Musicians Union Invoice Template for Easy and Professional Billing

Handling payments efficiently is crucial for any creative professional. A well-organized billing system not only ensures that you get paid on time but also adds a layer of professionalism to your business. Having a reliable document that outlines services rendered and expected payments is a key part of managing finances effectively.

By using a standardized document for payment requests, you can minimize errors, reduce misunderstandings with clients, and speed up the payment process. Whether you’re providing one-time services or working with regular clients, a structured approach can help keep everything on track.

Customizing these documents to fit your specific needs allows for more flexibility while maintaining a professional appearance. This article will explore how such tools can simplify your work, enhance your credibility, and help you stay organized financially.

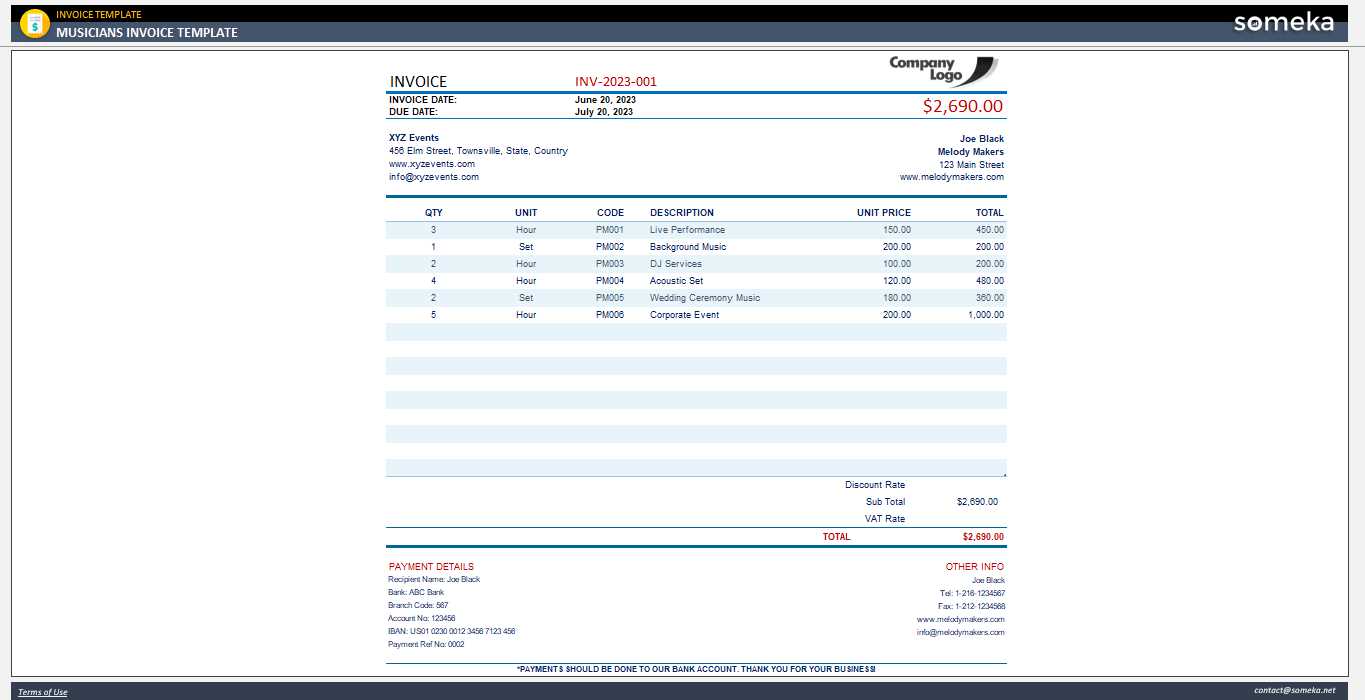

Musicians Union Invoice Template Overview

When it comes to requesting payment for services, having a clear and consistent format is essential. A professional document that outlines the terms of payment, along with the details of the work performed, helps ensure that both the service provider and the client are on the same page. This is especially important for creatives who rely on timely compensation for their efforts.

Using a standardized approach makes the process smoother and more efficient. It allows for easy tracking of transactions, minimizes potential disputes, and ensures that all necessary information is included in every request for payment. With the right structure, you can streamline your financial operations and present a polished image to clients.

