Free Therapy Invoice Template for Easy and Professional Billing

Managing financial transactions in a professional practice can be time-consuming and complex. Streamlining this process with the right tools ensures clarity, reduces errors, and saves valuable time. By utilizing a structured document, practitioners can create accurate records while maintaining a polished and professional image with their clients.

Whether you’re just starting out or looking to optimize your current workflow, a customizable billing document can make a significant difference. This essential resource helps you track services rendered, payments received, and outstanding balances with ease. Additionally, having a well-organized billing structure enhances client trust and fosters better financial management.

In this article, we’ll explore how to create an effective billing document that fits your practice’s needs. Learn how to customize it, what key elements to include, and how it can simplify your administrative tasks. With the right approach, managing finances becomes more manageable, leaving you with more time to focus on your clients.

Professional Billing Solutions for Practitioners

For any practitioner, keeping financial records organized and clear is essential to maintaining a smooth and professional practice. A well-structured billing document can help simplify the process of charging clients for services rendered, ensuring both accuracy and transparency. Whether you’re managing a growing practice or a solo venture, utilizing a customizable billing document can make your work more efficient.

Why Professionals Need an Organized Billing System

In any professional setting, maintaining clear records is not just a convenience but a necessity. Accurate financial tracking allows you to avoid discrepancies, prevents missed payments, and ensures that all transactions are properly documented. A streamlined process also enhances client relationships, as they can easily understand the charges and payment details. With a reliable system in place, your practice will run more smoothly, and you’ll have peace of mind knowing everything is properly recorded.

