Lawn Mowing Invoice Template for Efficient Billing

Running a landscaping business involves not only providing quality service but also managing the financial side effectively. One key aspect of this process is creating clear and professional documents that outline the cost of your services. These documents ensure that your clients understand exactly what they are paying for and help you maintain an organized record of your transactions.

Efficient billing is crucial for maintaining a positive relationship with customers and ensuring timely payments. Whether you’re a seasoned professional or just starting out, having a reliable method for generating these financial records can save you time and reduce potential confusion. An organized document system can also boost your credibility and make your business look more polished.

In this article, we’ll explore how to craft these important records, what information they should contain, and how you can tailor them to suit your specific needs. By the end, you’ll be ready to enhance your business’s administrative processes and improve communication with your clients.

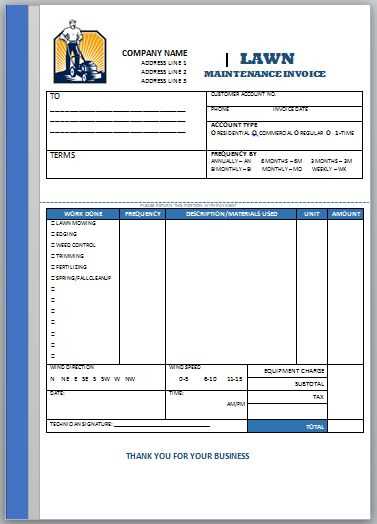

Creating a Lawn Mowing Invoice Template

When providing outdoor maintenance services, having a professional document for billing is essential. It serves as a clear communication tool between you and your clients, detailing the work done and the costs associated with it. A well-organized record not only helps ensure timely payment but also reflects your business’s professionalism.

To begin crafting your billing document, start with a simple structure that includes all necessary information. This should include your company name, the client’s details, a description of the work performed, and the corresponding charges. Ensuring clarity and precision in these sections will make the document easy to read and understand for both parties.

Additionally, consider adding payment terms, due dates, and any taxes or extra charges that might apply. A comprehensive format will help avoid misunderstandings and streamline your payment process. Customizing your billing document to fit your services will also allow you to present a personalized touch, reinforcing your reliability and attention to detail.

Why Use a Lawn Mowing Invoice?

Providing a detailed document for services rendered is crucial for any business. It not only outlines the costs but also serves as a formal record of the transaction. Using such a document can improve client relationships and help maintain a steady cash flow.

Here are several reasons why using a billing document is important:

- Clarity: Clearly stating the services provided and their associated costs avoids misunderstandings.

- Professionalism: A well-crafted document enhances your credibility and shows clients you take your work seriously.

- Record-Keeping: Keeping detailed records of all services allows for easier tracking of payments and helps with future business planning.

- Tax Purposes: Proper documentation of transactions ensures you’re prepared for any tax obligations.

- Legal Protection: In case of disputes, having a formal document can protect your business by serving as a legal proof of agreement.

By using a formal billing record, you are not only simplifying the payment process but also contributing to the organization and growth of your business.

