How to Customize Xero Invoice Template Fields for Effective Invoicing

Creating effective business forms is essential for streamlining transactions and ensuring clear communication with clients. Customizing these forms allows you to reflect your brand identity, organize information efficiently, and simplify financial interactions. With the right adjustments, every document you share can be both professional and easy to understand.

Learning how to personalize different sections of your forms can significantly enhance readability and functionality. From adjusting data sections to incorporating brand elements, these changes ensure that each document aligns with your business needs. Making thoughtful adjustments will not only improve client experience but also save time by minimizing confusion and follow-up questions.

In this guide, you’ll discover practical steps to customize your business forms, helping you optimize their layout, content, and style. These tips will empower you to craft documents that meet both your professional standards and your clients’ expectations, resulting in more efficient processes and better financial transparency.

Mastering Form Customization for Business Documentation

Adjusting business documentation to align with specific needs is a key step toward presenting clear and professional records. Customizing the structure and layout of essential documents enhances clarity, reinforces brand identity, and enables smoother transactions with clients. Thoughtful personalization of these documents can make them more effective and visually appealing, facilitating better communication and understanding.

Adapting Layout and Design for Clarity

By refining the layout and design, you can highlight important information and make each section of the document intuitive to read. This includes arranging sections logically and using headers, itemized lists, and color choices that fit your brand. A clear, well-organized design ensures that details stand out, helping your clients quickly grasp key information without confusion. Structuring the document thoughtfully reduces errors and creates a polished, professional impression.

Incorporating Essential Data Points

Choosing which data points to include is crucial to achieving balance in detail and conciseness. Adding only the necessary data for client understanding streamlines your documentation

Understanding Key Components in Business Billing Documents

Each section of a billing document serves a specific purpose, ensuring clear communication and efficient financial transactions. By identifying essential components, you can create documents that are both informative and easy to navigate for clients. A well-organized document supports a seamless exchange, minimizing the chance of misunderstandings and providing clarity on important details.

Essential Information to Include

Including the right elements is crucial to making these documents effective. Below are some critical components to consider:

- Client Details: Adding clear information about the client, such as their name, address, and contact information, helps personalize the document and ensure it reaches the correct person.

- Transaction Summary: A concise overview of the services or products involved in the transaction gives clients a quick understanding of the billed items.

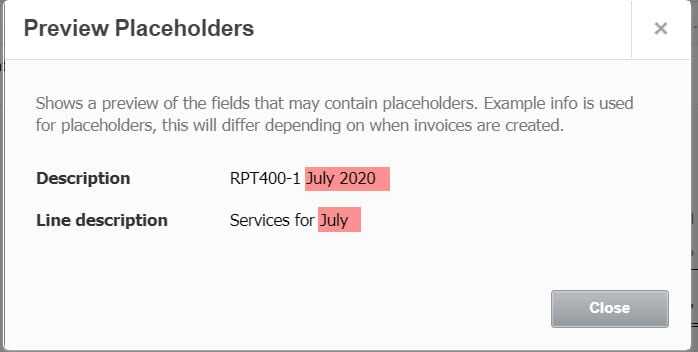

- Identify Required Information: Determine what additional details will benefit your documents, such as unique product codes, project timelines, or client-specific notes.

- Create Clear Labels: Use labels that describe the purpose of each new section clearly. This helps clients and team members understand what information each section provides.

- Organize Placement Logically: Position custom sections in areas that make sense within the overall layout. For example, add project timelines near service des

How to Edit Business Document Layouts for Customization

Adjusting the structure of your business documents allows you to create a format that better serves your company’s needs and aligns with your brand. Making edits to these layouts gives you flexibility in organizing information, improving readability, and ensuring all necessary details are clearly presented. With a few straightforward adjustments, you can design a more professional and effective document for client interactions.