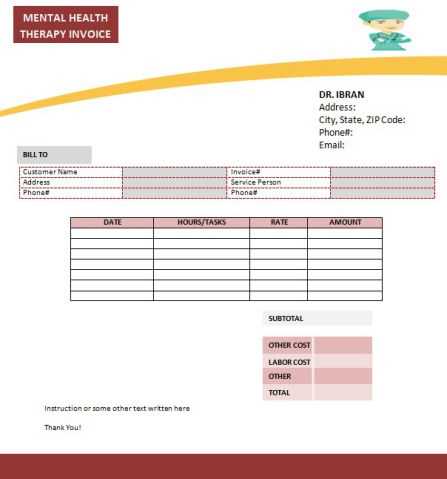

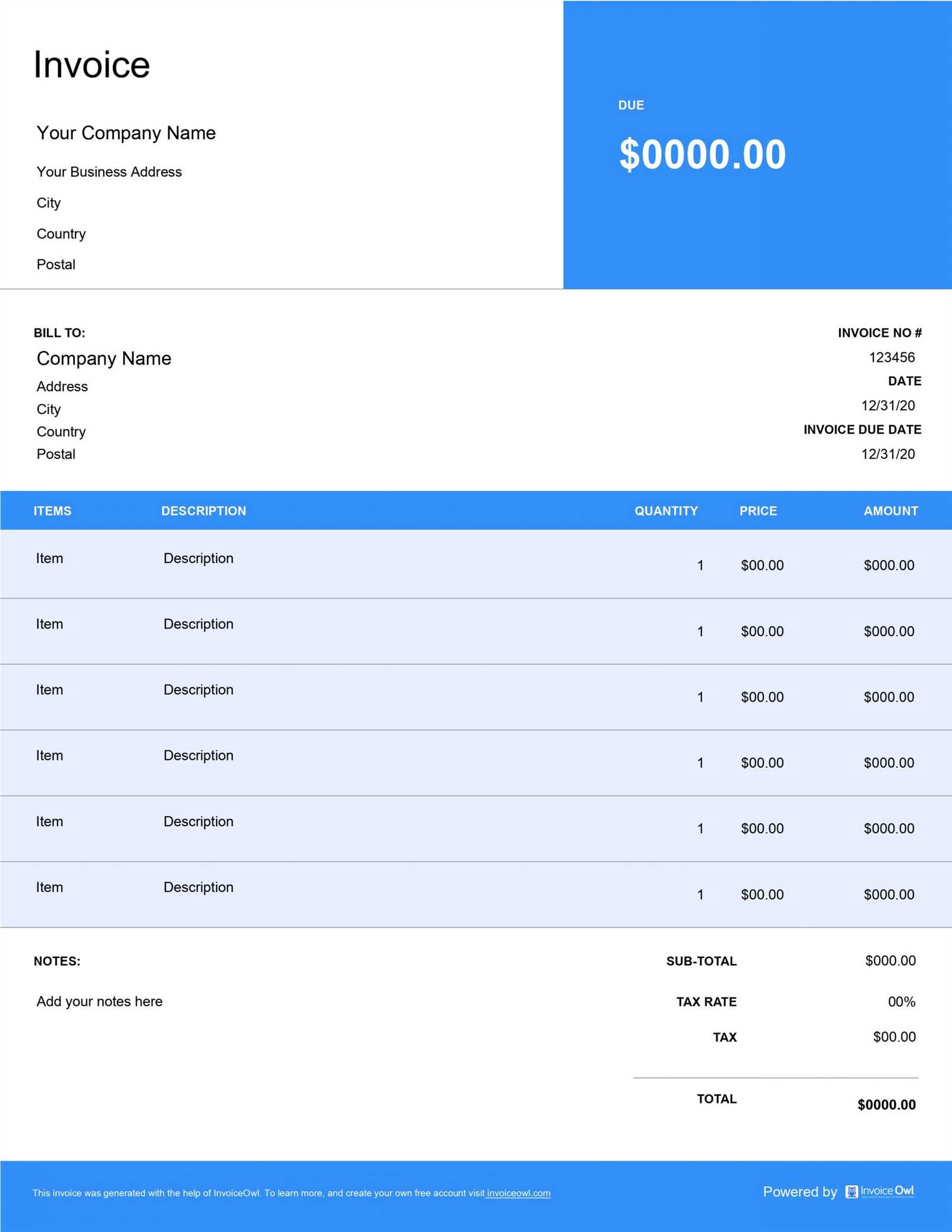

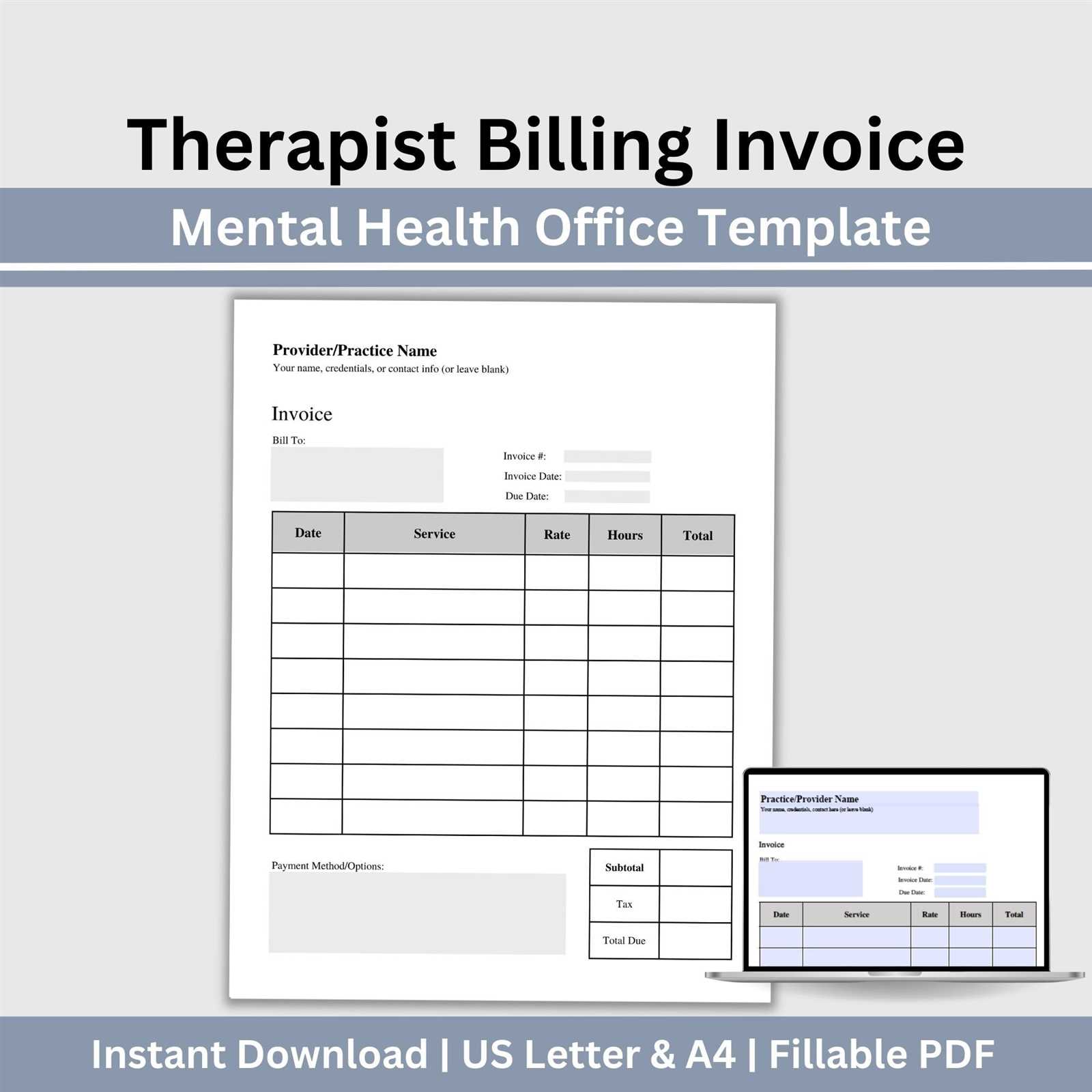

How to Create a Professional Billing Document

Creating a comprehensive billing document requires attention to detail and an understanding of what needs to be included. A professional billing document should feature key elements such as client information, session dates, a breakdown of services provided, and the total amount due. By including these essential components, you ensure clarity for both you and your clients. Customizable formats give you the flexibility to adapt to your specific needs, making it easier to update details as your practice evolves.

Ultimately, having a professional billing document simplifies your workflow and helps establish trust with your clients. It’s an essential tool for any practitioner aiming for operational efficiency and financial clarity.

Why You Need a Billing Document

In any professional service, ensuring clear communication regarding financial transactions is crucial. Having a standardized document for charging clients helps avoid misunderstandings and provides a straightforward way to track services and payments. A structured format not only promotes transparency but also supports smooth administrative operations, freeing up more time to focus on your work.

Using a consistent approach to billing allows you to quickly generate and send records without needing to recreate the format each time. This reduces the chances of errors, such as missing charges or incorrect totals. Moreover, a professional billing document ensures that all necessary details–such as dates, amounts, and descriptions–are always included, leading to more efficient financial management.