Customizability is key–being able to tailor the document to suit your specific needs allows for flexibility, while maintaining a professional appearance. In this section, we’ll dive into the essential components that make up such a tool and explore how it can simplify your billing process.

Why Use a Professional Invoice Template

Adopting a structured approach for billing not only improves your business’s efficiency but also enhances your professional image. Having a well-designed document to request payment for services provides clarity for both parties and ensures there are no misunderstandings. Whether you’re working with new clients or maintaining relationships with long-term ones, a formalized method streamlines the process.

Here are some key reasons why a polished, consistent document is essential:

1. Clear Communication of Terms

A professional layout allows you to clearly state the amount due, payment deadlines, and the specific services provided. This ensures both you and the client understand exactly what is expected, preventing any confusion or disputes later on.

2. Increased Credibility

When you use a formal document, it reflects your attention to detail and commitment to professionalism. Clients are more likely to take your work seriously and respect the payment terms you’ve set, which can lead to faster payments.

3. Efficient Record-Keeping

Standardized billing simplifies your financial record-keeping. You can easily track outstanding payments, organize completed projects, and maintain an organized archive for tax purposes. A structured document reduces the chances of forgetting important details, which helps you stay on top of your finances.

4. Time-Saving and Consistency

By using a ready-to-go format, you can save time on administrative tasks. Customizing the document for each client is quick and easy, yet it still conveys the professionalism that reflects positively on your business.

- Fast creation of billing documents

- Consistent presentation for all clients

- Reduced chance of errors

With the right approach, you can ensure that all your billing is handled with accuracy and efficiency, freeing up more time to focus on your craft.

Key Features of an Invoice Template

When creating a document to request payment, certain elements are essential to ensure that it is clear, professional, and easy to understand. A well-structured document should include the necessary details that both you and your clients need to avoid confusion and ensure smooth financial transactions. Below are the key features that every professional document should include:

- Contact Information – Your name or business name, along with your address, phone number, and email, should be clearly visible. This makes it easy for clients to contact you if needed.

- Client Details – Always include the client’s name, business name (if applicable), and their contact information. This ensures that the request is directed to the right person or department.

- Unique Identification Number – Each request should have a unique reference number for easy tracking and to avoid any confusion with previous or future requests.

- Clear Description of Services – A detailed breakdown of the work completed, including the date and specific tasks or deliverables, should be listed. This provides transparency and makes it clear what the payment is for.

- Payment Terms – Specify the total amount due, any applicable taxes, and the payment methods you accept. Additionally, include payment deadlines and late fees if relevant.

- Due Date – Clearly state the date by which payment is expected to avoid any misunderstandings regarding the timing of the transaction.

- Professional Design – A clean, easy-to-read layout with logical sections and formatting enhances the appearance of the document and helps maintain a professional image.

- Notes or Terms – Include any additional information that may be relevant, such as specific conditions for the work performed or a thank-you note for the client’s business.

By incorporating these key elements into your payment requests, you can ensure that they are clear, professional, and effective, which helps in building trust and fostering positive client relationships.

