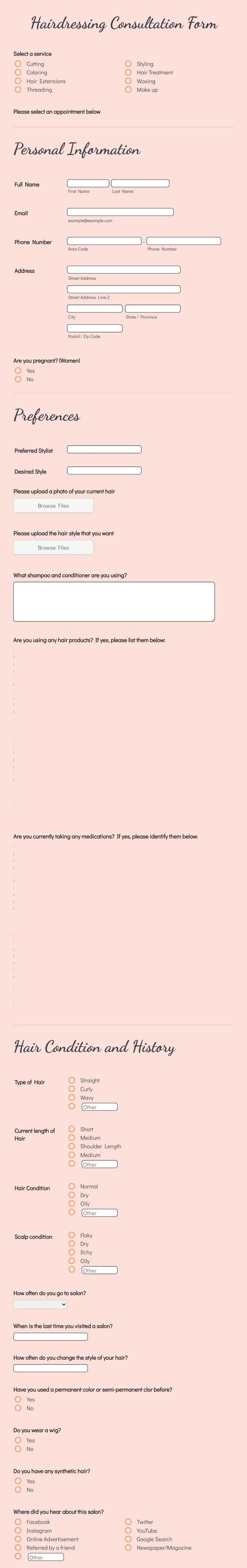

Hairdressing Invoice Template for Salons and Stylists

For salon owners and stylists, managing client transactions is essential to running a successful business. The process of documenting services and payments should be efficient, clear, and professional. An organized system helps maintain accurate records and ensures that clients receive the correct details about their appointments and charges.

Customizing your billing format can save time and reduce errors. By creating a streamlined method for detailing services, prices, and payment terms, you establish a clear communication line with clients while keeping operations smooth. Whether you’re a freelance stylist or managing a team, having a well-structured document makes all financial dealings easier to handle.

Understanding the essential elements of a good financial record is key. This includes clear service descriptions, pricing, tax information, and the correct payment details. By focusing on these aspects, businesses can provide a high-quality, professional experience for every client, strengthening trust and improving overall customer satisfaction.

Hairdressing Invoice Template Overview

Effective billing is an essential aspect of managing a beauty business. A professional document that outlines the services provided, costs, and payment details ensures both the client and the salon have a clear understanding of the transaction. This document serves as a record for both parties and is a vital tool for maintaining accurate financial information.

Why a Well-Structured Document is Crucial

Creating a well-organized record simplifies financial tracking and reduces confusion. It ensures that every service rendered is clearly listed, with associated costs and any applicable discounts or taxes. A professionally presented document enhances the image of the business, making it easier to establish credibility and trust with clients. Consistency in billing also helps ensure no detail is overlooked, which is essential for accurate accounting.

Key Features of a Comprehensive Record

A good document should include specific details such as the date of the appointment, services performed, and the total cost. It should also provide clear instructions on how payments can be made, whether it’s through cash, card, or other methods. Transparency in these areas ensures that both the client and business owner are on the same page, avoiding misunderstandings. Providing additional fields for tips, promotions, or memberships is also helpful in offering flexibility and accommodating client preferences.

Importance of Professional Invoices

Creating a polished and clear billing document is essential for any service-based business. It serves as a formal record of the transaction, ensuring that both the client and the business are aligned on the services provided and the payment terms. A well-crafted statement not only helps in managing finances but also plays a significant role in establishing professionalism and credibility.

Building Client Trust

When clients receive a neat and professional bill, it conveys a sense of trustworthiness and reliability. A properly formatted document demonstrates that the business is organized and values transparency in its dealings. Clear communication regarding charges and payment methods can strengthen the client’s confidence in the service they’ve received and encourage repeat business.

Efficient Financial Management

For the business owner, a well-structured record simplifies financial tracking and accounting. With all the necessary details readily available, it becomes easier to monitor outstanding payments, assess revenue, and manage taxes. Accuracy in billing ensures that there are no errors or misunderstandings, reducing the time spent on resolving payment issues and allowing the business to focus on growth.

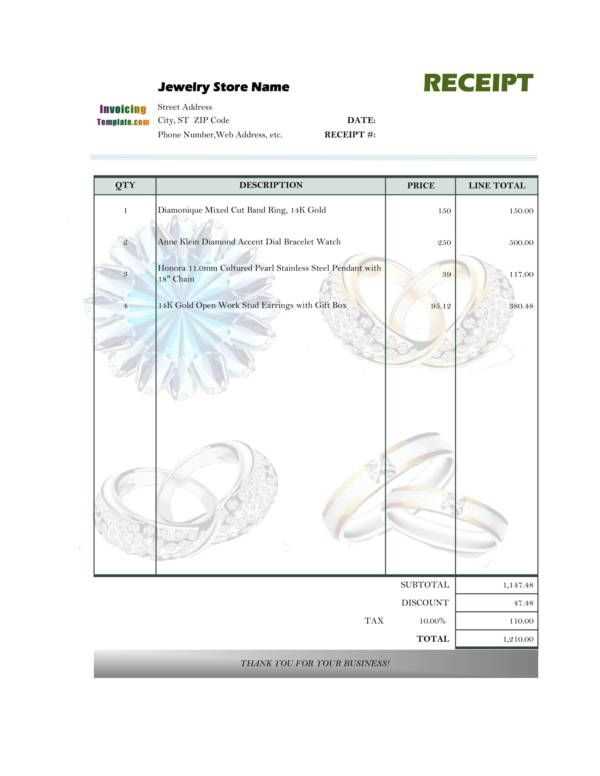

Key Elements in an Invoice

A clear and effective billing document should include several crucial components to ensure both parties understand the transaction. These details not only help in maintaining transparency but also streamline the payment process. Including the right information ensures that the document is legally compliant and easy to manage for future reference.

Essential Information for Clients

The document should include basic client details, such as their name and contact information, to make the transaction easily traceable. It is also important to note the date of service and the unique reference number, which helps in organizing records. Itemized service descriptions with individual pricing are necessary to clarify exactly what is being charged and to avoid confusion.

