QuickBooks Online Invoice Templates for Effortless and Professional Billing

Managing payments and ensuring timely receipts is essential for maintaining smooth operations in any business. One of the most effective ways to streamline this process is by using pre-designed documents that can be quickly customized and sent to clients. These tools not only save time but also enhance the professional appearance of your business communications.

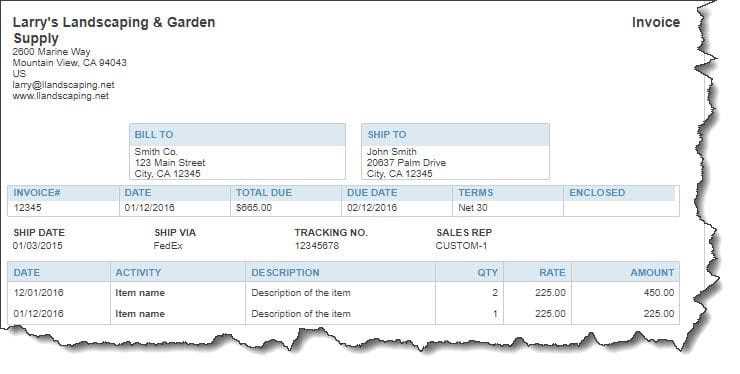

By selecting the right format for your financial statements, you can create professional records that are both clear and easy for your customers to understand. With the ability to include all necessary details, such as payment terms, company branding, and itemized charges, these solutions help reduce errors and speed up the billing cycle. Additionally, the flexibility to update and reuse your documents ensures consistency across all transactions.

Customizable billing formats offer a wide range of advantages, from improving cash flow to reducing administrative burdens. They are especially useful for small business owners who need a simple, yet effective way to manage financial documents without the hassle of manual creation each time. Whether you’re a freelancer or a growing company, using a reliable tool to handle client transactions can significantly improve operational efficiency.

QuickBooks Online Invoice Templates Overview

Managing financial transactions efficiently is crucial for any business. One of the best ways to handle billing processes is by utilizing pre-designed forms that allow quick customization for different clients and projects. These forms not only ensure accuracy but also improve professionalism in your communications, making it easier to maintain a consistent brand image across all your business dealings.

These customizable documents are designed to suit a wide range of industries and business types. Whether you run a small startup or a large enterprise, having access to flexible and easy-to-edit options helps save time and reduce the chances of mistakes. From adding payment terms and adjusting the layout to including your company logo, these tools provide all the necessary features to streamline the billing process.

Moreover, these solutions offer integration with other financial tools, allowing for seamless tracking and management of payments. By utilizing such systems, businesses can not only enhance efficiency but also stay on top of their financial health, ensuring timely follow-ups and better cash flow management. With just a few clicks, you can generate professional-looking documents ready to be sent to clients, making financial record-keeping effortless.

QuickBooks Online Invoice Templates Overview

Managing financial transactions efficiently is crucial for any business. One of the best ways to handle billing processes is by utilizing pre-designed forms that allow quick customization for different clients and projects. These forms not only ensure accuracy but also improve professionalism in your communications, making it easier to maintain a consistent brand image across all your business dealings.

These customizable documents are designed to suit a wide range of industries and business types. Whether you run a small startup or a large enterprise, having access to flexible and easy-to-edit options helps save time and reduce the chances of mistakes. From adding payment terms and adjusting the layout to including your company logo, these tools provide all the necessary features to streamline the billing process.

Moreover, these solutions offer integration with other financial tools, allowing for seamless tracking and management of payments. By utilizing such systems, businesses can not only enhance efficiency but also stay on top of their financial health, ensuring timely follow-ups and better cash flow management. With just a few clicks, you can generate professional-looking documents ready to be sent to clients, making financial record-keeping effortless.

QuickBooks Online Invoice Templates Overview

Managing financial transactions efficiently is crucial for any business. One of the best ways to handle billing processes is by utilizing pre-designed forms that allow quick customization for different clients and projects. These forms not only ensure accuracy but also improve professionalism in your communications, making it easier to maintain a consistent brand image across all your business dealings.

