Free Printable Invoice Template for Microsoft Word

Running a business requires efficient ways to manage finances, and one of the most essential tasks is generating accurate and professional billing statements. Having a streamlined process for crafting these documents can save valuable time and help maintain a polished image when dealing with clients.

Utilizing ready-made formats for generating payment requests allows business owners to quickly adapt to different needs without having to start from scratch each time. These ready-made solutions can be customized to fit individual preferences while ensuring consistency across all financial communications.

Whether you’re just starting out or have an established business, using digital tools to craft detailed and clear financial documents is a smart move. With a variety of resources available, you can easily create documents that reflect your brand and provide clients with all the necessary information in a clean and professional manner.

Free Printable Invoice Template for Microsoft Word

When managing a business, keeping track of payments and ensuring smooth transactions with clients is vital. One of the most effective ways to achieve this is by using pre-designed formats to create detailed billing statements. These resources allow for quick customization and efficient processing of payments, saving time and ensuring professionalism in all communications.

Customizable Formats for Different Needs

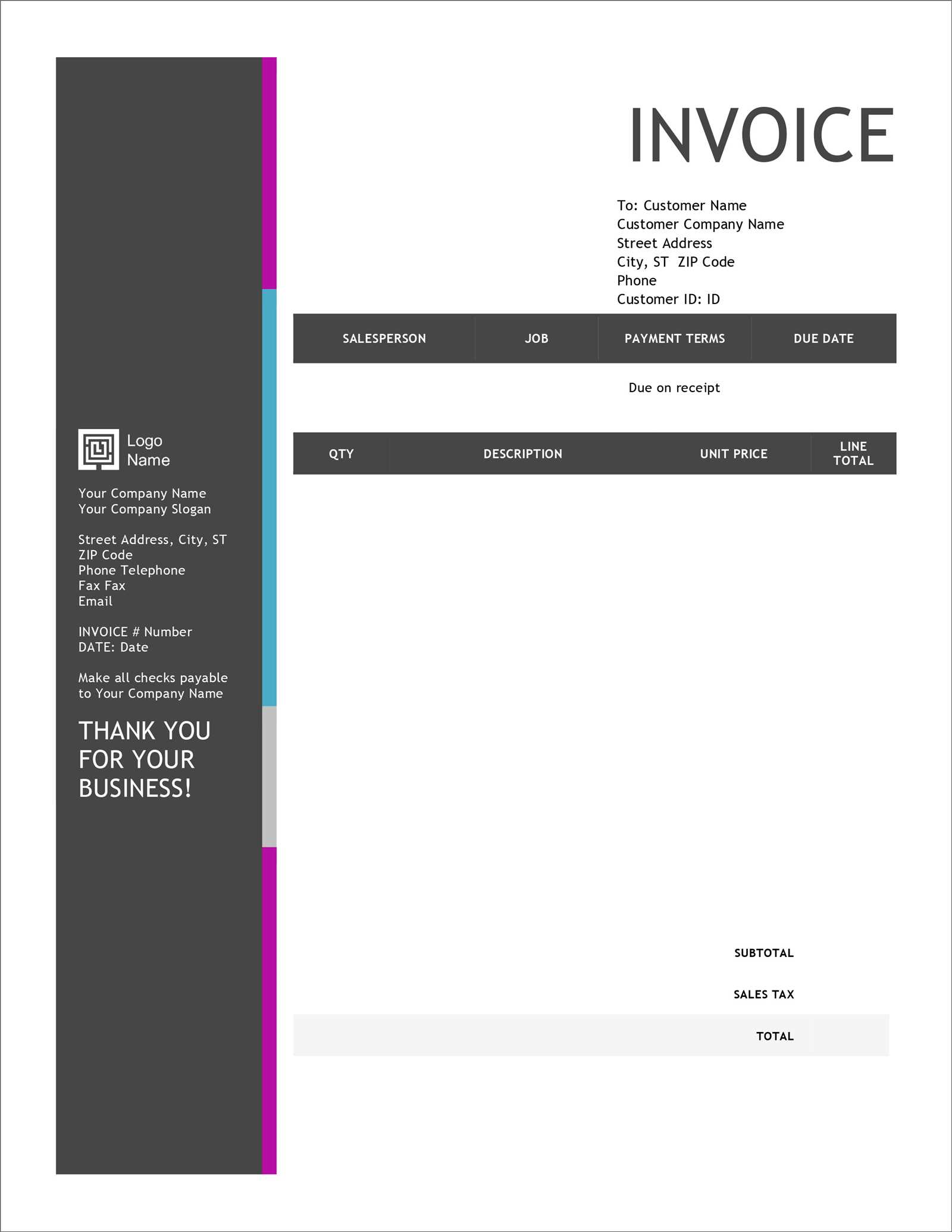

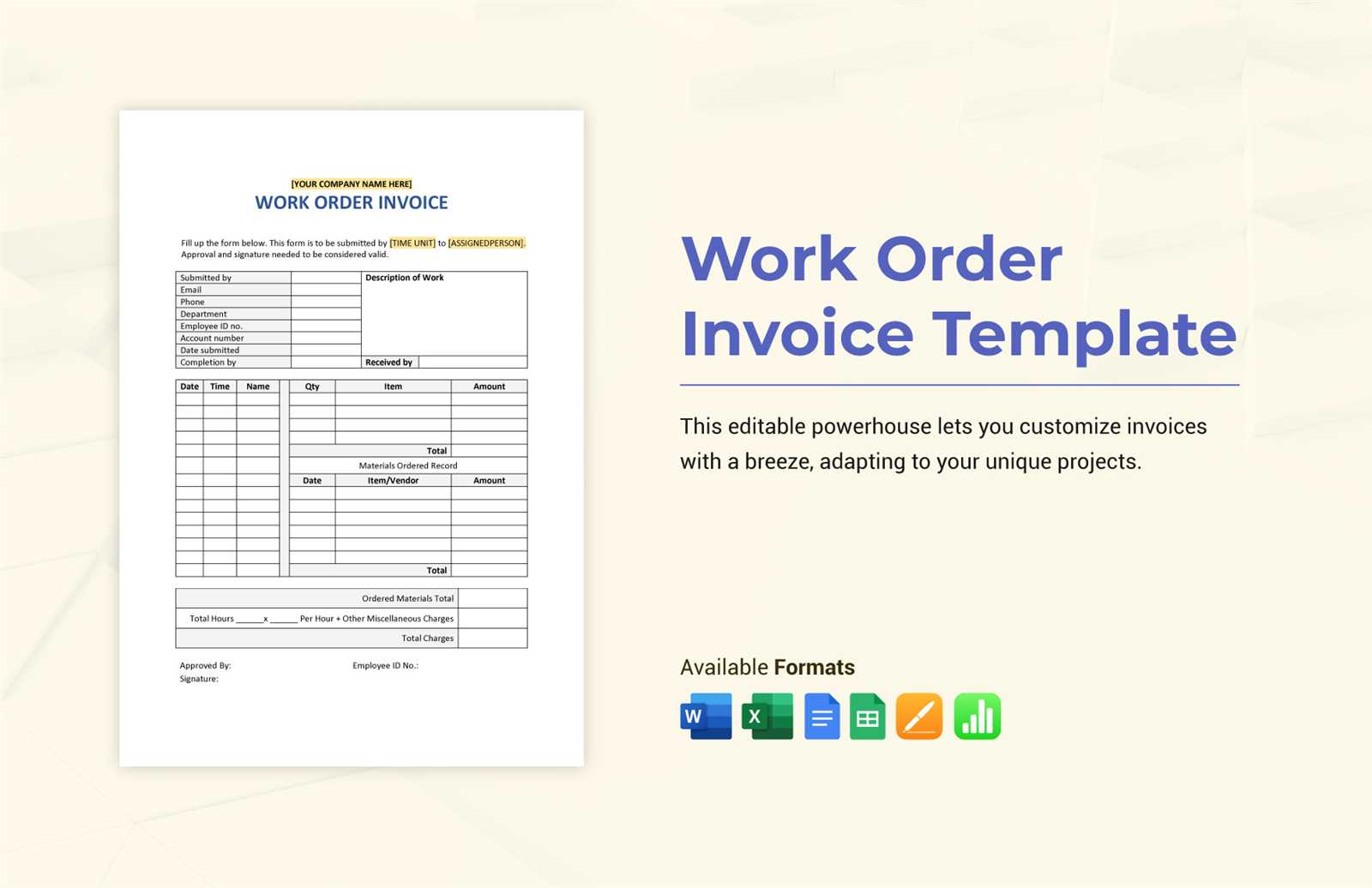

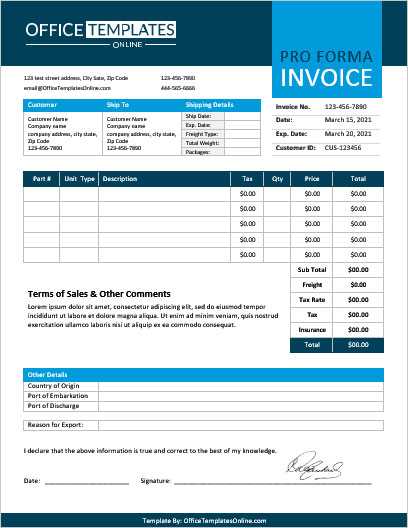

Having access to a well-structured document for generating billing requests is essential, especially when the needs of your business evolve. These formats allow for easy alterations, enabling you to include client details, itemized services, and payment instructions. Customizing the layout ensures that each document is tailored to specific transactions, reflecting your brand’s style and providing clients with a clear, professional request for payment.

Efficient Document Management

Managing multiple transactions can quickly become overwhelming, but using ready-made structures helps streamline the process. By organizing all your records within a consistent format, you ensure that every statement is clear and complete. Additionally, maintaining digital files makes it easy to track past transactions and manage your accounting more effectively.

Why Choose a Printable Invoice Template

Having a structured method to create payment requests is crucial for any business. Instead of starting from scratch, using ready-made solutions allows for a faster, more efficient process. These resources help ensure that all necessary information is included while maintaining consistency in your billing approach, which builds trust with clients.

Consistency and Professionalism

Using a pre-designed format ensures that each document you send out follows a consistent layout, which adds a level of professionalism to your business communications. A uniform style across all financial statements helps reinforce your brand identity and gives clients confidence in your organization.

Time Efficiency and Flexibility

With an established framework, you eliminate the need to design each document from scratch, saving valuable time. Moreover, these formats can be easily customized, giving you the flexibility to adjust elements based on specific transactions or client requirements, without losing the overall structure and clarity.

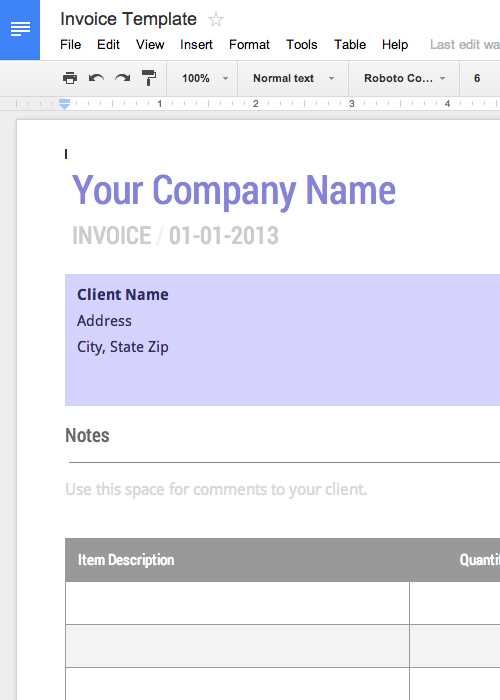

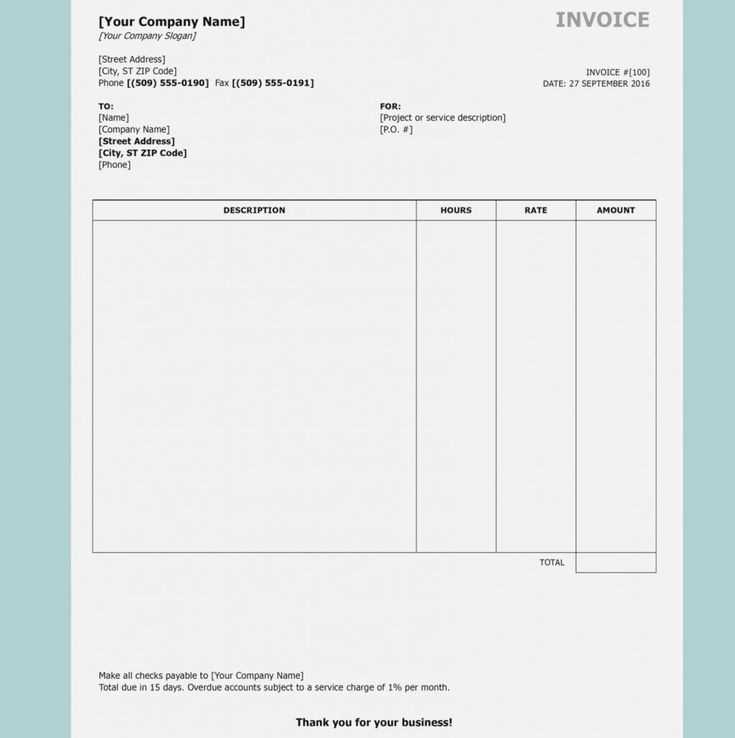

How to Use Invoice Templates in Word

Using a pre-designed structure for creating payment requests can simplify the process and ensure consistency in all your financial documents. These formats can be easily customized to fit your specific needs, allowing you to focus on the details while the layout remains professional and organized. Below is a simple guide on how to make the most of these resources.

Step-by-Step Guide

Follow these steps to effectively use these pre-designed formats in your document creation process:

| Step | Action |

|---|---|

| 1 | Open the document software and locate a pre-designed structure in the template section. |

| 2 | Select a layout that suits your business and transaction type. |

| 3 | Customize the fields for client details, service description, and pricing information. |

| 4 | Ensure payment terms and due dates are clearly stated. |

| 5 | Save the document and print or email it to your client. |

Customizing for Your Needs

Once you have selected a layout, you can further personalize it by adding your business logo, adjusting fonts, and modifying the color scheme. This flexibility allows you to create a document that represents your business identity while ensuring all important details are clearly presented for your clients.

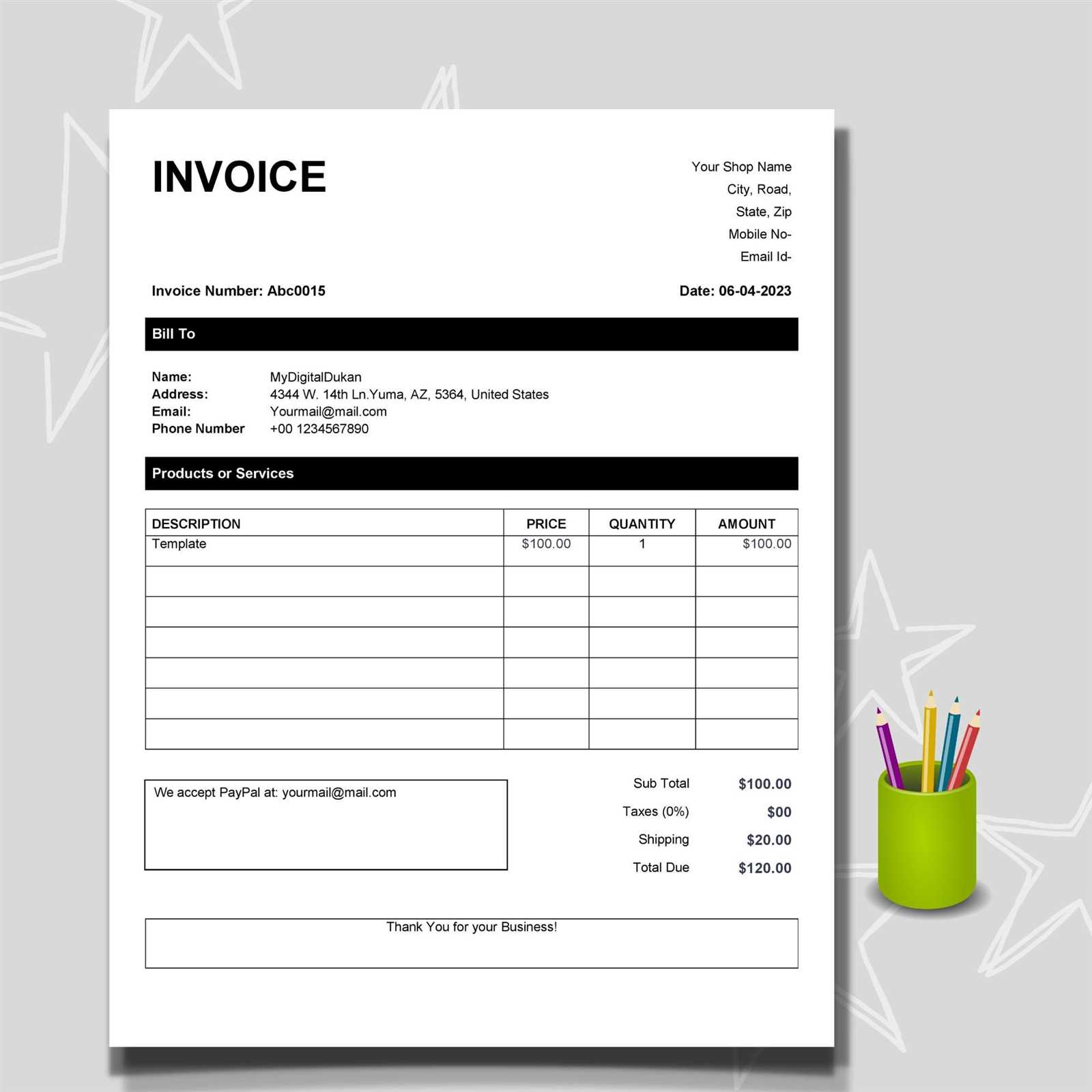

Benefits of Customizing Your Invoice

Personalizing your billing documents offers significant advantages for both your business and your clients. Customization allows you to better reflect your brand identity, present important details clearly, and maintain professionalism in all financial communications. Tailoring each document to suit the transaction ensures that all necessary information is included and easily understood.

Enhancing Brand Identity

Personalized designs enable your business to stand out. By incorporating your logo, colors, and other branding elements, you create a cohesive experience for clients that reinforces your company’s professional image. A customized document makes your business appear more credible and trustworthy.

Improving Clarity and Accuracy

When you customize your billing statements, you can ensure that all relevant details, such as payment terms, due dates, and service descriptions, are clearly presented. This reduces the risk of errors or misunderstandings, leading to smoother transactions and fewer follow-up queries from clients.