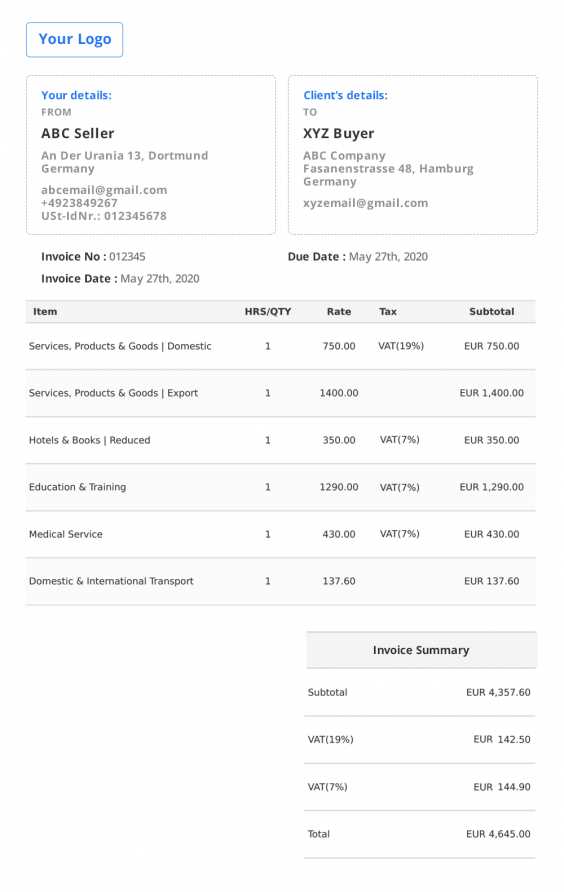

How to Customize Your Invoice

Personalizing your payment request document ensures that it aligns with your branding and meets the specific needs of your business. Customization allows you to maintain a consistent professional image while tailoring the document to each client’s requirements. By adjusting certain elements, you can make sure that the document is not only clear but also functional for your particular line of work.

1. Add Your Branding Elements

The first step in customizing your payment request document is to incorporate your unique branding. This could include your logo, company colors, and any specific fonts you use in your communications. A personalized header or footer with your business name and slogan will create a cohesive look and reinforce your brand identity.

2. Include Custom Payment Terms

Make sure to customize the payment terms for each client. You may have different arrangements depending on the nature of the project, such as hourly rates, flat fees, or milestone payments. Specify the payment methods you accept and provide detailed instructions for how the client should make the payment.

| Service Description | Quantity | Rate | Total |

|---|---|---|---|

| Service 1 | 1 | $100 | $100 |

| Service 2 | 2 | $50 | $100 |

| Total | $200 |

In the example above, you can easily customize the description of services, quantities, and rates to reflect the specifics of each transaction. Adjust the structure to include any additional costs, taxes, or discounts that apply to the project.

By personalizing these key areas, you ensure that your document looks polished and accurately represents the work done while clearly outlining the financial terms for the client.

Benefits of Using a Template for Billing

Utilizing a pre-designed document for payment requests offers numerous advantages for any business. It not only saves time but also helps maintain consistency and professionalism. By adopting a ready-to-use format, you can focus on delivering your services while ensuring that your financial transactions are well-organized and efficient.

1. Time-Saving Efficiency

Creating a new document from scratch for each payment request can be time-consuming and repetitive. By using a pre-made format, you can significantly speed up the process, allowing you to spend less time on paperwork and more time on your work. Customizing a ready-to-go layout is much quicker than starting from scratch every time.

2. Consistency and Professionalism

Using the same document for all your billing ensures that each request looks polished and professional. A consistent format improves your brand’s image and makes it easier for clients to understand the payment structure. It also conveys reliability, which can help build trust with clients over time.

- Uniform Appearance: All your billing requests will follow the same format, ensuring a clean and professional presentation.

- Improved Client Relationships: A clear and concise layout makes the process easier for clients, which can lead to better communication and fewer payment delays.

- Reduced Risk of Mistakes: A well-designed structure helps minimize errors in calculations and missing details.

3. Improved Organization

Using a standardized structure for all your payment requests allows for better organization. You can easily keep track of payments, manage your financial records, and ensure that every transaction is documented in an orderly manner. This is especially helpful when it comes time for tax reporting or auditing.

By incorporating a pre-designed structure into your billing process, you streamline your operations, boost professionalism, and ultimately enhance your financial management capabilities.

Understanding Musicians Union Payment Guidelines

When working in the creative industries, particularly in performance and production, it’s essential to understand the payment expectations and regulations set by industry organizations. These guidelines are in place to ensure fair compensation for services and to provide clarity on how payments should be structured, invoiced, and processed. Knowing these standards can help you avoid disputes and ensure that both you and your clients have clear expectations about payment terms.

1. Standardized Rates and Fees

One of the key aspects of industry payment guidelines is the establishment of standardized rates for services rendered. These rates may vary depending on the type of work, the location, and the duration of the project. Familiarizing yourself with these rates ensures that you’re charging appropriately for your services and can help prevent undercharging or overcharging clients.

