Pinterest Invoice Template for Simple and Efficient Billing

Managing financial transactions efficiently is crucial for any creative business. When it comes to receiving payments for services rendered, having a structured and clear method to request compensation can save time and reduce confusion. A well-organized payment request document helps ensure both parties are on the same page, leading to smoother operations and improved cash flow.

Customizable billing forms are essential for this purpose, offering flexibility and simplicity. These documents allow you to tailor the details according to your specific needs, whether you’re working on a one-time project or ongoing collaboration. With easy-to-use formats, it’s possible to present the necessary information in a professional and straightforward manner.

By using a standardized format, you can avoid common issues that arise from poorly structured requests. This makes it easier for clients to understand the payment expectations and for you to track outstanding amounts. In this guide, we’ll explore how to create and use these documents effectively for seamless financial management.

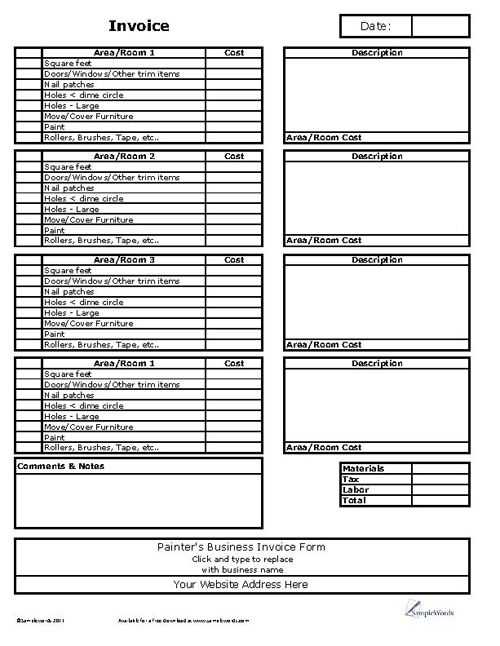

Pinterest Invoice Template Overview

Having a well-organized document to request payments for your work is essential for any business or freelance activity. It provides a clear structure that both the service provider and client can follow, ensuring transparency and avoiding misunderstandings. This type of document serves as a formal record of the transaction, listing services rendered, agreed rates, and payment deadlines.

With customizable formats, these billing forms can be adjusted to meet your specific needs. Whether you are sending a one-time request or creating a recurring payment form, the key elements remain the same. The design and content are flexible, allowing you to present the information in a professional and easy-to-read manner.

Key Elements of a Payment Request Document

- Contact Information: Your details and the recipient’s details, including email or physical address.

- Service Description: A breakdown of what was provided or completed, including dates and quantities.

- Payment Terms: Payment due date, late fees (if applicable), and accepted methods of payment.

- Pricing: A clear list of the costs associated with each service or product.

- Total Amount: The final amount due, including any taxes or additional charges.

Benefits of Using Customizable Payment Forms

- Professional appearance that enhances your brand image.

- Efficient management of financial records for easier tracking.

- Reduction of errors in billing through standardized information.

- Time-saving due to easy-to-fill-out structures.

- Flexibility to adjust details for different types of services or clients.

Why Use a Pinterest Invoice Template

Using a structured document for billing is a key practice for businesses and freelancers alike. It ensures that both the service provider and client have a clear understanding of payment expectations, timelines, and the services rendered. Without a proper format, confusion can arise, leading to delays or disputes. A well-organized form eliminates these risks and provides a professional touch to every transaction.

By utilizing a customizable format, you can streamline your billing process, save time, and ensure accuracy. It reduces the chances of forgetting crucial details and helps maintain consistency across all your financial documents. Additionally, using a ready-made structure allows for easy updates, whether for one-time projects or recurring work.

Benefits of Using a Structured Billing Document

- Clarity: Clearly outlines the services, payment terms, and amounts due, preventing confusion.

- Professionalism: Helps create a polished and credible image for your business.

- Efficiency: Saves time by having a pre-built structure that you can easily customize.

- Consistency: Ensures that every payment request follows the same format, making it easier to track records.

- Accuracy: Reduces the risk of mistakes by providing a clear framework for entering the right details.

How It Simplifies Record Keeping

- Tracking Payments: Easily monitor due and paid amounts for better cash flow management.

- Tax Purposes: Organized records help when filing taxes or for audit purposes.

- Future Reference: Can be saved and referred to for future transactions with the same client.