For clients, a clear, organized statement makes it easier to understand the charges and helps avoid disputes. The use of such a document builds credibility and trust in your practice, while also ensuring compliance with accounting and legal standards. In the long run, it saves both time and effort for you and your clients, making the entire process more efficient and professional.

Benefits of Using a Customizable Billing Document

Adopting a pre-designed document for financial transactions can significantly simplify the administrative side of your practice. By leveraging a ready-made structure, you save time and effort while ensuring consistency in how you handle billing. A well-organized document not only makes it easier to charge clients but also enhances the overall professionalism of your service.

Time and Effort Savings

One of the most immediate benefits of using a pre-designed billing solution is the time it saves. Instead of manually creating a new document for each client or session, you can quickly adjust an existing one to reflect the specifics of the service provided. This streamlined approach allows you to focus more on client care and less on paperwork.

Consistency and Accuracy

Using a standardized document ensures that all necessary details are included in every transaction, helping you avoid errors and omissions. Each time you issue a bill, you know that it will contain the same structure and vital information, such as client details, session dates, and amounts owed. This consistency boosts your credibility and helps establish a professional image with your clients.

In addition, a well-structured document ensures that you are adhering to best practices for financial recordkeeping. This not only supports smoother communication with clients but also reduces the likelihood of misunderstandings or disputes related to payment.

How to Customize Your Billing Document

Customizing a billing document allows you to tailor it to the specific needs of your practice and clients. By adjusting certain elements, you can ensure that the document accurately reflects the services you provide and aligns with your brand’s identity. A personalized format not only improves clarity but also reinforces professionalism in your financial communications.

Adjusting Basic Information

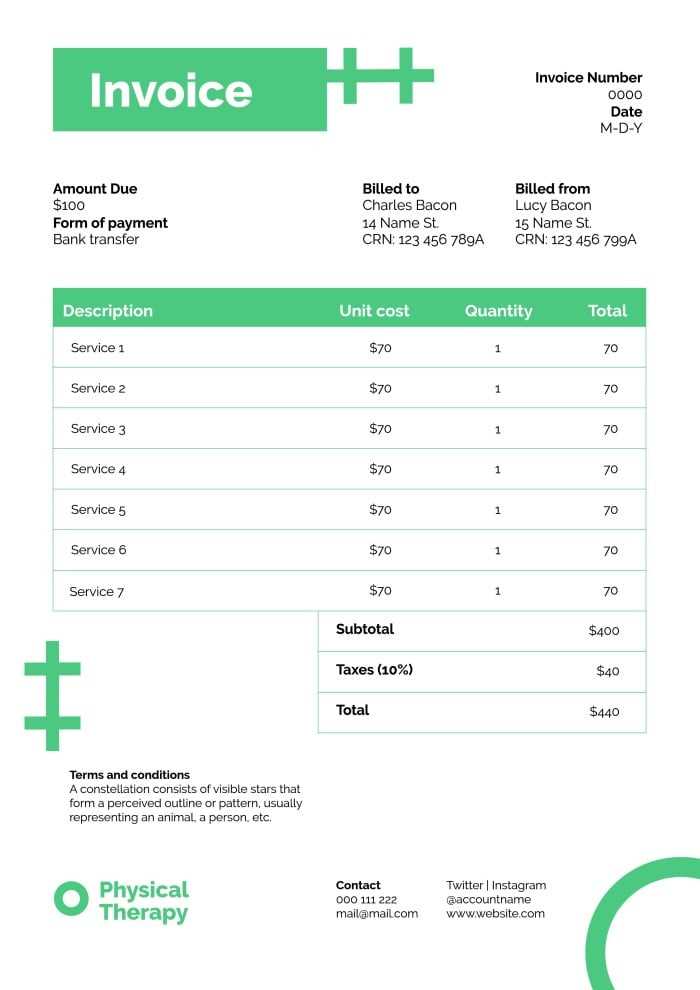

The first step in personalizing your billing document is to update the essential details. This includes your practice name, contact information, and any other relevant identifiers such as a logo or business number. Including clear and accurate information about both you and your client ensures there is no confusion about who is responsible for the charges and who provided the service.

Adding Customizable Sections

Beyond basic contact details, consider adding specific sections that reflect the nature of your services. For instance, you may want to include a detailed breakdown of each session, highlighting the time spent, the type of service provided, and the associated cost. This transparency helps build trust and ensures your clients fully understand the charges. You can also include payment terms, late fees, or discounts where applicable.

By customizing the layout and sections of your billing document, you create a unique and functional tool that supports both your business operations and client satisfaction.

Key Information to Include in a Billing Document

When creating a billing record, it’s essential to include all the necessary details to ensure clarity and accuracy. A well-structured document provides both the client and the provider with a clear understanding of the transaction, helping to avoid misunderstandings. Including the right information also supports smoother financial tracking and ensures compliance with legal or accounting requirements.

Client and Service Provider Details

At the top of the document, include both your contact information and your client’s. This should consist of names, addresses, and phone numbers for both parties. Having these details readily available ensures that there is no ambiguity regarding the involved parties. Additionally, adding your business logo or registration number can reinforce your professional identity.

Session Information and Payment Breakdown

Clearly listing the services provided is crucial. Include the date and duration of each session, along with a brief description of the service rendered. It’s also important to provide a breakdown of the cost for each service. This transparency not only makes it easier for clients to understand what they are being charged for but also helps avoid confusion about rates or additional fees.

Finally, ensure that the total amount due, payment terms, and any applicable taxes are clearly indicated. Adding payment due dates and acceptable payment methods further helps to streamline the payment process and set clear expectations for your clients.

