Easy to Use Piano Teacher Invoice Template for Simple Billing

For any music instructor, managing payments and keeping track of sessions is an essential part of running a successful practice. With the right tools, this task can be made significantly easier and more professional. One of the best ways to streamline this process is by using a structured document that clearly outlines the terms of each lesson and the amount owed by students.

Such a document not only ensures that both parties are on the same page but also helps in maintaining a well-organized record of financial transactions. Whether you work with private clients or teach group classes, having a consistent way to request payment can save time, reduce misunderstandings, and improve overall business operations.

By choosing the right format and customizing it to fit your needs, you can quickly generate a clear and professional request for payment after each session. This simple tool can become a key component in running your music business smoothly and efficiently, freeing up more time for what you do best – teaching and performing.

Why Use a Structured Payment Request Document

Having a well-organized system for requesting payment after each lesson is vital for any instructor. By using a standardized form, you can easily maintain professionalism while ensuring clarity between you and your clients. The right document can simplify the entire billing process, making it quicker and more efficient.

Here are some key reasons why utilizing such a structured system is beneficial:

- Consistency: Using a pre-designed form guarantees that all relevant details are included every time, reducing the risk of missing important information.

- Professionalism: A formal payment request reflects well on your business, giving students a sense of reliability and trust.

- Time Efficiency: With a ready-made structure, you can generate payment requests quickly, allowing you to focus more on teaching.

- Transparency: Clear documentation helps prevent confusion by specifying exactly what is being billed for, making sure both parties are on the same page.

- Record Keeping: A consistent payment system helps you keep a comprehensive and organized record of all transactions, useful for accounting and tax purposes.

Whether you have a handful of students or manage a busy schedule, using a pre-prepared structure for your financial transactions can save you time and ensure that you maintain smooth, professional relationships with your clients.

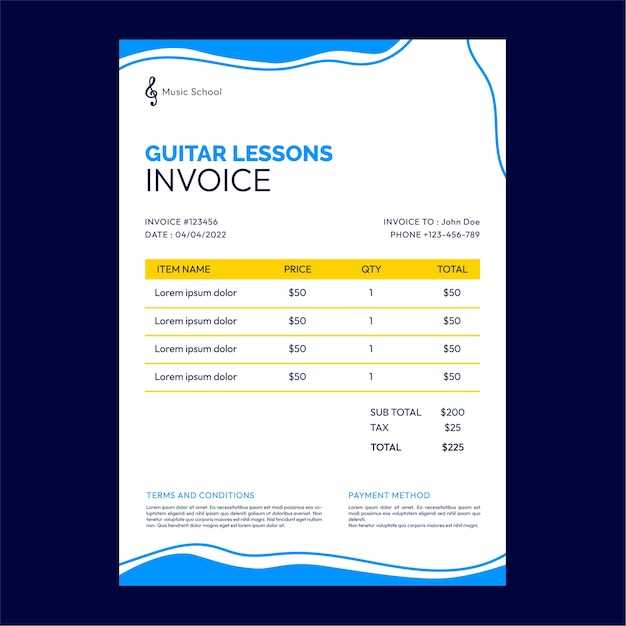

Benefits of Customizable Payment Request Documents

Having a flexible and adaptable structure for your financial requests can greatly enhance the efficiency of your business. Customizable forms allow you to adjust the layout, details, and design to fit your unique needs, ensuring that each billing statement is tailored to your specific services and client expectations. This approach provides not only convenience but also the ability to maintain a professional image while adapting to changes in your practice.

Personalization for Different Client Needs

One of the greatest advantages of using customizable forms is the ability to tailor them to different clients and types of services offered. You can easily adjust the format for:

- Different lesson durations and rates

- Special offers or bulk lesson discounts

- Personalized payment terms based on student agreements

These options allow you to ensure that each financial request is specific to the arrangement you have with your clients, making it more accurate and relevant.