Steps for Adjusting Document Layouts

To customize your document layouts, follow these steps to achieve a clean and organized format:

Step Description 1. Choose a Layout Select a layout that suits the nature of your services or products, ensuring it highlights the most relevant information for clients. 2. Modify Sections Organize and adjust existing sections or add Essential Fields for Professional Invoices

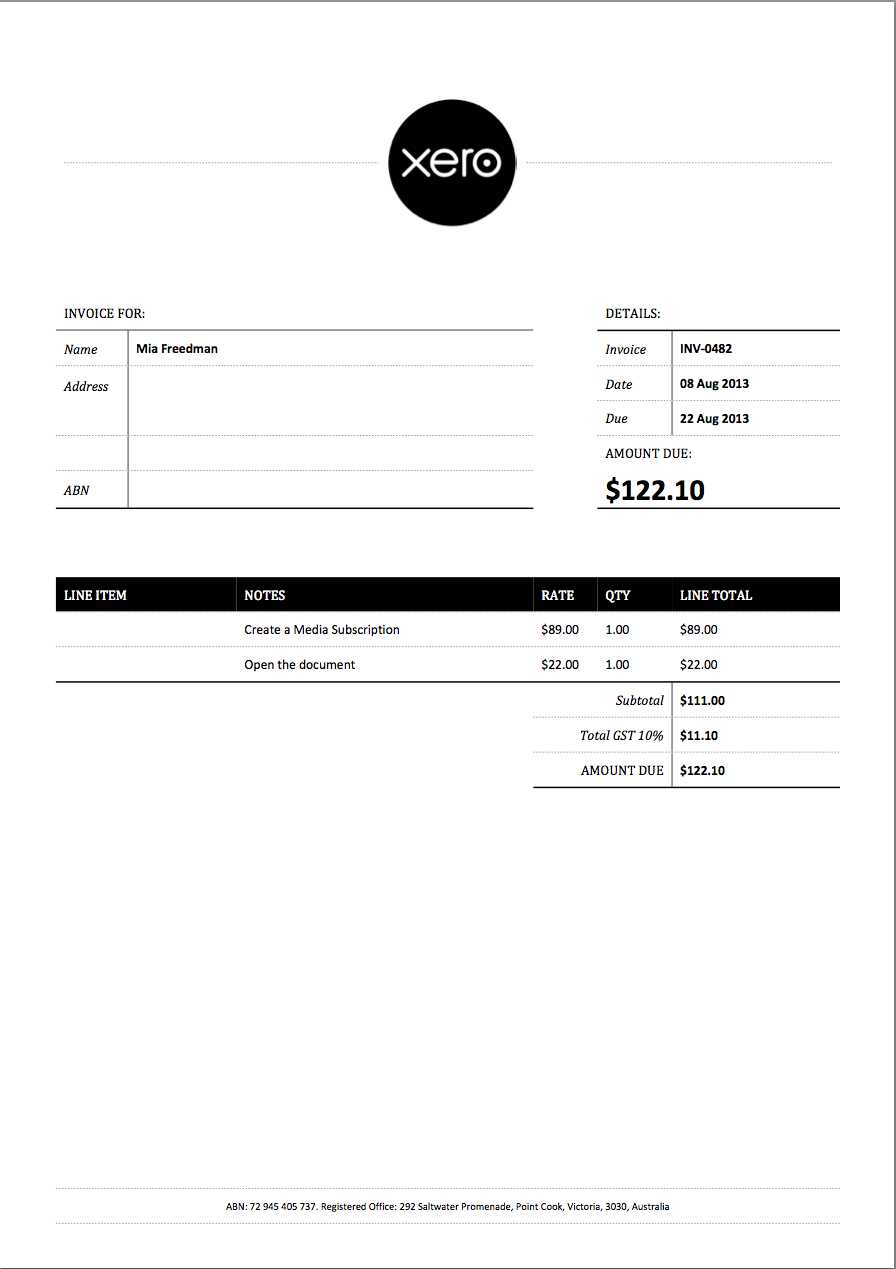

Creating a well-structured billing document is vital for establishing credibility and ensuring clear communication between businesses and clients. Each component within this document should serve to provide transparency, itemize services or products effectively, and clearly communicate payment terms. Including essential sections not only maintains a professional appearance but also minimizes the chances of misunderstandings regarding payments.