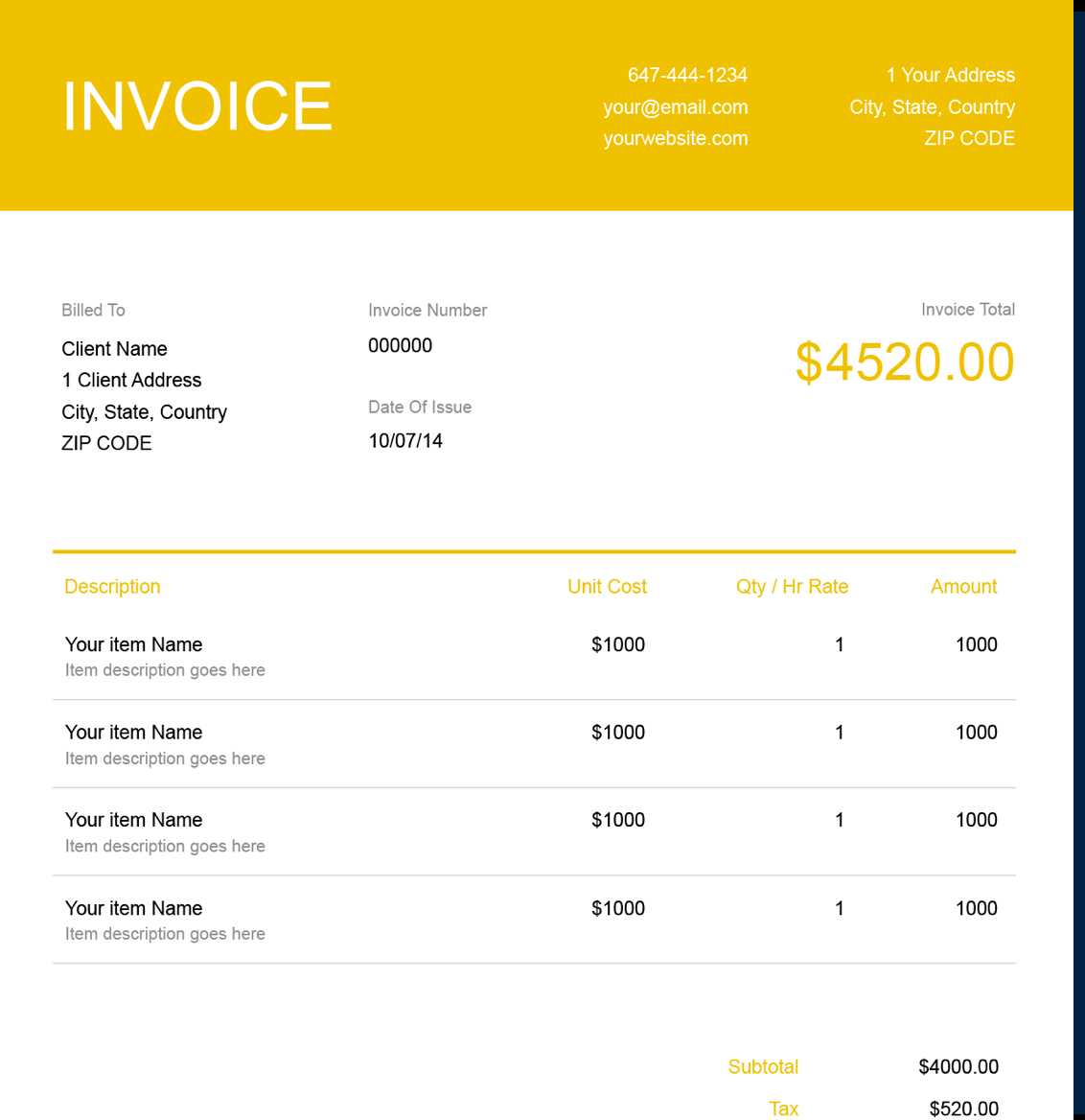

Simple Design for Better Clarity

A clean and straightforward design is key to ensuring that financial documents are easy to read and understand. When the layout is clear and intuitive, clients can quickly locate essential information without confusion. A simple design not only enhances the user experience but also reflects a sense of professionalism and attention to detail.

Organized Layout for Easy Navigation

One of the most effective ways to improve clarity is through organization. Grouping related information together, such as contact details, service descriptions, and payment breakdowns, helps clients process the information more quickly. Using ample white space between sections ensures that the document doesn’t appear cluttered, making it easier to read. Prioritize a logical flow that guides the viewer’s eye from one section to the next, avoiding overwhelming them with excessive detail.

Highlighting Key Information

While simplicity is important, it’s equally necessary to draw attention to the most crucial details. Use bold or larger fonts for total amounts, payment deadlines, and due dates. This way, the most important pieces of information stand out, allowing clients to grasp them at a glance. A clear distinction between charges and taxes, as well as payment methods, also helps avoid confusion and makes the entire document easier to follow.

By maintaining a simple design with clear distinctions between sections, you ensure that both you and your clients can quickly access and understand the key elements of the document. This leads to more efficient communication and smoother financial transactions.

