Download Free Invoice Template for Quick and Easy Invoicing

Managing finances effectively is a key part of running any business, and one of the most essential tasks is generating accurate and professional payment requests. By using a ready-made document that suits your needs, you can save valuable time and ensure consistency in all transactions. These tools can help simplify the process, making it easier to track payments and stay organized.

With a variety of customizable options available, you no longer need to start from scratch when preparing these important documents. Whether you’re a freelancer, small business owner, or part of a larger organization, having a reliable resource can help improve your overall workflow. A well-structured form can also enhance your credibility and ensure you receive payments on time.

Maximizing efficiency is one of the biggest advantages of using these pre-designed documents. You can focus on growing your business while the necessary paperwork is handled quickly and professionally. In this article, we’ll explore the different ways you can benefit from these convenient solutions and guide you through selecting the right one for your needs.

Free Invoice Templates for Small Businesses

For small business owners, managing financial documentation efficiently is critical to maintaining smooth operations. Instead of creating documents from scratch each time, using ready-made solutions can simplify the billing process, save time, and enhance professionalism. These tools allow entrepreneurs to maintain consistency in their paperwork while ensuring that all necessary details are included, reducing the risk of errors.

Benefits of Using Ready-Made Solutions

One of the primary advantages of utilizing pre-designed formats is the time-saving aspect. These resources are typically well-organized and contain the essential fields you need, such as client details, services rendered, and payment terms. As a result, you can focus more on your core business activities rather than spending valuable hours formatting and structuring each document.

How Small Businesses Can Benefit

Small businesses often operate with limited resources, so efficiency is key. Ready-made documents can help owners present a polished image to clients, while simultaneously streamlining the payment request process. This consistency can help build trust with clients and make financial tracking easier, contributing to better cash flow management.

Why Use a Free Invoice Template

Creating professional documents for payment requests can be a time-consuming task, especially when you are trying to ensure accuracy and consistency. By using pre-designed documents, you can avoid the hassle of manually formatting each one, while still maintaining a professional appearance. These resources allow you to focus on other important aspects of your business, knowing that your payment requests are well-organized and comprehensive.

Advantages of Ready-Made Documents

Using a pre-made solution brings several significant benefits, particularly for small business owners and freelancers:

- Time efficiency: Pre-designed documents are ready to be filled out, reducing the time spent on creating each request from scratch.

- Professional appearance: These tools ensure that your financial documents are structured in a way that reflects positively on your business.

- Cost savings: Many resources are available at no charge, allowing you to keep expenses low while still maintaining quality.

- Easy customization: You can tailor the fields and design to suit your needs without the need for advanced skills or software.

How It Supports Better Cash Flow Management

Having access to structured and clear payment requests makes it easier to track and follow up on outstanding balances. Clients are more likely to pay promptly when the document is professional and includes all necessary details. This helps maintain a steady cash flow, which is crucial for the ongoing success of any business.

Top Benefits of Free Invoice Templates

Using ready-made documents to request payments offers significant advantages, especially for businesses that need to streamline their billing process. These resources help ensure that your payment requests are clear, professional, and consistent. With the ability to customize details while maintaining a standard format, you can improve both your efficiency and the impression you make on clients.

Key Advantages of Ready-to-Use Billing Documents

There are several key reasons why businesses choose pre-made formats to handle their financial documentation:

- Quick Setup: You can create accurate and professional documents in minutes without the need to design them from scratch.

- Consistency: These tools ensure that every request follows the same structure, making it easier for clients to understand and process.

- Ease of Use: Most formats are simple to modify, even for those with limited technical skills.

- Cost-Effective: Many high-quality options are available at no charge, making them ideal for businesses on a budget.

- Time-Saving: By eliminating the need to create a new document each time, you can focus on more important business tasks.

Improving Client Relationships and Cash Flow

Clear and professional billing documents not only enhance your credibility but also foster trust with your clients. When clients receive an organized and comprehensive payment request, they are more likely to pay on time, helping to improve your cash flow. Furthermore, having a standard process for billing ensures that you never miss important details, which can ultimately prevent payment delays and disputes.

How to Customize Your Invoice Template

Personalizing your billing documents allows you to better reflect your brand and ensure that all the necessary details are included. Customization can range from simple adjustments, such as adding your logo, to more complex changes like altering the layout or payment terms. Tailoring the document to suit your business needs helps present a professional image and makes it easier for clients to process payments efficiently.

Steps to Personalize Your Billing Document

Customizing your document is simple and can be done in just a few steps:

- Add Your Business Information: Include your company name, address, phone number, and email. Make sure these details are easy to find for clients.

- Insert a Professional Logo: Adding your logo helps reinforce your brand identity and makes the document look more official.

- Modify Payment Terms: Clearly state the payment due date, late fees (if applicable), and accepted methods of payment.

- Customize the Layout: Adjust the layout of the fields to suit your preferences or industry needs. You can rearrange sections or change the font style to make the document easier to read.

- Include Custom Notes: Add a section for personalized messages, such as “Thank you for your business” or any additional terms related to the service provided.

Tips for Professional Customization

When personalizing your documents, keep the following tips in mind:

- Consistency: Ensure that the colors, fonts, and design match your overall branding to maintain a cohesive image across all materials.

- Simplicity: Keep the layout clean and organized. Avoid clutter, as a clear document is easier to read and more professional.

- Accuracy: Double-check all information, including pricing and terms, to avoid confusion or delays in payments.

Where to Find Free Invoice Templates

There are many places online where you can access ready-made resources to create payment requests. Whether you need a simple document or something more customized, these platforms provide a variety of options that can help you save time and maintain a professional image. These resources are often available in multiple formats, making it easy to choose one that suits your business needs.