Below are some of the most important components to include in a billing document to enhance professionalism:

Business and Client Information

Clearly display details for both your business and the client, including names, addresses, and contact numbers. This information personalizes the document and confirms the accuracy of recipient details, ensuring it reaches the intended party.

Detailed List of Services or Products

Provide a breakdown of each service or item provided, including quantities and individual prices. This section ensures transparency in pricing and allows clients to review exactly what they are being charged for.

Payment Instructions

Outline payment methods

Adding Client Information to Billing Documents

Including accurate and comprehensive client details in your billing documents is crucial for establishing professionalism and ensuring smooth transactions. This information not only helps identify the recipient but also facilitates easy communication and clarifies who is responsible for payments. It serves as a reference for both parties, promoting transparency and preventing potential errors.

Key Client Information to Include

To ensure your document is complete, include the following client details:

- Full Name or Business Name: Ensure that the recipient’s name or company name is clearly stated for proper identification.

- Contact Information: Include phone numbers, emails, and any other preferred communication channels to ensure that both parties can quickly address any issues or questions.

- Billing Address: Make sure the address is accurate, as this ensures correct document delivery and aligns with accounting records.

- Client ID or Account Number: If applicable, including a unique identifier for the client can help in tracking and organizing billing information effectively.

Why Accurate Client Information Matters

Correct client details ensure that there are no delays in processing payments or addressing concerns. It also helps maintain organized records, making it easier for you to manage past transactions and track client history. By taking the time to confirm client information is complete and accurate, you reduce the likelihood of confusion and ensure a smooth transaction experience for both parties.

Customizing Tax Fields for Billing Documents

When creating a billing document, tax information plays a critical role in ensuring accuracy and compliance. Customizing tax sections according to your business needs can help streamline the billing process, making sure clients are charged appropriately and taxes are calculated correctly. Tailoring these areas allows businesses to meet legal requirements and provide clarity to customers about their financial obligations.

Essential Tax Components to Customize

Here are some key tax components to consider when tailoring tax sections:

- Tax Rates: Set up different tax rates based on product types or regional requirements. This ensures that you apply the correct rate to each item or service listed.

- Tax Breakdown: Clearly separate the tax amount from the base price. This allows clients to understand the total tax they are being charged and helps maintain transparency.

- Tax Exemptions: If applicable, add exemptions for clients or specific services. Customizing this section ensures that these adjustments are accounted for and displayed properly.

- Tax Calculation Method: Choose the method for calculating taxes, whether it’s on the subtotal, per item, or in any other way specific to your business.

Why Tax Customization Matters

Customizing tax sections according to your specific needs ensures that your billing documents are accurate and meet regulatory standards. This helps reduce errors, saves time in manual calculations, and increases client trust by providing a clear, professional breakdown of charges. By offering detailed tax customization, you improve the overall billing experience for both your business and your clients.

Using Custom Documents for Branding

Incorporating your brand’s identity into official documents not only strengthens recognition but also adds a level of professionalism. By customizing your documents, you can create a consistent experience for clients, reflecting the values and style of your business. Branding these documents helps establish credibility, build trust, and enhance the overall customer experience.

Key Elements for Effective Branding

When customizing your documents to align with your brand, focus on the following key elements:

- Logo: Adding your company logo prominently ensures that your brand is immediately recognizable, even in official paperwork.

- Color Scheme: Use consistent colors that represent your brand’s visual identity. This helps create a cohesive look across all business materials.

- Fonts: Select fonts that match your brand’s tone and style. Using professional, legible fonts enhances the overall appearance and readability.

- Taglines or Slogans: Including your business’s slogan or tagline reinforces your brand message and sets the tone for your relationship with the client.

Why Branding Matters in Documents

Effective branding on your business documents ensures that your company stands out in a crowded marketplace. It sends a message of consistency and professionalism, which can enhance customer loyalty and improve brand recall. Whether it’s through the use of logos, colors, or typography, branding helps create a strong and lasting impression.