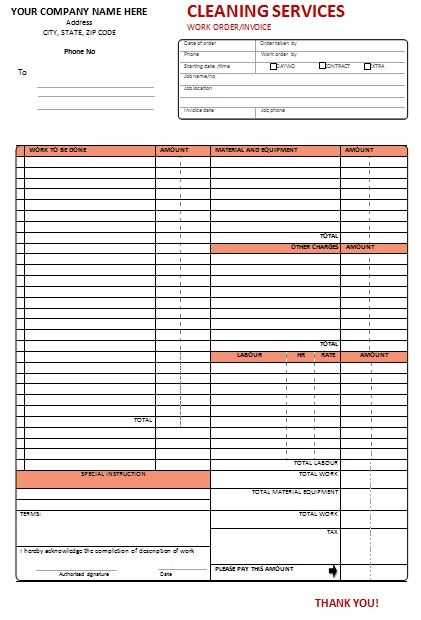

Key Features of a Pinterest Invoice

For an efficient and professional billing process, certain elements must be present in every payment request. These features help ensure that the document is clear, complete, and easy to understand for both the service provider and the client. By including these key components, you can avoid confusion and make your financial transactions more seamless.

Essential details like the recipient’s contact information, a detailed description of services provided, and payment terms are crucial to ensure the transaction goes smoothly. Each section should be clearly defined to prevent any ambiguity regarding what has been agreed upon. These features help create a transparent and organized record of the business exchange.

Core Elements of an Effective Payment Request

- Contact Information: The names, addresses, and communication details of both parties.

- Service Breakdown: A detailed description of the services rendered, including quantities and dates.

- Pricing and Charges: A clear listing of the costs, taxes, and any additional fees associated with the services.

- Payment Terms: The due date for payment, accepted payment methods, and penalties for late payments.

- Total Amount: A final sum indicating the total amount owed, including all charges and taxes.

Why These Features Matter

- Clarity: Helps avoid any misunderstandings by specifying what is expected from both sides.

- Professional Appearance: Shows that you value organization and transparency in your business dealings.

- Easy Tracking: Facilitates better financial tracking and management for both the provider and client.

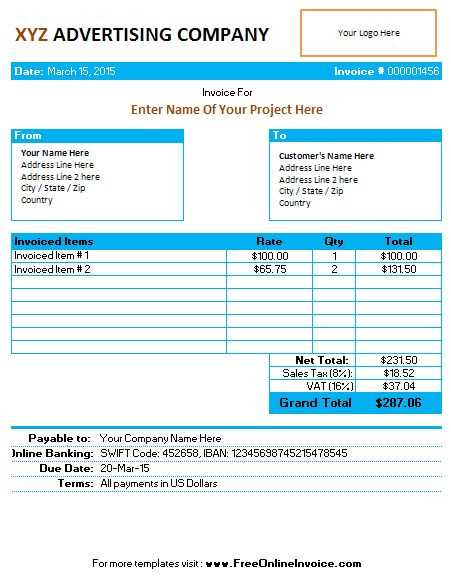

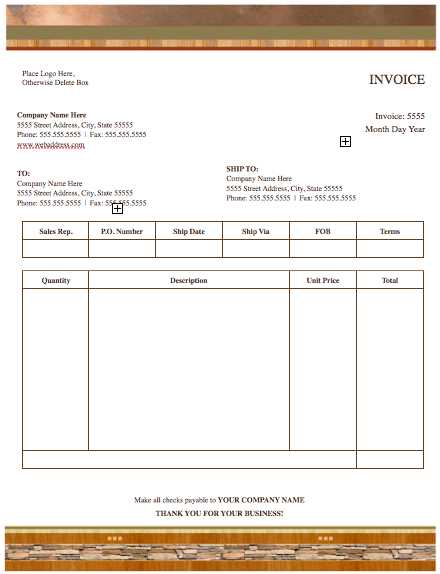

How to Customize Your Pinterest Invoice

Customizing your payment request document is essential for reflecting your brand and meeting specific transaction needs. A tailored document ensures that all relevant details are clearly presented and that it aligns with your business style. By adjusting key sections, you can make your billing form both professional and functional, allowing for easy updates as needed.

To begin customization, consider adjusting the layout, adding your business logo, and ensuring that the terms of payment are clear. You can also modify the service description fields to match the exact work or products provided, ensuring that clients have a precise understanding of what they are paying for.

Steps to Customize Your Billing Form

| Section | Customization Tips |

|---|---|

| Header | Add your company logo, name, and contact information. Include the date and unique document number for easy reference. |

| Service Description | Detail the services provided, including quantities, unit prices, and dates. Adjust the wording to fit the specific services you offer. |

| Payment Terms | Modify the due date, payment methods, and late fee policies according to your preferences or business practices. |

| Pricing | List each service or product with its associated cost, ensuring transparency in pricing. |

| Total Amount | Make sure the final amount is calculated correctly, taking into account taxes or other additional charges. |

With these customizations, you will be able to create a professional and personalized billing form that enhances the overall customer experience and ensures smooth financial transactions.