Easy-to-Use Document Features

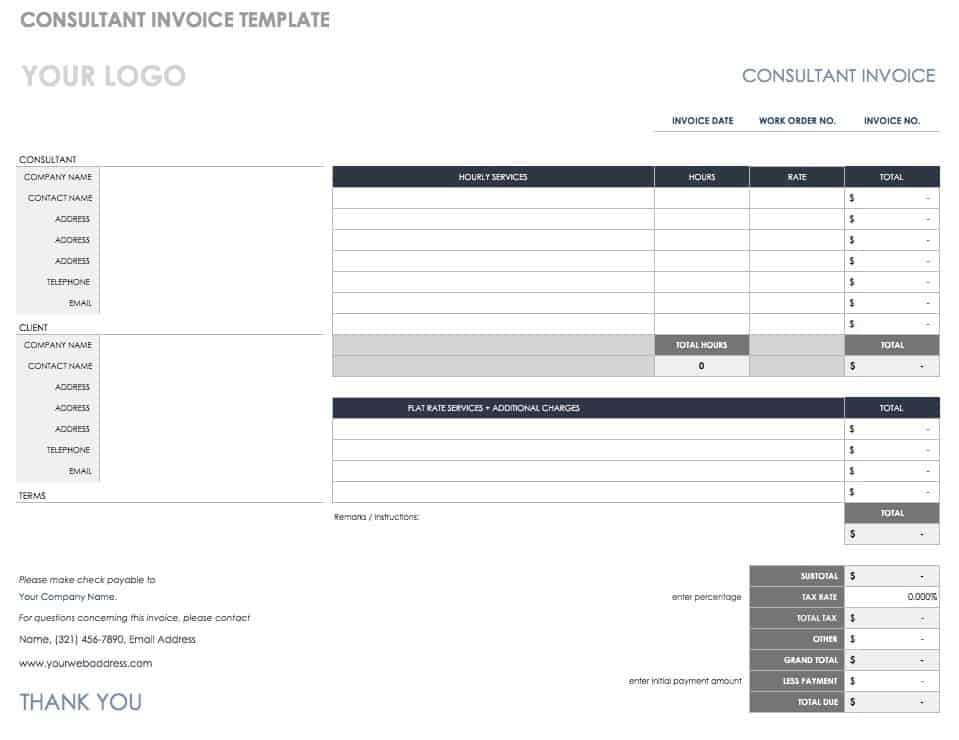

An effective billing document should be easy to work with, allowing you to quickly generate, customize, and send statements to clients. The best solutions are intuitive, requiring minimal effort to input and update information. Below are some of the key features that make a billing document user-friendly and efficient for professionals.

Key Features for Simple Use

- Pre-filled Fields: Essential information such as client name, service details, and dates are already set up, allowing you to simply fill in specific details without starting from scratch.

- Editable Sections: Easy-to-edit sections make customization a breeze. You can add or remove items based on the services you offer or the specifics of the transaction.

- Clear Formatting: An organized and well-structured layout ensures that all details are easy to find. This includes clear sections for contact information, charges, and payment terms.

- Customizable Payment Terms: Modify payment terms, such as deadlines, late fees, or discounts, to fit your practice’s policies.

- Automatic Calculations: Some documents include built-in calculation features that automatically compute totals, taxes, or discounts, saving you time and minimizing errors.

- Compatibility: Many documents are available in various file formats (e.g., PDF, Word, Excel) for easy printing or digital sharing via email or online platforms.

Benefits of an Easy-to-Use Structure

- Time Efficiency: Save valuable time by quickly generating accurate records without unnecessary steps.

- Professional Presentation: A polished, well-organized layout enhances your practice’s image and promotes trust with clients.

- Reduced Errors: Simple features such as automated calculations and clear sections reduce the likelihood of mistakes in billing.

With these features, managing financial records becomes a straightforward task that allows you to focus more on your clients and less on paperwork.

How to Save Time with Pre-Designed Documents

Efficiency is key when it comes to managing administrative tasks in any professional practice. Using a pre-designed document that you can quickly adjust and personalize helps save a significant amount of time. Rather than starting from scratch each time you need to bill a client, a customizable structure allows you to focus on what matters most–your work and your clients.

Speed Up the Billing Process

One of the biggest time-saving benefits is the ability to quickly generate a new document with minimal effort. Most of the details, such as your contact information and the basic layout, are already in place. This means you only need to enter specific data like service dates, charges, and client details, which can be done in a matter of minutes. This reduces the time spent on repetitive tasks and lets you move on to more important matters.

Reduce Administrative Overhead

Customizable documents also help eliminate the need for manual calculations and formatting. Many pre-designed systems come with automatic calculation features, which ensure that totals, taxes, or discounts are applied correctly every time. This not only saves time but also minimizes the chances of errors, which can lead to delays or confusion with clients.

By using a pre-built structure that requires minimal adjustment, you can create polished and accurate records quickly, allowing you to focus more on client interactions and less on paperwork.

Free vs Paid Billing Documents

When it comes to selecting a structured document for managing client payments, you’ll often face the choice between free and paid options. Both offer advantages, but understanding their differences can help you choose the right fit for your practice. While free resources may seem appealing, paid solutions often come with added features and support that could benefit your workflow in the long run.

Advantages of Free Documents

Free resources are ideal for those just starting out or running a small practice on a tight budget. These documents are often simple, easy to use, and require little setup. With basic fields for client information, session details, and charges, they can be easily customized to suit your needs. Free documents are a great choice if you’re looking for a straightforward solution without any added complexity.

Benefits of Paid Solutions

While paid documents typically come with a price tag, they offer additional benefits that can be valuable for growing practices. Paid solutions often include advanced features such as automatic calculations, integrated tax systems, customizable branding, and customer support. These premium options can help streamline your workflow, reduce the risk of errors, and enhance the professionalism of your financial records.

