Invoice Template for Services Easy to Customize and Professional

Managing financial transactions with clients can be a complex task, especially when it comes to ensuring clear and accurate documentation. Having a structured system to outline what is owed and how payments should be processed is essential for smooth operations in any business. The ability to generate professional, easily understandable records for each project is a key element in maintaining transparency and trust with clients.

Professionals and freelancers alike rely on organized billing methods to ensure timely payments and reduce misunderstandings. An effective method helps avoid costly mistakes, ensures proper tracking, and maintains a high level of professionalism in all interactions. By utilizing a well-designed billing framework, businesses can focus more on growth and client relations, rather than administrative tasks.

Invoice Template for Services: A Complete Guide

Creating a professional document to request payment from clients is a crucial part of any business operation. This document serves not only as a record of the transaction but also as a tool to ensure transparency and efficiency in financial dealings. Having a structured approach makes the process smoother, both for the provider and the client.

In this guide, we will walk through all the necessary components and steps involved in designing an efficient billing system. Whether you’re a freelancer or running a small business, understanding how to craft this document effectively can save time, reduce errors, and improve client relations. From organizing your details to formatting the document properly, every element plays a role in ensuring timely payment and clear communication.

We’ll also cover best practices for customizing your documents based on specific needs, helping you avoid common pitfalls and make the most out of each transaction. A streamlined approach not only saves you time but also elevates your professional image, ensuring your clients feel confident in their business relationship with you.

Why Use an Invoice Template

Having a standardized method for billing clients is essential for maintaining organization and professionalism in business transactions. A structured document ensures that all necessary details are included and presented clearly, reducing the likelihood of errors and misunderstandings. Whether you’re a freelancer or a business owner, using a well-defined format streamlines the entire process, making it more efficient and less prone to mistakes.

Time-Saving and Efficiency

One of the primary reasons to adopt a standardized billing system is the amount of time it saves. Instead of creating a new record from scratch for each client, you can quickly fill in the relevant details, reducing the time spent on administrative tasks. This allows you to focus more on your work, client relationships, and growing your business.

Professional Image

Using a consistent format not only ensures accuracy but also projects a polished and professional image to your clients. A well-structured document shows that you are organized and serious about your business, helping to build trust and credibility. Clients are more likely to pay on time when they receive clear, professional documentation outlining the terms of the agreement.

Benefits of Customizable Invoice Templates

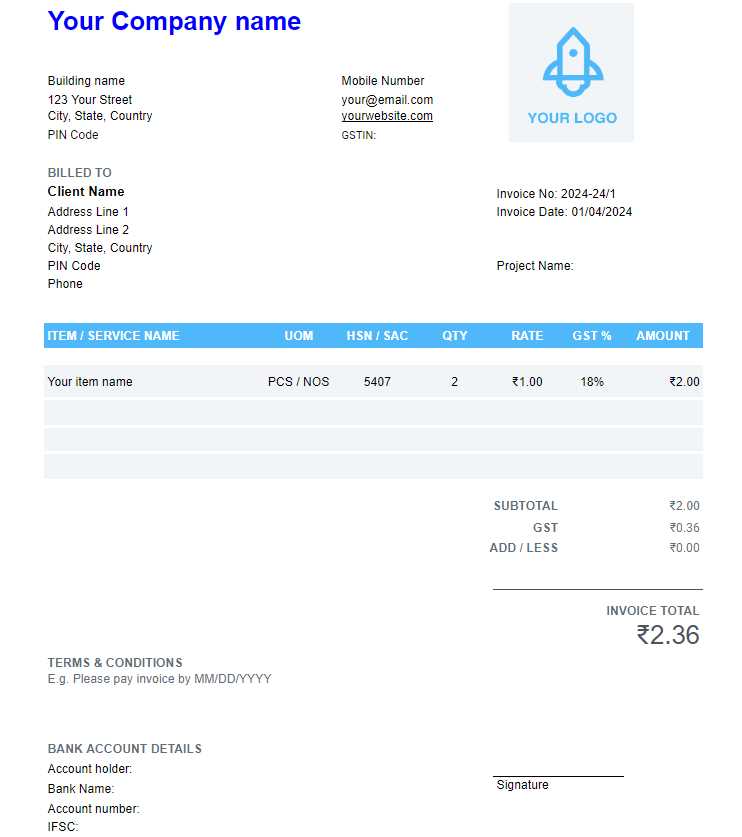

Having the ability to adapt your billing documents to meet specific needs can significantly improve both efficiency and accuracy in financial transactions. Customization allows you to tailor the structure and content, ensuring that every aspect of the payment request is aligned with your business model and client expectations. By adjusting the layout, fields, and branding, you can create a more professional and cohesive experience for your clients.

Flexibility to Match Business Needs

Customizable formats offer the flexibility to include or exclude certain details based on the type of project or client. Whether you’re working on a one-time job, a long-term contract, or offering different pricing models, you can adjust your document to reflect the unique aspects of each situation. This adaptability allows you to keep the billing process clear and accurate for both parties.

Branding and Professionalism

Personalizing your billing documents with your company’s logo, colors, and style can greatly enhance your professional image. A consistent visual identity not only builds trust with clients but also reinforces your brand. A tailored document signals to clients that you take your business seriously and pay attention to detail, which can ultimately improve payment timelines and client relationships.