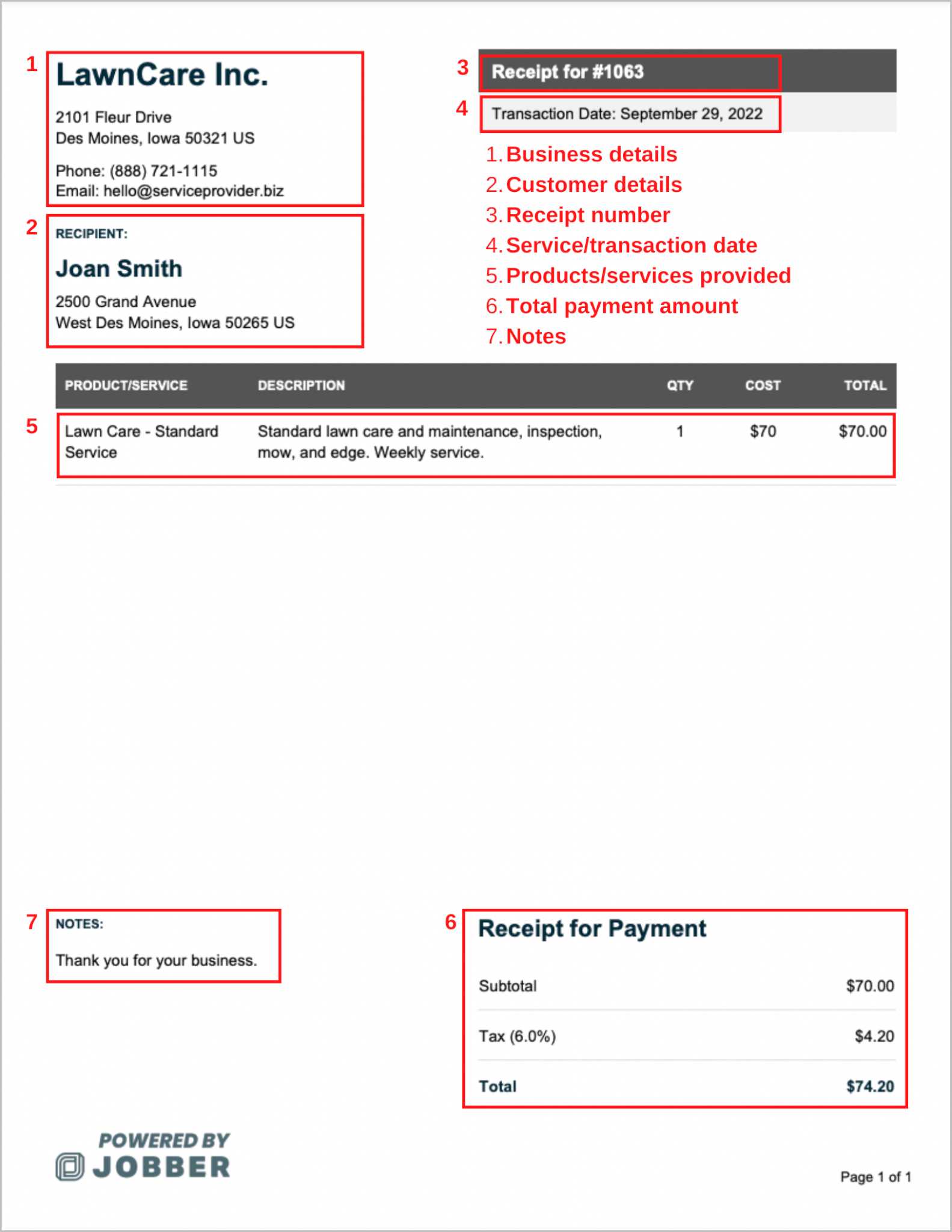

Essential Elements of a Lawn Care Invoice

When creating a billing document for yard services, it’s crucial to include key details that ensure transparency and professionalism. A well-structured document helps both you and your clients stay organized while minimizing confusion. There are a few essential components that should always be present in any service billing document to ensure clarity and accuracy.

Key Information to Include

Make sure to cover the following elements to create a complete and effective billing document:

| Element | Description |

|---|---|

| Business Details | Your business name, contact information, and logo, which provide clients with a professional touch and contact details. |

| Client Information | Client’s name, address, and phone number to ensure accurate record-keeping and communication. |

| Service Description | Clearly describe the services performed, including any specific tasks, frequency, and the duration of the job. |

| Cost Breakdown | Provide a detailed list of costs, including hourly rates, flat fees, or other charges for additional services. |

| Payment Terms | Clearly outline the payment method, due date, and any late fees or discounts for early payment. |

Additional Details to Consider

Including payment terms and any applicable taxes is crucial for a smooth transaction. Don’t forget to mention any discounts for regular clients or special offers to encourage repeat business. Having all these components in place will ensure your business operations run smoothly and professionally.