Steps to Create a Pinterest Invoice

Creating a billing document is an essential step in formalizing a financial transaction between you and your client. This process ensures that all the terms, conditions, and services rendered are clearly outlined, preventing misunderstandings and ensuring timely payments. By following a few simple steps, you can craft a professional document that serves both as a record and a tool for communication.

The first step involves gathering all relevant information, such as the recipient’s contact details, a breakdown of the services provided, and the agreed-upon payment terms. Once all the necessary information is collected, it’s important to structure the document in a clean, easy-to-follow format. This not only helps with clarity but also presents a professional image to your clients.

Step-by-Step Process to Create Your Billing Document

- Step 1: Collect all required details: Include your business name, client information, services offered, and specific costs.

- Step 2: Organize the structure: Create clear sections for service descriptions, pricing, and payment terms.

- Step 3: Include a unique document number: Helps to keep track of multiple transactions.

- Step 4: Add the payment terms: Clearly specify due dates, acceptable payment methods, and any applicable late fees.

- Step 5: Review for accuracy: Double-check the amounts, services, and client details to avoid any errors.

By following these steps, you’ll ensure that the payment request document is both professional and efficient, providing a clear understanding for both parties involved.

Best Practices for Using Pinterest Invoices

When creating and sending payment documents, it is important to adhere to best practices to ensure clarity, professionalism, and timely payment. By following a few key guidelines, you can streamline your financial transactions and foster positive relationships with your clients. These practices help avoid common errors, ensure compliance with agreements, and present a professional image to your clients.

One essential practice is to always ensure that your document includes clear and concise information about the services provided, payment terms, and contact details. Consistency in format and the inclusion of all necessary details not only helps prevent confusion but also creates a positive experience for your client. Additionally, it’s important to keep your records organized for easy reference and future use.

Key Guidelines for Efficient Billing

- Accurate Information: Ensure that all the details, such as service descriptions, costs, and client contact information, are correct and up-to-date.

- Timely Delivery: Send your payment requests promptly after providing the service to encourage timely payments and keep your cash flow steady.

- Clear Payment Terms: Specify due dates, acceptable payment methods, and any late fees to ensure both parties understand the terms of payment.

- Easy to Understand: Use a clean, professional layout to make the document easy to read and understand.

Why Following These Practices Matters

- Professionalism: Shows that you take your business seriously and value your clients’ time and payments.

- Efficiency: Helps to speed up the payment process and avoids delays due to misunderstandings or missing information.

- Organization: Makes managing and tracking payments easier, allowing for a smooth financial workflow.

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s easy to overlook certain details that can lead to confusion or delays in payment. Mistakes in your financial documents can cause frustration for both you and your clients, potentially damaging your professional reputation. By being aware of common pitfalls, you can ensure that your billing process runs smoothly and that you avoid unnecessary errors that may delay payments or complicate financial matters.

From missing essential details to unclear payment terms, several common issues can impact the efficiency and accuracy of your billing documents. It’s crucial to double-check all aspects before sending to maintain professionalism and transparency in your transactions.

Common Mistakes to Avoid

- Missing Contact Information: Always include both your business details and the client’s contact information to avoid confusion or missed payments.

- Incorrect Payment Terms: Be specific about payment deadlines, acceptable methods, and late fees to prevent misunderstandings.

- Lack of Itemized Services: Failing to list the services provided can lead to disputes or questions from your client about the charges.

- Not Using a Unique Reference Number: Each document should have a unique number for easy tracking and reference.

- Unclear Pricing: Ensure that prices are easy to read, and include any taxes or discounts so there are no surprises.

How to Avoid These Mistakes

- Double-check details: Review all client information, pricing, and payment terms before sending the document.

- Use professional templates: Templates can help standardize your process and reduce the risk of missing key information.

- Stay consistent: Use the same format and structure for every document to avoid confusion for both you and your clients.

How to Track Pinterest Payments Efficiently

Effectively managing and tracking payments is essential for maintaining a healthy cash flow and ensuring your financial operations run smoothly. Without a proper system in place, it can become challenging to monitor outstanding balances and ensure timely payments. Implementing an efficient tracking method allows you to stay organized, reduce errors, and address any payment issues quickly.

To streamline this process, it’s important to use organized record-keeping methods, whether digital or physical. A clear overview of all incoming payments and due amounts will help you stay on top of your financial responsibilities and avoid missing any transactions. By establishing a reliable tracking system, you ensure that payments are tracked accurately, and any discrepancies can be identified and resolved promptly.

- Use a Spreadsheet: Create a simple spreadsheet to track all payments, including the amounts, dates, and payment status. This will give you a quick overview of your financial situation.

- Leverage Accounting Software: Use specialized tools designed for tracking payments and managing client data. These tools can automatically update records and generate reports.

- Maintain Clear Payment Logs: Keep a log of each transaction, noting the payment method and date received. This will help prevent confusion and allow for easier follow-ups if needed.

