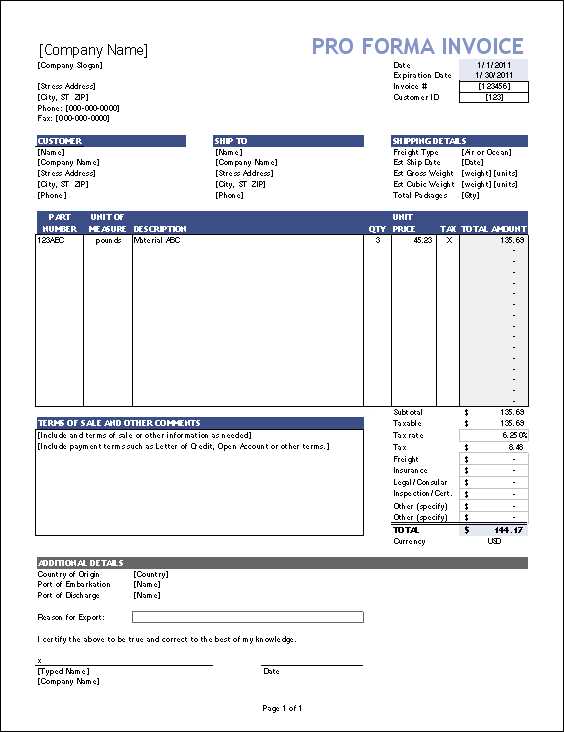

Proforma Invoice Template in Word Format for Easy Customization

When managing business transactions, having the right tools to streamline communication and documentation is essential. Whether you are offering goods, services, or estimates, it’s important to present your offers in a clear and professional manner. One way to achieve this is by using pre-designed documents that can be easily tailored to suit your needs.

Customizable templates allow you to create accurate and consistent documents, ensuring that all necessary details are included. These documents can be adjusted quickly, saving both time and effort when generating new versions for different clients or transactions.

By utilizing these resources, you can maintain a professional appearance while also improving the efficiency of your administrative processes. With the right document structure, you can avoid common mistakes and ensure clarity in your business dealings.

What is a Proforma Invoice

In business transactions, clear communication and proper documentation are crucial. One of the key documents used in various industries to outline the details of an upcoming sale is a preliminary document that acts as an early proposal. This document is typically shared with customers before a final agreement or official billing occurs. It provides a breakdown of the items, services, and terms, allowing both parties to review and agree on the proposed conditions before proceeding.

Purpose of the Document

This document is often used when a company needs to give a potential buyer an estimate of the cost or to clarify the details of a transaction before final confirmation. Unlike a traditional receipt or final bill, it does not request immediate payment but instead serves as a preliminary offer, outlining the expected costs and terms. It helps to establish trust and transparency between the seller and the customer.

Key Features

Detailed breakdowns of the offered goods or services are included in this type of document, along with prices, terms of delivery, and any applicable taxes or discounts. While it does not act as a final sales agreement, it is a vital tool for avoiding misunderstandings or confusion later in the process. Clarity and accuracy are essential in these documents to ensure both parties are aligned on expectations.

Benefits of Using a Proforma Invoice

Utilizing a preliminary document to outline the terms of a transaction offers numerous advantages for both businesses and customers. This early-stage offer not only clarifies expectations but also helps prevent potential misunderstandings. By providing a clear overview of the terms, the buyer and seller can align on the details before finalizing the agreement.

Advantages for Sellers

- Clarity in Pricing: This document ensures that both parties understand the cost breakdown before proceeding, reducing the chances of disputes over pricing later on.

- Improved Cash Flow Management: With clear terms, businesses can better forecast revenue and manage their financial processes.

- Professional Image: Providing such detailed documentation helps businesses present themselves as organized and transparent.

- Reduced Risk: By laying out all the terms beforehand, businesses can minimize misunderstandings that may lead to payment delays or non-payment.

Benefits for Buyers

- Clear Understanding of Costs: Buyers can assess the total cost upfront, including any taxes or extra fees, helping them plan accordingly.