Payment Terms and Methods

Providing clear instructions for payment is essential. The method of payment, whether cash, credit, or digital platforms, should be listed. Additionally, payment terms like due dates, late fees, or discounts for early payment should be specified. This ensures both clarity and smooth processing of financial transactions.

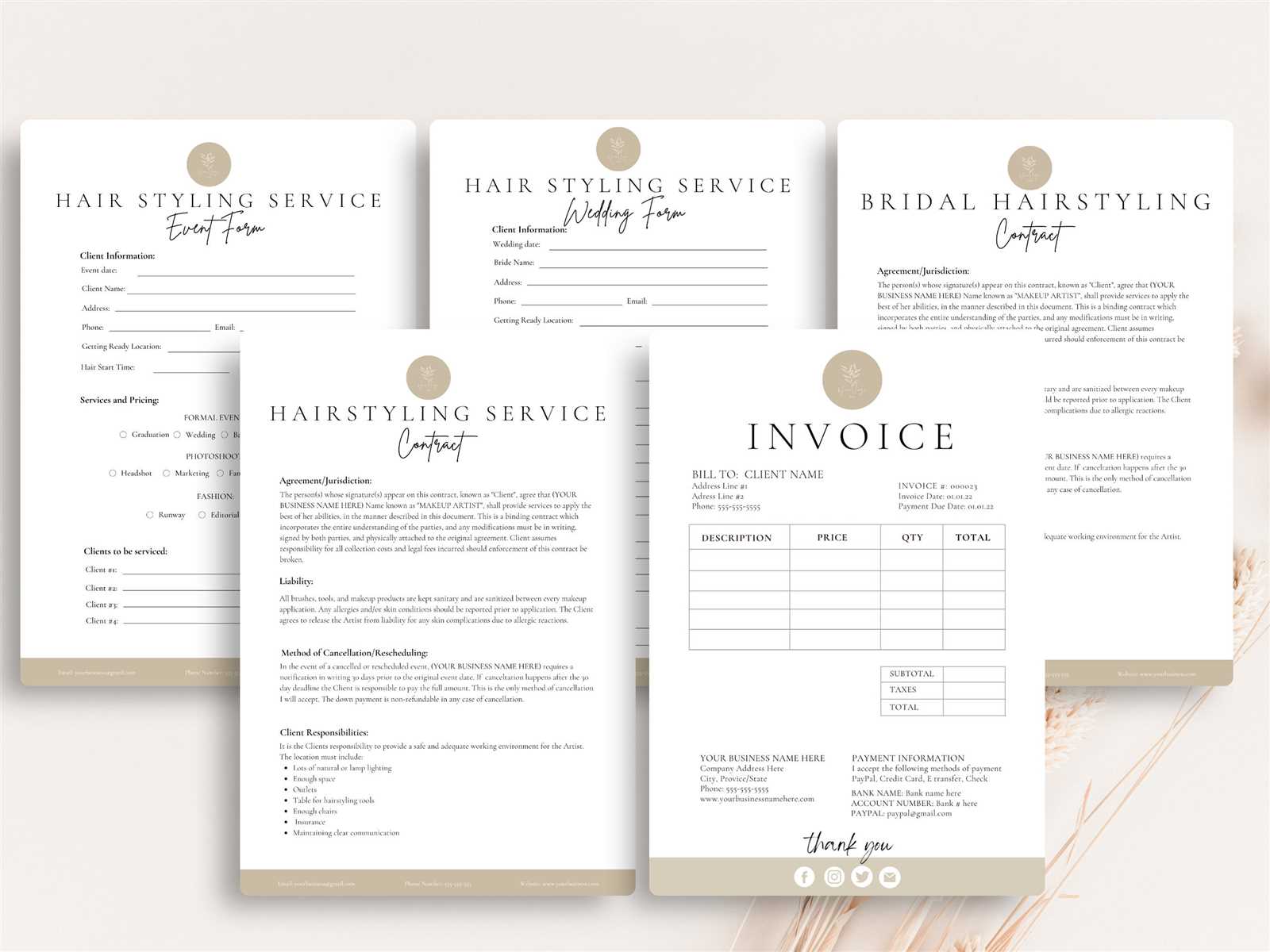

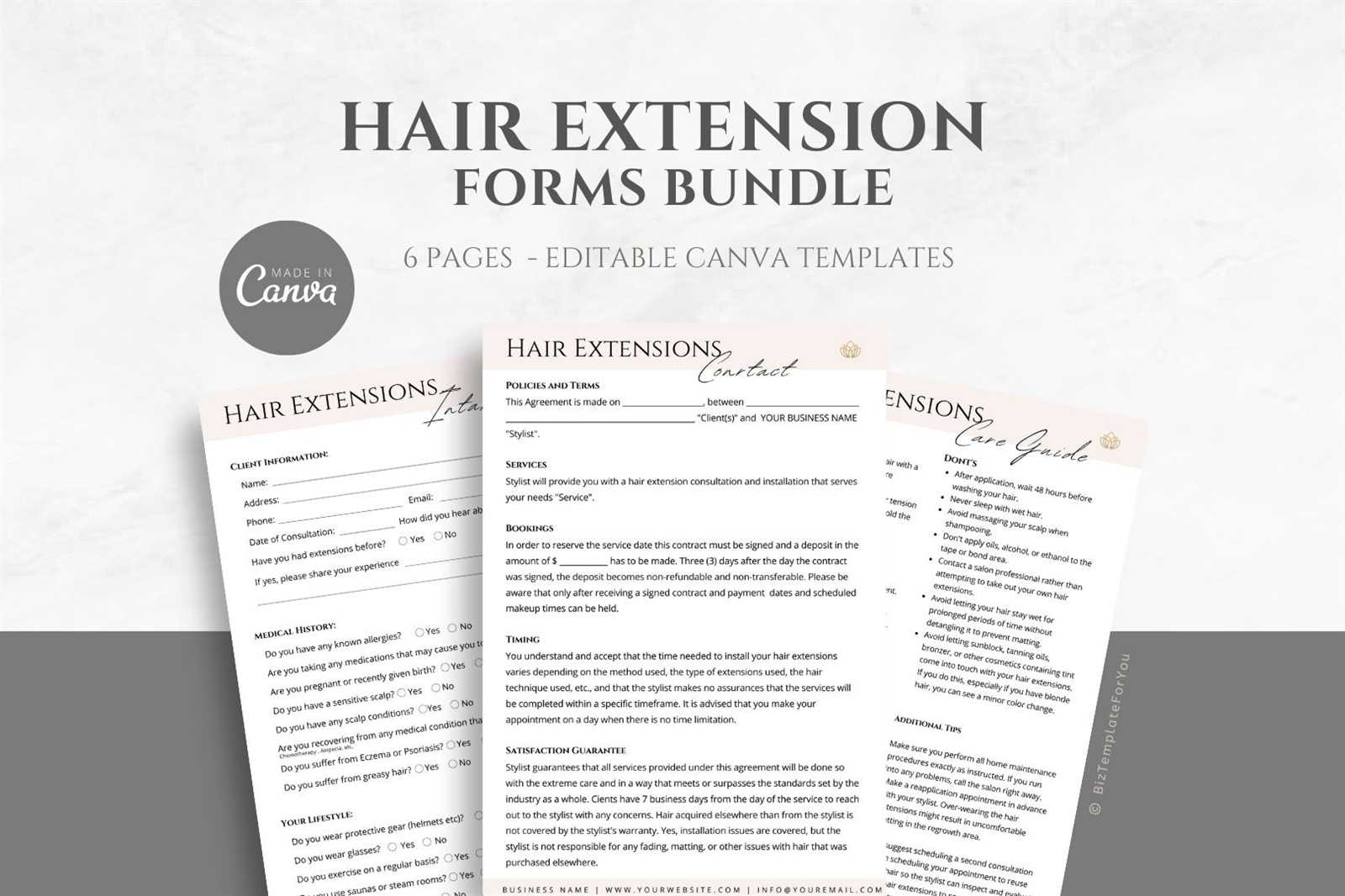

Customizing Templates for Your Salon

Every business has unique needs, and tailoring your billing records to fit your salon’s specific style and services can make a significant difference. Customizing the structure not only enhances branding but also ensures that the document includes all necessary information specific to your offerings. A personalized format allows you to stand out while keeping the process clear and professional.

Here are some elements you can adjust to suit your business:

- Branding: Incorporate your salon’s logo, colors, and contact information to create a consistent brand identity.

- Service List: Customize the list of services to reflect your unique offerings, from haircuts to special treatments.

- Pricing Structure: Tailor the pricing to suit your rates, discounts, or membership packages.

- Payment Methods: Include the preferred payment options that your salon accepts, such as card payments, bank transfers, or online payments.

By adjusting these components, you ensure that each document not only reflects your salon’s personality but also meets the operational needs of your business. This can also help in managing payments more efficiently and professionally.