- Regularly Review Payment History: Set a routine to review your payment records. By doing so, you can identify trends, outstanding invoices, or issues that need to be addressed.

Why Accurate Invoices Matter for Pinterest

Ensuring the accuracy of your financial documents is crucial for maintaining a smooth and professional relationship with clients. When these documents are unclear or contain errors, it can lead to confusion, delayed payments, and potential disputes. Accuracy plays a key role in ensuring that transactions are transparent, efficient, and trustworthy.

Correctly detailed billing statements ensure that both parties are on the same page regarding the amounts due, services provided, and payment terms. By providing clear and accurate records, you minimize the risk of misunderstandings and help facilitate quicker payments.

- Reduces Disputes: When all details are correct, clients are less likely to question charges or delay payments due to unclear terms.

- Ensures Timely Payments: Precise billing helps clients understand their obligations and avoid delays caused by confusion over the amount or payment deadlines.

- Builds Trust: Accurate documents reflect professionalism and reliability, helping to establish a strong relationship with clients.

- Prevents Legal Issues: Incorrect or misleading financial documents can lead to legal complications, so accuracy ensures you stay compliant with regulations.

- Enhances Financial Organization: Keeping records error-free makes it easier to track payments, calculate taxes, and generate reports for your business.

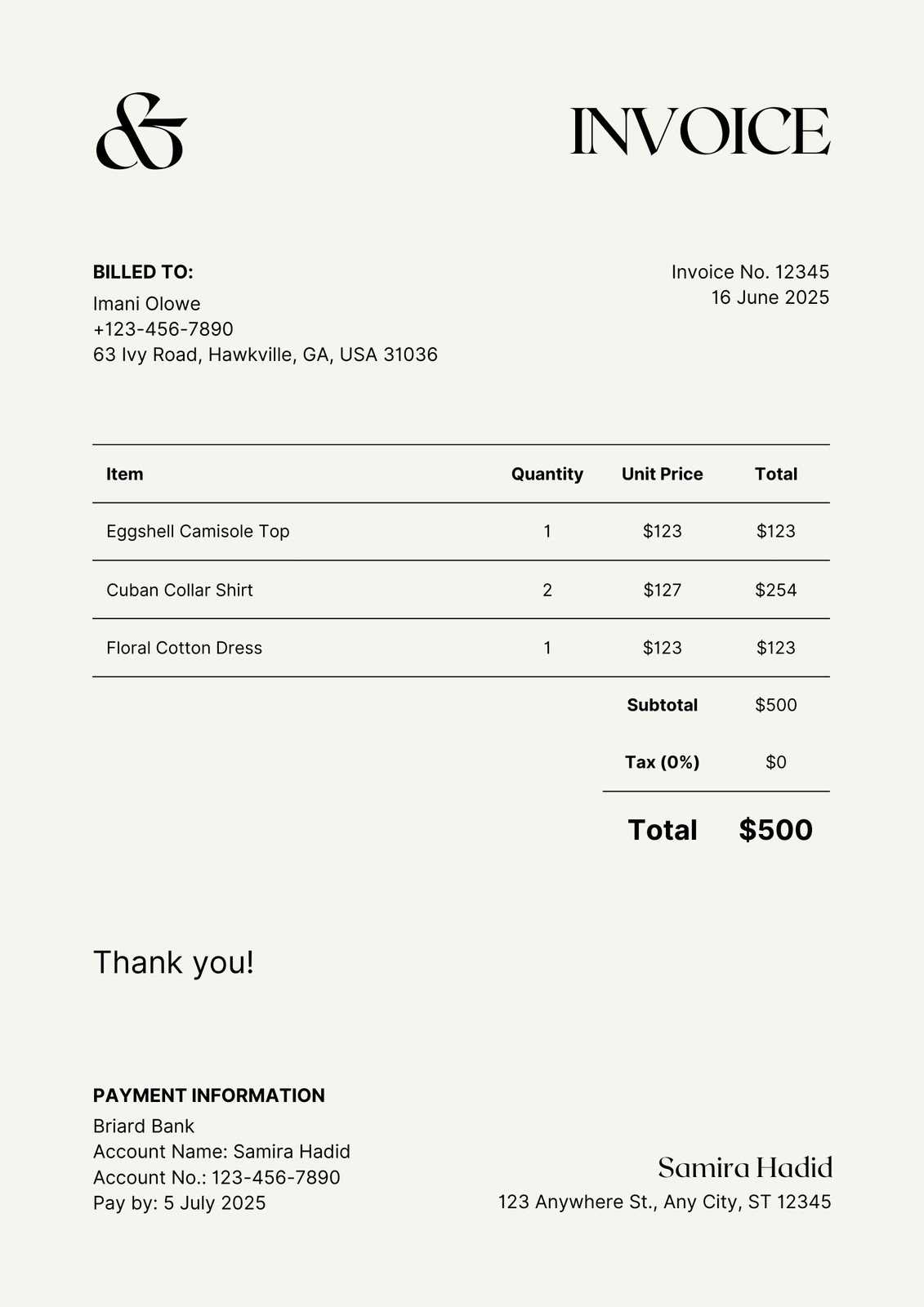

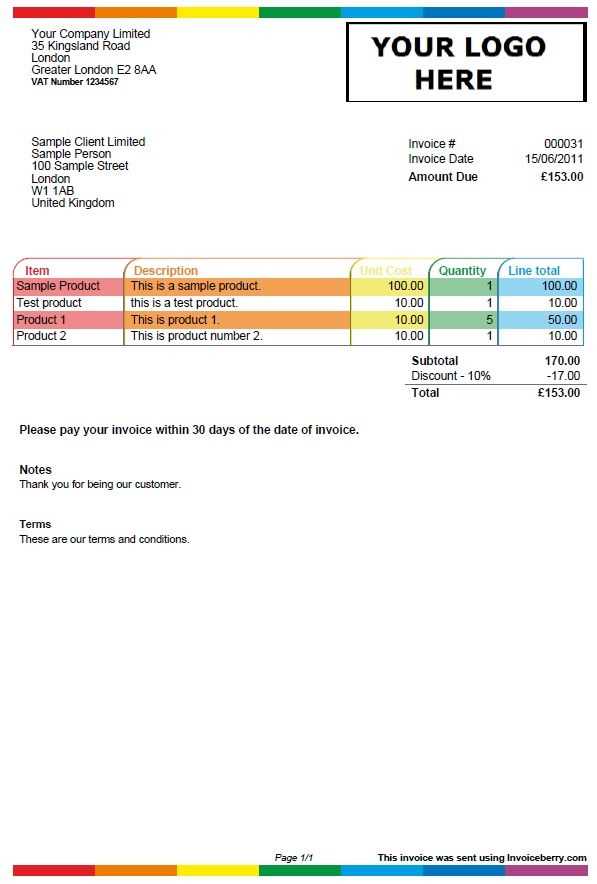

Free Pinterest Invoice Templates Online

There are many online resources that provide free tools for creating professional billing documents. These tools often offer a range of customizable options that can save time and help ensure your records are organized. Whether you’re a freelancer or managing a small business, having access to these free resources can be a great way to streamline your financial processes.

Benefits of Using Free Billing Documents

- Cost-Effective: No need to invest in expensive software or services when free options are available online.

- Customizable Designs: Tailor the layout and content to fit your specific needs, including payment terms and branding elements.

- Easy to Use: Most online tools are user-friendly, with simple forms and pre-filled fields that allow quick document creation.

- Instant Access: Download your documents immediately after customization, saving time and effort.

- Variety of Formats: Choose from different file types such as PDF, Word, or Excel to suit your needs and preferences.

Popular Platforms for Free Billing Resources

- Zoho Invoice: Offers a free plan with customizable templates to create professional billing documents.

- Invoice Generator: A simple online tool with basic templates for fast document creation.

- Wave: Provides free billing and accounting tools with customizable invoice designs.

- PayPal: Free options for generating professional invoices directly from your PayPal account.