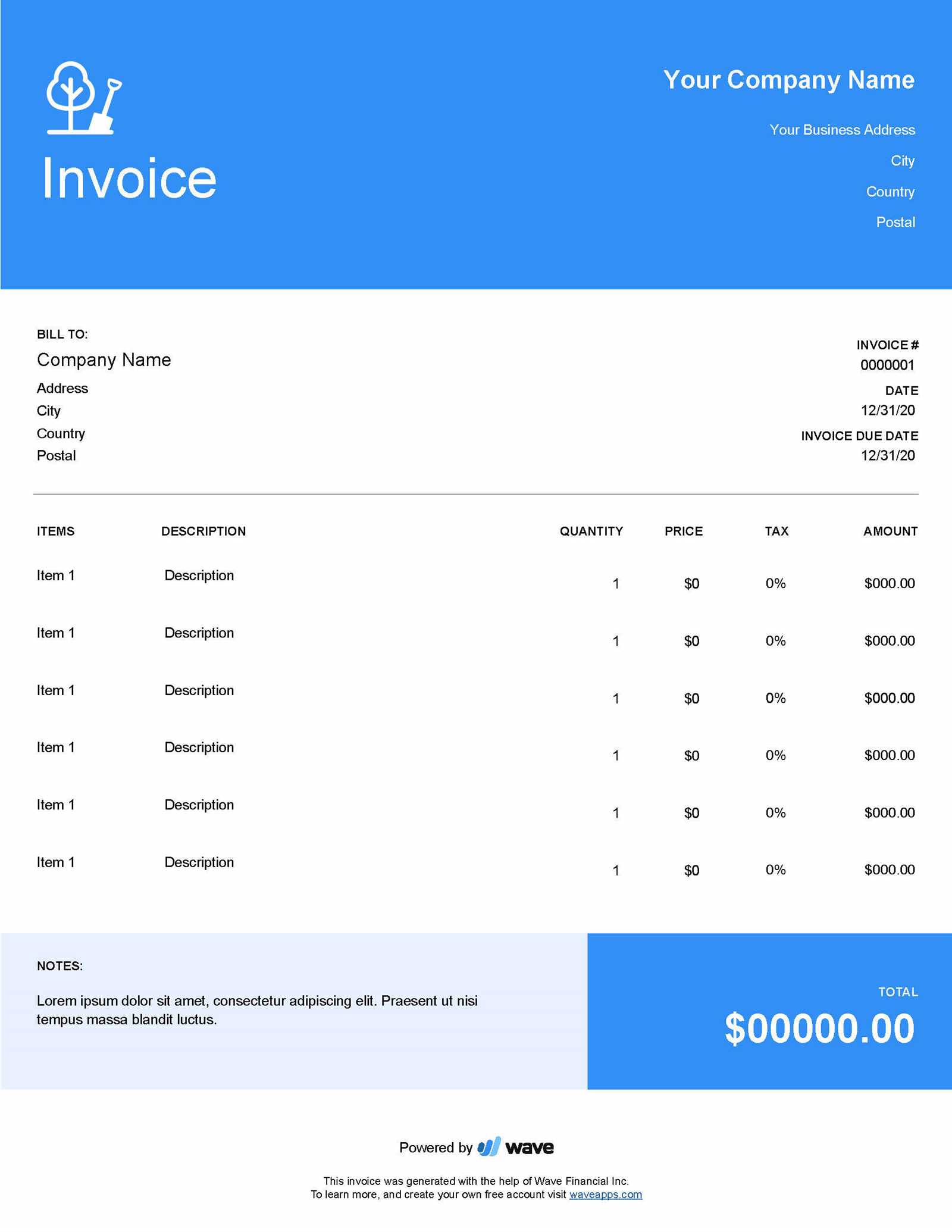

How to Customize Your Invoice Template

Personalizing your billing document helps ensure it aligns with your business’s brand and specific needs. Customization allows you to make the document more relevant to your services and clients, while also maintaining a professional appearance. With a few simple adjustments, you can create a tailored document that works best for your business.

Here are a few key steps to consider when customizing your billing record:

| Customization Area | What to Consider |

|---|---|

| Design and Layout | Choose fonts, colors, and logos that reflect your brand identity. Ensure the layout is clean and easy to read, with clearly marked sections for services, costs, and contact information. |

| Service Descriptions | Modify the service sections to suit the exact nature of the work you perform. Include details like task frequency, additional charges, or special instructions to ensure clients know exactly what they’re paying for. |

| Pricing Structure | Adjust pricing fields to fit your business model. Whether you charge hourly, per visit, or offer flat-rate pricing, make sure it’s clearly presented for easy understanding. |

| Payment Terms | Customize the payment terms to reflect your preferred policies, such as due dates, late fees, or discounts for early payments. |

By carefully adjusting these areas, you can create a billing document that is both functional and reflective of your business’s professionalism. A well-designed and tailored document not only enhances the client experience but also improves your business’s efficiency and credibility.

Tips for Organizing Lawn Mowing Invoices

Efficiently managing your billing documents is key to keeping your business operations smooth and ensuring timely payments. Organizing these records properly helps avoid confusion and reduces the risk of missing payments. With the right system in place, you can save time, stay on top of finances, and maintain a professional image with your clients.