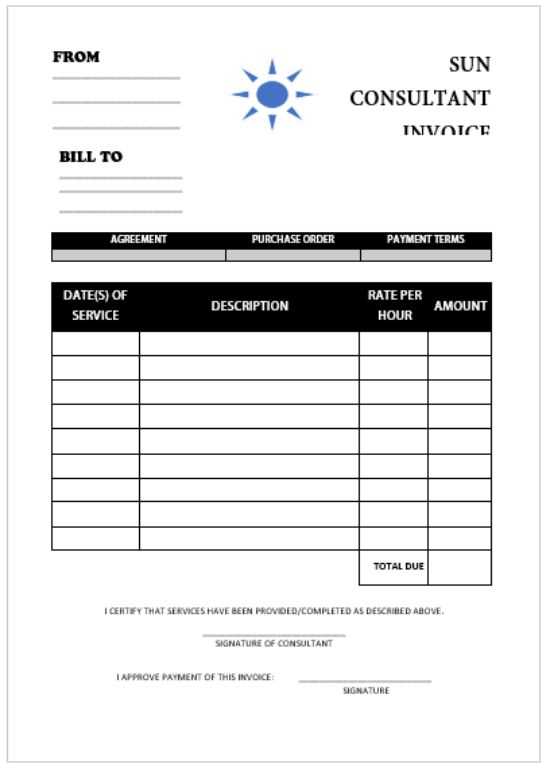

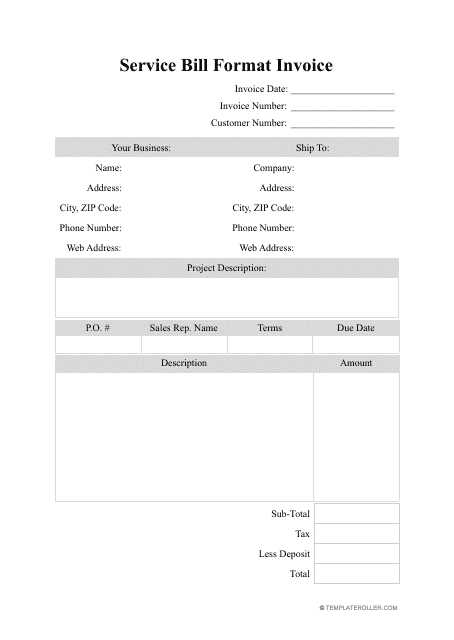

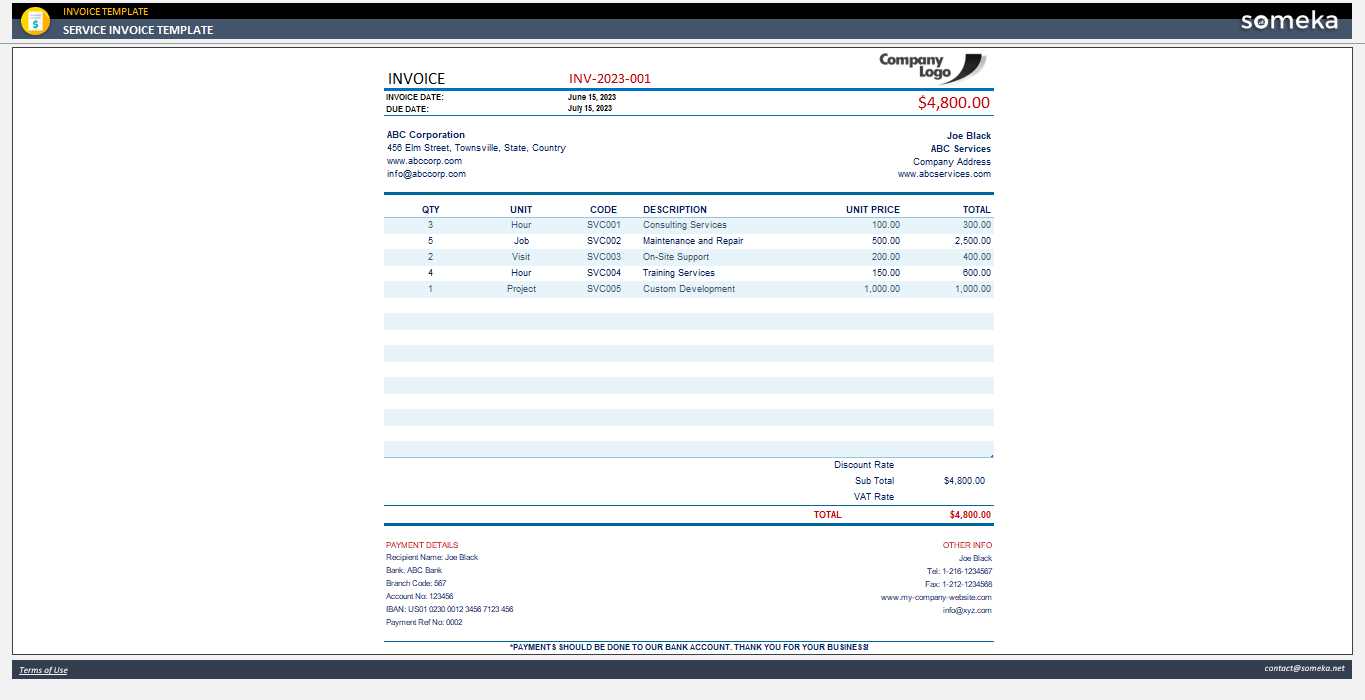

How to Create Your Own Invoice

Creating a professional payment request document doesn’t have to be complicated. By following a few simple steps, you can design a custom record that reflects your business’s needs and maintains clarity with clients. The key is to include all the necessary details in a clean and organized layout, ensuring that both you and the client have a clear understanding of the terms.

Here’s a step-by-step guide on how to create a customized document:

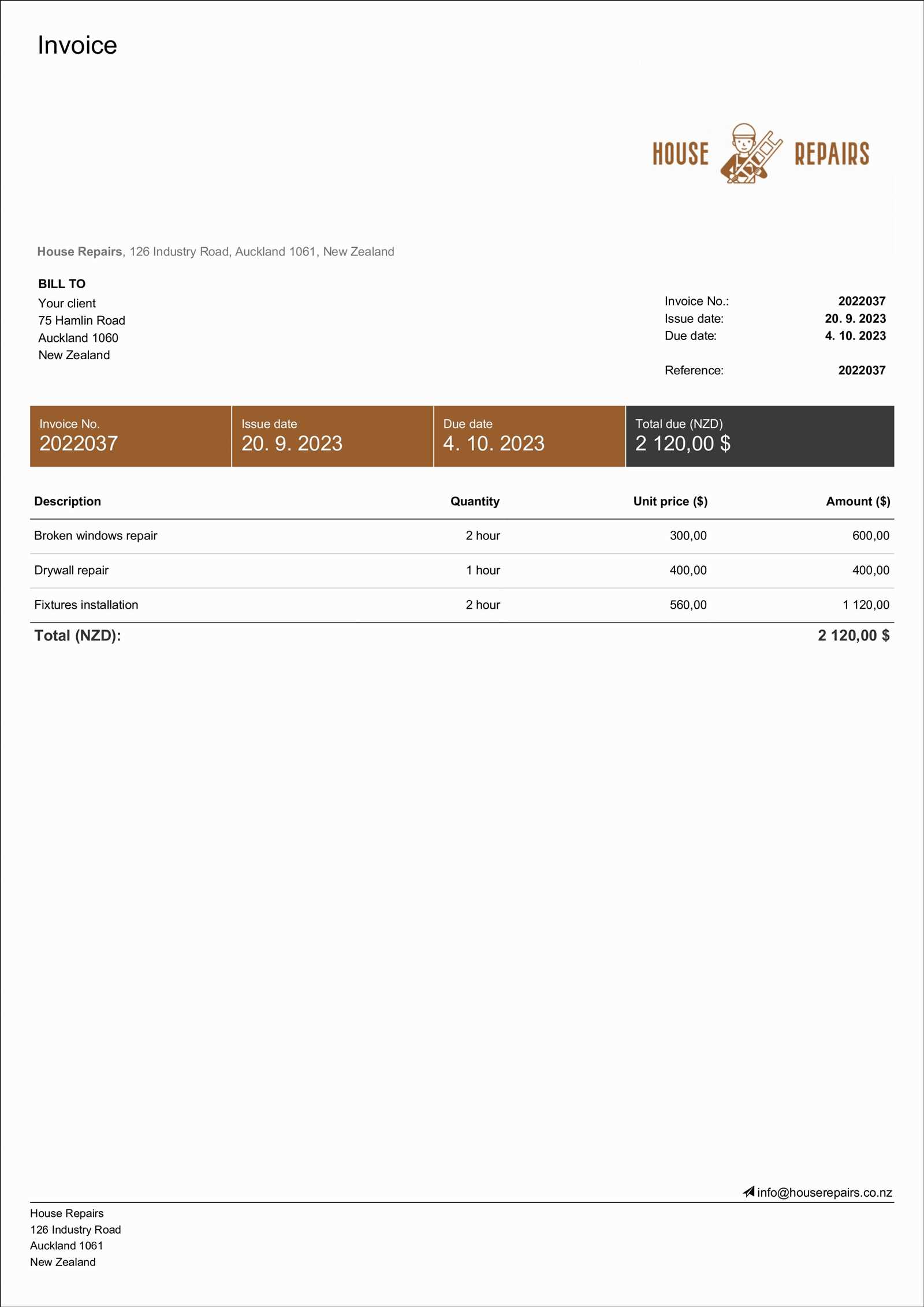

- Include Your Business Details: Add your company name, contact information, and any relevant registration details.

- Client Information: Ensure you have the client’s name, address, and contact details correctly listed.

- Clear Itemization: Break down the work done or products provided, including quantity, price, and total amount for each item.

- Payment Terms: Specify the due date, late fees (if any), and accepted payment methods.

- Professional Formatting: Use consistent fonts, alignment, and spacing to make the document easy to read and visually appealing.

- Additional Notes: Include any relevant terms, such as project specifics or special discounts, to avoid confusion.

Once you’ve added these essential elements, review the document for clarity and accuracy before sending it out. A well-organized payment request helps ensure smooth transactions and maintains a professional reputation with your clients.

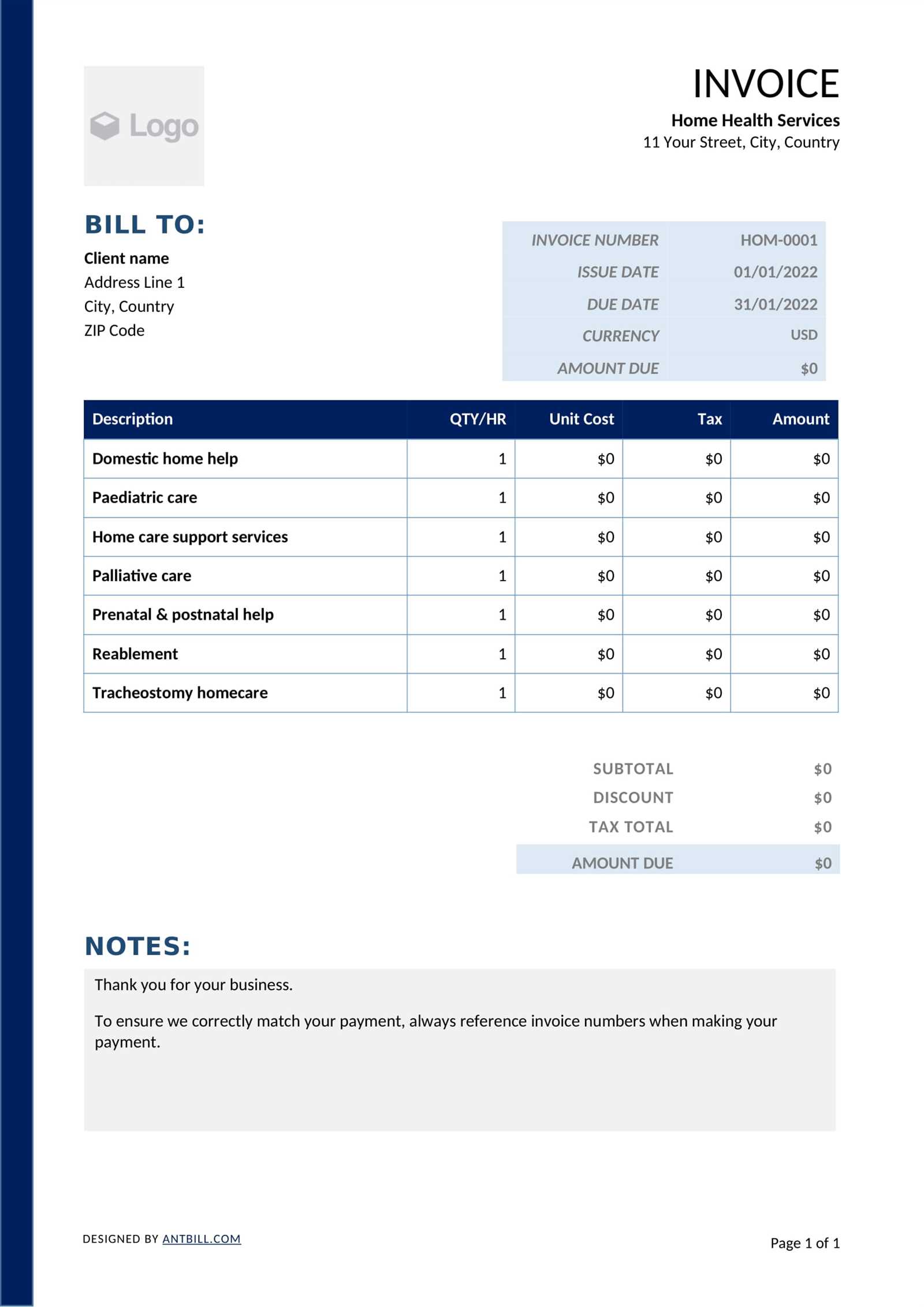

Key Elements of an Effective Invoice

An effective billing document serves not only as a record of the transaction but also as a clear, concise communication tool between you and your client. To ensure prompt and accurate payments, the document should include several crucial details. Each section must be well-organized to avoid confusion and ensure both parties understand the terms and conditions clearly.