2. Payment Timelines and Deadlines

Guidelines also outline acceptable payment timelines. These specify when payments should be made after services are completed, often including a grace period for processing. Adhering to these timelines ensures that payments are received promptly, reducing the likelihood of delayed compensation and improving cash flow management.

- Payment Schedule: Understand whether payments are to be made upfront, upon completion, or in installments.

- Late Fees: Be aware of any late fees or penalties that may apply if payments are not made by the agreed-upon deadline.

By aligning your payment processes with industry standards, you not only protect yourself financially but also maintain a professional reputation within the industry. Understanding these guidelines will also help you ensure transparency and trust in your business dealings with clients.

Essential Information to Include in Invoices

For any payment request to be processed smoothly, it’s important to include all the necessary details that clearly communicate the terms and conditions of the transaction. Providing complete and accurate information not only ensures timely payment but also avoids any potential confusion or disputes between you and the client. Below are the key elements that should always be present in a professional billing document:

- Your Contact Information: Include your name, business name (if applicable), phone number, and email address to ensure the client can easily reach you if needed.

- Client’s Contact Information: Make sure to include the client’s name, company name, and their contact details for clarity and to avoid any confusion.

- Unique Document Reference Number: Assign a unique number to each billing document for easy tracking and reference in future communications.

- Description of Services Rendered: List the specific tasks performed, including dates, duration, and detailed descriptions of the work completed. This helps the client understand exactly what they are being charged for.

- Total Amount Due: Clearly state the amount due, including any taxes or additional fees that apply to the payment. Make sure to break down the cost in a way that is easy to understand.

- Payment Terms: Include the payment due date, accepted payment methods, and any applicable late fees or penalties for overdue payments.

- Notes or Additional Terms: If there are any special conditions, discounts, or instructions, be sure to mention them. This ensures that both parties are aware of any particular agreements or expectations.

By including these essential components in your billing document, you create a clear, professional, and organized request that can help prevent misunderstandings and ensure that payments are made on time.

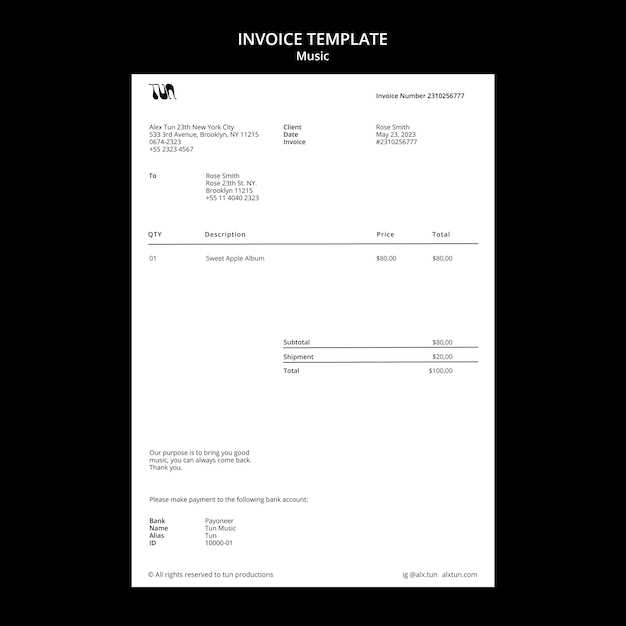

Design Tips for a Clean Invoice

A well-organized and visually appealing payment request not only makes it easier for your client to process but also enhances your professionalism. A clean and clear layout helps communicate your terms effectively and ensures that all important details are easy to find. Below are some essential design tips to help you create a streamlined, professional document that leaves a positive impression.

1. Use Clear, Readable Fonts

The font you choose can make a significant difference in the readability of your document. Stick to clean, simple fonts like Arial, Helvetica, or Times New Roman. Avoid overly decorative fonts that might make the content hard to read. Make sure that the text is large enough for easy scanning, especially the key information like totals and due dates.

2. Prioritize White Space

Don’t overcrowd your document with too much information or excessive design elements. Proper use of white space helps to separate sections, making the content easier to digest. Leave margins around the edges of the page and space between each section. This will allow your client to focus on the most important details without feeling overwhelmed.

- Keep sections distinct: Use lines or subtle shading to separate different sections of the document.