- Transparency: The detailed information allows customers to verify the goods or services they are receiving, making the transaction more trustworthy.

- Better Negotiation Opportunities: Knowing the terms ahead of time allows buyers to ask questions or negotiate the deal before finalizing any agreements.

Why Choose a Word Template

Choosing the right format for business documents can significantly impact efficiency and professionalism. Using an editable file that offers both flexibility and ease of use makes document creation simpler. When it comes to generating detailed proposals or cost estimates, opting for a format that allows for quick adjustments and customization is invaluable.

Ease of Customization

One of the key benefits of this type of format is the ability to easily modify text and structure. Whether you need to update pricing, add specific client information, or adjust payment terms, these documents can be quickly tailored to fit any situation. Flexibility is crucial when handling various clients and transactions, and a format that adapts to your needs makes the process much more efficient.

Accessibility and Compatibility

These files are universally compatible with most devices and software, making them easy to open, edit, and share. Whether you’re working in the office or remotely, the convenience of having a standard format available on virtually any computer ensures that you can work seamlessly with clients, colleagues, and business partners.

How to Create Proforma Invoices in Word

Creating a professional document for estimating costs or outlining the details of an upcoming sale is a straightforward process. By using an editable file format, you can easily structure your document to include all necessary information, ensuring clarity and transparency for your client. Below are the essential steps to create a customized document that will meet your business needs.

Step 1: Set Up the Document Layout

Start by opening a new file in your preferred word processing program. Set up the page layout to ensure the document is well-organized. Choose a clear font and adjust margins so that the information is presented neatly. It’s also a good idea to include your business logo and contact details at the top to make the document look professional.

Step 2: Add Key Information

Once the layout is ready, begin filling in the required details. Start with the client’s name and address, followed by a brief description of the products or services being offered. Make sure to include pricing, payment terms, and any applicable taxes or discounts. A clear, structured breakdown of each item helps avoid confusion later on. Finally, include the total amount due and any deadlines for payment.

Key Elements of a Proforma Invoice

When preparing a document to outline the terms of a potential transaction, it’s crucial to include all relevant details that will ensure both parties are on the same page. This document serves as a preliminary offer, and having all the necessary components is key to preventing any confusion. Below are the essential elements that should be included to make sure the document is comprehensive and clear.

| Element | Description |

|---|---|

| Header Information | Include your company name, logo, and contact details along with the recipient’s name and contact information. This helps identify the document and ensures it is directed to the right recipient. |

| Document Title | Clearly label the document with a title that indicates it’s a preliminary offer or estimate, so there’s no confusion with an official sales bill. |

| Itemized List | Provide a detailed list of the products or services being offered, including quantities, descriptions, and individual prices. |

| Total Amount | Summarize the total cost, including applicable taxes, shipping fees, or discounts. Make sure all costs are clearly outlined for transparency. |

| Payment Terms | Include any payment deadlines, methods of payment, and any specific terms like deposits or installment plans. |

| Validity Period | Indicate the period during which the offer is valid, after which the terms may change or the document may no longer be applicable. |