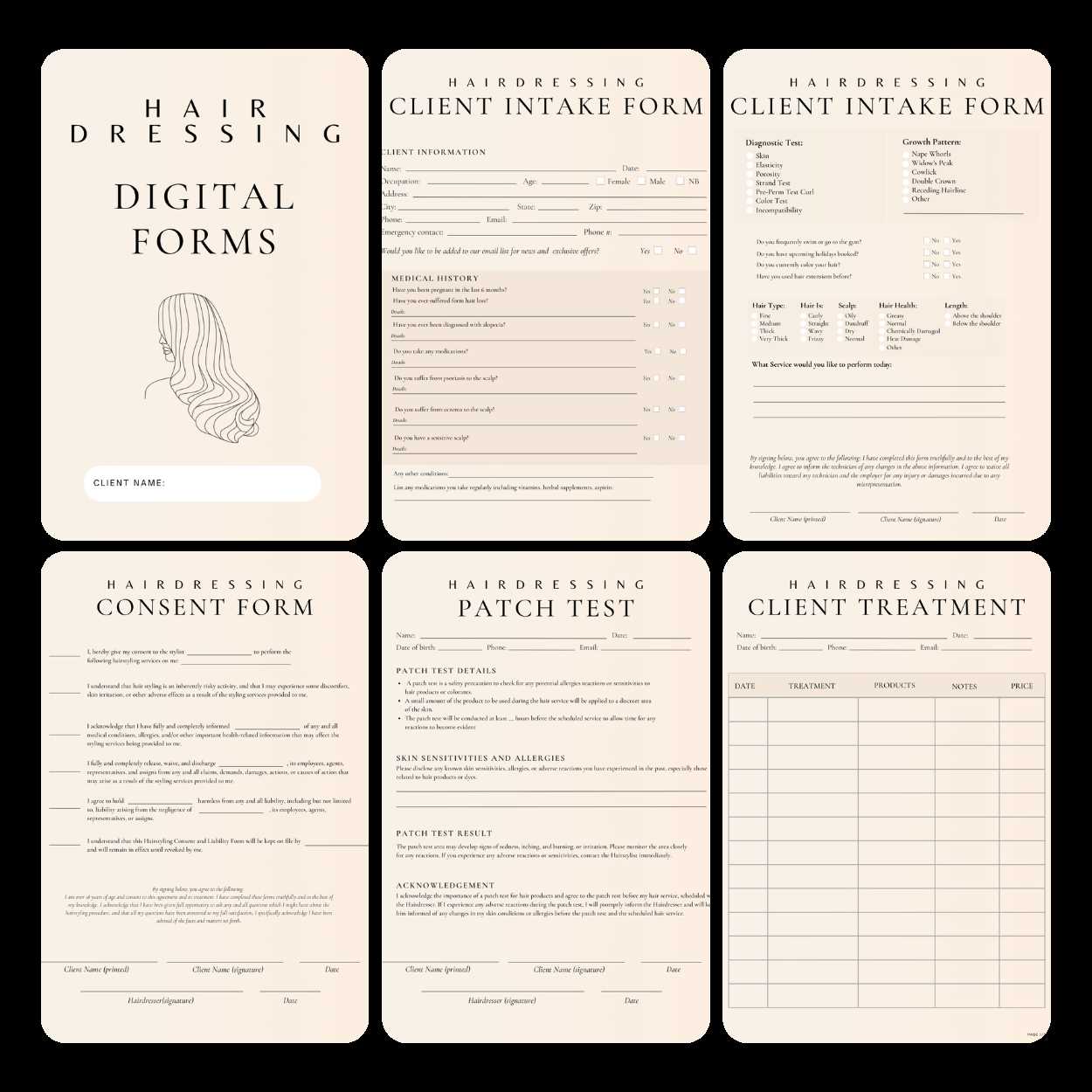

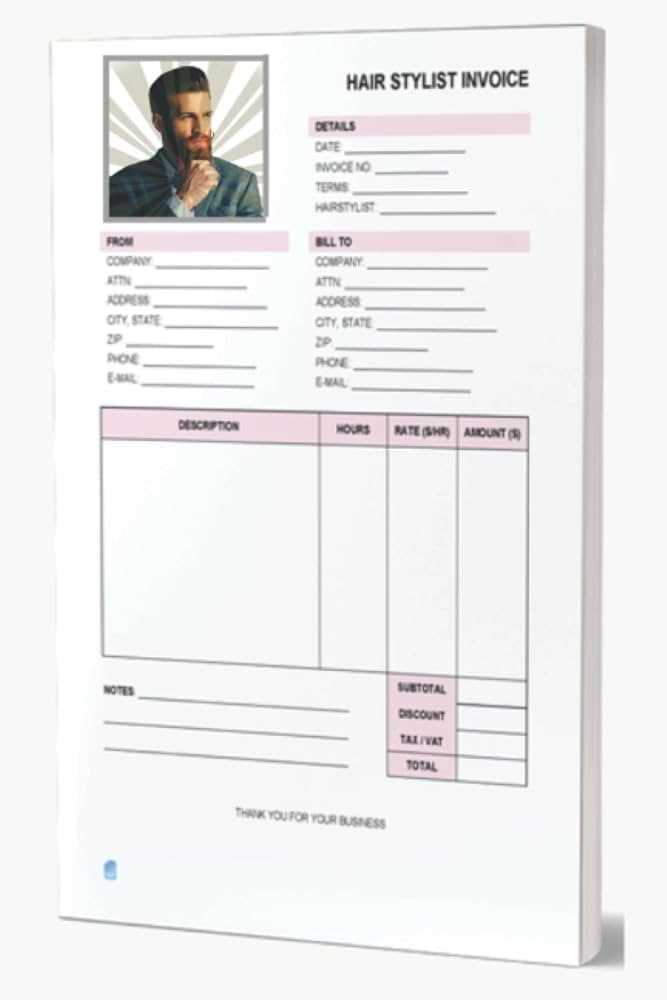

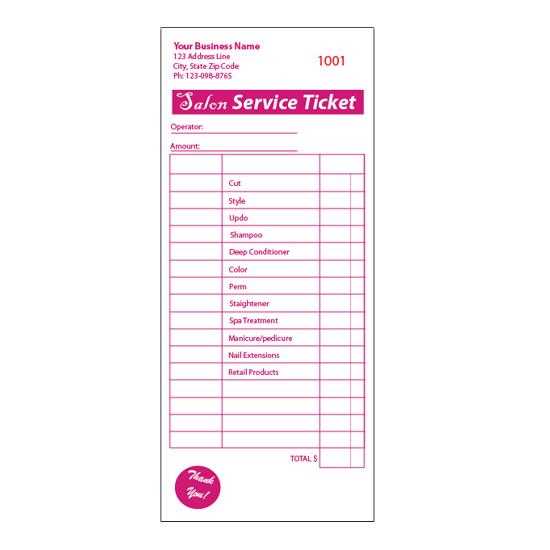

How to Add Service Details

Including accurate and clear descriptions of the services provided is essential in any billing document. This section helps to ensure that both the client and the business are aligned on what was performed and the cost associated with each item. A well-detailed list makes the entire transaction transparent and avoids potential confusion.

Describing Each Service Clearly

Each service should be listed with a brief yet precise description. This helps clients understand exactly what they are being charged for. For example, instead of simply stating “haircut,” you could specify “men’s haircut with styling.” Clarity is key to avoid misunderstandings, especially if multiple services were rendered during the same visit.

Breaking Down the Costs

It is important to break down the cost of each service separately. This allows the client to see how each charge contributes to the total amount. You can include additional information such as the duration of the service, any applicable discounts, or special offers. Detailed pricing helps ensure transparency and encourages trust between the business and the client.

How to Add Service Details

Including accurate and clear descriptions of the services provided is essential in any billing document. This section helps to ensure that both the client and the business are aligned on what was performed and the cost associated with each item. A well-detailed list makes the entire transaction transparent and avoids potential confusion.

Describing Each Service Clearly