1. Use a Consistent Naming System

To keep track of your documents, create a consistent naming convention for each one. This could include the client’s name, the service date, and a unique number for each transaction. For example, you might name a document “Smith_2024-04-01_001” to make it easy to identify and reference later.

2. Set Up a Digital Filing System

Keep your records organized by saving all your billing documents in a digital format. Use a file management system or cloud service to store and categorize them. Creating folders based on client names, service dates, or payment status will make finding documents quick and easy when you need them.

Benefits of Digital Organization:

- Easy access: Retrieve past records with just a few clicks.

- Space-saving: No need to store paper files that take up physical space.

- Security: Backup your files and protect them with passwords for added security.

By incorporating these tips into your organizational practices, you can create a streamlined, efficient system for managing your service records, leading to improved productivity and smoother business operations.

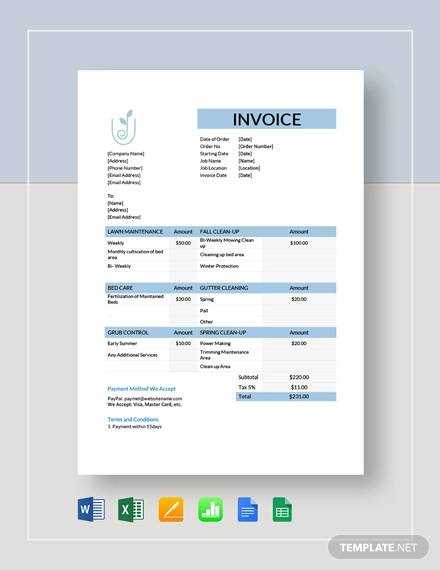

Free Lawn Mowing Invoice Templates Online

There are numerous free resources available online for creating professional billing documents, which can be a huge time-saver for business owners. These ready-made files are designed to be customizable, allowing you to easily adjust the content to fit your specific services and client needs. By utilizing these online options, you can generate accurate and visually appealing documents without having to start from scratch.

Many websites offer a variety of customizable formats, ranging from simple designs to more detailed layouts that suit different industries. These free tools are perfect for small business owners looking to streamline their administrative tasks and maintain a professional appearance when dealing with clients.

Advantages of Using Free Resources:

- No cost: Access high-quality documents without paying for expensive software or templates.

- Customization options: Tailor the content to include specific services, pricing, and terms relevant to your business.

- Time-saving: Quickly create and send documents, allowing you to focus more on your core services.

By using these free resources, you can easily manage your billing process and maintain a professional, organized approach to client transactions.

How to Include Payment Terms in Invoices

Clearly outlining payment expectations is essential for maintaining smooth financial transactions with clients. Including detailed payment terms in your billing documents helps prevent confusion and ensures that both parties are on the same page regarding when and how payments are due. Properly stated terms also help protect your business in case of delayed payments or disputes.

To effectively include payment terms, make sure to incorporate the following details in your records:

- Due Date: Specify when the payment is due. Whether it’s within 15, 30, or 60 days, make the deadline clear to avoid any misunderstandings.

- Accepted Payment Methods: List the payment options you accept, such as credit card, bank transfer, or cash, so clients know their available options.

- Late Fees: Include information about any late fees or interest that will be applied if the payment is not made by the due date. Be sure to mention the percentage or fixed fee for delayed payments.

- Early Payment Discounts: If you offer any discounts for early payment, be sure to state the conditions under which they apply. This can encourage clients to pay sooner.

Example Payment Terms:

“Payment is due within 30 days of the invoice date. A late fee of 2% will be applied to all overdue amounts. A 5% discount is offered for payments made within 10 days.”

Including these details will help streamline your billing process and ensure that both you and your clients have a clear understanding of payment expectations, which can contribute to a more professional and trustworthy business relationship.

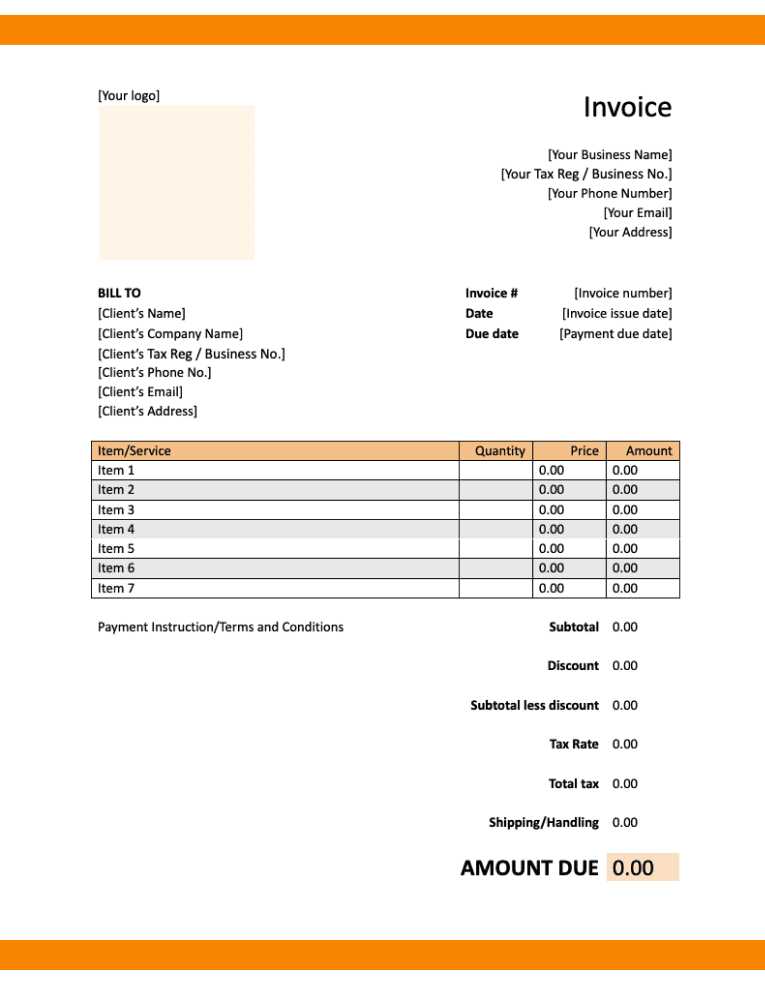

Best Practices for Invoice Formatting

Proper formatting is essential when creating a billing document. A well-organized, clear layout not only helps your clients understand the charges but also presents your business in a professional light. By following best practices for structuring and designing your financial records, you ensure ease of use, reduce errors, and promote prompt payments.

Key Formatting Elements

When formatting your billing document, focus on simplicity and clarity. A clean, easy-to-read design will make it easier for clients to find the information they need. Pay attention to the following elements:

| Element | Best Practice |

|---|---|

| Font Choice | Use simple, legible fonts like Arial or Times New Roman. Avoid decorative or overly stylized fonts that could make the document difficult to read. |

| Layout | Organize the content in sections with clear headings. Group similar information together (e.g., client details, services rendered, payment terms) to make it easy to find. |

| Amount Breakdown | List the charges in a clear table format, with line items for each service provided, including the cost per unit and total amount. |

| White Space | Ensure there’s enough white space around text and sections. This makes the document easier to read and less cluttered. |

Additional Tips for Clarity

Consider adding extra touches to improve the overall presentation of your document:

- Consistency: Maintain consistent formatting for headings, subheadings, and amounts throughout the document.

- Color: If using color, stick to a simple palette that aligns with your brand. Avoid overly bright or distracting colors that could detract from the document’s professionalism.

- Alignment: Align text properly, ensuring that numbers, especially monetary amounts, are right-aligned for easy reading.

By following these best practices, you’ll not only create an effective billing document but also enhance your business’s reputation for professionalism and attention to detail.

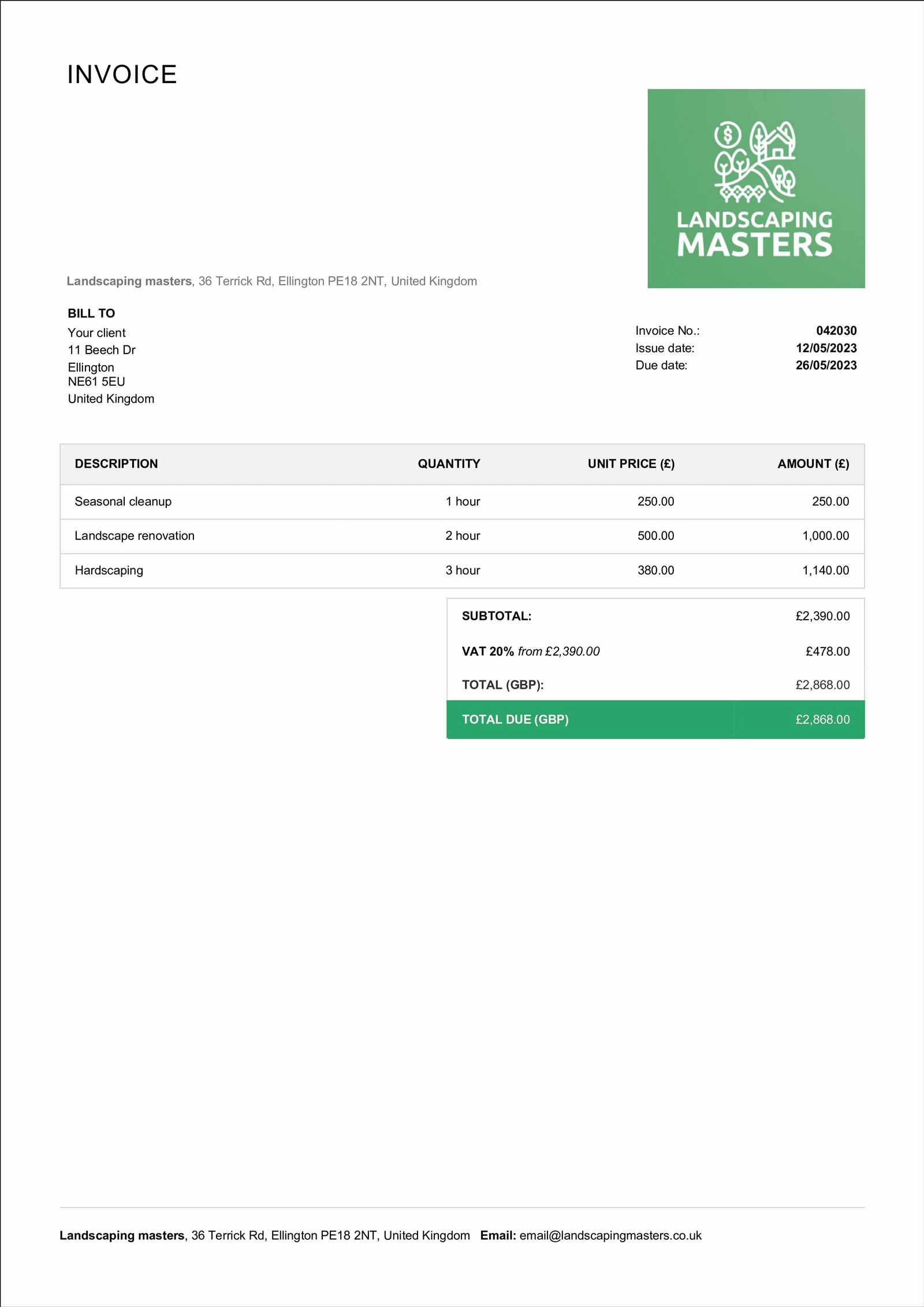

Incorporating Tax and Fees in Your Invoice

Including taxes and additional fees in your billing documents is an essential aspect of financial transparency and legal compliance. It ensures that clients understand the total cost they are responsible for paying, which includes any extra charges beyond the basic service price. Properly displaying taxes and fees not only keeps your business in line with regulations but also promotes trust with your clients.

How to Include Taxes

When adding taxes to your billing records, it’s important to clearly specify the tax rate applied and the total amount being charged. The most common approach is to display the base price first, followed by the tax amount and the total after tax. This makes it easy for clients to understand the breakdown of costs.

| Service Description | Amount |

|---|---|

| Basic Service | $100 |

| Sales Tax (8%) | $8 |

| Total | $108 |

Including Additional Fees

Some services may require additional charges, such as delivery fees, fuel surcharges, or administrative costs. It’s important to list these separately from the main service cost to ensure full transparency. Be sure to specify what each fee is for and its corresponding amount.

- Delivery Fee: $15

- Fuel Surcharge: $5

By clearly incorporating taxes and additional fees, you make your billing process easier to follow, reducing the likelihood of misunderstandings and disputes with clients.

Tracking Client Payments Using Invoices

Effective payment tracking is crucial for maintaining smooth financial operations and ensuring timely compensation for your services. Using well-structured billing records allows you to monitor the status of each payment, track overdue amounts, and maintain a professional relationship with clients. A clear payment tracking system can reduce the risk of errors and disputes, making your business more efficient and organized.

One of the best practices for tracking client payments is to include a unique reference number or code for each transaction. This makes it easier to identify and match payments with specific services rendered. Additionally, including clear payment terms and due dates will help both you and your clients stay on track with when payments are expected.

Keep a log of payments received and compare it to your original records to ensure that the amounts align. It’s also helpful to note the method of payment, whether it was cash, credit card, bank transfer, or another form of payment. This way, you can track the flow of money and ensure that all payments have been processed.

Benefits of Proper Payment Tracking:

- Improved cash flow management: By knowing when payments are due and when they are received, you can better plan your finances.

- Minimized disputes: Clear records help prevent misunderstandings with clients over payment status and amounts.

- Enhanced customer relationships: Timely reminders for overdue payments show clients that you are organized and professional.

With a solid system for tracking payments, you can ensure that your financial records remain accurate, and your business continues to run smoothly without interruptions.

How to Make Your Invoice Professional

Creating a polished and professional billing document is essential for building trust with clients and ensuring timely payments. A well-organized statement not only reflects your business’s professionalism but also helps you stand out in a competitive market. When clients receive a clear, structured, and visually appealing document, it reinforces the idea that your services are reliable and your business practices are well-managed.

Key Elements to Include

To make your billing statement look professional, it’s important to include the following key elements:

- Your business information: Include your company name, logo, address, phone number, and email. This helps clients identify your business and facilitates easy communication.

- Client details: Make sure to list the client’s name, address, and contact details clearly. This shows attention to detail and helps avoid confusion.

- Clear itemization: Break down each service provided, along with the corresponding price. This ensures transparency and helps clients understand what they are being charged for.

- Payment terms: Clearly state the due date, payment methods accepted, and any late fees. This will set clear expectations and promote timely payments.

Visual Design Tips

The visual appeal of your billing document plays a significant role in how professional it appears. Here are some design tips:

- Use a simple, readable font: Choose a clean, easy-to-read font like Arial or Times New Roman. Avoid cluttered or overly decorative fonts that could distract from the key details.

- Keep it organized: Use headings and subheadings to organize the sections. Make sure the items are aligned properly for easy readability, especially when it comes to prices and totals.

- Stay consistent: Ensure the design and formatting are consistent throughout the document, from font style to text alignment. This gives your document a polished and uniform appearance.

By incorporating these elements and design tips, you’ll not only enhance the professionalism of your billing documents but also ensure that your clients feel confident in their transactions with you.

Common Mistakes to Avoid in Billing Documents

When creating billing records, it’s crucial to avoid common errors that can lead to confusion, delays in payment, or a negative client experience. These mistakes often stem from a lack of attention to detail or failure to follow best practices for clear communication. Ensuring accuracy in every aspect of your billing process not only helps maintain your business’s professionalism but also fosters positive relationships with clients.

Incomplete or Incorrect Client Information

One of the most common errors is failing to include accurate client details. Missing or incorrect contact information can make it difficult to communicate with your client about the payment or any issues with the service. Always double-check the name, address, and email to ensure they are accurate before sending your billing records.

- Verify client names and addresses

- Ensure the correct email is included for easy communication

- Include your business contact information

Unclear or Missing Payment Terms

Another frequent mistake is not clearly specifying payment terms or deadlines. This can result in delayed payments or misunderstandings. It is essential to list the expected payment date, accepted payment methods, and any late fees or penalties for overdue payments. Clearly stating these terms ensures that your clients know exactly when and how to settle their balance.

- Include a clear due date

- List all accepted payment methods

- Outline any late fees or penalties

By avoiding these common errors, you can ensure that your billing process runs smoothly and clients are more likely to make timely payments without confusion or delay.

Understanding Lawn Care Pricing for Invoices

Setting appropriate pricing for services is essential for any business that provides outdoor maintenance. Understanding how to structure your pricing ensures that you can cover your costs while also offering competitive rates to your clients. It’s important to establish clear, transparent pricing on your billing documents so clients know exactly what they are paying for and why. In this section, we will explore how to calculate and present service rates accurately, ensuring both you and your clients are satisfied with the terms.

Factors That Influence Service Pricing

There are several factors that should be taken into account when determining the cost of services:

- Service type: The complexity and nature of the service provided will directly impact pricing. Simple tasks like trimming may be priced differently than more extensive maintenance services.

- Time and labor: The number of hours required to complete the job plays a significant role. The longer the job takes, the higher the price should be to account for time spent on-site.