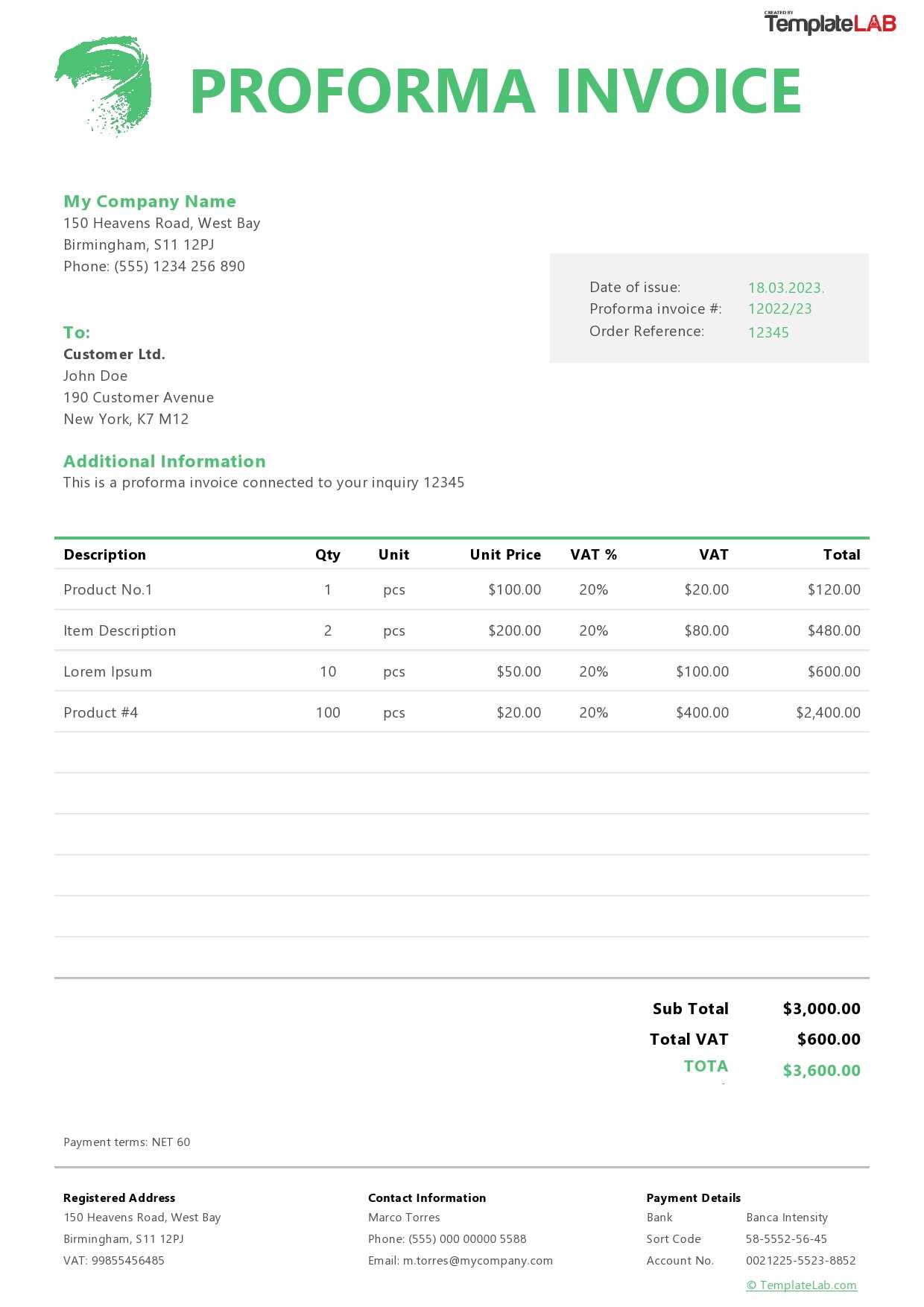

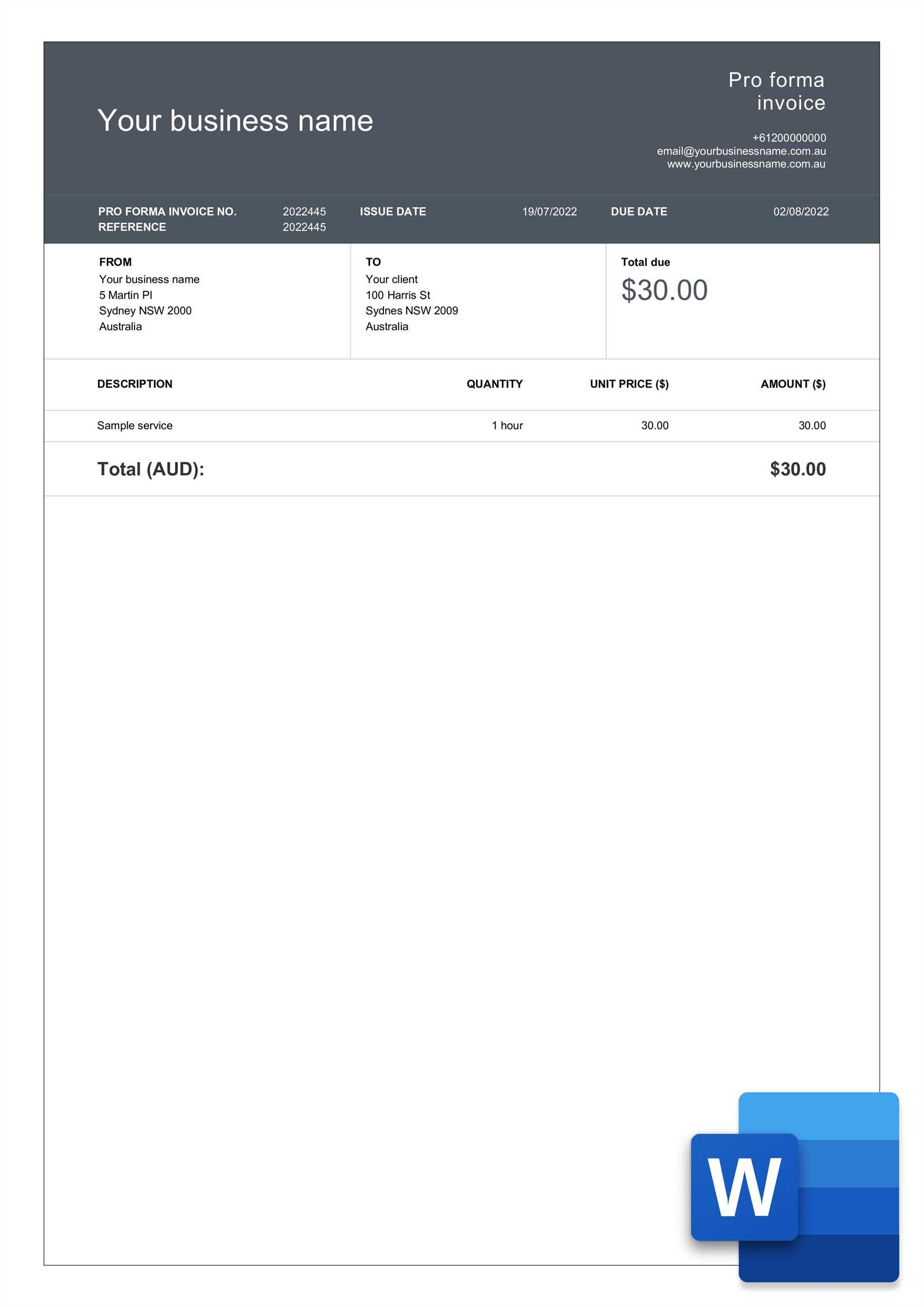

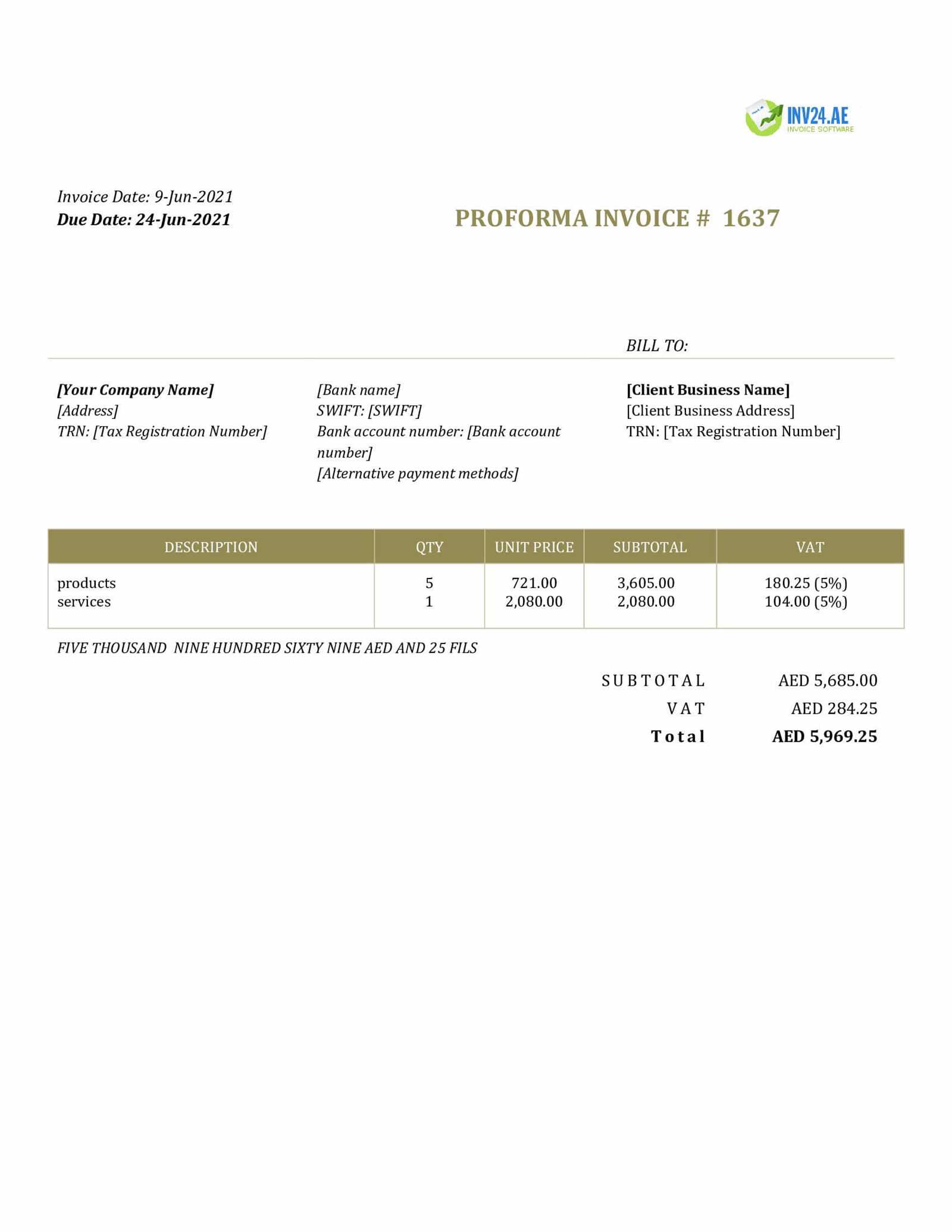

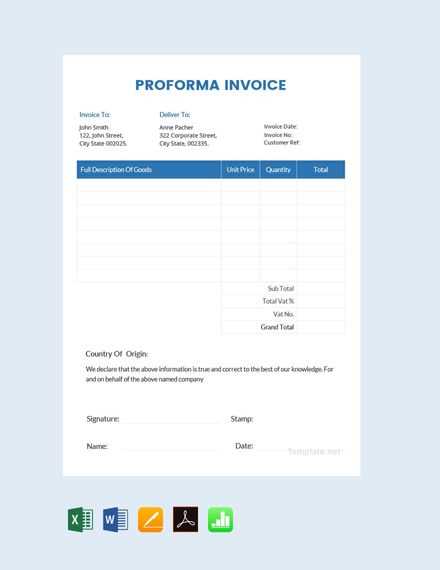

Free Proforma Invoice Templates for Word

For businesses looking to streamline their document creation process, free resources are available that allow you to quickly generate professional documents without the need to start from scratch. These resources provide customizable options that can be easily tailored to meet your specific needs, ensuring a seamless experience when preparing estimates or quotations.

Many online platforms offer free downloadable files that include pre-designed layouts, saving you time while ensuring that all necessary details are included. Below is an overview of what to look for when choosing a free document template for your business.

| Feature | Description |

|---|---|

| Easy Customization | Most free templates are designed to be user-friendly, allowing you to modify the text and structure to suit your specific transaction details with ease. |

| Professional Design | The available layouts are crafted with a polished, professional appearance, ensuring that your documents convey trustworthiness and clarity to your clients. |

| Predefined Fields | Free resources typically come with fields for all the essential information, such as item descriptions, pricing, terms, and client details, helping you stay organized. |

| Compatible Formats | These resources are usually compatible with popular office software, ensuring you can easily open, edit, and save the file on most devices. |

| Instant Download | Many sites offer immediate access to free files, so you can start creating documents right away without any delays. |

Customizing Your Proforma Invoice Template

When creating a professional document for business transactions, it’s important to ensure that it accurately reflects the specifics of the deal. Customizing an existing layout allows you to tailor the content and design to fit your unique needs, providing a personalized touch while maintaining a professional appearance. Whether you’re adjusting the format or adding specific details, customizing your document can significantly improve both functionality and client perception.

The first step in customization is to modify the header with your business name, logo, and contact information. This sets the tone for the document and ensures that it’s clearly linked to your company. You can also add your client’s information, ensuring the document is properly directed and professional.

Next, you should focus on adjusting the layout of the content. For example, you can change the placement of product descriptions, pricing details, or payment terms to better fit your style. It’s crucial that each section is clearly marked, allowing the recipient to quickly identify key points. You might also want to add a footer with additional notes or reminders about deadlines or policies.

Lastly, don’t forget to save your customized layout as a reusable file. This allows you to keep using the same design for future transactions, saving time and ensuring consistency across all your business documents.

Common Mistakes in Proforma Invoices

When preparing a document to outline the terms of a future transaction, it’s easy to overlook key details that can lead to confusion or misunderstandings. Whether it’s a simple error in pricing or an incomplete list of terms, these mistakes can affect your professional reputation and delay the process. Being aware of common pitfalls can help you avoid these issues and ensure your documents are clear, accurate, and reliable.

Missing or Inaccurate Pricing

One of the most frequent errors in these documents is incorrect pricing. Whether it’s a typo or an outdated rate, inaccurate pricing can lead to conflicts and damage trust between the seller and buyer. Always double-check the price of each item, including taxes, discounts, and shipping fees. It’s essential that the total cost is calculated correctly and clearly displayed for both parties to review.

Unclear Payment Terms

Another common mistake is failing to provide clear payment terms. If your document lacks specific details about payment deadlines, methods, or installment options, it can lead to confusion or delayed payments. Be sure to specify the due date, any advance deposits required, and acceptable payment methods to avoid misunderstandings later on.

How Proforma Invoices Differ from Invoices

While both documents are used to communicate the details of a transaction, they serve different purposes and are issued at different stages in the process. Understanding the distinction between the two is essential for both sellers and buyers to ensure clarity and avoid confusion.

A major difference between these documents is that the first type is a preliminary estimate, often provided before a sale is finalized. It outlines the proposed costs, terms, and conditions, but it is not a request for payment. Its main function is to give the buyer a preview of the upcoming transaction. In contrast, the latter document is a formal request for payment, issued after the goods or services have been delivered, and reflects the final amount owed for the transaction.

Legal Binding is another key distinction. While the first document is not legally binding and serves more as a confirmation or an offer, the latter is a formal document that usually constitutes a legally binding agreement. Once the buyer receives the final bill, they are expected to pay according to the terms set out in that document.

In summary, the primary difference lies in their timing and function. The first type is used for estimation and negotiation, whereas the second is a definitive request for payment after the delivery of goods or services. The first provides an outline, while the second demands settlement of the transaction.

When to Use a Proforma Invoice

Understanding when to use a preliminary document is essential for effective business transactions. This type of document is typically used early in the sales process to outline the terms of a potential deal before it becomes official. It provides the buyer with an estimate or proposal and ensures both parties are aligned on the key details before committing to the final sale.

