Excel Invoicing System Template for Simplified Billing

Efficient management of billing and payments is crucial for any business. With the right tools, you can automate and simplify the process, saving time and minimizing errors. A well-designed spreadsheet can help you create clear, professional documents that track sales, payments, and outstanding amounts.

By utilizing an organized spreadsheet format, you can easily manage client information, monitor due dates, and ensure that all calculations are accurate. The flexibility of such a solution allows for customization to meet specific business needs, whether you’re a freelancer or part of a larger company.

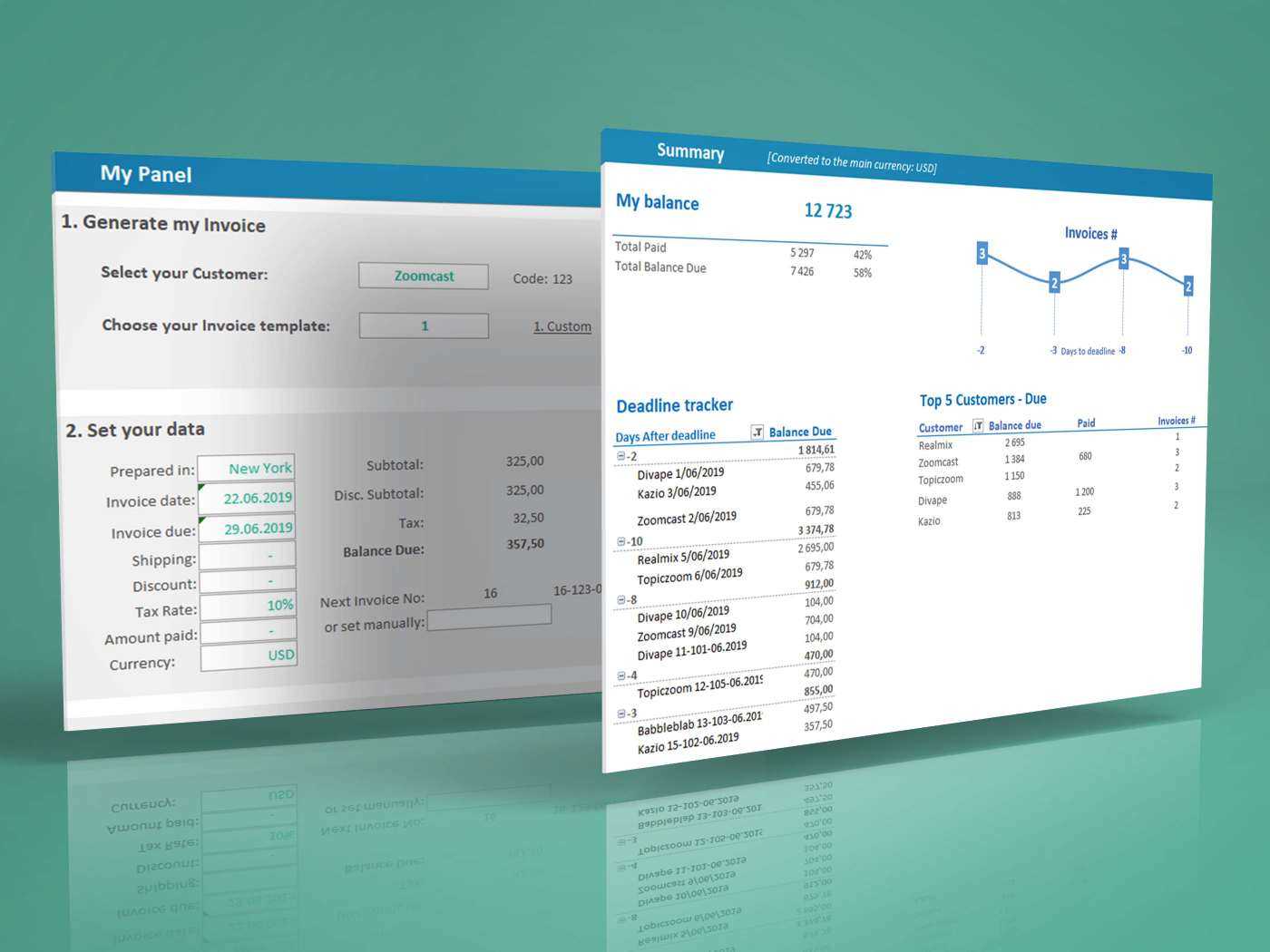

Enhancing productivity through automation is key. With the right setup, it’s possible to generate invoices with just a few clicks, reducing manual work and ensuring consistency across all documents. You can also track the financial health of your business in real time, enabling better decision-making.

In the following sections, we will explore how to create and use this powerful tool effectively, focusing on features that can transform your billing workflow into a smooth, efficient process.

Excel Invoicing System Template Overview

Managing payments and generating bills can become a time-consuming task if not properly organized. A well-structured document that automates key aspects of billing can significantly reduce errors and save time. This tool is designed to help individuals and businesses track payments, calculate totals, and create professional documents with ease.

It provides an intuitive way to input and track client information, as well as automatically calculate totals, taxes, and discounts. This setup simplifies the process of generating clear, accurate, and timely records for any transaction. By organizing the data in a central location, it becomes easier to manage and review invoices in one place.