Enhanced Branding and Professionalism

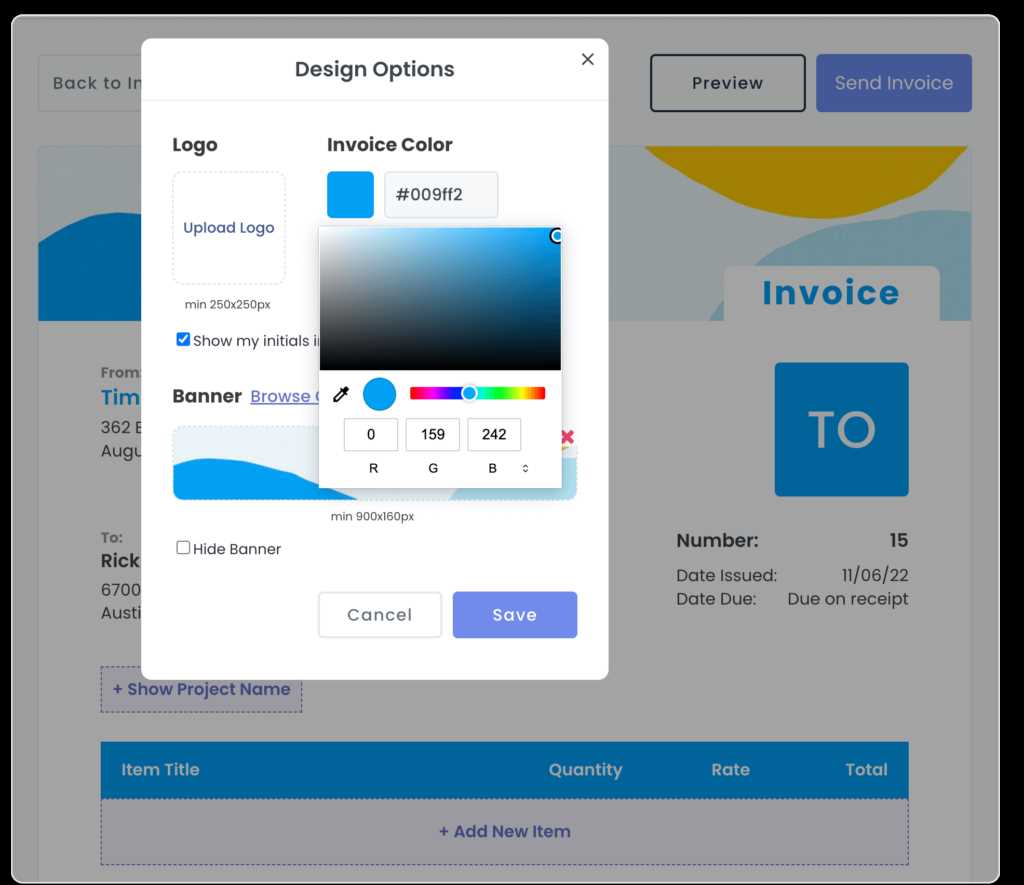

Customizable documents also give you the opportunity to incorporate your personal or business branding, such as logos, color schemes, and contact details. This contributes to a cohesive and professional appearance, reinforcing trust with your clients. A branded payment request can help distinguish your business from competitors, making your practice feel more established and reliable.

Ultimately, having the flexibility to modify your payment request documents can make your administrative tasks smoother, more efficient, and more aligned with your business goals, all while offering a better experience for your clients.

How to Create a Professional Payment Request

Creating a professional payment request is crucial for maintaining clarity and trust with your clients. A well-structured document not only ensures that all important details are included but also reflects your attention to detail and commitment to professionalism. Here are the essential steps to follow when crafting a payment request.