Each service should be listed with a brief yet precise description. This helps clients understand exactly what they are being charged for. For example, instead of simply stating “haircut,” you could specify “men’s haircut with styling.” Clarity is key to avoid misunderstandings, especially if multiple services were rendered during the same visit.

Breaking Down the Costs

It is important to break down the cost of each service separately. This allows the client to see how each charge contributes to the total amount. You can include additional information such as the duration of the service, any applicable discounts, or special offers. Detailed pricing helps ensure transparency and encourages trust between the business and the client.

Including Tax and Discounts Properly

In any business transaction, accurately including taxes and discounts is essential for maintaining transparency and avoiding confusion. Properly calculating and displaying these amounts ensures clients understand exactly what they are paying for and helps businesses stay compliant with regulations. When done correctly, this process not only helps with financial clarity but also builds trust with customers.

Here are some key points to keep in mind when applying taxes and discounts:

- Tax Calculation: Clearly display the tax rate and the total amount charged for tax. Be sure to follow local tax laws and include the correct percentage for each type of service.

- Itemized Discounts: If offering discounts, list them separately next to the related service. This allows clients to see exactly how much they are saving.

- Subtotal Clarity: Before applying any tax or discounts, show the subtotal for services rendered. This provides clarity before the final amount is calculated.

- Percentages vs. Fixed Amounts: Specify whether discounts are given as a percentage or a fixed amount. Both methods should be clearly labeled to avoid confusion.