Organizing Itemized Sections for Clarity

Properly organizing detailed sections in your billing documents is essential for maintaining clarity and transparency. By presenting each item or service in a clear, structured manner, you allow clients to easily understand the charges and make informed decisions. A well-organized document enhances professionalism and reduces confusion, ensuring that your clients see the value of each product or service they are being charged for.

Best Practices for Itemizing Information

When organizing the detailed sections of your billing documents, consider these key practices:

Item Description Quantity Unit Price Total Product A High-quality product with premium features 2 $50 $100 Service B Consultation for product implementation 1 $200 $200 Shipping Standard delivery charge 1 $20 $20 Why Clear Itemization Is Important

Clear itemization ensures that clients can easily identify each charge and understand exactly what they are paying for. It prevents misunderstandings and disputes, providing a transparent breakdown of costs. By organizing each section logically and presenting all relevant details, you not only enhance the customer experience but also demonstrate your business’s attention to detail and commitment to transparency.

Tips for Managing Data in Billing Documents

Efficiently managing the information in your billing documents is crucial for both organization and accuracy. By ensuring that each piece of data is properly captured and easily accessible, you can streamline your workflow and reduce the risk of errors. Proper data management not only helps with timely processing but also improves your ability to maintain clear communication with clients and comply with legal or tax requirements.

Consistency is Key

One of the most important aspects of managing data is consistency. Ensure that all relevant information is entered in a standardized format. This includes dates, amounts, descriptions, and account numbers. Keeping the structure consistent will not only make your documents easier to read but also facilitate automation and integrations with other systems.

Regular Updates and Reviews

To keep your billing documents accurate, it’s important to regularly review and update the information. This includes client details, service offerings, and pricing. Reviewing the data ensures that everything is up-to-date and that you are not using outdated information, which could cause confusion or legal issues. Set up regular reminders to audit and verify the details stored in your system.

Choosing Fonts and Styles in Templates

Selecting the right fonts and styles for your documents is crucial for ensuring clarity and professionalism. The visual appearance of your document can influence how it is perceived by your clients, as well as how easily they can navigate and understand the content. A good balance between style and readability is key to making a strong impression and maintaining a consistent brand image.

Consider Readability

When choosing fonts for your documents, prioritize readability above all else. Choose clear, simple fonts that are easy to read both on-screen and in print. Avoid overly decorative fonts that can distract from the content. Some fonts that are known for their readability include:

- Arial

- Helvetica

- Times New Roman

- Verdana

Reflect Your Brand Identity

Your font choice should reflect the personality of your brand while remaining professional. A consistent style across all your documents helps reinforce your company’s identity. If your brand uses a modern and clean design, opt for sans-serif fonts. For more traditional brands, serif fonts may be a better fit. Always ensure that the chosen font aligns with the tone you wish to convey.

Maintain Consistency

Consistency is vital in maintaining a professional appearance. Use the same font family for all sections of your document, and limit the number of different fonts to two or three. This will help prevent your document from appearing cluttered. Apply the same font style (bold, italic, etc.) to similar sections, like headings or important data points, to keep a uniform and organized layout.

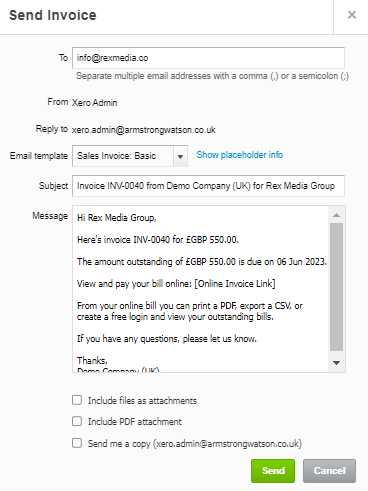

Adding Payment Terms to Invoices

Including clear payment terms in your documents is essential for establishing expectations and ensuring timely payments. These terms help both parties understand the due dates, any discounts for early payment, and the consequences of late payments. Properly outlining these details can prevent confusion and protect your cash flow.