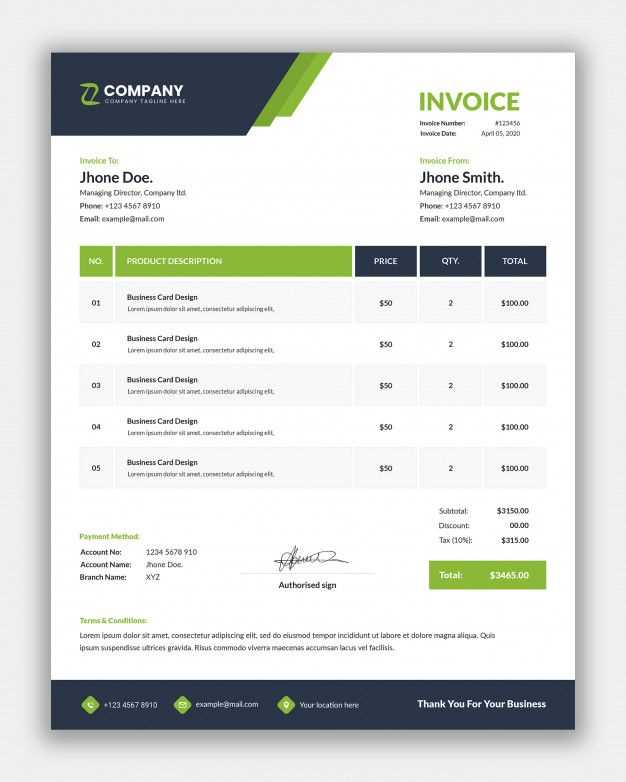

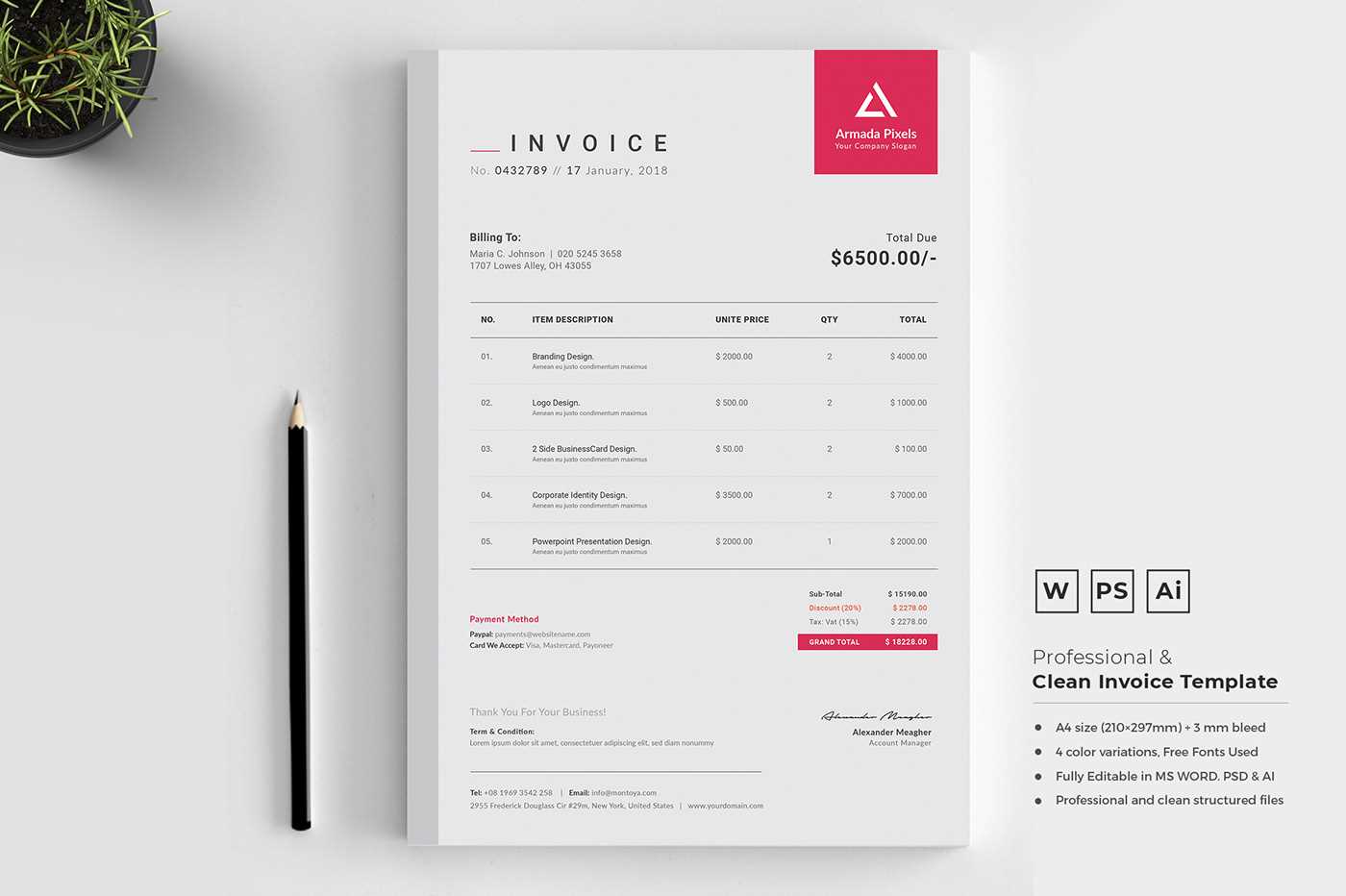

Design Tips for a Professional Invoice

Creating a well-structured and visually appealing document can enhance your professionalism and ensure your business transactions are clear and straightforward. The design of your financial documents plays a significant role in presenting a polished image to clients. By incorporating a few key design elements, you can make sure that your records are not only effective but also visually appealing.

Key Design Elements for a Professional Look

- Consistent Branding: Incorporate your business logo, brand colors, and fonts to maintain a cohesive brand identity throughout your documents.

- Clear Structure: Ensure that your document is easy to read by organizing sections with clear headings. Use bold text or dividers to separate key information such as payment terms and contact details.