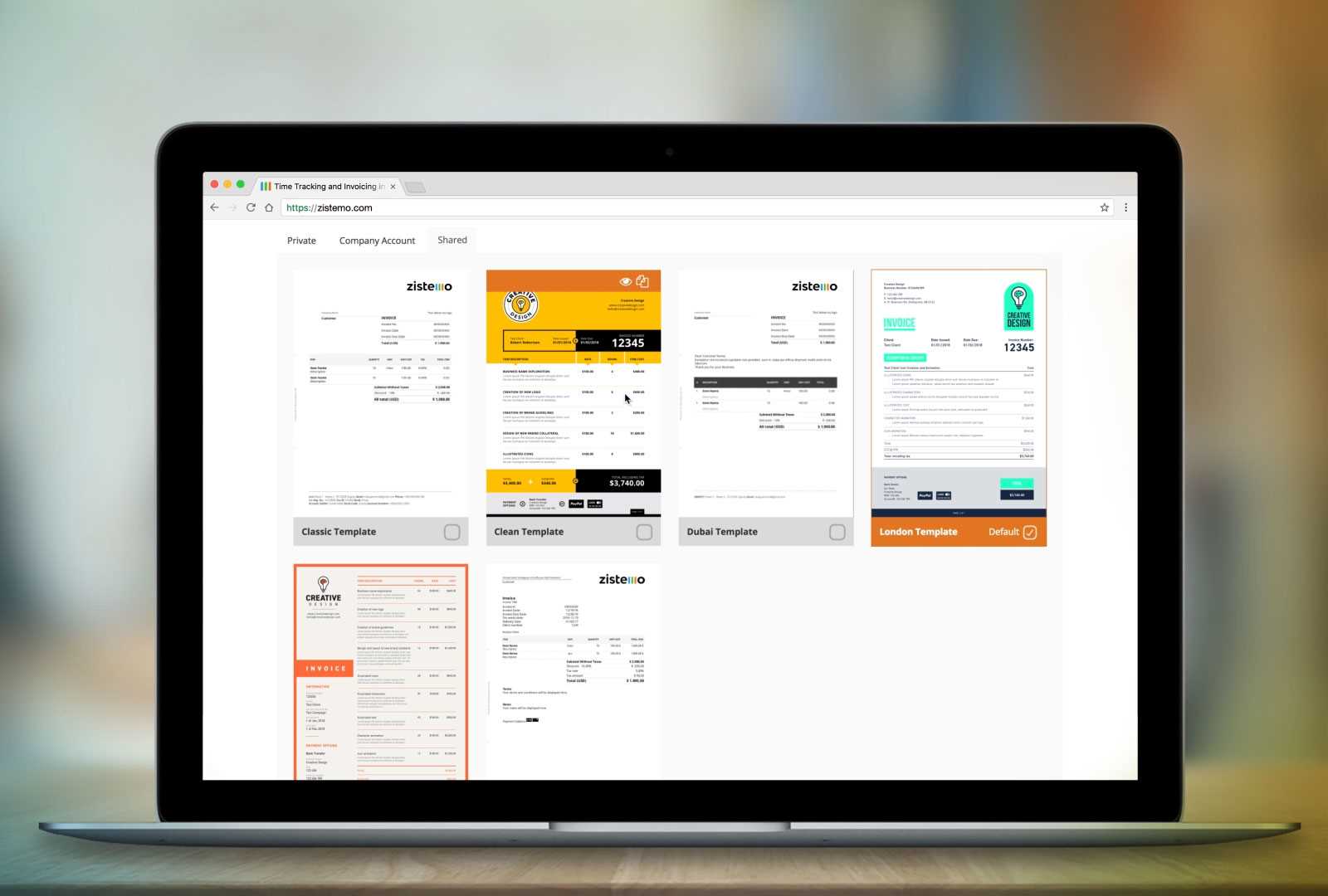

With customizable features, this tool allows users to adjust the layout, formulas, and design to fit their specific needs, whether for a small business or freelance work. The ability to quickly generate consistent, well-organized documents enhances efficiency and ensures that all billing is handled accurately and professionally.

Benefits of Using Excel for Invoices

Using a structured spreadsheet for managing payments offers several advantages, especially when it comes to accuracy, efficiency, and flexibility. It simplifies the process of tracking transactions and generating professional documents. With the right setup, you can reduce manual calculations, automate key tasks, and ensure consistent and error-free billing.

Improved Accuracy and Consistency

One of the key benefits is the ability to automate complex calculations. With built-in formulas, you can calculate totals, taxes, and discounts automatically, ensuring that no errors occur during the process. This not only improves accuracy but also maintains consistency across all generated documents. Each time you create a new record, the same precise formulas are applied without any additional effort.

Customization and Flexibility

Another advantage is the ability to fully customize the layout and design. You can tailor the document to reflect your brand, adjusting fonts, colors, and sections to meet your specific needs. The flexibility of a spreadsheet allows for changes as your business evolves, offering a scalable solution for managing finances. Whether you need to add more data fields or adjust the appearance, the customization options are nearly endless.

Overall, using a spreadsheet for billing is an efficient, reliable, and adaptable approach to managing financial documents, helping to save time and reduce administrative overhead.