These customizable documents are designed to suit a wide range of industries and business types. Whether you run a small startup or a large enterprise, having access to flexible and easy-to-edit options helps save time and reduce the chances of mistakes. From adding payment terms and adjusting the layout to including your company logo, these tools provide all the necessary features to streamline the billing process.

Moreover, these solutions offer integration with other financial tools, allowing for seamless tracking and management of payments. By utilizing such systems, businesses can not only enhance efficiency but also stay on top of their financial health, ensuring timely follow-ups and better cash flow management. With just a few clicks, you can generate professional-looking documents ready to be sent to clients, making financial record-keeping effortless.

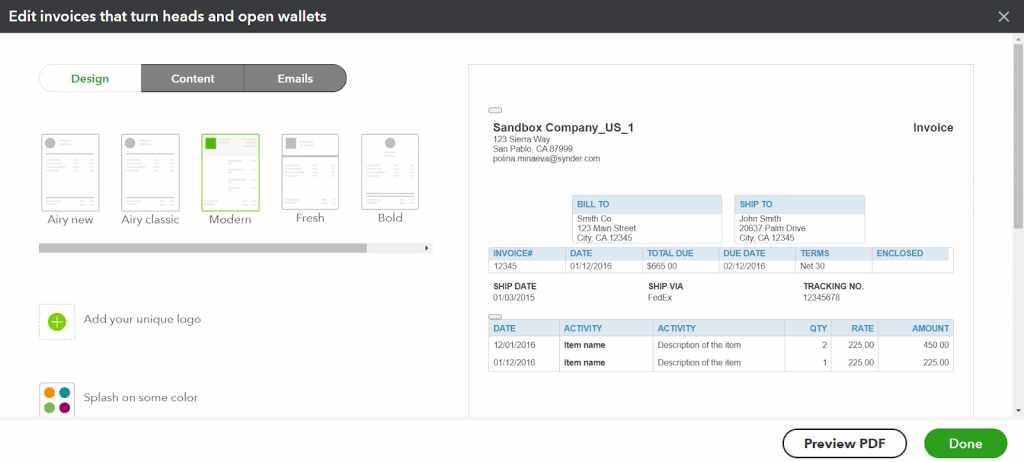

Customizing Your QuickBooks Invoice Template

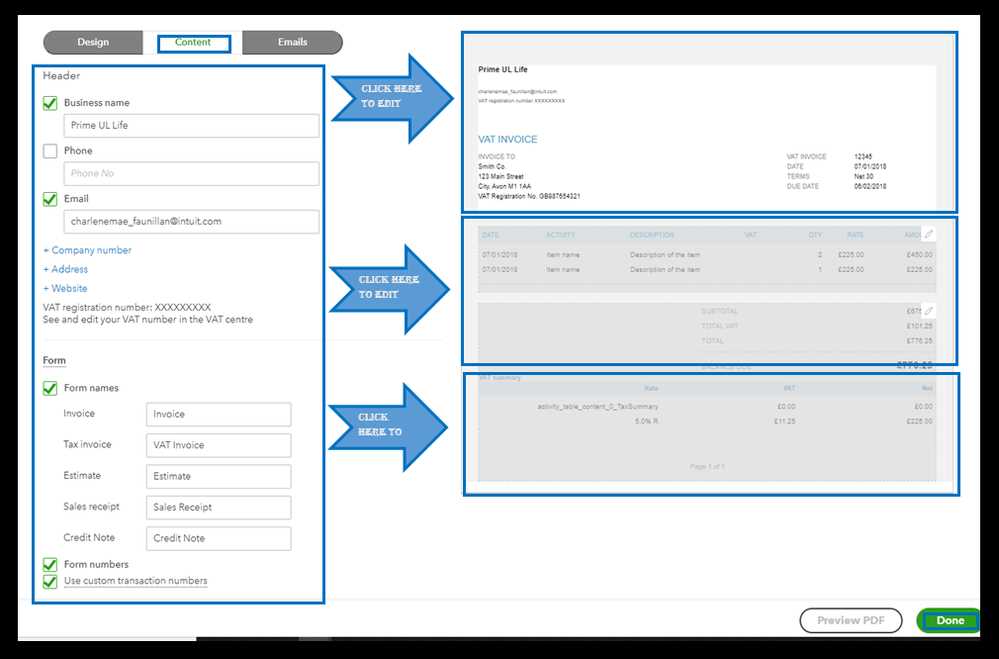

Personalizing your billing documents is an important step in ensuring that each communication aligns with your brand and specific business needs. Customization allows you to create professional and unique records that reflect your company’s identity while maintaining clarity and precision in the information provided.

Customizing these forms involves several key elements that can be easily adjusted to suit your preferences. You can modify aspects such as layout, colors, fonts, and even the sections included. Here are some common areas you may want to focus on:

- Branding: Add your company logo, contact information, and any branding elements that represent your business. This helps reinforce your professional image with every document you send.

- Payment Terms: Clearly define the terms for payment, including due dates, late fees, and any discounts for early payment. This ensures transparency and avoids misunderstandings.

- Itemized Lists: Customize the way you list products or services, allowing for clear descriptions, quantities, and prices. This helps clients easily understand the charges.

- Color and Design: Adjust the colors and overall design to match your business’s style. A clean, easy-to-read format can make a big difference in client perception.