Essential Components of a Billing Document

When creating a payment request, it’s important to include the following key elements:

| Element | Description |

|---|---|

| Header Information | Includes your business name, logo, and contact details, as well as the client’s information. |

| Unique Identifier | A unique reference number or code for tracking the document. |

| Description of Work | Clearly outlines the services or products provided, including quantities and prices. |

| Payment Terms | Specifies the due date, any late payment penalties, and accepted payment methods. |

| Total Amount Due | Displays the final amount owed, including taxes or additional fees if applicable. |

| Notes | Any special terms or additional details relevant to the transaction, such as discounts or special instructions. |

Why These Elements Matter

Each of these elements plays a vital role in ensuring clarity and avoiding misunderstandings. Providing a detailed breakdown of what is being charged, along with payment instructions, helps build trust and encourages timely settlement. Proper organization and clear information also protect both parties in the case of any disputes or discrepancies.

Free Invoice Templates for Service Providers

Finding free, customizable billing formats can be a game-changer for independent professionals and small businesses. These ready-made solutions save time, reduce the need for manual creation, and ensure accuracy in every transaction. Many providers offer free versions that are simple to download and adjust according to your specific needs, making it easy to generate professional documents quickly.

Here are some popular sources where you can access free, customizable formats:

- Online Platforms: Websites like Canva, Zoho, and Invoicely offer free templates that are easy to personalize with your business details.

- Spreadsheet Software: Google Sheets or Microsoft Excel provide built-in options that allow for easy customization and simple calculations for totals and taxes.

- Open-Source Templates: You can find free, editable formats on open-source platforms like GitHub, where other professionals share their designs.

By using these free tools, you can save money and effort while maintaining a high standard of professionalism in your financial documents. Customization options let you adjust the layout, fields, and branding, so the document fits seamlessly with your business style.

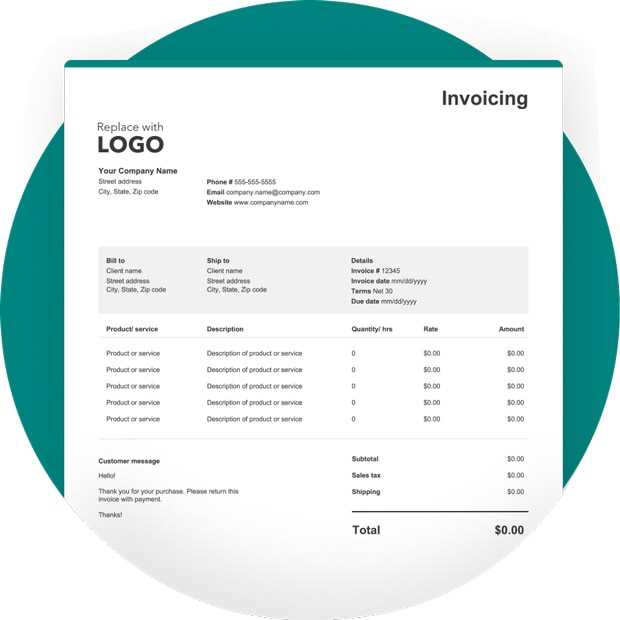

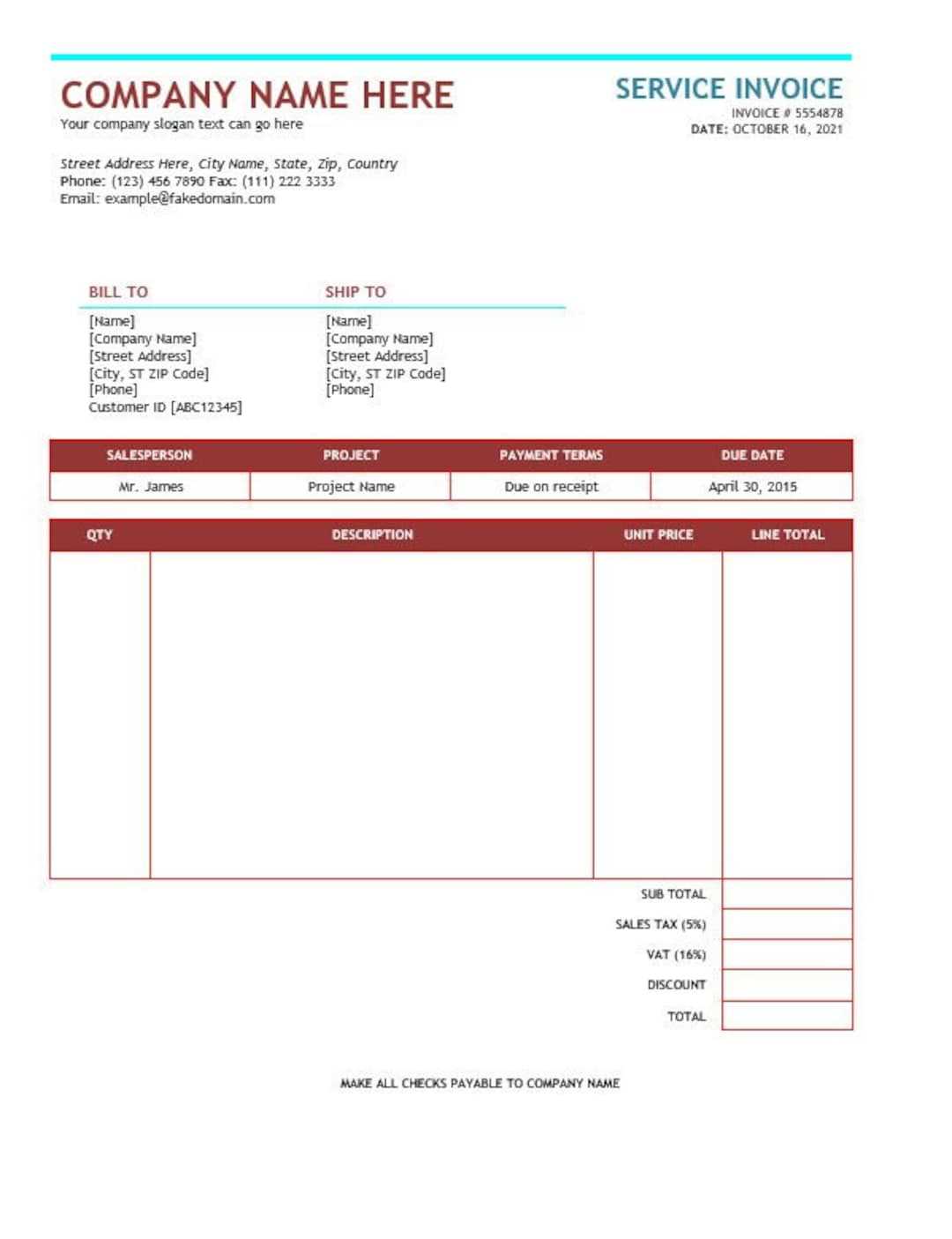

Choosing the Right Format for Your Invoices

Selecting the right format for your billing documents is crucial to maintaining clarity and professionalism in your transactions. The format you choose should align with your business needs, client expectations, and ease of use. Whether you’re working with a small set of clients or managing larger-scale projects, the layout and design of your payment requests can impact your business’s efficiency and image.