- Materials used: Some services may require additional materials, such as fertilizers, tools, or other supplies. These costs should be reflected in the total charge.

How to Structure Pricing on Your Billing Documents

When it comes to presenting your pricing, clarity is key. Break down the services provided and specify the corresponding costs in a clear a

Choosing the Right Billing Software for Your Business

When it comes to managing your financial records and client transactions, selecting the right software is crucial for maintaining efficiency and accuracy. With so many options available, it’s important to choose a system that aligns with your business needs, helps streamline your operations, and simplifies the process of creating and tracking payments. In this section, we’ll explore key features to look for when selecting software to manage your billing process effectively.

Key Features to Consider

Not all software solutions are created equal. When choosing the right tool for generating your billing records, make sure it includes the following features:

- Customizable templates: The ability to create personalized billing documents that reflect your brand and service details is essential for professionalism.

- Automated calculations: Automated tax calculations and total cost estimations will save you time and reduce human error.

- Client management: A good software should offer features to store and manage client information, making it easy to reference past transactions.

- Payment tracking: The software should allow you to track payments, outstanding balances, and send reminders to clients if needed.

Ease of Use and Integration

Choosing a user-friendly software platform is essential to ensure smooth operations, especially for those who aren’t tech-savvy. The software should be intuitive, with easy navigation and clear instructions. Additionally, it’s important to consider whether the tool integrates with other systems you use, such as accounting or payment processing software. Integration can save you time and reduce the chances of errors when transferring data.

By focusing on the features that align with your business needs and ensuring ease of use, you can find the right software to simplify your billing process and improve overall efficiency.

Why Timely Billing Boosts Business

Properly managing your billing cycle is a fundamental aspect of business operations. Sending requests for payment promptly not only ensures you maintain steady cash flow but also builds trust and professionalism with your clients. In this section, we’ll discuss why timely billing is crucial to the growth and stability of your business.

Improved Cash Flow

One of the most significant benefits of sending bills on time is that it keeps your cash flow consistent. When payments are delayed, it can create a gap in your revenue, making it difficult to meet your financial obligations. By sending out requests for payment promptly, you ensure that your business remains financially stable and able to cover operational costs without interruption.

Enhanced Client Relationships

Being timely with your billing shows clients that you are organized and professional. This contributes to positive customer relationships, as clients appreciate businesses that maintain clear and efficient financial processes. Additionally, it can lead to quicker payments, as clients are more likely to prioritize businesses that handle billing in an organized manner.

Timely billing not only helps with financial management but also strengthens your reputation in the industry. It shows your clients that you value their time and business, fostering trust and reliability.

Legal Considerations When Sending Invoices

When you request payment for your services, it’s essential to ensure that all legal aspects of the transaction are correctly addressed. Properly managing your payment requests not only guarantees smoother operations but also helps protect both you and your clients from potential legal issues. In this section, we’ll highlight key legal considerations to keep in mind when managing payment requests for your business.

Clear Terms and Conditions

One of the most important aspects of any financial agreement is clarity. Make sure that all the terms related to payment, such as due dates, fees, and penalties for late payments, are clearly outlined in your documents. This transparency can help prevent misunderstandings and disputes in the future.

Correct Business Information

Ensure that your business details, including your legal business name, tax ID number, and contact information, are accurately listed on your payment requests. This is not just important for professional purposes but also for legal compliance, especially if you are required to report earnings for tax purposes.

Payment Deadlines and Interest

Setting a clear payment deadline and defining what happens if payments are not received on time is essential. Many businesses also choose to include late payment fees or interest charges. Ensure that these terms comply with local laws regarding interest rates or maximum permissible fees.

Tax Compliance

It’s vital to understand and comply with tax regulations relevant to your business and location. For instance, certain services might be subject to sales tax, while others may not. You must specify the applicable taxes on your financial documents to maintain legal compliance and avoid any potential penalties.

Table: Legal Information Checklist

| Legal Consideration | Action |

|---|---|

| Business Information | Ensure legal business name, tax ID, and contact info are correct. |

| Payment Terms | Define deadlines, late fees, and penalties for non-payment. |

| Tax Details | Ensure proper tax rates are applied and documented. |

| Clarity of Terms | Clearly state payment expectations and additional fees. |

By addressing these legal considerations, you ensure that your business remains compliant and reduces the risk of disputes or legal complications. Taking the time to incorporate these details can save you from unnecessary headaches and contribute to smoother business operations.