How to Create Custom Invoices

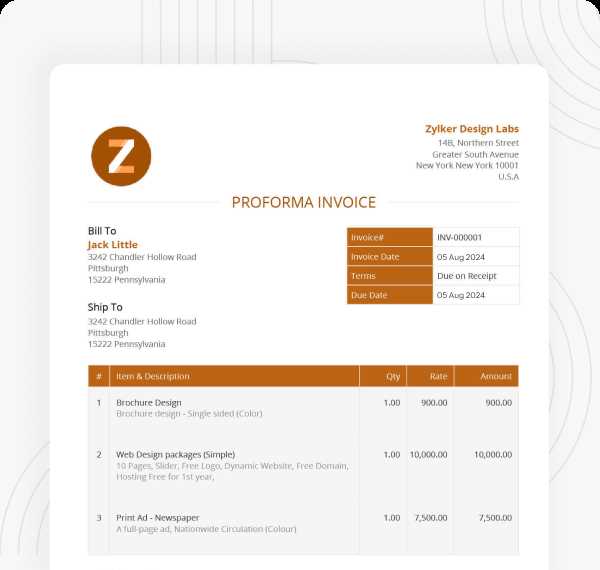

Creating personalized billing documents allows businesses to present a professional image while ensuring all necessary details are included. By setting up a customizable document, you can tailor the content, layout, and design to reflect your brand and meet your specific needs. This process can be done with ease, allowing you to generate documents quickly without sacrificing accuracy or consistency.