Paid solutions also tend to offer better security and the ability to store or sync documents across multiple devices. This can be especially important for businesses that need reliable, long-term access to records or require frequent updates to meet changing regulatory requirements.

Ultimately, the choice between free and paid options comes down to your specific needs. If you require a simple, no-cost solution, free options may suffice. However, for those seeking a more robust and scalable tool, investing in a paid solution can be a worthwhile decision.

How to Download a Billing Document

Downloading a ready-made document to manage client payments is a simple and effective way to streamline your administrative tasks. Whether you’re looking for a basic layout or a more customized option, the process is usually straightforward. By following a few simple steps, you can quickly access a professional document that suits your practice’s needs.

Step 1: Choose a Reliable Source

The first step is to find a trustworthy website or platform offering customizable billing documents. Ensure that the resource is from a reputable provider, ideally with positive reviews or recommendations from other professionals. Many websites offer both free and paid options, so be sure to choose one that aligns with your requirements. Look for websites that offer easy access and a variety of formats, such as Word, PDF, or Excel, depending on your preference.

Step 2: Download and Save the Document

Once you’ve found a document that fits your needs, simply click the download button. Most platforms will provide an immediate download link or send it directly to your email. Make sure to save the file in a location on your computer or cloud storage where you can easily access it when needed. Some providers may require you to create an account or sign up for updates, so be prepared for that step if necessary.

After downloading the file, you can begin customizing it to reflect your practice’s specific details. Adding your business logo, contact information, and adjusting the payment terms ensures that the document is ready for use with your clients.

Common Mistakes to Avoid in Billing Documents

When creating a document to request payment for services rendered, accuracy and clarity are essential. Small mistakes can lead to confusion, delayed payments, or even damage your professional reputation. By being aware of the most common errors, you can avoid them and ensure that your financial records are always clear, professional, and accurate.

Missing or Incorrect Client Information

One of the most common mistakes is failing to include correct client details. This includes the client’s full name, address, or contact information. Missing or inaccurate information can lead to confusion or delays in payment, as clients may not recognize the billing details or have trouble contacting you if there’s an issue. Always double-check the contact information before sending the document.