Here are some important factors to consider when choosing the right structure:

- Simplicity and Clarity: Choose a clean and straightforward layout that clearly presents all necessary information without overwhelming the reader. A simple format improves readability and reduces confusion.

- Customization Options: Make sure the design allows you to personalize key elements like your logo, contact details, and payment terms. This adds a professional touch and strengthens your brand identity.

- Compatibility with Accounting Tools: If you’re using accounting software or online platforms to manage your business, ensure that your billing document is compatible or can be easily integrated with those tools for automated tracking and payments.

- Client Preferences: Some clients may prefer certain formats over others. For example, some may prefer PDF documents, while others might opt for digital invoices that can be directly filled out online. Be prepared to adjust based on client preferences.

- Legal Requirements: Certain regions or industries have specific requirements for billing documents, such as tax details or specific language. Be sure the format complies with these regulations to avoid issues later.

By considering these factors, you can choose the best format that suits both your business model and your clients’ needs, ensuring smooth and timely payments while maintaining a professional appearance.

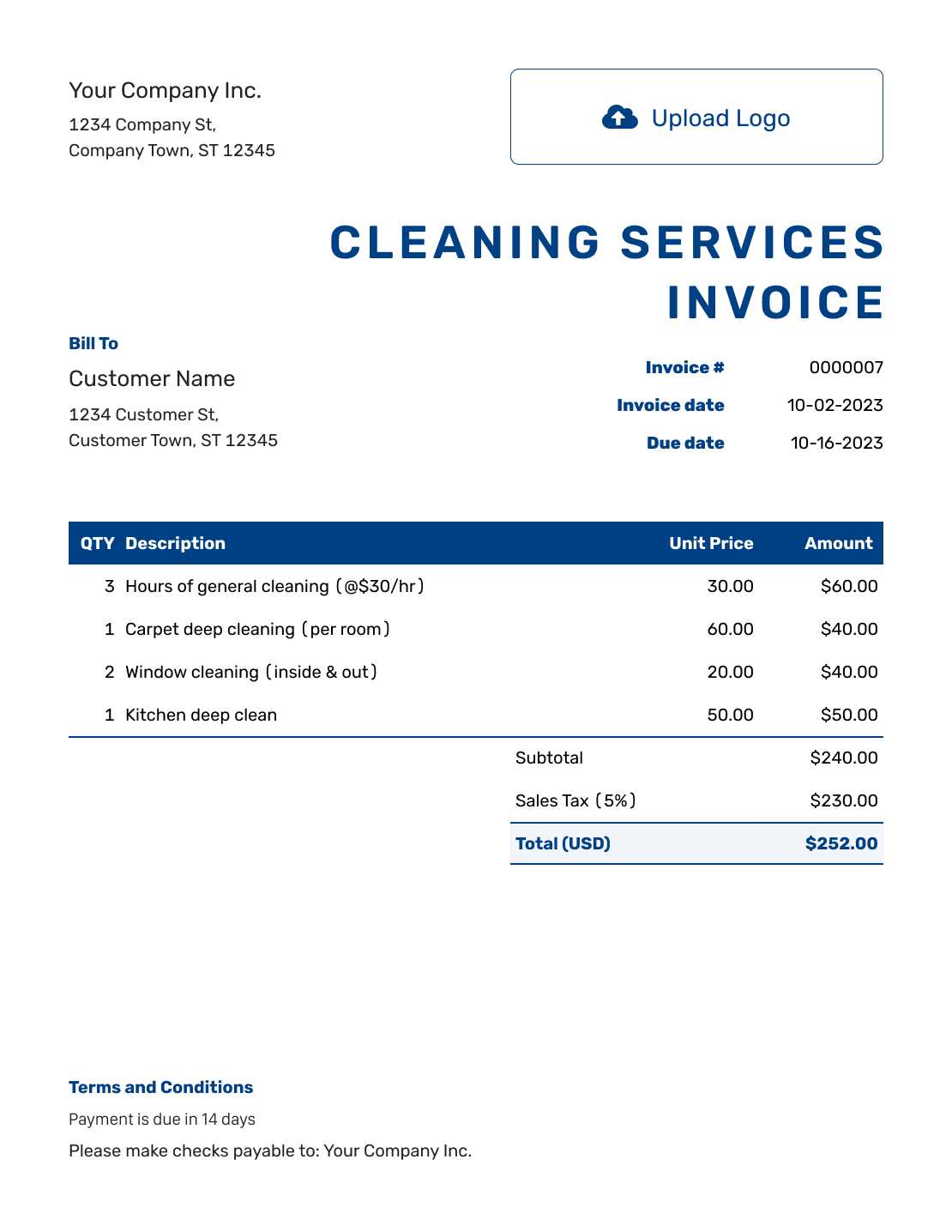

Best Software for Creating Invoices

Choosing the right software to generate professional billing documents is essential for streamlining your financial processes. With the right tool, you can create customized records quickly, automate calculations, and ensure accuracy in every transaction. There are several software solutions available, each offering different features that can help you meet the needs of your business while maintaining a polished and professional image.

Here are some of the best software options for creating payment requests:

- FreshBooks: This cloud-based software is popular among freelancers and small businesses. It offers an intuitive interface, easy customization, and automated reminders for clients, making it a great option for busy professionals.

- QuickBooks: Known for its comprehensive accounting tools, QuickBooks also provides simple options for generating payment documents. It’s ideal for those who need more than just billing functionality and want an all-in-one financial solution.

- Wave: A free, easy-to-use platform that offers customizable formats for creating clear billing documents. It’s ideal for small businesses and startups looking for a budget-friendly option with strong features.

- Zoho Invoice: A versatile tool that allows you to create, send, and track payment requests with ease. Zoho Invoice also includes automation features and integrates with other Zoho products, making it a good choice for businesses already using their suite of tools.