- Promotions: For special offers, ensure the discount is applied before tax if applicable, and explain any terms or restrictions.

By following these guidelines, businesses can ensure that their financial documents are accurate and professional, leading to smoother transactions and improved customer satisfaction.

Managing Multiple Client Invoices

Handling numerous client transactions can be challenging, especially when managing detailed records for each one. Organizing and tracking these documents effectively is crucial for maintaining financial order and ensuring that payments are processed promptly. A well-managed system helps prevent errors, avoids missed payments, and improves overall business efficiency.

Here are a few strategies for managing multiple client records effectively:

- Organized Filing System: Whether digital or physical, organizing records by client name, date, or service type helps quickly locate the necessary documents when needed.

- Clear Reference Numbers: Assign a unique identifier to each transaction. This allows for easy tracking and reference, especially when dealing with multiple clients or services at once.

- Digital Management Tools: Use accounting software or a spreadsheet to track payments, outstanding balances, and other details. Automation can help reduce manual entry errors.

- Set Payment Reminders: For clients with outstanding balances, set up automatic reminders or follow-ups to ensure timely payment. This helps avoid delays and maintains cash flow.

- Keep Detailed Notes: Document any special arrangements or payment terms for clients. This makes it easier to resolve disputes and clarify any misunderstandings.

By implementing these practices, businesses can ensure that they maintain a smooth workflow, prevent payment issues, and keep client relationships positive and professional.

Setting Payment Terms and Conditions

Clearly defining payment terms and conditions helps establish expectations between businesses and their clients. This ensures that both parties understand when payments are due, what methods are accepted, and any penalties for late payments. Properly setting these terms not only promotes professionalism but also helps in maintaining a steady cash flow and avoiding misunderstandings.

Here are some key aspects to consider when setting payment guidelines:

- Due Dates: Specify when payments are due, whether it’s immediately after the service, within a specific number of days, or on a recurring basis for regular clients.

- Accepted Payment Methods: List the payment options available, such as credit/debit cards, bank transfers, cash, or online payment platforms.

- Late Fees: Clearly state any penalties for late payments, such as a fixed fee or a percentage of the outstanding amount added after a certain period.

- Discounts for Early Payment: Offer incentives, such as a small discount for clients who pay before the due date. This can encourage quicker payments and improve cash flow.

- Refund Policies: Include details on refund eligibility and how refunds will be processed if the client is dissatisfied or cancels services.

By clearly outlining these terms in advance, businesses can reduce the risk of delayed payments, avoid confusion, and maintain a positive relationship with their clients.

Automating Invoice Creation for Efficiency

Streamlining the process of generating financial documents can significantly improve efficiency and reduce errors. By automating this task, businesses can save valuable time and ensure consistency across all transactions. Automation tools allow for quick generation, customization, and delivery of records, making the overall workflow much smoother.

Here are some benefits and tips for automating the creation of billing documents:

- Time Savings: Automated systems can generate documents instantly, eliminating the need for manual data entry and repetitive tasks, allowing staff to focus on other important duties.

- Accuracy: Automation reduces the chances of human error in calculations or data input, ensuring that all figures are correct and consistent across each transaction.

- Customizable Templates: Many automation tools offer customizable formats that align with your brand, making each document professional and personalized while saving you the effort of manual formatting.

- Integration with Other Systems: Automation can often be integrated with payment processing or scheduling software, automatically updating records as payments are received or services are scheduled.

- Automatic Reminders: Automated systems can send reminders for overdue payments or upcoming service dates, helping to ensure timely transactions and follow-ups.

By adopting automation, businesses can increase operational efficiency, reduce the risk of errors, and offer clients a more seamless and professional experience.