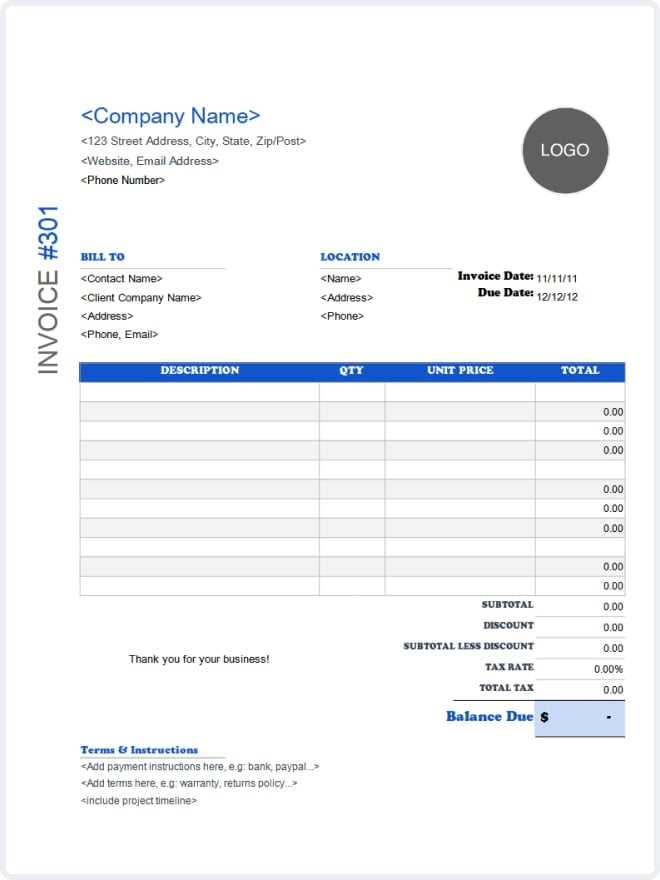

- Include Basic Contact Information: Start by clearly displaying your name or business name, address, phone number, and email at the top of the document. This makes it easy for clients to reach you if needed.

- Provide Client Information: Include your client’s name and contact details so there is no confusion about who the request is for.

- Define the Services Rendered: List the lessons or services provided, including the date, duration, and any specific details about the sessions. This ensures both parties understand exactly what is being billed.

- State the Payment Amount: Clearly specify the total amount due, including any applicable taxes or discounts. Break down the charges, if necessary, to show transparency in your pricing.

- Specify Payment Terms: Include the payment due date and any relevant terms, such as late fees or accepted payment methods. This sets clear expectations for when and how the payment should be made.

- Use a Professional Layout: Make sure the document is easy to read and well-organized. Use clean fonts, appropriate spacing, and sections to separate different types of information. A

Key Elements to Include in Your Payment Request

To ensure that your payment request is both professional and effective, it is essential to include all the necessary details. This will help avoid confusion and ensure timely payment from your clients. Below are the key elements that should always be present in your document.

Element Description Business and Client Information Include your contact details (name, address, phone, email) and your client’s details. This establishes clarity about who is involved in the transaction. Unique Reference Number A reference number helps both you and your client track the payment and avoid any confusion, especially if dealing with multiple clients. List of Services Provide a detailed breakdown of the services rendered, including the date, duration, and any special notes about the session. Amount Due Clearly state the total amount that needs to be paid, including any taxes or additional fees. Be transparent about the pricing structure. Payment Free Piano Teacher Invoice Templates Online