Before Finalizing a Sale

One of the most common times to issue this document is before the sale is finalized. When you’re negotiating with a client and want to outline the pricing, delivery terms, and other specifics, this document can serve as a formal estimate. It helps the buyer understand what to expect and provides both parties with a reference point for further discussions.

For International Transactions

In international transactions, this document is often used to meet customs requirements. It gives importers and exporters a clear idea of the goods or services being exchanged, their value, and any associated costs. It can be helpful for securing financing, arranging shipments, or clearing customs before the final agreement is made.

In summary, this document is ideal when you need to provide clarity on terms before moving forward with an official contract or payment request. It establishes the foundation for a successful business transaction by ensuring transparency and reducing misunderstandings.

How to Download a Proforma Invoice Template

When you need a professionally designed document to outline the terms of a transaction, downloading a ready-made file can save you time and effort. These files are available on various platforms and can be customized to fit your business needs. Here’s how to easily access and download a suitable document template that you can start using right away.

Step 1: Search for Reliable Sources

Start by looking for trusted websites that offer free or paid downloads of business document templates. Many business websites, accounting tools, and online marketplaces provide these resources. Ensure that the platform you choose offers files that are compatible with your preferred software and are up to date with current business standards.

Step 2: Download and Save the File

Once you’ve found a suitable file, simply click the download link or button. The document will typically be available in a format that can be easily opened and edited on your computer. After downloading, make sure to save it in a location where you can easily access it in the future, such as your desktop or a designated business folder.

With the file downloaded, you can now open it, fill in the necessary details, and begin customizing it for your specific transaction. Make sure to save a copy for future use, ensuring you always have a professional document ready when needed.

Tips for Effective Invoice Management

Managing business documents effectively is crucial for maintaining smooth operations and ensuring timely payments. Proper organization, attention to detail, and the use of reliable tools can help avoid common mistakes and delays. Below are some key strategies to improve your approach to managing business transactions and ensure you stay on top of your financial records.

1. Organize Your Records

One of the first steps to effective document management is organization. Create a system where all transaction records are stored in an easily accessible manner, either digitally or physically. Using folders, spreadsheets, or accounting software can help you quickly locate any document when needed.

2. Keep Track of Due Dates

Set reminders or alerts for important dates, such as payment deadlines or when to follow up on outstanding amounts. This ensures that you never miss a due date and can act promptly if a payment is delayed, improving cash flow management.

3. Automate Where Possible

Consider using software or online tools that can automate much of the document creation and tracking process. Many tools allow you to generate, send, and track payments automatically, freeing up your time and reducing the risk of errors.

4. Double-Check All Details

Before sending any document, always double-check the accuracy of key details such as pricing, client information, and payment terms. Small mistakes can lead to confusion and delays in receiving payment, so thorough review is essential.

5. Communicate with Clients

Good communication is key to successful transaction management. If there are any issues with the details or if payment terms change, inform your clients as early as possible. Clear and timely communication builds trust and ensures smoother transactions.

Legal Aspects of Proforma Invoices

When preparing documents for business transactions, it’s important to understand their legal implications. Although preliminary documents may seem less formal than official bills, they still play a role in shaping the terms of a deal. Understanding their legal standing can help avoid misunderstandings and ensure compliance with relevant laws. Below are some key legal considerations to keep in mind when using this type of document in your business practices.

1. Not Legally Binding

One of the most important things to understand is that these documents are typically not legally binding. They serve more as a quotation or estimate, outlining the potential terms of a future transaction. Since they do not request payment or create a financial obligation, they are generally not enforceable in a court of law.

2. Usage for Informational Purposes

This document is mainly used to provide a buyer with a preview of the costs and terms involved in a potential sale. It’s important to make it clear to the recipient that it is not a final agreement but rather a proposal subject to change. Misleading clients into thinking it’s a formal contract could result in legal complications.

3. Compliance with Local Regulations

Even though this document is not legally binding, it’s still important to ensure that it complies with local and international regulations, especially when dealing with international transactions. This could include accurate descriptions of goods or services, correct currency usage, and appropriate tax information. Failing to comply with specific legal requirements could cause delays or issues with customs or payments.