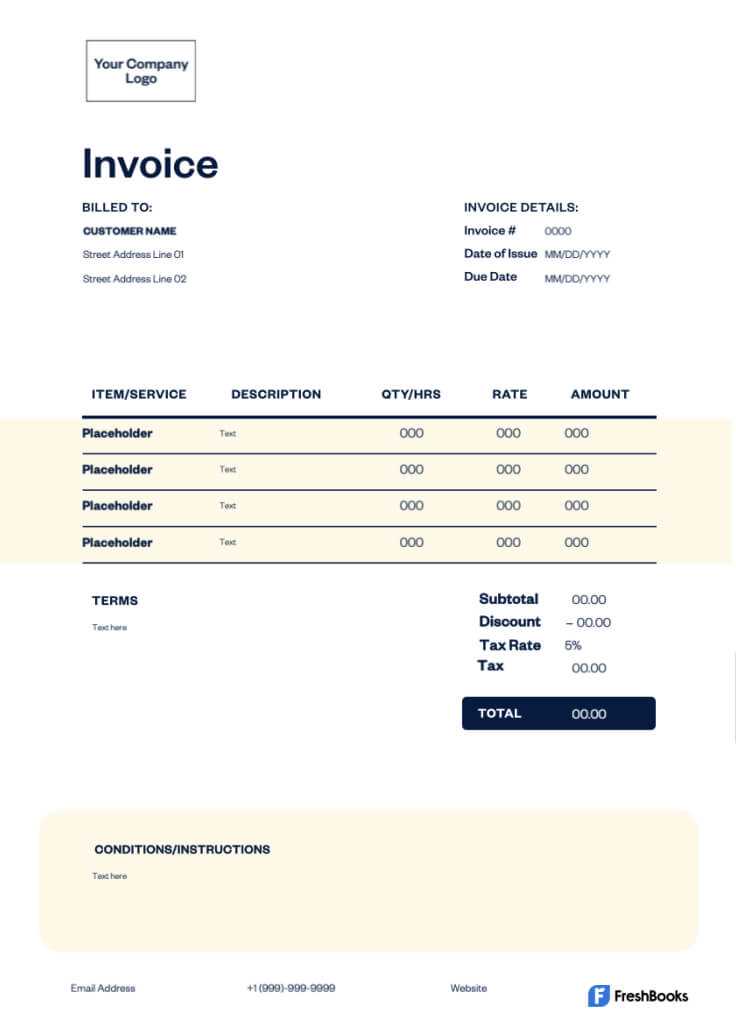

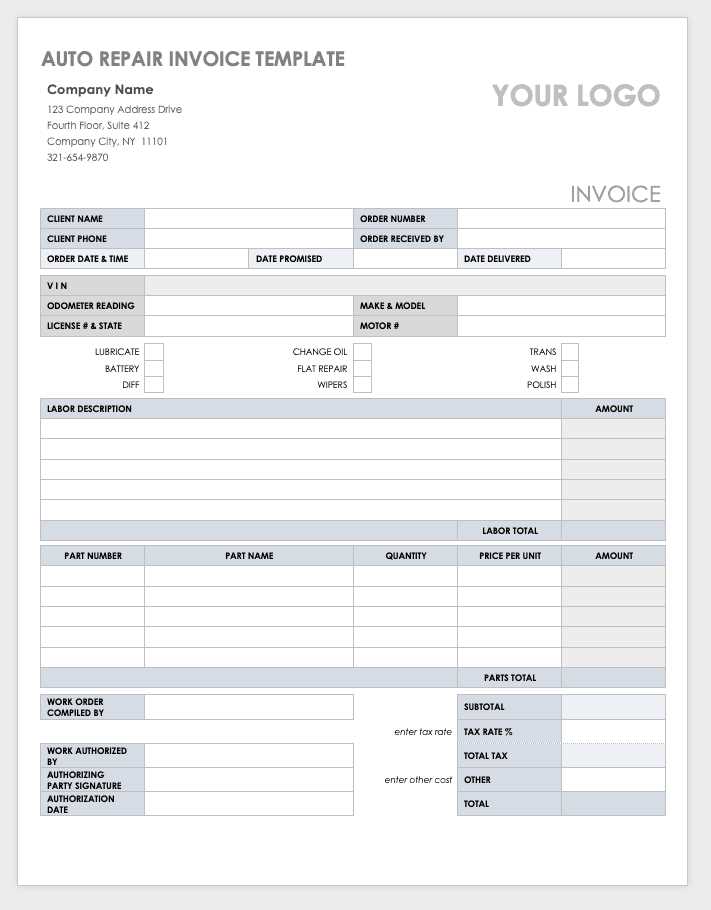

Essential Elements of a Professional Invoice

A well-structured billing document serves as an essential tool for maintaining clear communication between businesses and clients. It provides a record of transactions while ensuring that all relevant details are organized and easy to understand. By including the right elements, you can create a professional document that encourages timely payments and builds trust with your clients.

Key Components to Include

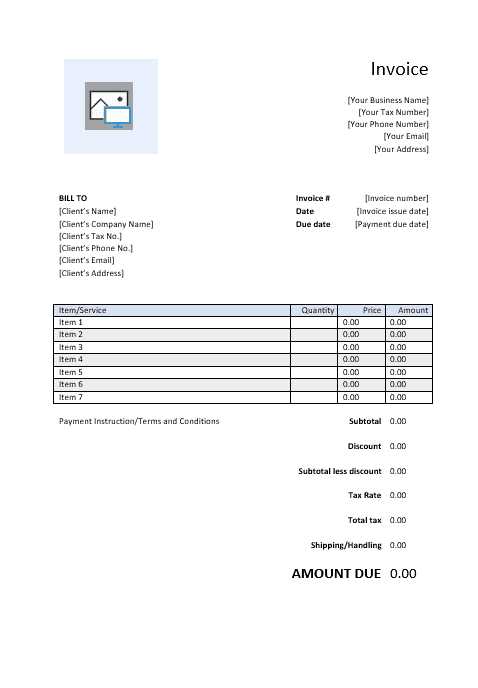

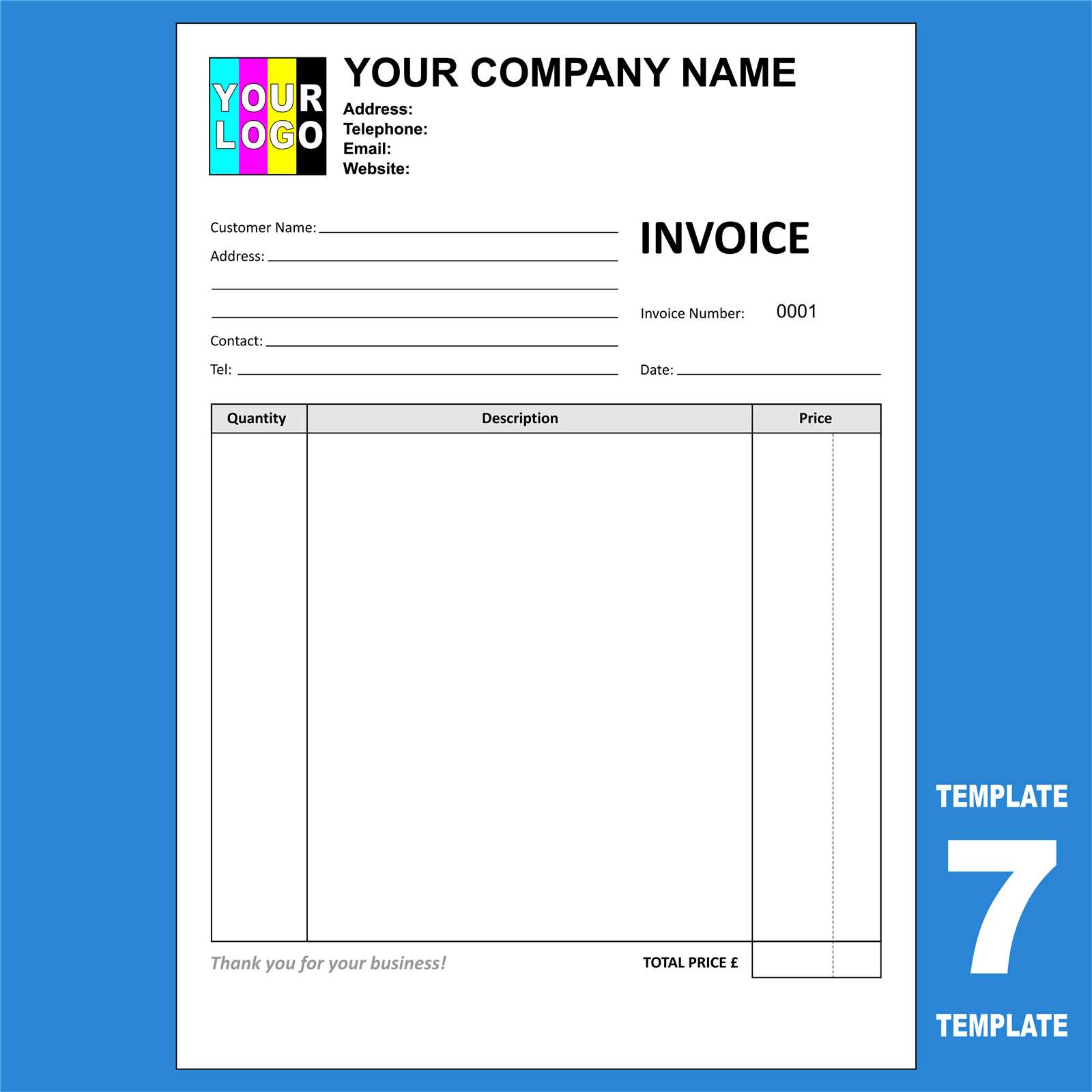

- Business Information: Include your company name, address, contact details, and logo to ensure clients know exactly who the document is from.

- Client Details: Make sure to include the client’s name, address, and any relevant contact information.

- Unique Reference Number: Assign a distinct identifier for each transaction to maintain proper records and make it easier to track payments.

- Itemized List of Services or Products: Clearly detail the goods or services provided, including quantities and prices to avoid confusion.

- Payment Terms: Specify due dates, late fees, and accepted payment methods to set expectations and avoid disputes.

Additional Information for Clarity

- Tax Details: Include any applicable taxes, such as sales tax or VAT, along with the total amount due.