- Balance text and numbers: Ensure that your descriptions, quantities, and pricing information are aligned properly for easy reading.

By focusing on simplicity and clarity, you can create a payment request that is both effective and professional, ensuring a positive experience for your clients and timely payments.

Common Mistakes to Avoid When Billing

Billing can be a straightforward process, but there are several common errors that can lead to confusion, delays, and even disputes with clients. It’s important to be diligent and accurate when preparing a payment request. Below are some of the most frequent mistakes to avoid to ensure a smooth and professional experience for both you and your clients.

- Missing Contact Information: Always ensure that both your contact details and the client’s are clearly listed. This ensures that any questions or issues can be addressed quickly.

- Unclear Payment Terms: Ambiguities about due dates, payment methods, or late fees can lead to confusion. Be explicit about when and how you expect payment, and include any penalties for overdue amounts.

- Failure to Itemize Charges: If the request includes multiple services, be sure to break down each service with a description, quantity, rate, and total. This prevents misunderstandings about what is being charged.

- Incorrect Calculations: Double-check all numbers, including totals, taxes, and any discounts. Even a small mistake in math can damage your professional reputation and cause payment delays.

- Not Including a Unique Reference Number: Failing to assign a reference number to each request can make it difficult for clients to track payments and can lead to confusion on both sides.

- Overcomplicating the Design: A cluttered or overly complicated document can make it harder for clients to find important information. Keep the design clean and simple for better readability.

By avoiding these common mistakes, you can ensure that your payment requests are clear, accurate, and professional, which will help facilitate timely payments and positive client relationships.

How to Track Payments with Templates

Managing payments efficiently is crucial for keeping your business finances organized. One of the most effective ways to track payments is by using a standardized document that helps you record and monitor transactions. With the right format, you can easily keep track of what has been paid, what is due, and when payments were made, all while maintaining professionalism and reducing the risk of errors.

1. Include a Payment Status Section

One of the simplest ways to track payments is by adding a clear “payment status” section within your billing document. This section should indicate whether the payment is pending, paid, or overdue. Updating this field after each payment will give you a quick overview of the financial status of each client.

2. Use Reference Numbers for Each Transaction

Assigning a unique reference number for each billing request makes it easy to track payments. When a client pays, you can link the payment to the reference number and monitor it against the record. This method also makes it easier to find specific transactions if you need to review them later, improving your overall record-keeping process.

- Organize by Date: List the payment due date and the actual payment date to track when payments are made relative to deadlines.

- Track Partial Payments: If a client pays in installments, keep a running total of the amount paid and the remaining balance on each request.

- Record Payment Methods: Specify how payments were made (e.g., bank transfer, credit card, cash), which helps ensure accuracy in your records and accounting.

By incorporating these elements into your billing documents, you can efficiently track outstanding payments, stay on top of your financial records, and avoid confusion when managing multiple clients and transactions.

Free vs Paid Invoice Templates for Musicians

When it comes to creating a payment request document, choosing the right format is essential for maintaining a professional appearance and ensuring that all details are clearly outlined. There are many options available, ranging from free to paid formats, each offering different features and benefits. The choice between a free and a paid option often depends on your specific needs, the level of customization you require, and your budget.

Free formats are often sufficient for basic billing needs, offering standard features like itemized services and payment details. However, paid options typically come with advanced features such as customizable branding, automated tracking, and enhanced reporting capabilities. Below, we compare the pros and cons of both free and paid options:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited customization, mostly fixed layouts | Highly customizable designs with more flexibility |

| Ease of Use | Simple and easy to use, but with fewer options | More intuitive with additional features for efficient usage |

| Branding | Basic or no branding options | Full branding options, including logos, color schemes, and fonts |

| Payment Tracking | Manual tracking or simple tracking features | Automatic payment tracking and reminders for overdue payments |

| Advanced Features | Basic document creation only | Advanced tools like tax calculations, multi-currency support, and reporting |

| Cost | Free | Subscription-based or one-time purchase fee |

For those just starting out or with simpler billing needs, free options may be adequate. However, for more advanced features such as payment tracking, branding, and customization, a paid solution is often a better investment in the long run. Choose the option that best suits your business’s needs and ensures that your payment request documents reflect the professionalism and organization you aim to portray.