- Invoicely: This software provides both free and premium plans with customizable formats, multi-currency support, and integrated payment gateways. It’s an excellent choice for businesses that need flexibility and global reach.

Each of these software options offers unique features that cater to different business needs. Choosing the right one depends on the size of your business, the complexity of your financial transactions, and the level of customization required. Whether you need a simple, streamlined tool or an advanced all-in-one accounting solution, these platforms can help you create professional payment requests with ease.

Common Mistakes to Avoid in Invoices

Creating a professional payment request is not just about formatting–it’s about ensuring accuracy and clarity in every detail. Small mistakes in your billing documents can lead to confusion, delayed payments, and potential misunderstandings with clients. By being aware of common errors, you can avoid costly oversights and maintain a smooth financial process.

Here are some common mistakes to watch out for when preparing payment documents:

| Mistake | How to Avoid It |

|---|---|

| Missing Contact Information | Ensure both your business and the client’s contact details are accurate and complete. This includes names, addresses, and phone numbers to avoid confusion. |

| Incorrect Payment Terms | Clearly specify the due date, accepted payment methods, and any late fees to prevent delays in payment. |

| Unclear Item Descriptions | Provide a detailed breakdown of the work done or products provided, including quantities, rates, and specific charges to avoid any ambiguity. |

| Missing or Incorrect Tax Information | Ensure taxes are calculated properly and displayed clearly, including the applicable rate and the total tax amount. |

| Failure to Include Unique Identifier | Assign a unique reference number or code for every transaction to help with tracking and organizing payments. |

| Using Non-Professional Formatting | Keep the layout clean, organized, and easy to read, using consistent fonts and spacing to ensure the document looks professional. |

By avoiding th

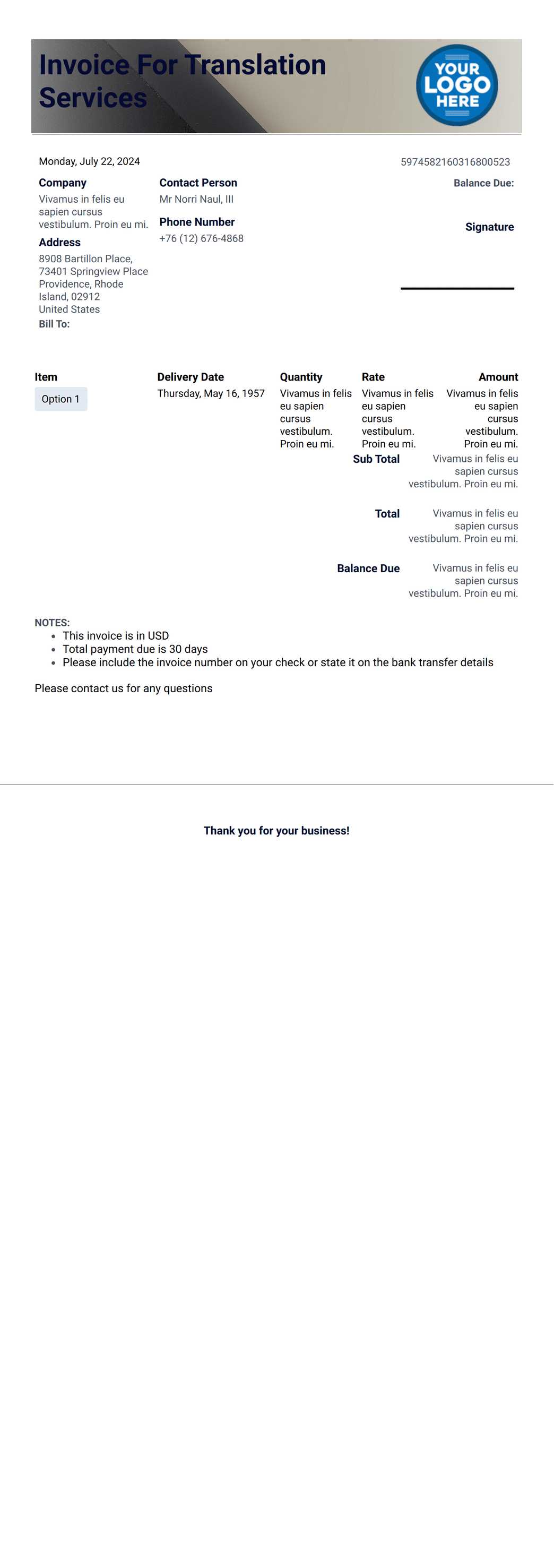

How to Include Payment Terms in Invoices

Clearly outlining the payment terms in your billing documents is crucial for ensuring timely payments and avoiding any misunderstandings with clients. By specifying the conditions under which payment is due, you provide transparency and set expectations from the start. Including the right payment terms also helps protect your business and ensures that your clients know exactly how and when to settle their outstanding balance.

Essential Elements of Payment Terms

When including payment terms, it’s important to cover the following details:

- Due Date: Clearly state the date by which the payment must be received. This can be a specific date or a set number of days after the work is completed or the document is issued (e.g., “Due within 30 days”).

- Late Fees: Specify any penalties or interest charges that will apply if payment is not made on time. This encourages timely settlement and provides a clear consequence for delays.

- Accepted Payment Methods: List the available payment options, such as bank transfers, credit cards, checks, or online payment platforms (e.g., PayPal, Stripe). Be sure to include the necessary account or payment details to make it easy for your client to pay.

- Early Payment Discounts: If applicable, you can offer incentives for early payment, such as a discount (e.g., “5% discount if paid within 7 days”). This can motivate clients to pay ahead of schedule.

Where to Place Payment Terms

It’s important to position the payment terms in a prominent place on the document, so the client can easily see them. Typically, they are placed either at the bottom or in a designated “Payment Terms” section. You can also highlight these terms with bold text or in a separate box to draw attention to them.

By clearly including these details, you ensure both you and your client are aligned on expectations, reducing the risk of delayed payments and maintaining a smooth business relationship.

How to Handle Late Payments with Invoices

Dealing with late payments is a common challenge for many businesses. While timely payment is crucial for maintaining cash flow, delays can happen for various reasons. However, it’s important to address late payments professionally and promptly to ensure your business doesn’t suffer. A clear strategy for handling overdue balances helps preserve client relationships while safeguarding your financial stability.

Here are some effective steps to take when payments are overdue:

- Send a Friendly Reminder: If payment has not been received by the due date, send a polite reminder. Keep the tone friendly and professional, providing a copy of the outstanding balance along with the original payment terms. Sometimes, clients may simply forget or overlook the due date.