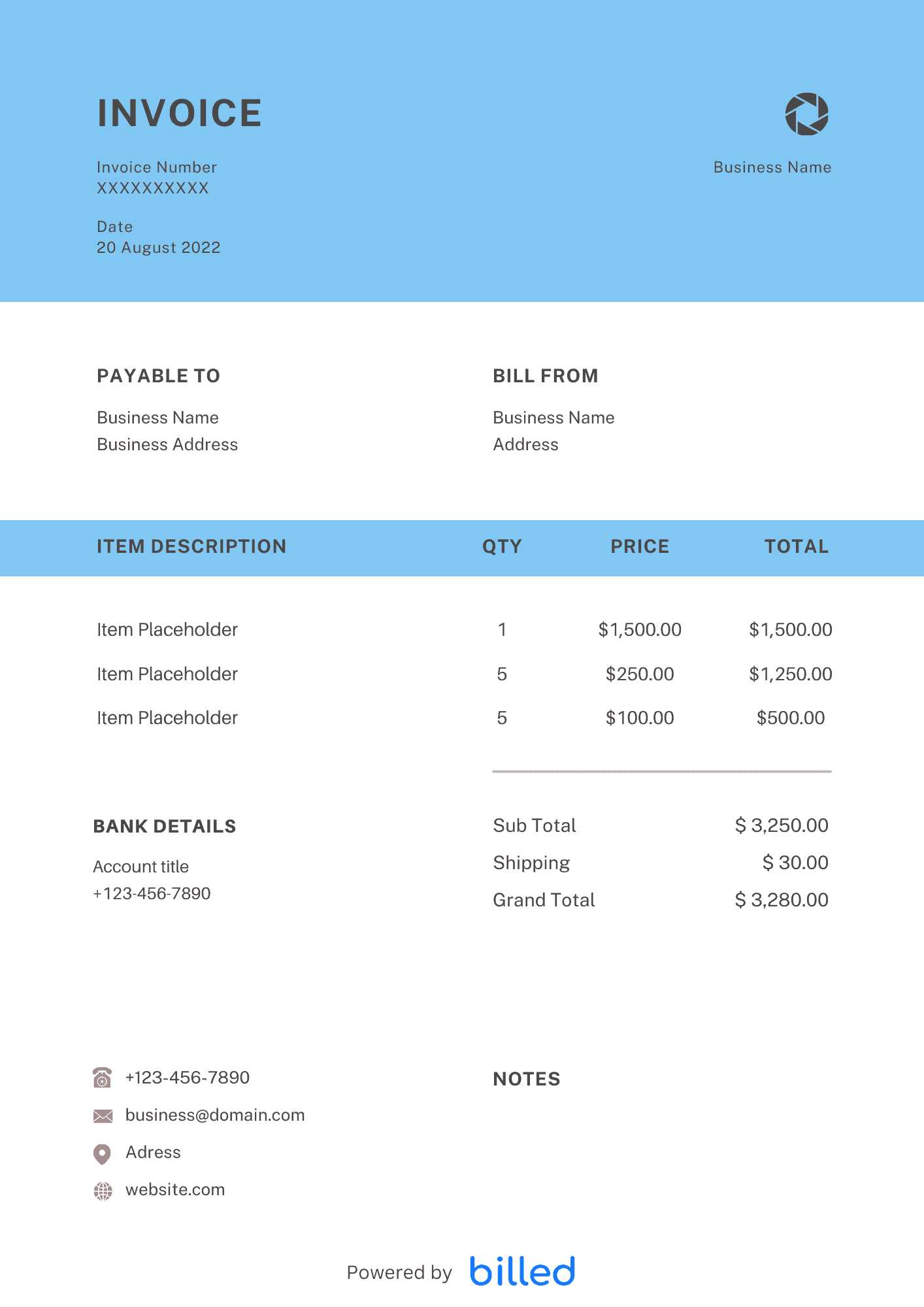

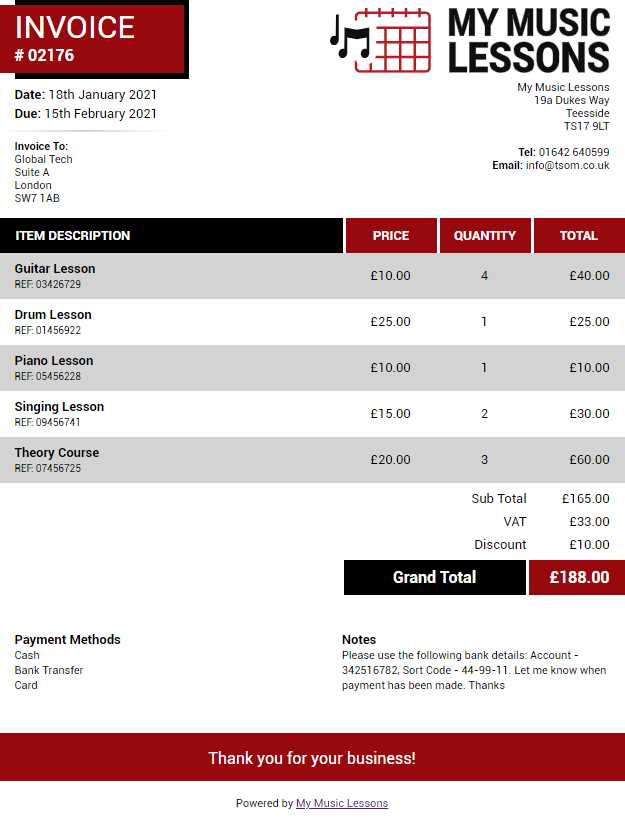

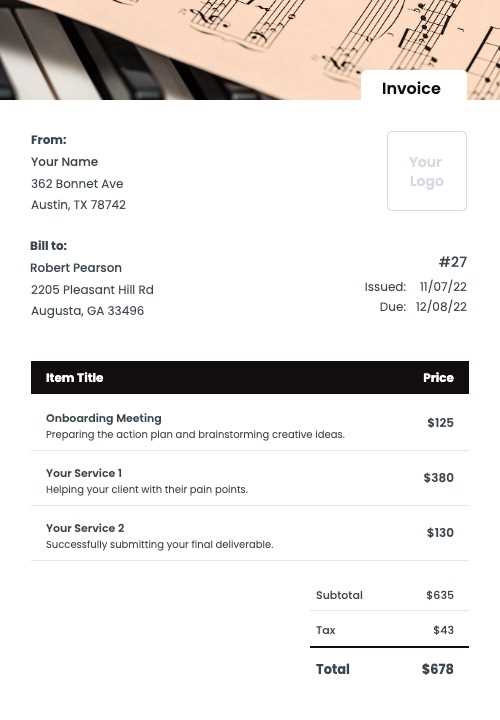

For music instructors, managing financial records can often be time-consuming and complex. Luckily, there are numerous online resources that offer free customizable documents to help streamline the process. These pre-designed forms are easy to modify and can be tailored to fit the specific needs of each educator, saving both time and effort. Whether you’re a freelance educator or running a small studio, these resources provide a simple solution for tracking services, fees, and payments.

By using online platforms, music instructors can quickly generate professional-looking documents that clearly outline the details of their sessions, payment terms, and any additional charges. This reduces administrative burdens, allowing more time to focus on teaching. Additionally, many of these tools are designed to be user-friendly, making them accessible to individuals with varying levels of technical expertise.

These resources are available for free, making them an ideal option for those starting their careers or those looking to avoid unnecessary expenses. With a wide variety of styles and formats to choose from, educators can find the perfect match for their business operations, ensuring that all essential information is presented in a clear and concise manner.

How Invoices Simplify Payment Collection

When it comes to receiving payments for services rendered, having a clear and organized method is essential for smooth financial transactions. By using structured documents to outline the amount due, payment terms, and other key details, the entire process becomes more transparent and manageable for both parties involved. This not only helps ensure timely payments but also minimizes misunderstandings and confusion.