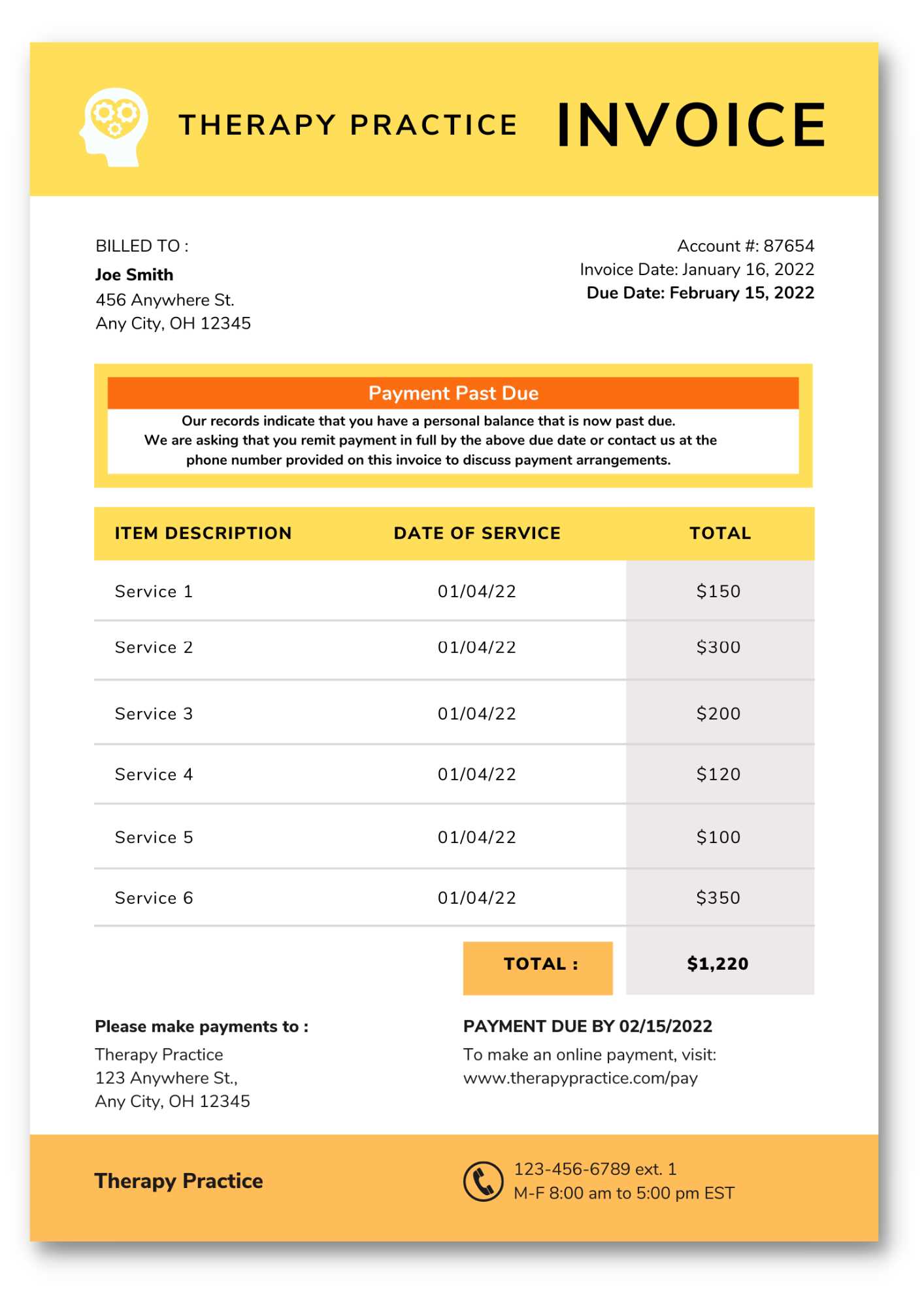

Not Including a Clear Payment Due Date

Another frequent error is neglecting to include a clear payment deadline. Without a due date, clients may delay payment or forget to make it altogether. Make sure to specify the payment terms, including the exact due date and any late fees if applicable. A clearly stated deadline helps set expectations and improves the likelihood of timely payments.

Failure to Break Down Charges

Providing a simple, lump-sum total without breaking down individual services can lead to misunderstandings. Clients should always be able to see what they are being charged for, whether it’s based on time, service type, or additional costs. A breakdown of charges ensures transparency and prevents potential disputes over pricing.

Omitting Tax Information

Many practitioners forget to include tax details or miscalculate them. Ensure that the correct tax rate is applied and clearly indicated on the document. If taxes are not applicable, be sure to state that as well to avoid confusion. Proper tax inclusion ensures compliance with local regulations and keeps your financial records in order.

Not Offering Clear Payment Methods

Another common mistake is not specifying accepted payment methods. Whether you accept bank transfers, credit card payments, or online payment systems, it’s essential to include this information so clients know how they can pay. Failure to do so can lead to delays as clients may not know how to submit payment.

By paying attention to these common mistakes, you can ensure that your billing documents are accurate, professional, and easy for clients to understand, leading to smoother transactions and timely payments.

Legal Requirements for Billing Documents

When providing professional services and issuing financial records, it’s essential to meet the legal standards that govern such transactions. Proper documentation ensures compliance with tax regulations, accounting standards, and client protection laws. While requirements can vary depending on your location, certain key elements are universally necessary to avoid legal issues and ensure transparent business operations.

One of the most important legal requirements is including accurate and detailed information in every billing record. This includes your business name, contact details, and any relevant registration numbers. Similarly, you must include your client’s full name and contact information to ensure there is no confusion about who is responsible for payment. Clear itemization of the services provided, along with the corresponding charges, is also necessary to avoid misunderstandings or disputes.

Tax compliance is another critical factor. Many regions require that taxes be applied to professional services. Whether it’s sales tax, VAT, or other local taxes, you must include the correct tax rate and ensure it’s clearly stated on the document. Additionally, if you are required to apply specific tax exemptions or discounts, these must be noted explicitly to avoid issues with tax authorities.

In some jurisdictions, keeping accurate financial records for a set period is also required by law. Therefore, ensuring that your documents include all relevant transaction details and are stored securely is vital for meeting audit and reporting standards.

By ensuring that your billing documents meet these legal requirements, you can operate your practice with greater confidence, knowing that you’re in compliance with necessary regulations and protecting both your business and clients.

How to Keep Records with Billing Documents

Maintaining accurate records is an essential part of any professional practice. Proper documentation ensures that all financial transactions are easily accessible and organized for future reference. By keeping thorough records, you can streamline your accounting, simplify tax filings, and avoid potential disputes with clients. Here are some key steps to ensure your records are kept in order.

Organizing Your Financial Documents

To keep your records clear and manageable, follow these basic organizational practices:

- Categorize by Date: Sort your records by the date the services were provided. This helps you maintain an organized timeline of your transactions, making it easier to review your business activity when needed.

- Group by Client: Create separate folders or files for each client. This way, you can quickly find all relevant billing documents for a specific individual or organization without searching through a large stack of records.

- Use Digital Storage: Scanning and saving your documents digitally can help reduce physical clutter and ensure easy access. Use secure cloud storage services to back up your files, making sure they are safely stored and easy to retrieve when needed.

Essential Information to Track

In order to keep comprehensive records, make sure each document includes the following details:

- Client Details: Always include the client’s full name and contact information to avoid confusion.

- Service Dates: Clearly record the dates when services were rendered. This is important for both financial tracking and tax purposes.

- Service Descriptions: Provide a clear breakdown of the services delivered and the associated costs.

- Payment Status: Track whether the client has paid, and note any outstanding balances. This helps with follow-ups and ensures you have a clear overview of your finances.

- Tax Information: If taxes were applied, ensure the correct tax rate and amount are documented for compliance with local tax laws.

By following these guidelines and keeping your documents organized, you ensure that your financial records remain accurate, accessible, and compliant with any regulatory requirements. Proper record-keeping is essential for the long-term success of your business.

How to Send Billing Documents to Clients

Sending accurate and professional billing records to clients is a critical part of maintaining a smooth and efficient payment process. Whether you are sending a physical document or using digital methods, it’s important to ensure the information is clear, timely, and secure. Below are steps to ensure your billing documents reach clients effectively.

Choosing the Right Delivery Method

The delivery method you choose depends on your client’s preferences and your business operations. You can send billing documents through:

- Email: This is the most common method for sending digital documents. Attach the file in PDF or another widely accepted format, ensuring it’s clearly named and easy to open. Always include a brief message explaining the document and any relevant details.

- Physical Mail: If your client prefers hard copies, printing and mailing the document is an option. Ensure it’s professionally formatted and sent with a secure and traceable mailing service to avoid any issues.