Integrating Invoices with Accounting Software

Efficient financial management is essential for any business, and integrating your payment request documents with accounting software can streamline your workflow, improve accuracy, and save you valuable time. This integration allows you to automate many manual tasks, such as tracking payments, generating financial reports, and reconciling accounts. By linking your payment requests directly to your accounting system, you can ensure that all your financial data is organized and up to date.

1. Benefits of Integration

Connecting your payment requests to accounting software offers several advantages, from reducing human error to enabling better tracking and analysis of your financial performance. With automated features, you can focus more on delivering your services and less on administrative tasks.

- Real-Time Updates: Any changes made to a payment request will be automatically reflected in your financial records, providing you with accurate and up-to-date information at all times.

- Improved Accuracy: Automation reduces the likelihood of errors in calculations and data entry, ensuring that all payments and transactions are properly recorded.

- Time-Saving Automation: With the integration, processes like generating financial statements or reconciling payments are automated, saving you hours of manual work.

2. Choosing the Right Accounting Software

Not all accounting systems are designed to integrate seamlessly with payment documents, so it’s important to choose software that supports this feature. Some popular options offer built-in integration with billing systems, while others require third-party plugins or manual imports. Below is a comparison of common integration features:

| Feature | Basic Accounting Software | Advanced Accounting Software | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Integration with Payment Requests | Manual import or limited integration | Seamless, real-time integration with automated syncing | ||||||||||||

| Expense Tracking | Basic tracking features | Advanced tracking, including automated categorization and expense analysis | ||||||||||||

| Reports and Analytics | Basic financial reports | In-depth, customizable financial reports and performance analytics |

| Legal Aspect | Description |

|---|---|

| Contractual Agreements | Always have a formal agreement in place outlining the scope of work, payment terms, deadlines, and other essential details to avoid misunderstandings. Contracts provide legal protection for both parties. |

| Copyright and Licensing | Ensure that the ownership of any original works or licenses is clearly defined. Include terms that specify how the work can be used and any royalties or fees that may apply. |

| Payment Terms and Deadlines | Clearly state when and how payments should be made. Consider including penalties for late payments or non-payment to protect your financial interests. |

| Tax Responsibilities | Make sure you account for taxes and include the appropriate tax information on your documents, including sales tax or VAT, depending on your location and the nature of the service. |

| Dispute Resolution | Include a clause outlining the steps for resolving disputes, such as mediation or arbitration, in case any issues arise regarding payment or terms. |

Protecting Your Rights

By addressing these legal considerations in your payment requests and contracts, you can protect your intellectual property, ensure compliance with tax regulations, and minimize the risk of disputes. Always consult a legal professional if you are unsure about any terms or need help drafting agreements specific to your services.

Creating Recurring Invoices for Regular Clients

For clients who require ongoing services or products, creating recurring payment requests can simplify your billing process and ensure consistent cash flow. By automating the generation of these documents, you can save time, reduce administrative work, and avoid any potential missed payments. Recurring payment schedules are especially useful for long-term relationships where regular billing is expected, such as monthly subscriptions, service retainers, or regular project work.

1. Setting Up a Recurring Billing Schedule

To create a recurring system, it’s important to establish a clear schedule with your client, detailing how often they will be billed (weekly, monthly, quarterly, etc.) and when the payment will be due. Once this is agreed upon, you can set up the billing system to generate the documents automatically based on the agreed-upon intervals.

- Frequency: Determine whether the payment will be made weekly, monthly, or on a different schedule.

- Payment Due Date: Set a consistent due date for each billing cycle, such as the 1st of every month or the 15th.

- Amount: Specify the regular amount due, ensuring that any changes (e.g., price adjustments) are clearly communicated.

2. Benefits of Recurring Billing for Long-Term Clients

Automating this process not only streamlines your workflow but also helps establish predictable cash flow, which can be essential for budgeting and managing finances. Additionally, it reduces the need for follow-up communication about payments, as both you and your client know exactly when the next payment is due.

- Time-Saving: Automating payment creation and sending reduces manual work each billing cycle.

- Consistency: Clients appreciate the predictability of regular payment requests, and it ensures you won’t miss payments.

- Reduced Administrative Work: Recurring billing cuts down on reminders and follow-up messages, as payments are scheduled automatically.

By setting up recurring payment schedules, you create a more efficient billing process and foster stronger relationships with clients by offering convenience and reliability. Be sure to use an automated system or software that supports recurring payments to make this process seamless and error-free.

How to Handle Late Payments in Invoices

Late payments can be a common challenge for many businesses, especially when clients delay or overlook payment due dates. While it’s important to maintain a professional and courteous approach, it’s equally vital to have a clear system in place for addressing overdue amounts. Handling late payments effectively ensures that your cash flow remains stable and minimizes the risk of financial strain.

1. Setting Clear Payment Terms

The first step in preventing late payments is establishing clear payment terms upfront. By outlining when payments are due and specifying any penalties for delays, you set expectations and reduce the chances of confusion or missed deadlines.

- Due Dates: Clearly state when payments are expected, whether it’s a specific day of the month or a set number of days after receiving the payment request.

- Late Fees: Specify any additional fees or interest charges that may apply if payments are not received on time. This serves as an incentive for clients to pay promptly.

- Payment Methods: Offer multiple payment options, making it easier for clients to pay on time.

2. Steps to Take When Payments Are Delayed

If a payment is overdue, follow a structured approach to gently remind the client and ensure that the issue is resolved. Here are steps to take when dealing with overdue amounts:

- Send a Reminder: After the due date has passed, send a polite reminder, referencing the outstanding balance and the original terms.

- Offer Assistance: If the client is facing challenges making the payment, offer alternative arrangements, such as payment plans, to keep the relationship positive.

- Escalate If Necessary: If the payment continues to be overdue, send a formal notice with the late fees applied. You may also need to consider more serious actions, such as pausing services or seeking legal advice, if the situation persists.

3. Implementing Late Payment Policies

To avoid recurring issues, it’s crucial to have a late payment policy in place. This should include how overdue accounts are handled and what steps are

How to Handle Late Payments in Invoices

Late payments can be a common challenge for many businesses, especially when clients delay or overlook payment due dates. While it’s important to maintain a professional and courteous approach, it’s equally vital to have a clear system in place for addressing overdue amounts. Handling late payments effectively ensures that your cash flow remains stable and minimizes the risk of financial strain.

1. Setting Clear Payment Terms

The first step in preventing late payments is establishing clear payment terms upfront. By outlining when payments are due and specifying any penalties for delays, you set expectations and reduce the chances of confusion or missed deadlines.

- Due Dates: Clearly state when payments are expected, whether it’s a specific day of the month or a set number of days after receiving the payment request.

- Late Fees: Specify any additional fees or interest charges that may apply if payments are not received on time. This serves as an incentive for clients to pay promptly.

- Payment Methods: Offer multiple payment options, making it easier for clients to pay on time.

2. Steps to Take When Payments Are Delayed

If a payment is overdue, follow a structured approach to gently remind the client and ensure that the issue is resolved. Here are steps to take when dealing with overdue amounts:

- Send a Reminder: After the due date has passed, send a polite reminder, referencing the outstanding balance and the original terms.

- Offer Assistance: If the client is facing challenges making the payment, offer alternative arrangements, such as payment plans, to keep the relationship positive.

- Escalate If Necessary: If the payment continues to be overdue, send a formal notice with the late fees applied. You may also need to consider more serious actions, such as pausing services or seeking legal advice, if the situation persists.

3. Implementing Late Payment Policies

To avoid recurring issues, it’s crucial to have a late payment policy in place. This should include how overdue accounts are handled and what steps are taken when payments are not received. Make sure to communicate these policies to your clients so they know the potential consequences of late payments from the start.

- Automate Reminders: Use software tools that automatically send reminders for upcoming or overdue payments to ensure consistency.

- Flexible Terms: While firmness is important, offering flexibility with payment plans or extended deadlines can help maintain goodwill with long-term clients.

By handling late payments promptly and professionally, you maintain financial health while preserving strong relationships with clients. Having clear payment terms, an organized system for reminders, and a structured policy for overdue amounts is essential for long-term business success.

