits your business requirements and budget.

Top Software Options for Creating Payment Documents

- QuickBooks: Known for its all-in-one accounting features, QuickBooks allows users to create customized billing documents, manage expenses, track payments, and even integrate with other financial tools. It is ideal for businesses of all sizes looking for an integrated solution.

- FreshBooks: FreshBooks is an easy-to-use invoicing software with a focus on small businesses and freelancers. It offers templates for payment requests, time tracking, automated reminders, and expense tracking–all with a simple and intuitive interface.

- Zoho Invoice: Zoho offers customizable and highly professional billing formats, along with automation features like recurring billing, late payment reminders, and expense management. It’s ideal for businesses looking for a cost-effective solution with advanced features.

- Wave: Wave is a free option that provides invoicing, accounting, and receipt scanning features. With a user-friendly interface and essential customization options, it’s a great choice for freelancers or small businesses that need a basic yet effective tool.

- PayPal Invoicing: For businesses that use PayPal as their primary payment platform, PayPal’s invoicing feature is a straightforward solution. It allows you to send custom billing documents and accept payments directly through PayPal, making it quick and easy for clients to pay online.

Factors to Consider When Choosing Software