Popular Websites Offering Free Options

Several websites offer downloadable documents that are easy to customize and use. Here are some popular places to check out:

- Microsoft Office Online: Offers a range of pre-designed documents in Word and Excel formats that can be customized to your business needs.

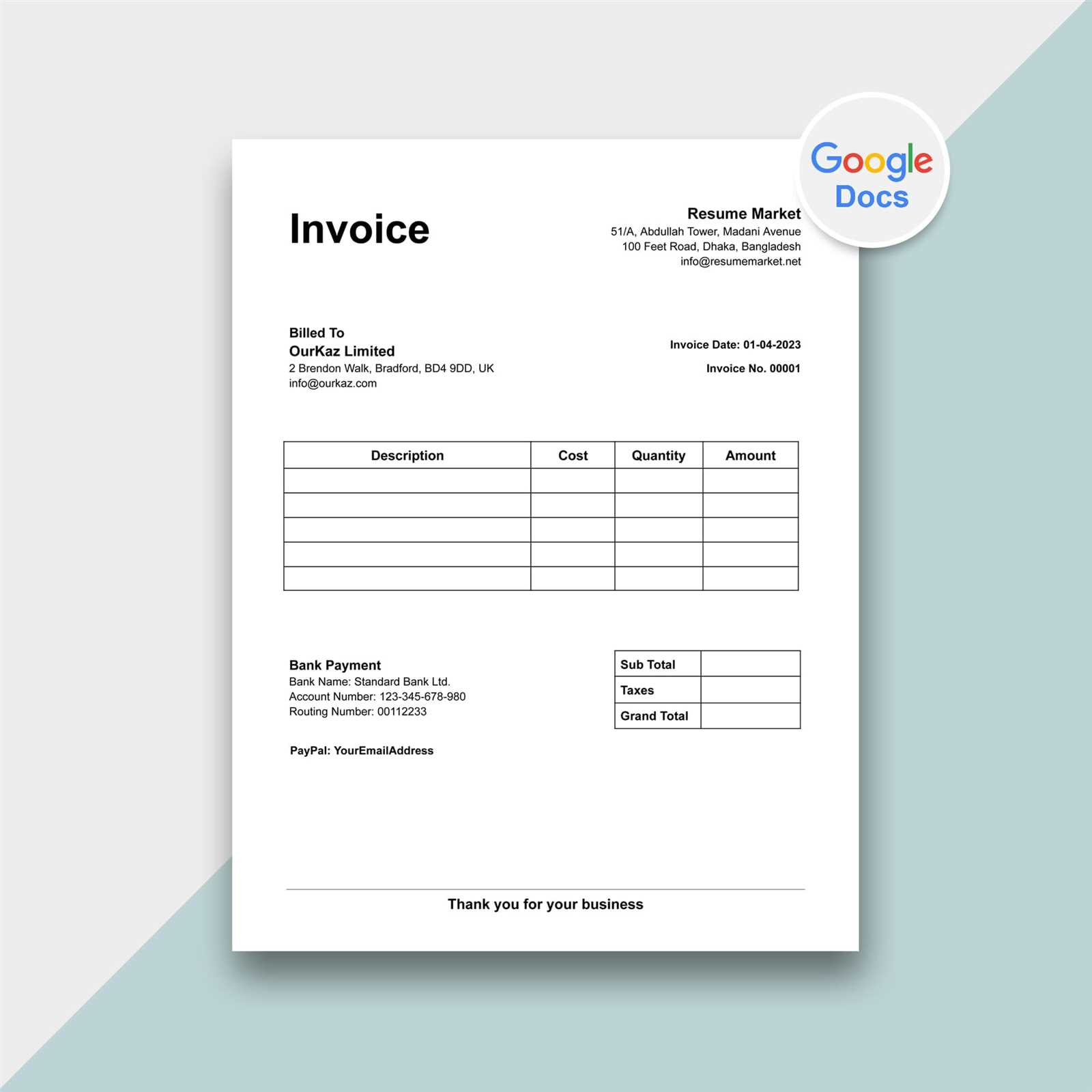

- Google Docs: Provides templates that can be accessed directly from your Google Drive, allowing you to work on documents from anywhere.

- Invoice Generator: A simple online tool that allows you to create and download payment requests without signing up or creating an account.

- Canva: Known for its design tools, Canva also offers customizable billing documents with various templates available for free.

- Zoho Invoice: Offers free billing solutions for small businesses, allowing for easy customization and tracking of payments.

Using Accounting Software for Payment Requests

Many accounting platforms also offer free billing solutions. While these tools typically have additional features for managing your finances, they often provide templates that make creating documents quick and easy. Some examples include:

- Wave: A free accounting software that offers customizable billing options for small businesses.

- PayPal: Allows you to create payment requests directly from your PayPal account, streamlining the process for businesses that use PayPal as a payment gateway.

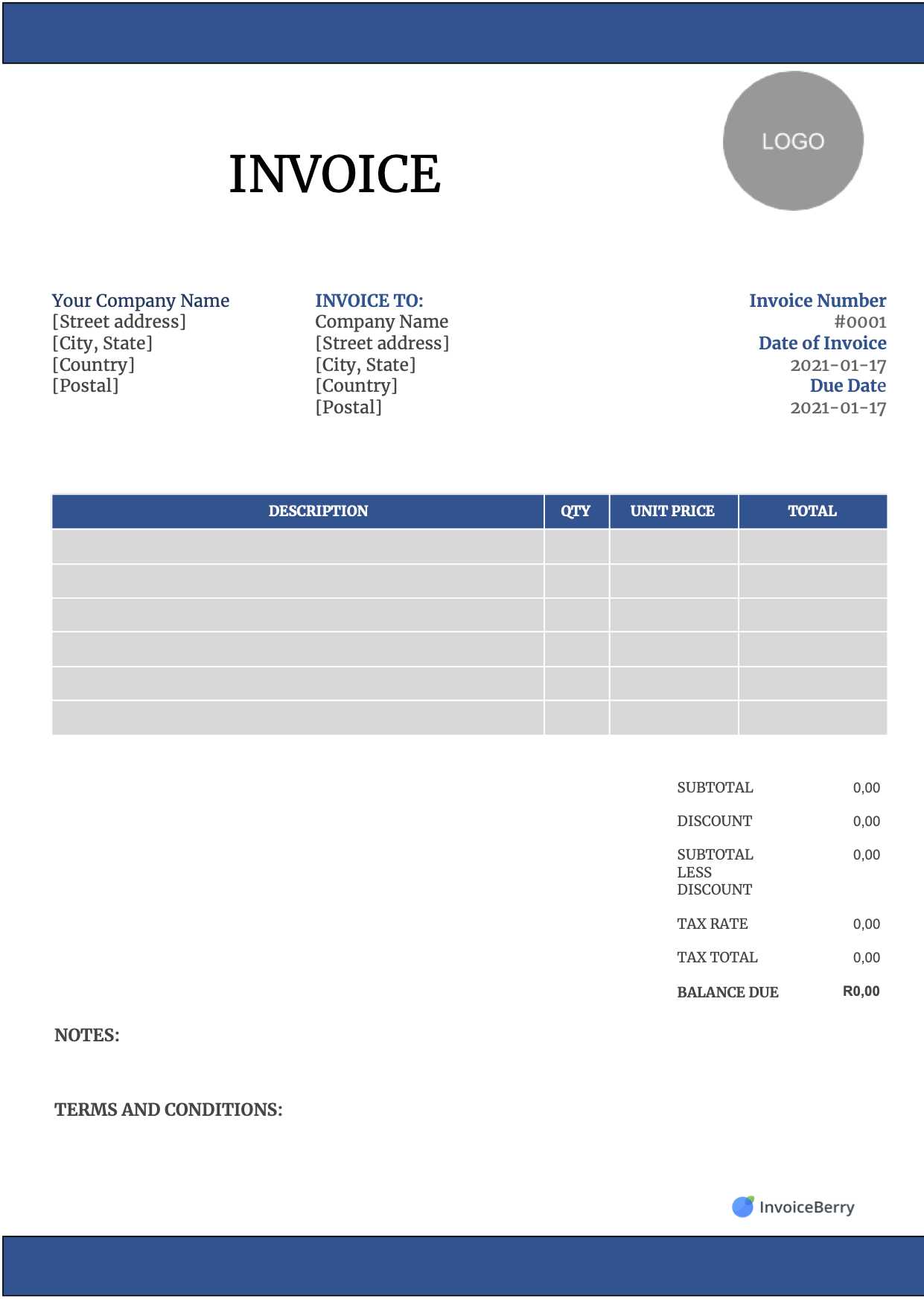

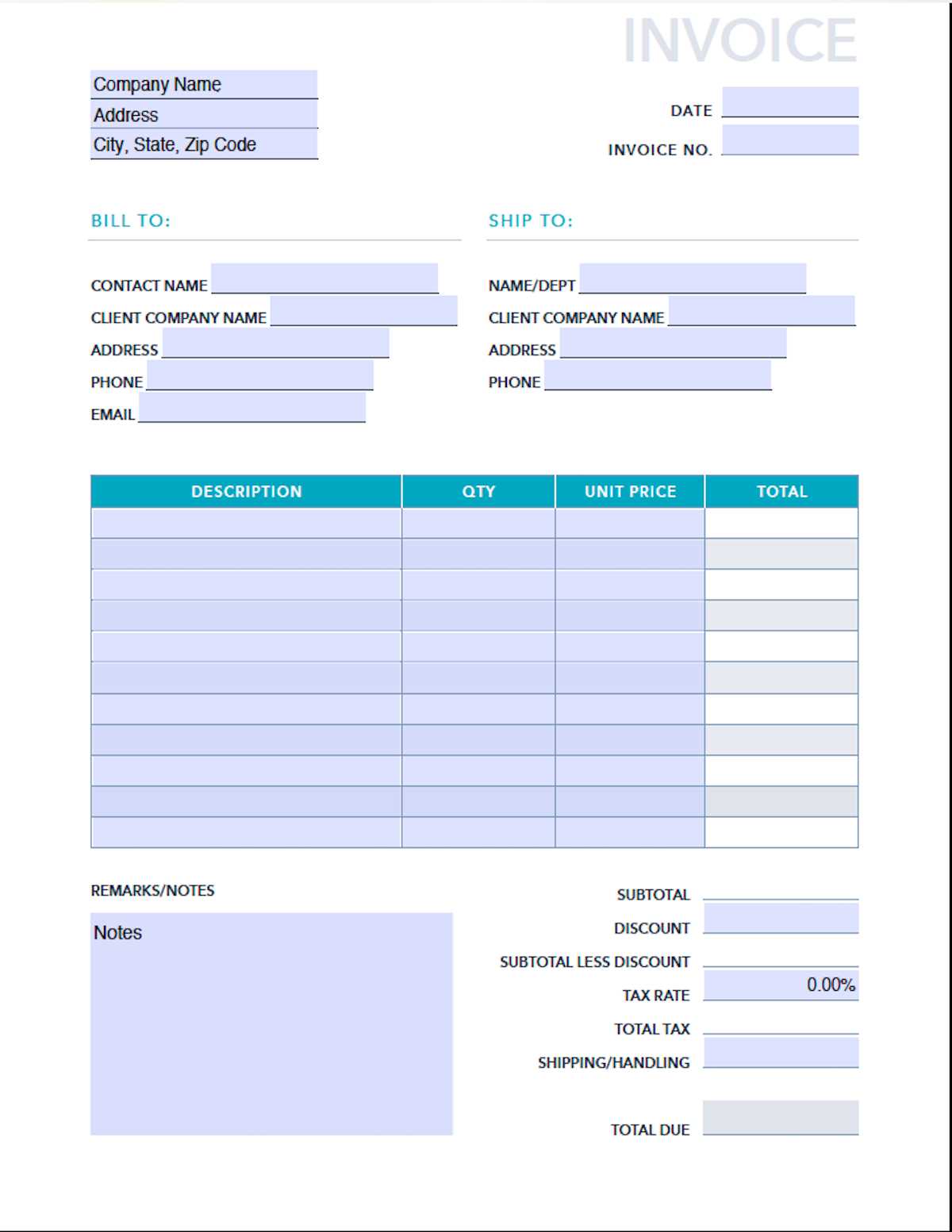

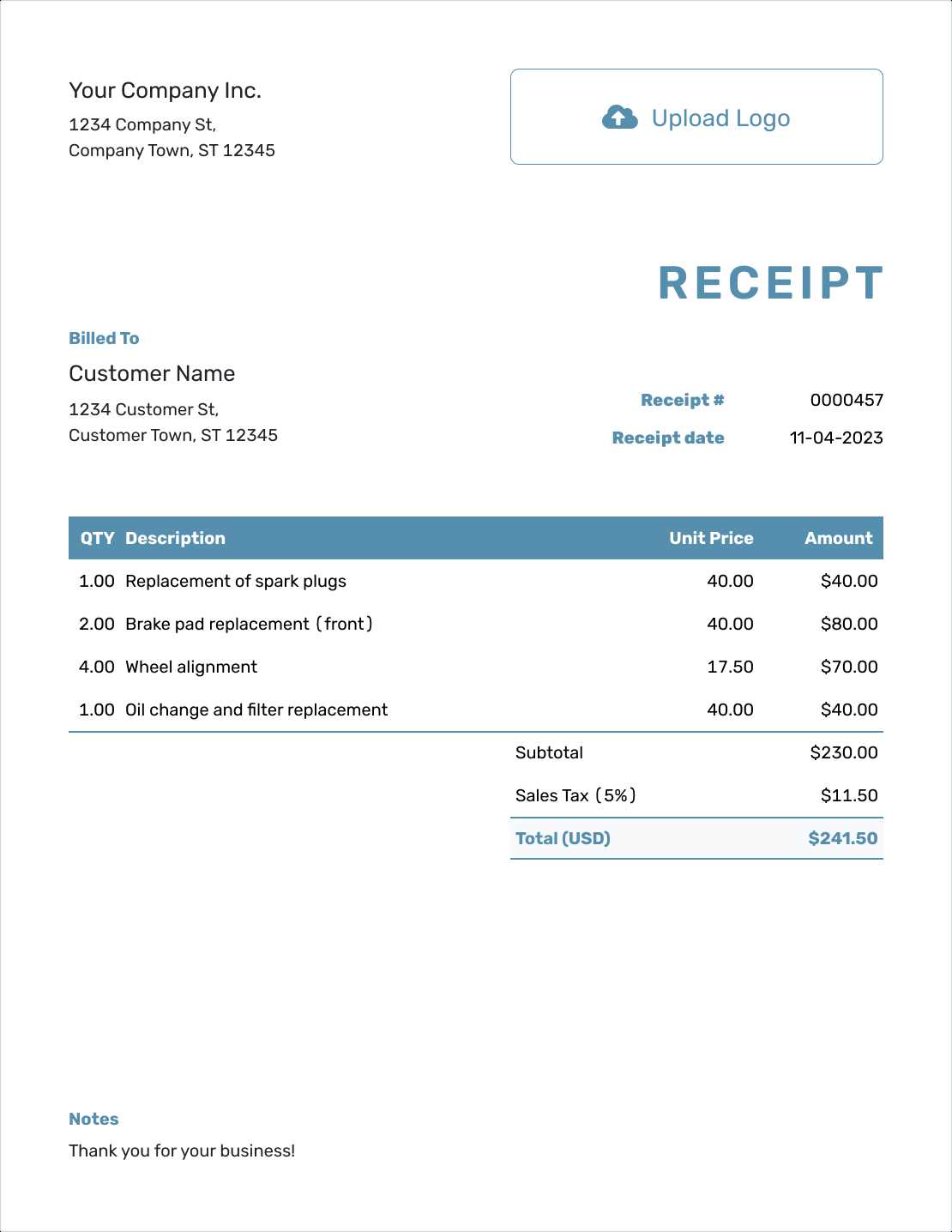

Common Features in Free Invoice Templates

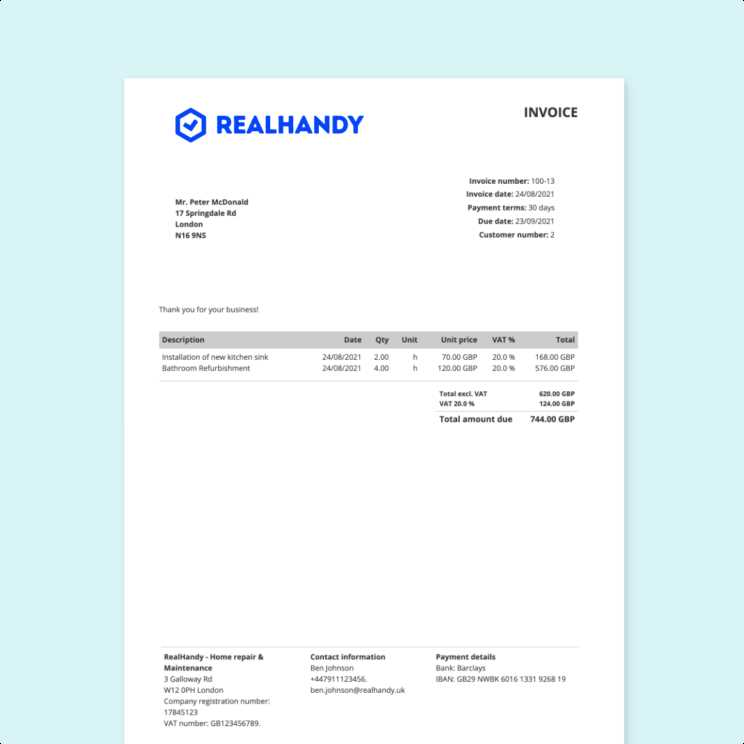

When using ready-made documents to request payments, there are several key features you can expect to find. These elements ensure that the payment request is clear, professional, and contains all necessary information for both parties. Regardless of the platform or format, most solutions include the same core components to make the document both functional and easy to read.

Essential Fields in Billing Documents

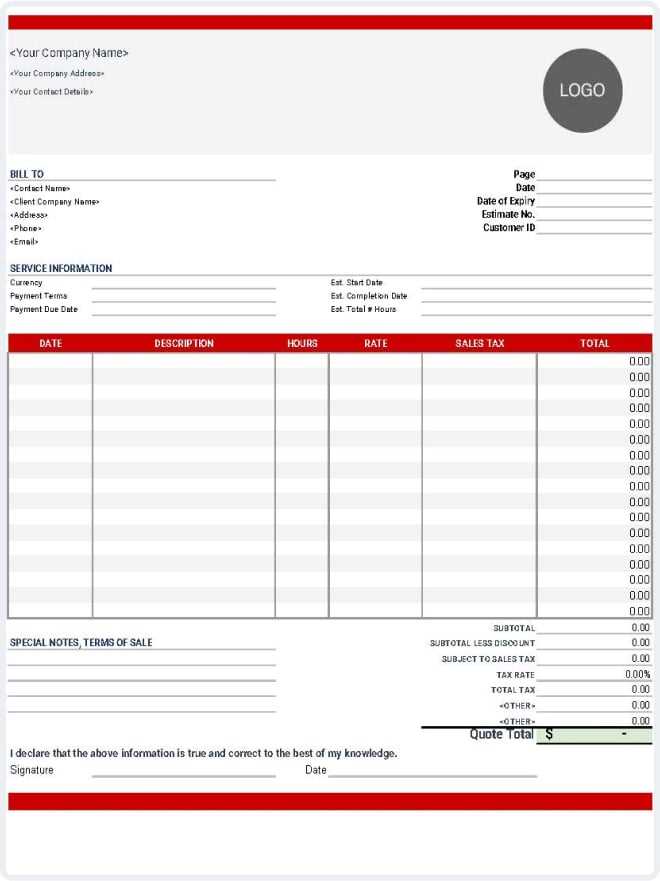

Here are some common fields that are typically included in these resources:

- Business Information: Your company name, contact details, and address are typically featured prominently at the top of the document.

- Client Details: Space for including the client’s name, address, and other contact information.

- Unique Reference Number: An identifier for the document to help track payments and manage records.

- Description of Goods or Services: A section to detail the products or services provided, including quantities and unit prices.

- Total Amount Due: A clear calculation of the amount the client is required to pay, including taxes and any discounts applied.

- Payment Terms: Information on due dates, payment methods, and any late fees for overdue payments.

- Notes or Additional Instructions: A section for any custom messages, such as “Thank you for your business” or special instructions regarding the payment process.

Formatting and Design Features

Along with the essential fields, the layout and design of the document play an important role in its effectiveness. Many ready-made documents include:

- Clean and Organized Layout: An easy-to-read design with clearly defined sections, making it simple for the client to find important details.

- Customizable Branding: Space to add your logo and adjust the color scheme to align with your company’s visual identity.

- Auto-Calculation Fields: Some resources include automatic calculation features, which can save time when adding up totals and taxes.

How to Choose the Right Invoice Template

Selecting the right document to request payments is crucial for maintaining professionalism and ensuring that all necessary information is included. The right format should align with your business needs, be easy for both you and your clients to use, and help maintain consistency across all your billing procedures. With many options available, it’s important to consider factors like design, functionality, and customization before making a choice.

Factors to Consider When Choosing a Billing Document

When selecting the right solution, keep these factors in mind to ensure it meets your business needs:

- Business Type: Consider your industry and the level of detail required. For example, a freelancer may need a simpler document, while a product-based business may require a more complex format to list multiple items.

- Customization Options: Look for a solution that allows you to personalize sections like branding, payment terms, and additional notes. Customization ensures that the document reflects your company’s identity and specific requirements.

- Ease of Use: The document should be user-friendly, with clearly defined fields that are easy to fill out. Make sure it can be quickly edited without requiring advanced software or skills.

- Compatibility: Choose a document that works with the tools you already use. For example, if you use Excel or Google Sheets, find a format that integrates smoothly with these platforms.

- Legality and Compliance: Ensure the document includes all legally required details, such as tax numbers, payment terms, and any necessary disclaimers, especially if you operate in a regulated industry.

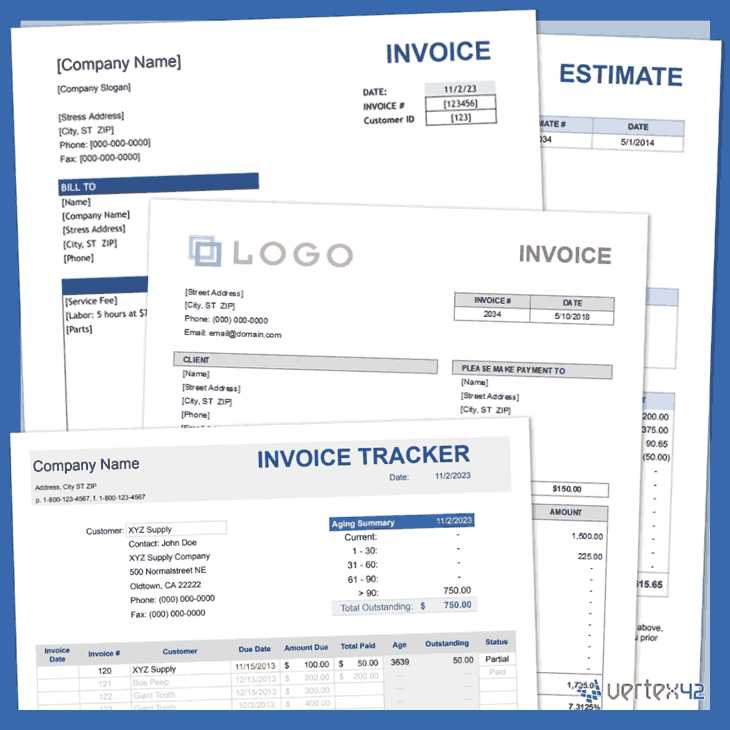

Types of Billing Documents to Choose From

Depending on your business needs, you might consider different types of payment request solutions:

- Simple Templates: Great for freelancers or small businesses with straightforward billing needs. These options are typically minimalistic and easy to use.

- Detailed Formats: Ideal for businesses that need to list multiple products or services. These formats include itemized sections with room for detailed descriptions, quantities, and prices.

- Professional Designs: Suitable for companies that want to present a polished image. These documents often include branded elements like logos and custom color schemes.

Free Invoice Templates vs Paid Options

When choosing a billing solution, businesses often face the decision between using free resources or investing in premium options. Both choices have their advantages, but understanding the differences can help you decide which one best meets your needs. Free documents may offer basic functionality, while paid solutions often come with additional features and customization options to improve efficiency and professionalism.

Advantages of Free Billing Documents

Free resources are a popular choice for small businesses or freelancers who are just starting out or have a limited budget. Here are the main benefits:

- Cost-Effective: The most obvious advantage is that they come at no cost, which makes them an ideal choice for businesses that want to minimize expenses.

- Quick Setup: Many free options are simple and easy to use, allowing you to get up and running with minimal effort.

- Basic Features: Free documents typically include all the essential fields, such as client details, item descriptions, and total amounts, making them functional for basic billing needs.

- No Long-Term Commitment: Since they are free, you are not locked into any subscription or long-term contract, which can be beneficial if your business needs change.

Advantages of Paid Billing Solutions

While free resources may be sufficient for some, paid solutions offer several enhanced features that can make a significant difference in your billing process:

- Advanced Features: Paid options often include more customization, such as integration with accounting software, auto-calculation of totals, and advanced reporting capabilities.

- Professional Design: Premium documents typically offer more polished designs and branding options, helping your business appear more professional to clients.

- Customer Support: With paid services, you often have access to customer support to assist with any issues or questions you might have.

- Scalability: As your business grows, paid solutions offer more advanced features to handle increased volume and complexity, making them a better long-term investment.

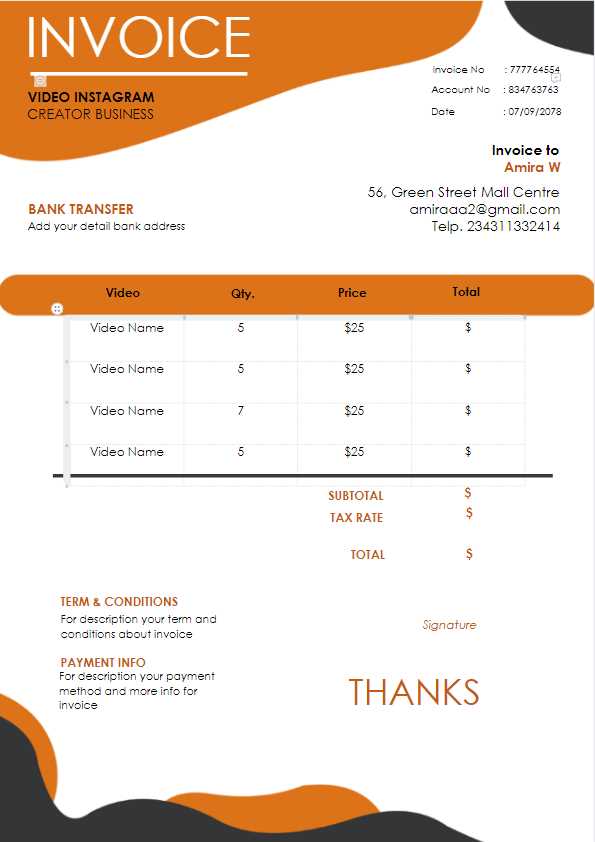

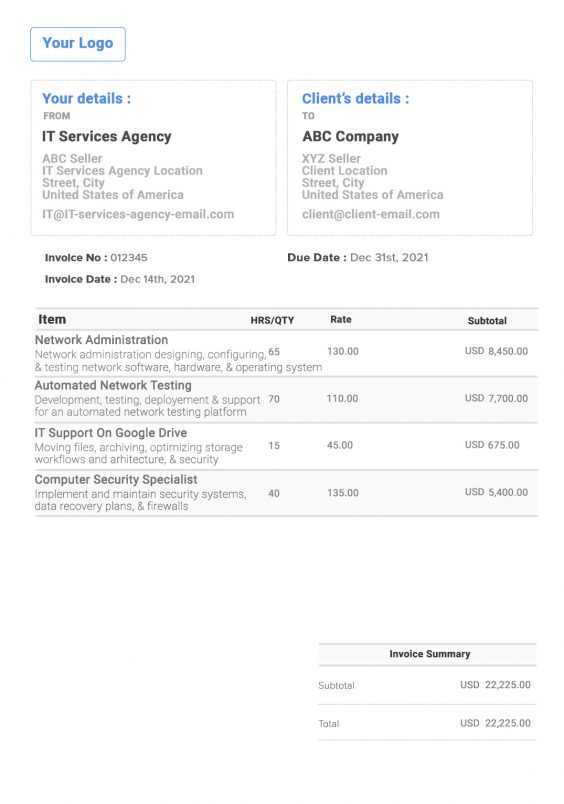

Invoice Templates for Different Industries

Every industry has unique needs when it comes to billing clients, and the type of document used should reflect those requirements. Whether you run a service-based business or sell physical products, having the right format can make a significant difference in efficiency and professionalism. Certain fields, sections, and layouts will be more suitable depending on the nature of your work.

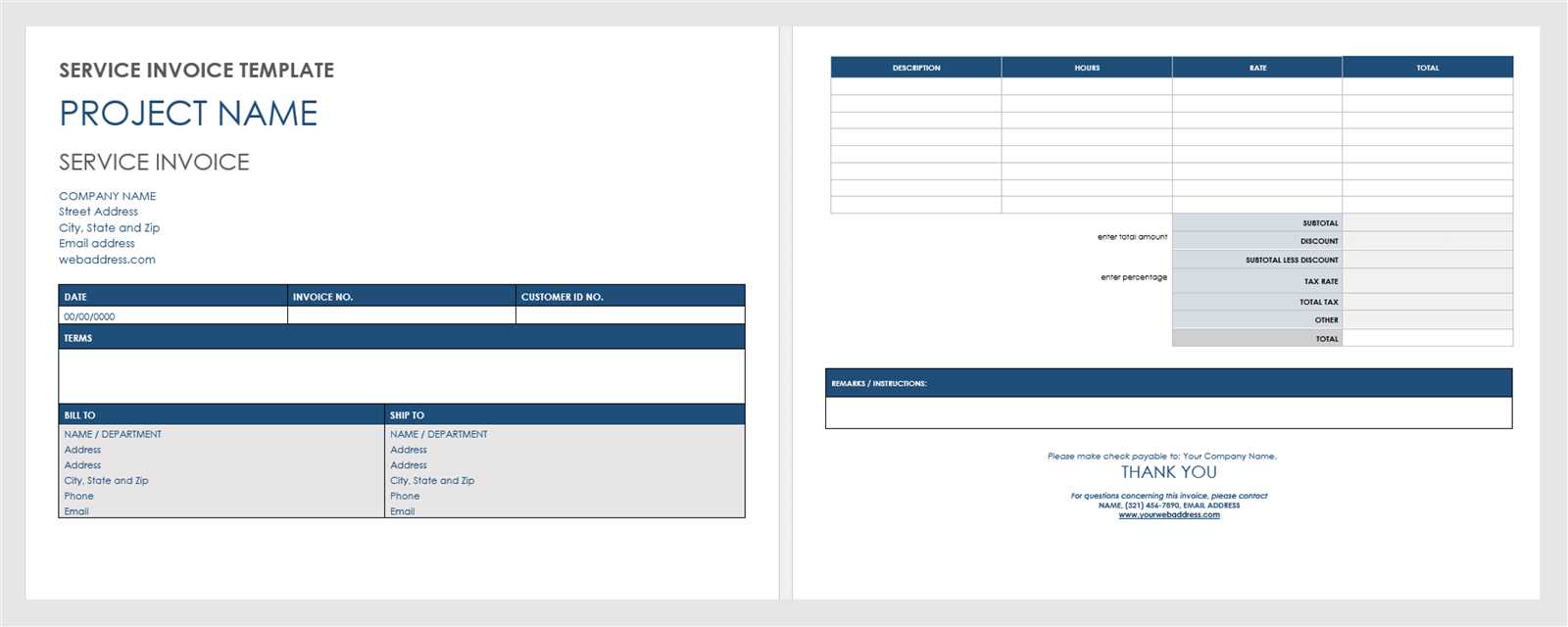

Billing Documents for Service-Based Businesses

Service-oriented businesses, such as freelancers, consultants, and agencies, often need documents that focus on time, hourly rates, and specific services provided. Here are some key features for service-based industries:

- Hourly Rate and Time Tracking: These documents should include fields for the number of hours worked and the rate charged per hour.

- Service Descriptions: Clear sections for detailed descriptions of services provided, ensuring transparency for clients.

- Milestone Payments: For projects with multiple phases, the ability to break down payments according to project milestones is essential.

- Terms and Conditions: Space to outline payment terms, including any late fees or penalties for overdue payments.

Billing Documents for Product-Based Businesses

Businesses that sell products require a different structure. These formats often need to include information about each item sold, quantities, and pricing. Common features for product-based businesses include:

- Itemized List: A section to list each product sold, along with a description, quantity, unit price, and total price for each item.

- Shipping Information: Fields to include delivery methods, shipping costs, and delivery dates.

- Sales Tax: A clear breakdown of taxes applied to the total amount, as required by local tax regulations.

- Inventory Number: For inventory management, it may be useful to include SKU numbers or item codes next to each product listed.

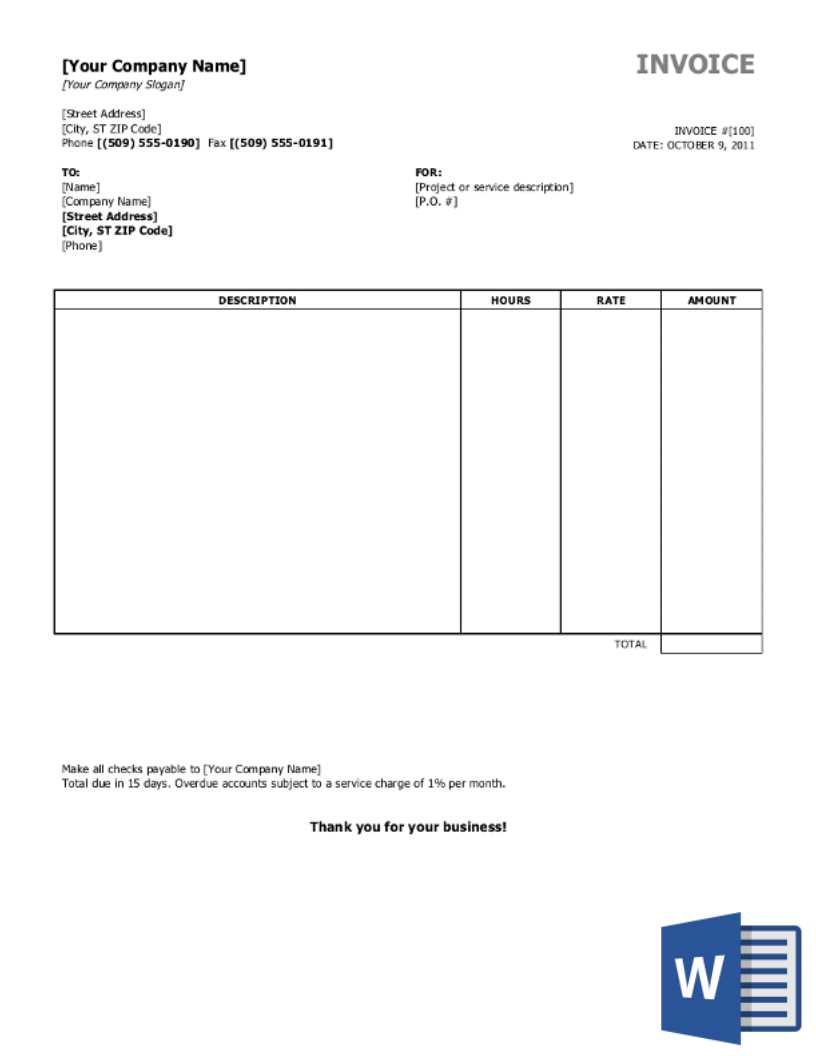

How to Use Invoice Templates in Excel

Excel is a powerful tool that can help you create and manage payment requests quickly and efficiently. By using pre-designed documents, you can easily fill in the necessary information without having to worry about formatting. Excel’s built-in functions, such as auto-calculation, make it an ideal choice for managing totals, taxes, and other financial details.

Steps to Use Excel for Payment Requests

Follow these simple steps to create and use your document in Excel:

- Download a Pre-designed Format: Search for Excel documents specifically designed for payment requests. These will often include necessary fields such as company details, client information, and a breakdown of services or products.

- Fill in Your Business Information: Start by entering your company name, address, phone number, and email at the top of the sheet. This ensures that all of your documents have a consistent look.

- Enter Client Details: In the appropriate section, input the client’s name, address, and contact information to personalize the request.

- Add Items or Services: List the products or services provided. Excel’s grid format allows for an easy way to itemize and add descriptions, quantities, and unit prices.

- Utilize Auto-Calculation: Excel’s formula capabilities allow you to calculate totals automatically, including taxes and discounts, ensuring accurate billing.

- Save or Print the Document: Once all information is entered, save the document as a template for future use, or print it out to send to your clients.

Example of an Excel Payment Request Layout

Below is an example of how the layout might look in Excel:

| Item | Description | Quantity | Unit Price | Total | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service 1 | Consulting Hourly Rate | 5 | $50.00 | $250.00 | |||||||||||

| Service 2 | Website Design | 1 | $500.00 | $500.00 | |||||||||||

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation Fee | 1 | $150 | $150 |

| Design Services | 3 | $100 | $300 |

| Total | $450 |

With a few simple entries, the document is ready to be sent out, saving time and ensuring that all necessary information is accurately presented.

Steps to Download a Free Invoice Template

Acquiring a pre-made billing document can simplify the process of issuing payment requests. By following a few straightforward steps, you can quickly access a professionally designed format that suits your needs. Whether you’re looking for a simple design or one with advanced features, downloading such a document is quick and easy. This section will walk you through the steps to find, download, and start using these resources to save time and ensure accuracy in your transactions.

Step-by-Step Guide to Download

Follow these simple steps to access and download a ready-to-use payment request format:

- Search for a Reliable Source: Look for trustworthy websites or platforms that offer no-cost, high-quality document options. Some popular sites include those dedicated to small businesses or freelance professionals.

- Choose the Right Format: Browse through the available options and select one that matches your business type and specific needs. You may find different styles such as minimalistic designs, detailed templates, or industry-specific layouts.

- Download the File: Once you have chosen a suitable document, click the download button, which is typically available in formats like Word, Excel, or PDF. Ensure that the file type is compatible with the software you use.

- Save and Organize: After downloading, save the document in an organized folder on your device. This will make it easy to find and reuse whenever you need it.

- Customize and Use: Open the downloaded file and begin entering your specific business information, client details, and payment terms. Once ready, you can print or email the document directly to your clients.

Common Platforms for Downloading

Here are a few platforms that commonly offer downloadable formats:

- Microsoft Office: You can often find free documents within the template library of Microsoft Word or Excel.

- Google Docs: Google offers simple, customizable billing documents that can be accessed directly through Google Drive.

- Online Business Resource Websites: Websites dedicated to small business tools often provide a variety of downloadable resources, including pre-designed billing documents.