- Custom Fields: Add any custom fields that may be relevant to your business, such as project names, order numbers, or specific tax information.

These options allow you to create a personalized, professional document that aligns with your business needs. Customizing your billing forms can help make the process smoother, reduce errors, and enhance client satisfaction by presenting them with clear, concise, and well-organized financial statements.

Customizing Your QuickBooks Invoice Template

Personalizing your billing documents is an important step in ensuring that each communication aligns with your brand and specific business needs. Customization allows you to create professional and unique records that reflect your company’s identity while maintaining clarity and precision in the information provided.

Customizing these forms involves several key elements that can be easily adjusted to suit your preferences. You can modify aspects such as layout, colors, fonts, and even the sections included. Here are some common areas you may want to focus on:

- Branding: Add your company logo, contact information, and any branding elements that represent your business. This helps reinforce your professional image with every document you send.

- Payment Terms: Clearly define the terms for payment, including due dates, late fees, and any discounts for early payment. This ensures transparency and avoids misunderstandings.

- Itemized Lists: Customize the way you list products or services, allowing for clear descriptions, quantities, and prices. This helps clients easily understand the charges.

- Color and Design: Adjust the colors and overall design to match your business’s style. A clean, easy-to-read format can make a big difference in client perception.

- Custom Fields: Add any custom fields that may be relevant to your business, such as project names, order numbers, or specific tax information.

These options allow you to create a personalized, professional document that aligns with your business needs. Customizing your billing forms can help make the process smoother, reduce errors, and enhance client satisfaction by presenting them with clear, concise, and well-organized financial statements.