4. Providing Clear Terms

Including clear terms and conditions in these documents can prevent disputes down the line. While these documents may not create an obligation, they can outline what each party expects from the transaction. In case the deal progresses, the terms listed may be referenced as part of the official contract.

5. Avoiding Misuse

It’s important not to use these documents in a way that could mislead clients or create confusion. Using them to imply a final agreement or to misrepresent the terms of the sale could result in legal repercussions. Always make sure your documents are used appropriately and are transparent about their status as preliminary offers.

In summary, understanding the legal aspects of such documents helps ensure your transactions remain smooth and transparent, avoiding potential issues with clients or regulatory bodies.

Integrating Proforma Invoices with Accounting Software

Integrating business documents with accounting software can significantly streamline financial operations and enhance efficiency. By linking these preliminary transaction documents with your accounting system, you can automate the tracking of potential sales, manage records more effectively, and reduce the chances of errors or duplication. This integration allows you to stay organized and ensures that all financial details are captured accurately in one place.

When you integrate this type of document with accounting software, you can automatically generate reports, update financial records, and even track unpaid amounts. Below are some key benefits of this integration:

| Benefit | Description |

|---|---|

| Time Efficiency | Integrating these documents saves you time by reducing the need to manually enter data into your accounting system, allowing for quicker updates and fewer errors. |

| Accuracy | Automatic syncing between your business documents and accounting software ensures that the data entered is accurate and reflects real-time changes, such as pricing or payment terms. |

| Consistency Across Documents | When you integrate these documents, it ensures consistency in the details across all files, minimizing discrepancies between different versions or systems. |

| Easy Tracking | With integration, it becomes easier to track the status of potential sales and payments, helping you follow up on pending transactions or update the status in real-time. |

| Improved Reporting | By syncing these documents with your accounting software, you can generate reports that include details about upcoming sales, expected revenues, and outstanding payments. |

Overall, integrating these documents into your accounting software can improve operational efficiency, reduce the risk of mistakes, and provide a more organized approach to managing your business transactions.

Best Practices for Proforma Invoice Creation

Creating accurate and professional documents is essential for building trust and ensuring smooth business transactions. Following best practices when drafting these types of documents can help you avoid mistakes and enhance clarity. By adhering to a set of standards, you can ensure that both you and your client are on the same page regarding the terms and expectations of the agreement.

1. Include Complete Contact Information

Always include your business’s full contact information, including the name, address, phone number, and email address. This makes it easy for your clients to reach you if needed and adds a professional touch to the document.

2. Be Clear About the Terms

It’s important to clearly outline the terms of the transaction, such as payment terms, delivery dates, and any applicable taxes. Make sure there’s no ambiguity, as this can lead to misunderstandings or delays. Specify whether payment is due upfront or upon delivery, and outline any discounts or penalties if applicable.

3. Provide Detailed Descriptions

When listing products or services, provide clear and detailed descriptions. Include quantities, unit prices, and specifications to avoid confusion. The more precise you are, the less likely it is that the client will question the terms of the deal.

4. Double-Check for Accuracy

Before sending the document, review all the information for accuracy. Mistakes in pricing, terms, or dates can lead to unnecessary issues. A quick check can save you time and potential embarrassment later on.

5. Maintain a Professional Layout

Keep the design clean and professional. Use consistent formatting, clear section headings, and logical organization to make the document easy to read and understand. Avoid clutter or excessive use of colors or fonts that may distract from the important details.

6. Add a Reference Number

Assign a reference number to each document you create. This helps you track transactions more easily and provides both you and your client with a unique identifier for future reference.

7. Ensure Consistency Across Documents

Ensure that the formatting and layout are consistent with other business documents you produce. This helps reinforce your brand and gives your clients a sense of professionalism and continuity.

By following these best practices, you can create clear, accurate, and professional business documents that enhance your credibility and facilitate smoother transactions.