- Legible Fonts: Choose a professional, easy-to-read font. Stick to one or two fonts to keep the design clean and simple.

- Whitespace: Don’t overcrowd the document with too much information. Leave enough empty space to make the content look organized and not overwhelming.

- Visual Hierarchy: Use font size variations and bold text to highlight important information like the total amount due and due dates.

Additional Tips for Enhancing Your Document

- Align Elements Properly: Keep text, numbers, and other elements aligned for a tidy and structured appearance.

- Use Borders or Shading: Subtle borders or shading can help separate sections and draw attention to key details without overwhelming the document.

- Use Color Wisely: While color can enhance the design, it should not distract from the content. Stick to a professional color palette that reflects your brand.

- Include Payment Instructions: Provide clear and concise payment instructions in a section that stands out, making it easy for clients to know how to pay.

How to Share Your Invoice

Sharing your billing documents efficiently ensures timely payments and maintains professional communication with clients. There are various methods available to deliver your documents, each offering its own benefits in terms of convenience and clarity. Choosing the best option depends on your business practices and the client’s preferences.

Methods of Sharing Your Document

- Email: One of the most common methods, sending a digital file via email ensures quick delivery. Attach the document as a PDF or other widely accepted formats to maintain formatting consistency.

- Cloud Storage: For larger files or for clients who prefer accessing documents through a shared platform, storing the file on cloud services like Google Drive, Dropbox, or OneDrive is an effective option. You can then share the document via a link.

- In-Person Delivery: Although less common in the digital age, hand-delivering printed documents can still be useful for local clients or for businesses that prefer hard copies for their records.

- Payment Platforms: Some businesses prefer using payment systems or invoicing tools that include sharing features, allowing you to send the document directly through the platform.

Things to Consider When Sharing Your Document

| Consideration | Why It Matters |

|---|---|

| File Format | Make sure the file format is accessible to your client, with PDF being the most universally accepted format. |

| Security | Ensure that sensitive information is protected, especially when sharing through online channels. Using secure email or password-protecting documents can help safeguard your data. |

| Clear Instructions | Provide clear payment instructions in the document, and specify how the client should proceed to avoid confusion. |

| Delivery Confirmation | If possible, confirm the receipt of the document. This is especially important for large transactions or when working with new clients. |

Legal Considerations for Billing Documents

When creating and sharing billing documents, it’s essential to adhere to legal standards to ensure that all transactions are properly recorded and compliant with tax laws. These documents serve as formal agreements between the business and the client, and failing to meet legal requirements can lead to financial or legal consequences. Understanding the key legal aspects of creating such documents is crucial for maintaining transparency and avoiding disputes.

Key Legal Aspects to Keep in Mind

- Tax Compliance: Ensure that the document includes the correct tax rates and that it complies with local tax laws. This may involve applying VAT, sales tax, or other applicable taxes based on the location of the business and client.

- Accurate Information: The document must accurately reflect the services rendered, including detailed descriptions, amounts, and payment terms. Inaccurate or incomplete details can lead to confusion and potential disputes.

- Payment Terms: Clearly outline payment terms, including due dates, late fees, and accepted methods of payment. These terms protect both parties by ensuring that expectations are clear from the outset.

- Record Keeping: Retaining a copy of all billing documents is essential for both legal compliance and future reference. Depending on local laws, businesses may be required to keep records for a set period of time for auditing purposes.

- Dispute Resolution: Consider including a clause specifying how disputes will be handled, whether through mediation, arbitration, or legal action. This ensures that both parties understand how issues will be addressed in the event of a disagreement.

Additional Legal Considerations

- Currency and Payment Methods: Specify the currency in which the payment is due and the accepted methods of payment (e.g., bank transfer, credit card). This helps avoid confusion, especially in international transactions.

- Late Payment Penalties: Clearly define any penalties or interest fees for overdue payments to encourage timely payments and protect the business’s cash flow.

Using Billing Document Formats for Business

In any business, maintaining professional and clear financial records is essential for managing transactions effectively. Utilizing standardized formats for billing documents can help streamline this process, ensuring that all details are accurately represented and easy to understand. These formats provide businesses with a structured way to communicate payment expectations, terms, and services rendered to clients.

Advantages of Using Standardized Billing Formats

- Consistency: A consistent format helps to build trust and credibility with clients. It ensures that every document follows the same structure, making it easier for both parties to process and understand the information.

- Time Efficiency: Using a ready-made structure saves time compared to creating each document from scratch. This allows businesses to focus more on core activities and improve productivity.

- Professional Appearance: A well-designed document reflects positively on the business, showcasing attention to detail and professionalism. This can enhance the company’s reputation with clients.

- Legal Compliance: Many formats include essential fields required by law, such as tax information and payment terms, helping businesses ensure compliance with local regulations.