With these documents, service providers can easily track outstanding amounts and send reminders when necessary. The clarity of these records helps prevent disputes and serves as a reference in case any questions arise. Having a formalized record makes it easier for clients to understand their obligations, while also providing a professional image that fosters trust.

Furthermore, such documents allow for quick and efficient payment processing. When all the necessary information is clearly outlined, clients can swiftly proceed with the payment, avoiding delays. This organized approach enhances cash flow, making it simpler for providers to manage their finances and plan for future expenses. Ultimately, the use of these records streamlines the financial aspects of service-based work.

Choosing the Right Format for Your Invoices

Selecting the appropriate format for billing documents is crucial for ensuring clarity and professionalism in your financial transactions. The format you choose should not only reflect your business style but also meet the needs of your clients and streamline the payment process. Whether you prefer a simple, minimalistic layout or a more detailed, comprehensive design, it’s important to pick one that is easy to read and understand.

Factors to Consider

- Clarity: Choose a format that clearly lists all necessary details such as services provided, total amount due, and payment terms. A straightforward layout prevents confusion and helps clients process payments quickly.

- Professionalism: The format should reflect your business’s image. A polished, well-organized document creates a positive impression and enhances your reputation.

- Customization: Flexibility in design allows you to adapt the document to different client needs, whether it’s adding specific payment instructions or including discounts for repeat customers.