- Set Clear Late Fees: To encourage timely payments, it’s important to specify late fees upfront in your documents. If a payment remains unpaid after the agreed period, apply the late fee as outlined. This ensures clients understand the financial consequences of missing the deadline.

- Offer Flexible Payment Options: Sometimes, clients may have cash flow issues preventing them from paying the full amount at once. Offering a payment plan or extending the deadline can help ease the situation and preserve the business relationship.

- Communicate Directly: If reminders and payment extensions don’t work, it may be necessary to directly contact the client to discuss the issue. A phone call or email might be more effective in understanding the reason for the delay and finding a solution.

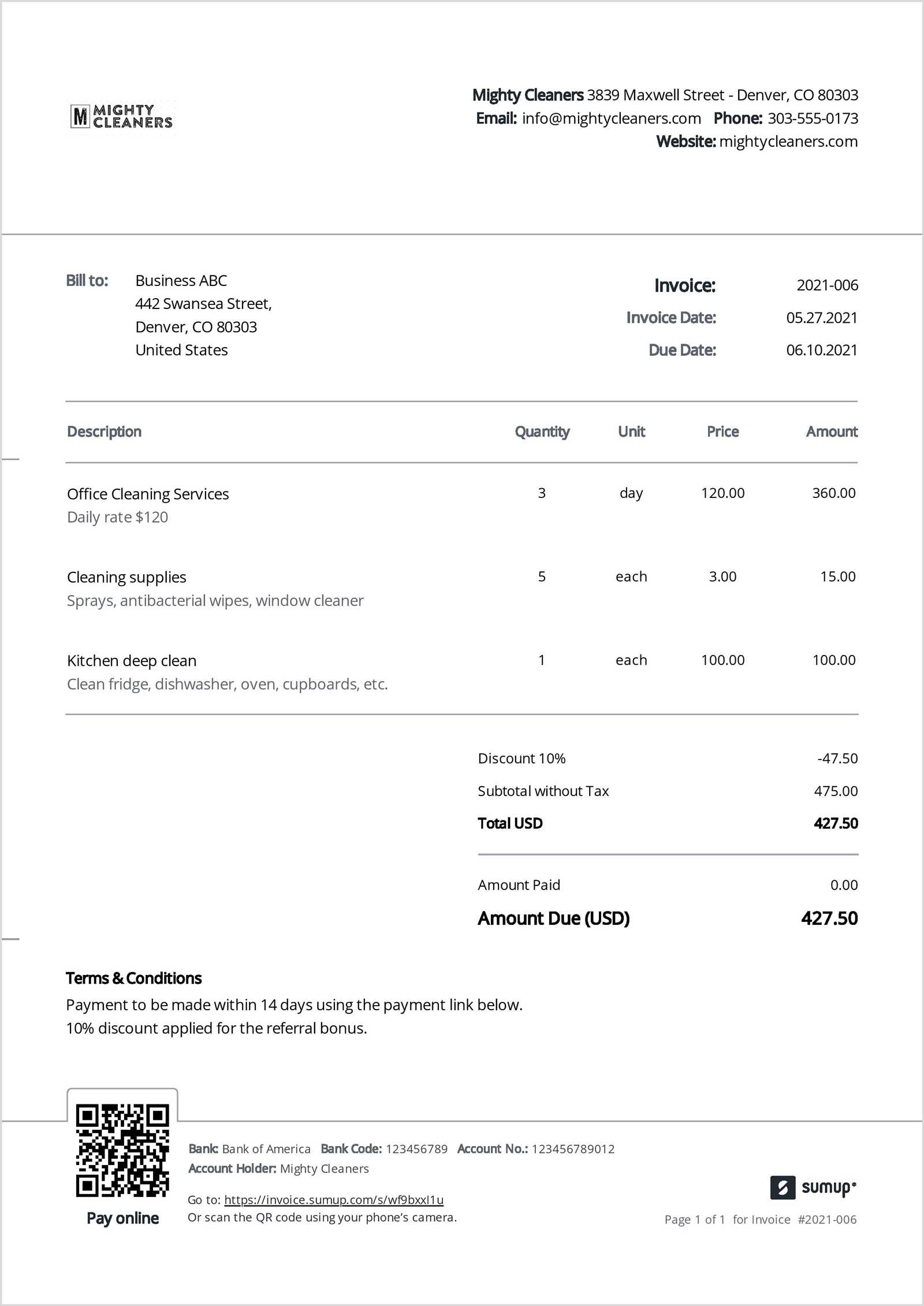

- Keep It Clean and Simple: Avoid cluttering your document with too much information. Focus on the key details–such as contact information, payment terms, and a clear breakdown of charges. A clean layout makes it easier for clients to find important information at a glance.

- Use Your Brand Colors and Logo: Incorporating your business’s brand colors and logo adds a personalized touch and reinforces your brand identity. Just ensure that these elements don’t overwhelm the document, as it should still maintain a professional, readable appearance.

- Organize Information Hierarchically: Place the most important details–such as your business name, payment amount, and due date–at the top. Then, follow with the itemized list, payment instructions, and any additional notes. Clear hierarchy improves readability.

- Choose Readable Fonts: Use legible, professional fonts for your text. Avoid overly decorative fonts that may be difficult to read, especially for key details like amounts and dates. Stick to simple, widely-used fonts like Arial, Helvetica, or Times New Roman.

- Ensure Consistent Alignment: Align text and numbers neatly, especially when displaying amounts, itemized lists, or totals. Proper alignment adds to the overall neatness and makes the document look more organized and easier to understand.

- Include Clear Payment Instructions: Make sure the payment terms and methods are easy to locate and read. Clearly list the accepted payment methods, account details, and any other relevant information, such as late fees or discounts.

- Leave Room for Notes: A section for additional comments, terms, or special instructions can be helpful. This space allows you to clarify specific details and show flexibility without cluttering the main sections of the document.

- Use Accounting Software: Many accounting platforms, such as QuickBooks, FreshBooks, or Xero, offer automated billing features. These tools allow you to set up recurring charges, customize document formats, and schedule when bills are sent to clients.

- Integrate with Your CRM System: If you’re using a customer relationship management (CRM) system, consider integrating it with your billing process. This allows you to pull client data directly into your payment records, eliminating the need for manual input and ensuring consistency.

- Set Up Recurring Billing: For clients with regular payments, you can automate recurring billing cycles. This feature allows the system to automatically generate and send a payment request based on your pre-established terms (e.g., monthly, quarterly).

- Use Online Platforms: Online invoicing platforms such as Zoho Invoice, Invoicely, and Bill.com offer easy-to-use automation tools. These platforms can automatically send payment reminders, apply late fees, and track payment status in real-time.

