Invoice Template for Freelance Graphic Designers

When working as an independent professional in the creative industry, managing billing can often be a challenge. Proper documentation not only helps maintain clear records but also ensures you are compensated fairly and on time. Having a streamlined approach to invoicing can save valuable time and prevent potential misunderstandings with clients.

Effective billing is essential for maintaining a healthy business, especially when providing specialized services. Clear, well-structured bills enhance your credibility and show clients that you take your work seriously. Whether you’re working on a small project or a large contract, having a well-organized statement of work is crucial.

Crafting the right documentation helps avoid delays in payment and reflects your professionalism. With the right tools and knowledge, you can easily customize a billing system to match your needs, ensuring a smooth financial workflow in every project you take on.

Essential Features of an Invoice Template

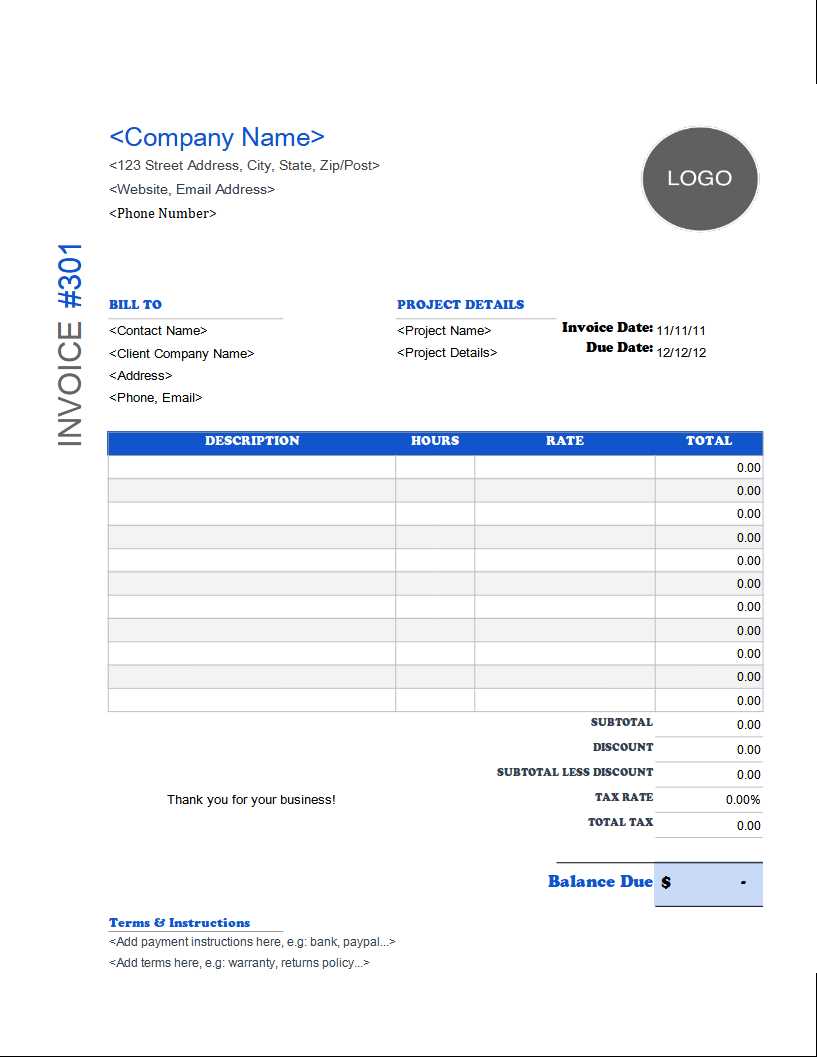

A professional billing document should provide all the necessary details that allow both you and your client to understand the transaction clearly. It should offer a clean and organized structure that includes all relevant information, ensuring smooth communication and timely payments. Below are the key elements that every well-crafted billing statement should include:

- Contact Information: Your name, business name, phone number, and email address should be easy to find. Similarly, include the client’s details such as their company name and contact information.

- Unique Identifier: A reference number or code to distinguish the document from others, ensuring easy tracking and record-keeping.

- Date: Include the date when the statement is issued and, if applicable, the date the work was completed or delivered.

- Payment Terms: Specify the due date and any conditions regarding late fees or discounts for early payments. Clear payment expectations help prevent confusion later.

- Description of Services: A detailed breakdown of the work performed, including hours worked, rates, and specific tasks completed. Transparency here is key to avoiding misunderstandings.

- Total Amount: Clearly indicate the total sum due, including any taxes, fees, or additional charges. This should be easy to identify and prominently displayed.

- Methods of Payment: Clearly list the acceptable methods of payment, such as bank transfers, online payment platforms, or checks, along with the necessary details for each.

- Notes and Additional Information: A space for any extra comments, instructions, or follow-up details that may be relevant to the client.

By including these essential features, you ensure that your billing documents remain clear, professional, and effective, promoting a smoother transaction process and building trust with your clients.

How to Create an Effective Invoice

Creating a clear and professional billing document is essential for maintaining positive relationships with clients and ensuring timely payments. A well-structured bill not only provides transparency but also conveys professionalism. The goal is to present the necessary details in an easy-to-read format, making it simple for your clients to understand the charges and the payment process.

Step 1: Organize Your Information

The first step in creating an effective billing statement is to organize all the relevant details. Ensure your contact information and the client’s details are clearly presented at the top of the document. This includes your business name, phone number, email, and the client’s name and address. Having this information easily accessible helps avoid confusion and makes communication smoother.

Step 2: Include Clear Payment Terms

Another key component of an effective billing document is the inclusion of clear payment terms. Specify the amount due, the due date, and any relevant conditions such as late fees or discounts for early payments. This helps set expectations and encourages timely settlement of the balance. Make sure the total amount is clearly visible and prominently displayed to avoid any misunderstandings.

Tip: Be precise with the payment methods. Specify whether clients can pay via bank transfer, credit card, or another method, and provide the necessary details for each option.

By following these simple steps, you can ensure that your billing documents are effective, organized, and easy to understand, helping you maintain a smooth financial workflow in your business.

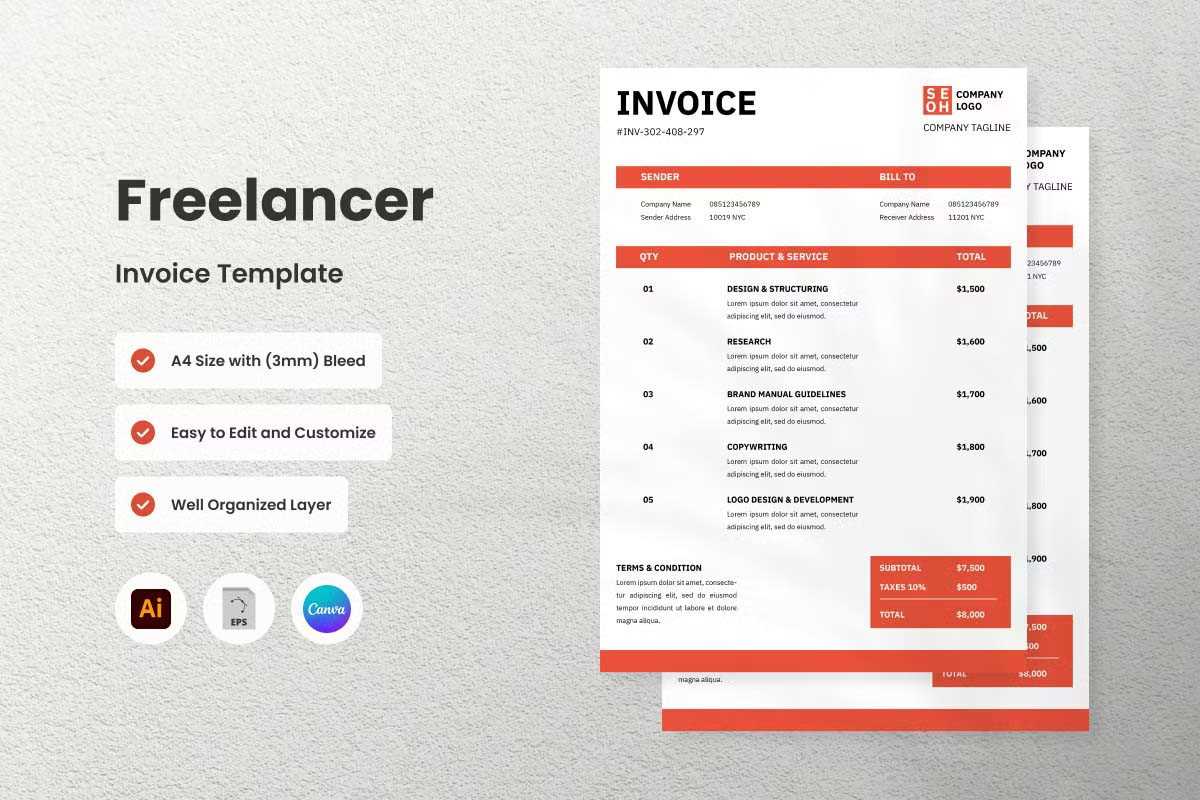

Why Freelance Designers Need Customized Invoices

When working independently in creative fields, having personalized billing documents is essential for maintaining clarity, professionalism, and control over finances. Generic, one-size-fits-all forms often fail to meet the specific needs of creative professionals who handle varied projects with different terms, deadlines, and payment structures. A customized bill reflects the uniqueness of each job and ensures that all details are accurately captured.

Tailored to Specific Projects

Every creative project is different, with unique deliverables, timelines, and pricing structures. A personalized billing document allows you to clearly outline all aspects of the work, from hourly rates to fixed fees, and any additional costs that may apply. By adjusting the content for each client, you ensure there is no confusion about the terms or the work involved.

Enhanced Professionalism

Using a customized document enhances your reputation and signals to clients that you take your business seriously. A well-organized, branded statement not only looks professional but also helps you stand out from the competition. It reassures clients that they are working with someone who is organized and committed to clear communication throughout the project.

By tailoring your billing documents, you can create a system that works for you, making the billing process more efficient and reducing the risk of errors or disputes.

Benefits of Using Templates for Invoicing

Utilizing pre-designed structures for billing can significantly streamline the process, saving valuable time and effort. These ready-made forms provide a consistent and professional way to present your financial documents. By relying on structured layouts, you ensure all essential details are included and formatted correctly, minimizing the risk of errors. Below are some key advantages of using these pre-built forms:

Time-Saving and Efficiency

One of the main benefits is the time saved. Instead of creating a new document from scratch for each client, you can use a pre-existing format, adjusting only the specifics of the project. This allows you to focus more on the work itself rather than administrative tasks.

Consistency and Professionalism

Using a consistent layout across all your bills ensures that your clients always receive professional, easy-to-read statements. A well-organized document makes a lasting impression and shows that you are serious about your business. The uniformity also helps you stay organized and maintain a clear record of your past projects.

| Benefit | Explanation | ||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Efficiency | Reduces the need to start from scratch for each client, making the process quicker and easier. | ||||||||||||||||||||||||||||||||||||||||||||||

| Professional Appearance | Consistent design and layout project a polished, business-like image to clients. | ||||||||||||||||||||||||||||||||||||||||||||||

| Accuracy | Pre-built forms reduce human error by ensuring all required fields are included and properly formatted. | ||||||||||||||||||||||||||||||||||||||||||||||

Cu

Key Information to Include on Your InvoiceWhen creating a billing statement, it’s crucial to include all the necessary details that clearly outline the services provided, the terms of payment, and the total amount due. Missing information can lead to confusion or delays in payment. Below are the essential elements that should always be included to ensure your document is both professional and complete.

By ensuring that all the necessary details are included, you make the payment process easier for your clients and increase the likelihood of timely payments. Keeping things clear, organized, and accurate is key to building trust and maintaining smooth financial transactions. How to Add Payment Terms in InvoicesClear payment terms are essential to ensure that both you and your client are on the same page regarding the timing and method of payment. Including detailed conditions in your billing document helps avoid confusion, sets expectations, and encourages timely settlements. Here’s how to effectively include payment terms in your documents:

By clearly communicating the payment terms in your documents, you eliminate potential misunderstandings and create a transparent process that encourages prompt payment. Ensuring that your clients are aware of the conditions beforehand can lead to a more professional and efficient workin Best Tools for Generating Designer InvoicesCreating professional billing documents can be made much easier with the right tools. Whether you’re looking for something simple or need advanced features for managing multiple clients and projects, the right software can save you time and effort. Below are some of the best tools available for creating and managing your billing process. 1. FreshBooksFreshBooks is a cloud-based accounting solution popular among independent professionals. It allows you to quickly generate customizable bills, track expenses, and monitor payments. You can also set up recurring billing, automate reminders, and integrate it with other financial tools. 2. QuickBooks OnlineQuickBooks is one of the most widely used accounting tools for small businesses. It offers easy invoice creation, expense tracking, and even payroll management. You can customize your billing documents to match your brand and keep track of your income and expenses seamlessly. Additional Features:

3. Zoho InvoiceZoho Invoice is another user-friendly tool that’s great for managing invoices and payments. It allows for automated billing, recurring invoices, and integration with payment gateways. The clean and simple interface makes it easy to create professional documents in minutes. Key Benefits:

Choosing the right software depends on your specific needs, whether it’s simple invoicing, comprehensive financial management, or something in between. These tools can help streamline your billing process, improve accuracy, and ensure that you are paid on time. Common Mistakes to Avoid in InvoicesCreating a billing statement may seem straightforward, but small errors can lead to confusion, delayed payments, or even lost clients. Avoiding common mistakes ensures that your financial documents are clear, professional, and effective. Here are some of the most frequent issues to watch out for when creating your documents: 1. Missing or Inaccurate Client InformationOne of the most basic yet crucial mistakes is failing to include accurate client details. Missing or incorrect contact information can cause delays in communication and payment processing.

2. Unclear Payment TermsAmbiguous payment terms can create confusion and disputes later on. Always specify the payment due date, the methods of payment you accept, and any conditions related to late fees or discounts for early payment.

3. Failing to Include a Unique Reference NumberEach document should have a unique reference number to make it easy to track and organize. Without it, both you and your client may have trouble finding specific transactions in the future.

4. Overcomplicating the Layout

A cluttered or overly complex layout can confuse clients and make it harder to read. A clean and simple design is essential for clarity and professionalism.

5. Not Including a Detailed Description of ServicesVague descriptions of the work completed can lead to misunderstandings. Always provide a clear breakdown of the tasks performed, the hours worked, or the project milestones achieved.

|