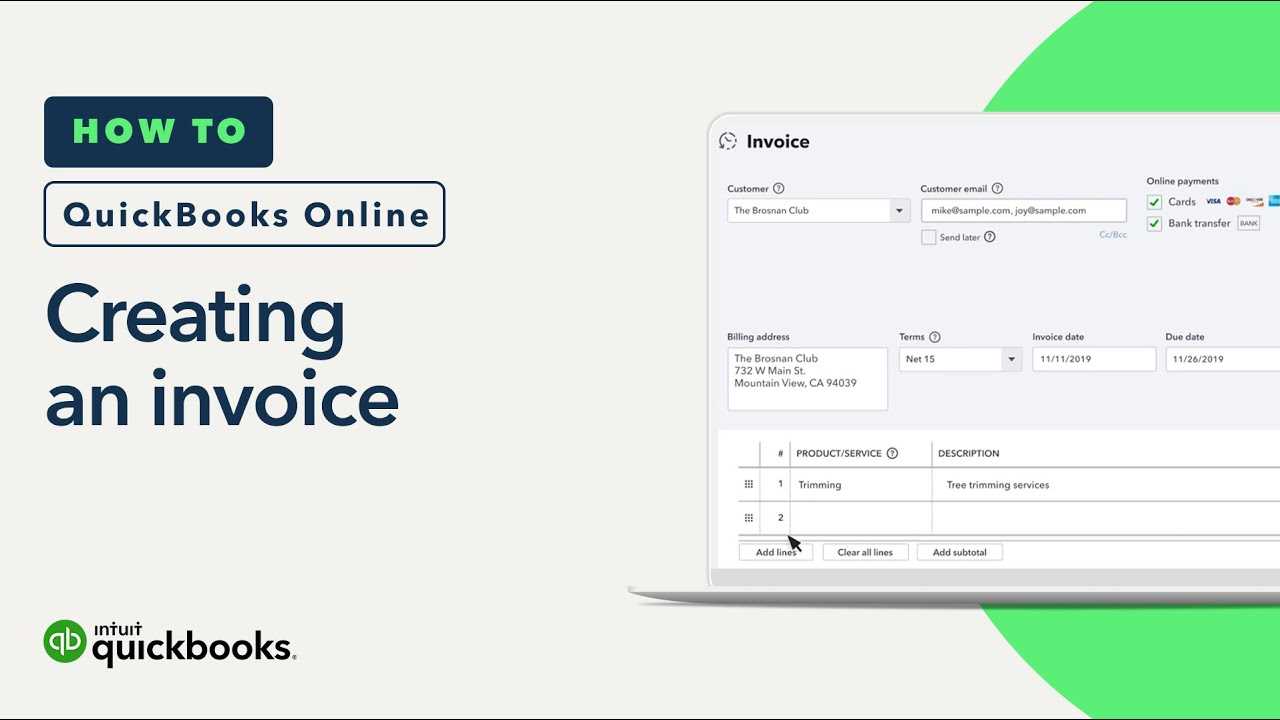

Creating Professional Invoices Quickly

Generating high-quality, accurate billing statements doesn’t have to be a time-consuming process. With the right tools, you can produce professional documents in just a few minutes, allowing you to focus more on growing your business rather than getting bogged down in administrative tasks. Streamlined features and efficient workflows are key to quickly preparing clear and professional financial statements for your clients.

Here are a few steps to help you create polished documents in no time:

- Use Pre-Formatted Designs: Select from ready-made layouts that are structured to include all necessary information. These designs are optimized for clarity and professionalism, reducing the need to start from scratch.

- Fill in Basic Information: Enter essential details such as the client’s name, services or products provided, prices, and payment terms. With templates, most of this data can be auto-filled from previous records, saving you time.

- Adjust for Custom Needs: Customize any additional fields like discounts, taxes, or project numbers that are specific to the transaction. This ensures each statement is tailored to the situation without extra effort.

- Preview and Edit: Before sending, review the document for any errors. Make sure all information is correct and aligned properly. A quick glance can save you from costly mistakes.

- Send Instantly: Once finalized, quickly send the document to the client via email or download it for later use. The process is efficient, helping you meet deadlines and maintain a professional image.

By using streamlined, ready-to-go designs and automating key steps, you can produce accurate, professional-looking financial documents in no time. This allows you to focus on the aspects of your business that require more attention while ensuring that clients receive clear, concise, and timely billing statements.

Free vs Paid Invoice Templates in QuickBooks

When it comes to creating professional billing documents, there are many options available–some of which come at no cost, while others require a paid subscription. Understanding the differences between free and paid options can help you choose the best solution for your business needs. Both have their advantages, but which one is right for you depends on the features, customization options, and overall ease of use you’re looking for.

Free Options: Basic but Functional

Free billing document designs often come with basic features that can be sufficient for small businesses or freelancers. These solutions allow you to quickly generate records with essential details, such as the amount due, client information, and a list of services or products. However, they may offer limited customization and fewer advanced features, such as automated payment tracking or integration with other financial tools. While free solutions can be a good starting point, they may not fully meet the needs of businesses looking for more professional or advanced billing capabilities.

Paid Options: More Features and Flexibility

Paid billing solutions generally offer more advanced features and greater customization options. With premium plans, you can access a wider variety of designs, more flexibility in adjusting layouts, and additional functionality like automated payment reminders, multi-currency support, and integration with accounting software. These enhanced capabilities allow for more efficient management of client transactions and can help present your business in a more polished light. For businesses that require more robust solutions, investing in paid options can significantly improve efficiency and professionalism.

In summary, free designs can be a good option for startups or small operations looking to save money, but as your business grows, the need for advanced features and more customization will likely make paid options more worthwhile. The right choice ultimately depends on your specific needs, budget, and how much control you want over the billing process.

How to Download and Install Templates

If you’re looking to personalize your billing system and enhance your workflow, it’s important to know how to acquire and set up various pre-designed formats for your documents. These pre-made layouts are designed to meet your business needs, allowing you to easily generate professional-looking paperwork. Below, we will guide you through the process of obtaining and implementing these designs on your platform.

Steps to Download

Follow these steps to download your desired design:

- Log in to your account and navigate to the templates section.

- Browse through the available collections and choose the one that suits your preferences.

- Click on the download button to save the layout to your computer or device.

- Ensure that the file format is compatible with your system to avoid any installation issues.

How to Install the Design

Once you have the design file ready, proceed with the installation by following these simple steps:

- Open your platform and locate the settings or customization section.

- Select the option to upload a new format or layout.

- Choose the file you downloaded earlier and upload it to the system.

- Apply the new design to your account and ensure it is correctly configured for your needs.

Once installed, you can begin using the new setup to generate documents according to your business specifications. Enjoy a streamlined and efficient process with a professional appearance.

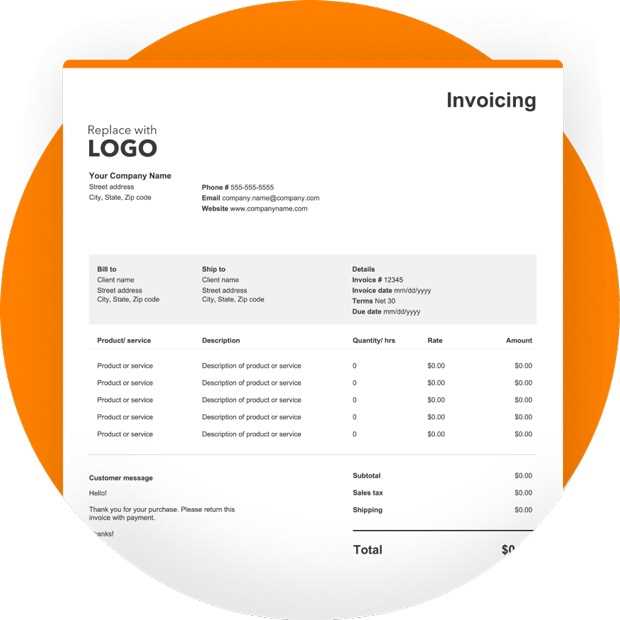

Using Logo and Branding in Invoices

Incorporating your brand’s identity into your business documents not only boosts recognition but also gives your communications a professional touch. Customizing your paperwork with a logo and consistent branding elements can enhance trust and credibility with clients. This section covers how to effectively integrate your visual identity into your business forms.

Benefits of Branding on Documents

Adding your company’s logo and branding to official documents provides several key advantages:

- Brand Recognition: Clients will immediately associate the document with your business.

- Professionalism: A well-branded document increases the perception of your business as reliable and organized.

- Consistency: Maintaining a consistent design across all documents strengthens your company’s image.

How to Customize Your Documents

Follow the steps below to effectively incorporate your branding elements:

| Step | Description |

|---|---|

| 1. Upload Your Logo | Locate the option to add or upload a logo in your document customization settings. Ensure the logo is in a high-resolution format. |

| 2. Choose Color Scheme | Select the color palette that reflects your business’s identity. Use these colors in headers, footers, and text where appropriate. |

| 3. Set Fonts | Choose fonts that align with your branding, ensuring they are clear and easy to read. Avoid using too many different fonts. |

| 4. Review Layout | Ensure the layout is clean and structured, leaving enough space for essential information without overcrowding. |

By following these steps, you can ensure that your official documents reflect your business’s branding, making them not only functional but also a powerful marketing tool.

Adding Payment Terms to Invoices

Clearly defining payment terms in your business documents helps ensure timely payments and prevents misunderstandings with clients. By specifying when and how payments are due, you create transparency and set expectations upfront. Below, we outline how to effectively add payment terms to your official documents to streamline your billing process.

Why Payment Terms Are Important

Including payment terms is essential for several reasons:

- Clarity: Clients know exactly when to pay and what the penalties may be if payments are delayed.

- Professionalism: Clear terms reflect well on your business and demonstrate that you manage transactions carefully.

- Cash Flow: Setting deadlines and payment guidelines helps maintain healthy cash flow by ensuring you are paid on time.

How to Add Payment Terms to Your Documents

Follow these steps to incorporate payment terms into your documents:

- Navigate to the section where you can customize or edit the document layout.

- Look for the option to add or edit payment details.

- Input clear payment terms, such as “Due in 30 days” or “Net 15,” depending on your agreement with the client.

- If necessary, include additional terms such as late payment fees or early payment discounts.

- Ensure the payment terms are placed in a prominent location on the document, such as near the total amount due or at the bottom.

By adding well-defined payment terms, you not only protect your business but also build trust with your clients by making the payment process clear and straightforward.

Tracking Payments with Templates

Efficiently tracking payments is vital for maintaining a smooth financial workflow. By using pre-designed documents, you can easily record and monitor payments, ensuring that all transactions are accounted for and that you stay on top of your finances. This process helps prevent missed payments and provides clear visibility into your cash flow.

Benefits of Tracking Payments

Tracking payments through your custom documents offers several advantages:

- Accuracy: You can instantly update the status of each transaction, ensuring that all records are up-to-date.

- Organization: A clear overview of your payments helps you stay organized and avoid confusion.

- Cash Flow Management: Monitoring incoming payments allows you to forecast your cash flow and plan future expenditures.

How to Track Payments

To begin tracking payments effectively, follow these simple steps:

- Choose the option to mark transactions as “paid” once a payment is received.

- Include a section in your document for payment status, where you can note whether the payment is “Pending,” “Paid,” or “Overdue.”

- If applicable, add a field for the payment method (e.g., bank transfer, credit card, etc.) to help track how the payment was made.

- Set reminders or notifications to alert you when a payment is due or overdue.

By following these steps, you ensure a more streamlined and efficient way of monitoring payments, improving both financial transparency and control over your business transactions.

Integrating with Payment Gateways

Integrating your business system with payment gateways allows for seamless transactions, improving efficiency and providing clients with more convenient payment options. This connection helps automate the payment process, reducing manual work and ensuring that payments are accurately recorded in your financial records. Below, we explore how to connect your system with popular payment processors to streamline the payment experience.

By linking your payment processor to your business platform, you can enable customers to make payments directly through their preferred methods, such as credit cards, bank transfers, or digital wallets. This integration eliminates the need for manual tracking and improves the speed at which payments are processed and confirmed.

Once integrated, you can easily view payment statuses in real-time, ensuring that you stay updated on any outstanding or completed transactions. This not only enhances customer satisfaction but also helps you maintain better control over your finances.

Common Mistakes to Avoid When Creating Invoices

Creating clear and accurate billing documents is essential for maintaining a smooth business operation. However, mistakes in the billing process can lead to confusion, delays in payments, and potential client dissatisfaction. In this section, we will highlight some of the most common errors to avoid when preparing your business paperwork.

1. Missing or Incorrect Client Information

Always double-check that the client’s name, address, and contact details are accurate. Missing or incorrect information can delay payments or cause confusion, especially if clients need to reach you for clarification.