- Notes or Special Instructions: Add any additional information that may be relevant to the client, such as warranty information or terms of service.

Step-by-Step Guide to Creating Invoices

Creating a professional billing document involves several key steps to ensure accuracy and clarity. By following a structured approach, you can quickly generate documents that are both easy to understand and reflect your business’s professionalism. The following guide will take you through the process, from start to finish, ensuring that all necessary details are included.

Detailed Process Overview

To begin, gather all the necessary information, such as the client’s details, list of services or products, and payment terms. Once you have everything, follow the steps outlined below to create a clear and organized document.

| Step | Action |

|---|---|

| 1 | Open your document editor and choose a layout that suits your business needs. |

| 2 | Add your company’s details, including name, address, and contact information. |

| 3 | Enter the client’s details, ensuring accuracy in their name and address. |

| 4 | List all goods or services provided, including descriptions, quantities, and prices. |

| 5 | Include the total amount due, taxes (if applicable), and payment terms (due date, method of payment). |

| 6 | Review the document for any errors or missing details, then save or print the document. |

Ensuring Accuracy and Professionalism

Double-checking your document for clarity and correctness is crucial before sending it to clients. A well-organized and error-free document not only helps prevent misunderstandings but also promotes a professional image, ensuring smoother transactions and timely payments.

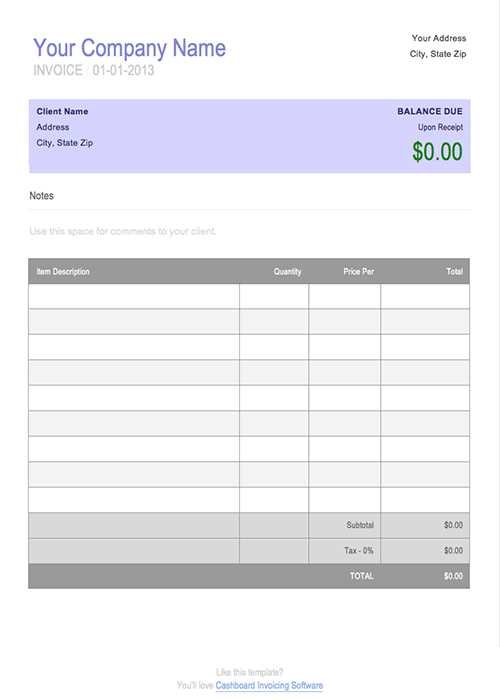

Design Tips for Your Invoice Template

Creating visually appealing and easy-to-read financial documents is essential for maintaining professionalism and ensuring that clients clearly understand the details of the transaction. A well-designed billing statement not only reflects your business identity but also helps to create a positive impression that encourages timely payments. Here are some key design tips to enhance your billing documents.

Focus on Clarity and Simplicity

A clean and organized layout makes it easier for clients to quickly find the information they need. Keep the design simple, with enough white space to prevent the document from feeling cluttered. Ensure that important details, such as total amounts, due dates, and itemized services, are prominently displayed and easy to read.

Use Consistent Branding Elements

Incorporating your brand’s logo, color scheme, and fonts into your document helps reinforce your business identity and adds a touch of professionalism. However, it’s important to strike a balance–avoid overusing graphics or design elements that could distract from the core information of the document. A well-branded, streamlined layout will leave a lasting impression while keeping the focus on the transaction.

How to Add Business Branding to Invoices

Integrating your company’s branding into financial documents is an effective way to reinforce your professional identity. It ensures that your clients not only recognize the source of the document but also perceive your business as organized and trustworthy. By adding distinct brand elements, such as logos, colors, and fonts, you create a consistent and memorable experience for your clients.

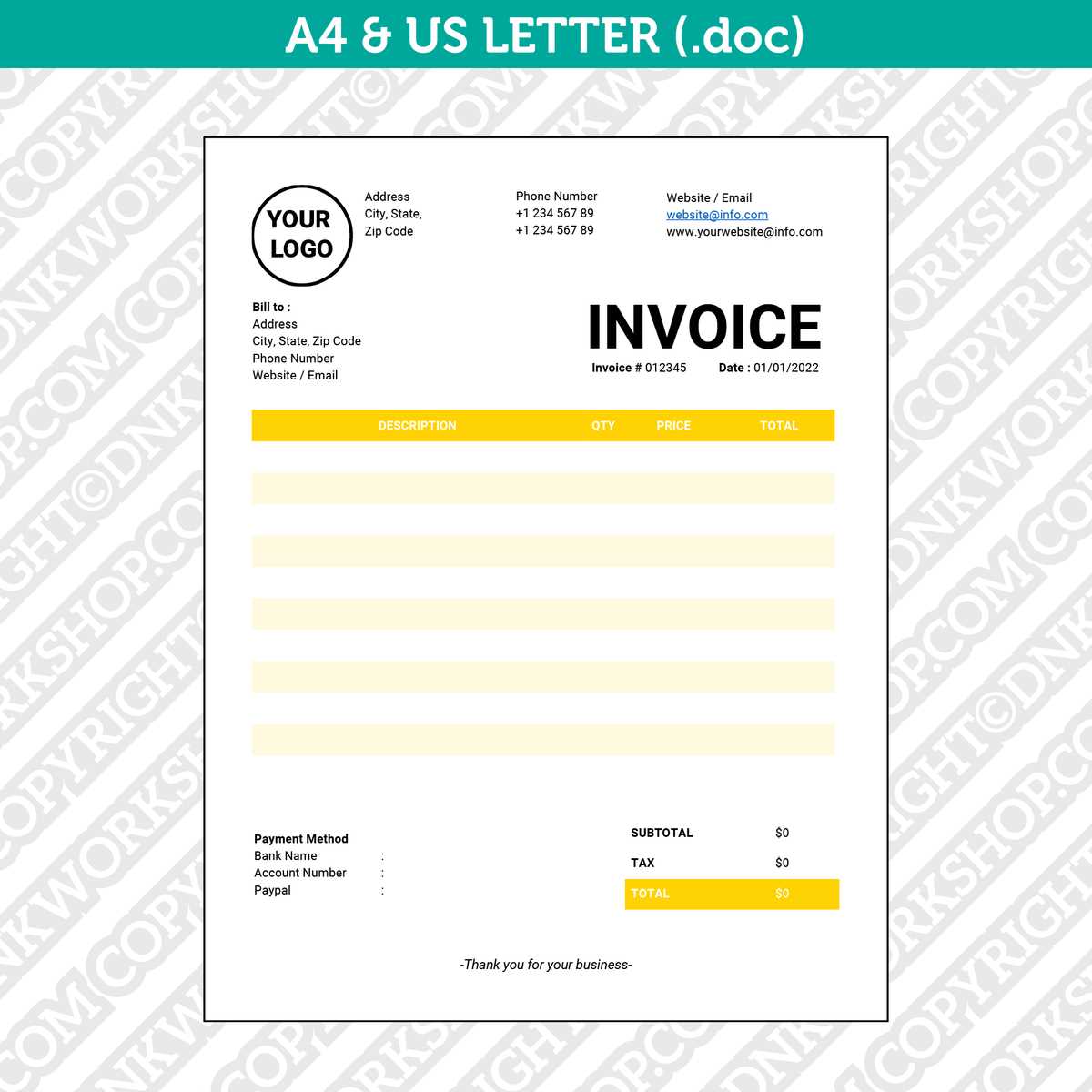

Incorporating Your Logo

Your logo is a key visual element that should be prominently displayed on all business communications. Place it at the top of the document, either in the header or as part of your company details, so it’s visible and reinforces your brand’s presence. This helps clients immediately recognize your business and adds a polished touch to your documents.