Key Elements of Payment Terms:

- Due Date: Specify the exact date by which payment is expected. This ensures that the client knows when the payment should be made.

- Early Payment Discounts: If you offer discounts for early payments, clearly mention the percentage and the timeframe in which the discount applies.

- Late Payment Penalties: Indicate any fees or interest that will be charged if payment is not made by the due date.

- Payment Methods: List the accepted methods of payment, such as bank transfers, credit cards, or checks, to avoid confusion.

Incorporating these elements will help streamline the payment process and maintain good relationships with clients by setting clear financial expectations.

Best Practices for Invoice Summaries

Providing a concise and clear summary of charges in your documents helps ensure that clients can easily understand the overall cost and the breakdown of individual items or services. A well-organized summary promotes transparency and reduces the likelihood of confusion or disputes over payments.

Key Tips for Effective Summaries:

- Clarity: Use simple, direct language to describe each item or service. Avoid jargon or technical terms that may confuse the reader.

- Itemized Breakdown: List each product or service separately with its corresponding price. This helps clients see exactly what they are being charged for.

- Highlight Total: Ensure the total amount due is clearly visible at the bottom of the summary to avoid any ambiguity.

- Include Taxes and Discounts: If applicable, mention taxes, fees, or any discounts clearly in the summary to give a full picture of the charges.

Following these practices will enhance the professionalism of your documents and ensure that clients can quickly and easily review the charges before making payment.

Incorporating Discounts in Invoice Documents

Including discounts in your billing documents can help incentivize clients, encourage timely payments, and build positive business relationships. Properly incorporating them ensures transparency and reduces the likelihood of confusion over the final amounts due.

How to Add Discounts

Discounts can be applied either as a percentage or a fixed amount. The following practices are essential for clear communication:

- Percentage-Based Discounts: Clearly state the discount percentage next to the relevant items or services. This ensures the client understands the exact amount being reduced.

- Fixed Amount Discounts: If you offer a specific monetary amount off, make sure the deduction is visible, and specify the total amount before and after the discount.

- Promotion Codes: If using a promotion code, list it prominently, and show how it affects the final amount.

Best Practices for Clarity

- Highlight Discounts: Place discounts in a separate line or section, so they stand out clearly from other charges.

- Transparent Calculation: Ensure the discount calculation is clear. Showing both the original price and the discount helps the client verify the final amount due.

By following these guidelines, you can effectively communicate discounts, build trust with clients, and ensure a smooth payment process.

How to Add Due Dates on Billing Documents

Including a clear due date on your billing documents helps ensure timely payments and sets clear expectations for your clients. The due date is an essential part of managing payment schedules and avoiding misunderstandings about payment timelines.

Steps to Add Due Dates

Here are some key points to consider when adding due dates:

- Choose a Clear Format: Ensure the date is easy to read and placed prominently at the top or bottom of the document, so clients can quickly identify it.

- Specify the Payment Period: If you have specific terms such as “Net 30” (payment due within 30 days), make this clear either near the total amount or in a separate section for payment terms.

- Use Calendar Dates: For clarity, it’s better to use specific calendar dates (e.g., “Due by November 30, 2024”) rather than just a number of days from the document date.

Best Practices for Clarity

- Bold or Highlight: Consider using bold or highlighted text for the due date to ensure it stands out to the client.

- Remind in the Notes: Include a reminder in the notes section or as part of the payment terms to emphasize the importance of adhering to the due date.

By following these steps, you can improve payment efficiency and maintain a professional approach to managing your billing processes.

Setting Up Custom Sections for Business Documents

Creating tailored sections in business documents allows you to capture unique information that standard formats may not cover. By setting up these personalized sections, you can include specific details relevant to your business needs, improving organization and enhancing clarity for clients. Customization options enable flexibility, allowing each document to be more aligned with your processes and client requirements.

Steps to Create Customized Sections

Here’s a guide to establishing these unique areas effectively: