Editable Commercial Invoice Template in Excel for Simple and Efficient Invoicing

Managing business transactions requires accurate and professional documentation. A well-organized billing sheet can streamline the process, ensuring you’re paid on time and maintain clear records. By using specialized tools to design and modify these documents, businesses can tailor their paperwork to fit specific needs and maintain consistency across all communications with clients.

Customizable solutions allow you to adapt your documents to reflect your brand identity, include necessary fields, and adjust to any legal or regulatory requirements. With the right structure, your billing can be both efficient and professional, reducing errors and improving your business’s credibility.

Whether you’re a freelancer, a small business owner, or part of a larger organization, creating the right billing paperwork is crucial for smooth financial operations. Having access to pre-designed formats that can be easily modified ensures you don’t waste time building from scratch while still achieving a professional look for your transactions.

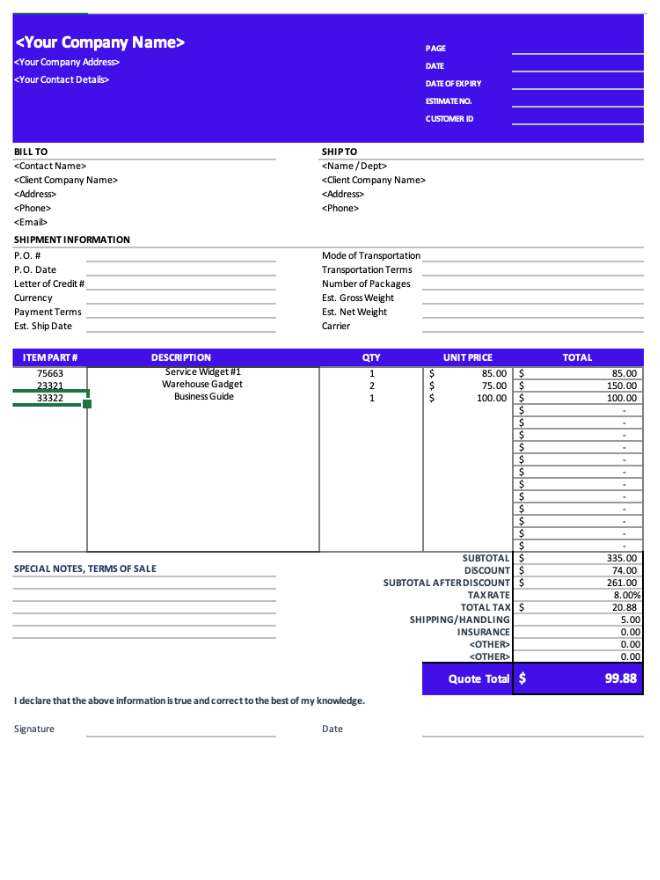

Customizable Billing Document Format in Spreadsheet Software

Having a flexible structure for your financial documents is key to managing transactions efficiently. A customizable form that can be easily modified within spreadsheet software offers the convenience of quick adjustments, whether you need to update client information, payment terms, or itemized lists. This allows businesses to maintain a consistent, professional appearance across all their records while saving time and effort.

Using a spreadsheet format for billing documents enables seamless editing and organization. You can effortlessly add new fields, adjust calculations, and track payments in real time. The ability to quickly modify the layout and content ensures that the document aligns with specific business needs, from the smallest details to overarching format changes.

Flexibility is one of the main advantages of this approach, as it gives users full control over the content. With just a few clicks, you can update tax rates, change payment terms, or even apply discounts and add additional charges. The ease of use and customization options make it an excellent choice for businesses looking to streamline their billing processes.

Moreover, this format can be reused across different clients and projects, making it a valuable asset for companies that need to generate numerous documents in a short time. Once you’ve created a master version, the template can be copied, adjusted, and saved without losing its integrity, ensuring consistency in every transaction.

Why Use an Editable Billing Document Format?

Using a customizable format for your billing documents offers several advantages, particularly when it comes to efficiency and accuracy. Having a pre-structured file that can be quickly updated ensures that you spend less time on administrative tasks and more time focusing on business growth. A flexible design lets you adjust key details, such as client information, payment terms, or specific charges, without having to recreate the entire document each time.

One of the key benefits is the reduction of human error. With a consistent format, fields that need to be filled out remain clear and organized, helping to ensure that nothing is overlooked. This makes the billing process faster and more reliable for both you and your clients.

Additionally, such a document can be easily adapted to different clients and projects. Whether you’re invoicing a small service or a large contract, a customizable structure allows you to modify the document according to the specifics of the transaction.

| Benefits | Description |

|---|---|

| Time Efficiency | Quickly modify and reuse documents for different clients or transactions. |

| Accuracy | Minimize errors with consistent and organized formatting. |

| Flexibility | Adjust the layout to meet specific business requirements and legal needs. |

| Professionalism | Ensure a polished and consistent appearance for every transaction. |

By using a customizable document format, businesses can ensure they maintain a high level of professionalism while streamlining their billing and accounting processes. This ultimately leads to better time management and smoother financial operations.

Benefits of Spreadsheet Software for Billing

Using spreadsheet software for creating billing documents offers numerous advantages that simplify and enhance the process of managing financial transactions. Its powerful features allow for efficient organization, calculation, and customization of records, making it an ideal tool for businesses of all sizes. Whether you’re tracking payments, calculating taxes, or organizing client data, spreadsheet software provides the flexibility and control needed to streamline these tasks.

One major benefit is its ability to automate complex calculations. With built-in formulas, you can quickly compute totals, apply tax rates, and calculate discounts, which eliminates the need for manual calculations and reduces the risk of errors. This leads to greater accuracy and faster turnaround times for your transactions.

Additionally, spreadsheets offer easy customization options, allowing you to adjust the layout, fonts, and design to meet your specific needs. This flexibility makes it simple to create documents that align with your business branding or comply with legal requirements.

The ability to store and organize data in one place also simplifies record-keeping. You can easily access and manage past transactions, track overdue payments, and generate reports to analyze financial performance. This comprehensive approach helps businesses maintain better control over their financials.

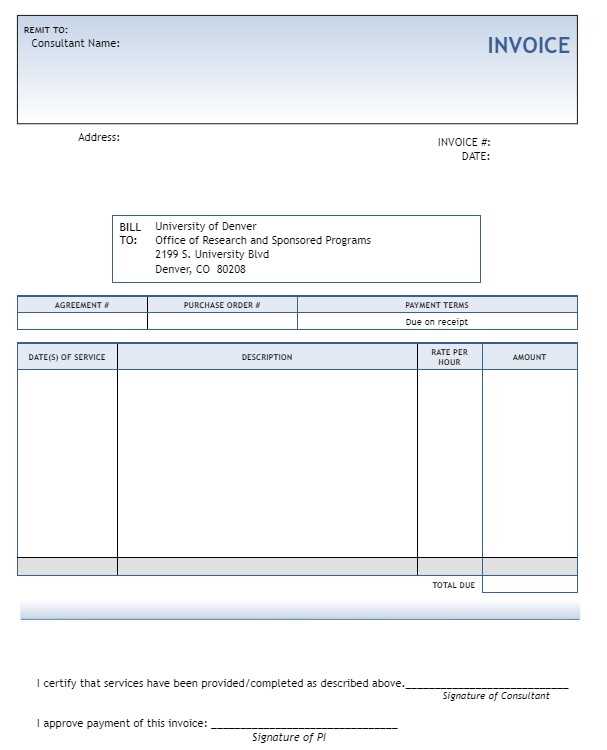

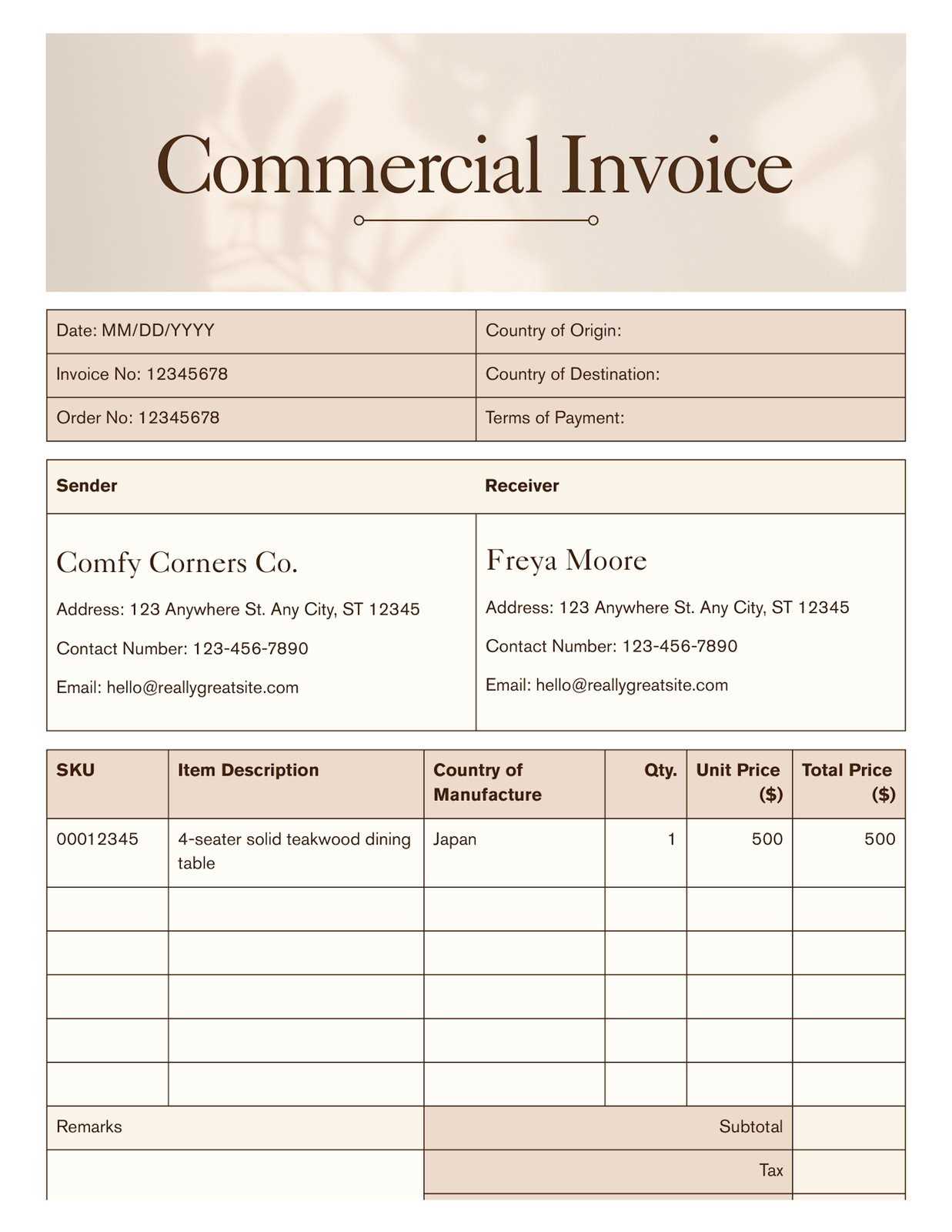

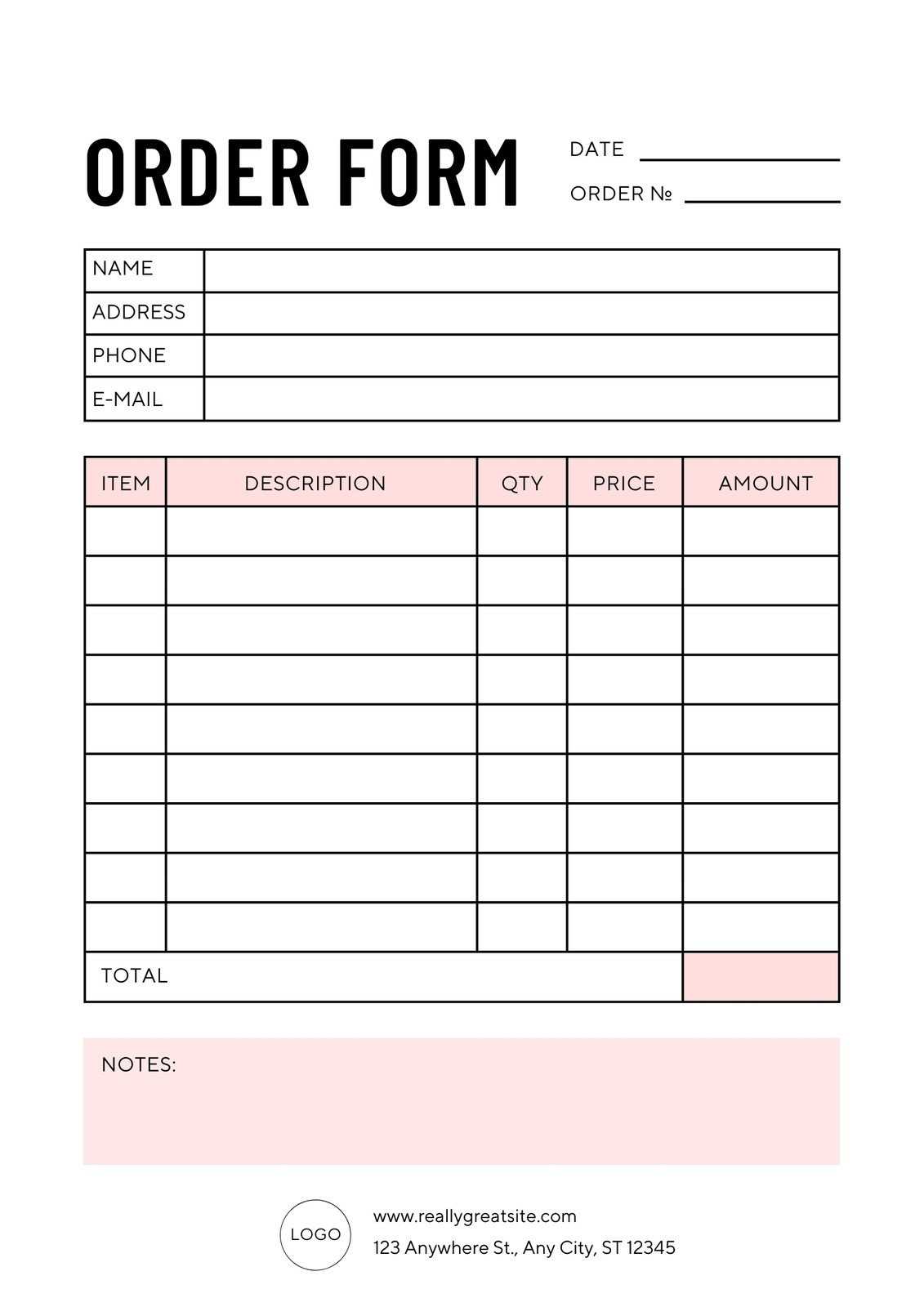

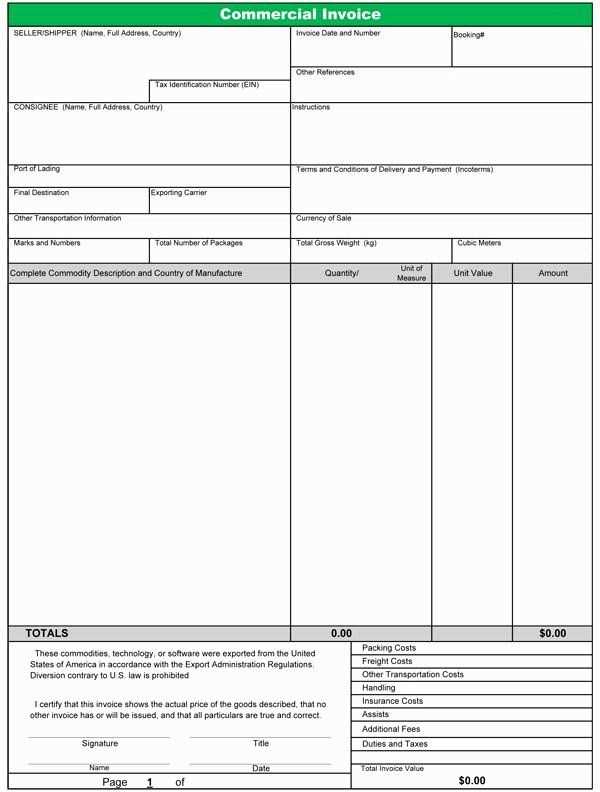

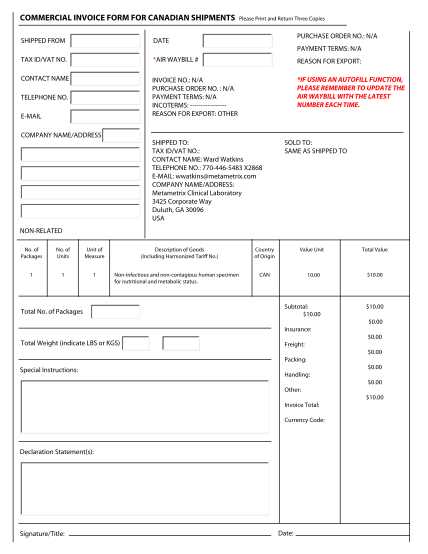

Key Features of a Billing Document

Creating a professional billing document requires including several essential components that provide clarity and ensure all necessary details are captured. These key elements not only ensure smooth transactions but also help maintain legal and financial accuracy. A well-structured record should contain specific information that both the business and the client can refer to throughout the payment process.

- Business Details: Include the name, address, and contact information of the company issuing the document. This ensures that the recipient knows who is billing them.

- Client Information: Clearly list the name, address, and contact details of the customer to whom the charges apply.

- Document Number: Every billing document should have a unique identifier or reference number. This helps in organizing and tracking the document for both internal and external record-keeping.

- Transaction Date: The date when the services or products were delivered or when the transaction was finalized.

- Description of Goods or Services: A detailed list of items or services provided, including quantities, unit prices, and any relevant descriptions.

- Payment Terms: Outline the due date for payment, accepted methods of payment, and any late fees or discounts offered for early settlement.

- Total Amount Due: Clearly state the final amount due, including taxes, discounts, or additional fees, ensuring all calculations are accurate.

In addition to these core elements, including payment instructions, tax identification numbers, and any legal disclaimers required by local regulations can further improve the document’s completeness and compliance. A comprehensive and well-organized billing record provides transparency, reduces confusion, and helps build trust with clients.

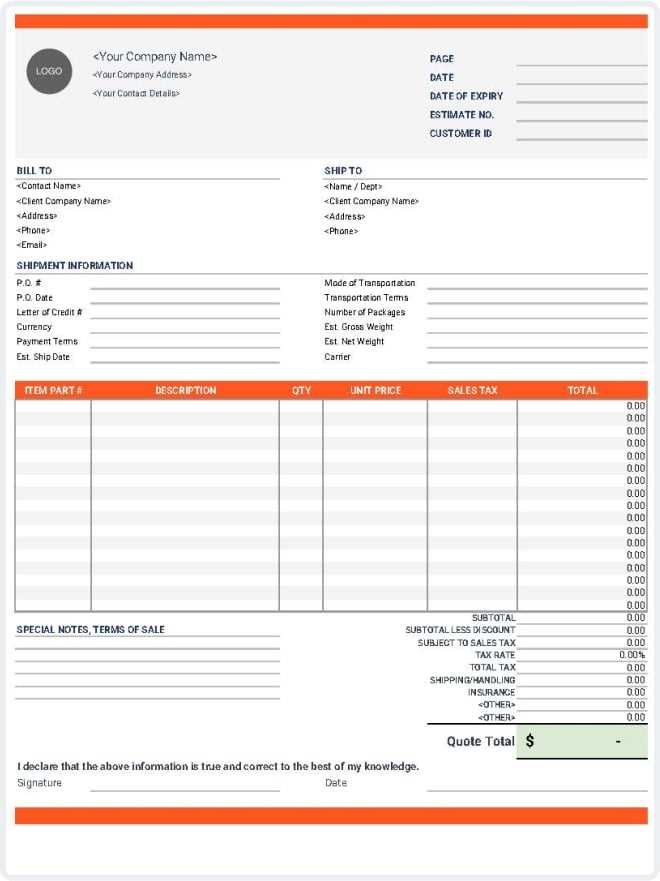

How to Customize Your Billing Document

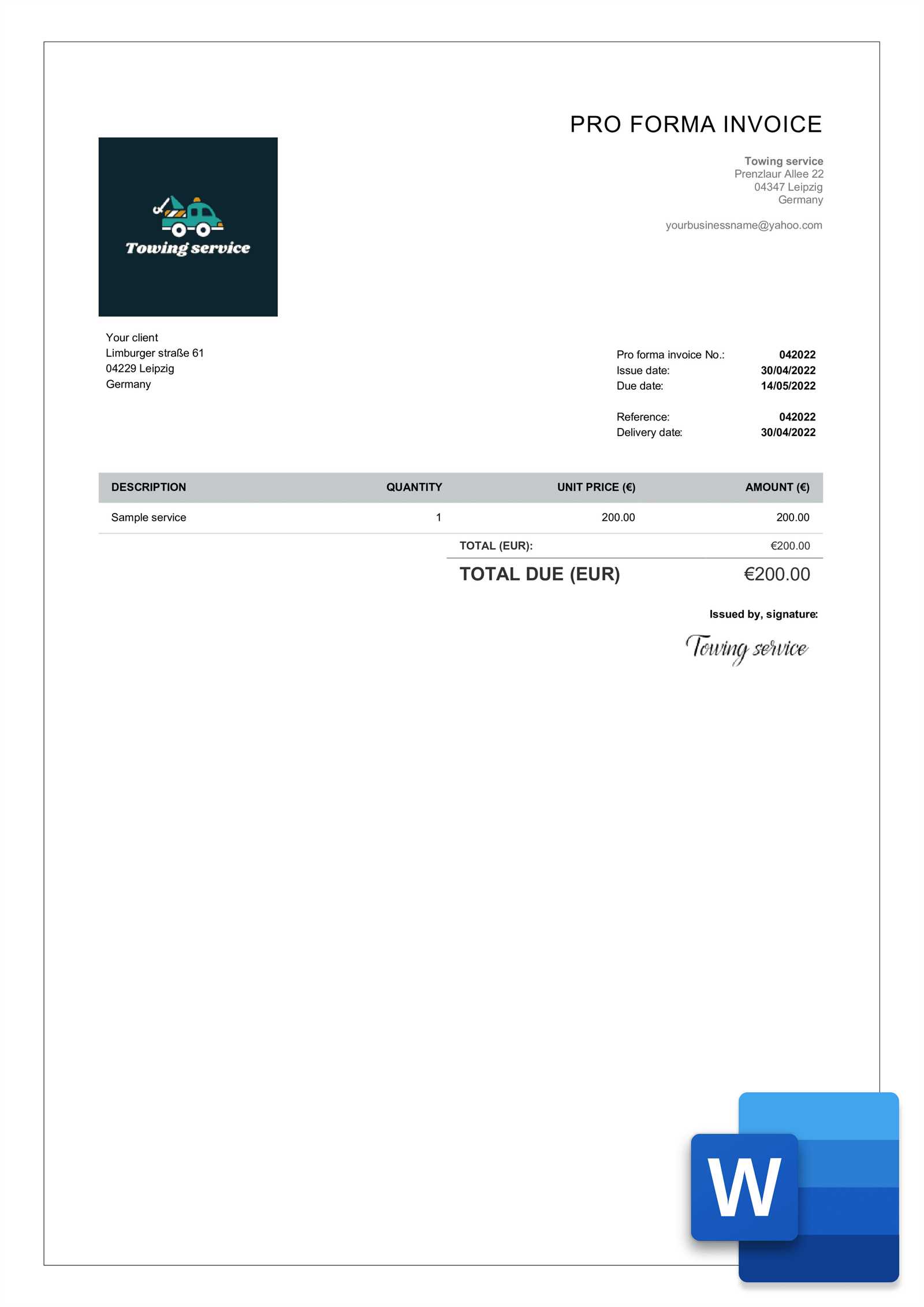

Customizing your billing document ensures that it accurately represents your business and meets your specific needs. Whether you’re adjusting the layout, adding business-specific fields, or incorporating your brand identity, the process is simple and straightforward. Customizing these documents allows you to maintain consistency across all transactions while saving time and improving accuracy.

Steps to Personalize Your Billing Document

- Change the Header: Add your company name, logo, and contact information at the top of the document. This personalizes the look and makes your document instantly recognizable.

- Adjust the Layout: Modify the design and positioning of the various sections. Ensure that important details like pricing, client information, and payment terms are easy to find.

- Modify Field Names: Customize field labels to match the specific needs of your business. For example, you can replace generic terms with those that fit your services or products.

- Add or Remove Columns: Depending on your offerings, you may need to add additional columns for things like product descriptions, serial numbers, or additional services. If certain sections are not necessary, you can remove them to simplify the document.

- Incorporate Payment Instructions: Customize sections that explain how clients can make payments, including bank account information, online payment options, or accepted methods.

Enhancing the Document’s Appearance

- Fonts and Colors: Use your brand’s fonts and color scheme to give the document a professional and consistent look.

- Borders and Shading: You can add borders or shading to sections to make the document more visually appealing and easier to navigate.

- Footer Information: Add any legal disclaimers, terms and conditions,

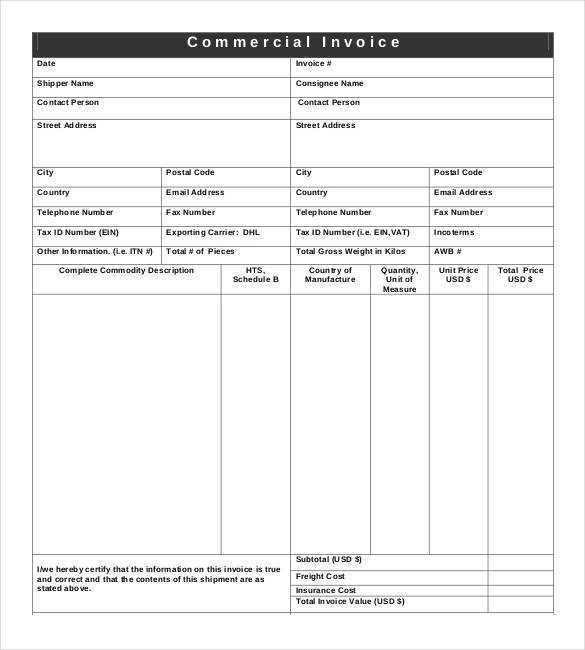

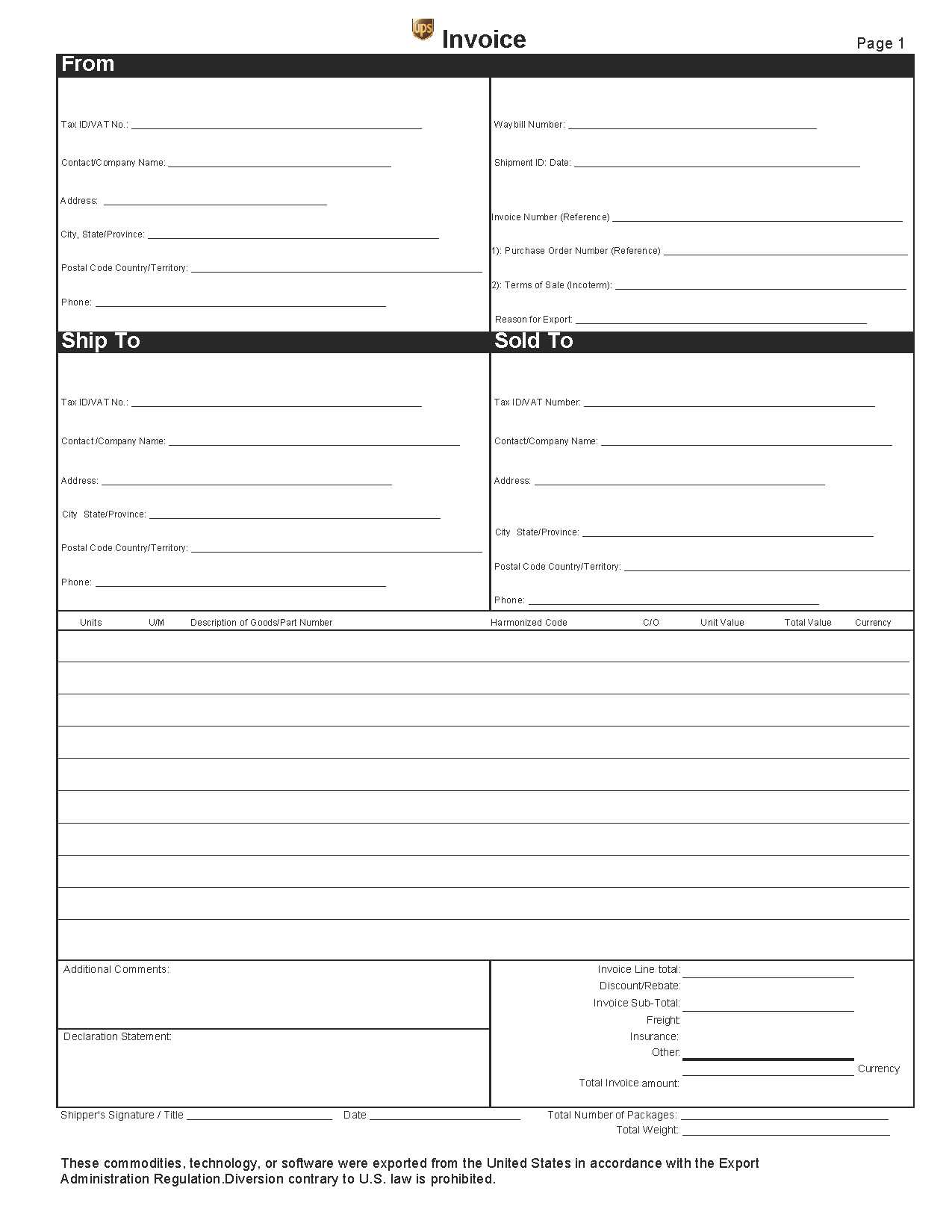

Steps to Create a Billing Document in Spreadsheet Software

Creating a professional billing document using spreadsheet software is a straightforward process that allows you to customize the layout, calculations, and content to suit your business needs. By following a few simple steps, you can create a polished and organized record that ensures accuracy and clarity in every transaction. This approach saves time and effort, providing you with a reusable document format for future use.

Here’s a step-by-step guide to creating an effective billing document in spreadsheet software:

- Open a New Document: Start by opening a new workbook in your spreadsheet software. Choose a blank sheet to begin designing your billing document from scratch.

- Add Header Information: In the top rows, enter your company name, address, and contact details. You should also include your client’s name and address in this section for clarity.

- Include a Unique Document Number: Assign a unique reference number to each billing record. This helps in tracking and organizing your documents.

- Enter Date Information: Add the date of the transaction and the due date for payment. This ensures both you and your client are aware of the timelines.

- Describe Products or Services: Create columns for each product or service provided. Include a description, quantity, unit price, and any applicable discounts or additional charges.

- Calculate Total Amount: Use formulas to calculate the total cost for each item, and then sum these amounts to provide the final total for the document. Don’t forget to include taxes or any other adjustments.

- Payment Instructions: Add clear instructions on how the client can make the payment, including bank account details, online payment methods, or other accepted forms of payment.

- Review and Format: Double-check all entries for accuracy, then format the document to make it visually appealing. Use bold text, borders, or shading to separate different sections and make important details stand out.

Once these steps are completed, you will have a professional and easy-to-understand billing document. The spreadsheet format allows for quick adjustments and reuse, making it a time-efficient solution for managing financia

How Spreadsheet Formats Save Time and Effort

Using pre-designed formats in spreadsheet software significantly reduces the time and effort required to create professional business documents. These ready-made layouts are structured to meet specific business needs, allowing you to focus on filling in key details rather than building the document from scratch. With automatic calculations, customizable fields, and easy-to-use features, businesses can streamline their administrative tasks and improve overall efficiency.

Quick Customization and Reuse

One of the main advantages of using structured formats in spreadsheet software is the ability to quickly adapt the layout to meet your needs. Once the basic structure is in place, it can be easily reused for future transactions. Customizing the document for each client or project only takes a few minutes, saving you from the time-consuming task of recreating the format each time. This makes it possible to handle a higher volume of work without sacrificing accuracy or professionalism.

Automated Calculations and Reduced Errors

Built-in formulas and calculation features allow for the automatic computation of totals, taxes, discounts, and other financial details. This not only speeds up the process but also ensures that calculations are accurate, reducing the risk of human error. With numbers updating in real-time as you make adjustments, the chance of oversight or miscalculation is minimized, which makes the whole process smoother and more reliable.

Time savings and efficiency are just two of the major benefits of using pre-designed formats in spreadsheet software. By simplifying the process, businesses can allocate more time to core activities while ensuring their financial documents remain accurate and professional.

Essential Information on a Billing Document

For any financial transaction, it’s crucial that the document reflects all the necessary details to ensure clarity and accuracy. A well-organized record provides both the issuer and the recipient with essential information regarding the goods or services provided, payment terms, and other legal requirements. By including key elements, you can avoid confusion and ensure a smooth business process.

Key Elements of a Complete Document

To create a comprehensive record, be sure to include the following essential details:

Element Description Business Information The name, address, and contact details of the entity issuing the document. Client Information The name and contact details of the customer or client receiving the goods or services. Unique Document Number A reference number assigned to the document for easy tracking and organization. Transaction Date The date when the goods or services were provided or the agreement was finalized. List of Goods/Services A clear description of the items or services provided, including quantities, unit prices, and total amounts. Payment Terms Details on the payment due date, method of payment, and any discounts or late fees. Total Amount Due The sum of the charges, including taxes, discounts, and additional fees, if applicable. Additional Information to Include

While the above elements are essential, other details may be important depending on your business and the nature of the transaction:

- Payment Instructions: Methods for how the client can pay, such as bank transfer, credit card, or online platforms.

- Tax Identification Numbers: Some regions require tax identification numbers to be included for both the business and the client.

- Legal Disclaimers: Any terms or conditions that apply to the transaction, such as return policies or warranty information.

Including these key elements ensures that your billing document is clear, professional, and legally sound, reducing the chance of disputes and facilitating smoother business operations.

Common Mistakes When Using Pre-Designed Formats

While using pre-designed formats for creating business documents offers numerous benefits, there are several common mistakes that can lead to inaccuracies, inefficiencies, or misunderstandings. These errors often occur due to neglecting important details, misusing the features of the format, or failing to fully customize the document to meet specific business needs. Being aware of these pitfalls can help you avoid unnecessary issues and ensure that your documents remain professional and accurate.

Common Errors to Avoid

- Forgetting to Update Client Information: One of the most common mistakes is failing to update the recipient’s contact details, such as their name, address, or email. Always double-check that the correct information is included before finalizing the document.

- Leaving Fields Blank: Omitting important sections like product descriptions, quantities, or payment terms can cause confusion and delay payments. Ensure all required fields are filled out completely.

- Using Outdated Information: Using old tax rates, pricing, or company information can lead to legal issues or customer dissatisfaction. Regularly review and update all relevant data to reflect the most current rates and policies.

- Not Customizing for Specific Transactions: Some businesses make the mistake of using the same format for all transactions without adjusting for specific client needs or special terms. Tailor the document for each unique transaction to avoid errors and ensure accuracy.

- Overlooking Calculations: Incorrectly applying formulas or forgetting to check totals can result in billing errors. Always verify that any automated calculations, such as tax amounts or discounts, are functioning correctly before sending the document.

- Inconsistent Formatting: Using inconsistent fonts, colors, or layout structures can make the document appear unprofessional. Keep the formatting consistent to maintain a clean and professional appearance throughout.

How to Prevent These Mistakes

- Review Every Document: Always double-check the information before sending out any document, especially for new clients or unique transactions.

- Use Templates as Starting Points: While pre-designed formats can save time, remember that they should be customized to reflect your specific business needs.

- Keep Data Up to Date:

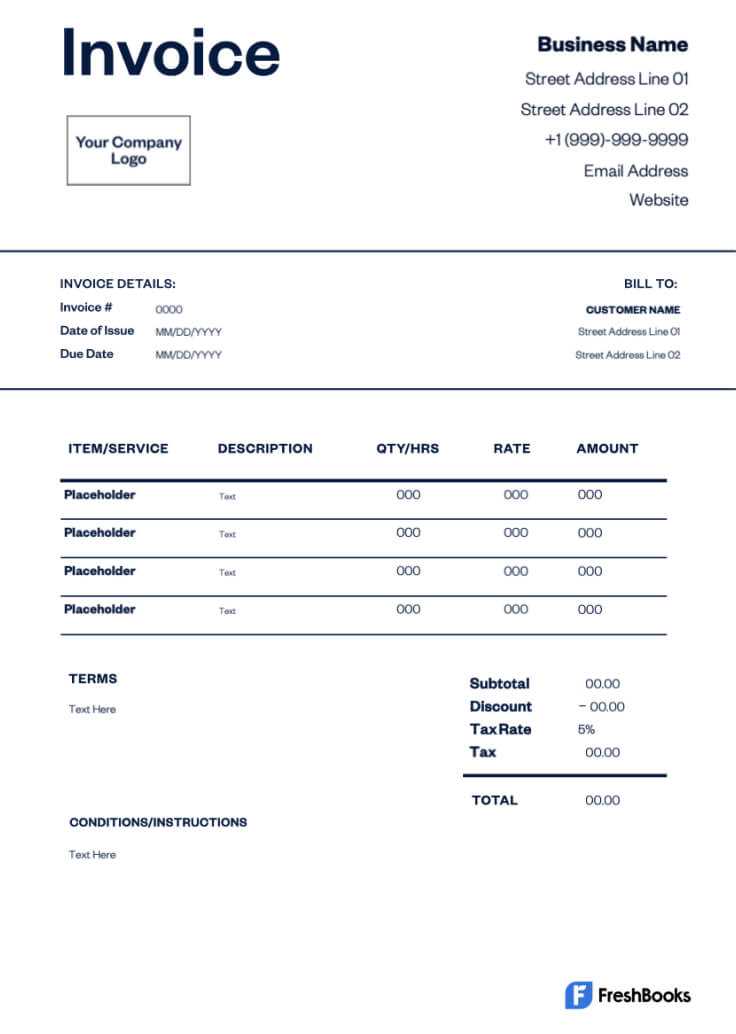

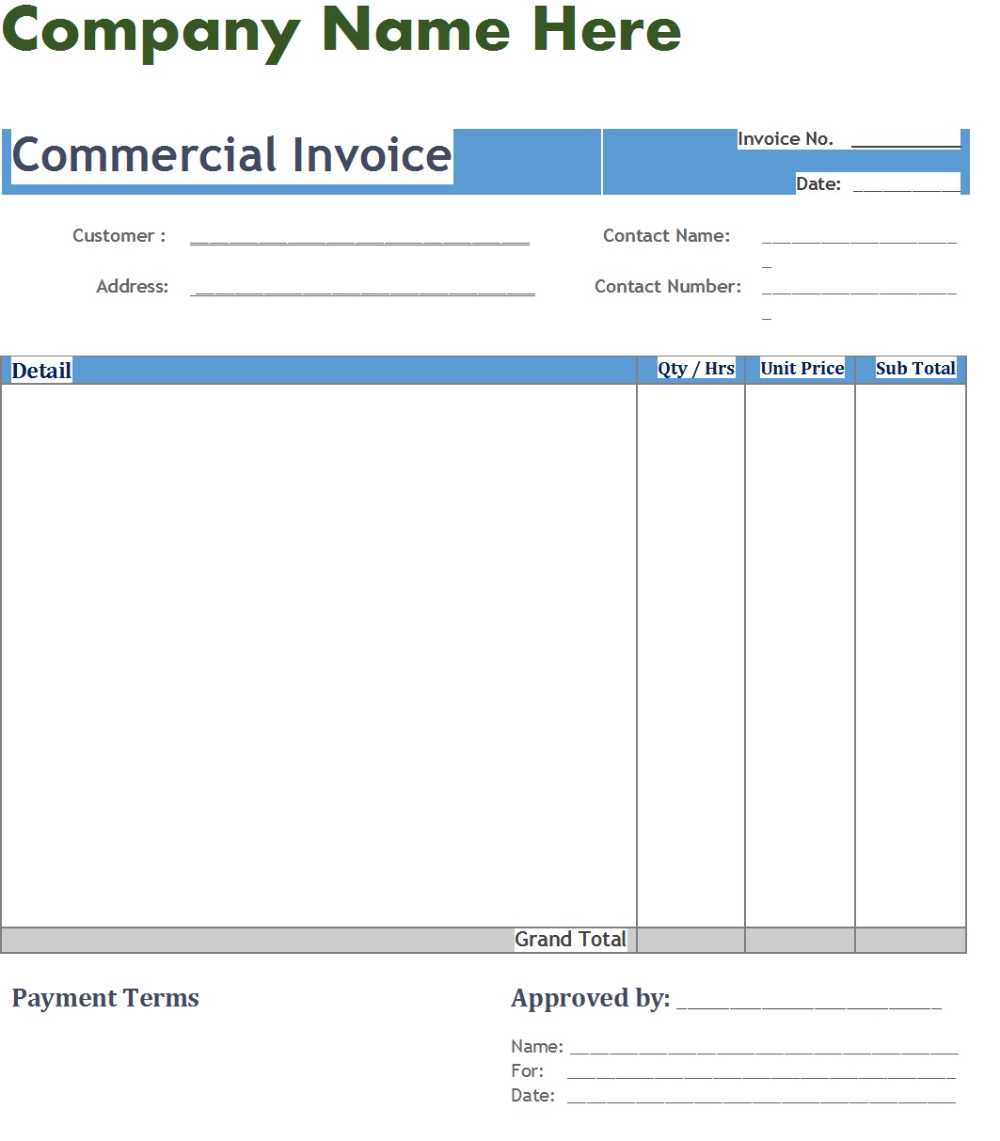

Formatting Tips for Billing Documents in Spreadsheet Software

Proper formatting can greatly enhance the readability and professionalism of your billing documents. When working with spreadsheet software, organizing your data clearly and effectively ensures that all necessary details are easy to locate, both for you and your clients. Simple formatting techniques can transform an average document into a polished and user-friendly record, making it easier to track transactions and reduce errors.

Formatting Tips to Enhance Your Billing Document

- Use Clear Headers: Use bold, larger fonts for section headers like “Business Information,” “Client Details,” and “Total Due” to help guide the reader’s eye. This makes the document easier to navigate.

- Align Text Properly: Align text in the appropriate columns: left for descriptions, right for numbers (such as quantities and prices), and center for titles or totals. This creates a clean and structured appearance.

- Highlight Key Information: Use borders, shading, or bold text to emphasize key figures like the total amount due or payment due date. This draws attention to the most important details of the document.

- Utilize Columns for Details: Break down information into columns with clear labels (e.g., item description, unit price, quantity, total cost). This not only organizes the data but also ensures that each part of the transaction is clearly presented.

- Consistent Number Formatting: Ensure that all numbers, such as prices and totals, are formatted consistently. Use the currency symbol, proper decimal points, and thousands separators for clarity and professionalism.

- Keep It Simple: Avoid cluttering the document with unnecessary colors or images. A clean, minimalist design is more effective in conveying important information quickly.

Table Layout Example for Billing Documents

Here’s a simple table layout you can follow to make your document clear and easy to read:

Item Description Unit Price Quantity Total Cost Service A $50.00 2 $100.00 Service B $30.00 1 $30.00 Total $130.00 Following these formatting tips will help you create professional and easy-to-read billing documents, enhancing both the appearance and functionality of your records. A well-formatted document ensures that all information is clear, accurate, and visually appealing, making it easier for clients to process and pay their bills on time.

How to Include Taxes and Discounts

When preparing a billing document, it’s essential to correctly apply taxes and discounts to ensure that both the business and the client are clear on the final amount due. Accurately calculating and displaying these adjustments not only reflects professionalism but also helps maintain transparency in financial transactions. Whether you’re adding sales tax or offering a discount, it’s crucial to include these details in a clear and organized way.

Adding Taxes to the Total Amount

Sales tax is commonly added to the total cost of goods or services, and it should be clearly displayed on the document. To include taxes, follow these steps:

- Calculate the Tax: Multiply the total cost of the goods or services by the applicable sales tax rate. For example, if the total cost is $200 and the tax rate is 10%, the tax will be $20.

- Display the Tax Separately: To avoid confusion, list the tax amount on a separate line, usually just below the subtotal and before the total amount due. Label it clearly as “Sales Tax” or the specific tax type (e.g., “VAT”).

- Ensure Accuracy: Double-check that the tax rate is correct for your location or the client’s region. Tax rates may vary, so it’s important to use the appropriate rate for each transaction.

Applying Discounts

Discounts are a great way to incentivize customers or offer special promotions, but they must be calculated and presented accurately to avoid confusion. Here’s how to apply a discount:

- Determine the Discount Type: Discounts can be either a percentage off the total amount or a fixed dollar amount. For example, a 10% discount on a $200 purchase would reduce the total by $20.

- Calculate the Discount: If the discount is a percentage, simply multiply the subtotal by the discount percentage. For a fixed discount, subtract the specified amount directly from the total cost.

- Display the Discount: List the discount on a separate line, usually beneath the subtotal, to make it clear to the client how much they’re saving. Label it as “Discount” or “Promo Discount” and indicate the percentage or amount deducted.

- Subtract the Discount from the Subtotal: Af

Managing Multiple Billing Document Layouts in Spreadsheet Software

For businesses handling various clients or projects, it is often necessary to create and manage different types of financial records. Whether you need a basic layout for regular transactions or a more detailed format for specific services, having multiple document structures can streamline your workflow. By organizing and managing these layouts efficiently, you ensure that each client receives the right document, tailored to their particular needs.

Organizing Your Documents

When dealing with multiple formats, it’s important to keep everything organized to avoid confusion. Here are some strategies to help you manage various layouts:

- Create Separate Files: If the documents require significantly different structures, it’s best to store them in separate files. This prevents mixing up layouts and allows for easier retrieval when needed.

- Use Folders for Classification: Organize different document types into folders based on client, project, or the purpose of the document. For example, you might have separate folders for “Retail Clients,” “Wholesale Clients,” and “Service Projects.”

- Label Files Clearly: Give each file a descriptive name that indicates its purpose, such as “Retail_Invoice_Template” or “Service_Billing_Format.” This makes it easier to locate the right document at a glance.

Streamlining the Process with Customization

While maintaining multiple layouts, customization is key to adapting each document to specific needs. Here are a few tips to streamline customization:

- Use Pre-Formatted Sections: Create consistent sections within your documents (e.g., “Billing Details,” “Client Information,” “Total Due”) that can be easily modified for different clients or transactions.

- Implement Reusable Fields: Include placeholders for frequently changing data, like client names, addresses, or amounts. This allows you to quickly update key details without altering the document’s overall structure.

- Leverage Copy-Paste Functions: If the layout for each client is relatively similar, you can copy sections from one document to another, minimizing the need for extensive formatting each time.

By organizing and customizing your billing records effectively, you can handle multiple layouts with ease and ensure that each document is tailored to your clients’ specific needs. Streamlining the process of creating and managing these documents ultimately saves time and enhances efficiency in your daily operations.

How to Track Payments with Spreadsheet Formats

Tracking payments efficiently is essential for managing cash flow and ensuring that clients pay on time. Using a well-organized system in spreadsheet software can help you keep track of which payments have been made, which are outstanding, and when follow-ups are necessary. By setting up a clear structure to monitor payment statuses, you can streamline your financial processes and reduce the likelihood of errors or missed payments.

Setting Up a Payment Tracking System

To effectively track payments, you’ll need to create a structured format that records all relevant transaction details. Here’s how to set it up:

- Columns for Key Information: Include columns for essential information such as client name, transaction date, total amount, payment due date, and payment status (paid, pending, overdue).

- Include Payment Methods: Track how payments are made, such as through bank transfer, credit card, check, or online payment platforms. This will help you identify payment patterns and manage future transactions more efficiently.

- Payment Date and Amount: Record the exact date when each payment is received and the amount paid. This ensures that you have a clear record of when payments were made and whether the full balance was paid.

Monitoring Outstanding Payments

Keeping track of outstanding payments is just as important as recording received payments. To do so effectively:

- Highlight Overdue Payments: Use conditional formatting to highlight overdue payments or those that are approaching their due date. This can alert you to follow up with clients who haven’t paid yet.

- Set Reminders: Set up a reminder system within the spreadsheet to notify you when payments are due or overdue. You can use simple formulas or integrations with calendar tools to automate this process.

- Track Partial Payments: If clients make partial payments, record them accurately and update the outstanding balance. This helps you keep track of any remaining amounts and manage follow-up actions.

Generating Reports for Better Insights

Generating regular reports from your payment tracking system will give you a clear overview of your business’s financial health. Consider the following:

- Summarize Total Payments: Use formulas to calculate the total payments received, total outstanding, and total overdue. This gives you a snapshot of cash flow at a glance.

- Analyze Payment Trends: Track payment behavior over time by analyzing which clients are timely, which ones tend to delay payments, and which methods of payment are most common.

- Export Data: Export your payment tracking data into other formats, such as PDFs or CSV files, for sharing with colleagues or accountants.

By using a systematic approach to track payments, you can stay organized and reduce the

Ensuring Professional Design for Billing Documents

Creating a well-designed financial record is essential for maintaining professionalism in business transactions. A visually appealing and clear layout not only helps your clients understand the details but also reinforces the credibility of your business. Ensuring that your document is both functional and aesthetically pleasing involves paying attention to several key design elements. From font choices to section alignment, each aspect contributes to the overall impression of your document.

Key Design Elements for Professional Documents

To create an effective and professional billing record, consider the following design principles:

- Use Clear and Readable Fonts: Opt for professional fonts like Arial, Calibri, or Times New Roman. Keep the font size between 10pt and 12pt for easy readability. Avoid overly decorative fonts that may distract from the content.

- Consistent Color Scheme: Choose a simple color scheme that aligns with your brand identity. For example, use a neutral background color with darker text for contrast. Avoid using too ma

Customizing Billing Documents for Your Business

Every business has unique needs when it comes to documenting financial transactions. Customizing your records ensures that the layout not only aligns with your branding but also includes the specific information necessary for your operations. By adjusting the structure, content, and design elements, you can create a tailored document that meets your company’s requirements while also enhancing the client experience.

When personalizing your financial documents, the goal is to reflect your business identity while ensuring clarity and ease of use. Consider incorporating your business logo, adjusting the layout for better readability, and adding or removing fields that are relevant to your particular industry or service model.

Tailoring Document Sections

Each business type may require different sections in their records. For example, a service provider might need to include detailed descriptions of the services rendered, while a retailer may only need a list of products sold. Customizing these sections ensures that your document provides all the relevant details without unnecessary information.

- Client and Business Information: Include specific details like your business address, client contact information, and a unique reference number for each transaction.

- Itemized Descriptions: For businesses offering services or custom products, detailed descriptions or service codes can help clarify what was provided.

- Payment Terms: Clearly define your payment terms (e.g., net 30, due upon receipt) and specify any late fees or discounts for early payments.

Incorporating Your Brand Identity

Your document should reflect your brand, making it recognizable and professional. Customizing the look and feel of your records can reinforce your business identity and build trust with clients.

- Logo and Branding: Place your company’s logo at the top or in the header area. Ensure the color scheme and font choices are consistent with your other marketing materials.

- Professional Design: Keep the design simple but consistent. Use borders, headings, and sections that align with your business’s professional image.

- Custom Fields: If your business has specific needs, such as tracking project numbers, delivery dates, or customer references, ensure these fields are added to your document format.

Integrating Billing Documents with Accounting Software

Streamlining your business’s financial processes can greatly enhance efficiency and reduce errors. One of the most effective ways to do this is by integrating your billing records with accounting software. This integration allows for automatic data transfer, minimizing the need for manual entry and ensuring that your financial reports are accurate and up-to-date. With the right setup, you can easily manage cash flow, track expenses, and ensure seamless communication between your accounting tools and your billing system.

Benefits of Integration

Integrating your billing documents with accounting software offers several key advantages:

- Reduced Data Entry: Instead of entering data manually into both your billing system and accounting software, integration allows for automatic syncing, saving time and effort.

- Improved Accuracy: By eliminating manual entry, you reduce the risk of errors, ensuring that your financial records are accurate and up to date.

- Real-Time Updates: Integration ensures that as soon as a payment is recorded or a bill is issued, your accounting software reflects the change, providing you with real-time data on your business’s financial health.

- Better Financial Reporting: By having all your data in one place, you can generate more comprehensive and accurate financial reports, which are essential for decision-making and tax purposes.

Steps to Integrate Billing Documents with Accounting Tools

To successfully integrate your billing records with accounting software, follow these basic steps:

- Choose Compatible Software: Ensure that your accounting software supports integration with your current billing system. Many accounting platforms offer built-in features or third-party connectors for easy syncing.

- Export Billing Data: Once a billing document is finalized, export the data in a format that can be imported into your accounting system (e.g., CSV, XML, or direct API integration).

- Map Data Fields: Configure the integration by mapping key fields from your billing records to the corresponding fields in your accounting software. This ensures that important details like client names, amounts due, and payment terms are accurately transferred.

- Automate Syncing: Set up automatic syncing between your billing system and accounting software. This ensures that every new entry, modification, or payment update is reflected in both systems.

Where to Find Free Billing Document Layouts for Spreadsheet Software Finding the right layout for creating billing records can be a time-consuming process, but there are many free resources available to help you get started. Whether you’re a small business owner, freelancer, or part of a larger organization, utilizing ready-made layouts can simplify the creation of financial documents. These layouts often come pre-designed, allowing you to easily customize them with your specific business information and save valuable time.

Various platforms offer downloadable options that are compatible with popular spreadsheet software, making it easier to manage your financial transactions. These free resources can help you create professional-looking records without the need for complex software or design skills.

Online Marketplaces and Resource Websites

Several websites specialize in providing free, customizable billing document layouts for download. These platforms allow you to access various designs that suit different business needs, from service-based businesses to product retailers.

- Microsoft Office Templates: Microsoft offers a wide range of free document layouts that can be easily used in spreadsheet software. Simply visit the official website or open the application to find numerous free options to download.

- Google Sheets: Google provides a selection of free billing layouts in its templates gallery. These are fully customizable and can be accessed directly through your Google account, making them easy to use and share online.

- Template Libraries on Business Websites: Many business-focused websites offer free downloadable layouts as part of their resources. These are often categorized by business type and can be customized to fit your needs.

Free Layouts from Freelance Communities and Blogs

If you’re looking for a more personal touch or unique designs, freelance communities and blogs often share free resources created by professionals. These options are great for businesses looking for a more tailored approach or industry-specific designs.

- Freelance Designers: Some freelance designers share free, high-quality layouts on platforms like Behance or Dribbble. These layouts can be downloaded and adapted to your specific requirements.

- Business Blogs: Many business blogs and finance websites offer free downloadable resources. These websites often feature customizable layouts designed by experts, providing both basic and advanced features for business owners.

By exploring these free options, you can easily find and download the right layout for your billing records. Whether you need a simple format for tracking payments or a detailed document for complex transactions, there is a vast selection available to suit your needs.