Choosing Brand Colors and Fonts

Color consistency is essential for creating a cohesive brand image. Use your brand’s color palette for headings, borders, or background accents to give your document a professional, unified look. Additionally, choose brand-approved fonts for text, ensuring that they are legible and easy to read while reflecting your brand’s personality.

Top Features of a Good Invoice Template

A well-constructed billing document is essential for maintaining smooth business operations. It should not only contain all the necessary information but also be easy to understand and visually appealing. The following features are crucial for creating a document that serves its purpose efficiently while leaving a professional impression on clients.

Clear and Organized Layout

One of the most important aspects of a professional document is a clean layout. The design should make it easy for clients to find key details such as the total amount due, itemized charges, and payment terms. A well-organized structure reduces the risk of confusion and ensures that all necessary information is readily accessible.

Customizable Fields

Customizable sections allow businesses to tailor documents to specific transactions. This flexibility ensures that each document meets the unique needs of the client and the services provided. Being able to adjust fields such as product descriptions, quantities, and prices makes the document versatile and adaptable to various situations.

Professional Appearance

Incorporating brand elements like logos, colors, and consistent fonts can significantly enhance the professionalism of the document. A polished look not only strengthens brand identity but also conveys a sense of credibility and trustworthiness to clients.

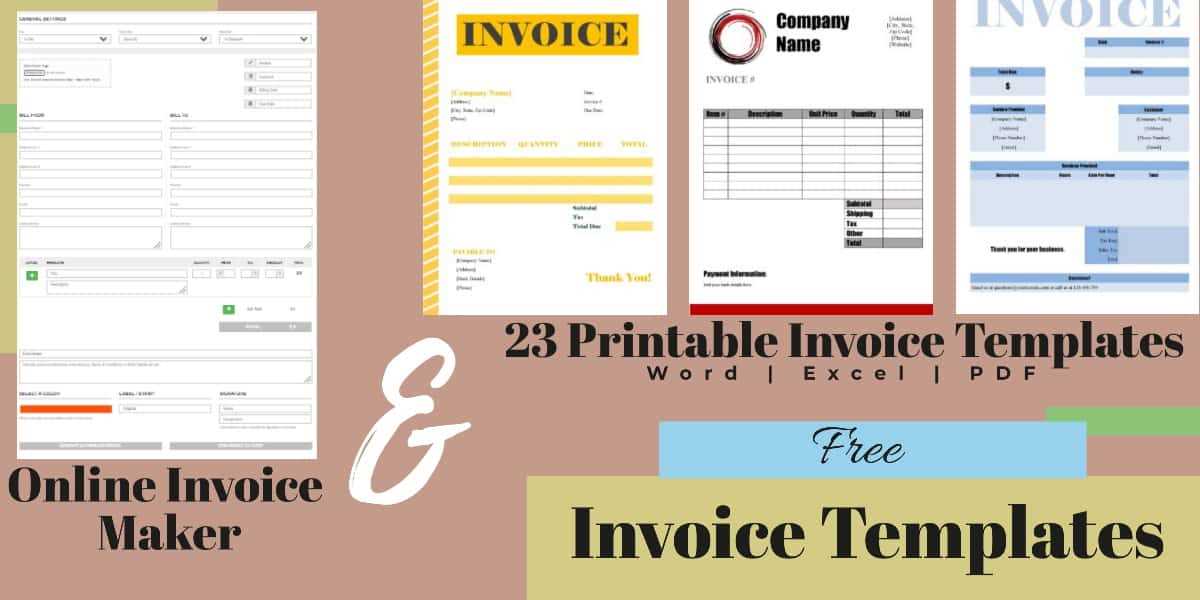

Free vs Paid Invoice Templates Comparison

When choosing a document format for billing purposes, businesses often face the decision of whether to opt for a no-cost or a premium option. Both types offer distinct advantages and limitations, depending on the specific needs of the business. Understanding the differences can help you make an informed choice about which solution is best suited to your requirements.

Cost and Accessibility

The most obvious distinction between free and paid solutions is the cost. Free options are easily accessible and can be downloaded or used instantly, making them an attractive choice for small businesses or startups with limited budgets. However, while these options may provide basic functionality, they often lack advanced features that businesses may need as they grow.

Features and Customization

Paid solutions typically offer more advanced features and greater flexibility for customization. These documents often include pre-set professional designs, the ability to integrate with accounting software, and additional fields for taxes, discounts, and other special services. On the other hand, free alternatives may be simpler, with fewer options for adjustments or complex needs.

Support and Updates

Paid solutions often come with dedicated customer support, ensuring any issues can be addressed quickly and effectively. Additionally, premium options are regularly updated with new features and improvements, keeping them in line with industry standards. Free versions, however, may lack ongoing support and updates, potentially leaving you with outdated or limited functionality.