- Leverage Zapier or Similar Tools: Zapier and similar automation platforms can connect your accounting software to other tools you use (e.g., email, project management software). By setting up workflows, you can automate the entire billing cycle, from task completion to payment request creation.

- Use Accounting Software: Many accounting platforms, such as QuickBooks, FreshBooks, or Xero, offer automated billing features. These tools allow you to set up recurring charges, customize document formats, and schedule when bills are sent to clients.

- Integrate with Your CRM System: If you’re using a customer relationship management (CRM) system, consider integrating it with your billing process. This allows you to pull client data directly into your payment records, eliminating the need for manual input and ensuring consistency.

- Set Up Recurring Billing: For clients with regular payments, you can automate recurring billing cycles. This feature allows the system to automatically generate and send a payment request based on your pre-established terms (e.g., monthly, quarterly).

- Use Online Platforms: Online invoicing platforms such as Zoho Invoice, Invoicely, and Bill.com offer easy-to-use automation tools. These platforms can automatically send payment reminders, apply late fees, and track payment status in real-time.

- Leverage Zapier or Similar Tools: Zapier and similar automation platforms can connect your accounting software to other tools you use (e.g., email, project management software). By setting up workflows, you can automate the entire billing cycle, from task completion to payment request creation.

- Email: Sending documents via email is one of the fastest and most cost-effective methods. Make sure the email contains a professional message and includes the document as an attachment in a commonly accepted format like PDF. You can also use email tracking tools to confirm when your client opens the document.

- Online Payment Platforms: Platforms like PayPal, Stripe, or Square often allow you to send payment requests directly through their system. These platforms can automate much of the process and include payment links, which makes it easier for clients to settle their balances immediately.

- Postal Mail: If necessary, you can still use traditional mail to send hard copies of payment documents, especially for clients who prefer physical copies. This option is slower, but it may be necessary for certain industries or legal requirements.

- Use Accounting Software: Most accounting platforms offer automated billing features that allow you to schedule and send payment requests on a regular basis. These platforms can also generate documents in the correct format and track payment statuses automatically.

- Integrate with CRM Systems: If you’re using a customer relationship management (CRM) system, consider linking it with your accounting software. This can help automate client data entry, personalize payment requests, and send reminders to clients when payments are due.

Design Tips for Professional Invoices

The design of your billing documents plays a significant role in how your business is perceived. A well-structured, visually appealing document not only helps your client understand the details of the transaction but also reflects your professionalism. The key to an effective design is clarity, simplicity, and consistency. Below are some useful tips for creating a polished, professional document that leaves a positive impression.

Here are some essential design tips to consider:

By following these design principles, you can create a billing document that not only looks professional but also makes it easy for clients to understand and process payments on time. A clean, well-designed payment request is an important part of your overall business communication and reputation.

How to Automate Invoice Creation

Automating the process of creating payment documents can save you valuable time and reduce the risk of human error. With the right tools and strategies in place, you can streamline your billing system, allowing you to generate professional records quickly and efficiently. Automation ensures consistency, accuracy, and timely delivery, which can greatly improve your cash flow and client satisfaction.

Here are some steps to automate the process of generating billing records:

By incorporating automation into your billing process, you not only save time but also reduce the chances of errors in your records. Automated systems handle repetitive tasks, allowing you to focus on growing your business while ensuring that all payments are processed on time and accurately.

How to Automate Invoice Creation

Automating the process of creating payment documents can save you valuable time and reduce the risk of human error. With the right tools and strategies in place, you can streamline your billing system, allowing you to generate professional records quickly and efficiently. Automation ensures consistency, accuracy, and timely delivery, which can greatly improve your cash flow and client satisfaction.

Here are some steps to automate the process of generating billing records:

By incorporating automation into your billing process, you not only save time but also reduce the chances of errors in your records. Automated systems handle repetitive tasks, allowing you to focus on growing your business while ensuring that all payments are processed on time and accurately.

Legal Considerations for Service Invoices

When creating payment records for your business transactions, it’s essential to understand the legal aspects that govern such documents. These records are not only a means of tracking payments but also serve as binding contracts in many cases. Ensuring that your records comply with relevant laws and regulations is crucial for protecting both you and your clients. Below are some key legal considerations to keep in mind when preparing such documents.

Key Legal Elements to Include

Including the right legal elements in your payment records can help prevent misunderstandings and ensure your business is in compliance with local laws. These elements help establish the terms of the transaction, provide clarity on your rights, and serve as evidence in case of disputes.

| Legal Requirement | Description |

|---|---|

| Business Information | Your business’s full legal name, address, and contact information should be clearly stated. This is necessary for both identification and compliance purposes. |

| Client Details | Ensure that the client’s legal name, address, and contact details are accurate. This helps in identifying the parties involved in the transaction and can be crucial in case of legal proceedings. |

| Agreement Terms | Clearly state the terms of the agreement, including the work performed or products provided, the agreed-upon price, and any payment deadlines. It’s also advisable to include payment methods and late fees if applicable. |

| Tax Information | Ensure the correct tax rates are applied and that they comply with local tax laws. Include the total tax amount and any relevant tax identification numbers to remain compliant with tax authorities. |

| Legal Notices | Include any necessary disclaimers, terms of service, or legal conditions that apply to the transaction. This could include return policies, warranties, or legal obligations for both parties. |

Understanding Local Regulations

Different jurisdictions may have varying laws concerning how payment records must be structured. These rules can include specific requirements for tax calculations, record-keeping, or language used in the document. It is essential to stay informed about the regulations that apply to your location or the location of your clients to ensure that your business remains compliant.

By incorporating these legal considerations into your payment documents, you can avoid disputes, prevent legal issues, and maintain a professional and trustworthy relationship with your clients. Always

How to Send Invoices to Clients Efficiently

Sending payment requests to clients can sometimes be a time-consuming task, especially when you’re managing multiple clients or a large volume of transactions. However, by adopting efficient methods and using the right tools, you can streamline the process and ensure that your clients receive their bills on time, every time. Timely delivery of payment documents not only facilitates smooth cash flow but also fosters strong client relationships.

Choosing the Right Delivery Method

The delivery method you choose will depend on your business model, the preferences of your clients, and the urgency of the payment. Here are some common ways to send payment requests:

Automating the Process

Manual sending of payment documents can be prone to errors and inefficiencies. Automation can simplify this process significantly:

By choosing the right delivery methods and automating the process where possible, you can ensure that payment requests reach clients efficiently and on time, helping to maintain steady cash flow and positive business relationships.