Popular Formats to Choose From

- Simple Digital Files: These are basic, often text-based formats that can be easily edited and shared via email. Ideal for smaller or one-time transactions.

- Professional PDF Documents: PDFs offer a polished appearance and can be securely shared and printed. This format is highly re

How to Personalize Your Invoice Template

Customizing your billing document is a great way to ensure that it accurately reflects your brand identity while also making the information more relevant to your specific business needs. Personalizing the document not only enhances its professional appearance but also improves its functionality, making it easier for clients to understand the details. By incorporating a few key elements, you can make your financial records stand out and maintain consistency across all your transactions.

Here are some important aspects to consider when personalizing your documents:

Customization Aspect How to Personalize Branding Add your logo, business name, and contact details to the top of the document. Choose fonts and colors that match your brand style for a cohesive look. Payment Terms Include specific instructions regarding payment methods, due dates, and any late fees. Customizing this section can avoid confusion and ensure timely payments. Itemization Break down the services provided into clear, easy-to-read categories. This helps clients understand what they are paying for and creates transparency. Personal Messages Consider adding a short, perso Managing Recurring Piano Lesson Payments

For instructors offering regular sessions, managing recurring payments can become a challenge if not handled efficiently. Establishing a clear and consistent method for billing is crucial to avoid confusion and ensure a steady cash flow. By setting up a system that automates payment schedules and reminds clients of upcoming dues, instructors can save time while maintaining a professional approach to financial management.

One effective way to manage recurring payments is to define clear billing cycles. Whether it’s weekly, bi-weekly, or monthly, having a fixed schedule helps clients anticipate payments and stay on top of their obligations. This reduces delays and misunderstandings. It’s also important to communicate these terms up front, so there are no surprises when the next payment is due.

Another helpful strategy is to incorporate payment reminders, either through email or a client management system. These notifications can be automated and sent before the due date, giving clients enough time to process their payment. Additionally, offering multiple payment options, such as bank transfers, credit cards, or online payment platforms, makes it easier for clients to pay on time, without the hassle of needing to follow up on missed payments.

Finally, consider offering discounts or incentives for clients who opt for prepayment or commit to a longer-term package. This not only encourages timely payments but can also help build loyalty and increase retention. By creating an organized and transparent approach to recurring payments, instructors can ensure a smooth and stress-free financial process, while focusing on what matters most – teaching.

Legal Considerations for Music Invoices

When handling financial transactions for your services, it’s important to ensure that your records are not only clear but also legally sound. Proper documentation serves as a contract between you and your clients, providing protection in case of disputes or misunderstandings. There are several legal aspects to keep in mind when creating your billing documents to ensure that they meet legal standards and safeguard both parties involved.

Key Legal Elements to Include

- Clear Payment Terms: Always outline the payment schedule, due dates, and accepted payment methods. Specifying late fees or interest on overdue payments can help enforce timely transactions.

- Tax Information: If applicable, include relevant tax details such as your tax identification number and the applicable tax rates. This is essential for compliance with local tax laws.

- Service Description: A detailed breakdown of the services rendered ensures that the client fully understands what they are paying for. This can also protect you if the client disputes the amount or the nature of the work.

Protecting Your Rights

- Legal Jurisdiction: It’s helpful to specify the legal jurisdiction in which any disputes will be resolved. This can avoid confusion if issues arise with clients from different regions.

- Cancellation and Refund Policies: Clearly state your cancellation policy, including any penalties for last-minute cancellations or refund procedures. This helps to prevent misunderstandings regarding refunds or service changes.

- Non-payment Consequences: Clearly communicate the consequences of non-payment, such as suspending services or legal action. This creates accountability for the client.

By addressing these legal considerations, you not only ensure that your business operates smoothly but also protect yourself from potential legal challenges. Keep in mind that every region may have its own set of regulations, so it’s a good idea to consult with a legal expert to tailor your documents to your specific needs.

Best Practices for Clear Invoicing

Clear and effective billing is essential for maintaining a professional relationship with clients. It not only ensures prompt payments but also minimizes confusion regarding charges. By following a few best practices, you can make sure your financial records are straightforward, transparent, and easy to understand for everyone involved.