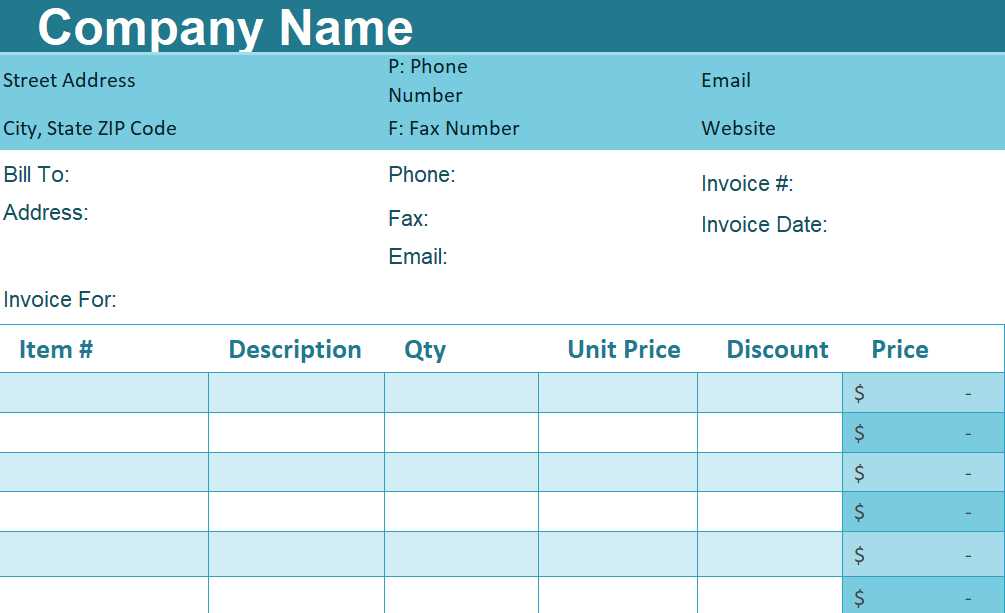

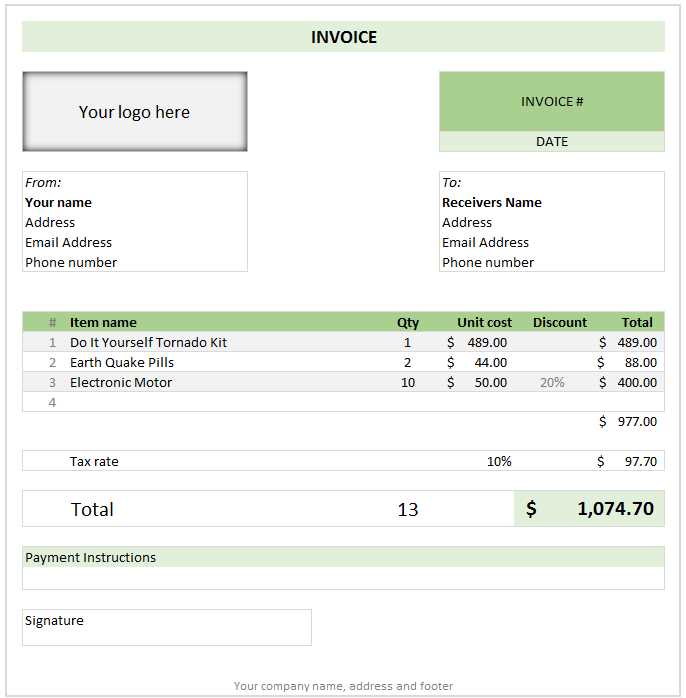

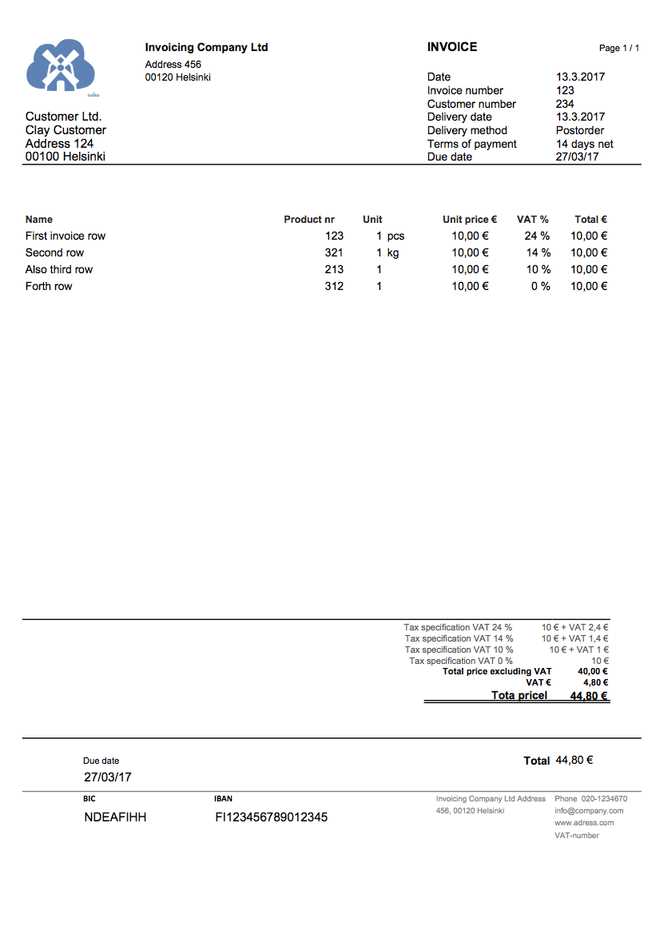

The first step is to establish the key sections of the document. These typically include customer information, product or service details, pricing, taxes, and payment terms. By using structured rows and columns, you can ensure that all necessary fields are included and easy to navigate. Adjusting the layout is simple, allowing you to prioritize the most relevant information based on your business requirements.

Once the basic structure is in place, you can further customize it with specific features like automatic date generation, unique invoice numbers, or customizable fields for discounts and additional charges. You can also add your company logo and adjust fonts and colors to match your brand’s identity. These small adjustments create a personalized, professional look that enhances the customer experience.

Finally, integrating automatic calculations for totals, taxes, and other charges ensures accuracy. Once set up, this method allows you to create new documents with just a few clicks, saving time and minimizing the risk of errors in your billing process.

Key Features of an Excel Template

When designing a document to manage payments and transactions, there are several essential features that enhance its functionality and make it easier to use. These features not only improve the accuracy of the records but also streamline the entire process, allowing for quick generation and management of financial documents. Below are some of the most important elements that make such a document effective and efficient.

Automation of Calculations

One of the core advantages of using this type of document is the ability to automate key calculations, saving time and reducing the risk of errors. Important features include:

- Automatic Total Calculation: The ability to quickly calculate totals for each item or service provided, as well as overall totals.

- Tax and Discount Calculations: Built-in formulas to calculate tax rates and apply discounts based on specific conditions or pricing rules.

- Payment Due Date Calculation: Automatic generation of payment due dates based on the invoice issue date, ensuring timely follow-ups.

Customization and Flexibility

Flexibility is another key feature, as it allows users to adjust the document based on their specific business needs. Some customization options include:

- Customizable Layout: Users can design the document layout to suit their business needs, such as adding or removing sections, rearranging columns, or adjusting the size of fields.

- Branding Elements: The ability to add logos, choose fonts, and apply color schemes that align with your brand identity.

- Adjustable Fields: Fields like client information, item descriptions, and service charges can be tailored to fit various business models and industries.

These key features work together to create a highly functional and professional tool for managing financial records, ensuring accuracy, and enhancing the user experience. With automation and customization at the forefront, this document can be adapted to meet a wide range of needs, from small businesses to larger enterprises.

Designing an Easy-to-Use Interface

Creating a user-friendly design is essential when developing any document for managing financial transactions. An intuitive and simple interface helps users navigate easily, minimizing the learning curve and ensuring quick access to all key functions. A well-organized layout makes it easier to input data, view important details, and generate professional documents without unnecessary complexity.

Key Design Principles

To ensure the document is easy to use, several design principles should be followed:

- Simplicity: Keep the layout clean and uncluttered. Limit the number of sections to only those necessary for the task, ensuring that the document remains straightforward and accessible.

- Logical Flow: Organize the fields in a logical sequence. Start with client information, followed by service or product details, and conclude with pricing and payment terms.

- Consistent Formatting: Use consistent fonts, colors, and alignment to maintain a professional appearance. Clear headings and sections help users quickly find what they need.

Making Data Entry Easy

Another important aspect of user-friendly design is facilitating quick and accurate data entry. Consider the following features to enhance the experience:

- Pre-populated Fields: Use drop-down lists or pre-filled data wherever possible to reduce manual input and avoid errors.

- Data Validation: Set rules for certain fields, such as ensuring that prices are numeric or dates are in the correct format, to prevent invalid entries.

- Clear Instructions: Provide brief, on-screen instructions or tooltips for first-time users to guide them through the process.

By following these principles, you can create a seamless and efficient experience for users, allowing them to generate accurate financial documents with minimal effort.