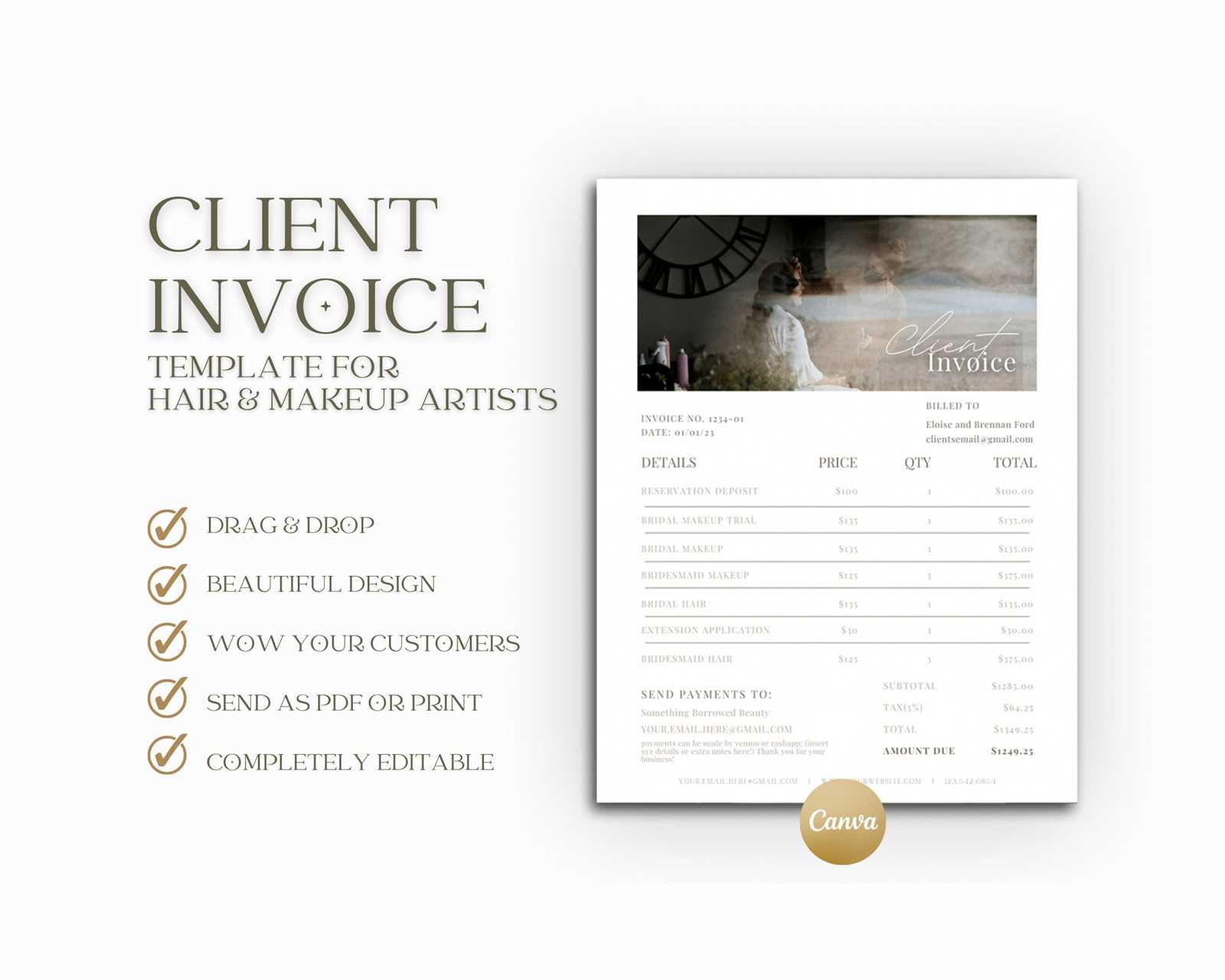

Design Tips for a Professional Look

Creating well-designed financial documents is essential for presenting a professional image to clients. A clean, organized, and visually appealing layout can enhance the credibility of your business and ensure that the recipient can quickly understand the details. Attention to design elements such as typography, color schemes, and structure helps convey professionalism while making the document easy to read.

Here are some key design elements to consider for a polished look:

1. Consistent Branding

Incorporate your brand’s colors, logo, and fonts to reinforce your business identity. A document that reflects your branding ensures a cohesive experience for your clients, making it instantly recognizable.

2. Clear and Readable Layout

Use a logical structure that organizes information in a clear manner. Break down content into sections, such as services, prices, and totals, to make it easy for clients to navigate. A cluttered document can be overwhelming and lead to confusion.

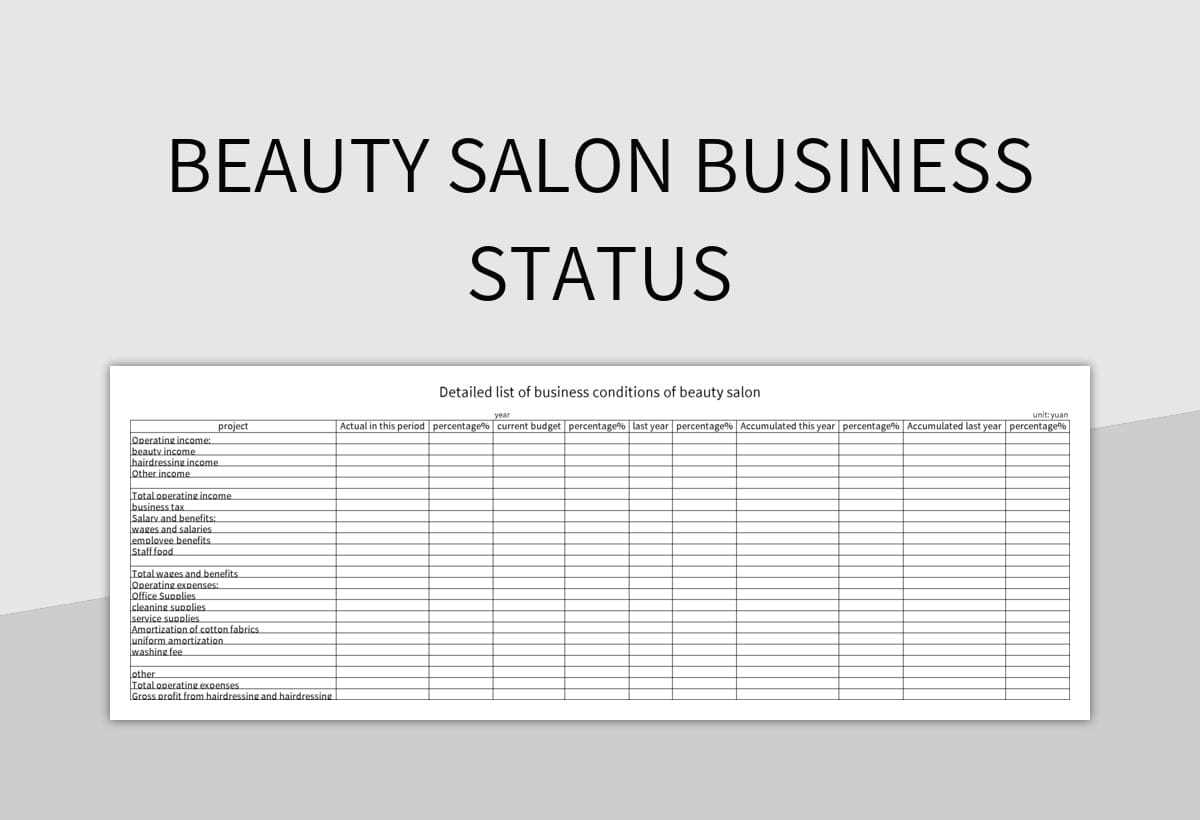

| Element | Tip |

|---|---|

| Typography | Choose professional and legible fonts. Avoid decorative fonts that may be hard to read. |

| Spacing | Ensure adequate spacing between sections and text to avoid a crowded appearance. |

| Color Scheme | Use complementary colors that align with your brand but keep it simple to maintain clarity. |

| Logo | Place your logo prominently at the top to make your brand easily identifiable. |

By paying attention to these design tips, you can create documents that not only look professional but also improve the overall client experience and enhance your business’s reputation.

Choosing Software for Invoice Management

When selecting software for managing financial documents, it’s important to consider tools that offer efficiency, ease of use, and the ability to scale with your business needs. The right software can automate tasks, reduce human error, and provide valuable insights into financial performance. Whether you’re a small business or a growing company, the right solution should align with your operational requirements while offering robust features for tracking, organizing, and reporting.