First and foremost, clarity is key. Each bill should clearly outline the services provided, including dates, descriptions, and the corresponding fees. This avoids misunderstandings and ensures that clients know exactly what they are paying for. Avoid jargon and use simple, precise language that anyone can understand.

Another best practice is itemization. Break down your charges into specific categories, whether by hours worked, materials used, or additional services provided. This detailed breakdown helps clients see the full picture and can prevent any confusion about the total amount due. It also makes the payment process smoother, as clients can easily match the charges with the services they received.

Consistency is also important. Use the same format and structure for each bill to create familiarity. This can include using the same layout, fonts, and payment terms each time. When a client receives a consistent, predictable document, it makes the entire process more professional and reduces the risk of errors or oversights.

Lastly, always include payment instructions that are clear and accessible. Specify accepted payment methods, due dates, and any penalties for late payments. This information should be prominently displayed, ensuring that clients don’t miss any crucial details. A transparent approach to payment terms can significantly reduce delays and disputes.

By following these best practices, you ensure that your financial documentation is clear, professional, and easy to manage.

How to Track Payments with Invoices

Tracking payments efficiently is essential for maintaining a smooth cash flow and staying organized. By using well-structured financial documents, you can easily monitor what has been paid, what remains outstanding, and when payments are due. Keeping track of these records helps prevent confusion and ensures that you get compensated on time for your services.

Essential Details for Tracking Payments

- Unique Identification Number: Assign a unique number to each document you issue. This makes it easier to reference specific transactions and avoids mixing up records.

- Payment Due Dates: Clearly display the payment due date on each document. This helps both you and your clients stay aware of upcoming deadlines and reduces the chance of missed payments.

- Payment Status: Keep track of the status of each payment, whether it is pending, partially paid, or fully settled. This can be noted directly on the document or in your financial records.

Methods to Streamline Payment Tracking

- Digital Tools: Use online platforms or software designed for financial management. These tools often provide automated tracking, send reminders to clients, and can generate reports, making payment monitoring much easier.

- Manual Logs: If you prefer a hands-on approach, you can create a simple spreadsheet or logbook where you record each payment, the amount paid, and the outstanding balance. This method requires more effort but can still be effective for smaller operations.

- Payment Reminders: Send polite reminders to clients before the payment due date, or after it passes, to keep payments on track. A gentle reminder can go a long way in preventing delays.

By staying on

Common Invoice Mistakes to Avoid

Creating accurate and professional billing documents is crucial for maintaining smooth financial transactions. However, small errors in these documents can lead to misunderstandings, delayed payments, and frustration for both you and your clients. Avoiding common mistakes can help you maintain a positive relationship with your clients and ensure timely compensation for your services.

Frequent Errors to Watch Out For

- Missing or Incorrect Information: Always double-check that your contact details, the client’s information, and the service dates are accurate. Mistakes in these areas can cause delays in payments and create confusion.

- Unclear Payment Terms: Failing to specify the payment due date, accepted payment methods, or late fees can lead to misunderstandings. Be clear and precise about when and how you expect to be paid.

- Not Itemizing Services: Without a detailed breakdown of the services provided, clients may be unsure about what they are paying for. Itemizing the work makes the document clearer and helps avoid disputes over the charges.

Other Mistakes to Avoid

- Forgetting to Include a Unique Reference Number: Each document should have a unique reference number to keep track of individual transactions. This helps both you and your clients quickly locate records when necessary.

- Not Keeping a Copy: Always keep a copy of every document issued. Not retaining these records could lead to difficulties if there is ever a question about a past transaction.

- Overcomplicating the Design: While personalization is important, overly complex designs can make the document harder to read. Keep the layout simple and professional to ensure clarity and ease of use.

By being mindful of these common mistakes, you can improve the accuracy and efficiency of your financial documents, leading to better client satisfaction and smoother transactions overall.