2. Failure to Include Clear Payment Terms

Not specifying when payment is due or the accepted payment methods can lead to misunderstandings. Always make sure to include clear and concise payment terms, such as “Net 30” or “Due upon receipt,” so clients know exactly when and how to pay.

3. Overlooking Tax and Additional Fees

Omitting applicable taxes or failing to include extra charges for services can lead to discrepancies. Always ensure that taxes, delivery fees, and any other additional costs are properly included in the final amount due.

4. Not Using a Unique Identifier

Each billing document should have a unique reference number. This makes it easier to track payments, manage records, and resolve any disputes that may arise. Avoid using the same reference number for multiple transactions.

5. Inconsistent Formatting

Inconsistent fonts, sizes, or layout can make the document look unprofessional and difficult to read. Stick to a clean and organized format to ensure that your documents are both visually appealing and easy to understand.

6. Not Including a Description of Services or Products

Be sure to clearly describe the goods or services provided, including quantities, prices, and any relevant details. A vague or incomplete description can lead to confusion and disputes over charges.

By avoiding these common mistakes, you can ensure that your billing documents are clear, professional, and efficient, helping to foster trust and prompt payments from your clients.

How to Duplicate and Reuse Templates

Reusing pre-designed documents can save you a significant amount of time and effort. By duplicating a previously created layout, you can quickly adapt it for future use without needing to start from scratch each time. This section will guide you through the process of duplicating and reusing your customized designs efficiently, ensuring a consistent and professional appearance for your business forms.

Benefits of Reusing Documents

Reusing your pre-set formats offers several key advantages:

- Efficiency: You don’t need to redesign each document every time, which speeds up your workflow.

- Consistency: Reusing the same format ensures all your documents maintain a uniform and professional look.

- Time-Saving: Duplicating a previous design saves you time by eliminating the need to input all the details repeatedly.

Steps to Duplicate and Reuse Your Design

Follow these simple steps to easily duplicate and reuse your document layouts:

| Step | Description |

|---|---|

| 1. Open Your Document | Locate the existing document layout you wish to duplicate within your system. |

| 2. Select Duplicate Option | Look for the option to “duplicate” or “copy” the design. This option is usually found in the settings or file menu. |

| 3. Edit Details | Once duplicated, modify any details that are unique to the new document, such as client information or specific dates. |

| 4. Save and Use | Save the newly created document and use it as needed for future transactions. |

By following these simple steps, you can easily duplicate your existing layouts and reuse them for future needs, maintaining a consistent and professional standard across all your business documentation.

Updating Templates for Business Growth

As your business evolves, so should the documents you use to communicate with clients. Regularly updating your designs to reflect changes in your business model, branding, or product offerings ensures that your paperwork remains relevant and professional. This section discusses the importance of adapting your designs to support business growth and maintain a cohesive brand image.

When your business expands, you may introduce new products, services, or payment structures. These changes should be reflected in your official documents to ensure they stay accurate and aligned with your current operations. Regular updates also provide an opportunity to improve the overall look and functionality of your documents, enhancing both client experience and internal efficiency.

Additionally, aligning your paperwork with your evolving business identity helps maintain consistency across all customer touchpoints, reinforcing your brand and building trust. By periodically reviewing and updating your formats, you ensure that your business is always presenting a modern, polished image.

Invoicing for Multiple Currencies

When doing business internationally, handling transactions in various currencies can be a challenge. The ability to manage multiple currencies on your billing documents is essential for ensuring accurate and seamless transactions with clients from different countries. This section explores how to set up and manage multiple currencies for your business dealings, allowing for smoother financial operations and better client relationships.

Why Managing Multiple Currencies is Important

As your business grows globally, you may need to issue documents in various currencies. Having the option to select the appropriate currency for each client ensures that you provide accurate billing information and eliminates the risk of misunderstandings due to currency conversion. This is especially important for businesses dealing with international clients or vendors on a regular basis.