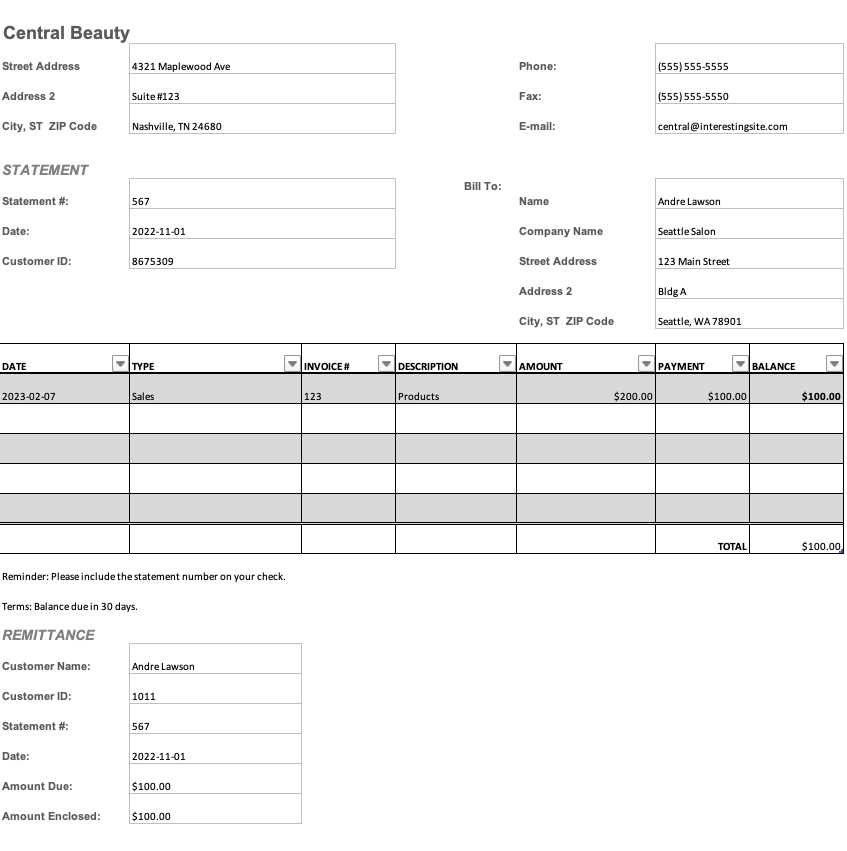

Tracking Payments and Due Dates

Efficiently tracking payments and their corresponding due dates is vital for maintaining a smooth cash flow and ensuring timely financial management. A well-organized document can automatically monitor outstanding balances and notify you of upcoming deadlines, reducing the