How Invoices Help Build Professionalism

Having a clear and formal method of requesting payment not only facilitates financial transactions but also reinforces trust and respect between individuals in any business relationship. Such documents serve as a demonstration of commitment to transparency and help establish credibility in any profession. They reflect an organized approach, which is crucial for maintaining long-term relationships and achieving professional success.

Establishing Credibility and Trust

When clients receive a formal statement detailing services rendered and expected compensation, it conveys that the service provider takes their work seriously. It eliminates any uncertainty regarding the cost and terms, reducing potential misunderstandings. Clients are more likely to view the individual as reliable and organized, fostering a positive reputation in the industry.

Promoting Financial Organization

Clear documentation of transactions plays an essential role in personal and business financial management. It helps keep track of earnings, monitor outstanding balances, and ensure timely payments. A structured approach to payments not only improves cash flow but also ensures that both parties are aligned on financial expectations. This attention to detail signals professionalism and responsibility in handling monetary matters.

Streamlining Your Studio Finances

Efficient financial management is key to running a successful creative business. By implementing simple systems and tools, you can ensure smoother transactions, reduce errors, and save valuable time. Organizing finances not only helps maintain cash flow but also minimizes stress and allows you to focus more on what matters most: your craft and clients.

Key Practices for Financial Efficiency

- Set Clear Payment Terms: Clearly outline when payments are due, accepted methods, and any late fees. This sets expectations upfront and reduces confusion later on.

- Track Payments Regularly: Keep a close eye on payments received and pending balances to avoid delays or missed revenue.

- Use Automated Systems: Automation tools can help generate and send financial documents, reminders, and even handle some aspects of accounting. This saves you time and reduces the risk of errors.

- Establish a Budget: Creating a detailed budget helps you track expenses, monitor income, and plan for future growth without financial surprises.

Tools to Simplify Your Workflow

- Accounting Software: Software like QuickBooks or FreshBooks simplifies invoicing, tracking, and reporting, ensuring everything is organized and easily accessible.

- Online Payment Systems: Tools like PayPal or Stripe make it easy to receive payments, providing convenience for both you and your clients.

- Financial Spreadsheets: For those who prefer a more hands-on approach, a well-organized spreadsheet can help track income and expenses effectively.

Invoice Tips for Music Instructors on the Go

For those who spend a significant amount of time traveling between sessions, managing finances efficiently becomes essential. A streamlined approach to documenting services and handling payments ensures that nothing is overlooked, even when you’re on the move. The key is to integrate flexible tools that allow you to manage billing quickly and professionally, no matter where you are.

Leverage Mobile-Friendly Solutions

- Use Apps for Quick Billing: Take advantage of mobile applications that allow you to create and send payment requests instantly from your phone or tablet. These apps often offer templates that can be customized to suit your needs, helping you save time and reduce paperwork.

- Track Payments in Real Time: Many apps and tools allow you to see when payments are made, ensuring you stay up-to-date on your finances without needing to return to your office or computer.

Essential Details to Include

- Clear Service Descriptions: Whether you’re offering a single lesson or a package deal, be specific about what clients are being charged for. Include the date, duration, and type of service rendered.

- Payment Terms: Make sure to outline when payment is due and any late fees associated with missed deadlines. Having clear terms prevents misunderstandings and ensures prompt payment.

- Multiple Payment Options:

How to Save Time with Invoice Automation

Automating the process of billing and payment requests can significantly reduce the time spent on administrative tasks, allowing you to focus more on your core work. By utilizing automated systems, you can streamline repetitive actions, minimize human error, and ensure that your clients receive timely and accurate documentation without additional effort on your part. This not only saves you time but also enhances the efficiency and professionalism of your business.

Automated systems can create and send payment requests automatically based on pre-set schedules, saving you the hassle of manually generating documents for each transaction. These tools can also send reminders to clients, helping to reduce late payments. Additionally, many of these systems integrate with other financial software, allowing for seamless tracking and reporting, further reducing the time spent managing accounts.

By setting up recurring billing for ongoing services, you can eliminate the need to issue separate requests for every session, providing both convenience and consistency for your clients. Ultimately, automation can free up your time for more important tasks while keeping your financial operations smooth and professional.