How to Handle Multiple Currencies in Your Documents

To effectively manage transactions in different currencies, follow these steps:

- Enable multi-currency support in your system settings to allow for the selection of different currencies.

- For each client or transaction, select the relevant currency from the available options.

- Ensure that the exchange rates are updated regularly to reflect current market values.

- Include the currency symbol or code clearly on each document to avoid confusion.

By following these steps, you can effectively manage and track transactions in multiple currencies, helping your business thrive in the global market.

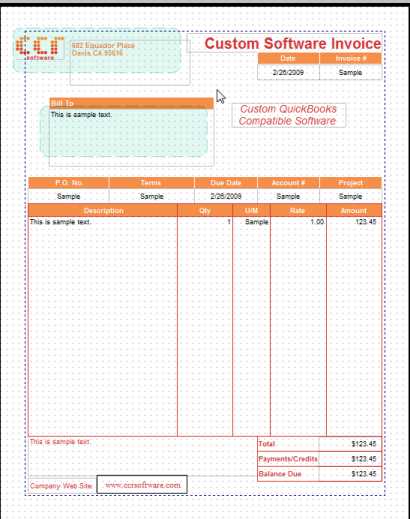

Invoice Designs for Small Businesses

For small businesses, having professionally designed documents is key to maintaining a polished and credible image with clients. Using pre-designed forms tailored to your business needs can help streamline the billing process, improve efficiency, and ensure that all necessary details are captured accurately. This section discusses how small businesses can benefit from using customizable document formats to improve their financial operations.

Why Custom Designs Matter for Small Businesses

Customizing your business forms allows you to present a consistent and professional image, which can boost trust and encourage timely payments from clients. By using a well-organized design, you make it easier for clients to understand the services or products being billed and the associated costs. This also minimizes the chances of errors or disputes, ensuring smooth transactions.

Key Features to Look for in Custom Forms

When selecting a document design for your business, ensure it includes the following features:

- Clear Branding: Incorporate your logo, business name, and contact details to ensure clients easily recognize your company.

- Comprehensive Fields: Include spaces for essential information such as item descriptions, quantities, prices, and applicable taxes.

- Payment Terms: Clearly state your payment terms to avoid confusion regarding due dates and methods of payment.

- Easy to Read Layout: A clean, well-organized layout helps clients quickly understand the document’s content and makes the payment process smoother.

By selecting or creating a design that suits your business needs, you can enhance your billing process, build credibility, and maintain a professional standard in all your transactions.

Improving Cash Flow with Better Invoices

Efficiently managing your billing process can significantly impact your business’s cash flow. By issuing clear, professional, and timely documents, you can reduce delays, ensure quicker payments, and maintain a steady income stream. This section discusses the strategies that can help optimize your financial transactions and improve cash flow through better document management.

Key Strategies for Improving Cash Flow

- Timely Billing: Ensure that you issue your documents promptly after providing goods or services. Delays in sending out documents can lead to delayed payments, which directly affects cash flow.

- Clear Payment Terms: Clearly outline payment terms, including due dates and accepted payment methods. When clients understand the terms, they are more likely to adhere to them and settle payments on time.

- Regular Follow-Ups: Set reminders to follow up with clients who haven’t made payments by the due date. A simple reminder can encourage clients to pay quickly and reduce the risk of overdue accounts.

- Offer Multiple Payment Methods: The more convenient you make it for clients to pay, the more likely they are to do so promptly. Offering options like bank transfers, online payments, and credit card payments can speed up the process.

Best Practices for Clear and Professional Documents

- Consistent Formatting: Maintain a clean, organized format for your documents. This helps clients quickly understand the details of the transaction and makes the document look more professional.

- Include All Relevant Information: Always provide complete details, including the description of goods or services, quantities, prices, taxes, and the total amount due. Missing information can lead to confusion and delays.

- Leverage Customization: Personalize your documents to reflect your business brand and provide a more professional look, which builds trust and encourages clients to make payments on time.

By implementing these strategies, you can improve the effectiveness of your billing process, ensuring that payments are made faster and that cash flow remains steady for your business.