Key Features to Look For

Consider the following features when evaluating software for document management:

| Feature | Description |

|---|---|

| Automation | Look for software that automates repetitive tasks like document creation, sending reminders, and updating records. |

| Integration | Choose a platform that can integrate with other tools you already use, such as payment processors or scheduling systems. |

| Customization | Ensure the software allows for customization, so your documents reflect your brand’s look and feel. |

| Reporting | Reporting capabilities will help you track payments, overdue balances, and generate financial summaries easily. |

| Cloud Accessibility | Cloud-based software provides flexibility, allowing you to access documents and records from anywhere. |

Top Software Options

There are several software solutions available, from simple apps to more advanced systems. Some popular options include:

- QuickBooks: Ideal for small to medium businesses with a range of features including invoicing, payment tracking, and reporting.

- FreshBooks: A user-friendly option for freelancers and small businesses, offering features for time tracking, invoicing, and expense management.

- Xero: Great for businesses that need advanced accounting features, including integration with a variety of payment processors and other business tools.

Choosing the right software will depend on your specific needs and budget. Ensure the software you select aligns with your business processes and offers the functionality that will help you streamline operations and improve client interactions.

Legal Requirements for Hairdressing Invoices

When issuing financial documents for services rendered, it is essential to comply with the legal regulations that apply to your business. These requirements ensure transparency, protect both the service provider and client, and help maintain proper records for tax and legal purposes. In many regions, specific details must be included in every document to meet local laws and industry standards.

Here are some important legal aspects to consider when preparing these documents:

- Business Information: Always include the name of your business, address, and contact details. This information helps verify your identity and ensures that the document is traceable to your enterprise.

- Client Information: Clearly state the client’s full name or company name and their address to avoid any confusion regarding the recipient of the services.

- Unique Identification Number: Each document should have a unique number for identification purposes. This helps in tracking transactions and simplifying the accounting process.

- Description of Services: Be detailed about the services provided, including any products used, their costs, and the time spent. This ensures transparency and helps the client understand what they are being charged for.

- Tax Information: Depending on the jurisdiction, you may need to include tax rates and the amount of tax charged. Make sure to apply the correct rates to stay compliant with local tax laws.

- Payment Terms: Clearly outline payment deadlines, accepted payment methods, and any late fees or penalties. This prevents misunderstandings about when payments are due and what happens in the case of a delay.

- Legal Disclaimers: Some regions require specific legal disclaimers on business documents. These may include information about consumer rights, refunds, and cancellations, depending on the type of service provided.

By ensuring that all legal requirements are met, you can protect your business from potential disputes and maintain a professional image with your clients. Additionally, these practices contribute to better financial management and smoother operations.

Tracking Payments Through Your Invoice

Efficiently managing financial transactions is crucial for any business. By tracking payments properly, you ensure that all amounts owed are collected on time and that your records remain accurate. A well-structured document can help you monitor the status of payments, whether they are pending, completed, or overdue, making it easier to stay on top of your financial management.

Here are some important elements to include in your documents to help with payment tracking:

| Element | Description |

|---|---|

| Payment Due Date | Clearly state when the payment is due. This helps clients understand the timeline for settling their balance and helps you track overdue amounts. |

| Amount Due | Always specify the total amount due, including any taxes, discounts, or additional charges. This ensures the client knows exactly what they need to pay. |

| Payment Status | Mark the payment status on each document, such as “Paid”, “Pending”, or “Overdue”. This makes it easy to monitor which payments have been received and which are outstanding. |

| Transaction Reference | If the payment has been made, include a reference number or transaction ID to verify the payment has been processed. This helps resolve any discrepancies later on. |

| Late Fees | Outline any applicable late fees for overdue payments. This serves as a reminder for clients to pay on time and discourages delayed payments. |

By incorporating these elements into your financial documents, you can better track the status of payments, reduce administrative effort, and ensure that you receive payment on time. Regularly reviewing the payment status helps identify any potential issues early and resolve them before they escalate.

Common Mistakes in Invoice Creation

When creating financial documents, it’s important to avoid common errors that could lead to confusion, delays in payment, or even legal issues. Whether you’re handling payments for products or services, small mistakes can have a big impact on your business operations. Below are some frequent pitfalls to watch out for when preparing documents to request payment:

- Incorrect Client Information: Always double-check that client names, addresses, and contact details are accurate. A small error can cause delivery issues or misunderstandings.

- Missing Payment Terms: Clearly define when payment is due and any late fees that apply. Without this, clients may not be aware of when payments are expected, leading to delays.

- Failure to Include a Unique Identifier: Every document should have a unique reference number. This helps track payments and resolve any disputes quickly.

- Unclear Service Descriptions: Avoid vague descriptions of the work or goods provided. Clearly state the details to prevent misunderstandings about what was delivered and the agreed-upon price.

- Not Accounting for Taxes and Additional Charges: Forgetting to add applicable taxes, shipping, or handling fees can lead to undercharging and potential loss of revenue.

- Overlooking Payment Methods: Always specify the accepted payment methods (e.g., bank transfer, credit card, online payment platform). Not doing so can delay the transaction process.

- Inconsistent Formatting: Use a consistent layout for all your documents. A cluttered or disorganized appearance can make it difficult for clients to find essential information like the due amount or payment terms.

By avoiding these common errors, you can ensure that your financial records are clear, accurate, and professional. This not only helps build trust with clients but also improves the efficiency of your payment collection process.