How to Protect Your Invoice Data

Protecting sensitive billing information is crucial in maintaining the security and privacy of your financial transactions. With the increasing risk of cyber threats, ensuring that your payment records are safely stored and transmitted is essential for both your business and your clients. Implementing proper security measures can prevent unauthorized access, data breaches, and potential fraud.

1. Use Secure Storage Methods

One of the primary steps in safeguarding your billing data is ensuring that it is stored securely. Whether you’re using physical records or digital files, it’s important to use secure methods to prevent unauthorized access.

- Encrypted Digital Files: Store all electronic records on encrypted devices or cloud storage services with strong security protocols. Encryption ensures that even if files are accessed, they cannot be read without the proper decryption key.

- Physical Storage: If you keep hard copies of any documents, store them in a locked filing cabinet or secure storage facility to prevent unauthorized access.

- Access Control: Limit access to sensitive financial records to authorized personnel only. Use password protection or biometric authentication to enhance security.

2. Secure Communication Channels

When transmitting billing documents to clients or partners, always ensure that the communication method is secure to prevent data interception. This is especially important when dealing with large sums of money or sensitive information.

- Use Secure Email Services: When sending payment requests electronically, use email services that offer end-to-end encryption, such as ProtonMail or services that support encrypted attachments.

- Secure Online Portals: If you use a digital platform to manage payments, ensure that it offers secure connections (look for HTTPS and SSL certificates) to protect data during transfer.

- Avoid Public Networks: When accessing billing information or sending sensitive documents, avoid using public Wi-Fi networks. Use a virtual private network (VPN) to ensure secure online transactions.

3. Regularly Update Your Security Measures

As cyber threats evolve, it’s important to continuously update your security measures to stay ahead of potential risks. Regularly audit your security protocols and implement updates as needed.

- Software Updates: Ensure that any software you use for financial transactions or document storage is regularly updated with the latest security patches.

- Two-Factor Authentication (2FA): Enable 2FA on all accounts that store or handle billing data. This adds an additional layer of security,

Getting Paid Faster with a Professional Template

Receiving timely payments is essential for maintaining a steady cash flow, especially for those offering services on a project or freelance basis. One of the best ways to encourage faster payments is by using well-organized and professional billing documents. Clear, easy-to-read records that convey all necessary information help clients process payments quickly and accurately, reducing delays and misunderstandings.

1. Clear and Organized Information

When clients receive a payment request, it should be straightforward and comprehensive. Including all essential details such as the amount due, payment terms, due dates, and any relevant references helps prevent confusion and provides clients with everything they need to settle the balance promptly.

- Detailed Breakdown: Include a clear breakdown of services rendered or products delivered, with quantities, rates, and total amounts. This transparency minimizes any potential questions from the client, reducing delays caused by back-and-forth communication.

- Payment Methods: Offering multiple payment options (e.g., bank transfer, PayPal, credit card) makes it easier for clients to pay quickly. Make sure to clearly list the methods available and include any relevant account or contact details.

- Due Dates and Late Fees: Clearly state the due date and, if applicable, include information about any late fees or penalties for overdue payments. This encourages timely payments by making the consequences of delays known from the outset.

2. Professional Design and Branding

First impressions matter, and a well-designed billing document reflects professionalism. A clean, branded document not only conveys trustworthiness but also reinforces your commitment to high standards, encouraging clients to prioritize your payment over others.

- Consistent Branding: Include your logo, business name, and contact information in a consistent and visually appealing way. This helps reinforce your business identity and adds credibility to the document.

- Clarity and Readability: Use a simple, easy-to-read layout with clear headings and sufficient white space. A clutter-free design helps the client focus on the essential details, such as the amount due and payment instructions.

- Professional Language: Use polite and clear language, maintaining a formal tone in your communication. Even though you may have an ongoing relationship with the client, professionalism ensures respect and encourages prompt action.

3. Automation for Efficiency

Using automated systems for billing not only saves time but also ensures that your payment requests are sent out on time. Automating reminders and payment confirmations reduces the risk of missing follow-ups and helps clients stay on track with payment schedules.

- A