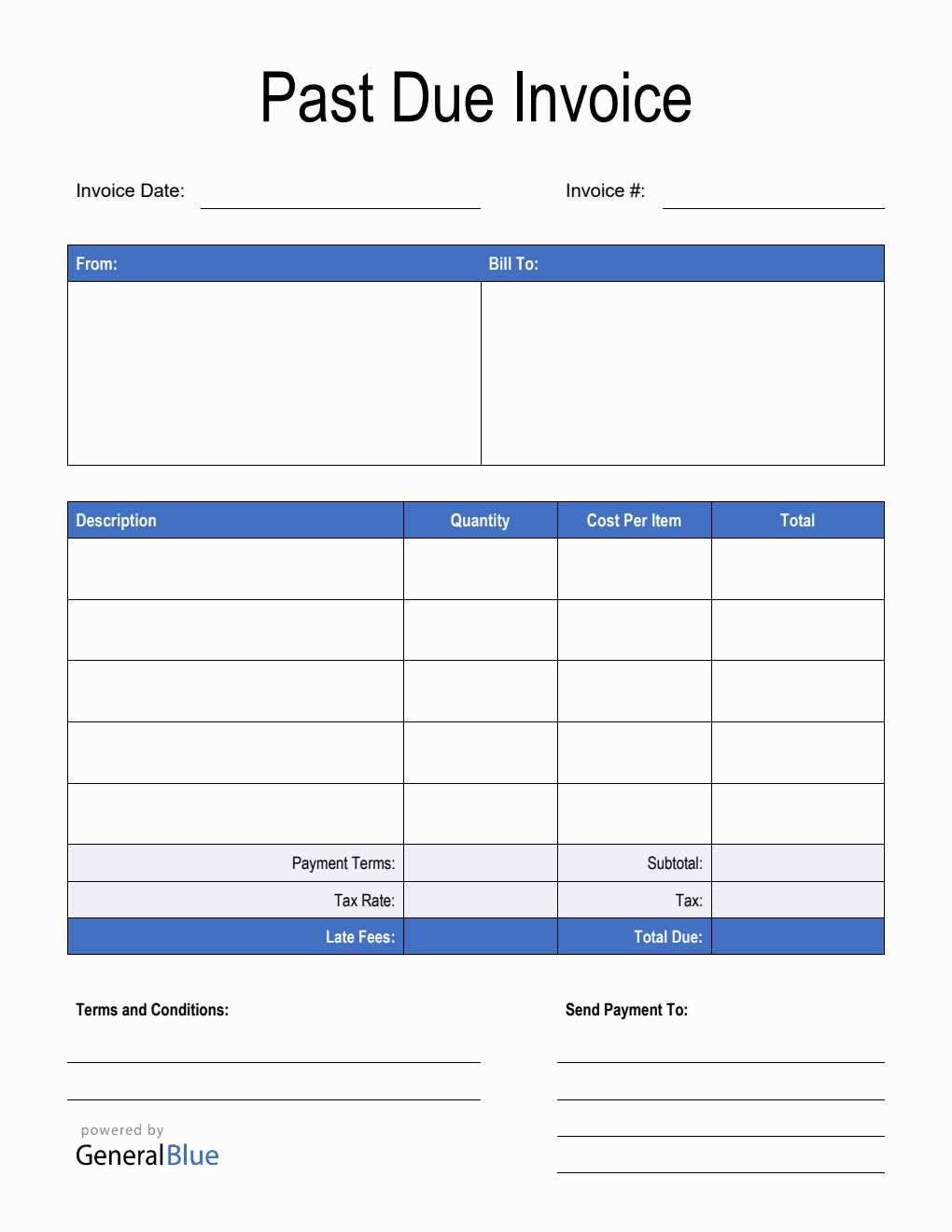

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for maintaining smooth transactions with clients. However, even minor errors can lead to confusion, delays in payments, or damage to your business’s reputation. To avoid these pitfalls, it’s important to be aware of the most common mistakes and take steps to prevent them.

Missing or Incorrect Contact Information

One of the most frequent errors is failing to include or incorrectly listing contact details. Always ensure that your business’s name, address, phone number, and email are clearly visible, as well as the recipient’s information. This helps avoid any confusion about who the bill is for and ensures that your client can reach out to you if needed.

Unclear Payment Terms

Another common mistake is not clearly stating payment terms. Be sure to specify the due date, late fees (if any), and the preferred payment methods. Without this clarity, clients may delay payments or misunderstand when the amount is due, which can disrupt your cash flow.

How to Save Time with Templates

Using pre-designed structures for your business documents can significantly reduce the time spent on repetitive tasks. Instead of starting from scratch with each new document, these ready-made solutions allow you to quickly fill in the necessary information. This streamlined approach not only saves time but also ensures consistency across all your business communications.

Streamlined Data Entry

When you have a structure in place, you only need to input the specific details for each transaction. This process is far quicker than manually creating a document every time. Here are a few ways using a pre-structured solution can help:

- Pre-filled fields for business information like your company name, logo, and contact details.

- Automatic calculations for totals and taxes, reducing the chance of errors.

- Consistent formatting that requires minimal adjustments.

Reduce Errors and Improve Accuracy

By using a standardized structure, you can reduce the likelihood of mistakes such as forgetting to include vital details or miscalculating totals. When all the necessary fields are pre-designed, all you need to do is update the relevant information, ensuring greater consistency and accuracy across your documents.

Best Practices for Invoice Numbering

Properly numbering your billing documents is a crucial aspect of maintaining order and clarity in your accounting processes. A well-structured numbering system not only helps you keep track of transactions but also ensures compliance with legal and tax regulations. Establishing a clear, sequential numbering system can help prevent confusion and minimize errors in your financial records.

Sequential Numbering

Always use a sequential numbering system. This method ensures that each document has a unique identifier and that your records are in chronological order. Sequential numbering is easy to follow and is particularly useful for accounting purposes. Here’s an example of how a typical sequence might look:

| Document Number | Date Issued |

|---|---|

| 000001 | 2024-11-01 |

| 000002 | 2024-11-05 |

| 000003 | 2024-11-10 |

Use a Prefix or Suffix for Categorization

To make the numbering system even more organized, consider adding a prefix or suffix to denote specific categories, departments, or clients. For example, you could use “SAL” for sales-related documents or “CONS” for consulting projects. This additional layer of categorization can further streamline your record-keeping and make it easier to identify related transactions.

Including Payment Terms on Invoices

Clearly stating payment expectations on your business documents is essential for maintaining smooth financial operations. Payment terms provide both the buyer and seller with clear guidelines on when and how payments are due. By specifying these details upfront, you can help ensure timely payments and avoid misunderstandings.

Key Elements of Payment Terms

When outlining the terms for payment, there are several key elements to include. These details can vary depending on your business needs, but common elements often include:

| Term | Description |

|---|---|

| Due Date | The date by which payment must be made, typically set within 30 days of the transaction. |

| Late Fees | Any additional charges that apply if payment is not received by the due date. |

| Early Payment Discount | Discount offered for payments made before the due date to encourage early settlement. |

Examples of Payment Terms

Here are some common phrases and structures used to specify payment terms:

- Net 30: Payment is due within 30 days from the issue date.

- Due on Receipt: Payment is due immediately upon receipt of the document.

- 2/10 Net 30: A 2% discount is offered if payment is made within 10 days; otherwise, the full amount is due within 30 days.

By including clear payment terms on each document, you can establish clear expectations and encourage prompt settlement, ensuring that your cash flow remains steady.

How to Share Invoices with Clients

Effectively delivering financial documents to clients is an important step in ensuring smooth transactions and clear communication. Whether you are working with individual clients or large organizations, choosing the right method to share these documents is essential for maintaining professionalism and encouraging timely payments. Different methods offer varying levels of convenience, security, and formality, depending on the client’s preferences and your business needs.

Email Delivery

One of the most common and efficient ways to send financial documents is through email. This method is quick, cost-effective, and allows for easy tracking of when the document was sent. When using email to send a document, consider the following tips:

- Use a professional subject line: Ensure the email clearly indicates that it contains important payment details. For example, “Invoice for [Service/Product] – Due Date [Date]”.

- Attach a PDF: Save the document as a PDF to ensure that the format is preserved across different devices and to prevent any accidental editing.

- Include a personal message: A brief, friendly message can reinforce professionalism and remind the client of the payment deadline.

Using Online Payment Platforms

For more automated and secure transactions, online payment platforms often allow businesses to send financial documents directly through their interface. These platforms usually offer additional features like tracking and reminders. Some popular options include PayPal, Stripe, or dedicated invoicing services. Benefits of using these platforms include:

- Instant delivery: Documents are sent directly through the platform, allowing for instant confirmation of receipt.

- Payment integration: Clients can easily view the details and make payments directly from the same platform.

- Automated reminders: Many platforms send out automated reminders to clients as the payment due date approaches, ensuring timely payments.

Whichever method you choose, ensure that the client has a clear understanding of how to access the financial document and any instructions for making payment. Properly sharing documents not only improves cash flow but also strengthens the professional relationship between you and your clients.

Printing Invoices for Small Businesses

For small businesses, printing financial documents can be just as important as sending them electronically. Physical copies can be used for record-keeping, client meetings, or situations where digital methods are not suitable. The process of preparing printed documents requires careful attention to detail to maintain professionalism and accuracy. Whether you are printing a few documents or handling larger volumes, understanding the steps and tools available can save time and prevent costly mistakes.

Choosing the Right Printing Method

When printing business documents, selecting the appropriate printing method depends on your volume and quality requirements. Here are some common options:

- Home Printer: Ideal for low-volume printing. Most small businesses use home or office printers for small batches. Ensure your printer can handle high-quality prints to maintain a professional appearance.