- Online Payment Platforms: Some businesses use online platforms that allow direct payment through a secure portal. These platforms may also offer an option to send the document automatically when the transaction is initiated.

Important Tips for Sending Billing Records

To ensure timely payments and minimize confusion, consider these tips when sending out your billing documents:

- Clear Subject Line: When sending by email, include a subject line that clearly states the purpose of the message (e.g., “Payment Request for [Client Name] – [Service Date]”).

- Follow-Up Reminder: If the payment due date is approaching or has passed, sending a polite reminder can encourage prompt action. Include a clear reference to the original document and any relevant details about the payment status.

- Track the Delivery: For physical mail, always use a tracked service to ensure your document reaches the client securely and on time. This helps resolve any potential di

Managing Payments Through Billing Documents

Effectively managing payments is an essential part of running a successful business. A well-organized system for sending out financial records and tracking payments ensures smooth transactions and prevents any misunderstandings with clients. By keeping careful records of all payments, you can stay on top of your finances, avoid overdue accounts, and maintain a professional reputation.

Tracking Payment Status

One of the most important aspects of managing payments is ensuring you can easily track the status of each transaction. It’s essential to keep detailed records that indicate whether a client has paid, partially paid, or still owes a balance. Here’s how to stay organized:

- Use a Payment Log: Maintain a log where you track all payment-related details for each client. Record the date of payment, the amount paid, and the remaining balance if applicable.

- Mark Paid Transactions: When payments are received, mark them as “paid” in your system or financial records. This makes it easier to spot any overdue payments and follow up appropriately.

- Highlight Overdue Accounts: Keep a separate list of accounts with outstanding balances. This way, you can send reminders and follow up with clients before the debt accumulates further.

Payment Methods and Flexibility

Offering flexible payment methods can help clients pay their bills more easily and promptly. Accepting various forms of payment–such as credit cards, bank transfers, or online payment platforms–ensures that your clients have the option that works best for them. Be sure to clearly communicate which payment methods you accept in your documents.

By managing payments effectively and keeping clear, organized records, you reduce the risk of delayed payments and improve your overall cash flow. This also helps build trust with clients, ensuring a smooth and professional relationship.

Improving Client Relationships with Clear Billing Documents

Clear and transparent billing documents play a significant role in building strong, trust-based relationships with clients. When your financial records are easy to understand, clients are more likely to feel confident in your professionalism and the services you provide. It’s not just about requesting payment–it’s about fostering open communication and mutual respect. Properly formatted documents can help avoid confusion, reduce disputes, and improve client satisfaction.

Clarity in Communication

One of the main ways billing documents contribute to strong client relationships is through clear communication. When all charges are detailed and well-explained, clients are less likely to feel surprised or confused about the payment request. Including breakdowns for each service and corresponding costs provides transparency and reassures clients that they are being charged fairly.

Timeliness and Professionalism

Sending documents promptly and in a professional format also conveys reliability. Clients appreciate timely billing, which allows them to plan their payments and avoid any misunderstandings. Professionalism in presentation further reinforces your credibility as a service provider.

Example of Clear Billing Structure

Below is an example of how to structure your billing document for clarity:

Service Description Quantity Unit Price Total Consultation (1 hour) 1 $100 $100 Follow-up Session (30 minutes) 1 $50 $50 Total $150 By offering clients a clear breakdown like the one shown above, you not only show your professionalism but also make it easier for them to understand and manage their payments.

Building strong client relationships is about trust, and clear financial documentation is an essential part of that process. When clients feel confident in the transparency and accuracy of their billing records, they are more likely to return for your services and recommend you to others.

Tips

Creating professional and clear financial records is essential for smooth business operations and maintaining strong client relationships. Whether you’re new to managing billing or looking for ways to improve your existing process, these helpful tips will guide you toward efficiency, accuracy, and professionalism in your documentation.

Best Practices for Effective Billing

Here are some key tips to help you enhance your billing system:

- Use Clear and Concise Language: Avoid jargon and be straightforward in your descriptions. A client should easily understand what they are being charged for without needing further clarification.

- Always Include Key Details: Make sure to include the service provided, the date of service, the total amount, and any applicable taxes. Missing information can lead to confusion and delays in payment.

- Set Payment Terms Upfront: Clearly state the due date and payment options. This helps avoid misunderstandings and sets expectations for both parties.

- Automate When Possible: Using automated tools for generating records can save time and reduce errors. Many software options allow for easy customization and tracking of payments.

- Keep a Backup Copy: Always retain a digital and physical copy of your records for your reference. This ensures you have a backup in case of any issues or disputes.

Tips for Sending and Following Up

How you send and follow up on your financial records can impact payment timeliness and client satisfaction:

- Send Promptly: Ensure that your records are sent immediately after services are rendered to avoid delays. The quicker you send it, the sooner the client can review and make payments.

- Offer Multiple Payment Methods: Providing a variety of payment options increases the likelihood of timely payments. Accepting online payments, bank transfers, or credit card options can make it more convenient for clients.

- Follow Up Professionally: If a payment is overdue, a polite reminder is often all that is needed. Be professional and courteous in your communication to maintain a positive relationship with your clients.

- Keep Records Organized: An easy-to-access filing system is crucial. Whether digital or physical, ensure all financial documents are organized by date and client, making it easier to track payments and manage future transactions.

By following these tips, you can streamline your financial process, reduce errors, and build a reputation for professionalism. Clear, accurate, and timely billing helps keep your business running smoothly and ensures that your clients