Using Formulas for Accurate Calculations

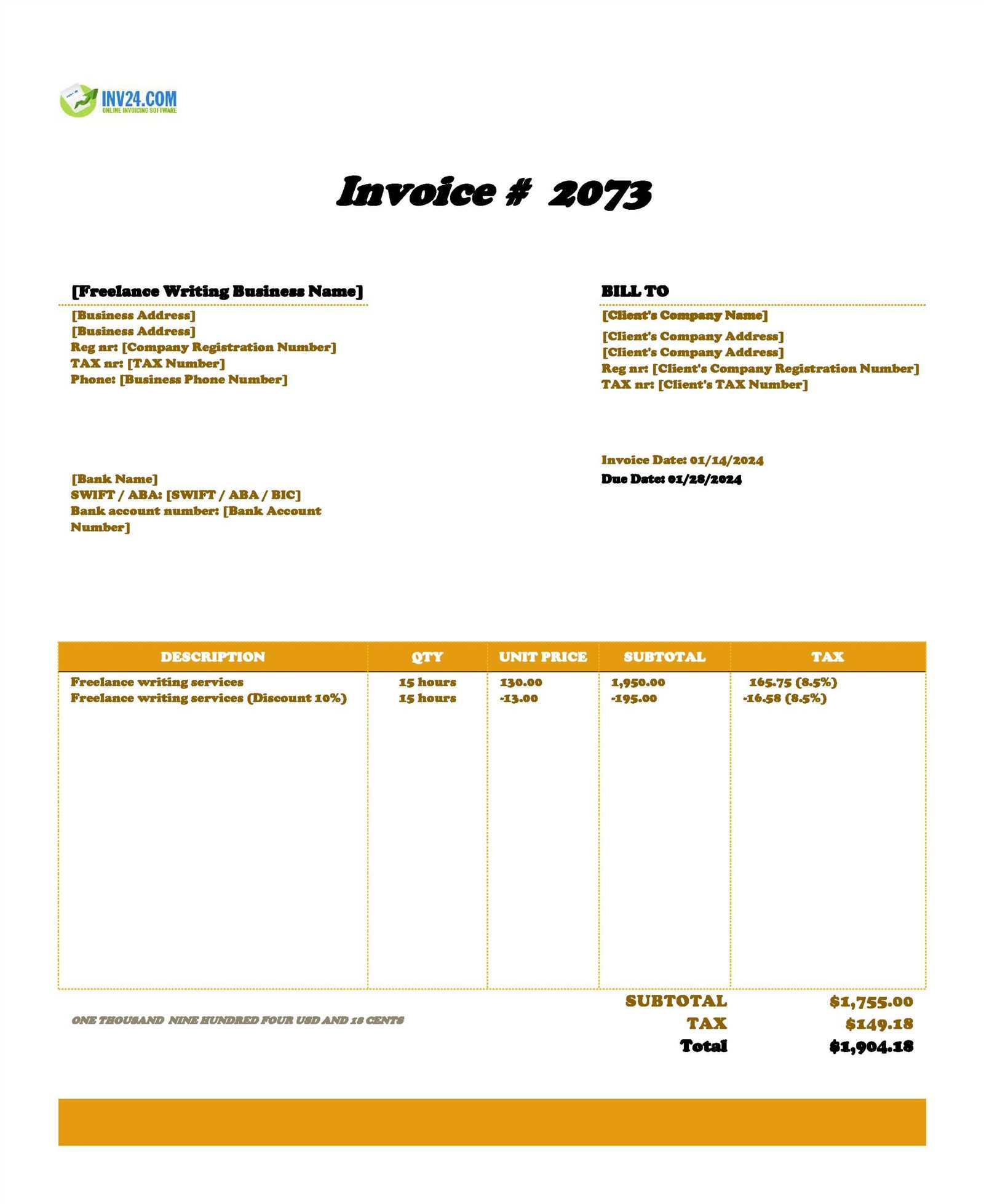

Accurate financial calculations are essential when creating any document for managing transactions. Manual calculations can lead to errors, but incorporating built-in formulas ensures precision and saves valuable time. By automating the mathematical processes, you can focus on other tasks while trusting that the totals, taxes, and discounts are correctly computed.

Essential Calculations with Formulas

Formulas can be used to automate a variety of calculations that are necessary for billing. Here are some of the most common and useful ones:

- Total Amount Calculation: Automatically sum up the costs of all items or services, ensuring no line is missed.

- Tax Calculation: Easily calculate tax based on predefined rates, adjusting for different jurisdictions or pricing structures.

- Discount Application: Automatically apply discount percentages to the total, depending on the conditions set by the user.

Advanced Formula Functions

For more complex billing scenarios, advanced formulas can offer additional functionality, such as:

- Conditional Formulas: Use IF statements to apply different formulas based on certain conditions, like payment status or product category.

- Date-Based Calculations: Calculate due dates or payment schedules based on specific start dates or contract terms.

- Dynamic Pricing: Adjust pricing formulas based on quantity purchased, offering volume discounts automatically.

By using these formulas, you can ensure that all calculations are accurate and consistent across documents, reducing the possibility of errors and improving efficiency.

Automating Invoice Generation

Streamlining the process of creating billing documents is a powerful way to save time and reduce errors. By automating the generation of these documents, you can ensure consistency, accuracy, and efficiency, allowing you to focus on more critical aspects of your business. Automation minimizes manual data entry and speeds up the document creation process, helping you handle large volumes of transactions with ease.

Key Automation Features

There are several ways to automate the creation of billing documents, each enhancing the workflow and ensuring that key details are automatically filled in. Common features include:

- Auto-Population of Client Data: Client information, such as names, addresses, and payment details, can be automatically filled in from a pre-existing database or list, eliminating the need for repetitive data entry.

- Dynamic Invoice Numbering: Automatically generating unique invoice numbers ensures that each document is distinct and properly tracked, without the risk of duplication.

- Pre-set Payment Terms: Payment terms such as due dates, discounts, and interest charges can be predefined and automatically applied to each generated document, saving time and reducing the chances of human error.

Streamlining the Document Creation Process

Automation can also be used to streamline the document creation process by generating invoices at the click of a button. With the right setup, you can:

- One-Click Generation: With a simple command or button, invoices can be created for multiple clients or transactions, ensuring fast document production.

- Batch Processing: Generate invoices for multiple clients at once, even if they have varying amounts or terms, to quickly handle large workloads.

- Consistent Formatting: Ensure that every document generated maintains a consistent layout, improving professionalism and readability.

By incorporating automation into the document creation process, you can significantly enhance the speed and accuracy of your billing workflow, saving time and ensuring that every transaction is properly documented.

Best Practices for Invoice Organization

Organizing billing documents is crucial for maintaining clear financial records and ensuring easy access when needed. A structured approach to managing these documents helps avoid confusion, reduces the risk of missing payments, and improves overall financial efficiency. By adopting a few key practices, businesses can maintain a well-organized and effective invoicing process that ensures consistency and accuracy across all transactions.

Creating a Clear Filing System

Establishing a logical filing system is one of the first steps toward effective invoice organization. This can be done by categorizing invoices based on criteria such as:

- Date: Sorting documents chronologically allows for quick access to recent or overdue transactions.

- Client: Grouping invoices by customer or client ensures easy retrieval of their payment history.

- Payment Status: Organizing invoices by their payment status (paid, pending, overdue) helps prioritize follow-ups and ensures that no payments are missed.

Maintaining Consistent Naming Conventions

A consistent naming convention is essential for easy identification and searchability of billing documents. Consider the following tips:

- Invoice Number: Include a unique invoice number in the file name, which makes it easy to identify and track each document.

- Client or Project Name: Add the client or project name to the file name, ensuring quick association with the relevant account.

- Date: Including the date (e.g., year-month-day format) in the file name helps you sort documents in a chronological order.

By applying these practices, you can improve both the accessibility and the accuracy of your financial records, making it easier to manage and track your transactions over time.

Adding Branding to Your Invoice Template

Incorporating your brand identity into your billing documents not only helps maintain a professional appearance but also reinforces your business’s image and builds trust with your clients. By adding consistent branding elements, such as logos, color schemes, and fonts, you can make your documents instantly recognizable and ensure they align with your overall brand. This creates a cohesive experience for your clients, from the moment they receive your document to their final payment.

Key Branding Elements

There are several elements you can integrate into your document to reflect your brand’s style:

- Logo: Place your company logo prominently at the top of the document, making it easily identifiable and strengthening your brand presence.

- Color Scheme: Use colors that align with your brand’s visual identity to enhance the overall design and maintain a consistent look across all your business communications.

- Fonts: Select fonts that match your brand’s aesthetic, ensuring the text remains clear and professional while adhering to your brand guidelines.