- Commercial Printing Services: If you need to print large quantities of documents or require a higher quality finish (e.g., glossy paper or embossed logos), commercial services may be the best option. These services often provide bulk discounts and professional-grade printing.

- Laser Printers: Great for high-volume printing. Laser printers offer faster printing speeds and are more cost-effective for large quantities compared to inkjet printers.

Key Considerations for Printing Documents

When preparing to print, it is essential to ensure that your document appears professional and meets all necessary formatting standards. Here are some key factors to consider:

- Paper Quality: Use high-quality paper that reflects your brand’s image. Thicker, high-quality paper gives a more professional appearance and is less likely to tear or smudge.

- Margins and Alignment: Ensure that all text, logos, and other elements are properly aligned and have adequate margins. This prevents content from being cut off when printed.

- Proofreading: Always double-check your documents for errors before printing. Typos, incorrect figures, or missing information can harm your business’s credibility.

- Environmental Impact: Consider eco-friendly options, such as recycled paper, to reduce your business’s environmental footprint.

By carefully selecting the right printing method and ensuring high-quality output, small businesses can present themselves professionally, even when using traditional print for financial documentation.

Maintaining Invoice Records for Taxes

For businesses, proper record-keeping is essential not only for tracking transactions but also for complying with tax laws. Maintaining organized records of all financial exchanges helps ensure that taxes are filed correctly and on time. Failure to keep accurate records can lead to costly errors, missed deductions, or even audits. By establishing a systematic approach to storing and managing these records, businesses can simplify their tax preparation and avoid potential legal issues.

Why Accurate Records Matter

Maintaining detailed and accurate financial records is crucial for several reasons:

- Tax Compliance: Properly recorded transactions ensure compliance with tax regulations, helping businesses avoid penalties for incomplete or inaccurate filings.

- Deductions and Credits: Detailed records make it easier to identify eligible deductions and credits, potentially lowering tax liabilities.

- Audit Preparedness: In the event of an audit, well-maintained records can provide evidence to support your claims, reducing the risk of penalties or fines.

Best Practices for Managing Records

To keep track of financial documentation efficiently, businesses should adopt the following best practices:

- Organize by Date: Keep records in chronological order. This makes it easier to track payments, expenses, and income over a given period.

- Separate Business and Personal Finances: Maintain separate accounts for business transactions to avoid confusion and simplify the record-keeping process.

- Use Digital Tools: Consider using accounting software to store and organize records. Many software tools offer features like automatic categorization and easy access to historical data, which can streamline tax preparation.

- Store Supporting Documents: Keep all receipts, contracts, and other documents that support your financial records. These can be useful if you need to verify information for tax purposes.

- Review Regularly: Schedule regular reviews of your records to ensure that everything is up-to-date and accurate. This can help prevent errors before they become major issues.

By following these practices and maintaining comprehensive records, businesses can ensure smoother tax filing processes a

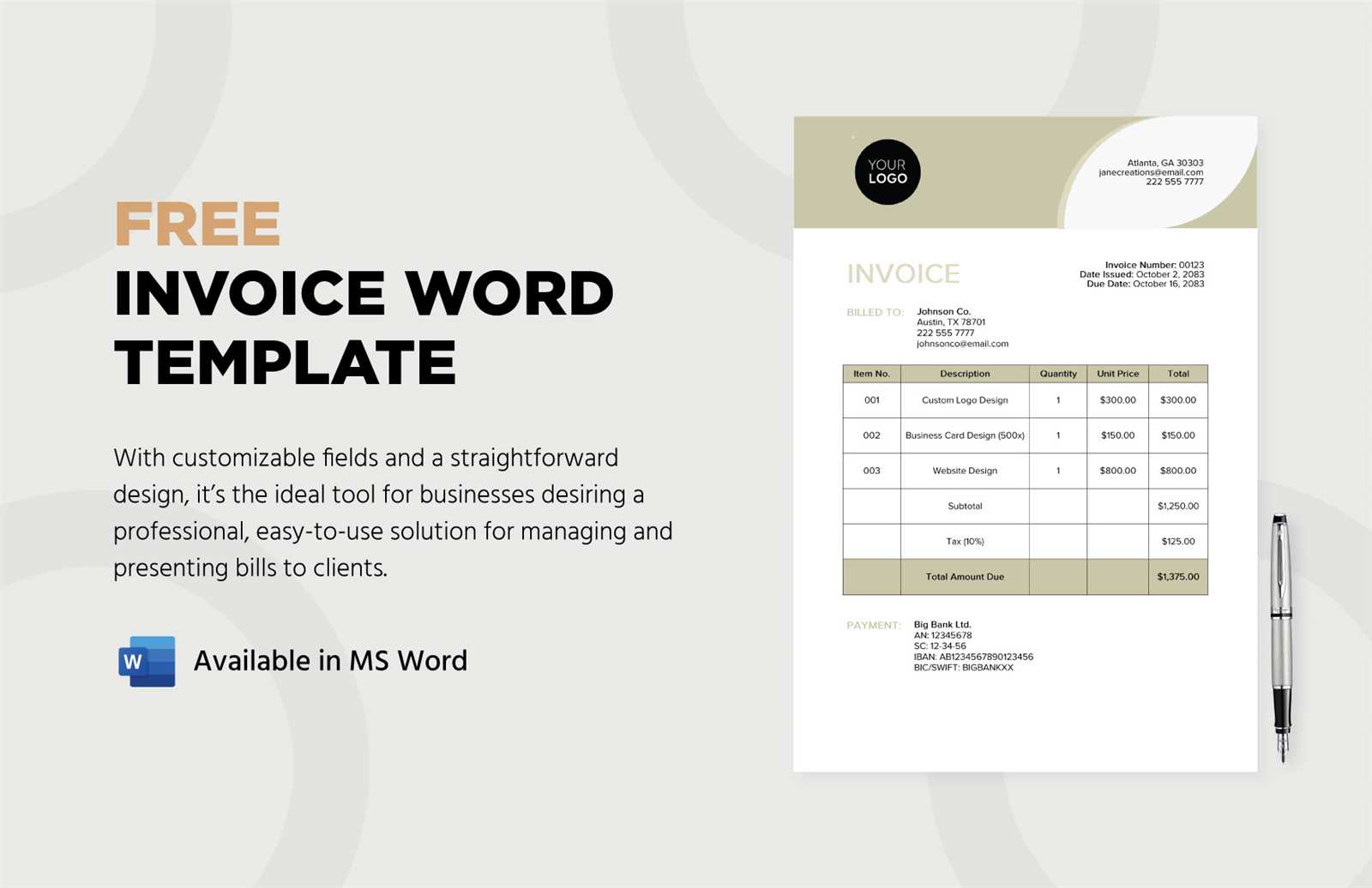

Free Resources for Invoice Templates

For businesses looking to streamline their billing process, there are numerous online platforms offering tools that can simplify document creation without incurring additional costs. These resources provide customizable layouts that can be easily adapted to suit various business needs. Whether you’re an entrepreneur, freelancer, or small business owner, these platforms offer an efficient solution for generating professional documents with minimal effort.

Many of these platforms not only provide editable documents but also feature a variety of designs, allowing users to select a style that matches their branding. Additionally, these resources are typically user-friendly, offering quick access to documents and reducing the need for advanced software. By utilizing these tools, businesses can save time while maintaining a high standard of professionalism in their transactions.