How to Implement These Formats in Your Business

- Customization: Adapt the format to suit your specific needs by including your logo, contact details, and any other relevant information that reflects your business identity.

- Digital Tools: Use digital platforms to generate and manage these documents, allowing for easy updates and quick distribution via email or cloud storage.

- Consistency in Use: Make it a practice to always use the chosen format for all transactions to maintain uniformity and avoid confusion with clients.

How to Download and Edit Templates

Accessing and modifying ready-made document formats can significantly improve efficiency when creating important business records. These pre-designed structures allow for quick customization, ensuring that the necessary details are included without having to start from scratch. The process of downloading and editing these formats is simple and can be done using various tools, making it easy to maintain professionalism and accuracy in every transaction.

Steps to Download a Format

- Choose a Reliable Source: Look for trustworthy websites or platforms that offer high-quality and secure download options. Be sure to select one that aligns with your business needs and industry standards.

- Select the Format: Browse through available options and choose a structure that best suits your business style and requirements. Many platforms offer various designs, such as basic, modern, or more detailed formats.

- Download the File: After selecting the desired format, click the download link or button. Typically, these formats are available in PDF, Word, or Excel formats, depending on the platform.

How to Edit the Downloaded Document

Once you’ve downloaded the file, you can easily edit it to reflect the details specific to your transactions. Most tools allow you to modify text, add logos, or adjust the layout to suit your needs.

| Editing Tool | Steps |

|---|---|

| Word Processor (e.g., Microsoft Word) | Edit text fields, add company logo, adjust formatting, and save as a new file. |

| Spreadsheet Software (e.g., Microsoft Excel) | Update numbers, dates, and any financial information directly in the cells. Adjust columns and rows as needed. |

| PDF Editor | Directly edit text or use tools to add annotations. Many PDF editors also allow you to add images or adjust document layouts. |

Editing tools may vary depending on the format you downloaded, but they all provide straightforward options for personalizing the document to your business needs. Always ensure that the final document reflects the correct information before sharing or printing it for clients.

Integrating Invoices with Accounting Software

Efficient financial management often involves syncing transactional records with accounting systems. By integrating prepared transaction documents with accounting software, businesses can streamline their financial processes, ensuring that all records are accurately captured and reported. This integration reduces the risk of errors, improves productivity, and saves valuable time during the reconciliation process.

Benefits of Integration

- Automatic Data Entry: Eliminates the need for manual input by automatically transferring data from the document to the accounting system.

- Improved Accuracy: Reduces human errors in data entry, ensuring that financial records are consistent and precise.

- Faster Reconciliation: With real-time synchronization, businesses can quickly match transactions and balances without manual effort.

- Better Reporting: Integration allows for better tracking of financial performance, generating more accurate reports for decision-making.

How to Integrate

| Step | Description |

|---|---|

| Choose Compatible Software | Select an accounting system that supports integration with document tools. Look for software with features such as cloud-based sync or automated imports. |

| Set Up Integration | Follow the setup instructions to link your business’s transaction documents to the accounting system. This may involve connecting your software to specific templates or formats. |

| Test the Connection | Before full implementation, test the integration to ensure data is accurately transferred. Perform a few trial transactions and verify that all details match. |

| Monitor and Update Regularly | After successful integration, monitor the system regularly to ensure continued accuracy and update the software or connections as needed. |

By following these steps and ensuring a smooth integration process, businesses can significantly improve their financial workflows and enhance the overall efficiency of their accounting tasks.

How to Manage Multiple Transactions

Handling numerous financial exchanges efficiently is crucial for maintaining organized records and ensuring smooth operations. When dealing with multiple transactions, it’s essential to have a clear process for tracking, categorizing, and reconciling each one. By implementing strategic methods and utilizing the right tools, businesses can streamline their financial workflows, reduce errors, and stay on top of all payments.

To effectively manage multiple exchanges, consider the following approaches:

- Organize by Categories: Group transactions by type, date, or client to make it easier to track and review them. This allows for better organization and quicker retrieval of information when needed.

- Use Automation Tools: Take advantage of software that can automatically record and categorize transactions. This reduces the manual effort and minimizes the risk of mistakes.

- Set Clear Timelines: Establish a timeline for reviewing and reconciling each transaction. Regularly scheduled reviews will help ensure that nothing is overlooked and that any discrepancies are caught early.

- Maintain Consistency: Implement a standard process for documenting and processing each exchange. Consistent practices make it easier to manage and reference past transactions.

- Monitor Payments in Real-Time: Keep track of payments and receipts as they come in, instead of waiting until the end of a billing cycle. This will give you a clearer picture of cash flow and allow for prompt issue resolution.

By incorporating these techniques into your workflow, you can efficiently manage a high volume of exchanges while ensuring accuracy and organization in your financial records.