Enhancing Consistency Across Documents

Incorporating branding elements into your billing documents is not just about one invoice; it’s about creating consistency across all your documents. This can be achieved by:

- Standardized Header and Footer: Use the same header and footer across all your documents to ensure a consistent and polished appearance.

- Branding Across Platforms: Ensure that all digital and printed communications, including emails, contracts, and invoices, feature your brand consistently.

By incorporating these branding practices, your billing documents will reflect your company’s professionalism, making them not only functional but also a powerful branding tool.

Integrating with Accounting Software

Seamlessly connecting your billing process with accounting tools is essential for maintaining accurate financial records and ensuring that all transactions are properly tracked. By integrating these tools, you can streamline workflows, minimize errors, and eliminate the need for duplicate data entry. This integration allows you to easily transfer financial data between systems, giving you a more comprehensive view of your business’s financial health.

Benefits of Integration

Connecting your billing process with accounting software offers several advantages that improve both efficiency and accuracy:

- Automatic Data Sync: Transfer billing details, including amounts and payment dates, directly into your accounting software, reducing the risk of manual errors.

- Real-Time Updates: Instantly update your financial records with any changes in the billing process, ensuring that your accounts are always current.

- Streamlined Reporting: Easily generate financial reports without the need to manually input data, saving time and improving the accuracy of your financial insights.

How to Integrate with Accounting Software

Integrating your billing records with accounting software can be achieved through a few methods, depending on the tools you are using. Here are the common approaches:

- API Integration: Many accounting tools offer application programming interfaces (APIs) that allow for automated data transfer between the two systems.

- Manual Data Export/Import: For software without direct integration options, you can manually export data from your billing tool and import it into your accounting software in the correct format.

- Third-Party Tools: There are several third-party solutions designed to bridge the gap between billing and accounting tools, allowing for smooth integration.

By integrating your billing process with accounting software, you reduce the amount of time spent on administrative tasks and improve the accuracy and reliability of your financial records.

Managing Multiple Clients in One Template

Handling multiple clients within a single document can significantly improve organization and save time. By structuring your workflow in a way that allows you to easily manage client-specific data, you can streamline the process of creating and tracking payments, while ensuring that each client’s information remains distinct and easily accessible. A well-organized structure makes it simple to switch between clients, update details, and monitor financial activity without confusion.

Key Strategies for Client Management

To effectively manage multiple clients in a single document, consider the following strategies:

- Separate Sections for Each Client: Organize the document by creating dedicated sections for each client. This allows for easy tracking of their individual information without mixing details.

- Custom Fields: Use customizable fields for each client’s specific needs, such as payment terms, service details, or custom discounts. This ensures that each client’s data remains unique and tailored to their needs.

- Color-Coding or Highlighting: Implement color-coding or text highlighting for different clients to visually distinguish between their entries, making it easier to locate relevant information quickly.

Automating Client-Specific Details

Automation features can also help simplify the management of multiple clients:

- Drop-Down Menus: Use drop-down menus for selecting clients, which automatically fill in their details such as name, address, and payment terms, minimizing the need for manual entry.

- Customizable Calculations: Set up formulas that adjust based on client-specific conditions, such as varying tax rates, discounts, or payment schedules.

By incorporating these strategies into your workflow, you can efficiently manage multiple clients in one document, reducing the complexity and increasing the speed at which you can process client-related data.

Ensuring Tax Calculations Are Correct

Accurate tax calculations are essential for maintaining compliance with regulations and avoiding costly mistakes. In any billing process, ensuring that taxes are calculated correctly can prevent discrepancies and improve the overall financial integrity of your business. Proper tax management not only saves time but also helps build trust with clients, ensuring that there are no surprises when it comes to final payment amounts.

Setting Up Tax Rates

One of the first steps in ensuring accurate tax calculations is setting up the correct tax rates based on your location and the products or services you offer. This can vary depending on local, state, or international regulations. Here are some tips for getting it right:

- Research Local Tax Regulations: Make sure you are familiar with the tax rates applicable to your area or the areas where your clients are located.

- Apply Different Tax Rates: If you provide services or products in different regions, set up separate tax rates to account for the variations in tax laws.

- Include Special Tax Categories: Some items or services may be exempt from tax or subject to reduced rates. Ensure these are accounted for in your calculations.

Using Formulas for Accuracy

To ensure tax calculations are automatically accurate, using built-in formulas can help eliminate human error. Formulas can be set up to:

- Automatically Calculate Tax: Use formulas to calculate taxes based on predefined rates, so they are applied consistently every time a transaction occurs.

- Handle Discounts and Special Rates: Implement conditional formulas that adjust the tax amount when discounts or special rates are applied to specific products or services.

- Update Rates Dynamically: Formulas can be adjusted to account for tax rate changes, making sure that all future invoices reflect the correct amount without requiring manual updates.

By properly setting up your tax rates and using formulas to calculate taxes automatically, you can significantly reduce the risk of errors and ensure that your billing process is both efficient and accurate.

How to Save Time with Templates

Streamlining your workflow is essential for increasing efficiency, especially when it comes to tasks like generating client documents. Using pre-designed layouts allows you to quickly produce professional, consistent records without having to recreate the same structure repeatedly. This approach saves significant time, reduces errors, and ensures that you can focus on more important tasks rather than the mechanics of formatting or data entry.