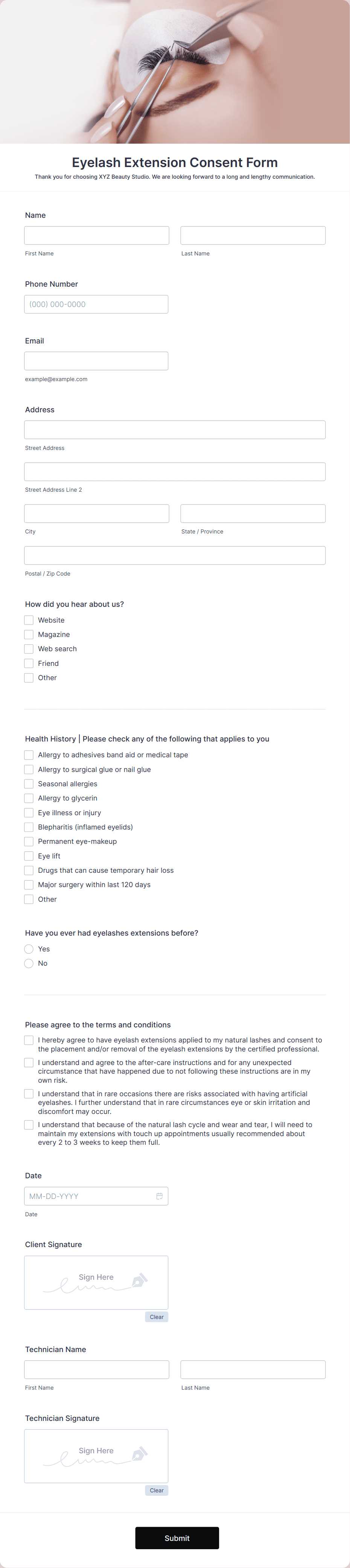

How to Send Invoices to Clients

Sending a payment request to clients requires both clarity and professionalism. The method of delivery plays a crucial role in ensuring the client receives the document in a timely and secure manner. There are several ways to send payment requests, each with its own benefits depending on your business model and client preferences. Below are the most common methods for dispatching payment documents:

- Email: One of the most efficient ways to send payment requests is via email. Simply attach the document in a PDF format, ensuring the file is easy to open and read. This method is fast and allows you to keep a digital record of the transaction.

- Postal Mail: For clients who prefer hard copies or in cases where digital delivery isn’t an option, mailing a physical document might be necessary. Ensure you use reliable postal services and send documents with tracking to confirm delivery.

- Online Payment Platforms: Many businesses use online payment systems such as PayPal, Stripe, or specialized invoicing software. These platforms often allow you to send documents directly through their interface, making the payment process streamlined and secure for both parties.

- Hand Delivery: In some cases, especially for local clients or in the case of large businesses, delivering payment requests in person can help reinforce professional relationships. It also allows you to answer any immediate questions the client may have.

- SMS or Messaging Apps: For quick and informal transactions, you may send a snapshot or scanned version of the document through text messages or apps like WhatsApp, ensuring that you follow up with a formal delivery method if necessary.

Regardless of the method, make sure to follow up with clients to ensure they’ve received the request and are aware of the payment terms. Timely communication is essential in maintaining positive client relations and ensuring prompt payments.

Using Digital Invoices for Convenience

Digital documents have become an essential tool for streamlining administrative tasks and ensuring quick, efficient payment processing. Switching from traditional paper-based methods to digital formats offers numerous advantages, especially when it comes to sending, receiving, and tracking transactions. With the increasing reliance on technology, digital records not only simplify the process for businesses but also make it more convenient for clients.

Benefits of Going Digital

There are several reasons why digital documents are becoming the preferred choice for many businesses:

- Time-Saving: Digital documents can be created and sent instantly, eliminating the time spent on printing, mailing, or manually organizing physical paperwork. This speeds up the entire payment process.

- Easy Storage: Storing documents electronically ensures that all records are organized and easy to access. You can quickly search and retrieve any document when needed, without the risk of losing physical copies.

- Cost-Effective: By using digital formats, you save on paper, ink, and mailing costs. You can also reduce the time spent managing paperwork, allowing your team to focus on other tasks.

- Environmentally Friendly: Digital documents help reduce paper waste, contributing to a more sustainable business model.

- Improved Accuracy: Automation tools for creating digital records help minimize errors that might occur with manual entry, ensuring that the data is accurate and up to date.

How to Use Digital Formats Effectively

To make the most of digital records, it’s important to use the right tools and processes:

- Choose the Right Software: Many platforms offer customizable digital forms that allow you to easily input details, add services, and calculate totals. Select software that fits your business needs and integrates well with your other systems.

- Use Secure Methods for Sending: When sending digital documents, ensure that you use secure email or payment platforms to protect sensitive client information.

- Offer Multiple Payment Options: Digital formats allow you to include direct links to online payment systems, giving clients a range of convenient payment methods to choose from.

By embracing digital documentation, businesses can operate more efficiently while offering clients an easy, hassle-free way to manage transactions.

Keeping Accurate Financial Records

Maintaining precise financial documentation is critical for any business, ensuring both compliance and efficiency in operations. Accurate records not only allow for better decision-making but also provide the foundation for effective financial management. Whether tracking expenses, monitoring revenue, or handling taxes, clear and organized financial records help prevent errors and confusion down the line.

Why Accurate Financial Records Matter

Having a systematic approach to record-keeping benefits businesses in many ways:

- Financial Transparency: Properly recorded transactions provide clear insight into a company’s financial health, making it easier to assess profitability and cash flow.

- Tax Compliance: Correct records ensure that taxes are filed accurately, reducing the risk of penalties and audits.

- Informed Decision-Making: With access to up-to-date financial data, businesses can make more informed decisions about spending, investment, and future growth.

- Efficient Audits: Maintaining organized records helps ensure that audits are easier and quicker, saving time and stress during the process.

Best Practices for Accurate Record-Keeping

To ensure accuracy, it’s important to follow consistent practices when managing financial data:

- Use Reliable Software: Invest in software that can automatically track and categorize financial transactions, reducing human error and improving overall accuracy.

- Regularly Reconcile Accounts: Periodically compare your financial records with bank statements to catch any discrepancies early and ensure consistency.

- Store Records Securely: Make sure that financial documents are stored securely, whether digitally or physically, and back up data regularly to avoid loss.

- Stay Consistent: Consistency is key in record-keeping. Stick to a routine for entering data and organizing documents to ensure everything is up to date.

By maintaining organized, precise financial records, businesses can streamline their operations, reduce stress during tax season, and ensure long-term success.