Key Advantages of Using Pre-Designed Layouts

By relying on reusable structures, you can save valuable time in several ways:

- Consistency: Pre-designed structures ensure uniformity across all your documents, making them look professional and well-organized every time.

- Speed: You no longer have to manually set up layouts or format data for each new document, allowing for faster turnaround times.

- Efficiency: Save time by simply updating client-specific information in an established framework, eliminating the need for repetitive work.

- Fewer Errors: Automated fields reduce the chance of mistakes during data entry, leading to more accurate records.

Tips for Maximizing Time Savings

Here are a few additional strategies to ensure that using pre-built layouts is as efficient as possible:

- Pre-Fill Common Information: Set up default fields for regularly used details, such as company name, contact info, or standard terms, so you don’t need to input them manually each time.

- Automate Calculations: Use built-in formulas to automatically calculate totals, taxes, and discounts, further reducing the time spent on each document.

- Customizable Fields: Make sure the layout allows you to easily adjust fields to suit the unique needs of each client, ensuring flexibility while saving time on customization.

By taking advantage of pre-designed layouts and automating repetitive tasks, you can save valuable time and focus on delivering quality service to your clients.

Troubleshooting Common Errors

While working with automated document tools, it’s not uncommon to encounter issues such as incorrect calculations, missing data, or unexpected formatting. These problems can interrupt workflow and lead to errors in the final output. Identifying the source of the issue and resolving it quickly is crucial to maintaining accuracy and efficiency. Understanding the most common issues and their solutions can help you avoid delays and keep your work on track.

1. Formula Errors

One of the most frequent issues in automated documents is formula-related errors. These can occur for various reasons, including improper syntax, missing references, or incorrect use of functions. Here’s how to address them:

- #REF!: This error occurs when a formula references a cell that has been deleted or moved. Check the formula for any broken references and correct them.

- #DIV/0!: This error happens when a formula attempts to divide by zero. Ensure that the denominator in the formula is not zero or is properly handled with an IFERROR function.

- #VALUE!: This error appears when there is a mismatch in data types. Verify that the correct data type is being used in the formula, such as numbers instead of text.

2. Formatting Issues

Another common issue is the improper display of data or incorrect formatting. These errors can make documents appear unprofessional or difficult to read. Common formatting issues include:

- Misaligned Data: Ensure that all cells are properly aligned to the left, right, or center as appropriate for your document’s layout.

- Incorrect Currency Symbols: Double-check that the currency formatting is consistent across all amounts and that the correct symbol is used.

- Text Overflow: If text is spilling over into adjacent cells, adjust column widths or use text wrapping to fit the content within the cell.

By understanding and addressing these common errors, you can avoid disruptions and maintain the smooth functioning of your automated documents, ensuring they remain professional and error-free.

Securing Your Invoice Template

When dealing with sensitive financial data, ensuring the security of your documents is crucial. Protecting your work from unauthorized access, tampering, or accidental alterations is essential for both privacy and accuracy. There are several measures you can take to secure your document and prevent unauthorized individuals from making changes. Implementing these precautions will help maintain the integrity of your data and protect your business transactions.

1. Password Protection

One of the most effective ways to protect your document is by setting a password. This ensures that only authorized individuals can access or modify the content. Password protection can be applied to the entire document or specific sections where sensitive information is stored.

- Strong Passwords: Use a complex combination of letters, numbers, and symbols to make the password harder to guess or crack.

- Limit Access: Only share the password with individuals who absolutely need it. Avoid sharing it over insecure channels.

2. Locking Cells and Hiding Formulas

To prevent accidental or intentional alterations to key data, you can lock certain cells or hide formulas. This prevents users from modifying sensitive fields while still allowing them to enter necessary information in other areas of the document.

- Locking Cells: Lock specific cells to prevent editing. This can be useful for areas where calculations or fixed data should remain intact.

- Hiding Formulas: Hiding the formulas behind the calculations ensures they cannot be viewed or altered, preventing any accidental changes to your calculations.

By implementing these security measures, you can safeguard your important documents from unauthorized access or modification, maintaining confidentiality and accuracy in all your financial records.

Advanced Tips for Financial Document Management

Enhancing your document creation process can significantly improve both efficiency and accuracy when managing financial transactions. Advanced features in spreadsheet software allow you to automate calculations, format documents dynamically, and customize content based on specific criteria. By mastering these techniques, you can streamline your workflow and ensure consistent, professional results every time you generate a document.

1. Automating Calculations

One of the most powerful ways to save time and reduce errors is through automation. Spreadsheet formulas can calculate totals, taxes, and discounts with just a few simple functions. Here’s an example of how automated calculations can work:

| Item | Unit Price | Quantity | Total |

|---|---|---|---|

| Product A | $10.00 | 2 | =B2*C2 |

| Product B | $15.00 | 3 | =B3*C3 |

| Grand Total | =SUM(D2:D3) |

In this table, the formula automatically calculates the total for each item and adds them up for the final amount, reducing manual errors and ensuring accuracy.

2. Conditional Formatting for Quick Insights

Conditional formatting is an excellent way to highlight specific information, such as overdue payments or high-value transactions. For instance, you can set up conditional formatting to change the color of overdue invoices or flag those that exceed a certain threshold.

To implement conditional formatting:

- Highlight Overdue Items: Use conditional formatting to automatically highlight rows where the due date has passed.

- Identify High-Value Transactions: Set a rule to format invoices with amounts greater than a specific value, helping you quickly identify priority items.

These features enable